1. Introduction

In recent years, challenges including climate change, resource waste, and the degradation of ecosystems have gained considerable prominence. The awakening of public environmental concern (PEC) has led consumers to favor brands and products that are committed to environmental protection. This transformation offers unique opportunities and challenges for businesses, necessitating that they not only address the market demand for sustainable products but also thoroughly evaluate and enhance their environmental impact during the innovation process. This ensures that their products not only comply with environmental standards but also stand out in the marketplace [

1]. When pursuing green innovation, firms need to view environmental responsibility as a core component of their brand strategy in order to enhance consumer brand loyalty [

2]. Hence, improving the green innovation quality has become an essential condition for the survival and development of enterprises, while also reflecting corporate value and social responsibility.

Although macro-level governance measures, such as environmental regulations, can effectively curb corporate environmental pollution and emissions, these effects are often more apparent at the terminal level of environmental governance. The realization of green production processes and the construction of a green value chain require the collaborative participation and oversight of multiple stakeholders. Thus, the collaborative governance of social organizations and the public serves as an effective complement to government-level green governance systems [

3,

4].

In an era marked by the rapid advancement of social media and information technology, the speed of information dissemination has accelerated, significantly enhancing public scrutiny of corporate environmental performance. A company’s actions regarding environmental protection directly impact its social reputation and potential for sustainable development. As public recognition of green and sustainable development continues to grow, many companies have adopted a green agenda as the driving force behind a business model centered on green innovation [

5]. Consequently, public concern for environmental issues is crucial in affecting green innovation. “Environment-market” theory reveals that green innovation practices are a logical response to the public’s demand for the protection of the environment. The adoption of green products contributes to both environmental protection and improved stakeholder outcomes [

6]. For instance, the added value of green products can enhance consumer preferences, leading consumers to be willing to pay higher prices for market transactions and to expect increasingly responsible products and services from companies [

7]. This dynamic significantly impacts green innovation [

8].

According to the research report “2023 China Consumer Insights and Market Outlook”, over 60% of consumers willingly give a premium for green consumption. Some perspectives suggest that public environmental awareness has significantly increased the reputational costs associated with corporate environmental violations [

9,

10], compelling companies to allocate resources towards high-quality green innovation. In the new media era, the public scrutiny manifested through social discourse is continuously amplified by modern information dissemination networks, necessitating that enterprises conduct more rigorous self-assessments of the environmental benefits of their innovative activities [

11,

12]. At the resource allocation level, public oversight directs companies to shift their research and development resources from short-term incremental projects to groundbreaking fundamental research, while also enhancing the synergy between research and development departments and other functional units, thereby establishing a more systematic innovation management framework [

13,

14,

15,

16]. At the level of knowledge reconstruction, public environmental demands, as an external source of knowledge, are integrated into the corporate innovation process, promoting a deep coupling between technological pathway selection and sustainable development goals, ultimately achieving a substantial leap in innovation quality [

17,

18,

19,

20].

However, many questions remain unresolved in this field of study. PEC, as an important dimension of informal institutions, has not been sufficiently analyzed regarding its impact mechanism on green innovation quality in regard to external pressure and internal motivation. Existing research still lacks a micro-level examination of the dynamic interaction process between “public demands—corporate responses”. Furthermore, the existing literature often analyzes the direct impacts of PEC or digital transformation on green innovation in isolation, failing to reveal how digital technologies reconstruct the transmission pathways of “PEC—green innovation quality”. Particularly, effective empirical analyses and data support are lacking on how digital transformation converts dispersed public demands into actionable green innovation decisions. This study attempts to investigate how PEC relates to green innovation quality by exploring these research questions. Through a multidimensional analysis of external pressures and internal motivations, this research will reveal the channels through which PEC impacts green innovation quality and will further investigate the impact of digital transformation.

In this study, the marginal contributions can be summarized as follows:

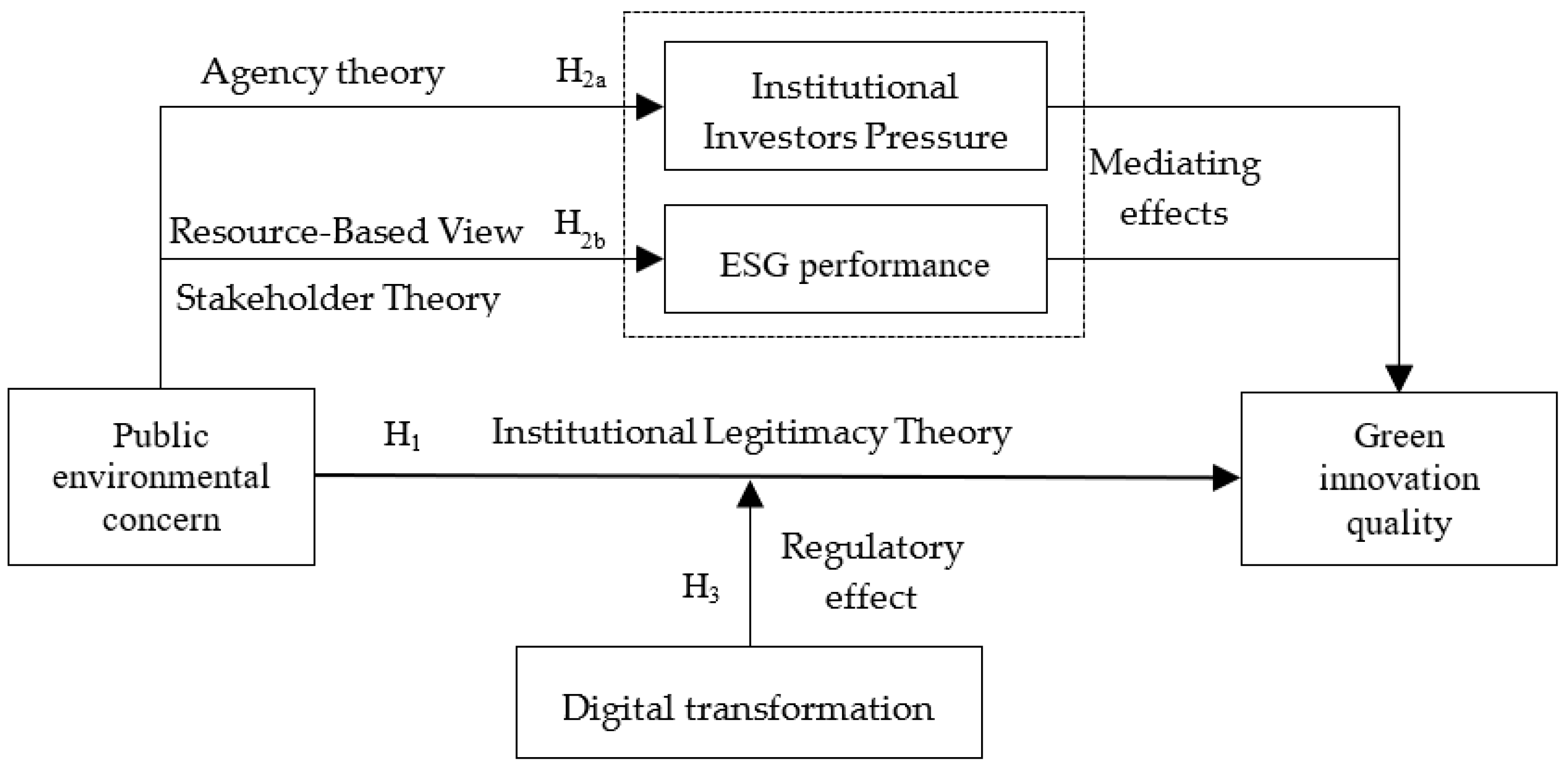

- (1)

This paper conducted a systematic empirical analysis to explore the mechanisms through which PEC impacts the green innovation quality, particularly focusing on the relationship between the external pressures exerted by institutional investors and the internal motivations provided by the ESG performance. This research not only verifies how both external and internal drivers jointly influence the green innovation quality against the background of public concern for environmental issues, but also reveals the potential channel mechanisms involved. This finding offers important insights for constructing a diversified and collaborative environmental governance system, highlighting the interactive relationship between external investors and internal environmental management within companies in achieving green and sustainable development. By understanding this interaction mechanism, policymakers and corporate management can more effectively design environmental governance measures to encourage companies to improve the green innovation quality, thereby addressing global environmental challenges.

