Mitigating Transport-Based CO2 Emissions in Landlocked Countries: The Role of Economic Growth, Trade Openness, Freight Transportation and Renewable Energy Consumption

Abstract

1. Introduction

2. Literature Review

2.1. Nexus Between Financial Development, Energy Consumption, Economic Growth, and Environmental Degradation

2.2. Nexus Between Renewable Energy, Energy Consumption and Environmental Degradation

2.3. Nexus Between Trade Openness and Environmental Degradation

2.4. Nexus Between Freight Transportation and Environmental Degradation

2.5. Nexus Between Industrialization and Environmental Degradation

3. Data and Methodology

3.1. Data, Variables and Sources

- −

- TCO2: This variable is considered a dependent variable. This dimension is expressed as a percentage of total fuel combustion, which facilitates a focused examination of the environmental consequences attributable to the transportation sector. It is frequently neglected in research concerning landlocked nations.

- −

- ROFT: This variable quantifies the volume of goods transported via road, articulated in million ton-kilometers. Road transport exhibits a higher intensity of CO2 emissions, primarily attributed to the predominant use of diesel-powered vehicles. The incorporation of this variable facilitates the evaluation of the environmental implications associated with short- and medium-haul freight transportation in landlocked regions.

- −

- RAFT: It pertains to the movement of freight via rail, quantified in million ton-kilometers. Rail transport generally exhibits greater energy efficiency and lower carbon intensity in comparison to road transport. The disaggregation of freight by mode, specifically comparing road and rail, facilitates the identification of modal shifts, which may serve as a viable mitigation strategy. Freight transport (ROFT and RAFT) exhibits a direct correlation with emissions levels. Road freight exhibits a considerably higher emission intensity, primarily attributed to its dependence on diesel fuel and the fragmented nature of logistics. In contrast, rail transport presents a more sustainable, lower-carbon alternative. The separation of freight modes facilitates the examination of potential shifts between different transportation methods.

- −

- GDP: It is quantified in constant US dollars and serves as a metric for assessing the magnitude of economic activity. Within the framework of the EKC, it is anticipated that GDP exhibits a non-linear correlation with CO2 emissions. Initially, economic growth is associated with an increase in emissions, referred to as the scale effect. This phase is subsequently followed by a decline in emissions as advancements in cleaner technologies and the implementation of regulatory measures come into play, known as the technique effect.

- −

- IND: This variable quantifies the impact of the industrial sector, encompassing both manufacturing and construction, on the GDP. Given that industrial activities generally require significant energy consumption, this variable functions as an indicator of the underlying structural factors influencing CO2 emissions within the economic framework. The relationship between GDP and industrial value added aligns with the principles of the EKC, wherein emissions initially increase in tandem with economic growth, subsequently declining as a result of the implementation of cleaner technologies and environmental regulations.

- −

- EC: It is a consumption originating from fossil fuels, specifically coal, oil, and natural gas. It serves as a direct indicator of the carbon intensity associated with the energy system. This study aims to quantify the extent of fossil energy dependence in landlocked nations.

- −

- TOP: It is posited to have dual effects: scale effects that lead to an increase in emissions, and technique effects that contribute to their reduction, mediated by its impact on production intensity and logistics demand. In landlocked nations, elevated logistics expenses and reliance on terrestrial transportation could intensify the emissions consequences of trade, unless efficiency improvements are achieved.

- −

- RE: It is defined by the proportion of total final energy consumption derived from renewable sources, including wind, solar, hydroelectricity, and biomass, as per the classifications established by the IEA (2024) [65]. RE contributes to a reduction in emissions through the decrease in carbon intensity associated with transportation and industrial activities. Nevertheless, the beneficial impact may be attenuated in landlocked nations as a result of infrastructural constraints and limited integration into energy networks.

- −

- FD: It is measured by domestic credit to the private sector as a percentage of GDP. It is included to assess its role in enabling (or exacerbating) CO2 emissions. While expanded credit can stimulate investment in cleaner infrastructure, it may also lead to higher emissions through increased consumption and industrial activity, depending on the regulatory environment.

