Two-Way Carbon Options Game Model of Construction Supply Chain with Cap-And-Trade

Abstract

1. Introduction

- (1)

- Although previous studies have explored the role of option contracts in supply chain risk hedging, they have mainly focused on manufacturing or retail scenarios. In the construction industry, previous research has focused on the development of green building materials and the optimization of supply chain processes, and carbon financial tools have not yet been incorporated into the construction supply chain management framework. This study introduces two-way carbon options into the construction supply chain environment for the first time to manage the price fluctuations of carbon quotas. Through the above innovations, this study bridges the key gap between carbon financing and construction supply chain management and broadens the research scope of option contract theory.

- (2)

- A novel Holistic Stackelberg game-based model is proposed for a construction supply chain operating under cap-and-trade. The model jointly optimizes the profit-sharing ratio, carbon emission reduction levels, and the amount of carbon allowances purchased through carbon option contracts within a unified decision framework. This integrated approach captures the hierarchical leader–follower dynamics in the supply chain, thereby transcending the fragmented approaches of prior studies, which treat emission mitigation, contract design, and carbon credit procurement in isolation. The model advances the theoretical discourse at the intersection of green construction supply chain management and option contract theory, while offering practical insights for policymakers and industry stakeholders seeking integrated strategies in the construction sector.

- (3)

- From the perspective of practical value, the construction supply chain’s emission reduction is confronted with three major predicaments: high emission reduction costs, significant risks of carbon price fluctuations and difficulty in coordinating the interests of the main parties. Most existing research remains at the theoretical deduction stage and lacks an adaptive design for practical operation scenarios in the construction supply chain. This study verified the role of option tools in mitigating carbon price fluctuation risks and optimizing emission reduction decisions by constructing a building supply chain game model with two-way carbon options. Through numerical analysis, it revealed the correlation rules between key parameters such as the carbon price benchmark and the emission reduction cost coefficient and the optimal strategy. It should be noted that the model of this study is based on a series of simplified assumptions, such as complete information symmetry and complete risk transfer. These assumptions aim to strip away complex interfering factors, clearly depict the interaction mechanism between two-way options and supply chain emission reduction decisions, and make the model results unable to be directly used as precise quantitative tools in the actual operation of enterprises. Despite this, the research conclusions can still provide theoretical references and decision-making ideas for construction enterprises and offer a theoretical analysis framework for understanding the strategic interactions in the low-carbon transformation of the construction supply chain. This is in sharp contrast to existing research focusing on manufacturing.

2. Literature Review

2.1. Decision Optimization of Supply Chain Under Carbon Cap-And-Trade Policy

2.2. Decision Optimization of Supply Chain Under Option Contracts

2.3. Construction Supply Chain Management

3. Model Assumptions and Description

- (1)

- Under the Engineering Procurement and Construction (EPC), the general contractor, as the primary party contracted by the project owner, is responsible for overall project coordination and resource allocation, thereby holding a dominant position. The subcontractor, by contrast, performs specific tasks under the general contractor’s direction. Therefore, a Stackelberg game is established between the two parties, with the general contractor as the leader and the subcontractor as the follower.

- (2)

- The general contractor and the subcontractor must comply with government regulations, and the carbon market is relatively active. The third party in the market can fulfill carbon option contracts and meet the general contractor’s carbon option needs.

- (3)

- It is assumed that the information between the general contractor and the subcontractor is completely symmetrical, both parties are completely rational, and both aim to maximize their expected profits. Given the prevalence of information asymmetry in the construction supply chain, this study temporarily adopts the assumption of complete information symmetry to simplify the model. This is mainly based on the reality that the general contractor and subcontractors in the EPC model of the construction supply chain achieve information sharing through standardized contracts, and the general contractor and subcontractors achieve carbon emission data symmetry through BIM technology. However, the general contractor reserves the right to make decisions. Future research can explore the impact of information asymmetry by combining signal games or contract design.

- (4)

- Under emission reduction incentives, both the general contractor and the subcontractor will increase their carbon reduction efforts by investing more in technological and managerial innovations. As the level of investment increases, their emission reduction costs will also rise accordingly. The emission reduction investment cost of firm is .

- (5)

- Assuming that the project’s initial carbon emissions per unit building area exceed the benchmark level (advanced carbon emissions level), that is, . This assumption reflects the common high-emission status of construction projects in the absence of emission reduction measures. Excess emissions will result in additional carbon costs.

- (6)

- Assume that the general contractor and subcontractor engage in a single short-term cooperation without any long-term cooperation constraints, and that the risks and costs of emission reduction are completely transferred to the subcontractor. Under such restrictive assumptions, the equilibrium result that the general contractor’s optimal emission reduction effort is zero emerges as a theoretical artifact rather than a universal practical rule.

