Green Hydrogen Supply Chain Decision-Making and Contract Optimization Under Uncertainty: A Pessimistic-Based Perspective

Abstract

1. Introduction

- (1)

- How do excessively pessimistic hydrogen production stations and hydrogen refueling stations make decisions under stochastic production and demand?

- (2)

- What is the impact of excessive pessimism on hydrogen production stations and hydrogen refueling stations in the green hydrogen supply chain?

- (3)

- How do excessively pessimistic hydrogen production stations and hydrogen refueling stations make decisions under an option contract?

- (4)

- How do hydrogen production stations and hydrogen refueling stations make decisions under an excessively pessimistic option contract?

2. Literature Review

2.1. Option Contracts

2.2. Excessively Pessimistic Behavior

2.3. Supply Chain Decision-Making Under Stochastic Production and Demand

2.4. Research Related to the Green Hydrogen Supply Chain

2.5. Research Gap

3. Model Construction

3.1. Model Assumptions and Descriptions

- (1)

- Consider a two-stage green hydrogen supply chain consisting of an upstream hydrogen production station and a downstream hydrogen refueling station, where the hydrogen refueling station forecasts the demand in advance during the planning period, determines the ordering quantity based on the forecast, and then sends an ordering request to the hydrogen production station. The hydrogen production station determines the planned production quantity based on the ordering request from the hydrogen refueling station to go into production and deliver the green hydrogen on time.

- (2)

- If the hydrogen refueling station faces a supply–demand imbalance, and if orders cannot be fulfilled on time due to insufficient inventory, it is necessary to urgently procure green hydrogen to meet the delayed demand, and it is also necessary to bear the loss of price discounts for delayed-delivery orders. Regarding the cost of adapting the hydrogen production station, if there is insufficient output, it is necessary to obtain power through the grid to produce hydrogen on an emergency basis, thus bearing the cost of emergency production [45].

- (3)

- Consider that the demand for green hydrogen follows a random distribution. There are two possible excessively pessimistic perceptions regarding green hydrogen market demand held by downstream hydrogen refueling stations: (1) they may underestimate the accuracy of their own demand forecasts for the green hydrogen market, where the variance of their perceived market demand is larger than the actual market demand variance; and (2) they may underestimate their own market share and marketing capabilities, where their perceived market expected demand is lower than the actual market demand value.

- (4)

- Consider that the green hydrogen output rate of hydrogen production stations follows a random distribution. There are two possible types of excessively pessimistic perceptions regarding hydrogen production output held by upstream hydrogen refueling stations: (1) they may underestimate the accuracy of their own predictions of the green hydrogen production rate of hydrogen production stations, where the variance of their perceived green hydrogen production rate is larger than that of the actual green hydrogen production rate; and (2) they may underestimate their own hydrogen production capacity, where their perceived green hydrogen production rate is lower than that of the actual green hydrogen production rate.

