The Impact of Environmental Protection Tax on Green Behaviors and ESG Performance of Industrial Enterprises

Abstract

1. Introduction

2. Theoretical Framework and Hypotheses

2.1. Environmental Protection Tax and Corporate ESG Performance

2.2. Environmental Protection Tax and Green Innovation

2.3. The Mediating Effect of Green Innovation on Environmental Protection Tax

3. Methods and Data

3.1. Sample Selection

3.2. Variable Definition

3.2.1. Explanatory Explained Variable: Environmental Protection Tax

3.2.2. Explained Variable: ESG Performance of Enterprises

3.2.3. Moderating Variables: Green Innovation Behavior

3.2.4. Controlled Variables

3.3. Model Specification

3.4. Descriptive Statistics

4. Empirical Analysis and Tests

4.1. Correlation Analysis

4.2. Basic Regression Analysis

4.3. Robustness Test

4.3.1. Robustness Tests: Alternative Measurement of Core Variables

4.3.2. Robustness Tests: Impact of Capital Governance

4.4. Further Analysis

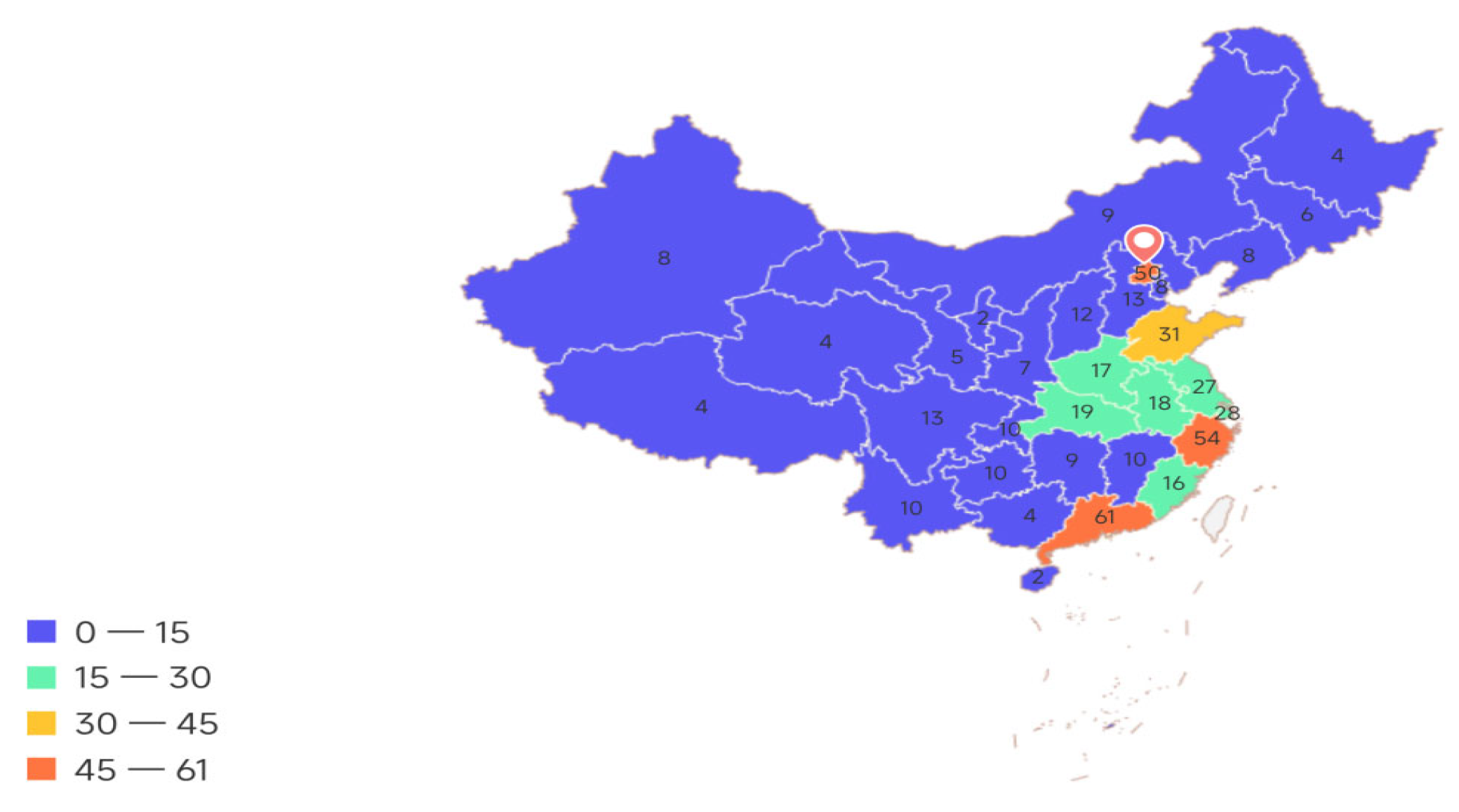

4.4.1. Heterogeneity Analysis by Pollution Level

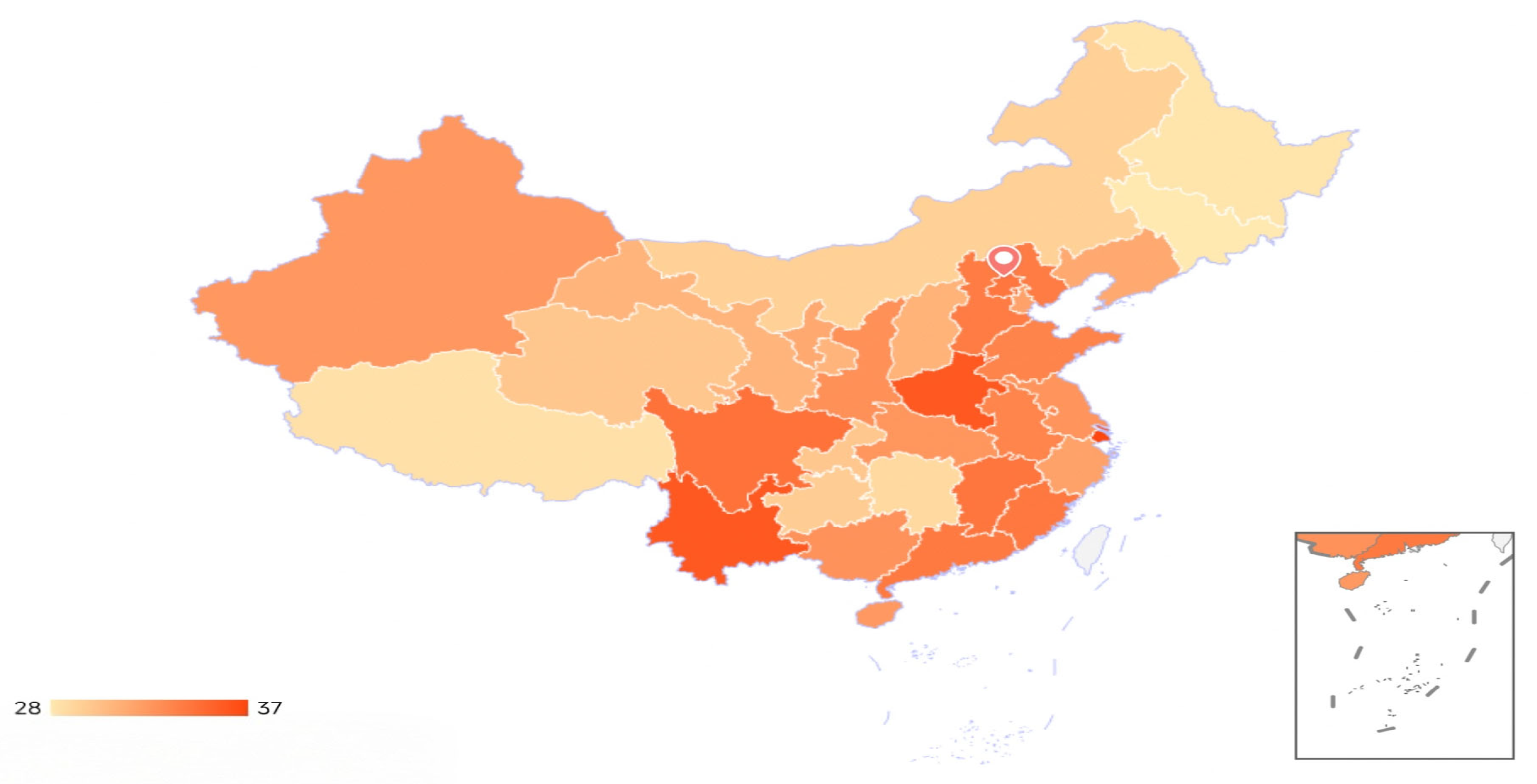

4.4.2. Regional Heterogeneity Analysis (Central and Western Regions)

4.5. Discussion—Comparison with Prior Studies

4.6. Limitations

4.6.1. Limitations of Excessive Environmental Taxes and Potential Enterprise Relocation

4.6.2. Institutional Differences & Limitation

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Yu, W.; Wang, H.; Shuang, X. Greening of tax system and corporate ESG performance: A quasi-natural experiment based on the environmental protection tax law. J. Financ. Econ. 2022, 48, 47–62. [Google Scholar] [CrossRef]

