Managing the Integration of Companies into Green Value Chains: A Regional Perspective

Abstract

1. Introduction

- –

- Green internal integration—the intra-organizational management of environmental practices within a company;

- –

- Green supplier integration—collaboration with suppliers to adopt green principles in product development and process design;

- –

- Green customer integration—engagement with customers to gather market intelligence and understand environmental product demand;

- –

- Green external integration—joint implementation of inter-organizational green initiatives between suppliers and customers.

2. Literature Review

2.1. Green Value Chains

- (1)

- (2)

- (3)

- (4)

- Value chain as a cycle: The development of a green value chain is viewed as a systems approach. A green value chain integrates environmental support mechanisms, regulatory frameworks, and stakeholder cooperation, aiming to consider environmental aspects throughout the product life cycle. This approach reframes the traditional linear model as a cyclic system [12,13,14].

- Agro-industrial parks, by promoting sustainable production, enhancing competitiveness, and increasing value addition along the supply chain, as well as facilitating linkages between small farmers and agribusinesses.

- Cluster development, by developing clusters and networks of SMEs for inclusive economic growth.

- Industrial Upgrading and Modernization Programme (IUMP) [15].

2.2. Integration Capital

3. Materials and Methods

- (1)

- Broadening the conceptual understanding of green construction;

- (2)

- Reducing the resource and carbon intensity of buildings;

- (3)

- Lowering the energy and carbon intensity of building materials production and manufacturing and promoting the use of green construction materials;

- (4)

- Establishing closed-loop economic linkages among participants in green construction initiatives.

- (1)

- The structure of green integration potential;

- (2)

- A system of performance indicators;

- (3)

- A scoring methodology for expert evaluation;

- (4)

- Defined maturity levels of integration capital.

- –

- The consistency of expert opinions was checked based on the calculation of the Kendall concordance coefficient. The obtained values (W = 0.72; p < 0.05) confirm sufficient consistency for subsequent data aggregation.

- –

- Expert opinions with a strong deviation from the median were excluded.

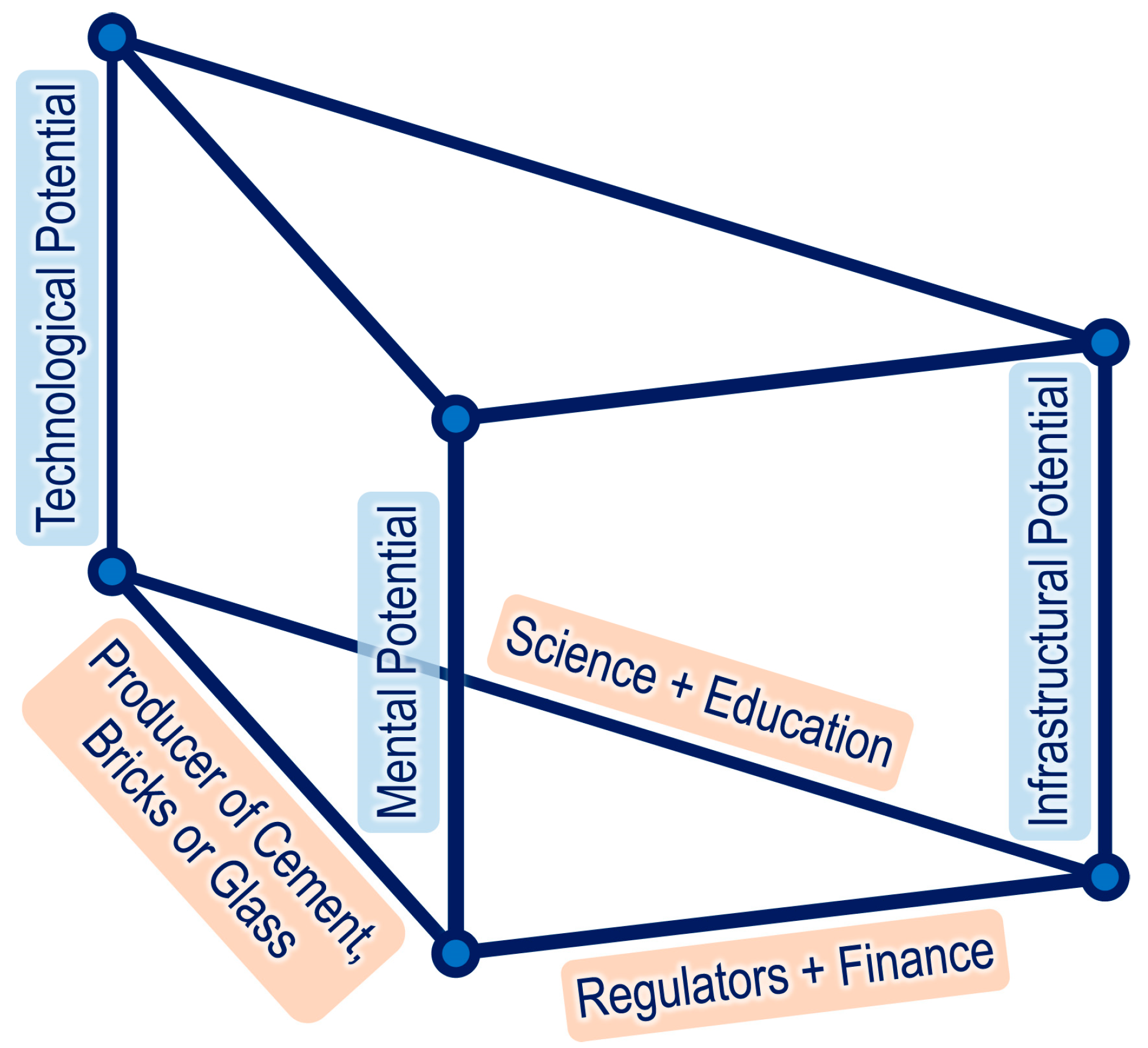

- Technological potential development: Implementation of engineering (technological, technical) and organizational measures to reduce carbon intensity, boost recycling, apply low-waste technologies, improve resource (especially energy) efficiency, and achieve other similar results.

