6.1. Formulation of Preliminary Policy Recommendations

The empirical findings substantiate the significant catalytic effect of industrial design agglomeration on manufacturing innovation performance. Grounded in this evidence, we propose a dual-tier policy framework integrating macro-level governance with micro-level support mechanisms. This systematic guidance architecture addresses regional developmental disparities through four strategic dimensions: spatial optimization, digital transformation, talent ecosystem cultivation, and governmental function reorientation. The framework advocates gradient development strategies for spatial planning, implementing differentiated guidance based on regional agglomeration levels, intelligent design infrastructure construction and AI-assisted design technology adoption, enhanced industry-academia-research collaboration for multidisciplinary talent development, and governmental transition from direct intervention to institutional provisioning.

(1) Establishing Differentiated Agglomeration Strategies Based on Regional Foundations

The agglomeration development of the industrial design sector must be grounded in rigorous analysis of regional characteristics and industrial foundations. Given the current regional development disparities, differentiated agglomeration guidance strategies should be implemented.

At the macro level, low-agglomeration regions typically exhibit three distinctive characteristics: scarcity of design firms, deficiency in innovation resources, and underdeveloped industrial chain support. For these regions, fundamental capacity-building strategies should be prioritized, including:

Strategic planning and development of specialized design industrial parks, supported by fiscal incentives such as land concession fee reductions and corporate income tax exemptions (three-year full exemption followed by three-year 50% reduction) to attract design institutions.

Concurrent development of professional infrastructure systems encompassing rapid prototyping laboratories, material libraries, and user experience testing centers.

Implementation of “Design+” industrial integration programs to foster long-term collaborative partnerships between local manufacturers and newly introduced design organizations.

For medium-to-high agglomeration regions with established industrial scale, policy focus should shift toward enhancing cluster quality and innovation efficiency through:

Establishment of design innovation alliances to facilitate specialized division of labor and collaboration among enterprises.

Targeted cultivation of industry leaders capable of providing comprehensive system solutions, supported by the development of provincial-level industrial design centers.

Formation of integrated “R&D-Design-Manufacturing” innovation chains with design as the driving force.

Complementary measures should include:

Development of design achievement trading platforms to facilitate intellectual property circulation

Formulation of industry standards to regulate market competition

Implementation of regional coordination mechanisms to encourage technology spillover and talent exchange from high-agglomeration to low-agglomeration areas

This multi-dimensional approach will ultimately establish a clearly stratified yet complementary regional industrial design ecosystem, achieving optimal resource allocation efficiency and comprehensive enhancement of industrial competitiveness.

(2) Advancing Digital Transformation in Industrial Design to Achieve Dual Expansion in Scale and Intelligence

The digital transformation of industrial design represents a critical pathway for enhancing industrial sophistication and competitive advantage. This transformation requires coordinated advancement across four key dimensions: infrastructure development, technology application, business model innovation, and ecosystem construction.

At the infrastructure level, regional authorities should accelerate the establishment of cloud-based industrial design service platforms. These platforms should integrate computing resources, design tool libraries, and industry-specific databases, with particular emphasis on deploying GPU cluster-based real-time rendering systems, high-performance computing nodes capable of multi-physics simulations, and design resource repositories accommodating millions of 3D models. In technology application, enterprises should be guided to deeply implement generative AI design systems trained on industry-specific large language models for intelligent product form generation and optimization, digital twin technology for design verification so as to establish closed-loop feedback mechanisms from virtual prototypes to physical samples, and blockchain-based collaborative platforms to ensure secure cloud-based cooperation among distributed teams. For business model innovation, the focus should shift from traditional design services to platform-based solutions, including subscription-based design tools, modular design component marketplaces, crowdsourced design innovation platforms, and third-party service platforms with intelligent design resource matching capabilities. Ecosystem development requires market-oriented circulation of design data elements, construction of design knowledge graphs covering entire product lifecycles, and establishment of “design-manufacturing-user” data feedback loops. This comprehensive digital transformation will facilitate three fundamental transitions: (1) from isolated tool applications to fully digitized workflows; (2) from individual creativity to collective intelligence, and (3) from closed operations to open innovation. Ultimately, the industrial design sector will emerge as a core driver of high-quality manufacturing development. By enhancing its own scale efficiency while upgrading manufacturing value chains through design data flows, a virtuous cycle between design innovation and industrial advancement can be achieved.

(3) Establishing an Industry-Academia-Research Integrated Talent Development System to Enhance Design-Manufacturing Compatibility

The prevalent structural disconnect between creative design and engineering implementation necessitates a comprehensive industry-academia-research integration mechanism throughout the entire talent cultivation cycle. At the institutional level, we recommend that local governments establish regional industrial design education-industry alliances, consolidating resources from university design schools, manufacturing innovation centers, key laboratories, and industry leaders. These alliances should jointly develop dual-track “design + engineering” curricula, incorporating engineering modules such as materials science, mechanical principles, and smart manufacturing into design programs. Concurrently, an “industry mentor database” should be created to implement a dual-supervisor system, pairing senior engineers with over a decade of product development experience with design professors to jointly guide graduate projects. For practical training platforms, three key facilities should be prioritized. First, design workshop-style training centers equipped with advanced manufacturing tools including 5-axis machining systems and 3D printing clusters, enabling students to participate in complete product development cycles from concept sketching to prototyping; Second, industry-proposed project repositories where manufacturers annually submit authentic product improvement challenges as thesis topics, with outstanding solutions directly entering production pipelines; Third, technology transfer pilot platforms facilitating the application of university-developed materials and processes in design practice.

