Carbon Risk and Capital Mismatch: Evidence from Carbon-Intensive Firms in China

Abstract

1. Introduction

2. Literature Review

2.1. Capital Mismatch

2.2. Carbon Risk

3. Theoretical Analysis and Research Hypotheses

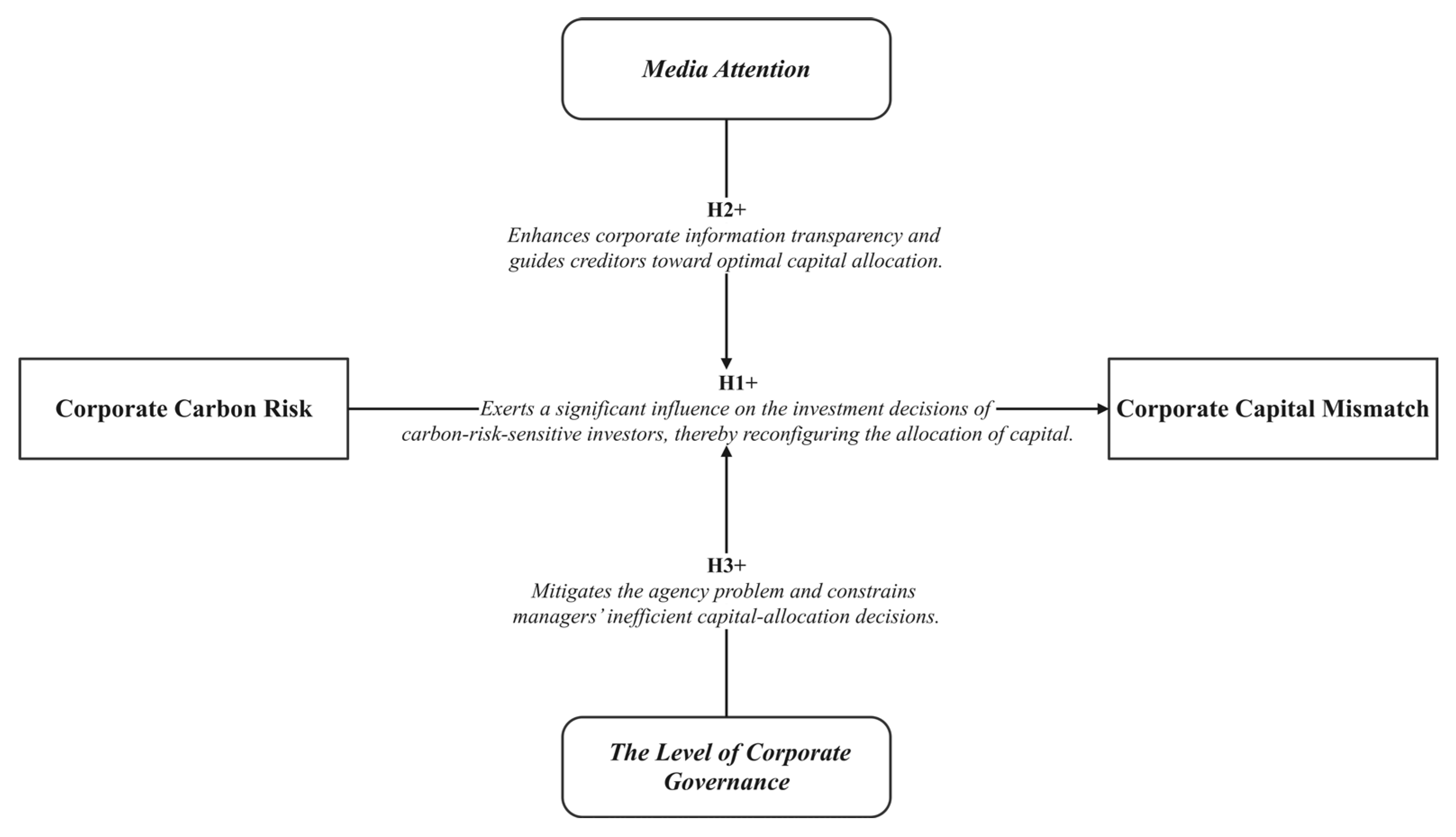

3.1. The Impact of Carbon Risk on Capital Mismatch in Carbon-Intensive Firms

3.2. Moderating the Effects of Media Attention

3.3. Moderating the Effects of the Level of Corporate Governance

4. Research Design

4.1. Variable Selection

4.2. Data Source

4.3. Empirical Model

4.3.1. Baseline Regression Model

4.3.2. Moderating Effects Model

5. Empirical Results and Discussion

5.1. Baseline Regression Results

5.2. Moderating Effects Results

5.2.1. Media Attention

5.2.2. Corporate Governance Level

5.3. Robustness Checks

6. Research Conclusions, Implications, and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, S.; Luo, J.; Huang, D.-H.; Xu, J. Market distortion, factor misallocation, and efficiency loss in manufacturing enterprises. J. Bus. Res. 2023, 154, 54. [Google Scholar] [CrossRef]

- Wang, S.; Tian, W.; Lu, B. Impact of capital investment and industrial structure optimization from the perspective of “resource curse”: Evidence from developing countries. Resour. Policy 2023, 80, 103276. [Google Scholar] [CrossRef]

- Wei, C.; Li, C.-Z. Resource misallocation in Chinese manufacturing enterprises: Evidence from firm-level data. J. Clean Prod. 2017, 142, 837–845. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, D.; Chen, H. Government corruption, resource misallocation, and ecological efficiency. Energy Econ. 2020, 85, 104573. [Google Scholar] [CrossRef]

- Jin, L.; Dai, J.; Jiang, W.; Cao, K. Digital finance and misallocation of resources among firms: Evidence from China. N. Am. J. Econ. Financ. 2023, 66, 101911. [Google Scholar] [CrossRef]

