1. Introduction

Currently, nearly 400 million waste tires are generated annually in China (Li et al., 2025) [

1], yet the standardized recycling rate remains approximately 48.1% (China Materials Recycling Association, 2024) [

2]. Notably, around 70% of waste tires are collected by individual recyclers under the existing recycling system. Compared with standardized recycling processes, individual recyclers often adopt non-compliant treatment methods—such as manual crushing and open-air incineration—to minimize costs and maximize profits. These methods release harmful substances including sulfur dioxide, nitrogen dioxide, cyanide, dioxins, and phenols, which pose significant threats to environmental quality (e.g., soil acidification) and human health (Liu and Zheng, 2025) [

3]. Waste tires exhibit dual attributes of both hazard and resource potential (Liu et al., 2022) [

4]. Therefore, exploring efficient and eco-friendly resource utilization paths and establishing a sound recycling management system are crucial for mitigating environmental risks and achieving sustainable development.

In recent years, extensive research has been conducted both domestically and internationally on waste tire management. In terms of environmental pollution and its causes, Aliyu et al. (2025) investigated the severe environmental consequences in Nigeria resulting from open-air burning and landfill disposal of waste tires, highlighting the deficiencies in regulatory mechanisms [

5]. Oliveira and Carrasco (2025) focused on the Brazilian city of Contagem, examining how eco-points optimize reverse logistics and promote compliant recycling behaviors [

6].

Regarding technological evaluations of resource recovery, Liu and Tian (2021) [

7] analyzed multiple approaches—including tire retreading, mechanical shredding, rubber powder applications, pyrolysis, fuel conversion, and reclaimed rubber—by assessing both the value of rubber powder and the potential of pyrolysis products. They noted that although Pyrolysis Technology offers efficient resource recovery, challenges remain in pollution control, cost of technology, and the supporting recycling infrastructure [

7]. Liu (2025) further compared pyrolysis, reclaimed rubber, and incineration pathways, emphasizing the high efficiency of pyrolysis along with its energy-intensive limitations, and called for innovations in technology and integrated thermal energy utilization [

8].

In terms of recycling systems and supply chain optimization, Meng et al. (2023) employed Material Flow Analysis (MFA) to quantify the generation, recycling rates, and environmental impacts of various recovery technologies for waste tires in China from 2011 to 2019, thereby providing data-driven insights into flow paths and environmental performance [

9]. Addressing weaknesses such as unregulated informal collection, low recycling efficiency, and secondary pollution, Zhao et al. (2024) developed a recoverability evaluation model for tires based on statistical entropy and hierarchical rules, identifying five representative tire categories (e.g., truck and passenger car tires) and proposing targeted improvement strategies [

10]. Ghasemzadeh and Sadeghieh (2021) constructed a multi-objective stochastic programming model that considers demand and recycling uncertainty to design a closed-loop supply chain network, advocating energy-oriented recycling strategies to balance economic and environmental goals [

11]. Hu et al. (2021), from a Life Cycle Assessment (LCA) perspective, proposed an integrated supply chain system for waste tire management in China and identified key barriers to scaling in collection, processing, sales, and coordination stages [

12].

Regarding technological bottlenecks and environmental impact assessments, Wang (2021) reviewed core technical constraints from a Circular Economy perspective, pointing out that process complexity in retreading and high capital investment in pyrolysis significantly hinder their promotion [

13]. Jiang et al. (2020) systematically examined the effects of critical process parameters—such as temperature, catalysts, and reactor types—on the distribution and quality of pyrolysis products (oil, gas, Carbon Black), and explored the industrialization challenges of pyrolysis [

14]. Guo et al. (2025) [

15] focused on the high-value utilization of Waste Tire Pyrolysis Char (WTPC) by elaborating on its formation mechanism, purification methods, thermal treatment optimization, and potential applications in materials science. The study emphasized that achieving large-scale application of tire pyrolysis demands effective solutions for cost control and pollutant management [

15].

In terms of comparative analyses of different technological paths, Li et al. (2024) and Xu et al. (2024) [

16,

17] evaluated the economics and technical limitations of cryogenic grinding, wet pulverization, and pyrolysis. They concluded that while cryogenic grinding can produce high-performance rubber powder, its high liquid nitrogen consumption increases costs; wet pulverization yields fine products but entails greater risks of secondary pollution; pyrolysis, though relatively simple in process, faces challenges including high equipment investment, difficult technology adoption, and low-value pyrolysis byproducts such as Carbon Black and oil [

16,

17]. For environmental benefit quantification, Luo et al. (2024) [

18] compared the carbon emission intensities of four recycling pathways—including pyrolysis and retreading—using traditional incineration as the baseline. Their findings indicated that pyrolysis and retreading technologies perform best in achieving Carbon Emission Reduction [

18]. Li et al. (2024) [

19] further proposed a comprehensive pathway toward tire carbon neutrality from a life cycle perspective—covering raw material selection, design, production, and recycling. The study particularly emphasized the potential of replacing traditional industrial Carbon Black with modified pyrolytic Carbon Black as a key solution for closed-loop resource recovery [

19].

Pyrolysis Technology decomposes tires into Pyrolysis Oil, Carbon Black, and Steel Wire, enabling the comprehensive recovery of all material components (Zhang, 2025) [

20]. In China, large-scale applications of this technology have progressed rapidly, with an annual processing capacity exceeding 2 million tons. The environmental benefits are substantial: compared to petroleum coke-based pyrolysis, greenhouse gas emissions are reduced by 43–45%, and solid waste generation is lowered by 25–29% (Mao, 2025) [

21]. However, its further promotion remains constrained by two major issues: (1) high equipment investment in the pretreatment phase elevates operational costs; (2) illegal workshops conduct non-compliant treatment with minimal environmental costs, severely undercutting the profit margins of compliant pyrolysis enterprises (Yang, 2025) [

22].

Hence, a deeper understanding of the complex interactions among multiple stakeholders in the waste tire pyrolysis industry chain—such as consumers, recyclers, and regulators—is essential. Exploring their behavioral logic and interest conflicts provides a practical foundation for proposing effective strategies to promote the standardized and large-scale application of Pyrolysis Technology.

In contrast, relatively few studies have adopted the perspective of Evolutionary Game theory to investigate the resource reuse of waste tires. Existing research primarily focuses on the application of Evolutionary Game Models within industrial recycling systems, such as in government regulation, carbon trading, and carbon emission quota mechanisms. Specifically, current studies in this field can be broadly categorized into the following core themes:

Design and Effectiveness of Governmental Regulatory Mechanisms: Su (2020) [

23] constructed a Tripartite Evolutionary Game Model involving the government, recyclers, and producers in the context of construction waste recycling. The model explored the dynamics of strategic evolution and conditions for stability, and further discussed the evolving role of the government across different phases of the industrial life cycle [

23]. Xiao et al. (2020) developed a Tripartite Evolutionary Game Model among local governments, upstream, and downstream manufacturers, with a focus on assessing the effectiveness of environmental regulation measures (e.g., subsidies, taxation) and their sensitivity to external Carbon Emission Reduction costs [

24]. Fu and Chen (2023) examined the co-innovation process between recyclers and concrete producers under market mechanisms and government intervention, emphasizing the need for technological investment, institutional standardization, and fiscal subsidies to foster cooperation [

25]. Gao et al. (2025) built a game model between government authorities and tire manufacturers to simulate how carbon taxation influences the strategic choices between producing new or recycled tires, while analyzing the trade-off between social welfare and carbon emissions [

26].

Driving Effects of Carbon Policies (Carbon Taxation and Carbon Trading) on Emission Reduction Behavior: Ding et al. (2020) [

27] formulated a Tripartite Evolutionary Game Model involving upstream manufacturers, downstream manufacturers, and banks under a “Dynamic Carbon Taxation + Cap-and-Trade” policy framework. The impact of carbon tax rates, quota allocation, and banks’ lending preferences on corporate Carbon Emission Reduction strategies was thoroughly explored [

27]. Cao et al. (2023) focused on a resource-circulating value chain reliant on waste inputs and developed an Evolutionary Game Model between manufacturers and waste tire recyclers, analyzing how dynamic carbon tax and carbon trading systems jointly promote emission reduction [

28]. Cao and Xiao (2023) further investigated Evolutionary Stable Strategies (ESS) under the carbon trading mechanism, illustrating how the use of waste as alternative input materials fosters clean production, improves energy efficiency, reduces emissions, and enhances long-term profitability and competitiveness [

29]. He et al. (2023) [

30] examined the promotion of voluntary emission reduction mechanisms in the carbon market through a Tripartite Evolutionary Game Model involving governments, emission-controlled enterprises, and renewable energy companies. The study evaluated the effects of carbon pricing, penalty intensity, quota distribution, and government subsidies on system evolution [

30].

