Does the Development of Digital Finance Enhance Urban Energy Resilience? Evidence from Machine Learning

Abstract

1. Introduction

2. Theoretical Mechanism and Research Hypothesis

2.1. Literature Review

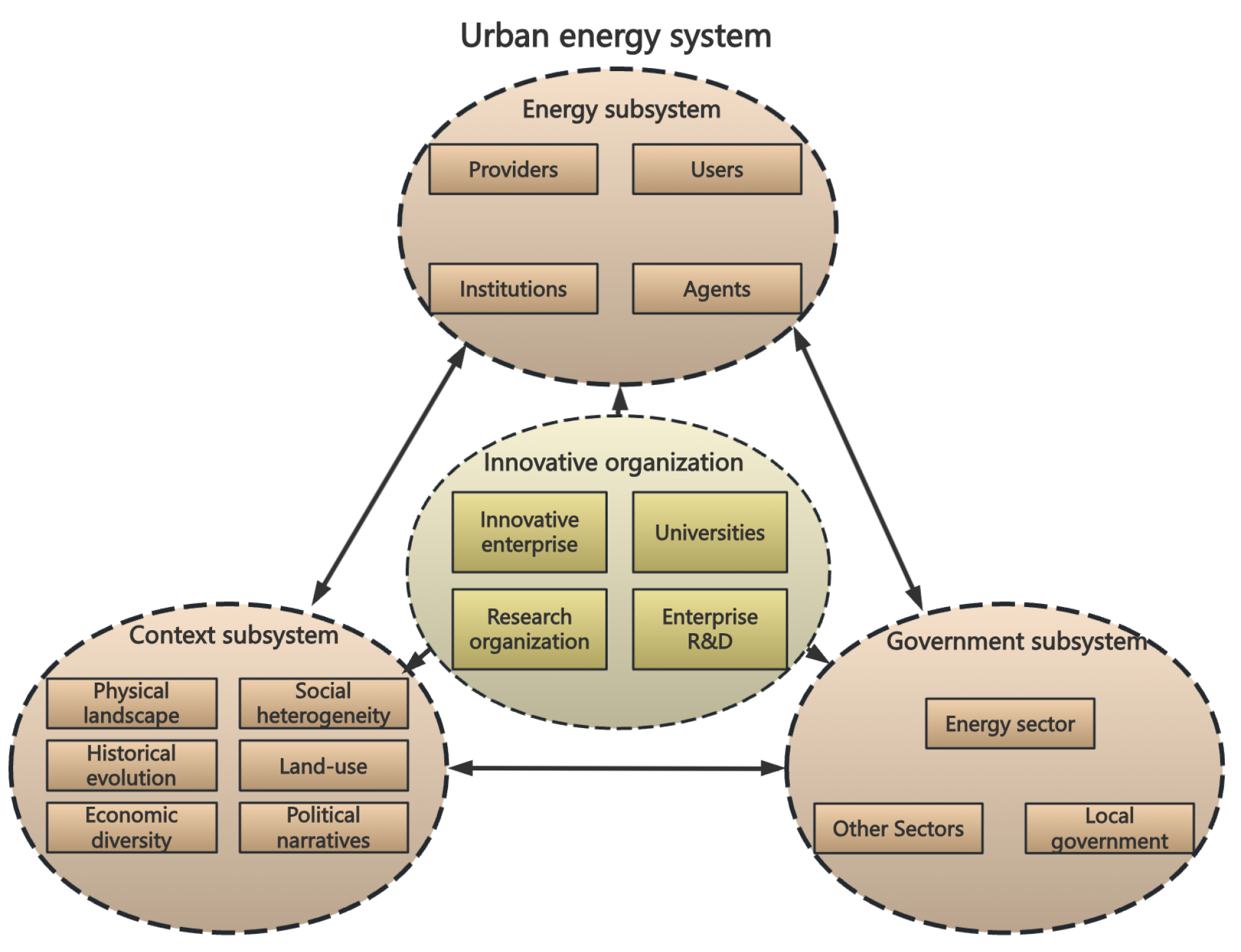

2.2. Complex Systems Theory and Urban Energy Systems

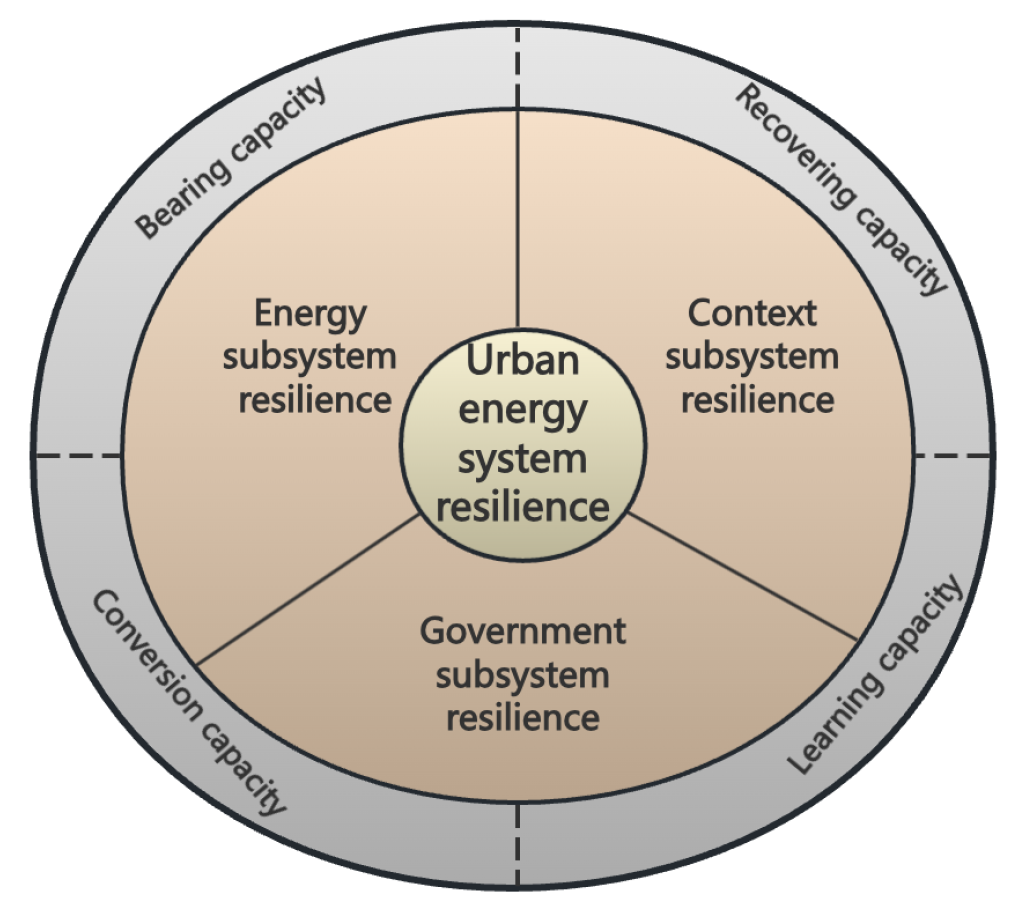

2.3. System Resilience Formation

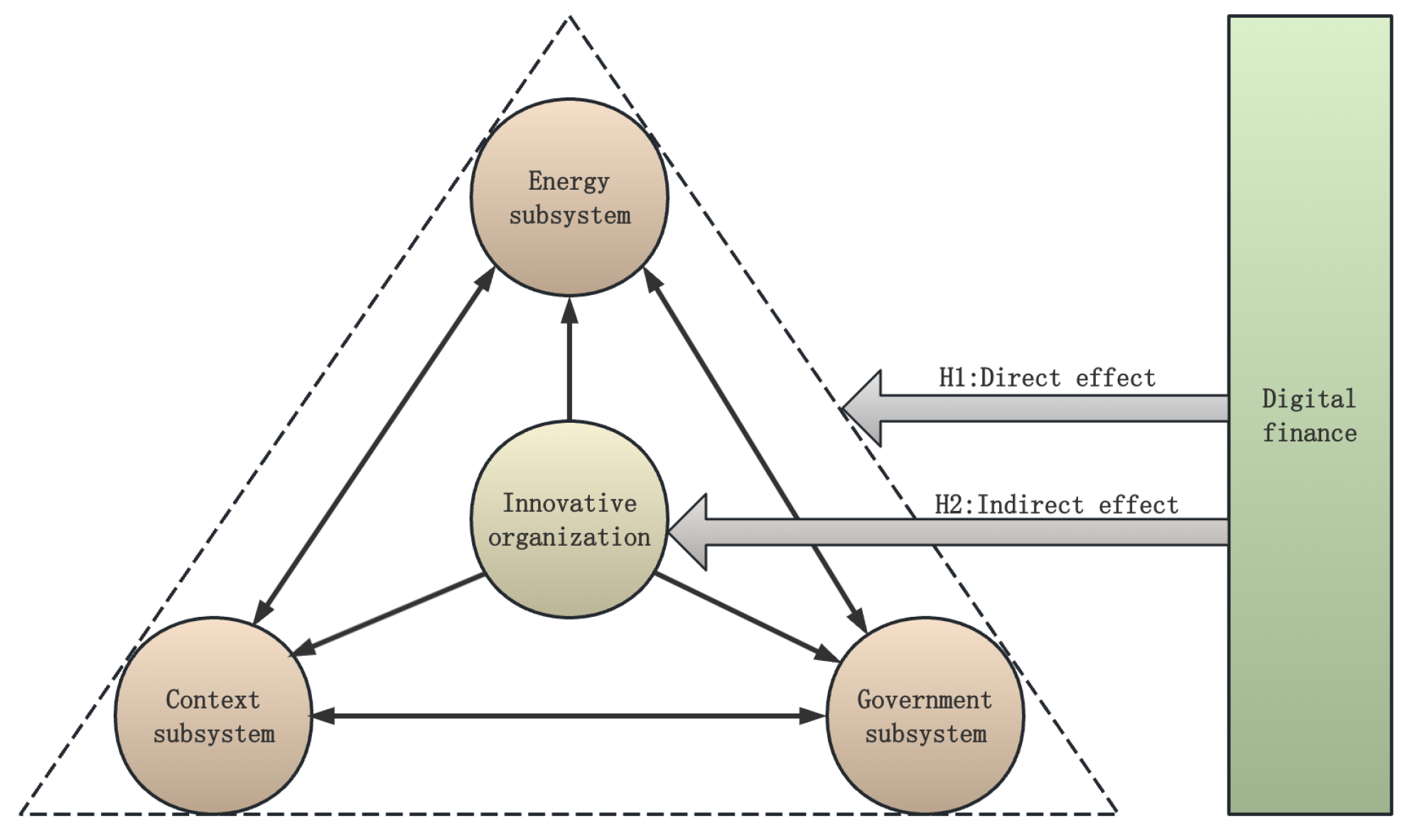

2.4. Mechanism Analysis of Digital Finance Development

2.5. Analysis of Innovative Organizations’ Mediating Effect

3. Research Design and Status Analysis

3.1. Model Construction

3.1.1. Basic Regression Model

