Abstract

This study examines the effects of the International Maritime Organization’s (IMO) market-based measures, with a particular focus on the greenhouse gas (GHG) levy and on the financial and operational performance of Korean shipping companies. The analysis estimates that these companies, which play a vital role in global trade, consume approximately 9211 kilotons of fuel annually and emit 28.5 million tons of carbon dioxide. Under the lowest proposed carbon tax scenario, the financial burden on these companies is estimated at approximately KRW 1.07 trillion, resulting in an 8.8% reduction in net profit, a 2.4% decrease in return on equity (ROE), and a 1.1% decline in return on assets (ROA). Conversely, under the highest carbon tax scenario, costs rise to KRW 4.89 trillion, leading to a significant 40.2% decrease in net profit, thereby posing a serious threat to the financial stability and competitiveness of these firms. These findings underscore the urgent need for strategic policy interventions to mitigate the financial impact of carbon taxation while promoting both environmental sustainability and economic resilience in the maritime sector.

1. Introduction

As global efforts to combat climate change intensify, the shipping industry is increasingly subject to a growing array of environmental regulations and economic instruments. In particular, the ambitious greenhouse gas (GHG) reduction targets established by the International Maritime Organization (IMO) and the European Union (EU) have introduced substantial uncertainty regarding the future trajectory of the sector. At its 80th session, the Marine Environment Protection Committee (MEPC) of the IMO adopted a target of achieving net-zero GHG emissions from international shipping by 2050. To meet this objective, the IMO is currently deliberating a range of regulatory measures. These include short-term instruments such as the Energy Efficiency Design Index (EEDI), Energy Efficiency Existing Ship Index (EEXI), and Carbon Intensity Indicator (CII), alongside medium-term measures such as a GHG levy system, an emissions trading system, and a GHG fuel standard.

In parallel, comprehensive impact assessments are being conducted through scenario-based modeling frameworks. At MEPC 80, seven combined policy scenarios were formulated, integrating both technical and economic elements. The committee resolved to evaluate the potential impacts of each scenario, including the GHG fuel standard, flexible mechanisms, and the GHG levy. These measures are expected to play a pivotal role in reducing GHG emissions from the maritime sector and in facilitating the industry’s transition to sustainable fuels (MEPC 80, 2023) [1].

In response to these international environmental mandates, the Republic of Korea has implemented various support mechanisms for the supply of eco-friendly vessels, as well as educational programs aimed at industry compliance. Korean shipping companies have taken steps to align with regulatory demands, primarily by installing exhaust gas cleaning systems (scrubbers) and adopting liquefied natural gas (LNG)-powered vessels. Nevertheless, these adaptations are largely short-term in nature. As such, the forthcoming introduction of market-based measures (MBMs), such as carbon taxes or emissions trading schemes, is anticipated to substantially increase the financial burden borne by shipping companies.

In particular, the imposition of a carbon tax is expected to elevate operating costs, compress profit margins, and require additional capital expenditures for carbon mitigation technologies. It is thus imperative to accurately estimate the carbon emissions of Korean shipping companies and to empirically assess the financial burdens that may arise from carbon taxation. This will enable proactive strategic planning in the face of increasingly stringent international GHG regulations.

Against this backdrop, the present study aims to investigate the implications of carbon taxation for Korean shipping firms. The first objective is to estimate vessel-level carbon emissions and quantify the expected cost burden arising from carbon taxes. The second objective is to evaluate the financial implications of these costs on firm-level financial stability, utilizing the Merton structural credit risk model. The Merton model provides a robust framework for estimating the probability of default based on a firm’s asset valuation and capital structure, thereby enabling a comprehensive financial risk assessment under policy uncertainty.

This study pursues three primary contributions. First, it provides practical guidance for shipping company management by quantifying the financial burden imposed by carbon taxes. Second, it enhances understanding of the macroeconomic and microeconomic consequences of carbon pricing by applying the Merton model to assess corporate financial stability under various taxation scenarios. Third, in the absence of an existing systematic methodology for evaluating the impact of carbon taxation on the Korean shipping sector, this study establishes a novel analytical framework for both academic inquiry and policy formulation.

The remainder of this paper is structured as follows. Section 2 presents a critical review of the literature and identifies the unique contributions of this research. Section 3 provides estimates of fuel consumption and carbon emissions from Korean shipping firms. Section 4 analyzes the financial implications of a carbon tax, focusing on the cost burden and its effect on financial structure. Section 5 concludes with key findings and policy implications.

2. Literature Review

The introduction of a carbon tax has emerged as a central theme in the discourse on decarbonizing the maritime transport sector. A substantial body of literature has examined the economic, environmental, and policy implications of carbon pricing in shipping, particularly in the context of international climate commitments and evolving regulatory frameworks.

Carbon taxation is widely regarded as an effective MBM for reducing GHG emissions from the shipping industry. Psaraftis and Kontovas (2020) [2] argue that a carbon tax creates incentives for shipping firms to adopt low-carbon fuels and more energy-efficient technologies. Mundaca et al. (2013) [3] further emphasize the role of carbon pricing in reshaping the cost structure of fossil-based marine fuels, thereby encouraging emission mitigation. Similarly, Lin and Li (2011) [4] underscore the efficacy of market-based instruments, including carbon taxes, in reducing maritime emissions and enhancing air quality.

Despite these environmental benefits, several studies highlight the considerable economic burden carbon taxation may impose on the shipping sector. According to the World Bank (2021) [5], the imposition of a carbon tax could generate tens of billions of dollars in additional annual costs, which are likely to be passed on to end-users through increased freight rates and commodity prices. Wu, Wen, and Zou (2022) [6] provide empirical evidence from China’s dry bulk market, showing that a carbon tax could lead to a 10–30% increase in freight rates and a 1–4% rise in commodity prices, thereby raising concerns over cost pass-through and its broader economic implications.

To examine these impacts more rigorously, various studies have employed mathematical modeling and optimization frameworks. Bakkehaug et al. (2021) [7] and Yu (2022) [8] utilize stochastic programming to explore fleet investment decisions under carbon price uncertainty, while Meng and Wang (2019) [9] adopt a chance-constrained optimization model to simulate compliance strategies. Zhu, Chen, and Kristal (2020) [10] integrate stochastic and perfect information models to evaluate the effect of carbon tax uncertainty on liner chartering decisions. Their results reveal that heightened carbon price risks may incentivize fleet expansion, highlighting the trade-offs between environmental compliance and financial sustainability.

At the global level, Pereda et al. (2023) [11] employ a computable general equilibrium (CGE) model based on the Global Trade Analysis Project (GTAP) to simulate the economy-wide effects of carbon taxes, incorporating transport substitution dynamics and vessel-level cost structures. Their findings indicate that while carbon taxes of USD 50–100 per ton of CO2 achieve moderate emissions reductions, they also result in slight contractions in global GDP and trade. The authors stress the importance of complementary instruments—such as fuel standards and energy-efficiency mandates—to augment the effectiveness of carbon pricing and mitigate distributional regressivity.

In contrast, literature focusing on Korea’s maritime sector remains relatively limited. Park, Han, and Kim (2021) [12] analyze the financial burden associated with the IMO’s sulfur oxide regulations, and Han and Kim (2022) [13] examine the decarbonization strategies of Korean shipping firms under GHG mandates. However, these studies do not directly assess the financial risk associated with carbon taxation, nor do they explore firm-level vulnerabilities under differentiated policy scenarios.

From the reviewed literature, three insights are especially salient. First, while carbon taxes are environmentally effective, their economic repercussions require careful calibration. Second, most studies focus on macroeconomic or market-level effects, offering limited attention to micro-level financial exposure. Third, there exists a significant research gap concerning the credit risk implications of carbon taxation, particularly for publicly listed shipping firms.