3.2. Parameter Definitions

4. Decentralized Decision-Making Models

4.1. Optimal Ordering Decision for Hydrogen Refueling Stations Under Decentralized Decision Making

4.2. Optimal Production Decision for Hydrogen Production Station

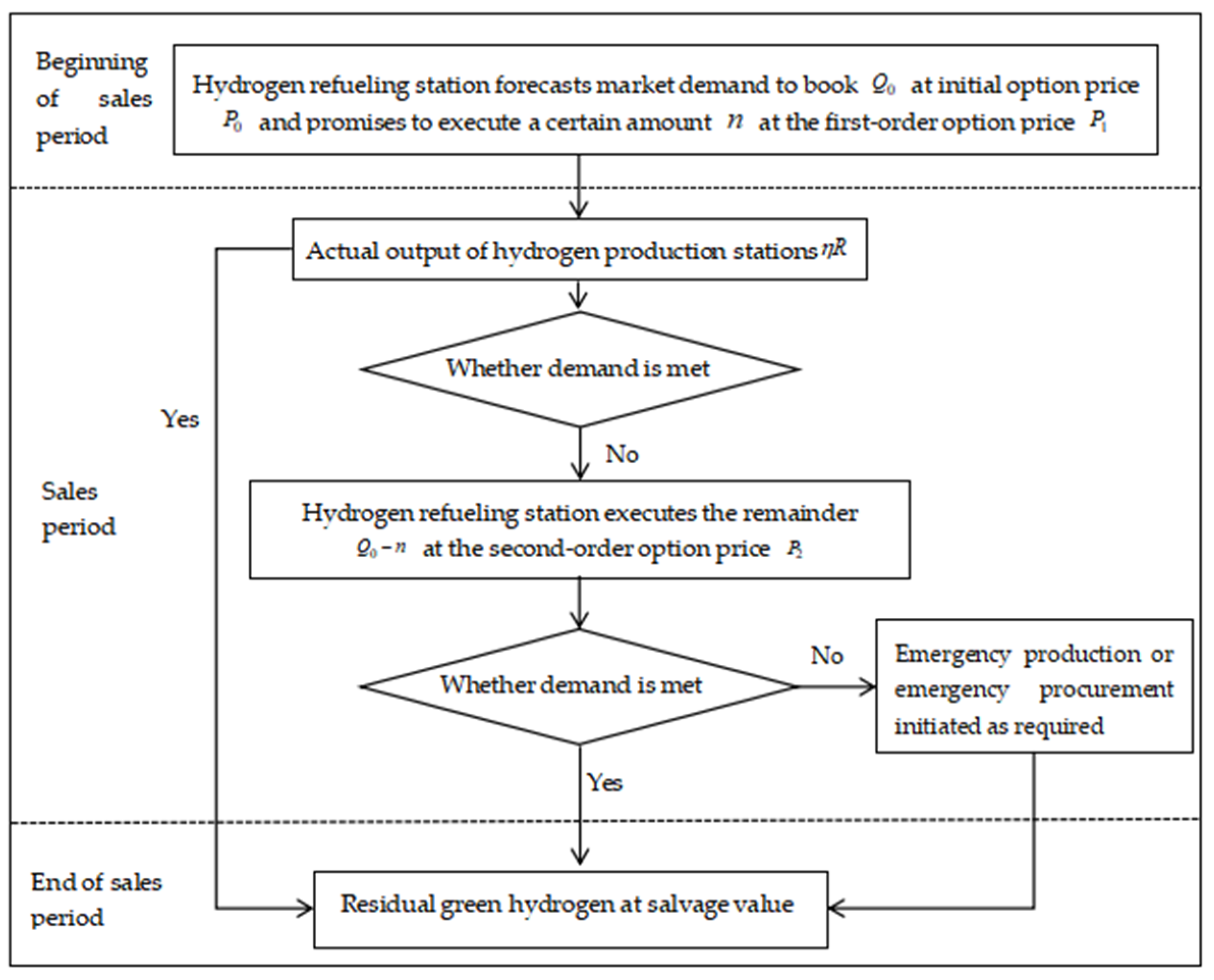

5. Option Contract Modeling

5.1. Optimal Ordering Decision for Hydrogen Refueling Stations Under Option Contracts

