1. Introduction

Climate change and urbanization have increased the frequency and intensity of natural disasters, significantly impacting the housing market [

1]. In particular, landslides not only cause short-term damage but also have complex long-term effects on the local economy and real estate values.

Previous studies on the impact of landslides on the real estate market have primarily relied on single models or hierarchical linear models focused on two levels (APT and neighborhood characteristics), which failed to adequately consider higher-level spatial factors, such as urban characteristics [

2,

3,

4,

5].

In addition, most existing studies analyze the relationship between landslides and housing prices based on a single city, making it challenging to apply to other cities [

2,

3,

4,

6]. Various factors, such as transportation, environment, economy, and culture, influence housing prices in each city. The real estate markets of the capital, major cities, and small to mid-sized cities differ significantly [

7,

8].

Therefore, this study applies 120 hierarchical linear regression (HLR) models to empirically analyze the impact of landslides on housing prices, addressing the limitations of previous research. By examining Seoul (capital city), Busan (metropolitan city), and Gunsan (medium-sized local city)—cities with different urban scales and characteristics—this study systematically analyzes changes in housing prices before and after landslides.

To be specific, Seoul is selected as the representative of large-scale capital cities because it is the political, economic, and cultural center of South Korea, with highly developed infrastructure, a dense urban environment, and dynamic housing market characteristics. Busan represents metropolitan-scale cities as it is South Korea’s second-largest city, a major coastal hub, and an area with distinct geographic features, different economic structures, and unique housing dynamics compared to Seoul.

Gunsan is chosen to represent medium-sized local cities because it reflects the characteristics of less densely populated urban areas, with slower economic growth, lower housing demand, and greater sensitivity to environmental risks. Together, these three cities capture a broad spectrum of geographic, cultural, and socioeconomic diversity within South Korea, making them suitable case studies for analyzing spatial and temporal variations in housing price responses to landslides.