- Wang, X.; Wang, S.; Wu, K.; Zhai, C.; Li, Y. Environmental protection tax and enterprises’ green technology innovation: Evidence from China. Int. Rev. Econ. Financ. 2024, 96, 103617. [Google Scholar] [CrossRef]

- Shi, X.; Jiang, Z.; Bai, D.; Fahad, S.; Irfan, M. Assessing the impact of green tax reforms on corporate environmental performance and economic growth: Do green reforms promote the environmental performance in heavily polluted enterprises? Environ. Sci. Pollut. Res. 2023, 30, 56054–56072. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Y.; Su, Q. Environmental protection tax, management efficiency, and enterprise green technology innovation. Financ. Res. Lett. 2025, 75, 106860. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, T.; Ostic, D. Research on the green technology innovation cultivation path of manufacturing enterprises under the regulation of environmental protection tax law in China. Front. Environ. Sci. 2022, 10, 874865. [Google Scholar] [CrossRef]

- Ding, X.; Petrovskaya, M. The relationship between environmental taxes, technological innovation and corporate financial performance: A heterogeneous analysis of micro-evidence from China. BRICS J. Econ. 2022, 3, 249–270. [Google Scholar] [CrossRef]

- Peng, M.; Wei, C.; Jin, Y.; Ran, H. Does the environmental tax reform positively impact corporate environmental performance? Sustainability 2023, 15, 8023. [Google Scholar] [CrossRef]

