How Does Fintech Affect Green Total Factor Energy Efficiency? Evidence from 240 Cities in China

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

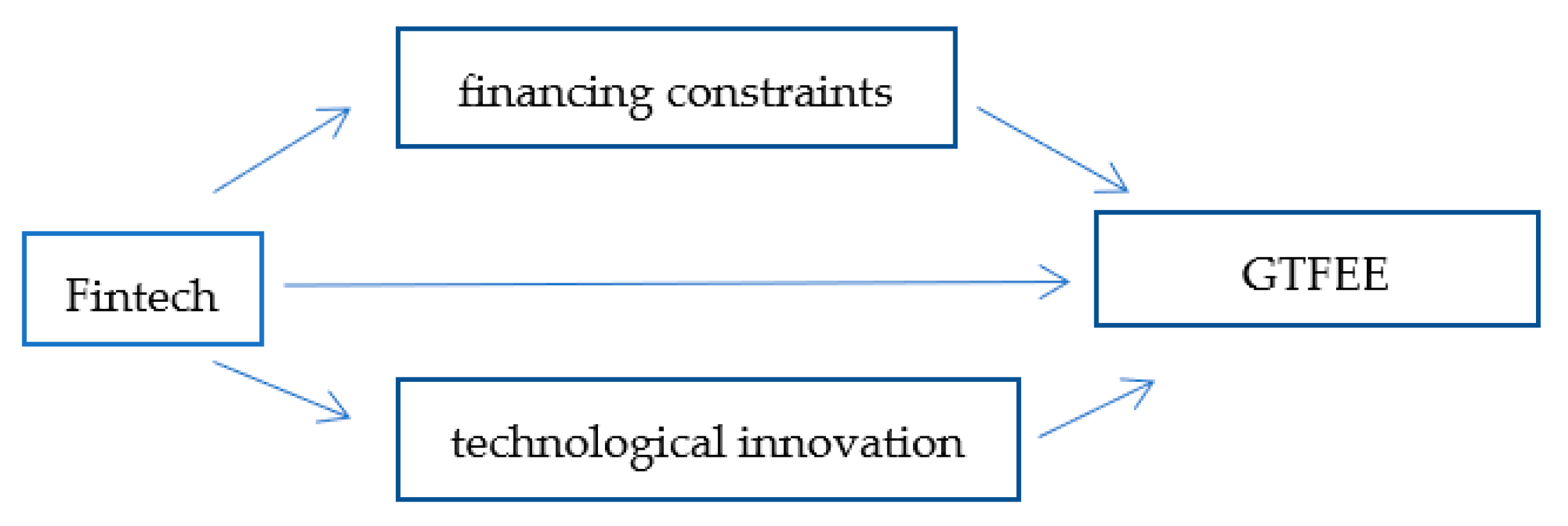

2.2. Research Hypotheses

3. Methods

3.1. Data Sources

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variables

3.3. Slack-Based Measure (SBM) Model

3.4. Malmquist–Luenberger (ML) Index

3.5. Model Construction

4. Results

4.1. Descriptive Statistics

4.2. Baseline Regression

4.3. Mechanism Analysis

4.3.1. Mediating Effect of Financing Constraints

4.3.2. Mediating Effect of Technological Innovation

4.4. Heterogeneity Analysis

4.4.1. Regional Heterogeneity Analysis

4.4.2. Stages of Economic Development Heterogeneity Analysis

4.4.3. Resource Endowment Heterogeneity Analysis

4.4.4. Urban Scale Heterogeneity Analysis

4.5. Robustness Tests

4.5.1. Endogeneity Tests

4.5.2. Explained Variable Replacement

4.5.3. Explanatory Variable Replacement

4.5.4. Model Replacement

5. Discussion

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Shangguan, J.; Xiong, P.; Ye, Z.; Wang, J. The Dynamic Relationships Among Green Technological Innovation, Government Policies, and the Low-Carbon Transformation of the Manufacturing Industry in the Yangtze River Economic Belt: An Analysis Based on the PVAR Model. Sustainability 2025, 17, 4544. [Google Scholar] [CrossRef]

- Wu, X.; Zhang, Y.; Lee, C.-C. Driving low-carbon energy transition with FinTech: The role of government environmental attention. Energy 2025, 330, 136993. [Google Scholar] [CrossRef]

- Benti, N.E.; Chaka, M.D.; Semie, A.G. Forecasting renewable energy generation with machine learning and deep learning: Current advances and future prospects. Sustainability 2023, 15, 7087. [Google Scholar] [CrossRef]