Cooperation and Synergy Mechanisms in Waste Recycling: Yuan et al. (2020) [

31] investigated the parameter conditions and likelihood of upstream and downstream firms forming collaborative governance models for industrial waste. The findings highlighted the importance of narrowing the gap between waste processing and compliant treatment costs, and emphasized the need for governmental support in terms of legal frameworks, policy mechanisms, financial investment, and technological innovation [

31]. Ramani and Giovanni (2025) conducted a systematic review of Circular Economy studies based on game theory, analyzing various circular strategies adopted by enterprises—such as circular inputs and resource recovery—and the design of public policy mechanisms that support circular systems [

32]. Hao et al. (2022) established a Tripartite Evolutionary Game Model involving governments, enterprises, and academic research institutions, to explore the co-evolution of stakeholder strategies within an innovation ecosystem for the circular resource industry [

33].

In summary, although Pyrolysis Technology for waste tires offers considerable resource and environmental benefits, its large-scale application remains constrained by high operational costs and competition from non-compliant workshops. Therefore, it is critical to examine the interaction mechanisms among key stakeholders in the pyrolysis industry chain to formulate effective policy interventions. However, current research has seldom investigated the resource reutilization of waste tires from the Evolutionary Game perspective, particularly lacking dynamic modeling of multi-agent interaction in core pyrolysis processes.

To address this gap, the present study constructs a Tripartite Evolutionary Game Model encompassing pyrolysis plants, waste tire recyclers, and government regulators. Based on the 100-year Global Warming Potential (GWP100) framework adopted by the Intergovernmental Panel on Climate Change (IPCC), emissions from the pyrolysis process—including carbon dioxide, nitrogen oxides, and sulfur dioxide—are uniformly converted into Carbon Dioxide Equivalent (CO2-eq) and integrated into the carbon taxation mechanism. A novel Differential Carbon Taxation scheme is designed, targeting both pyrolysis enterprises and recyclers, in order to promote resource utilization and standardize the recycling system.

This study systematically conducts model formulation, equilibrium analysis, and stability assessment, and employs MATLAB R2021a-based multi-scenario numerical simulation to dynamically evaluate how variations in policy parameters—such as tax rates, subsidies, and regulatory intensity—affect the strategic choices of stakeholders and the evolution trajectory of the system. Based on theoretical insights and simulation outcomes, targeted policy recommendations and managerial implications are proposed to promote the scalable and standardized development of waste tire Pyrolysis Technology, thereby offering decision-making support for overcoming current implementation challenges.

2. Evolutionary Game Model Assumptions and Construction

A Tripartite Evolutionary Game Model involving pyrolysis plants, waste tire recyclers, and government regulatory authorities is developed. Prior to constructing the game model, the following assumptions are made:

Assumption 1. All three parties are assumed to be boundedly rational. Pyrolysis plants choose to adopt Waste Tire Derived Fuel Pyrolysis (WTDF Pyrolysis) with probability x, referred to as “tire pyrolysis”, or choose Petroleum Coke-Based Pyrolysis with probability (1 − x), referred to as “petroleum coke pyrolysis”. Waste tire recyclers choose to conduct compliant treatment (i.e., pretreatment of waste tires for pyrolysis use according to government requirements) with probability y, or opt for non-compliant treatment (e.g., landfill disposal, open-air incineration) with probability (1 − y). Government regulators impose environmental regulations on the carbon emissions of both pyrolysis plants and recyclers with probability z, or choose not to implement regulations with probability (1 − z). Here, .

Assumption 2. The market price of terminal products (e.g., Pyrolysis Oil, Carbon Black) produced by pyrolysis plants is denoted as . If petroleum coke is used as feedstock, the raw material cost is , with associated carbon emissions . If waste tires are used as feedstock, the plant must purchase pretreated tires from compliant recyclers at price , and additionally incur pretreatment costs (e.g., manual crushing, Steel Wire separation, sulfur content control), resulting in carbon emissions . If recyclers opt for non-compliant treatment, leading to a shortage of compliant raw materials, the pyrolysis plant must switch to petroleum coke-based production.

Assumption 3. If recyclers choose compliant treatment, the treatment cost is , and they can sell pretreated tires to pyrolysis plants for , with associated emissions . If the pyrolysis plant does not purchase these materials (e.g., it chooses petroleum coke), the recycler must sell to external markets (e.g., reclaimed rubber plants, road base material producers) at a price . If non-compliant treatment (e.g., landfilling, incineration) is chosen, recyclers receive a revenue of , incur a cost of , and generate emissions of .

Assumption 4. The total regulatory implementation cost for government authorities is denoted (covering law enforcement, monitoring, data management, etc.). Regulatory actions include imposing carbon taxes on pyrolysis plants and recyclers, with tax rates and , respectively. The cost of managing environmental pollution caused by non-compliant emissions is Gt. The social benefits of environmental regulation, such as Carbon Emission Reduction and resource circulation, are denoted by . If regulation is not implemented, resulting in excessive carbon emissions, the government may incur an administrative penalty from higher-level authorities, denoted as .

The parameters of the Tripartite Evolutionary Game Model and their respective meanings are presented in

Table 1.

To ensure consistency, all economic indicators such as costs, revenues, and penalties are measured in Chinese Yuan per ton of input material (CNY/t), unless otherwise specified. Emission indicators are quantified in terms of Carbon Dioxide Equivalent (CO2-eq) per ton of raw material (t CO2-eq/t), in line with the IPCC GWP100 framework. Carbon taxation variables are expressed in CNY per ton of CO2-eq emitted (CNY/t CO2-eq).

Based on the above assumptions, the payoff matrix of the evolutionary game can be constructed, as shown in

Table 2.

3. Evolutionary Model Analysis

3.1. Strategy Stability Analysis of Pyrolysis Plants

The expected payoffs and average expected payoff for a pyrolysis plant choosing between the waste tire pyrolysis strategy and the petroleum coke-based pyrolysis strategy are expressed as:

The replication dynamic equation for the pyrolysis plant is given by:

The first derivative of

with respect to

x is:

The strategy of choosing the waste tire pyrolysis option reaches a stable state when and . Since: , it follows that is monotonically increasing with respect to both y and z. When: . then , and the stable strategy of the pyrolysis plant becomes indeterminate. If , then , and: , indicating that is the ESS for the pyrolysis plant. Conversely, when , becomes the ESS. Therefore, as the probabilities y (of compliant treatment by recyclers) and z (of environmental regulation by the government) increase, the stable strategy for pyrolysis plants shifts from (choosing petroleum coke-based pyrolysis) to (choosing waste tire pyrolysis).

Proposition 1. The probability of pyrolysis plants adopting the waste tire pyrolysis strategy increases with higher probabilities of compliant treatment by waste tire recyclers and environmental regulation by government authorities.

This proposition suggests that government agencies may enhance regulatory oversight of waste tire recyclers to increase the likelihood of compliant treatment—for example, by encouraging public reporting of non-compliant disposal behavior. These measures help leverage social supervision to build a co-governance regulatory framework.

