Medium- and Heavy-Duty Electric Truck Charging Assessment to 2035 in California: Projections and Practical Challenges

Abstract

1. Introduction

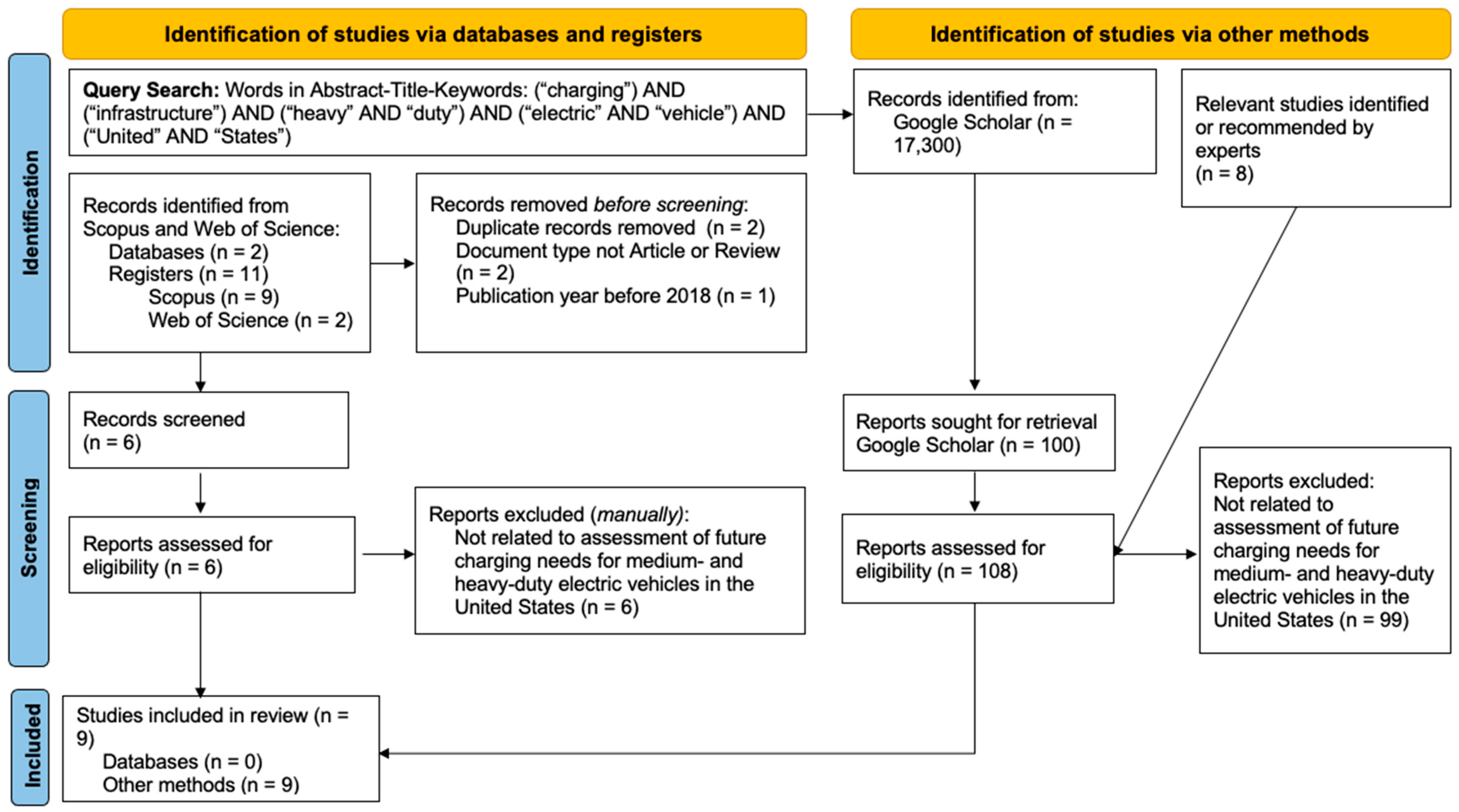

2. Materials and Methods

3. Results

3.1. Studies Found

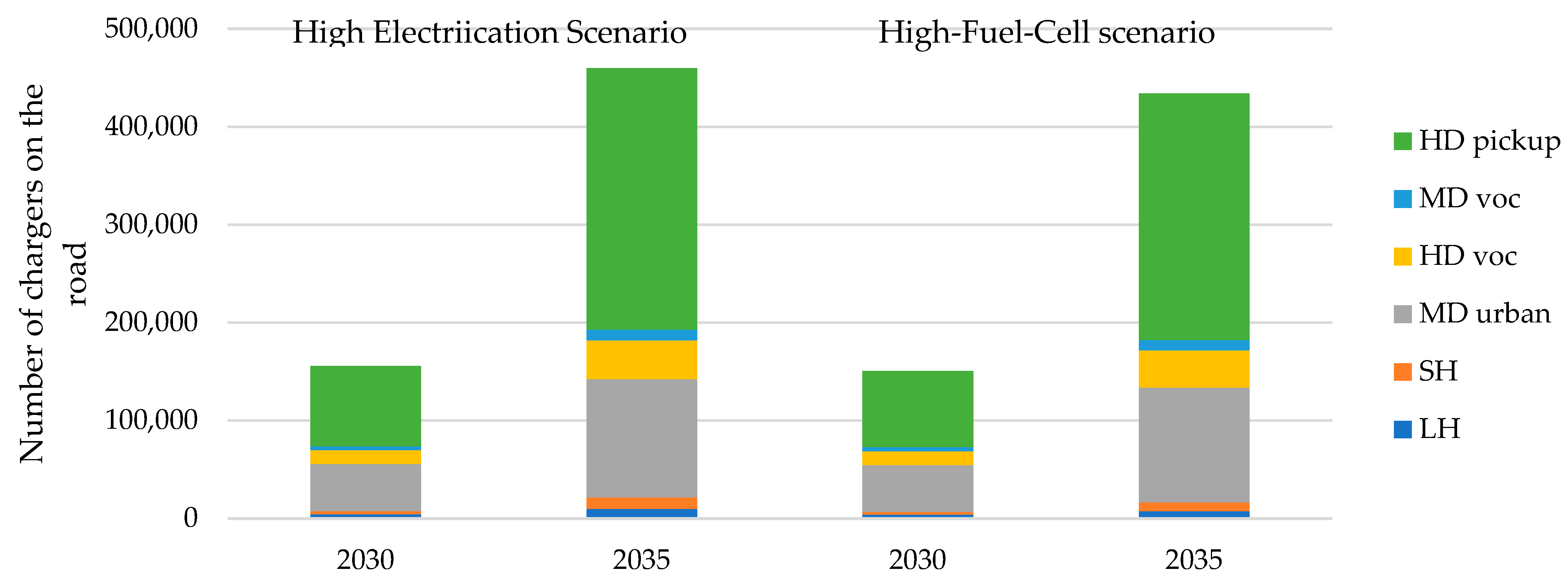

3.2. Future Charging Needs

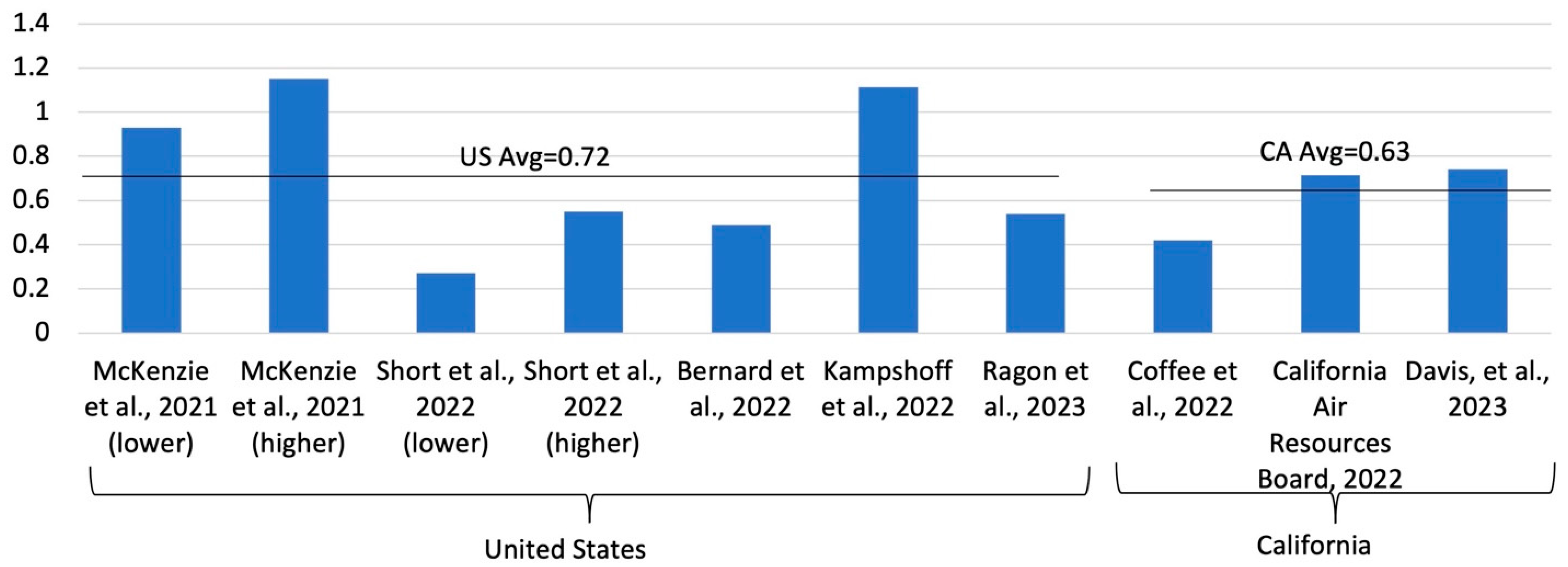

3.3. Charger-to-Vehicle Ratio

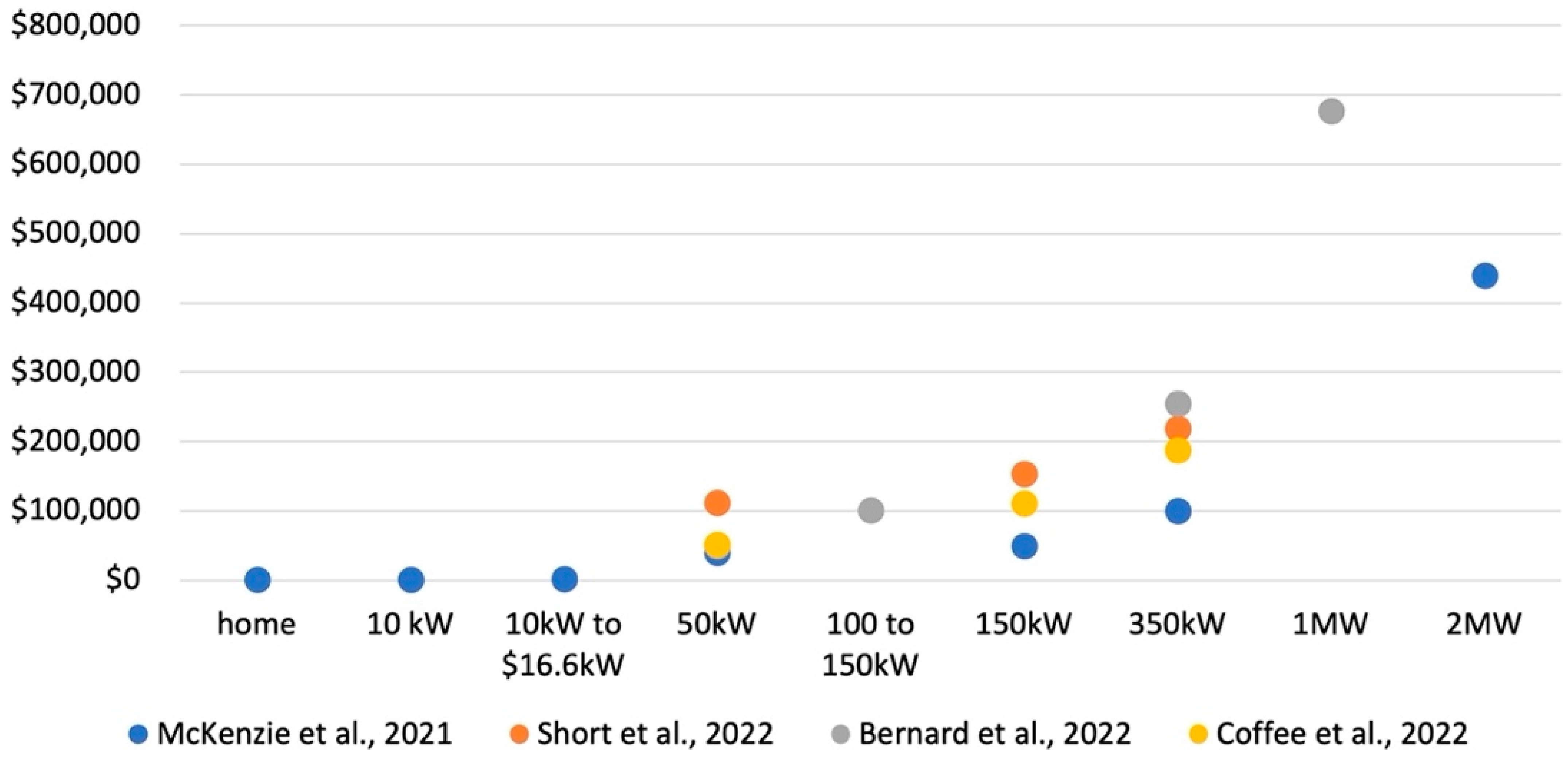

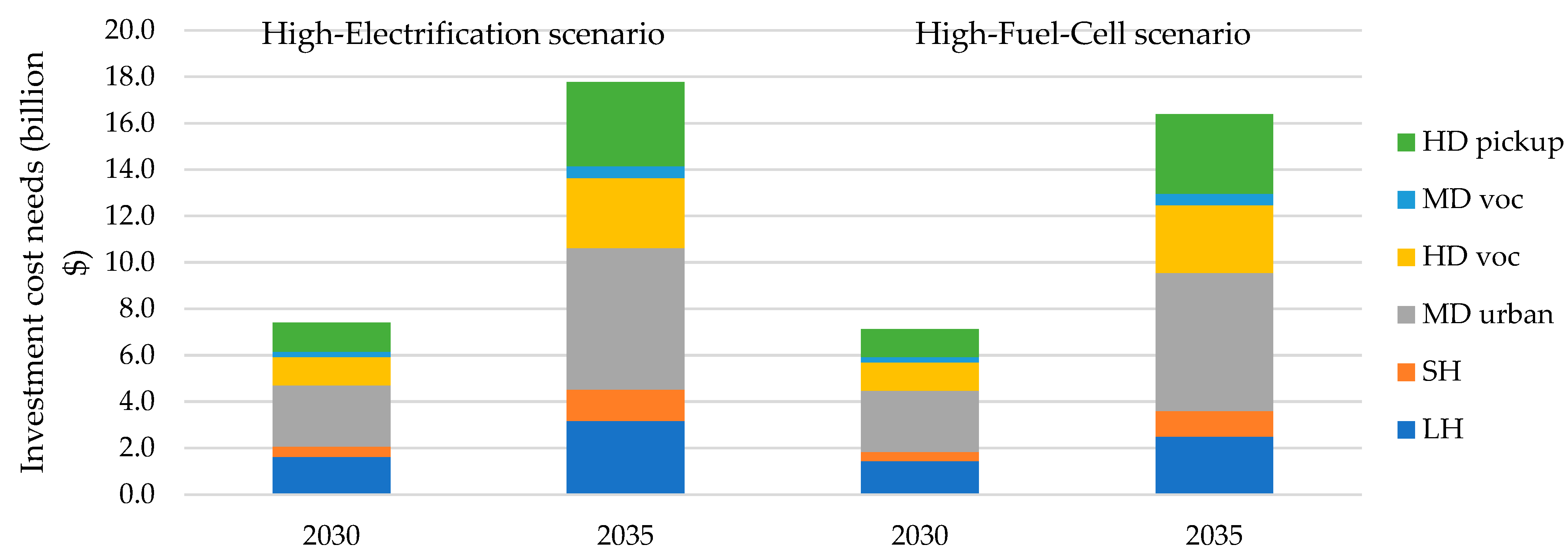

3.4. Associated Investment Needs for M/HD Charging

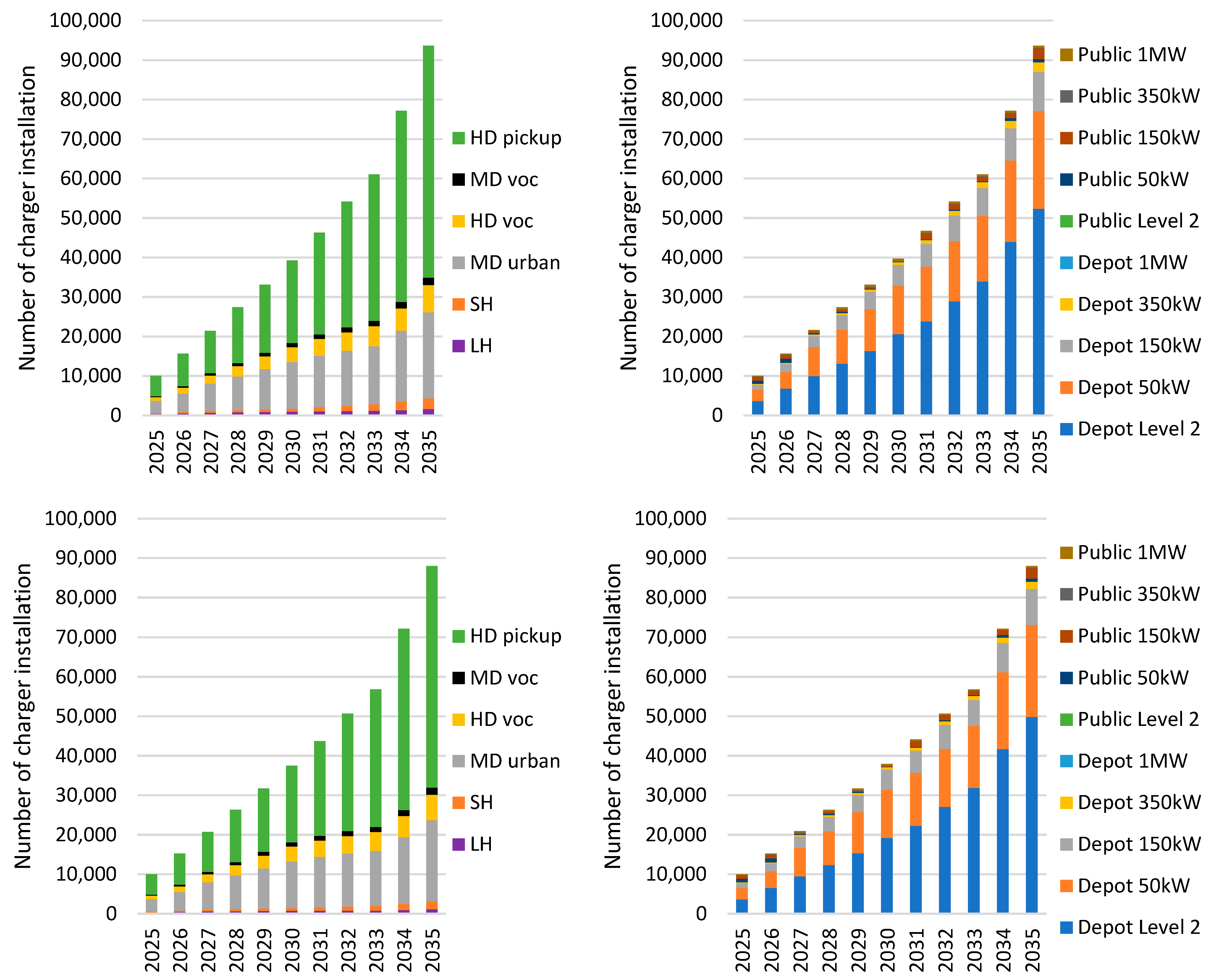

4. A Matrix for Projecting M/HD Charging Needs and Scenario Analysis Results

5. Discussion

- Creating a detailed roadmap for charging infrastructure planning in cooperation with fleets and stakeholders;

- Setting up charging pilot programs with detailed data acquisition and analysis to better understand battery-electric truck charging behavior in their operations;

