Incorporating Carbon Fees into the Efficiency Evaluation of Taiwan’s Steel Industry Using Data Envelopment Analysis with Negative Data †

Abstract

1. Introduction

2. Literature Review

3. Methods

4. Sample and Data Collection

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abbass, K.; Qasim, M.Z.; Song, H.; Murshed, M.; Mahmood, H.; Younis, I. A Review of the Global Climate Change Impacts, Adaptation, and Sustainable Mitigation Measures. Environ. Sci. Pollut. Res. 2022, 29, 42539–42559. [Google Scholar] [CrossRef]

- Armstrong McKay, D.I.; Staal, A.; Abrams, J.F.; Winkelmann, R.; Sakschewski, B.; Loriani, S.; Fetzer, I.; Cornell, S.E.; Rockström, J.; Lenton, T.M. Exceeding 1.5 °C global warming could trigger multiple climate tipping points. Science 2022, 377, eabn7950. [Google Scholar] [CrossRef]

- Rogelj, J.; Geden, O.; Cowie, A.; Reisinger, A. Three ways to improve net-zero emissions targets. Nature 2021, 591, 365–368. [Google Scholar] [CrossRef] [PubMed]

- Ahmad, M.; Li, X.F.; Wu, Q. Carbon taxes and emission trading systems: Which one is more effective in reducing carbon emissions?—A meta-analysis. J. Clean. Prod. 2024, 476, 143761. [Google Scholar] [CrossRef]

- Boroumand, R.H.; Goutte, S.; Porcher, T.; Stocker, T.F. A fair and progressive carbon price for a sustainable economy. J. Environ. Manag. 2022, 303, 113935. [Google Scholar] [CrossRef] [PubMed]

- Tvinnereim, E.; Mehling, M. Carbon pricing and deep decarbonisation. Energy Policy 2018, 121, 185–189. [Google Scholar] [CrossRef]

- Zakeri, A.; Dehghanian, F.; Fahimnia, B.; Sarkis, J. Carbon pricing versus emissions trading: A supply chain planning perspective. Int. J. Prod. Econ. 2015, 164, 197–205. [Google Scholar] [CrossRef]

- World Bank. State and Trends of Carbon Pricing 2024; World Bank: Washington, DC, USA, 2024. [Google Scholar]

- Lin, Y.-S.; Zhang, J.-L.; Hsu, C.-S.; Cheng, S.-M.; Yu, S.-H. The Impact of Levying Carbon Fees on the Steel Industry: An Efficiency Perspective. In Proceedings of the 2024 Annual Conference of the Chinese Institute of Industrial Engineers, Taipei, Taiwan, 29–30 November 2024. (In Chinese). [Google Scholar]

- Lin, J.W. How Can Carbon Fees Help Taiwan Reduce Carbon Emissions? Sustainability 2025, 17, 1885. [Google Scholar] [CrossRef]

- Taiwan’s Ministry of Environment (MOENV). Special Report on “Assessment of the Impact of Taiwan’s Carbon Fee Collection Mechanism on Industries and Carbon Border Adjustment Mechanism (CBAM) Promotion Plan”; Taiwan Ministry of Environment: Taipei, Taiwan, 2024. Available online: https://service.cca.gov.tw/File/Get/cca/zh-tw/fCxn5qaGNQEabkU (accessed on 8 April 2025).

- Taiwan’s Ministry of Environment (MOENV). Implementation of a Carbon Fee System: Officially Entering the Era of Carbon Pricing. Available online: https://service.cca.gov.tw/File/Get/cca/zh-tw/G8SevpfeOZ2UZSw (accessed on 8 April 2025).

- Taiwan’s Ministry of Environment (MOENV). Taiwan’s Ministry of Environment Announces “Fee-Charging Rates of Carbon Fees”. Available online: https://www.moenv.gov.tw/en/news/press-releases/31552.html (accessed on 2 April 2025).

- Taiwan’s Ministry of Environment (MOENV). Carbon Fee Imposition for Dedicated Funds. Available online: https://www.cca.gov.tw/en/affairs/carbon-fee-fund/2301.html (accessed on 8 April 2025).

- Li, Q.; Zhao, B.; Wang, X.; Yang, G.; Chang, Y.; Chen, X.; Chen, B.M. Autonomous building material stock estimation using 3D modeling and multilayer perceptron. Sustain. Cities Soc. 2025, 130, 106522. [Google Scholar] [CrossRef]

- Griffin, P.W.; Hammond, G.P. Industrial energy use and carbon emissions reduction in the iron and steel sector: A UK perspective. Appl. Energy 2019, 249, 109–125. [Google Scholar] [CrossRef]