5.2. Optimal Production Decisions for a Hydrogen Production Station

6. Arithmetic Analysis

6.1. Assessment of Excessively Pessimistic Bias

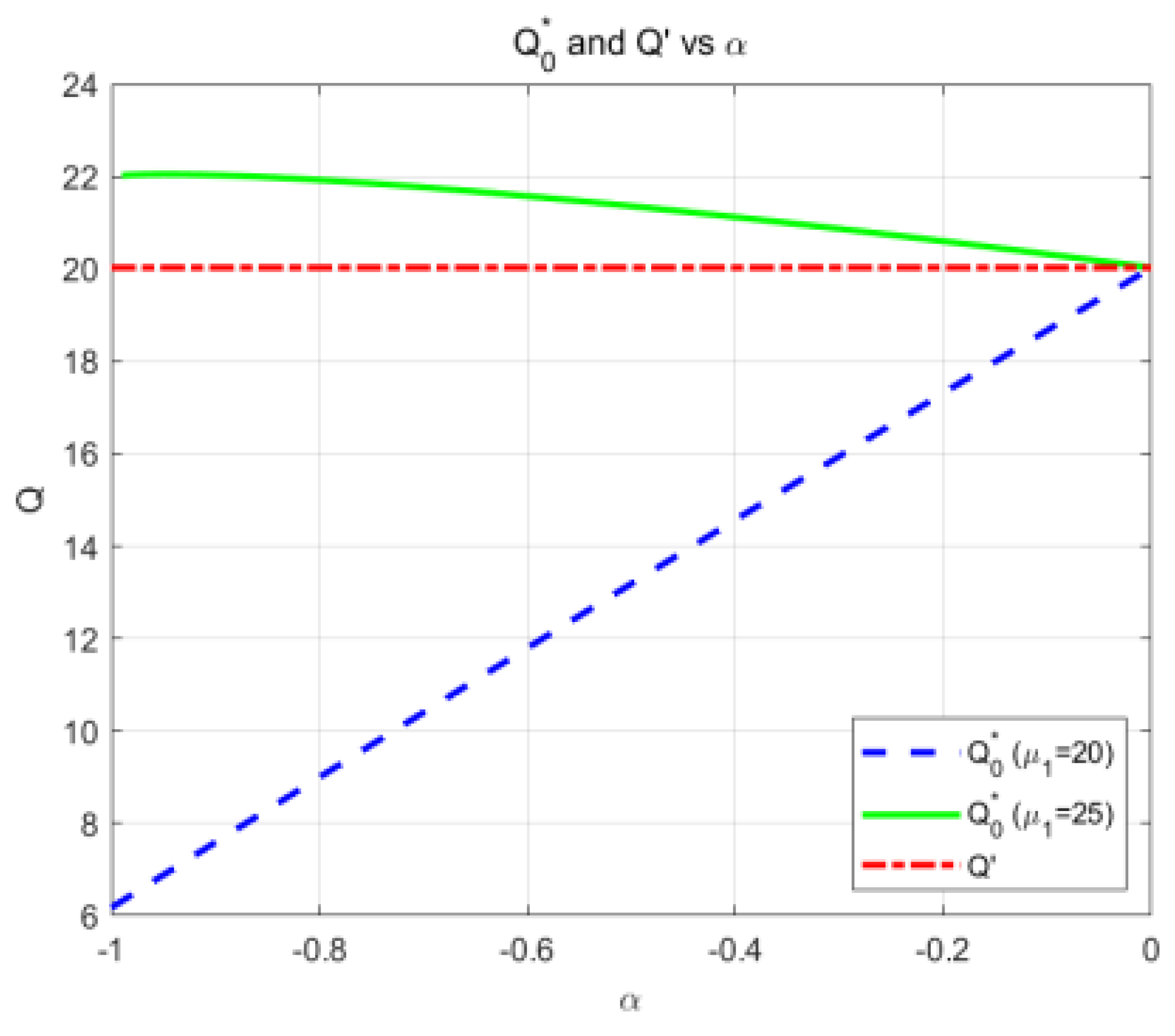

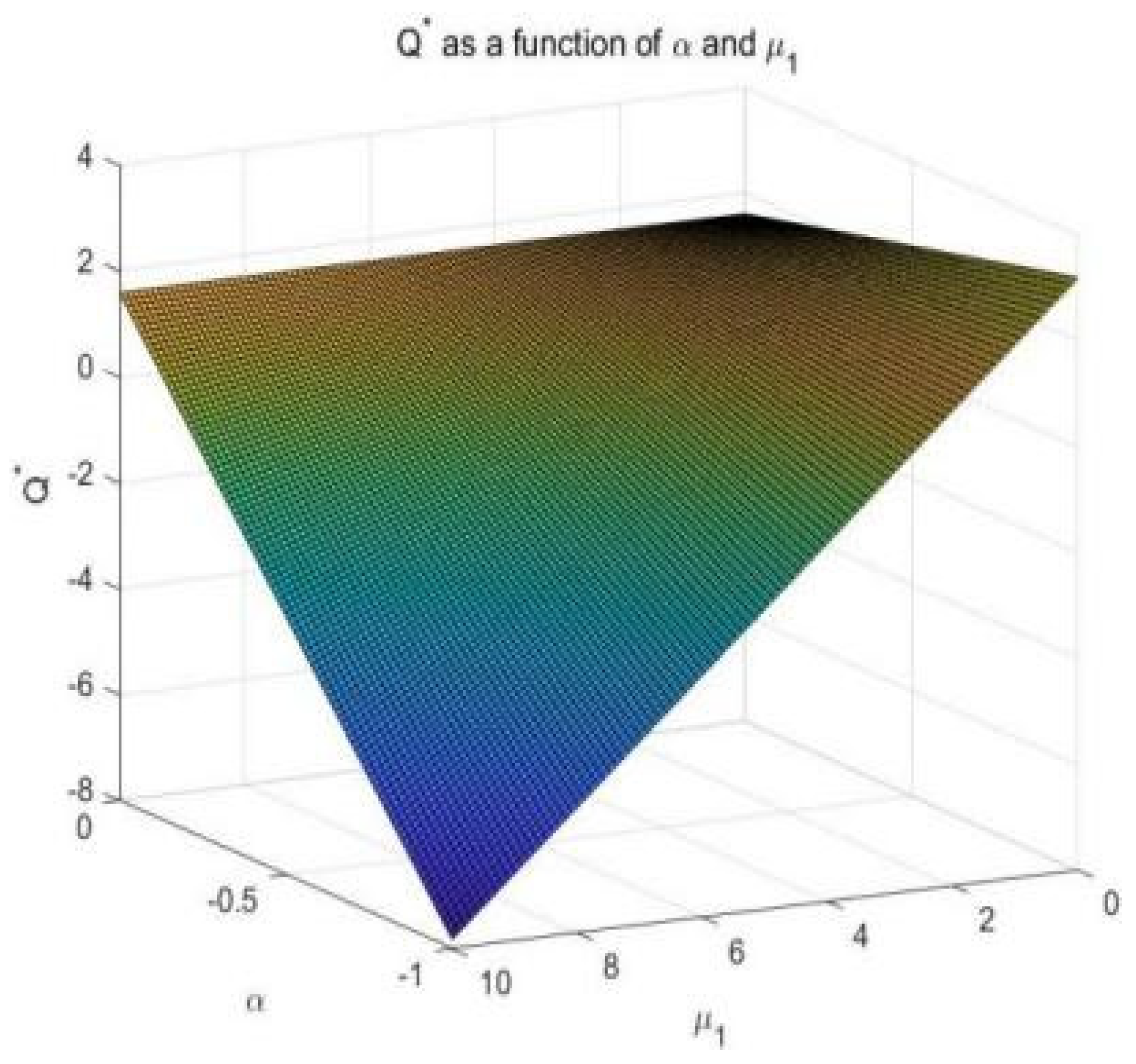

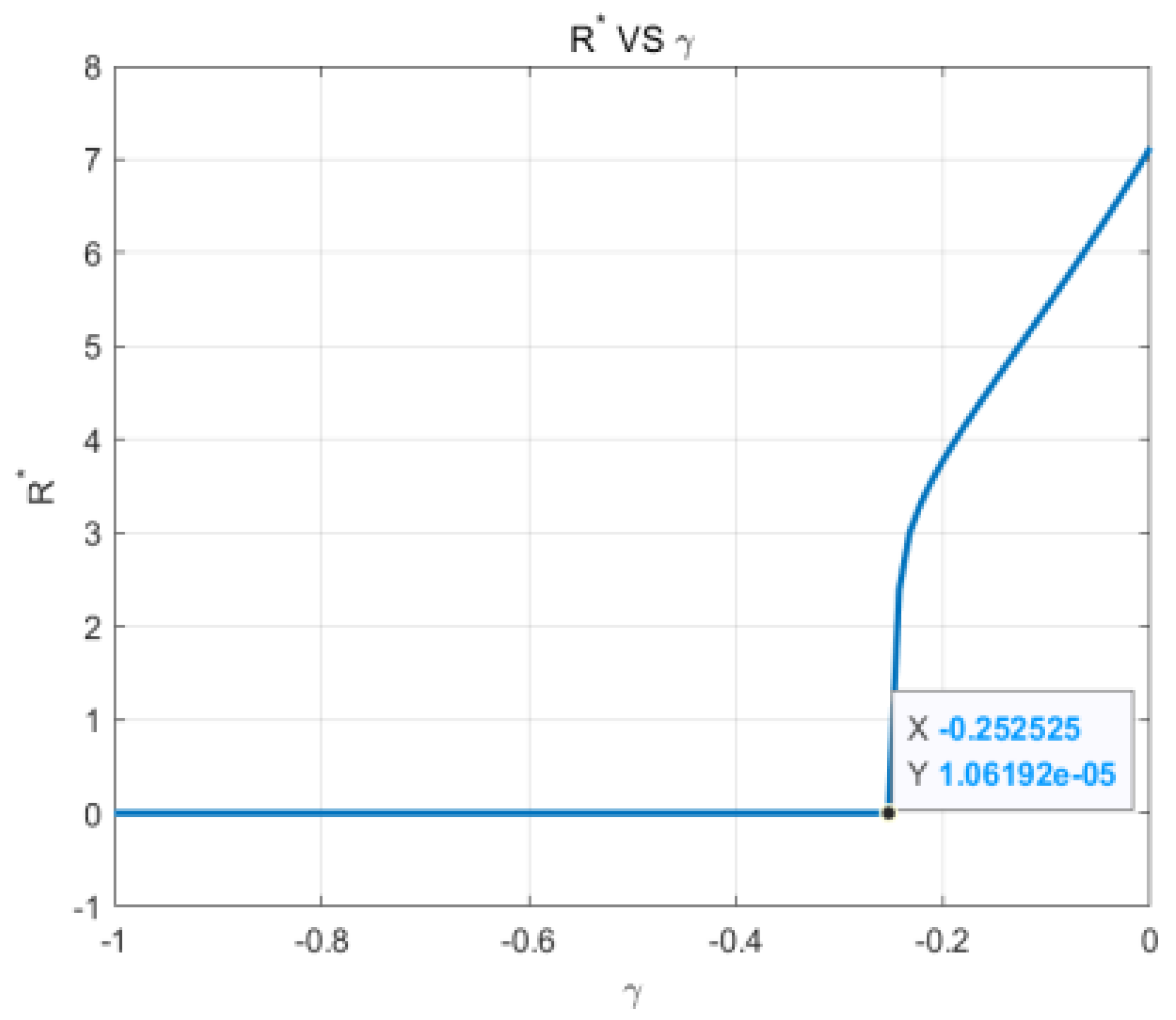

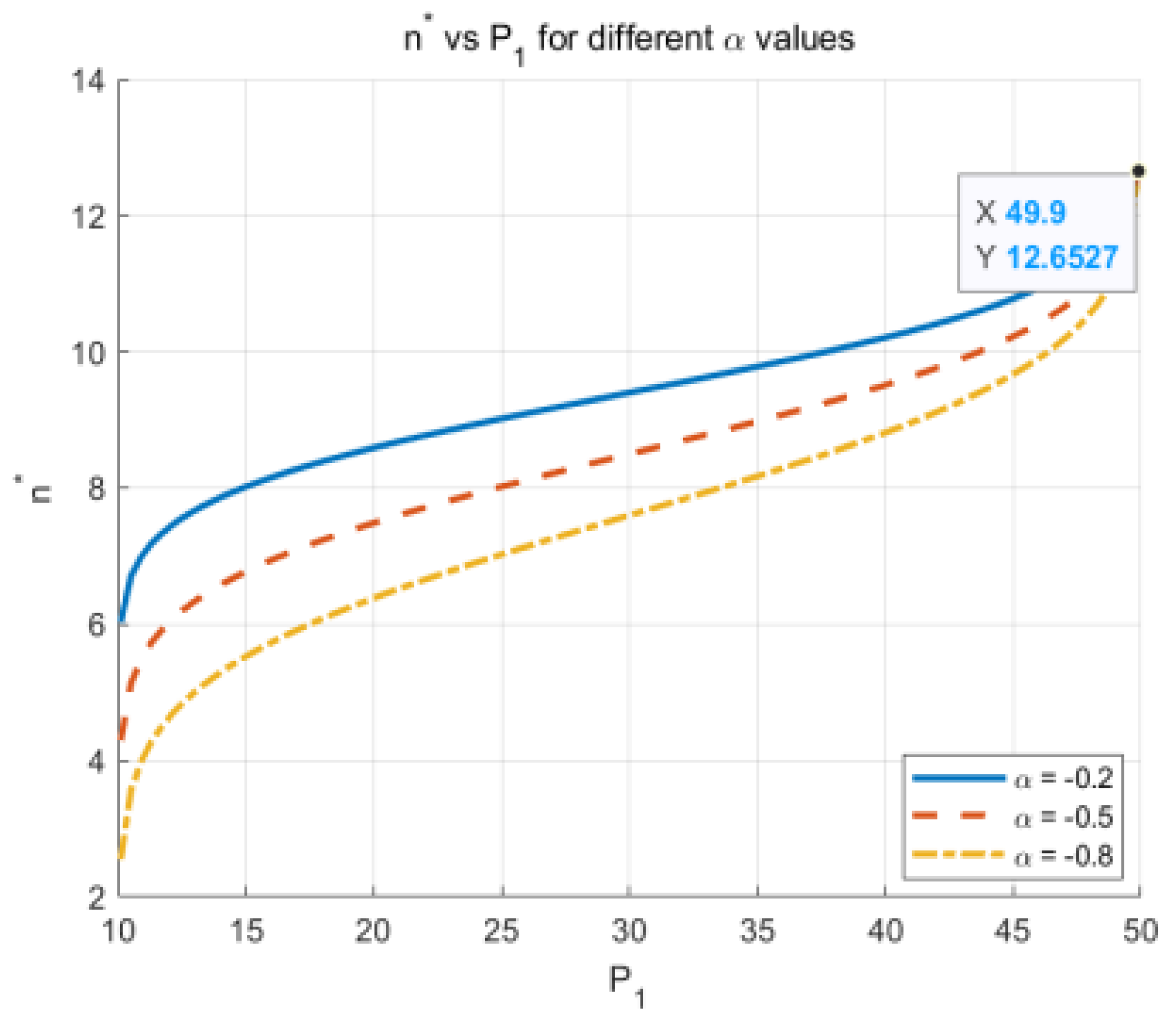

6.2. Analysis of Contributing Factors

7. Conclusions and Implications

7.1. Conclusions

- (1)

