Identifying the Impact of Green Fiscal Policy on Urban Carbon Emissions: New Insights from the Energy Saving and Emission Reduction Pilot Policy in China

Abstract

1. Introduction

2. Literature Review

2.1. Research on Carbon Output Determinants

2.2. Research on the Economic and Environmental Effects of Green Fiscal Policy

2.3. Studies on the Implementation of Difference-in-Differences Methodology

3. Policy Background and Research Hypothesis

3.1. Policy Background

3.2. Theoretical Analysis and Research Hypotheses

4. Materials and Methods

4.1. The Specifications of the Multi-Period DID Model

4.2. Variables Declaration

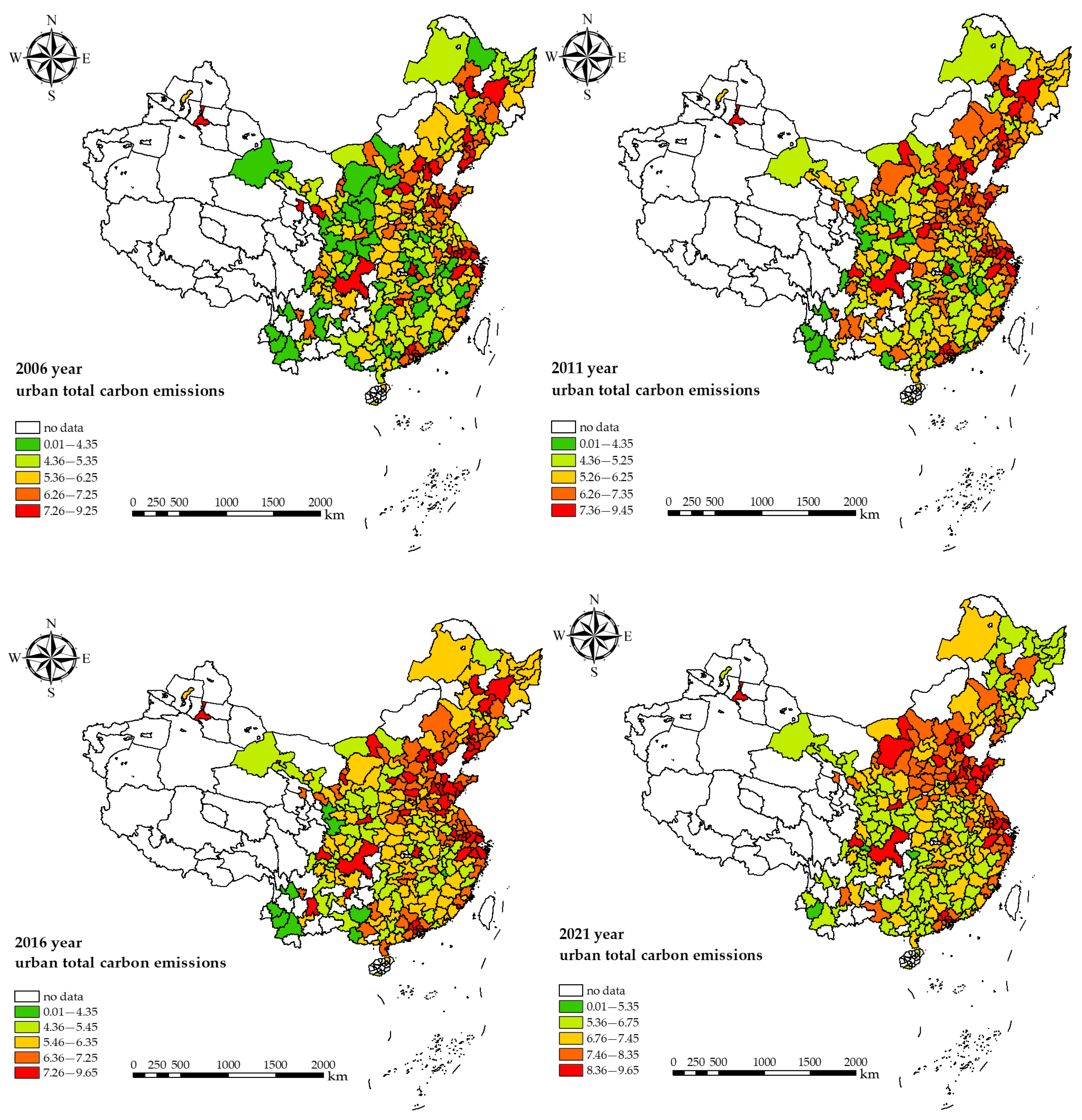

4.2.1. Explained Variable: Urban Carbon Emissions (CE)

4.2.2. Core Explanatory Variable: Energy Saving and Emission Reduction (ESER) City Pilot

4.2.3. Control Variables

4.3. Data Sources and Description

5. Empirical Results and Analysis

5.1. Baseline Regression Analysis

5.2. Robustness Analysis

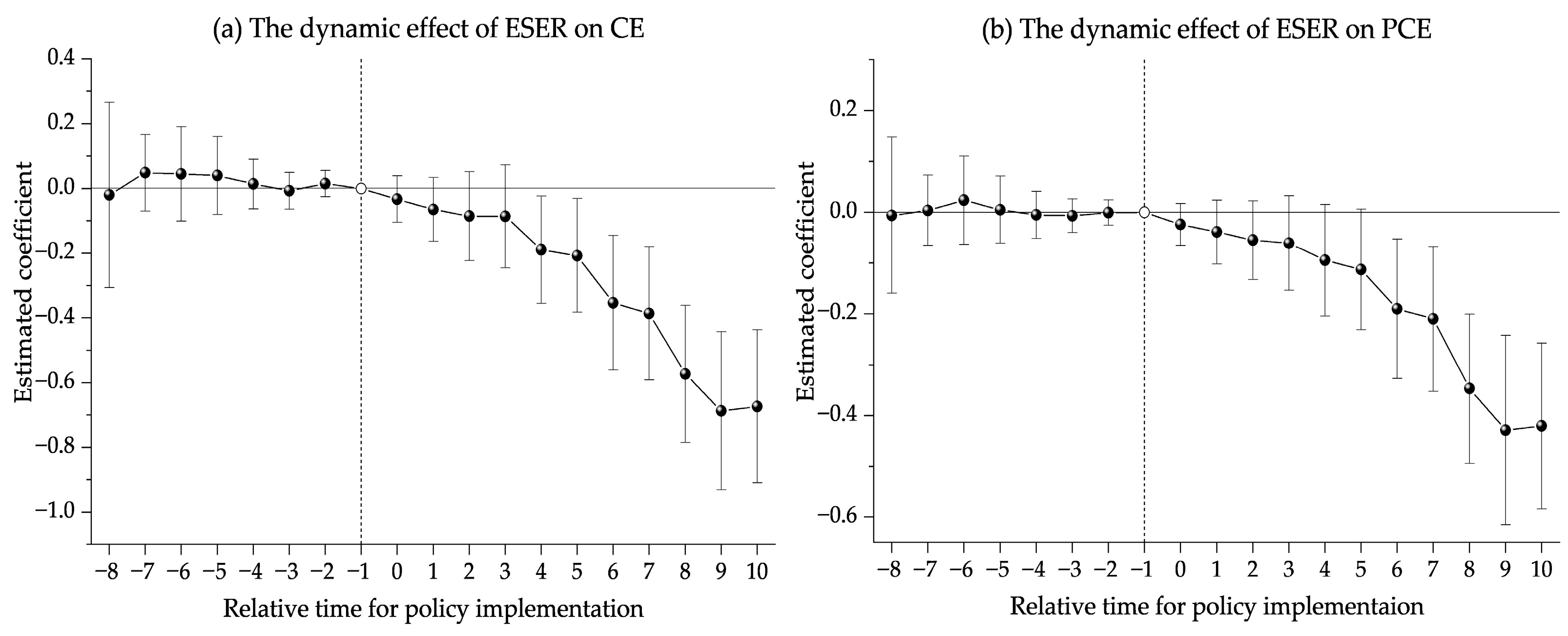

5.2.1. Parallel Trend Testing