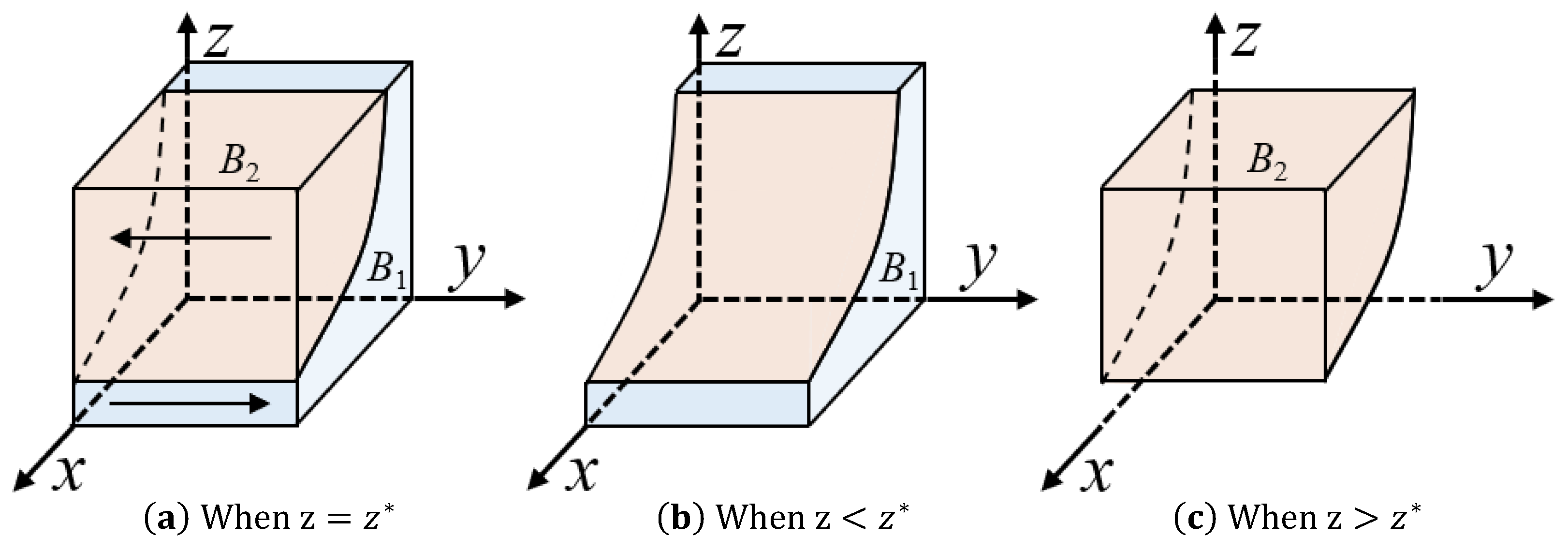

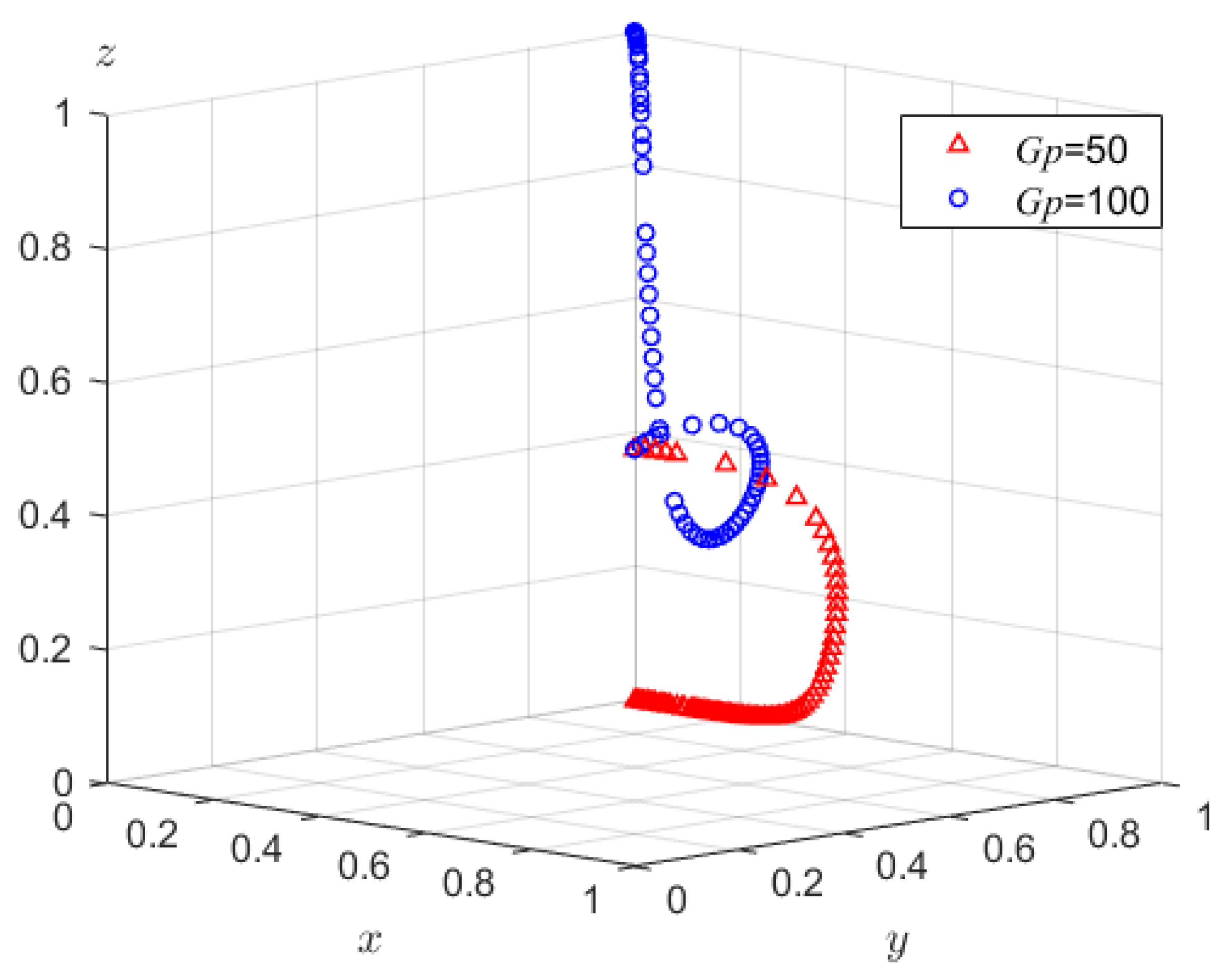

The phase diagram of the strategy evolution of pyrolysis plants is illustrated in

Figure 1.

In

Figure 1, the volume of the probability space

, where the petroleum coke-based pyrolysis strategy is stably selected, is denoted as

, while the volume for the stable selection of the waste tire pyrolysis strategy

is denoted as

. The volume

is calculated as:

Proposition 2. The probability of adopting the waste tire pyrolysis strategy is positively correlated with the carbon tax rate, the carbon emissions of petroleum coke-based pyrolysis, and the raw material cost of petroleum coke; it is negatively correlated with the additional cost of waste tire pyrolysis, its carbon emissions, and the price of treated waste tires.

Proof of Proposition 2. By computing the partial derivatives of , the following relationships are obtained: , , . □

These findings indicate that government interventions—such as raising the carbon tax rate, increasing the price of petroleum coke, reducing the additional cost of waste tire pyrolysis, and lowering the price of treated waste—can effectively promote the selection of the waste tire pyrolysis strategy by pyrolysis plants. In addition, greater investment in Carbon Emission Reduction technologies, such as carbon capture and storage (CCS) in waste tire pyrolysis, is recommended to reduce process-related emissions.

3.2. Strategy Stability Analysis of Waste Tire Recyclers

The expected payoffs and average expected payoff for waste tire recyclers choosing between compliant and non-compliant treatment are expressed as follows:

The replicator dynamic equation for waste tire recyclers is given by:

The first-order derivative of

with respect to

y is:

The strategy of choosing compliant treatment reaches a stable state when and . Since and , the function is strictly increasing in both x and z. When: and , then , and no evolutionary stable strategy can be determined. If , then , which leads to , implying that is an ESS for compliant treatment. Conversely, when , becomes the ESS, indicating a preference for non-compliant treatment.

Proposition 3. During the evolutionary process, the probability of waste tire recyclers choosing compliant treatment increases with higher probabilities of pyrolysis plant adoption of Pyrolysis Technology and stricter government regulation.

Proposition 3 suggests that promoting compliant treatment and improving the recovery rate of industrial waste requires stringent government regulation, incentivizing pyrolysis plant adoption of waste tire pyrolysis, and raising environmental awareness within the waste treatment industry.