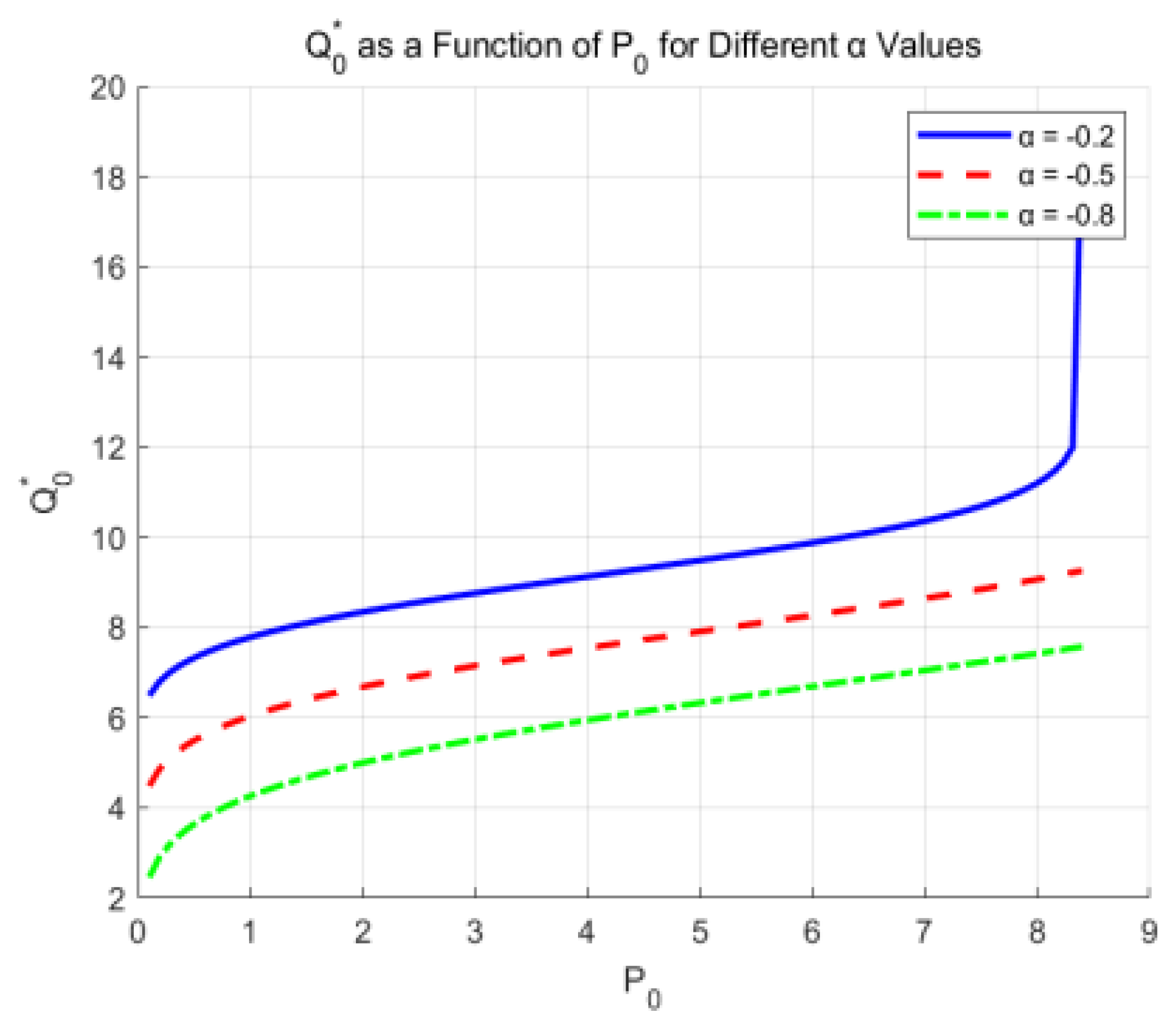

- Under decentralized decision-making, the optimal ordering policy for hydrogen refueling stations operating under excessive pessimism may not necessarily be lower than that under rational expectations. Excessive pessimism among hydrogen refueling stations does not invariably exert a negative influence on ordering strategies; in fact, when the expected value of the green hydrogen market is low, it may lead to an increase in green hydrogen procurement volumes. Only when the hydrogen production plants exhibit a relatively mild degree of pessimism does this significantly impact the optimal production scheduling.

- (2)