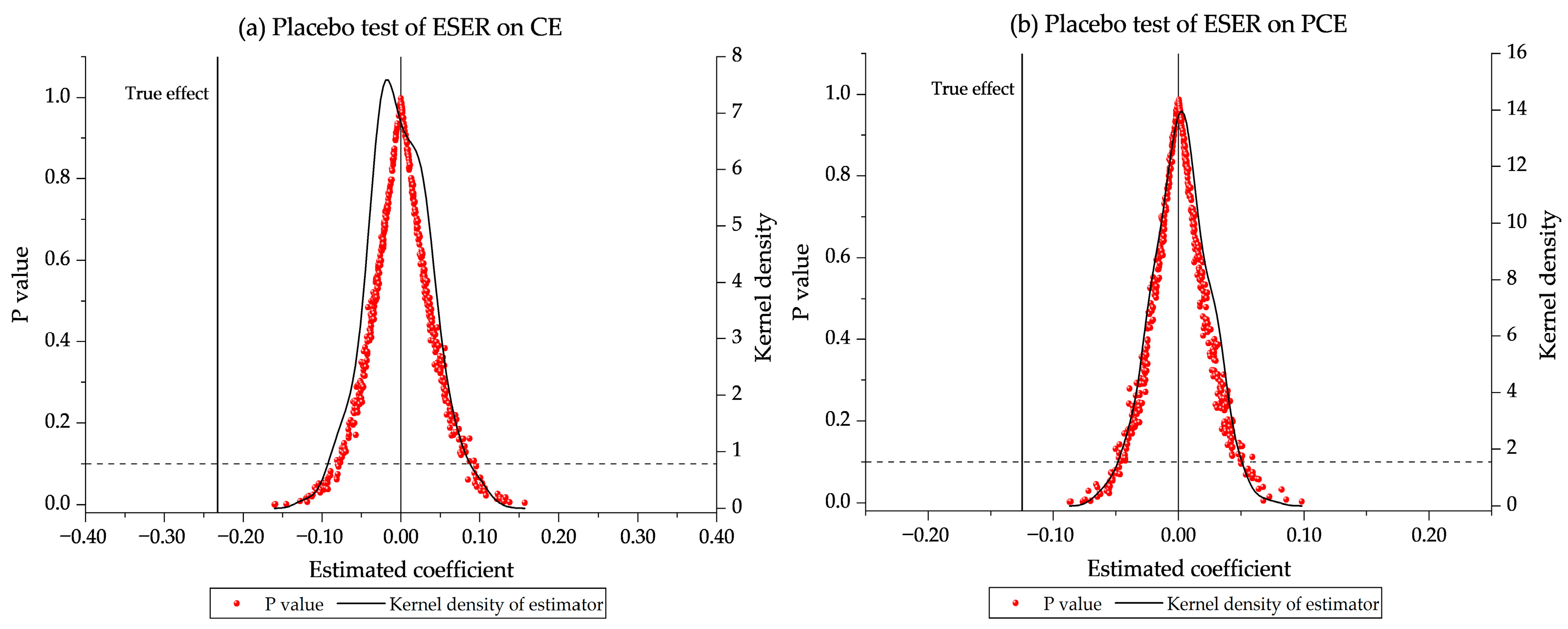

5.2.2. Placebo Testing

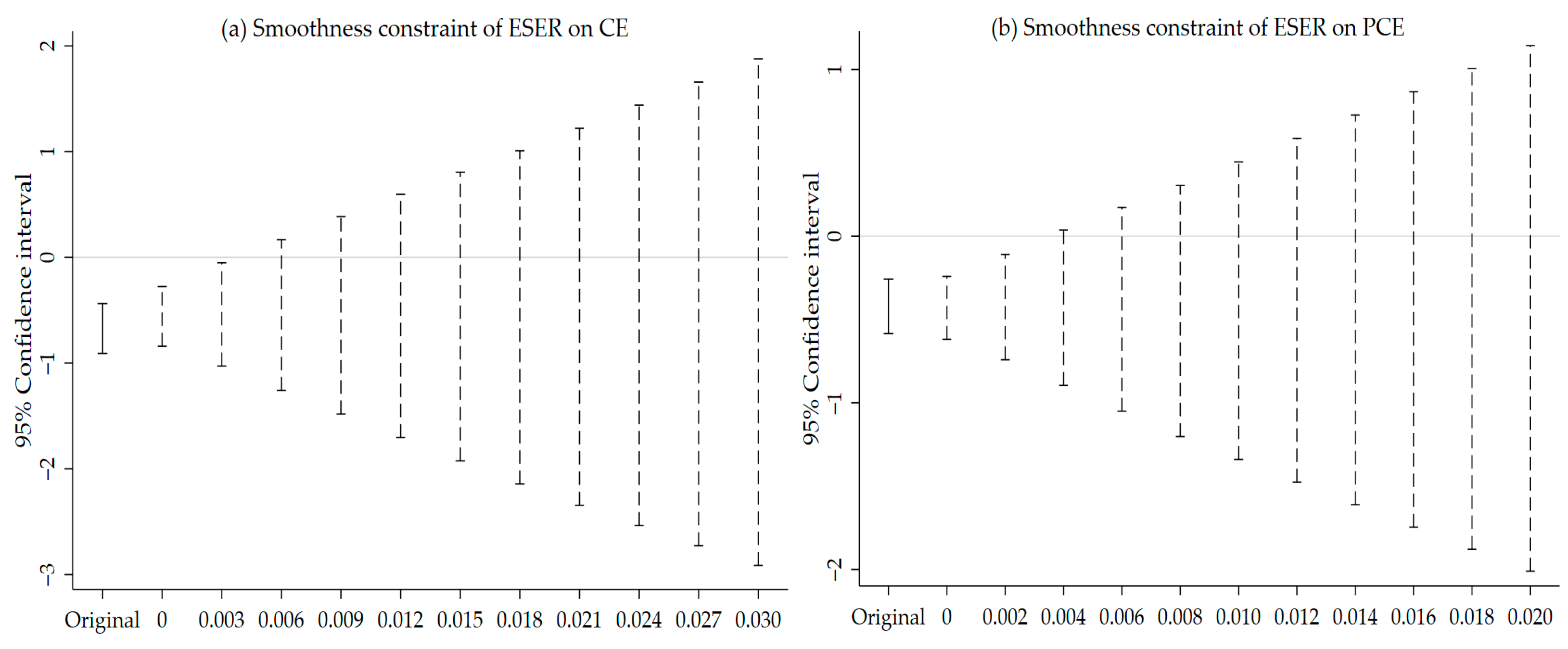

5.2.3. Policy Uniqueness Test

5.2.4. Other Robustness Tests

5.2.5. Bacon Decomposition

5.3. Heterogeneity Tests

5.4. Transmission Mechanism Analysis

6. Spatial Spillover Effects Analysis

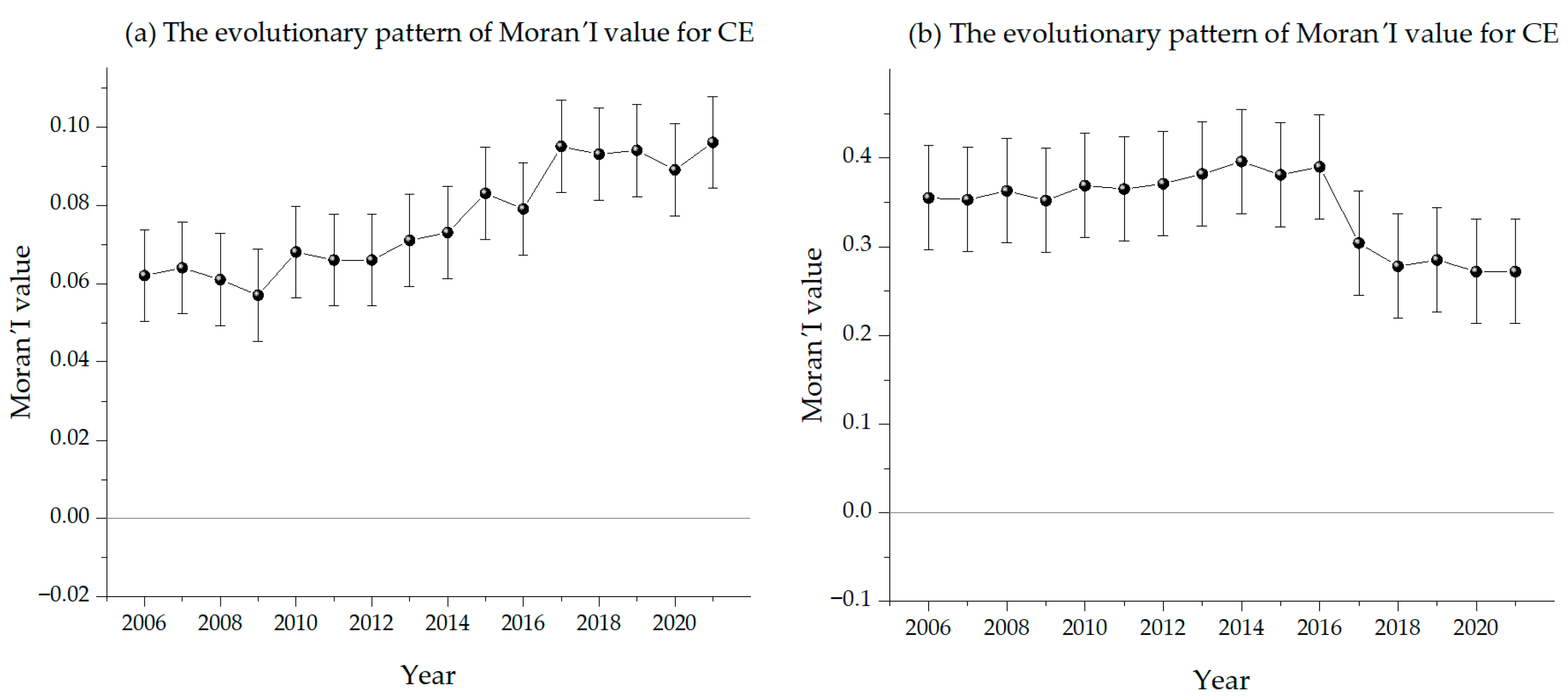

6.1. Spatial Autocorrelation Test

6.2. Spatial Panel Regression Findings

6.3. Decay Boundaries for Spatial Spillover Effects

7. Conclusion and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sufyanullah, K.; Ahmad, K.A.; Sufyan Ali, M.A. Does emission of carbon dioxide is impacted by urbanization? An empirical study of urbanization, energy consumption, economic growth and carbon emissions—Using ARDL bound testing approach. Energy Policy 2022, 164, 112908. [Google Scholar] [CrossRef]

- Wang, J.Q.; Tian, J.X.; Kang, Y.X.; Guo, K. Can green finance development abate carbon emissions: Evidence from China. Int. Rev. Econ. Financ. 2023, 88, 73–91. [Google Scholar] [CrossRef]

