Abstract

This study explores the innovation barriers and implementation strategies within small and medium-sized manufacturing enterprises (SMEs) in the Mazowieckie Voivodeship of Poland. Despite their crucial role in the regional economy, these enterprises face significant hurdles that impede their growth potential and innovation capabilities. Using a mixed-methods approach, the research analyzes both quantitative and qualitative data from 426 manufacturing enterprises. The findings reveal that the primary barriers include limited access to capital, outdated technologies, and a shortage of skilled labor. Furthermore, the study identifies that while company size and age do not significantly influence the type of innovations introduced, external factors such as market reach and capital availability play critical roles. The study underscores the need for tailored policy interventions to support SMEs in overcoming these barriers and fostering an environment conducive to innovation.

1. Introduction

Manufacturing SMEs in Central and Eastern Europe face a double innovation paradox: they are expected to deliver Industry 4.0-ready, low-carbon solutions, yet remain structurally under-financed and skill-constrained. In the Mazowieckie Voivodeship—Poland’s most industrialized region—this tension is particularly acute, jeopardizing the achievement of SDG 8 (Decent Work & Economic Growth) and SDG 9 (Industry, Innovation & Infrastructure). This study thus delves into the barriers affecting SMEs in the Mazowieckie region, scrutinizing the interplay between company size, market reach, innovation capabilities, and sustainability potential. Although focused on a national context, the findings are interpreted in light of global innovation and sustainability frameworks, making the results applicable to international audiences interested in structural and strategic impediments to innovation in SMEs.

The innovativeness of SMEs in the Mazowieckie region, as in many parts of the world, is hindered by numerous obstacles, including financial and institutional constraints. Arza and López demonstrate that cost-related and institutional factors influence investment decisions in different ways, underscoring the need to adapt support instruments to the specific needs of micro and small enterprises [1]. Similar conclusions emerge from studies on enterprises in Mazovia, which are particularly exposed to capital constraints. Meanwhile, Blick, Paeleman, and Laveren argue that process innovations can serve as a buffer for firms operating under capital shortages, enabling revenue growth despite limited resources [2]. Promoting “lean innovation” approaches may therefore become a key component of regional development programs [3,4,5].

The digital transformation of SMEs has become not only a technological necessity but also a response to external challenges such as the COVID-19 pandemic. Justy et al. show that market pressure and the health crisis accelerated the adoption of data analytics among SMEs, although a critical barrier remains the shortage of digital competencies—an issue clearly observed among Mazovian enterprises as well [3]. Hafeez, Shahzad, and De Silva emphasize the role of intermediary organizations, such as clusters or technology transfer centers, in enhancing the digital capacities of SMEs [4]. These institutions are particularly crucial in regions with a diversified industrial structure, such as Mazovia [1,2,3,4,5,6].

Industry 4.0 technologies, such as the Internet of Things (IoT) and digital twins, offer micro and small businesses a real opportunity to reduce their carbon footprint, provided they have access to the necessary competencies [5]. In Mazovia, where many firms operate in traditional sectors, this challenge is of particular relevance. Gómez-Garza, Güereca, and Padilla-Rivera additionally identify high costs, a lack of data, and skilled personnel shortages as the main barriers to implementing life cycle assessment (LCA), proposing simplified cluster-based methods as a potential solution for regional manufacturers [6]. Other studies also highlight the importance of combining environmental and digital capabilities [1,2,3,4].

The development of SMEs is increasingly taking place within complex digital ecosystems, which offer both new opportunities and challenges. Autio et al. show that digital platforms can significantly expand the market reach of small firms but also intensify competition, demanding high adaptability and rapid learning—qualities increasingly required of Mazovian entrepreneurs [7]. In the context of global megatrends such as decarbonization and demographic change, Zahoor et al. emphasize the importance of strategic agility and gender diversity, pointing to the growing role of female innovators—an increasingly visible trend also in Poland [8]. These findings are supported by other research addressing SME adaptability and digital transformation [2,3,4,6].

The COVID-19 pandemic triggered the accelerated digitalization of SMEs, as confirmed by the case studies of Baptista, Karaoz, and Mendonça [9]. Enterprises that had previously postponed implementing digital solutions were forced to react quickly during the health crisis. Similar processes were observed in the Polish SME sector, including in Mazovia, where many firms accelerated digital adaptation to remain competitive [2,3,4,6].

Sustainable innovation—defined as the development of new products, processes, or practices that contribute to environmental, economic, and social goals—has become a strategic priority for many enterprises. It integrates ecological responsibility with economic performance and social well-being, and is increasingly viewed not only as a compliance requirement or reputational asset but as a core strategic element in value creation for firms, especially those operating in resource-intensive industries [10,11,12,13,14].

To ensure conceptual clarity and avoid semantic overlaps in the interpretation of innovation processes in SMEs, this study adopts a distinction among three closely related constructs: innovation capability, innovation implementation, and innovation strategy.

Innovation capability refers to an enterprise’s internal capacity—its resources, knowledge, and routines—that enable it to generate, absorb, and transform ideas into value [15,16]. In the RBV framework, capabilities are understood as part of a firm’s resource base and include both tangible and intangible assets, such as technical know-how, organizational culture, and employee competencies [17,18]. In this sense, capabilities are the preconditions for innovation but do not guarantee its realization.

Innovation implementation, in turn, denotes the operational process of putting innovative ideas into practice. It involves activities such as prototyping, testing, process reengineering, or the actual market launch of new products [19]. Implementation is particularly critical for SMEs, which often rely on lean structures and informal mechanisms to carry out innovation without dedicated R&D units [3].

Innovation strategy refers to the deliberate and long-term orientation that guides innovation investments, choices, and trajectories in alignment with a firm’s competitive positioning [20,21]. While capability is about what a firm can do, and implementation is about what a firm does, strategy is about what a firm intends to do—including decisions on whether to pursue product vs. process innovation, incremental vs. radical approaches, or closed vs. open innovation models.

By distinguishing these three dimensions, the study enables a more granular understanding of how SMEs navigate innovation under financial, technological, and institutional constraints. Instead of presenting these categories in tabular form, the study discusses them individually: financial constraints, such as limited access to external financing or low internal capital availability, have been widely recognized as key barriers to SME innovation [22]. Technological constraints refer to a lack of digital infrastructure, limited R&D capacity, or insufficient skills, which are particularly critical for firms in early stages of digital transition [23]. Institutional constraints, in turn, include regulatory burdens, administrative inefficiencies, or the absence of supportive innovation ecosystems, which can vary significantly depending on national or regional governance contexts [24,25]. These three dimensions serve as the analytical lens throughout both the quantitative and qualitative parts of the study.

These distinctions allow for a more nuanced understanding of how SMEs navigate innovation under sustainability pressures.

Research distinguishes several forms of sustainable innovation, including eco-innovation, circular innovation, social innovation, and frugal innovation—each of which contributes to sustainability in unique ways. Eco-innovation focuses on reducing environmental impacts through technology or design changes, while circular innovation emphasizes closed-loop systems that minimize waste and maximize resource efficiency [26,27,28,29,30].

This approach reflects a shift from linear to regenerative models of value creation, aligning with the circular economy paradigm described by Geissdoerfer et al. [27], which integrates economic, environmental, and social objectives into a cohesive sustainability strategy.

Small and medium-sized enterprises (SMEs) often experience unique barriers and opportunities in implementing sustainable innovation. On one hand, they face constraints related to capital, expertise, and access to technology [31,32,33]. On the other hand, their flexible organizational structures and proximity to local markets enable quicker adaptation and stakeholder engagement [34,35,36]. Studies suggest that collaboration networks, regional policy support, and digital tools significantly enhance the ability of SMEs to implement sustainable practices [34,37,38,39,40].

Theoretical frameworks such as the Triple Bottom Line (TBL), Responsible Innovation (RI), and the Resource-Based View (RBV) provide scaffolding for analyzing how and why companies innovate sustainably. TBL encourages a balanced approach to economic, environmental, and social outcomes, pressing firms to internalize externalities and redefine success metrics. RI focuses on ethical foresight and inclusivity, promoting anticipatory governance in innovation processes, while the RBV highlights internal capabilities and resources—like knowledge assets, routines, and organizational culture—that drive or hinder the transition to sustainable models [18,29,41,42,43].

Sustainable innovation also requires rethinking value chains. Life cycle assessment, green supply chain management, and product–service systems (PSS) are essential components that help reconfigure business models around sustainability objectives [44]. Emerging concepts such as regenerative design and biomimicry are increasingly influencing innovation strategies, particularly in architecture, agriculture, and materials science [27,45,46,47].