- Su, M.; Zhao, R.; Jiang, J.; Zhao, J.; Wang, M.; Zha, D.; Li, C. A blockchain system supporting cross-border data protection and consistency verification in unified global carbon emissions trading framework. J. Clean. Prod. 2024, 448, 141693. [Google Scholar] [CrossRef]

- Liu, J.; Lau, S.; Liu, S.S.; Hu, Y. How firm’s commitment to ESG drives green and low-carbon transition: A longitudinal case study from hang lung properties. Sustainability 2024, 16, 711. [Google Scholar] [CrossRef]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 2022, 193, 107308. [Google Scholar] [CrossRef]

- Dong, K.; Wang, S.; Hu, H.; Guan, N.; Shi, X.; Song, Y. Financial development, carbon dioxide emissions, and sustainable development. Sustain. Dev. 2024, 32, 348–366. [Google Scholar] [CrossRef]

- Tian, Z.; Mu, X. Towards China’s dual-carbon target: Energy efficiency analysis of cities in the Yellow River Basin based on a “geography and high-quality development” heterogeneity framework. Energy 2024, 306, 132396. [Google Scholar] [CrossRef]

- Chen, L.; Ma, M.; Xiang, X. Decarbonizing or illusion? How carbon emissions of commercial building operations change worldwide. Sustain. Cities Soc. 2023, 96, 104654. [Google Scholar] [CrossRef]

- Li, X.Y.; Zhang, H.; Peng, Z. The nonlinear dynamic effects of fintech on carbon emissions: Evidence from Chinese cities. Int. Rev. Financ. Anal. 2025, 104, 104335. [Google Scholar] [CrossRef]

- Guo, W.; Xia, W.; Kong, W.; Pan, Y. Policy, innovation, market or behavior driven effects: Energy green transition and environmental management in Chinese heterogeneous cities. J. Environ. Manag. 2024, 370, 122634. [Google Scholar] [CrossRef]

- Su, X.; He, J. Quantile connectedness among fintech, carbon future, and energy markets: Implications for hedging and investment strategies. Energy Econ. 2024, 139, 107904. [Google Scholar] [CrossRef]

- Ha, L.T.; Bouteska, A.; Harasheh, M. Dynamic connectedness between FinTech and energy markets: Evidence from fat tails, serial dependence, and Bayesian approach. Int. Rev. Econ. Financ. 2024, 93, 574–586. [Google Scholar] [CrossRef]

- Li, H.; Luo, F.; Hao, J.; Li, J.; Guo, L. How does fintech affect energy transition: Evidence from Chinese industrial firms. Environ. Impact Assess. Rev. 2023, 102, 107181. [Google Scholar] [CrossRef]

- Aziz, G.; Sarwar, S.; Waheed, R.; Anwar, H.; Khan, M.S. Relevance of fintech and energy transition to green growth: Empirical evidence from China. Heliyon 2024, 10, e33315. [Google Scholar] [CrossRef]

- Dai, B.; Zhang, J.; Hussain, N. Policy pathways through FinTech and green finance for low-carbon energy transition in BRICS nations. Energy Strat. Rev. 2025, 57, 101603. [Google Scholar] [CrossRef]

- Zeng, L.; Wong, W.-K.; Fu, H.; Mahmoud, H.A.; Cong, P.T.; Thuy, D.T.T.; Bach, P.X. FinTech and sustainable financing for low carbon energy transitions: A biodiversity and natural resource perspective in BRICS economies. Resour. Policy 2023, 88, 104486. [Google Scholar] [CrossRef]

- Siddik, A.B.; Mondal, M.S.A.; Uddin, M.; Yong, L. Harnessing FinTech for Green Growth: Financial Innovations and Energy Efficiency in OECD Nations. Res. Int. Bus. Financ. 2025, 79, 103062. [Google Scholar] [CrossRef]

- Li, B.; Wang, J.; Wang, M. Pursuit of sustainable environment; Quantifying the role of fintech, natural resources and energy efficiency in carbon neutrality in top six manufacturing nations. Resour. Policy 2024, 97, 105247. [Google Scholar] [CrossRef]

- Teng, M.; Shen, M. Fintech and energy efficiency: Evidence from OECD countries. Resour. Policy 2023, 82, 103550. [Google Scholar] [CrossRef]

