Capital Formation and Oil Consumption Drive CO2 Emissions in Ecuador: Evidence from an ARDL Model in Log-First Differences

Abstract

1. Introduction

- Investment, proxied by gross fixed capital formation (GFCF), is typically linked to increased economic and industrial activity, which tends to increase emissions. Rahman and Ahmad [13], using a Nonlinear Autoregressive Distributed Lag (NARDL) model applied to Pakistan, found that a 1% increase in GFCF leads to an approximate 0.58% rise in CO2 emissions, indicating a positive and significant impact of investment on pollution levels. However, other studies suggest that this effect may vary depending on the context: Adebayo and Kalmaz [15], analyzing the determinants of emissions in Egypt, found that GFCF did not exert a statistically significant influence on CO2 emissions, whereas energy consumption displayed a positive and significant relationship with environmental degradation in that country. These differences suggest that the link between investment and pollution may depend on how investment is allocated (e.g., towards cleaner or more carbon-intensive sectors) and on the specific conditions of each economy. In fact, Oncu et al. [16], using a global panel dataset, report that while increases in GFCF can raise CO2 emissions in the short run, the long-term effect of capital accumulation on emissions is often statistically insignificant. This suggests that without environmental regulations guiding investment towards low-carbon technologies, the pollution impact of new capital formation may be muted or vary widely across countries.

- In this context, economic growth, typically measured through GDP per capita, plays a dual role in the environmental discourse. On the one hand, higher income levels generally imply greater consumption of energy and goods, driving emissions during the early stages of development. A study on Southern European countries found a long-term positive relationship: a 1% increase in GDP per capita leads to an estimated 1.77% rise in CO2 emissions [17]. On the other hand, at more advanced stages of development, economies may have access to cleaner technologies and the capacity to implement stricter environmental regulations, potentially decoupling economic growth from emissions (Environmental Kuznets Curve hypothesis). Wang et al. [18] provide evidence in this regard by reexamining the impact of Foreign Direct Investment (FDI) on carbon emissions under different income levels: their results indicate that when a country’s GDP per capita is relatively low (below approximately USD 541.87), FDI tends to significantly increase CO2 emissions; however, once the GDP per capita exceeds around USD 46,515, FDI’s influence becomes negative, contributing to emission reductions. Provided that income reaches a sufficient threshold to support the adoption of clean technologies and green policies, economic development may supply the tools necessary to mitigate pollution. Furthermore, recent global research underscores that the growth–emissions relationship might not simply stabilize at high income levels but could eventually intensify again. For instance, Wang et al. [19], analyzing a panel of 214 countries, identified an N-shaped pattern in the income–emissions trajectory: while emissions initially decline after a turning point (consistent with the EKC hypothesis), they begin to rise again once GDP per capita crosses a second high threshold (around USD 73,000). This finding suggests that even in very-high-income economies, continuous growth without additional mitigation measures can lead to reaccelerating CO2 emissions, highlighting the need for ongoing innovation and policy vigilance. In the case of Ecuador, Borja et al. [20] explored the relationship between economic development and sectoral CO2 emissions. Using data from 1990 to 2018 and Granger causality tests, the authors found no significant causal relationship between growth (measured by sectoral GDP per capita) and CO2 emissions in the agriculture and transport sectors. However, in the industrial and services sectors, a long-term causal link was identified. This implies that increased economic activity in Ecuador’s industry and services sectors has been accompanied by higher emissions, in contrast to other sectors where traditional practices or efficiencies may be moderating this relationship.

- The use of non-renewable energy—particularly that derived from oil—has been confirmed as a direct driver of CO2 emissions. Different studies support the hypothesis that higher fossil fuel consumption leads to environmental degradation. Apergis et al. [21] conducted a study focused on Uzbekistan to estimate the impact of renewable and non-renewable energy consumption on CO2 emissions, using an Autoregressive Distributed Lag (ARDL) model. Their results indicate that hydroelectric energy consumption (as a renewable source) has a significant negative effect on CO2 emissions—that is, it contributes to their reduction—whereas consumption of non-renewable sources such as natural gas and oil exerts a significant positive effect, increasing emissions in both the short and long run. However, the magnitude of each fossil fuel’s contribution may vary depending on the specific context. In the case of India, for instance, fossil fuels collectively have a detrimental effect on environmental sustainability, though with notable distinctions: coal is found to be the most harmful fuel in terms of CO2 emissions, followed by oil, while natural gas consumption has a relatively smaller impact [22]. This finding suggests that although oil consumption clearly contributes to emissions, its effect may be less severe than that of coal, partly due to differences in carbon intensity and fuel efficiency. Similarly, recent evidence from Pakistan indicates that an energy mix heavily dominated by fossil fuels has led to substantial CO2 growth, whereas the country’s nascent renewable sector has so far had only a negligible effect on overall emissions. In any case, reducing dependence on all fossil fuels remains essential for mitigating climate change.