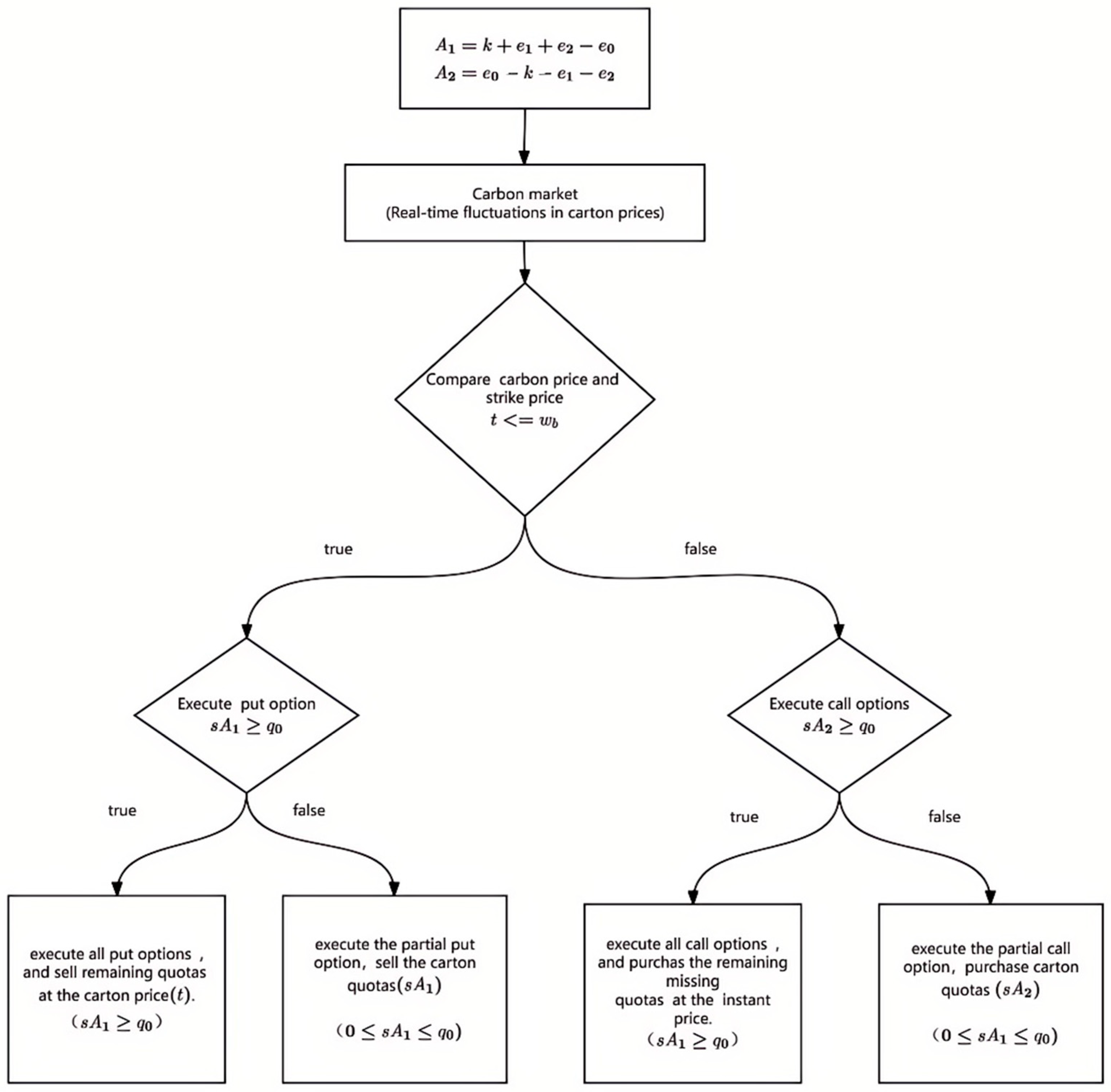

4. General Contractor’s Two-Way Option Model for Purchasing Carbon Emission Rights

4.1. The Model

- (1)

- Case 1:

- (2)

- Case 2:

- (3)

- Case 3:

- (4)

- Case 4:

4.2. The Optimal Decisions

- (1)

- Case 1:

- (2)

- Case 2:

- (3)

- Case 3:

- (4)

- Case 4:

5. Sensitivity Analysis

6. Numerical Analysis

6.1. The Impact of the Introduction of Two-Way Options on the Decision-Making and Profits of Supply Chain Enterprises

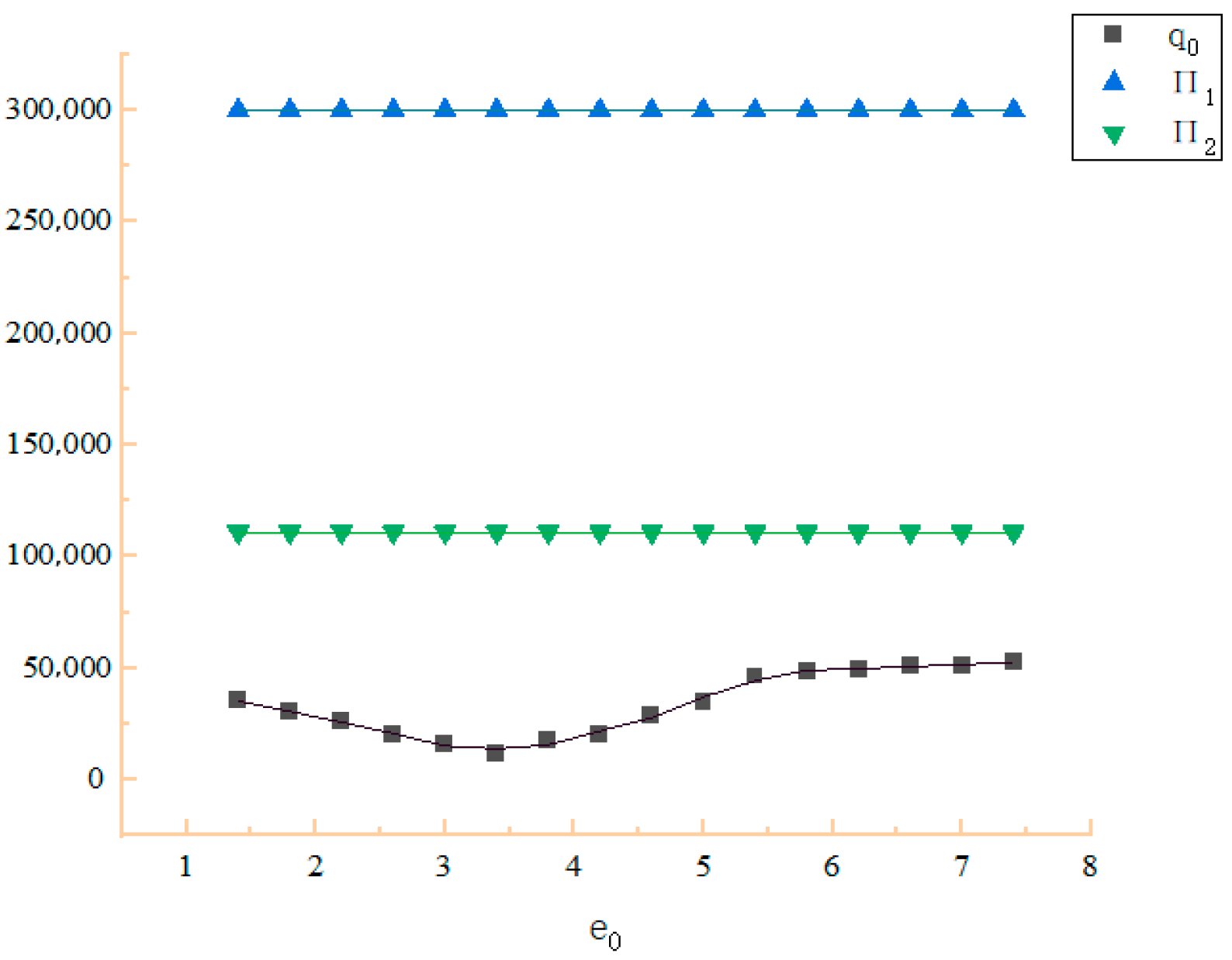

6.1.1. The Impact of Initial Carbon Emissions per Unit Building Area of the Project on Supply Chain Decisions and Profits

