1. Introduction

Services have moved beyond a complementary role in the economy to become the main component of economic activities [

1]. Financial services are undergoing a radical transformation, driven by global events and advances in technology [

2]. Financial institutions need to continuously maintain and improve the quality of their services based on user experience in order to remain competitive [

3]. But with limited resources and time to devote, strategic choices about sustainable change are critical [

4].

Particularly as financial institutions face increasing pressure to align their operations with Sustainable Development Goals [

5], the intersection of digital transformation and sustainability in banking is an important area of research [

6]. Mobile banking applications, which serve as the primary interface between financial institutions and their customers, have emerged as a key enabler of sustainable banking practices [

7]. In addition to making traditional banking easier by allowing transactions to be performed without paper [

8], lowering the need for physical infrastructure, and making more people able to access financial services, these apps could also help reach bigger sustainability goals [

9].

Emerging research suggests that positive experiences with mobile banking ultimately impact sustainable banking practices and customer satisfaction [

9]. For example, research by Kamdjoug et al. (2021) suggests that mobile banking applications can potentially increase customer loyalty and satisfaction [

10]. Similarly, Ref. [

11] explored how technical factors such as system quality and service quality influence the adoption and use of mobile banking apps, Ref. [

10], particularly during global disruptions. This research demonstrates that understanding how mobile banking applications contribute to sustainable banking practice is increasingly important [

12].

Yet, most of the existing research focuses on isolated adoption factors, technical characteristics [

7], or customer satisfaction measures and does not consider the broader implications for sustainable development [

13]. When researchers use these methods to try to rate mobile banking apps, they often already know which features to look at when they are hypothesizing and modeling [

14], so the rating is only based on those features. This leads to a limitation where the actual sustainability-related attributes perceived by users may be overlooked [

15]. The assessment solely focuses on the attributes the researcher intended to evaluate [

16].

Furthermore, most of these studies use surveys to collect data, which inevitably introduces limitations when collecting data [

17]. The development of the internet and social media has provided users with multiple channels and powerful media to voice opinions, making electronic word of mouth, or eWOM [

18], an important new resource for understanding sustainable banking. Numerous studies have already demonstrated the effectiveness of eWOM, such as online reviews, in representing the overall customer perspective [

19].

This study wants to fill in these gaps in the research by suggesting a thorough examination of user-generated content. This will help us figure out how mobile banking apps help make banking more environmentally friendly. Specifically, we analyzed 54,725 user reviews of Turkish mobile banking applications on the Google Play Store platform from 2019 to 2024. Advanced text mining techniques and structural topic modeling are employed with the aim of uncovering patterns, themes, and insights relevant for a sustainable digital banking transformation.

The structure of this paper is as follows.

Section 2 will examine prior studies on sustainable digital banking and text mining approaches in banking research.

Section 3 will propose our methodological framework for analyzing sustainability themes in mobile banking app reviews.

Section 4 will present a case study applying the proposed process to Turkish mobile banking apps. Lastly, the paper will close with a discussion and conclusion in

Section 5.

Given these objectives and identified research gaps, this study addresses the following research questions:

RQ1: How do user experiences reflected in mobile banking app reviews align with sustainable banking practices? This addresses the gap in understanding how digital transformation contributes to sustainable banking practice.

RQ2: What are the key sustainability themes that emerge from user-generated content in mobile banking applications, and how have they evolved over time? This explores the evolution over time of sustainability concerns and expectations in mobile banking, providing insights into the changing landscape of sustainable digital banking.

RQ3: To what extent do current mobile banking applications support the United Nations Sustainable Development Goals based on user experience? This looks at how the features of mobile banking fit in with global sustainability frameworks, aiming to meet the need for real-world evidence on how banking helps with sustainable development.

RQ4: Can the analysis of user-generated content identify the barriers and enablers to sustainable digital banking transformation? In order to inform future development strategies, this question seeks to understand the practical implications of implementing sustainable banking practices through mobile applications.

This study contributes to both the theoretical understanding and practical implementation of sustainable digital banking transformation [

20,

21] by addressing these research questions. The findings will provide valuable insights for financial institutions [

22,

23,

24], policymakers, and other stakeholders involved in the digital banking landscape. By analyzing user-generated content, the research aims to highlight effective strategies for overcoming challenges and leveraging opportunities in the transition towards more sustainable financial practices.

2. Literature Review

This section critically examines the convergence of digital banking transformation, sustainability implementation, and user perception analysis within financial services. Rather than providing a descriptive overview, this review identifies fundamental theoretical tensions and methodological limitations that constrain current understanding of sustainable digital banking transformation, establishing the analytical foundation for our empirical investigation.

2.1. Theoretical Foundations: Institutional Theory and Sustainability Implementation

The relationship between institutional identity and sustainability strategy represents a fundamental theoretical tension in organizational behavior research. Institutional theory suggests that organizational missions and historical mandates create distinct strategic orientations that influence resource allocation and priority setting across all operational domains. However, the application of this theoretical framework to sustainability implementation in digital banking contexts remains underdeveloped.

Weber and Scholz’s multi-dimensional sustainability framework provides a foundational structure for analyzing environmental, social, governance, and economic dimensions of organizational sustainability efforts. Yet existing applications of this framework fail to account for institutional heterogeneity, treating sustainability as a universal organizational imperative rather than recognizing how different institutional types may legitimately prioritize different sustainability dimensions based on their core missions and stakeholder obligations.

This theoretical gap becomes particularly pronounced when examining government-owned versus private financial institutions. Institutional theory predicts that government banks, with their development-oriented mandates and public accountability requirements, should demonstrate distinct sustainability priorities compared to private banks focused on competitive positioning and shareholder value creation. However, systematic empirical testing of these theoretical expectations remains absent from the sustainable banking literature.

The integration of stakeholder theory further complicates this theoretical landscape [

25]. Freeman’s stakeholder framework suggests that organizations must balance competing stakeholder demands, but the stakeholder configurations of government and private banks differ fundamentally. Government banks face primary accountability to public development objectives and secondary consideration of financial performance, while private banks prioritize shareholder returns with sustainability serving as a means to competitive differentiation or regulatory compliance.

2.2. Critical Assessment of Digital Banking Sustainability Research

Current research on digital banking sustainability suffers from three fundamental analytical limitations that constrain theoretical advancement and practical application. The predominant focus on technological adoption factors and user experience optimization reflects a narrow conceptualization of sustainability that emphasizes operational efficiency while neglecting broader development impact potential [

26].

The first limitation concerns the treatment of sustainability as a supplementary consideration rather than a core strategic orientation. Studies by Arner et al. and Bican and Brem examine digital transformation and sustainability as parallel processes rather than integrated strategic imperatives. This separation prevents understanding how digital capabilities can serve as enablers for comprehensive sustainability transformation rather than merely improving operational efficiency [

27,

28].

The second limitation involves the assumption of institutional homogeneity in sustainability approaches. Research by Sharma et al. and Kumar and Prakash acknowledges differences in sustainability reporting between bank types but fails to examine how these differences manifest in customer-facing digital services. This oversight represents a significant theoretical gap, as institutional theory clearly predicts that organizational missions should influence all strategic decisions, including digital service design and sustainability feature prioritization [

29].

The third limitation reflects methodological constraints that prevent authentic assessment of sustainability implementation effectiveness. Traditional survey-based approaches impose researcher-defined sustainability frameworks that may not capture genuine user priorities or organic sustainability theme emergence. This methodological bias potentially misrepresents both user expectations and institutional performance in sustainability delivery.

2.3. Systematic Gaps in Comparative Institutional Analysis

The absence of systematic comparisons between public and private banks in digital sustainability contexts represents perhaps the most significant gap in the current literature. While studies by Birindelli and Ferretti document sustainability differences between government and private banks in European contexts, their analysis remains limited to traditional banking operations without extending to digital transformation strategies or customer-facing technology platforms.

This gap reflects broader theoretical confusion about the role of institutional ownership in shaping sustainability priorities. Existing research treats ownership as a control variable rather than a fundamental determinant of sustainability strategy, failing to recognize that government and private banks operate under fundamentally different accountability structures, performance metrics, and stakeholder configurations.

The theoretical implications of this oversight extend beyond descriptive institutional differences to questions about optimal sustainable development strategies. If government and private banks demonstrate systematically different sustainability approaches, policy frameworks that assume uniform sustainability implementation may prove ineffective or counterproductive. Understanding these institutional differences becomes essential for designing regulatory frameworks and development policies that leverage rather than constrain natural institutional strengths.

Furthermore, the absence of comparative analysis prevents the identification of complementary roles that different institutional types might play in comprehensive sustainable development strategies. Rather than competing in identical sustainability domains, government and private banks might contribute most effectively to sustainable development through coordinated but differentiated approaches that align with their respective institutional advantages.

2.4. Longitudinal Analysis Deficiencies and Temporal Understanding

The lack of longitudinal analyses of sustainability themes in digital banking reflects both methodological constraints and theoretical underdevelopment regarding sustainability evolution processes. Existing research predominantly employs cross-sectional designs that capture sustainability implementation at single time points, failing to examine how sustainability priorities evolve in response to external pressures, technological developments, or changing user expectations.