Case studies show how SMEs adopt sustainability not just as a risk mitigation strategy but as a pathway to differentiation and long-term resilience [48]. For instance, small firms in the European bioeconomy have successfully used local waste streams as raw materials for biodegradable packaging, combining cost savings with environmental impact reduction [46]. Similarly, green construction SMEs frequently collaborate with research institutions and use public funding to integrate energy-efficient technologies into modular housing systems [49].

Digitalization and Industry 4.0 technologies are also playing a critical role in enabling sustainable innovation. Technologies such as IoT, blockchain, and AI facilitate the real-time monitoring of emissions, supply chain transparency, and predictive maintenance—all of which can reduce environmental footprints while improving efficiency [45,50,51,52,53,54,55].

In sum, embedding sustainability into innovation requires a systemic transformation that transcends technological changes. It demands leadership commitment, cultural change, external collaboration, and alignment with macro-level sustainability goals, such as the United Nations Sustainable Development Goals (SDGs) [56]. In the case of SMEs, targeted support through policy instruments, capacity building, and financial mechanisms remains key to scaling sustainable innovation practices across regions and sectors [32,57,58,59].

Sustainable innovation integrates ecological responsibility with economic performance and social well-being [60,61,62,63]. It is not only a response to regulatory pressure or stakeholder expectations but also a source of competitive advantage [40]. The literature suggests that sustainable innovation can take many forms, such as eco-innovation, frugal innovation, or systemic innovation within circular economy frameworks [64,65,66].

In the context of SMEs, sustainable innovation is often hindered by limited resources, but it can be enabled by network-based strategies, government incentives, and alignment with local or regional development policies [67,68]. Empirical research also confirms that SMEs often prioritize incremental eco-efficiency improvements over radical sustainability-driven changes, primarily due to risk aversion and a lack of long-term vision [17,18,29,69,70,71].

Key frameworks used to study sustainable innovation include the Triple Bottom Line (TBL), Responsible Innovation, and the Resource-Based View (RBV). The TBL focuses on balancing people, planet, and profit, encouraging firms to internalize social and environmental costs. Responsible Innovation emphasizes anticipation, inclusion, reflexivity, and responsiveness in innovation processes [72]. The RBV highlights how internal capabilities—such as dynamic capabilities and absorptive capacity—can be leveraged to implement sustainability-oriented change [72,73,74,75].

In practical terms, sustainable innovation strategies have been documented in SMEs across various sectors, including furniture manufacturing, food processing, and green construction [76,77,78]. These strategies often rely on lifecycle thinking, lean management, collaboration with universities, and participation in regional innovation ecosystems.

Overall, embedding sustainability into innovation requires a systemic shift in business models, organizational culture, and stakeholder engagement. It also implies a reconfiguration of value creation and value capture mechanisms. Given the growing societal and environmental challenges, sustainable innovation is increasingly regarded not as a niche strategy but as a necessity for long-term viability [79,80,81,82].

To place this discussion within a broader theoretical context, this study draws on key principles of innovation theory. According to Schumpeterian and neo-Schumpeterian approaches, innovation is a central mechanism of economic development and competitive advantage. SMEs, however, often operate at a disadvantage due to resource constraints, making it more difficult for them to invest in innovation activities. Open innovation models and the Resource-Based View (RBV) further highlight the importance of external collaboration and intangible resources in overcoming these barriers [83,84,85,86].

The industrial landscape of the Mazowieckie Voivodeship in Poland represents a vital arena for small and medium manufacturing enterprises (SMEs), which are essential contributors to regional economic growth, innovation, and employment. Despite their significance, these enterprises encounter numerous challenges that impede their development and innovative output [87,88,89].

Innovation serves as a critical differentiator in the global market, particularly for small and medium-sized enterprises (SMEs) striving to maintain competitiveness and foster growth. However, it is well documented that barriers such as limited access to capital, outdated technology, and skill shortages significantly impede innovation, especially among SMEs [88,90,91,92,93].

These constraints restrict their ability to invest in modern technologies and workforce development, thereby limiting their capacity to introduce innovative solutions. Importantly, the impact of innovation barriers is not uniform across firm sizes. While SMEs grapple with acute resource shortages and external dependencies, larger enterprises, despite their relatively greater resources, often face different sets of challenges. These include technological obsolescence due to slow adoption cycles and internal inefficiencies stemming from complex organizational structures, which may inhibit agility and responsiveness to market changes [83,84,94,95].

Against this backdrop, the present study seeks to clarify why many manufacturing SMEs in the Mazowieckie Voivodeship remain non-innovative despite growing policy pressure and market opportunities. Drawing on the Resource-Based View, Responsible Innovation principles and recent regional evidence, we focus on the interplay between organizational characteristics, external constraints and managerial agency. To steer the empirical investigation, we pose the following research questions (RQs):

RQ1: Which internal and external barriers most strongly predict the absence of innovation in Mazowieckie manufacturing SMEs?

RQ2: Do structural characteristics (size, age, scope) moderate the relationship between barriers and innovation outcomes?

RQ3: How do owners/managers narrate leadership and governance practices that help them overcome these barriers?

2. Materials and Methods

This research was conducted using a mixed-methods approach, integrating quantitative data from surveys with qualitative interviews to assess innovation barriers in small and medium manufacturing enterprises in the Mazowieckie Voivodeship. This combination of methods allowed for a comprehensive analysis of factors influencing innovative activities. A random sampling method was applied to select 426 manufacturing enterprises from the Mazowieckie Voivodeship. The diversity of the sample included companies of various sizes and market scopes, providing a representative cross-section for analysis. The randomness of the sample was verified using a runs test, confirming the absence of systematic selection bias. Quantitative data were collected through structured surveys distributed among managers and key personnel involved in innovation processes within the companies. Qualitative data were obtained from semi-structured interviews aimed at gaining deeper insights into the challenges and strategies related to innovation. Quantitative data were analyzed using statistical software to perform descriptive and inferential statistics, including chi-square tests and Kruskal–Wallis tests, to explore relationships between company characteristics and types of innovations. Qualitative data from interviews were transcribed and subjected to thematic analysis to identify common themes and insights.

The thematic analysis followed Braun and Clarke’s six-phase approach: (1) familiarization with data, (2) initial code generation, (3) theme searching, (4) theme review, (5) theme definition and naming, and (6) final report production. Coding was conducted manually by two researchers who independently analyzed the full set of interview transcripts using a shared codebook. The codebook was developed inductively during the open coding phase and refined iteratively. Codes were grouped into categories reflecting recurring patterns related to innovation barriers, resource constraints, leadership behaviors, and external policy support. To ensure inter-coder reliability, a subset of 20% of the data was double-coded. Cohen’s kappa coefficient for agreement between coders reached 0.82, indicating strong reliability. Discrepancies were resolved through discussion until a consensus was reached. NVivo version 15 software was used to assist with code organization and thematic structuring. The final themes were validated through team debriefing sessions and aligned with the theoretical frameworks discussed in the literature review, such as RBV and stakeholder theory.

To enhance transparency and interpretive depth, selected representative quotes from the interviews are presented below to illustrate key themes:

“We would invest in modern machines, but the banks are not interested in firms our size.” [Manager, micro-enterprise]. This quote reflects the theme of capital constraints and institutional financing gaps.

“Our clients demand more sustainable products, but we don’t have the people or tools to make that happen.” [Owner, small manufacturing firm]. This quote highlights resource and skill shortages in delivering sustainability.

“Innovation is not a department here—it’s part of everyone’s job. We talk, we try new things, and fix what doesn’t work.” [Production manager, medium enterprise]. This illustrates informal innovation practices in the absence of a formal innovation unit.

“The regional cluster meetings helped us see that others face the same challenges. That gave us ideas and confidence.” [CEO, furniture SME]. This reflects the value of peer networks and stakeholder engagement.

These quotes enrich the quantitative findings by grounding the analysis in lived experience and providing insights into organizational dynamics that may not be visible through survey data alone.

Despite providing valuable findings, the ability to generalize the results may be limited by the specific economic context of the Mazowieckie Voivodeship. Future studies could expand the geographical scope to include other regions to gain a more comprehensive understanding of the barriers to innovation in manufacturing enterprises. This structure ensures that the methods section provides all necessary details for replication and builds upon previously established methodologies, ensuring transparency and adherence to ethical standards.