3.1.2. Mechanism Effects Model

3.1.3. Causal Forest Model

3.2. Data and Variables

3.2.1. Explained Variable

3.2.2. Core Explanatory Variable

3.2.3. Control Variables

3.2.4. Mechanism Variables

3.2.5. Data Sources

4. Results

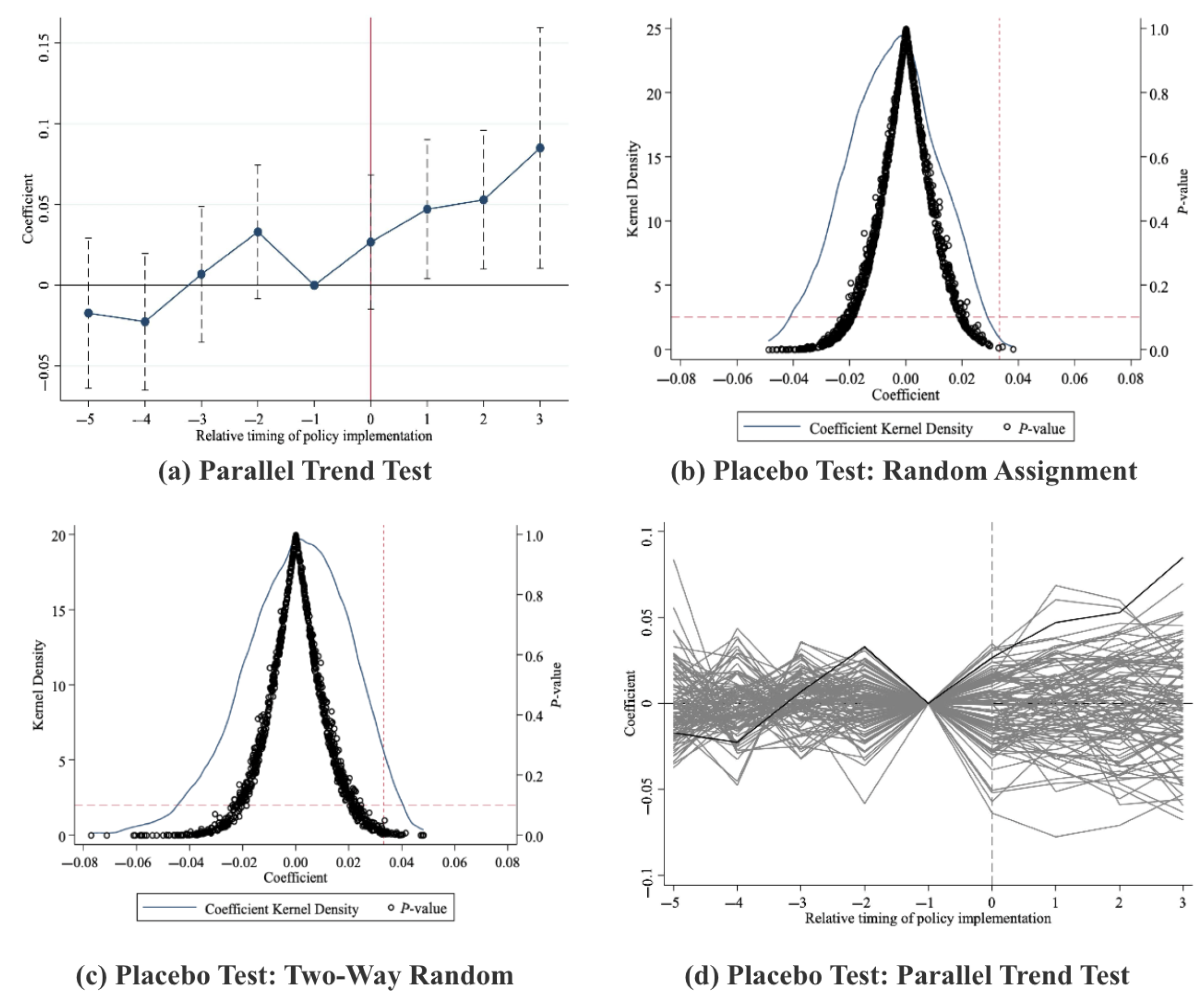

4.1. Parallel Trend Test

4.2. Benchmark Result

4.3. Robustness Check

4.3.1. Placebo Test

4.3.2. Bacon Decomposition

4.3.3. Double Machine Learning Testing

4.3.4. Excluding Other Policies Interference Test

4.3.5. PSM-DID

4.3.6. Other Robustness Tests

4.3.7. Other Endogeneity Tests

5. Further Analysis

5.1. Mechanism Analysis

5.2. Machine Learning Analytics