- (2)

It further explores the positive moderating role of digital transformation between PEC and green innovation quality. Research results indicate that digital transformation not only enhances companies’ responsiveness to environmental concerns but also effectively promotes the green innovation quality. This discovery expands the economic impact research on digital transformation within the field of environmental governance, providing new perspectives and directions for future studies. By identifying the role of digital transformation as a positive force in facilitating environmental governance and green innovation, we contribute empirical evidence to the formulation of corporate digital strategies and the enforcement of relevant policies, thereby advancing the exploration of digital applications in environmental governance within both academic and practical realms.

The structure of this paper is arranged as follows: The second section summarizes relevant research, both domestically and internationally. The third section includes a theoretical analysis and research hypotheses. The fourth section provides an overview of the research design. The fifth section presents an empirical analysis. The sixth section discusses the findings, while the seventh section shows the conclusions and recommendations. The last section revises the limitations.

2. Literature Review

2.1. Research on the Economic Effects of PEC

Environmental concerns of the public have been increasing in popularity over the last few years, a phenomenon that has had profound impacts on economic activities. Many studies have explored how PEC influences corporate behavior, policy formulation, and socioeconomic development. Firstly, PEC significantly affects corporate environmental behavior. When faced with public scrutiny regarding environmental issues, companies typically improve their environmental management practices, implement stricter environmental standards, and adopt green technologies to optimize resource use, thereby enhancing their ESG performance [

21,

22]. Secondly, PEC has driven the formulation of environmental protection regulations. The strong public interest in environmental issues urges governments to adopt more stringent environmental policies, which not only help reduce environmental risks but also incentivize companies to carry on green innovation [

23]. Geng and He (2021) [

24] emphasize that PEC plays a vital role in the formulation of government policies. Increasingly, governments take public expectations into account when developing environmental regulations and policies [

24]. This interactive relationship not only improves the effectiveness of policies but also enhances public support for these policies, thereby promoting broader social participation and collaborative governance.

Furthermore, the relation of PEC to investment behavior has gained prominence in recent years. Companies with outstanding environmental performance will be more likely to draw the interest of investors and tend to do better than their peers on the stock market [

25]. For instance, the findings of Khan et al. (2016) [

26] indicate that the performance of a company in terms of environmental and social governance significantly influences its market performance and investor trust.

Moreover, the connection between PEC and investment behavior has attracted growing interest in recent years. Companies with robust environmental performance tend to attract more investor attention and often outshine their competitors in the stock market [

25]. For instance, research by Khan et al. (2016) [

26] demonstrates that ESG performance has a significant impact on market success and investor trust. Notably, companies that excel in environmental protection are often able to achieve higher stock prices and returns [

26]. This phenomenon largely reflects investors’ recognition of and emphasis on ESG factors. Say and Herberg (2016) suggest that companies are increasingly considering PEC when formulating their investment strategies [

27]. This trend encourages greater investment in sectors such as renewable energy, green technology, and sustainable supply chains. Moreover, PEC can significantly enhance corporate investments in environmental protection [

28,

29], thereby strengthening companies’ capabilities for green innovation [

30].

In recent years, one crucial area of research by scholars has been the effect of PEC on corporate innovation behavior. Institutional theory reveals that public environmental demands exert pressure on local governments to strengthen environmental enforcement, such as increasing the frequency of environmental inspections or raising the standards for pollution fees, thereby compelling enterprises to undertake green technological innovation to cut down the cost of environmental compliance [

31,

32]. The study by Chen and Liu (2023) found that media attention indirectly promotes green innovation through a complete mediating effect of “command-and-control” environmental regulation and a partial mediating effect of “market incentive” regulation [

33]. However, the “sheltering effect” of politically connected firms may weaken the effectiveness of this pathway [

4]. Based on agency theory, public pressure reduces agency costs by enhancing corporate awareness of ecological responsibility, prompting management to incorporate environmental strategies into innovation decision-making [

9,

16]. For instance, research by Gu et al. (2021) [

29] indicates that public environmental demands strengthen corporate ecological consciousness, leading to a reallocation of resources toward green research and development projects. These studies reveal the significant effect of PEC in fostering green innovation while also highlighting various factors that influence this relationship [

29].

In conclusion, the research on the economic effects of PEC has gradually developed into a systematic theoretical framework that encompasses various aspects, including corporate performance, policy impact, investment behavior, and social capital. These studies provide vital theoretical support and practical guidance for understanding the complex links between environmental issues and economic development.

2.2. Research on the Driving Force of Green Innovation

With the widespread adoption of sustainable development principles and the increasing severity of environmental issues, green innovation has emerged as a focal point of research. Not only does green innovation enhance a company’s market competitiveness, but it is also of great significance for environmental protection and social responsibility. In recent years, researchers have extensively examined the factors driving green innovation, with a primary emphasis on both internal motivators and external environmental influences.

Internally, managerial experience, knowledge management, R&D investment, and organizational culture are factors that have a critical influence on green innovation. According to Zhao et al. (2021), the academic experience of management is a significant driver of green innovation within firms [

34]. Abbas and Khan (2023) demonstrate that the effectiveness of green knowledge management in companies is directly correlated with their green innovation capabilities [

35]. Additionally, investment in research and development is seen as an essential element in encouraging green innovation capacity [

36]. Shi and Yang (2022) found that higher levels of R&D investment can facilitate the development of green technologies [

37], thereby improving the quality and market performance of green products. Moreover, a crucial role is played by organizational culture in raising the green innovation quality. The openness, innovativeness, and environmental responsibility inherent in corporate culture can significantly influence employees’ innovative behaviors, which in turn affect the performance of green innovation [

38]. Güerlek and Tuna (2018) argue that possessing a green corporate culture centered on sustainable development can better motivate employees to carry on green innovation activities, thereby helping firms establish a competitive advantage [

39].

Furthermore, external environmental factors, including regulations, market demand, and social pressure, significantly influence the green innovation quality. Wang et al. (2022) revealed that environmental regulations and incentive measures effectively promote the green innovation quality, particularly in heavily polluting industries [

40]. Additionally, consumer preferences for green products and increasing market competition drive firms to continuously enhance the green innovation quality. Khan et al. (2022) indicate a growing consumer demand for sustainable products, prompting companies to increase their investments in green innovation [

41]. Furthermore, Li and Lv (2021) demonstrate that heightened consumer awareness of environmental issues encourages companies to pursue more innovations in green technologies and product design [

42].

Recently, there has been widespread academic interest in the effect of digital economic development in incentivizing green innovation. Numerous studies indicate that the digital economy, as a new engine driving high-quality development, significantly stimulates green innovation activities by reconstructing innovation factors and transforming organizational models, thereby reducing information asymmetry and systematically optimizing resource allocation efficiency [

43,

44,

45]. The widespread utilization of digital technologies has notably strengthened environmental information disclosure in terms of transparency and timeliness, creating a dynamic monitoring network that makes corporate environmental behaviors traceable and verifiable. This not only strengthens the precision and timeliness of government environmental enforcement but also empowers public participation in environmental governance, fostering a multi-actor co-governance pattern through digital channels such as social media and environmental protection apps [

46,

47]. Sustained external pressure compels enterprises to internalize environmental responsibilities as strategic objectives, accelerating the iteration of green technologies [

48]. The construction of digital platforms breaks down the temporal and spatial barriers of traditional innovation systems, facilitating the rapid flow and efficient integration of green technology knowledge through the establishment of virtual collaborative networks across regions and fields. This significantly reduces the trial-and-error costs of technological research and development, as well as market risks, effectively stimulating corporate motivation for green innovation [

49,

50].