- Liu, A.; Dai, S.; Wang, Z. Environmental protection tax on enterprise environmental, social and governance performance: A multi-perspective analysis based on financing constraints. J. Asian Econ. 2023, 89, 101671. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.F.; Chang, C.P. How does ESG performance promote corporate green innovation? Econ. Change Restruct. 2023, 56, 2889–2913. [Google Scholar] [CrossRef]

- Tahani, T.; Nazmul, M.H.; Jamaliah, S.; Saona, P.; Kalam Azad, M.A. Does ESG initiatives yield greater firm value and performance? New evidence from European firms. Cogent Bus. Manag. 2022, 9, 2144098. [Google Scholar] [CrossRef]

- Li, S.; Liu, Y.; Xu, Y. Does ESG performance improve the quantity and quality of innovation? The mediating role of internal control effectiveness and analyst coverage. Sustainability 2022, 15, 104. [Google Scholar] [CrossRef]

- Yang, X.; Li, Z.; Qiu, Z.; Wang, J.; Liu, B. ESG performance and corporate technology innovation: Evidence from China. Technol. Forecast. Soc. Change 2024, 206, 123520. [Google Scholar] [CrossRef]

- Aydoğmuş, M.; Gülay, G.; Ergun, K. Impact of ESG performance on firm value and profitability. Borsa Istanb. Rev. 2022, 22, S119–S127. [Google Scholar] [CrossRef]

- Gang, D.; Chuanmei, Z.; Yinuo, M. Impact mechanism of environmental protection tax policy on enterprises’ green technology innovation with quantity and quality from the micro-enterprise perspective. Environ. Sci. Pollut. Res. Int. 2023, 30, 80713–80731. [Google Scholar] [CrossRef]