- On-going tracking of the system and where new investment is needed;

- Standardization of both hardware and software to create a clear view on the level of power needed in different situations.

- Coordinate with the utility earlier on to identify any technical challenges and associated costs.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| BEVs | Battery-electric vehicle |

| EVs | Electric vehicles |

| CA | California |

| CEC | California Energy Commission |

| CARB | California Air Resources Board |

| DCFC | Direct current fast charger |

| DOE | Department of Energy |

| EVSE | Electric vehicle supply equipment |

| FCEVs | Fuel-cell electric vehicles |

| ICE | Internal combustion engine vehicles |

| IEPR | Integrated Energy Policy Report |

| MDVs | Medium-duty vehicles (Class2b-6) |

| M/HD | Medium- and heavy-duty (Class2b-8) |

| MD | Medium-duty |

| HD | Heavy-duty |

| NA | Not applicable |

| HDVs | Heavy-duty vehicles (Class 7 and 8) |

| PEVs | Plug-in electric vehicles (including battery-electric vehicles and plug-in hybrid electric vehicles) |

| U.S. | United States |

| ZEV | Zero-emission vehicle |

Appendix A. Estimated Charging Needs and Assumptions of M/HD Battery-Electric Truck Stock in Reviewed Studies

| Citation | Has Estimates of Public Charging? | Has Estimates of Private Charging? | Has Estimates of Electric M/HD Stock Size? | Details About Modeled Charging Type |

|---|---|---|---|---|

| [7] | Yes, referring to on-road charging. | Yes, including home charging and depot charging. | Yes, including Class 3 to 8. | Class 3 (home Level 2, 11.5 kW) Class 3 (depot Level 2, 10 kW) Classes 4–6 (depot Level 2, 10 kW & 16.6 kW) Classes 4–6 (depot 50 kW) Classes 4–6 (on-road 150 kW or 350 kW) Classes 7–8 excl. long-haul (depot 50 kW) Classes 7–8 excl. long-haul (depot 150 kW) Classes 7–8 excl. long-haul (on-road 350 kW) Long-haul trucks (on-road 350 kW or 2 MW) Motorhomes (on-road 350 kW) |

| [8] | Only has estimates for the total charging needs without further distinguishing it by charging type. | Only has estimated truck stock without further distinguishing it by truck type or Classes. | 120~250 kW, with an average of 210 kW. | |

| [11] | Yes. | Yes, referring to depot charging. | Yes, including charging power from 19 kW to 1600 kW. | (share of number of chargers) 19 kW & 25 kW (100% depot) 50 kW & 75 kW (87% depot & 13% public) 100 kW & 150 kW (96% depot & 4% public) 225 kW, 250 kW, & 300 kW (82% depot & 18% public) 350 kW, 450 kW, & 500 kW (83% depot & 17% public) 750 kW, 900 kW, 1000 kW, 1.05 MW, 1.2 MW, 1.4 MW, 1.6 MW (100% public) |