3.2. Empirical Model

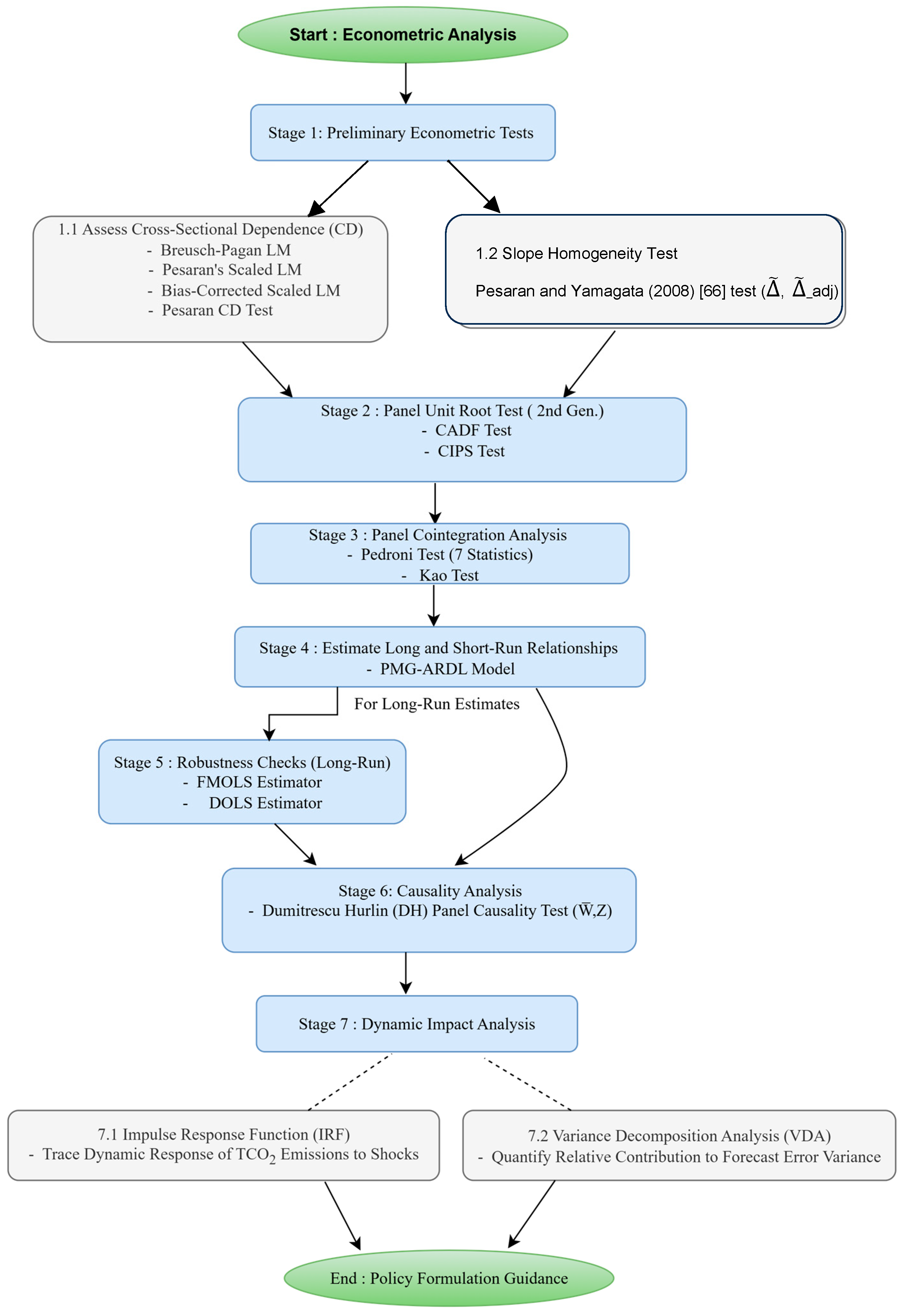

3.3. The Flowchart of the Analysis

3.4. Cross-Sectional Dependence Test

3.5. Slope Homogeneity Test

3.6. Panel Unit Root Test

3.7. Panel Cointegration Test

3.8. PMG-ARDL Model

3.9. Robustness Check

3.10. Dumitrescu Hurlin Panel Causality Test

4. Results and Discussion

4.1. Descriptive Analysis

4.2. Cross-Sectional Dependence Test Results and Discussion

4.3. Slope Homogeneity Test Results and Discussion

4.4. Panel Unit Root Test Results and Discussion

4.5. Panel Cointegration Tests Results and Discussion

4.6. Results of the PMG-ARDL Estimation and Discussion

4.7. Robustness Check Results and Discussion

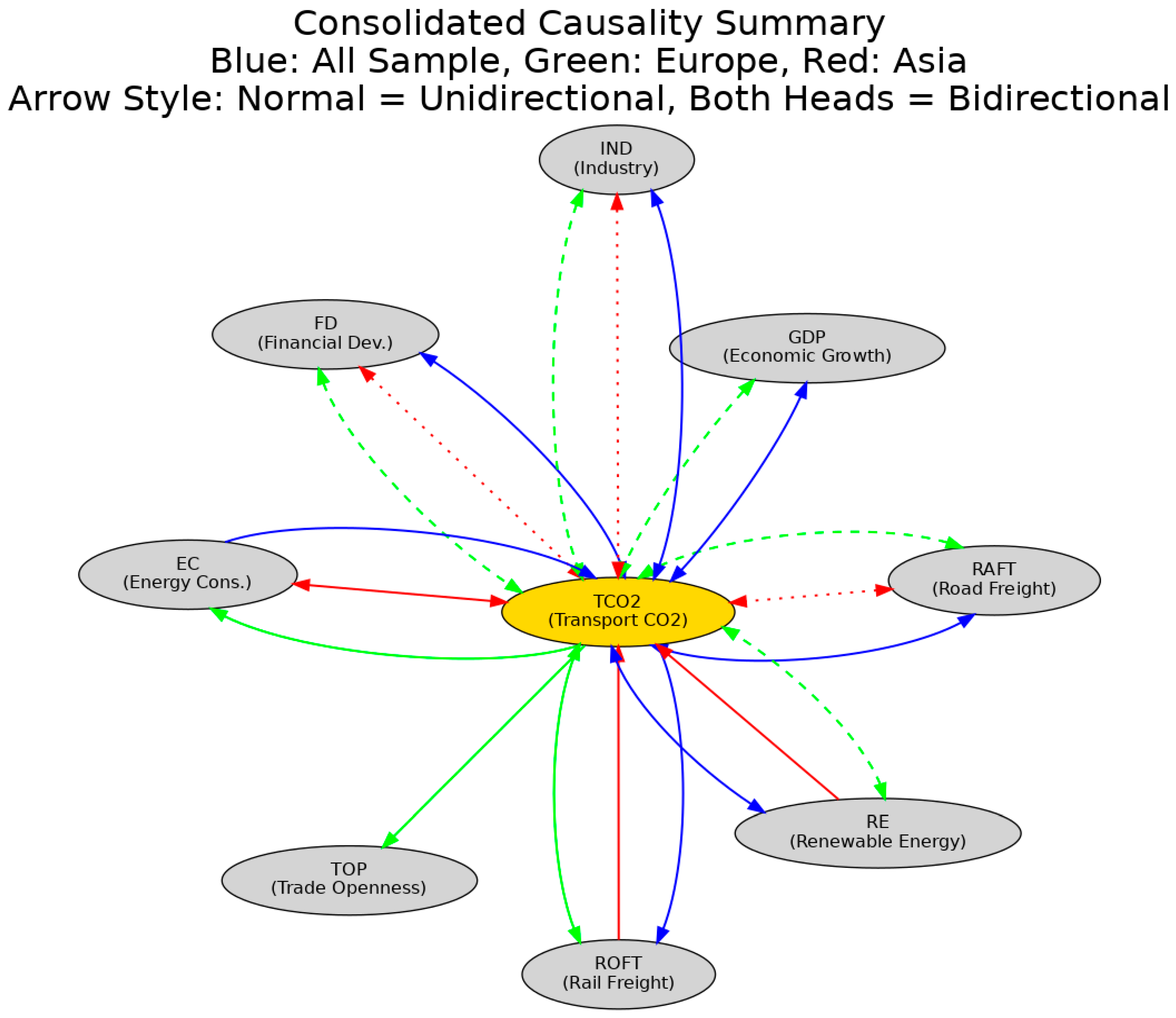

4.8. Results of the Dumitrescu Hurlin Panel Causality Test and Discussion

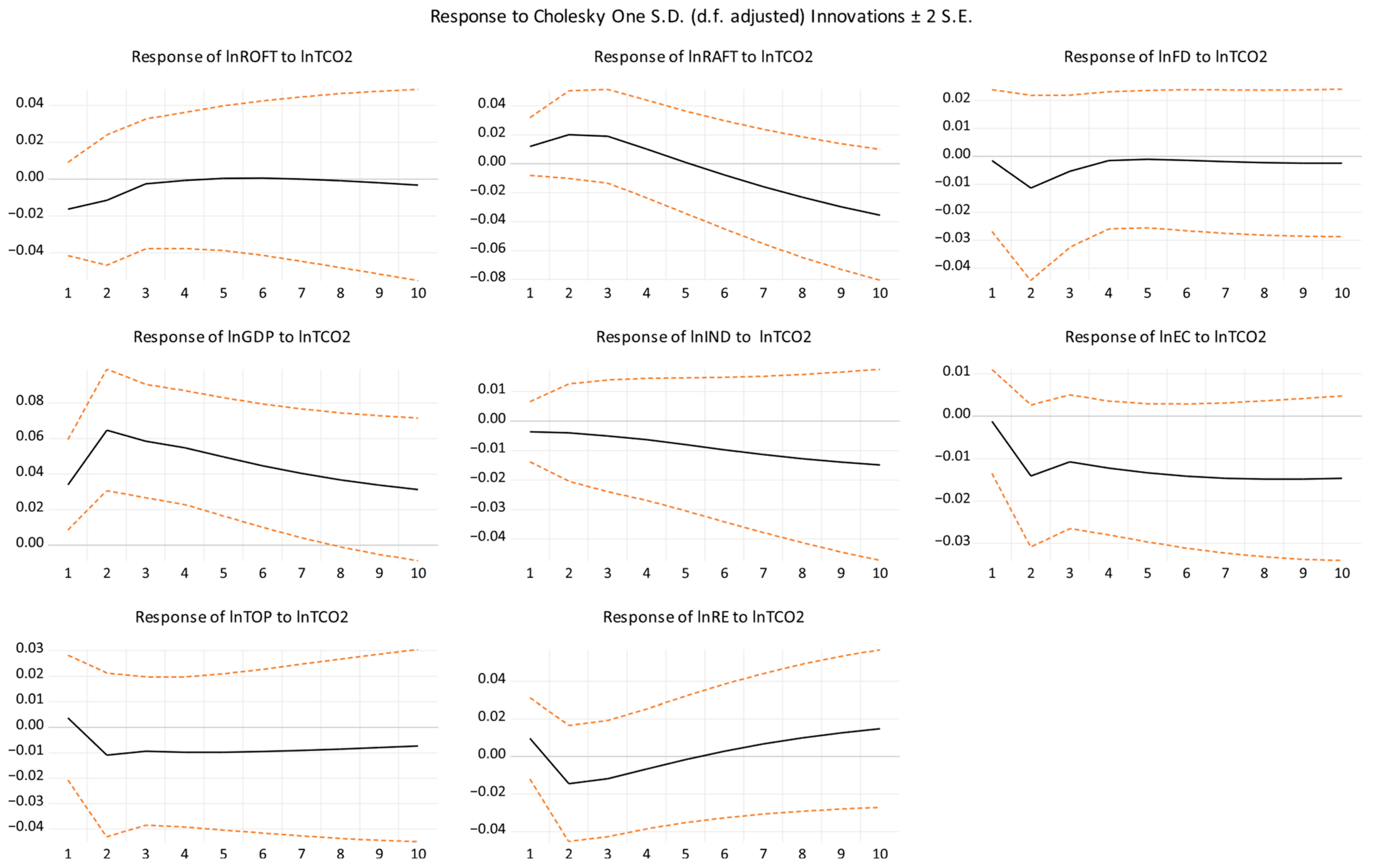

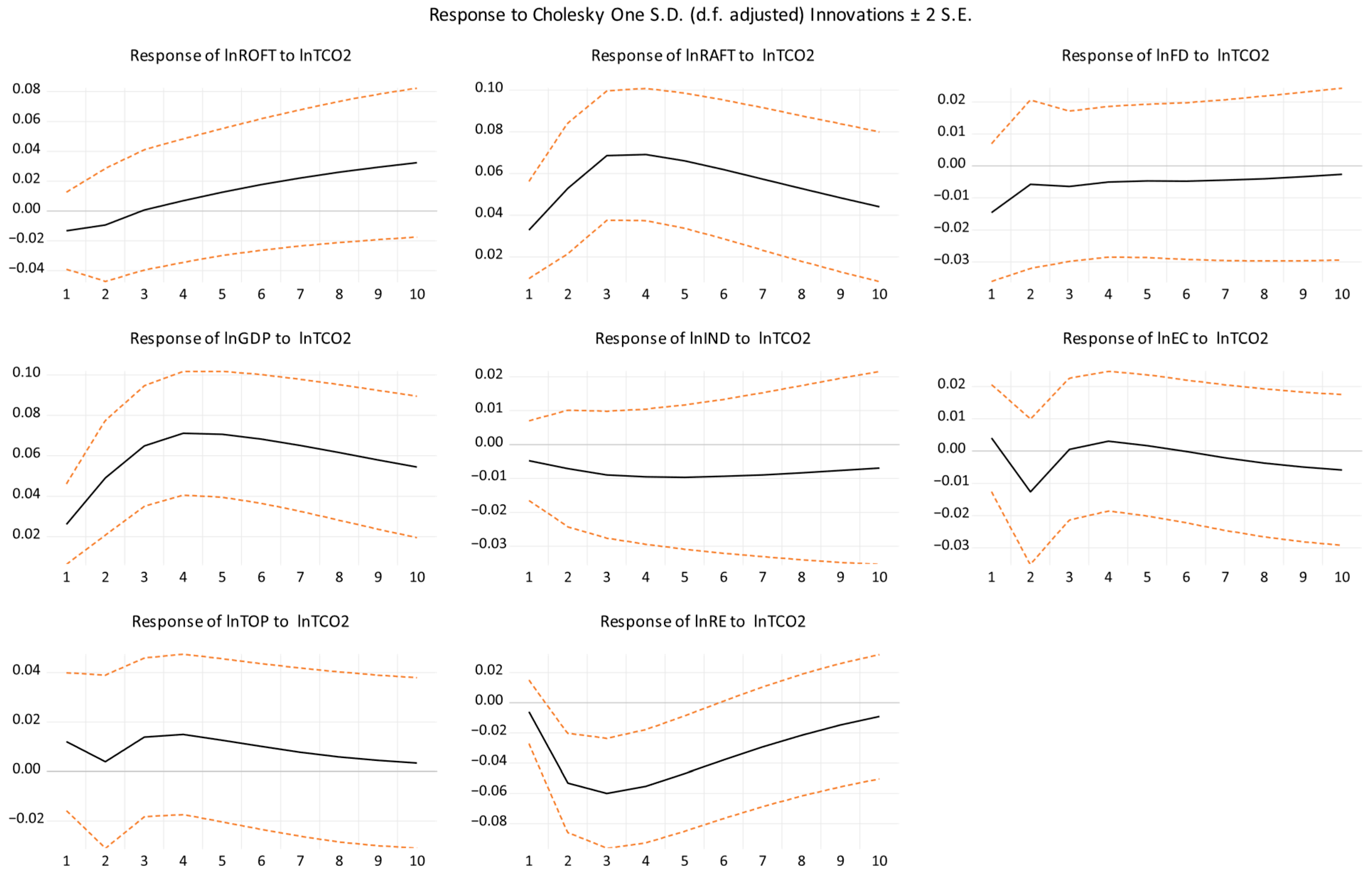

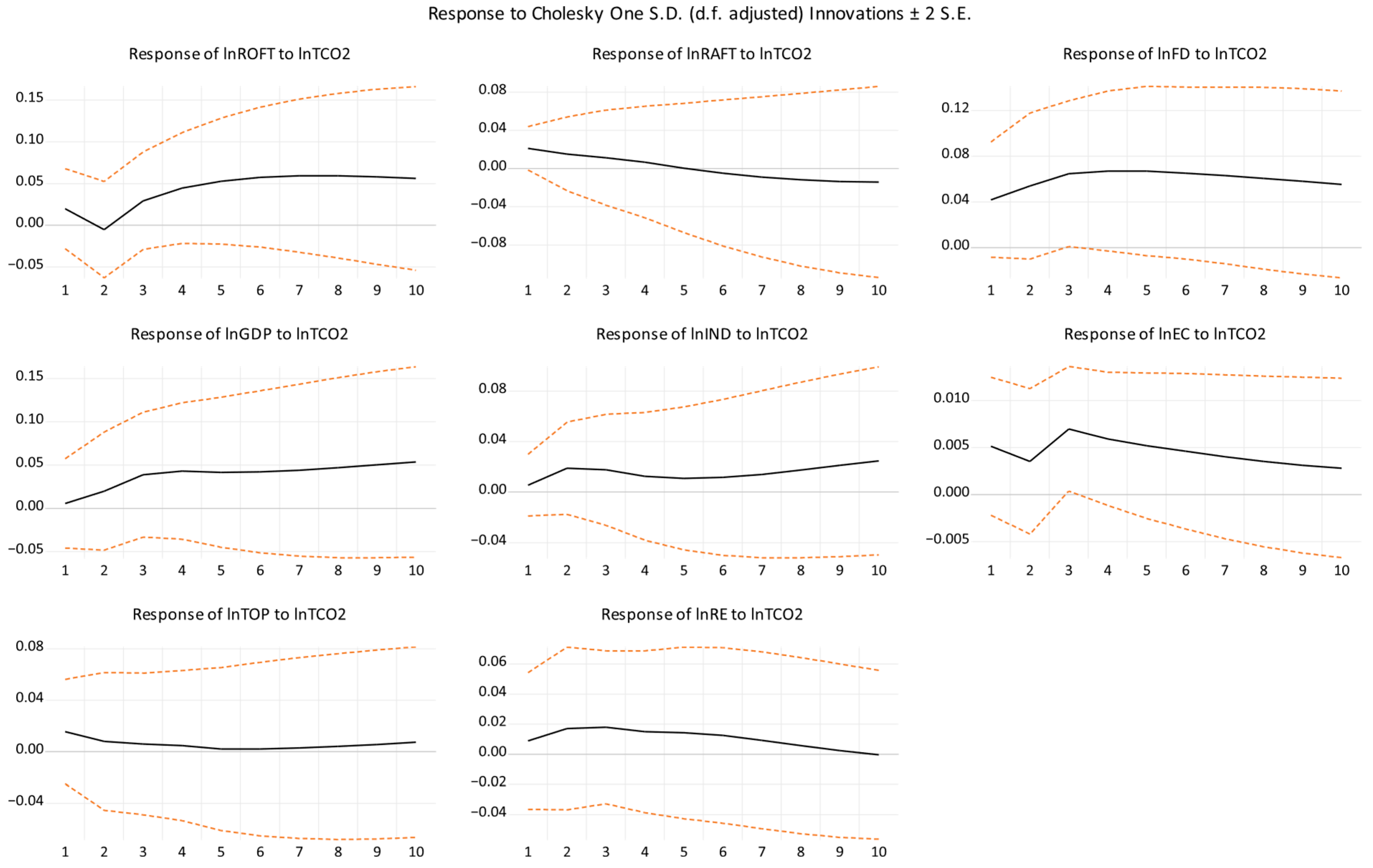

4.9. Dynamic Impact Analysis

5. Conclusions and Policy Implications

- Invest in rail infrastructure: Given that rail freight transport substantially decreases total CO2 emissions over time, landlocked nations should prioritize the expansion and modernization of rail networks to transition freight from road-based transport systems.

- Diversify energy sources: While the effects of renewable energy differ by region, sustained investment in renewable infrastructure, like electrified railroads and biofuel-compatible transportation systems, can facilitate sustainable mobility.

- Promote trade liberalization and industrial efficiency: The inverse correlation between trade openness and TCO2 indicates that participation in global markets, coupled with effective logistics, might improve environmental outcomes. Advocating for sustainable industrial policies is equally essential.

- Augment regional collaboration: Landlocked nations ought to capitalize on regional trade accords and collaborative infrastructure initiatives to enhance connectivity, optimize border processes, and ease access to global markets.

- Advocate for technology and innovation: Digital technology for supply chain optimization, real-time tracking, and customs automation can markedly improve logistics efficiency while minimizing emissions.