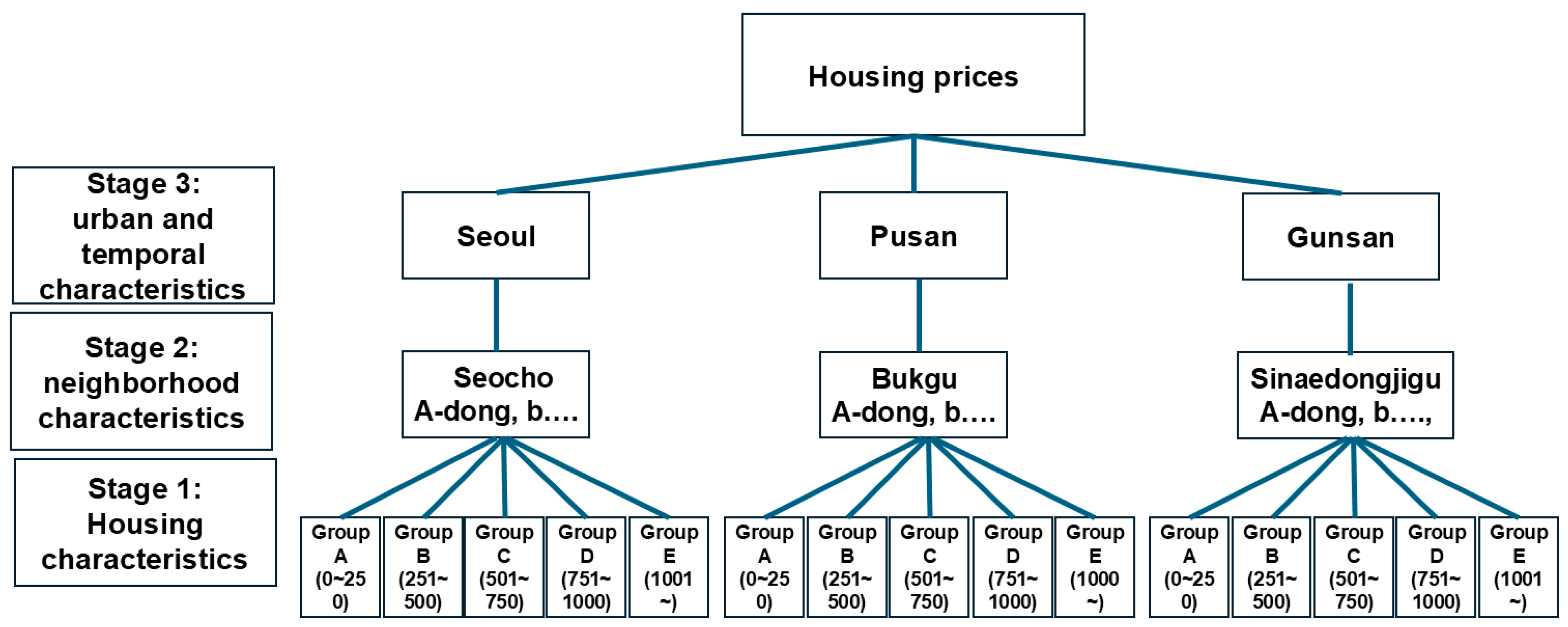

This study aims to answer the following research question: How do landslides influence housing prices in different cities? This study hypothesizes that the impacts of landslides on housing prices are not uniform but instead vary depending on their spatial proximity to hazard zones, as well as on neighborhood, urban, and temporal characteristics of each city. The hypothesis is empirically tested to enhance the understanding of real estate market dynamics following natural disasters, contributing to disaster management and urban planning. The research structure of this study is as follows (

Figure 1).

Next, landslides have long affected human lives in various ways, leading to the development of several theories related to landslides and housing prices. The theories explore the relationship between landslides and housing prices, focusing on risk perception, market behavior, and mitigation efforts [

9,

10].

The hedonic pricing theory is an economic approach that is used to estimate the impact of environmental risks, such as landslides in this study, on property values. The hedonic pricing theory assumes that housing prices reflect various attributes, including location, amenities, and risks [

11,

12].

The negative amenity theory suggests that certain environmental hazards or undesirable conditions reduce the attractiveness and housing prices. In the context of housing markets, a negative amenity refers to any factor that diminishes the desirability of a location, leading to lower housing prices [

13].

The capitalization of risk theory suggests that housing values adjust to reflect the level of risk associated with them. If landslides occur frequently in the region, housing prices may permanently decline. However, if mitigation measures, such as retaining walls, drainage systems, or zoning laws, are in place, prices may not fall as much [

14].

The spatial autocorrelation theory highlights that housing prices in landslide-prone areas do not decline uniformly; instead, price effects depend on proximity to recent disasters and the level of awareness in the community [

15].

The resilience and recovery theory reveals that some markets demonstrate resilience, with housing prices rebounding after mitigation efforts, infrastructure improvements, or time passing since the last disaster [

16].

Academic research has extensively examined the relationship between landslide risks and housing prices, employing various methodologies to assess how such hazards influence property values. A common approach is the Hedonic Pricing Model (HPM), which analyzes how different factors, including environmental risks, affect property prices. For example, Rosiers et al. highlighted that the compensation did not manage to completely offset the disadvantages of building constraints on high-risk sites in La Baie, Canada, using a representative sample of 813 between 2009 and 2016 [

2].

Scholars also have employed various econometric models to analyze the relationship between landslides and housing prices [

17,

18]. For instance, Barclay and Heath reported that elevated landslide risk is related to increased financial, economic, social, and environmental costs of housing development, as observed in case studies on Bath, one of the most intense landslide areas in the UK [

17].

Some scholars have used hierarchical linear models to understand explanatory factors related to housing prices [

3,

19]. For example, Jung and Yoon reported the effects of a landslide disaster on housing prices in Seoul, using two-stage hierarchical linear models [

3].