3. Theoretical Analysis and Research Hypotheses

3.1. The PEC and the Green Innovation Quality

Based on institutional legitimacy theory, PEC influences the green innovation quality through a threefold mechanism comprising regulative, normative, and cultural-cognitive pillars. First, heightened PEC intensifies the pressure for institutional legitimacy, thereby highlighting the role of environmental regulation. Porter’s Hypothesis reveals that environmental regulations drive corporate green technological innovation through the “innovation compensation effect” [

51,

52]. Furthermore, the cognitive legitimacy formed by public environmental preferences compels enterprises to align their technological innovation activities for sustainable development, concentrating resources on high-quality green innovation. In addition, the normative legitimacy arising from ESG ratings and similar frameworks encourages companies to integrate ecological considerations into their innovation strategies. An enhanced ecological awareness among management significantly improves the green innovation quality.

From a practical standpoint, to enhance the effectiveness of government-imposed green governance, the importance of public oversight and participation in monitoring environmental issues has been underscored in multiple revisions of China’s environmental regulations [

4]. The implementation of environmental regulations can trigger a herd effect, boosting public consciousness of environmental protection issues [

53]. As public concern for environmental protection increases, there is a greater capacity for the public to monitor corporate environmental behaviors more extensively [

54]. This heightened scrutiny compels companies to enforce stricter constraints on their environmental practices and outcomes [

55], ultimately driving them to achieve their green development objectives through enhanced green innovation. The following hypothesis is therefore put forward:

Hypothesis 1. PEC contributes to the improvement of the green innovation quality.

3.2. The Mechanisms Linking to Institutional Investors’ Pressure and ESG Performance

3.2.1. Institutional Investors Pressure

Based on agency theory, institutional investors influence the green innovation quality by mitigating information asymmetry and agency conflicts between shareholders and management. As professional monitors, institutional investors directly intervene in corporate governance through mechanisms such as exercising voting rights and appointing directors, thereby curbing short-termism among management and encouraging a focus on long-term environmental benefits rather than short-term financial performance [

56,

57]. Furthermore, institutional investors compel companies to improve transparent disclosure of green information and reduce agency costs through ESG ratings and the threat of exit, thereby optimizing the efficiency of resource allocation for green innovation [

58,

59].

Recent studies have identified the behavior of institutional investors as a significant factor influencing PEC and corporate innovation activities. An increase in public concern for environmental issues often prompts institutional investors to reassess their investment portfolios. When the public raises expectations regarding corporate environmental performance, institutional investors may exert external pressure on companies by reducing their investments in firms that fail to adequately address environmental challenges. This behavior reflects not only the financial objectives of institutional investors but also their commitment to social responsibility, thereby impacting companies’ access to capital and market performance [

60,

61]. In response to external pressure from institutional investors focusing on environmental performance, companies are expected to boost their investment in innovation, particularly in the areas of green technologies and sustainable products [

62]. For instance, research by Zhao et al. (2023) indicates that by implementing higher-quality green innovations, companies can effectively respond to pressure from institutional investors, thereby restoring or enhancing their brand image and ensuring long-term economic benefits and market positioning [

63]. Thus, the following hypothesis is put forward:

Hypothesis 2a. PEC promotes improvements in green innovation quality by influencing the shareholding patterns of institutional investors.

3.2.2. ESG Performance

Drawing on stakeholder theory, PEC drives firms to improve their ESG performance through multiple pressure transmission mechanisms. The environmental demands of the public create reputational pressure through social media discourse, compelling companies to improve their ESG performance to meet stakeholder expectations and avoid legitimacy crises [

22,

64]. Furthermore, consumers’ green preferences and investors’ ESG screening behaviors translate public concern into market pressure, directly influencing corporate sales revenue and financing costs [

8]. What is more, the growing awareness of public environmental rights advocates prompts governments to strengthen environmental regulations, thereby exerting policy pressure on companies to optimize their environmental management systems and improve ESG disclosure performance.

Resource-based view theory confirms that firms with strong ESG performance tend to possess superior resource integration capabilities and technological R&D competencies, enabling them to attain sustained competitive advantages in green innovation. Concurrently, high-quality ESG disclosure improves firms’ access to policy resources, enabling them to obtain government green subsidies and green credit, thereby promoting greater investment in green technologies and sustainable innovation, ultimately improving the green innovation quality [

65,

66]. The sustainable reputational capital derived from strong ESG performance facilitates the attraction of environmental technology talent and reduces innovation costs through green supply chain synergies, contributing to the dual enhancement of both green patent quality and commercial value [

67]. Thus, the following hypothesis is put forward:

Hypothesis 2b. PEC fosters improvements in green innovation quality by improving ESG performance.

3.3. Moderating Effect of Digital Transformation

Digital transformation is becoming widely recognized in corporate operations and management, giving rise to new models, methods, and mechanisms within business processes. Digital technologies facilitate the rapid acquisition of market information, enabling companies to better monitor their environmental impacts and identify public concerns. This, in turn, allows firms to formulate more effective green innovation strategies and respond more efficiently to public interest in environmental issues. The rise of digital platforms and social media has facilitated the public expression of concerns about corporate environmental performance. This feedback mechanism enhances information transparency and interaction between companies and stakeholders, further strengthening public oversight and support for corporate green initiatives [

68], thus compelling companies to implement higher-quality green innovations.

Additionally, digital transformation offers companies greater opportunities for collaboration in green innovation [

69]. Digital platforms can facilitate cooperation between firms, research institutions, and supply chain partners, creating an open innovation ecosystem. This not only enhances resource integration efficiency but also accelerates the revolution of green technologies, thereby boosting the green innovation quality. Finally, digital transformation enables companies to achieve higher efficiency and cost-effectiveness in their green innovation efforts. Through digital tools, firms can optimize resource allocation and reduce operational costs, allowing them to invest more resources in green innovation. This process enhances environmental performance and provides a competitive advantage. The following hypothesis is therefore proposed:

Hypothesis 3. The digital transformation process amplifies the positive influence of PEC on green innovation quality.

The conceptual framework is shown in

Figure 1.

4. Research Design

4.1. Sample Selection and Data Sources

This research focuses on Chinese A-share listed companies spanning from 2011 to 2022. To enhance data robustness, the sample excludes ST firms, financial institutions, and observations with incomplete variable information. To control for outliers, winsorization was applied to continuous variables at the 1% and 99% levels. The final dataset comprises 29,877 firm-year observations across 4607 unique listed companies.

This research utilizes multi-source datasets: (1) PEC indicators are measured using the Baidu Search Index; (2) green innovation metrics are extracted from the CNRDS database; and (3) ESG scores come from Shanghai Huazheng’s proprietary rating system. Additional variables, including institutional investor pressure, digital transformation indices, and control variables, were collected from Wind Financial Terminal and corporate annual reports.

4.2. Variable Definitions

4.2.1. Core Explanatory Variables

The development of the internet and big data technologies has enabled web search engines to capture public attention toward environmental issues through recorded search terms and their frequencies. These digital traces effectively reveal geographical variations in public environmental concern across different regions. Compared to traditional indicators such as environmental complaint statistics and proposals from political advisory bodies, the Baidu Index provides a more timely measure of public environmental concern, leading to its increasing adoption by scholars in recent years [

70]. This study follows the methodologies of Huang (2020) [

54] and Xu et al. (2023) [

70] by employing term frequency analysis using Baidu Search Index data for the keywords ‘environmental pollution’ and ‘haze’ at the city level. Then, these search index values are matched with the locations of listed companies in order to construct a public environmental concern index for each firm. Additionally, to address potential issues with heteroscedasticity, the dataset is subjected to a natural logarithmic transformation.