- Waldinger, M. The Economic Effects of Long-Term Climate Change: Evidence from the Little Ice Age. J. Polit. Econ. 2022, 130, 2275–2314. [Google Scholar] [CrossRef]

- Lin, B.Q.; Zhu, J.P. Is the implementation of energy saving and emission reduction policy really effective in Chinese cities? A policy evaluation perspective. J. Clean. Prod. 2019, 220, 1111–1120. [Google Scholar] [CrossRef]

- Wang, Z.L.; Qiu, S.L. Can “energy saving and emission reduction” demonstration city selection actually contribute to pollution abatement in China? Sustain. Prod. Consump. 2021, 27, 1882–1902. [Google Scholar] [CrossRef]

- Ma, Q.S.; Zhang, Y.M.; Hu, F.; Zhou, H.Y. Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? Evidence from 283 cities in China. Cities 2024, 154, 105323. [Google Scholar] [CrossRef]

- Wang, K.K.; Yin, R.; He, Q.; Wang, S.H. Transfer payments and carbon reduction in China: The effect of the national comprehensive demonstration city of energy saving and emission reduction fiscal policy. Energy 2024, 297, 131253. [Google Scholar] [CrossRef]

- Jin, H.; Yang, J.; Chen, Y.Y. Energy saving and emission reduction fiscal policy and corporate green technology innovation. Front. Psychol. 2022, 13, 1056038. [Google Scholar] [CrossRef]

- Sun, L.; Feng, N. Research on fiscal policies supporting green and low-carbon transition to promote energy conservation and emission reduction in cities: Empirical evidence from China. J. Clean. Prod. 2023, 430, 139688. [Google Scholar] [CrossRef]

- Acheampong, A.O. Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Econ. 2018, 74, 677–692. [Google Scholar] [CrossRef]

- Mirza, F.M.; Kanwal, A. Energy consumption, carbon emissions and economic growth in Pakistan: Dynamic causality analysis. Renew. Sustain. Energy Rev. 2017, 72, 1233–1240. [Google Scholar] [CrossRef]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef]

- Shahbaz, M.; Destek, M.A.; Dong, K.Y.; Jiao, Z.L. Time-varying impact of financial development on carbon emissions in G-7 countries: Evidence from the long history. Technol. Forecast. Soc. Change 2021, 171, 120966. [Google Scholar] [CrossRef]