- Infrastructural potential development: Promotion of collaboration among actors in environmental responsibility; development of shared infrastructure (e.g., logistics, digital platforms, territorial accessibility).

- Mental potential development: Initiation of green projects, production of eco-friendly goods, implementation of voluntary environmental activities, and adoption of sustainable practices across operations.

- (1)

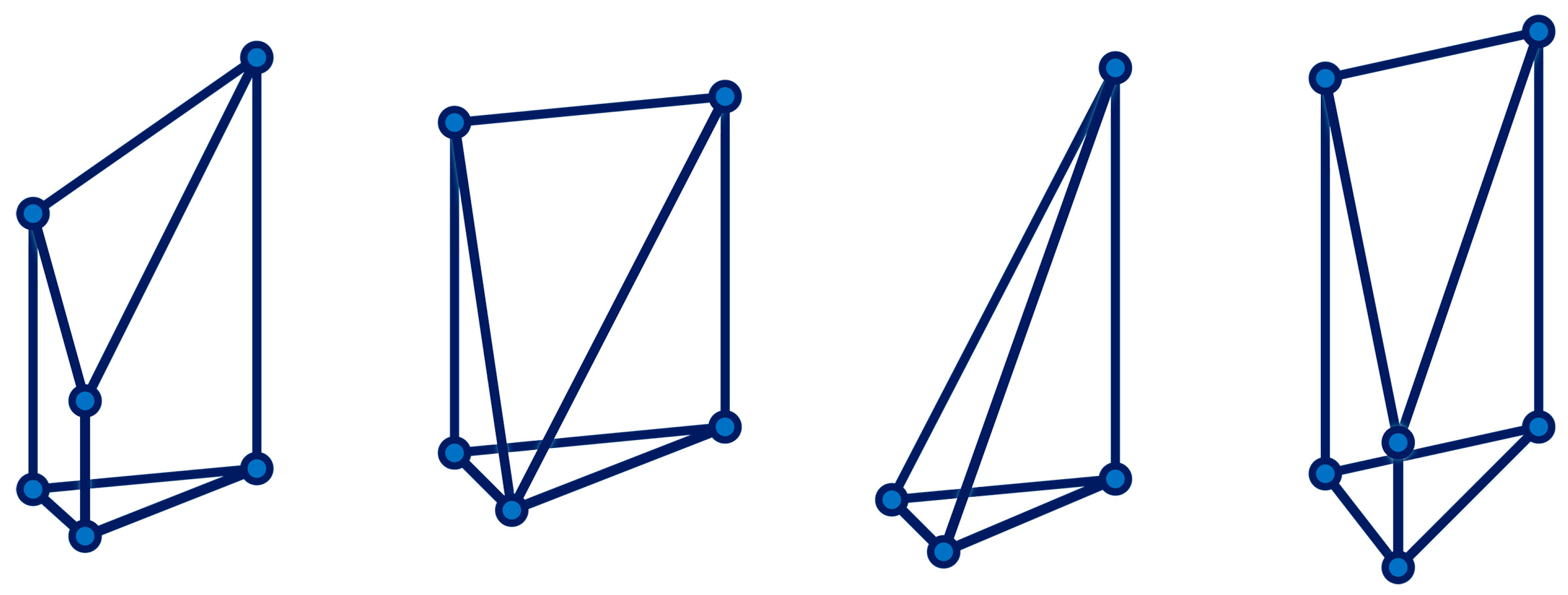

- The scope of actors and industries considered in this analysis is limited. The calculation of actors’ integration capital employs a geometric approach, which involves determining the volume of a geometric figure—specifically, a polygon whose vertices represent distinct groups of actors. Consequently, an increase in the number of actor groups, as well as in their combined capitals, knowledge assets, green value chains, and other relevant factors, substantially complicates both the graphical representation and the calculation of the figure’s volume. Beyond a certain number of groups, it becomes increasingly challenging to ensure that the results remain objective and reliable.

- (2)

- Averaging potentials using the arithmetic mean formula can lead to misleading conclusions. For instance, combining low and high values into a single average may obscure the fact that a low potential value could be critically important for a particular actor.

- (3)

- The subjectivity inherent in expert assessments necessitates validation through an audit process.

4. Results

- Pobeda LSR (brick producer, SPb);

- Ryabovsky Brick Factory (Leningrad region);

- Pikalevo Cement Plant (Leningrad region);

- Tsesla JSC (cement producer, Leningrad region);

- Klin Glass Factory (the closest flat glass producer, located ~ 500 km from Saint Petersburg);

- Baltiyskoye Steklo JSC (SPb company manufacturing flat glass constructions such as double-glazed windows);

- Forestry enterprises located in the Leningrad region.