To address this gap, recent advances in climate finance literature suggest the utility of the Merton structural model as a tool for evaluating firm-level default risk under transition shocks. Originally developed to estimate the probability of corporate default based on a firm’s asset value and capital structure, the Merton model has been adapted to assess the financial resilience of firms and financial institutions exposed to climate policy risks, including carbon taxation (Battiston et al., 2017 [14]; Reinders et al., 2020 [15]; Naim & Condamin, 2021 [16]; Capasso, Gianfrate, and Spinelli, 2020 [17]).

Capasso, Gianfrate, and Spinelli (2022) [17] empirically analyze the relationship between carbon emissions and creditworthiness, demonstrating a negative correlation between a firm’s carbon intensity and its distance to default. Their findings suggest that credit markets are increasingly pricing climate risk, with implications for the valuation of loans and bonds. Reinders et al. (2020) [15] simulate the impact of carbon tax scenarios on bank asset values using a Merton-based contingent claims model calibrated to Dutch financial institutions. Their simulations show that carbon taxes of EUR 100–200 per ton could erode bank assets by 4–63% of core capital, depending on the policy design and exposure levels.

In parallel, institutions such as the Bank of Korea (2021) [18] have recognized climate-related transition and physical risks as systemic stressors to the financial system. The Bank recommends forward-looking modeling techniques, including the Merton model, for climate risk stress testing and regulatory assessment.

Despite its extensive use in finance and climate policy, the Merton model has not yet been applied to the maritime transport sector. Existing studies on carbon taxation in shipping have yet to incorporate firm-level credit risk assessment, particularly under capital-intensive transition scenarios. This study addresses this important gap by applying the Merton model to publicly listed Korean shipping firms in order to estimate default probabilities under varying carbon tax scenarios.

By integrating carbon pricing analysis with structural credit risk modeling, this research introduces a novel analytical framework for evaluating financial resilience in carbon-constrained shipping environments. Moreover, by focusing on Korea’s uniquely structured and policy-sensitive maritime sector, this study provides context-specific insights that are directly relevant for both corporate risk management and national regulatory strategy.

The academic contributions of this study are threefold. First, it bridges the gap between environmental economics and financial risk analysis by applying the Merton framework to a high-emissions industrial sector. Second, it brings firm-level credit risk modeling into maritime decarbonization research, enriching the microeconomic analysis of climate policy. Third, it contributes to the emerging field of climate-related financial disclosures and scenario-based stress testing by demonstrating the relevance of structural models for transition risk in the shipping industry.

In sum, this study offers both methodological innovation and empirical insights to support the development of sustainable and financially resilient pathways for the global maritime sector in the era of climate regulation.

3. Estimation of Fuel Consumption and Carbon Emissions of Korean Shipping Companies’ Vessels

3.1. Analysis Method

Building on prior assessments of sector-wide decarbonization trends, the IMO (2020) [19] provides a comprehensive annual survey of global shipping activity, collecting data on total time at sea, distance traveled, average operating speed, and other key operational indicators. These data form the basis for estimating fuel consumption and carbon emissions, offering critical insights into the environmental performance of maritime transport. The most recent estimates cover GHG emissions from 2012 to 2018 and include a retrospective benchmark for carbon intensity in 2008. In addition, forward-looking projections extend to 2050, with particular emphasis on carbon dioxide (CO2) emissions, which constitute the primary GHG emitted by ships.

The IMO’s scope includes both domestic and international vessels with a gross tonnage (GT) of 100 or more, presenting GHG emissions in total as well as disaggregated by vessel type and size class. The inventory covers carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6), along with other relevant pollutants such as nitrogen oxides (NOx), non-methane volatile organic compounds (NMVOC), carbon monoxide (CO), particulate matter (PM), sulfur oxides (SOx), and black carbon (BC).

In line with past IMO GHG studies, a bottom-up methodology is employed using automatic identification system (AIS) data that capture ship-level operational activities. This approach enables the estimation of hourly fuel consumption and emissions per vessel per year, based on a detailed operational database. Furthermore, AIS-based voyage tracking allows for the differentiation between international and domestic voyages and enables more accurate apportionment of emissions accordingly. The bottom-up method is consistent with Intergovernmental Panel on Climate Change (IPCC) guidelines, enhancing the credibility and precision of the resulting fuel use and GHG estimates.

3.1.1. Fuel Consumption Estimation Method

Accordingly, in the present study, we adopt a bottom-up methodology that has been consistently utilized in previous IMO GHG studies to estimate fuel consumption. Specifically, the hourly fuel consumption FCi of ships—attributable to the main engine, auxiliary engine, and boiler—is estimated using the same technical approach outlined as follows:

In Equation (1), Wi represents the hourly power demand of each system—the main engine, auxiliary engine, and boiler—while SFCi denotes the specific fuel consumption rate for each respective system.

The fourth IMO GHG study presents comprehensive findings on fuel consumption and emissions from the global fleet for the year 2018. It provides detailed data on average fuel consumption by ship type and size, which forms the basis for firm-level GHG analysis (IMO, 2020) [17]. The Appendix of this study builds upon these results and reports the average annual fuel consumption (in kilotons) by engine category—main engine, auxiliary engine, and boiler.

Furthermore, based on the “Detailed results for 2018 using the bottom-up method” provided by IMO (2020) [17], the operational characteristics of Korean shipping companies, extracted from the World Fleet Register (WFR), are organized according to ship type, ship size, gross tonnage (GT), deadweight tonnage (DWT), cubic capacity (CU M), shipowner, operator, scrubber installation status, main engine fuel type, and operational speed. Using this classification, the average annual fuel consumption of 1783 ships is estimated by engine type. This granular categorization enables a more accurate assessment of fuel use, which serves as the empirical foundation for the subsequent credit risk estimation under carbon pricing scenarios.

3.1.2. Carbon Emission Estimation Method

The fourth International Maritime Organization (IMO) greenhouse gas (GHG) study presents two methods for calculating hourly GHG emissions from each shipboard system, namely the main engine, auxiliary engine, and boiler. These methods include the energy-based emission estimation method and the fuel-based emission estimation method. The latter allows for the quantification of pollutants based on the specific characteristics of the fuel and engine types employed. In the present study, the fuel-based emission estimation method is adopted.

Under this method, the emission of each pollutant (EMi) is computed by multiplying the hourly fuel consumption (FCi) by the corresponding fuel-based emission factor (EFf), as shown in Equation (2). The result (EMi) is expressed in grams of pollutant per gram of fuel, as follows:

This approach enables the estimation of pollutants such as carbon dioxide (CO2), sulfur oxides (SOx), and black carbon (BC) for marine diesel engines. While engines powered by liquefied natural gas (LNG), steam turbines, and gas turbines only have energy-based emission factors for BC, these can be converted into fuel-based factors by applying assumptions about specific fuel consumption.

The IMO provides emission factor guidelines through the Energy Efficiency Design Index (EEDI), which specifies mass-based CO2 emission factors by fuel type. According to the 2018 EEDI guidelines, calculating EFf for CO2 requires classifying the primary engine fuel type in accordance with five predefined categories: heavy fuel oil (HFO), marine diesel oil (MDO), LNG, methanol, and low-sulfur heavy fuel oil (LSHFO 1.0%) [19]. MDO is often used interchangeably with marine gas oil (MGO), while LSHFO 1.0% is assumed to have the same carbon content as HFO. In engines using pilot fuel, the emissions from the pilot fuel are incorporated into total CO2 emissions by weighting the fuel mixture based on CO2 mass proportions.