| [3] | Yes, including publicly accessible depot charging, and fast and ultrafast charging. | Yes, referring to overnight private depot charging. | Only has estimated truck stock without further distinguishing it by truck type or Classes. | Private charging (50 kW DC and 100–150 kW DC at depot) Private charging (350 kW DC at destination opportunity) Public charging (100–150 kW DC overnight) Public charging (350 kW DCFC for en-route and destination fast) Public charging (1 MW and 3 MW DC for en-route and destination ultrafast) |

| [9] | No. | Yes, referring to fleet depot charging. | Only has estimated truck stock without further distinguishing it by truck type or Classes. | NA |

| [12] | Yes, including Level 2 public charging and DCFC charging. | No. | Yes, including MDV and HDV. | DCFC (50 kW, 150 kW, 350 kW) |

| [13] | Yes. | Yes. | Yes, including Classes 4 to 8. | NA |

| [14] | Yes. | Yes, referring to depot charging. | Yes, including Classes 3 to 8. | Depot charging at 20 kW, 50 kW, 100 kW, and 150 kW; and public charging at 350 kW, 500 kW, 750 kW, 1 MW, 1.5 MW. Classes 7 & 8 charge at both public and depot; Classes 4–6 charge at public sites; light–heavy-duty (10,001–14,000 lbs. GVWR) charge at public sites. |

| [10] | Yes, including fast and ultrafast chargers. | Yes, referring to overnight chargers. | Yes, including Class 4 to 8 M/HD vehicles. | Overnight charging at 50–150 kW, opportunity fast charging at 350 kW, and opportunity ultrafast charging at 2 MW. |

Appendix B

| Truck Type | Depot Charging | Public Charging | Total | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Level 2 | 50 kW | 150 kW | 350 kW | 1 MW | Level 2 | 50 kW | 150 kW | 350 kW | 1 MW | ||

| 2025 | |||||||||||

| HD pickup | 71% | 10% | 0% | 0% | 0% | 0% | 14% | 10% | 0% | 0% | 105% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 20% | 10% | 105% |

| 2026 | |||||||||||

| HD pickup | 71% | 10% | 0% | 0% | 0% | 0% | 14% | 10% | 0% | 0% | 105% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 59% | 8% | 0% | 0% | 0% | 10% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 20% | 10% | 105% |

| 2027 | |||||||||||

| HD pickup | 73% | 10% | 0% | 0% | 0% | 0% | 13% | 8% | 0% | 0% | 104% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 19% | 10% | 104% |

| 2028 | |||||||||||

| HD pickup | 75% | 10% | 0% | 0% | 0% | 0% | 12% | 7% | 0% | 0% | 104% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 19% | 10% | 104% |

| 2029 | |||||||||||

| HD pickup | 77% | 10% | 0% | 0% | 0% | 0% | 11% | 6% | 0% | 0% | 104% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 19% | 10% | 104% |

| 2030 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 8% | 5% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 20% | 70% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 45% | 30% | 0% | 0% | 0% | 0% | 18% | 10% | 103% |

| 2031 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 5% | 8% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 18% | 72% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 44% | 31% | 0% | 0% | 0% | 0% | 16% | 11% | 102% |

| 2032 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 4% | 9% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 16% | 74% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 43% | 32% | 0% | 0% | 0% | 0% | 15% | 12% | 102% |

| 2033 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 4% | 9% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 14% | 76% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 42% | 33% | 0% | 0% | 0% | 0% | 14% | 13% | 102% |

| 2034 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 4% | 9% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 12% | 78% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 41% | 34% | 0% | 0% | 0% | 0% | 13% | 14% | 102% |

| 2035 | |||||||||||

| HD pickup | 80% | 10% | 0% | 0% | 0% | 0% | 3% | 10% | 0% | 0% | 103% |

| HD voc | 0% | 10% | 90% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| LH | 0% | 0% | 0% | 10% | 0% | 0% | 0% | 0% | 10% | 80% | 100% |

| MD urban | 8% | 64% | 8% | 0% | 0% | 0% | 5% | 15% | 0% | 0% | 100% |

| MD voc | 20% | 60% | 20% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 100% |