- SPb State Technological University;

- SPb Polytechnic University.

- Construction Committee of Saint Petersburg (part of the city government);

- Construction Committee of the Leningrad region (part of the regional government);

- Setl Group (developer);

- Glavstroy SPb (developer);

- Bank of Saint Petersburg.

- –

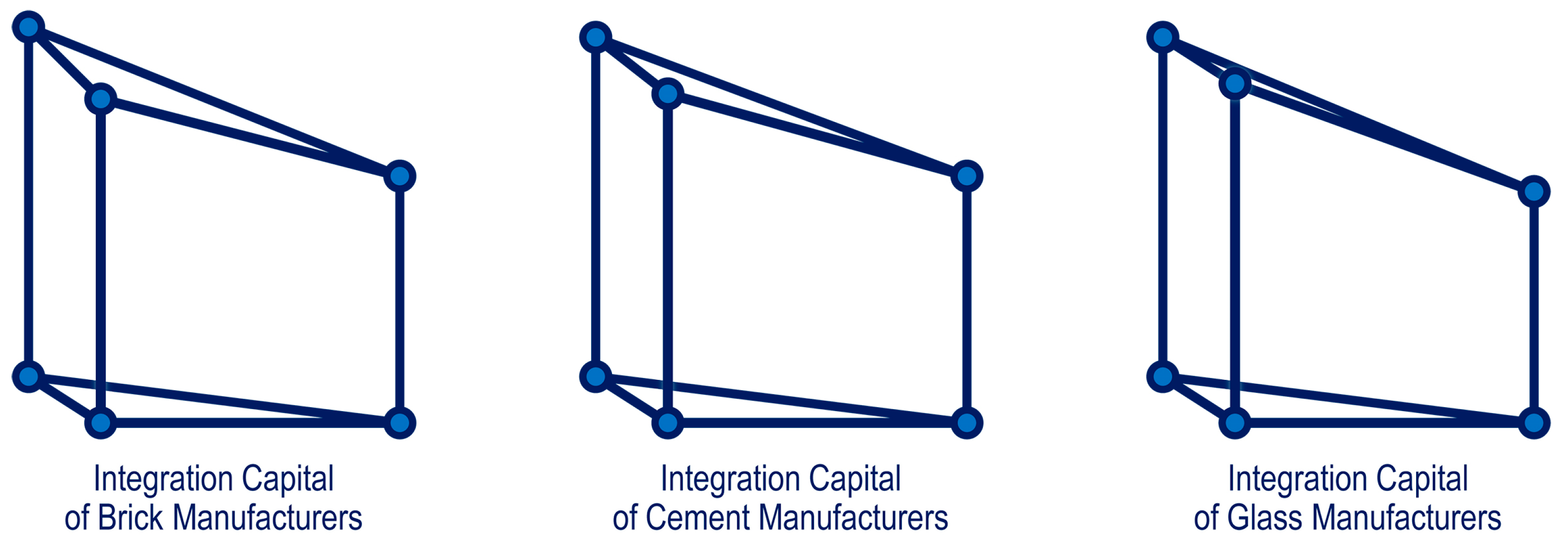

- Brick manufacturers (Pobeda LSR and Ryabovsky Brick Factory);

- –

- Cement manufacturers (Pikalevo Cement Plant and Tsesla JSC);

- –

- Glass and glass construction manufacturers (Klin Glass Factory and Baltiyskoye Steklo JSC).

- –

- Reducing carbon and energy intensity. Enterprises with high values in these indicators must implement modern resource-efficient technologies (including Best Available Techniques) as well as energy and environmental management systems.

- –

- Developing partnerships. Organizations exhibiting low activity in ESG-related initiatives should intensify collaboration with other actors—particularly academic and financial institutions—to facilitate knowledge and resource exchange.

- –

- Considering the product life cycle. Improving this indicator can significantly enhance the sustainability of enterprises.

- –

- Establishing sustainable relations among participants and ensuring their active engagement;

- –

- Including participants with substantial capabilities in generating shared meanings and fostering trust within the network.

5. Discussion and Conclusions

- Self-assessment by actors regarding their alignment with green agenda and the formation of actionable strategies for enhancing integration capital;

- Implementation of green development strategies through green co-evolution and the cultivation of a cognitive space between actors;

- Development of green value chains within integration frameworks, thereby contributing positively to environmental sustainability in the region where the actors operate.

5.1. Scenario 1: Innovation and Technology Leader

5.2. Scenario 2: Environmentally Friendly Development

5.3. Scenario 3: Green Integration

- Considering collaboration with companies producing refuse-derived fuel (RDF) and biofuel, with the specific focus on the RDF originating from municipal waste generated in the target cities. This would be of interest for the city and regional governments and could enhance their green policies.

- Including chemical industries in the green integration, since iron- and calcium-containing waste of the chemical industry is a promising substitute for raw materials. For example, in the Leningrad region, such waste was formed at Kingisepp industrial sites and needs to be processed.

- Collaborating with the research institutes promoting low-clinker cement as a sustainable building material [78].

- Widening the scope of “green building ceramics” by including such energy- and carbon-intensive products as roof tiles, wall and floor tiles, and sanitary ware.

- Collaborating with research institutes running pilot projects on the production of construction bricks by partial replacement of natural raw materials with waste plastics. This may also be of interest to city and regional authorities, as plastic waste accounts for a large share of municipal waste structure [79].