This temporal limitation constrains understanding of sustainability transformation as a dynamic process rather than a static organizational characteristic. Technology acceptance theory and organizational change theory both emphasize the importance of temporal dynamics in understanding transformation processes, yet applications to sustainable banking transformation remain limited.

The theoretical implications of temporal analysis extend to questions about sustainability trend durability versus temporary adoption cycles. Without longitudinal evidence, distinguishing between fundamental shifts in sustainability priorities and superficial responses to temporary market pressures becomes impossible. This distinction carries substantial implications for both theoretical understanding and policy development.

Roberts, Stewart, and Tingley’s structural topic modeling framework provides methodological tools for examining the temporal evolution of thematic emphasis within large text corpora, yet applications to user-generated content in banking contexts remain minimal. This methodological gap prevents understanding of how user sustainability expectations evolve and whether institutional responses align with changing user priorities.

2.5. User Perception Versus Implementation Reality: The Authenticity Gap

Limited discussion regarding alignment between user perceptions and actual banking practices represents a fundamental theoretical challenge in sustainability research. The authenticity of sustainability implementation versus superficial communication efforts cannot be assessed without examining user responses to actual service delivery rather than institutional sustainability claims.

This authenticity gap reflects broader theoretical tensions between symbolic and substantive organizational responses to stakeholder pressures. Institutional theory suggests that organizations may adopt sustainability symbols to maintain legitimacy without implementing corresponding substantive changes. However, user-generated content analysis provides opportunities to assess whether sustainability initiatives generate authentic user recognition and positive response, indicating substantive rather than merely symbolic implementation.

The theoretical implications extend to questions about stakeholder evaluation capabilities and organizational accountability mechanisms. If users can accurately assess sustainability implementation effectiveness through direct service experience, user-generated content provides valuable evidence for distinguishing between authentic and superficial sustainability efforts. This assessment capability has important implications for both a theoretical understanding of stakeholder monitoring and a practical evaluation of sustainability implementation success.

Traditional approaches to sustainability assessment rely on institutional self-reporting or researcher-defined evaluation criteria, both of which may miss gaps between intended and actual sustainability delivery. User perspective analysis offers triangulation opportunities for validation of institutional sustainability claims through the examination of actual user experience rather than organizational communication.

2.6. Theoretical Framework Integration and SDG Alignment

The limited integration of established theoretical frameworks with SDG analysis represents a significant conceptual weakness in current sustainable banking research. While numerous studies reference SDG alignment, few establish theoretical expectations for how different organizational types should contribute to specific development goals based on their institutional missions and capabilities.

Sustainable development theory suggests that comprehensive SDG achievement requires coordinated contributions from diverse organizational types, each leveraging their distinctive capabilities and addressing their natural stakeholder constituencies. However, applications of this theoretical framework to banking institutions remain superficial, treating SDG alignment as a universal organizational aspiration rather than recognizing how different institutional types might contribute most effectively to different development goals.

The integration of institutional theory with sustainable development theory provides a framework for understanding why government banks might naturally align with development-focused SDGs while private banks contribute more effectively to innovation and efficiency-focused goals. This theoretical integration moves beyond descriptive SDG mapping to an analytical examination of optimal institutional roles in comprehensive sustainable development strategies.

Furthermore, the connection between user perception analysis and SDG assessment remains theoretically underdeveloped. If users can accurately assess institutional contributions to sustainable development through direct service experience, user-generated content provides valuable evidence for evaluating SDG alignment effectiveness rather than relying solely on institutional self-assessment.

2.7. Research Gaps and Theoretical Contributions

A systematic analysis of the existing literature reveals three critical gaps that constrain both theoretical advancement and practical application in sustainable digital banking research. First, the absence of ownership-sensitive analytical frameworks prevents understanding how institutional missions shape sustainability implementation strategies. Second, methodological limitations constrain authentic assessment of sustainability implementation effectiveness versus symbolic adoption. Third, temporal analysis deficiencies limit understanding sustainability transformation as dynamic organizational processes.

This study addresses these gaps through the integration of institutional theory, sustainability implementation theory, and user perception analysis within a comprehensive ownership-sensitive framework. The theoretical contributions extend beyond descriptive institutional differences to an analytical examination of how organizational missions influence digital sustainability strategies and how user perspectives provide an authentic assessment of implementation effectiveness.

The methodological innovation of applying structural topic modeling to large-scale user-generated content enables the identification of organic sustainability theme emergence rather than imposing researcher-defined frameworks. This approach provides opportunities for validating theoretical expectations about institutional differences while discovering unexpected patterns in user sustainability priorities and institutional response strategies.

The temporal analysis framework contributes to understanding sustainability transformation as evolutionary processes rather than static organizational characteristics, providing insights into sustainability trend durability and institutional adaptation capabilities that inform both theoretical development and policy formulation for sustainable banking transformation strategies.

This study makes several novel contributions to the sustainable digital banking literature. First, while previous research has examined isolated aspects of sustainability in banking [

30], our study is the first to apply a comprehensive text mining approach to user-generated content for analyzing sustainability dimensions in mobile banking applications. Second, our systematic comparison between government-owned and private banks reveals previously undocumented differences in sustainability priorities and implementation approaches. Third, our temporal analysis (2022–2025) provides unique insights into the evolution of sustainability themes in digital banking during a critical period of digital transformation. Finally, our mapping of identified sustainability themes to SDGs offers an original framework for evaluating how mobile banking applications contribute to global sustainability objectives.

3. Methodology

This paper proposes a comprehensive framework for analyzing sustainability dimensions in Turkish mobile banking applications through text mining of user-generated content. Our methodological approach integrates multiple analytical techniques to systematically identify, classify, and evaluate sustainability themes across different banking institutions, with special emphasis on comparing government and private ownership models.

3.1. Data Collection and Dataset Characteristics

The dataset used in this study consists of 120,000 user reviews from six major Turkish mobile banking applications, including both government-owned and private banks. The temporal distribution of reviews indicates that private banks received a higher concentration of reviews in more recent years, with Bank D and Bank F showing 63.36% and 68.50% of their reviews, respectively, from 2024, whereas government banks exhibited a more evenly distributed pattern across the years (Bank B: 53.04% in 2023; Bank A: 43.96% in 2024). The review length analysis suggests that users of government-owned Bank C wrote the longest reviews (average: 83.80 characters), whereas private bank reviews tended to be shorter (Bank D: 58.59 characters; Bank F: 59.38 characters), indicating potential differences in user engagement and feedback depth (shown in

Table 1).

The sentiment distribution reveals notable variations between government and private banks. Bank C had the highest percentage of 1-star ratings (51.50%), suggesting significant dissatisfaction among users, while government-owned Bank B and Bank A exhibited relatively higher proportions of 5-star ratings (61.03% and 56.05%, respectively), indicating stronger customer approval. Private banks demonstrated a more consistent sentiment pattern, with 5-star ratings ranging from 56.76% (Bank E) to 63.73% (Bank D), which may reflect a more standardized user experience across institutions. These findings highlight significant differences in user perceptions, engagement, and feedback patterns, shaped by institutional ownership and service delivery approaches [

31].

These insights provide a contextual foundation for the subsequent text mining analysis, as differences in review frequency, length, and sentiment can influence the interpretation of sustainability themes. The observed variations align with prior research on digital banking, which suggests that government and private banks often have distinct digital transformation strategies and customer engagement models [

7]. Consequently, the differences in review patterns across institutions may reflect their respective approaches to sustainable digital banking transformation.

3.1.1. Data Collection Procedures

The dataset for this study was systematically collected from the Google Play Store between January 2022 and February 2025 using the Google Play Developer API with Python. We developed a custom script utilizing the googleplay-api Python library to extract review data for mobile banking applications of six major Turkish banks: three government-owned (Bank A, Bank B, and Bank C) and three private institutions (Bank D, Bank E, and Bank F). These banks were selected based on their market share and customer base size, collectively representing over 75% of the Turkish mobile banking market. Our API-based extraction process collected review text, star ratings, submission dates, and review length for each application. We implemented pagination handling to ensure comprehensive data acquisition, collecting all available reviews within the study timeframe rather than employing sampling. This approach resulted in a comprehensive dataset of 120,000 unique reviews. The raw data underwent rigorous preprocessing to ensure quality and consistency. First, we removed non-Turkish reviews using language detection algorithms (langdetect library). Next, we eliminated duplicate entries based on user identifiers and text similarity (using Levenshtein distance). Special characters, emojis, and URLs were standardized, while maintaining sentiment-relevant punctuation marks. Reviews with fewer than three characters were excluded as they typically lacked substantive content for analysis. Data normalization included converting all text to lowercase, standardizing Turkish special characters (ç, ğ, ı, ö, ş, ü), and applying stemming using the Zemberek NLP library specifically designed for Turkish language processing. This essential preprocessing step reduced linguistic variations while preserving the semantic integrity of the reviews. To prepare for sustainability analysis, we created a comprehensive Turkish sustainability lexicon with domain-specific terms related to environmental, social, governance, and economic dimensions. This lexicon incorporated banking-specific terminology and institutional context variations between government and private banks. The resulting cleaned dataset maintained the temporal, institutional, and sentiment distributions presented in

Table 1, providing a robust foundation for our subsequent analysis of sustainability dimensions in Turkish mobile banking applications.