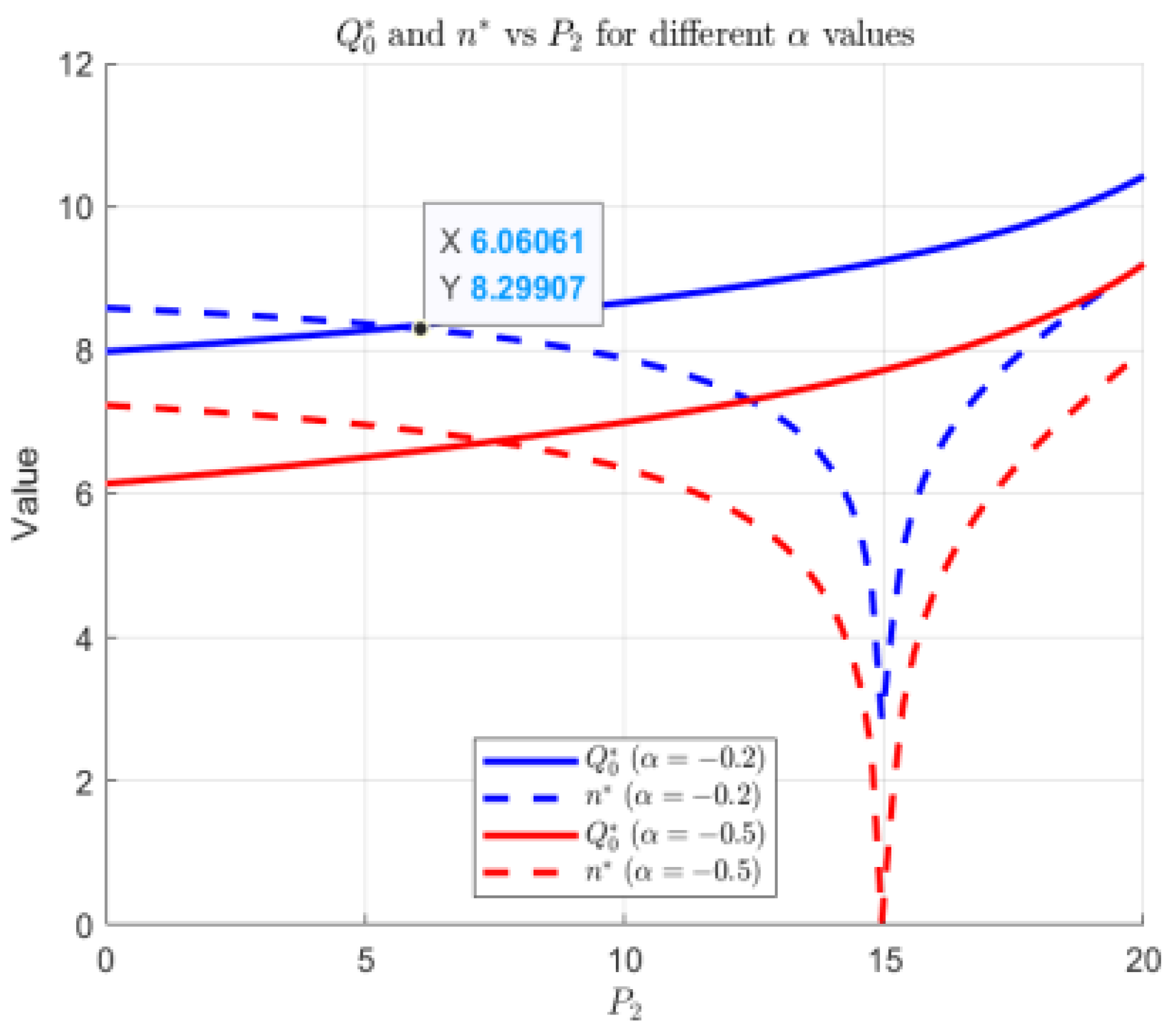

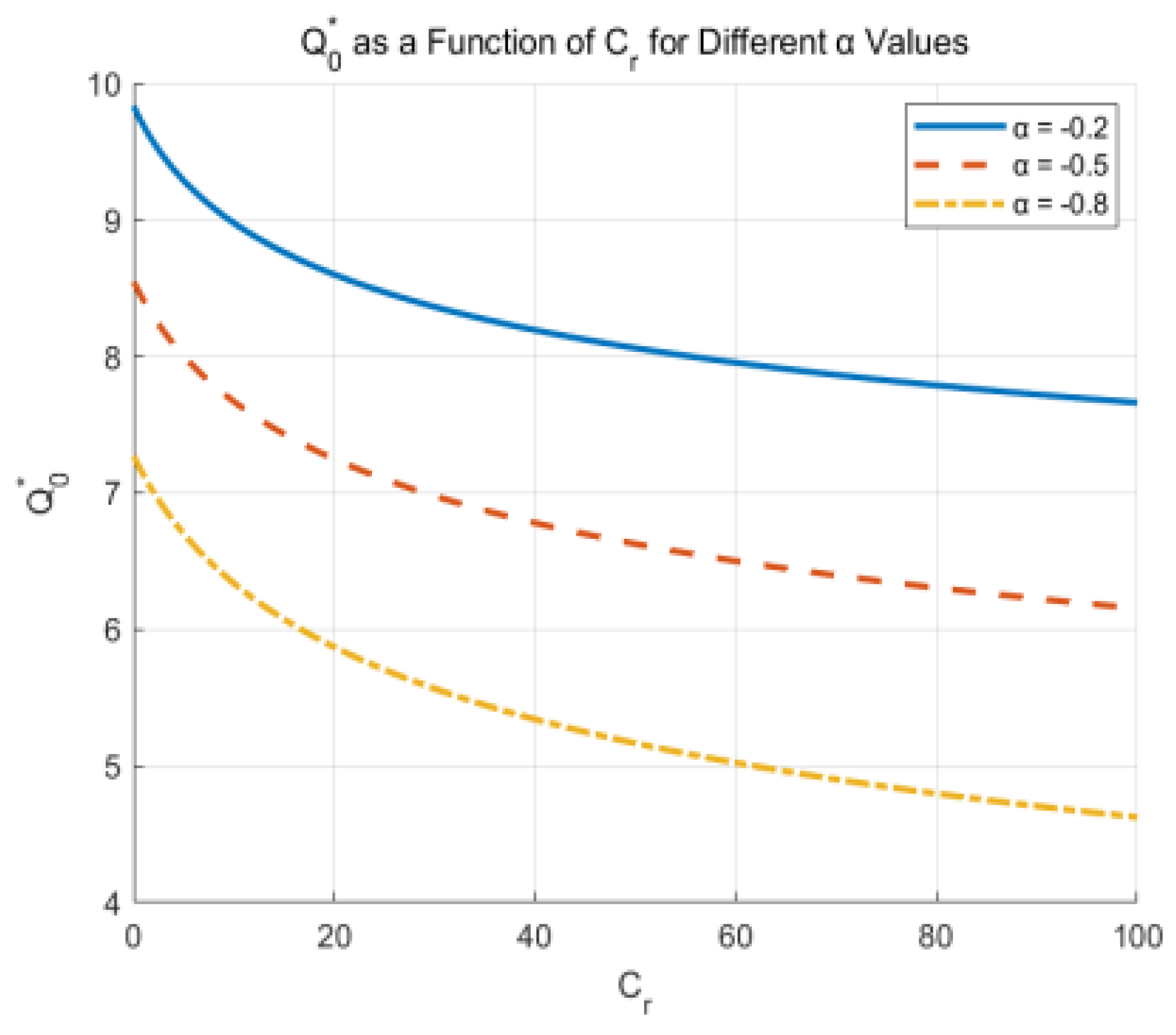

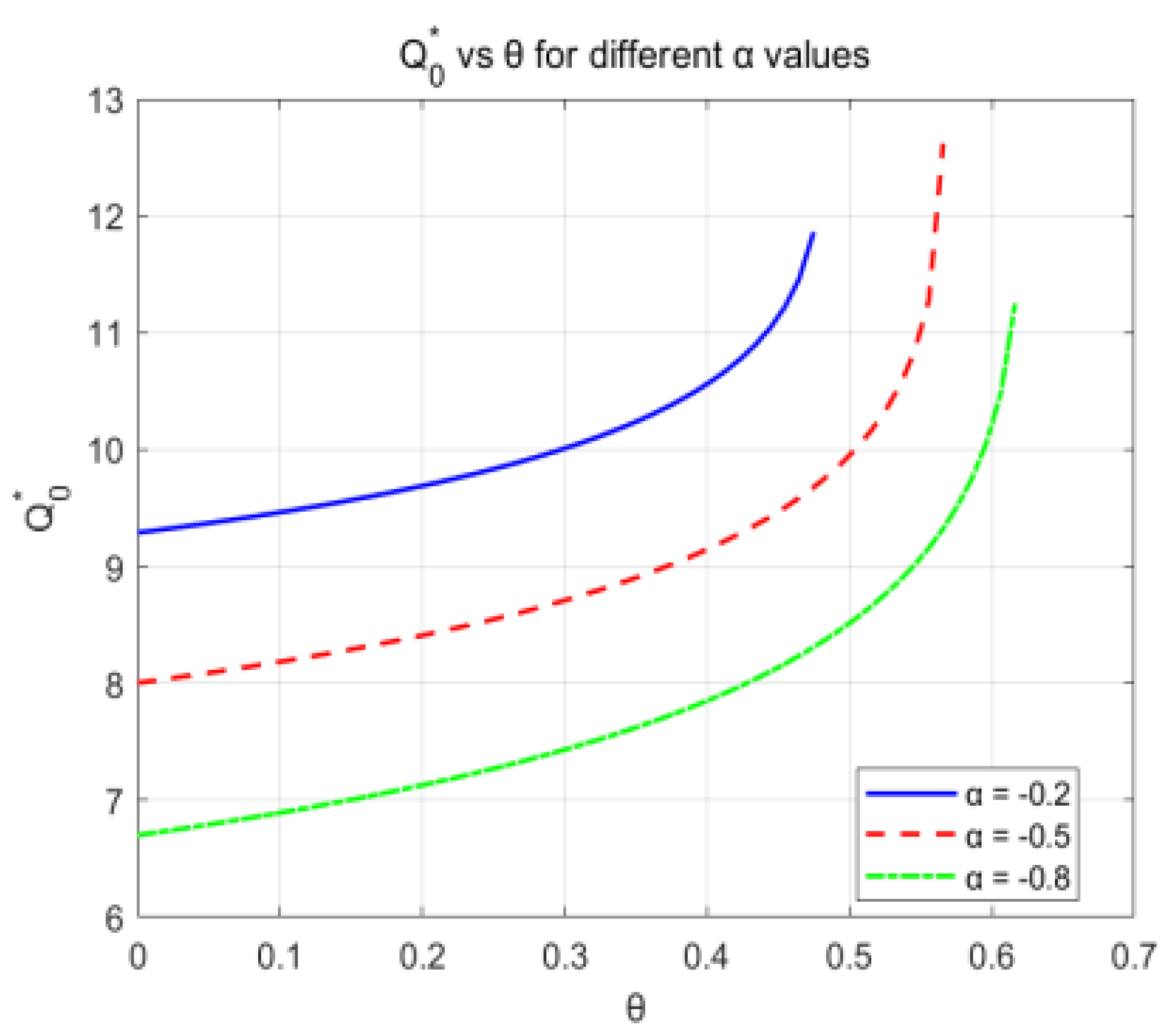

- Under the option contract, initial option ordering and minimum execution quantity increase with decreasing levels of excessive pessimism and vice versa when green hydrogen market expectations are high. In addition, the initial option ordering quantity is always higher than the minimum execution quantity. Higher green hydrogen sales prices, contingency purchasing costs, and residual values of green hydrogen units all reduce the initial ordering quantity at hydrogen refueling stations.