- Li, Z.; Xing, Y.; Shao, X.; Zhong, Y.; Su, Y.H. Transitioning the energy landscape: AI’s role in shifting from fossil fuels to renewable energy. Energy Econ. 2025, 149, 108729. [Google Scholar] [CrossRef]

- Wang, X.; Wang, K.; Safi, A.; Umar, M. How is artificial intelligence technology transforming energy security? New evidence from global supply chains. Oeconomia Copernic. 2025, 2025, 15–38. [Google Scholar] [CrossRef]

- Bonsu, M.O.-A.; Guo, Y.; Wang, Y.; Li, K. Does Fintech lead to enhanced environmental sustainability? The mediating role of green innovation in China and India. J. Environ. Manag. 2025, 376, 124442. [Google Scholar] [CrossRef]

- Li, C.; Zhang, S. Do Innovation Policies and Fintech Create Synergistic Effects for the Sustainability of Urban Green Innovation?: An Empirical Test Based on a Triple Difference Approach. Sustain. Futures 2025, 9, 100696. [Google Scholar] [CrossRef]

- Yang, X.; Razzaq, A. Does Fintech influence green utilization efficiency of mineral resources? Evidence from China’s regional data. Resour. Policy 2024, 99, 105404. [Google Scholar] [CrossRef]

- Zhang, X.; Bao, K.; Liu, Z.; Yang, L. Digital finance, industrial structure, and total factor energy efficiency: A study on moderated mediation model with resource dependence. Sustainability 2022, 14, 14718. [Google Scholar] [CrossRef]

- Shi, Y.; Yang, B. How digital finance and green finance can synergize to improve urban energy use efficiency? New evidence from China. Energy Strat. Rev. 2024, 55, 101553. [Google Scholar] [CrossRef]

- Wu, H.; Wen, H.; Li, G.; Yin, Y.; Zhang, S. Unlocking a greener future: The role of digital finance in enhancing green total factor energy efficiency. J. Environ. Manag. 2024, 364, 121456. [Google Scholar] [CrossRef]

- Zhang, J.; Sun, Z. Does the synergy between fintech and green finance lead to the enhancement of urban green total factor energy efficiency? Empirical evidence from China. J. Environ. Manag. 2025, 382, 125366. [Google Scholar] [CrossRef]

- Bie, F.; Zhou, L.; Liu, S.; Yang, T. Government digital transformation, resource curse and green total factor energy efficiency in Chinese cities. Resour. Policy 2024, 92, 105002. [Google Scholar] [CrossRef]

- Hou, Y.; Li, X.; Wang, H.; Yunusova, R. Focusing on energy efficiency: The convergence of green financing, FinTech, financial inclusion, and natural resource rents for a greener Asia. Resour. Policy 2024, 93, 105052. [Google Scholar] [CrossRef]

- Feng, J.; Jiao, W.; Wang, Y. Bank fintech and lending distance: The role of information asymmetry and risk management channels. Econ. Model. 2025, 151, 107154. [Google Scholar] [CrossRef]

- Ahl, A.; Yarime, M.; Tanaka, K.; Sagawa, D. Review of blockchain-based distributed energy: Implications for institu-tional development. Renew. Sustain. Energy Rev. 2019, 107, 200–211. [Google Scholar] [CrossRef]

- Li, C.; Khaliq, N.; Chinove, L.; Khaliq, U.; Ullah, M.; Lakner, Z.; Popp, J. Perceived transaction cost and its antecedents associated with fintech users’ intention: Evidence from Pakistan. Heliyon 2023, 9, e15140. [Google Scholar] [CrossRef]

- Khan, H.H.; Ahmad, M.R. The Fintech Revolution: Exploring the Potential of Fintech Finance in Reducing Corporate Credit Constraints. Res. Int. Bus. Financ. 2025, 79, 103033. [Google Scholar] [CrossRef]

- Huang, A.G.; Sun, K.J. Equity financing restrictions and the asset growth effect: International vs. Asian evidence. Pac.-Basin Financ. J. 2019, 57, 101053. [Google Scholar] [CrossRef]

- Liao, K.; Ma, C.; Zhang, J.; Wang, Z. Does big data infrastructure development facilitate bank fintech innovation? Evidence from China. Financ. Res. Lett. 2024, 65, 105540. [Google Scholar] [CrossRef]

- Wang, X.; Wang, K.; Xu, B.; Jin, W. Digitalisation and technological innovation: Panaceas for sustainability? Int. J. Prod. Res. 2025, 63, 6071–6088. [Google Scholar] [CrossRef]