2. Research Methodology

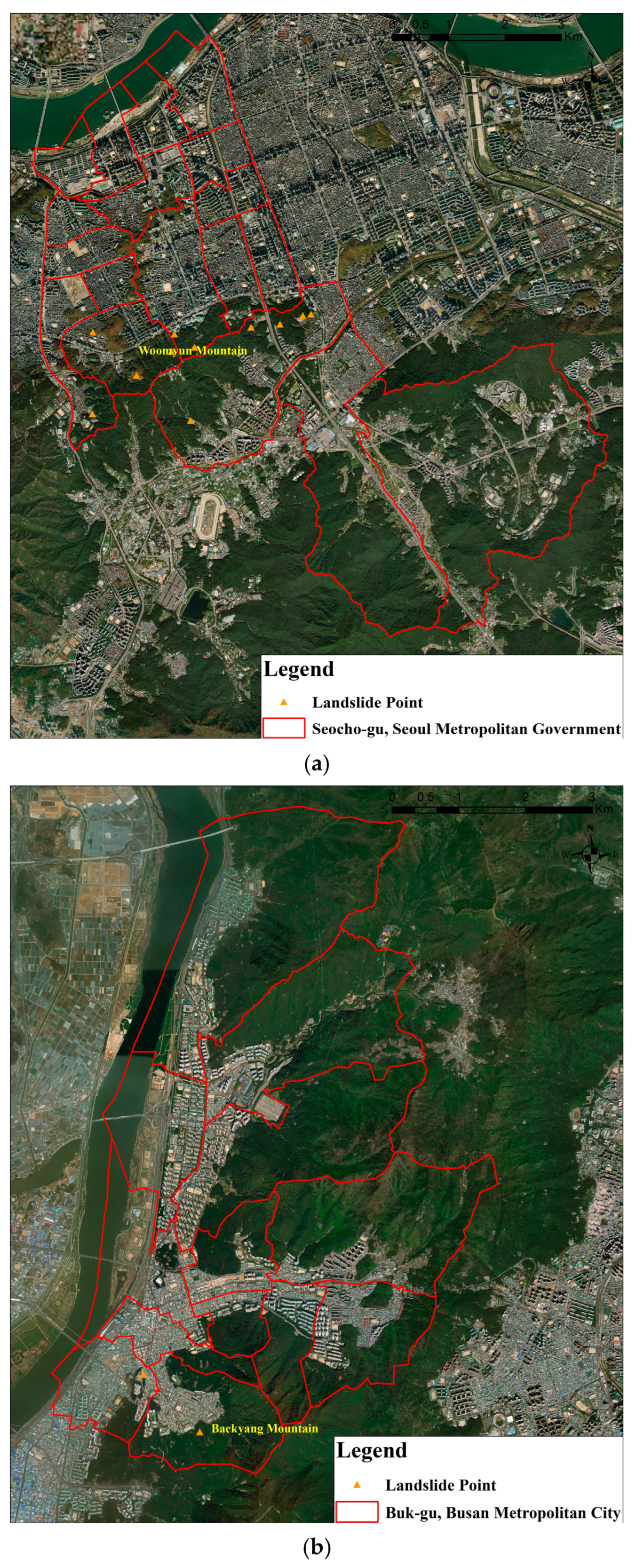

This study analyzes the APT (APT) transactions in Seochogu, Seoul (2010 to 2014), Bukgu, Busan (2013~2017), and Sinaedongjigu, Gunsan (2011~2015) based on the sales data of the Ministry of Land, Infrastructure, and Transport and the Korean Statistical Information Service, Korea (

Figure 2).

This study employs three-stage hierarchical linear regression (HLR) models to investigate the role of housing, neighborhood, city, and temporal factors in determining housing sales prices. This is because APT prices are influenced by their locations; thus, the neighborhood characteristics should be considered in the pricing model [

20].

Statistically speaking, real estate prices are determined by the attributes of individual housing units, but they also interact with neighborhood and urban characteristics [

21]. As a result, spatial autocorrelation tends to be observed at a higher spatial level that includes these properties [

22]. In such cases, if ordinary least squares (OLS) estimation is used, assuming independence of observations and homoscedasticity of errors, the estimates may not be unbiased or efficient [

23].

On the other hand, HLR provides a more robust alternative than OLS because HLR accounts for spatial dependence, reduces spatial bias in parameter estimates, adjusts for spatially varying relationships, improves standard error estimates, and allows for hierarchical data structures [

24].

This study employs three-stage HLR models, and the first block entered into the HLR has the housing variables. The second block entered into the HLR has neighborhood variables. The third block entered into the HLR includes city and temporal variables.

The dependent variable is the log value of housing sale price (completed transactions) based on the sales data adjusted for the market trend (as of June 2021: based on the data collected in February 2025, this is the most up-to-date data), using the official Korean Housing Price Index provided by the Korean government.

This adjustment method reflects macroeconomic fluctuations, policy interventions, and inflationary trends, thereby ensuring that housing prices across different years are standardized to a single comparable reference period. The application of the log transformation serves to mitigate the influence of extreme values by compressing the distribution and reducing skewness, which is common in housing price data.

Independent variables in the Stage 1 models are group 1 (~250 m), group 2 (251~500 m), group 3 (501~750 m), group 4 (751~1000 m), group 5 (1001 m~) (reference group), area, age, age

2, floor, the number of rooms, and the number of baths. The 250-m interval for the gradation of groups is determined based on both empirical housing market patterns and previous studies examining the spatial impacts of natural hazards on property values. In the context of landslide risk, the effect on housing prices tends to diminish as the distance from the hazard site increases. Prior research has suggested that housing price sensitivity to environmental hazards is most prominent within the first few hundred meters [

3,

25,

26].

The number of rooms and APT size are the most direct indicators of a property’s space and functionality. A larger APT with more rooms can accommodate more people and offers greater flexibility for living, dining, and working areas. Floor Level directly increases its value. This factor affects both desirability and safety. The number of bathrooms is crucial for a home’s convenience and comfort. Building age is a strong proxy for a property’s condition and future maintenance costs [

27,

28,

29].