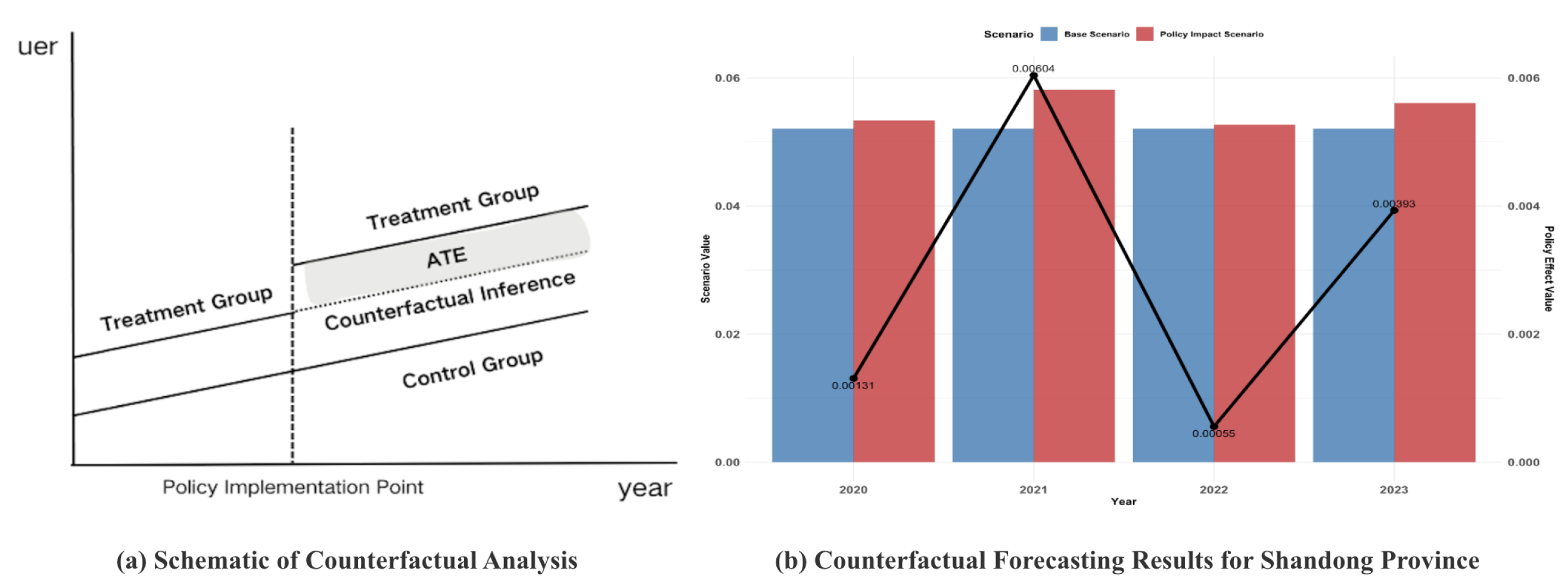

5.2.1. Counterfactual Forecasting

5.2.2. Causal Forest

6. Conclusions, Discussion, and Policy Implications

6.1. Research Conclusions

6.2. Discussion

6.3. Policy Recommendations

6.4. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Kim, J.; Jaumotte, F.; Panton, A.J.; Schwerhoff, G. Energy security and the green transition. Energy Policy 2025, 198, 114409. [Google Scholar] [CrossRef]

- Zhang, M.; Zhou, S.; Wang, Q.; Liu, L.; Zhou, D. Will the carbon neutrality target impact China’s energy security? A dynamic bayesian network model. Energy Econ. 2023, 125, 106850. [Google Scholar] [CrossRef]