- Li, Y.; Ji, Q.; Wang, Z.; Xiong, Z.; Zhan, S.; Yang, Y.; Hao, Y. Green energy mismatch, industrial intelligence and economics growth: Theory and empirical evidence from China. Environ. Dev. Sustain. 2022, 24, 11785–11816. [Google Scholar] [CrossRef]

- Tang, L. Investment dynamics and capital distortion: State and non-state firms in China. J. Asian Econ. 2021, 73, 101274. [Google Scholar] [CrossRef]

- Wu, J.; Lu, W.; Li, M. A DEA-based improvement of China’s green development from the perspective of resource reallocation. Sci. Total Environ. 2020, 717, 137106. [Google Scholar] [CrossRef]

- Cumming, D.; Duppati, G.; Fernando, R.; Singh, S.P.; Tiwari, A.K. Dynamics of carbon risk, cost of debt and leverage adjustments. Br. Account. Rev. 2025, 57, 101353. [Google Scholar] [CrossRef]

- Zhu, B.; Zhao, Y. Carbon risk and the cost of bank loans: Evidence from China. Technol. Forecast. Soc. Change 2022, 180, 121741. [Google Scholar] [CrossRef]

- Capasso, G.; Gianfrate, G.; Spinelli, M. Climate change and credit risk. J. Clean Prod. 2020, 266, 121634. [Google Scholar] [CrossRef]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Deng, W.; Liu, L. Comparison of carbon emission reduction modes: Impacts of capital constraint and risk aversion. Sustainability 2019, 11, 1661. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Tran, V.T.; Ming, T.C.; Le, A. Carbon risk and corporate investment: A cross-country evidence. Financ. Res. Lett. 2022, 46, 102376. [Google Scholar] [CrossRef]

- Jung, J.; Herbohn, K.; Clarkson, P. Carbon Risk, Carbon Risk Awareness and the Cost of Debt Financing. J. Bus. Ethics 2018, 150, 1151–1171. [Google Scholar] [CrossRef]

- Arian, A.G.; Sands, J. Do corporate carbon emissions affect risk and capital costs? Int. Rev. Econ. Financ. 2024, 93, 1363–1377. [Google Scholar] [CrossRef]