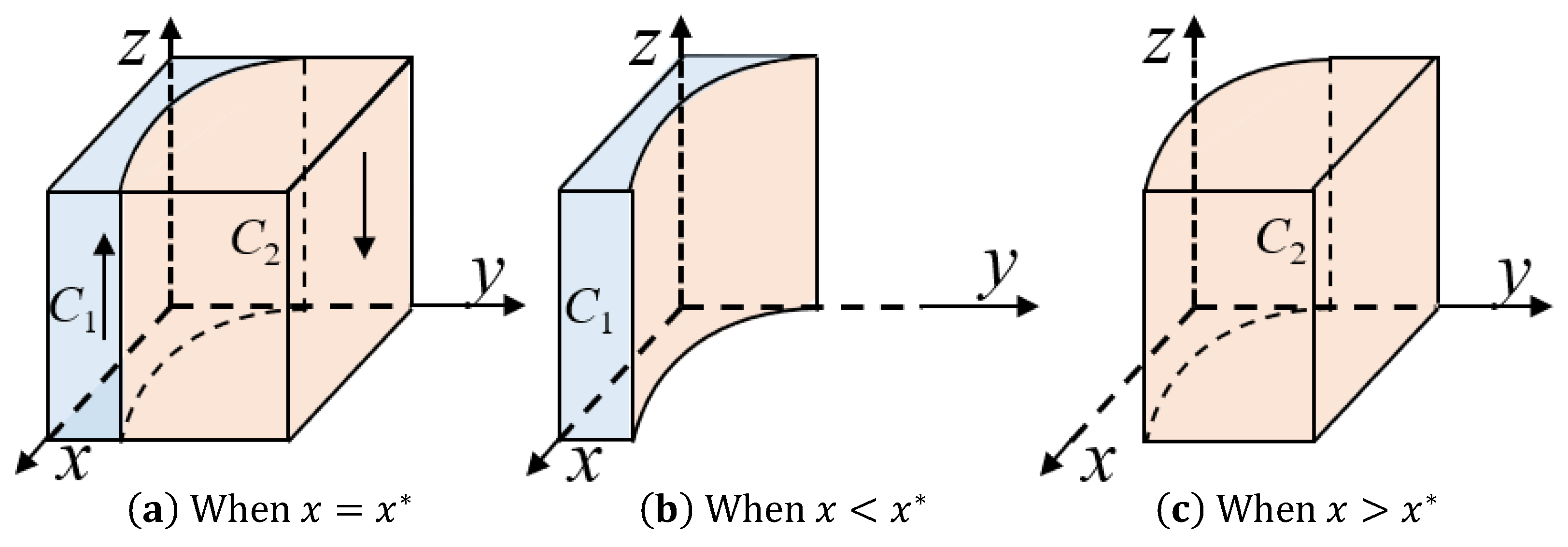

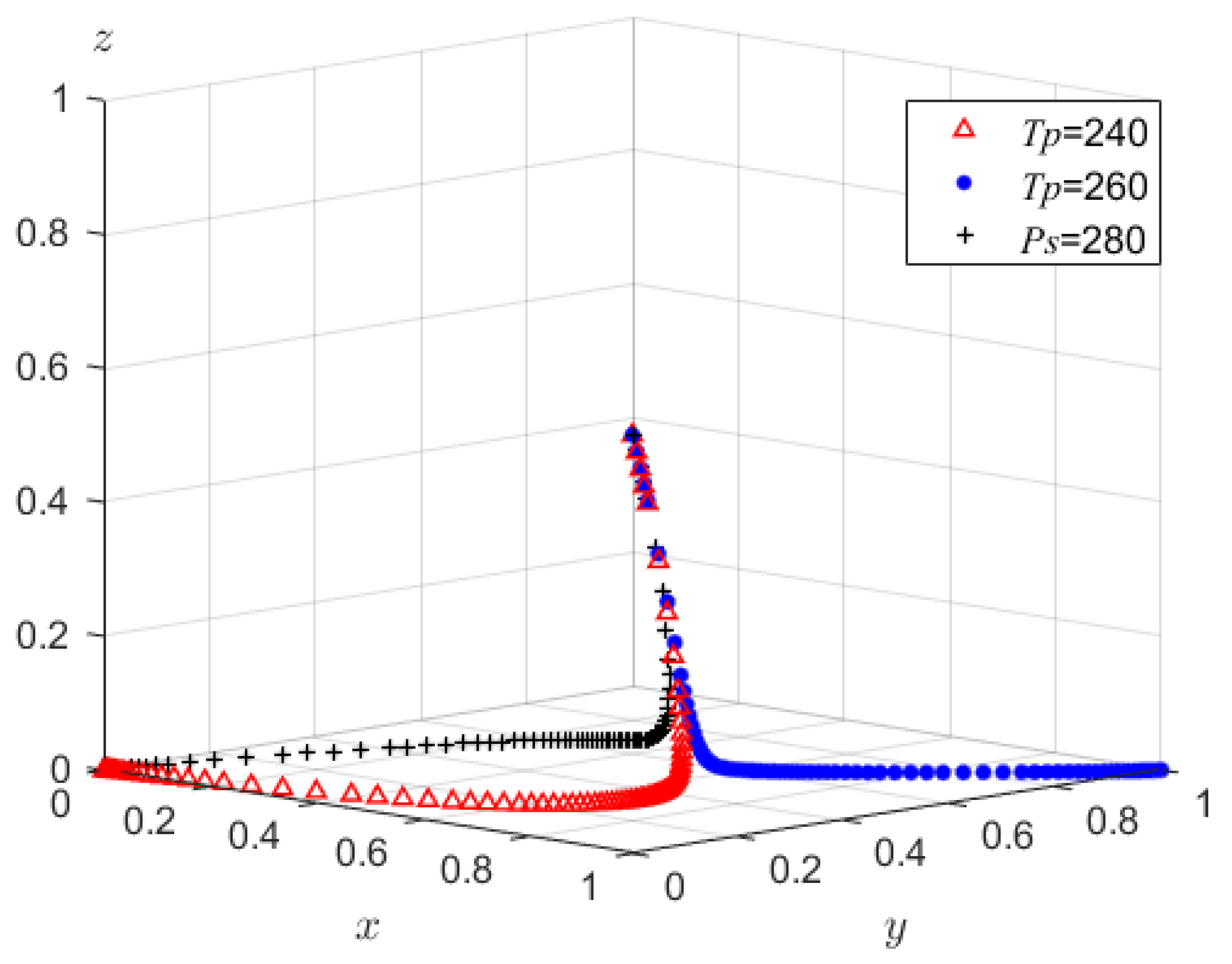

The strategy evolution phase diagram for waste tire recyclers is illustrated in

Figure 2.

Figure 2 indicates that the probability space for waste tire recyclers to stably choose non-compliant treatment is represented by volume

of region

, while the probability space for compliant treatment corresponds to volume

of region

. The volume

is calculated as follows:

Proposition 4. The probability of choosing compliant treatment by waste tire recyclers is positively correlated with the cost of non-compliant treatment, the price received from pyrolysis plants after compliant treatment, the external market price after compliant treatment, the carbon tax imposed by the government, and the carbon emissions from non-compliant treatment. It is negatively correlated with the selling price after non-compliant treatment, the cost of compliant treatment, and carbon emissions from compliant treatment.

Proof of Proposition 4. Based on the expression of , the first-order partial derivatives with respect to each parameter are as follows: , , , , , , , . □

Proposition 4 implies that government efforts to improve the probability of compliant treatment by recyclers may include: regulating and standardizing the waste trading market to increase the selling price of legally treated waste, reducing the market attractiveness of illegally treated waste, increasing carbon taxation on recyclers, and promoting the development of resource utilization technologies to lower the cost of compliant treatment. Additionally, greater investment in resource recovery technologies can reduce carbon emissions during the recycling process.

3.3. Stability Analysis of the Regulatory Authority’s Strategy

The expected payoffs for the regulatory authority when choosing to implement or not implement environmental regulation, as well as the average expected payoff, are given as follows:

The replication dynamic equation for the regulatory authority is as follows:

The first-order derivative of

with respect to

z is:

The strategy of implementing environmental regulation by the regulatory authority is stable when and . Since , is a monotonically decreasing function with respect to both and . When , then , and the regulatory authority cannot determine a stable strategy. If , then , and , implying that is the ESS. Conversely, when , then is the ESS.

Proposition 5. During the evolutionary process, the probability that the regulatory authority chooses to implement environmental regulation decreases as the probability of pyrolysis plants choosing Pyrolysis Technology or waste tire recyclers choosing compliant treatment increases.

This proposition suggests that the regulatory authority tends to reduce environmental regulation when pyrolysis plants are more likely to adopt Pyrolysis Technology and waste tire recyclers are more likely to conduct compliant treatment. Therefore, regulatory efforts should be reduced at appropriate stages to allow the market mechanism to self-regulate the operation of the industrial symbiosis chain, provided that healthy industry development is ensured.