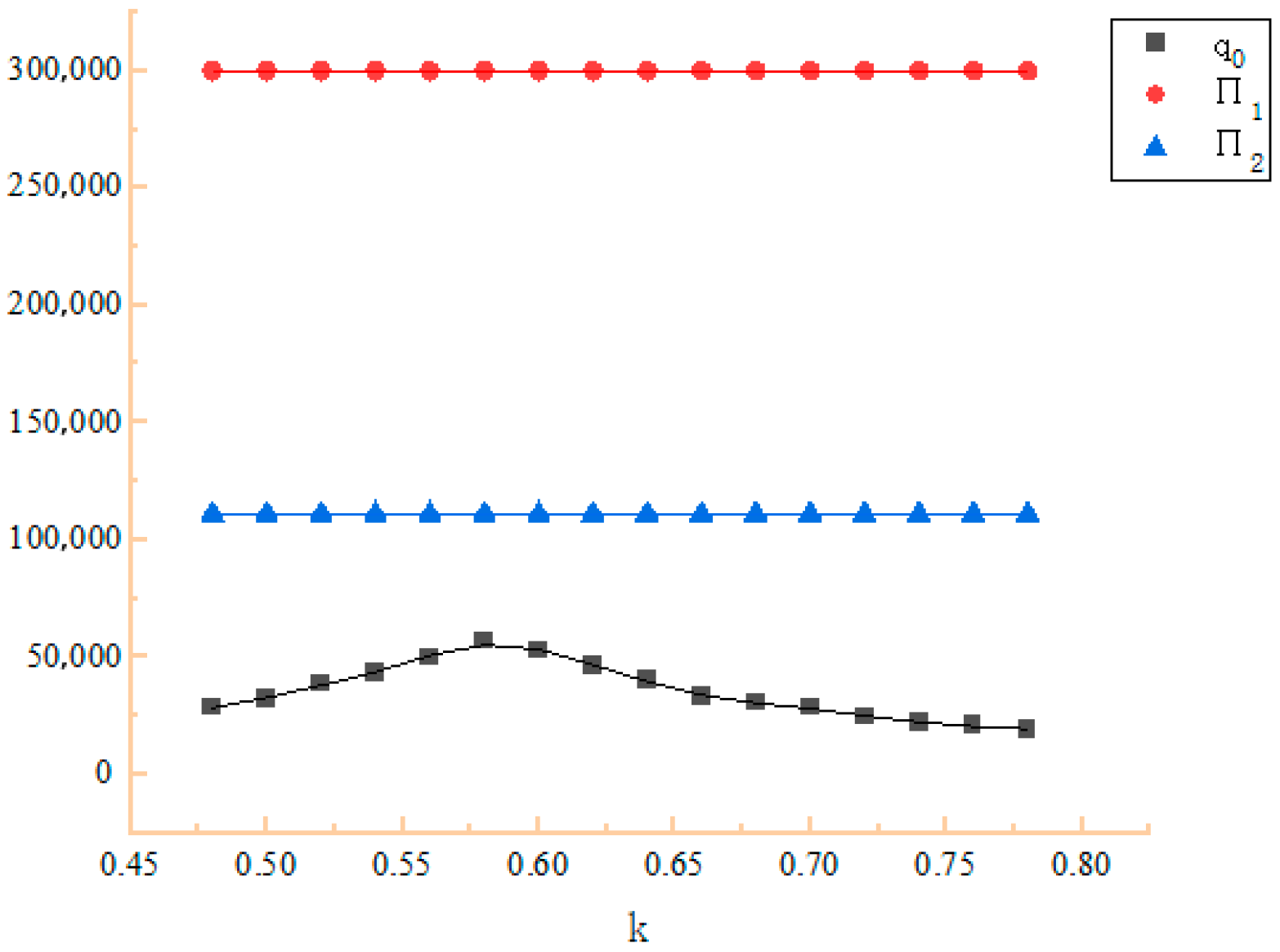

6.1.2. The Impact of Carbon Emission Benchmark per Unit Building Area of Engineering Projects (Advanced Carbon Emission Level) on Supply Chain Decisions and Profits

6.1.3. The Impact of the Option Price per Unit of Carbon Quota on a Carbon Option Contract on Supply Chain Decisions and Profits

7. Conclusions and Future Research

7.1. Conclusions

- (1)

- Under decentralized decision-making, enterprises face complex market environments and decision-making choices. Carbon options can give enterprises flexibility in the face of price fluctuations in carbon emission rights. Enterprises can choose favorable times to trade carbon emission rights. Through analysis of the model, it is found that the profits of enterprises under the execution of carbon options are higher than those under the non-execution of carbon options. As shown in Table 2 and Figure 2, Figure 3 and Figure 4, the expected profits with carbon options are consistently higher than without them. The option mechanism enables enterprises to better hedge carbon price risks and choose optimal trading timing.Therefore, it is recommended that policymakers promote the popularization and application of carbon option tools in the construction industry, and provide fiscal and tax incentives for enterprises that adopt carbon options for emission reduction risk management, such as reducing or exempting option transaction fees, incorporating option costs into the scope of emission reduction subsidy accounting, etc., to enhance enterprises’ enthusiasm for participation.

- (2)

- Due to the complexity and uncertainty of the market, subcontractors cannot determine the optimal price and exercise price of carbon options at the same time. However, when either price is determined, subcontractors can maximize their expected profits by deciding on the other price. Therefore, whether it is the exercise price of carbon options or the option price, subcontractors can adjust another corresponding uncertain pricing strategy based on their circumstances and market forecasts to adapt to the market and achieve profit optimization. Subcontractors can achieve a balance between risk and return through option transactions. They can use the profit share allocated by the general contractor to participate in option investments, prioritizing the selection of option products that align with their own emission reduction capabilities, and sharing both emission reduction costs and option benefits with the general contractor. For example, when subcontractors’ actual emission reductions exceed the agreed targets, they can share the profits obtained by the general contractor through option transactions in proportion, which enhances the willingness for long-term cooperation.