Education, culture, shopping, and amenity (park) variables are added in the Stage 2 models. A neighborhood’s access to high-quality schools, both at the primary and secondary levels, significantly impacts its appeal to families. The presence of cultural amenities, such as museums, theaters, libraries, and art galleries, enriches a community and attracts a specific demographic. This increased demand can lead to higher property values. Proximity to diverse and convenient shopping options is a major draw for residents. Parks and green spaces are a crucial amenity that offers numerous benefits [

30,

31,

32].

The following temporal variables are entered into the Stage 3 models: the economy (GRDP: gross regional domestic product), population density, mean APT price, and transportation (measured by the area of roads). GRDP is a key measure of a region’s economic health and productivity. Population density reflects the concentration of demand for housing. The mean APT price of a region serves as a baseline market indicator. It reflects the general price level and affordability of housing in a given area. Well-developed transportation networks reduce commute times, improve access to jobs and services, and make a location more attractive. Temporal variables capture the impact of time-based trends and events on the housing market. For example, housing prices might increase in the spring due to higher buyer activity or fluctuate in response to changes in interest rates or government regulations [

33,

34,

35].

For the sake of readers, some people believe that neighborhood variables, such as education, culture, shopping, and parks, may be subject to endogeneity. However, the study employs a three-stage Hierarchical Linear Regression (HLR) modeling framework, which effectively separates the effects of housing-level, neighborhood-level, and city-level characteristics. By structuring the model hierarchically, we reduce the potential for confounding between neighborhood attributes and housing prices, as variations at each level are estimated independently.

Additionally, we conducted a multicollinearity diagnostic using the Variance Inflation Factor (VIF) and removed variables with high VIF values to minimize the risk of bias caused by overlapping explanatory power among neighborhood characteristics. As a result, the included variables exhibit low collinearity, allowing for a more robust estimation of the unique effects of neighborhood factors on housing prices. The final sample of this study is 60,892 (

Table 1).

One of the most significant differences between this study and previous research is the approach to analyzing the interaction between APT prices and landslide periods. While previous studies typically build a single model using interaction variables between the periods after a landslide and the APT transaction, this study employs 10 separate models for different time periods.

Furthermore, this study develops Stage 1 to Stage 3 hierarchical models for nationwide, Seoul, Busan, and Gunsan regions, to empirically demonstrate how housing, neighborhood, city, and temporal characteristics play a different role in APT prices across the three stages and regions.

To be specific, while prior research presents a simple single model, this paper proposes a total of 120 econometric models (10 time periods (first and second half year × five years) × 4 regions (nationwide, Seoul, Busan, and Gunsan) × 3 hierarchical stages (housing, neighborhood, and city and temporal characteristics)).

The temporal scope of the three landslides considered in this study spans the 2010s but differs slightly: Seoul (2010–2014), Busan (2013–2017), and Gunsan (2011–2015). This study divides the time periods into ten phases to examine pre- and post-landslide APT prices as follows: p1 (first half of the year, one year before the landslide), p2 (second half of the year, one year before the landslide), p3 (first half of the year, based on the landslide occurrence), p4 (second half of the year, based on the landslide occurrence).

P5 (first half of the year, one year after the landslide), p6 (second half of the year, one year after the landslide), p7 (first half of the year, two years after the landslide), p8 (second half of the year, two years after the landslide), p9 (first half of the year, three years after the landslide), and p10 (second half of the year, three years after the landslide). The ten periods allow authors to employ a comprehensive examination of APT price changes across different periods.

Next, all prices are adjusted to June 2021 values using the Housing Sales Price Index provided by the Korean government, and then converted into logarithmic values, as APT prices may react differently across different time periods. Additionally, an annual–month control variable is established, starting from January 2010, to control for the different timelines among Seoul, Busan, and Gunsan.

Additionally, in Seoul, the landslide typically occurs in July, whereas in Busan and Gunsan, it occurs in August. To prepare for potential multicollinearity issues between the year–month control variable and other explanatory variables, an alternative month control variable starting in January is also constructed to control for monthly effects over time in relation to landslide events.

To be specific, since the landslide events in Seoul, Busan, and Gunsan occurred in different years, incorporating a single year–month control variable would likely have created strong multicollinearity with the explanatory variables, which represent the unique characteristics of each city. Therefore, we constructed a separate month control variable, beginning in January, as an alternative. This approach allows us to properly account for monthly or seasonal effects across all three cities without compromising the statistical validity of our models.

To address potential multicollinearity issues, we first perform a preliminary analysis by including all constructed variables in our initial models. Variables with high Variance Inflation Factor (VIF) values are subsequently removed. This process ensured the elimination of multicollinearity issues, allowing us to select the final, robust model.