- Strengthening collaboration with the design companies, jointly developing projects and marketing not glass but project solutions. They could be called sustainable, green, or low-carbon, depending on the preferences of the urban development policies. Energy-efficient flat glass solutions help to reduce the carbon footprint of buildings by significantly lowering energy consumption. Worldwide, these attributes align with the increasing demand for green building materials in the construction industry.

- Considering opportunities for making glass fully recyclable in reality by means of involving companies running renovation projects in the integration contour. Nowadays, in Russia, glass-containing components of construction and demolition waste are rarely separated and returned to manufacturing of products that are not too admixture-sensitive, such as road marking paints.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Handfield, R. Preparing for the Era of the Digitally Transparent Supply Chain: A Call to Research in a New Kind of Journal. Logistics 2017, 1, 2. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T.; Huo, B. Green Supply Chain Integration and Financial Performance: A Social Contagion and Information Sharing Perspective. Bus. Strategy Environ. 2021, 30, 2255–2270. [Google Scholar] [CrossRef]

- Abbas, A.; Luo, X.; Wattoo, M.U.; Hu, R. Organizational Behavior in Green Supply Chain Integration: Nexus Between Information Technology Capability, Green Innovation, and Organizational Performance. Front. Psychol. 2022, 13, 874639. [Google Scholar] [CrossRef] [PubMed]

- Kaplinsky, R. Global Value Chains: Where They Came From, Where They Are Going and Why This Is Important. Innov. Knowl. Dev. Work. Pap. 2013, 11, 1–27. [Google Scholar]

- Building Green Global Value Chains (OECD). Available online: https://www.oecd.org/en/publications/building-green-global-value-chains_5k483jndzwtj-en.html (accessed on 5 August 2025).

- Research Network Sustainable Global Supply Chains. Sustainable Global Supply Chains Annual Report 2022. Bonn: German Development Institute/Deutsches Institut für Entwicklungspolitik (DIE). Available online: https://www.idos-research.de/en/books/article/sustainable-global-supply-chains-annual-report-2022/ (accessed on 30 July 2025).

- Li, G.; Li, L.; Choi, T.M.; Sethi, S.P. Green Supply Chain Management in Chinese Firms: Innovative Measures and the Moderating Role of Quick Response Technology. J. Oper. Manag. 2020, 66, 958–988. [Google Scholar] [CrossRef]

- World Trade Organization. Global Value Chain Development Report 2019. Technological Innovation, Supply Chain Trade, and Workers in a Globalized World; World Bank: Washington, DC, USA; World Trade Organization: Geneva, Switzerland, 2019. [Google Scholar]

- Ricciotti, F. From value chain to value network: A systematic literature review. Manag. Rev. Q. 2020, 70, 191–212. [Google Scholar] [CrossRef]

- Panahifar, F.; Byrne, P.J.; Salam Mohammad, A.; Heavey, C. Supply chain collaboration and firm’s performance: The critical role of information sharing and trust. J. Enterp. Inf. Manag. 2018, 31, 358–379. [Google Scholar] [CrossRef]

- Leschinskaya, A.; Kirillova, O.; Palyanov, M. Assessment of the Formation of the Economic Effect of Cross-Subsidization in the Electric Power Industry. Energies 2023, 16, 6004. [Google Scholar] [CrossRef]

- Wong, C.Y.; Wong, C.W.; Boonitt, S. Effects of green supply chain integration and green innovation on environmental and cost performance. Int. J. Prod. Res. 2020, 58, 4589–4609. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, M.; Huo, B. The impact of supply chain quality integration on green supply chain management and environmental performance. Total Qual. Manag. Bus. Excell. 2019, 30, 1110–1125. [Google Scholar] [CrossRef]

- Yang, G.; Singhdong, P. A conceptual framework of green supply chain integration toward enterprise performance through ambidextrous green innovation: An organizational capability perspective. J. Int. Logist. Trade 2024, 22, 93–106. [Google Scholar] [CrossRef]

- UNIDO’s Approach to Supporting Sustainable Supply Chains. Available online: https://lkdfacility.org/news/sustainable-supply-chains (accessed on 30 July 2025).

- Gelmez, E.; Özceylan, E.; Mrugalska, B. The Impact of Green Supply Chain Management on Green Innovation, Environmental Performance, and Competitive Advantage. Sustainability 2024, 16, 9757. [Google Scholar] [CrossRef]

- Lo, S.M.; Zhang, S.; Wang, Z.; Zhao, X. The impact of relationship quality and supplier development on green supply chain integration: AKONGET AL. mediation and moderation analysis. J. Clean. Prod. 2018, 202, 524–535. [Google Scholar] [CrossRef]

- Hasan, M.; Nekmahmud, A.; Yajuan, L.; Patwary, M. Green business value chain: A systematic review. Sustain. Prod. Consum. 2019, 20, 326–339. [Google Scholar] [CrossRef]

- Chin, T.; Zuraidah, T. Green Supply Chain Management, Environmental Collaboration and Sustainability Performance. Procedia CIRP 2015, 26, 695–699. [Google Scholar] [CrossRef]

- Sugandini, D.; Susilowati, C.; Siswanti, Y.; Syafri, W. Green supply management and green marketing strategy on green purchase intention: SMEs cases. J. Ind. Eng. Manag. 2020, 13, 79–92. [Google Scholar] [CrossRef]