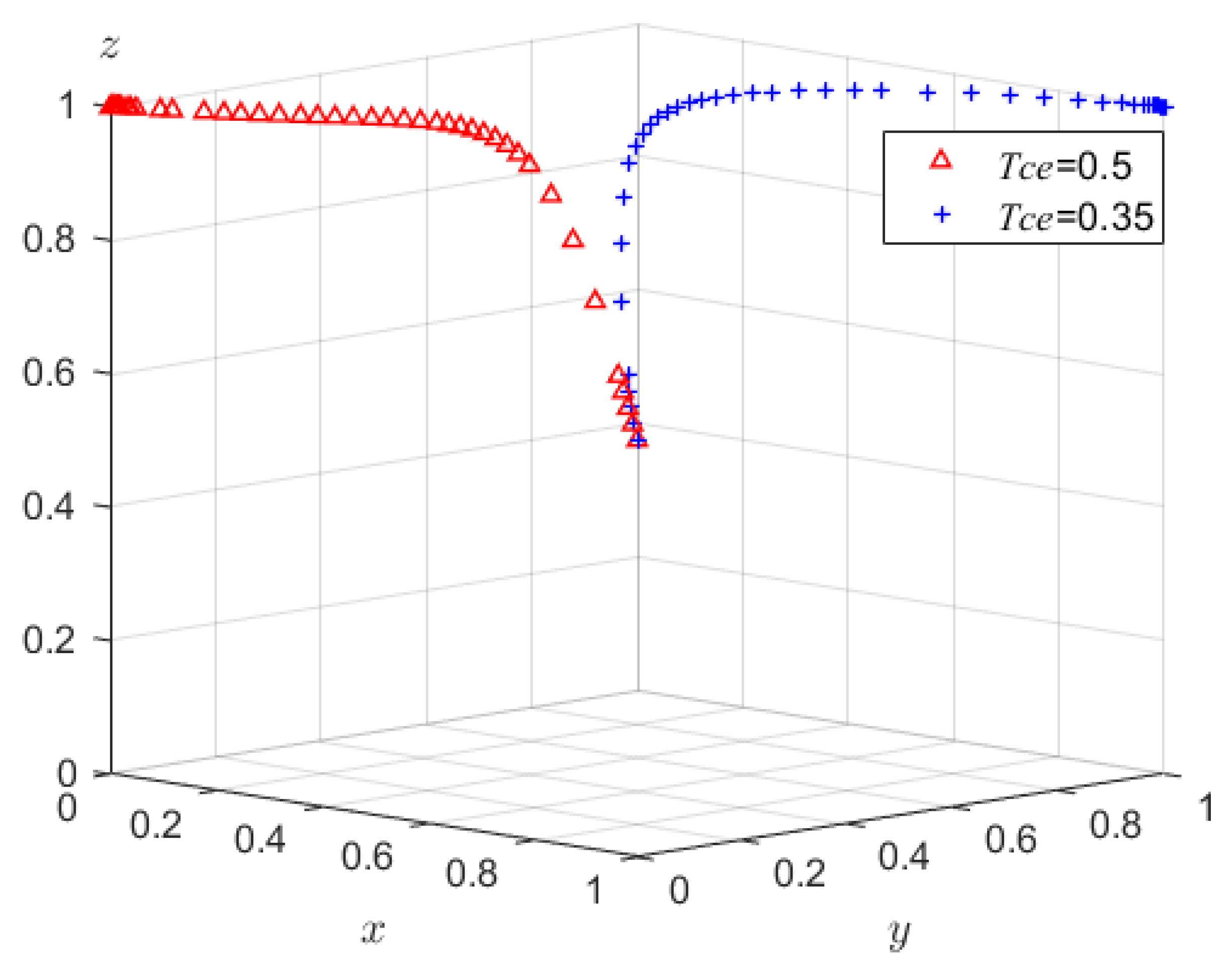

The phase diagram for the regulatory authority’s strategy evolution is shown in

Figure 3.

Figure 3 illustrates that the stable probability space for choosing to implement environmental regulation by the regulatory authority, denoted as

, has a volume of

, while the space for choosing not to implement environmental regulation, denoted as

, has a volume of

. The calculation yields:

Proposition 6. The probability that the regulatory authority chooses to implement environmental regulation is positively correlated with the carbon emissions in the production and treatment processes and the carbon tax imposed on waste tire recyclers; and is negatively correlated with the cost of implementing regulation. Under specific conditions, it is also positively correlated with the carbon tax on pyrolysis plants and the penalties imposed by higher authorities due to excessive emissions when regulation is not implemented.

Proof of Proposition 6. By deriving the partial derivatives of the expression for , the following results are obtained: , , , , , , , . □

This proposition indicates that high regulatory implementation costs reduce the likelihood that the regulatory authority will opt to implement environmental regulation. In contrast, higher carbon emissions, carbon taxes on pyrolysis plants and waste tire recyclers, and penalties from higher authorities can incentivize regulatory action. Therefore, policy design should involve setting appropriate carbon tax rates for different stakeholders and reducing enforcement costs for regulatory departments, rather than solely increasing administrative penalties, to effectively motivate regulatory agencies.

3.4. Managerial Implications

(1) The low-carbon transition of pyrolysis plants is not an isolated decision, but rather a result of the synergistic influence of the compliant treatment probability of upstream recyclers () and the regulatory enforcement probability of the government (). To leverage social supervision as a catalyst for enhancing compliance, the government is advised to establish a “report-verification-incentive” mechanism (e.g., reward schemes for reporting non-compliant treatment). Such mechanisms can indirectly incentivize pyrolysis plants to adopt waste tire Pyrolysis Technology, thereby forming a virtuous cycle of “regulation–recycling–production.”

(2) This result corroborates the industrial principle that “demand drives supply.” An increase in pyrolysis plants’ willingness to procure compliantly treated waste tires () leads to a higher probability of compliance among recyclers (). To reinforce this linkage, the government should prioritize the integration of the “recycling–pyrolysis” supply chain by establishing regional waste tire trading platforms, ensuring preferential procurement rights for compliantly treated tires.

(3) A floating carbon tax mechanism is recommended, wherein the carbon tax rate automatically increases when the price of petroleum coke falls, and decreases when the price rises. This dynamic adjustment would suppress reliance on traditional technologies and enhance the policy’s effectiveness in carbon emission control.

(4) A regulatory withdrawal effect is observed: when pyrolysis plants show strong willingness to utilize waste tires () and recyclers demonstrate high compliance (), the government’s probability of implementing environmental regulation () declines. To mitigate this effect, a tiered regulatory framework should be adopted, featuring corporate self-discipline with governmental oversight as a safeguard. For enterprises meeting compliance standards, a “white-list” exemption from inspection can be introduced; for transitional enterprises, carbon tax obligations may remain while on-site inspections are waived, and only high-risk regions should maintain intensive regulatory interventions.

4. Stability Analysis of the Evolutionary Game

Let , yielding eight pure strategy equilibrium points: . In addition, six mixed-strategy equilibrium points are obtained: to .

Given that the ESS in multi-group evolutionary games exhibit asymptotically stable behavior, and that only pure strategies are asymptotically stable under asymmetric games, the ESS of such multi-population games must correspond to strict Nash equilibria, that is, pure strategy equilibria (Selten, 1988) [

34]. Therefore, the stability analysis focuses solely on the eight pure strategy equilibrium points.

The first Lyapunov method is employed to determine the stability of these equilibria. Specifically, the Jacobian matrix of the system at each equilibrium point is analyzed: If any eigenvalue has a positive real part, the equilibrium is unstable; If all eigenvalues have negative real parts, the equilibrium is asymptotically stable; If some eigenvalues have zero real parts while the others are negative, the equilibrium is in a critical state, requiring further investigation.

The Jacobian matrix of the Tripartite Evolutionary Game Model is expressed as:

Substituting

to

into the Jacobian matrix yields the stability characteristics summarized in

Table 3.

Based on the environmental performance and the effectiveness of policy interventions, the equilibrium points are classified into two categories: Environmentally Friendly Equilibria: Pyrolysis plants adopt the waste tire pyrolysis strategy (

), and recyclers choose compliant treatment (

); Traditional Mode Equilibria: Pyrolysis plants adopt petroleum coke-based pyrolysis (

), and recyclers engage in non-compliant treatment (

). The interaction between government environmental regulation (

) and market self-organization (

) further defines the nature of equilibrium states. A total of six typical equilibrium states are identified, as shown in

Table 4.