- Wang, K.-H.; Li, S.-M.; Lobonţ, O.-R.; Moldovan, N.-C. Is Green Innovation the “Golden Ticket” in Achieving Energy Security and Sustainable Development? Econ. Anal. Policy 2025, 87, 297–314. [Google Scholar] [CrossRef]

- Su, C.-W.; Ding, Y.-M.; Wang, K.-H. The dynamic connectedness in the carbon-clean energy-climate policy-green finance-innovation system. Econ. Change Restruct. 2025, 58, 69. [Google Scholar] [CrossRef]

- Wan, J.; Niu, Z.; Li, B. Does Fintech improve the carbon reduction effect of green credit policy? Evidence from China. Econ. Anal. Policy 2025, 85, 1258–1269. [Google Scholar] [CrossRef]

- Xuan, S.; Hu, J.; Yin, J.; Li, Y.; Peng, J. The role of FinTech in shaping urban innovation: A study of financial markets from the perspective of the patent renewal model. Pac.-Basin Financ. J. 2025, 91, 102750. [Google Scholar] [CrossRef]

- Li, Y.; Chen, Y. Development of an SBM-ML model for the measurement of green total factor productivity: The case of pearl river delta urban agglomeration. Renew. Sustain. Energy Rev. 2021, 145, 111131. [Google Scholar] [CrossRef]

- Chen, W.; Wang, J.; Ye, Y. Financial technology as a heterogeneous driver of carbon emission reduction in China: Evidence from a novel sparse quantile regression. J. Innov. Knowl. 2024, 9, 100476. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Wang, K.-L.; Pang, S.-Q.; Ding, L.-L.; Miao, Z. Combining the biennial Malmquist–Luenberger index and panel quantile regression to analyze the green total factor productivity of the industrial sector in China. Sci. Total Environ. 2020, 739, 140280. [Google Scholar] [CrossRef]

- Li, N.; Wu, D. Green supply chain, financing constraints and carbon emission reduction. Financ. Res. Lett. 2025, 80, 107382. [Google Scholar] [CrossRef]

- Klein, M.A. Patent policy, invention and innovation in the theory of Schumpeterian growth. J. Econ. Dyn. Control. 2025, 176, 105112. [Google Scholar] [CrossRef]

- Wang, W.; Wang, J.; Wu, H. Assessing the potential of energy transition policy in driving renewable energy technology innovation: Evidence from new energy demonstration city pilots in China. Econ. Change Restruct. 2024, 57, 160. [Google Scholar] [CrossRef]

- Appiah-Otoo, I.; Chen, X.; Ampah, J.D. Does financial structure affect renewable energy consumption? Evidence from G20 countries. Energy 2023, 272, 127130. [Google Scholar] [CrossRef]

- Yang, X.; Liu, X.; Ran, Q.; Razzaq, A. How does natural resource dependence influence industrial green transformation in China? Appraising underlying mechanisms for sustainable development at regional level. Resour. Policy 2023, 86, 104191. [Google Scholar] [CrossRef]

- Juknys, R.; Liobikienė, G.; Dagiliūtė, R. Sustainability of economic growth and convergence in regions of different developmental stages. Sustain. Dev. 2017, 25, 276–287. [Google Scholar] [CrossRef]

- Wu, B.; Xu, Y. Towards sustainable development: Can industrial collaborative agglomeration become an accelerator for green and low-carbon transformation of resource-based cities in China? J. Environ. Manag. 2025, 381, 125199. [Google Scholar] [CrossRef] [PubMed]

- He, N.; Zeng, S.; Jin, G. Achieving synergy between carbon mitigation and pollution reduction: Does green finance matter? J. Environ. Manag. 2023, 342, 118356. [Google Scholar] [CrossRef] [PubMed]