At the evaluation mechanism level, reforms should be enforced through an industry-participatory certification system incorporating engineering criteria like CMF (Color-Material-Finish) application competence and DFM (Design for Manufacturing) compliance, as well as the establishment of joint industry-academia innovation funds to prioritize research projects with commercialization potential. This tripartite approach—curriculum restructuring, platform co-development, and evaluation innovation—will fundamentally transform design education from its current overemphasis on artistic expression to balanced engineering implementation capabilities. The ultimate outcome will be a new generation of multidisciplinary designers proficient in both aesthetic conceptualization and manufacturing constraints, achieving seamless design-engineering integration and positioning industrial design as a central driver of product innovation.

(4) Enhancing the Institutional Innovation Support System and Transforming the Government Role

The industrial design sector requires fundamental reforms in institutional innovation support systems, necessitating a transformation of government roles from traditional regulators to ecosystem facilitators. This shift calls for replacing fragmented policy interventions with comprehensive institutional arrangements across multiple dimensions. In fiscal policy innovation, the conventional subsidy model should transition to market-oriented mechanisms. This includes implementing design innovation vouchers that allow manufacturing enterprises to claim tax deductions when purchasing design services, establishing risk compensation funds to mitigate innovation risks in design achievement industrialization, and introducing interest subsidy policies for design patent collateral financing to reduce intellectual property monetization costs. Platform development should focus on creating regional industrial design innovation centers that consolidate professional services including technology transfer, intellectual property valuation, and investment financing. These centers need supporting infrastructure such as design achievement valuation systems for transaction pricing references and design-manufacturing matchmaking databases to facilitate precise demand alignment. The institutional environment requires optimization through several measures: establishing comprehensive design service standards and quality certification systems, developing model contract templates to standardize transactions, implementing efficient dispute resolution mechanisms, and incorporating design achievements into high-tech enterprise evaluation criteria. To strengthen collaborative innovation networks, policymakers should encourage forming cross-sector industrial design alliances, launch interdisciplinary “Design+” research initiatives, organize regular demand-supply matching events, and create shared talent platforms. Such an integrated policy framework creates an innovation ecosystem characterized by market-driven mechanisms, government guidance, enterprise leadership, and multi-stakeholder participation. By maintaining policy consistency while preserving market vitality, this approach facilitates the sector’s transition from policy-driven to endogenous growth, ultimately providing sustainable support for high-quality manufacturing development through enhanced industrial design capabilities.

6.2. Feasibility Assessment and Analytical Findings

To evaluate the scientific validity and implementation potential of the proposed policy recommendations, this study employed a dual-method approach combining expert surveys with structural equation modeling. The questionnaire utilized a 7-point Likert scale to assess three policy categories across four dimensions: feasibility, innovation promotion, regional compatibility, and sustainability. Valid responses were collected from 15 experts representing academia, research institutions, and industrial parks (see

Table 8).

Key findings from the expert evaluations reveal distinct patterns:

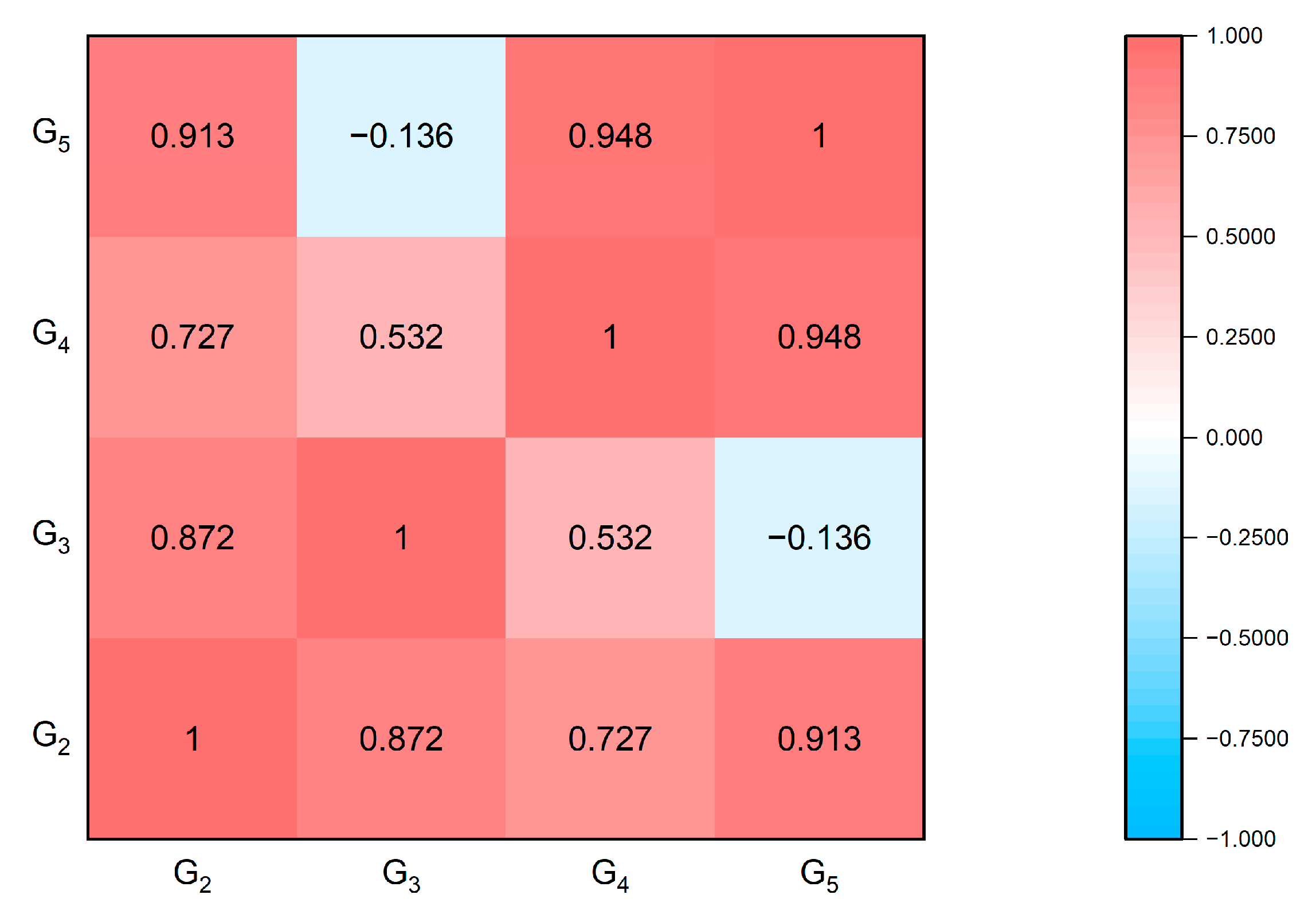

The initiative of “Establishing Differentiated Agglomeration Strategies Based on Regional Foundations” demonstrated mixed results. While scoring well in innovation promotion (mean = 5.60, SD = 0.76), it received comparatively lower and more variable ratings for regional compatibility and feasibility (means = 5.13 and 5.27, respectively). Several experts noted that spatial policies alone may prove insufficient in low-agglomeration areas without complementary fiscal investments and public platform development. Conversely, in established clusters, concerns were raised about potential resource duplication and diminishing returns.

The initiative of “Advancing Digital Transformation in Industrial Design to Achieve Dual Expansion in Scale and Intelligence” achieved above-average scores overall, particularly in feasibility (5.80) and innovation promotion (5.67), reflecting expert consensus on its multiplier effects for design-manufacturing integration. However, its regional compatibility score (5.20) suggests reservations about implementation in areas with underdeveloped digital infrastructure. Experts recommended parallel development of edge computing nodes and cloud platform capabilities to prevent digital divides across regions.