- Huang, Y.; Liu, C.; Wang, L.; Qi, Y. The impact of environmental protection tax on corporate ESG performance and corporate green behavior. Res. Int. Bus. Financ. 2025, 75, 102772. [Google Scholar] [CrossRef]

- Duan, Y.; Rahbarimanesh, A. The impact of environmental protection tax on green innovation of heavily polluting enterprises in china: A mediating role based on ESG performance. Sustainability 2024, 16, 7509. [Google Scholar] [CrossRef]

- Cao, G.; She, J.; Cao, C.; Cao, Q. Environmental protection tax and green innovation: The mediating role of digitalization and ESG. Sustainability 2024, 16, 577. [Google Scholar] [CrossRef]

- Hu, J.; Fang, Q.; Wu, H. Environmental tax and highly polluting firms’ green transformation: Evidence from green mergers and acquisitions. Energy Econ. 2023, 127, 107046. [Google Scholar] [CrossRef]

- Yu, Y.; Liu, J.; Wang, Q. Has environmental protection tax reform promoted green transformation of enterprises? Evidence from China. Environ. Sci. Pollut. Res. Int. 2024, 31, 29472–29496. [Google Scholar] [CrossRef]

- Zhang, Z.; Shi, K.; Gao, Y.; Feng, Y. How does environmental regulation promote green technology innovation in enterprises? A policy simulation approach with an evolutionary game. J. Environ. Plan. Manag. 2025, 68, 979–1008. [Google Scholar] [CrossRef]

- Wang, J.; Tang, D. Air pollution, environmental protection tax and well-being. Int. J. Environ. Res. Public Health 2023, 20, 2599. [Google Scholar] [CrossRef]

- Yu, X.; Wang, P. Economic effects analysis of environmental regulation policy in the process of industrial structure upgrading: Evidence from Chinese provincial panel data. Sci. Total Environ. 2021, 753, 142004. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Li, J.; Li, S. Environmental protection tax, corporate ESG performance, and green technological innovation. Front. Environ. Sci. 2022, 10, 982132. [Google Scholar] [CrossRef]

- Zhang, C.; Zou, C.F.; Luo, W.; Liao, L. Effect of environmental tax reform on corporate green technology innovation. Front. Environ. Sci. 2022, 10, 1036810. [Google Scholar] [CrossRef]

- Long, F.; Lin, F.; Ge, C. Impact of China’s environmental protection tax on corporate performance: Empirical data from heavily polluting industries. Environ. Impact Assess. Rev. 2022, 97, 106892. [Google Scholar] [CrossRef]

- Mao, W.; Wang, W.; Sun, H. Optimization path for overcoming barriers in China’s environmental protection institutional system. J. Clean. Prod. 2020, 251, 119712. [Google Scholar] [CrossRef]

- Cai, W.; Bai, M.; Davey, H. Implementing environmental protection tax in China: An alternative framework. Pac. Account. Rev. 2022, 34, 479–513. [Google Scholar] [CrossRef]

- Yin, K.; Miao, Y.; Huang, C. Environmental regulation, technological innovation, and industrial structure upgrading. Energy Environ. 2024, 35, 207–227. [Google Scholar] [CrossRef]

- Wang, Y.; Xu, S.; Meng, X. Environmental protection tax and green innovation. Environ. Sci. Pollut. Res. 2023, 30, 56670–56686. [Google Scholar] [CrossRef]

- Xu, Y.; Wen, S.; Tao, C.Q. Impact of environmental tax on pollution control: A sustainable development perspective. Econ. Anal. Policy 2023, 79, 89–106. [Google Scholar] [CrossRef]

- Hu, S.; Chen, Y.; Wu, H.; Sun, D. Fostering green-tech innovation through digitalization: The role of legitimacy and CEO characteristics. An empirical study of China’s listed companies. J. Environ. Plan. Manag. 2025, 68, 2165–2193. [Google Scholar] [CrossRef]

- Su, Y.; Zhu, X.; Deng, Y.; Chen, M.; Piao, Z. Does the greening of the tax system promote the green transformation of China’s heavily polluting enterprises? Environ. Sci. Pollut. Res. 2023, 30, 54927–54944. [Google Scholar] [CrossRef] [PubMed]