- (3)

- The initial option ordering quantity and the minimum execution quantity are affected by the second-order option price at the same time. The initial option ordering quantity increases with the second-order option price, while the minimum execution quantity decreases with the second-order option price, and at the same time, the minimum execution quantity is only affected when the second-order option price is high enough. A design comprising a higher initial option price and first-order option price and a lower second-order option price design can effectively increase the ordering quantity in the green hydrogen supply chain.

- (4)

- Under the option contract, the hydrogen station’s optimal planned production always increases with its own level of excessive pessimism, with the effect being most pronounced when the hydrogen station tends to be rational. Hydrogen stations’ excessive pessimism also reduces the optimal planned production.

7.2. Implications

- (1)

- Hydrogen refueling stations need to rationally analyze the actual market demand data, flexibly use option contracts, and respond to demand fluctuations by dynamically adjusting the initial option ordering quantity and the minimum execution quantity. They also need to pay attention to the cost of emergency procurement and the residual value of green hydrogen utilization, weigh the pros and cons of initial ordering and emergency procurement, and optimize the inventory management strategy to reduce operational risks.

- (2)

- Hydrogen production facilities must develop optimized production schedules aligned with the procurement demands of refueling stations and their own manufacturing capacities. As market rationalization progresses, these facilities should scale up green hydrogen output to meet increasing demand. Through technological innovation and economies of scale, they can reduce green hydrogen production costs and enhance operational efficiency, thereby strengthening their competitiveness within the energy sector. Additionally, hydrogen production plants must monitor market demand fluctuations and adapt their production strategies flexibly to mitigate the risks associated with conservative procurement decisions by refueling stations.

- (3)

- An efficient information-sharing mechanism should be established between hydrogen production facilities and refueling stations to mitigate decision-making biases caused by information asymmetry. This will facilitate the better alignment of green hydrogen supply chain demand and supply, enabling joint responses to market uncertainties and reducing economic losses attributable to suboptimal decisions. The implementation of rational option contract designs, such as dynamic adjustments of first- and second-order option premiums, can incentivize supply chain participants to share risks collectively, thereby optimizing resource allocation and enhancing overall supply chain efficiency. Such measures not only contribute to lowering green hydrogen production costs but also to strengthening its competitiveness within the energy market, thus promoting the sustainable development of the green hydrogen industry.

- (4)

- Although the option contract model theoretically offers the effective optimization of supply chain decision-making and risk sharing, its practical implementation may encounter several challenges. To enhance the feasibility of this model within real-world green hydrogen supply chains, it is recommended to focus on the following aspects: firstly, simplifying the model design to improve comprehensibility and operational ease while maintaining its validity; secondly, establishing an efficient information-sharing mechanism to reduce asymmetries and bolster stakeholder trust; and thirdly, conducting pilot projects within limited scopes to accumulate experiential insights, refine the model, and facilitate gradual scaling. Finally, policymakers and industry associations should promote adoption through strategic policy guidance and incentive schemes, thereby fostering sustainable development within the green hydrogen sector. These measures are anticipated to enable the option contract model to play a more significant role in practical green hydrogen supply chains, supporting the industry’s healthy growth.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Tuluhong, A.; Chang, Q.; Xie, L.; Xu, Z.; Song, T. Current Status of Green Hydrogen Production Technology: A Review. Sustainability 2024, 16, 9070. [Google Scholar] [CrossRef]

- Yuan, J.; Mou, Q.; Xu, C.; Zhang, J. Simulation study on the development policy of China’s green hydrogen industry based on system dynamics. China Popul. Resour. Environ. 2023, 33, 49–58. [Google Scholar]

- Yang, L.; Wang, S.; Zhang, Z.; Lin, K.; Zheng, M. Current Development Status, Policy Support and Promotion Path of China’s Green Hydrogen Industries under the Target of Carbon Emission Peaking and Carbon Neutrality. Sustainability 2023, 15, 10118. [Google Scholar] [CrossRef]

- Wang, J.; Fan, J.; Zhu, B.; Farnoosh, A. Comprehensive assessment of China’s hydrogen energy supply chain: Energy, environment, and economy. Int. J. Hydrogen Energy 2025, 113, 715–729. [Google Scholar] [CrossRef]

- Webb, J.; Longden, T.; Boulaire, F.; Gono, M.; Wilson, C. The application of green finance to the production of blue and green hydrogen: A comparative study. Renew Energy 2023, 219, 119236. [Google Scholar] [CrossRef]

- Harichandan, S.; Kar, S.K.; Rai, P.K. A systematic and critical review of green hydrogen economy in India. Int. J. Hydrogen Energy 2023, 48, 31425–31442. [Google Scholar] [CrossRef]

- Jindal, A.; Shrimali, G.; Tiwary, N. At scale adoption of Green Hydrogen in Indian Industry: Costs, subsidies and policies. Energy Sustain. Dev. 2024, 83, 101549. [Google Scholar] [CrossRef]

- Roy, R.; Antonini, G.; Hayibo, K.S.; Rahman, M.M.; Khan, S.; Tian, W.; Boutilier, M.S.H.; Zhang, W.; Zheng, Y.; Bassi, A.; et al. Comparative techno-environmental analysis of grey, blue, green/yellow and pale-blue hydrogen production. Int. J. Hydrogen Energy 2025, 116, 200–210. [Google Scholar] [CrossRef]

- Wan, N.; Fan, J. Impacts of put option contract and supply chain structure in a multi-period supply chain with uncertain demand. Rairo-Oper. Res. 2021, 55, S1969–S1996. [Google Scholar] [CrossRef]

- Zhao, J. Sustainability on the Service Capacity in Elderly Healthcare Service Supply Chains: An Application of Flexible Contracts. IEEE Trans. Eng. Manag. 2023, 70, 2034–2044. [Google Scholar] [CrossRef]

- Wang, S.; Choi, S.H.; Xiao, J.; Huang, G.Q. Low-carbon supply chain coordination through dual contracts considering pareto-efficiency. Int. J. Prod. Res. 2024, 62, 6627–6648. [Google Scholar] [CrossRef]

- Ding, J.; Zhang, W.; Pu, X.; Wang, S. Analysis on emission-dependent supply chains with carbon option contract. Int. J. Prod. Res. 2025, 1–21. [Google Scholar] [CrossRef]

- Chen, B.; Xie, W.; Huang, F.; He, J. Collaboration and sharing in a retailer-led supply chain with yield uncertainty and loss aversion. Eur. J. Ind. Eng. 2021, 15, 381–404. [Google Scholar] [CrossRef]

- Wang, L.; Wu, Y.; Hu, S. Make-to-order supply chain coordination through option contract with random yields and overconfidence. Int. J. Prod. Econ. 2021, 242, 108299. [Google Scholar] [CrossRef]

- Yan, B.; Liu, G.; Wu, X.; Wu, J. Decision-Making on the Supply Chain of Fresh Agricultural Products with Two-Period Price and Option Contract. Asia-Pac. J. Oper. Res. 2021, 38, 1–22. [Google Scholar] [CrossRef]

- Zhao, Z.; Cheng, Y. Two-Stage Decision Model of Fresh Agricultural Products Supply Chain Based on Option Contract. IEEE Access 2022, 10, 119777–119795. [Google Scholar] [CrossRef]

- Li, X.-J.; Zhang, Y. Production Capacity Reserve and Supply Chain Coordination Based on Option Contract. IEEE Access 2024, 12, 134614–134623. [Google Scholar] [CrossRef]