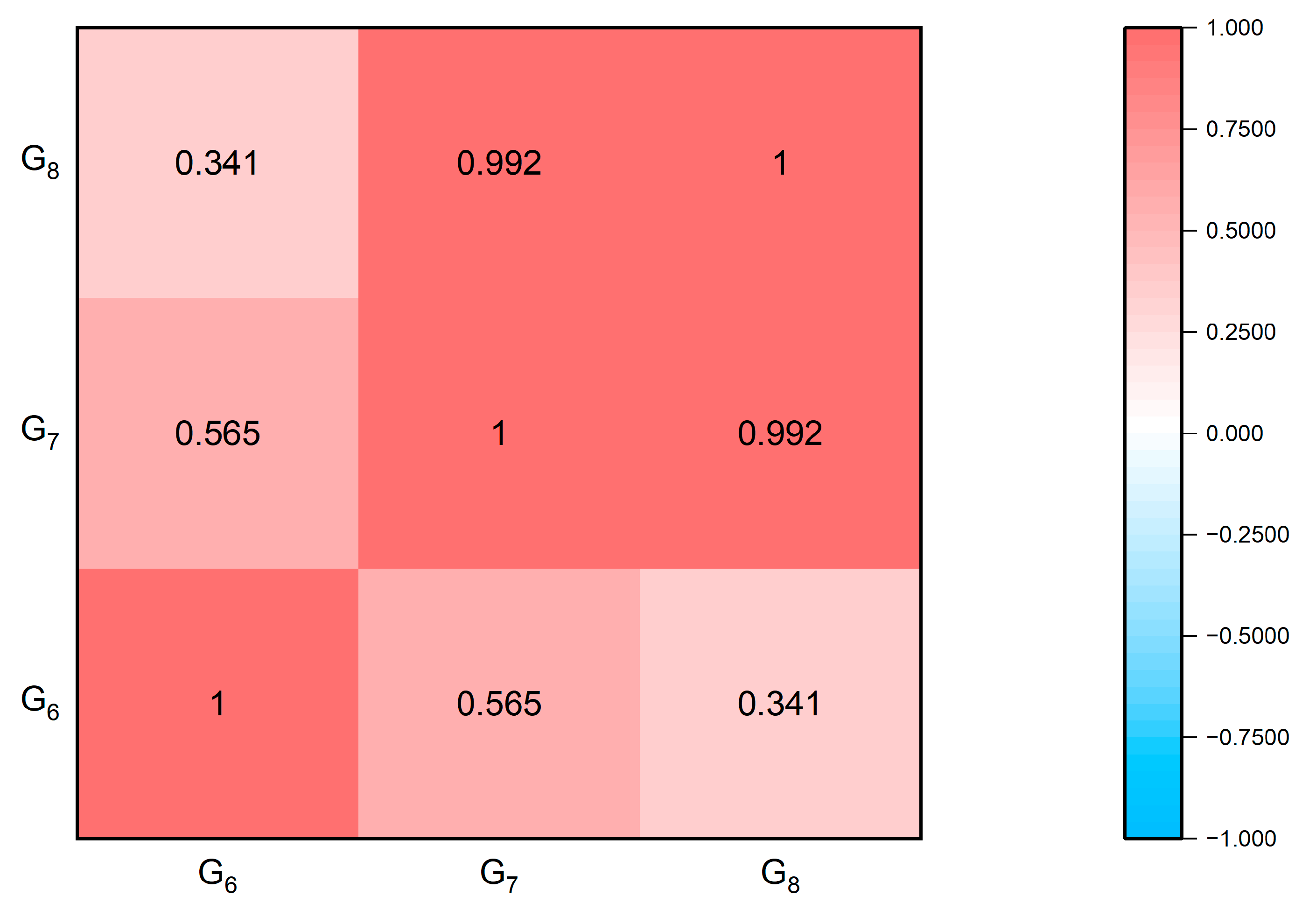

The initiative of “Establishing an Industry-Academia-Research Integrated Talent Development System to Enhance Design-Manufacturing Compatibility” emerged as the highest-rated recommendation, with consistently strong scores across all dimensions (feasibility = 6.00, innovation promotion = 6.13, regional compatibility = 5.80, sustainability = 6.07) and low standard deviations (<0.8). Experts particularly emphasized its effectiveness in bridging the education-industry gap through real-world project experience, making it a cornerstone strategy for manufacturing innovation.

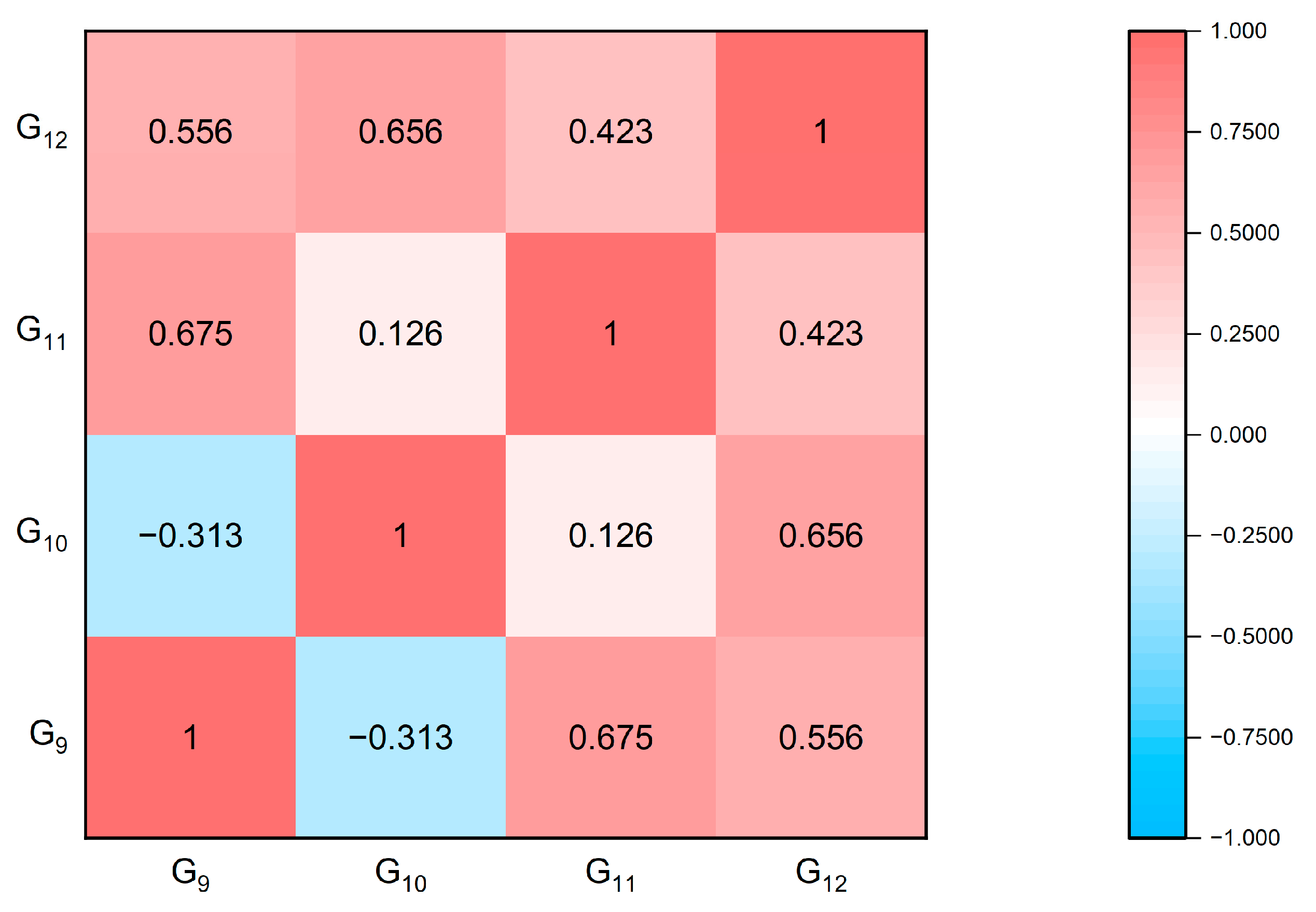

The initiative of “Enhancing Institutional Innovation Support System and Transforming Government Role” received more conservative evaluations, with notably divergent opinions on regional compatibility (mean = 4.93, SD = 1.12). While acknowledging its long-term strategic value, many experts expressed concerns about immediate implementation challenges, especially in regions with weaker governance capacity or immature market mechanisms. Gradual, context-sensitive adoption with risk mitigation measures was widely recommended, avoiding a “one-size-fits-all” approach, and risk warning and supporting mechanisms should be established to enhance policy resilience.