- Yan, A.; Xiao, Y.; Ren, H.; Lin, B.; Zhang, H.; Wang, Y.; Li, X.; Wang, B.; Tang, J. Combining the life cycle model and corrosion model to analyze the impact of corrosion on carbon emissions of steel pipelines. Environ. Impact Assess. Rev. 2025, 115, 108027. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Takayabu, H.; Kagawa, S.; Fujii, H.; Managi, S.; Eguchi, S. Impacts of productive efficiency improvement in the global metal industry on CO2 emissions. J. Environ. Manag. 2019, 248, 109261. [Google Scholar] [CrossRef]

- Wu, F.; Huang, N.; Zhang, F.; Niu, L.; Zhang, Y. Analysis of the carbon emission reduction potential of China’s key industries under the IPCC 2 °C and 1.5 °C limits. Technol. Forecast. Soc. Change 2020, 159, 120198. [Google Scholar] [CrossRef]

- Wu, R.; Tan, Z.; Lin, B. Does carbon emission trading scheme really improve the CO2 emission efficiency? Evidence from China’s iron and steel industry. Energy 2023, 277, 127743. [Google Scholar] [CrossRef]

- Ray, S.C.; Kim, H.J. Cost efficiency in the US steel industry: A nonparametric analysis using data envelopment analysis. Eur. J. Oper. Res. 1995, 80, 654–671. [Google Scholar] [CrossRef]

- Ma, J.; Evans, D.G.; Fuller, R.J.; Stewart, D.F. Technical efficiency and productivity change of China’s iron and steel industry. Int. J. Prod. Econ. 2002, 76, 293–312. [Google Scholar] [CrossRef]

- Yang, T.-H.; Choi, H.-c.P. Performance Analysis of International Steel Manufacturers: A Benchmark Study for Steel Supply Chains. Int. J. Supply Chain Manag. 2013, 2, 25–31. [Google Scholar]

- Debnath, R.M.; Sebastian, V.J. Efficiency in the Indian iron and steel industry—An application of data envelopment analysis. J. Adv. Manag. Res. 2014, 11, 4–19. [Google Scholar] [CrossRef]

- Yang, W.; Shi, J.; Qiao, H.; Shao, Y.; Wang, S. Regional technical efficiency of Chinese iron and steel industry based on bootstrap network data envelopment analysis. Socio-Econ. Plan. Sci. 2017, 57, 14–24. [Google Scholar] [CrossRef]

- He, F.; Zhang, Q.; Lei, J.; Fu, W.; Xu, X. Energy efficiency and productivity change of China’s iron and steel industry: Accounting for undesirable outputs. Energy Policy 2013, 54, 204–213. [Google Scholar] [CrossRef]

- Ohlan, R. Energy efficiency in India’s iron and steel industry: A firm-level data envelopment analysis. Strateg. Plan. Energy Environ. 2019, 38, 27–36. [Google Scholar] [CrossRef]

- Kim, N.H.; He, F.; Kwon, O.C. Combining common-weights DEA window with the Malmquist index: A case of China’s iron and steel industry. Socio-Econ. Plan. Sci. 2023, 87, 101596. [Google Scholar] [CrossRef]

- Kim, N.H.; He, F.; Nasir, R.M.; Kwak, S.-I. Stepwise benchmarking based on production function: Selecting path towards closest target. Expert Syst. Appl. 2023, 228, 120308. [Google Scholar] [CrossRef]

- Wu, H.; Lv, K.; Liang, L.; Hu, H. Measuring performance of sustainable manufacturing with recyclable wastes: A case from China’s iron and steel industry. Omega 2017, 66, 38–47. [Google Scholar] [CrossRef]

- Gong, B.; Guo, D.; Zhang, X.; Cheng, J. An approach for evaluating cleaner production performance in iron and steel enterprises involving competitive relationships. J. Clean. Prod. 2017, 142, 739–748. [Google Scholar] [CrossRef]

- Wang, Y.; Wen, Z.; Cao, X.; Zheng, Z.; Xu, J. Environmental efficiency evaluation of China’s iron and steel industry: A process-level data envelopment analysis. Sci. Total Environ. 2020, 707, 135903. [Google Scholar] [CrossRef]

- Li, H.; Zhu, X.; Chen, J. Total factor waste gas treatment efficiency of China’s iron and steel enterprises and its influencing factors: An empirical analysis based on the four-stage SBM-DEA model. Ecol. Indic. 2020, 119, 106812. [Google Scholar] [CrossRef]

- Fukuyama, H.; Liu, H.H.; Song, Y.Y.; Yang, G.L. Measuring the capacity utilization of the 48 largest iron and steel enterprises in China. Eur. J. Oper. Res. 2021, 288, 648–665. [Google Scholar] [CrossRef]

- Fukuyama, H.; Song, Y.-Y.; Ren, X.-T.; Yang, G.-L. Using a novel DEA-based model to investigate capacity utilization of Chinese firms. Omega 2022, 106, 102534. [Google Scholar] [CrossRef]

- Li, K.; Zou, D.; Li, H. Environmental regulation and green technical efficiency: A process-level data envelopment analysis from Chinese iron and steel enterprises. Energy 2023, 277, 127662. [Google Scholar] [CrossRef]