- Tan, F.F.; Yang, S.S.; Niu, Z.Y. The impact of urbanization on carbon emissions: Both from heterogeneity and mechanism test. Environ. Dev. Sustain. 2023, 25, 4813–4829. [Google Scholar] [CrossRef]

- Musah, M.; Kong, Y.S.; Mensah, I.A.; Antwi, S.K.; Donkor, M. The connection between urbanization and carbon emissions: A panel evidence from West Africa. Environ. Dev. Sustain. 2020, 23, 11525–11552. [Google Scholar] [CrossRef]

- Xu, X.P.; Zhu, Y.Q. Towards Green Development: Identifying the Impact of Population Aging on China’s Carbon Emissions Based on the Provincial Panel Data Analysis. Pol. J. Environ. Stud. 2024, 33, 4861–4877. [Google Scholar] [CrossRef] [PubMed]

- Dalton, M.; O’Neill, B.; Prskawetz, A.; Jiang, L.W.; Pitkin, J. Population aging and future carbon emissions in the United States. Energy Econ. 2008, 30, 642–675. [Google Scholar] [CrossRef]

- Wan, G.H.; Wang, C.; Wang, J.X.; Zhang, X. The income inequality-CO2 emissions nexus: Transmission mechanisms. Ecol. Econ. 2022, 195, 107360. [Google Scholar] [CrossRef]

- Hailemariam, A.; Dzhumashev, R.; Shahbaz, M. Carbon emissions, income inequality and economic development. Empir. Econ. 2019, 59, 1139–1159. [Google Scholar] [CrossRef]

- Han, D.R.; Bi, C.F.; Wu, H.S.; Hao, P. Energy and environment: How could energy-consuming transition promote the synergy of pollution reduction and carbon emission reduction in China? Urban Clim. 2024, 55, 101931. [Google Scholar] [CrossRef]

- Hu, H.S.; Dong, W.H.; Zhou, Q. A comparative study on the environmental and economic effects of a resource tax and carbon tax in China: Analysis based on the computable general equilibrium model. Energy Policy 2021, 156, 112460. [Google Scholar] [CrossRef]

- Al Mamun, M.; Boubaker, S.; Nguyen, D.K. Green finance and decarbonization: Evidence from around the world. Financ. Res. Lett. 2022, 46, 102807. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of green finance in improving energy efficiency and renewable energy development. Energy Effic. 2022, 15, 14. [Google Scholar] [CrossRef] [PubMed]

- Li, Z.; Gao, S.; Song, S.F. Can Green Fiscal Policies Drive the Digital Transformation of Enterprises? J. Knowl. Econ. 2024, 1–36. [Google Scholar] [CrossRef]

- Lee, C.C.; Wang, E.Z.; Tang, H.M. Green fiscal policy and carbon emission: Enterprises’ level evidence from China. Renew. Sustain. Energy Rev. 2024, 203, 114795. [Google Scholar] [CrossRef]

- Zhou, Y.C.; Lin, B.Q. The energy-saving effect of green fiscal policy: Empirical evidence from China’s comprehensive demonstration cities of energy conservation and emission reduction fiscal policy. Appl. Energy 2025, 378, 124784. [Google Scholar] [CrossRef]

- Bujunoori, R.R.; Mannil, N.; Tantri, P. Does labor composition impact the transmission of monetary policy to output? J. Dev. Econ. 2024, 167, 103241. [Google Scholar] [CrossRef]

- Salinas, P.; Solé-Ollé, A. Partial fiscal decentralization reforms and educational outcomes: A difference-in-differences analysis for Spain. J. Urban Econ. 2018, 107, 31–46. [Google Scholar] [CrossRef]

- Gomes, P.; Librero-Cano, A. Evaluating three decades of the European Capital of Culture programme: A difference-in-differences approach. J. Cult. Econ. 2016, 42, 57–73. [Google Scholar] [CrossRef]

- Jiang, L.; Zhang, Z.N.; Zhang, B.; He, S.X. Does “National Civilized City” policy mitigate air pollution in China? A spatial Durbin difference-in-differences analysis. BMC Public Health 2024, 24, 1234. [Google Scholar] [CrossRef]

- Nenavath, S. Impact of fintech and green finance on environmental quality protection in India: By applying the semi-parametric difference-in-differences (SDID). Renew. Energy 2022, 193, 913–919. [Google Scholar] [CrossRef]

- Miyawaki, A.; Noguchi, H.; Kobayashi, Y. Impact of medical subsidy disqualification on children’s healthcare utilization: A difference-in-differences analysis from Japan. Soc. Sci. Med. 2017, 191, 89–98. [Google Scholar] [CrossRef] [PubMed]

- Bielen, S. Prosecutors and crime deterrence: Evidence from a difference-in-differences analysis with staggered treatment. J. Crim. Justice 2024, 90, 102147. [Google Scholar] [CrossRef]

- McGavock, T. Here waits the bride? The effect of Ethiopia’s child marriage law. J. Dev. Econ. 2021, 149, 102580. [Google Scholar] [CrossRef]

- Xu, H.Z.; Li, X.Y. Effect mechanism of Chinese-style decentralization on regional carbon emissions and policy improvement: Evidence from China’s 12 urban agglomerations. Environ. Dev. Sustain. 2023, 25, 474–505. [Google Scholar] [CrossRef]

- Zhao, Y.H.; Zhang, Y.Y.; Wang, S.Y. Can a Policy Mix Achieve a Collaborative Effect? Exploring the Nested Implementation Process of Urban Carbon Emission Reduction Policies. Sustainability 2024, 16, 6529. [Google Scholar] [CrossRef]