- Cai, J.; Zhou, Q.; Sun, J.; Hu, X.; Feng, C.; Li, X. Competition model and coordination mechanism considering strategic customer behavior under vendor-managed inventory. Int. Trans. Oper. Res. 2021, 28, 2782–2809. [Google Scholar] [CrossRef]

- Hou, Y.; Yu, H. Dual-Source Procurement Strategies of Emergency Materials Considering Risk Attitudes. Discret. Dyn. Nat. Soc. 2022, 1, 1–16. [Google Scholar] [CrossRef]

- Liu, J.; Zhang, Y.; Li, C.; Yang, Y.; Liu, Y.; Ouyang, W. Adaptive pessimism via target Q-value for offline reinforcement learning. Neural Netw. 2024, 180, 106588. [Google Scholar] [CrossRef]

- Guo, B.; Li, Y. A study of steady-state strategies for collaborative quality improvement in new retail service supply chains considering emotional factors. PLoS ONE 2023, 18, e0294175. [Google Scholar] [CrossRef] [PubMed]

- Lan, C.; Lan, Y.; Liu, S. Pricing strategy of traceable agricultural supply chain decisions considering retailer’s overconfidence with government subsidy. Alex. Eng. J. 2025, 112, 487–495. [Google Scholar] [CrossRef]

- Chen, Z.; Khalilpour, K.; Shao, L.; Zhao, R.; Li, X.; Yao, Q. Pricing and coordination in green supply chains: The impact of overconfident retailers under reference price effect. Environ. Dev. Sustain. 2025, 1–23. [Google Scholar] [CrossRef]

- Li, J. Demand Forecast Investment by Overconfident Retailer in Supply Chains. Mathematics 2025, 13, 1478. [Google Scholar] [CrossRef]

- Liu, C.; Lee, C.K.M.; Zhang, L.L. Pricing strategy in a dual-channel supply chain with overconfident consumers. Comput. Ind. Eng. 2022, 172, 108515. [Google Scholar] [CrossRef]

- Lu, W.; Jiang, Y.; Xia, P.; Huang, Z. How retailer overconfidence affects supply chain transparency with manufacturer encroachment. Ann. Oper. Res. 2023, 329, 1149–1174. [Google Scholar] [CrossRef]

- Du, X.; Zhan, H.; Zhu, X.; He, X. The upstream innovation with an overconfident manufacturer in a supply chain. Omega-Int. J. Manag. Sci. 2021, 105, 102497. [Google Scholar] [CrossRef]

- Song, R.; Wu, Z. Centralized Decision Making in an Omnichannel Supply Chain with Stochastic Demand. Sustainability 2023, 15, 13113. [Google Scholar] [CrossRef]

- Li, L.; Liu, X.; Hu, M. Textile and apparel supply chain coordination under ESG related cost-sharing contract based on stochastic demand. J. Clean. Prod. 2024, 437, 140491. [Google Scholar] [CrossRef]

- Wu, K.; De Schutter, B.; Rezaei, J.; Tavasszy, L. Decision analysis and coordination in green supply chains with stochastic demand. Int. J. Syst. Sci.-Oper. Logist. 2023, 10, 2208277. [Google Scholar] [CrossRef]

- Bhosekar, A.; Badejo, O.; Ierapetritou, M. Modular supply chain optimization considering demand uncertainty to manage risk. Aiche J. 2021, 67, e17367. [Google Scholar] [CrossRef]

- Peng, Y.; Yan, X.; Zhou, A.; Cheng, T.C.E.; Ji, M. Entry game in supply chains with yield uncertainty. J. Ind. Manag. Optim. 2023, 19, 4989–5010. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Cai, X. A note on the random yield from the perspective of the supply chain. Omega-Int. J. Manag. Sci. 2012, 40, 601–610. [Google Scholar] [CrossRef]

- Peng, J.; Zhuo, W.; Wang, J. Production and procurement plans via option contract with random yield and demand information updating. Comput. Ind. Eng. 2022, 170, 108338. [Google Scholar] [CrossRef]

- Feng, Y.; Chen, R.; He, L. Decision Model of Contract-Farming Supply Chain Considering Producer’s Fairness Concerns under Random Yield. Complexity 2022, 1, 4119728. [Google Scholar] [CrossRef]

- Hosoda, T.; Disney, S.M.; Gavirneni, S. The impact of information sharing, random yield, correlation, and lead times in closed loop supply chains. Eur. J. Oper. Res. 2015, 246, 827–836. [Google Scholar] [CrossRef]

- Zare, M.; Esmaeili, M.; He, Y. Implications of risk-sharing strategies on supply chains with multiple retailers and under random yield. Int. J. Prod. Econ. 2019, 216, 413–424. [Google Scholar] [CrossRef]

- Chen, K.; Xiao, T. Production planning and backup sourcing strategy of a buyer-dominant supply chain with random yield and demand. Int. J. Syst. Sci. 2015, 46, 2799–2817. [Google Scholar] [CrossRef]

- Luo, J.; Zhang, X.; Wang, C. Using put option contracts in supply chains to manage demand and supply uncertainty. Ind. Manag. Data Syst. 2018, 118, 1477–1497. [Google Scholar] [CrossRef]

- Giri, B.C.; Majhi, J.K.; Chaudhuri, K. Coordination mechanisms of a three-layer supply chain under demand and supply risk uncertainties. Rairo-Oper. Res. 2021, 55, S2593–S2617. [Google Scholar] [CrossRef]

- Azadnia, A.H.; McDaid, C.; Andwari, A.M.; Hosseini, S.E. Green hydrogen supply chain risk analysis: A european hard-to-abate sectors perspective. Renew. Sustain. Energy Rev. 2023, 182, 113371. [Google Scholar] [CrossRef]

- Stoeckl, F.; Schill, W.-P.; Zerrahn, A. Optimal supply chains and power sector benefits of green hydrogen. Sci. Rep. 2021, 11, 14191. [Google Scholar] [CrossRef] [PubMed]

- Alexandrou, S.; Khatiwada, D. Strategies for decarbonizing the aviation sector: Evaluating economic competitiveness of green hydrogen value chains- A case study in France. Energy 2025, 314, 134111. [Google Scholar] [CrossRef]

- Borge-Diez, D.; Rosales-Asensio, E.; Icaza, D.; Acikkalp, E. The green hydrogen-water-food nexus: Analysis for Spain. Int. J. Hydrogen Energy 2024, 77, 1026–1042. [Google Scholar] [CrossRef]

- Ma, Y.; Huang, M.; Zhou, Y.; Xu, F.; Xu, C. Modeling of the multi-period two-stage green hydrogen supply chain with consideration of supply and demand uncertainties. Int. J. Hydrogen Energy 2025, 129, 297–314. [Google Scholar] [CrossRef]

- Zhang, L.; Song, X. Managerial overconfidence and corporate digital transformation. J. Financ. Res. Lett. 2025, 75, 106828. [Google Scholar] [CrossRef]

- Zied, B.M.; Yong, D.; Qinyun, L.; Aris, S.; Xun, W. Forecasting of lead-time demand variance: Implications for safety stock calculations. J Eur. J. Oper. Res. 2022, 296, 846–861. [Google Scholar]

- Fazli-Khalaf, M.; Naderi, B.; Mohammadi, M.; Pishvaee, M.S. Design of a sustainable and reliable hydrogen supply chain network under mixed uncertainties: A case study. Int. J. Hydrogen Energy 2020, 45, 34503–34531. [Google Scholar] [CrossRef]

- Zhao, Y.; Ma, L.; Xie, G.; Cheng, T.C.E. Coordination of supply chains with bidirectional option contracts. Eur. J. Oper. Res. 2013, 229, 375–381. [Google Scholar] [CrossRef]