- Finally, the expansion of renewable energy plays a fundamental role as a mechanism for emissions mitigation. Empirical evidence indicates that higher consumption of clean energy is generally associated with lower CO2 levels, although complementary conditions are often necessary to maximize this benefit. Traoré and Asongu [23] analyzed Sub-Saharan African countries using a panel VAR model and concluded that there is a negative and significant relationship between renewable energy use and CO2 emissions: as the share of clean energy in the energy mix increases, emissions tend to decline. However, the impact of energy-related technologies and behaviors can be complex. Nghiem et al. [24] studied OECD countries and found contrasting results when considering certain technological indicators: higher mobile phone penetration appears to help mitigate CO2 emissions (possibly due to efficiency improvements and digitalization), whereas greater internet usage is associated with increased emissions, highlighting that not all technological innovation automatically ensures a reduced carbon footprint. Additionally, research in emerging economies emphasizes the crucial role of institutional frameworks and public policy in enhancing the beneficial effect of renewables. Specifically, Abbas et al. [25] evaluated the BRICS countries and found that the development of renewable energy, by itself, is insufficient to curb emissions unless accompanied by appropriate market regulations and environmental innovation. In line with this perspective, Fu et al. [26] provide new evidence that renewable energy expansion yields significant CO2 reductions only once certain development and efficiency thresholds are met. Analyzing 36 major emitting countries, they observe that a renewable energy strategy becomes effective only when a nation’s per capita GDP exceeds roughly USD 16,000 and when energy intensity and carbon intensity fall below specific limits; below those levels, the impact of renewables tends to be limited or even counterproductive due to technological constraints, fossil-dependent industrial structures, or weak environmental governance. Such findings underscore that the adoption of market-based policies, alongside the promotion of green innovation and broader economic structural changes, reinforces the effectiveness of renewables in reducing CO2 emissions and helps steer countries toward greater environmental sustainability.