- Piao, Z.; Wu, C.; Su, N.; Lin, Y.; Zheng, Z. Financial constraints, capital misallocation and firm’s total factor productivity (TFP) loss—Empirical evidence from listed manufacturing companies in China. Appl. Econ. 2023, 55, 4572–4585. [Google Scholar] [CrossRef]

- Uras, B.R. Corporate financial structure, misallocation and total factor productivity. J. Bank Financ. 2014, 39, 177–191. [Google Scholar] [CrossRef]

- Xiao, W.; Deng, Q.; Yuan, W.; Wu, N. Financial frictions, capital misallocation, and total factor productivity: Evidence from China. Appl. Econ. 2023, 55, 4853–4870. [Google Scholar] [CrossRef]

- Neuhann, D.; Sockin, M. Financial market concentration and misallocation. J. Financ. Econ. 2024, 159, 103875. [Google Scholar] [CrossRef]

- Klenow, H.C.-T.P.J. Misallocation and Manufacturing TFP in China and India. Q. J. Econ. 2009, 124, 1403–1448. [Google Scholar] [CrossRef]

- Restuccia, D.; Rogerson, R. Policy distortions and aggregate productivity with heterogeneous establishments. Rev. Econ. Dyn. 2008, 11, 707–720. [Google Scholar] [CrossRef]

- Asker, J.; Collard-Wexler, A.; De Loecker, J. Dynamic Inputs and Resource (Mis)Allocation. J. Political Econ. 2014, 122, 1013–1063. [Google Scholar] [CrossRef]

- Belloni, A.; Lopomo, G.; Wang, S. Resource Allocation Under Demand Uncertainty and Private Information. Manag. Sci. 2017, 63, 4219–4235. [Google Scholar] [CrossRef]

- Wang, H. China’s Economic System Reform (1978–2018); Springer: Berlin/Heidelberg, Germany, 2024. [Google Scholar]

- Wu, G.L. Capital misallocation in China: Financial frictions or policy distortions? J. Dev. Econ. 2018, 130, 203–223. [Google Scholar] [CrossRef]

- Hao, Y.; Gai, Z.Q.; Wu, H.T. How do resource misallocation and government corruption affect green total factor energy efficiency? Evidence from China. Energy Policy 2020, 143, 111562. [Google Scholar] [CrossRef]

- Brandt, L.; Tombe, T.; Zhu, X. Factor market distortions across time, space and sectors in China. Rev. Econ. Dyn. 2013, 16, 39–58. [Google Scholar] [CrossRef]

- Huang, X.L.; Ge, P.F.; Zhou, B.L. Selective industrial policy and capital misallocation: Evidence from the ‘Revitalization Plan for Ten Industries’ in China. J. Asia Pac. Econ. 2024, 29, 206–236. [Google Scholar] [CrossRef]

- Sun, C.; Zhan, Y.; Du, G. Can value-added tax incentives of new energy industry increase firm’s profitability? Evidence from financial data of China’s listed companies. Energy Econ. 2020, 86, 104654. [Google Scholar] [CrossRef]

- Chen, R.; Wu, L. Calculation and analysis of the efficiency of resource allocation for technological innovation in China. PLoS ONE 2024, 19, e0308960. [Google Scholar] [CrossRef]

- Li, S.; Huifang, E.; Wang, L.; Xue, H. Factor Misallocation and Optimization in China’s Manufacturing Industry. Sustainability 2023, 15, 4279. [Google Scholar] [CrossRef]

- Chen, S.Y.; Lin, B. Dual-track interest rates and capital misallocation. China Econ. Rev. 2019, 57, 101338. [Google Scholar] [CrossRef]

- Piao, Z.F.; Jia, J.N.; Shen, F.Y.; Chen, R.D. Research of Microcosmic Affection Factors on Capital Misallocation: A Case of Chinese Listed Companies. Math. Probl. Eng. 2016, 2016, 8921418. [Google Scholar] [CrossRef]

- Deng, G.J.; Zhou, C.W.; Wang, D.X.; Zhou, W.H. Local government debt, resource misallocation, and green total factor productivity in China. Front. Environ. Sci. 2023, 11, 1257912. [Google Scholar] [CrossRef]