- Choi, Y.; Yu, Y.; Lee, H.S. A Study on the Sustainable Performance of the Steel Industry in Korea Based on SBM-DEA. Sustainability 2018, 10, 173. [Google Scholar] [CrossRef]

- Li, H.; Zhu, X.; Chen, J.; Jiang, F. Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol. Econ. 2019, 165, 106397. [Google Scholar] [CrossRef]

- Liu, R.; He, F.; Ren, J. Promoting or Inhibiting? The Impact of Enterprise Environmental Performance on Economic Performance: Evidence from China’s Large Iron and Steel Enterprises. Sustainability 2021, 13, 6465. [Google Scholar] [CrossRef]

- Ding, S.; Zhao, J.; Zhang, M.; Yang, S.; Zhang, H. Measuring the environmental protection efficiency and productivity of the 49 largest iron and steel enterprises in China. Environ. Dev. Sustain. 2022, 24, 454–472. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Data Envelopment Analysis: A Comprehensive Text with Models, Applications, References and DEA-Solver Software; Springer: New York, NY, USA, 2007. [Google Scholar]

- Yeh, L.T. Incorporating workplace injury to measure the safety performance of industrial sectors in Taiwan. Sustainability 2017, 9, 2241. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Paradi, J.C.; Rouatt, S.; Zhu, H. Two-stage evaluation of bank branch efficiency using data envelopment analysis. Omega 2011, 39, 99–105. [Google Scholar] [CrossRef]

- Tone, K.; Chang, T.-S.; Wu, C.-H. Handling negative data in slacks-based measure data envelopment analysis models. Eur. J. Oper. Res. 2020, 282, 926–935. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 2002, 143, 32–41. [Google Scholar] [CrossRef]

- Fang, H.H.; Lee, H.S.; Hwang, S.N.; Chung, C.C. A slacks-based measure of super-efficiency in data envelopment analysis: An alternative approach. Omega 2013, 41, 731–734. [Google Scholar] [CrossRef]

- Leeson, D.; MacDowell, N.; Shah, N.; Petit, C.; Fennell, P.S. A techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. Int. J. Greenh. Gas Control 2017, 61, 71–84. [Google Scholar] [CrossRef]

- Toktarova, A.; Karlsson, I.; Rootzén, J.; Göransson, L.; Odenberger, M.; Johnsson, F. Pathways for low-carbon transition of the steel industry—A Swedish case study. Energies 2020, 13, 3840. [Google Scholar] [CrossRef]

- Zhang, X.; Jiao, K.; Zhang, J.; Guo, Z. A review on low carbon emissions projects of steel industry in the world. J. Clean. Prod. 2021, 306, 127259. [Google Scholar] [CrossRef]

| Stock Code | Firm Name | Location | Supply Chain Segment | Firm Code |

|---|---|---|---|---|

| 2002 | China Steel | Kaohsiung City, Taiwan | Upstream | US01 |

| 2006 | Tung Ho Steel | Taipei City, Taiwan | Upstream | US02 |

| 2007 | Yieh Hsing | Kaohsiung City, Taiwan | Midstream | MS01 |

| 2008 | Kao Hsing Chang Iron & Steel | Kaohsiung City, Taiwan | Midstream | MS02 |

| 2009 | First Copper Technology | Kaohsiung City, Taiwan | Midstream | MS03 |

| 2010 | Chun Yuan Steel | New Taipei City, Taiwan | Midstream | MS04 |

| 2012 | Chun Yu | Kaohsiung City, Taiwan | Midstream | MS05 |

| 2013 | China Steel Structure | Kaohsiung City, Taiwan | Downstream | DS01 |

| 2014 | Chung Hung Steel | Kaohsiung City, Taiwan | Midstream | MS06 |

| 2015 | Feng Hsin Steel | Taichung City, Taiwan | Upstream | US03 |

| 2017 | Quintain Steel | Tainan City, Taiwan | Midstream | MS07 |

| 2020 | Mayer Steel Pipe | Taipei City, Taiwan | Midstream | MS08 |

| 2022 | Tycoons Group | Kaohsiung City, Taiwan | Midstream | MS09 |

| 2023 | Yieh Phui | Kaohsiung City, Taiwan | Midstream | MS10 |

| 2024 | Chih Lien | Taoyuan City, Taiwan | Downstream | DS02 |

| 2025 | Chien Shing Stainless Steel | Tainan City, Taiwan | Midstream | MS11 |

| 2027 | Ta Chen Stainless Pipe | Tainan City, Taiwan | Midstream | MS12 |

| 2028 | Wei Chih Steel | Tainan City, Taiwan | Upstream | US04 |

| 2029 | Sheng Yu Steel | Kaohsiung City, Taiwan | Midstream | MS13 |

| 2030 | Froch | Yunlin County, Taiwan | Midstream | MS14 |

| 2031 | Hsin Kuang Steel | New Taipei City, Taiwan | Midstream | MS15 |

| 2032 | Sinkang | New Taipei City, Taiwan | Midstream | MS16 |

| 2033 | Chia Ta World | Tainan City, Taiwan | Downstream | DS03 |

| 2034 | YC Inox | Changhua County, Taiwan | Midstream | MS17 |

| 2038 | Hai Kwang | Kaohsiung City, Taiwan | Midstream | MS18 |

| 2069 | Yuen Chang Stainless Steel | Kaohsiung City, Taiwan | Midstream | MS19 |