| SH | 0% | 0% | 40% | 35% | 0% | 0% | 0% | 0% | 12% | 15% | 102% |

| Year | Level 2 | 50 kW | 150 kW | 350 kW | 1 MW |

|---|---|---|---|---|---|

| 2025 | 1 | 0.5 | 0.5 | 0.4 | 0.2 |

| 2026 | 1 | 0.5 | 0.5 | 0.4 | 0.2 |

| 2027 | 1 | 0.4 | 0.4 | 0.4 | 0.2 |

| 2028 | 1 | 0.35 | 0.35 | 0.35 | 0.2 |

| 2029 | 1 | 0.3 | 0.3 | 0.3 | 0.2 |

| 2030 | 1 | 0.25 | 0.25 | 0.25 | 0.2 |

| 2031 | 1 | 0.24 | 0.24 | 0.24 | 0.18 |

| 2032 | 1 | 0.23 | 0.23 | 0.23 | 0.16 |

| 2033 | 1 | 0.22 | 0.22 | 0.22 | 0.14 |

| 2034 | 1 | 0.21 | 0.21 | 0.21 | 0.12 |

| 2035 | 1 | 0.2 | 0.2 | 0.2 | 0.1 |

| Year | Level 2 | 50 kW | 150 kW | 350 kW | 1 MW |

|---|---|---|---|---|---|

| 2024 | USD 9450.00 | USD 66,150.00 | USD 110,250.00 | USD 199,500.00 | USD 714,000.00 |

| 2025 | USD 9000.00 | USD 63,000.00 | USD 105,000.00 | USD 190,000.00 | USD 680,000.00 |

| 2026 | USD 8571.43 | USD 60,000.00 | USD 100,000.00 | USD 180,952.38 | USD 647,619.05 |

| 2027 | USD 8163.27 | USD 57,142.86 | USD 95,238.10 | USD 172,335.60 | USD 616,780.05 |

| 2028 | USD 7774.54 | USD 54,421.77 | USD 90,702.95 | USD 164,129.14 | USD 587,409.57 |

| 2029 | USD 7404.32 | USD 51,830.26 | USD 86,383.76 | USD 156,313.47 | USD 559,437.68 |

| 2030 | USD 7051.74 | USD 49,362.15 | USD 82,270.25 | USD 148,869.97 | USD 532,797.79 |

| 2031 | USD 6715.94 | USD 47,011.57 | USD 78,352.62 | USD 141,780.93 | USD 507,426.47 |

| 2032 | USD 6396.13 | USD 44,772.92 | USD 74,621.54 | USD 135,029.45 | USD 483,263.30 |

| 2033 | USD 6091.55 | USD 42,640.88 | USD 71,068.13 | USD 128,599.48 | USD 460,250.77 |

| 2034 | USD 5801.48 | USD 40,610.36 | USD 67,683.94 | USD 122,475.69 | USD 438,334.06 |

| 2035 | USD 5525.22 | USD 38,676.53 | USD 64,460.89 | USD 116,643.52 | USD 417,461.01 |

References

- Inventory of U.S. Greenhouse Gas Emissions and Sinks. Available online: https://www.epa.gov/ghgemissions/inventory-us-greenhouse-gas-emissions-and-sinks#:~:text=In%202022%2C%20U.S.%20greenhouse%20gas,sequestration%20from%20the%20land%20sector (accessed on 3 July 2024).

- Fast Facts on Transportation Greenhouse Gas Emissions. Available online: https://www.epa.gov/greenvehicles/fast-facts-transportation-greenhouse-gas-emissions (accessed on 3 July 2024).

- Bernard, M.R.; Tankou, A.; Cui, H.; Ragon, P.-L. Charging Solutions for Battery-Electric Truck; The International Council on Clean Transportation: Washington, DC, USA, 2022; Available online: https://theicct.org/wp-content/uploads/2022/12/charging-infrastructure-trucks-zeva-dec22.pdf (accessed on 29 August 2025).

- Agreement. Available online: https://ww2.arb.ca.gov/sites/default/files/2023-07/Final%20Agreement%20between%20CARB%20and%20EMA%202023_06_27.pdf (accessed on 29 August 2025).

- Abdullahi, A.; Candan, S.A.; Abba, M.A.; Bello, A.H.; Alshehri, M.A.; Afamefuna, V.E.; Umar, N.A.; Kundakci, B. Neurological and Musculoskeletal Features of COVID-19: A Systematic Review and Meta-Analysis. Front. Neurol. 2020, 11, 687. [Google Scholar] [CrossRef] [PubMed]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef] [PubMed]

- McKenzie, L.; Di Filippo, J.; Rosenberg, J.; Nigro, N. U.S. Vehicle Electrification Infrastructure Assessment—Medium- and Heavy-Duty Truck Charging. Available online: https://atlaspolicy.com/wp-content/uploads/2021/11/2021-11-12_Atlas_US_Electrification_Infrastructure_Assessment_MD-HD-trucks.pdf (accessed on 10 August 2025).

- Short, J.; Shirk, A.; Pupillo, A. Charging Infrastructure Challenges for the U.S. Electric Vehicle Fleet. Available online: https://truckingresearch.org/2022/12/charging-infrastructure-challenges-for-the-u-s-electric-vehicle-fleet/ (accessed on 10 August 2025).

- Kampshoff, P.; Kumar, A.; Peloquin, S.; Sahdev, S. Building the Electric-Vehicle Charging Infrastructure America Needs. Available online: https://www.mckinsey.com/~/media/mckinsey/industries/public%20and%20social%20sector/our%20insights/building%20the%20electric%20vehicle%20charging%20infrastructure%20america%20needs/building%20the%20electric-vehicle-charging-infrastructure-america-needs-vf.pdf (accessed on 10 August 2025).

- Ragon, P.-L.; Kelly, S.; Egerstrom, N.; Brito, J.; Sharpe, B.; Allcock, C.; Minjares, R.; Rodríguez, F. Near-Term Infrastructure Deployment to Support Zero-Emission Medium- and Heavy-Duty Vehicles in the United States. Available online: https://theicct.org/wp-content/uploads/2023/05/infrastructure-deployment-mhdv-may23.pdf (accessed on 10 August 2025).

- California Air Resources Board. Draft 2022 State Strategy for the State Implementation Plan. Available online: https://ww2.arb.ca.gov/sites/default/files/2022-08/2022_State_SIP_Strategy.pdf (accessed on 10 August 2025).

- Coffee, D.; Voleti, A.; Segui, J.; Yang, A.; DeShazo, J.R.; Kong, W. Workforce Impacts of Achieving Carbon-Neutral Transportation in California. Available online: https://innovation.luskin.ucla.edu/wp-content/uploads/2022/09/Workforce-Impacts-of-Achieving-Carbon-Neutral-Transportation-in-California.pdf (accessed on 10 August 2025).

- California Transportation Commission. California SB 671 Clean Freight Corridor Efficiency Assessment; California Transportation Commission: Sacramento, CA, USA, 2023. [Google Scholar]

- Davis, A. California Transportation Commission. Assembly Bill 2127 Electric Vehicle Charging Infrastructure Second Assessment Staff Draft Report; California Transportation Commission: Sacramento, CA, USA, 2023. [Google Scholar]

- Nicholas, M.; Hall, D.; Lutsey, N. Quantifying the Electric Vehicle Charging Infrastructure Gap Across U.S. Markets. Available online: https://theicct.org/wp-content/uploads/2021/06/US_charging_Gap_20190124.pdf (accessed on 29 August 2025).

