Sharing Economy Platforms in the Face of Crises: A Conceptual Framework

Abstract

1. Introduction

2. Conceptual Framework

3. Results

3.1. Short-Term Analysis

3.2. Medium-Term Analysis

3.2.1. Changes in Participation Due to Network Effects

3.2.2. Changes in Participation Due to Platforms’ Strategic Moves

3.3. Long-Term Analysis

4. Discussion

4.1. Insights into Our Two Research Questions

4.2. Platform Diversity: The Role of the Degree of Centralization

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

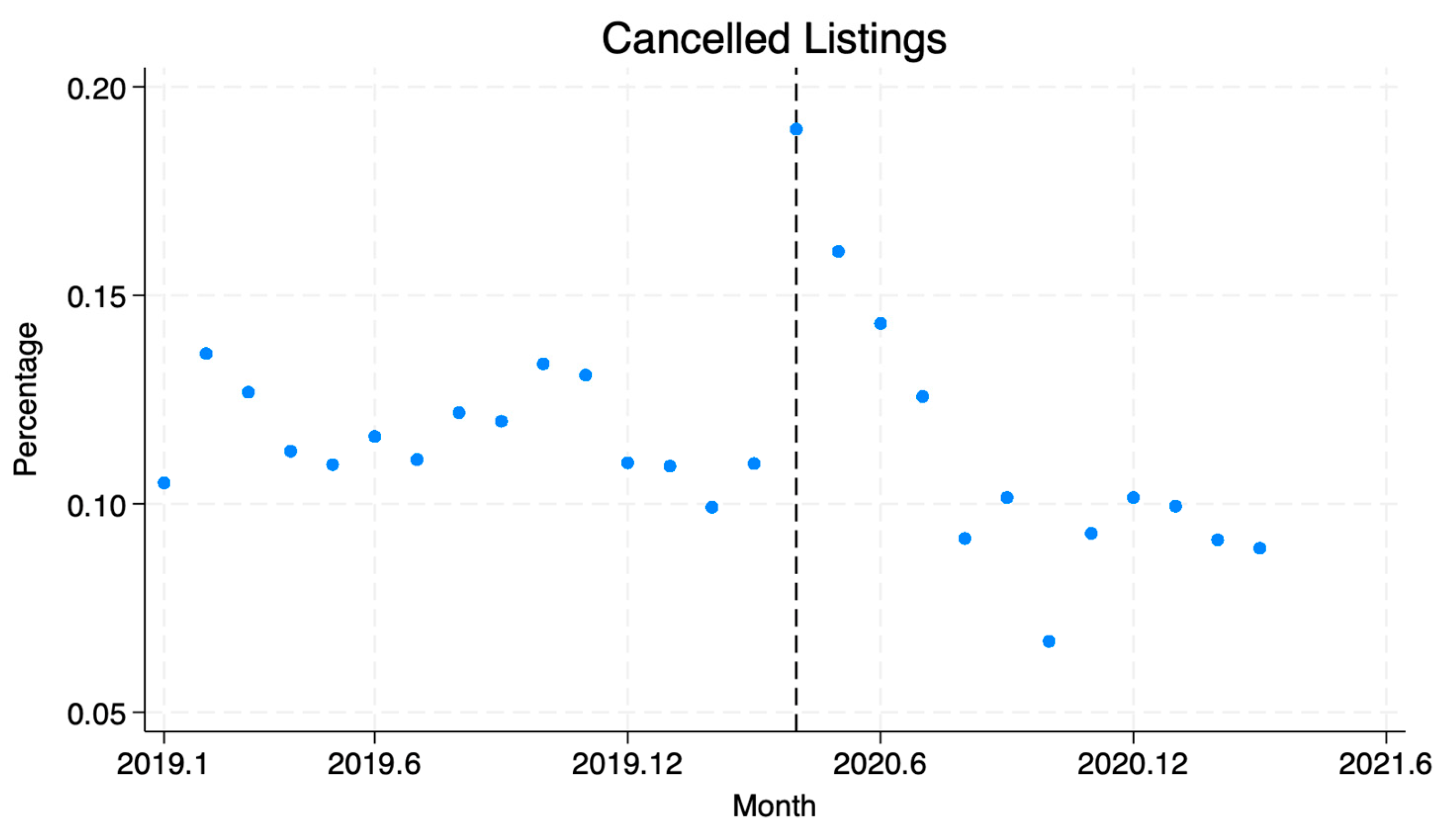

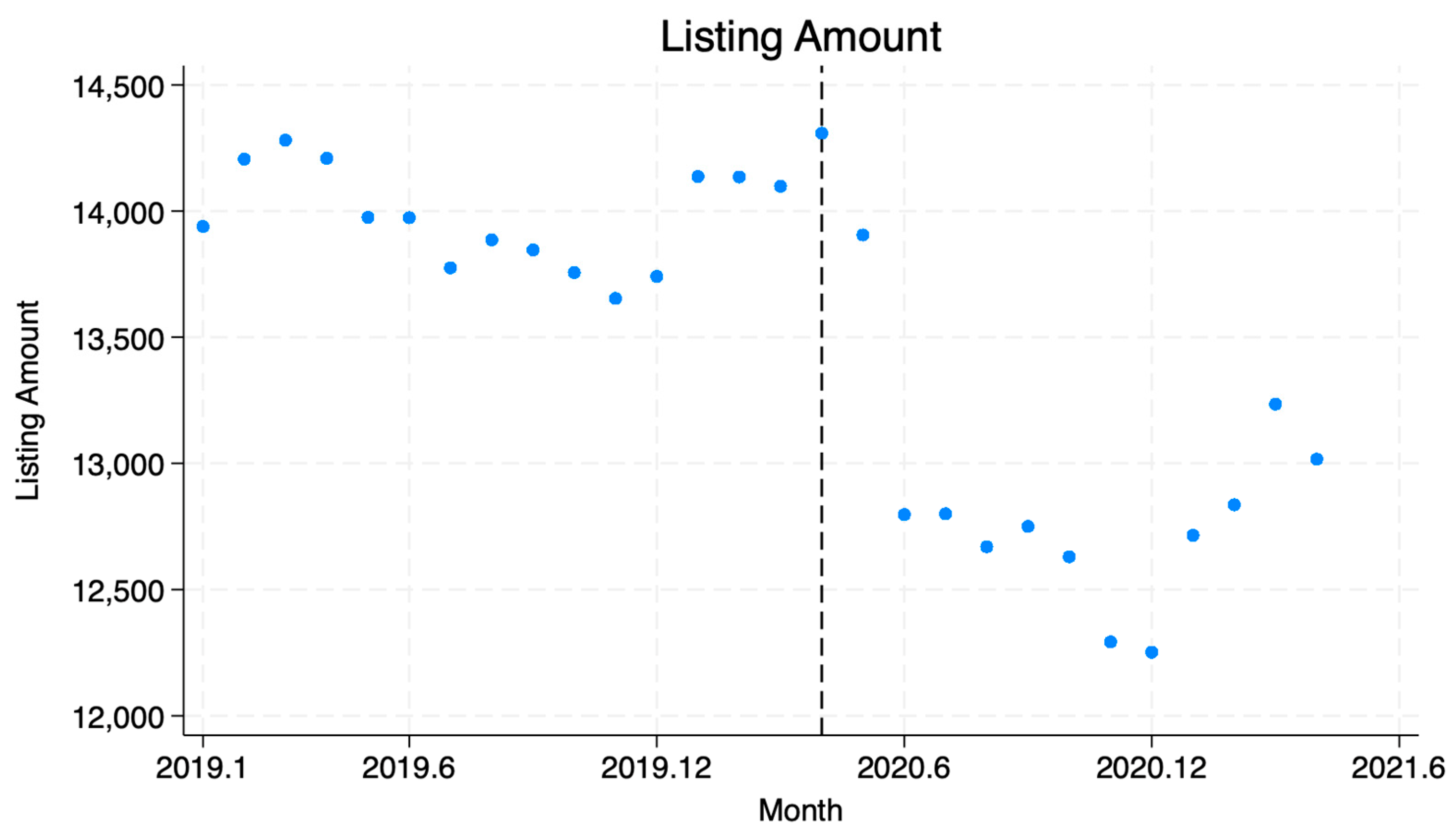