The survey instrument was developed based on validated measures and constructs used in previous research on SME innovation barriers (e.g., [73,74,75,76]). It included both closed-ended and Likert-scale questions designed to assess firm characteristics, perceived barriers to innovation, and the presence of innovation–support structures. A pilot test was conducted with 12 SME managers from the Mazowieckie Voivodeship to ensure clarity, reliability, and contextual relevance of the items. Feedback from the pilot led to minor adjustments in question wording and response options. Variables such as “capital constraints”, “outdated technology”, and “skilled labor shortages” were operationalized as binary and ordinal categories, depending on the scale. Innovation types (product, process, organizational, marketing) followed OECD/Oslo Manual definitions. The reliability of multi-item scales was evaluated using Cronbach’s alpha, which exceeded 0.75 for all applicable constructs.

3. Results

The analysis showed that the majority of surveyed enterprises, 72.58%, are micro-enterprises employing up to nine people, while large companies constituted only 0.65% of the sample. About 42% of enterprises introduced innovations, with product innovations and process innovations being the most common at 15% and 10%, respectively. The main barriers to innovation were a lack of capital at 65%, outdated technologies at 15%, and a shortage of skilled staff at 20%. Statistical tests did not confirm a dependency between the age of the enterprise, its size, and the type of innovations introduced. However, the scope of operations proved to be a significant factor influencing the presence of an innovation unit—local enterprises more often had such units than companies operating internationally.

To make the subsequent analyses easier to follow, Table 1 summarizes the key descriptive statistics for the study sample. It shows the mean firm age, employment size and sectoral distribution. The data confirm that the sample is highly heterogeneous—the average enterprise has existed for 22.3 years (SD = 19.2), and three-quarters of the surveyed firms are micro-businesses employing fewer than nine people.

Table 1.

Descriptive statistics of the surveyed enterprises (N = 426).

As a methodological note, because some firms reported more than one primary activity, the percentages may sum up to slightly over 100%.

The study included owners and managers of 426 manufacturing enterprises operating in the Mazowieckie Voivodeship. These enterprises were randomly selected from the population of all manufacturing enterprises, resulting in a sample that included a variety of companies in terms of activity profile and age. The sample was random, as confirmed by the results of the runs test: Z = −1.742; p = 0.081. There was no basis for rejecting the hypothesis about the random nature of the sample.

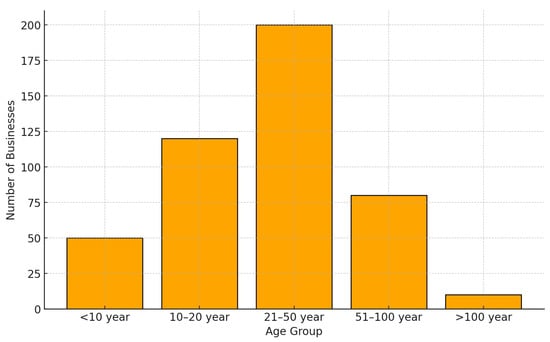

The average duration of the surveyed enterprises in the market was 22.3 years. The youngest company had been operating for a year, while the oldest had been in existence for 151 years. The standard deviation of the age of enterprises was 19.2 years, indicating a variability coefficient of 86%. This reflects great diversity among the surveyed companies. A typical enterprise had been in the market for a period ranging from 3.1 to 41.5 years, which accounted for nearly 93% of the entire sample. Only five enterprises were younger than typical. Twenty older companies constituted nearly 4.7% of the surveyed group. The characteristics of the research group indicate a right-skewed distribution, meaning that younger enterprises predominated in the sample (Figure 1).

Figure 1.

Distribution of business ages. Source: authors’ own elaboration.

The histogram of the age of enterprises depicted below reflects an asymmetrical distribution with a predominance of younger enterprises. The data are grouped by age brackets, demonstrating a wide variety in the sample. The average age of enterprises was 22.3 years, with the youngest enterprise being 1 year old and the oldest being 151 years old. The typical age range, encompassing 93% of the enterprises, ranged from 3.1 to 41.5 years. Detailed data for each age bracket are as follows: less than 10 years (50 enterprises), 10–20 years (120 enterprises), 21–50 years (200 enterprises), 51–100 years (80 enterprises), and over 100 years (10 enterprises). This distribution indicates a significant right-skew, reflecting the dominance of younger enterprises in the sample.

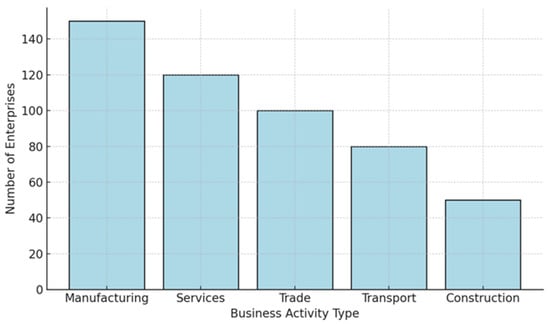

Figure 2 presents the structure of the surveyed enterprises based on their primary type of operation. It shows the diversity of economic activities among the group of 426 manufacturing companies located in the Mazowieckie Voivodeship, providing a visual representation of the sectoral composition that highlights the industrial dynamics of the region. This breakdown facilitates a better understanding of the dominant economic roles and the supporting sectors that collectively shape the local economy.

Figure 2.

Structure of surveyed enterprises by primary type of operation. Source: authors’ own elaboration.

The analysis revealed a significant dominance of enterprises from the manufacturing sector, which constituted 35.2% of all surveyed firms (150 enterprises). The next largest group consisted of service providers, accounting for 28.2% of the sample (120 enterprises).

Enterprises engaged in trade comprised 23.5% of the surveyed group (100 enterprises), indicating the significant role of the distribution sector in the analyzed region. Transport companies had a smaller representation, making up 18.8% of the sample (80 enterprises), and construction enterprises were the least numerous, accounting for 11.7% of the surveyed firms (50 enterprises).

The results indicate that manufacturing enterprises play an important role in the region, which may stem from the industrial traditions of the Mazowieckie Voivodeship and its infrastructure supporting manufacturing activities. The second-largest category, service enterprises, reflects the dynamic development of activities supporting other economic sectors, such as consulting, IT, and transportation. The presence of a large number of trading enterprises highlights the importance of distribution and product sales in the local and national market. Although transportation and construction play important roles in value chains, their smaller number might suggest a more specialized nature of these industries in the analyzed region. The diversity of business types in the sample reflects the complexity of the Mazowieckie Voivodeship’s economy, where the dominance of the manufacturing and service sectors indicates their important role in the region’s economy, and smaller sectors such as transportation and construction serve supportive functions.

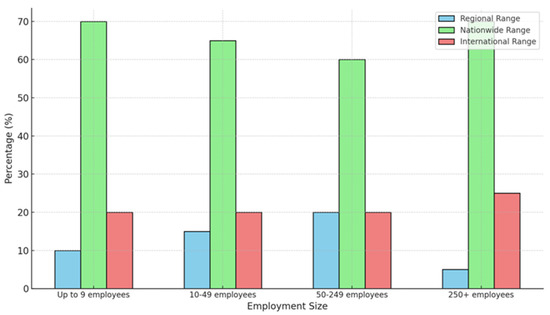

Figure 3 illustrates the distribution of enterprises based on the number of employees and their operational scope, categorized into regional, national, and international activities. It provides insights into how the size of a company correlates with its geographical market reach, highlighting the varying strategies and focus areas across different enterprise sizes. This visualization aids in understanding the dynamics between enterprise scale and market engagement.

Figure 3.

Structure of enterprises by employment size and range of activity. Source: authors’ own elaboration.

Figure 3 presents the percentage distribution of enterprises by employment size and scope of operations, including regional, national, and international categories. The data demonstrate how different groups of enterprises, diversified by the number of employees, conduct activities with varying geographical reaches. Enterprises employing up to nine workers predominantly engage in national operations, which account for 70% of all firms in this category. Companies with a regional reach constitute 10%, and those with an international scope constitute 20%. The results suggest that micro-enterprises mainly focus on serving the national market, though a portion also engages in international activities.

For enterprises employing 10 to 49 workers, national operations also dominate, comprising 65% of these enterprises. Regional and international activities are at similar levels, each accounting for 15% and 20%, respectively. This distribution may stem from the increasing resources and capabilities of companies in this category, allowing for expansion beyond their region. In enterprises employing 50 to 249 workers, 60% conduct national operations, with 20% engaged in regional and another 20% in international activities. There is a slightly smaller share of national operations compared to smaller companies, which may indicate a more balanced approach to serving different markets.