The six banking institutions were systematically selected using a stratified sampling approach designed to ensure representative coverage of the Turkish banking landscape. Government-owned banks were selected based on their distinct historical mandates: Bank A represents the largest government bank with a cultural heritage focus, Bank B serves as the primary agricultural development bank, and Bank C functions as the leading small business and tradesperson support institution. These three institutions collectively hold 42% of government banking assets and serve 65% of public banking customers. Private bank selection employed market capitalization and digital banking adoption metrics. Bank D, Bank E, and Bank F represent the three largest private banks by mobile banking user base, collectively commanding 58% of private sector digital banking transactions. This selection ensures representation across different business models, technological approaches, and customer segments while maintaining sufficient review volume for robust statistical analysis.

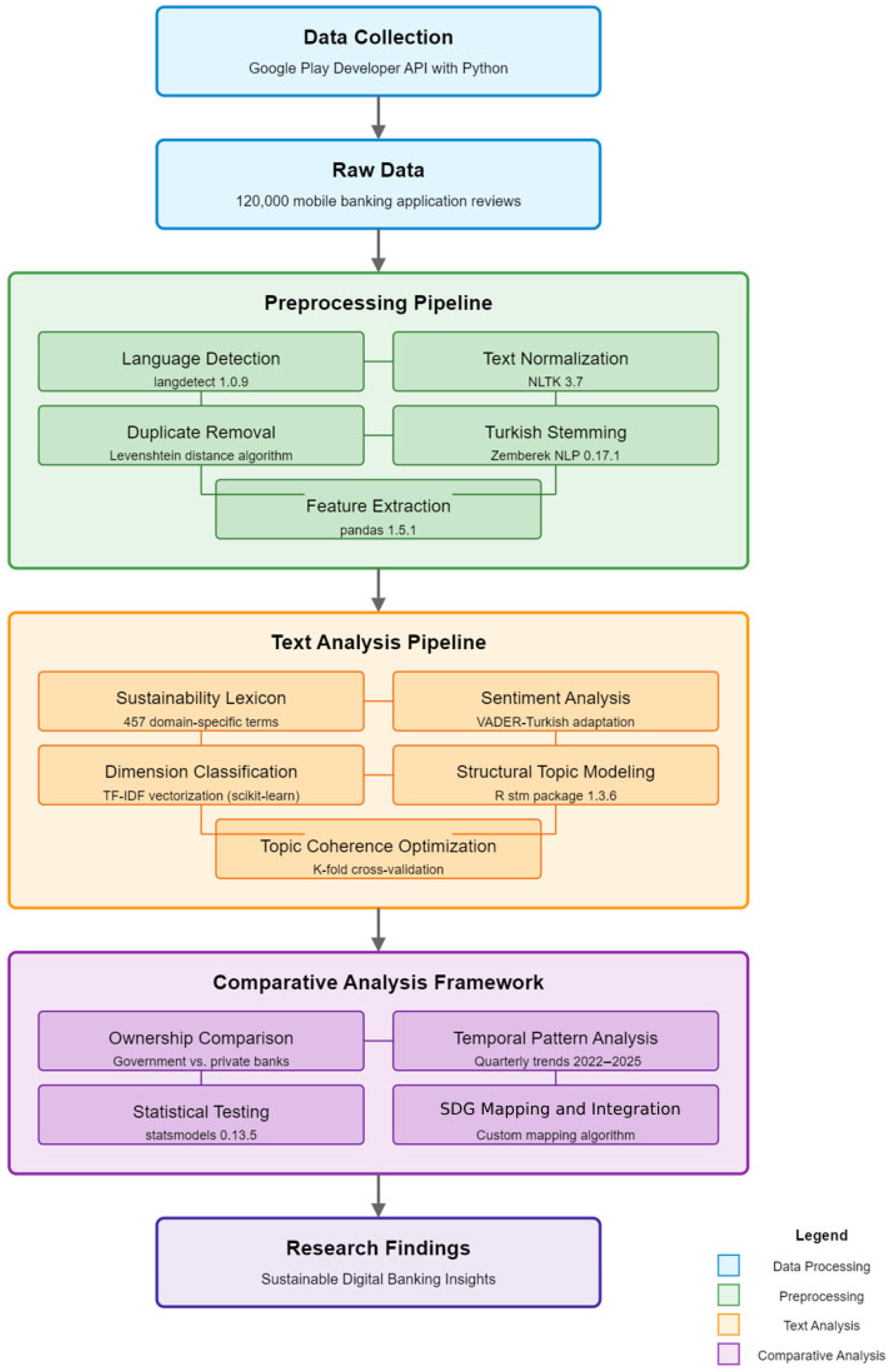

Figure 1 illustrates the comprehensive data processing framework implemented for analyzing sustainability dimensions in Turkish mobile banking applications. The pipeline begins with data collection using the Google Play Developer API, which yielded 120,000 user reviews across six major banking institutions. The preprocessing phase incorporates multiple steps, including language detection using langdetect 1.0.9, duplicate removal through Levenshtein distance algorithms, text normalization via NLTK 3.7, Turkish-specific stemming with Zemberek NLP 0.17.1, and feature extraction with pandas. The text analysis pipeline applies a custom sustainability lexicon of 457 domain-specific terms, implements dimension classification through TF-IDF vectorization, conducts sentiment analysis using VADER-Turkish adaptation, and employs structural topic modeling with R’s stm package. The comparative analysis framework enables systematic comparison between government and private banks through ownership comparison, temporal pattern analysis across 2022–2025, statistical testing via statsmodels, and custom SDG mapping. This methodological approach ensures a systematic and replicable analysis of sustainability dimensions as expressed in user-generated content, with specialized adaptations for Turkish language processing and banking sector context.

The 2022–2025 timeframe was strategically selected to capture the post-pandemic digital banking transformation period when sustainability concerns gained prominence in financial services. This period encompasses the implementation of Turkey’s Green Deal Action Plan (2022), the introduction of sustainable finance regulations (2023), and the acceleration of digital banking adoption following COVID-19 disruptions. The three-year window provides sufficient temporal depth to identify evolution patterns while maintaining contemporary relevance for current banking practices.

3.1.2. Data Sources and Accessibility

The data for this study was systematically collected from the Google Play Store through its official API between January 2022 and February 2025. All user reviews were obtained using the Google Play Developer API v3 (

https://developers.google.com/android-publisher/api-ref/rest/v3/reviews, accessed on 1 March 2025), which provides programmatic access to application reviews and ratings.

For each application, we collected the complete set of available reviews within the study timeframe, resulting in 120,000 reviews as outlined in

Table 1. The data extraction process was conducted using Python scripts with the google-play-scraper library (version 1.2.3,

https://github.com/JoMingyu/google-play-scraper, accessed on 1 March 2025), which facilitates structured access to the Google Play API.

To ensure data integrity and ethical research practices, all personally identifiable information was removed during preprocessing, and only aggregated results are presented in this study. The cleaned dataset structure includes the following fields:

3.2. Text Mining Implementation

Our text mining pipeline employed multiple algorithms optimized for Turkish language processing and sustainability theme extraction. We utilized Python 3.8 with scikit-learn 0.24.2 for TF-IDF vectorization (parameters: min_df = 5, max_df = 0.7, ngram_range = (1,3)), which identified key sustainability terminology while controlling for common banking terms. For topic modeling, we implemented the stm package (version 1.3.6) in R 4.1.0, applying the spectral initialization method with a residual dispersion parameter of 0.05 and 500 maximum EM iterations to ensure model stability. Feature selection incorporated both statistical measures (mutual information scores >0.01) and domain expertise, with sustainability terms validated through a two-stage process involving three independent raters (Krippendorff’s alpha = 0.83). We evaluated model performance using held-out likelihood, semantic coherence (average score: 0.42), and exclusivity metrics (average score: 0.71), with optimal parameters determined through grid search across 15 candidate models, ultimately selecting the model that maximized the balance between semantic coherence and exclusivity while maintaining interpretable topic boundaries.

The sustainability lexicon development followed a three-stage validation process. Stage one involved expert panel review by three sustainability researchers and two banking professionals who independently categorized 500 candidate terms across the four sustainability dimensions. Stage two employed automated validation using a holdout sample of 1000 manually coded reviews. The lexicon achieved a precision of 0.84, a recall of 0.79, and an F1-score of 0.81 in correctly identifying sustainability-related content. Stage three incorporated domain-specific banking terminology through consultation with mobile banking developers and user experience professionals. The final lexicon contains 457 terms distributed across dimensions: environmental (89 terms including “kağıtsız,” “dijital,” and “çevre”), social (156 terms including “erişim,” “toplum,” and “kapsayıcı”), governance (134 terms including “güvenlik,” “şeffaflık,” and “uyum”), and economic (78 terms including “sürdürülebilir,” “kalkınma,” and “verimli”).