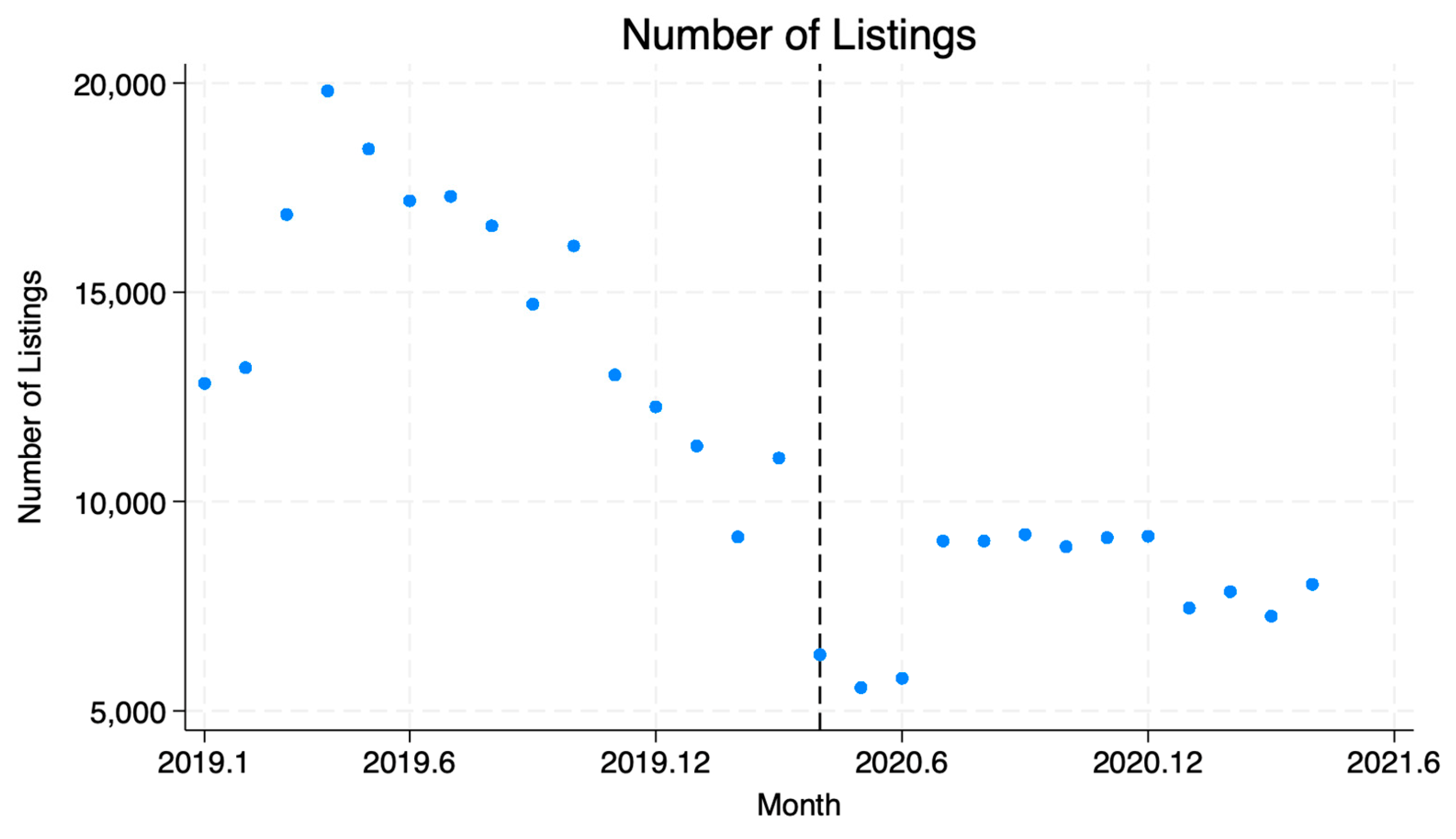

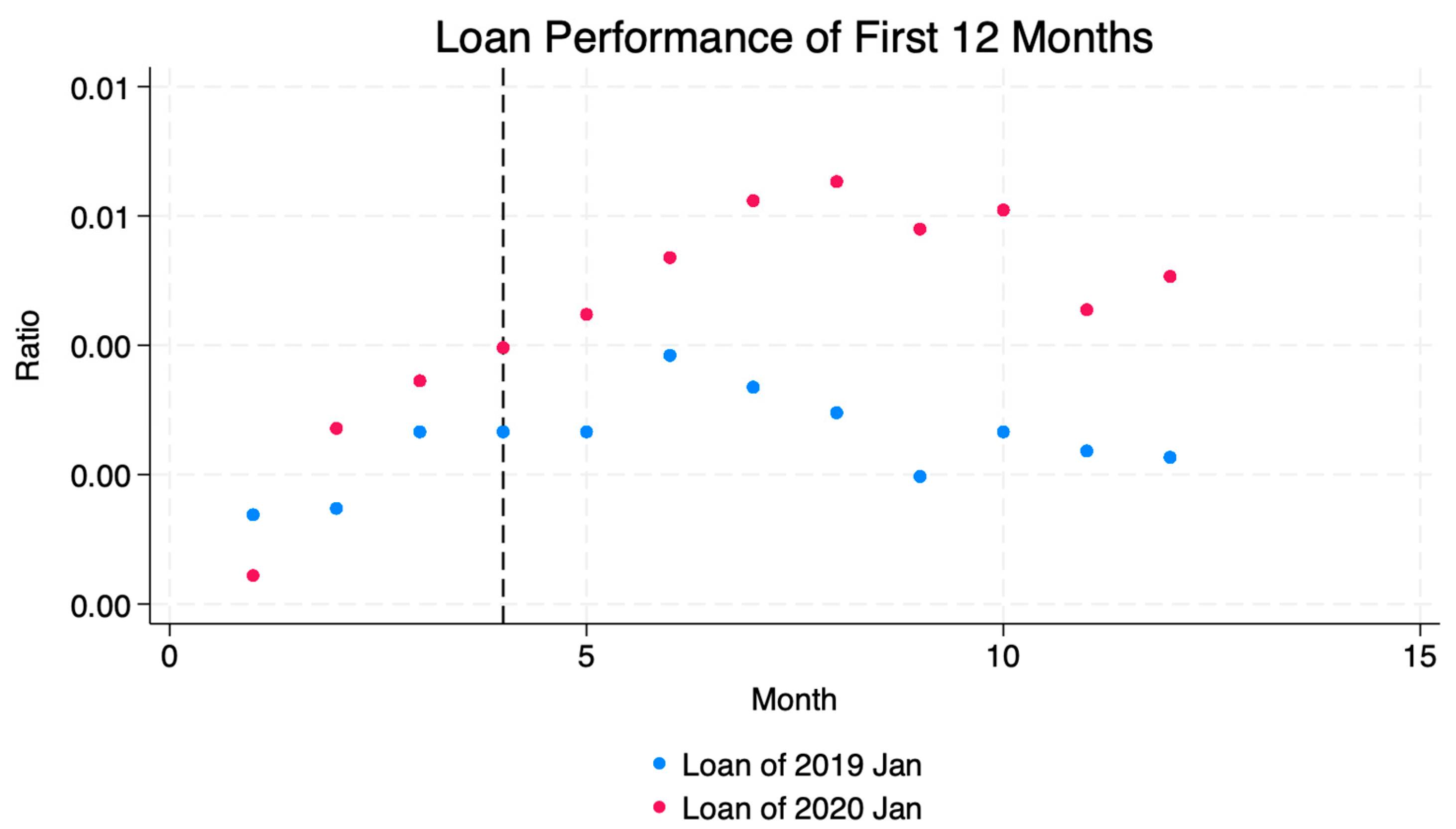

Appendix A. Empirical Analysis of Prosper.com

References

- Ranjbari, M.; Esfandabadi, Z.S.; Zanetti, M.C.; Scagnelli, S.D.; Siebers, P.O.; Aghbashlo, M.; Wanxi, P.; Quatraro, F.; Tabatabaei, M. Three pillars of sustainability in the wake of COVID-19: A systematic review and future research agenda for sustainable development. J. Clean. Prod. 2021, 297, 126660. [Google Scholar] [CrossRef] [PubMed]

- World Bank. COVID-19 to Plunge Global Economy into Worst Recession Since World War II. Press Release. 