For the largest enterprises, employing over 250 workers, 70% operate in the national market, 25% engage in international activities, and only 5% focus on the regional market. The findings indicate that large enterprises have significant capabilities for expansion into foreign markets, though the majority still focus on the domestic market. The analysis shows that the scope of enterprise activities is largely dependent on their employment size. Micro and small enterprises primarily focus on national activities, with limited presence in international markets. As employment size increases, the share of companies operating internationally grows, reflecting the greater resource and logistical capabilities of large enterprises. Regional activities remain relatively minor across all groups, suggesting that most firms prefer broader markets.

These results highlight the importance of supporting smaller enterprises in their potential expansion into foreign markets and the necessity of developing infrastructure that supports international activity. The data also show the stability of large firms in the domestic market, which forms the foundation for their further expansion.

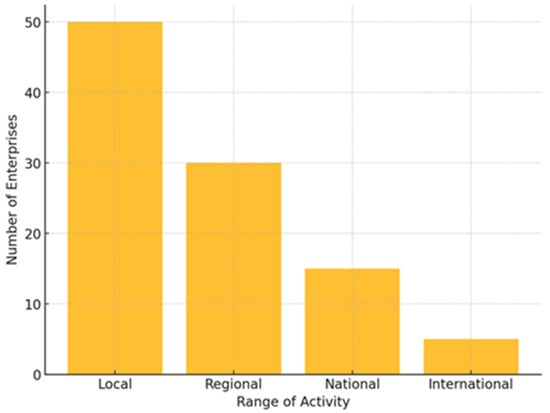

Figure 4 depicts the structure of surveyed enterprises in terms of their operational scope, showing that the majority of firms operate at a local level (50 firms), followed by regional (30 firms), national (15 firms), and international (5 firms) levels. These data reflect the predominance of enterprises focused on the local market, which may result from limited resources or a deliberate strategic choice. Conversely, international activity, though least numerous, may indicate greater demands associated with such expansion.

Figure 4.

Structure of surveyed enterprises by range of activity. Source: authors’ own elaboration.

The Kruskal–Wallis test results (H(4) = 2.380; p= 0.666) did not confirm any dependency between the length of a company’s existence and the type of innovations introduced. Data indicate that enterprises introducing product and marketing innovations have been in existence for an average of 18 years, those introducing organizational innovations have been in existence for 16 years, and those introducing process innovations have been in the market the longest. Companies that did not introduce innovations or introduced different types of innovations had an average duration of existence of 16 years.

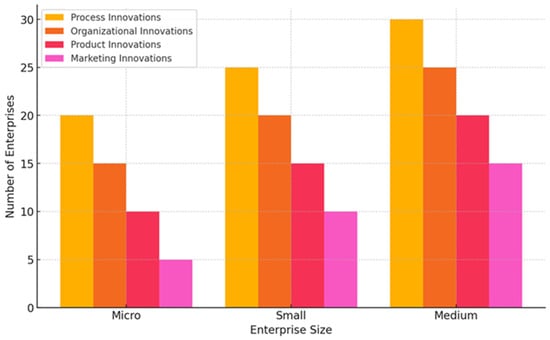

The chi-squared test (χ2(12) = 15.066; p = 0.238) showed no significant relationships between the size of the enterprise (micro, small, medium) and the type of innovations introduced. Microenterprises introduced process innovations to a similar extent to larger companies (20, 25, and 30 firms, respectively, for micro, small, and medium enterprises), organizational innovations (15, 20, and 25 firms), product innovations (10, 15, and 20 firms), and marketing innovations (5, 10, and15 firms).

The analysis demonstrated that neither the length of existence nor the size of employment significantly influences the type of innovations implemented, suggesting the need to consider other factors, such as industry or management strategy.

This chart provides a overview of the types of innovations introduced by enterprises of varying sizes, categorized into micro, small, and medium. It visually demonstrates how each size group engages in process, organizational, product, and marketing innovations. The visualization helps in analyzing the distribution and frequency of different innovation types within each enterprise size category, highlighting trends and insights into the strategic focus of these businesses as they scale. Figure 5 is instrumental in understanding how company size influences the type and extent of innovation pursued.

Figure 5.

Types of innovations introduced by enterprise size. Source: authors’ own elaboration.

The scope of a company’s operations, encompassing local, regional, national, and international levels, potentially influences the type of innovations introduced. However, data analysis did not show statistically significant correlations between these factors. Locally operating enterprises, which formed the largest group in the study, primarily focus on basic innovations, such as organizational or process changes. This allows for increased efficiency and cost reduction but limits the development of more advanced product or marketing innovations. Such companies often operate under less competitive pressure, which influences their innovation profile.

Enterprises with regional and national scope have greater potential to introduce more complex innovations, stemming from the need to adapt products and services to diverse customer needs and greater competition in a broader market. This situation may favor the development of more innovative strategies, although statistical analysis did not reveal significant differences in the length of operation of these companies depending on the type of innovations introduced. This suggests that the scope of activity itself is not a key factor.

Enterprises operating in international markets formed the smallest group in the study, yet their activities are often associated with the introduction of more advanced innovations. These companies must adapt to the specific requirements of different markets, which stimulates innovation, particularly in products and marketing efforts. At the same time, their actions are supported by investments in technology and research, further developing their innovative capabilities. Nevertheless, the analysis did not reveal statistical correlations between the scope of activity and the type of innovations introduced, which may indicate the greater importance of other factors such as company size, industry specifics, or access to resources.

Local enterprises focus on improving operational efficiency, while companies with a broader scope have greater potential to develop product and marketing innovations. The lack of differences stemming from the scope of activity in the analyzed group of companies suggests that innovation studies should consider additional variables, such as management structure, industry, or access to technology. This will allow for a more precise understanding of the relationship between innovation and the scope of activity.

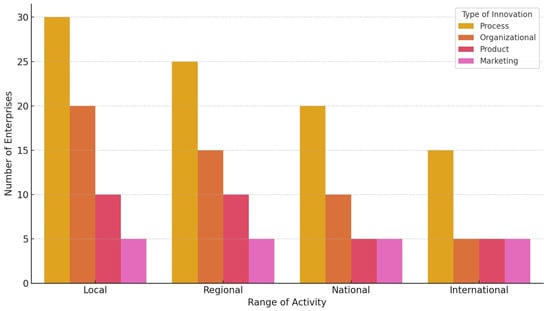

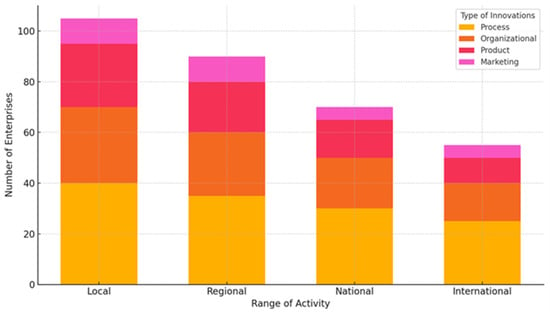

Figure 6 provides a detailed visualization of the distribution of enterprises categorized by their range of activity—local, regional, national, and international—and the types of innovations they have introduced, including process, organizational, product, and marketing innovations. It highlights the correlation between the geographical scope of the enterprises, their operations and their innovation strategies, showing how different scales of operation might influence the focus and diversity of innovation types.

Figure 6.

Structure of enterprises by range of activity and type of introduced innovations. Source: authors’ own elaboration.

The data indicate that for companies with a local scope, the most frequently introduced innovations were process innovations (30 enterprises) and organizational innovations (20 enterprises). Product innovations (10 enterprises) and marketing innovations (5 enterprises) were less popular within this group. For regional enterprises, the highest number of firms also introduced process innovations (25 enterprises), followed by organizational (15 enterprises), product (10 enterprises), and marketing innovations (5 enterprises). For national enterprises, process innovations dominated (20 enterprises), although their numbers were lower than in the local and regional groups, and other types of innovations were less popular: organizational (10 enterprises), product (5 enterprises), and marketing (5 enterprises). In the case of international enterprises, the number of firms introducing innovations was the smallest: process (15 enterprises), organizational (5 enterprises), product (5 enterprises), and marketing (5 enterprises) innovations. The results show that local and regional scopes of activity favor the more frequent introduction of innovations, especially process innovations, while international companies introduce innovations less often, likely due to the more complex challenges associated with global operations.