In the final model, there are multicollinearity issues between the APT age and the squared term of the APT age. Thus, this study excludes the squared term of APT age in the model. Additionally, there are high multicollinearity problems among the city variables, specifically GRDP, population density, road area, and average APT prices. Therefore, this study utilizes dummy variables for Busan and Gunsan in reference to Seoul. Lastly, due to high multicollinearity between the year–month variable and city dummy variables, the year–month variable is replaced with the monthly variable in the Stage 3 model to control for monthly effects.

3. Results

All 10 nationwide models show that the Stage 2 and Stage 3 models are statistically and significantly better than the Stage 1 model (

Table 2). For example, at P4 (right after the landslide), the Stage 2 model shows an R

2 change of 0.140 and an F change of 353.646 at the 0.001 significance level. In the Stage 3 model, the R

2 change is 0.249, and the F change is 2643.223. These results indicate that neighborhood, city, and temporal factors should be considered when analyzing changes in APT prices, supporting the suitability of the hierarchical linear model. For a more specific example, in the post-landslide period (p4), the regression coefficients for the group within 250 m of the landslide are as follows: only Stage 1 characteristics are considered (−0.072), Stage 2 characteristics are included (−0.101), and Stage 3 characteristics are added (−0.081). The results highlight that prior studies, which do not consider neighborhood, city, and temporal characteristics, may have biased coefficients in the econometric model.

Next, in Seoul, Busan, and Gunsan models, the Stage 2 models are statistically and significantly better than the Stage 1 model across all 60 models. Temporal characteristics in Stage 3 are significant for four out of ten models in Seoul, five out of ten models in Busan, and seven out of ten models in Gunsan. The results suggest that seasonal variations have a more significant impact on changes in APT prices from Seoul to smaller cities. One interesting characteristic is that temporal characteristics do not show significant values in APT prices due to seasonal variations right after the landslide (p4) in all three regions.

To be specific, in the nationwide model, similar to previous studies, which are based on Seoul, the post-landslide period (p4) shows that transaction prices are lower in all distance groups: 8.1% for the 250-m group, 3.5% for the 500-m group, 3.6% for the 750-m group, and 4.6% for the 1000-m group. However, this result does not indicate that housing prices drop due to the landslide. The pre-landslide period (p3) model reveals that the 250-m group is already trading at 8.9% lower, the 500-m group at 4.0% lower, the 750-m group at 5.5% lower, and the 1000-m group at 3.7% lower. In fact, after the landslide (p4), the 250-m group shows a 0.8% increase, the 500-m group a 0.5% increase, and the 750-m group a 1.9% increase, whereas only the 1000-m group shows a 0.9% decrease (

Table 3 and

Table 4). Therefore, at the national level, price fluctuations among groups right after the landslides cannot be considered negative.

From a long-term perspective, both 250-m and 500-m groups demonstrate slight price increases after the landslide but experience a significant drop the following year (

Figure 3). Starting from P7 (first half of the second year), prices begin to rise again. Prices in the 750-m group rise immediately after the landslide, then decline, which shows a fluctuating pattern of ups and downs. Prices in the 1000-m group drop immediately after the landslide and continue to decline until the first half of the following year, after which they show a general upward trend. These patterns indicate varied short- and long-term price reactions to landslides depending on the distance to the mountain. One interesting finding is that the 250-m group, the 500-m group, the 750-m group, and the 1000-m group all show lower housing prices than the reference group (1001~) during all 10 periods. The finding implies that the amenity effects of mountains are not greater than their hazard effects.

In contrast, Seoul generally shows a decrease in APT prices after the landslide. For example, pre-landslide APT prices (p3) reveal that the 250-m group trades at 10.6% lower, the 500-m group at 7.0% lower, the 750-m group at 6.9% lower, and the 1000-m group at 0.1% lower. After the landslide (p4), the 250-m group increases by 0.9%, while the 500-m group, 750-m group, and 1000-m group trade at 1.9%, 4.2%, and 3.5% lower, respectively (

Table 5 and

Table 6).

From a long-term perspective, prices in 250-m and 500-m groups remain similar to pre-landslide levels in the next year but drop significantly in the second year. Although there is a rebound, prices are never fully recovered to their original levels. Prices of the 750-m group decline until the first half of the year following the landslide and then stabilize. Prices of the 1000-m group increase in the next year but begin to decline again two years later, ultimately returning to levels similar to the pre-landslide period.

For Busan, pre-landslide APT prices (p3) are lower by 13.4% for the 250-m group, 2.5% for the 500-m and 750-m groups, and 3.7% for the 1000-m group. Post-landslide (p4), the 250-m group decreases by 3.2%, the 500-m group by 4.1%, and the 1000-m group by 2.2%, while the 750-m group shows no change (

Table 7 and

Table 8).