2. Methodology

2.1. Variables and Data Collection

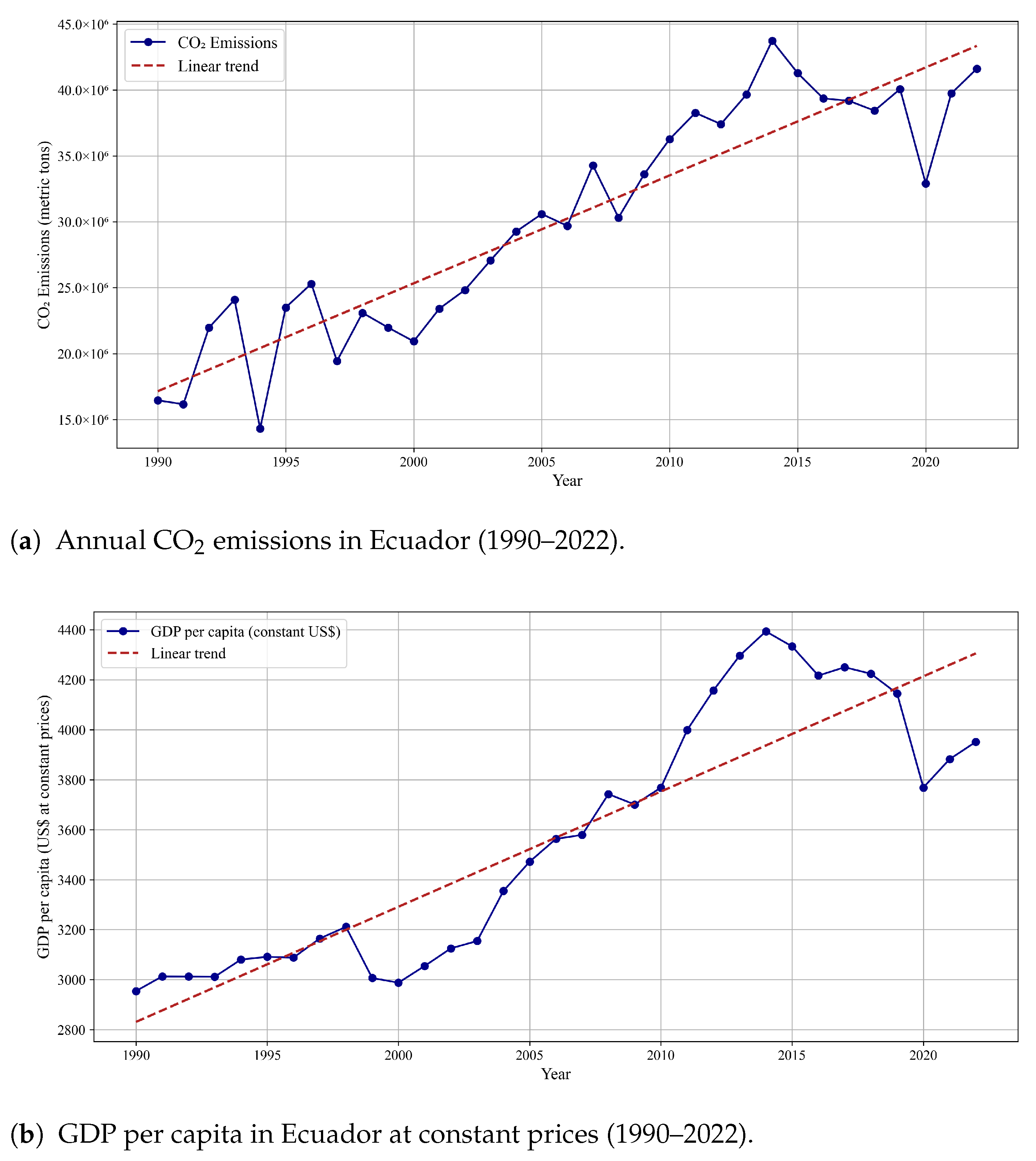

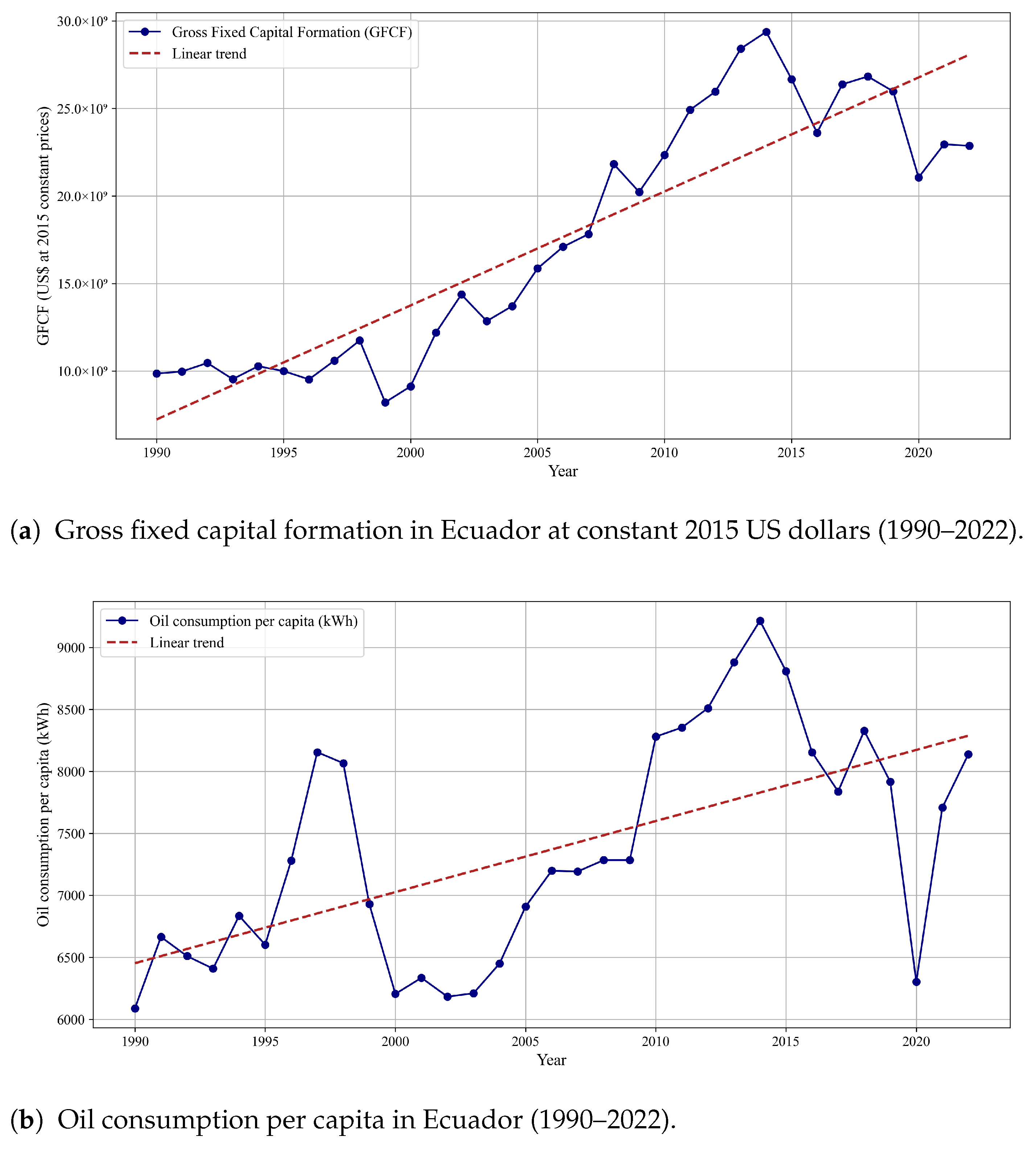

2.2. Descriptive Analysis of the Variables

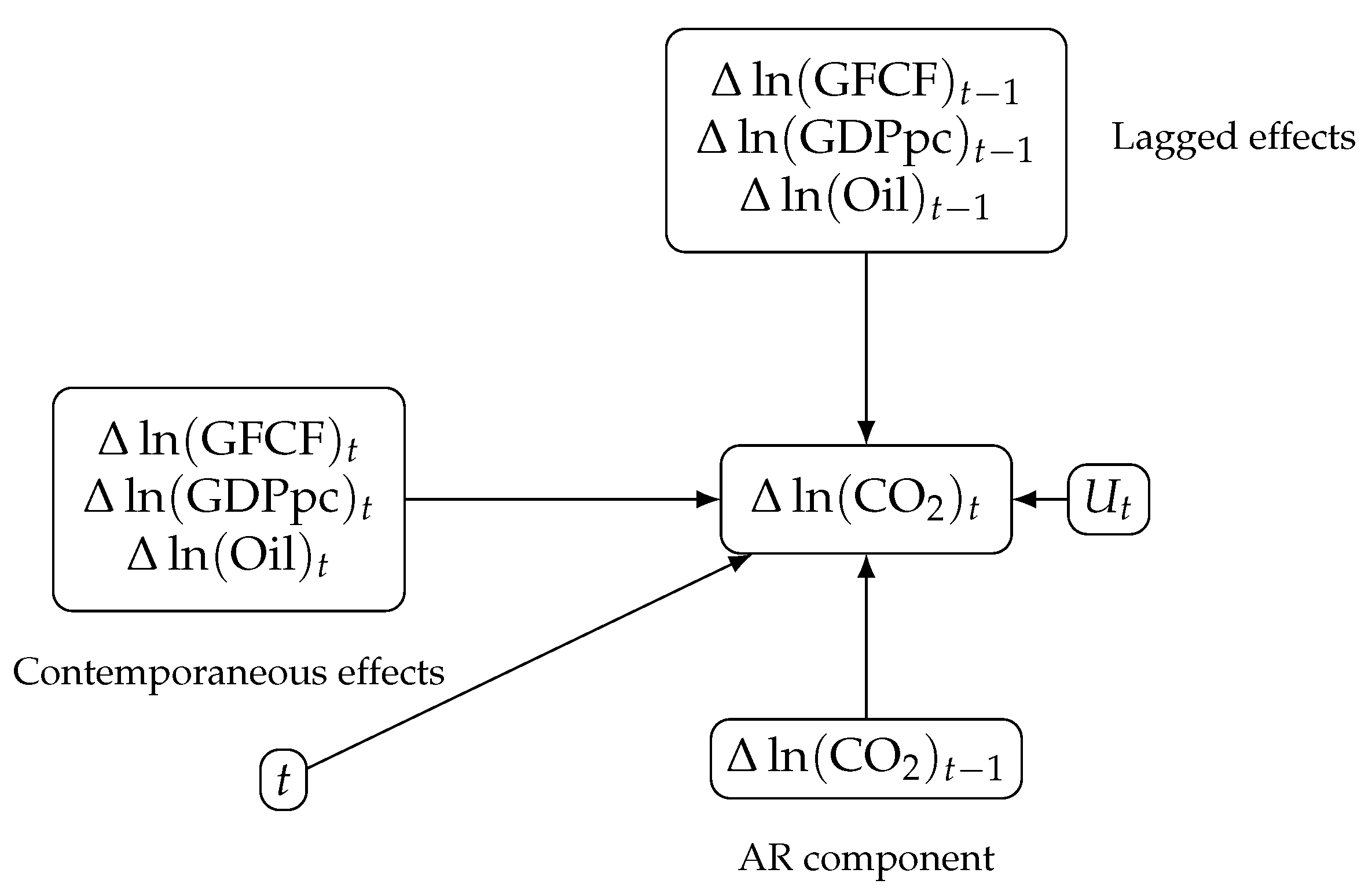

2.3. Model Specification and Justification

- : The first-difference operator, used to transform the series and ensure stationarity.

- : Natural logarithm of (per capita) carbon dioxide emissions at time t.

- : Natural logarithm of gross fixed capital formation (investment), a proxy for capital accumulation.

- : Natural logarithm of GDP per capita, capturing the effect of economic growth.

- : Natural logarithm of oil consumption, representing fossil fuel use in the energy mix.

- : Speed-of-adjustment parameter, indicating how quickly deviations from the long-run equilibrium are corrected.

- : Long-run elasticity coefficients; percent change in CO2 emissions from a 1% change in the respective regressor.

- c: Intercept term in the long-run (level) relationship.

- : Short-run dynamic coefficients measuring the immediate effects of changes in , , , and , respectively (with summation ranges as given in Equation (2)).