| 2211 | Evergreen Steel | Taipei City, Taiwan | Downstream | DS04 |

| 3004 | National Aerospace Fasteners | Taoyuan City, Taiwan | Downstream | DS05 |

| 5007 | San Shing Fastech | Tainan City, Taiwan | Downstream | DS06 |

| 9958 | Century Iron and Steel | Taoyuan City, Taiwan | Downstream | DS07 |

| Supply Chain Segment | Statistic | Carbon Fees (NT$thousand) | Property, Plant, and Equipment (NT$thousand) | Number of Employees (No.) | Operating Expenses (NT$thousand) | Operating Revenue (NT$thousand) | Operating Profit (NT$thousand) |

|---|---|---|---|---|---|---|---|

| Upstream | Mean | 467,983 | 107,580,986 | 3284 | 4,254,104 | 116,318,542 | 2,661,661 |

| (n = 4) | Maximum | 1,751,983 | 397,633,498 | 9632 | 13,269,169 | 360,535,714 | 5,704,942 |

| Minimum | 14,042 | 4,226,820 | 387 | 179,858 | 10,196,132 | 376,970 | |

| SD | 856,265 | 193,461,538 | 4294 | 6,102,013 | 164,084,809 | 2,254,627 | |

| Midstream | Mean | 4780 | 7,648,014 | 542 | 1,308,581 | 17,668,636 | 463,074 |

| (n = 19) | Maximum | 31,172 | 44,403,003 | 1500 | 10,941,106 | 90,398,484 | 6,112,121 |

| Minimum | 53 | 358,030 | 80 | 48,899 | 1,058,326 | −1,240,502 | |

| SD | 7553 | 11,703,967 | 432 | 2,625,514 | 24,092,936 | 1,471,389 | |

| Downstream | Mean | 2803 | 4,424,981 | 530 | 383,790 | 8,154,638 | 1,179,388 |

| (n = 7) | Maximum | 14,338 | 17,157,127 | 1452 | 609,140 | 19,695,058 | 2,971,348 |

| Minimum | 208 | 440,665 | 115 | 60,624 | 577,650 | 16,504 | |

| SD | 5131 | 5,790,056 | 449 | 231,014 | 7,131,892 | 1,257,652 | |

| Overall | Mean | 66,079 | 20,220,369 | 905 | 1,485,533 | 28,602,024 | 923,359 |

| (n = 30) | Maximum | 1,751,983 | 397,633,498 | 9632 | 13,269,169 | 360,535,714 | 6,112,121 |