- Kong, T.; Feng, T.; Ye, C. Advanced Manufacturing Technologies and Green Innovation: The Role of Internal Environmental Collaboration. Sustainability 2016, 8, 1056. [Google Scholar] [CrossRef]

- Abbas, H.; Tong, S. Green Supply Chain Management Practices of Firms with Competitive Strategic Alliances—A Study of the Automobile Industry. Sustainability 2023, 15, 2156. [Google Scholar] [CrossRef]

- Abdallah, A.B.; Al-Ghwayeen, W.S. Green supply chain management and business performance: The mediating roles of environmental and operational performances. Bus. Process Manag. J. 2020, 26, 489–512. [Google Scholar] [CrossRef]

- Al-khawaldah, R.; Al-zoubi, W.; Alshaer, S.; Almarshad, M.; ALShalabi, F.; Altahrawi, M.; Al-Hawary, S. Green supply chain management and competitive advantage: The mediating role of organizational ambidexterity. Uncertain. Supply Chain. Manag. 2022, 10, 961–972. [Google Scholar] [CrossRef]

- Wiredu, J.; Yang, Q.; Sampene, A.K.; Gyamfi, B.A.; Asongu, S.A. The effect of green supply chain management practices on corporate environmental performance: Does supply chain competitive advantage matter? Bus. Strateg. Environ. 2024, 33, 2578–2599. [Google Scholar] [CrossRef]

- Novitasari, M.; Agustia, D. Assessing the impact of green supply chain management, competitive advantage and firm performance in PROPER companies in Indonesia. Oper. Supply Chain. Manag. 2022, 15, 395–409. [Google Scholar] [CrossRef]

- Hilal, F. The effect of green supply chain management practices and competitive advantage on financial performance. Int. J. Bus. 2022, 27, 1–13. [Google Scholar] [CrossRef] [PubMed]

- Zhang, C.; Tang, L.; Zhang, J. Identifying Critical Indicators in Performance Evaluation of Green Supply Chains Using Hybrid Multiple-Criteria Decision-Making. Sustainability 2023, 15, 6095. [Google Scholar] [CrossRef]

- Ye, Y.; Lau, K.H. Competitive Green Supply Chain Transformation with Dynamic Capabilities—An Exploratory Case Study of Chinese Electronics Industry. Sustainability 2022, 14, 8640. [Google Scholar] [CrossRef]

- Roh, T.; Noh, J.; Oh, Y.; Park, K.S. Structural relationships of a firm’s green strategies for environmental performance: The roles of green supply chain management and green marketing innovation. J. Clean. Prod. 2022, 356, 131877. [Google Scholar] [CrossRef]

- Negri, M.; Cagno, E.; Colicchia, C.; Sarkis, J. Integrating Sustainability and Resilience in the Supply Chain: A Systematic Literature Review and a Research Agenda. Bus. Strategy Environ. 2021, 30, 2858–2886. [Google Scholar] [CrossRef]

- Bourdieu, P. Forms of Capital. In The Sociology of Economic Life; Westview Press Inc.: Boulder, CO, USA, 2001. [Google Scholar]

- Ali, M.A.; Hussin, N.; Haddad, H.; Al-Araj, R.; Abed, I.A. Intellectual capital and innovation performance: Systematic literature review. Risks 2021, 9, 170. [Google Scholar] [CrossRef]

- Paoloni, P.; Modaffari, G.; Ricci, F.; Della Corte, G. Intellectual capital between measurement and reporting: A structured literature review. J. Intellect. Cap. 2023, 24, 115–176. [Google Scholar] [CrossRef]

- Asiaei, K.; O’Connor, N.; Barani, O.; Joshi, M. Green intellectual capital and ambidextrous green innovation: The impact on environmental performance. Bus. Strategy Environ. 2023, 32, 369–386. [Google Scholar] [CrossRef]

- Zhang, Z.; Luo, T. Network capital, exploitative and exploratory innovations—From the perspective of network dynamics. Technol. Forecast. Social Chang. 2020, 152, 119910. [Google Scholar] [CrossRef]

- Menshikov, V.; Lavrinenko, O.; Sinica, L. Network capital phenomenon and its possibilities under the influence of development of information and communication technologies. J. Secur. Sustain. 2017, 6, 585–604. [Google Scholar] [CrossRef]

- Gamidullaeva, L.; Shmeleva, N.; Mityakov, E.; Tolstykh, T.; Vasin, S. Strategic Tools for the Formation of Cluster Capital to Implement Technological Innovations. Systems 2025, 13, 270. [Google Scholar] [CrossRef]

- Wang, Q.; Geng, C.; He, E. Dynamic coevolution of capital allocation efficiency of new energy vehicle enterprises from financing niche perspective. Math. Probl. Eng. 2019, 2019, 1412950. [Google Scholar] [CrossRef]

- Ocicka, B.; Baraniecka, A.; Jefmański, B. Exploring supply chain collaboration for green innovations: Evidence from the high-tech industry in Poland. Energies 2022, 15, 1750. [Google Scholar] [CrossRef]

- Yu, Y.; Huo, B. The impact of environmental orientation on supplier green management and financial performance: The moderating role of relational capital. J. Clean. Prod. 2019, 211, 628–639. [Google Scholar] [CrossRef]

- Woo, C.; Kim, M.G.; Chung, Y.; Rho, J.J. Suppliers’ communication capability and external green integration for green and financial performance in Korean construction industry. J. Clean. Prod. 2016, 112, 483–493. [Google Scholar] [CrossRef]