- Fan, W.; Lv, W.; Wang, Z. How to measure and enhance the resilience of energy systems? Sustain. Prod. Consum. 2023, 39, 191–202. [Google Scholar] [CrossRef]

- Zhong, Y.; Li, Y. Statistical evaluation of sustainable urban planning: Integrating renewable energy sources, energy-efficient buildings, and climate resilience measures. Sustain. Cities Soc. 2024, 101, 105160. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Fu, H.; Zheng, C.; Yang, P. Digital inclusive finance and green transformation of manufacturing enterprises: Empirical analysis based on the dual perspectives of demand and supply. Technol. Forecast. Soc. Chang. 2024, 200, 123152. [Google Scholar] [CrossRef]

- Lee, C.C.; Li, M.; Li, X.; Song, H. More green digital finance with less energy poverty? Key role of climate risk. Energy Econ. 2024, 2024, 108144. [Google Scholar] [CrossRef]

- Zhao, H.; Chen, S.; Zhang, W. Does digital inclusive finance affect urban carbon emission intensity: Evidence from 285 cities in China. Cities 2023, 142, 104552. [Google Scholar] [CrossRef]

- Wang, Y.; Yuan, Z.; Luo, H.; Zeng, H.; Huang, J.; Li, Y. Promoting low-carbon energy transition through green finance: New evidence from a demand-supply perspective. Energy Policy 2024, 195, 114376. [Google Scholar] [CrossRef]

- Lin, B.; Shi, F. Coal price, economic growth and electricity consumption in China under the background of energy transition. Energy Policy 2024, 195, 114400. [Google Scholar] [CrossRef]

- Chen, W.; Chen, Z.; Luo, Q. Predicting volatility in China’s clean energy sector: Advantages of the carbon transition risk. Financ. Res. Lett. 2024, 2024, 106534. [Google Scholar] [CrossRef]

- Guo, D.; Li, Q.; Liu, P.; Shi, X.; Yu, J. Power shortage and firm performance: Evidence from a chinese city power shortage index. Energy Econ. 2023, 119, 106593. [Google Scholar] [CrossRef]

- Peng, W.; Liu, W.; Li, Y. The impact of digital financial development on pollution reduction: Evidence from provinces in China. Technol. Forecast. Soc. Chang. 2025, 212, 123926. [Google Scholar] [CrossRef]

- Chen, G.; Yu, Z. Digital finance, value cocreation, and supply chain resilience: Evidence from listed manufacturing firms in China. Financ. Res. Lett. 2024, 70, 106322. [Google Scholar] [CrossRef]

- Bansal, S.; Kumar, S.; Ali, S.; Singh, S.; Nangia, P.; Bamel, U. Harnessing digital finance for sustainability: An integrative review and research agenda. Res. Int. Bus. Financ. 2024, 2024, 102682. [Google Scholar] [CrossRef]

- Shi, Y.; Du, B.; Yang, B. How does digital inclusive finance affect common prosperity: Empirical evidence from China’s underdeveloped and developed regions. Cities 2025, 158, 105640. [Google Scholar] [CrossRef]

- Zhen, Z.; Cao, R.; Gan, X.; Wang, C. The impact of digital finance on urban entrepreneurial activity: The moderating effect of advanced human capital structure. Financ. Res. Lett. 2024, 64, 105414. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhang, S.; Huang, B.; Hu, X. Research on the impact of digital finance on the high-quality development of education. Financ. Res. Lett. 2024, 70, 106188. [Google Scholar] [CrossRef]

- Liu, Y.; Peng, Y.; Wang, W.; Liu, S.; Yin, Q. Does the pilot zone for green finance reform and innovation policy improve urban green total factor productivity? the role of digitization and technological innovation. J. Clean. Prod. 2024, 471, 143365. [Google Scholar] [CrossRef]

- Younesi, A.; Wang, Z.; Siano, P. Enhancing the resilience of zero-carbon energy communities: Leveraging network reconfiguration and effective load carrying capability quantification. J. Clean. Prod. 2024, 434, 139794. [Google Scholar] [CrossRef]

- Zhou, Y. Low-carbon urban–rural modern energy systems with energy resilience under climate change and extreme events in China—A state-of-the-art review. Energy Build. 2024, 2024, 114661. [Google Scholar] [CrossRef]

- Nepal, R.; Zhao, X.; Liu, Y.; Dong, K. Can green finance strengthen energy resilience? the case of China. Technol. Forecast. Soc. Chang. 2024, 202, 123302. [Google Scholar] [CrossRef]

- Holland, J.H. Adaptation in Natural and Artificial Systems: An Introductory Analysis with Applications to Biology, Control, and Artificial Intelligence; MIT Press: Cambridge, MA, USA, 1992. [Google Scholar] [CrossRef]

- Correljé, A.; Hoppe, T.; Künneke, R. Guest editorial: Special issue on “sustainable urban energy systems–governance and citizen involvement”. Energy Policy 2024, 192, 114237. [Google Scholar] [CrossRef]

- Hu, R.; Zhou, K.; Yang, J.; Yin, H. Management of resilient urban integrated energy system: State-of-the-art and future directions. J. Environ. Manag. 2024, 363, 121318. [Google Scholar] [CrossRef]

- Basu, S.; Bale, C.S.; Wehnert, T.; Topp, K. A complexity approach to defining urban energy systems. Cities 2019, 95, 102358. [Google Scholar] [CrossRef]

- Wang, H.J.; Tang, K. Extreme climate, innovative ability and energy efficiency. Energy Econ. 2023, 120, 106586. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, Y.; Zheng, T.; Zhang, K. Complex network theory-based optimization for enhancing resilience of large-scale multi-energy system. Appl. Energy 2024, 370, 123593. [Google Scholar] [CrossRef]

- Shi, Y.; Zhai, G.; Xu, L.; Zhou, S.; Lu, Y.; Liu, H.; Huang, W. Assessment methods of urban system resilience: From the perspective of complex adaptive system theory. Cities 2021, 112, 103141. [Google Scholar] [CrossRef]

- Holling, C.S. Resilience and Stability of Ecological Systems; International Institute for Applied Systems Analysis Laxenburg: Laxenburg, Austria, 1973. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, T.; Goh, Y.M.; He, P.; Hua, L. The effects of long-term policies on urban resilience: A dynamic assessment framework. Cities 2024, 153, 105294. [Google Scholar] [CrossRef]

- Ahmadi, S.; Saboohi, Y.; Vakili, A. Frameworks, quantitative indicators, characters, and modeling approaches to analysis of energy system resilience: A review. Renew. Sustain. Energy Rev. 2021, 144, 110988. [Google Scholar] [CrossRef]