- Antweiler, W.; Copeland, B.R.; Taylor, M.S. Is free trade good for the environment? Am. Econ. Rev. 2001, 91, 877–908. [Google Scholar] [CrossRef]

- Andersen, D.C. Do credit constraints favor dirty production? Theory and plant-level evidence. J. Environ. Econ. Manag. 2017, 84, 189–208. [Google Scholar] [CrossRef]

- Xu, X.P.; Song, Y.C. Is there a conflict between automation and environment? Implications of artificial intelligence for carbon emissions in China. Sustainability 2023, 15, 12437. [Google Scholar] [CrossRef]

- Qi, J.; Tang, X.; Xi, X.C. The size distribution of firms and industrial water pollution: A quantitative analysis of China. Am. Econ. J. Macroecon. 2021, 13, 151–183. [Google Scholar] [CrossRef]

- Xu, X.P.; Liu, L. Effects of climate policy on urban carbon emissions—New insights from China’s Low-Carbon City Pilot policy. Appl. Ecol. Environ. Res. 2025, 23, 3637–3661. [Google Scholar] [CrossRef]

- Wang, L.; Zhang, N.Y.; Deng, H.G.; Wang, P.F.; Yang, F.; Qu, J.J.; Zhou, X.X. Monitoring urban carbon emissions from energy consumption over China with DMSP/OLS nighttime light observations. Theor. Appl. Climatol. 2022, 149, 983–992. [Google Scholar] [CrossRef]

- Liang, X.Y.; Fan, M.; Xiao, Y.T.; Yao, J. Temporal-spatial characteristics of energy-based carbon dioxide emissions and driving factors during 2004–2019, China. Energy 2022, 261, 124965. [Google Scholar] [CrossRef]

- Xu, T.T.; Kang, C.Y.; Zhang, H. China’s efforts towards carbon neutrality: Does energy-saving and emission-reduction policy mitigate carbon emissions? J. Environ. Manag. 2022, 316, 115286. [Google Scholar] [CrossRef]

- Biasi, B.; Sarsons, H. Flexible wages, bargaining, and the gender gap. Q. J. Econ. 2022, 137, 215–266. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Goodman-Bacon, A. Difference-in-differences with variation in treatment timing. J. Econom. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- Xu, X.P.; Meng, Q.Q.; Huang, J. Identifying the Impact of New Digital Infrastructure on Urban Energy Consumption: Evidence from the Broadband China Strategy. Energies 2025, 18, 1072. [Google Scholar] [CrossRef]

- Baysoy, M.A.; Altug, S. Growth Spillovers for the MENA Region: Geography, Institutions, or Trade? Dev. Econ. 2021, 59, 275–305. [Google Scholar] [CrossRef]

- Lin, B.; Tang, J.; Dai, C.; Lu, B. Spatial effect of digital economy on the coordinated development of Port cities. Res. Transp. Econ. 2024, 103, 101385. [Google Scholar] [CrossRef]

| Variable | Definition | The Whole Sample | Pilot Cities | Non-Pilot Cities | |||||

|---|---|---|---|---|---|---|---|---|---|

| SD | Mean | Obs | VIF | SD | Mean | SD | Mean | ||

| CE | Urban carbon emissions | 1.186 | 6.251 | 4512 | — | 1.204 | 7.077 | 1.147 | 6.156 |

| Fiscal_did | ESER pilot city policy | 0.236 | 0.059 | 4512 | 1.07 | 0.495 | 0.573 | 0 | 0 |

| Densi | Population density | 0.923 | 5.737 | 4512 | 1.14 | 0.725 | 5.932 | 0.941 | 5.715 |

| Indust | Industrialization level | 0.077 | 0.381 | 4512 | 1.57 | 0.078 | 0.374 | 0.077 | 0.382 |

| Spend | Fiscal support | 0.017 | 0.036 | 4512 | 1.58 | 0.012 | 0.032 | 0.017 | 0.036 |

| Financ | Financial development | 0.250 | 0.631 | 4512 | 1.69 | 0.312 | 0.735 | 0.239 | 0.619 |

| Econo | Economic development | 0.718 | 10.490 | 4512 | 1.75 | 0.658 | 10.757 | 0.718 | 10.460 |

| Openn | Economic openness level | 0.276 | 0.192 | 4512 | 1.11 | 0.336 | 0.262 | 0.267 | 0.184 |

| Variable | CE | PCE | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Fiscal_did | −0.283 *** | −0.225 *** | −0.226 *** | −0.233 *** | −0.234 *** | −0.232 *** | −0.233 *** | −0.125 *** |

| (−7.54) | (−6.22) | (−6.25) | (−6.43) | (−6.46) | (−6.39) | (−6.41) | (−6.03) | |

| Econo | 0.643 *** | 0.677 *** | 0.673 *** | 0.662 *** | 0.677 *** | 0.676 *** | 0.075 *** | |