- (3)

- Under certain conditions, carbon option contracts can achieve supply chain coordination, which can prompt members of the construction supply chain to form synergy in carbon emission management and jointly deal with carbon emission constraints and market risks. However, when the supply chain is coordinated, general contractors pay more attention to coping with carbon emission challenges through collaboration with subcontractors rather than relying on the external carbon option market. Therefore, the decision-making of general contractors shows a specific pattern: general contractors often choose not to exercise carbon options.

- (4)

- The increase in the carbon emission cap and the initial carbon emissions per unit building area are key factors affecting the construction supply chain. First, the increase in the carbon emission cap means that companies have more carbon emission quotas, and companies can maintain normal production operations without increasing too much emission reduction costs, thereby reducing the cost pressure caused by emission reduction investment and increasing the expected profit of the supply chain. Secondly, the reduction in the initial carbon emissions per unit building area means that companies gradually have higher carbon emission levels, indicating that improvements in production or construction technology by companies will help reduce the total amount of carbon emissions and reduce emission reduction costs, thereby increasing the expected profit level of the supply chain. Therefore, considering the impact of carbon emission benchmarks on decision-making in the model, it is suggested that the government refine the carbon emission benchmark values for different building types, such as residential buildings and public buildings. This will provide an accurate basis for setting the strike price of carbon options and accounting for quotas and avoid option trading disputes caused by ambiguous benchmarks.

- (5)

- Under the carbon option contract, the general contractor tends to purchase carbon emission rights in the form of options because it provides a risk-controlled purchase method for the general contractor, which can lock in the transaction price of carbon emission rights in the future. In addition, the general contractor will no longer make up for the insufficient carbon emission rights by immediate purchase. The missing carbon quota will be achieved through its own emission reduction, which reflects the general contractor’s emphasis on long-term development. By improving its own emission reduction technology and carbon emission reduction efficiency, it can reduce dependence on external carbon emission rights, enhance market competitiveness and help promote emission reduction actions throughout the supply chain, thereby achieving low-carbon goals. Given the hierarchical characteristics of the construction supply chain, it is proposed to design a “stepwise incentive policy”. To address insufficient emission reduction motivation among small and medium-sized subcontractors, a stepwise incentive policy tailored to the construction supply chain’s hierarchical structure is proposed, with core mechanisms and implementation considerations as follows: Initially, general contractors adopting two-way carbon option cooperation with subcontractors could qualify for a 10–15% increase in initial carbon quota allocation. In the medium term, subcontractors’ emission reduction performance and option execution records should be linked to low-carbon credits, which can be converted into tax preferences or government project priorities. In the long run, mature option-based models can be promoted as industry guidelines via construction associations. We can adopt blockchain technology to record option trading and emission data, alleviate information asymmetry, and establish a joint working group involving the environmental, construction and financial sectors to align carbon quota rules with project approval procedures. At the same time, we can provide government guarantees for the option premiums of subcontractors to reduce the financial burden in the early stage.

7.2. Limitations and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Proofs of Propositions

- (1)

- ;

- (2)

- ;

- (3)

- ;

- (4)

- ;

- (5)

- .

- (1)

- ;

- (2)

- (3)

- ;

- (4)

- ;

- (5)

- ;

- (6)

- ;

- (7)

- .

- (1)

- ;

- (2)

- ;

- (3)

- .

- (1)

- ;

- (2)

- (3)

- ;

- (4)

- ;

- (5)

- . The solutions of are , , . □

- (1)

- ;

- (2)

- ;

- (3)

- . The solutions of are , .

- (1)

- ;

- (2)

- (3)

- ;

- (4)

- ;

- (5)

- .

- (1)

- ;

- (2)

- ;

- (3)

- ;

- (4)

- ;

- (5)

- .

- (1)

- ;

- (2)

- (3)

- ;

- (4)

- ;

- (5)

- ;

- (6)

- ;

- (7)

- .

References

- Dou, G.; Guo, H.; Zhang, Q.; Li, X. A Two-Period Carbon Tax Regulation for Manufacturing and Remanufacturing Production Planning. Comput. Ind. Eng. 2019, 128, 502–513. [Google Scholar] [CrossRef]

- Marufu zaman, M.; Ekşioğlu, S.D.; Hernandez, R. Environmentally Friendly Supply Chain Planning and Design for Biodiesel Production via Wastewater Sludge. Transp. Sci. 2014, 48, 555–574. [Google Scholar] [CrossRef]

- Koskela, L. Application of the New Production Philosophy to Construction; Stanford University: Stanford, CA, USA, 1992. [Google Scholar]