- Guo, Z.; Li, Z.; Lu, C.; She, J.; Zhou, Y. Spatio-temporal evolution of resilience: The case of the chengdu-chongqing urban agglomeration in China. Cities 2024, 153, 105226. [Google Scholar] [CrossRef]

- Mao, C.; Yue, A.; Wang, Z.; Zhao, S.; Su, Y.; Zeng, S. Are cities genuinely healthy? diagnosis of urban development from the perspective of adaptive capacity. Sustain. Cities Soc. 2024, 108, 105494. [Google Scholar] [CrossRef]

- Pradhan, K.; Rajabifard, A.; Aryal, J.; Crompvoets, J. Dissecting multidimensional morphology of urban sprawl: Framework for policy intervention. Cities 2025, 157, 105627. [Google Scholar] [CrossRef]

- Razzaq, A.; Yang, X. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Chang. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Wang, W.; Dong, Y. Spatial-temporal coupling and interactive effects of digital finance and green technology innovation: Empirical evidence from China. J. Clean. Prod. 2024, 470, 143354. [Google Scholar] [CrossRef]

- Cao, L.; Wang, Y.; Yu, J.; Zhang, Y.; Yin, X. The impact of digital economy on low-carbon transition: What is the role of human capital? Financ. Res. Lett. 2024, 69, 106246. [Google Scholar] [CrossRef]

- Zhang, C.; Deng, Y. How does digital transformation affect firm technical efficiency? evidence from China. Financ. Res. Lett. 2024, 69, 106069. [Google Scholar] [CrossRef]

- Peng, Z.; Huang, Y.; Liu, L.; Xu, W.; Qian, X. How government digital attention alleviates enterprise financing constraints: An enterprise digitalization perspective. Financ. Res. Lett. 2024, 67, 105883. [Google Scholar] [CrossRef]

- Gong, Q.; Zhang, R. Digital finance as a catalyst for energy transition and sustainable rural economic growth. Financ. Res. Lett. 2025, 71, 106405. [Google Scholar] [CrossRef]

- Li, G.; Wu, H.; Jiang, J.; Zong, Q. Digital finance and the low-carbon energy transition (lcet) from the perspective of capital-biased technical progress. Energy Econ. 2023, 120, 106623. [Google Scholar] [CrossRef]

- Duan, Z.; Yuan, F.; Tian, Z. Evaluating the effects of digital finance on urban poverty. Socio-Econ. Plan. Sci. 2024, 96, 102099. [Google Scholar] [CrossRef]

- Zou, J.; Yao, L.; Wang, B.; Zhang, Y.; Deng, X. How does digital inclusive finance promote the journey of common prosperity in China? Cities 2024, 150, 105083. [Google Scholar] [CrossRef]

- Dogan, B.; Nketiah, E.; Ghosh, S.; Nassani, A.A. The impact of the green technology on the renewable energy innovation: Fresh pieces of evidence under the role of research & development and digital economy. Renew. Sustain. Energy Rev. 2025, 210, 115193. [Google Scholar] [CrossRef]

- Huang, S.; Tan, H. Evaluating the effects of green supply chain, digital technologies, and energy prices on renewable energy innovations: A way forward for an emerging economy. Energy Econ. 2025, 141, 108038. [Google Scholar] [CrossRef]

- Du, J.; Shen, Z.; Song, M.; Zhang, L. Nexus between digital transformation and energy technology innovation: An empirical test of a-share listed enterprises. Energy Econ. 2023, 120, 106572. [Google Scholar] [CrossRef]

- Tang, M.; Liu, Y.; Hu, F.; Wu, B. Effect of digital transformation on enterprises’ green innovation: Empirical evidence from listed companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- Wu, H.; Yin, Y.; Li, G.; Ye, X. Digital finance, capital-biased and labor-biased technical progress: Important grips for mitigating carbon emission inequality. J. Environ. Manag. 2024, 371, 123198. [Google Scholar] [CrossRef]

- Tiwari, S.; Shahzad, U.; Alofaysan, H.; Walsh, S.T.; Kumari, P. How do renewable energy, energy innovation and climate change shape the energy transition in usa? Unraveling the role of green finance development. Energy Econ. 2024, 140, 107947. [Google Scholar] [CrossRef]

- Zhang, S.; Wang, X. Does innovative city construction improve the industry–university–research knowledge flow in urban China? Technol. Forecast. Soc. Chang. 2022, 174, 121200. [Google Scholar] [CrossRef]

- Zhao, F.; Hu, Z.; Zhao, X. Does innovative city construction improve urban carbon unlocking efficiency? Evidence from China. Sustain. Cities Soc. 2023, 92, 104494. [Google Scholar] [CrossRef]

- Tang, J.; Li, W.; Hu, J.; Ren, Y. Can government digital transformation improve corporate energy efficiency in resource-based cities? Energy Econ. 2025, 141, 108043. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big bad banks? The winners and losers from bank deregulation in the united states. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Yu, T.; Mao, S. Does the establishment of China’s national innovation demonstration zone for sustainable development enhance urban sustainable competitiveness?—Policy effects assessment based on multi-period difference-in-differences models. J. Environ. Manag. 2024, 372, 123439. [Google Scholar] [CrossRef] [PubMed]

- Wang, F. Does the construction of smart cities make cities green? evidence from a quasi-natural experiment in China. Cities 2023, 140, 104436. [Google Scholar] [CrossRef]

- Esposti, R. Non-monetary motivations of the eu agri-environmental policy adoption. a causal forest approach. J. Environ. Manag. 2024, 352, 119992. [Google Scholar] [CrossRef]

- Tian, Y.; Yang, H.; Zhang, M.; Wang, J. Green innovation effects of ecological civilization pilot policies. Pol. J. Environ. Stud. 2024, 33, 2331–2343. [Google Scholar] [CrossRef]

- Miller, S. Causal forest estimation of heterogeneous and time-varying environmental policy effects. J. Environ. Econ. Manag. 2020, 103, 102337. [Google Scholar] [CrossRef]

- Kharrazi, A.; Sato, M.; Yarime, M.; Nakayama, H.; Yu, Y.; Kraines, S. Examining the resilience of national energy systems: Measurements of diversity in production-based and consumption-based electricity in the globalization of trade networks. Energy Policy 2015, 87, 455–464. [Google Scholar] [CrossRef]