- Hu, B.; Qu, J.; Meng, C. Supply chain coordination under option contracts with joint pricing under price-dependent demand. Int. J. Prod. Econ. 2018, 205, 74–86. [Google Scholar] [CrossRef]

- Liang, L.; Wang, X.; Gao, J. An option contract pricing model of relief material supply chain. Omega-Int. J. Manag. Sci. 2012, 40, 594–600. [Google Scholar] [CrossRef]

- Wang, L.; Lai, J. Research on Green Supply Chain Decision Based on Flexible Option and Forward Contract. Chin. J. Manag. Sci. 2023, 31, 61–73. [Google Scholar]

- Patra, T.D.P.; Jha, J.K. Bidirectional option contract for prepositioning of relief supplies under demand uncertainty. Comput. Ind. Eng. 2022, 163, 107861. [Google Scholar] [CrossRef]

| Literature | Stochastic Demand | Stochastic Output | Excessive Pessimistic Behavior | Supply Chain Decision-Making | Contract Optimization |

|---|---|---|---|---|---|

| Chen et al. [13] | √ | √ | |||

| Yan et al. [15] | |||||

| Zhao et al. [16] | |||||

| Wang et al. [14] | √ | √ | |||

| Hou et al. [19] | |||||

| Li et al. [33] | |||||

| Guo et al. [21] | √ | ||||

| Song et al. [28] | √ | √ | |||

| Li et al. [29] | |||||

| Peng et al. [32] | √ | √ | |||

| Feng et al. [35] | |||||

| Zare et al. [37] | √ | √ | √ | ||

| Chen et al. [38] | |||||

| Luo et al. [39] | √ | √ | |||

| Girir et al. [40] | |||||

| Borge-Diez et al. [44] | √ | √ | |||

| Our study | √ | √ | √ | √ | √ |

| Parameters | Parameter Definition | Parameters | Parameter Definition |

|---|---|---|---|

| Excessively pessimistic hydrogen refueling station perceptions of green hydrogen market demand | Excessively pessimistic about the perceived green hydrogen output rate of hydrogen production stations | ||

| Actual demand in the green hydrogen market | Green hydrogen actual output rate | ||

| Hydrogen refueling stations’ level of excessive pessimism about the accuracy of demand forecasts in the green hydrogen market | Hydrogen production stations’ level of excessive pessimism about the accuracy of predictions of green hydrogen output rates | ||

| Hydrogen refueling stations’ level of excessive pessimism about the green hydrogen market demand | Hydrogen production stations’ level of excessive pessimism about green hydrogen output rates | ||

| Green hydrogen ordering quantity | Planned production of green hydrogen | ||

| Market price of green hydrogen | Wholesale price of green hydrogen units | ||

| Contingency procurement costs for hydrogen refueling stations | Unit production cost of green hydrogen | ||

| Green hydrogen delayed delivery price discount rate | Emergency production cost of green hydrogen | ||

| Residual value per unit of unsold green hydrogen at hydrogen refueling stations | Residual value per unit of excess green hydrogen produced at hydrogen production stations | ||

| Cumulative distribution function of green hydrogen market demand for excessively pessimistic hydrogen refueling station perceptions | Cumulative distribution function of green hydrogen output rates for excessively pessimistic hydrogen production station perceptions | ||

| Probability density functions of green hydrogen market demand for excessively pessimistic hydrogen refueling station perceptions | Probability density functions of green hydrogen output rates for excessively pessimistic hydrogen production station perceptions |

| Year | Case Count | Normal Distribution Parameters | Statistical Hypothesis Testing | Asymptotic Significance (Two-Tailed) | |

|---|---|---|---|---|---|

| Mean Value | Standard Deviation | ||||

| 2019 | 12 | 847.35 | 122.48 | 0.0682 | 0.200 a,b |

| 2020 | 12 | 905.12 | 113.67 | 0.0721 | 0.200 a,b |

| 2021 | 12 | 884.76 | 128.93 | 0.0593 | 0.200 a,b |

| 2022 | 12 | 827.49 | 126.54 | 0.0814 | 0.050 a |

| 2023 | 12 | 872.83 | 117.36 | 0.0635 | 0.035 a,b |

| 2024 | 12 | 893.21 | 121.09 | 0.0756 | 0.200 a,b |

| Year | α | β |

|---|---|---|

| 2019 | −0.147235 | 0.912874 |

| 2020 | −0.092548 | 0.921736 |

| 2021 | −0.218763 | 0.898125 |

| 2022 | −0.305487 | 0.873652 |

| 2023 | −0.119872 | 0.930258 |

| 2024 | −0.187324 | 0.903821 |

| Excessive Pessimism Level | Market Demand Expectation Value | Optimal Order Quantity Under Excessive Pessimism | Optimal Order Quantity Under Rational Conditions | Initial Option Order Quantity |

|---|---|---|---|---|

| −0.147235 | 40 | 38.5 | 35 | 41.8 |

| −0.092548 | 35 | 34.2 | 32 | 39.2 |

| −0.218763 | 20 | 19.8 | 22 | 20.9 |

| −0.305487 | 15 | 14.5 | 16 | 13.7 |

| Selling Price of Green Hydrogen | First-Order Option Prices | Second-Order Option Prices | Initial Option Price | Excessive Pessimism Levels for Hydrogen Refueling Stations | Market Demand Expectation Value | Initial Option Order Quantity | Minimum Execution Quantity |

|---|---|---|---|---|---|---|---|

| 20 | 8 | 15 | 5 | −0.2 | 30 | 38.2 | 22.8 |

| 15 (−25%) | 8 | 15 | 5 | −0.2 | 30 | 44.4 (+16.2%) | 22.8 |

| 25 (+25%) | 8 | 15 | 5 | −0.2 | 30 | 31.9 (−16.5%) | 22.8 |

| 20 | 12 (+50%) | 15 | 5 | −0.2 | 30 | 38.2 | 25.6 (+12.3%) |

| 20 | 14 (+75%) | 15 | 5 | −0.2 | 30 | 38.2 | 28.3 (+24.1%) |

| 20 | 8 | 22.5 (+50%) | 5 | −0.2 | 30 | 49.6 (+29.8%) | 17.5 (−23.2%) |

| 20 | 8 | 25 (+67%) | 5 | −0.2 | 30 | 45.8 (+20.0%) | 18.9 (−16.2%) |

| 20 | 8 | 15 | 5.25 (+5%) | −0.2 | 30 | 42.6 (+11.5%) | 22.8 |

| 20 | 8 | 15 | 6 (+20%) | −0.2 | 30 | 41.7 (+9.4%) | 22.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hou, J.; Xu, C.; Liu, J.; Wen, Z. Green Hydrogen Supply Chain Decision-Making and Contract Optimization Under Uncertainty: A Pessimistic-Based Perspective. Sustainability 2025, 17, 6181. https://doi.org/10.3390/su17136181

Hou J, Xu C, Liu J, Wen Z. Green Hydrogen Supply Chain Decision-Making and Contract Optimization Under Uncertainty: A Pessimistic-Based Perspective. Sustainability. 2025; 17(13):6181. https://doi.org/10.3390/su17136181

Chicago/Turabian StyleHou, Jian, Chong Xu, Junhua Liu, and Zongchuan Wen. 2025. "Green Hydrogen Supply Chain Decision-Making and Contract Optimization Under Uncertainty: A Pessimistic-Based Perspective" Sustainability 17, no. 13: 6181. https://doi.org/10.3390/su17136181

APA StyleHou, J., Xu, C., Liu, J., & Wen, Z. (2025). Green Hydrogen Supply Chain Decision-Making and Contract Optimization Under Uncertainty: A Pessimistic-Based Perspective. Sustainability, 17(13), 6181. https://doi.org/10.3390/su17136181