- Du, S.; Zhu, L.; Liang, L.; Ma, F. Emission-Dependent Supply Chain and Environment-Policymaking in the ‘Cap-and-Trade’ System. Energy Policy 2013, 57, 61–67. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; Zhang, Q. Optimal Production and Carbon Emission Reduction Level under Cap-and-Trade and Low Carbon Subsidy Policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- García-Alvarado, M.; Paquet, M.; Chaabane, A.; Amodeo, L. Inventory Management under Joint Product Recovery and Cap-and-Trade Constraints. J. Clean. Prod. 2017, 167, 1499–1517. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X.; Kumar, V.; Kumar, N. Low Carbon Warehouse Management under Cap-and-Trade Policy. J. Clean. Prod. 2016, 139, 894–904. [Google Scholar] [CrossRef]

- Cong, J.; Pang, T.; Peng, H. Optimal Strategies for Capital Constrained Low-Carbon Supply Chains under Yield Uncertainty. J. Clean. Prod. 2020, 256, 120339. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, C.; Yu, C. The Evolutionary Game Analysis and Simulation with System Dynamics of Manufacturer’s Emissions Abatement Behavior under Cap-and-Trade Regulation. Appl. Math. Comput. 2019, 355, 343–355. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Z.; Jin, M.; Mao, J. Decisions and Coordination of Retailer-Led Low-Carbon Supply Chain under Altruistic Preference. Eur. J. Oper. Res. 2021, 293, 910–925. [Google Scholar] [CrossRef]

- Wang, Z.; Brownlee, A.E.I.; Wu, Q. Production and Joint Emission Reduction Decisions Based on Two-Way Cost-Sharing Con tract under Cap-and-Trade Regulation. Comput. Ind. Eng. 2020, 146, 106549. [Google Scholar] [CrossRef]

- Ji, T.; Xu, X.; Yan, X.; Yu, Y. The Production Decisions and Cap Setting with Wholesale Price and Revenue Sharing Contracts under Cap-and-Trade Regulation. Int. J. Prod. Res. 2020, 58, 128–147. [Google Scholar] [CrossRef]

- Xu, L.; Xie, F.; Yuan, Q.; Chen, J. Pricing and Carbon Footprint in a Two-Echelon Supply Chain under Cap-and-Trade Regulation. Int. J. Low-Carbon Technol. 2019, 14, 212–221. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; He, P.; Xu, X. Production and Pricing Problems in Make-to-Order Supply Chain with Cap-and-Trade Regulation. Omega 2017, 66, 248–257. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J. Pricing and Carbon Emission Reduction Decisions in Supply Chains with Vertical and Horizontal Cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Chen, X.; Wang, X. Effects of Carbon Emission Reduction Policies on Transportation Mode Selections with Stochastic Demand. Transp. Res. Part E Logist. Transp. Rev. 2016, 90, 196–205. [Google Scholar] [CrossRef]

- Bai, Q.; Xu, J.; Zhang, Y. Emission Reduction Decision and Coordination of a Make-to-Order Supply Chain with Two Products under Cap-and-Trade Regulation. Comput. Ind. Eng. 2018, 119, 131–145. [Google Scholar] [CrossRef]

- Yang, L.; Ji, J.; Wang, M.; Wang, Z. The Manufacturer’s Joint Decisions of Channel Selections and Carbon Emission Reductions under the Cap-and-Trade Regulation. J. Clean. Prod. 2018, 193, 506–523. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.; Zhao, J. Decision and Coordination in the Dual-Channel Supply Chain Considering Cap-and-Trade Regulation. J. Clean. Prod. 2018, 197, 551–561. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon Emission Reduction Decisions in the Retail-/Dual-Channel Supply Chain with Consumers’ Preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Hua, S.; Liu, J.; Cheng, T.C.E.; Zhai, X. Financing and Ordering Strategies for a Supply Chain under the Option Contract. Int. J. Prod. Econ. 2019, 208, 100–121. [Google Scholar] [CrossRef]

- Wang, S.Y.; Choi, S.H. Decision Analysis for the Emission-Limited Manufacturer with Option Contracts under Demand Uncertainty. J. Clean. Prod. 2020, 258, 120712. [Google Scholar] [CrossRef]

- Wang, R.; Song, S.; Wu, C. Coordination of Supply Chain with One Supplier and Two Competing Risk-Averse Retailers under an Option Contract. Math. Probl. Eng. 2016, 2016, 1970615. [Google Scholar] [CrossRef]

- Sharma, A.; Dwivedi, G.; Singh, A. Game-Theoretic Analysis of a Two-Echelon Supply Chain with Option Contract under Fair ness Concerns. Comput. Ind. Eng. 2019, 137, 106096. [Google Scholar] [CrossRef]

- Wang, C.; Chen, X. Optimal Ordering Policy for a Price-Setting Newsvendor with Option Contracts under Demand Uncertainty. Int. J. Prod. Res. 2015, 53, 6279–6293. [Google Scholar] [CrossRef]

- Wang, C.; Chen, J.; Chen, X. Pricing and Order Decisions with Option Contracts in the Presence of Customer Returns. Int. J. Prod. Econ. 2017, 193, 422–436. [Google Scholar] [CrossRef]