The primary rationale for selecting “environmental pollution” and “haze” as keywords is as follows. First, these terms are core expressions of public environmental concerns, with “haze” being a highly recognizable environmental issue and “environmental pollution” encompassing a broader scope of content. Second, data from Baidu Index demonstrate that the search volumes for these keywords are significantly correlated with environmental events; for instance, there is a substantial increase in search volume for these keywords during episodes of severe pollution, which reflects the public’s sensitivity to environmental incidents. Finally, the combination of these terms captures attention to specific types of pollution while also monitoring changes in overall environmental awareness. Furthermore, there is a high degree of co-occurrence with other environmental keywords, collectively forming an effective measurement framework.

4.2.2. Explained Variable

To assess the green innovation quality accurately, this study adopts the methodology of Li and Liu (2021) [

71], which involves standardizing the proportion of granted green invention patents to the total green patents. This metric quantitatively represents green innovation quality, where increased values demonstrate enhanced innovation performance in sustainability. Since there is often a delay in authorizing green innovations, lagged data is used for empirical analysis.

4.2.3. Mediating Variables

- (1)

Institutional Investors Pressure. Compared to other market investors, institutional investors typically possess more specialized investment teams, diversified information sources, and rigorous investment processes. They are characterized by substantial investment capital, a strong capacity for information collection and analysis, and less frequent trading. Institutional shareholding ratio serves as a dual indicator, simultaneously reflecting investor confidence in corporate operational efficiency and long-term sustainability commitments. Consequently, this ratio is operationalized to quantify institutional investor pressure in our empirical framework.

- (2)

ESG Performance. The Huazheng ESG Index covers a majority of companies listed on the A-share market, effectively mitigating the impact of data omission on empirical analysis. Therefore, this study utilizes it as a substitute indicator for ESG performance. The Huazheng ESG Index employs a nine-tier scoring system, and this study quantifies it based on annual averages, assigning values from 1 to 9 across the nine levels, with higher scores indicating superior ESG performance.

4.2.4. Moderating Variable

The keyword frequency analysis method, as outlined in the study by Zhao et al. (2021) [

72], is utilized to evaluate digital transformation. The process involves extracting frequency data for 99 terms related to digital transformation, including intelligent manufacturing, information integration, and machine learning, from the annual financial reports. The annual statistical results are then matched with the corresponding company codes. To mitigate the risk of heteroscedasticity, the natural logarithm of the frequency data is calculated.

4.2.5. Instrumental Variables

Drawing on the research of Xu et al. (2023) [

70], the number of broadband internet access users is selected as the first instrumental variable for PEC. This indicator reflects the level of internet penetration in a certain area, and an increase in the number of internet users significantly enhances the visibility of environmental issues through scale effects, thereby influencing the Baidu Index for environmental problem searches. This choice meets the relevance and exogeneity criteria required for instrumental variables.

Furthermore, recognizing that mobile phone adoption similarly amplifies public exposure to environmental discourse, we select the year-end count of mobile phone subscribers as the second IV for measuring public environmental concern. This dual-IV approach accounts for complementary technological channels affecting environmental awareness while maintaining the exclusion restriction assumption.

4.2.6. Control Variables

Drawing on the research of Cheng and Liu (2018) [

73] and Liu and Li (2022) [

74], the influence of multiple variables on green innovation is controlled for, including company size (Size), establishment year (Age), ownership concentration (Top1), board size (Board), profitability (Profit), debt repayment ability (Lev), and proportion of independent directors (Indep). The main variables are presented in

Table 1.

4.3. Model Construction

The Hausman test was implemented to statistically justify the choice between fixed effects and random effects estimators, where the null hypothesis assumes the appropriateness of random effects modeling. Diagnostic tests confirmed the superiority of fixed effects specification, prompting the adoption of the fixed effects model with temporal and industrial dimensions. To address potential spatial autocorrelation, we implement city-level clustered standard errors. The core assumption of cluster robust standard errors is that firms within the same cluster are influenced by common policies. Given that cities exhibit high similarity in terms of green resource endowment, intensity of environmental regulations, and industrial structure, clustering at the city level satisfies the necessary condition of correlation among observations within the group.

Firstly, model (1) is constructed to test the first hypothesis:

Secondly, the stepwise testing is employed to assess the mediating effects of institutional investors’ pressure and ESG performance. Furthermore, to rigorously validate the mediation effects, a comparative analysis is performed using both the nonparametric bootstrap resampling technique and the Sobel test. Models (2) and (3) are specified as follows:

Thirdly, the model (4) is constructed to test the moderating effects:

In the aforementioned model, represents the lagged data of green innovation quality, denotes the core explanatory variable PEC, indicates the mediating variables of institutional investor pressure and ESG performance, and serves as the moderating variable. represents a series of control variables. , , and are constant terms, while , , and are the corresponding coefficients. The error term captures all omitted variables and measurement errors that potentially affect the dependent variable.

4.4. Descriptive Statistics

The variance inflation factors (VIFs) for all variables were determined to be below 10, indicating a lack of significant multicollinearity. Descriptive statistics for the key variables are presented in

Table 2.

4.5. Correlation Analysis

Table 3 presents the correlation tests for the main variables.

5. Empirical Analysis

5.1. The Baseline Regression Results

The findings in columns (1) to (3) of

Table 4 suggest that PEC has a positive effect on green innovation quality, regardless of whether other influencing variables are taken into account. For every 1% increase in PEC, green innovation quality increases by 0.013%. This supports Hypothesis 1, which was proposed in this study.

5.2. Robustness Checks

- (1)

Replace the Explained Variable

Drawing upon the existing literature, three alternatives are used to measure the dependent variable, which is the number of authorized green invention patents, the number of registered green invention patents, and the ratio of registered green invention patents to total green patents, in order to test its robustness. Additionally, to consider the potential lagged effect of PEC on green innovation, one-period lagged dependent variable data is incorporated into the regression analysis. The regression findings presented in

Table 5 show that all estimated coefficients are significant at the 1% level, which further confirms the robustness of Hypothesis 1.

- (2)

Using Samples from Different Time Periods

According to the

China Digital Economy Development and Employment White Paper, China’s digital transformation began to accelerate significantly in 2018. Therefore, this study adopts 2018 as the cutoff point for robustness tests. Columns (1) and (2) of

Table 6 respectively present the period-specific regression results before and after 2018. The analysis shows that the impact of PEC on green innovation quality increased after 2018, remaining statistically significant at the 1% level. This validates the robustness of Hypothesis 1 and demonstrates that digital transformation amplifies the beneficial impact of PEC on firms’ green innovation quality.

- (3)

Change the Empirical Method and Eliminate Some Industries

Furthermore, this research employs the Generalized Method of Moments (GMMs) approach to provide additional robustness checks. Columns (1) and (2) of

Table 7 present the GMM estimated regression results, with the number of internet users and mobile phone subscribers at the city level serving as instrumental variables, respectively. The findings show that PEC significantly improves the quality of green innovation at the 1% significance level. Column (3) displays the results of an empirical analysis conducted after excluding the wholesale and retail industries, which yields consistent conclusions.

5.3. Endogeneity Test

- (1)

Instrumental variable method

Instrumental variables (IVs) and the two-stage least squares (2SLS) approach are used to overcome endogenous issues caused by reverse causality and omitted variables. Following the research by Xu et al. (2023) [

70], the number of internet users and mobile phone users is utilized as the instrumental variables. As can be seen in

Table 8, the Kleibergen–Paap rk LM statistics are found to be significant at the 1% level, thus refuting the null hypothesis of the inadequacy of the identification of the IV. Furthermore, the Cragg–Donald Wald F statistics are all in excess of the critical values for 10% bias in the Stock–Yogo weak identification (ID) test, suggesting that there are no issues with weak instruments. The

p-values for the Hansen J statistics are all above 0.1, showing that the IV selected meet the requirements for exogeneity. The results demonstrate persistent positive effects of PEC on green innovation quality after instrumenting endogenous regressors, thereby substantiating our core findings

- (2)

PSM Method

Considering that the PEC samples may exhibit inherent differences, the PSM method is employed to pair firms that are similar in character in order to isolate the effects of public policy concern. The specific approach involves conducting a one-to-many matching with replacement among individuals within the common support range of the samples. The outcomes of the tests performed on the matched and unmatched samples, shown in

Table 9, are aligned with the baseline regression results. Furthermore, the impact coefficients after matching are significantly greater than those before matching, indicating that the conclusions are robust.