- Capacity building and regulatory harmonization: Enhancing human capital and aligning customs and transportation rules with worldwide standards will facilitate effective and sustainable logistics systems.

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| ADF | Augmented Dickey-Fuller |

| AR | Autoregressive |

| CADF | Cross-sectionally Augmented Dicky-Fuller |

| CD | Cross-sectional Dependence |

| CIPS | Cross-sectionally augmented Im-Pesaran-Shin |

| CIS | Commonwealth of Independent States |

| CO2 | Carbon dioxide |

| DH | Dumitrescu Hurlin |

| DOLS | Dynamic Ordinary Least Squares |

| EC | Energy Consumption |

| EEA | European Environment Agency |

| EKC | Environmental Kuznets Curve |

| EU | European Union |

| FD | Financial Development |

| FMOLS | Fully Modified Ordinary Least Squares |

| GDP | Gross Domestic Product |

| GHGs | Greenhouse Gases |

| IEA | International Energy Agency |

| IND | Industry |

| IRF | Impulse Response Function |

| LLCs | Landlocked Countries |

| LM | Lagrange Multiplier |

| NREC | Non-Renewable Energy Consumption |

| OECD | Organisation for Economic Co-operation and Development |

| OLS | Ordinary Least Squares |

| PMG-ARDL | Pool Means Group-Autoregressive Distributed Lag |

| PP | Phillips-Perron |

| RAFT | Rail Freight Transport |

| RE | Renewable Energy |

| ROFT | Road Freight Transport |

| S.E. | Standard Error |

| STIRPAT | Stochastic Impacts by Regression on Population, Affluence, and Technology |

| TCO2 | Carbon dioxide emissions from transport sector |

| TOP | Trade Openness |

| UN | United Nations |

| V | Variance |

| VDA | Variance Decomposition Analysis |

| VECM | Vector Error Correction Model |

| WDI | World Development Indicators |

References

- Fan, W.; Hao, Y. An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew. Energy 2020, 146, 598–609. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Shrestha, A. Transport sector CO2 emissions growth in Asia: Underlying factors and policy options. Energy Policy 2009, 37, 4523–4539. [Google Scholar] [CrossRef]