- Zhang, B.; Zhao, S.; Fan, X.; Wang, S.; Shao, D. Green supply chain integration, supply chain agility and green innovation performance: Evidence from Chinese manufacturing enterprises. Front. Environ. Sci. 2022, 10, 1045414. [Google Scholar] [CrossRef]

- Yardımcı, P.; Oskay, C. The Impact of Green Finance and Financial Globalization on Environmental Sustainability: Empirical Evidence from Türkiye. Sustainability 2025, 17, 5696. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F.; Lou, R.; Wang, K. How Does Green Finance Drive the Decarbonization of the Economy? Empirical Evidence from China. Renew. Energy 2023, 204, 671–684. [Google Scholar] [CrossRef]

- Tolliver, C.; Keeley, A.R.; Managi, S. Drivers of Green Bond Market Growth: The Importance of Nationally Determined Contributions to the Paris Agreement and Implications for Sustainability. J. Clean. Prod. 2020, 244, 118643. [Google Scholar] [CrossRef]

- Bhutta, U.S.; Tariq, A.; Farrukh, M.; Raza, A.; Iqbal, M.K. Green Bonds for Sustainable Development: Review of Literature on Development and Impact of Green Bonds. Technol. Forecast. Soc. Change 2022, 175, 121378. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The Limits of Green Finance: A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- International Capital Market Association (ICMA). Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds (With June 2022 Appendix 1). 2021. Available online: https://www.icmagroup.org/assets/documents/sustainable-finance/2022-updates/green-bond-principles_june-2022-280622.pdf (accessed on 10 June 2025).

- Zournatzidou, G. Green Finance and Sustainable Development: Investigating the Role of Greentech Business Ecosystem Through PRISMA-Driven Bibliometric Analysis. Adm. Sci. 2025, 15, 150. [Google Scholar] [CrossRef]

- Kwong, R.; Kwok, M.L.J.; Wong, H.S.M. Green FinTech Innovation as a Future Research Direction: A Bibliometric Analysis on Green Finance and FinTech. Sustainability 2023, 15, 14683. [Google Scholar] [CrossRef]

- Olabi, A.O.; Shehata, N.; Issa, U.H.; Mohamed, O.A.; Mahmoud, M.; Abdelkareem, M.A.; Abdelzaher, M.A. The Role of Green Buildings in Achieving the Sustainable Development Goals. Int. J. Thermofluids. 2025, 25, 101002. [Google Scholar] [CrossRef]

- Green Buildings. EPA, 2025. Available online: https://www.epa.gov/land-revitalization/green-buildings (accessed on 25 June 2025).

- BREEAM. International New Construction Version 6.0. Technical Manual—SD250. BREE Global: London, UK, 2024. Available online: https://breeam.com/standards/technical-manuals-form (accessed on 25 June 2025).

- LEED v5 Reference Guide for Building Design and Construction. The U.S. Green Building Council: Washington, DC, USA, 2025. Available online: https://www.usgbc.org/resources/leed-v5-reference-guide-building-design-and-construction-april-2025-launch-edition (accessed on 30 June 2025).

- Strategic Approach to the Selection and Procurement of Construction Materials and Products. BREE Trust: London, UK, 2015. Available online: https://tools.breeam.com/filelibrary/Briefing%20Papers/Strategic-Approach-to-the-Selection-and-Procurement-of-Construction-Materials-and-Products.pdf (accessed on 28 June 2025).

- The Role of Construction Materials in BREAM. A Guide to Our Sustainability Credentials. Tarmac: Birmingham, UK, 2015. Available online: https://bregroup.com/services/standards/environmental/environmental-technology-verification (accessed on 28 June 2025).

- Astafyeva, N.; Laguta, I.; Kukarina, E.; Emelyanova, Y. Tendencies of “Green” Construction in the World and Modern Russia. Urban. Constr. Archit. 2019, 9, 109–117. [Google Scholar] [CrossRef]

- Gurieva, L.; Kurnosova, T. Green Infrastructure Development as a Factor of Moscow Metropolis Sustainable Development. BIO Web Conf. 2024, 105, 06018. [Google Scholar] [CrossRef]

- Vaytens, A.; Yankovskaya, Y. Saint-Petersburg Landscape Scenarios and Green Architecture in the Strategy of Urban Development. MATEC Web Conf. 2018, 170, 02001. [Google Scholar] [CrossRef]

- Green Construction. Residential and Public Buildings. Rating System for Environment Sustainability Evaluation. ABOK Association: Moscow, Russia, 2024. Available online: https://www.abok.ru/eng/page/green8_e.html#:~:text=Overall%20the%20rating%20system%20requirements,architectural%2C%20construction%20and%20engineering%20solutions (accessed on 29 June 2025).