- (1)

Market-Dominated Optimal Equilibrium

The stability conditions for this equilibrium are as follows: fiscal unsustainability (

θ); cost advantage for pyrolysis plants

; and revenue advantage for recyclers

. When the fiscal cost of environmental regulation

exceeds the revenue from carbon taxation

, the government lacks the motivation to intervene (

). In this case, the market mechanism dominates resource allocation: pyrolysis plants spontaneously adopt low-carbon technologies due to the cost advantage of waste tires

, and process recyclers gain comparative benefits from compliant treatment

, thereby maximizing their respective profits. This equilibrium demonstrates that, under stringent cost-benefit conditions, the market pricing mechanism can internalize environmental externalities through profit-driven enterprise behavior (Pigou, 2017) [

35].

- (2)

Policy-Market Synergy Optimal Equilibrium

The stability conditions for this equilibrium are: fiscal sustainability ; compensable cost disadvantage for pyrolysis plants ; and compensable revenue disadvantage for recyclers . When the carbon tax revenue (θ) exceeds the regulatory fiscal cost , the government is motivated to intervene (). In this scenario, resource allocation is co-influenced by policy and market forces: pyrolysis plants are incentivized to adopt low-carbon processes as policy incentives offset their cost disadvantage , and recyclers realize net benefits from compliant treatment under policy incentives , both achieving profit maximization.

The government provides differentiated carbon tax incentives. For pyrolysis plants, the carbon tax rate

must satisfy

to offset the cost disadvantage of tire pyrolysis. For recyclers, the carbon tax rate

must meet

to counterbalance the revenue disadvantage of compliant treatment. This equilibrium validates the Policy Calibration Hypothesis (Weitzman, 2018) [

36], which posits that aligning carbon tax rates with industry-specific marginal abatement costs can stimulate synergistic effects between policy and market mechanisms.

- (3)

Unilateral Policy-Compensation Effective Equilibrium

The stability conditions for this equilibrium are as follows: sustainable net policy benefits ; insufficient incentives for pyrolysis plants ; and effective incentives for recyclers . Structural distortions in carbon tax design—such as an excessively low θ or an excessively high —may result in asymmetric incentive effects: recyclers are inclined toward compliant treatment as policy incentives offset the revenue disadvantage , while pyrolysis plants continue using petroleum coke-based processes due to insufficient policy compensation ).

This equilibrium reveals the risk of Targeting Failure in carbon tax policy and highlights the necessity of constructing industry-specific heterogeneous response models (Nordhaus, 2015) [

37].

- (4)

Market-Unilateral Compliance Equilibrium

This equilibrium is stable under the following conditions: the integrated policy return is unsustainable

; pyrolysis plants face a cost disadvantage

; and recyclers obtain a relative revenue advantage from compliant treatment

. In the absence of government intervention (

), market forces exhibit asymmetric effects: on the pyrolysis plant side, market failure occurs due to the loss of economic viability of tire pyrolysis caused by its cost disadvantage

; conversely, on the recycler side, spontaneous governance emerges as external market mechanisms—either through price signals (high

) or technology spillovers (low

)—incentivize compliant treatment. This results in a localized Coase solution (Coase, 2013) [

38].

To address this, the government may cultivate a standardized waste tire reuse market (by increasing

) or promote low-cost treatment technologies (by reducing

), thereby achieving a Pareto improvement at the recycling end without direct intervention. This aligns with the theory of Voluntary Environmental Agreements (VEA) (Lyon and Maxwell, 2003) [

39].

- (5)

Policy Intervention Failure Equilibrium

This equilibrium becomes stable under the following conditions: the integrated policy return is sustainable , yet incentives for recyclers fail .

Although administrative penalty pressure prompts government regulation (), policy tools exhibit systemic ineffectiveness. The carbon tax rate φ is set below the threshold needed to offset the relative loss of returns from compliant treatment , rendering it economically rational for recyclers to persist in non-compliant practices.

This scenario reflects the phenomenon of regulatory illusion, wherein policy intervention results in a zero-sum effect due to miscalibration of parameters (Goulder and Parry, 2008) [

40]. Resolving this dilemma requires a policy mix: supplementing carbon taxation with R&D subsidies (by reducing

) and compliant premium mechanisms (by increasing

).

- (6)

Complete Market Failure Equilibrium

This equilibrium requires the following conditions: the integrated policy return is unsustainable , and recyclers experience a revenue disadvantage .

When full reliance is placed on market regulation, the system falls into a dual externality trap. High process-switching costs (

) impede low-carbon technology innovation among pyrolysis plants, consistent with the Carbon Lock-in theory (Unruh, 2000) [

41]. Meanwhile, recyclers engage in adverse selection: non-compliant treatment, offering superior returns

, becomes the dominant strategy.

This condition highlights the fundamental limitations of market mechanisms in environmental governance. The resolution lies in adhering to Oates’ Decentralization Principle (Oates, 1972) [

42]: the central government should legislate minimum carbon tax standards (

θmin, φmin), while local governments dynamically optimize policy portfolios based on regional market characteristics.

5. Evolutionary Simulation Analysis and Discussion

Through an interview-based investigation of a pyrolysis plant, detailed information was collected regarding its production processes, raw material composition, tire pyrolysis parameters, and pollutant emission data, as well as the disposal processes, cost structures, and sales conditions of waste tire recyclers. The baseline parameter values adopted in this study were primarily obtained from on-site interviews with a medium-sized continuous pyrolysis facility located in eastern China. These were further triangulated with authoritative industry reports and relevant academic literature to comprehensively determine the ranges of prices, costs, and emission factors. Specifically, the carbon tax rates (,) were set with reference to recent average prices in China’s national carbon market and simulated levels commonly used in evolutionary game literature, ensuring alignment with both policy practice and academic norms. Key price, cost, and emission parameters were derived from field interviews and then cross-validated and calibrated using comparative emission studies, the IPCC Emission Factor Database, and industry-specific reports.

The above model was numerically simulated using MATLAB 2021a. The ode45 solver was employed to simulate the evolutionary trajectories over the time span with a step size of 0.05. The baseline parameter set was configured as follows: , , , , , , , , , , , , , , . All initial strategy probabilities were set to , representing a symmetric starting point without prior information. Based on this baseline setting, the effects of various parameters on the system’s evolutionary equilibrium were analyzed.

According to their attributes and mechanisms of influence on the system dynamics, model parameters were categorized into four groups:

Policy Intervention Parameters (, , ): Fully controlled by governmental authority, reflecting regulatory intensity and incentive policies.

Exogenous Market Parameters (, , , , , , , ): Determined directly by market supply-demand dynamics, characterizing product prices and cost structures.

Technological Performance Parameters (, , ): Determined by process design and technical development level, representing resource conversion efficiency and pollution control capability.

Strategy-Independent Constants (, ): Fixed income or cost items whose values are independent of the strategies chosen by game participants.