- Hall, D.; Lutsey, N. Emerging Best Practices for Electric Vehicle Charging Infrastructure. 2017. Available online: https://theicct.org/wp-content/uploads/2021/06/EV-charging-best-practices_ICCT-white-paper_04102017_vF.pdf (accessed on 29 August 2025).

- Engelhardt, J.; Andersen, P.; Teoh, T. Guidelines—Charging Infrastructure for Truck Depots; Smart Freight Centre: Amsterdam, The Netherlands, 2023; Available online: https://smart-freight-centre-media.s3.amazonaws.com/documents/Guidelines-Charging-Infrastructure-for-Truck-Depots.pdf (accessed on 29 August 2025).

- Miller, M.; Fulton, L.; Yang, H.; Zhao, J.; Burke, A. Technology and Fuel Transition Scenarios to Low Greenhouse Gas Futures for Cars and Trucks in California to 2050. 2025. Available online: https://escholarship.org/uc/item/40k5w5h9 (accessed on 29 August 2025).

- Quan, R.; Cheng, G.; Guan, X.; Zhang, G.; Quan, J. A HO-BiGRU-Transformer based PEMFC degradation prediction method under different current conditions. Renew. Energy 2025, 256, 124132. [Google Scholar] [CrossRef]

| Document Name | Citation | Type | Geography |

|---|---|---|---|

| U.S. Vehicle Electrification Infrastructure Assessment: Medium- and Heavy-Duty Truck Charging | [7] | Think tank report | U.S. |

| Charging Infrastructure Challenges for the U.S. Electric Vehicle Fleet | [8] | Think tank report | U.S. |

| Charging Solutions for Battery-Electric Trucks | [3] | Think tank report | U.S. |

| Building the electric vehicle charging infrastructure America needs | [9] | Consulting report | U.S. |

| Near-term Infrastructure Deployment to Support Zero-emission Medium- and Heavy-duty Vehicles in the United States | [10] | Think tank report | U.S. |

| Draft 2022 State Strategy for the State Implementation Plan | [11] | Government agency document | CA |

| Workforce Impacts of Achieving Carbon-Neutral Transportation in California | [12] | Consulting report | CA |

| SB 671 Clean Freight Corridor Efficiency Assessment | [13] | Government agency document | Priority corridors in CA and CA |

| Assembly Bill 2127 Electric Vehicle Charging Infrastructure Second Assessment Staff Draft Report | [14] | Government agency document | CA |

| Citation | Geography | M/HD BEV Stock in 2030 | Estimated Number of Chargers Needed by 2030 | Share of Private/Depot Versus Public/On-Road a | Charger-to-Vehicle Ratio to 2030 | |

|---|---|---|---|---|---|---|

| Private/Depot | Public/On-Road | |||||

| [7] | U.S. | 800,000 | 564,000~470,000 b ports, and 254,000 ports for home charging. | 53,000~93,000 350 kW-ports or 10,000~19,000 2 MW-ports for long-haul truck; 6500~32,000 c ports for other trucks. | 89~97% versus 3~11% | 0.93~1.15 |

| [8] | U.S. | 2,925,000 | 801,427~1,602,855 d | NA | 0.27~0.55 | |

| [3] | U.S. | 4,700,000 by 2040 | 2,093,000 overnight private depot chargers, 69,000 public depot chargers by 2040. | 138,000 fast and ultrafast chargers by 2040. | 94% versus 6% | 0.49 |

| [9] | U.S. | 486,000 | 541,000 chargers | NA | NA | 1.11 |

| [10] | U.S. | 1,100,000 | 580,054 overnight chargers, 7869 fast chargers, 5639 ultrafast chargers. | 98% versus 2% | 0.54 | |

| [11] | CA | 112,000 | 70,391 chargers | 9599 chargers | 88% versus 12% | 0.71 |

| [12] | CA | 146,000 e | 37,357 chargers for Level 2 public charging and 23,955 DCFC chargers. | Not sure f | 0.42 | |

| [13] | CA | N/A | 152~392 private stations by 2025 (2566~7468 stations by 2040), depending on the scenario | 17~50 public stations by 2025 (1099~3648 stations by 2040), depending on the scenario | 89% versus 11% (2025) | N/A |

| [14] | CA | 155,000 | 109,497 depot chargers | 5527 public chargers | 95% versus 5% | 0.74 |

| Citation | Charger Hardware | Labor | Planning | Installation | Electrical Upgrades | Note |

|---|---|---|---|---|---|---|

| [7] | Yes | Yes | Yes | Yes | Yes a | Design, permitting, project management, and other site construction costs are included. It is assumed that EVSE hardware cost reduced by 3% per year for the next 10 years, and no further cost decline after 2030; cost of labor or other materials over time do not decline. |

| [8] | Yes | Yes | Regular maintenance and inspection cost b is not included. | |||

| [3] | Yes | Yes | Yes | Electric utility connection and construction permit are included. Cost for subsidies, inflation and the rising price of materials, or potential electricity grid upgrade due to significant variation in project and location are excluded. It is assumed that investment cost will be reduced by around 2% per year due to learning and scale effect. | ||

| [9] | Yes | Yes | Yes | |||

| [13] | Yes | Yes | Cost for site readiness and construction, design, and permitting are also included. | |||

| [12] | Yes c | Yes d |

| High-Electrification Scenario | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| LH | SH | MD Urban | HD voc | MD voc | HD pick up | Total BEV | Total FCEV | |||||||

| BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | |||

| 2025 | 1.8 | 0.1 | 0.5 | 0.0 | 7.5 | 0.2 | 1.8 | 0.0 | 0.4 | 0.0 | 12.0 | 0.4 | 24.0 | 0.7 |

| 2026 | 3.3 | 0.3 | 0.9 | 0.1 | 12.9 | 0.4 | 3.2 | 0.0 | 0.9 | 0.0 | 20.3 | 1.2 | 41.5 | 2.1 |