| Minimum | 53 | 358,030 | 80 | 48,899 | 577,650 | −1,240,502 | |

| SD | 318,741 | 71,973,685 | 1722 | 3,084,195 | 66,306,438 | 1,663,823 |

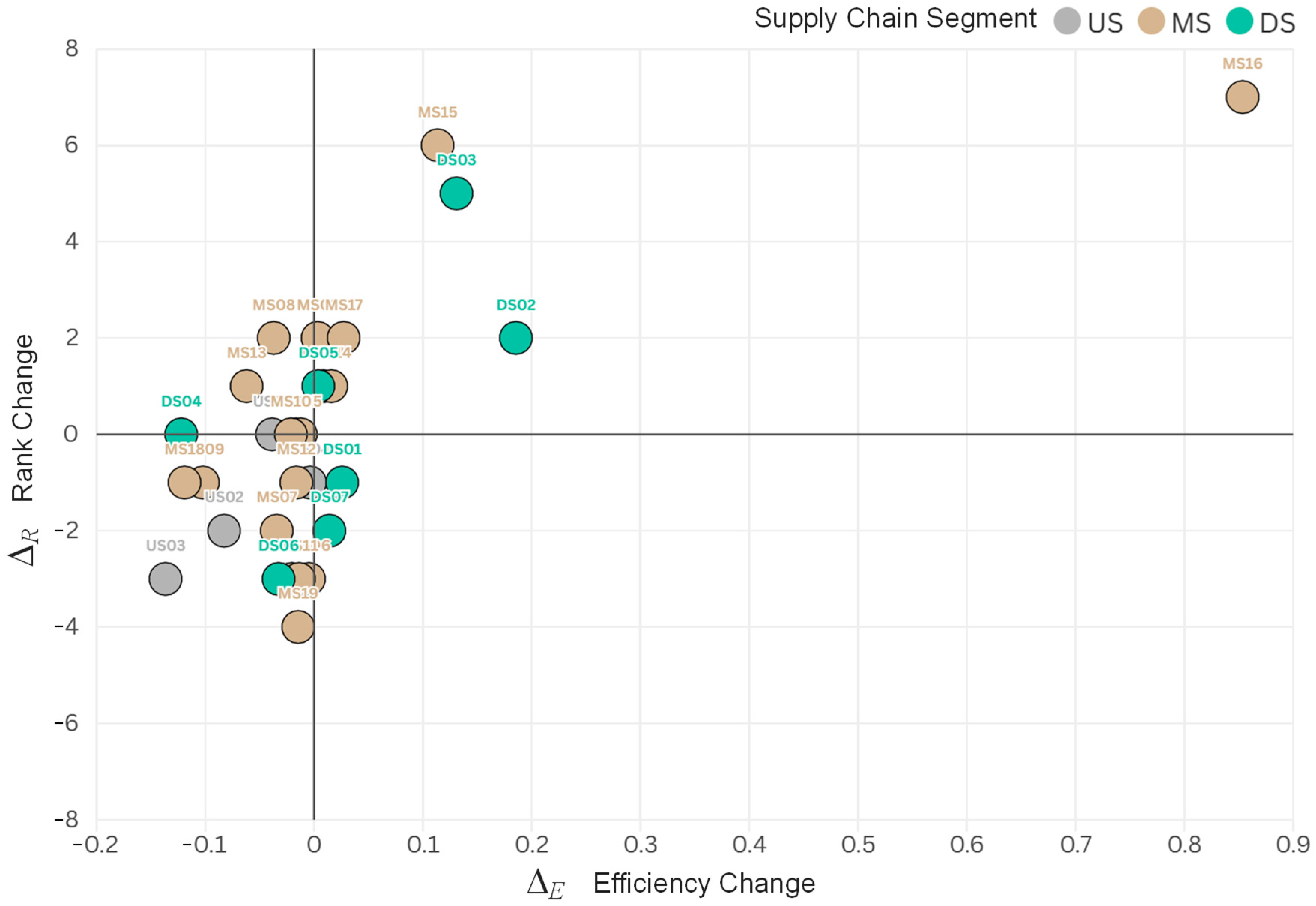

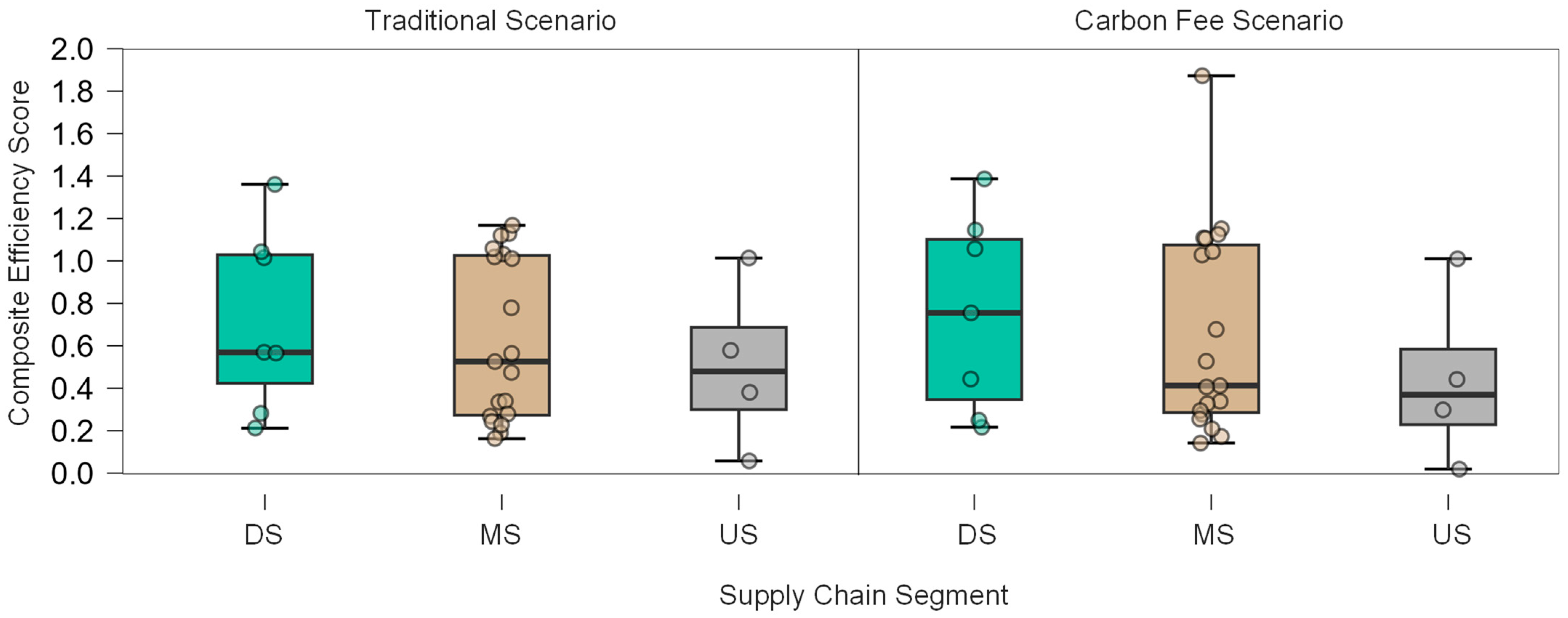

| Steel Firms | Traditional Scenario | Carbon Fee Scenario | Comparison | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SBM Score | Super SBM Score | Composite Score | Rank | SBM Score | Super SBM Score | Composite Score | Rank | Efficiency Change | Rank Change | |

| US01 | 0.057642 | - | 0.057642 | 30 | 0.019014 | - | 0.019014 | 30 | Decreased | Unchanged |

| US02 | 0.380949 | - | 0.380949 | 19 | 0.298134 | - | 0.298134 | 21 | Decreased | Declined |

| US03 | 0.578329 | - | 0.578329 | 13 | 0.441671 | - | 0.441671 | 16 | Decreased | Declined |

| US04 | 1 | 1.013787 | 1.013787 | 10 | 1 | 1.010061 | 1.010061 | 11 | Decreased | Declined |

| MS01 | 0.189406 | - | 0.189406 | 28 | 0.172898 | - | 0.172898 | 28 | Decreased | Unchanged |

| MS02 | 0.335183 | - | 0.335183 | 21 | 0.338393 | - | 0.338393 | 19 | Increased | Improved |

| MS03 | 1 | 1.128864 | 1.128864 | 3 | 1 | 1.108518 | 1.108518 | 6 | Decreased | Declined |

| MS04 | 0.268585 | - | 0.268585 | 24 | 0.277183 | - | 0.277183 | 23 | Increased | Improved |

| MS05 | 0.339615 | - | 0.339615 | 20 | 0.327356 | - | 0.327356 | 20 | Decreased | Unchanged |

| MS06 | 1 | 1.032727 | 1.032727 | 7 | 1 | 1.028015 | 1.028015 | 10 | Decreased | Declined |

| MS07 | 0.24311 | - | 0.24311 | 25 | 0.20877 | - | 0.20877 | 27 | Decreased | Declined |

| MS08 | 0.564157 | - | 0.564157 | 16 | 0.527047 | - | 0.527047 | 14 | Decreased | Improved |