- Shang, X.; Liu, Q. Digital inclusive finance and regional economic resilience: Evidence from China’s 283 Cities over 2011–2021. Financ. Res. Lett. 2024, 69, 105953. [Google Scholar] [CrossRef]

| Type | Variables | Explanation | Measurement |

|---|---|---|---|

| Explained variable | GTFEE | Green total factor energy efficiency | SBM-ML method calculation |

| Explanatory variable | fintech | fintech | Fintech-related keywords were extracted from Baidu News; the total search result counts for all keywords corresponding to each prefecture-level city or municipality directly under the central government were aggregated and log-transformed. |

| Control variable | IS | Industrial structure | Value-added of secondary industry/real GDP |

| UR | Urbanization rate | Permanent urban population/total population | |

| ERS | Environmental regulation strength | Annual expenditure on waste gas/water pollution control in the regions of the listed companies and/annual industrial output value | |

| FDI | Foreign direct investment | Annual utilized FDI amount/regional GDP | |

| INV | Capital investment intensity | General budgetary expenditure of local government/regional GDP | |

| SEC | Energy consumption structure | Coal consumption/total energy consumption |

| VarName | Obs | Mean | SD | Min | P25 | Median | P75 | Max |

|---|---|---|---|---|---|---|---|---|

| GTFEE | 12,137 | 0.657 | 0.160 | 0.462 | 0.538 | 0.611 | 0.719 | 1.049 |

| fintech | 12,137 | 3.780 | 1.153 | 1.609 | 2.944 | 3.689 | 4.615 | 6.698 |

| IS | 12,137 | 0.463 | 0.070 | 0.297 | 0.413 | 0.470 | 0.519 | 0.587 |

| UR | 12,137 | 0.699 | 0.143 | 0.485 | 0.597 | 0.688 | 0.763 | 1.000 |

| ERS | 12,137 | 0.213 | 0.126 | 0.040 | 0.110 | 0.170 | 0.290 | 0.500 |

| FDI | 12,137 | 0.373 | 0.205 | 0.059 | 0.204 | 0.352 | 0.518 | 0.807 |

| INV | 12,137 | 3.678 | 2.039 | 1.105 | 2.051 | 3.328 | 5.015 | 9.152 |

| SEC | 12,137 | 0.794 | 0.089 | 0.608 | 0.722 | 0.803 | 0.858 | 0.939 |

| GPPH | 12,137 | 1.939 | 0.184 | 1.599 | 1.812 | 1.980 | 2.085 | 2.246 |

| EPE | 12,137 | 3.179 | 1.619 | 0.720 | 2.054 | 2.833 | 3.940 | 8.397 |

| (1) | (2) | |

|---|---|---|

| GTFEE | GTFEE | |

| fintech | 0.040 ** | 0.038 *** |

| (2.15) | (3.01) | |

| IS | 0.287 | |

| (1.04) | ||

| UR | −0.222 | |

| (−1.52) | ||

| ERS | 0.150 *** | |

| (3.34) | ||

| FDI | 0.049 | |

| (1.25) | ||

| INV | 0.019 *** | |

| (3.46) | ||

| SEC | −0.069 | |

| (−0.79) | ||

| GPPH | −0.283 * | |

| (−1.97) | ||

| EPE | −0.026 * | |

| (−1.66) | ||

| _cons | 0.270 *** | 0.868 *** |

| (3.80) | (3.33) | |

| Firm fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Observations | 12,135 | 12,135 |

| R2 | 0.834 | 0.877 |

| AR2 | 0.831 | 0.875 |

| (1) | (2) | |

|---|---|---|

| FC | TI | |

| fintech | −0.008 * | 0.003 *** |

| (−1.77) | (3.96) | |

| IS | −0.004 | 0.120 *** |

| (−0.05) | (7.74) | |

| UR | 0.036 | −0.020 ** |

| (0.45) | (2.05) | |

| ERS | −0.000 | 0.004 |

| (−0.02) | (1.07) | |

| FDI | 0.030 | 0.015 *** |

| (1.35) | (4.99) | |

| INV | −0.005 | 0.001 *** |

| (−1.44) | (3.75) | |

| SEC | −0.138 ** | 0.036 *** |

| (2.49) | (3.56) | |

| GPPH | 0.029 | 0.088 *** |

| (0.47) | (8.26) | |

| EPE | 0.001 | −0.001 ** |

| (0.52) | (−2.46) | |

| _cons | 3.821 *** | 4.224 *** |

| (31.56) | (171.28) | |

| Firm fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Observations | 12,135 | 12,135 |