5.4. Mediation Effect Test

- (1)

Stepwise testing

Columns (1) to (3) of

Table 10 display the results of the regression analysis, with structural investor pressure acting as the mediating variable. The results suggest that an increase in PEC leads to a reduction in institutional investors’ shareholding ratio, thereby increasing the external pressure from institutional investors and significantly enhancing the green innovation quality. Hypothesis 2a is thus validated. Columns (4) to (6) display the outcomes of the regression analysis with ESG performance as the mediating variable. The rise in PEC is clearly shown to significantly improve firms’ ESG performance, which significantly promotes the green innovation quality. This validates Hypothesis 2b.

- (2)

Sobel test

To further examine the robustness of the mediating effects, Sobel tests were conducted in this study. As shown in

Table 11, the Sobel statistic is statistically significant at the 10% confidence level, and the Goodman test also meets the requirements for statistical significance, thus confirming the presence of mediating effects. When institutional investor pressure acts as the mediator, the mediating effect explains 5% of the total effect, whereas when ESG performance acts as the mediator, this proportion increases to 10%. This suggests that ESG performance plays a more substantial mediating role than institutional investor pressure.

- (3)

Bootstrap test

To further test the mediating effects, a bootstrap analysis was performed using 500 random samples. As can be seen in

Table 12, the 95% bias-corrected confidence interval did not include zero for either the direct or indirect effects, indicating the robustness of the mediation modelling and supporting study’s conclusions.

5.5. Moderation Effect Test

Table 13, columns (1) to (3), provides the empirical results after incorporating the digital transformation variable. These results are presented for models that do not include control variables, models that include control variables, and models that also include time and industry fixed effects. The results suggest that digital transformation increases the effectiveness of PEC in promoting green innovation quality, thereby validating Hypothesis 3.

5.6. Heterogeneity Analysis

In order to investigate whether the effects of PEC on green innovation quality are heterogeneous, and to provide targeted policy recommendations, this study conducted group analyses based on the criteria of high-tech enterprises, heavy-polluting enterprises, and the geographical locations. The p-values from the Chow test for each group were found to be less than 0.05, indicating significant inter-group differences, which can be utilized for heterogeneity analysis.

- (1)

Grouping by High-Tech and Heavy-Polluting Enterprises

The results of

Table 14 demonstrate that the empirical findings remain significant after grouping; however, the impact coefficients indicate that PEC is more effective in enhancing the green innovation quality of high-tech and non-heavy-polluting firms. This may be attributed to the fact that high-tech enterprises typically possess more advanced R&D systems and an innovation culture that enables them to swiftly transform public environmental demands into driving forces for green technology development. Their technological accumulation also facilitates the easier development of cutting-edge products that meet environmental protection requirements. In contrast, non-heavy polluting enterprises, owing to their lighter environmental burden, are more inclined to shape an environmentally friendly image through green innovation in response to public expectations. Furthermore, their business models are more conducive to integrating clean production technologies.

- (2)

Grouping by Regional Location of Enterprises

To explore the effect of regional characteristics on the empirical outcomes, this study conducts further grouping tests based on the geographical location of firms. The empirical results in

Table 15 indicate that PEC is more likely to enhance green innovation quality in enterprises located in the eastern and western regions than in those in the central region. The differences arise from the heterogeneity in economic development levels, policy implementation intensity, and market mechanisms among different regions in China. Enterprises in the eastern area, which is distinguished by its advanced economy, strong environmental awareness, and strict environmental regulations, can respond quickly to public environmental demands and invest in researching and developing green technology. In contrast, the western region benefits from national ecological compensation policies and the advantages of latecomer industries, where public environmental concerns can effectively drive its green transformation. Conversely, the central region, as a traditional industrial base with a heavy industry structure and high transformation costs, experiences a “low-lying effect” in environmental policy implementation, making it difficult for public environmental pressure to be effectively converted into innovation motivation. Additionally, the relatively low degree of marketization and insufficient environmental technology reserves in this region further weaken the stimulating effect of environmental concerns on green innovation.

6. Discussion

This study, conducted using a dataset of Chinese publicly listed companies, thoroughly investigates the potential influence of PEC on green innovation quality. Baseline regression analysis and a series of rigorous robustness tests reveal that active public engagement in environmental issues is a key driver of green innovation. Furthermore, the findings confirm that digital transformation significantly enhances this effect.

The industry and regional characteristics of the enterprises also influence the effectiveness of this process to some extent. Mechanism analysis delves deeper into the pathways through which PEC affects the green innovation quality, revealing the primary channel effects of external pressure from institutional investors and internal impetus from ESG performance. Specifically, institutional investors, as key market participants, respond sensitively to environmental issues and public pressure, which encourages companies to place greater emphasis on green innovation. Meanwhile, improvements in ESG performance provide direction and motivation for internal green innovation activities, creating a dual driving force that operates from the inside out.

The baseline regression analysis clearly reveals one key finding: the PEC improves the green innovation quality in China, which is supported by the viewpoints of Ma et al. (2024) [

23] and Li and Wang et al. (2021) [

9]. Essentially, as public concern for environmental topics increases, the aggregation of this social force effectively compels enterprises to demonstrate higher quality and levels of green innovation. This conclusion underscores the necessity for governments to recognize the importance of public engagement in environmental governance and the need to enhance the public’s voice on environmental issues. As active participants in environmental governance, the high level of environmental awareness among the public can create substantial external constraints on the actions of both government and enterprises. This pressure prompts policymakers to more carefully consider the long-term benefits of environmental governance and to avoid short-sighted decisions. This fully demonstrates the application of the institutional legitimacy theory in the field of green innovation. Widespread public participation and oversight not only enhance the transparency of environmental governance but also promote the scientific and democratic nature of decision-making processes, aligning policies more closely with societal expectations and actual needs. Furthermore, increased PEC can help alleviate the resource constraints that governments face in the environmental governance process. By incorporating public oversight, it is possible to significantly improve the effectiveness and efficiency of environmental governance while effectively reducing governance costs.

From an industry characteristics perspective, PEC has a particularly significant effect on the enhancement of green innovation quality in high-tech and non-heavy-polluting firms, a viewpoint that is similar to that of Yi et al. (2024) [

21]. High-tech enterprises typically possess stronger technological innovation capabilities and higher environmental awareness, making them more inclined to achieve green innovation driven by public environmental demands. In contrast, non-heavy-polluting enterprises face fewer transformation barriers, allowing them to implement green transitions more readily under public scrutiny. From the perspective of regional characteristics, PEC exerts a more significant positive influence on the green innovation quality of firms situated in the eastern and western regions, whereas its effect on firms in the central region is comparatively lesser. This discrepancy may be attributed to variations in economic development levels, industrial structures, the enforcement of environmental policies, and differences in PEC across the various regions.

Further mechanism examinations provide deeper insights. Specifically, PEC exerts greater pressure on institutional investors, which in turn forces companies to commit to enhancing the green innovation quality, which aligns with the viewpoints of Lv et al. (2024) [

62] and Zhao et al. (2023) [

63]. This finding underscores the critical role of institutional investors as external oversight mechanisms; in the face of growing public environmental demands, they can exert significant external pressure to encourage firms to adopt more environmentally friendly and innovative practices. Additionally, PEC improves corporate ESG performance, providing internal motivation for enhancing green innovation quality, a notion similarly articulated by Yi et al. (2024) [

21] and Long et al. (2023) [

75]. Improvements in ESG performance not only reflect a firm’s proactive approach to environmental responsibilities but also offer direction and impetus for internal innovation activities, thus forming an internal driving force for the enhancement of green innovation quality. This verifies the application of the resource-based view and stakeholder theory in the field of PEC and green innovation.