- Deng, W.; Kharuddin, S.; Ashhari, Z.M. Green finance transforms developed countries’ green growth: Mediating effect of clean technology innovation and threshold effect of environmental tax. J. Clean. Prod. 2024, 448, 141642. [Google Scholar] [CrossRef]

- Jiang, Z.; Xu, C.; Zhou, J. Government environmental protection subsidies, environmental tax collection, and green innovation: Evidence from listed enterprises in China. Environ. Sci. Pollut. Res. 2023, 30, 4627–4641. [Google Scholar] [CrossRef] [PubMed]

- Li, S.; Jia, N.; Chen, Z.; Du, H.; Zhang, Z.; Bian, B. Multi-objective optimization of environmental tax for mitigating air pollution and greenhouse gas. J. Manag. Sci. Eng. 2022, 7, 473–488. [Google Scholar] [CrossRef]

- Berman, E.; Bui, L.T. Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Stat. 2001, 83, 498–510. [Google Scholar] [CrossRef]

- Xie, Z.; Chen, F.; Chen, Z. Unintended results: Inter-provincial differences in environmental protection tax rates and relocation strategies of polluting enterprises. China Financ. Econ. Rev. 2023, 12, 72–93. [Google Scholar] [CrossRef]

- Qin, X.; Wang, L. Causal moderated mediation analysis: Methods and software. Behav. Res. Methods 2024, 56, 1314–1334. [Google Scholar] [CrossRef]

- Miočević, M.; O’Rourke, H.P.; MacKinnon, D.P.; Brown, H.C. Statistical properties of four effect-size measures for mediation models. Behav. Res. Methods 2018, 50, 285–301. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Variable Description |

|---|---|---|---|

| Explained variable | the ESG performance of the enterprise | ESG | The ESG Bloomberg database ESG rating score |

| Explanatory variable | Environmental protection Tax | Tax | The natural logarithm of the amount of environmental protection tax |

| Mediating variable | Green innovation behavior | GTI | Take the natural logarithm of the total number of green patent applications by enterprises after adding 1 |

| Control variable | Growth capacity | Growth | Growth rate of current operating income |

| Capital expenditure | Capital | The natural logarithm of capital expenditure | |

| Returns on assets | ROA | Net profit of the enterprise divided by total assets | |

| Asset-liability ratio | Lev | The total liabilities divided by the total assets | |

| Cash flow | Cash | The ratio of a company’s net cash flow to its total assets | |

| Share concentration | Share | The shareholding ratio of the top ten shareholders | |

| Board size | Board | The natural logarithm of the number of people on the board |

| Variable | Sample Observations | Mean | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|

| ROA | 2395 | 0.053 | 0.0568 | −0.253 | 0.372 |

| Lev | 2395 | 0.449 | 0.180 | 0.008 | 0.941 |

| Cash | 2395 | 0.080 | 0.077 | −0.319 | 0.706 |

| Share | 2395 | 0.594 | 0.152 | 0.188 | 1.010 |

| Growth | 2395 | 0.215 | 0.575 | −0.863 | 9.235 |

| Board | 2395 | 2.178 | 0.207 | 1.099 | 2.833 |

| Capital | 2395 | 19.970 | 1.613 | 13.700 | 26.510 |

| ESG | 2395 | 33.270 | 7.773 | 19.010 | 67.940 |

| GTI | 2395 | 1.756 | 1.543 | 0.000 | 7.307 |

| Tax | 2395 | 15.070 | 1.397 | 10.160 | 21.070 |

| Variable | ESG | GTI | Tax | ROA | Lev | Cash | Share | Growth | Board | Capital |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | 1 | |||||||||

| GTI | 0.304 *** | 1 | ||||||||

| Tax | 0.480 *** | 0.585 *** | 1 | |||||||

| ROA | 0.022 | −0.151 *** | 0.006 | 1 | ||||||

| Lev | 0.128 *** | 0.390 *** | 0.475 *** | −0.436 *** | 1 | |||||

| Cash | 0.097 *** | −0.108 *** | 0.094 *** | 0.616 *** | −0.187 *** | 1 | ||||

| Share | 0.249 *** | 0.094 *** | 0.326 *** | 0.176 *** | 0.011 | 0.167 *** | 1 | |||

| Growth | −0.117 *** | −0.002 | 0.014 | −0.047 ** | 0.053 *** | −0.092 *** | 0.016 | 1 | ||