As summarized in Table 1, a WFR shipping company utilizes eight distinct categories of primary engine fuels: IFO180, IFO380, LNG VLS IFO, LNG VLS MDO, LNG VLS MGO, VLS IFO, VLS MDO, and VLS MGO. In accordance with the 2018 EEDI classification [19], IFO180, IFO380, and VLS IFO are treated as HFO; LNG VLS IFO, LNG VLS MDO, and LNG VLS MGO are classified as LNG; and VLS MDO and VLS MGO fall under the MDO category. In cases where the engine fuel type is not explicitly reported, it defaults to the HFO classification.

Table 1.

Main engine fuel type classification.

By classifying the main engine fuel in accordance with the 2018 EEDI guidelines, it becomes possible to determine the appropriate emission factor (EFf) for each corresponding fuel type. Table 2 summarizes the mass-based carbon dioxide (CO2) emission factors for each fuel category, as specified in the 2018 EEDI guidelines (IMO, 2020) [19]. Based on the classification of fuel types described earlier, the carbon dioxide emission factor (EFf) for each vessel is calculated using the values presented in Table 2.

Table 2.

Fuel-based carbon content and carbon dioxide emission factors () by fuel type.

3.2. Analysis Results

3.2.1. Basic Analysis Data

For this study, the estimation of fuel consumption and carbon emissions for Korean shipping companies was conducted using vessel statistics from Clarkson’s World Fleet Register (WFR) [20], financial data from the Korea Shipowners’ Association [21], and standard vessel-level data from the IMO’s 2018 bottom-up analysis [19]. A detailed description of the data sources and their respective characteristics is presented in Table 3.

Table 3.

Data description and sources.

The initial step involved extracting statistical data on vessels owned by Korean shipping companies from WFR [20]. This dataset was structured based on several criteria, including vessel type, size, weight, age, shipowner, operator, presence of scrubbers, main engine fuel type, speed, and other relevant variables.

As of May 2022, the organized statistics indicate that 444 shipping companies operated a total of 1783 vessels. The fleet composition includes 367 bulk carriers, 282 chemical tankers, 217 container ships, 76 crude tankers, 410 general cargo ships, 49 LNG carriers, 86 LPG carriers, and 296 product tankers.

The primary segments of the fleet consist of general cargo ships, bulk carriers, chemical tankers, and product tankers, as summarized in Table 4.

Table 4.

Statistics of vessels owned by Korean shipping companies.

The second set of data comprises financial information related to Korean shipping companies, as compiled by the Korea Shipowners’ Association. This dataset includes income statements and balance sheets of Korean shipping companies from 2000 to 2021. Based on the 2021 income statement, a total of 127 shipping companies were identified. These companies were subsequently extracted for analysis by matching them with the vessel operation data from the Clarksons World Fleet Register (WFR). Of the 127 shipping companies identified in the initial dataset, 95 were found to correspond with the Clarksons WFR Korean shipping company vessel operation data. These 95 companies include four publicly traded entities: HMM, Pan Ocean, Korea Line, and KSS Line.

The third set of data comes from the IMO’s 2018 bottom-up fleet standard data. This dataset provides information on vessel type, vessel size, average deadweight tonnage, average design power (in kilowatts), average design speed (in knots), average sailing days, average sailing speed, average sailing distance, average fuel consumption (in kilotons), total greenhouse gas emissions (in million tons), and total carbon dioxide emissions (in million tons). In accordance with the IMO’s 2018 bottom-up fleet standard data, the mean annual fuel consumption (in kilotons) for the primary engine, auxiliary engine, and boiler has been calculated based on vessel size. To calculate fuel consumption and carbon emissions, the Clarksons WFR Korean shipping company vessel operation data are organized according to the criteria specified in the IMO 2018 bottom-up fleet standard data.

3.2.2. Estimated Results of Fuel Consumption for Korean Shipping Companies

The analysis focuses on 95 Korean shipping companies, based on vessel operation data from WFR. The annual fuel consumption (in kilotons) and carbon emissions were estimated for a total of 1094 vessels. The total annual fuel consumption for these companies is approximately 9211 kilotons.

A breakdown by vessel type and size reveals that 309 bulk carriers account for 2581 kilotons of annual fuel consumption, 202 chemical tankers consume 669 kilotons, and 209 container ships consume 2591 kilotons annually. Additionally, 67 oil tankers consume 1159 kilotons, 104 general cargo ships consume 137 kilotons, 36 LNG carriers consume 970 kilotons, 59 LPG carriers consume 433 kilotons, and 108 product carriers consume 672 kilotons. As summarized in Table 5, the majority of fuel consumption is concentrated in bulk carriers, chemical tankers, and container ships, which together account for a significant portion of both the total fleet and overall fuel consumption.

Table 5.

Annual fuel consumption (kt) by vessel type for Korean shipping companies.

A total of four Korean shipping companies are publicly listed. An analysis of their fuel consumption reveals that HMM operates 57 vessels, with a combined DWT of 8.56 million and an annual fuel consumption of 1284 kilotons. Pan Ocean manages a fleet of 110 vessels, consuming 858 kilotons annually. Korea Line operates 39 vessels with an annual fuel consumption of 373 kilotons. Finally, KSS Line owns 29 vessels, consuming 217 kilotons per year. The details of fuel consumption by publicly listed Korean shipping companies are presented in Table 6.

Table 6.

Estimated fuel consumption results for Korean shipping companies.

3.2.3. Estimated Carbon Emissions Results for Korean Shipping Companies

Estimated Carbon Emissions by Vessel Type for Korean Shipping Companies

The aggregate carbon emissions from 1094 vessels operated by Korean shipping companies are estimated at approximately 28.5 million tons per year. A breakdown by vessel type shows that bulk carriers (309 vessels) emit 8.02 million tons, chemical tankers (202 vessels) emit 2.08 million tons, and container ships (209 vessels) emit 8.07 million tons annually. Crude oil tankers (67 vessels) emit 3 million tons, general cargo ships (104 vessels) account for 0.43 million tons, LNG carriers (36 vessels) emit 2.89 million tons, LPG carriers (59 vessels) emit 1.35 million tons, and product tankers (108 vessels) emit 2.09 million tons annually. The detailed carbon emissions by vessel type are summarized in Table 7.

Table 7.

Estimated carbon emissions by vessel type.

Estimated Carbon Emissions by Listed Shipping Companies

Table 8 presents the carbon emissions for four publicly listed shipping companies. The consolidated results of the annual carbon emissions calculations, based on the current fleet holdings, indicate that HMM emits approximately 4 million tons, Pan Ocean 2.67 million tons, Korea Line 1.16 million tons, and KSS Line 0.67 million tons. It is noteworthy that HMM exhibits the second-highest emissions despite having a significantly smaller fleet than the other two companies. This can be attributed to HMM’s primary focus on container ships, which typically have more average sailing days than bulk carriers or tankers. Furthermore, the emphasis on punctuality in container shipping services constrains the potential for slow steaming, which in turn results in higher fuel consumption. It can thus be inferred that the characteristics of a company’s fleet composition exert a significant influence on its total carbon emissions.

Table 8.

Carbon emissions of listed shipping companies.

An analysis of the vessel type distribution and annual carbon emissions of listed Korean shipping companies reveals that HMM operates 45 container ships, accounting for 82% of its total fleet, while Pan Ocean operates 81 bulk carriers, representing 74% of its fleet. Although Pan Ocean’s fleet consists of 110 vessels—twice the size of HMM’s 55 vessels—HMM’s annual carbon emissions (3.97 million tons) exceed those of Pan Ocean (2.67 million tons). This difference is largely due to the higher average sailing days and limited slow steaming potential of container ships compared with bulk carriers and tankers.

Similarly, Korea Line has a high proportion of bulk carriers (82%), but its smaller fleet size results in relatively lower carbon emissions. KSS Line’s fleet mainly consists of LPG carriers, with 20 vessels making up 69% of its total fleet, contributing to its notably lower carbon emissions. The detailed distribution of vessel types and corresponding carbon emissions for these listed companies is presented in Table 9.