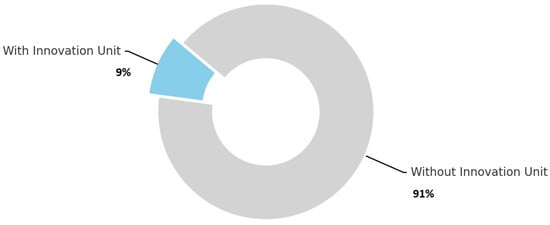

Figure 7 presents a pie chart illustrating the distribution of surveyed enterprises based on the presence of a dedicated innovation unit within their organizational structure. The sample is clearly divided into two groups: enterprises with such a unit and those without. The chart provides a visual comparison showing that a significant majority of companies do not have a formally established innovation unit, which may indicate potential areas for development in building innovation-supporting infrastructure. This visualization offers insight into the prevalence of formal innovation support mechanisms among the surveyed enterprises, based on data collected through questionnaires.

Figure 7.

Presence of a dedicated innovation unit in the organizational structure of the surveyed enterprises. Source:authors’ own elaboration.

The pie chart shows that only 9% (n = 9) of enterprises had an innovation unit, while 91% (n = 91) did not. This example highlights a clear predominance of enterprises that have not created dedicated structures for handling innovations. Among the firms that possessed innovation units, larger enterprises and those with a broader scope of activity were dominant.

In this study, an “innovation unit” refers to a formally designated internal structure within an enterprise—such as a department, team, or task force—tasked with identifying, developing, and implementing new ideas, products, or processes. These units may vary in formality and size but typically involve dedicated personnel responsible for monitoring trends, facilitating collaboration, and coordinating innovation projects. In SMEs, innovation units are often small and integrated into broader operational roles. For example, one of the interviewed firms, a furniture manufacturer with 45 employees, established a cross-functional innovation team composed of the production manager, two senior technicians, and a marketing specialist. This team met monthly to review customer feedback, propose design updates, and test new materials. Although informal, this unit played a pivotal role in implementing product and process improvements that enhanced both efficiency and customer satisfaction.

The average age of enterprises with an innovation unit was 17 years, which corresponded to the same average age for firms without such units, as indicated by the Mann–Whitney U test (Z = −1.000, p = 0.317). These results emphasize that the age of the enterprise was not a determining factor in having a dedicated innovation unit.

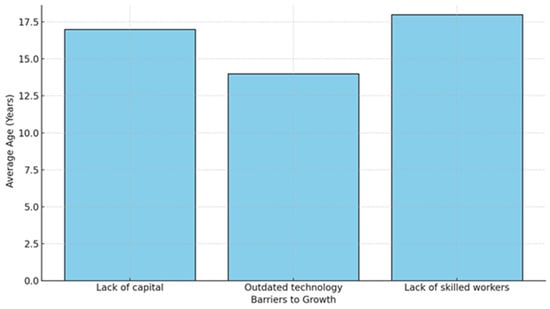

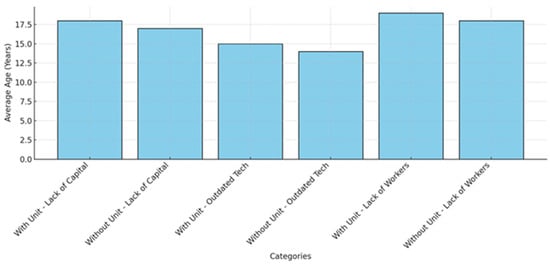

This bar chart illustrates the average age of enterprises categorized by three different barriers to growth: a lack of capital, outdated technology, and a lack of skilled workers. By comparing these barriers, the chart provides a clear visual representation of how different challenges correlate with the age of enterprises. This analysis helps to understand if more established companies face particular obstacles differently than younger companies. The data drawn from questionnaires offer insights into the impact that these growth barriers have on the lifespan of enterprises across various sectors.

Figure 8 shows how the average age of enterprises varies depending on barriers to growth. Enterprises identifying a lack of capital as the main barrier have been in the market for an average of 17 years. Companies that cited outdated technology as a hindrance were younger, with an average age of 14 years. Enterprises struggling with a lack of skilled workers were the oldest, with an average age of 18 years. The results suggest that both a lack of capital and a shortage of skilled workers are problems affecting older and younger companies alike. On the other hand, outdated technology as a barrier is more characteristic of younger enterprises, which may not have the resources to modernize it.

Figure 8.

Average age of enterprises by barriers to growth. Source: authors’ own elaboration.

The Figure 9 displays the distribution of enterprises introducing various types of innovations depending on their range of activity. Local companies most frequently implemented process innovations (40 enterprises) and organizational innovations (35 enterprises). Product innovations (30 enterprises) and marketing innovations (25 enterprises) were less popular. For regional companies, the numbers of enterprises were, respectively, 30, 25, 20, and 15. In national enterprises, process innovations dominated (25 enterprises), and in international companies, process innovations were the most common as well (10 enterprises). The data indicate that as the scope of activity expands, the number of implemented innovations decreases, which may be associated with more complex operational requirements in companies operating in international markets.

Figure 9.

Distribution of enterprises by type of innovation and range of activity. Source: authors’ own elaboration.

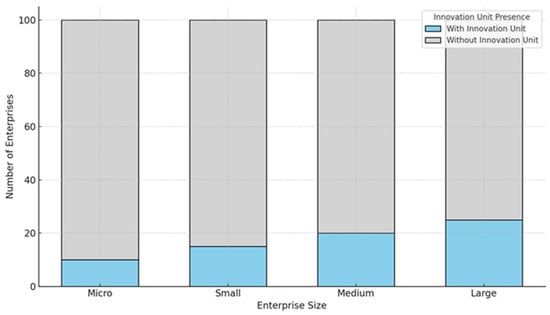

In Figure 10 below, the presence of innovation departments in enterprises is presented according to their employment size.

Figure 10.

Presence of innovation departments in enterprises according to employment size. Source: authors’ own elaboration.

The chart illustrates that in micro-enterprises, only 10% of companies had a dedicated innovation department (10 enterprises), while a significant majority of 90% did not have such a unit (90 enterprises). In small companies, this proportion was slightly higher, with 15% having an innovation department (15 enterprises) versus 85% without one (85 enterprises). Medium-sized companies showed a further increase, with 20% having such a department (20 enterprises) compared to 80% not having one (80 enterprises). Among large companies, 25% had established innovation units (25 enterprises), while 75% did not (75 enterprises).

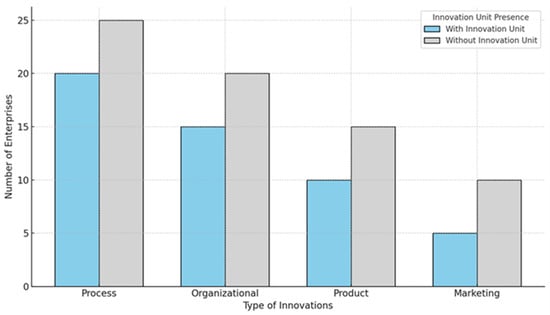

Figure 11 presents the impact of having an innovation department on the types of innovations introduced by enterprises.

Figure 11.

Impact of having an innovation department on the type of innovations introduced. Source:authors’ own elaboration.

Figure 11 displays the number of enterprises introducing various types of innovations, differentiated by whether they have a dedicated innovation department or not. Companies with such a department more frequently introduced process innovations (20 enterprises), organizational innovations (15 enterprises), product innovations (10 enterprises), and marketing innovations (5 enterprises). Conversely, companies without an innovation department presented higher figures for each type of innovation: 25, 20, 15, and 10 enterprises, respectively.

These results suggest that the absence of a dedicated innovation unit does not hinder the implementation of innovations, which may indicate that companies find alternative ways to manage innovation, such as by integrating innovative activities within other organizational structures.

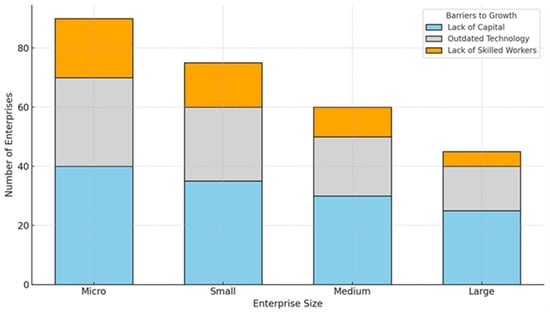

Figure 12 presents the barriers to growth reported by enterprises according to their employment size.

Figure 12.

Barriers to growth in enterprises by employment size. Source: authors’ own elaboration.

Micro-enterprises most commonly identified a lack of capital as the primary obstacle (40 enterprises), followed by outdated technology (30 enterprises) and a shortage of skilled staff (20 enterprises). In small enterprises, these numbers were slightly lower, with 35 enterprises reporting a lack of capital, 25 facing outdated technology, and 15 noting a shortage of skilled staff. For medium-sized enterprises, the figures were 30, 20, and 10, respectively, and for large enterprises, they were 25, 15, and 5, respectively.