| R2 | 0.175 | 0.979 |

| AR2 | 0.161 | 0.979 |

| (1) Eastern | (2) Central | (3) Western | |

|---|---|---|---|

| GTFEE | GTFEE | GTFEE | |

| fintech | 0.022 *** | 0.004 | 0.006 |

| (10.54) | (1.52) | (0.85) | |

| IS | 0.497 *** | 0.359 *** | 0.612 *** |

| (13.07) | (9.02) | (3.33) | |

| UR | −0.240 *** | 0.159 *** | 1.751 *** |

| (−9.48) | (5.05) | (3.14) | |

| ERS | 0.136 *** | 0.014 | −0.018 * |

| (15.38) | (1.03) | (−1.87) | |

| FDI | 0.037 *** | −0.044 *** | −0.037 |

| (6.66) | (−3.10) | (−1.24) | |

| INV | 0.018 *** | 0.002 ** | 0.009 |

| (18.22) | (2.00) | (1.13) | |

| SEC | −0.155 *** | 0.021 | 0.778 *** |

| (−8.09) | (1.26) | (10.66) | |

| GPPH | −0.499 *** | −0.048 *** | −0.055 |

| (−25.50) | (−3.02) | (−0.96) | |

| EPE | −0.031 *** | 0.002 ** | −0.010 ** |

| (−48.15) | (2.47) | (−2.51) | |

| _cons | 1.395 *** | 0.153 *** | −1.512 *** |

| (28.28) | (4.04) | (−4.28) | |

| Firm fixed effect | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes |

| Chow Test | 253.685 | ||

| p-Value | 0 | ||

| Observations | 8821 | 3116 | 198 |

| R2 | 0.887 | 0.893 | 0.979 |

| AR2 | 0.886 | 0.890 | 0.977 |

| (1) Service Cities | (2) Industrial Cities | |

|---|---|---|

| GTFEE | GTFEE | |

| fintech | 0.023 *** | 0.016 *** |

| (7.47) | (6.59) | |

| IS | 0.319 *** | −0.035 |

| (6.17) | (−0.29) | |

| UR | −0.188 *** | 0.004 |

| (−6.76) | (0.27) | |

| ERS | 0.072 *** | 0.001 |

| (10.18) | (0.07) | |

| FDI | 0.013 ** | 0.056 *** |

| (2.23) | (3.75) | |

| INV | 0.011 *** | −0.002 |

| (11.00) | (−1.06) | |

| SEC | 0.129 *** | −0.079 * |

| (4.56) | (−1.90) | |

| GPPH | −0.257 *** | −0.018 |

| (−8.11) | (−1.51) | |

| EPE | −0.029 *** | 0.002 *** |

| (−8.97) | (3.04) | |

| _cons | 0.754 *** | 0.394 *** |

| (10.67) | (4.86) | |

| Firm fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Chow Test | 993.043 | |

| p-Value | 0 | |

| Observations | 8345 | 2198 |

| R2 | 0.873 | 0.926 |

| AR2 | 0.870 | 0.921 |

| (1) Resource-Based | (2) Non-Resource-Based | |

|---|---|---|

| GTFEE | GTFEE | |

| fintech | −0.004 | 0.028 *** |

| (−0.89) | (8.43) | |

| IS | 0.322 *** | 0.371 *** |

| (5.05) | (4.97) | |

| UR | −0.038 * | −0.319 *** |

| (−1.75) | (−9.07) | |

| ERS | −0.009 | 0.122 *** |

| (−0.57) | (8.12) | |

| FDI | −0.014 | 0.031 *** |

| (−1.09) | (3.09) | |

| INV | −0.005 *** | 0.013 *** |

| (−2.85) | (13.96) | |

| SEC | 0.021 | −0.012 |

| (0.96) | (−0.52) | |

| GPPH | −0.049 *** | −0.413 *** |

| (−3.13) | (−9.96) | |

| EPE | 0.003 *** | −0.025 *** |

| (2.69) | (−8.07) | |

| _cons | 0.257 *** | 1.198 *** |

| (5.82) | (15.67) | |

| Firm fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Chow Test | 124.347 | |

| p-Value | 0 | |

| Observations | 1660 | 10,420 |

| R2 | 0.901 | 0.876 |

| AR2 | 0.896 | 0.874 |

| (1) Tier 1 Cities | (2) Tier 2 Cities | (3) Tier 3 Cities | (4) Tier 4 Cities | (5) Tier 5 Cities | |