| Board | 0.105 *** | 0.082 *** | 0.160 *** | −0.063 *** | 0.161 *** | −0.013 | 0.064 *** | 0.074 *** | 1 | |

| Capital | 0.442 *** | 0.517 *** | 0.741 *** | 0.001 | 0.389 *** | 0.150 *** | 0.295 *** | −0.117 *** | 0.164 *** | 1 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG | GTI | ESG | ESG | |

| Tax | 0.717 *** | 0.115 *** | 0.665 *** | |

| (−0.232) | (−0.041) | (−0.232) | ||

| ROA | −2.504 | 0.008 | −0.472 | −2.508 |

| (−2.437) | (−0.428) | (−2.328) | (−2.43) | |

| Lev | −2.293 | −0.153 | −1.222 | −2.224 |

| (−1.411) | (−0.248) | (−1.366) | (−1.407) | |

| Cash | −1.127 | −0.251 | −0.742 | −1.015 |

| (−1.444) | (−0.254) | (−1.44) | (−1.44) | |

| Share | 5.119 ** | −0.048 | 5.293 *** | 5.140 *** |

| (−1.988) | (−0.349) | (−1.985) | (−1.982) | |

| Growth | −0.422 ** | −0.073 ** | −0.262 | −0.389 ** |

| (−0.192) | (−0.034) | (−0.187) | (−0.192) | |

| Board | −0.09 | 0.144 | −0.081 | −0.155 |

| (−0.883) | (−0.155) | (−0.882) | (−0.88) | |

| Capital | 0.246 * | 0.100 *** | 0.228 * | 0.201 |

| (−0.134) | (−0.024) | (−0.135) | (−0.135) | |

| GTI | 0.471 *** | 0.447 *** | ||

| (−0.13) | (−0.13) | |||

| Cons | 13.234 *** | −2.403 *** | 22.754 *** | 14.309 *** |

| (−4.454) | (−0.783) | (−3.345) | (−4.453) | |

| N | 2395 | 2395 | 2395 | 2395 |

| R2 | 0.372 | 0.149 | 0.374 | 0.376 |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG | GTI1 | ESG | ESG | |

| Tax | 0.717 *** | 0.068 * | 0.690 *** | |

| (−0.232) | (−0.04) | (−0.232) | ||

| ROA | −2.504 | −0.313 | −0.257 | −2.38 |

| (−2.437) | (−0.415) | (−2.33) | (−2.432) | |

| Lev | −2.293 | −0.221 | −1.163 | −2.205 |

| (−1.411) | (−0.24) | (−1.367) | (−1.408) | |

| Cash | −1.127 | −0.276 | −0.736 | −1.017 |

| (−1.444) | (−0.246) | (−1.441) | (−1.442) | |

| Share | 5.119 ** | 0.005 | 5.274 *** | 5.117 *** |

| (−1.988) | (−0.338) | (−1.987) | (−1.984) | |

| Growth | −0.422 ** | −0.071 ** | −0.262 | −0.394 ** |

| (−0.192) | (−0.033) | (−0.187) | (−0.192) | |

| Board | −0.09 | 0.048 | −0.03 | −0.11 |

| (−0.883) | (−0.15) | (−0.882) | (−0.881) | |

| Capital | 0.246 * | 0.077 *** | 0.244 * | 0.215 |

| (−0.134) | (−0.023) | (−0.135) | (−0.135) | |

| GTI1 | 0.413 *** | 0.398 *** | ||

| (−0.135) | (−0.134) | |||

| Cons | 13.234 *** | −1.457 * | 22.560 *** | 13.814 *** |

| (−4.454) | (−0.758) | (−3.347) | (−4.45) | |

| N | 2395 | 2395 | 2395 | 2395 |

| R2 | 0.372 | 0.102 | 0.372 | 0.375 |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG | GTI1 | ESG | ESG | |