| MS09 | 0.779305 | - | 0.779305 | 12 | 0.676996 | - | 0.676996 | 13 | Decreased | Declined |

| MS10 | 0.162941 | - | 0.162941 | 29 | 0.141578 | - | 0.141578 | 29 | Decreased | Unchanged |

| MS11 | 1 | 1.11991 | 1.11991 | 4 | 1 | 1.106031 | 1.106031 | 7 | Decreased | Declined |

| MS12 | 1 | 1.167897 | 1.167897 | 2 | 1 | 1.151558 | 1.151558 | 3 | Decreased | Declined |

| MS13 | 0.474426 | - | 0.474426 | 18 | 0.412338 | - | 0.412338 | 17 | Decreased | Improved |

| MS14 | 0.27908 | - | 0.27908 | 23 | 0.29486 | - | 0.29486 | 22 | Increased | Improved |

| MS15 | 1 | 1.011209 | 1.011209 | 11 | 1 | 1.124636 | 1.124636 | 5 | Increased | Improved |

| MS16 | 1 | 1.018897 | 1.018897 | 8 | 1 | 1.872449 | 1.872449 | 1 | Increased | Improved |

| MS17 | 0.227885 | - | 0.227885 | 26 | 0.254988 | - | 0.254988 | 24 | Increased | Improved |

| MS18 | 0.525486 | - | 0.525486 | 17 | 0.406267 | - | 0.406267 | 18 | Decreased | Declined |

| MS19 | 1 | 1.05847 | 1.05847 | 5 | 1 | 1.043819 | 1.043819 | 9 | Decreased | Declined |

| DS01 | 1 | 1.360718 | 1.360718 | 1 | 1 | 1.386502 | 1.386502 | 2 | Increased | Declined |

| DS02 | 0.569669 | - | 0.569669 | 14 | 0.755185 | - | 0.755185 | 12 | Increased | Improved |

| DS03 | 1 | 1.014992 | 1.014992 | 9 | 1 | 1.145818 | 1.145818 | 4 | Increased | Improved |

| DS04 | 0.565703 | - | 0.565703 | 15 | 0.443439 | - | 0.443439 | 15 | Decreased | Unchanged |

| DS05 | 0.212327 | - | 0.212327 | 27 | 0.216199 | - | 0.216199 | 26 | Increased | Improved |

| DS06 | 0.282148 | - | 0.282148 | 22 | 0.249472 | - | 0.249472 | 25 | Decreased | Declined |

| DS07 | 1 | 1.043417 | 1.043417 | 6 | 1 | 1.05742 | 1.05742 | 8 | Increased | Declined |