- Yang, J.; Zhou, K.; Hu, R. City-level resilience assessment of integrated energy systems in china. Energy Policy 2024, 193, 114294. [Google Scholar] [CrossRef]

- Zeng, Z.; Fang, Y.P.; Zhai, Q.; Du, S. A markov reward process-based framework for resilience analysis of multistate energy systems under the threat of extreme events. Reliab. Eng. Syst. Saf. 2021, 209, 107443. [Google Scholar] [CrossRef]

- Chai, J.; Tian, L.; Jia, R. New energy demonstration city, spatial spillover and carbon emission efficiency: Evidence from China’s quasi-natural experiment. Energy Policy 2023, 173, 113389. [Google Scholar] [CrossRef]

- Chen, L.; Wang, K. The spatial spillover effect of low-carbon city pilot scheme on green efficiency in China’s cities: Evidence from a quasi-natural experiment. Energy Econ. 2022, 110, 106018. [Google Scholar] [CrossRef]

- Xin, B.; Zhou, L.; Gonzalez, E.D.S. Does green finance reform hit urban employment?—Evidence from China’s green finance pilot policy. Cities 2024, 152, 105239. [Google Scholar] [CrossRef]

- Cui, H.; Cao, Y. Energy rights trading policy, spatial spillovers, and energy utilization performance: Evidence from chinese cities. Energy Policy 2024, 192, 114234. [Google Scholar] [CrossRef]

- Zhang, K.; Zhu, P.H.; Qian, X.Y. National information consumption demonstration city construction and urban green development: A quasi-experiment from chinese cities. Energy Econ. 2024, 130, 107313. [Google Scholar] [CrossRef]

- Ruan, R.; Chen, W. Research on the impact of geographic distance on corporate technology for social good: From the perspective of institutional environment and regional innovation capability. J. Clean. Prod. 2024, 457, 142391. [Google Scholar] [CrossRef]

- Tan, R.; Zhu, W.; Xu, M.; Zhang, Z. From voluntary to mandatory implementation: The impact of green credit policy on de-zombification in China. Energy Econ. 2024, 2024, 108045. [Google Scholar] [CrossRef]

- Ma, Q.; Zhang, Y.; Hu, F.; Zhou, H. Can the energy conservation and emission reduction demonstration city policy enhance urban domestic waste control? evidence from 283 cities in China. Cities 2024, 154, 105323. [Google Scholar] [CrossRef]

- Wang, J.; Wang, S. The effect of electricity market reform on energy efficiency in China. Energy Policy 2023, 181, 113722. [Google Scholar] [CrossRef]

- Goodman-Bacon, A. Difference-in-differences with variation in treatment timing. J. Econom. 2021, 225, 254–277. [Google Scholar] [CrossRef]

- Dong, K.; Yang, S.; Wang, J. How digital economy lead to low-carbon development in China? The case of e-commerce city pilot reform. J. Clean. Prod. 2023, 391, 136177. [Google Scholar] [CrossRef]

- Ling, S.; Jin, S.; Wang, H.; Zhang, Z.; Feng, Y. Transportation infrastructure upgrading and green development efficiency: Empirical analysis with double machine learning method. J. Environ. Manag. 2024, 358, 120922. [Google Scholar] [CrossRef]

- Chen, X.; Wang, H. Do China’s ecological civilization advance demonstration zones inhibit fisheries’ carbon emission intensity? A quasi-natural experiment using double machine learning and spatial difference-in-differences. J. Environ. Manag. 2024, 370, 122682. [Google Scholar] [CrossRef] [PubMed]

- Huang, S.; Luan, Z. Can green finance supports improve environmental firm performance? evidence from listed environmental firms in China. Financ. Res. Lett. 2024, 70, 106321. [Google Scholar] [CrossRef]

- Wu, D.; Xie, Y. Unveiling the impact of public data access on collaborative reduction of pollutants and carbon emissions: Evidence from open government data policy. Energy Econ. 2024, 138, 107822. [Google Scholar] [CrossRef]

- Chen, C.; Zhang, T.; Chen, H.; Qi, X. Regional financial reform and corporate green innovation–evidence based on the establishment of China national financial comprehensive reform pilot zones. Financ. Res. Lett. 2024, 60, 104849. [Google Scholar] [CrossRef]

- Jiang, Z.; Yuan, C.; Xu, J. The impact of digital government on energy sustainability: Empirical evidence from prefecture-level cities in China. Technol. Forecast. Soc. Chang. 2024, 209, 123776. [Google Scholar] [CrossRef]

- Jiang, N.; Jiang, W.; Wang, Y.; Zhang, J. Impact of financial reform on urban resilience: Evidence from the financial reform pilot zones in China. Socio-Econ. Plan. Sci. 2024, 2024, 101962. [Google Scholar] [CrossRef]

- Wen, S.; Liu, H. Research on energy conservation and carbon emission reduction effects and mechanism: Quasi-experimental evidence from China. Energy Policy 2022, 169, 113180. [Google Scholar] [CrossRef]

- Fang, Y.; Lu, X.; Li, H. A random forest-based model for the prediction of construction-stage carbon emissions at the early design stage. J. Clean. Prod. 2021, 328, 129657. [Google Scholar] [CrossRef]

- Caron, A.; Baio, G.; Manolopoulou, I. Shrinkage bayesian causal forests for heterogeneous treatment effects estimation. J. Comput. Graph. Stat. 2022, 31, 1202–1214. [Google Scholar] [CrossRef]

- Feng, L.; Qi, J.; Zheng, Y. How can ai reduce carbon emissions? insights from a quasi-natural experiment using generalized random forest. Energy Econ. 2025, 141, 108040. [Google Scholar] [CrossRef]

- Bi, S.; Du, J.; Yan, Z.; Appolloni, A. Can “zero waste city” policy promote green technology? evidence from econometrics and machine learning. J. Environ. Manag. 2024, 370, 122895. [Google Scholar] [CrossRef] [PubMed]

- Huang, H.; Mbanyele, W.; Fan, S.; Zhao, X. Digital financial inclusion and energy-environment performance: What can learn from China. Struct. Chang. Econ. Dyn. 2022, 63, 342–366. [Google Scholar] [CrossRef]

- Ma, X.; Ma, X.; Fei, W.; Jiang, Q.; Qin, W. Is more always better? investor-firm interactions, market competition and innovation performance of firms. Technol. Forecast. Soc. Chang. 2025, 210, 123856. [Google Scholar] [CrossRef]