| Tax | 0.865 *** | 0.125 *** | 0.810 *** | |

| (−0.247) | (−0.043) | (−0.247) | ||

| ROA | −1.673 | 0.064 | −0.057 | −1.701 |

| (−2.482) | (−0.437) | (−2.43) | (−2.475) | |

| Lev | −2.426 * | −0.162 | −1.193 | −2.354 * |

| (−1.412) | (−0.248) | (−1.367) | (−1.409) | |

| Cash | −0.98 | −0.241 | −0.675 | −0.873 |

| (−1.446) | (−0.254) | (−1.444) | (−1.442) | |

| Share | 4.940 ** | −0.06 | 5.246 *** | 4.967 ** |

| (−1.989) | (−0.35) | (−1.987) | (−1.984) | |

| Growth | −0.474 ** | −0.077 ** | −0.269 | −0.440 ** |

| (−0.195) | (−0.034) | (−0.188) | (−0.194) | |

| Board | −0.123 | 0.141 | −0.086 | −0.186 |

| (−0.882) | (−0.155) | (−0.882) | (−0.88) | |

| Capital | 0.209 | 0.098 *** | 0.218 | 0.165 |

| (−0.136) | (−0.024) | −0.136) | (−0.136) | |

| Density | 0.201 * | 0.013 | 0.065 | 0.195 * |

| (−0.115) | (−0.02) | (−0.108) | (−0.115) | |

| GTI1 | 0.472 *** | 0.444 *** | ||

| (−0.13) | (−0.13) | |||

| Cons | 11.501 ** | −2.519 *** | 22.804 *** | 12.620 *** |

| (−4.562) | (−0.803) | (−3.347) | (−4.561) | |

| N | 2395 | 2395 | 2395 | 2395 |

| R2 | 0.373 | 0.15 | 0.374 | 0.377 |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG | GTI1 | ESG | ESG | |

| Tax | 0.740 *** | 0.112 *** | 0.689 *** | |

| (−0.233) | (−0.041) | (−0.232) | ||

| ROA | −2.425 | 0.052 | −0.315 | −2.449 |

| (−2.444) | (−0.429) | (−2.334) | (−2.437) | |

| Lev | −2.499 * | −0.14 | −1.398 | −2.436 * |

| (−1.412) | (−0.248) | (−1.367) | (−1.408) | |

| Cash | −1.29 | −0.262 | −0.901 | −1.172 |

| (−1.445) | (−0.253) | (−1.441) | (−1.441) | |

| Top1 | 1.828 | −0.682 * | 1.86 | 2.136 |

| (−2.34) | (−0.411) | (−2.338) | (−2.335) | |

| Growth | −0.391 ** | −0.072 ** | −0.224 | −0.359 * |

| (−0.192) | (−0.034) | (−0.187) | (−0.192) | |

| Board | −0.136 | 0.137 | −0.126 | −0.198 |

| (−0.884) | (−0.155) | (−0.883) | (−0.882) | |

| Capital | 0.270 ** | 0.099 *** | 0.253 * | 0.225 * |

| (−0.134) | (−0.024) | (−0.135) | (−0.135) | |

| GTI1 | 0.475 *** | 0.451 *** | ||

| (−0.13) | (−0.13) | |||

| Cons | 14.971 *** | −2.098 *** | 24.880 *** | 15.917 *** |

| (−4.488) | (−0.787) | (−3.32) | (−4.484) | |

| N | 2395 | 2395 | 2395 | 2395 |

| R2 | 0.37 | 0.151 | 0.371 | 0.374 |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Variables | Model (1) | Model (2) | Model (3) | Model (4) |

|---|---|---|---|---|

| Non-Heavily Polluting Enterprises | Heavily Polluting Enterprises | Non-Heavily Polluting Enterprises | Heavily Polluting Enterprises | |