From a long-term perspective, all distance groups (250 m, 500 m, 750 m, and 1000 m) show a downward trend in APT prices. Busan demonstrates the most significant price decline across all groups compared to pre-landslide levels, indicating that Busan is the most sensitive city among the three cities to the landslide’s impact.

For Gunsan, pre-landslide APT prices (p3) are lower by 5.1% for the 250-m group, 0.8% for the 500-m group, 9.4% for the 750-m group, and 7.2% for the 1000-m group. Post-landslide (p4), the 250-m group shows a 0.1% decrease, the 500-m group a 1.6% decrease, and the 750-m group a 3.6% increase, while the 1000-m group trades at 7.0% lower (

Table 9 and

Table 10).

From a long-term perspective, the 250-m group experiences the smallest changes and eventually recovers to pre-landslide price levels. The 500-m group exhibits a sharp decline in the year following the landslide, with prices rebounding two years later but ultimately remaining below pre-landslide levels. The 750-m and 1000-m groups, despite some fluctuations, end up with prices higher than pre-landslide levels.

In sum, the landslide’s impact on APT prices across zones is not negative at the national level. In Seoul, consistent with previous studies, the landslide generally has a negative impact on prices. In Busan, the landslide has the most pronounced impact, with significant price declines across all distance groups. Gunsan exhibits mixed fluctuations, with some groups recovering or even exceeding pre-landslide prices (

Table 11).

These findings highlight that the impact of landslides on APT prices varies depending on the neighborhood, city, and temporal characteristics. The results underscore that scholars should take the different characteristics of neighborhoods, cities, and time into account when explaining the effects of landslides on APT prices in their empirical models.

4. Discussion

4.1. Theoretical Contributions

This study contributes to disaster risk, housing market, and urban resilience theories by integrating spatial–temporal dynamics into the analysis of landslide impacts. Our findings align with and extend previous studies on risk perception and housing market behavior.

For instance, prior studies emphasize that residents’ perceptions of environmental hazards significantly affect property values, which is consistent with our result showing sharp APT price declines within the 250 m risk zone [

36,

37,

38]. By providing quantitative evidence based on a multi-city framework, our findings strengthen theoretical claims that hazard proximity strongly influences buyer decision-making, while also showing that the magnitude of the effect varies across urban contexts.

This study further advances theories of urban vulnerability and resilience. Previous literature highlights the concept of disaster capitalism, in which natural disasters may create investment opportunities in some areas while accelerating economic decline in others [

39].

Our findings provide empirical support for this theory by demonstrating that Seoul’s high-income housing markets recovered more quickly after landslides. At the same time, Busan and Gunsan exhibited prolonged declines, indicating city-specific resilience capacities. This highlights that resilience cannot be generalized across regions and must be analyzed within spatially heterogeneous urban contexts.

Additionally, our results contribute to theories of spatial justice and housing inequality [

40,

41]. While prior studies often assumed uniform price responses to disasters, we show that price gradients differ substantially among cities, suggesting that residents in smaller or economically weaker cities face disproportionate financial vulnerability after landslides. This extends Yiftachel’s (1989) and Kemeny’s (2013) arguments regarding urban inequality by demonstrating how environmental risks amplify existing market disparities [

42,

43].

4.2. Practical Contributions

From a methodological perspective, this study differs significantly from prior research on the relationship between landslides and housing prices by applying a three-stage hierarchical linear model across multiple cities. While previous studies have examined hazard effects on property markets, they primarily relied on single-level or single-city models [

3,

4,

44].

Our multi-stage framework captures both urban-level and temporal-level variations simultaneously, revealing that the magnitude of price changes depends not only on hazard proximity but also on broader city-level socioeconomic structures. This offers a more robust analytical foundation for future disaster-related housing studies.

Furthermore, unlike previous studies that focused solely on post-disaster price dynamics [

2,

3,

4], we explicitly differentiate between pre-landslide and post-landslide housing prices. This distinction allows for a clearer understanding of how landslides reshape market trajectories rather than simply identifying price declines after disasters. Our results show that price recovery patterns are nonlinear and differ by city, which suggests that disaster impacts cannot be fully understood without considering temporal dimensions.

Lastly, our findings address a critical limitation in prior research, which often concentrated on capital cities or large metropolitan areas when analyzing hazard impacts [

5,

6,

7]. By including Seoul, Busan, and Gunsan—cities with distinct geographic locations, administrative structures, and cultural contexts—our study demonstrates that landslide effects vary widely across different urban environments.

5. Conclusions

This study suggests significant findings as follows: First, urban characteristics always play an important role in determining housing prices, regardless of the period. Second, temporal characteristics play a different role in housing prices across cities, with smaller cities being more sensitive to the temporal changes. Third, price fluctuations are differentiated by distance groups.