- Ren, Y.S.; Jiang, Y.; Narayan, S.; Ma, C.Q.; Yang, X.G. Marketisation and rural energy poverty: Evidence from provincial panel data in China. Energy Econ. 2022, 111, 106073. [Google Scholar] [CrossRef]

- Hu, W.; He, X. The role of fiscal policies in supporting a transition to a low-carbon economy: Evidence from the chinese shipping industry. Transp. Res. Part A Policy Pract. 2024, 179, 103940. [Google Scholar] [CrossRef]

- Zhou, Y.; Lin, B. The impact of fiscal transfer payments on energy conservation and emission reduction in China: Does the development stage matter? J. Environ. Manag. 2023, 339, 117795. [Google Scholar] [CrossRef]

- Wang, S.; Ma, L. Fiscal decentralisation and renewable energy development: Inhibition or promotion? Energy 2024, 311, 133303. [Google Scholar] [CrossRef]

- Shi, Y.; Yang, B. China’s energy system building toward an era of resilience: How green fintech can empower? Int. Rev. Econ. Financ. 2025, 98, 103876. [Google Scholar] [CrossRef]

- Jiang, G.; Chen, F.; Gu, M. Supply chain digitization and energy resilience: Evidence from China. Energy Econ. 2025, 144, 108420. [Google Scholar] [CrossRef]

- Ozhan, G.K. Financial intermediation, resource allocation, and macroeconomic interdependence. J. Monet. Econ. 2020, 115, 265–278. [Google Scholar] [CrossRef]

- Chan, Y.-S. On the positive role of financial intermediation in allocation of venture capital in a market with imperfect information. J. Financ. 1983, 38, 1543–1568. [Google Scholar] [CrossRef]

- Di Tella, S. Optimal regulation of financial intermediaries. Am. Econ. Rev. 2019, 109, 271–313. [Google Scholar] [CrossRef]

- Nepal, R.; Zhao, X.; Dong, K.; Wang, J.; Sharif, A. Can artificial intelligence technology innovation boost energy resilience? The role of green finance. Energy Econ. 2025, 142, 108159. [Google Scholar] [CrossRef]

- Jiang, W.; Jiang, N. From sustainable development towards resilience: Does digital finance matter in enhancing ecological resilience? Sustain. Dev. 2025, 33, 2535–2552. [Google Scholar] [CrossRef]

- Kakimoto, S.; Mieno, T.; Tanaka, T.S.; Bullock, D.S. Causal forest approach for site-specific input management via on-farm precision experimentation. Comput. Electron. Agric. 2022, 199, 107164. [Google Scholar] [CrossRef]

- Davis, J.M.; Heller, S.B. Using causal forests to predict treatment heterogeneity: An application to summer jobs. Am. Econ. Rev. 2017, 107, 546–550. [Google Scholar] [CrossRef]

- Mukalayi, N.M.; Inglesi-Lotz, R. Digital financial inclusion and energy and environment: Global positioning of Sub-Saharan African countries. Renew. Sustain. Energy Rev. 2023, 173, 113069. [Google Scholar] [CrossRef]

- Zhang, Y.; Hu, W.; Tao, Y.; Zhang, B. How does smart artificial intelligence influence energy system resilience? Evidence from energy vulnerability assessments in G20 countries. Energy 2025, 314, 134290. [Google Scholar] [CrossRef]

- Ghezelbash, A.; Liu, J.; Fahimifard, S.H.; Khaligh, V. Exploring the influence of the digital economy on energy, economic, and environmental resilience: A multinational study across varied carbon emission groups. Sustainability 2024, 16, 2993. [Google Scholar] [CrossRef]

- Zhang, Z.; Wu, H.; Zhang, Y.; Hu, S.; Pan, Y.; Feng, Y. Does digital global value chain participation reduce energy resilience? Evidence from 49 countries worldwide. Technol. Forecast. Soc. Chang. 2024, 208, 123712. [Google Scholar] [CrossRef]

- Lupu, D.; Maha, L.-G.; Viorica, E.-D. The relevance of smart cities’ features in exploring urban labour market resilience: The specificity of post-transition economies. Reg. Stud. 2023, 57, 2406–2425. [Google Scholar] [CrossRef]

| Subsystem | Resilience Capacity | Measurement | Direction |

|---|---|---|---|

| Energy subsystem | Bearing capacity | Consumption volatility | − |

| Supply stability | + | ||

| Structural diversity | + | ||

| Recovering capacity | Supply chain resilience | + | |

| Infrastructure support capability | + | ||

| Institutional adjustment capacity | + | ||

| Learning capacity | Transformation capabilities | + | |

| Talent development and skill enhancement | + | ||

| Technological innovation | + | ||

| Conversion capacity | Structural optimization | + | |

| Informatization and digitization | + | ||

| Institutional guidance and infrastructure upgrade | + | ||

| Context subsystem | Bearing capacity | Social and ecological affordability | + |

| Economic diversity and resource allocation | + | ||

| Cultural identity and community resilience | + | ||

| Recovering capacity | Index of economic recovery capacity | + | |

| Resource allocation efficiency | + | ||

| Policy and infrastructure support | + | ||

| Learning capacity | Space utilization and infrastructure upgrades | + | |

| Innovation and technological capabilities | + | ||

| Policy innovation and governance learning capacity | + | ||

| Conversion capacity | Resource efficiency conversion capabilities | + | |

| Fiscal flexibility and resource allocation capacity | + | ||

| International cooperation and openness | + | ||

| Government subsystem | Bearing capacity | Ability to identify and analyze risks | + |

| Digital science decision-making capabilities | + | ||

| Resource allocation capabilities | + | ||

| Recovering capacity | Emergency response capability | + | |

| Restore the ability to develop a strategy | + | ||

| Restore efficiency | + | ||

| Learning capacity | Ability to respond and adjust policies | + | |

| Information transparency and communication skills | + | ||

| Community engagement and feedback capabilities | + | ||

| Conversion capacity | Transformative capacity for sustainable development | + | |

| Process optimization capabilities | + | ||

| Structural adjustment capacity | + |

| Variable Type | Variables | N | Mean | SD | Max | Min |

|---|---|---|---|---|---|---|

| Explained variable | UER | 248 | 0.218 | 0.193 | 0.889 | 0.0480 |

| Core explanatory variable | DID | 248 | 0.0650 | 0.246 | 1 | 0 |

| Control variables | Fisdec | 248 | 0.452 | 0.188 | 0.926 | 0.0690 |

| Edu | 248 | 16.31 | 0.721 | 18.17 | 14.44 | |

| Pub | 248 | 0.0820 | 0.0640 | 0.533 | 0.0120 | |

| Eco | 248 | 0.0280 | 0.0180 | 0.119 | 0.00700 | |

| Market | 248 | 0.132 | 0.0460 | 0.292 | 0.0530 | |

| Mechanism variables | Rd | 248 | 0.217 | 0.209 | 1 | 0 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| UER | UER | UER_E | UER_B | UER_G | |