Table 9.

Listed shipping companies’ vessel type distribution and annual carbon emissions.

4. Analysis of Cost Burden and Financial Structure Impact Due to Carbon Tax Introduction

4.1. Analysis Method

The KMV–Merton structural model (hereafter referred to as the "Merton model") is derived from the concept of state-dependent contracts between shareholders and bondholders of a company (Jang and Park, 2009) [22]. When a company issues a discount bond (B) to raise the necessary funds, the bondholder receives the agreed-upon debt repayment amount if the company’s asset value (V) at maturity is equal to or greater than the bond’s face value (F). In this case, shareholders retain the remaining asset value. However, if the asset value (V) is less than the face value (F), the company may be considered in default, and all of the company’s assets are then regarded as the property of the bondholders.

The value of the shares is equivalent to that of a European call option with an exercise price of F. The value of the bond is equivalent to that of a risk-free bond combined with a short position in a European put option with an exercise price of F. The logistic regression methodology, which relies on discontinuous financial data, has inherent limitations in explaining the continuous nature of the default rate. Furthermore, this model posits that a bank’s default is contingent upon the discrepancy between its asset value and its debt value. This assumption is based on the idea that the asset value, derived by applying an appropriate discount rate to the company’s future cash flows, is a more reliable indicator than historical financial data. In other words, to derive a bank’s default probability using the Merton model, it is necessary to estimate the asset value and volatility, use the distance to default as a measure of default risk, and adjust the actual default probability with default data.

4.1.1. Estimation of Asset Value and Volatility

In the event that the bank’s stock price data are available, the stock can be conceptualized as a perpetual call option, with the bank’s assets serving as the underlying asset. At the default point, the asset value is assumed to be zero. Consequently, similar to the underlying asset, the value and implied volatility of the assets can be derived using the market price and volatility of options in the option pricing model. For the sake of analysis, it is assumed that the bank’s asset value, represented by VAV_AVA, follows a geometric Brownian motion.

In this case, the standard Brownian motion is observed for , with representing the asset volatility and denoting the asset return. At the time point designated as T, which is used to predict the occurrence of default, if the book value of debt at this point is designated as K, the market price of the stock, , according to the Black–Scholes (BS) option pricing formula, is as follows:

where is the risk-free interest rate, , , and .

From Equation (6), we find that, as is a function of , the volatility of stocks and assets satisfies the following relationship:

where is the stock price volatility, and, if the asset follows a geometric Brownian motion, it can be seen that .

4.1.2. Calculation of Distance to Default (DD)

In the context of option pricing models, the occurrence of a default can be defined as a situation in which the value of the bank’s assets declines to a level below the default point. Consequently, the probability of default can be understood as the likelihood of the asset value falling below this aforementioned default point. If the distribution of the asset value is known, the default probability can be readily calculated through the cumulative distribution function. However, in practice, it is challenging to ascertain the precise distribution. To address this challenge, the Merton model initially defines the distance to default as the gap between the asset value and the default point, expressed in units of the standard deviation of the asset value. Subsequently, the default probability is calculated using the distribution of empirical data. In other words, the distance to default is calculated as follows:

To illustrate, if the asset value of Company A is 10 billion and the default point is 25, the net value of the company is 75. This indicates that a 75% decline in asset value would result in the company becoming insolvent. If we assume that that company’s asset value volatility (standard deviation) is 25%, then the distance to default (DD) is equal to three standard deviations.

If the asset value follows a geometric Brownian motion, where T is the time point at which default is to be predicted, if the book value of debt at this point is , the distance to default is as follows:

The DD includes the asset value , which reflects all information related to the company’s expected returns, the leverage ratio , which is the book value of all debts the bank must pay divided by the asset value, and the asset volatility , which indicates the risk of the asset. Therefore, it has the completeness that Gropp, Vesala and Vulpes (2006) [23] have presented as an indicator of bank distress. Moreover, the distance to default satisfies the following three conditions:

Consequently, a negative distance to default (DD) value serves as an indicator of bank distress. This indicator decreases as the asset value increases and increases as either the leverage ratio or asset volatility rises. This phenomenon is known as unbiasedness.

Empirical data analysis by KMV on defaults has demonstrated that, in certain cases, default does not occur even when the asset value equals the book value of total liabilities. Therefore, the point at which default occurs can be simplified as follows:

4.1.3. Calculation of Expected Default Frequency (EDF)

KMV calculated the default probability from a given distance to default using historical data, and this is referred to as the expected default frequency (EDF). To illustrate, if a company’s distance to default after one year is 7, and if 5 out of 10,000 companies with a distance to default of 7 default after one year, the EDF is calculated as 0.05%.

In the event that the asset value is subject to a geometric Brownian motion, and at the specified time point T, where default is to be predicted, if the book value of debt at this point is , the default probability EDF is as follows:

where is the standard normal distribution and DD is the distance to default obtained in the previous step.

The inverse relationship between EDF and DD can be explained by the fact that, as DD increases, the probability of bankruptcy decreases. Given that DD is influenced by factors such as asset volatility, asset market value, and default point, it can be observed that a reduction in asset market value, coupled with an increase in the book value of debt and asset volatility, leads to an expansion of EDF.

4.2. Analysis Results

4.2.1. Basic Analysis Data

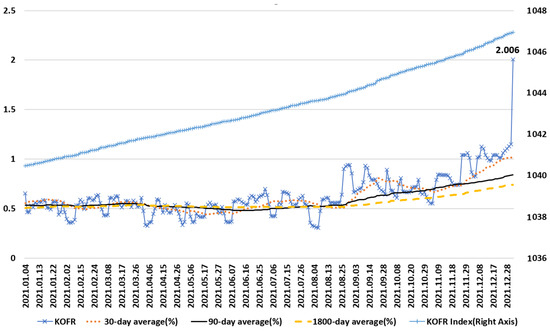

The risk-free interest rate (RFR) used in this study was 2.006% as of 31 December 2021, based on the Korea Overnight Financing Repo Rate (KOFR) calculated by the Korea Securities Depository [24]. For the listed shipping companies—HMM, Pan Ocean, Korea Line, and KSS Line—data on stock price volatility and market capitalization were obtained from FnGuide’s daily dataset [25]. Additionally, the financial statistics of Korean shipping companies were sourced from the annual financial statements provided by the Korea Shipowners’ Association [21]. Furthermore, local tax exemption and reduction incentives for registering international ships, which can influence the financial structure of shipping companies, are summarized in Table 10.

Table 10.

Local tax exemption/tax reduction as incentives for registering international ships by year.

The KOFR serves as the RFR, reflecting the theoretical interest rate of a risk-free investment. To accurately calculate the RFR, it is crucial to rely on financial transactions that closely approximate a risk-free status. Major economies such as those of the United States, the United Kingdom, and the Eurozone have adopted overnight (secured or unsecured) rates as their RFRs. These transactions are primarily conducted by highly creditworthy financial institutions and involve short maturities, thereby minimizing credit risk and aligning with the concept of a risk-free rate. Additionally, because RFRs are based on actual transaction data, they are less susceptible to manipulation.

In Korea, the KOFR is calculated based on the overnight repurchase agreement (RP) rates of government bonds and monetary stabilization bonds, in line with international best practices. The historical trend of the KOFR is presented in Figure 1.

Figure 1.

The trend of the Korea Overnight Financing Repo Rate (KOFR). Source: Korea Securities Depository website (accessed on 6 August 2022) [24].