- : Stochastic disturbance term, assumed to be i.i.d.

2.4. Pre-Estimation Tests: Stationarity, Lag Selection, and Cointegration

2.5. Post-Estimation Diagnostics

3. Results

3.1. General Model Analysis

3.2. Coefficient Analysis

3.2.1. Gross Fixed Capital Formation

3.2.2. Gross Domestic Product per Capita

3.2.3. Oil Consumption

3.3. Lag Structure Analysis

3.3.1. Lagged CO2

3.3.2. Lagged GFCF

3.3.3. Lagged GDP per Capita

3.3.4. Lagged Oil Consumption

3.4. Time Trend

3.5. Model Interpretation

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| CO2 | Carbon Dioxide |

| GFCF | Gross Fixed Capital Formation |

| NARDL | Nonlinear Autoregressive Distributed Lag |

| ARDL | Autoregressive Distributed Lag |

| GDP per capita | Gross Domestic Product per capita |

| OECD | Organisation for Economic Co-operation and Development |

| BRICS | Brasil, Rusia, India, China and South Africa |

| EIA | Energy Information Administration |

| VEC | Vector Error Correction |

| ASEAN | Association of Southeast Asian Nations |

| EKC | Environmental Kuznets Curve |

References

- Alam, M.S. Is trade, energy consumption and economic growth threat to environmental quality in Bahrain–evidence from VECM and ARDL bound test approach. Int. J. Emerg. Serv. 2022, 11, 396–408. [Google Scholar] [CrossRef]

- Álvarez, S.; Rubio, A.; Rodríguez, A. Conceptos Básicos de la Huella de Carbono, 2nd ed.; AENOR (Asociación Española de Normalización y Certificación): Madrid, Spain, 2021. [Google Scholar]

- Gough, I. Calentamiento Global, Codicia y Necesidades Humanas: Cambio Climático, Capitalismo y Bienestar Sostenible; Miño y Dávila: Buenos Aires, Argentina, 2023. [Google Scholar]

- Menéndez, R.; Moliner, R. Energía sin CO2: Realidad o Utopía; Los Libros de la Catarata: Madrid, Spain, 2011. [Google Scholar]

- del Río, A.; Luna, N. Cómo ves?: Energías Renovables: Hacia la Sustentabilidad; Universidad Nacional Autónoma de México: Ciudad de México, Mexico, 2019. [Google Scholar]

- The Influence of Energy Consumption, Economic Growth, Industrialisation and Corruption on Carbon Dioxide Emissions: Evidence from Selected Asian Economies. In The Impact of Environmental Emissions and Aggregate Economic Activity on Industry: Theoretical and Empirical Perspectives; Emerald Publishing Limited: Leeds, UK, 2023; pp. 93–110. [CrossRef]

- Das, R.C.; Nayak, A. Do Energy Use and Environmental Pollution Cause Income? A Study on the BRICS Nations. In Multidimensional Strategic Outlook on Global Competitive Energy Economics and Finance; Emerald Publishing Limited: Leeds, UK, 2022; pp. 27–39. [Google Scholar]

- Sajjad, F.; Bhuiyan, R.; Dwyer, R.; Bashir, A.; Zhang, C. Balancing prosperity and sustainability: Unraveling financial risks and green finance through a COP27 lens. Stud. Econ. Financ. 2024, 41, 545–570. [Google Scholar] [CrossRef]

- Banco Mundial. Emisiones de CO2 (kt)-Mundo. World Development Indicators, Banco Mundial (Consulta 2024). 2024. Available online: https://data360.worldbank.org/en/indicator/WB_MPO_ENATMCO2EKT (accessed on 31 December 2023).

- Banco Mundial. Emisiones de CO2 (kt)-Ecuador. World Development Indicators, Banco Mundial. 2023. Available online: https://data360.worldbank.org/en/indicator/WB_ESG_EN_ATM_CO2E_PC (accessed on 31 December 2023).

- Dogan, E.; Seker, F. Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renew. Energy 2016, 94, 429–439. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 Emissions, Renewable Energy and the Environmental Kuznets Curve, a Panel Cointegration Approach. Renew. Sustain. Energy Rev. 2017, 72, 1067–1075. [Google Scholar] [CrossRef]

- Rahman, Z.U.; Ahmad, M. Modeling the relationship between gross capital formation and CO2 (a)symmetrically in the case of Pakistan: An empirical analysis through NARDL approach. Environ. Sci. Pollut. Res. 2019, 26, 34568–34580. [Google Scholar] [CrossRef]

- Alonso, H.C. Impacto de las energías renovables en las emisiones de gases efecto invernadero en México. Probl. del Desarro. 2021, 52, 59–83. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Beton Kalmaz, D. Determinants of CO2 emissions: Empirical evidence from Egypt. Environ. Ecol. Stat. 2021, 28, 239–260. [Google Scholar] [CrossRef]