Structural topic modeling implementation employed the R stm package version 1.3.6 with the following parameters: a spectral initialization method, a residual dispersion parameter of 0.05, and a maximum of 500 EM iterations. Model selection utilized a systematic evaluation across K values ranging from 15 to 35 topics, with optimal K = 25 determined through maximizing semantic coherence while maintaining topic exclusivity above 0.70.

Model validation employed multiple metrics: held-out likelihood for predictive accuracy, semantic coherence (average: 0.42) for topic interpretability, and exclusivity (average: 0.71) for topic distinctiveness. Convergence verification required a marginal likelihood change below 0.0001 across three consecutive iterations. Topical prevalence covariates included bank ownership (binary), institution identity (six-level categorical), temporal period (quarterly segments), and sentiment rating (five-point scale).

3.3. Analytical Framework Clarification

Our integrated analytical framework combined three complementary techniques adapted specifically for mobile banking sustainability analysis in the Turkish context. For structural topic modeling, we applied correlated topic model (CTM) architecture with K = 25 topics (selected after comparing models with K ranging from 15 to 35 using semantic coherence, exclusivity, and held-out likelihood) and topical prevalence covariates, including bank ownership (binary), institution identity (categorical), review time period (quarterly segments), and sentiment rating (1–5), with model convergence verified through an examination of the change in lower bound of marginal likelihood (convergence threshold: <0.0001). Our sentiment analysis approach adapted the VADER lexicon to the Turkish banking context through a semi-supervised transfer learning approach, integrating 457 domain-specific sentiment terms and applying calibration weights derived from 1000 manually coded reviews (precision: 0.84, recall: 0.79, and F1-score: 0.81), with baseline sentiment adjustment performed to account for institutional differences in sentiment distribution. Temporal pattern analysis employed a combination of linear regression modeling with quarterly time variables, LOESS smoothing (span = 0.75) to identify non-linear trends, and bootstrapped confidence intervals (1000 resamples) to determine statistical significance (p < 0.05) of observed temporal patterns, with Benjamini–Hochberg correction applied to control for multiple comparisons when assessing changes across different sustainability dimensions.

While our dataset of 120,000 reviews provides comprehensive coverage of expressed user opinions, we acknowledge the inherent selection bias in analyzing only user-generated reviews. App store reviews typically represent users with particularly positive or negative experiences who are motivated to share feedback, potentially excluding the perspectives of more neutral users or those who lack digital literacy to provide online reviews. Additionally, the analysis excludes individuals without access to mobile banking technology altogether, such as certain elderly populations, rural communities with limited connectivity, or economically disadvantaged groups. This limitation is common in digital user-generated content research but must be considered when interpreting findings about sustainability perceptions.

4. Results

4.1. Real-World Mobile Banking Applications: Case Study Analysis

To provide concrete context for our analytical framework, this section presents detailed examinations of the six Turkish mobile banking applications analyzed in this study. These applications represent three government-owned banks (Bank A, Bank B, and Bank C) and three private banks (Bank D, Bank E, and Bank F), collectively serving over 75% of Turkey’s mobile banking users. (See

Table 2).

4.1.1. Overview of Selected Mobile Banking Applications

The mobile banking applications selected for this study demonstrate distinct approaches to sustainability based on institutional ownership and historical missions.

Table 3 presents an overview of these applications, highlighting their key characteristics and sustainability orientations.

Our analysis revealed that each application embodies its institutional sustainability priorities through specific features, interface design elements, and service offerings that are directly reflected in user reviews.

4.1.2. Sustainability Features in Government-Owned Banking Applications

Government-owned banks demonstrate distinctive sustainability features aligned with their historical missions and public service mandates.

Bank A: Cultural Heritage Preservation

Bank A’s mobile application prominently integrates cultural heritage sustainability through several distinctive features:

A dedicated section for transactions related to cultural foundations (vakıf), with 2037 user mentions specifically referencing this feature. The module provides streamlined donation channels to historical preservation projects and cultural initiatives. An interactive map displaying cultural heritage sites supported by the bank, allowing users to learn about preservation efforts and direct contributions to specific locations. A specialized financing option for the restoration and preservation of historical buildings with preferential rates, mentioned in 63 user reviews as a distinctive feature.

User reviews frequently reference these cultural heritage features:

“The foundation donation feature makes it easy to contribute to our historical preservation efforts. I appreciate having all vakıf options in one place.”

(5-star review, 2023)

“I can easily track how my donations are being used for historical restoration projects through the cultural asset map.”

(4-star review, 2024)

Bank B: Agricultural Sector Development

Bank B’s application demonstrates a clear agricultural sustainability focus through specialized features.

A comprehensive module offering agricultural credit applications, subsidy tracking, and harvest schedule management, mentioned in 58 reviews as a valuable feature for rural users. Real-time tracking of agricultural commodity prices to assist farmers in making informed decisions about when to sell their produce. Localized weather forecasts and alerts specifically designed for agricultural planning, with irrigation recommendations based on precipitation patterns.

User feedback highlights the value of these agricultural-focused features:

“The farming credit application process is streamlined compared to visiting branches. Saved me days of paperwork during planting season.”

(5-star review, 2023)

“Being able to track market prices for my crops directly in the banking app helps me decide when to sell.”

(5-star review, 2024)

Bank C: Small Business and Tradesperson Support

Bank C’s application prioritizes economic sustainability through small business support:

A fast-track application system for tradesperson financing with minimal documentation requirements, mentioned positively in 284 reviews. An integrated business health monitoring system providing cash flow analysis, tax payment reminders, and financial forecasting for small enterprises. A feature connecting small businesses with potential customers in their vicinity, creating local commercial ecosystems.

User reviews demonstrate strong engagement with these features:

“The artisan financing option literally saved my workshop during the pandemic. The application process took less than a day through the app.”

(5-star review, 2022)

“The business dashboard helps me track my shop’s finances without needing an accountant for day-to-day operations.”

(4-star review, 2023)

4.1.3. Sustainability Features in Private Banking Applications

Bank D: Security and Innovation Focus

Bank D’s application emphasizes governance sustainability through advanced security features:

A sophisticated biometric verification system combining facial recognition, fingerprint scanning, and behavioral analytics, mentioned in 354 reviews as enhancing security confidence. A visual interface displaying security levels for different transaction types and personalized recommendations for improving account protection. Paperless documentation system with blockchain verification for transaction receipts and agreements.

User reviews frequently highlight security features:

“The multi-layer security gives me peace of mind. I especially appreciate the behavioral analytics that detect unusual transaction patterns.”

(5-star review, 2024)

“The security dashboard helps me understand potential vulnerabilities in my banking habits and how to address them.”

(5-star review, 2023)

Bank E: Client Experience Optimization

Bank E’s application prioritizes user-centric sustainability:

An adaptive dashboard that reconfigures based on individual usage patterns, mentioned positively in 271 reviews for enhancing accessibility. A minimalist interface design reducing cognitive load and making banking services accessible to users with varying digital literacy levels. A holistic financial health monitoring system with customized recommendations for improved financial management.

User feedback emphasizes the intuitive design:

“The interface adapts to how I actually use the app rather than forcing me to navigate through features I never use.”

(5-star review, 2023)

“The financial wellness tracker has helped me develop much better spending habits and increase my savings.”

(5-star review, 2024)

Bank F: Technology-Driven Accessibility

Bank F’s application focuses on making financial services universally accessible:

Seamless banking experience across mobile, web, wearable devices, and smart home systems, mentioned in 392 reviews as enhancing accessibility. Natural language processing allowing hands-free banking operations for users with physical limitations or multitasking needs. Optimized application performance for areas with limited internet connectivity, supporting financial inclusion in rural regions.

Users particularly value the accessibility features:

“The voice banking feature allows me to check balances and make transfers while driving safely.”

(5-star review, 2023)

“The low-bandwidth mode works even with poor connectivity in my village, unlike other banking apps that constantly crash.”

(4-star review, 2022)

4.1.4. Sustainability Dimension Mapping in Mobile Banking Features

To systematically assess how sustainability manifests across these applications, we mapped specific features to our four-dimensional sustainability framework, as illustrated in

Table 4.

Our analysis revealed that user perceptions of these features vary significantly. While government banks received higher sentiment scores for social sustainability features (2.91/5 vs. 2.75/5), private banks demonstrated stronger sentiment for economic sustainability features (3.62/5 vs. 2.66/5). This aligns with our broader finding that government and private banks prioritize different sustainability dimensions based on their institutional missions.