It is noteworthy that digital transformation plays a vital role, which is similar to the viewpoints of Tang et al. (2023) [

69]. The findings indicate that digital transformation significantly fortifies the positive impact of PEC on green innovation quality, acting as a positive moderating factor. This suggests that with the deepening application of information technology, companies can respond more efficiently to public expectations for environmental protection, optimizing resource allocation through digital means and reinforcing the green innovation quality.

7. Conclusions and Recommendations

7.1. Conclusions

This research uses a dataset of publicly listed Chinese companies and an approach involving dual fixed effects to comprehensively examine the potential influence of PEC on green innovation quality. Furthermore, it explores the mechanisms driving this impact and the moderating role of digital transformation. The key empirical findings are as follows:

- (1)

It has been suggested that a stronger level of public concern for environmental issues is correlated with higher quality green innovations. This conclusion remains robust through multiple tests, including variations of the dependent variable, changes in time frames, and exclusion of certain industries, as well as through the use of instrumental variables and a 2SLS approach for endogenous testing. These findings suggest that the empirical results are highly reliable.

- (2)

From an industry perspective, the influence of the PEC on green innovation quality is more evident in high-tech and non-polluting firms. At a regional level, firms in the central region are more sensitive than those in the east and west. These findings suggest that the impact of PEC on the green innovation quality varies across different industries and regions, offering valuable insights for the implementation of green innovation practices in diverse sectors.

- (3)

This paper explores the ways in which PEC enhances the green innovation quality from internal and external viewpoints. Specifically, it illustrates how PEC impacts green innovation quality via external pressure from institutional investors and internal motivation driven by ESG performance. It also sheds light on the mechanisms by which PEC enhances green innovation quality, thereby broadening our understanding of the economic implications of public involvement in environmental governance.

- (4)

The results of the moderation effect tests show that digital transformation markedly increases the impact of PEC on green innovation quality in the context of digital economic development. This finding provides governments with valuable information for developing policies that encourage digital transformation alongside the growth of the digital economy.

7.2. Recommendations

- (1)

The government should strengthen its efforts to raise awareness of environmental issues by utilizing various channels such as media, social platforms, and educational institutions to conduct public environmental education activities. To enhance public consciousness of environmental protection and create a societal atmosphere of collective concern for environmental issues, initiatives such as ‘household low-carbon points’ and ‘upcycling workshops’ should be implemented. This would encourage businesses to develop high-quality green products and services. For example, in 2024, Shenzhen, China, launched the “Low-Carbon Planet” mini-program to track residents’ green travel points and implemented a rewards program for point redemption, allowing residents to actively participate in environmental protection activities.

- (2)

The government should offer policies such as green investment subsidies and special funds for green transformation to encourage high-tech and non-heavy-polluting firms to conduct more green innovation activities and enhance the technological content of their products. This would promote sustainable economic development. The government can provide policy support to firms in the central region in areas such as green technology transfer and the recruitment of environmental expertise, with the aim of enhancing the green innovation capabilities of local businesses.

- (3)

The government should recognize the role of institutional investors in green investment decisions. By innovating the supply of financial products and increasing government-guided funds for green investments, the government can enhance institutional investors’ willingness to allocate assets towards green initiatives and promote green innovation through market mechanisms. Additionally, by regularly engaging independent third-party organizations for assessments and compiling ESG reports, the government can encourage companies to improve their ESG information disclosure, allowing investors and the public to understand the companies’ green performance.

- (4)

To enhance the digital transformation of enterprises, the government should increase its support for the digital economy, providing funding and technological support. By implementing policies such as green bond subsidies and R&D tax credits [

76], the government can reduce the costs associated with digital transformation. For example, the “Digital Loan” policy implemented in Zhejiang Province, China, provides a 3% interest subsidy to companies undergoing smart upgrades, leading to an approximate 9% growth in the added value of the province’s core digital economy industries in 2024.

- (5)

The government should take the lead in establishing platforms for green innovation technology research and development, collaborative bodies for industry-university-research green innovation, and green technology supply-demand databases. This will create a normalized collaboration mechanism among firms, the public, and investors to foster cooperation in green innovation, share resources and outcomes, and jointly enhance green innovation, thereby improving the green innovation levels across the entire industry.

8. Limitations and Future Directions

This study has several limitations. First of all, it relies on existing research and employs keyword data from the Baidu Search Index for “environmental pollution” and “haze” to measure public concern for environmental issues. However, this approach may not comprehensively reflect the multidimensional aspects of public attention to environmental problems, potentially leading to results that are biased toward internet user demographics. Future research will incorporate a diverse range of environmental keywords, such as “carbon emissions”, “noise”, and “biodiversity”, to further broaden the measurement dimensions of public environmental concern. Additionally, we aim to develop a multi-source data integration measurement system by combining social media sentiment analysis, environmental complaint data, and survey data to mitigate the representational bias of online data.

Furthermore, this study exclusively utilizes data from listed Chinese companies to validate the function of PEC on the green innovation quality, omitting companies listed on the Hong Kong Stock Exchange and the Growth Enterprise Market. This may limit the generalizability of the research conclusions. Given that the Hong Kong market has a higher degree of international investor participation and stricter ESG information disclosure requirements, while companies on the Growth Enterprise Market generally exhibit greater innovation activity and growth characteristics, the mechanisms through which PEC influences green innovation may differ significantly across market environments. Future research could expand the sample scope and conduct cross-market comparative analyses to examine how factors such as institutional environment and investor structure moderate the link between PEC and green innovation.

Finally, due to data availability constraints, the calculation method of green innovation quality using the proportion of granted green patents fails to fully account for factors such as patent value differentials and technological maturity. Future research could incorporate green technology maturity assessment systems and patent text-mining techniques to develop standardized green patent value indices, thereby advancing the study of green innovation quality.

Author Contributions

Data collection, G.S. and F.W.; writing—original draft, G.S. and F.W.; writing—review and editing, G.S. and F.W.; methodology, G.S. and F.W.; software, G.S. and F.W.; supervision, F.W.; funding acquisition, F.W.; validation, G.S. and F.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Social Science Planning Project of Shandong Province (grant No. 22CGLJ33 and No. 23CGLJ36).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the Corresponding author.

Acknowledgments

The authors wish to appreciate the valuable comments of the anonymous reviewers. All errors remain the sole responsibility of the authors.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Nidumolu, R.; Prahalad, C.K.; Rangaswami, M.R. Why Sustainability Is Now the Key Driver of Innovation. Harv. Bus. Rev. 2009, 87, 56–64. [Google Scholar]

- Lindgreen, A.; Xu, Y.; Maon, F.; Wilcock, J. Corporate Social Responsibility Brand Leadership: A Multiple Case Study. Eur. J. Mark. 2012, 46, 965–993. [Google Scholar] [CrossRef]

- Wang, Y.; Sun, X.H.; Guo, X. Environmental Regulation and Green Productivity Growth: Empirical Evidence on the Porter Hypothesis from OECD Industrial Sectors. Energy Policy 2019, 132, 611–619. [Google Scholar] [CrossRef]

- Yi, Z.H.; Chen, X.; Tian, L. The Impact of Public Environmental Concerns on Corporate Green Innovation. Econo. Theory Econ. Manag. 2022, 42, 32–48. [Google Scholar]

- Cajias, M.; Geiger, P.; Bienert, S. Green Agenda and Green Performance: Empirical Evidence for Real Estate Companies. J. Eur. Real. Estate Res. 2012, 5, 135–155. [Google Scholar] [CrossRef]

- Kammerer, D. The Effects of Customer Benefit and Regulation on Environmental Product Innovation. Ecol. Econ. 2009, 68, 2285–2295. [Google Scholar] [CrossRef]

- Tang, M.; Walsh, G.; Lerner, D.; Fitza, M.A.; Li, Q. Green Innovation, Managerial Concern and Firm Performance: An Empirical Study. Bus. Strat. Environ. 2018, 27, 39–51. [Google Scholar] [CrossRef]