| (18.91) | (17.11) | (17.01) | (15.97) | (15.82) | (15.82) | (3.09) | ||

| Indust | −0.332 * | −0.366 * | −0.382 * | −0.367 * | −0.343 * | −0.290 ** | ||

| (−1.67) | (−1.84) | (−1.91) | (−1.83) | (−1.71) | (−2.53) | |||

| Densi | 0.335 *** | 0.334 *** | 0.329 *** | 0.303 *** | −0.151 ** | |||

| (3.00) | (2.99) | (2.94) | (2.67) | (−2.33) | ||||

| Financ | −0.058 | −0.066 | −0.063 | −0.122 *** | ||||

| (−0.89) | (−1.00) | (−0.96) | (−3.25) | |||||

| Spend | 1.375 | 1.557 | −0.473 | |||||

| (1.41) | (1.58) | (−0.84) | ||||||

| Openn | −0.057 | −0.002 | ||||||

| (−1.28) | (−0.07) | |||||||

| _Cons | 6.268 *** | −0.481 | −0.708 * | −2.577 *** | −2.412 *** | −2.589 *** | −2.444 *** | 1.335 *** |

| (1037.82) | (−1.35) | (−1.85) | (−3.53) | (−3.20) | (−3.39) | (−3.16) | (3.03) | |

| ID Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.899 | 0.907 | 0.907 | 0.907 | 0.907 | 0.907 | 0.907 | 0.912 |

| F statistic | 56.84 | 209.6 | 140.7 | 108.0 | 86.53 | 72.46 | 62.35 | 11.16 |

| Obs | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 |

| Variable | CE | PCE | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Fiscal_did | −0.239 *** | −0.230 *** | −0.222 *** | −0.227 *** | −0.218 *** | −0.120 *** |

| (−3.13) | (−3.02) | (−2.89) | (−2.89) | (−2.87) | (−5.82) | |

| Energy_did | −0.137 ** | −0.136 ** | −0.040 *** | |||

| (−2.18) | (−2.25) | (−2.61) | ||||

| Green_did | −0.334 *** | −0.374 *** | −0.089 ** | |||

| (−2.78) | (−3.64) | (−2.27) | ||||

| Low_did | −0.073 | −0.082 * | −0.017 | |||

| (−1.62) | (−1.88) | (−1.34) | ||||

| Tax_did | −0.155 ** | −0.168 ** | −0.094 *** | |||

| (−2.23) | (−2.42) | (−6.43) | ||||

| _Cons | −2.662 | −2.643 | −2.525 | −3.307 * | −3.906 ** | 0.680 |

| (−1.49) | (−1.43) | (−1.37) | (−1.75) | (−2.09) | (1.52) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| ID Fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.907 | 0.907 | 0.907 | 0.908 | 0.909 | 0.913 |

| F statistic | 11.55 | 10.89 | 10.93 | 11.18 | 10.05 | 12.00 |

| Obs | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 |

| Variable | Exclude Expectation | CE_GDP | PSM-DID | Adjust Interval | Adjust Sample | Lagged Control | IV_Air Estimation | IV_River Estimation |

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Fiscal_did | −0.216 *** | −0.113 *** | −0.196 ** | −0.191 *** | −0.210 ** | −0.231 *** | −0.228 *** | −0.311 *** |

| (−3.38) | (−2.90) | (−2.52) | (−2.89) | (−2.00) | (−3.05) | (−2.90) | (−4.29) | |

| Fiscal_did_f1 | −0.017 | |||||||

| (−0.85) | ||||||||

| Fiscal_did_f2 | −0.002 | |||||||

| (−0.04) | ||||||||

| _Cons | −2.441 | 1.097 * | −0.168 | −0.619 | −3.674 * | −2.766 | — | — |

| (−1.33) | (1.69) | (−0.08) | (−0.32) | (−1.71) | (−1.44) | — | — | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ID Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.907 | 0.765 | 0.891 | 0.912 | 0.889 | 0.905 | — | — |

| CD-Wald-F | 1.5 × 106 | 2.0 × 104 | ||||||

| KP-rk-LM | 35.161 | 111.681 | ||||||

| F statistic | 9.56 | 5.38 | 4.34 | 6.58 | 11.02 | 11.70 | 11.62 | 13.26 |

| Obs | 4512 | 4512 | 3184 | 3384 | 4032 | 4230 | 4512 | 4512 |

| Testing Type | Estimator | Weight |

|---|---|---|

| Timing_groups | 0.1055 | 0.0163 |

| Never_v_timing | −0.2901 | 0.9686 |

| Within | 3.0967 | 0.0151 |

| Variable | Economy Attribute | Population Attribute | Innovation Attribute | Industrial Attribute | ||||

|---|---|---|---|---|---|---|---|---|

| Eco | Others_Eco | Lar | Others_Lar | Innov | Others_Inn | Non-Old | Old_Ind | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Fiscal_did | −0.160 ** | −0.232 | −0.169 ** | −0.227 | −0.168 ** | −0.151 | −0.296 *** | 0.032 |

| (−2.33) | (−1.08) | (−2.18) | (−1.48) | (−2.37) | (−1.13) | (−3.29) | (0.28) | |

| _Cons | 3.636 * | −8.329 *** | 2.044 | −9.594 *** | 7.493 *** | −8.668 *** | 1.853 | −3.690 * |

| (1.67) | (−3.26) | (0.86) | (−4.18) | (3.81) | (−4.11) | (0.79) | (−1.67) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| ID Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.900 | 0.867 | 0.939 | 0.852 | 0.931 | 0.862 | 0.921 | 0.883 |

| F statistic | 2.63 | 13.47 | 4.60 | 13.32 | 3.85 | 13.41 | 9.87 | 18.50 |

| Obs | 2256 | 2256 | 2208 | 2304 | 1200 | 3312 | 2992 | 1520 |

| Variable | Energy Consumption | Industrial Upgrading | Green Innovation | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Energy | Energy | CE | Ind_up | Ind_up | CE | Patent | Patent | CE | |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| Fiscal_did | −0.061 *** | −0.029 ** | 0.102 *** | 0.064 *** | 0.084 *** | 0.059 *** | |||