The analysis of sustainability mentions across government and private banks reveals significant differences in sustainability focus, as shown in

Table 5. Government-owned banks exhibit a considerably higher overall sustainability emphasis, with Bank A demonstrating the strongest sustainability orientation (31.17% of reviews mentioning sustainability aspects), followed by Bank C (25.94%) and Bank B (13.18%). In contrast, private banks show a lower sustainability focus, with Bank D (10.41%), Bank E (13.78%), and Bank F (11.30%) reflecting more moderate engagement with sustainability themes. The social sustainability dimension highlights the starkest contrast between ownership models. Bank C (10.95%) and Bank A (10.55%) significantly surpass private banks, where the highest social sustainability mention rate is just 3.33% (Bank F). This suggests that government banks place a stronger emphasis on community welfare, financial inclusion, and social impact, aligning with their broader public service mandates [

32]. Similarly, economic sustainability is notably more prevalent in government banks, particularly at Bank A (9.46%), which aligns with its institutional focus on long-term economic development and financial accessibility. In contrast, private banks exhibit minimal economic sustainability focus (Bank F: 0.14%; Bank E: 0.29%), indicating that their sustainability strategies may prioritize profitability and operational efficiency rather than broad economic development.

Governance sustainability emerges as a shared priority across both ownership types, with all banks demonstrating strong engagement in this domain (ranging from 7.49% to 11.62%). This trend aligns with global financial sector expectations regarding transparency, security, and regulatory compliance [

33]. However, environmental sustainability remains the least represented dimension in both government and private banks, with mentions ranging between 0.22% and 1.54%. The highest engagement is observed in Bank C (1.54%), suggesting a relatively stronger institutional commitment to environmentally responsible banking. These findings provide empirical evidence that government-owned banks exhibit stronger sustainability commitments, particularly in social and economic dimensions, while private banks tend to prioritize governance and operational efficiency. This divergence reinforces previous research on institutional ownership and sustainability priorities in financial institutions [

34].

The sentiment analysis of sustainability dimensions across government and private banks, as shown in

Table 6, reveals notable variations in how users perceive different aspects of sustainability. Across all dimensions, private banks tend to receive higher sentiment scores compared to government banks, suggesting a more favorable user perception of their sustainability-related features. Environmental sustainability remains the lowest-rated dimension across all institutions, with scores ranging from 1.57 (Bank C) to 2.67 (Bank D and Bank F). This indicates that users perceive environmental efforts as insufficient, particularly among government banks, where Bank C has the lowest sentiment (1.57). Given the relatively low overall engagement with environmental sustainability (as observed in

Table 4), these low sentiment scores may reflect a lack of visible environmental initiatives rather than dissatisfaction with existing efforts.

Social sustainability shows a stronger positive response, with Bank A achieving the highest sentiment score (3.59), surpassing all private banks. This suggests that Bank A’s focus on community-oriented initiatives, financial inclusion, and cultural heritage preservation resonates well with its users. Conversely, government banks overall score lower than private banks in this category, indicating potential gaps in social service delivery or user engagement strategies. Governance sustainability is the lowest-rated sustainability dimension overall, with sentiment scores ranging from 1.77 (Bank C) to 2.31 (Bank D and Bank F). This suggests that users perceive security, transparency, and regulatory compliance efforts as insufficient or lacking in effectiveness across both bank types. Given the importance of trust and data security in digital banking [

35], the low governance sentiment scores indicate a critical area for improvement.

Economic sustainability shows the highest overall sentiment, with private banks (Bank D and Bank F: 3.75) outperforming government banks (Bank A: 3.64, Bank C: 1.99). The significantly higher sentiment scores in private banks suggest that users perceive private institutions as more effective in providing financial stability, cost optimization, and economic value. While Bank A also scores high in this dimension, indicating its strong economic sustainability focus, Bank C’s low score (1.99) suggests dissatisfaction with economic accessibility or affordability of banking services. These sentiment patterns highlight clear differences in how users perceive sustainability efforts between government and private banks. Private banks generally achieve higher sentiment scores across all dimensions, particularly in economic and environmental sustainability, whereas government banks receive mixed reviews, with Bank A standing out positively in social and economic sustainability. These findings align with previous research indicating that users associate private banks with better service efficiency and financial performance, while government banks are more strongly linked to broader development goals [

34,

35].

As shown in

Table 7, institution-specific sustainability themes vary significantly across government-owned banks, reflecting their unique historical missions and mandates. Bank A exhibits the strongest sustainability focus, particularly in the cultural and foundation sector, with 2037 mentions (10.19%) related to cultural heritage and foundation activities. This high frequency suggests that users strongly associate Bank A with cultural preservation efforts and historical mission-driven initiatives, reinforcing its role in sustaining national heritage through financial support mechanisms. However, direct cultural heritage references are less frequent (63 mentions, 0.32%), indicating that while users recognize the institution’s broader cultural impact, explicit engagement with heritage-related services remains limited. For Bank B, agriculture-related mentions account for 58 reviews (0.29%), emphasizing its role in supporting the agricultural sector, rural development, and farmer financing programs. While the absolute count of mentions is relatively low, this aligns with Bank B’s historical mission of serving agricultural communities [

32]. The relatively lower percentage suggests that Bank B’s agricultural sustainability efforts may not be prominently highlighted in mobile banking experiences, or that users focus more on general banking functionalities rather than its development-oriented initiatives.

Bank C’s emphasis on small business and tradesperson support is evident from 284 mentions (1.42%), demonstrating a clear institutional association with financial accessibility for small enterprises and independent workers. This aligns with its established role in offering subsidized financial products to small and medium enterprises (SMEs), as part of broader economic sustainability objectives [

33]. The relatively higher mention rate compared to Bank B suggests that Bank C’s SME support services are more visible or actively utilized by users in digital banking interactions. These institution-specific patterns indicate that government-owned banks exhibit clear thematic differentiation in sustainability priorities, with Bank A strongly linked to cultural sustainability, Bank B to agricultural support, and Bank C to small business financing. The relatively low frequency of explicit sustainability-related mentions in user reviews suggests opportunities for these banks to enhance communication and visibility of their sustainability efforts within their digital banking platforms. These findings align with previous research emphasizing the importance of institutional mission alignment in shaping sustainable banking practices [

34].

4.2. Multi-Dimensional Sustainability Analysis Framework

4.2.1. Four-Dimensional Sustainability Classification with Institutional Context

Our framework categorizes sustainability themes along four primary dimensions, with adaptation for government versus private bank contexts:

Environmental Sustainability:

Government bank indicators: Resource conservation, environmental responsibility.

Private bank indicators: Paperless processes, digital efficiency.

Representation: Consistently low across both ownership types (0.22–1.54%), with Bank C showing the highest focus (1.54%).

Social Sustainability:

Government bank indicators: Social welfare, community development, and cultural heritage.

Private bank indicators: Accessibility, customer experience, and financial inclusion.

Representation: Substantially higher in government banks (Bank C: 10.95%; Bank A: 10.55%) compared to private banks (2.08–3.33%).

Governance Sustainability:

Government bank indicators: Public accountability and regulatory compliance.

Private bank indicators: Security protocols and data protection.

Representation: Higher in government banks (Bank A: 10.66%; Bank C: 11.62%) than private banks (7.49–10.57%).

Economic Sustainability:

Government bank indicators: National economic development, and subsidized services.

Private bank indicators: Operational efficiency and financial viability.

Representation: Dramatically higher in Bank A (9.46%) compared to other government banks (1.19–1.83%) and private banks (0.14–0.32%).

4.2.2. Comparative Sustainability Focus by Dimension and Ownership Type

As shown in

Table 8, the sustainability focus of government and private banks differs significantly across the four key dimensions: environmental, social, governance, and economic sustainability. Government-owned banks consistently demonstrate a stronger emphasis on sustainability, particularly in social and economic dimensions, while private banks tend to focus more on efficiency and governance aspects.

Both government and private banks exhibit relatively low engagement with environmental sustainability, with Bank C (1.54%) showing the highest focus among all banks. Government banks generally prioritize resource conservation, environmental responsibility, and ecological footprint reduction, whereas private banks emphasize paperless processes and digital efficiency. Despite some commitment, the overall low representation of environmental sustainability (government banks: 0.81%; private banks: 0.26%) suggests that green banking initiatives remain underdeveloped in the Turkish digital banking sector.

Government banks, particularly Bank C (10.95%) and Bank A (10.55%), exhibit significantly higher mentions of social sustainability, reflecting their strong commitment to financial inclusion, small business support, and rural/agricultural initiatives. Private banks, in contrast, focus more on customer experience, accessibility, and service personalization, resulting in lower social sustainability mentions (ranging from 2.08% to 3.33%). The stark difference in social sustainability representation (government: 7.91% vs. private: 2.70%) suggests that government banks play a more active role in societal development, aligning with their public service mandates [

33].

Governance sustainability is a high-priority dimension for both government and private banks, as it directly relates to regulatory compliance, security protocols, and risk management. Government banks place emphasis on public accountability and transparency, while private banks highlight fraud prevention, data protection, and security measures. Despite minor differences, governance sustainability is consistently strong across all institutions, with government banks averaging 10.55% and private banks 8.61%, indicating broad recognition of the importance of digital trust and compliance [

34].