- Tazmeen, T.; Mir, F.Q. Sustainability through Materials: A Review of Green Options in Construction. Results Surf. Interfaces 2024, 14, 100206. [Google Scholar] [CrossRef]

- Etzkowitz, H.; Zhou, C. The Triple Helix: University–Industry–Government Innovation and Entrepreneurship, 2nd ed.; Routledge: London, UK, 2017. [Google Scholar] [CrossRef]

- Labaran, Y.H.; Mathur, V.S.; Muhammad, S.U.; Musa, A.A. Carbon Footprint Management: A Review of Construction Industry. Clean. Eng. Technol. 2022, 9, 100531. [Google Scholar] [CrossRef]

- Guseva, T.; Begak, M.; Potapova, E.; Molchanova, Y.; Lomakina, I. Public dialogue in the field of best available techniques and integrated permits: Lessons from Russian construction materials industry. In Proceedings of the 17th Interdisciplinary Scientific Conference SGEM, Albena, Bulgaria, 27 June–6 July 2017; pp. 733–740. [Google Scholar] [CrossRef]

- Guseva, T.; Tikhonova, I.; Grevtsov, O.; Kostyleva, V.; Begak, M. Environmental performance enhancement programmes and management systems of industrial enterprises. In Proceedings of the 19th Interdisciplinary Scientific Conference SGEM, Albena, Bulgaria, 28 June–7 July 2019; pp. 261–268. [Google Scholar] [CrossRef]

- IWA 48:2024; Framework for Implementing Environmental, Social and Governance (ESG) Principles. ISO International International Organization for Standardization: Geneva, Switzerland, 2024.

- Zhitin, D.V.; Lachininskii, S.S.; Mikhaylova, A.A.; Shendrik, A.V. Urban transformation of a post-soviet coastal city: The case of Saint Petersburg. Geogr. Environ. Sustain. 2020, 13, 145–158. [Google Scholar] [CrossRef]

- Arroyave, J.J.; Martínez, F.J.S.; González-Moreno, Á. Cooperation with universities in the development of eco-innovations and firms’ performance. Front. Psychol. 2020, 11, 612465. [Google Scholar] [CrossRef] [PubMed]

- Birasnav, M.; Bienstock, J. Supply chain integration, advanced manufacturing technology, and strategic leadership: An empirical study. Comput. Ind. Eng. 2019, 130, 142–157. [Google Scholar] [CrossRef]

- Donbesuur, F.; Zahoor, N.; Adomako, S. Postformation alliance capabilities and environmental innovation: The roles of environmental in-learning and relation-specific investments. Bus. Strategy Environ. 2021, 30, 3330–3343. [Google Scholar] [CrossRef]

- Guo, X.; Xia, W.; Feng, T.; Sheng, H. Sustainable supply chain finance adoption and firm performance: Is green supply chain integration a missing link? Sustain. Dev. 2022, 1135–1154. [Google Scholar] [CrossRef]

- Ji, L.; Yuan, C.; Feng, T.; Wang, C. Achieving the environmental profits of green supplier integration: The roles of supply chain resilience and knowledge combination. Sustain. Dev. 2020, 28, 978–989. [Google Scholar] [CrossRef]

- Khmeleva, G.; Fedorenko, R. Modern scientific approaches to development of integration processes at the regional level. J. Int. Econ. Affairs. 2019, 9, 1643. [Google Scholar] [CrossRef]

- Kharin, A.A.; Kharina, O.S.; Yeleneva, J.Y.; Andreev, V.N. Innovative infrastructure as basic element of national innovative system. In Proceedings of the 2nd International Conference on Business, Economics and Management (BEM 2017), Moscow, Russia, 28–29 June 2017; Volume 7, pp. 3–7. [Google Scholar]

- Islamutdinov, V.; Semenov, S. Modeling the co-evolution of economic institutions and the economy of resource producing regions. Herald. Omsk. Univ. Ser. Econ. 2020, 18, 122–131. [Google Scholar] [CrossRef]

- Islamutdinov, V. Prospects for synthesis of capital theories based on the negentropy approach. Sib. Financ. Sch. 2025, 1, 88–107. [Google Scholar] [CrossRef]

- Black, L. Low clinker cement as a sustainable construction material. In Sustainability of Construction Materials; Khatib, J.M., Ed.; Woodhead Publishing Series in Civil and Structural Engineering; Woodhead Publishing: Cambridge, UK, 2016; pp. 415–457. ISBN 978-0-08-100995-6. [Google Scholar]

- Prem Kumar, K. Production of Construction Bricks by Partial Replacement of Waste Plastics. IOSR J. Mech. Civ. Eng. 2017, 14, 09–12. [Google Scholar] [CrossRef]

- Potapova, E.; Korchunov, I.; Mikhailidi, D.; Rudomazin, V. Increasing the durability in the context of green construction in regions with Arctic and Alpine climate. AIP Conf. Proc. 2024, 1501, 107. [Google Scholar] [CrossRef]

| Components of Potentials | Scale |

|---|---|

| Technological potential (TP) (industrial actors only) | |

| Carbon intensity | 2–3: Carbon intensity levels meet the sector’s green benchmark 1–2: Carbon intensity levels are between restrictive and motivational benchmarks 0–1: Carbon intensity levels are above restrictive benchmarks |

| Energy intensity | 2–3: Energy intensity levels meet the sector’s green benchmark 1–2: Energy intensity levels are between restrictive and motivational benchmarks 0–1: Energy intensity levels are above restrictive benchmarks |

| Resource intensity | 2–3: Resource intensity levels meet the sector’s green benchmark 1–2: Resource intensity levels are between restrictive and motivational benchmarks 0–1: Resource intensity levels are above restrictive benchmarks |

| Implementation of Best Available Techniques | 2–3: Integrated Environmental Permit (IEP) without EPEP 1–2: Integrated Environmental Permit with EPEP 0–1: IEP not obtained |

| Life cycle consideration in green construction chains | 2–3: Fully considered 1–2: Partially considered 0–1: Not considered |