- Chu, Z.; Wang, L.; Lai, F. Customer Pressure and Green Innovations at Third Party Logistics Providers in China. Int. J. Logist. Manag. 2019, 30, 57–75. [Google Scholar] [CrossRef]

- Li, Y.; Wang, Z. Will Public Environmental Concerns Foster Green Innovation in China’s Automotive Industry? An Empirical Study Based on Multi-Sourced Data Streams. Front. Energy Res. 2021, 9, 623638. [Google Scholar] [CrossRef]

- Geng, Y.; Chen, J.; Liu, T.; Tao, D. Public Environmental Attention, Media Coverage, and Corporate Green Innovation: Evidence from Heavily Polluting Industries in China. Environ. Sci. Pollut. R. 2023, 30, 86911–86926. [Google Scholar] [CrossRef]

- Zhou, B.; Ding, H. How Public Attention Drives Corporate Environmental Protection: Effects and Channels. Technol. Forecast. Soc. 2023, 191, 122486. [Google Scholar] [CrossRef]

- Chen, Y.; Hu, J.; Chen, H.; Chu, Z.; Hu, M. Public Attention, Big Data Technology, and Green Innovation Efficiency: Empirical Analysis Based on Spatial Metrology. J. Environ. Plann Manag. 2023, 68, 1807–1833. [Google Scholar] [CrossRef]

- Eveleens, C. Innovation Management; a Literature Review of Innovation Process Models and Their Implications. Science 2010, 800, 1–16. [Google Scholar]

- Mergel, I. Agile Innovation Management in Government: A Research Agenda. Gov. Inf. Q. 2016, 33, 516–523. [Google Scholar] [CrossRef]

- Del Brío, J.Á.; Junquera, B. A Review of the Literature on Environmental Innovation Management in SMEs: Implications for Public Policies. Technovation 2003, 23, 939–948. [Google Scholar] [CrossRef]

- Xu, Y.; Yang, L.; Hossain, M.E.; Haseeb, M.; Ran, Q. Unveiling the Trajectory of Corporate Green Innovation: The Roles of the Public Attention and Government. J. Clean. Prod. 2024, 444, 141119. [Google Scholar] [CrossRef]

- Du, Y.; Li, Z.; Du, J.; Li, N.; Yan, B. Public Environmental Appeal and Innovation of Heavy-Polluting Enterprises. J. Clean. Prod. 2019, 222, 1009–1022. [Google Scholar] [CrossRef]

- Liao, Z.; Weng, C.; Shen, C. Can Public Surveillance Promote Corporate Environmental Innovation? The Mediating Role of Environmental Law Enforcement. Sustain. Dev. 2020, 28, 1519–1527. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, L.; Sun, J.; He, P. Can Public Participation Constraints Promote Green Technological Innovation of Chinese Enterprises? The Moderating Role of Government Environmental Regulatory Enforcement. Technol. Forecast. Soc. 2022, 174, 121198. [Google Scholar] [CrossRef]

- Song, C.; Ma, W. ESG and Green Innovation: Nonlinear Moderation of Public Attention. Hum. Soc. Sci. Commun. 2025, 12, 667. [Google Scholar] [CrossRef]

- Yi, L.X.; Jiang, Y.C.; Liu, H. The Power of the Public: Air Environmental Concern and Corporate ESG Performance. Chin. Manag. Stud. 2024, 18, 1107–1129. [Google Scholar] [CrossRef]

- Ren, X.; Ren, Y. Public Environmental Concern and Corporate ESG Performance. Financ. Res. Lett. 2024, 61, 104991. [Google Scholar] [CrossRef]

- Ma, P.P.; Zhang, M.; Wang, L.K. Public Environmental Concerns and Corporate Green Transformation: The Dual Examination of Government Environmental Regulations and the Internal Capacity of Enterprises. China Popul. Resour. Environ. 2024, 34, 112–123. [Google Scholar]

- Geng, M.-M.; He, L.-Y. Environmental Regulation, Environmental Awareness and Environmental Governance Satisfaction. Sustainability 2021, 13, 3960. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Khan, M.; Serafeim, G.; Yoon, A. Corporate Sustainability: First Evidence on Materiality. Acc. Rev. 2016, 91, 1697–1724. [Google Scholar] [CrossRef]

- Say, N.; Herberg, A. The Contribution of Public Participation in a Good-Quality Strategic Environmental Assessment (Sea). Fresen Environ. Bull 2016, 25, 5751–5757. [Google Scholar]

- Li, L.L.; Zhang, J.T.; Bai, Y.; Yang, R.R. Public Environmental Concern and Enterprise Environmental Protection Investment: From the Perspective of Enterprise Life Cycle. Environ. Dev. Sustain. 2024, 26, 15031–15065. [Google Scholar] [CrossRef]

- Gu, Y.; Ho, K.C.; Yan, C.; Gozgor, G. Public Environmental Concern, CEO Turnover, and Green Investment: Evidence from a Quasi-Natural Experiment in China. Energy Econ. 2021, 100, 105379. [Google Scholar] [CrossRef]

- Yang, G.; Wang, C. Can External Pressure Promote Enterprise Environmental Investment? A Study Based on the Dual Perspectives of the Public and the Government. Environ. Dev. Sustain. 2024; Early Access. [Google Scholar] [CrossRef]

- Liao, X. Public Appeal, Environmental Regulation and Green Investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Pan, K.; He, F. Does Public Environmental Attention Improve Green Investment efficiency?—Based on the Perspective of Environmental Regulation and Environmental Responsibility. Sustainability 2022, 14, 12861. [Google Scholar] [CrossRef]

- Chen, Y.P.; Liu, Y. The Mechanism of How Media Coverage Influences High-polluting Enterprises’ Green Technology Innovation-Based on the Mediating Effect of Government Environmental Regulation and Public Participation. Manag. Rev. 2023, 35, 111–122. [Google Scholar]

- Zhao, S.; Zhang, B.C.; Shao, D.; Wang, S. Can Top Management Teams’ Academic Experience Promote Green Innovation Output: Evidence from Chinese Enterprises. Sustainability 2021, 13, 1453. [Google Scholar] [CrossRef]

- Abbas, J.; Khan, S.M. Green Knowledge Management and Organizational Green Culture: An Interaction for Organizational Green Innovation and Green Performance. J. Knowl. Manag. 2023, 27, 1852–1870. [Google Scholar] [CrossRef]

- Xu, J.; Liu, F.; Shang, Y. R&D Investment, ESG Performance and Green Innovation Performance: Evidence from China. Kybernetes 2021, 50, 737–756. [Google Scholar] [CrossRef]

- Shi, Y.; Yang, C. How Does Multidimensional R&D Investment Affect Green Innovation? Evidence from China. Front. Psychol. 2022, 13, 947108. [Google Scholar] [CrossRef]

- Khalil, M.K.; Muneenam, U. Total Quality Management Practices and Corporate Green Performance: Does Organizational Culture Matter? Sustainability 2021, 13, 1021. [Google Scholar] [CrossRef]

- Güerlek, M.; Tuna, M. Reinforcing Competitive Advantage through Green Organizational Culture and Green Innovation. Serv. Ind. J. 2018, 38, 467–491. [Google Scholar] [CrossRef]

- Wang, H.; Qi, S.; Zhou, C.; Zhou, J.; Huang, X. Green Credit Policy, Government Behavior and Green Innovation Quality of Enterprises. J. Clean. Prod. 2022, 331, 129834. [Google Scholar] [CrossRef]

- Khan, M.A.S.; Du, J.G.; Malik, H.A.; Anuar, M.M.; Pradana, M.; Yaacob, M.R.B. Green Innovation Practices and Consumer Resistance to Green Innovation Products: Moderating Role of Environmental Knowledge and pro-Environmental Behavior. J. Innov. Knowl. 2022, 7, 100280. [Google Scholar] [CrossRef]

- Li, D.D.; Lv, H.J. Investment in Environmental Innovation with Environmental Regulation and Consumers’ Environmental Awareness: A Dynamic Analysis. Sustain. Prod. Consum. 2021, 28, 1366–1380. [Google Scholar] [CrossRef]