- Maryam, J.; Mittal, A.; Sharma, V. CO2 emissions, energy consumption and economic growth in BRICS: An empirical analysis. IOSR J. Humanit. Soc. Sci. 2017, 22, 53–58. [Google Scholar] [CrossRef]

- Cook, D.; Davíðsdóttir, B. An appraisal of interlinkages between macro-economic indicators of economic well-being and the sustainable development goals. Ecol. Econ. 2021, 184, 106996. [Google Scholar] [CrossRef]

- Jensen, M.F. How Could Trade Measures Being Considered to Mitigate Climate Change Affect LDC Exports? World Bank: Washington, DC, USA, 2020; p. 160573. [Google Scholar]

- Nnene, O.A.; Senshaw, D.; Zuidgeest, M.; Mwaura, O.; Yitayih, Y. Developing Low-Carbon Pathways for the Transport Sector in Ethiopia. Climate 2025, 13, 96. [Google Scholar] [CrossRef]

- Ofelia, F.A.; Morte, I.B.; Tancredo Borges, C.L.; Morgado, C.; de Medeiros, J.L. Beyond clean and affordable transition pathways: A review of issues and strategies to sustainable energy supply. Int. J. Electr. Power Energy Syst. 2024, 155, 109544. [Google Scholar] [CrossRef]

- Nathaniel, S.; Nwodo, O.; Adediran, A.; Sharma, G.; Shah, M.; Adeleye, N. Ecological footprint, urbanization, and energy consumption in South Africa: Including the excluded. Environ. Sci. Pollut. Res. 2019, 26, 27168–27179. [Google Scholar] [CrossRef]

- Raza, S.A.; Shah, N.; Sharif, A. Time frequency relationship between energy consumption, economic growth and environmental degradation in the United States: Evidence from transportation sector. Energy 2019, 173, 706–720. [Google Scholar] [CrossRef]

- Wada, I.; Faizulayev, A.; Bekun, F.V. Exploring the role of conventional energy consumption on environmental quality in Brazil: Evidence from cointegration and conditional causality. Gondwana Res. 2021, 98, 244–256. [Google Scholar] [CrossRef]

- Destek, M.A. Financial development and environmental degradation in emerging economies. In Energy and Environmental Strategies in the Era of Globalization; Springer Nature: Berlin, Allemagne, 2019; pp. 115–132. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmed, Z.; Yang, X.Y.; Hussain, N.; Sinha, A. Financial development and environmental degradation: Do human capital and institutional quality make a difference? Gondwana Res. 2022, 105, 299–310. [Google Scholar] [CrossRef]

- Baloch, M.A.; Zhang, J.; Iqbal, K.; Iqbal, Z. The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 2019, 26, 6199–6208. [Google Scholar] [CrossRef]

- Al-mulali, U.; Sab, C.N.B.C. The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 2012, 39, 180–186. [Google Scholar] [CrossRef]

- Gursoy-Haksevenler, B.H.; Atasoy-Aytis, E.; Dilaver, M.; Yalcinkaya, S.; Findik-Cinar, N.; Kucuk, E.; Pilevneli, T.; Koc-Orhon, A.; Siltu, E.; Gucver, S.M.; et al. A strategy for the implementation of water-quality-based discharge limits for the regulation of hazardous substances. Environ. Sci. Pollut. Res. 2021, 28, 24706–24720. [Google Scholar] [CrossRef] [PubMed]

- Vidyarthi, H. An econometric study of energy consumption, carbon emissions and economic growth in South Asia: 1972–2009. World J. Sci. Technol. Sustain. Dev. 2014, 11, 182–195. [Google Scholar] [CrossRef]

- Hassan, K.; Salim, R. Population ageing, income growth and CO2 emission: Empirical evidence from high income OECD countries. J. Econ. Stud. 2015, 42, 54–67. [Google Scholar] [CrossRef]

- Ahmad, A.; Zhao, Y.; Shahbaz, M.; Bano, S.; Zhang, Z.; Wang, S.; Liu, Y. Carbon emissions, energy consumption and economic growth: An aggregate and disaggregate analysis of the Indian economy. Energy Policy 2016, 96, 131–143. [Google Scholar] [CrossRef]

- Mohammed, K.S.; Tiwari, S.; Ferraz, D.; Shahzadi, I. Assessing the EKC hypothesis by considering the supply chain disruption and greener energy: Findings in the lens of sustainable development goals. Environ. Sci. Pollut. Res. 2023, 30, 18168–18180. [Google Scholar] [CrossRef]

- Bölük, G.; Mert, M. Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 2014, 74, 439–446. [Google Scholar] [CrossRef]

- Ben Jebli, M.; Ben Youssef, S.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2016, 60, 824–831. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 emissions, renewable energy, and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- Hu, H.; Xie, N.; Fang, D.; Zhang, X. The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: Evidence from 25 developing countries. Appl. Energy 2018, 211, 1229–1244. [Google Scholar] [CrossRef]

- Sharif, A.; Raza, S.A.; Ozturk, I.; Afshan, S. The dynamic relationship of renewable and nonrenewable energy consumption with carbon emission: A global study with the application of heterogeneous panel estimations. Renew. Energy 2019, 133, 685–691. [Google Scholar] [CrossRef]

- Raihan, A.; Rashid, M.; Voumik, L.C.; Akter, S.; Esquivias, M.A. The dynamic impacts of economic growth, financial globalization, fossil fuel, renewable energy, and urbanization on load capacity factor in Mexico. Sustainability 2023, 15, 13462. [Google Scholar] [CrossRef]

- Wang, Z.; Pham, T.L.H.; Sun, K.; Wang, B.; Bui, Q.; Hashemizadeh, A. The moderating role of financial development in the renewable energy consumption-CO2 emissions linkage: The case study of Next-11 countries. Energy 2022, 254, 124386. [Google Scholar] [CrossRef]

- Murshed, M.; Rashid, S.; Ulucak, R.; Dagar, V.; Rehman, A.; Alvarado, R.; Nathaniel, S.P. Mitigating energy production-based carbon dioxide emissions in Argentina: The roles of renewable energy and economic globalization. Environ. Sci. Pollut. Res. 2022, 29, 16939–16958. [Google Scholar] [CrossRef] [PubMed]

- Zahoor, A.; Mehr, F.; Mao, G.; Yu, Y.; Sápi, A. The carbon neutrality feasibility of worldwide and in China’s transportation sector by E-car and renewable energy sources before 2060. J. Energy Storage 2023, 61, 106696. [Google Scholar] [CrossRef]

- Gu, Z.; Gao, Y.; Li, C. An empirical research on trade liberalization and CO2 emissions in China. In Proceedings of the International Conference on Education Technology and Information System (ICETIS), Sanya, China, 21–22 June 2013; pp. 243–246. [Google Scholar] [CrossRef]

- Akın, C.S. The impact of foreign trade, energy consumption and income on CO2 emissions. Int. J. Energy Econ. Policy 2014, 4, 465–475. [Google Scholar]

- Hakimi, A.; Hamdi, H. Trade liberalization, FDI inflows, environmental quality and economic growth: A comparative analysis between Tunisia and Morocco. Renew. Sustain. Energy Rev. 2016, 58, 1445–1456. [Google Scholar] [CrossRef]

- Ling, T.Y.; Ab-Rahim, R.; Mohd-Kamal, K.-A. Trade openness and environmental degradation in Asean-5 countries. Int. J. Acad. Res. Bus. Soc. Sci. 2020, 10, 691–707. [Google Scholar] [CrossRef]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef]

- Naranpanawa, A. Does Trade Openness Promote Carbon Emissions? Empirical Evidence from Sri Lanka. Empir. Econ. Lett. 2011, 10, 973–986. [Google Scholar]

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef]

- Dogan, E.; Turkekul, B. CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef]

- Zamil, A.M.A.; Furqan, M.; Mahmood, H. Trade openness and CO2 emissions nexus in Oman. J. Entrep. Sustain. Issues 2019, 7, 1319–1329. [Google Scholar] [CrossRef]

- Rahman, M.M.; Saidi, K.; Ben Mbarek, M. Economic growth in South Asia: The role of CO2 emissions, population density and trade openness. Heliyon 2020, 6, e03903. [Google Scholar] [CrossRef] [PubMed]