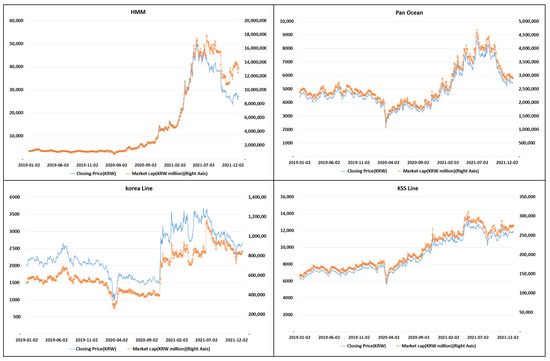

To estimate the stock price volatility of listed shipping companies, daily stock returns were calculated using daily stock prices for 2021. The annual standard deviation rate was then determined by multiplying the standard deviation of daily stock returns by the square root of 252. The market capitalization of each shipping company was calculated using data from the end of 2021 (Figure 2).

Figure 2.

Stock price and market capitalization trends of domestic listed shipping companies.

As shown in Table 11, the calculations reveal that HMM’s stock price volatility is 0.6056, with a market capitalization of approximately KRW 13.16 trillion. Pan Ocean’s stock price volatility is 0.4814, with a market capitalization of approximately KRW 2.89 trillion. Korea Line’s stock price volatility is 0.4675, with a market capitalization of approximately KRW 843 billion. Lastly, KSS Line’s stock price volatility is 0.289, with a market capitalization of approximately KRW 275 billion.

Table 11.

Market value and stock price volatility of domestic listed shipping companies.

The data concerning the debt of listed shipping companies were obtained from the annual financial statements compiled by the Korea Shipowners’ Association for the year 2021. As shown in Table 12, HMM’s total debt in 2021 was approximately KRW 7.52 trillion, Pan Ocean’s was approximately KRW 2.89 trillion, Korea Line’s was approximately KRW 2.34 trillion, and KSS Line’s was approximately KRW 1.10 trillion.

Table 12.

Total liabilities of domestic listed shipping companies.

The return on listed shipping companies can be estimated using the earnings before interest, taxes, depreciation, and amortization (EBITDA) to total assets ratio, which represents the expected return generated by utilizing each company’s total assets. Based on data provided by the Korea Shipowners’ Association, as presented in Table 13, the projected expected returns for 2021 were 0.298564 for HMM, 0.084655 for Pan Ocean, 0.079433 for Korea Line, and 0.038771 for KSS Line.

Table 13.

Asset values and expected return rates of domestic listed shipping companies.

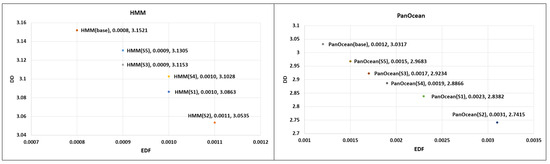

The results of the DD and EDF for the listed shipping companies, estimated based on the aforementioned data, are presented in Table 14. According to the estimation results, KSS Line exhibits the lowest probability of default, with a DD of 4.1567 and an EDF of 0.0000. This is followed by HMM, with a DD of 3.1521 and an EDF of 0.0008; Pan Ocean, with a DD of 3.0317 and an EDF of 0.0012; and Korea Line, with a DD of 2.8816 and an EDF of 0.0020.

Table 14.

Distance to default (DD) and expected default frequency (EDF) of domestic listed shipping companies.

4.2.2. Carbon Tax Introduction Scenarios

The present study establishes five distinct carbon tax price scenarios. The scenarios were established with consideration of the prices being discussed for the international implementation of a carbon tax in the shipping industry and the carbon tax prices that are already in effect for other industries in major countries.

The initial implementation of the carbon tax is set at USD 100 per ton of greenhouse gas emissions from ships in Scenario 1, which is based on the price proposed by the Marshall Islands to the IMO. The governments of the Marshall Islands and Solomon Islands have proposed the implementation of a greenhouse gas contribution system (GHG levy), whereby a specified amount is to be paid per ton of greenhouse gas emissions from ships. The initial implementation is proposed to commence at USD 100 per ton of greenhouse gas emissions, with the contribution subsequently increasing annually or in stages (Maritime Korea, 2021) [26].

Scenario 2 is based on the price proposed by the global shipping company AP Moller-Maersk, which is set at USD 150 per ton of carbon dioxide. AP Moller-Maersk has proposed the imposition of a carbon tax of USD 450 per ton of bunker fuel in order to achieve carbon neutrality (Ship & Bunker, 2021) [27].

Scenario 3 is predicated on the carbon tax rate proposed by the Japanese government for decarbonization, which is set at USD 56 per ton of carbon dioxide. The Japanese government has announced its intention to raise in excess of USD 50 billion annually in order to reduce greenhouse gas emissions from maritime transport. The shipping industry is to be charged USD 56 per ton from 2025 to 2030, with costs increasing every five years to a maximum of USD 135 per ton from 2030 (Financial Times, 2022) [28].

Scenario 4 is based on the carbon tax price proposed by the International Monetary Fund (IMF), which is set at USD 75 per ton of carbon dioxide. In its 2019 report, the IMF put forth the radical proposal that the global average carbon tax should be set at USD 75 per ton. This is a significant departure from the global average carbon emission price of USD 2 per ton as of the end of 2019 (Deloitte Insights Editorial Department, 2021) [29].

Scenario 5 is set at USD 32.80 per ton of carbon dioxide, which represents the average carbon tax price of 27 countries that have implemented carbon taxes in other industries as of April 2021. As of April 2021, 27 countries have implemented carbon taxes at the national level, including Sweden and Japan. Additionally, eight regions within countries, such as Hawaii in the United States and Catalonia in Spain, have also implemented carbon taxes at the regional level. The carbon tax rates per ton vary considerably depending on the region in question. For example, while Sweden, Liechtenstein, and Switzerland have carbon tax rates exceeding USD 100 per ton, countries such as Poland, Ukraine, Estonia, and Japan have rates below USD 5 per ton (Deloitte Insights Editorial Department, 2021) [29].

The financial analysis under these five scenarios utilizes data on the market value and stock price volatility of domestic listed shipping companies, as summarized in Table 15.

Table 15.

Market value and stock price volatility of domestic listed shipping companies.

4.2.3. Analysis Results of Carbon Tax Cost Burden

The estimated carbon tax costs under each scenario and where the annual carbon emissions of Korean shipping companies reach a total of 28.5 million tons, are presented in Table 16. The estimation results indicate that Korean shipping companies would face a cost burden of approximately KRW 3.26 trillion in Scenario 1 (USD 100 per ton of carbon emissions), KRW 4.89 trillion in Scenario 2 (USD 150 per ton), KRW 1.83 trillion in Scenario 3 (USD 56 per ton), KRW 2.45 trillion in Scenario 4 (USD 75 per ton), and KRW 1.07 trillion in Scenario 5 (USD 32.81 per ton).

Table 16.

Estimated carbon tax costs by scenario.

Table 16 also details the reduction or exemption of tax incentives for ships registered in the special ship zone by year.

The financial implications of implementing a carbon tax on listed shipping companies are detailed in Table 17. This analysis evaluates the impact under five distinct carbon tax scenarios, each reflecting varying tax rates per ton of carbon emissions.

Table 17.

The carbon tax cost burden for listed shipping companies by scenario (unit: 1 billion KRW).

For HMM, which has carbon emissions amounting to 1.28 million tons, the estimated carbon tax liability varies significantly across the different scenarios. Under Scenario 1, which imposes a tax of USD 100 per ton, HMM would incur a cost of approximately KRW 457.40 billion. In Scenario 2, with a tax rate of USD 150 per ton, the cost increases to about KRW 686.15 billion. Conversely, Scenario 3, which sets the tax at USD 56 per ton, results in a lower burden of KRW 256.16 billion. Scenario 4, proposing a rate of USD 75 per ton, would lead to a tax cost of around KRW 343.08 billion, while Scenario 5, with the lowest rate of USD 32.81 per ton, would result in a tax of approximately KRW 150.86 billion.