- Luo, S.; Yimamu, N.; Li, Y.; Wu, H.; Irfan, M.; Hao, Y. Digitalization and Sustainable Development: How Could Digital Economy Development Improve Green Innovation in China? Bus. Strat. Environ. 2023, 32, 1847–1871. [Google Scholar] [CrossRef]

- Dou, Q.; Gao, X. The Double-Edged Role of the Digital Economy in Firm Green Innovation: Micro-Evidence from Chinese Manufacturing Industry. Environ. Sci. Pollut. R. 2022, 29, 67856–67874. [Google Scholar] [CrossRef] [PubMed]

- Chen, K.; Zhao, S.; Jiang, G.; He, Y.; Li, H. The Green Innovation Effect of the Digital Economy. Int. Rev. Econ. Financ. 2025, 99, 103970. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, Z. Impact of Digital Economy Development on Corporate Green Governance Efficiency. Technol. Anal. Strat. 2024; Early Access. [Google Scholar] [CrossRef]

- Hou, J.; Li, X.; Chen, F.; Hou, B. The Effect of Digital Economy on Rural Environmental Governance: Evidence from China. Agriculture 2024, 14, 1974. [Google Scholar] [CrossRef]

- Tan, W.Y.; Guo, L.; Wang, W. Research on the Relationship between Environmental Governance Pressure and Green Innovation. Environ. Dev. Sustain. 2025, 27, 5255–5278. [Google Scholar] [CrossRef]

- Li, H.Y.; Liu, Q.; Ye, H.Z. Digital Development Influencing Mechanism on Green Innovation Performance: A Perspective of Green Innovation Network. IEEE Access 2023, 11, 22490–22504. [Google Scholar] [CrossRef]

- Yu, F.; Chen, J. The Impact of Industrial Internet Platform on Green Innovation: Evidence from a Quasi-Natural Experiment. J. Clean. Prod. 2023, 414, 137645. [Google Scholar] [CrossRef]

- Porter, M.E.; van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Zeng, Y. Can Voluntary Environmental Regulation Promote Corporate Technological Innovation? Bus. Strat. Environ. 2020, 29, 390–406. [Google Scholar] [CrossRef]

- Zheng, Y.L.; Lu, M. Are big cities less green?—Based on the analysis of scale effect and peer effect. J. Fudan Univ. 2018, 60, 133–144. [Google Scholar]

- Huang, Y.Y.; Zhu, S.J. Public environmental concern, environmental regulation and dynamics of China’s energy intensive industries. J. Nat. Resour. 2020, 35, 2744–2758. [Google Scholar]

- El Ouadghiri, I.; Guesmi, K.; Peillex, J.; Ziegler, A. Public Attention to Environmental Issues and Stock Market Returns. Ecol. Econ. 2021, 180, 106836. [Google Scholar] [CrossRef]

- Kordsachia, O.; Focke, M.; Velte, P. Do Sustainable Institutional Investors Contribute to Firms’ Environmental Performance? Empirical Evidence from Europe. Rev. Manag. Sci. 2022, 16, 1409–1436. [Google Scholar] [CrossRef]

- Miller, S.M.; Qiu, B.; Wang, B.; Yang, T. Institutional Investors and Corporate Environmental and Financial Performance. Eur. Financ. Manag. 2023, 29, 1218–1262. [Google Scholar] [CrossRef]

- Jiang, L.; Bai, Y. Strategic or Substantive Innovation? -The Impact of Institutional Investors’ Site Visits on Green Innovation Evidence from China. Technol. Soc. 2022, 68, 101904. [Google Scholar] [CrossRef]

- Yang, Z.; Su, D.; Xu, S.; Han, X. Institutional Investors and Corporate Green Innovation: Evidence from China. PAC Econ. Rev. 2024, 29, 230–266. [Google Scholar] [CrossRef]

- Wei, L.; Chengshu, W. Company ESG Performance and Institutional Investor Ownership Preferences. Bus. Ethics Environ. Responsib. 2024, 33, 287–307. [Google Scholar] [CrossRef]

- McCahery, J.A.; Pudschedl, P.C.; Steindl, M. Institutional Investors, Alternative Asset Managers, and ESG Preferences. Eur. Bus. Organ. Law Rev. 2022, 23, 821–868. [Google Scholar] [CrossRef]

- Lv, Q.; Li, X.C.; Sun, Y.C.; Han, Y. Institutional Investors’ Green Activism and Corporate Green Innovation: Based on the Behind-Scene Communications. Emerg. Mark. Financ. Tr. 2024, 60, 3284–3307. [Google Scholar] [CrossRef]

- Zhao, J.Y.; Qu, J.; Wei, J.; Yin, H.; Xi, X. The Effects of Institutional Investors on Firms’ Green Innovation. J. Prod. Innov. Manag. 2023, 40, 195–230. [Google Scholar] [CrossRef]

- Liu, M.; Luo, X.; Lu, W.Z. Public Perceptions of Environmental, Social, and Governance (ESG) Based on Social Media Data: Evidence from China. J. Clean. Prod. 2023, 387, 135840. [Google Scholar] [CrossRef]

- Li, J.; Lian, G.; Xu, A. How Do ESG Affect the Spillover of Green Innovation among Peer Firms? Mechanism Discussion and Performance Study. J. Bus. Res. 2023, 158, 113648. [Google Scholar] [CrossRef]

- Wang, J.; Ma, M.; Dong, T.; Zhang, Z. Do ESG Ratings Promote Corporate Green Innovation? A Quasi-Natural Experiment Based on SynTao Green Finance’s ESG Ratings. Int. Rev. Financ. Anal. 2023, 87, 102623. [Google Scholar] [CrossRef]

- Kumar, M.; Raut, R.D.; Mangla, S.K.; Chowdhury, S.; Choubey, V.K. Moderating ESG Compliance between Industry 4.0 and Green Practices with Green Servitization: Examining Its Impact on Green Supply Chain Performance. Technovation 2024, 129, 102898. [Google Scholar] [CrossRef]

- He, X.; Liu, Y. The Public Environmental Awareness and the Air Pollution Effect in Chinese Stock Market. J. Clean. Prod. 2018, 185, 446–454. [Google Scholar] [CrossRef]

- Tang, M.; Liu, Y.; Hu, F.; Wu, B. Effect of Digital Transformation on Enterprises’ Green Innovation: Empirical Evidence from Listed Companies in China. Energy Econ. 2023, 128, 107135. [Google Scholar] [CrossRef]

- Xu, J.H.; Fei, Y.S.; Shang, L.X. Research on the influence of public environmental attention on corporate carbon performance level. J. Manag. 2023, 11, 1–11. [Google Scholar]

- Li, R.; Liu, L.X. Green finance and corporate green innovation. J. Wuhan Univ. Philos. Soc. Sci. 2021, 74, 127–140. [Google Scholar] [CrossRef]

- Zhao, C.Y.; Wang, W.H.; Li, X.S. How does digital transformation affect corporate total factor productivity? Finan. Trade Econ. 2021, 42, 114–129. [Google Scholar]

- Cheng, J.; Liu, Y. The Effects of Public Attention on the Environmental Performance of High-Polluting Firms: Based on Big Data from Web Search in China. J. Clean. Prod. 2018, 186, 335–341. [Google Scholar] [CrossRef]

- Liu, M.; Li, Y. Environmental Regulation and Green Innovation: Evidence from China?s Carbon Emissions Trading Policy. Finan Resh Let. 2022, 48, 103051. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.; Gong, Q.; Chang, C. ESG Performance and Green Innovation: An Investigation Based on Quantile Regression. Bus. Strat. Environ. 2023, 32, 5102–5118. [Google Scholar] [CrossRef]

- Feng, H.; Song, G.M.; Wang, F.Y.; Liu, L.L. Research on the Impact of Income Tax System on Chinese Enterprises’ OFDI Layout; China Economic Publishing: Beijing, China, 2024. [Google Scholar]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).