- Hoffmann, V.H.; Busch, T. Corporate Carbon Performance Indicators—Carbon Intensity, Dependency, Exposure and Risk. J. Ind. Ecol. 2008, 12, 505–520. [Google Scholar] [CrossRef]

- Labatt, S.; White, R.R. Carbon Finance: The Financial Implications of Climate Change; John Wiley & Sons: New York, NY, USA, 2011. [Google Scholar]

- Subramaniam, C.; Watson, M. Additional evidence on the sticky behavior of costs. Adv. Manag. Account. 2016, 26, 275–305. [Google Scholar]

- Gasbarro, F.; Iraldo, F.; Daddi, T. The drivers of multinational enterprises’ climate change strategies: A quantitative study on climate-related risks and opportunities. J. Clean Prod. 2017, 160, 8–26. [Google Scholar] [CrossRef]

- Gorgen, M.; Jacob, A.; Nerlinger, M. Get Green or Die Trying? Carbon Risk Integration into Portfolio Management. J. Portf. Manag. 2021, 47, 77–93. [Google Scholar] [CrossRef]

- Herbohn, K.; Gao, R.; Clarkson, P. Evidence on Whether Banks Consider Carbon Risk in Their Lending Decisions. J. Bus. Ethics 2017, 158, 155–175. [Google Scholar] [CrossRef]

- Duan, T.; Li, F.W.; Wen, Q. Is Carbon Risk Priced in the Cross Section of Corporate Bond Returns? J. Financ. Quant. Anal. 2023, 60, 1–35. [Google Scholar] [CrossRef]

- Bose, S.; Minnick, K.; Shams, S. Does carbon risk matter for corporate acquisition decisions? J. Corp. Financ. 2021, 70, 102058. [Google Scholar] [CrossRef]

- Gallego-Álvarez, I.; Segura, L.; Martínez-Ferrero, J. Carbon emission reduction: The impact on the financial and operational performance of international companies. J. Clean Prod. 2015, 103, 149–159. [Google Scholar] [CrossRef]

- Lewandowski, S. Corporate Carbon and Financial Performance: The Role of Emission Reductions. Bus. Strategy Environ. 2017, 26, 1196–1211. [Google Scholar] [CrossRef]

- Lee, S.-Y.; Choi, D.-K. Does Corporate Carbon Risk Management Mitigate the Cost of Debt Capital? Evidence from South Korean Climate Change Policies. Emerg. Mark. Financ. Trade 2021, 57, 2138–2151. [Google Scholar] [CrossRef]

- van Vliet, O.; Hanger-Kopp, S.; Nikas, A.; Spijker, E.; Carlsen, H.; Doukas, H.; Lieu, J. The importance of stakeholders in scoping risk assessments—Lessons from low-carbon transitions. Environ. Innov. Soc. Transit. 2020, 35, 400–413. [Google Scholar] [CrossRef]

- Ek, C.; Wu, G.L. Investment-cash flow sensitivities and capital misallocation. J. Dev. Econ. 2018, 133, 220–230. [Google Scholar] [CrossRef]

- Dong, X.; Yang, Y.; Zhao, X.; Feng, Y.; Liu, C. Environmental Regulation, Resource Misallocation and Industrial Total Factor Productivity: A Spatial Empirical Study Based on China’s Provincial Panel Data. Sustainability 2021, 13, 2390. [Google Scholar] [CrossRef]

- Aharonson, B.S.; Bort, S. Institutional pressure and an organization’s strategic response in Corporate Social Action engagement: The role of ownership and media attention. Strateg. Organ. 2015, 13, 307–339. [Google Scholar] [CrossRef]

- He, F.; Guo, X.; Yue, P. Media coverage and corporate ESG performance: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103003. [Google Scholar] [CrossRef]

- Luo, C.; Wei, D.; He, F. Corporate ESG performance and trade credit financing—Evidence from China. Int. Rev. Econ. Financ. 2023, 85, 337–351. [Google Scholar] [CrossRef]

- Houqe, M.N.; Khan, H.Z.; Moses, O.; Elias, A. Corporate reputation, cost of capital and the moderating role of economic development: International evidence. Meditari Account. Res. 2024, 32, 1106–1134. [Google Scholar] [CrossRef]