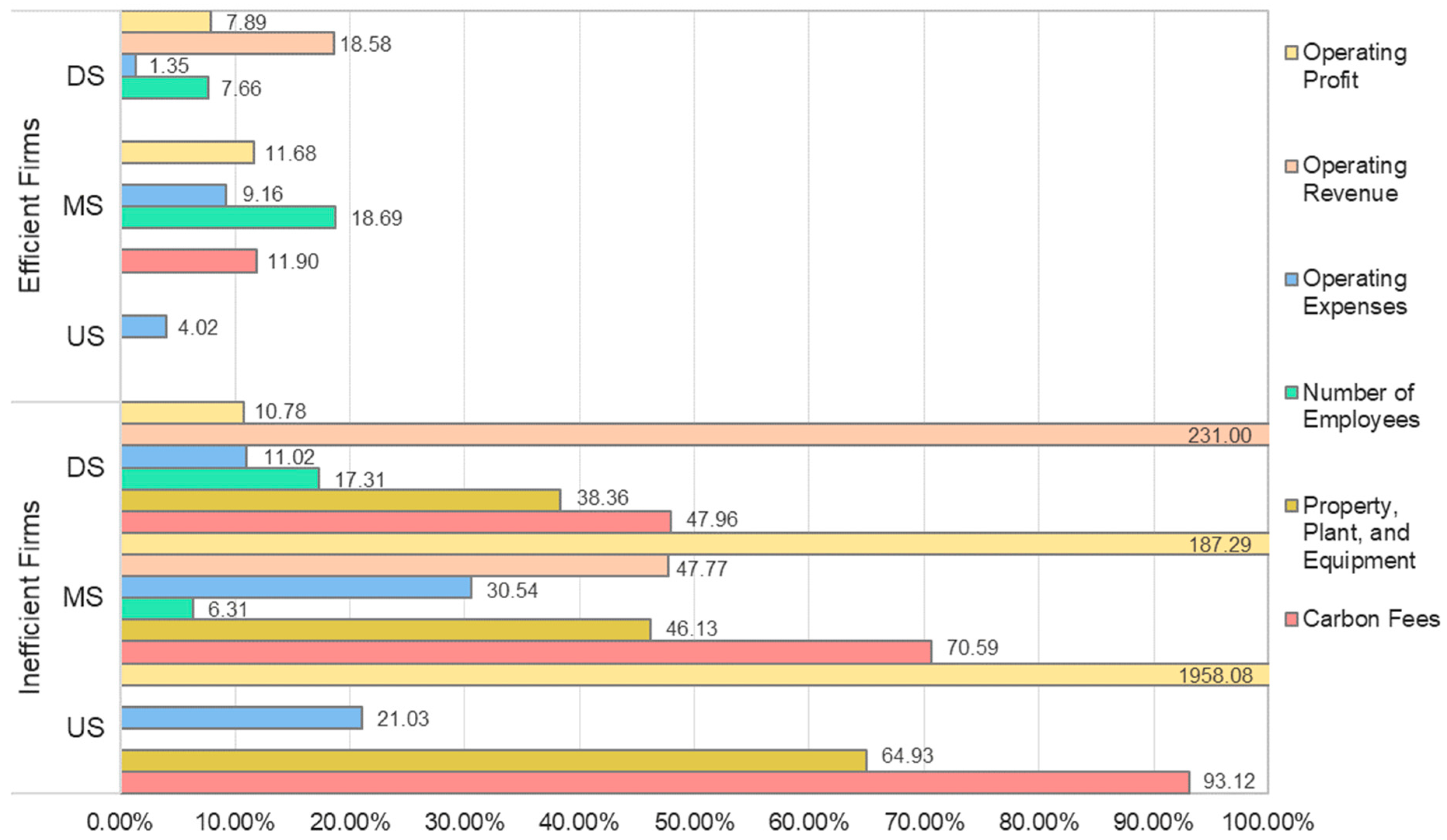

| Steel Firms | Status | Carbon Fees (%) | Property, Plant, and Equipment (%) | Number of Employees (%) | Operating Expenses (%) | Operating Revenue (%) | Operating Profit (%) |