- Yu, C.; Nataliia, D.; Yoo, S.J.; Hwang, Y.-S. Does trade openness convey a positive impact for the environmental quality? Evidence from a panel of CIS countries. Eurasian Geogr. Econ. 2019, 60, 333–356. [Google Scholar] [CrossRef]

- Jun, W.; Mahmood, H.; Zakaria, M. Impact of trade openness on environment in China. J. Bus. Econ. Manag. 2020, 21, 1185–1202. [Google Scholar] [CrossRef]

- Adom, P.K.; Barnor, C.; Agradi, M.P. Road transport energy demand in West Africa: A test of the consumer-tolerable price hypothesis. Int. J. Sustain. Energy 2018, 37, 919–940. [Google Scholar] [CrossRef]

- Achour, H.; Belloumi, M. Investigating the causal relationship between transport infrastructure, transport energy consumption and economic growth in Tunisia. Renew. Sustain. Energy Rev. 2016, 56, 988–998. [Google Scholar] [CrossRef]

- Neves, S.A.; Marques, A.C.; Fuinhas, J.A. Is energy consumption in the transport sector hampering both economic growth and the reduction of CO2 emissions? A disaggregated energy consumption analysis. Transp. Policy 2017, 59, 64–70. [Google Scholar] [CrossRef]

- Song, M.; Wu, N.; Wu, K. Energy consumption and energy efficiency of the transportation sector in Shanghai. Sustainability 2014, 6, 702–717. [Google Scholar] [CrossRef]

- Murtishaw, S.; Schipper, L. Disaggregated analysis of US energy consumption in the 1990s: Evidence of the effects of the internet and rapid economic growth. Energy Policy 2001, 29, 1335–1356. [Google Scholar] [CrossRef]

- Linton, C.; Grant-Muller, S.; Gale, W.F. Approaches and techniques for modelling CO2 emissions from road transport. Transp. Rev. 2015, 35, 533–553. [Google Scholar] [CrossRef]

- Saidi, S.; Hammami, S. Modeling the causal linkages between transport, economic growth and environmental degradation for 75 countries. Transp. Res. Part D Transp. Environ. 2017, 53, 415–427. [Google Scholar] [CrossRef]

- Shafique, M.; Azam, A.; Rafiq, M.; Luo, X. Evaluating the relationship between freight transport, economic prosperity, urbanization, and CO2 emissions: Evidence from Hong Kong, Singapore, and South Korea. Sustainability 2020, 12, 10664. [Google Scholar] [CrossRef]

- Carvalho, N.; Chaim, O.; Cazarini, E.; Gerolamo, M. Manufacturing in the fourth industrial revolution: A positive prospect in Sustainable Manufacturing. Procedia Manuf. 2018, 21, 671–678. [Google Scholar] [CrossRef]

- Wang, F.; Shackman, J.; Liu, X. Carbon emission flow in the power industry and provincial CO2 emissions: Evidence from cross-provincial secondary energy trading in China. J. Clean. Prod. 2017, 159, 397–409. [Google Scholar] [CrossRef]

- Abou-Ali, H.; Abdelfattah, Y.M.; Adams, J. Population Dynamics and Carbon Emissions in the Arab Region: An Extended STIRPAT II Model; The Economic Research Forum: Giza, Egypt, 2016; Volume 988. [Google Scholar]

- Rafiq, S.; Salim, R.; Apergis, N. Agriculture, trade openness and emissions: An empirical analysis and policy options. Aust. J. Agric. Resour. Econ. 2015, 60, 348–365. [Google Scholar] [CrossRef]

- Nejat, P.; Jomehzadeh, F.; Taheri, M.M.; Gohari, M.; Abd Majid, M.Z. A global review of energy consumption, CO2 emissions and policy in the residential sector (with an overview of the top ten CO2 emitting countries). Renew. Sustain. Energy Rev. 2015, 43, 843–862. [Google Scholar] [CrossRef]

- Tian, X.; Chang, M.; Shi, F.; Tanikawa, H. How does industrial structure change impact carbon dioxide emissions? A comparative analysis focusing on nine provincial regions in China. Environ. Sci. Policy 2014, 37, 243–254. [Google Scholar] [CrossRef]

- Salim, R.A.; Shafiei, S. Urbanization and renewable and non-renewable energy consumption in OECD countries: An empirical analysis. Econ. Model. 2014, 38, 581–591. [Google Scholar] [CrossRef]

- Cherniwchan, J. Economic growth, industrialization, and the environment. Resour. Energy Econ. 2012, 34, 442–467. [Google Scholar] [CrossRef]

- Shahbaz, M.; Salah Uddin, G.; Ur Rehman, I.; Imran, K. Industrialization, electricity consumption and CO2 emissions in Bangladesh. Renew. Sustain. Energy Rev. 2014, 31, 575–586. [Google Scholar] [CrossRef]

- Asumadu-Sarkodie, S.; Owusu, P.A. Energy use, carbon dioxide emissions, GDP, industrialization, financial development, and population, a causal nexus in Sri Lanka: With a subsequent prediction of energy use using neural network. Energy Sources Part B Econ. Plan. Policy 2016, 11, 889–899. [Google Scholar] [CrossRef]

- Asumadu-Sarkodie, S.; Owusu, P.A. Carbon dioxide emissions, GDP per capita, industrialization and population: An evidence from Rwanda. Environ. Eng. Res. 2017, 22, 116–124. [Google Scholar] [CrossRef]

- Appiah, K.; Du, J.; Yeboah, M.; Appiah, R. Causal relationship between industrialization, energy intensity, economic growth and carbon dioxide emissions: Recent evidence from Uganda. Int. J. Energy Econ. Policy 2019, 9, 237–245. [Google Scholar] [CrossRef]

- Anwar, N.; Elfaki, K.E. Examining the Relationship Between Energy Consumption, Economic Growth and Environmental Degradation in Indonesia: Do Capital and Trade Openness Matter? Int. J. Renew. Energy Dev. 2021, 10, 769–778. [Google Scholar] [CrossRef]

- Nasrollahi, Z.; Hashemi, M.-S.; Bameri, S.; Taghvaee, V.M. Environmental pollution, economic growth, population, industrialization, and technology in weak and strong sustainability: Using STIRPAT model. Environ. Dev. Sustain. A Multidiscip. Approach Theory Pract. Sustain. Dev. 2020, 22, 1105–1122. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators (WDI) 2024. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 7 July 2025).

- International Energy Agency. World Energy Outlook 2024. Available online: https://www.iea.org (accessed on 7 July 2025).

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Swamy, P.A.V.B. Efficient inference in a random coefficient regression model. Econometrica 1970, 38, 311–323. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Pedroni, P. Panel cointegration: A symptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom. Theory 2004, 20, 597–625. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Pedroni, P. Fully Modified OLS for Heterogeneous Cointegrated Panels. In Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Advances in Econometrics, Volume 15); Altagi, B.H., Fomby, T.B., Carter Hill, R., Eds.; Emerald Group Publishing Limited: Leeds, UK, 2001; pp. 93–130. [Google Scholar] [CrossRef]

- Mark, N.C.; Sul, D. Nominal exchange rates and monetary fundamentals: Evidence from a small post-Bretton Woods panel. J. Int. Econ. 2001, 53, 29–52. [Google Scholar] [CrossRef]

- Álvarez, I.C.; Barbero, J.; Rodríguez-Pose, A.; Zofío, J.L. Does institutional quality matter for trade? Institutional conditions in a sectoral trade framework. World Dev. 2018, 103, 72–87. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- You, Z.; Li, L.; Waqas, M. How do information and communication technology, human capital and renewable energy affect CO2 emission; New insights from BRI countries. Heliyon 2024, 10, e26481. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Mukhtarov, S.; Suleymanov, E. The role of renewable energy and total factor productivity in reducing CO2 emissions in Azerbaijan. Fresh insights from a new theoretical framework coupled with Autometrics. Energy Strategy Rev. 2023, 47, 101079. [Google Scholar] [CrossRef]

- Lopez, L.; Weber, S. Testing for Granger causality in panel data. Stata J. Promot. Commun. Stat. Stata 2017, 17, 972–984. [Google Scholar] [CrossRef]

- Rashid Khan, H.U.; Siddique, M.; Zaman, K.; Yousaf, S.U.; Shoukry, A.M.; Gani, S.; Sasmoko; Khan, A.; Hishan, S.S.; Saleem, H. The impact of air transportation, railways transportation, and port container traffic on energy demand, customs duty, and economic growth: Evidence from a panel of low-, middle-, and high-income countries. J. Air Transp. Manag. 2018, 70, 18–35. [Google Scholar] [CrossRef]

- McKinnon, A. Decarbonizing Logistics: Distributing Goods in a Low Carbon World, 1st ed.; Kogan Page Publishers: London, UK; New York, NY, USA, 2018; 328p. [Google Scholar]

- International Energy Agency. World Energy Outlook 2021. Available online: https://www.iea.org (accessed on 7 July 2025).