Fourth, price fluctuations among groups immediately after the landslides are not negative at the national level, whereas price fluctuations differ by city. For example, Seoul generally experiences declining housing prices, and Busan shows the most significant price drop. In contrast, Gunsan exhibits fluctuating prices according to periods. Fifth, from a long-term perspective, groups closer to the landslide experience a significant decline in prices, followed by a recovery to pre-landslide levels at the national level. Sixth, each city shows unique price fluctuations from a long-term perspective. Seventh, the amenity effects of mountains are not greater than their hazard effects.

Our results reveal distinct temporal patterns depending on distance from landslide-prone areas and urban characteristics. At the national level, transaction prices immediately after landslides (p4) show minimal changes compared to pre-landslide levels. For instance, within the 250-m group, prices increase by 0.8%, while the 500-m and 750-m groups increase by 0.5% and 1.9%, respectively. Only the 1000-m group shows a 0.9% decrease.

These findings indicate that short-term price fluctuations are not uniformly negative nationwide. However, our forecasts suggest a significant price drop for the 250-m and 500-m groups in the year following the landslide, with recovery beginning around P7 (the first half of the second year). This temporal pattern shows that housing markets exhibit delayed responses rather than immediate declines, which is critical for forecasting future housing affordability and recovery timelines.

City-specific forecasting highlights significant regional differences. In Seoul, consistent with prior studies focused on the capital, prices generally decline in the medium to long term. Although the 250-m group shows a slight 0.9% increase immediately after the landslide, the 500-m, 750-m, and 1000-m groups decline by 1.9%, 4.2%, and 3.5%, respectively. Long-term forecasts indicate that the 250-m and 500-m zones experience a substantial decrease in the second year post-landslide, and even though partial recovery occurs afterward, prices never return to pre-landslide levels.

In Busan, our model forecasts the sharpest and most persistent declines among the three cities. Immediately after the landslide, the 250-m, 500-m, and 1000-m groups show decreases of 3.2%, 4.1%, and 2.2%, respectively, with continued downward trajectories across all distance zones in the following years. This pattern suggests that Busan’s housing market is more vulnerable and slower to recover from landslide-related disruptions.

In contrast, Gunsan demonstrates mixed trends and comparatively faster recovery. Post-landslide forecasts show that the 750-m group increases by 3.6%, while the 250-m and 500-m groups exhibit minimal short-term changes. Over the long term, prices in the 750-m and 1000-m groups eventually exceed pre-landslide levels, while the 500-m group partially rebounds but remains slightly below initial prices. These heterogeneous trajectories highlight that mid-sized cities like Gunsan may recover more quickly than larger metropolitan markets.

Finally, across all three cities, our models consistently show that APTs within the 250-m, 500-m, 750-m, and 1000-m groups trade at lower prices compared to the reference group (1001 m and beyond) during all observed periods. This finding implies that the hazard effects of mountain proximity outweigh the amenity effects, a result that challenges conventional assumptions in previous studies.

In this study, the presence of non-significant coefficients for certain periods and regions is interpreted not as a limitation but as an important empirical finding that enhances the theoretical contribution. Specifically, the non-significant effects observed in some periods and locations indicate that housing markets may respond differently to landslide risks depending on prior capitalization and residents’ risk perceptions.

First, in certain areas, housing markets may have already capitalized on the landslide risk before the event occurred. The results show that, even in the pre-landslide period (P3), housing prices in high-risk zones—such as the 250-m and 500-m groups—were already trading at lower levels compared to safer zones. Also, regional differences in risk sensitivity help explain the non-significant coefficients. In smaller cities like Gunsan, the housing market is relatively less competitive and less liquid than in Seoul or Busan, meaning that residents may perceive mountain-related hazards as less critical when making housing decisions.

This study provides several city-specific policy recommendations based on the differentiated impacts of landslides on housing prices across Seoul, Busan, and Gunsan. By tailoring strategies to each city’s housing market characteristics, risk exposure, and socioeconomic context, policymakers can enhance disaster resilience and mitigate negative price shocks more effectively.

For Seoul, as the capital city with a highly competitive and dense housing market, the findings emphasize the importance of strengthening early warning systems and improving information disclosure mechanisms. Given that housing prices in Seoul demonstrate significant sensitivity to risk perception, enhancing real-time monitoring of landslide-prone areas and providing transparent information to buyers and sellers can reduce uncertainty and stabilize the market. Additionally, integrating disaster risk data into official housing transaction platforms can improve decision-making for both residents and investors.