|---|---|---|---|---|---|---|---|

| US01 | Inefficient | 97.40 | 79.75 | 0.00 | 0.00 | 0.00 | 5660.29 |

| US02 | Inefficient | 88.29 | 54.17 | 0.00 | 44.86 | 0.00 | 156.67 |

| US03 | Inefficient | 93.65 | 60.87 | 0.00 | 18.22 | 0.00 | 57.27 |

| US04 | Efficient | 0.00 | 0.00 | 0.00 | 4.02 | 0.00 | 0.00 |

| MS01 | Inefficient | 60.01 | 75.79 | 32.88 | 0.00 | 0.00 | 468.95 |

| MS02 | Inefficient | 74.84 | 59.35 | 6.94 | 0.00 | 182.49 | 0.00 |

| MS03 | Efficient | 0.00 | 0.00 | 0.00 | 43.41 | 0.00 | 0.00 |

| MS04 | Inefficient | 74.44 | 29.62 | 0.00 | 5.37 | 0.67 | 323.47 |

| MS05 | Inefficient | 89.45 | 46.39 | 0.00 | 67.10 | 0.00 | 101.00 |

| MS06 | Efficient | 0.00 | 0.00 | 0.00 | 11.21 | 0.00 | 0.00 |

| MS07 | Inefficient | 73.62 | 71.72 | 0.00 | 44.35 | 282.09 | 21.61 |

| MS08 | Inefficient | 46.80 | 0.00 | 3.13 | 25.43 | 107.98 | 0.00 |

| MS09 | Inefficient | 61.53 | 11.53 | 0.00 | 41.24 | 0.00 | 11.01 |

| MS10 | Inefficient | 55.67 | 34.34 | 0.00 | 18.75 | 0.00 | 828.53 |

| MS11 | Efficient | 0.00 | 0.00 | 17.83 | 9.52 | 0.00 | 6.81 |

| MS12 | Efficient | 0.00 | 0.00 | 60.62 | 0.00 | 0.00 | 0.00 |

| MS13 | Inefficient | 60.42 | 11.07 | 0.00 | 48.86 | 0.00 | 139.11 |

| MS14 | Inefficient | 79.85 | 62.94 | 0.00 | 55.25 | 0.00 | 142.49 |

| MS15 | Efficient | 15.00 | 0.00 | 34.85 | 0.00 | 0.00 | 0.00 |

| MS16 | Efficient | 68.30 | 0.00 | 0.00 | 0.00 | 0.00 | 74.95 |

| MS17 | Inefficient | 77.28 | 75.56 | 0.00 | 60.19 | 0.00 | 166.63 |

| MS18 | Inefficient | 93.14 | 75.30 | 32.72 | 0.00 | 0.00 | 44.71 |

| MS19 | Efficient | 0.00 | 0.00 | 17.53 | 0.00 | 0.00 | 0.00 |

| DS01 | Efficient | 0.00 | 0.00 | 0.00 | 0.00 | 55.75 | 0.00 |

| DS02 | Inefficient | 29.43 | 51.05 | 17.45 | 0.00 | 0.00 | 0.00 |

| DS03 | Efficient | 0.00 | 0.00 | 0.00 | 4.06 | 0.00 | 23.68 |

| DS04 | Inefficient | 88.52 | 45.44 | 0.00 | 22.33 | 74.80 | 0.00 |

| DS05 | Inefficient | 15.93 | 43.08 | 0.00 | 21.73 | 514.45 | 23.91 |

| DS06 | Inefficient | 57.95 | 13.88 | 51.79 | 0.00 | 334.75 | 19.19 |

| DS07 | Efficient | 0.00 | 0.00 | 22.97 | 0.00 | 0.00 | 0.00 |

| Average | 46.72 | 30.06 | 9.96 | 18.20 | 51.77 | 275.68 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, S.-H.; Lin, Y.-S.; Zhang, J.-L.; Hsu, C.-S.; Cheng, S.-M. Incorporating Carbon Fees into the Efficiency Evaluation of Taiwan’s Steel Industry Using Data Envelopment Analysis with Negative Data. Sustainability 2025, 17, 8384. https://doi.org/10.3390/su17188384

Yu S-H, Lin Y-S, Zhang J-L, Hsu C-S, Cheng S-M. Incorporating Carbon Fees into the Efficiency Evaluation of Taiwan’s Steel Industry Using Data Envelopment Analysis with Negative Data. Sustainability. 2025; 17(18):8384. https://doi.org/10.3390/su17188384

Chicago/Turabian StyleYu, Shih-Heng, Ying-Sin Lin, Jia-Li Zhang, Chia-Shan Hsu, and Shu-Min Cheng. 2025. "Incorporating Carbon Fees into the Efficiency Evaluation of Taiwan’s Steel Industry Using Data Envelopment Analysis with Negative Data" Sustainability 17, no. 18: 8384. https://doi.org/10.3390/su17188384

APA StyleYu, S.-H., Lin, Y.-S., Zhang, J.-L., Hsu, C.-S., & Cheng, S.-M. (2025). Incorporating Carbon Fees into the Efficiency Evaluation of Taiwan’s Steel Industry Using Data Envelopment Analysis with Negative Data. Sustainability, 17(18), 8384. https://doi.org/10.3390/su17188384