Similarly, for Pan Ocean, with emissions of 0.86 million tons, the financial impact under Scenario 1 is estimated at KRW 305.67 billion. This increases to KRW 458.51 billion under Scenario 2. Scenario 3 would result in a tax of KRW 171.18 billion, Scenario 4 would incur a cost of KRW 229.27 billion, and Scenario 5 would lead to an expenditure of KRW 100.29 billion.

Korea Line, emitting 0.37 million tons of carbon, faces a potential tax liability of KRW 133.04 billion in Scenario 1. This amount would rise to KRW 199.55 billion in Scenario 2, while Scenario 3 would impose a cost of KRW 74.49 billion. Under Scenario 4, the tax would be KRW 99.75 billion, and Scenario 5 would result in a financial impact of KRW 43.65 billion.

For KSS Line, with emissions totaling 0.22 million tons, the estimated carbon tax costs are KRW 77.23 billion in Scenario 1, escalating to KRW 115.85 billion in Scenario 2. Scenario 3 projects a cost of KRW 43.25 billion, Scenario 4 estimates a tax of KRW 57.94 billion, and Scenario 5 suggests a cost of KRW 25.34 billion.

4.2.4. Analysis Results of Carbon Tax Introduction Impact Through the Merton Model

The impact of the carbon tax on the shipping industry is assessed by benchmarking the S&P Global TRUCOST analysis method, which estimates the carbon costs and adjusted EBITDA for shipping companies using scenario-specific carbon taxes. When EBITDA declines due to increased carbon tax expenses, the anticipated return rate will also decrease in the DD calculation formula shown below. Assuming other factors such as market capitalization, asset volatility, total debt, and risk-free interest rate remain constant, a reduction in the anticipated return rate leads to a shorter DD and an increase in the EDF.

The impact of a decline in EBITDA on the expected return rates of listed shipping companies under various carbon tax scenarios is presented in Table 18. The analysis indicates that the expected return rates decrease as the carbon tax burden increases across the four listed shipping companies (HMM, Pan Ocean, Korea Line, and KSS Line). Under the lowest carbon tax scenario (Scenario 5, USD 32.81 per ton), the expected return rates are 0.290168 for HMM (a decrease of 0.0008 from the 2021 base), 0.069198 for Pan Ocean (a decrease of 0.015), 0.068124 for Korea Line (a decrease of 0.011), and 0.021249 for KSS Line (a decrease of 0.018). In contrast, under the highest carbon tax scenario (Scenario 2, USD 150 per ton), the expected return rates decline more significantly to 0.260179 for HMM (a decrease of 0.038), 0.013992 for Pan Ocean (a decrease of 0.071), 0.027732 for Korea Line (a decrease of 0.052), and −0.04133 for KSS Line (a decrease of 0.080).

Table 18.

The changes in expected return rate according to the decrease in EBITDA for listed shipping companies by carbon tax scenario.

Based on the analysis in Table 18, KSS Line’s expected return turns negative under the high carbon tax scenario, suggesting that the firm is approaching a state of technical default. This reflects a sharp increase in its financial vulnerability and implies the potential for industry restructuring through mechanisms such as mergers and acquisitions (M&As) or market exit. In contrast, HMM maintains relatively strong profitability and financial resilience across all scenarios, indicating a likely competitive advantage driven by factors such as fleet composition, economies of scale, and capital structure.

These findings highlight the strategic divergence among heterogeneous firms in the shipping industry and underscore the need for differentiated policy approaches tailored to firm-specific characteristics. Financially vulnerable firms may require targeted financial or regulatory support, while more robust operators like HMM are better positioned to capitalize on market consolidation opportunities or green investment incentives. Ultimately, market-based measures such as carbon taxation may accelerate structural shifts within the industry, widen competitive disparities among firms, and incentivize the early development of proactive decarbonization strategies. Additionally, these results align with the findings of the World Bank (2021) [5], Wu, Wen, and Zou (2022) [6], and Pereda et al. (2023) [11], indicating that the application of carbon measures can impose a burden on shipping companies.

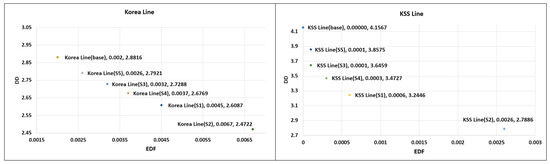

By employing the DD and EDF calculation formulas, as in the base scenario, it is possible to estimate the DD and EDF for each company under different carbon tax scenarios. This is achieved by estimating the scenario-specific expected return rates. The estimation results are presented in Table 19.

Table 19.

Distance to default (DD) and expected default frequency (EDF) for domestic listed shipping companies under various scenarios.

Upon examination of the estimation results, it becomes evident that, as the carbon tax increases in each scenario, the DD for each company decreases while the EDF increases. The relationship between the EDF and the DD is inverse, as a larger DD indicates a lower probability of bankruptcy. The DD is influenced by three factors: asset volatility, asset market value, and the default point. Consequently, a reduction in asset market value, coupled with an increase in the book value of debt and asset volatility, will result in an elevated EDF.

An examination of the DD and EDF estimation results for the four listed shipping companies reveals that, when the highest carbon tax price in Scenario 2 (USD 150/t) is applied, HMM exhibits the lowest probability of default, with a DD of 3.0535 and an EDF of 0.0011. KSS Line exhibits a DD of 2.7886 and an EDF of 0.0026. Pan Ocean is in third place with a DD of 2.7415 and an EDF of 0.0031. Korea Line exhibits the highest probability of default, with a DD of 2.4722 and an EDF of 0.0067.

When the lowest carbon tax price is applied, Scenario 5 (USD 32.8/t), the shipping companies with the lowest probability of default are ranked as KSS Line, HMM, Pan Ocean, and Korea Line. KSS Line shows a DD of 3.8575 and an EDF of 0.0001; HMM shows a DD of 3.1305 and an EDF of 0.0009; Pan Ocean shows a DD of 2.9683 and an EDF of 0.0015; and Korea Line shows a DD of 2.7921 and an EDF of 0.0026, indicating the highest probability of default.

In the base scenario, KSS Line, which exhibited low asset value volatility, demonstrated the lowest probability of default. However, when the highest carbon tax price was applied in Scenario 2 (USD 150/t), KSS Line’s ranking shifted to the second lowest after HMM. This is due to the fact that, although KSS Line exhibits low asset value volatility, its EBITDA is also markedly lower in comparison to other companies. As a consequence, the carbon tax cost burden exerted a more pronounced influence on the alteration in anticipated return rates for KSS Line.

DD represents the buffer—measured in standard deviations—between a firm’s asset value and the default threshold, while EDF quantifies the probability of default within a given time horizon. The results indicate that HMM consistently maintains high DD and low EDF values across all scenarios, suggesting strong financial resilience to external shocks. In contrast, KSS Line shows a significant decline in DD and a corresponding rise in EDF as carbon tax levels increase, indicating a substantial elevation in default risk. This implies that, beyond profitability measures, the structural integrity of a firm’s capital position and its inherent risk profile critically influence its vulnerability to carbon pricing. Notably, EDF reflects market-perceived default risk in a probabilistic framework, which may translate into cascading effects such as credit rating downgrades, higher borrowing costs, and reduced investor confidence. These findings highlight the importance for shipping firms to regularly monitor risk indicators such as DD and EDF and to develop mid-to-long-term financial strategies that include asset restructuring and capital optimization to enhance resilience against carbon-related regulatory shocks (Figure 3).

Figure 3.