|---|---|---|---|---|---|

| GTFEE | GTFEE | GTFEE | GTFEE | GTFEE | |

| fintech | 0.018 *** | 0.005 ** | 0.009 *** | 0.010 *** | −0.015 |

| (4.37) | (2.29) | (3.34) | (4.05) | (−0.84) | |

| IS | 0.775 *** | −0.183 *** | 0.086 * | 0.122 *** | 0.872 *** |

| (11.72) | (−4.64) | (1.92) | (3.36) | (3.03) | |

| UR | −0.229 *** | 0.207 *** | 0.041 | 0.008 | −0.699 * |

| (−7.40) | (5.73) | (1.16) | (0.28) | (−1.70) | |

| ERS | 0.236 *** | 0.173 *** | 0.023 * | −0.018 | 0.234 ** |

| (9.98) | (17.17) | (1.67) | (−1.22) | (2.09) | |

| FDI | 0.090 *** | 0.035 *** | 0.051 *** | 0.014 | −0.022 |

| (6.36) | (4.57) | (4.47) | (1.54) | (−0.20) | |

| INV | 0.013 *** | 0.012 *** | −0.004 ** | 0.001 | −0.003 |

| (9.17) | (11.87) | (−2.19) | (0.49) | (−0.31) | |

| SEC | 0.563 *** | −0.226 *** | −0.204 *** | 0.007 | 0.439 * |

| (14.09) | (−13.35) | (−9.85) | (0.31) | (1.77) | |

| GPPH | −0.855 *** | −0.397 *** | −0.127 *** | −0.039 * | 0.156 |

| (−13.19) | (−19.27) | (−5.55) | (−1.80) | (0.06) | |

| EPE | −0.036 *** | 0.004 *** | −0.006 *** | 0.002 ** | 0.008 |

| (−32.86) | (6.26) | (−4.84) | (1.97) | (1.24) | |

| _cons | 1.674 *** | 1.166 *** | 0.651 *** | 0.283 *** | −0.353 |

| (12.90) | (22.09) | (13.26) | (6.70) | (−0.09) | |

| Firm fixed effect | Yes | Yes | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes | Yes | Yes |