- Huang, T.; Zhang, X. Media coverage of industry and the cross-section of stock returns. Account. Financ. 2022, 62, 1107–1141. [Google Scholar] [CrossRef]

- Bessler, W.; Drobetz, W.; Grüninger, M.C. Information Asymmetry and Financing Decisions. Int. Rev. Financ. 2011, 11, 123–154. [Google Scholar] [CrossRef]

- Chih, H.-H.; Chih, H.-L. Doing good with or without being known? Media coverage of corporate social performance and its impact on corporate financial performance. Manag. Financ. 2014, 40, 883. [Google Scholar] [CrossRef]

- Palea, V.; Drogo, F. Carbon emissions and the cost of debt in the eurozone: The role of public policies, climate-related disclosure and corporate governance. Bus. Strateg. Environ. 2020, 29, 2953–2972. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency Theory: An Assessment and Review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef]

- Jiang, F.; Kim, K.A. Corporate Governance in China: A Survey. Rev. Financ. 2020, 24, 733–772. [Google Scholar] [CrossRef]

- Li, X.; Liu, G.; Fu, Q.; Abdul Rahman, A.A.; Meero, A.; Sial, M.S. Does corporate social responsibility impact on corporate risk-taking? Evidence from emerging economy. Sustainability 2022, 14, 531. [Google Scholar] [CrossRef]

- Koch, N.; Bassen, A. Valuing the carbon exposure of European utilities. The role of fuel mix, permit allocation and replacement investments. Energy Econ. 2013, 36, 431–443. [Google Scholar] [CrossRef]

- Pirson, M.; Turnbull, S. Corporate governance, risk management, and the financial crisis: An information processing view. Corp. Gov. Int. Rev. 2011, 19, 459–470. [Google Scholar] [CrossRef]

- Love, I. Corporate Governance and Performance around the World: What We Know and What We Don’t. World Bank Res. Obs. 2010, 26, 42–70. [Google Scholar] [CrossRef]

- Bouteska, A.; Mili, M. Does corporate governance affect financial analysts’ stock recommendations, target prices accuracy and earnings forecast characteristics? An empirical investigation of US companies. Empir. Econ. 2022, 63, 2125–2171. [Google Scholar] [CrossRef] [PubMed]

- Aoki, S. A simple accounting framework for the effect of resource misallocation on aggregate productivity. J. Jpn. Int. Econ. 2012, 26, 473–494. [Google Scholar] [CrossRef]

- Ren, X.; Li, Y.; Shahbaz, M.; Dong, K.; Lu, Z. Climate risk and corporate environmental performance: Empirical evidence from China. Sustain. Prod. Consump. 2022, 30, 467–477. [Google Scholar] [CrossRef]

- Curtin, J.; McInerney, C.; Gallachoir, B.O.; Hickey, C.; Deane, P.; Deeney, P. Quantifying stranding risk for fossil fuel assets and implications for renewable energy investment: A review of the literature. Renew. Sustain. Energy Rev. 2019, 116, 109402. [Google Scholar] [CrossRef]

- Carson, T.L. Self–Interest and Business Ethics: Some Lessons of the Recent Corporate Scandals. J. Bus. Ethics 2003, 43, 389–394. [Google Scholar] [CrossRef]

- Vogler, D.; Eisenegger, M. CSR Communication, Corporate Reputation, and the Role of the News Media as an Agenda-Setter in the Digital Age. Bus. Soc. 2021, 60, 1957–1986. [Google Scholar] [CrossRef]

- OuYang, Z.; Xu, J.; Wei, J.; Liu, Y. Information Asymmetry and Investor Reaction to Corporate Crisis: Media Reputation as a Stock Market Signal. J. Media Econ. 2017, 30, 82–95. [Google Scholar] [CrossRef]

- Aktas, N.; Andreou, P.C.; Karasamani, I.; Philip, D. CEO Duality, Agency Costs, and Internal Capital Allocation Efficiency. Br. J. Manag. 2019, 30, 473–493. [Google Scholar] [CrossRef]