These results suggest that while a lack of capital is the most frequently cited barrier across all groups, issues such as insufficient skilled personnel and outdated technology are more prevalent in smaller enterprises.

Figure 13 presents the average age of enterprises depending on the presence of an innovation department and the growth barriers they report.

Figure 13.

Average age of enterprises by presence of innovation department and growth barriers. Source: authors’ own elaboration.

Figure 13 presents the average age of enterprises based on the presence of a dedicated innovation department and the growth barriers they report: a lack of capital, outdated technology, and a shortage of skilled workers. Enterprises with an innovation department that identified lack of capital as a barrier had an average age of 18 years, while those without such a department had an average age of 17 years. In the case of outdated technology, companies with an innovation unit had an average age of 15 years, compared to 14 years for those without one. The oldest enterprises were those reporting a shortage of skilled workers: companies with an innovation department had an average age of 19 years, and those without had an average age of 18 years. These findings suggest that enterprises with innovation-supporting structures tend to be older and more experienced. Lack of capital appears to be a common barrier regardless of age or organizational structure, while outdated technology is more often an issue for younger companies, possibly due to limited modernization resources. The oldest firms struggle primarily with attracting or retaining qualified personnel, indicating increasing staffing challenges in more mature organizations.

These findings suggest that structural characteristics alone cannot fully explain the innovation performance of SMEs. Instead, soft factors such as managerial vision, leadership style, and governance structures may play a decisive role in shaping innovation outcomes. In contexts of resource scarcity—typical for micro and small enterprises—transformational and sustainability-oriented leadership can compensate for financial and technological limitations by fostering a culture of innovation, openness, and long-term orientation. Leadership, therefore, should be regarded not just as a contextual variable but as a strategic driver of innovation under constraints. Future research should incorporate variables such as leadership type, governance structure, and decision-making autonomy to better understand their role in overcoming innovation barriers and achieving sustainable development goals.

4. Discussion

Several hypotheses were rejected in the study regarding factors that influence innovation in enterprises. It was found that the age of an enterprise does not impact the type of innovations introduced, as demonstrated by the Kruskal–Wallis test (H(4) = 2.380; p = 0.666), which showed no significant differences. Similarly, the size of employment within an enterprise was proven not to affect the type of innovations introduced, as evidenced by a chi-square test (χ2(12) = 15.066; p = 0.238) that found no relationship. The scope of an enterprise’s activities also does not affect the type of innovations introduced, with results indicating no significant differences between the scope of operation and the type of innovations. Furthermore, the presence of a dedicated innovation unit within an enterprise does not affect the frequency of introducing innovations, as another chi-square test (χ2(4) = 1.017; p = 0.907) showed no link. Lastly, the age of an enterprise does not influence the perception of outdated technology as a main developmental barrier, as indicated by a Kruskal–Wallis test (H(2) = 2.648; p = 0.266), which also revealed no significant differences between the age of enterprises and the perception of barriers.

These results align with findings from Rammer et al. (2009) [83], who argue that managerial practices and strategic coordination may substitute for R&D capacity in SMEs. Similarly, Segarra-Blasco et al. (2008) [84] and Coad et al. (2016) [93] suggest that structural features like firm size and age are not definitive predictors of innovation behavior; rather, contextual factors and firm-specific resource strategies play a more decisive role.

Furthermore, leadership style may significantly influence how firms approach sustainability-oriented innovation, especially under resource constraints. Transformational leadership—which emphasizes vision, inspiration, and change-orientation—can motivate firms to pursue long-term innovation goals despite short-term limitations. In contrast, transactional leadership may focus on efficiency and risk avoidance, potentially limiting investments in uncertain or high-cost innovation pathways. In resource-constrained SMEs, participative leadership that promotes employee involvement and decentralized decision-making may enhance adaptability and support incremental sustainability efforts. These distinctions underline that not only leadership presence, but also its style and orientation, may critically shape how innovation decisions are made and implemented in SMEs.

These findings underscore the importance of embedding leadership theories within broader strategic management frameworks. For instance, under the Resource-Based View, transformational and participative leadership styles can be interpreted as dynamic capabilities—organizational routines and cognitive assets that help firms reconfigure internal resources toward sustainability goals. Managerial vision, when aligned with long-term environmental and social objectives, becomes a form of strategic foresight that enables SMEs to bypass structural limitations such as outdated technology or capital scarcity. Moreover, stakeholder theory supports the notion that leadership-driven collaboration with external actors—such as universities, cluster organizations, or financing institutions—can enhance innovation capacity by mobilizing social capital and building trust-based networks. Thus, integrating leadership orientation into strategic models allows for a more nuanced understanding of how SMEs pursue sustainability-oriented innovation under real-world constraints.

For conceptual clarity, this study distinguishes between innovation capability, referring to an enterprise’s internal capacity—resources, knowledge, and routines—to generate and sustain innovation (as emphasized in RBV literature); innovation implementation, defined as the actual execution of innovation-related processes and projects; and innovation capability, understood as a deliberate, long-term plan adopted by management to guide innovation efforts in alignment with organizational goals. These distinctions allow a more nuanced analysis of how SMEs navigate innovation under sustainability pressures.

Based on the analysis of the article content and the results of statistical tests, the hypotheses regarding the barriers to implementing innovations in manufacturing enterprises were examined. It was confirmed that a lack of capital is the most frequently indicated barrier, as 65% of the enterprises identified it as a key obstacle. Additionally, it was confirmed that the size of the enterprise influences the perception of growth barriers such as lack of capital, outdated technology, or lack of skilled staff. Specifically, micro-enterprises more frequently pointed to a lack of capital as a barrier, while smaller enterprises more often identified outdated technology as a problem. These findings highlight the significant impact of financial constraints and technological challenges on innovation capacity within the sector.

These findings resonate with the assumptions of the Resource-Based View (RBV), which posits that innovation potential is driven not solely by firm size or age, but by unique internal resources such as knowledge, routines, and managerial capabilities. The absence of statistical significance for structural variables underscores the relevance of dynamic capabilities—firms’ ability to integrate, build, and reconfigure internal competencies in response to rapidly changing environments. Moreover, stakeholder theory may offer complementary insights, suggesting that firms more actively engaged with local networks, universities, or policy actors might be better positioned to overcome innovation barriers through collaborative advantage.

Integrating digital and sustainability strategies offers a promising pathway for SMEs to overcome resource constraints while advancing environmental objectives. Technologies such as the Internet of Things (IoT), smart sensors, and AI-enabled analytics can simultaneously increase operational efficiency and reduce carbon emissions through better energy management, predictive maintenance, and real-time supply chain optimization. For example, one interviewed firm in the metal fabrication sector implemented a basic IoT-based monitoring system to track energy usage, resulting in a 12% reduction in electricity consumption over six months. Another enterprise reported using low-cost automation to optimize raw material inputs, which reduced waste and cut production costs. These cases suggest that even minimal investments in digital tools can produce measurable sustainability gains, especially when aligned with lean or circular innovation strategies.

The barriers identified in this study—particularly a lack of capital and outdated technologies—have direct consequences for environmental sustainability outcomes. Limited financial resources restrict the ability of SMEs to invest in cleaner production technologies, energy-efficient machinery, or materials that reduce environmental harm. Similarly, reliance on outdated technologies prolongs dependence on carbon-intensive processes, inhibiting improvements in eco-efficiency and lifecycle performance. For instance, firms lacking access to capital reported difficulties in upgrading equipment that could reduce emissions or resource consumption. In this sense, innovation barriers are not only economic impediments but also environmental risks, as they delay the decarbonization and modernization needed for achieving sustainability goals. These findings support prior research showing that overcoming such barriers is essential for enabling SMEs to contribute meaningfully to climate mitigation and environmental resilience [6,17,18,29,32,40,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76,77,78,79,80,81].

In the article, the following hypotheses were confirmed:

- Lack of capital is the most frequently indicated barrier to implementing innovations in manufacturing enterprises.

- The size of the enterprise affects the perception of growth barriers, such as lack of capital, outdated technology, or lack of skilled staff.

On the other hand, the following hypotheses were rejected:

- The age of the enterprise affects the type of innovations introduced.

- The size of employment in the enterprise affects the type of innovations introduced.

- The scope of the enterprise’s activity affects the type of innovations introduced.

- Having a unit dedicated to innovation affects the frequency of introducing innovations.

- The age of the enterprise affects the perception of outdated technology as the main barrier to development.