5.1. Policy Intervention Parameters

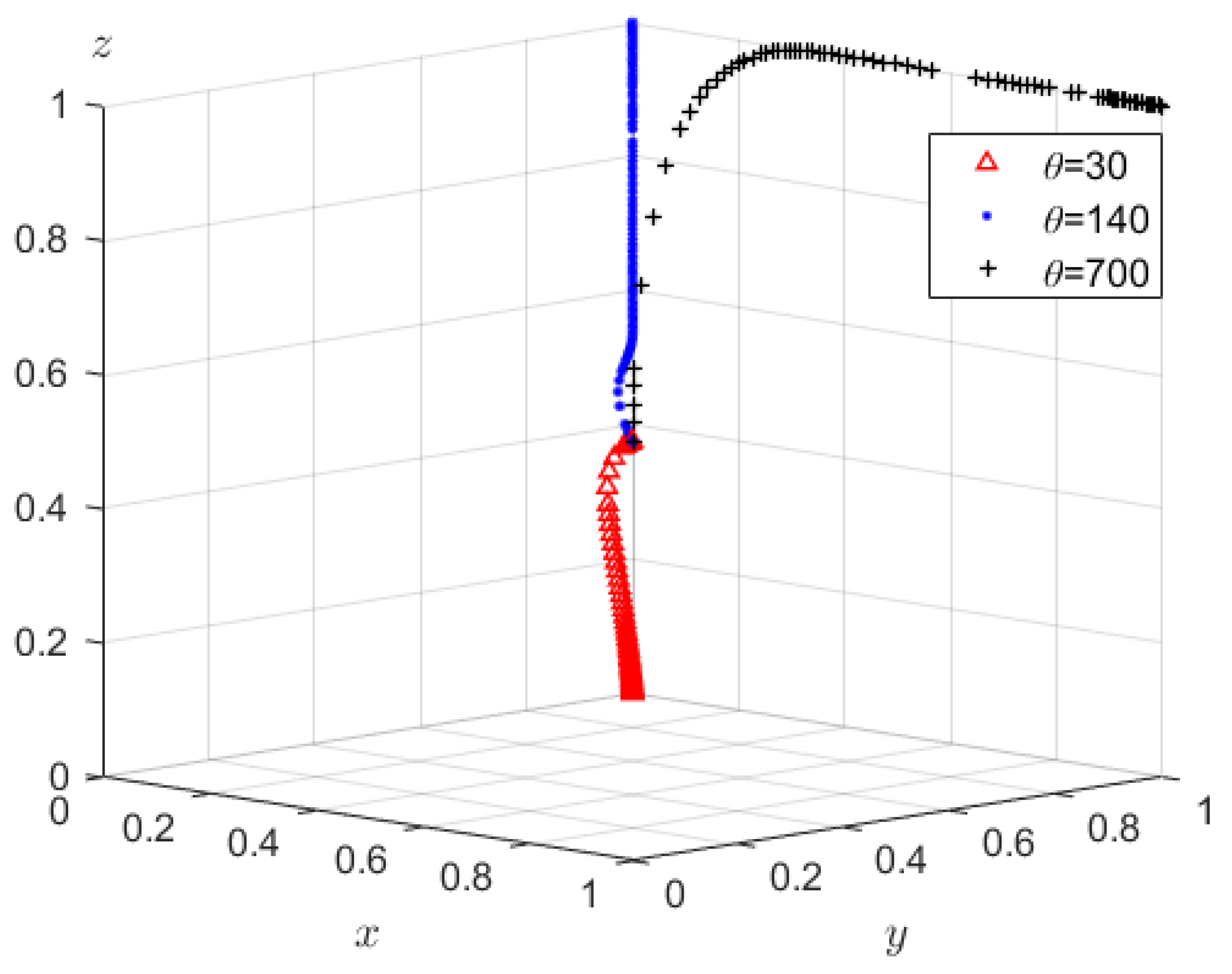

5.1.1. Impact of Pyrolysis Plant Carbon Tax Rate () on the Evolutionary Equilibrium

To investigate how carbon taxation affects the system dynamics, three scenarios were set for the pyrolysis plant’s carbon tax rate: low (

), medium (

), and high (

). Other key parameters were fixed as

,

, and

. Simulation results are shown in

Figure 4.

As shown in

Figure 4, an increase in the carbon tax rate

leads to a shift in the system’s evolutionary equilibrium. Higher

values enhance the relative cost advantage of waste tire pyrolysis compared to petroleum coke-based pyrolysis, thereby influencing stakeholders’ strategy selection.

When , the system evolves to equilibrium point , where pyrolysis plants adopt petroleum coke, recyclers conduct compliant treatment, and the government abstains from regulation. This equilibrium is sustained under the following conditions: Policy net benefit is unsustainable, pyrolysis plant faces a cost disadvantage, and recycler gains are insufficient.

When , the system reaches equilibrium point , with continued use of petroleum coke by pyrolysis plants, compliance by recyclers, and active government regulation. This reflects a scenario in which: Policy benefit is sustainable, pyrolysis plants are not sufficiently incentivized to shift, but recyclers receive adequate incentives.

When , the system evolves to equilibrium point , indicating full adoption of waste tire pyrolysis, recycler compliance, and effective government enforcement. The equilibrium is supported by: fiscal sustainability, cost offset for pyrolysis plants, and sufficient recycler compensation.

Figure 4 demonstrates that the carbon tax rate

directly influences the cost-benefit comparison between waste tire pyrolysis (a low-carbon process) and petroleum coke-based pyrolysis (a traditional method). A higher

increases the carbon tax burden on the traditional process, thereby enhancing the relative advantage of tire pyrolysis. The government may adjust

to balance carbon tax revenue against regulatory implementation costs, thereby deciding whether to enforce environmental regulations.

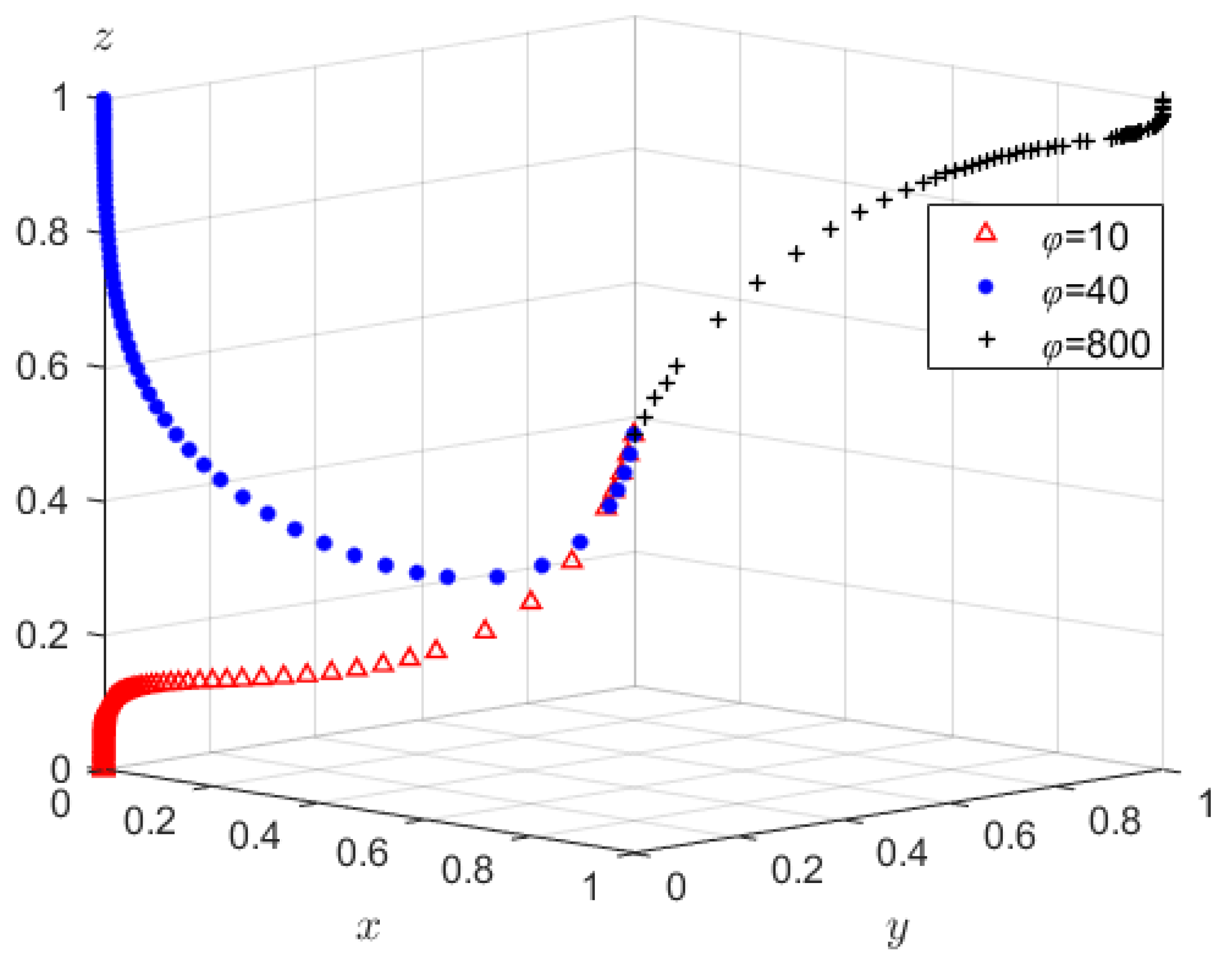

5.1.2. Impact of the Carbon Tax Rate () on the Evolutionary Equilibrium

Three scenarios were set for the recycler’s carbon tax rate

: low (

), medium (

), and high (

). Other parameters were fixed as

,

, and

. Results are shown in

Figure 5.

As increases, the system transitions from low compliance to full compliance and regulatory enforcement.

When , the system evolves to : petroleum coke use, recycler non-compliance, and no regulation. This equilibrium reflects: Policy benefits are unsustainable and non-compliant treatment remains more profitable.

When , the system moves to : continued non-compliance, but with regulation. Conditions met include: Policy benefits are sustainable, but recycler incentives remain ineffective.