- Bosse, D.A.; Phillips, R.A. Agency Theory and Bounded Self-Interest. Acad. Manag. Rev. 2016, 41, 276–297. [Google Scholar]

- Nguyen, J.H.; Phan, H.V. Carbon risk and corporate capital structure. J. Corp. Financ. 2020, 64, 101713. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, Z.; Liang, S. The effect of government intervention on the resource misallocation in innovation: Ownership differences. Asia-Pac. J. Account. Econ. 2023, 30, 230–246. [Google Scholar] [CrossRef]

- Liu, D.; Xiong, Y.; Wang, L.; Yao, S. Corporate carbon risk and green M&As. Res. Int. Bus. Financ. 2025, 75, 102714. [Google Scholar]

| Variable Type | Variable Name | Variable Symbol | Calculation Method |

|---|---|---|---|

| Dependent variables | Capital mismatch | Capmis | Degree of deviation of marginal output of capital from the cost of capital employed |

| Independent variables | Carbon risk | Risk | Carbon dioxide emissions/(Enterprise main business income × 1,000,000) |

| Moderator variables | Media attention | MA | Ln (1 + Total number of carbon news stories) |

| Corporate governance | Govern | Based on eight indicators calculated by principal component analysis | |

| Control variables | Corporate size | Size | Logarithm of total assets for the year |

| CEO duality | Dual | 1 is assigned when the chairman of the firm’s board and CEO are the same individual, and 0 otherwise | |

| Shareholding concentration | Top1 | The shareholding ratio of the largest shareholder | |

| Profitability | ROA | Net profit/Total assets | |

| Gearing ratio | Lev | Total corporate liabilities at year-end/Total corporate assets | |

| Corporate cashflow | Cashflow | Net cash flows from operating activities/Total profit | |

| Year-fixed effects | Year | Annual dummy variables | |

| Individual-fixed effects | Id | Individual dummy variables |

| Variable | N | Mean | p50 | sd | Min | Max |

|---|---|---|---|---|---|---|

| Capmis | 4978 | 1.271 | 1.278 | 0.943 | −1.188 | 4.071 |

| Risk | 4978 | 1.309 | 1.254 | 0.486 | 0.059 | 2.513 |

| MA | 4946 | 4.336 | 4.407 | 0.971 | 0.693 | 6.340 |

| Govern | 4724 | −0.035 | −0.229 | 0.591 | −1.535 | 2.400 |

| Size | 4978 | 22.48 | 22.250 | 1.414 | 19.950 | 26.340 |

| Dual | 4978 | 0.229 | 0.000 | 0.420 | 0.000 | 1.000 |

| Top1 | 4978 | 34.37 | 31.770 | 14.950 | 9.182 | 77.290 |

| ROA | 4978 | 0.042 | 0.038 | 0.063 | −0.196 | 0.235 |

| Lev | 4978 | 0.442 | 0.445 | 0.208 | 0.062 | 0.936 |

| Cashflow | 4978 | 0.058 | 0.058 | 0.066 | −0.136 | 0.248 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Capmis | Capmis | Capmis | |

| Risk | 0.374 *** | 0.412 *** | 0.055 ** |

| (0.027) | (0.023) | (0.025) | |

| Size | −0.243 *** | −0.317 *** | |

| (0.010) | (0.017) | ||

| Dual | 0.084 *** | 0.026 | |

| (0.027) | (0.023) | ||

| Top1 | −0.001 | −0.000 | |

| (0.001) | (0.001) | ||

| ROA | 2.230 *** | 0.748 *** | |

| (0.225) | (0.144) | ||

| Lev | −0.665 *** | −0.180 *** | |

| (0.071) | (0.066) | ||

| Cashflow | −0.701 *** | −0.320 ** | |

| (0.191) | (0.117) | ||

| _cons | 0.783 *** | 6.440 *** | 8.045 *** |

| (0.038) | (0.205) | (0.393) | |

| Id | NO | NO | YES |

| Year | NO | NO | YES |

| N | 4978 | 4978 | 4978 |

| R2 | 0.037 | 0.304 | 0.837 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| MA | MA | Govern | Govern | |