Hypotheses regarding cooperation with research and development centers, the use of grants for innovations, and the impact of the type of innovations introduced on the competitive advantage of the enterprise were not verified due to the lack of direct data in the article.

5. Conclusions

The analysis shows that the innovativeness of the surveyed enterprises depends primarily on external barriers, while structural characteristics—age, employment size, scope of activity, and the presence of a dedicated innovation unit—have no statistically significant impact. A lack of capital remains the most frequently reported obstacle, especially among micro and small firms, indicating the need for broader access to preferential loans, R&D grants, and equity instruments that support the transition toward sustainable development. The shortage of qualified personnel intensifies as organizations mature: the oldest companies find it increasingly difficult to retain or attract specialists, underscoring the importance of university partnerships, reskilling programs, and tax incentives for employers who invest in workforce skills. Outdated technology, in turn, constrains primarily younger enterprises that have not yet accumulated sufficient resources for modernization; hence, rapid digital-support tools—such as technology vouchers and loans—are crucial.

Kruskal–Wallis and χ2 tests confirmed the lack of a relationship between structural variables and either the type or frequency of innovations implemented—process, product, organizational, or marketing—suggesting that public policy should focus on removing systemic barriers rather than applying one-size-fits-all support models for selected firm groups. The presence of a formal innovation department does not itself guarantee a higher number of implementations, yet it correlates with greater process professionalism; therefore, promoting flexible structures—ad hoc teams and cross-functional squads—and open-innovation practices is advisable. Collaboration networks also matter greatly: firms active in clusters or using technology transfer centers compensate for resource gaps more effectively and accelerate the adoption of new solutions.

In addition to financial and technological support, the findings highlight the potential importance of internal leadership factors. Sustainable innovation requires not only external incentives but also strong managerial commitment, strategic vision, and adaptive governance. Leadership development programs aimed at fostering sustainability-oriented mindsets among SME managers could significantly enhance the long-term innovation capacity of firms. Embedding these soft dimensions into public support schemes may ensure that funding and policy instruments translate into lasting organizational change.

The Mazowieckie Voivodeship represents Poland’s most economically developed and industrially diversified region. It combines a strong manufacturing base—ranging from traditional sectors such as metal processing and textiles to emerging areas like bio-based materials and green technologies—with access to key policy instruments funded by the European Union and national innovation schemes. Despite this relatively favorable environment, the surveyed SMEs report barriers typical of semi-peripheral regions, including limited capital, skill shortages, and underdeveloped innovation infrastructure. Given these characteristics, the findings from Mazovia can be cautiously extrapolated to other regions in Central and Eastern Europe (CEE) that share similar structural and policy challenges. This includes areas with a high prevalence of micro and small enterprises, weak innovation ecosystems, and limited absorption capacity for public support instruments. The study thus contributes to a broader understanding of SME innovation dynamics in post-transition economies facing sustainability pressures.

Theoretically, the findings contribute to the literature on sustainable strategic management in SMEs by integrating the Resource-Based View (RBV) and dynamic capabilities framework with real-world constraints typical of micro and small firms. The study reinforces that access to internal capabilities—such as managerial vision, adaptive governance, and absorptive capacity—is often more decisive for innovation outcomes than structural variables like firm size or age [18,70,71,72]. By empirically confirming the limited predictive power of structural characteristics, the research shifts the focus toward intangible assets and leadership dynamics as strategic levers for sustainability-oriented change [79,80,81].

From the perspective of the Triple Bottom Line (TBL) framework, the study’s findings suggest an imbalance in how SMEs address the three pillars of sustainability. While most surveyed firms focus on economic survival and incremental efficiency gains—particularly through process and organizational innovations—there is limited evidence of innovation explicitly targeting environmental or social outcomes. This indicates that the “planet” and “people” dimensions of TBL remain underdeveloped in SME innovation strategies, often due to resource constraints and a lack of long-term strategic planning. For example, very few enterprises referenced eco-innovation or lifecycle-oriented changes during interviews, and most innovation decisions were framed around cost reduction rather than emission reduction or inclusive practices. These insights support the prior literature emphasizing the need for policy tools that integrate financial incentives with sustainability metrics, to nudge SMEs toward innovation that balances profit, environmental responsibility, and social value creation [30,61,69].

Moreover, the study complements the Triple Bottom Line (TBL) and Responsible Innovation (RI) frameworks by demonstrating how financial and technological barriers intersect with social and organizational capacities to shape innovation trajectories [27,30,31,32,33,69]. It thus advances a more integrated understanding of how SMEs can achieve long-term viability through embedded sustainability in strategy, structure, and culture [10,11,12,13,14,61,76,77,78,79].

This study also contributes to the growing body of research on strategic decision-making under sustainability pressures by highlighting how resource-constrained SMEs pragmatically prioritize innovation. The findings suggest that, in the absence of formal innovation structures or sufficient capital, SMEs rely heavily on managerial agency, improvisational strategies, and flexible governance to navigate uncertainty—thus extending prior work on frugal innovation and informal strategic processes [17,18,29,32,40,52,53,54,55,56,57,58,59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,76]. In particular, the role of leadership becomes central not only in driving innovation but in enabling firms to align short-term survival with long-term sustainability objectives. This reinforces emerging perspectives that view innovation leadership as context-sensitive and highly dependent on non-structural, cognitive, and behavioral dimensions within the firm [17,18,29,67,68,69,70,71,72,73,74,75,76]. By grounding these insights in empirical data from the Mazowieckie Voivodeship, the study provides a localized yet transferable model of innovation governance under systemic constraints.

Future research should operationalize strategic management frameworks such as the RBV and dynamic capabilities to better understand how internal competences and external partnerships support sustainable innovation in SMEs. Understanding the role of stakeholder engagement, especially in regional ecosystems, could provide further insight into how firms compensate for structural limitations by mobilizing relational and social capital.

From a sustainability perspective, financial support should be tied to ESG criteria and aligned with decarbonization goals and Industry 4.0, thus improving the cost-effectiveness of innovation investments while cutting emissions.

In addition to aligning subsidies and loans with ESG metrics, sustainability-linked financial instruments such as green bonds, sustainability-linked loans (SLLs), and impact-oriented credit schemes could help SMEs bridge capital gaps. These mechanisms tie financing conditions to measurable sustainability outcomes—such as reductions in carbon intensity, resource use, or social equity metrics—thus encouraging firms to align innovation strategies with environmental and social goals. Programs such as the EU’s InvestEU or national ESG-credit pilot schemes could be tailored to address the fragmented needs of SMEs in semi-peripheral regions, where high risk perception and lack of collateral often prevent firms from accessing traditional financing. Embedding sustainability-linked finance in SME policy could therefore enhance both innovation capacity and climate resilience.

To further enhance policy relevance, it is crucial to promote synergies between digitalization and sustainability through integrated public support schemes. Digital transformation programs—such as those focused on Industry 4.0 adoption, smart factories, or AI-enabled optimization—should be designed with embedded environmental goals. For example, SMEs adopting IoT solutions for production monitoring could simultaneously be incentivized to measure and reduce their carbon emissions. Additionally, green finance mechanisms—including ESG-linked loans, green bonds, and performance-based subsidies—should explicitly reward digital innovations that contribute to sustainability indicators. This integrated approach would not only address capital constraints but also accelerate the diffusion of low-carbon technologies in traditional sectors. Policymakers should thus consider bundling digital transformation grants with climate finance tools, ensuring that resource-constrained SMEs are supported in both technological modernization and emissions reduction. These synergies are essential for aligning SME development with broader sustainability targets such as the European Green Deal and the UN Sustainable Development Goals (SDGs).

To operationalize the policy recommendations, we propose the introduction of sectoral innovation vouchers targeted at SMEs in traditional manufacturing sectors. These vouchers could subsidize the acquisition of digital tools, such as basic IoT systems, ERP platforms, or low-code automation software, enabling firms to modernize incrementally without large upfront investments. In parallel, regional platforms for SME–university collaboration should be developed to facilitate joint R&D projects, student internships, and access to technical consulting. Such platforms could be modeled after existing cluster initiatives and supported by local innovation agencies. Additionally, modular training programs focused on sustainable production and digital maturity could complement these efforts, reinforcing absorptive capacity in SMEs.

Because this study focused on the Mazovian region and the manufacturing sector, future research should expand to other regions and industries and include longitudinal designs to capture changes over time. Further work should also explore how management style affects innovation performance, using advanced econometric models that consider organizational culture, digital maturity, and participation in global value chains. Overall, the findings indicate that effectively boosting innovative capacity requires a package of measures that integrates financing, technological support, skills development, and network building—allowing enterprises to enhance their innovation potential on a sustained basis.