- Oncu, E.; Ozturk, N.S.; Erdogan, A. Sustainable Development in Focus: CO2 Emissions and Capital Accumulation. Sustainability 2025, 17, 3513. [Google Scholar] [CrossRef]

- Ali, M.; Kirikkaleli, D.; Altuntaş, M. The nexus between CO2 intensity of GDP and environmental degradation in South European countries. Environ. Dev. Sustain. 2023, 25, 1161–1179. [Google Scholar] [CrossRef]

- Wang, Q.; Yang, T.; Li, R.; Wang, X. Reexamining the impact of foreign direct investment on carbon emissions: Does per capita GDP matter? Humanit. Soc. Sci. Commun. 2023, 10, 406. [Google Scholar] [CrossRef]

- Wang, Q.; Li, Y.; Li, R. Rethinking the environmental Kuznets curve hypothesis across 214 countries: The impacts of 12 economic, institutional, technological, resource, and social factors. Humanit. Soc. Sci. Commun. 2024, 11, 292. [Google Scholar] [CrossRef]

- Borja, J.; Robalino, A.; Mena, A. Breaking the unsustainable paradigm: Exploring the relationship between energy consumption, economic development and carbon dioxide emissions in Ecuador. Sustain. Sci. 2024, 19, 403–421. [Google Scholar] [CrossRef]

- Apergis, N.; Kuziboev, B.; Abdullaev, I.; Rajabov, A. Investigating the association among CO2 emissions, renewable and non-renewable energy consumption in Uzbekistan: An ARDL approach. Environ. Sci. Pollut. Res. 2023, 30, 39666–39679. [Google Scholar] [CrossRef]

- Uğur, M.; Çatık, A.N.; Sigeze, C.; Ballı, E. Time-varying impact of income and fossil fuel consumption on CO2 emissions in India. Environ. Sci. Pollut. Res. 2023, 30, 121960–121982. [Google Scholar] [CrossRef] [PubMed]

- Traoré, A.; Asongu, S.A. The diffusion of green technology, governance and CO2 emissions in Sub-Saharan Africa. Manag. Environ. Qual. 2023, 34, 1121–1138. [Google Scholar] [CrossRef]

- Nghiem, X.; Bakry, W.; Al-Malkawi, H.; Farouk, S. Does technological progress make OECD countries greener? New evidence from panel CS-ARDL. Manag. Environ. Qual. 2023, 34, 1555–1579. [Google Scholar] [CrossRef]

- Abbas, S.; Gui, P.; Chen, A.; Ali, N. The effect of renewable energy development, market regulation, and environmental innovation on CO2 emissions in BRICS countries. Environ. Sci. Pollut. Res. 2022, 29, 59483–59501. [Google Scholar] [CrossRef] [PubMed]

- Fu, J.; Qu, X.; Huang, X. Does the reduction of CO2 emissions from renewable energy generation vary depending on economic and industrial structure? Empirical evidence from major CO2 emitting countries. Energy 2025, 330, 136794. [Google Scholar] [CrossRef]

- Durmaz, N.; Liu, Q.; Lu, Z. CO2 Emission, Energy Consumption, and Economic Growth in Latin America. Energy Res. Lett. 2025, 6. [Google Scholar] [CrossRef]

- Ar Salan, M.S.; Ali, A.; Amin, R.; Sultana, A.; Siddik, M.A.B.; Kabir, M.A. Exploring the nexus of industrial production and energy consumption on CO2 emissions in Bangladesh through ARDL bounds testing insights. Sci. Rep. 2025, 15, 14443. [Google Scholar] [CrossRef]

- Le Quéré, C.; Jackson, R.B.; Jones, M.W.; Smith, A.J.; Abernethy, S.; Andrew, R.M.; De-Gol, A.J.; Willis, D.R.; Shan, Y.; Canadell, J.G.; et al. Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nat. Clim. Change 2020, 10, 647–653. [Google Scholar] [CrossRef]

- International Monetary Fund. Ecuador: Selected Issues and Statistical Appendix; IMF Country Report No. 04/27; International Monetary Fund: Washington, DC, USA, 2004. [Google Scholar]

- Canton, H. Economic Commission for Latin America and the Caribbean—ECLAC. In The Europa Directory of International Organizations 2021; Routledge: London, UK, 2021; pp. 142–144. [Google Scholar]

- The Europa Directory of International Organizations 2021, 23rd ed.Routledge: London, UK, 2021.