Distance to default (DD) and expected default frequency (EDF) of domestic listed shipping companies by carbon tax scenario.

5. Conclusions

This study examined the impact of carbon tax implementation on Korean shipping companies to support proactive responses to the IMO’s market-based measures and to inform policy development. By estimating fuel consumption, carbon emissions, and financial burdens under various carbon tax scenarios, the study further assessed the effect of carbon tax introduction on the financial stability of shipping companies using the Merton model.

The results indicate that 95 Korean shipping companies, operating a total of 1094 vessels, recorded total fuel consumption of 9211 kilotons, resulting in approximately 28.5 million tons of carbon emissions. By vessel type, bulk carriers (309 vessels) emitted 8.02 million tons, container ships (209 vessels) emitted 8.07 million tons, and oil tankers (67 vessels) emitted 3.57 million tons annually. Although container ships have fewer vessels than bulk carriers, they generate higher carbon emissions due to their longer average sailing days and the operational need to maintain strict schedules, which limits the use of fuel-saving measures such as slow steaming, leading to increased fuel consumption and emissions.

Under the lowest carbon tax scenario (USD 32.8 per ton), the total carbon tax cost is estimated at KRW 1.07 trillion, reducing net profit by 8.8%, return on equity by 2.4%, and return on assets by 1.1%. In contrast, under the highest carbon tax scenario (USD 150 per ton), the burden increases to KRW 4.89 trillion, with net profit falling by 40.2%, return on equity by 6.0%, and return on assets by 4.9%.

An analysis of the DD and EDF results for the four listed shipping companies shows that under the highest carbon tax scenario (USD 150 per ton), HMM has the lowest default risk, followed by KSS Line, Pan Ocean, and Korea Line. Conversely, under the lowest carbon tax scenario (USD 32.8 per ton), KSS Line ranks first, followed by HMM, Pan Ocean, and Korea Line. Overall, higher carbon tax costs increase default risk, with Korea Line consistently showing the highest probability of default across scenarios.

In the base scenario, KSS Line had the lowest probability of default due to its low asset value volatility. However, under the highest carbon tax scenario (USD 150 per ton), its ranking dropped to second place after HMM. This shift occurred because, despite its stable asset values, KSS Line’s relatively low EBITDA made it more vulnerable to the increased carbon tax burden, which significantly reduced its expected return rate.

This study is significant in that it extends beyond the policy-level discussions of previous research, which primarily focused on international trends and regulatory developments related to market-based measures such as the IMO and EU carbon regulations. Unlike earlier studies that were limited to analyzing carbon emissions or conducting case studies on a small number of shipping companies, this research provides a comprehensive analysis of the entire Korean shipping industry, encompassing 95 domestic shipping companies.

In particular, this study is distinctive as it is the first to apply the Merton model to the shipping industry to assess the impact of carbon pricing on financial stability. While previous studies have estimated carbon emissions or analyzed cost burdens from market-based measures, they have not extended their analysis to evaluating the default risk of shipping companies using a structural credit risk model. By utilizing the Merton model, which has been adopted by financial institutions to measure default probabilities under climate-related financial stress, this study provides a novel methodological contribution by introducing a quantitative risk assessment framework specifically tailored to the Korean shipping sector.

Ultimately, this research contributes to filling the gap in domestic studies by presenting a systematic and quantitative framework for analyzing the impact of carbon pricing on the Korean shipping industry. These findings are expected to support Korean shipping companies in establishing proactive management strategies and to provide valuable insights for policymakers seeking to mitigate the financial risks associated with market-based environmental regulations.

The results of this study are based on an analysis conducted during a period of market upturn in the shipping industry. As such, the projected cost burden of market-based measures (MBMs) on Korean shipping companies may appear relatively limited under current conditions. However, in periods of market downturn or reduced profitability, the introduction of such carbon pricing mechanisms could impose a substantial financial burden on shipping companies. This highlights the limitations of relying solely on firm-level responses to international environmental regulations. Accordingly, it is imperative for the government to develop and implement policy-level support measures. In this context, the following areas should be considered in future discussions related to this study.

First, to strengthen the competitiveness of the national fleet, the government should expand its support for the development and construction of eco-friendly vessels by domestic shipping companies. While public funding is currently allocated to support green ship technologies, it is crucial to establish a cooperative framework between technology suppliers and shipowners to ensure policy effectiveness. Historically, Korean bulk carriers have favored low-cost construction at Chinese shipyards, with only 10–20% of orders placed at domestic shipbuilders, resulting in considerable economic opportunity costs for the national economy. Given the tightening of international environmental regulations, the construction of LNG-powered or other high-efficiency vessels is expected to increase. Korean shipyards, in particular, possess a competitive edge in building LNG carriers and other advanced green vessels. Therefore, it is essential to build a government-led tripartite cooperation system involving shipping companies, shipyards, and financial institutions, enabling shipping firms to procure high-quality eco-friendly vessels at competitive prices. To this end, government support for R&D initiatives, such as the development of standardized hull forms for bulk carriers, should also be considered.

Second, the government should expand the scope and scale of the current subsidy program supporting the transition to eco-friendly ships. Under the existing program, subsidies are granted only when scrapping and newbuilding occur simultaneously, largely due to budget constraints. However, international environmental regulations are long-term challenges that extend to at least 2050, making it difficult to expect meaningful results from short-term assistance alone. A broader and more sustained budgetary commitment is needed, with flexible eligibility criteria covering a wider range of firms and vessel types (Park, Ko, and Lee, 2021) [30].

Third, it is necessary to develop institutional mechanisms to promote private sector participation in ship finance. Although green ship bond issuance and other innovative financing mechanisms are actively discussed in the global maritime sector, research and application in Korea remain limited. As investment in low-carbon ships becomes essential for survival under IMO regulations, leading maritime nations are actively supporting eco-ship procurement through green finance and subsidy schemes. Korea must likewise develop financial instruments tailored to the shipping sector—such as green bonds or credit guarantees—and integrate them into a comprehensive policy framework to ensure long-term competitiveness.

Fourth, preferential tax treatment should be considered for eco-friendly ship construction. According to Park, Ko, and Lee (2021) [30], Singapore offers a 75% reduction in initial registration fees and a 50% annual tonnage tax discount for LNG-fueled vessels, while ships using fuels with lower carbon content than LNG receive a 50% reduction in registration fees and a 20% tonnage tax discount. In Korea, it would be advisable to explore the application of similar incentives under the existing ship registration and tonnage tax regimes. In addition, tax incentives could be offered through the ship investment company (SIC) system or incorporated into the ship tax lease scheme currently under government review, particularly for vessels meeting eco-design criteria.

Finally, a public discussion is needed regarding whether the cost of compliance with environmental regulations in the shipping sector should be borne entirely by shipping companies. These firms provide services for cargo owners and contribute to broader societal benefits when investing in low-carbon technologies. Such positive externalities justify the need for a cost-sharing framework involving the government, shipping firms, and cargo owners. Establishing a fair and efficient allocation of environmental compliance costs would align private investment incentives with public policy objectives, ensuring the sustainable development of the national shipping industry.

Although this study provides an important analysis of the potential impacts of carbon taxation on Korean shipping companies and offers policy recommendations for mitigating those impacts, it is subject to the following limitations.

First, the analysis is based on fleet and financial data from the pre-2022 period and assumes a static financial structure, without incorporating firm-level adaptive responses such as fuel switching, cost pass-through, or strategic capital adjustments. By employing a ceteris paribus framework to isolate the effects of carbon taxation, the study may overstate the financial burden relative to actual market conditions in which firms are likely to respond strategically. These modeling constraints are explicitly acknowledged to delineate the analytical boundaries of the research. Future studies are encouraged to integrate dynamic behavioral responses and policy mechanisms—such as green financing instruments and targeted subsidies—to enhance realism and policy relevance.