In conclusion, the expert evaluations demonstrate clear consensus regarding the initiative of “Establishing an Industry-Academia-Research Integrated Talent Development System to Enhance Design-Manufacturing Compatibility”, which received consistently positive assessments as the most actionable and outcome-driven strategy. The initiative of “Advancing Digital Transformation in Industrial Design to Achieve Dual Expansion in Scale and Intelligence” ranked second in expert preference, presenting viable implementation prospects, particularly in regions with established technological infrastructure. The initiative of “Establishing Differentiated Agglomeration Strategies Based on Regional Foundations” yielded more divergent feasibility assessments, reflecting the necessity for careful consideration of local resource disparities. While the initiative of “Enhancing Institutional Innovation Support System and Transforming Government Role” holds strategic importance, experts emphasized the need for context-specific, phased implementation to ensure practical effectiveness.

Given the limited number of items measuring each dimension across individual policy recommendations, we consolidated items sharing common latent constructs for comprehensive reliability testing. As shown in

Table 9, Cronbach’s alpha coefficients were calculated to assess internal consistency. The results indicate high reliability across all four dimensions. All alpha values (α) exceeded 0.84, with the highest reaching 0.958, demonstrating excellent measurement consistency for the Feasibility, Innovation Promotion, Regional Compatibility, and Sustainability dimensions. These robust reliability statistics provide a solid foundation for subsequent statistical analyses and empirical validation of the policy recommendations.

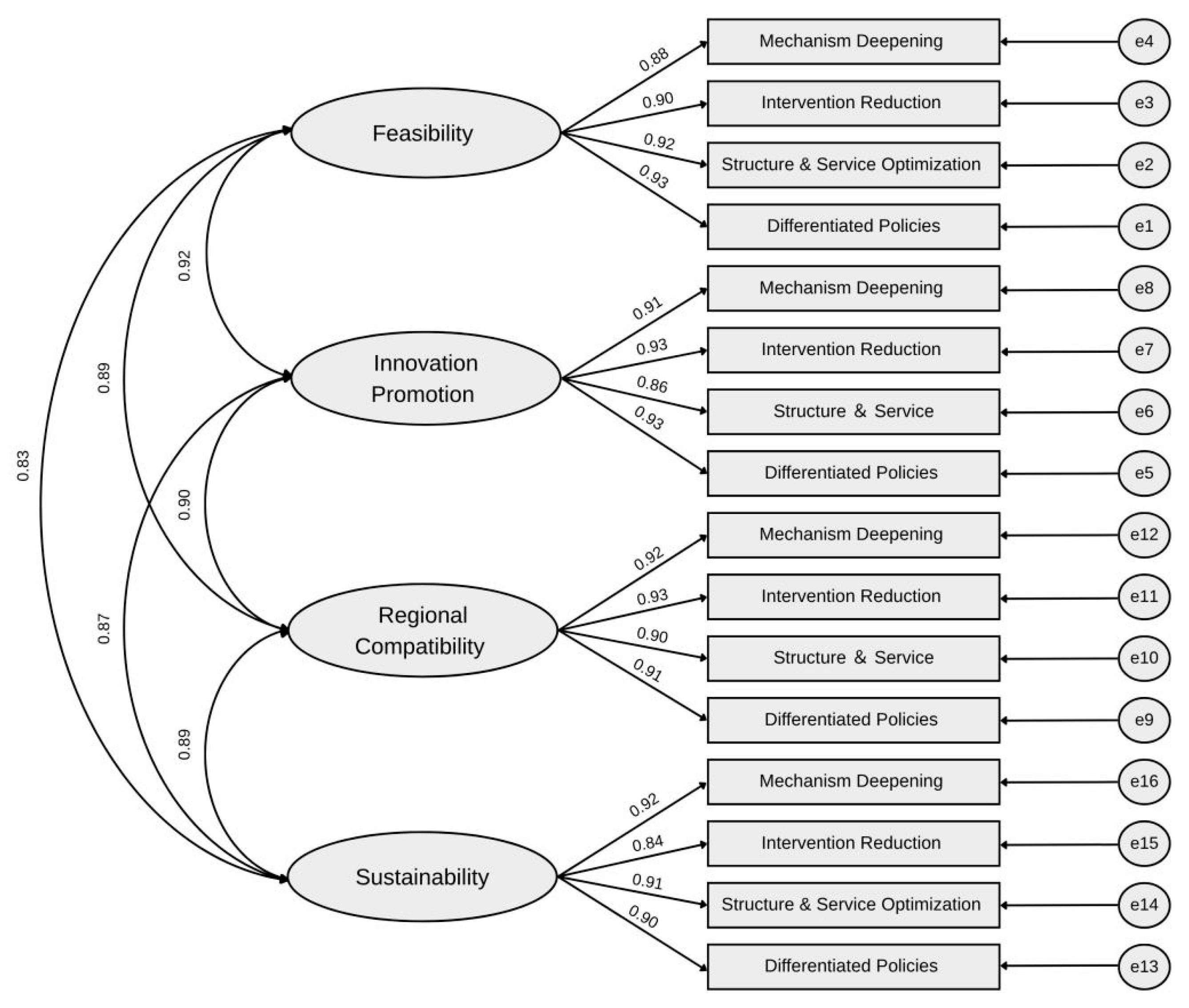

The confirmatory factor analysis (CFA) validated the structural validity and model fit of the proposed four-dimensional measurement framework. Using AMOS 28.0, all standardized factor loadings for the latent variables (Feasibility, Innovation Promotion, Regional Compatibility, and Sustainability) exceeded 0.80, confirming the strong explanatory power of the observed indicators. Notably, the “Reduced Intervention” indicator demonstrated the highest factor loading (0.91–0.93), indicating exceptional representativeness. Inter-factor correlations among latent variables were consistently high (0.83–0.92), reflecting robust internal consistency and structural stability (see

Figure 9).

Figure 9.