- Verdezoto, P.L.C.; Vidoza, J.A.; Gallo, W.L.R. Analysis and projection of energy consumption in Ecuador: Energy efficiency policies in the transportation sector. Energy Policy 2019, 134, 110948. [Google Scholar] [CrossRef]

- Pinzón, K. Dynamics between energy consumption and economic growth in Ecuador: A granger causality analysis. Econ. Anal. Policy 2018, 57, 88–101. [Google Scholar] [CrossRef]

- Beckerman, P.; Solimano, A. Crisis and Dollarization in Ecuador: Stability, Growth, and Social Equity; The World Bank: Washington, DC, USA, 2002. [Google Scholar]

- Le Quéré, C.; Peters, G.P.; Friedlingstein, P.; Andrew, R.M.; Canadell, J.G.; Davis, S.J.; Jackson, R.B.; Jones, M.W. Fossil CO2 emissions in the post-COVID-19 era. Nat. Clim. Change 2021, 11, 197–199. [Google Scholar] [CrossRef]

- Jácome, L.I.; Fischer, S. The Late 1990s Financial Crisis in Ecuador: Institutional Weaknesses, Fiscal Rigidities, and Financial Dollarization at Work. IMF Work. Pap. 2004, 2004, 1–47. [Google Scholar] [CrossRef]

- García-Amate, A.; Yépez, E.T. Macroeconomic Study of the Oil Sector in Ecuador: Statistical Approach through Data Panel. In Proceedings of the 5th International Annual Meeting of Sosyoekonomi Society, Milan, Italy, 25–27 October 2018. [Google Scholar]

- Mendieta Muñoz, L.R.; Pontarollo, N. Territorial Growth in Ecuador: The Role of Economic Sectors. Rom. J. Econ. Forecast. 2018, 21, 124–139. [Google Scholar]

- Lanchimba, C.; Bonilla-Bolaños, A.; Díaz-Sánchez, J.P. The COVID-19 pandemic: Theoretical scenarios of its socioeconomic impacts in Latin America and the Caribbean. Braz. J. Political Econ. 2020, 40, 622–646. [Google Scholar] [CrossRef]

- Blofield, M.; Hoffmann, B.; Llanos, M. Assessing the Political and Social Impact of the COVID-19 Crisis in Latin America; GIGA Focus Lateinamerika, GIGA German Institute of Global and Area Studies-Leibniz-Institut für Globale und Regionale Studien, Institut für Lateinamerika-Studien: Hamburg, Germany, 2020; Volume 3, p. 12. [Google Scholar]

- Karedla, Y.; Mishra, R.; Patel, N. The impact of economic growth, trade openness and manufacturing on CO2 emissions in India: An autoregressive distributive lag (ARDL) bounds test approach. J. Econ. Financ. Adm. Sci. 2021, 26, 376–389. [Google Scholar] [CrossRef]

- Mehmood, U. Investigating the linkages of female employer, education expenditures, renewable energy, and CO2 emissions: Application of CS-ARDL. Environ. Sci. Pollut. Res. 2022, 29, 61277–61282. [Google Scholar] [CrossRef]

- Alshammry, M.A.D.; Muneer, S. The influence of economic development, capital formation, and internet use on environmental degradation in Saudi Arabia. Future Bus. J. 2023, 9, 60. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, X.; Liu, Y.; Usman, M. Technological innovation, capital formation, and carbon dioxide emissions in BRICS countries: Fresh insights from ARDL and NARDL approaches. J. Clean. Prod. 2022, 345, 131131. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Dinda, S. Environmental Kuznets Curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Perwithosuci, A.; Mafruhah, I.; Gravitiani, E.; Sarmidi, T. Determinants of CO2 emissions in ASEAN countries: The role of oil consumption, population, tourism and governance. Environ. Sustain. Indic. 2023, 17, 100256. [Google Scholar] [CrossRef]

- Salazar, N.; Venegas, K.; Lozano, J.L. The role of renewable and non-renewable energy consumption in CO2 emissions: Evidence from economic sectors in Mexico. Renew. Energy 2022, 181, 827–838. [Google Scholar] [CrossRef]

- Chen, J.; Yang, F.; Liu, Y.; Usman, A. The asymmetric effect of technology shocks on CO2 emissions: a panel analysis of BRICS economies. Environ. Sci. Pollut. Res. 2022, 29, 27115–27123. [Google Scholar] [CrossRef]

- Bekhet, H.A.; Othman, N.S. Impact of urbanization growth on Malaysia CO2 emissions: Evidence from the dynamic relationship. J. Clean. Prod. 2017, 154, 374–388. [Google Scholar] [CrossRef]

- Baek, J. Environmental Kuznets curve for CO2 emissions: Evidence from selected Asian countries. Appl. Energy 2016, 183, 647–654. [Google Scholar] [CrossRef]

- Oscullo Lala, J.; Carvajal Mora, H.; Orozco Garzón, N.; Vega, J.; Ohishi, T. Examining the evolution of energy storing in the Ecuadorian electricity system: A case study (2006–2023). Energies 2024, 17, 3500. [Google Scholar] [CrossRef]

- Acevedo, L.; Jarrín, F. La transición energética en Ecuador: Avances y desafíos hacia un modelo sostenible. Rev. Latinoam. De Políticas Energéticas 2023, 14, 45–62. [Google Scholar]