- Arbolino, R.; Carlucci, F.; de Simone, L.; Ioppolo, G.; Yigitcanlar, T. The policy diffusion of environmental performance in the European countries. Ecol. Indic. 2018, 89, 130–138. [Google Scholar] [CrossRef]

- Ćosović, E.; Mihajlović, I.; Spasojević Brkić, V. Impact of fuel consumption on CO2 emissions in road transport in European countries. In Proceedings of the XIV International Conference-Industrial Engineering and Environmental Protection (IIZS), Technical Faculty “Mihajlo Pupin”, Zrenjanin, Serbia, 3–4 October 2024; pp. 380–387. [Google Scholar] [CrossRef]

- Saha, R.C.; Abdus Sabur, H.M.; Saif, T.M.R. Environmental sustainability of inland freight transportation systems in Bangladesh. Int. Supply Chain. Technol. J. 2023, 9, 1–21. [Google Scholar] [CrossRef]

- Rabbi, M.F.; Abdullah, M. Fossil fuel CO2 emissions and economic growth in the Visegrád region: A study based on the Environmental Kuznets Curve hypothesis. Climate 2024, 12, 115. [Google Scholar] [CrossRef]

- Holappa, L. A general vision for reduction of energy consumption and CO2 emissions from the steel industry. Metals 2020, 10, 1117. [Google Scholar] [CrossRef]

- Lei, R.; Feng, S.; Lauvaux, T. Country-scale trends in air pollution and fossil fuel CO2 emissions during 2001–2018: Confronting the roles of national policies and economic growth. Environ. Res. Lett. 2021, 16, 014006. [Google Scholar] [CrossRef]

- Vo, N. Assessing the Impact of Feed-in Tariffs and Renewable Portfolio Standards on the Development of Solar Photovoltaic in Vietnam—Opportunities and Challenges. Bachelor’s Thesis, Aalto University, Espoo, Finland, 2024. [Google Scholar]

- Hariyani, H.F.; Prasetyo, D.G.; Van Ha, T.T.; Dam, B.H.; Nguyen, T.T.H. Unlocking CO2 emissions in East Asia Pacific-5 countries: Exploring the dynamics relationships among economic growth, foreign direct investment, trade openness, financial development and energy consumption. J. Infrastruct. Policy Dev. 2024, 8, 5639. [Google Scholar] [CrossRef]

- Ansari, M.A.; Haider, S.; Khan, N.A. Does trade openness affects global carbon dioxide emissions: Evidence from the top CO2 emitters. Manag. Environ. Qual. Int. J. 2020, 31, 32–53. [Google Scholar] [CrossRef]

- Yang, X.; Ramos-Meza, C.S.; Shabbir, M.S.; Ali, S.A.; Jain, V. The impact of renewable energy consumption, trade openness, CO2 emissions, income inequality, on economic growth. Energy Strategy Rev. 2022, 44, 101003. [Google Scholar] [CrossRef]

- Nasrullah, N.; Husnain, M.I.U.; Khan, M.A. The dynamic impact of renewable energy consumption, trade, and financial development on carbon emissions in low-, middle-, and high-income countries. Environ. Sci. Pollut. Res. 2023, 30, 56759–56773. [Google Scholar] [CrossRef] [PubMed]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 2018, 650 Pt 2, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Wijethunga, A.W.G.C.N.; Rahman, M.M.; Sarker, T. Does financial development moderate the relationship between economic growth and environmental quality? Environ. Sustain. Indic. 2025, 27, 100728. [Google Scholar] [CrossRef]

| Variables | Measurements | Sources |

|---|---|---|

| TCO2 | % of total fuel combustion | IEA (2024) |

| ROFT | Millions of metric tons times kilometers traveled | WDI (2024) |

| RAFT | Millions of metric tons times kilometers traveled Constant US$ | WDI (2024) |

| GDP | WDI (2024) | |

| IND | Constant US$ | WDI (2024) |

| EC | % of total energy consumption | WDI (2024) |

| TOP | Million US dollars | WDI (2024) |

| RE | % of total final energy consumption | WDI (2024) |

| FD | Domestic credit to private sector (% of GDP) | WDI (2024) |

| Ln TCO2 | Ln ROFT | Ln RAFT | Ln FD | Ln GDP | Ln IND | Ln EC | Ln TOP | Ln RE | |

|---|---|---|---|---|---|---|---|---|---|

| All sample LLCs | |||||||||

| Mean | 2.869 | 9.495 | 9.436 | 3.677 | 8.914 | 21.652 | 5.040 | 11.302 | 1.835 |

| Maximum | 4.224 | 12.115 | 12.648 | 5.194 | 11.803 | 25.988 | 11.833 | 14.105 | 3.951 |

| Minimum | 1.537 | 4.889 | 5.948 | 0.009 | 4.098 | 2.641 | 3.840 | 8.315 | −0.328 |

| Std. Dev. | 0.729 | 1.393 | 1.407 | 1.021 | 1.590 | 6.333 | 1.950 | 1.392 | 1.185 |

| European LLCs | |||||||||

| Mean | 3.158 | 9.651 | 9.227 | 4.117 | 9.599 | 21.018 | 5.233 | 2.433 | 11.929 |

| Maximum | 4.232 | 11.460 | 11.230 | 5.227 | 11.803 | 26.122 | 11.833 | 3.951 | 14.105 |

| Minimum | 1.548 | 5.624 | 5.948 | 1.360 | 6.387 | 2.641 | 3.808 | −0.083 | 8.315 |

| Std. Dev. | 0.624 | 1.087 | 0.909 | 0.749 | 1.359 | 7.472 | 2.310 | 0.931 | 1.216 |

| Asian LLCs | |||||||||

| Mean | 2.333 | 8.814 | 9.375 | 2.778 | 7.499 | 23.005 | 4.512 | 10.063 | 0.938 |

| Maximum | 3.626 | 12.115 | 12.648 | 4.369 | 9.538 | 25.070 | 4.612 | 11.960 | 2.876 |

| Minimum | 0.641 | 4.889 | 5.777 | 0.009 | 4.098 | 20.448 | 4.054 | 8.344 | −0.328 |

| Std. Dev. | 0.668 | 2.105 | 2.204 | 0.893 | 1.120 | 1.216 | 0.142 | 0.978 | 0.772 |

| Breusch-Pagan LM | Pesaran Scaled LM | Bias-Corrected Scaled LM | Pesaran CD | |

|---|---|---|---|---|

| All sample LLCs | ||||

| Ln TCO2 | 776.236 (0.000) *** | 68.767 (0.000) *** | 68.595 (0.000) *** | 21.246 (0.000) *** |

| Ln ROFT | 735.059 (0.000) *** | 64.841 (0.000) *** | 64.669 (0.000) *** | 24.921 (0.000) *** |

| Ln RAFT | 435.153 (0.000) *** | 36.246 (0.000) *** | 36.074 (0.000) *** | 6.876 (0.000) *** |

| Ln FD | 370.518 (0.000) *** | 30.083 (0.000) *** | 29.911 (0.000) *** | 11.440 (0.000) *** |

| Ln GDP | 1542.792 (0.000) *** | 141.855 (0.000) *** | 141.683 (0.000) *** | 39.187 (0.000) *** |

| Ln IND | 1085.402 (0.000) *** | 98.244 (0.000) *** | 98.073 (0.000) *** | 31.677 (0.000) *** |

| Ln EC | 650.825 (0.000) *** | 56.809 (0.000) *** | 56.637 (0.000) *** | 10.302 (0.000) *** |

| Ln TOP | 917.698 (0.000) *** | 82.255 (0.000) *** | 82.083 (0.000) *** | 28.152 (0.000) *** |

| Ln RE | 461.787 (0.000) *** | 38.785 (0.000) *** | 38.613 (0.000) *** | 15.105 (0.000) *** |

| European LLCs | ||||

| Ln TCO2 | 476.746 (0.000) *** | 70.323 (0.000) *** | 70.213 (0.000) *** | 21.753 (0.000) *** |

| Ln ROFT | 269.915 (0.000) *** | 38.408 (0.000) *** | 38.299 (0.000) *** | 14.507 (0.000) *** |

| Ln RAFT | 197.594 (0.000) *** | 27.249 (0.000) *** | 27.139 (0.000) *** | 2.525 (0.011) ** |

| Ln FD | 102.947 (0.000) *** | 12.644 (0.000) *** | 12.535 (0.000) *** | 4.072 (0.000) *** |

| Ln GDP | 629.852 (0.000) *** | 93.947 (0.000) *** | 93.838 (0.000) *** | 25.081 (0.000) *** |

| Ln IND | 387.646 (0.000) *** | 56.574 (0.000) *** | 56.465 (0.000) *** | 18.605 (0.000) *** |

| Ln EC | 293.971 (0.000) *** | 42.120 (0.000) *** | 42.011 (0.000) *** | 15.467 (0.000) *** |