The Path Coefficient Analysis Model of Policy Recommendations. Note: The curved arrows represent the correlations among the four latent variables, while the straight arrows indicate the standardized factor loadings between each latent variable and its observed indicators.The model fit indices, as detailed in

Table 10, all meet recommended thresholds: χ

2/df = 1.925 < 3, RMSEA (Root Mean Square Error of Approximation) = 0.046 < 0.08, GFI (Goodness-of-Fit Index) = 0.942, TLI (Tucker–Lewis Index) = 0.955, CFI (Comparative Fit Index) = 0.961, NFI (Normed Fit Index) = 0.930, all exceeding the 0.90 benchmark for satisfactory model fit. These results confirm strong overall model fit, supporting both the theoretical soundness and empirical feasibility of the measurement structure. This validation establishes a solid theoretical foundation for subsequent strategy evaluation and comparative analysis.

Figure 9.

The Path Coefficient Analysis Model of Policy Recommendations. Note: The curved arrows represent the correlations among the four latent variables, while the straight arrows indicate the standardized factor loadings between each latent variable and its observed indicators.The model fit indices, as detailed in

Table 10, all meet recommended thresholds: χ

2/df = 1.925 < 3, RMSEA (Root Mean Square Error of Approximation) = 0.046 < 0.08, GFI (Goodness-of-Fit Index) = 0.942, TLI (Tucker–Lewis Index) = 0.955, CFI (Comparative Fit Index) = 0.961, NFI (Normed Fit Index) = 0.930, all exceeding the 0.90 benchmark for satisfactory model fit. These results confirm strong overall model fit, supporting both the theoretical soundness and empirical feasibility of the measurement structure. This validation establishes a solid theoretical foundation for subsequent strategy evaluation and comparative analysis.

Table 10.

Fitting Coefficients.

Table 10.

Fitting Coefficients.

| | | | | | | |

|---|

| 92.357 | 48 | 1.925 | 0.046 | 0.942 | 0.955 | 0.961 | 0.930 |

6.3. Policy Refinement and Implementation Pathways

To effectively promote positive coupling between industrial design agglomeration and manufacturing innovation performance, this study systematically refines four core policy recommendations based on empirical analysis and expert evaluation. The enhanced framework specifies policy objectives, critical pathways, and implementation mechanisms to achieve precision, effectiveness, and adaptability.

It should be noted that the above policy recommendations are primarily grounded in the practical foundation of the deep integration between industrial design and manufacturing in Zhejiang Province, and thus exhibit strong regional adaptability. Although specific policy instruments need to be flexibly adjusted according to the industrial structures and development stages of different regions, the experience in mechanism design and pathway planning also provides valuable insights for other regions in China with potential for industrial agglomeration.

It should also be acknowledged that potential endogeneity concerns—such as reverse causality, whereby highly innovative manufacturing firms may attract greater industrial design agglomeration—cannot be fully ruled out within the current framework. Although the fixed-effects model helps mitigate unobservable heterogeneity, future research could employ instrumental variables, quasi-experimental approaches, or longitudinal case-tracking to more rigorously identify causal pathways. From a policy perspective, recognizing these possible bidirectional dynamics highlights the need for adaptive implementation and continuous evaluation mechanisms.

(1) Deepening Industry-Design Collaboration Mechanisms: Building Cross-Sector Innovation Ecosystems

The integration of industrial design and manufacturing serves dual purposes: driving product sophistication (smart, green, high-end manufacturing) and transforming design value from aesthetic enhancement to systemic innovation. We propose establishing an integrated “R&D-Design-Production” collaborative mechanism with three core processes: joint problem identification, cooperative development, and achievement transformation. The government can take the lead in establishing a “joint industrial design innovation project database” to encourage leading enterprises and design institutions to jointly publish their needs in areas such as key technological bottlenecks and new material applications. Universities and small and medium-sized enterprises can then form joint ventures to conduct research and development, while introducing third-party platform institutions to provide results assessment and resource integration services, so as to enhance collaborative efficiency. However, attention should be paid to risks such as resource misallocation and redundant construction.

In the design of collaborative mechanisms, it may be advisable to promote the “mixed ownership + diversified income distribution” model, clarify the technical inputs, equity distribution, and outcome attribution mechanism of all parties in joint research and development, explore the establishment of a “intellectual property pool” management mechanism, share patent achievements for authorized use, and ensure the transparency and controllability of technology transfer process through technologies such as blockchain. Additionally, it is essential to promote the construction of a “collaborative performance evaluation system”, set milestone nodes for collaborative projects, conduct comprehensive evaluations based on dimensions such as product development cycle, design conversion rate, and market application performance, and directly link performance outcomes with the intensity of financial support to enhance the quality and efficiency of project implementation. Through co-building mechanisms and innovative rules, the transformation from “point-to-point cooperation” to “systematic co-creation” can be achieved, truly establishing a collaborative path that integrates industrial design into the entire manufacturing process, and propelling the manufacturing industry towards a new stage of high-quality development, but full consideration should be given to differences in industrial foundation, organizational capacity, and other aspects across regions, so as to avoid the efficiency losses caused by a “one-size-fits-all” promotion approach.