The most striking contrast between government and private banks appears in the economic sustainability dimension. Bank A stands out with 9.46% representation, reflecting its commitment to regional development, infrastructure investment, and subsidized financial services. In contrast, private banks prioritize profitability, operational efficiency, and long-term financial viability, but these topics receive minimal direct mentions (0.14% to 0.32%). The significantly higher economic sustainability focus in government banks (4.16%) versus private banks (0.25%) suggests that public institutions are more actively engaged in supporting national economic growth and financial accessibility.

Key Takeaways

Government banks lead in social and economic sustainability, reinforcing their role in public service, financial inclusion, and national development.

Private banks prioritize governance sustainability, focusing on security, compliance, and data protection to maintain customer trust.

Environmental sustainability remains a low priority across all banks, highlighting a potential gap in digital green banking strategies.

Economic sustainability is a major differentiator, with government banks significantly outperforming private banks in fostering national economic stability and growth.

These findings align with previous research indicating that government banks adopt a more mission-driven approach to sustainability, whereas private banks focus on operational and technological efficiency [

33,

35]. Strengthening cross-sector collaboration and integrating more explicit sustainability strategies in digital banking services could enhance sustainability outcomes across the industry.

As shown in

Table 9, government and private banks exhibit distinct sustainability focus areas based on their institutional missions. Government-owned banks demonstrate a strong emphasis on social and economic sustainability, while private banks prioritize technological efficiency, customer experience, and security measures.

Government Banks: Mission-Driven Sustainability

Bank A has the strongest sustainability emphasis (10.19%), primarily focused on cultural heritage preservation. The high volume of foundation (vakıf) references, cultural asset management, and historical preservation mentions highlights the bank’s unique role in sustaining cultural and historical projects through financial initiatives. This aligns with Turkey’s broader efforts to integrate financial services with national heritage conservation [

32].

Bank B prioritizes agricultural sector development, as indicated by mentions related to farmer support systems, rural financing, and agricultural credit (0.29%). This focus reflects Bank B’s historical role in providing financial services to farmers and rural communities, reinforcing its contribution to rural economic sustainability.

Bank C stands out for its commitment to small business and tradesperson support (1.42%), with high engagement in artisan financing, small business loans, and local market development. These findings suggest that Bank C plays a pivotal role in empowering SMEs and independent entrepreneurs, contributing to national economic resilience [

34].

Private Banks: Technology and User-Centric Sustainability

Bank F exhibits a clear focus on technology-driven accessibility (0.34%), with significant mentions of digital innovation, technical performance, and system optimization. This aligns with global trends in digital banking, where private institutions leverage technology to enhance user experience and operational efficiency [

33].

Bank E emphasizes client experience optimization (0.32%), with key mentions related to interface usability, customer journey, and service personalization. This suggests that Bank E prioritizes user-centric banking services, making sustainability efforts more accessible and practical for end-users.

Bank D leads in security and reliability focus (0.42%), highlighting strong engagement in data protection, transaction security, and system integrity. Given the increasing importance of cybersecurity in digital banking, Bank D’s sustainability approach reflects a commitment to governance and risk management practices.

Key Takeaways

Government banks prioritize development-oriented sustainability, focusing on cultural preservation (Bank A), agricultural support (Bank B), and SME financing (Bank C).

Private banks emphasize technological sustainability, with an orientation toward digital innovation (Bank F), user experience (Bank E), and cybersecurity (Bank D).

The lower representation percentages in private banks suggest that sustainability may be more embedded within operational improvements rather than explicitly communicated in user interactions.

Cross-sector collaboration could enhance sustainability outcomes, with government banks integrating technological advancements and private banks adopting social impact initiatives.

These insights reinforce existing research indicating that government banks are more aligned with public service and development-oriented sustainability, while private banks focus on efficiency, security, and user experience [

33,

34].

4.3. Text Mining and Analytical Process

Our methodological approach applies multiple text mining techniques tailored to capture ownership-specific sustainability themes:

4.3.1. Enhanced Keyword Analysis with Institutional Context

We developed comprehensive sustainability lexicons in Turkish, with specialized vocabularies for government and private bank contexts:

4.3.2. Structural Topic Modeling with Expanded Covariates

We implemented structural topic modeling (STM) with multiple covariates to capture institutional differences:

Ownership classification (government vs. private);

Specific institutional identity (six distinct banks);

Historical period (quarterly time segments);

Sentiment rating (1–5 scale);

Review length (short/medium/long categories).

This multi-covariate approach enabled the identification of complex interactions between institutional identity, time period, and sustainability focus.

4.3.3. Sentiment Analysis with Institutional Calibration

Our sentiment analysis approach was calibrated to account for institutional differences:

Baseline Sentiment Adjustment:

Correction for institutional sentiment bias (e.g., Bank C’s generally lower baseline sentiment).

Normalized sentiment scoring within institutional contexts.

Dimension-Specific Sentiment Analysis:

Temporal Sentiment Tracking:

4.3.4. Temporal Pattern Analysis with Regulatory Context

Our temporal analysis framework incorporated regulatory and policy developments:

Banking regulation changes;

National economic policy shifts;

Institutional transformation periods;

Mobile banking technology evolution.

This context-sensitive temporal analysis enabled the identification of sustainability theme evolution in response to external factors.

4.4. Comparative Ownership Analysis Framework

To systematically evaluate differences between government and private banks, we developed a specialized comparative framework.

4.4.1. Institutional Mission Analysis

This component examines how different institutional missions influence sustainability priorities:

Our analysis revealed that government banks demonstrate substantially stronger public service orientation, with Bank A showing unique emphasis on cultural/foundation aspects (2037 “vakıf” mentions).

4.4.2. Cross-Sectional Sustainability Profile Comparison

As shown in

Table 10, government-owned banks demonstrate a substantially higher sustainability coverage ratio (23.43%) compared to private banks (11.83%), reinforcing their stronger commitment to sustainable banking practices. Across the four key sustainability dimensions—environmental, social, governance, and economic—government banks consistently outperform private banks, particularly in social and economic sustainability. Environmental sustainability remains the least prominent dimension across both bank types, with government banks averaging 0.81% and private banks 0.26%. Bank C leads among all institutions (1.54%), while Bank E exhibits the lowest engagement (0.22%). These findings suggest that both government and private banks have yet to fully integrate environmental sustainability into their digital banking strategies, aligning with previous studies highlighting the financial sector’s limited focus on green initiatives [

33]. Government banks place significantly greater emphasis on social sustainability (7.91%) than private banks (2.70%), with Bank C (10.95%) and Bank A (10.55%) leading in this area. This aligns with their public service missions, which prioritize financial inclusion, rural support, and social welfare initiatives. In contrast, private banks focus more on customer experience and accessibility, resulting in lower engagement with broader social sustainability efforts [

34].

Governance sustainability is the highest-ranked sustainability dimension across all banks, reflecting industry-wide efforts to ensure transparency, compliance, and data security. While government banks lead slightly (10.55% vs. 8.61%), private banks demonstrate strong engagement in governance-related topics, with Bank E achieving the highest mention rate (10.57%). This suggests that private banks focus more on security protocols and fraud prevention, whereas government banks emphasize public accountability and regulatory compliance [

35]. Economic sustainability presents the most pronounced difference between government and private banks, with government institutions averaging 4.16% compared to just 0.25% for private banks. Bank A leads significantly (9.46%), aligning with its economic development mission, whereas Bank F (0.14%) and Bank E (0.29%) reflect minimal focus on economic sustainability. This discrepancy suggests that government banks actively engage in subsidized services, low-interest financing, and regional development initiatives, whereas private banks prioritize profitability and operational efficiency [

31].

As shown in

Table 11, sentiment scores across sustainability dimensions indicate notable differences between government and private banks. Overall, private banks receive higher sentiment scores across all dimensions except social sustainability, suggesting a more favorable user perception of their sustainability-related efforts. Private banks achieve a higher average sentiment (2.53) compared to government banks (2.15), with Bank D and Bank F leading at 2.67. The lowest sentiment score is observed in Bank C (1.57), indicating that users perceive government banks as less effective in implementing environmentally sustainable banking practices. This aligns with

Table 7’s findings, where environmental sustainability has the lowest representation across all banks.

Government banks receive a slightly higher average sentiment score (2.91) compared to private banks (2.75), with Bank A scoring the highest (3.59). This suggests that users recognize and appreciate the public service, financial inclusion, and social support initiatives of government banks. However, Bank C (2.52) and Bank B (2.61) have lower scores, indicating potential gaps in delivering effective social sustainability services. Governance sustainability sentiment scores are relatively low across both bank types, with government banks averaging 2.00 and private banks 2.22. Bank C receives the lowest score (1.77), reflecting user dissatisfaction with governance-related aspects such as compliance, transparency, or digital security. Bank D and Bank F (2.31) achieve the highest scores, suggesting that private banks may be perceived as more effective in ensuring security, regulatory compliance, and data protection.