| Ln TOP | 343.282 (0.000) *** | 49.729 (0.000) *** | 49.619 (0.000) *** | 16.981 (0.000) *** |

| Ln RE | 412.020 (0.000) *** | 60.335 (0.000) *** | 60.226 (0.000) *** | 19.988 (0.000) *** |

| Asian LLCs | ||||

| Ln TCO2 | 34.127 (0.000) *** | 8.119 (0.000) *** | 8.057 (0.000) *** | 0.645 (0.518) |

| Ln ROFT | 69.731 (0.000) *** | 18.397 (0.000) *** | 18.335 (0.000) *** | 7.984 (0.000) *** |

| Ln RAFT | 26.741 (0.000) *** | 5.987 (0.000) *** | 5.925 (0.000) *** | 1.517 (0.129) |

| Ln FD | 49.639 (0.000) *** | 12.597 (0.000) *** | 12.535 (0.000) *** | 6.676 (0.000) *** |

| Ln GDP | 160.542 (0.000) *** | 44.612 (0.000) *** | 44.550 (0.000) *** | 12.643 (0.000) *** |

| Ln IND | 147.389 (0.000) *** | 40.815 (0.000) *** | 40.753 (0.000) *** | 12.117 (0.000) *** |

| Ln EC | 49.186 (0.000) *** | 12.466 (0.000) *** | 12.404 (0.000) *** | −1.154 (0.248) |

| Ln TOP | 116.111 (0.000) *** | 31.786 (0.000) *** | 31.723 (0.000) *** | 10.600 (0.000) *** |

| Ln RE | 24.201 (0.000) *** | 5.254 (0.000) *** | 5.191 (0.000) *** | −1.097 (0.272) |

| All sample LLCs | European LLCs | Asian LLCs | ||||

|---|---|---|---|---|---|---|

| Statistics | T-Statistics | p-Value | T-Statistics | p-Value | T-Statistics | p-Value |