Second, the generalizability of the findings is constrained by the limited scope of the sample. The Merton model relies on market-based inputs and, as such, is only applicable to publicly listed firms. In the Korean shipping sector, only four such companies meet this criterion, inherently restricting the empirical breadth of the analysis. Additionally, due to limitations in the data, we were unable to develop a dynamic model using the Merton framework. To improve external validity, future research should extend the analysis to a broader set of international shipping firms with publicly available financial and market data, thereby enabling more comprehensive cross-country and firm-level comparisons.

Third, the model does not explicitly account for mitigation strategies that shipping firms might employ in response to carbon pricing—such as the adoption of energy-efficient technologies, retrofitting, or divestment of carbon-intensive assets. The exclusion of these factors limits the model’s ability to reflect real-world firm behavior under regulatory transition. Addressing these elements in future research would significantly enhance the explanatory power and practical applicability of the modeling framework.

Author Contributions

Conceptualization, H.K.; Methodology, H.K. and S.P.; Software, S.P.; Validation, H.K.; Formal analysis, H.K. and S.P.; Investigation, H.K. and S.P.; Resources, H.K.; Data curation, H.K.; Writing—original draft, H.K. and S.P.; Writing—review & editing, H.K. and S.P.; Visualization, H.K.; Supervision, S.P.; Project administration, H.K.; Funding acquisition, H.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Korea Maritime Institute, grant number GP2022-03.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Statistical data are provided upon request to the corresponding author.

Acknowledgments

This study is a revised and expanded version of “Effect of IMO Market-Based Measures on Korean Shipping Companies” supported by Korea Maritime Institute [grant number: GP2022–03] [31].

Conflicts of Interest

The authors declare no conflicts of interest.

References

- International Maritime Organization. Draft Report of the Marine Environment Protection Committee on Its Eightieth Session; International Maritime Organization: London, UK, 2023. [Google Scholar]

- Psaraftis, H.N.; Kontovas, C.A. Decarbonization of maritime transport: Is there light at the end of the tunnel? Sustainability 2020, 13, 237. [Google Scholar] [CrossRef]

- Mundaca, G.; Strand, J.; Young, I.R. Carbon pricing of international transport fuels: Impacts on carbon emissions and trade activity. J. Environ. Econ. Manag. 2021, 110, 102517. [Google Scholar] [CrossRef]

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emissions. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- World Bank. Emissions Trading in Practice: A Handbook on Design and Implementation, 2nd ed.; World Bank: Washington, DC, USA, 2021. [Google Scholar]

- Wu, Y.; Wen, K.; Zou, X. Impacts of Shipping Carbon Tax on Dry Bulk Shipping Costs and Maritime Trades—The Case of China. J. Mar. Sci. Eng. 2022, 10, 1105. [Google Scholar] [CrossRef]

- Bakkehaug, R.; Fagerholt, K.; Lindstad, H. A stochastic programming formulation for strategic fleet renewal in shipping. Transp. Res. Part E Logist. Transp. Rev. 2014, 72, 60–76. [Google Scholar] [CrossRef]

- Yu, H. Stochastic Ship Fleet Routing with Inventory Limits. Ph.D. Thesis, University of Edinburgh, Edinburgh, UK, 2010. [Google Scholar]

- Meng, Q.; Wang, S. A chance constrained programming model for short-term liner ship fleet planning problems. Marit. Policy Manag. 2010, 37, 329–346. [Google Scholar] [CrossRef]

- Zhu, C.; Chen, Y.; Kristal, M. Modelling the impacts of uncertain carbon tax policy on maritime fleet mix strategy and carbon mitigation. Transport 2018, 33, 707–717. [Google Scholar] [CrossRef]

- Pereda, P.C.; Lucchesi, A.; Oliveira, T.D.; Wolf, R. Carbon tax in the shipping sector: Assessing economic and environmental impacts. Energy Policy 2025, 204, 114627. [Google Scholar] [CrossRef]

- Park, S.-H.; Han, C.-W.; Kim, T.-I. Effect of low sulphur fuel oil use on Korean container shipping companies by IMO environmental regulations. Korea Port Econ. Assoc. 2020, 36, 23–40. [Google Scholar] [CrossRef]

- Han, N.H.; Kim, M.J. A study on the decarbonization strategy of global shipping. J. Marit. Bus. 2020, 47, 143–164. [Google Scholar]

- Battiston, S.; Mandel, A.; Monasterolo, I.; Schütze, F.; Visentin, G. A climate stress-test of the financial system. Nat. Clim. Change 2017, 7, 283–288. [Google Scholar] [CrossRef]

- Reinders, H.J.; Schoenmaker, D.; Van Dijk, M. A finance approach to climate stress testing. J. Int. Money Financ. 2020. preprint. [Google Scholar] [CrossRef]

- Naim, P.; Condamin, L. Modeling corporate credit climate risk. Am. Bank. Assoc. Bank. J. 2021, 113, 26–29. [Google Scholar]

- Capasso, G.; Gianfrate, G.; Spinelli, M. Climate change and credit risk. J. Clean. Prod. 2020, 266, 121634. [Google Scholar] [CrossRef]

- Bank of Korea. Current Status of Carbon Neutrality Promotion in the International Community and Its Economic Impact; Overseas Economy Focus No. 2021-16; Bank of Korea: Seoul, Republic of Korea, 2018. [Google Scholar]

- International Maritime Organization (IMO). Fourth IMO Greenhouse Gas Study; International Maritime Organization: London, UK, 2020. [Google Scholar]

- World Fleet Register (WFR). Available online: https://www.clarksons.net/wfr/ (accessed on 30 May 2022).

- Korea Shipowners’ Association, internal data.

- Jang, W.; Park, J.W. Credit Risk Management; Korea Financial Training Institute: Seoul, Republic of Korea, 2009. [Google Scholar]

- Gropp, R.; Vesala, J.; Vulpes, G. Equity and bond market signals as leading indicators of bank fragility. J. Money Credit Bank 2006, 38, 399–428. [Google Scholar] [CrossRef]

- Korea Securities Depository. RFR Information. Available online: https://www.kofr.kr/intro/RFRinfo.jsp (accessed on 6 August 2022).

- FnGuide’s Daily Dataset. Available online: https://www.fnguide.com (accessed on 26 July 2022).

- Maritime Korea. Urgent Response Needed from Shipping Industry to IMO’s 2050 Carbon Neutral and Zero Carbon Goals. Available online: http://m.monthlymaritimekorea.com/news/articleView.html?idxno=33095 (accessed on 19 April 2022).

- Ship & Bunker. Maersk Proposes $450/MT Carbon Tax for Bunker Fuel. Available online: https://shipandbunker.com/news/world/633414-maersk-proposes-450mt-carbon-tax-for-bunker-fuel (accessed on 8 August 2022).

- Financial Times. Shipping Heavyweight Japan Tables Carbon Tax Proposal for the Industry. Available online: https://www.ft.com/content/ae5893a1-4a7e-4152-8fb2-65679ebc73c4 (accessed on 26 July 2022).

- Deloitte Insights Editorial Department. 2050 Carbon Neutral Roadmap Chapter 03: Global Carbon Pricing System Status; Deloitte: London, UK, 2021; pp. 1–27. [Google Scholar]

- Park, S.; Ko, B.; Lee, K. Study on the Development of Support Programs for the Transition to Eco-Friendly Ships; Korea Shipowners’ Association: Seoul, Republic of Korea, 2021. [Google Scholar]

- Kim, H.; Park, S.; Kim, T.; Choi, S. Effect of IMO Market-Based Measures on Korean Shipping Companies; Korea Maritime Institute: Busan, Republic of Korea, 2022. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).