| 2027 | 5.3 | 0.8 | 1.4 | 0.3 | 20.6 | 0.8 | 5.3 | 0.1 | 1.4 | 0.0 | 31.9 | 2.4 | 65.8 | 4.4 |

| 2028 | 7.8 | 1.4 | 2.0 | 0.5 | 30.5 | 1.4 | 7.9 | 0.2 | 2.2 | 0.1 | 46.5 | 4.0 | 96.9 | 7.5 |

| 2029 | 10.8 | 2.3 | 2.7 | 0.7 | 42.7 | 2.0 | 11.1 | 0.3 | 3.1 | 0.1 | 64.2 | 5.9 | 134.6 | 11.4 |

| 2030 | 14.3 | 3.3 | 3.5 | 1.0 | 57.0 | 2.8 | 14.8 | 0.5 | 4.2 | 0.2 | 84.9 | 8.3 | 178.7 | 16.0 |

| 2031 | 18.9 | 4.7 | 4.7 | 1.4 | 72.4 | 3.7 | 19.0 | 0.7 | 5.4 | 0.3 | 110.5 | 12.5 | 230.9 | 23.2 |

| 2032 | 24.8 | 6.4 | 6.2 | 1.8 | 89.0 | 4.7 | 23.6 | 1.0 | 6.6 | 0.4 | 140.7 | 18.6 | 291.0 | 32.9 |

| 2033 | 31.9 | 8.5 | 8.2 | 2.4 | 106.6 | 5.9 | 28.7 | 1.3 | 7.9 | 0.6 | 175.5 | 26.5 | 358.8 | 45.1 |

| 2034 | 40.3 | 11.0 | 10.6 | 3.0 | 125.1 | 7.2 | 34.2 | 1.7 | 9.2 | 0.8 | 214.7 | 36.2 | 434.1 | 59.9 |

| 2035 | 50.0 | 13.9 | 13.4 | 3.7 | 144.5 | 8.7 | 40.1 | 2.1 | 10.5 | 1.0 | 258.1 | 47.7 | 516.7 | 77.0 |

| High-Fuel-Cell Scenario | ||||||||||||||

| LH | SH | MD Urban | HD voc | MD voc | HD pick up | Total BEV | Total FCEV | |||||||

| BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | BEV | FCEV | |||

| 2025 | 1.7 | 0.2 | 0.5 | 0.0 | 7.5 | 0.2 | 1.8 | 0.0 | 0.4 | 0.0 | 12.0 | 0.4 | 23.9 | 0.8 |

| 2026 | 3.0 | 0.7 | 0.8 | 0.2 | 12.1 | 1.2 | 3.2 | 0.1 | 0.8 | 0.1 | 19.4 | 2.2 | 39.2 | 4.4 |

| 2027 | 4.7 | 1.4 | 1.0 | 0.6 | 18.3 | 3.1 | 5.1 | 0.2 | 1.3 | 0.2 | 29.0 | 5.2 | 59.3 | 10.9 |

| 2028 | 6.8 | 2.5 | 1.2 | 1.2 | 25.9 | 6.0 | 7.6 | 0.5 | 1.8 | 0.5 | 40.8 | 9.7 | 84.2 | 20.2 |

| 2029 | 9.3 | 3.8 | 1.5 | 1.9 | 35.0 | 9.7 | 10.6 | 0.8 | 2.5 | 0.7 | 54.8 | 15.4 | 113.7 | 32.3 |

| 2030 | 12.2 | 5.4 | 1.8 | 2.7 | 45.4 | 14.3 | 14.1 | 1.2 | 3.3 | 1.1 | 70.7 | 22.5 | 147.6 | 47.2 |

| 2031 | 16.0 | 7.7 | 2.3 | 3.8 | 56.0 | 20.1 | 18.0 | 1.7 | 4.1 | 1.5 | 89.4 | 33.6 | 185.7 | 68.4 |

| 2032 | 20.6 | 10.6 | 3.1 | 5.0 | 66.6 | 27.2 | 22.3 | 2.3 | 4.9 | 2.1 | 110.5 | 48.7 | 228.1 | 95.8 |

| 2033 | 26.2 | 14.2 | 4.1 | 6.5 | 77.2 | 35.3 | 27.0 | 3.0 | 5.8 | 2.7 | 134.2 | 67.8 | 274.5 | 129.4 |

| 2034 | 32.8 | 18.6 | 5.5 | 8.1 | 87.8 | 44.6 | 32.1 | 3.7 | 6.6 | 3.4 | 160.2 | 90.7 | 324.8 | 169.1 |

| 2035 | 40.2 | 23.6 | 7.1 | 10.0 | 98.2 | 55.0 | 37.6 | 4.6 | 7.4 | 4.2 | 188.5 | 117.3 | 379.0 | 214.7 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, H.; Miller, M.; Fulton, L.; Kailas, A. Medium- and Heavy-Duty Electric Truck Charging Assessment to 2035 in California: Projections and Practical Challenges. Sustainability 2025, 17, 8693. https://doi.org/10.3390/su17198693

Yang H, Miller M, Fulton L, Kailas A. Medium- and Heavy-Duty Electric Truck Charging Assessment to 2035 in California: Projections and Practical Challenges. Sustainability. 2025; 17(19):8693. https://doi.org/10.3390/su17198693

Chicago/Turabian StyleYang, Hong, Marshall Miller, Lewis Fulton, and Aravind Kailas. 2025. "Medium- and Heavy-Duty Electric Truck Charging Assessment to 2035 in California: Projections and Practical Challenges" Sustainability 17, no. 19: 8693. https://doi.org/10.3390/su17198693

APA StyleYang, H., Miller, M., Fulton, L., & Kailas, A. (2025). Medium- and Heavy-Duty Electric Truck Charging Assessment to 2035 in California: Projections and Practical Challenges. Sustainability, 17(19), 8693. https://doi.org/10.3390/su17198693