(2) Optimizing Industrial Structure and Supply Mechanisms: Implementing Region-Specific Policy Matching

Given the varying agglomeration levels of industrial design across different regions, a three-tier spatial development framework may be considered, characterized by “policy differentiation–gradient guidance–dynamic upgrading”. This framework could aim to create an interconnected spatial pattern consisting of “agglomeration hubs—growth echelons—cultivation bases”. In regions with high design resource concentration and complete industrial chains, the focus might be placed on deep integration between design and advanced manufacturing. The establishment of “Advanced Design Pilot Zones” is advisable to explore pioneering integrated innovation in cross-disciplinary fields such as intelligent manufacturing, green design, and service-oriented manufacturing. These initiatives will propel industrial design towards the medium-high end of the value chain while generating positive spillover effects. For regions with medium-low agglomeration levels and underdeveloped industrial systems, the strategy should center on building public service capabilities and industrial incubation foundations. This can be achieved by facilitating deep collaboration between incubators and local manufacturers within industrial parks, implementing “design-in-park” mechanisms to enhance regional innovation vitality. Concurrently, resource transfer mechanisms might be established between high- and low-agglomeration regions to encourage cross-regional flow of talent and technology, thereby improving coordinated development of design capabilities across all regions, but full consideration should be given to differences in industrial foundation, organizational capacity, and other regional conditions so as to avoid the efficiency losses caused by a “one-size-fits-all” promotion approach.

Regarding talent supply mechanisms, emphasis should be placed on developing a “design + engineering” interdisciplinary talent system to address the structural imbalance between strong creative capabilities and weak implementation. Local governments could take the lead in encouraging joint talent development programs between universities and manufacturers. These programs might incorporate design curriculum modules covering material processing, manufacturing logic, and smart equipment applications into existing design education systems. Manufacturing enterprises should be encouraged to establish “design engineer training positions” that provide hands-on experience in product co-creation and manufacturing validation. Joint training bases and industry-education integration laboratories equipped with processing equipment and simulated production lines could be established through university-enterprise collaboration to validate academic outcomes through engineering applications. A competency-based design talent evaluation system incorporating DFM compliance, engineering communication skills, and commercialization performance should be implemented to enhance industry recognition and utilization of design professionals.

For financial support mechanisms, a diversified financial service package oriented towards “design-driven manufacturing innovation” should be developed. This includes establishing joint loan programs for startup design firms and small–medium-sized manufacturers, with government and financial institutions co-funding a “Design Innovation Development Fund” to provide interest subsidies, risk-sharing, and performance-based incentives for qualifying projects, but such initiatives should be advanced prudently in line with the realities of regional financial resources. The implementation of intellectual property pledge financing should be advanced by incorporating design patents, appearance innovations, and platform services into intellectual asset valuation systems. Local governments could guide industrial investment institutions to establish “Achievement Conversion Special Funds” that facilitate the application of design innovations through equity investments and technology transactions. A dual-driven investment mechanism combining policy support and market forces may be gradually refined and perfected to construct a full-cycle financial support chain covering “creative incubation—prototype development—mass production application”, thereby comprehensively enhancing factor supply capacity and industrial support effectiveness.

(3) Accelerating Digital Transformation in the Design Industry: Building Future-Oriented Intelligent Collaborative Infrastructure

As manufacturing rapidly advances toward intelligent and green development, design services—positioned at the forefront of innovation chains—increasingly need to undergo digital transformation to enhance their responsiveness to manufacturing scenarios and service scalability. We propose a tripartite approach integrating infrastructure development, platform services, and institutional safeguards to systematically advance digital capabilities in industrial design [

57].

Regarding infrastructure development, local governments could facilitate, where conditions permit, the establishment of intelligent design infrastructure clusters within industrial design agglomeration zones. These clusters might incorporate high-performance design cloud platforms, 3D modeling and rendering centers, and virtual collaborative workspaces to provide enterprises with standardized, accessible design computing resources and tools. To address digital capability gaps among small and medium enterprises, pilot “Design SaaS Service Marketplaces” could be explored, offering modular, subscription-based services to lower digital adoption barriers, while ensuring continuous attention to SMEs’ cognitive acceptance and sustained usage capacity so as to safeguard policy effectiveness.

For platform services, we recommend creating industrial design data resource platforms that consolidate diverse datasets including material libraries, case repositories, user research reports, and technical parameters. These platforms could integrate with manufacturers’ Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES) systems to enable seamless online collaboration throughout the entire “concept-design-verification-production” workflow. The establishment of “Regional Industrial Design Middle Platforms” would facilitate data aggregation and behavioral insights from local design activities, providing real-time support for government policy evaluation and industry trend monitoring.

In terms of institutional safeguards, pilot programs for design data standardization can be introduced to develop unified formats, interface protocols, and outcome evaluation metrics. This would address current information silos between design and manufacturing digital systems. At the same time, it may also be worth exploring differentiated implementation across regions, incorporating digital capabilities into enterprise design competency assessments and government policy support criteria would incentivize proactive digital capacity building. These measures collectively could contribute to fostering a new generation of design innovation ecosystems characterized by intelligent collaboration.

(4) Implementing Differentiated Policy Orientation: Establishing a Multi-tier Governance Framework with Dynamic Adjustment Mechanisms

To address regional disparities in industrial foundations, governance capacity, and policy responsiveness, a differentiated policy implementation mechanism should be developed, characterized by hierarchical coordination, task delegation, and collaborative execution. This approach establishes a multi-level implementation network spanning provincial guidance, municipal coordination, and industrial park execution.

At the provincial level, governments might consider formulating Industrial Design Industry Support Guidelines that delineate region-specific policy directions, support parameters, and regulatory boundaries based on local industrial chains and resource endowments. The establishment of inter-departmental joint conference mechanisms would further enhance horizontal coordination efficiency. Municipal governments, while adhering to provincial directives, may develop tailored policy packages incorporating measures such as tax incentives, specialized subsidies, financial interest discounts, land-use priorities, and industrial chain support to potentially improve policy relevance and implementation effectiveness. Industrial parks, as frontline policy implementers, might focus on integrated “design-manufacturing” services by consolidating administrative windows and industrial service platforms. The exploration of park-level Industrial Design Promotion Centers could provide centralized, one-stop services encompassing enterprise consultation, resource allocation, and service coordination.