2020. Available online: https://www.worldbank.org/en/news/press-release/2020/06/08/covid-19-to-plunge-global-economy-into-worst-recession-since-world-war-ii (accessed on 8 June 2020).

- Mont, O.; Palgan, Y.V.; Bradley, K.; Zvolska, L. A decade of the sharing economy: Concepts, users, business and governance perspectives. J. Clean. Prod. 2020, 269, 122215. [Google Scholar] [CrossRef]

- European Commission. A European Agenda for the Collaborative Economy. COM(2016) 356 Final. 2016. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52016DC0356&from=EN (accessed on 2 February 2025).

- Chen, Y.; Richter, J.I.; Patel, P.C. Decentralized governance of digital platforms. J. Manag. 2021, 47, 1305–1307. [Google Scholar] [CrossRef]

- Mair, J.; Reischauer, G. Capturing the dynamics of the sharing economy: Institutional research on the plural forms and practices of sharing economy organizations. Technol. Forecast. Soc. Change 2017, 125, 11–20. [Google Scholar] [CrossRef]

- Cossey, J.; Dedeurwaerdere, T.; Périlleux, A. Inherently unstable? Scaling, mission drift, and the comparative performance of community-based platforms in the sharing economy. Ecol. Econ. 2023, 212, 107927. [Google Scholar] [CrossRef]