| Chow Test | 1087.912 | ||||

| p-Value | 0 | ||||

| Observations | 4380 | 4200 | 2149 | 1193 | 176 |

| R2 | 0.934 | 0.801 | 0.769 | 0.903 | 0.835 |

| AR2 | 0.934 | 0.799 | 0.761 | 0.897 | 0.791 |

| (1) | (2) | |

|---|---|---|

| fintech | GTFEE | |

| afintech | −247.674 *** | |

| (−222.941) | ||

| IS | −0.334 *** | 0.252 *** |

| (−5.252) | (7.826) | |

| UR | −0.068 | −0.037 |

| (−1.498) | (−1.611) | |

| ERS | −0.136 *** | 0.122 *** |

| (−6.097) | (10.831) | |

| FDI | −0.115 *** | 0.051 *** |

| (−7.406) | (6.499) | |

| INV | 0.019 *** | 0.018 *** |

| (10.421) | (20.033) | |

| SEC | 0.022 | −0.142 *** |

| (0.599) | (−7.653) | |

| GPPH | 0.320 *** | −0.127 *** |

| (7.978) | (−6.221) | |

| EPE | −0.008 *** | −0.026 *** |

| (−6.411) | (−39.921) | |

| fintech | 0.027 *** | |

| (12.053) | ||

| _cons | 480.912 *** | 0.531 *** |

| (223.132) | (12.487) | |

| Firm fixed effect | Yes | Yes |

| Year fixed effect | Yes | Yes |

| Observations | 12,137 | 12,137 |

| R2 | 0.983 | 0.009 |

| Cragg-Donald Wald F | 35,569.43 |

| (1) | |

|---|---|

| lnsuperccr | |

| fintech | 0.039 ** |

| (2.14) | |

| IS | −0.341 |

| (−1.17) | |

| UR | −0.004 |

| (−0.03) | |

| ERS | 0.142 ** |

| (2.02) | |

| FDI | 0.046 |

| (0.71) | |

| INV | 0.015 ** |

| (2.36) | |

| SEC | −0.376 * |

| (−1.97) | |

| GPPH | −0.477 ** |

| (−2.46) | |

| EPE | 0.002 |

| (0.28) | |

| _cons | 0.685 |

| (1.49) | |

| Firm fixed effect | Yes |

| Year fixed effect | Yes |

| Observations | 12,135 |

| R2 | 0.898 |

| AR2 | 0.896 |

| (1) | (2) | (3) | |

|---|---|---|---|

| GTFEE | GTFEE | GTFEE | |

| index _aggregate | 0.001 *** | ||

| (4.63) | |||

| IS | 0.263 *** | 0.278 *** | 0.272 *** |

| (9.06) | (9.76) | (9.38) | |

| UR | −0.261 *** | −0.350 *** | −0.221 *** |

| (−11.68) | (−15.70) | (−9.72) | |

| ERS | 0.129 *** | 0.099 *** | 0.134 *** |

| (12.50) | (9.74) | (13.04) | |

| FDI | 0.056 *** | 0.045 *** | 0.061 *** |

| (7.75) | (6.49) | (8.37) | |

| INV | 0.017 *** | 0.015 *** | 0.016 *** |

| (20.25) | (19.27) | (19.00) | |

| SEC | −0.088 *** | −0.087 *** | −0.089 *** |

| (−5.17) | (−5.24) | (−5.29) | |

| GPPH | −0.233 *** | −0.288 *** | −0.233 *** |

| (−12.06) | (−15.06) | (−12.11) | |

| EPE | −0.027 *** | −0.028 *** | −0.027 *** |

| (−47.44) | (−49.01) | (−47.61) | |

| coverage _breadth | 0.005 *** | ||

| (21.81) | |||

| usage _depth | 0.001 *** | ||

| (7.61) | |||

| _cons | 0.818 *** | 0.209 *** | 0.799 *** |

| (15.13) | (3.84) | (16.61) | |

| Firm fixed effect | Yes | Yes | Yes |

| Year fixed effect | Yes | Yes | Yes |

| Observations | 12,135 | 12,135 | 12,135 |

| R2 | 0.873 | 0.878 | 0.873 |

| AR2 | 0.871 | 0.876 | 0.871 |

| Variable | Q(0.25) | Q(0.50) | Q(0.75) | Q(0.90) |

|---|---|---|---|---|

| Fintech | 0.0148 (0.0124) | 0.0085 (0.0591) | 0.0318 * (0.0169) | 0.0038 *** (0.0013) |

| is | −0.1331 (0.0652) | −0.0215 (0.5316) | −0.1131 (0.1987) | −0.0894 *** (0.0183) |

| ur | 0.0895 (0.0714) | 0.2777 (0.2056) | 0.4071 *** (0.0649) | 0.6368 *** (0.0065) |

| sec | −0.1797 *** (0.0505) | −0.2167 *** (0.0512) | −0.6200 *** (0.1894) | −0.2888 *** (0.0017) |

| ers2 | −0.0663 * (0.0401) | −0.0416 * (0.0242) | 0.0498 * (0.0299) | 2.6000 *** (0.0303) |

| environmentalprotection | 0.0007 (0.0458) | −0.0002 (0.0182) | −0.0128 (0.0107) | −0.0134 *** (0.0006) |

| inv2 | 0.0005 (0.0039) | −0.0052 (0.0108) | 0.1156 *** (0.0331) | −0.0069 *** (0.0001) |

| fdii | −0.0534 ** (0.0236) | −0.0607 (0.0945) | −0.1142 (0.1632) | −0.0313 *** (0.0051) |

| lngreenpatents | 0.1441 *** (0.0358) | 0.0746 (0.0742) | 0.0059 (0.0195) | −0.1224 *** (0.0034) |

| City FE | YES | YES | YES | YES |

| Time FE | YES | YES | YES | YES |

| Observations | 12,137 | 12,137 | 12,137 | 12,137 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Z.-H.; Li, Z.-Z.; Lobonț, O.R.; Wang, K.-H. How Does Fintech Affect Green Total Factor Energy Efficiency? Evidence from 240 Cities in China. Sustainability 2025, 17, 8671. https://doi.org/10.3390/su17198671

Liu Z-H, Li Z-Z, Lobonț OR, Wang K-H. How Does Fintech Affect Green Total Factor Energy Efficiency? Evidence from 240 Cities in China. Sustainability. 2025; 17(19):8671. https://doi.org/10.3390/su17198671

Chicago/Turabian StyleLiu, Zi-Han, Zheng-Zheng Li, Oana Ramona Lobonț, and Kai-Hua Wang. 2025. "How Does Fintech Affect Green Total Factor Energy Efficiency? Evidence from 240 Cities in China" Sustainability 17, no. 19: 8671. https://doi.org/10.3390/su17198671

APA StyleLiu, Z.-H., Li, Z.-Z., Lobonț, O. R., & Wang, K.-H. (2025). How Does Fintech Affect Green Total Factor Energy Efficiency? Evidence from 240 Cities in China. Sustainability, 17(19), 8671. https://doi.org/10.3390/su17198671