To ensure policy flexibility and adaptability, a comprehensive feedback and iteration mechanism is advisable to establish. This includes implementing a closed-loop adjustment system featuring pilot releases, phased evaluations, and rolling optimizations. Initial policy pilots might incorporate multi-stage assessment checkpoints, with third-party experts conducting quantitative monitoring and qualitative field interviews to evaluate policy effectiveness and enterprise responses. Furthermore, regional digital governance platforms may be leveraged to develop policy performance information systems that regularly generate Policy Effectiveness Evaluation Reports. These reports would track key indicators including policy coverage, implementation progress, and support outcomes. Identified issues such as inadequate supporting measures, implementation deviations, or coverage gaps should trigger careful considerations of dynamic policy revisions and enhancements. Through this data-driven, intelligently iterative, and cross-level responsive adjustment system, the policy framework could gradually gain both resilience and extensibility. This would help ensure precise support for the strategic objectives of industrial design agglomeration and manufacturing innovation integration across various development stages and regional contexts, while also leaving sufficient room for future evolution and adaptive refinement.

(5) Reconstructing Innovation Incentive Mechanisms and Institutional Support Systems: Cultivating a Design-Driven Growth Ecosystem

To facilitate the transition from policy-driven to endogenous innovation-driven development, it is imperative to establish a comprehensive lifecycle incentive and support framework that fosters an inclusive design innovation ecosystem. Addressing potential transformation challenges during policy phase-out periods, an Innovation Transition Facilitation Mechanism could be considered, incorporating three key elements: a gradually tapered subsidy scheme, technical diagnostics and transformation advisory services, and joint technology development funding. This integrated approach mitigates resource gaps during initial R&D and organizational restructuring, ensuring smoother transition periods, although the effectiveness of such fiscal adjustment and enterprise qualification criteria may vary depending on local financial capacity and firm-level conditions. Concurrently, a “Design Enterprise Growth Support Registry” could be explored to provide stage-specific assistance. For startups, “innovation vouchers + design consulting subsidies” would facilitate concept validation and market access. Growth-stage enterprises would benefit from a “Brand Enhancement Program” offering visual identity design grants and market expansion support. Mature firms may be connected to a “Capital Matching Platform” connecting them with multi-level capital markets to strengthen independent R&D and industrial expansion capabilities.

At the institutional level, we recommend accelerating the development of a design achievement management framework centered on “outcome registration—IP confirmation—transaction facilitation”. To enhance the institutional framework, a dual-track approach may be introduced. The primary track involves establishing an “expedited patent review channel for industrial design” coupled with a “design achievement registration platform” to streamline intellectual property confirmation processes and improve market liquidity, thereby accelerating the transformation of design value into industrial value. The secondary track focuses on strengthening regional legal support systems through the creation of a fast-track intellectual property arbitration mechanism. This system would provide specialized mediation services for design-related infringement disputes and collaborative ownership conflicts, helping to reducing rights protection costs and shortening resolution periods to bolster corporate confidence in intellectual property protection.

Complementing these measures, a “Design Maturity Evaluation Model” could be developed, incorporating three core assessment dimensions: technological accumulation, market performance, and organizational capabilities. This model would serve as a reference for precise allocation of public resources and policy instrument selection, marking a strategic shift from universal support to targeted assistance. The implementation of this comprehensive institutional safeguard system might extend across the entire innovation lifecycle—from initial incubation and prototype testing to commercial scale-up—ultimately fostering a stable and sustainable collaborative ecosystem where design and manufacturing capabilities mutually reinforce each other’s development, though the specific models and standards for long-term institutionalization would still require iterative validation and refinement based on local practices.

(6) Enhancing Industry-Specific Policy Design: Targeted Support for Strategic Sectors’ Design Needs

The manufacturing sector exhibits significant variations across subsectors in terms of design service penetration, innovation pathways, and value chain distribution. To improve policy precision, we recommend conducting systematic “industry-design” compatibility analyses to identify strategic sectors with high design-driven potential. For key industries such as intelligent manufacturing, high-end equipment, advanced materials, and green manufacturing, governments could consider collaborating with industry associations, academic institutions, and third-party organizations to conduct specialized research. These efforts might lead to the development of “Industrial Design Empowerment Maps” that document typical pain points, potential breakthroughs, and value realization pathways, ultimately providing reference for actionable industry-specific design support guidelines for policy formulation and project planning.

Mechanistically, local governments may explore developing “White Papers on Deep Integration of Industrial Design and Manufacturing” that systematically analyze regional industrial structures and design resource endowments. These documents should identify priority integration sectors and directions while outlining phased implementation roadmaps. Concurrently, “Design Demand Response Platforms” should be established through local manufacturing innovation centers and high-tech zone administrations to coordinate resource allocation among manufacturers, designers, and service providers. These platforms should incorporate standardized demand templates, project solicitation mechanisms, and intelligent matching engines, enabling real-time updates and potentially facilitating the dissemination of design challenges, manufacturing needs, policy support, and technology transfer opportunities through API-driven data exchange.

To strengthen policy synergy, sector-specific design guidance catalogs may be developed alongside dedicated funding mechanisms that allocate design resources to critical industrial nodes. This approach enhances horizontal coordination between industrial and innovation policies, creating a closed-loop system for “design + industry chain” integration. Such institutional arrangements will facilitate the large-scale application and demonstration of design-driven manufacturing innovation across diverse industrial segments, contributing to broader sectoral adoption.