- Wang, S.Y.; Choi, S.H. Decision Analysis with Green Awareness and Demand Uncertainties under the Option-Available ETS System. Comput. Ind. Eng. 2020, 140, 106254. [Google Scholar] [CrossRef]

- Zhao, H.; Song, S.; Zhang, Y.; Liao, Y.; Yue, F. Optimal Decisions in Supply Chains with a Call Option Contract under the Carbon Emissions Tax Regulation. J. Clean. Prod. 2020, 271, 122199. [Google Scholar] [CrossRef]

- Peng, Q.; Wang, C.; Xu, L. Emission Abatement and Procurement Strategies in a Low-Carbon Supply Chain with Option Contracts under Stochastic Demand. Comput. Ind. Eng. 2020, 144, 106502. [Google Scholar] [CrossRef]

- Ding, J.; Chen, W.; Fu, S. Optimal Policy for Remanufacturing Firms with Carbon Options under Service Requirements. J. Syst. Sci. Syst. Eng. 2022, 31, 34–63. [Google Scholar] [CrossRef]

- Wang, L.; Su, X. Carbon Reduction Decision-Making in the Supply Chain Considering Carbon Allowances and Bidirectional Option Trading Mode of Carbon Emission Rights. Energy Rep. 2025, 13, 2678–2696. [Google Scholar] [CrossRef]

- Ding, J.; Zhang, W.; Pu, X.; Wang, S. Analysis on Emission-Dependent Supply Chains with Carbon Option Contract. Int. J. Prod. Res. 2025, 63, 1–21. [Google Scholar] [CrossRef]

- Wang, S.; Choi, S.H.; Xiao, J.; Huang, G.Q. Low-Carbon Supply Chain Coordination through Dual Contracts Considering Pareto-Efficiency. Int. J. Prod. Res. 2024, 62, 6627–6648. [Google Scholar] [CrossRef]

- Rezgui, Y.; Miles, J. Exploring the Potential of SME Alliances in the Construction Sector. J. Constr. Eng. Manag. 2010, 136, 558–567. [Google Scholar] [CrossRef]

- Bohari, A.A.M.; Skitmore, M.; Xia, B.; Teo, M.; Khalil, N. Key Stakeholder Values in Encouraging Green Orientation of Construction Procurement. J. Clean. Prod. 2020, 270, 122246. [Google Scholar] [CrossRef]

- Shen, L.; Zhang, Z.; Zhang, X. Key Factors Affecting Green Procurement in Real Estate Development: A China Study. J. Clean. Prod. 2017, 153, 372–383. [Google Scholar] [CrossRef]

- Xiong, L.; Wang, M.; Mao, J.; Huang, B. A Review of Building Carbon Emission Accounting Methods under Low-Carbon Building Background. Buildings 2024, 14, 777. [Google Scholar] [CrossRef]

- Jia, G.; Guo, J.; Guo, Y.; Yang, F.; Ma, Z. CO2 Adsorption Properties of Aerogel and Application Prospects in Low-Carbon Building Materials: A Review. Case Stud. Constr. Mater. 2024, 20, e03171. [Google Scholar] [CrossRef]

- Abdous, M.; Aslani, A.; Noorollahi, Y.; Zahedi, R.; Yousefi, H. Design and Analysis of Zero-Energy and Carbon Buildings with Renewable Energy Supply and Recycled Materials. Energy Build. 2024, 324, 114922. [Google Scholar] [CrossRef]

- Duan, J. Strategic Interaction among Stakeholders on Low-Carbon Buildings: A Tripartite Evolutionary Game Based on Prospect Theory. Environ. Sci. Pollut. Res. 2024, 31, 11096–11114. [Google Scholar] [CrossRef]

- Sacks, R.; Koskela, L.; Dave, B.A.; Owen, R. Interaction of Lean and Building Information Modeling in Construction. J. Constr. Eng. Manag. 2010, 136, 968–980. [Google Scholar] [CrossRef]

- Lin, Y.; Guo, C.; Tan, Y. The Incentive and Coordination Strategy of Sustainable Construction Supply Chain Based on Robust Optimisation. J. Control Decis. 2020, 7, 126–159. [Google Scholar] [CrossRef]

- Feng, C.; Ma, Y.; Zhou, G.; Ni, T. Stackelberg Game Optimization for Integrated Production-Distribution-Construction System in Construction Supply Chain. Knowl.-Based Syst. 2018, 157, 52–67. [Google Scholar] [CrossRef]

- Kosanoglu, F.; Kus, H.T. Sustainable Supply Chain Management in Construction Industry: A Turkish Case. Clean Technol. Environ. Policy 2021, 23, 2589–2613. [Google Scholar] [CrossRef]

- Yuan, H.P.; Shen, L.Y.; Hao, J.J.L.; Lu, W.S. A Model for Cost–Benefit Analysis of Construction and Demolition Waste Management throughout the Waste Chain. Resour. Conserv. Recycl. 2011, 55, 604–612. [Google Scholar] [CrossRef]