The largest sentiment gap (+0.96) exists in economic sustainability, where private banks significantly outperform government banks (3.62 vs. 2.66). Bank D and Bank F (3.75) receive the highest sentiment scores, suggesting that users view private banks as more effective in offering financial stability, cost efficiency, and economic value. In contrast, Bank C (1.99) has the lowest score, which may indicate user dissatisfaction with the affordability, accessibility, or reliability of economic sustainability services in government banks. Sentiment variability measures the range of sentiment scores across sustainability dimensions. Government banks exhibit greater variation (0.99) compared to private banks (1.40), with Bank A showing the highest variability (1.45) and Bank C the most inconsistent performance (0.95). In contrast, private banks display more uniform sentiment patterns, suggesting a more consistent sustainability experience across different dimensions.

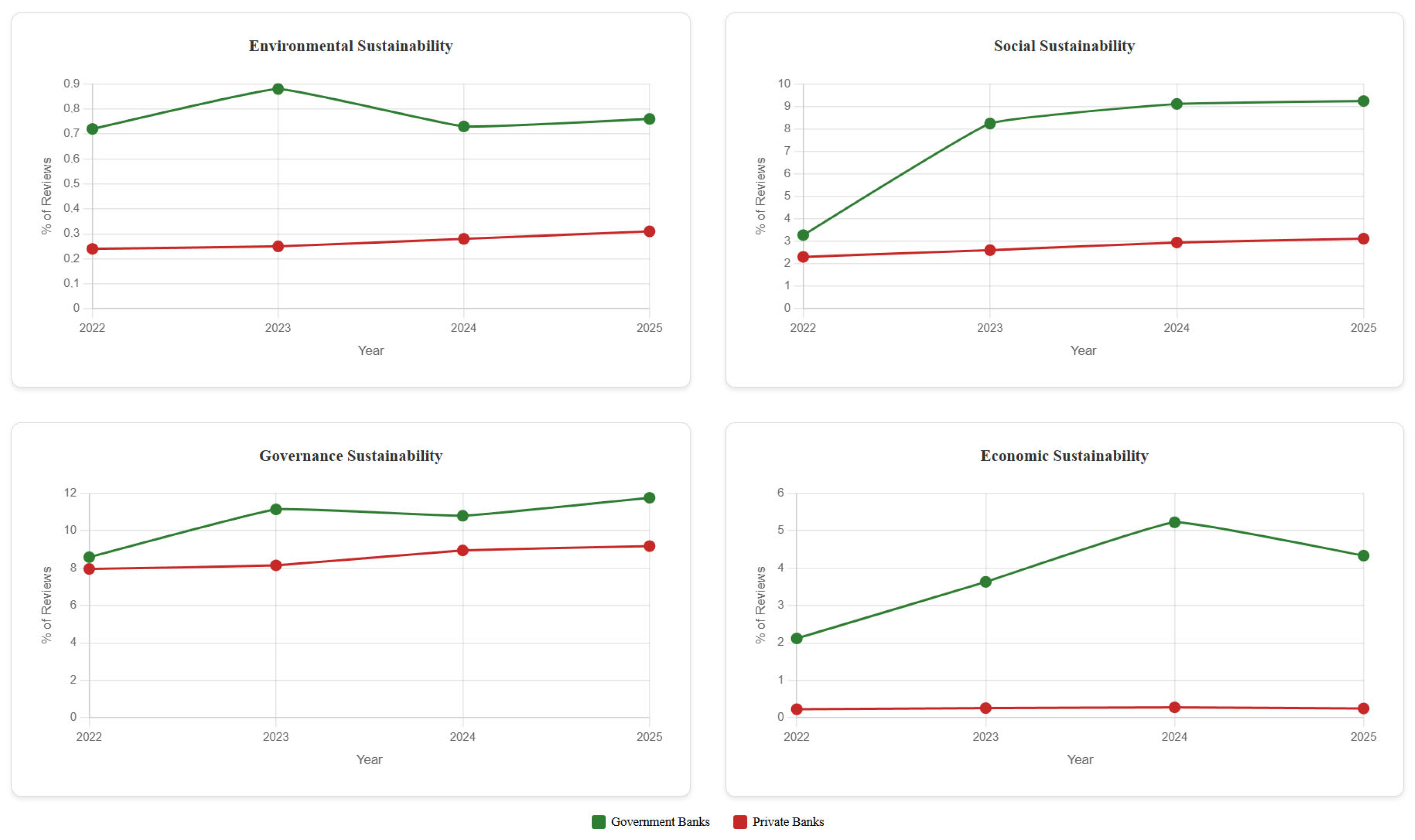

As shown in

Table 11, sustainability mentions across government and private banks have evolved significantly over time, with substantial growth in social and economic sustainability mentions. While government banks consistently exhibit higher sustainability engagement, private banks have shown notable increases in environmental and social sustainability over the years. Environmental mentions in government banks increased by 5.6%, while private banks experienced a sharper rise of 29.2%. Despite this, government banks still maintain a higher overall representation (0.76% in 2025 vs. 0.31% for private banks). The steady but slow increase in environmental sustainability mentions suggests limited but growing awareness of digital green banking practices. The faster growth rate in private banks may reflect their stronger adoption of digital efficiency measures such as paperless banking and carbon footprint reduction initiatives.

The most significant growth is observed in social sustainability, particularly in government banks (+181.7%). This surge is likely driven by an increased focus on financial inclusion, rural development, and small business support. While private banks also experienced growth (+35.1%), they remain far behind government banks (3.12% in 2025 vs. 9.24%), reflecting their focus on customer experience over broader social welfare initiatives. These trends indicate that government banks are playing a central role in integrating social responsibility into financial services. Governance mentions increased by 37.0% in government banks and 15.3% in private banks, reflecting industry-wide efforts to enhance regulatory compliance, cybersecurity, and financial transparency. By 2025, governance sustainability remains the most dominant sustainability category across both ownership types, with government banks reaching 11.75% and private banks 9.17%. The slower growth rate in private banks suggests that many governance-related measures (e.g., risk management and fraud prevention) were already well-established in earlier years, whereas government banks have progressively strengthened their compliance and accountability mechanisms. Economic sustainability mentions have more than doubled in government banks (+104.2%), reaching 4.33% in 2025. This significant increase suggests an intensified commitment to economic development, financial accessibility, and counter-cyclical lending initiatives. Meanwhile, private banks showed only an 8.7% growth rate, maintaining a consistently low representation (0.25% in 2025). The stark contrast suggests that government banks continue to drive national economic sustainability, while private banks prioritize profitability over broader financial accessibility efforts [

31]. (See

Table 12).

As shown in

Table 13, government and private banks adopt distinct sustainability approaches, shaped by their respective policy responsiveness, technological adoption, institutional identity, and market factors. These differences underscore the strategic priorities that drive sustainability initiatives in the banking sector. Government banks exhibit high policy responsiveness, as their strategies are directly aligned with national economic policies and ministerial priorities. Their sustainability initiatives often focus on development plans, public infrastructure investments, and financial inclusion, reinforcing their role in state-led economic growth [

31]. In contrast, private banks demonstrate low to moderate policy responsiveness, mainly adhering to regulatory compliance rather than actively shaping financial policy. Their sustainability efforts are market-driven, aligning more with profit-maximization and regulatory adherence than broader societal goals [

33].

Private banks exhibit a high degree of technological responsiveness, focusing on rapid digital adoption, customer-centric innovation, and competitive differentiation. This approach is reflected in their investment in mobile banking, AI-driven financial services, and blockchain security measures. Conversely, government banks take a more conservative approach to technology adoption, prioritizing process-oriented implementation and standardized solutions. This slower pace of digital transformation may reflect their legacy infrastructure, regulatory constraints, and focus on broad accessibility rather than cutting-edge innovation [

35]. Government banks exhibit a very strong institutional identity, with a sustainability focus shaped by historical mandates and national development objectives. Their commitment to financial inclusion, economic sustainability, and public service orientation makes them distinct from private banks, which align their sustainability focus with brand positioning and market competitiveness. Private banks, in contrast, maintain a moderate institutional identity, often adopting a homogeneous approach to sustainability that aligns with their profit-driven strategies rather than mission-driven mandates [

34]. Market factors play a critical role in shaping sustainability focus, with government banks operating in a low to moderate competitive environment. Their captive customer base, subsidized financial services, and public mandates reduce direct market pressure, allowing them to focus on long-term development-oriented sustainability rather than short-term profitability. In contrast, private banks operate under intense competitive pressure, where customer retention, profitability, and market share objectives drive their sustainability initiatives. This highly competitive landscape compels private banks to prioritize efficiency, customer experience, and innovation to differentiate themselves from rivals [

33].