To enhance the generalizability and comparative value of the findings, future studies should undertake cross-regional analyses involving other areas of Central and Eastern Europe (CEE) or EU member states. Regions such as Silesia (Poland), Northern Hungary, or Eastern Slovakia share similar post-industrial characteristics, SME sector compositions, and innovation ecosystem maturity levels with the Mazowieckie Voivodeship. Comparative studies across these regions could help identify common structural barriers and context-specific enablers of innovation in SMEs, particularly under sustainability pressures. This would allow policymakers to design better-targeted support mechanisms and foster collaborative learning between regions facing analogous development challenges.

Future research should explore specific mechanisms through which internal capabilities such as digital literacy influence innovation performance. In particular, research questions could address the following: To what extent does digital literacy among SME managers affect the adoption of sustainability-oriented innovations? How do digital skills mediate the relationship between external support (e.g., innovation vouchers) and internal innovation outcomes? Longitudinal or comparative studies across CEE regions could also clarify how digital competencies evolve and how they interact with resource availability, leadership styles, and innovation culture.

Author Contributions

Conceptualization, H.W. and I.M. (Ireneusz Miciuła); methodology, A.K. and M.H.; software, D.B.; validation, A.P., H.W. and I.M. (Irena Malinowska); formal analysis, H.W.; investigation, I.M. (Ireneusz Miciuła); resources, I.M. (Ireneusz Miciuła); data curation, H.W.; writing—original draft preparation, H.W. and I.M. (Ireneusz Miciuła); writing—review and editing, I.M. (Ireneusz Miciuła) and H.W.; visualization, A.W.-C.; supervision, H.W., I.M. (Irena Malinowska), D.B. and M.H.; project administration, A.W.-C.; funding acquisition, A.W.-C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Ethical review and approval were waived for this study because no sensitive personal data were collected, and the research involved only anonymized survey and interview data from adult participants in a non-clinical, non-intervention setting.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study. Participation was voluntary, and all responses were anonymized to ensure confidentiality.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Arza, V.; López, E. Obstacles Affecting Innovation in Small and Medium Enterprises: Quantitative Analysis of the Argentinean Manufacturing Sector. Res. Policy 2021, 50, 104324. [Google Scholar] [CrossRef]

- Blick, T.; Paeleman, I.; Laveren, E. Financing Constraints and SME Growth: The Suppression Effect of Cost-Saving Management Innovations. Small Bus. Econ. 2024, 62, 961–986. [Google Scholar] [CrossRef]

- Justy, T.; Pellegrin-Boucher, E.; Lescop, D.; Granata, J.; Gupta, S. On the edge of big data: Drivers and barriers to data analytics adoption in SMEs. Technovation 2023, 127, 102850. [Google Scholar] [CrossRef]

- Hafeez, S.; Shahzad, K.; De Silva, M. Enhancing Digital Transformation in SMEs: The Dynamic Capabilities of Innovation Intermediaries within Ecosystems. Long Range Plann. 2025, 58, 102525. [Google Scholar] [CrossRef]

- de Mendonça Santos, A.; Sant’Anna, Â.M.O. Industry 4.0 Technologies for Sustainability within Small and Medium Enterprises: A Systematic Literature Review and Future Directions. J. Clean. Prod. 2024, 467, 143023. [Google Scholar] [CrossRef]

- Gómez-Garza, R.; Güereca, L.P.; Padilla-Rivera, A. Barriers and Enablers of Life-Cycle Assessment in SMEs: A Systematic Review. Environ. Dev. Sustain. 2024, 1, 1–26. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.W.; Wright, M. Digital Affordances, Spatial Affordances, and the Genesis of Entrepreneurial Ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Zahoor, N.; Khan, H.; Donbesuur, F.; Khan, Z.; Rajwani, T. Grand Challenges and Emerging-Market SMEs: The Role of Strategic Agility and Gender Diversity. J. Prod. Innov. Manag. 2024, 41, 473–500. [Google Scholar] [CrossRef]

- Baptista, R.; Karaoz, M.; Mendonça, J. Digital Transformation of SMEs in Response to the COVID-19 Pandemic. Ind. Mark. Manag. 2020, 88, 225–229. [Google Scholar] [CrossRef]

- Bossle, M.B.; Dutra de Barcellos, M.; Vieira, L.M.; Sauvée, L. The drivers for adoption of eco-innovation. J. Clean. Prod. 2016, 113, 861–872. [Google Scholar] [CrossRef]

- Alamandi, Y. Embedding Sustainability as Strategic Core in SMEs: Lessons from Integrative Resource Use. Sustainability 2025, 17, 4362. [Google Scholar] [CrossRef]

- Weng, D.H.; Lin, Y.C.; Chiu, C. Sustainable Innovation Management: Balancing Economic Growth and Environmental Responsibility. Sustainability 2025, 17, 2188. [Google Scholar] [CrossRef]

- Baeshen, Y.; Soomro, Y.A.; Bhutto, M.Y. Determinants of green innovation to achieve sustainable business performance: Evidence from SMEs. Front. Psychol. 2021, 12, 767968. [Google Scholar] [CrossRef] [PubMed]

- Koszewska, M. Business Model Innovation for Sustainability in the Construction Sector: Creating Environmental, Social, and Economic Value. Sustainability 2022, 14, 10101. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Kirner, E.; Kinkel, S.; Jaeger, A. Innovation-oriented production in SMEs: The impact of internal and external resources. Int. J. Technol. Manag. 2009, 47, 233–250. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef]

- Gunday, G.; Ulusoy, G.; Kilic, K.; Alpkan, L. Effects of innovation types on firm performance. Int. J. Prod. Econ. 2011, 133, 662–676. [Google Scholar] [CrossRef]

- Tidd, J.; Bessant, J. Managing Innovation: Integrating Technological, Market and Organizational Change, 7th ed.; Wiley: Hoboken, NJ, USA, 2021. [Google Scholar]

- Beck, T.; Demirgüç-Kunt, A. Small and medium-size enterprises: Access to finance as a growth constraint. J. Bank. Financ. 2006, 30, 2931–2943. [Google Scholar] [CrossRef]

- OECD. OECD SME and Entrepreneurship Outlook 2019; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Arbussa, A.; Bikfalvi, A.; Marquès, P. Strategic agility-driven business model renewal: The case of an SME. Manag. Decis. 2017, 55, 271–293. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar] [CrossRef]

- Edquist, C. Systems of innovation: Perspectives and challenges. In The Oxford Handbook of Innovation; Fagerberg, J., Mowery, D.C., Nelson, R.R., Eds.; Oxford University Press: Oxford, UK, 2005; pp. 181–208. [Google Scholar] [CrossRef]

- Carrillo-Hermosilla, J.; del Río, P.; Könnölä, T. Eco-Innovation: When Sustainability and Competitiveness Shake Hands. Technol. Forecast. Soc. Change 2010, 77, 1203–1211. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A New Sustainability Paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Ziegler, R. Social Innovation as a Collaborative Concept. Innov. Eur. J. Soc. Sci. Res. 2017, 30, 388–405. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A Literature and Practice Review to Develop Sustainable Business Model Archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Hossain, M. Frugal Innovation: A Review and Research Agenda. J. Clean. Prod. 2018, 182, 926–936. [Google Scholar] [CrossRef]

- Alayón, C.L.; Säfsten, K.; Johansson, G. Barriers and Enablers for the Adoption of Sustainable Manufacturing by Manufacturing SMEs. Sustainability 2022, 14, 2364. [Google Scholar] [CrossRef]

- Kannan, S.; Gambetta, N. Technology-Driven Sustainability in Small and Medium-Sized Enterprises: A Systematic Literature Review. J. Small Bus. Strategy 2025, 35, 129–157. [Google Scholar] [CrossRef]

- Durrani, N.; Raziq, A.; Mahmood, T.; Khan, M.R. Barriers to adaptation of environmental sustainability in SMEs: A qualitative study. PLoS ONE 2024, 19, e0298580. [Google Scholar] [CrossRef]

- Franco, M. Inter-Organisational Cooperation Oriented Towards Sustainability Involving SMEs: A Systematic Literature Review. J. Knowl. Econ. 2023, 15, 1952–1972. [Google Scholar] [CrossRef]

- OECD. SME Digitalisation to Manage Shocks and Transitions: 2024 D4SME Survey; OECD Publishing: Paris, France, 2024. [Google Scholar] [CrossRef]