| DID | 0.0215 * | 0.0332 *** | 0.0280 *** | 0.0358 ** | 0.0440 ** |

| (0.0123) | (0.0124) | (0.0105) | (0.0142) | (0.0200) | |

| Control variables | N | Y | Y | Y | Y |

| City FEs | Y | Y | Y | Y | Y |

| Year FEs | Y | Y | Y | Y | Y |

| _cons | 0.2674 *** | 2.4325 *** | 2.1739 *** | 2.5640 *** | 2.8917 *** |

| (0.0063) | (0.6556) | (0.5549) | (0.7495) | (1.0523) | |

| N | 248 | 248 | 248 | 248 | 248 |

| (1) | (2) | |

|---|---|---|

| Beta | Total Weight | |

| Early_v_Late | 0.0031781953 | 0.0079840324 |

| Late_v_Early | −0.0249783173 | 0.0059880239 |

| Never_v_timing | 0.0219318685 | 0.9860279437 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| 1:4 LassoIC | 1:9 LassoIC | 1:9 RidgeCV | Green Finance Pilot | Public Data Policy | Inclusive Finance Reform | |

| DID | 0.0251 ** | 0.0264 ** | 0.0367 *** | 0.0347 *** | 0.0323 ** | 0.0286 ** |

| (0.0114) | (0.0108) | (0.0109) | (0.0125) | (0.0125) | (0.0130) | |

| gfr | 0.0259 | |||||

| (0.0174) | ||||||

| opd | −0.0091 | |||||

| (0.0077) | ||||||

| fir | 0.0206 | |||||

| (0.0177) | ||||||

| Control variables | Y | Y | Y | Y | Y | Y |

| City FEs | Y | Y | Y | Y | Y | Y |

| Year FEs | Y | Y | Y | Y | Y | Y |

| _cons | −0.0008 | −0.0008 | −0.0009 | 2.6502 *** | 2.3224 *** | 2.4452 *** |

| (0.0025) | (0.0023) | (0.0023) | (0.6698) | (0.6615) | (0.6551) | |

| N | 248 | 248 | 248 | 248 | 248 | 248 |

| (1) | (2) | (3) | |

|---|---|---|---|

| UER | UER | UER | |

| DID | 0.0392 * | 0.0498 ** | 0.0393 ** |

| (0.0204) | (0.0242) | (0.0199) | |

| Control variables | Y | Y | Y |

| City FEs | Y | Y | Y |

| Year FEs | Y | Y | Y |

| _cons | 3.0821 *** | 3.1739 *** | 3.0815 *** |

| (0.6810) | (0.6730) | (0.6793) | |

| N | 222 | 222 | 224 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Eliminate Special Samples | Adjust Sample Time | Exclude Extreme Outliers | Add Control Variables | Lagged Explanatory Variable | Lagged Dependent Variable | Instrumental | Variable Method | |

| DID | 0.0414 *** | 0.0396 *** | 0.0455 *** | 0.0278 ** | 0.0319 ** | 0.0359 *** | ||

| (0.0120) | (0.0135) | (0.0130) | (0.0126) | (0.0136) | (0.0132) | |||

| L.DID | 0.0293 ** | |||||||

| (0.0117) | ||||||||

| Trend × id | −0.0002 ** | |||||||

| (0.0001) | ||||||||

| Ivpost | 0.0175 *** | |||||||

| (0.0005) | ||||||||

| Control variables | Y | Y | Y | Y | Y | Y | Y | Y |

| City FEs | Y | Y | Y | Y | Y | Y | Y | Y |

| Year FEs | Y | Y | Y | Y | Y | Y | Y | Y |

| _cons | 2.4826 *** | 2.4589 *** | 3.0053 *** | 9.2556 *** | 2.8098 *** | 2.4217 *** | ||

| (0.5841) | (0.6790) | (0.7190) | (3.4815) | (0.6480) | (0.6858) | |||

| F-value | 1052.98 | |||||||

| N | 216 | 217 | 248 | 248 | 217 | 217 | 248 | 248 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Rd | UER | Rd | UER_E | Rd | UER_B | Rd | UER_G | |

| DID | 0.0346 *** | 0.0279 ** | 0.0346 *** | 0.0233 ** | 0.0346 *** | 0.0301 ** | 0.0346 *** | 0.0371 * |

| (0.0119) | (0.0126) | (0.0119) | (0.0107) | (0.0119) | (0.0144) | (0.0119) | (0.0203) | |

| Rd | 0.1539 ** | 0.1358 ** | 0.1625 * | 0.1983 * | ||||

| (0.0725) | (0.0613) | (0.0830) | (0.1168) | |||||

| Control variables | Y | Y | Y | Y | Y | Y | Y | Y |

| City FEs | Y | Y | Y | Y | Y | Y | Y | Y |

| Year FEs | Y | Y | Y | Y | Y | Y | Y | Y |

| N | 248 | 248 | 248 | 248 | 248 | 248 | 248 | 248 |

| (1) | (2) | (3) | |

|---|---|---|---|

| UER | UER | UER | |

| DID | 0.007 ** | 0.007 ** | 0.007 ** |

| (2.017) | (1.983) | (1.992) | |

| Trees | 5000 | 10,000 | 15,000 |

| N | 248 | 248 | 248 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, J.; Wang, H. Does the Development of Digital Finance Enhance Urban Energy Resilience? Evidence from Machine Learning. Sustainability 2025, 17, 6434. https://doi.org/10.3390/su17146434

Yan J, Wang H. Does the Development of Digital Finance Enhance Urban Energy Resilience? Evidence from Machine Learning. Sustainability. 2025; 17(14):6434. https://doi.org/10.3390/su17146434

Chicago/Turabian StyleYan, Jie, and Hailing Wang. 2025. "Does the Development of Digital Finance Enhance Urban Energy Resilience? Evidence from Machine Learning" Sustainability 17, no. 14: 6434. https://doi.org/10.3390/su17146434

APA StyleYan, J., & Wang, H. (2025). Does the Development of Digital Finance Enhance Urban Energy Resilience? Evidence from Machine Learning. Sustainability, 17(14), 6434. https://doi.org/10.3390/su17146434