- Tirole, J. Competition and the industrial challenge for the digital age. Annu. Rev. Econ. 2023, 15, 573–605. [Google Scholar] [CrossRef]

- Huang, J.; Lu, H.; Du, M. Can digital economy narrow the regional economic gap? Evidence from China. J. Asian Econ. 2025, 98, 101929. [Google Scholar] [CrossRef]

- Kim, J.; Lee, J.J.; Na, H.J.H. Resilience through an online platform: Evidence from airbnb and hotels. Inf. Manag. 2025, 62, 104157. [Google Scholar] [CrossRef]

- Floetgen, R.J.; Strauss, J.; Weking, J.; Hein, A.; Urmetzer, F.; Böhm, M.; Krcmar, H. Introducing platform ecosystem resilience: Leveraging mobility platforms and their ecosystems for the new normal during COVID-19. Eur. J. Inf. Syst. 2021, 30, 304–321. [Google Scholar] [CrossRef]

- Qiu, D.; Lv, B.; Chan, C.M. How digital platforms enhance urban resilience. Sustainability 2022, 14, 1285. [Google Scholar] [CrossRef]

- Hossain, M. The effect of the COVID-19 on sharing economy activities. J. Clean. Prod. 2021, 280, 124782. [Google Scholar] [CrossRef] [PubMed]

- Mont, O.; Curtis, S.K.; Palgan, Y.V. Organisational Response Strategies to COVID-19 in the Sharing Economy. Sustain. Prod. Consum. 2021, 28, 52–70. [Google Scholar] [CrossRef]

- Acquier, A.; Daudigeos, T.; Pinkse, J. Promises and paradoxes of the sharing economy: An organizing framework. Technol. Forecast. Soc. Change 2017, 125, 1–10. Available online: http://www.sciencedirect.com/science/article/pii/S0040162517309101 (accessed on 20 April 2025). [CrossRef]

- Alt, R.; Zimmermann, H.D. Electronic markets on platform competition. Electron. Mark. 2019, 29, 143–149. Available online: https://link.springer.com/article/10.1007/s12525-019-00353-y (accessed on 20 April 2025). [CrossRef]

- Geissinger, A.; Laurell, C.; Öberg, C.; Sandström, C. How sustainable is the sharing economy? On the sustainability connotations of sharing economy platforms. J. Clean. Prod. 2019, 206, 419–429. [Google Scholar] [CrossRef]

- Zhu, X.; Liu, K. A systematic review and future directions of the sharing economy: Business models, operational insights and environment-based utilities. J. Clean. Prod. 2021, 290, 125209. [Google Scholar] [CrossRef]

- Belleflamme, P.; Peitz, M. The Economics of Platforms: Concepts and Strategies; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar] [CrossRef]

- Rong, K.; Li, B.; Peng, W.; Zhou, D.; Shi, X. Sharing economy platforms: Creating shared value at a business ecosystem level. Technol. Forecast. Soc. Change 2021, 169, 120804. [Google Scholar] [CrossRef]

- Abdelkafi, N.; Raasch, C.; Roth, A.; Srinivasan, R. Multi-sided platforms. Electron. Mark. 2019, 29, 553–559. [Google Scholar] [CrossRef]

- Hossain, M.; Mozahem, N.A. Drivers’ perceptions of the sharing economy for transport services. Technol. Forecast. Soc. Change 2022, 179, 121668. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Two-sided markets: A progress report. RAND J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Armstrong, M. Competition in two-sided markets. RAND J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef]

- Arthur, W.B. Competing technologies, increasing returns, and lock-in by historical events. Econ. J. 1989, 99, 116–131. [Google Scholar] [CrossRef]

- Bugalski, Ł. The undisrupted growth of the Airbnb phenomenon between 2014–2020. The touristification of European Cities before the COVID-19 outbreak. Sustainability 2020, 12, 9841. [Google Scholar] [CrossRef]

- Agina, M.F.; Aliane, N.; Sawy, O.E.; Khairy, H.A.; Fayyad, S. Risks in relation to adopting airbnb accommodation: The role of fear of COVID-19. Sustainability 2023, 15, 5050. [Google Scholar] [CrossRef]

- Farmaki, A.; Miguel, C.; Drotarova, M.H.; Aleksi, A.; Casni, A.; Efthymiadou, F. Impacts of COVID-19 on peer-to-peer accommodation platforms: Host perceptions and responses. Int. J. Hosp. Manag. 2020, 91, 102663. [Google Scholar] [CrossRef]

- Lee, S.; Hong, S.; Shin, W.Y.; Lee, B.G. The experiences of layoff survivors: Navigating organizational justice in times of crisis. Sustainability 2023, 15, 16717. [Google Scholar] [CrossRef]

