Economy-Wide Material Flow Accounting: Application in the Italian Glass Industry

Abstract

1. Introduction

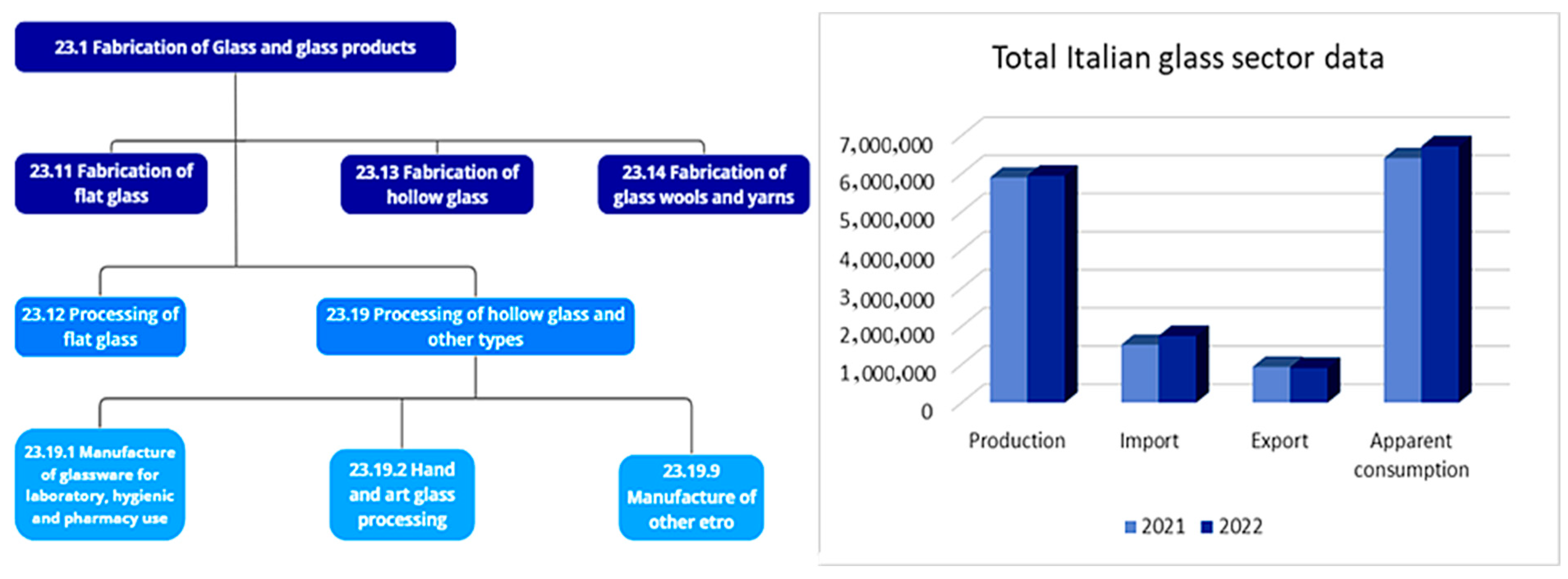

Literature Review

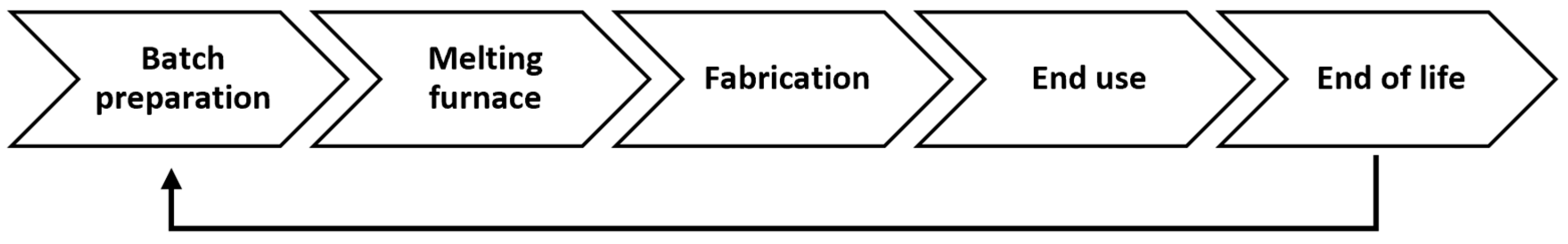

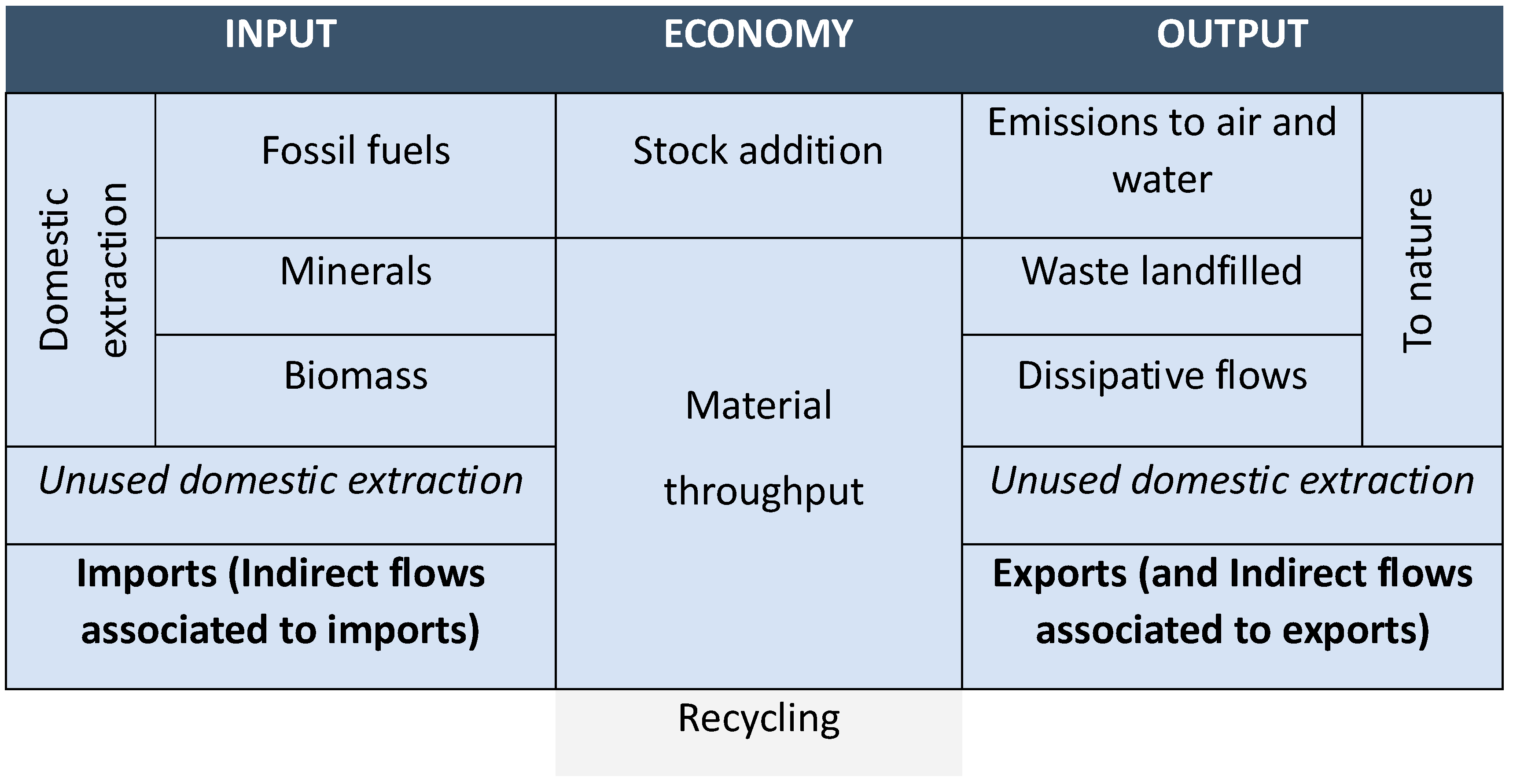

2. Materials and Methods

2.1. Key Indicators

- Inputs. Domestic Extraction Used (DEU) plus imports yields Direct Material Input (DMI).

- Outputs. Domestic Processed Output (DPO) combined with exports gives Domestic Material Output (DMO).

- Consumption. Domestic Material Consumption (DMC) is defined as DMI minus exports.

- Balance. Net Additions to Stock (NAS) are calculated as DMI minus DPO minus exports, while the Physical Trade Balance (PTB) equals imports minus exports.

- Productivity. Material productivity is expressed as GDP divided by DMI (GDP/DMI).