- Salazar, D.; Venegas, C.; Lozano, M. Relaciones entre energía renovable, energía no renovable, crecimiento económico y emisiones de CO2 en México (1973–2018). Rev. de Econ. del Medio Ambiente 2022, 29, 97–118. [Google Scholar]

- Mitić, P.; Kostić, A.; Petrović, E.; Cvetanovic, S. The Relationship between CO2 Emissions, Industry, Services and Gross Fixed Capital Formation in the Balkan Countries. Eng. Econ. 2020, 31, 425–436. [Google Scholar] [CrossRef]

- Prakash, N.; Sethi, M. Relationship between fixed capital formation and carbon emissions: Impact of trade liberalization in India. Cogent Econ. Financ. 2023, 11, 2245274. [Google Scholar] [CrossRef]

| Statistic | CO2 Emissions | GFCF | Oil Consumption | GDP per Capita |

|---|---|---|---|---|

| (Metric Tons) | (USD 2015) | (kWh) | (USD Constant) | |

| Mean | 30,246,019.27 | 17,653,357,074.24 | 7,370,195 | 3568.17 |

| Standard Deviation | 8,577,191.68 | 7,031,140,207.63 | 9,197,633.00 | 499.13 |

| Skewness | −0.155 | 0.153 | 0.248747 | 0.251 |

| Kurtosis | 1.766 | 1.475 | 1,821,244.00 | 1.530 |

| Jarque–Bera | 2.225 | 3.328 | 2,250,828.00 | 3.317 |

| Probability | 0.329 | 0.189 | 0.324518 | 0.190 |

| Variable | Test Form (Exogenous Terms) | ADF Statistic | 1% Crit. Val. | 5% Crit. Val. | 10% Crit. Val. | p-Value | Order |

|---|---|---|---|---|---|---|---|

| Constant, Linear Trend | |||||||

| Constant, Linear Trend | |||||||

| Constant, Linear Trend | |||||||

| Constant, Linear Trend |

| Test | Null Hypothesis | Stat. | df | p-Val. | Conclusion |

|---|---|---|---|---|---|

| Breusch–Pagan–Godfrey (F-statistic) | Homoskedasticity | 1.0359 | (18, 10) | 0.4967 | Fail to reject —no evidence of heteroskedasticity |

| Breusch–Pagan–Godfrey (Obs*) | Homoskedasticity | 18.8764 | 18 | 0.3995 | Fail to reject —no evidence of heteroskedasticity |

| Breusch–Pagan–Godfrey (scaled explained SS) | Homoskedasticity | 2.3580 | 18 | 1.0000 | Fail to reject —no evidence of heteroskedasticity |

| Variable | Coefficient | Std. Error | t-Statistic | p-Value |

|---|---|---|---|---|

| C | ||||

| @TREND | ||||

| (CointEq(-1)∗) | ||||

| Model statistics | ||||

| 0.964262 | Mean dependent var | 0.018851 | ||

| Adjusted | 0.923026 | S.D. dependent var | 0.169264 | |

| S.E. of regression | 0.046961 | Akaike info criterion | ||

| Sum squared resid | 0.028669 | Schwarz criterion | ||

| Log likelihood | 5.917948 | Hannan–Quinn criter. | ||

| F-statistic | 2.338388 | Durbin–Watson stat | 2.150187 | |

| Prob(F-statistic) | 0.000001 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guevara-Segarra, M.F.; Guevara-Segarra, M.G.; Quinde-Pineda, A.P.; Guerrero-Vásquez, L.F. Capital Formation and Oil Consumption Drive CO2 Emissions in Ecuador: Evidence from an ARDL Model in Log-First Differences. Sustainability 2025, 17, 7771. https://doi.org/10.3390/su17177771

Guevara-Segarra MF, Guevara-Segarra MG, Quinde-Pineda AP, Guerrero-Vásquez LF. Capital Formation and Oil Consumption Drive CO2 Emissions in Ecuador: Evidence from an ARDL Model in Log-First Differences. Sustainability. 2025; 17(17):7771. https://doi.org/10.3390/su17177771

Chicago/Turabian StyleGuevara-Segarra, María Fernanda, María Gabriela Guevara-Segarra, Ana Paula Quinde-Pineda, and Luis Fernando Guerrero-Vásquez. 2025. "Capital Formation and Oil Consumption Drive CO2 Emissions in Ecuador: Evidence from an ARDL Model in Log-First Differences" Sustainability 17, no. 17: 7771. https://doi.org/10.3390/su17177771

APA StyleGuevara-Segarra, M. F., Guevara-Segarra, M. G., Quinde-Pineda, A. P., & Guerrero-Vásquez, L. F. (2025). Capital Formation and Oil Consumption Drive CO2 Emissions in Ecuador: Evidence from an ARDL Model in Log-First Differences. Sustainability, 17(17), 7771. https://doi.org/10.3390/su17177771