When , the system stabilizes at : full compliance and regulation. This scenario meets: fiscal sustainability, cost coverage for pyrolysis plants, and adequate recycler compensation.

Figure 5 demonstrates that an increased carbon tax rate

penalizes non-compliant treatment (with high carbon emissions) and enhances the relative profitability of compliant treatment. As

increases, the cost of non-compliance rises, making compliant treatment more attractive. The government can leverage

adjustments to influence total carbon tax revenue

, thereby improving fiscal sustainability and motivating environmental regulatory enforcement.

5.1.3. Impact of Administrative Penalties () on the Evolutionary Equilibrium

Two levels of administrative penalty

were set: low (

) and high (

), with

,

, and

. Results are presented in

Figure 6.

Higher enhances regulatory enforcement but does not directly affect enterprise incentives.

When , the system stabilizes at : compliant recyclers but no regulation. This reflects: Policy benefits are unsustainable, pyrolysis plants face a cost disadvantage, and compliant treatment is economically unfavorable.

When , the system shifts to : same strategies, but with regulation. This reflects: Policy benefit is sustainable and recyclers are sufficiently incentivized, but pyrolysis plants remain unmotivated to shift.

Figure 6 indicates that the intensity of administrative penalties from central authorities directly affects the motivation of local governments to implement environmental regulations. By increasing

, the overall regulatory benefits are improved, encouraging a shift from non-intervention to active intervention. However,

does not directly incentivize enterprises. In cases where carbon tax revenue is insufficient to cover regulatory costs, increasing

can mitigate local governments’ regulatory inertia.

5.2. Exogenous Market Parameters

Impact of the Waste Tire Price () at Pyrolysis Plants on the Evolutionary Equilibrium

Three levels of

were analyzed:

,

, and

, with

,

,

, and

. Results are in

Figure 7.

influences both pyrolysis plant cost structure and recycler behavior.

When , the system evolves to : non-compliance dominates, no regulation. Policy benefit is unsustainable, and recycler revenue is insufficient.

When , the system stabilizes at : tire pyrolysis and compliance, but no regulation. Pyrolysis and compliance become cost-effective, but fiscal sustainability is not yet achieved.

When , the system reverts to due to compressed pyrolysis margins.

Figure 7 demonstrates that the market price of waste tires as a raw material directly affects the economic viability of selecting waste tire pyrolysis at the plant level. A higher price increases the cost advantage of tire pyrolysis. Meanwhile, the price indirectly influences recyclers’ strategies by shaping the profit margins from compliant treatment. However, an excessively high price may compress the profit margin of pyrolysis plants, thereby reducing their likelihood of choosing waste tires as feedstock.

5.3. Technological Performance Parameters

5.3.1. Impact of Carbon Emissions () from Waste Tire Pyrolysis on the Evolutionary Equilibrium

Two emission levels were set: high (

) and low (

), with

,

, and

. Simulation results are shown in

Figure 8.

Lower increases emission reduction efficiency and strengthens incentives.

When , the system stabilizes at : traditional pyrolysis, compliance, and regulation. Incentives are insufficient for pyrolysis plants to shift.

When , the system evolves to : low-carbon transition achieved. Carbon tax effectively offsets pyrolysis cost gap and recyclers receive adequate compensation.

As shown in

Figure 8, the lower the carbon emissions (

) of low-carbon pyrolysis technologies, the higher the Carbon Emission Reduction efficiency and the stronger the incentive effect of carbon taxation. The unit revenue per unit of carbon reduction increases correspondingly. The value of

directly determines the carbon tax compensation threshold that incentivizes pyrolysis plants to adopt low-carbon technologies. A smaller

is more likely to attract pyrolysis plants to choose low-carbon processes and utilize waste tires as the pyrolysis feedstock.

5.3.2. Impact of Pollutant Emissions from Compliant Treatment by Waste Tire Recyclers () on the Evolutionary Equilibrium

was set at

(high) and

(low), with

,

,

, and

. The simulation results are illustrated in

Figure 9.

Lower improves carbon abatement efficiency and recycler incentives.

When , the system stabilizes at : non-compliance with regulation. Recycler incentives are invalid at high emissions.

When , the system evolves to : full compliance achieved. All incentive conditions are satisfied.

Figure 9 demonstrates that the lower the environmental emission intensity

associated with compliant treatment, the greater the unit carbon abatement achieved, and the stronger the incentive effect of carbon taxation. The value of

directly determines the carbon tax compensation threshold required to shift recyclers toward compliant treatment. A lower

makes compliant treatment more attractive to recyclers.

6. Conclusions and Prospects

Considering the potential for low-carbon collaboration between pyrolysis enterprises and recycling enterprises, this study constructed a Tripartite Evolutionary Game Model involving pyrolysis plants, recyclers, and governmental regulators. The model analyzed the stability of strategy choices under a generalized carbon tax mechanism, the evolutionary patterns of system equilibrium combinations, and the regulatory impacts of key parameters. Numerical simulations validated the theoretical findings, revealing the conditions under which an environmentally friendly equilibrium—low-carbon transition by pyrolysis plants and compliant treatment by recyclers—emerges as an ESS. Based on the mechanism of factor influence, optimization pathways for regulatory governance on Carbon Emission Reduction in the waste tire industry were proposed.

The study demonstrates that the proposed bilateral generalized carbon taxation scheme, through a unified carbon tax rate and dynamic adjustment mechanism for pollutants such as Carbon Dioxide Equivalent (CO2-eq), provides institutional incentives for inter-enterprise emission reduction cooperation and resource sharing, thereby significantly reducing the risk of the system falling into a high-emission trap.

Based on the analysis above, the following policy and management recommendations are proposed:

- (1)

Establish a phased carbon tax regulation mechanism. Governments should adopt a dynamic tax rate design, implementing a high-intensity carbon tax in the early stages, supplemented with transformation subsidies to compel enterprises to invest in emission reduction technologies. As the industry’s low-carbon transition becomes normalized, the system should gradually shift to a market-led model, enabling automatic linkage between tax rates and market parameters to stimulate firms’ intrinsic motivation for emission reduction.

- (2)

Build a green market cultivation and stabilization system. By means of guaranteed government procurement (e.g., setting a minimum purchase price for waste tires) and Green Premium Certification for eco-friendly products, price stability in critical resource markets can be ensured. A cost hedging mechanism should also be established; when market price fluctuations exceed a given threshold, subsidies for compliant treatment should be triggered to mitigate the risk of market failure.

- (3)

Promote technology-efficiency-oriented incentive policies. A system should be implemented in which emission intensity is inversely linked to the carbon tax rate. Enterprises adopting advanced Carbon Emission Reduction technologies should receive tax relief, while lagging firms should face higher tax rates. In parallel, specialized loans for technology upgrades should be provided, with interest rates tied to the annual savings in carbon taxes, thereby amplifying the benefits of technological innovation.

- (4)

Strengthen the synergy between administrative supervision and market-based policies. A coordination mechanism should be established between Central Environmental Inspection and local carbon tax enforcement. Trigger conditions for governmental regulation should be clearly defined, and regions that consistently meet emission reduction targets should be exempted from administrative accountability to avoid “policy idling”.

While this study reveals the interactive mechanisms between policy parameters and market variables through a Tripartite Evolutionary Game Model, several limitations remain. First, the model treats pyrolysis plants and recyclers as homogeneous groups, without adequately considering heterogeneity in terms of enterprise size, technological capability, or regional distribution. In practice, large enterprises may possess stronger capacities for technological upgrading and cost absorption, whereas small and medium-sized enterprises (SMEs) and individual recyclers are more sensitive to cost fluctuations. This divergence may result in significantly different responses to carbon taxation and market-based incentives, thereby limiting the generalizability of model predictions.

Second, the model assumes that the regulatory strategy of governmental agencies is unified. However, in reality, substantial variations exist across Chinese provinces and cities in terms of environmental enforcement intensity, regulatory stringency, fiscal capacity, and commitment to the Circular Economy. These regional policy implementation gradients may lead to spatial heterogeneity in the actual application of carbon tax policies and regulatory enforcement, thereby affecting the realization of model equilibria across different local contexts.

Future research should consider incorporating firm-scale adjustment coefficients and indices of regional policy enforcement strength to construct heterogeneous-agent models. Empirical calibration and validation could be conducted using operational data from enterprises, which would further enhance the practical applicability and robustness of policy recommendations.