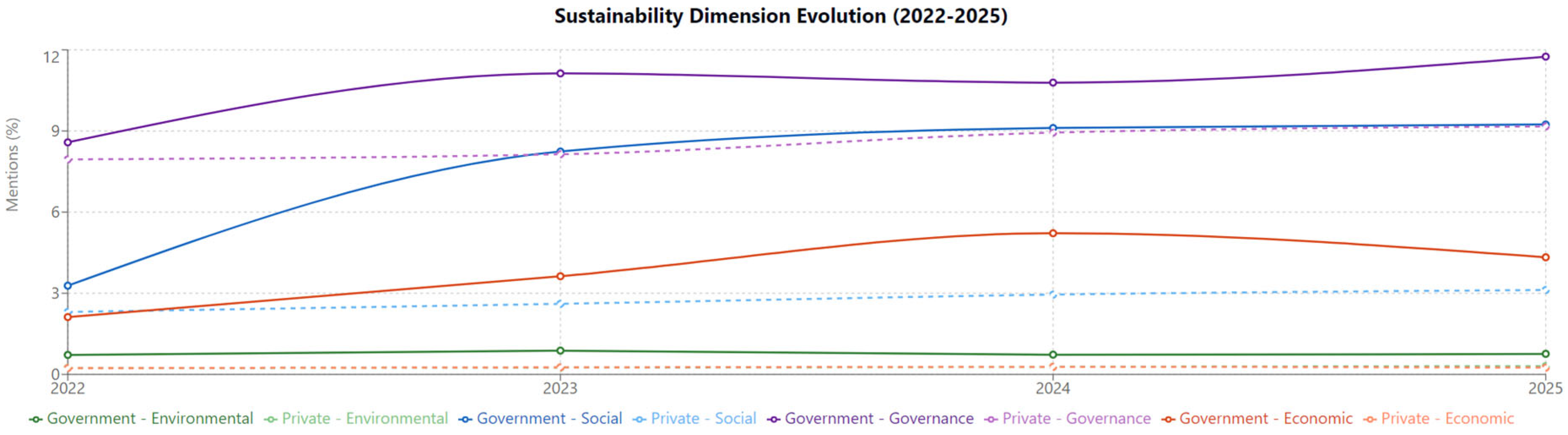

Figure 2 illustrates the temporal evolution of sustainability mentions in bank reviews from 2022 to 2025, highlighting differences in sustainability focus between government and private banks across four key dimensions: environmental, social, governance, and economic sustainability. Governance-related mentions show the highest representation, with government banks maintaining a steady upward trend, reaching nearly 12% by 2025. Private banks exhibit a slower but consistent increase, reflecting ongoing efforts in regulatory compliance, risk management, and financial transparency. This aligns with prior research indicating that both government and private banks prioritize governance-related sustainability due to regulatory pressures and cybersecurity risks [

35]. Government banks show a sharp rise in social sustainability mentions, growing from around 3% in 2022 to nearly 9% by 2025. This suggests an increased emphasis on financial inclusion, small business support, and community engagement. Private banks, however, show only a marginal increase, indicating that social sustainability remains a lower priority in market-driven financial strategies. Government banks experience a gradual increase in economic sustainability mentions, peaking in 2024, followed by a slight decline in 2025. This fluctuation may reflect shifts in policy focus, economic downturns, or changing financial accessibility strategies. Private banks maintain consistently low economic sustainability mentions, reinforcing their focus on profitability rather than national economic development [

33]. Both government and private banks exhibit minimal engagement with environmental sustainability, with little to no growth over time. Government banks focus on resource conservation and climate resilience, while private banks emphasize digital efficiency and paperless banking. The lack of significant upward trends suggests that green banking initiatives remain underdeveloped in the financial sector.

4.5. Integration with Sustainability Frameworks

To contextualize findings within broader sustainability discourse, we mapped identified themes to established frameworks:

SDG Alignment Assessment with Institutional Context

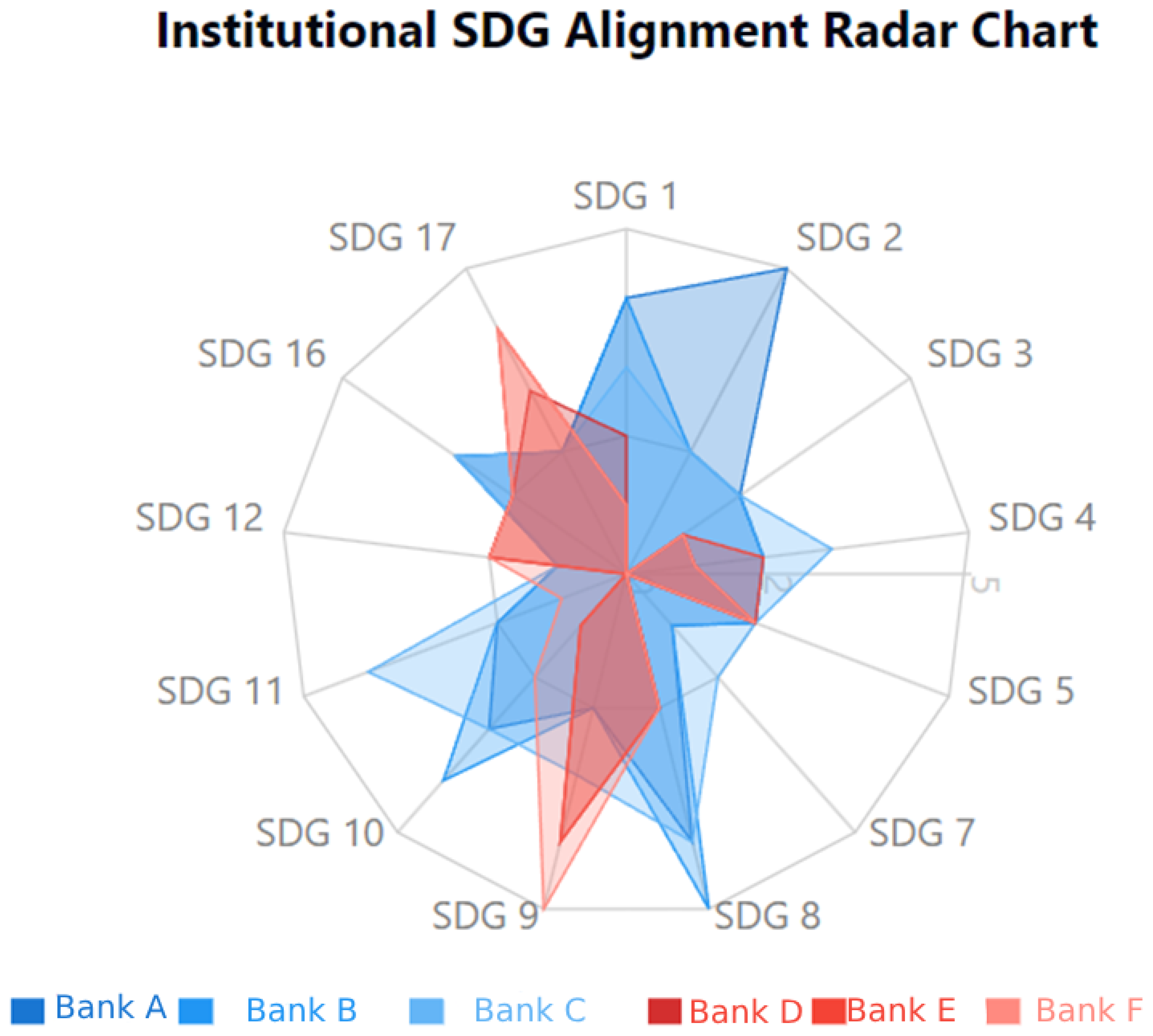

As shown in

Table 14, government and private banks demonstrate distinct sustainability priorities in their alignment with the United Nations Sustainable Development Goals (SDGs). Government banks align more strongly with economic development, poverty reduction, and social welfare-related SDGs, while private banks focus more on innovation, industry, and partnerships.

Strong Government Bank Focus on Social and Economic SDGs

SDG 1: No Poverty and SDG 8: Decent Work and Economic Growth receive strong alignment from government banks, particularly Bank C and Bank B, reflecting their commitment to financial inclusion, SME support, and employment-driven lending programs [

31].

SDG 2: Zero Hunger is exclusively emphasized by Bank B, reinforcing its historical mission of supporting agricultural sustainability and rural development. Private banks, in contrast, show no alignment with this SDG.

SDG 10: Reduced Inequalities is another key focus for government banks, with Bank C leading in financial accessibility and social equity. Private banks show only minimal engagement, aligning with research suggesting that state-owned institutions play a stronger role in reducing financial disparities [

34].

SDG 11: Sustainable Cities and Communities receives its strongest alignment from Bank A, aligning with its cultural preservation initiatives and investments in urban infrastructure development.

Private Banks Prioritize Innovation, Industry, and Global Partnerships

SDG 9: Industry, Innovation, and Infrastructure exhibits stronger alignment with private banks, particularly Bank F, which shows very strong alignment. This suggests a focus on technology-driven financial services and infrastructure investment, an area where private institutions often lead due to competitive market pressures [

35].