- Kim, K.; Paulson, B.C. Agent-Based Compensatory Negotiation Methodology to Facilitate Distributed Coordination of Project Schedule Changes. J. Comput. Civ. Eng. 2003, 17, 10–18. [Google Scholar] [CrossRef]

- Tavakolan, M.; Nikoukar, S. Developing an Optimization Financing Cost-Scheduling Trade-off Model in Construction Project. Int. J. Constr. Manag. 2022, 22, 262–277. [Google Scholar] [CrossRef]

- GB 55015-2021; General Specification for Energy Conservation and Renewable Energy Utilization in Buildings. China Architecture & Building Press: Beijing, China, 2021.

| Symbol Description | |

|---|---|

| Parameters | |

| Fixed contract price for the enterprise (, represents general contractor and subcontractor respectively) | |

| Total construction area of the project | |

| The option price per unit of carbon quota in a carbon option contract | |

| The strike price per unit of carbon quota in a carbon option contract | |

| The incentive factor given by the owner to the general contractor for each unit of emission reduction | |

| Fixed costs of the enterprise (, represents general contractor and subcontractor) | |

| Emission reduction input cost of enterprise (, represents general contractor and subcontractor) | |

| Emission reduction cost coefficient of the enterprise (, represents general contractor and subcontractor) | |

| Initial carbon emissions per unit building area of the project | |

| Carbon emission benchmark per unit building area of engineering projects (advanced carbon emission level). The carbon emission benchmark refers to the “General Specification for Building Energy Efficiency and Renewable Energy Utilization” (GB 55015-2021) [48]. For residential buildings, is taken as 0.6 tCO2/m2, and for public buildings, is taken as 0.8 tCO2/m2. The numerical analysis in this paper adopts the weighted average value of the location of the construction unit. | |

| Expected profit of the enterprise ( represents general contractor and subcontractor) | |

| Expected profits from construction supply chain | |

| The carbon price of the instant purchase of carbon emission rights has a distribution function and density function of and respectively, the market carbon price adopted in this paper follows a uniform distribution , a mean of , a minimum carbon price of , a maximum carbon price of | |

| Decision variables | |

| The amount of carbon allowances purchased through carbon option contracts | |

| Profit-sharing ratio given by the general contractor to the subcontractor | |

| Carbon emission reduction per unit building area of the enterprise (, represents general contractor and subcontractor) | |

| Case Number | Carbon Quota Surplus or Deficit | Actual Meaning |

|---|---|---|

| Case 1 | Low surplus: The surplus amount of carbon credits generated by emissions reductions ≤ the amount of bidirectional options purchased. | |

| Case 2 | High surplus: The surplus amount of carbon allowances generated by emissions reductions > the amount of bidirectional options purchased. | |

| Case 3 | High deficit: Carbon allowance deficit after emissions reduction still exceeds the amount of two-way options purchased. | |

| Case 4 | Low deficit: The carbon quota deficit remaining after emissions reductions is ≤ the amount of purchased two-way options. |

| Variable | Case 1 | Case 2 | Case 3 | Case 4 |

| 0 | 0 | 0 | 0 | |

| 2900 | 2500 | 1300 | 1800 | |

| 1 | 1 | 1 | 1 | |

| 0.282 | 0.182 | 0.182 | 0.138 | |

| 300,000 | 300,000 | 300,000 | 300,000 | |

| 82,166.857 | 104,284.295 | 104,284.295 | 110,912.651 | |

| 382,166.857 | 404,284.295 | 404,284.295 | 410,912.651 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiang, W.; Tong, Z.; Yuan, Y.; Yang, Q.; Wu, J.; Li, R. Two-Way Carbon Options Game Model of Construction Supply Chain with Cap-And-Trade. Sustainability 2025, 17, 8089. https://doi.org/10.3390/su17178089

Jiang W, Tong Z, Yuan Y, Yang Q, Wu J, Li R. Two-Way Carbon Options Game Model of Construction Supply Chain with Cap-And-Trade. Sustainability. 2025; 17(17):8089. https://doi.org/10.3390/su17178089

Chicago/Turabian StyleJiang, Wen, Zhaoyi Tong, Yifan Yuan, Qingqing Yang, Jiangyan Wu, and Ruixiang Li. 2025. "Two-Way Carbon Options Game Model of Construction Supply Chain with Cap-And-Trade" Sustainability 17, no. 17: 8089. https://doi.org/10.3390/su17178089

APA StyleJiang, W., Tong, Z., Yuan, Y., Yang, Q., Wu, J., & Li, R. (2025). Two-Way Carbon Options Game Model of Construction Supply Chain with Cap-And-Trade. Sustainability, 17(17), 8089. https://doi.org/10.3390/su17178089