- Gerwe, O. The COVID-19 pandemic and the accommodation sharing sector: Effects and prospects for recovery. Technol. Forecast. Soc. Change 2021, 167, 120733. [Google Scholar] [CrossRef]

- Huang, S.L.; Siao, H.R. Factors affecting the implementation of online food delivery and its impact on restaurant performance during the COVID-19 pandemic. Sustainability 2023, 15, 12147. [Google Scholar] [CrossRef]

- Raj, M.; Sundararajan, A.; You, C. COVID-19 and Digital Resilience: Evidence from Uber Eats. arXiv 2021, arXiv:2006.07204. [Google Scholar] [CrossRef]

- Cumming, D.; Salgueiro, A.M.; Sewaid, A. COVID-19 bust, policy response, and rebound: Equity crowdfunding and P2P versus banks. J. Technol. Transf. 2021, 47, 1825–1846. [Google Scholar] [CrossRef]

- Ren, J.; Raghupathi, V.; Raghupathi, W. Exploring the subjective nature of crowdfunding decisions. J. Bus. Ventur. Insights 2021, 15, e00233. [Google Scholar] [CrossRef]

- Otte, P.P.; Maehle, N. The combined effect of success factors in crowdfunding of cleantech projects. J. Clean. Prod. 2022, 366, 132921. [Google Scholar] [CrossRef]

- Koch, J.-A.; Siering, M. The recipe of successful crowdfunding campaigns: An analysis of crowdfunding success factors and their interrelations. Electron. Mark. 2019, 29, 661–679. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3439202 (accessed on 20 April 2025). [CrossRef]

- Belleflamme, P.; Omrani, N.; Peitz, M. The Economics of Crowdfunding Platforms. Inf. Econ. Policy 2015, 33, 11–28. [Google Scholar] [CrossRef]

- Brown, R.; Rocha, A. Entrepreneurial uncertainty during the COVID-19 crisis: Mapping the temporal dynamics of entrepreneurial finance. J. Bus. Ventur. Insights 2021, 14, e00174. [Google Scholar] [CrossRef]

- Ziegler, T.; Zhang, B.Z.; Carvajal, A.; Barton, M.E.; Smit, H.; Wenzlaff, K.; Natarajan, H.; Paes, F.; Suresh, K.; Forbes, H.; et al. The Global COVID-19 FinTech Market Rapid Assessment Study; SSRN Working Paper. Available online: https://ssrn.com/abstract=3770789 (accessed on 20 April 2025).

- Najaf, K.; Subramaniam, R.K.; Atayah, O.F. Understanding the implications of FinTech Peer-to-Peer (P2P) lending during the COVID-19 pandemic. J. Sustain. Financ. Investig. 2022, 12, 87–102. [Google Scholar] [CrossRef]

- Chandler, J.A.; Short, J.C.; Wolfe, M.T. Finding the crowd after exogenous shocks: Exploring the future of crowdfunding. J. Bus. Ventur. Insights 2021, 15, e00245. [Google Scholar] [CrossRef]

- Alois, J.D. Prosper Quarterly Report Provides Insight into Operations in a Coronavirus Economy. Crowdfund Insider. 2020. Available online: https://www.crowdfundinsider.com/2020/05/161834-prosper-quarterly-report-provides-insight-into-operations-in-a-coronavirus-economy/ (accessed on 22 May 2020).

- Airbnb. Shareholder Letter Q4 2021. 2021. Available online: https://s26.q4cdn.com/656283129/files/doc_financials/2021/q4/Airbnb_Q4-2021-Shareholder-Letter_Final.pdf (accessed on 20 April 2025).

- Jamal, T.; Budke, C. Tourism in a world with pandemics: Local-global responsibility and action. J. Tour. Futures 2020, 6, 181–188. [Google Scholar] [CrossRef]

- Airbnb. Hosts to Help Provide Housing to 100,000 COVID-19 Responders. 2020. Available online: https://news.airbnb.com/airbnb-to-help-provide-housing-to-100000-covid-19-responders (accessed on 20 April 2025).