| Infrastructural potential (IP) | |

| Shared physical infrastructure (transportation/logistics) | 2–3: Fully developed 1–2: Partially developed 0–1: Absent or undeveloped |

| Shared intangible infrastructure (digital platforms, IT products) | 2–3: Fully developed 1–2: Partially developed 0–1: Absent or undeveloped |

| ESG collaboration among actors | 2–3: Active collaboration 1–2: Collaboration intentions stated 0–1: No collaboration |

| Prior experience with green partnerships | 2–3: Proven successful experience (e.g., publications, reports) 1–2: Unconfirmed experience 0–1: No experience |

| Mental potential/green thinking (MP) | |

| Promotion of green initiatives (green projects, products, or publications) | 2–3: Ongoing and consistent 1–2: Intermittent 0–1: Absent |

| Investment in green projects | 2–3: Long-term investment programs 1–2: Occasional investments 0–1: None |

| ESG effects (Environmental, Social, and Governance) [62]. | 2–3: All “dimensions” present (Environmental, Social, and Governance) 1–2: Two “dimensions” (for example, S + G) 0–1: None |

| Strategic alignment with green agenda | 2–3: Published strategy with confirmed results 1–2: Published strategy without confirmed results 0–1: No strategy |

| Level | Description |

|---|---|

| 1. Emerging | Integration has not yet materialized. Actors begin to recognize the need for partnerships to achieve network effects and generate additional green value through pooled resources and capabilities. Partners are sought based on complementary strengths and reputations in environmental responsibility. |

| 2. Developing | A core group of key actors is established. They start exploring their own potential and that of partners to increase green value. Collaborative efforts focus on addressing key questions:

|

| 3. Optimized | Integration processes are fully operational. Actors recognize the strategic advantages of collaboration for generating green value. Emphasis is placed on continuous self-improvement and network optimization. |

| Potential Component | Expert Score |

|---|---|

| Technological potential (TP) | |

| Carbon intensity | 2.1 |

| Energy intensity | 2.2 |

| Resource intensity | 2.0 |

| BAT implementation | 3.0 |

| Life cycle consideration in green construction chains | 2.3 |

| Infrastructural potential (P) | |

| Shared physical infrastructure (transportation/logistics) | 2.8 |

| Shared intangible infrastructure (digital platforms, IT products) | 1.6 |

| ESG collaboration among actors | 2.0 |

| Prior experience with green partnerships | 2.5 |

| Mental potential/green thinking (MP) | |

| Promotion of green initiatives (green projects, products, or publications) | 1.8 |

| Investment in green projects | 2.0 |

| ESG effects (Environmental, Social, Governance) | 1.5 |

| Strategic alignment with green agenda | 1.5 |

| Actors | TP | IP | MP | hcp | V |

|---|---|---|---|---|---|

| Pobeda LSR | 2.30 | 2.18 | 1.69 | 2.05 | 0.89 |

| Ryabovsky Brick Factory | 2.44 | 2.22 | 1.74 | 2.09 | 0.90 |

| Pikalevo Cement Plant | 2.08 | 2.09 | 1.58 | 1.96 | 0.85 |

| Tsesla JSC | 2.16 | 2.04 | 1.58 | 1.94 | 0.84 |

| Klin Glass Factory | 2.29 | 2.25 | 1.32 | 2.02 | 0.88 |

| Baltiyskoye Steklo JSC | 2.20 | 2.37 | 1.77 | 2.21 | 0.96 |

| Forestries | 2.32 | 2.02 | 1.79 | 2.04 | 0.89 |

| SPb State Technological University | - | 2.49 | 1.77 | 2.13 | 0.92 |

| SPb Polytechnic University | - | 2.72 | 2.65 | 2.68 | 1.16 |

| Construction Committee of Saint Petersburg | - | 2.52 | 2.59 | 2.56 | 1.11 |

| Construction Committee of the Leningrad Region | - | 2.34 | 2.50 | 2.42 | 1.05 |

| Setl Group | - | 2.69 | 2.26 | 2.48 | 1.07 |

| Glavstroy SPb | - | 2.57 | 1.98 | 2.28 | 0.99 |

| Bank of Saint Petersburg | - | 2.77 | 2.71 | 2.74 | 1.19 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shmeleva, N.; Andreev, V.; Tolstykh, T.; Guseva, T.; Rudomazin, V. Managing the Integration of Companies into Green Value Chains: A Regional Perspective. Sustainability 2025, 17, 7582. https://doi.org/10.3390/su17177582

Shmeleva N, Andreev V, Tolstykh T, Guseva T, Rudomazin V. Managing the Integration of Companies into Green Value Chains: A Regional Perspective. Sustainability. 2025; 17(17):7582. https://doi.org/10.3390/su17177582

Chicago/Turabian StyleShmeleva, Nadezhda, Vladimir Andreev, Tatyana Tolstykh, Tatiana Guseva, and Viktor Rudomazin. 2025. "Managing the Integration of Companies into Green Value Chains: A Regional Perspective" Sustainability 17, no. 17: 7582. https://doi.org/10.3390/su17177582

APA StyleShmeleva, N., Andreev, V., Tolstykh, T., Guseva, T., & Rudomazin, V. (2025). Managing the Integration of Companies into Green Value Chains: A Regional Perspective. Sustainability, 17(17), 7582. https://doi.org/10.3390/su17177582