| Risk | 0.058 ** | 0.056 ** | 0.064 ** | 0.045 * |

| (0.025) | (0.025) | (0.025) | (0.026) | |

| MA | −0.010 | −0.009 | ||

| (0.009) | (0.009) | |||

| Risk × MA | −0.034 ** | |||

| (0.017) | ||||

| Govern | −0.030 | −0.036 | ||

| (0.033) | (0.033) | |||

| Risk × Govern | −0.156 *** | |||

| (0.037) | ||||

| Size | −0.316 *** | −0.315 *** | −0.317 *** | −0.313 *** |

| (0.017) | (0.017) | (0.017) | (0.017) | |

| Dual | 0.026 | 0.027 | 0.044 | 0.044 |

| (0.023) | (0.023) | (0.027) | (0.027) | |

| Top1 | −0.000 | −0.000 | −0.002 | −0.002 |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| ROA | 0.760 *** | 0.756 *** | 0.708 *** | 0.685 *** |

| (0.146) | (0.146) | (0.147) | (0.147) | |

| Lev | −0.175 *** | −0.166 ** | −0.234 *** | −0.233 *** |

| (0.067) | (0.067) | (0.068) | (0.068) | |

| Cashflow | −0.317 *** | −0.319 *** | −0.129 | −0.127 |

| (0.118) | (0.118) | (0.119) | (0.119) | |

| _cons | 8.037 *** | 8.016 *** | 8.049 *** | 7.981 *** |

| (0.395) | (0.395) | (0.405) | (0.404) | |

| Id | YES | YES | YES | YES |

| Year | YES | YES | YES | YES |

| N | 4946 | 4946 | 4724 | 4724 |

| R2 | 0.836 | 0.837 | 0.844 | 0.845 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| OP | Include Province-Fixed Effects | Reduced Sample Period | |

| Risk | 0.029 *** | 0.032 *** | 0.070 ** |

| (0.011) | (0.022) | (0.033) | |

| Size | −0.087 *** | −0.315 *** | −0.283 *** |

| (0.008) | (0.017) | (0.025) | |

| Dual | −0.012 | 0.025 | 0.037 |

| (0.011) | (0.023) | (0.030) | |

| Top1 | −0.001 | −0.001 | −0.001 |

| (0.000) | (0.001) | (0.001) | |

| ROA | 0.369 *** | 0.739 *** | 0.678 *** |

| (0.068) | (0.143) | (0.178) | |

| Lev | −0.170 *** | −0.175 *** | −0.224 ** |

| (0.031) | (0.067) | (0.087) | |

| Cashflow | −0.389 *** | −0.332 *** | −0.171 |

| (0.055) | (0.117) | (0.146) | |

| _cons | 2.239 *** | 8.379 *** | 7.241 *** |

| (0.055) | (0.362) | (0.576) | |

| Id | YES | YES | YES |

| Year | YES | YES | YES |

| Province | NO | YES | NO |

| N | 4978 | 4978 | 3109 |

| R2 | 0.594 | 0.839 | 0.875 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, C.; Zhang, S.; Zhao, C.; He, B. Carbon Risk and Capital Mismatch: Evidence from Carbon-Intensive Firms in China. Sustainability 2025, 17, 6477. https://doi.org/10.3390/su17146477

Zhang C, Zhang S, Zhao C, He B. Carbon Risk and Capital Mismatch: Evidence from Carbon-Intensive Firms in China. Sustainability. 2025; 17(14):6477. https://doi.org/10.3390/su17146477

Chicago/Turabian StyleZhang, Changjiang, Sihan Zhang, Chunyan Zhao, and Bing He. 2025. "Carbon Risk and Capital Mismatch: Evidence from Carbon-Intensive Firms in China" Sustainability 17, no. 14: 6477. https://doi.org/10.3390/su17146477

APA StyleZhang, C., Zhang, S., Zhao, C., & He, B. (2025). Carbon Risk and Capital Mismatch: Evidence from Carbon-Intensive Firms in China. Sustainability, 17(14), 6477. https://doi.org/10.3390/su17146477