- Hein, A.; Schreieck, M.; Wiesche, M.; Böhm, M.; Krcmar, H. The emergence of native multi-sided platforms and their influence on incumbents. Electron. Mark. 2019, 29, 631–647. [Google Scholar] [CrossRef]

- Gardiner, S.; Dolnicar, S. Airbnb’s offerings beyond space—Before, during and after COVID-19. In Airbnb Before, During and After COVID-19; Dolnicar, S., Ed.; University of Queensland: St Lucia, QLD, Australia, 2021. [Google Scholar] [CrossRef]

- Dolnicar, S.; Zare, S. COVID19 and Airbnb–Disrupting the disruptor. Ann. Tour. Res. 2020, 83, 102961. [Google Scholar] [CrossRef]

- Fairley, S.; Babiak, K.; MacInnes, S.; Dolnicar, S. Hosting and co-hosting on Airbnb—Before, during and after COVID-19. In Airbnb Before, During and After COVID-19; Dolnicar, S., Ed.; University of Queensland: St Lucia, QLD, Australia, 2021. [Google Scholar] [CrossRef]

- Mitra, P.; Zhang, Y.; Mitra, B.K.; Shaw, R. Assessment of Impacts and Resilience of Online Food Services in the Post-COVID-19 Era. Sustainability 2023, 15, 13213. [Google Scholar] [CrossRef]

- Colley, J. How the Gig Economy Could Suffer from a Labour Shortage—But Workers May Be Better Off. The Conversation. 2021. Available online: https://theconversation.com/how-the-gig-economy-could-suffer-from-a-labour-shortage-but-workers-may-be-better-off-166368 (accessed on 19 August 2021).

- Allegretti, G.; Holz, S.; Rodrigues, N. At a crossroads: Uber and the ambiguities of the COVID-19 emergency in Lisbon. Work Organ. Labour Glob. 2021, 15, 85–106. [Google Scholar] [CrossRef]

- Gupta, A. Prosper Investor Update. Prosper.com. 2020. Available online: https://web.archive.org/web/20210227125221/https://www.prosper.com/blog/2020/04/20/prosper-investor-update/ (accessed on 20 April 2020).

- Eisenmann, T.R.; Parker, G.; van Alstyne, M. Strategies for two-sided markets. Harv. Bus. Rev. 2006, 84, 92. [Google Scholar]

- Greener, I. Theorising path-dependency: How does history come to matter in organisations? Manag. Decis. 2002, 40, 614–619. [Google Scholar] [CrossRef]

- Sydow, J.; Schreyögg, G.; Koch, J. Organizational path dependence: Opening the black box. Acad. Manag. Rev. 2009, 34, 689–709. [Google Scholar]

- Maréchal, K. Not irrational but habitual: The importance of “behavioural lock-in” in energy consumption. Ecol. Econ. 2010, 69, 1104–1114. [Google Scholar] [CrossRef]

- Dew, R.; Ascarza, E.; Netzer, O.; Sicherman, N. Detecting routines: Applications to ridesharing customer relationship management. J. Mark. Res. 2024, 61, 368–392. [Google Scholar] [CrossRef]

- Wood, W.; Tam, L.; Witt, M.G. Changing circumstances, disrupting habits. J. Personal. Soc. Psychol. 2005, 88, 918. [Google Scholar] [CrossRef]

- Derwin, J. Airbnb Properties Are Flooding Back onto the Rental Market Across Australia. Available online: https://web.archive.org/web/20200325193912/https://www.businessinsider.com.au/coronavirus-airbnb-rents-impact-rental-market-australia-2020-3 (accessed on 20 April 2025).

- DuBois, D. Impact of the Coronavirus on Global Short-Term Rental Markets. AIRDNA Website. 2020. Available online: https://www.airdna.co/blog/coronavirus-impact-on-global-short-term-rental-markets (accessed on 20 April 2025).

- Airbnb. Airbnb Q4-2023 and Full-Year Financial Results. 2024. Available online: https://news.airbnb.com/airbnb-q4-2023-and-full-year-financial-results/ (accessed on 20 April 2025).

- Gyódi, K. Airbnb and hotels during COVID-19: Different strategies to survive. Int. J. Cult. Tour. Hosp. Res. 2021; ahead of printing. [Google Scholar] [CrossRef]

- Sterling, T. Analysis: Eat or Be Eaten? Food Delivery Apps Have Knives out as Pandemic Boom Fades. Reuters. 21 October 2021. Available online: https://www.reuters.com/technology/eat-or-be-eaten-food-delivery-apps-have-knives-out-pandemic-boom-fades-2021-10-20/ (accessed on 20 April 2025).

- Curry, D. Food Delivery App Report 2024. Key Insights into the Food Delivery App Market. Business of Apps, January, 2025. 2025. Available online: https://www.businessofapps.com/data/food-delivery-app-market/ (accessed on 20 April 2025).

- Curry, D. Uber Eats Revenue and Usage Statistics, Business of Apps. 2025. Available online: https://www.businessofapps.com/data/uber-eats-statistics/ (accessed on 26 February 2025).