| 12.255 | 0.0001 *** | 17.698 | 0.0000 *** | 12.084 | 0.0000 *** | |

| _adj | 18.053 | 0.000 *** | 12.292 | 0.0005 *** | 16.115 | 0.0000 *** |

| CIPS | CADF | |||

|---|---|---|---|---|

| Level | 1st Difference | Level | 1st Difference | |

| All sample | ||||

| Ln TCO2 | −2.273 ** | −5.774 *** | −1.564 | −4.431 *** |

| Ln GDP | −3.476 *** | −5.254 *** | −2.557 *** | −3.986 *** |

| Ln RAFT | −1.908 | −5.317 *** | −1.935 | −4.101 *** |

| Ln ROFT | −1.816 | −5.337 *** | −1.454 | −4.059 *** |

| Ln FD | −1.788 | −5.175 *** | −1.992 | −3.752 *** |

| Ln IND | −1.798 | −4.312 *** | −2.402 ** | −3.647 *** |

| Ln TOP | −1.794 | −5.167 *** | −1.687 | −4.230 *** |

| Ln EC | −1.371 | −5.276 *** | −1.201 | −3.767 *** |

| Ln RE | −1.973 | −4.989 *** | −2.110 | −3.326 *** |

| Europe | ||||

| Ln TCO2 | −3.269 *** | −5.776 *** | −2.469 ** | −4.315 *** |

| Ln GDP | −4.193 *** | −5.933 *** | −1.912 | −4.404 *** |

| Ln RAFT | −1.747 | −5.018 *** | −1.742 | −3.717 *** |

| Ln ROFT | −1.934 | −5.946 *** | −2.228 | −4.133 *** |

| Ln FD | −1.640 | −5.053 *** | −1.630 | −3.806 *** |

| Ln IND | −0.812 | −5.151 *** | −1.067 | −4.322 *** |

| Ln TOP | −1.515 | −5.284 *** | −1.651 | −3.478 *** |

| Ln EC | −2.077 | −5.365 *** | −1.822 | −4.130 *** |

| Ln RE | −2.032 | −5.320 *** | −1.536 | −4.119 *** |

| Asia | ||||

| Ln TCO2 | −2.856 *** | −5.442 *** | −2.131 | −4.589 *** |

| Ln GDP | −2.062 | −4.970 *** | −2.229 | −4.223 *** |

| Ln RAFT | −1.832 | −5.696 *** | −2.839 ** | −4.662 *** |

| Ln ROFT | −1.913 | −5.539 *** | −1.865 | −4.589 *** |

| Ln FD | −1.946 | −5.485 *** | −2.766 ** | −4.172 *** |

| Ln IND | −1.742 | −4.845 *** | −2.391 * | −3.576 *** |

| Ln TOP | −1.896 | −5.454 *** | −2.087 | −4.252 *** |

| Ln EC | −2.237 * | −6.072 *** | −1.690 | −4.757 *** |

| Ln RE | −2.551 ** | −5.272 *** | −2.562 ** | −4.280 *** |

| All Sample LLCs | European LLCs | Asian LLCs | ||||

|---|---|---|---|---|---|---|

| Pedroni Residual Cointegration Test | ||||||

| Alternative hypothesis: common AR coefs. (within-dimension) | ||||||

| Statistic | p-value | Statistic | p-value | Statistic | p-value | |

| Panel v-Statistic | −2.244 | 0.987 | −0.300 | 0.618 | −1.857 | 0.968 |

| Panel rho-Statistic | 2.480 | 0.993 | 1.182 | 0.881 | 1.826 | 0.966 |

| Panel PP-Statistic | −0.751 | 0.226 | −2.482 | 0.006 *** | 0.321 | 0.626 |

| Panel ADF-Statistic | −1.004 | 0.157 | −3.543 | 0.000 *** | 0.537 | 0.704 |

| Alternative hypothesis: individual AR coefs. (between-dimension) | ||||||

| Panel rho-Statistic | 2.983 | 0.998 | 2.054 | 0.980 | 2.229 | 0.987 |

| Panel PP-Statistic | −2.265 | 0.011 ** | −2.165 | 0.015 ** | −0.892 | 0.186 |

| Panel ADF-Statistic | −0.033 | 0.486 | −0.785 | 0.216 | 0.983 | 0.837 |

| Kao Residual Cointegration Test | ||||||

| t-Statistic | Prob. | t-Statistic | Prob. | t-Statistic | Prob. | |

| ADF | −1.267 | 0.102 | −3.190 | 0.000 *** | −4.745 | 0.000 *** |

| All Sample LLCs | European LLCs | Asian LLCs | ||||

|---|---|---|---|---|---|---|

| Variables | Coef. | p-Value | Coef. | p-Value | Coef. | p-Value |

| Long-run analysis | ||||||

| Ln ROFT | 0.053 | 0.568 | 0.874 | 0.000 *** | 0.251 | 0.000 *** |

| Ln RAFT | −0.690 | 0.000 *** | 0.017 | 0.658 | −0.806 | 0.000 *** |

| Ln FD | 0.650 | 0.000 *** | −1.204 | 0.000 *** | 0.535 | 0.000 *** |

| Ln GDP | 0.720 | 0.000 *** | −0.355 | 0.000 *** | 0.318 | 0.000 *** |

| Ln IND | −1.104 | 0.000 *** | 1.327 | 0.000 *** | −0.525 | 0.000 *** |

| Ln EC | −3.362 | 0.000 *** | 0.303 | 0.318 | 12.595 | 0.000 *** |

| Ln TOP | −0.394 | 0.001 *** | −0.208 | 0.000 *** | 0.074 | 0.468 |

| Ln RE | 0.176 | 0.129 | 0.368 | 0.000 *** | 0.512 | 0.000 *** |

| Short-run analysis | ||||||

| Coint Eq (-1) | −0.108 | (0.053) ** | −0.121 | 0.024 ** | −0.410 | 0.025 ** |

| D(Ln ROFT) | 0.012 | (0.889) | −0.168 | 0.396 | −0.042 | 0.631 |

| D(Ln RAFT) | 0.032 | (0.574) | −0.049 | 0.504 | 0.147 | 0.590 |

| D(Ln FD) | −0.213 | (0.293) | 0.594 | 0.443 | 0.298 | 0.469 |

| D(Ln GDP) | 0.037 | (0.368) | 0.030 | 0.661 | −0.276 | 0.014 ** |

| D(Ln IND) | 0.062 | (0.635) | −0.062 | 0.712 | −0.125 | 0.675 |

| D(Ln EC) | −0.303 | (0.579) | 0.071 | 0.908 | −6.755 | 0.273 |

| D(Ln TOP) | 0.078 | (0.012) ** | −0.180 | 0.417 | −0.016 | 0.896 |

| D(Ln RE) | 0.054 | (0.423) | 0.166 | 0.268 | −0.037 | 0.663 |

| C | 4.871 | (0.057) ** | −3.352 | 0.265 | −17.395 | 0.025 * |

| All Sample LLCs | European LLCs | Asian LLCs | |

|---|---|---|---|

| Variables | Coefficient | Coefficient | Coefficient |

| FMOLS | |||

| Ln TCO2 | - | - | - |

| Ln ROFT | −0.019 (0.000) *** | 3.95 10−5 (0.997) | 0.164 (0.000) *** |

| Ln RAFT | −0.243 (0.000) *** | 0.027 (0.099) * | 0.154 (0.005) *** |

| Ln FD | −0.202 (0.000) *** | −0.248 (0.000) *** | 0.171 (0.003) *** |

| Ln GDP | 0.382 (0.000) *** | 0.544 (0.000) *** | 0.293 (0.000) *** |

| Ln IND | 0.066 (0.000) *** | −0.081 (0.000) *** | −0.305 (0.000) *** |

| Ln EC | 0.119 (0.000) *** | −0.157 (0.000) *** | −0.473 (0.000) *** |

| Ln TOP | 0.030 (0.000) *** | 0.080 (0.000) *** | −0.249 (0.000) *** |

| Ln RE | 0.098 (0.000) *** | 0.023 (0.000) *** | −0.419 (0.000) *** |

| DOLS | |||

| Ln TCO2 | - | - | - |

| Ln ROFT | −0.665 (0.000) *** | −0.014 (0.764) | 0.391 (0.001) *** |

| Ln RAFT | 1.319 (0.000) *** | 0.135 (0.006) *** | −0.252 (0.004) *** |

| Ln FD | 2.059 (0.000) *** | −0.326 (0.003) *** | 0.255 (0.011) * |

| Ln GDP | 0.848 (0.000) *** | 0.527 (0.000) *** | 0.518 (0.000) *** |

| Ln IND | −0.218 (0.594) | −0.086 (0.001) *** | −1.296 (0.000) *** |

| Ln EC | 0.423 (0.032) ** | −0.195 (0.003) *** | 5.145 (0.000) *** |

| Ln TOP | 0.203(0.112) | 0.086 (0.107) | 0.306 (0.025) * |

| Ln RE | −2.070 (0.000) *** | 0.048 (0.429) | 0.289 (0.351) |

| All Sample LLCs | European LLCs | Asian LLCs | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Null Hypothesis | W-Stat. | Zbar-Stat. | Prob. | W-Stat. | Zbar-Stat. | Prob. | W-Stat. | Zbar-Stat. | Prob. |

| Ln RAFT ≠ Ln TCO2 | 5.231 | 2.075 | 0.037 ** | 17.468 | 3.410 | 0.000 *** | 46.386 | 7.159 | 8.10−13 *** |

| Ln TCO2 ≠ Ln RAFT | 7.207 | 4.208 | 3.10−5 *** | 25.300 | 6.407 | 1.10−10 *** | 26.934 | 5.316 | 1.10−7 *** |

| Ln ROFT ≠ Ln TCO2 | 4.483 | 1.273 | 0.203 | 11.966 | 3.749 | 0.000 *** | 24.519 | 2.776 | 0.005 *** |

| Ln TCO2 ≠ Ln ROFT | 8.981 | 6.139 | 8.10−10 *** | 15.924 | 2.819 | 0.004 *** | 10.175 | −0.098 | 0.921 |

| Ln FD ≠ Ln TCO2 | 8.405 | 5.543 | 3.10−8 *** | 3.508 | 4.006 | 6.10−5 *** | 92.597 | 16.422 | 0.000 *** |

| Ln TCO2 ≠ Ln FD | 4.920 | 1.758 | 0.0786 * | 3.932 | 4.705 | 3.10−6 *** | 34.068 | 4.690 | 3.10−6 *** |

| Ln GDP ≠ Ln TCO2 | 6.923 | 3.934 | 8.10−5 *** | 4.780 | 2.936 | 0.003 *** | 13.145 | 0.496 | 0.619 |

| Ln TCO2 ≠ Ln GDP | 4.853 | 1.686 | 0.0917 * | 4.536 | 2.662 | 0.007 *** | 9.236 | −0.286 | 0.774 |

| Ln IND ≠ Ln TCO2 | 9.886 | 6.939 | 4.10−12 *** | 3.273 | 3.620 | 0.000 *** | 23.052 | 10.099 | 0.000 *** |

| Ln TCO2 ≠ Ln IND | 6.256 | 3.098 | 0.001 *** | 3.858 | 4.582 | 5.10−6 *** | 9.759 | 2.884 | 0.003 *** |

| Ln EC ≠ Ln TCO2 | 2.568 | 3.062 | 0.002 *** | 1.599 | −0.637 | 0.523 | 53.231 | 8.531 | 0.000 *** |

| Ln TCO2 ≠ Ln EC | 0.955 | −0.248 | 0.803 | 4.465 | 2.582 | 0.009 ** | 35.371 | 4.951 | 710−7 *** |

| Ln TOP ≠ Ln TCO2 | 3.847 | 0.455 | 0.648 | 16.776 | 0.191 | 0.847 | 7.075 | −0.719 | 0.471 |

| Ln TCO2 ≠ Ln TOP | 2.984 | −0.394 | 0.693 | 41.008 | 2.809 | 0.005 *** | 15.945 | 1.058 | 0.290 |

| Ln RE ≠ Ln TCO2 | 2.456 | 2.828 | 0.004 *** | 24.182 | 3.584 | 0.000 *** | 34.954 | 4.868 | 1.10−6 *** |

| Ln TCO2 ≠ Ln RE | 2.033 | 1.959 | 0.050 ** | 27.921 | 4.575 | 5.10−6 *** | 15.446 | 0.958 | 0.338 |

| Summary of causalities: All sample LLCs: RAFT ↔ TCO2; TCO2 → ROFT; FD ↔ TCO2; GDP ↔ TCO2; IND ↔ TCO2; EC → TCO2; TCO2 ↔ RE European LLCs: ROFT ↔ TCO2; RAFT ↔ TCO2; FD ↔ TCO2; GDP ↔ TCO2; IND ↔ TCO2; TCO2 → EC; TCO2 → TOP; RE ↔ TCO2 Asian LLCs: RAFT↔TCO2; ROFT→ TCO2; FD ↔ TCO2; IND ↔ TCO2; EC ↔ TCO2; RE → TCO2 | |||||||||

| Period | S.E. | Ln TCO2 | Ln ROFT | Ln RAFT | Ln FD | Ln GDP | Ln IND | Ln EC | Ln TOP | Ln RE |

|---|---|---|---|---|---|---|---|---|---|---|

| All sample LLCs | ||||||||||

| 2023 | 0.101 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 2028 | 0.193 | 96.709 | 1.040 | 0.348 | 0.724 | 0.174 | 0.324 | 0.011 | 0.173 | 0.492 |

| 2033 | 0.251 | 90.176 | 1.196 | 3.684 | 1.324 | 0.209 | 0.426 | 0.047 | 0.994 | 1.940 |

| European LLCs | ||||||||||

| 2023 | 0.081 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 2028 | 0.164 | 90.589 | 4.520 | 1.497 | 0.089 | 0.942 | 1.426 | 0.853 | 0.017 | 0.063 |

| 2033 | 0.205 | 84.927 | 7.7889 | 1.408 | 0.108 | 1.238 | 1.994 | 2.019 | 0.436 | 0.077 |

| Asian LLCs | ||||||||||

| 2023 | 0.226 | 100.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| 2028 | 0.461 | 74.878 | 1.930 | 9.988 | 2.024 | 3.634 | 1.518 | 0.992 | 0.047 | 4.986 |

| 2033 | 0.5493 | 60.925 | 1.7838 | 13.623 | 6.345 | 7.957 | 1.651 | 3.163 | 0.250 | 4.299 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Messaoudi, O.; Ouni, F.; Samet, K. Mitigating Transport-Based CO2 Emissions in Landlocked Countries: The Role of Economic Growth, Trade Openness, Freight Transportation and Renewable Energy Consumption. Sustainability 2025, 17, 9058. https://doi.org/10.3390/su17209058

Messaoudi O, Ouni F, Samet K. Mitigating Transport-Based CO2 Emissions in Landlocked Countries: The Role of Economic Growth, Trade Openness, Freight Transportation and Renewable Energy Consumption. Sustainability. 2025; 17(20):9058. https://doi.org/10.3390/su17209058

Chicago/Turabian StyleMessaoudi, Oumayma, Fedy Ouni, and Kaies Samet. 2025. "Mitigating Transport-Based CO2 Emissions in Landlocked Countries: The Role of Economic Growth, Trade Openness, Freight Transportation and Renewable Energy Consumption" Sustainability 17, no. 20: 9058. https://doi.org/10.3390/su17209058

APA StyleMessaoudi, O., Ouni, F., & Samet, K. (2025). Mitigating Transport-Based CO2 Emissions in Landlocked Countries: The Role of Economic Growth, Trade Openness, Freight Transportation and Renewable Energy Consumption. Sustainability, 17(20), 9058. https://doi.org/10.3390/su17209058