| (−4.85) | (−2.44) | (7.59) | (6.23) | (10.10) | (7.82) | ||||

| Fiscal_did_high | −0.195 *** | −0.217 *** | −0.375 *** | ||||||

| (−3.17) | (−5.22) | (−8.81) | |||||||

| Fiscal_did_low | 0.238 * | −0.009 | 0.420 *** | ||||||

| (1.95) | (−0.11) | (2.94) | |||||||

| _Cons | 1.324 *** | 0.677 *** | −2.417 *** | 0.734 *** | −0.719 *** | −2.568 *** | 0.101 *** | −0.817 *** | −2.567 *** |

| (658.52) | (2.69) | (−3.22) | (339.52) | (−3.29) | (−3.43) | (75.88) | (−5.12) | (−3.45) | |

| Control | No | Yes | Yes | No | Yes | Yes | No | Yes | Yes |

| ID Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Wald statistic | 10.03 | 4.84 | 28.49 | ||||||

| [0.0015] | [0.0279] | [0.0000] | |||||||

| R2 | 0.938 | 0.945 | 0.660 | 0.886 | 0.935 | 0.661 | 0.731 | 0.783 | 0.666 |

| F statistic | 23.56 | 85.42 | 393.8 | 57.66 | 464.80 | 395.6 | 101.9 | 163.0 | 403.7 |

| Obs | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 |

| Variable | Geometric Matrix_CE | Economic Matrix_CE | ||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| Main_Geo | Direct_Geo | Indirect_Geo | Total_Geo | Main_Eco | Direct_Eco | Indirect_Eco | Total_Eco | |

| Fiscal_did | −0.240 *** | −0.239 *** | −0.284 *** | −0.524 *** | −0.230 *** | −0.230 *** | −0.068 *** | −0.298 *** |

| (−6.88) | (−6.66) | (−2.91) | (−4.41) | (−6.64) | (−6.43) | (−4.77) | (−6.27) | |

| Econo | 0.622 *** | 0.623 *** | 0.736 *** | 1.359 *** | 0.612 *** | 0.615 *** | 0.180 *** | 0.795 *** |

| (14.88) | (15.49) | (3.35) | (6.05) | (14.75) | (15.35) | (7.06) | (14.94) | |

| Indust | −0.225 | −0.205 | −0.237 | −0.441 | −0.306 | −0.287 | −0.084 | −0.371 |

| (−1.16) | (−1.09) | (−1.00) | (−1.06) | (−1.60) | (−1.55) | (−1.50) | (−1.54) | |

| Densi | 0.230 ** | 0.229 ** | 0.263 ** | 0.491 ** | 0.360 *** | 0.361 *** | 0.106 *** | 0.467 *** |

| (2.10) | (2.15) | (1.97) | (2.14) | (3.31) | (3.40) | (3.13) | (3.40) | |

| Financ | −0.022 | −0.021 | −0.025 | −0.046 | −0.094 | −0.094 | −0.028 | −0.122 |

| (−0.35) | (−0.33) | (−0.32) | (−0.33) | (−1.50) | (−1.49) | (−1.44) | (−1.48) | |

| Spend | 1.562 * | 1.626 * | 1.948 | 3.574 | 0.953 | 1.017 | 0.298 | 1.315 |

| (1.65) | (1.73) | (1.44) | (1.61) | (1.01) | (1.08) | (1.06) | (1.08) | |

| Openn | −0.077 * | −0.078 * | −0.092 | −0.170 * | −0.075 * | −0.077 * | −0.022 * | −0.099 * |

| (−1.77) | (−1.74) | (−1.48) | (−1.65) | (−1.76) | (−1.72) | (−1.66) | (−1.72) | |

| ρ | 0.534 *** | 0.233 *** | ||||||

| (7.11) | (8.71) | |||||||

| R2 | 0.445 | 0.528 | ||||||

| Log-Lik | −1639.108 | −1622.968 | ||||||

| Obs | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 | 4512 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, J.; Xu, X.; Liu, L. Identifying the Impact of Green Fiscal Policy on Urban Carbon Emissions: New Insights from the Energy Saving and Emission Reduction Pilot Policy in China. Sustainability 2025, 17, 7632. https://doi.org/10.3390/su17177632

Luo J, Xu X, Liu L. Identifying the Impact of Green Fiscal Policy on Urban Carbon Emissions: New Insights from the Energy Saving and Emission Reduction Pilot Policy in China. Sustainability. 2025; 17(17):7632. https://doi.org/10.3390/su17177632

Chicago/Turabian StyleLuo, Jianzhe, Xianpu Xu, and Lei Liu. 2025. "Identifying the Impact of Green Fiscal Policy on Urban Carbon Emissions: New Insights from the Energy Saving and Emission Reduction Pilot Policy in China" Sustainability 17, no. 17: 7632. https://doi.org/10.3390/su17177632

APA StyleLuo, J., Xu, X., & Liu, L. (2025). Identifying the Impact of Green Fiscal Policy on Urban Carbon Emissions: New Insights from the Energy Saving and Emission Reduction Pilot Policy in China. Sustainability, 17(17), 7632. https://doi.org/10.3390/su17177632