- Kawane, T.; Adu-Gyamfi, B.; Cao, Y.; Zhang, Y.; Yamazawa, N.; He, Z.; Shaw, R. Digitization as an Adaptation and Resilience Measure for MSMEs amid the COVID-19 Pandemic in Japan: Lessons from the Food Service Industry for Collaborative Future Engagements. Sustainability 2024, 16, 1550. [Google Scholar] [CrossRef]

- Uber. Uber Announces Results for the Second Quarter of 2021. Uber Investor. 2021. Available online: https://investor.uber.com/news-events/news/press-release-details/2021/Uber-Announces-Results-for-Second-Quarter-2021/ (accessed on 4 August 2021).

- Li, X.; Ching, A.T. How does a firm adapt in a changing world? The case of prosper marketplace. Mark. Sci. 2024, 43, 673–693. [Google Scholar] [CrossRef]

- Faridi, O. Prosper Marketplace Secures $75M in Growth Capital. Crowdfund Insider. 2022. Available online: https://www.crowdfundinsider.com/2022/11/198817-prosper-marketplace-secures-75m-in-growth-capital/ (accessed on 20 April 2025).

- Zhou, F.; Chang, A.; Shi, J. How the Economic Policy Uncertainty (EPU) impacts FinTech: The implication of P2P lending markets. Financ. Res. Lett. 2024, 70, 106268. [Google Scholar] [CrossRef]

- Papadimitropoulos, V.; Malamidis, H. The transformative potential of platform cooperativism: The case of CoopCycle. tripleC: Communication, Capitalism & Critique. Open Access J. A Glob. Sustain. Inf. Soc. 2024, 22, 1–24. [Google Scholar]

- Long, N. Carsharing Platform Getaround Closes $140 Million. Pulse 2.0. 2020. Available online: https://pulse2.com/carsharing-platform-getaround-closes-140-million/ (accessed on 20 April 2025).

| The Crisis Hurts Both Sides. | The Crisis Benefits Both Sides. | The Crisis Hurts One Side and Benefits the Other. | |

|---|---|---|---|

| SHORT TERM Start of the crisis | Fact. Participation decreases on both sides. | Fact. Participation increases on both sides. | Fact. Participation increases on one side and decreases on the other. |

| MEDIUM TERM During the crisis (network effects are at work) | Action. Modify strategies to break the vicious circle. Strategy oriented toward the demand side (i.e., guests). | Action. Modify strategies to make the most of the virtuous circle. Strategy oriented toward the demand side (i.e., diners). | Action. Modify strategies to rebalance participation across sides. Strategy oriented toward the supply side (i.e., lenders). |

| LONG TERM After the crisis | Fact. Some crisis-driven changes in user behavior and platform operations prove difficult to reverse, especially when they reshape expectations, habits, or market structure. | Fact. Participation levels may stabilize at higher-than-pre-crisis levels, but sustaining this growth requires continued strategic investment on both sides. | Fact. Asymmetric participation persists if user perceptions or external conditions do not fully normalize. |

| Action. Platforms adjust strategies to mitigate persistent losses and capitalize on new types of gains. Typically, strategies become more balanced, with greater emphasis on strengthening the supply side (e.g., hosts) to restore ecosystem health. | Action. Platforms shift toward a more balanced strategy, giving greater emphasis to the supply side (e.g., restaurants) to retain supply capacity and ensure quality. | Action. Platforms adopt a more balanced strategy, placing greater emphasis on re-engaging the previously harmed side (e.g., borrowers) to restore equilibrium. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Belleflamme, P.; Li, M.; Périlleux, A. Sharing Economy Platforms in the Face of Crises: A Conceptual Framework. Sustainability 2025, 17, 6370. https://doi.org/10.3390/su17146370

Belleflamme P, Li M, Périlleux A. Sharing Economy Platforms in the Face of Crises: A Conceptual Framework. Sustainability. 2025; 17(14):6370. https://doi.org/10.3390/su17146370

Chicago/Turabian StyleBelleflamme, Paul, Muxin Li, and Anaïs Périlleux. 2025. "Sharing Economy Platforms in the Face of Crises: A Conceptual Framework" Sustainability 17, no. 14: 6370. https://doi.org/10.3390/su17146370

APA StyleBelleflamme, P., Li, M., & Périlleux, A. (2025). Sharing Economy Platforms in the Face of Crises: A Conceptual Framework. Sustainability, 17(14), 6370. https://doi.org/10.3390/su17146370

_Li.png)