For Busan, as a major coastal metropolitan city with recurring exposure to landslides due to its steep topography and heavy rainfall, the focus should be on enhancing infrastructure resilience and expanding insurance mechanisms. This includes reinforcing slope stabilization measures, upgrading drainage systems, and expanding subsidized landslide insurance coverage to protect homeowners from catastrophic losses. Given that Busan’s housing market shows a moderate price recovery trend, proactive infrastructure investment can shorten recovery time and prevent long-term price depreciation.

For Gunsan, representing a medium-to-small city with lower overall housing demand and slower post-disaster recovery, the policy priority should be on post-disaster reconstruction support and rebuilding market confidence. Targeted subsidies, tax relief programs, and low-interest reconstruction loans can accelerate recovery in areas most affected by landslides. In addition, public–private partnerships could be introduced to incentivize developers and homeowners to reinvest in the local housing market, preventing prolonged stagnation and enhancing resilience in vulnerable neighborhoods.

Although this study analyzes three cities within South Korea, which are relatively homogeneous in terms of cultural and socioeconomic contexts, the findings reveal structural dynamics in housing price responses to landslides that may extend beyond national boundaries. Specifically, by employing 120 hierarchical linear regression (HLR) models across three distinct urban scales—Seoul (capital city), Busan (metropolitan city), and Gunsan (medium-sized local city)—our results highlight how urban scale and temporal characteristics mediate the effects of natural hazards on housing prices. These mechanisms are not unique to South Korea and can provide valuable insights into understanding hazard-related housing price fluctuations globally.

First, in certain areas, housing markets may have already capitalized on the landslide risk before the event occurred. The results show that, even in the pre-landslide period (P3), housing prices in high-risk zones—such as the 250-m and 500-m groups—were already trading at lower levels compared to safer zones.

Second, although the three cities are located within one country, they differ significantly in population density, economic activity, housing market structures, and vulnerability to natural hazards. These inter-urban variations partly capture the heterogeneity that would be observed in cross-country studies.

Third, although the study focuses on a single country, Seoul, Busan, and Gunsan are geographically distant from one another and belong to three distinct regions: Seoul, as the capital; Busan, in the Gyeongsang region; and Gunsan, in the Jeolla region. These cities exhibit substantially different regional characteristics and cultural contexts, making them well-suited for capturing diverse local attributes that can be applied to cities in other countries.

Lastly, differences between Seoul, Busan, and Gunsan may reflect deeper structural, behavioral, and informational dynamics beyond city size alone. First, Seoul, as the capital and largest city, likely experiences more intense media exposure and widespread information dissemination regarding landslide events. Such extensive coverage can amplify risk perception, leading to stronger short-term market reactions.

Second, Busan, a large coastal and mountainous metropolitan city, shows a more pronounced and persistent decline in APT prices following landslides. One possible explanation is that residents in Busan are generally more familiar with mountainous environments and thus may engage in a more rational and pessimistic risk assessment.

Third, Gunsan, a medium-sized local city with relatively lower housing market liquidity and a higher dominance of local buyers compared to speculative investors, shows more fluctuation and recovery in price trends. Since local buyers often have stronger place attachment and fewer alternative housing options, demand recovers more quickly after the initial price drop.

The limitations of this study are as follows: first, this study focuses only on three cities—Seoul, Busan, and Gunsan—that have clear hierarchies. As a result, in the statistical model, multicollinearity among variables related to city characteristics is high, which hinders the effective utilization of the collected variables in this study. Future studies should include a larger urban sample within each size category to improve statistical robustness, capture more diverse market conditions, and validate whether the patterns observed here hold across different regions.

Second, this study analyzes the impact of landslides on APT prices using incidents that occur at different times. It would be more appropriate for follow-up research to examine landslides that occur during the same period to control temporal effects. Third, this study does not explain why landslide-induced price fluctuations vary by distance groups. Future research should analyze the reasons for these differing impacts across distance groups.

Fourth, there is the potential issue of selective migration, where higher-income or more risk-sensitive households relocate from landslide-prone areas after an event. This migration could lead to declining housing prices independent of the direct physical impact of landslides. Future studies should integrate household-level mobility and panel transaction data to better capture relocation decisions and disentangle behavioral effects from physical hazard impacts.

Fifth, pre-existing economic disadvantages in hazard-prone areas may contribute to systematically lower housing prices even before landslides occur. Future studies should incorporate neighborhood-level socioeconomic indicators and infrastructure quality measures to separate the effects of pre-existing vulnerabilities from the direct influence of landslides.

Sixth, while the multilevel HLR model helps control temporal macroeconomic shocks and urban structural differences, residual confounding remains possible due to unobserved variables, such as private risk mitigation investments, localized real estate speculation, or informal risk information exchange within communities. Future studies should combine housing market data with survey-based measures of household-level risk mitigation behavior and community-based hazard awareness to strengthen causal inference.