| ESG | ESG | GTI | GTI | |

| Tax | 0.828 ** | 0.625 ** | 0.142 ** | 0.100 * |

| (−0.345) | (−0.312) | (−0.063) | (−0.054) | |

| ROA | −4.956 | −1.345 | 0.049 | −0.062 |

| (−3.365) | (−3.459) | (−0.617) | (−0.598) | |

| Lev | −2.47 | −1.315 | −0.496 | 0.017 |

| (−2.124) | (−1.944) | (−0.39) | (−0.336) | |

| Cash | −1.721 | −0.669 | −0.654 * | 0.05 |

| (−2.079) | (−2.026) | (−0.381) | (−0.35) | |

| Share | −0.57 | 7.675 *** | −0.436 | 0.056 |

| (−3.103) | (−2.606) | (−0.569) | (−0.451) | |

| Growth | −0.562 * | −0.437 * | −0.03 | −0.099 ** |

| (−0.309) | (−0.248) | (−0.057) | (−0.043) | |

| Board | −0.696 | 0.159 | 0.363 | −0.005 |

| (−1.228) | (−1.233) | (−0.225) | (−0.213) | |

| Capital | 0.458 ** | 0.011 | 0.109 *** | 0.087 *** |

| (−0.191) | (−0.187) | (−0.035) | (−0.032) | |

| Cons | 11.813 * | 16.922 *** | −2.505 ** | −2.129 * |

| (−6.091) | (−6.364) | (−1.117) | (−1.101) | |

| N | 993 | 1402 | 993 | 1402 |

| R2 | 0.36 | 0.391 | 0.164 | 0.148 |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) | Model (6) |

|---|---|---|---|---|---|---|

| Eastern Region | Western Region | Central Region | Eastern Region | Western Region | Central Region | |

| ESG | ESG | ESG | GTI | GTI | GTI | |

| Tax | 0.787 *** | 1.238 ** | 0.063 | 0.150 *** | 0.011 | 0.003 |

| (−0.294) | (−0.567) | (−0.511) | (−0.051) | (−0.101) | (−0.096) | |

| ROA | 0.014 | −19.539 *** | 1.207 | −0.291 | −0.091 | 0.948 |

| (−3.023) | (−6.714) | (−5.224) | (−0.523) | (−1.199) | (−0.979) | |

| Lev | −2.529 | −4.693 | 1.422 | −0.51 | 0.941 | 0.104 |

| (−1.806) | (−3.474) | (−2.926) | (−0.312) | (−0.621) | (−0.548) | |

| Cash | −3.190 * | 1.272 | 3.051 | −0.605 * | −0.621 | 0.991 * |

| (−1.841) | (−3.613) | (−3.085) | (−0.319) | (−0.645) | (−0.578) | |

| Share | 0.828 | 15.653 *** | 13.228 *** | −0.082 | −0.224 | −0.15 |

| (−2.503) | (4.916) | (−4.5) | (−0.433) | (−0.878) | (−0.843) | |

| Growth | −0.487 ** | −0.671 | 0.144 | −0.057 | −0.056 | −0.101 |

| (−0.243) | (−0.453) | (−0.457) | (−0.042) | (−0.081) | (−0.086) | |

| Board | −1.592 | 2.108 | 2.153 | 0.317 | −0.55 | 0.11 |

| (−1.199) | (−2.152) | (−1.624) | (−0.207) | (−0.384) | (−0.304) | |

| Capital | 0.216 | 0.384 | 0.078 | 0.115 *** | 0.081 | 0.091 * |

| (−0.175) | (−0.308) | (−0.284) | (−0.03) | (−0.055) | (−0.053) | |

| Cons | 18.993 *** | −5.983 | 12.835 | −3.273 *** | 0.576 | −1.001 |

| −5.816 | −11.066 | −8.984 | −1.006 | −1.977 | −1.684 | |

| N | 1490 | 478 | 427 | 1490 | 478 | 427 |

| R2 | 0.407 | 0.305 | 0.397 | 0.156 | 0.144 | 0.196 |

| Individual fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, X.; Zhuang, L. The Impact of Environmental Protection Tax on Green Behaviors and ESG Performance of Industrial Enterprises. Sustainability 2025, 17, 8592. https://doi.org/10.3390/su17198592

Zheng X, Zhuang L. The Impact of Environmental Protection Tax on Green Behaviors and ESG Performance of Industrial Enterprises. Sustainability. 2025; 17(19):8592. https://doi.org/10.3390/su17198592

Chicago/Turabian StyleZheng, Xuejia, and Lei Zhuang. 2025. "The Impact of Environmental Protection Tax on Green Behaviors and ESG Performance of Industrial Enterprises" Sustainability 17, no. 19: 8592. https://doi.org/10.3390/su17198592

APA StyleZheng, X., & Zhuang, L. (2025). The Impact of Environmental Protection Tax on Green Behaviors and ESG Performance of Industrial Enterprises. Sustainability, 17(19), 8592. https://doi.org/10.3390/su17198592