2.2. Software STAN

2.3. Stepwise Approach

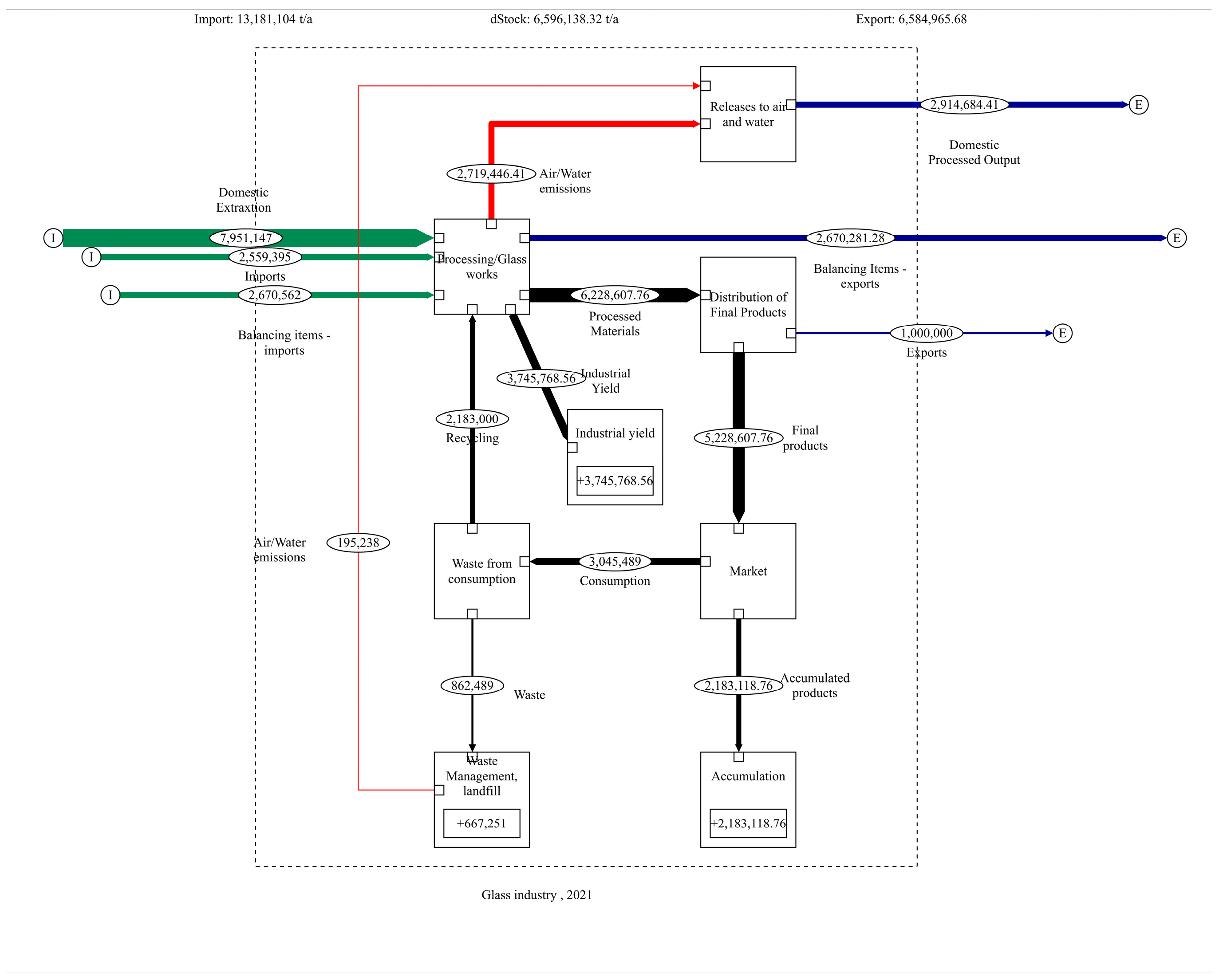

3. Results

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Vinci, G.; D’Ascenzo, F.; Esposito, A.; Musarra, M.; Rapa, M.; Rocchi, A. A sustainable innovation in the Italian glass production: LCA and Eco-Care matrix evaluation. J. Clean. Prod. 2019, 223, 587–595. [Google Scholar] [CrossRef]

- Statista. EU Total Glass Production 2010–2023. 2024. Available online: https://www.statista.com/statistics/1154296/glass-production-eu/ (accessed on 14 May 2025).

- Atzori, D.; Tiozzo, S.; Vellini, M.; Gambini, M.; Mazzoni, S. Industrial Technologies for CO2 Reduction Applicable to Glass Furnaces. Thermo 2023, 3, 682–710. [Google Scholar] [CrossRef]

- Chioatto, E.; Fedele, A.; Liscio, M.C.; Sospiro, P. Testing data envelopment analysis models on the performance of European Union regions in sustainable waste management. Waste Manag. 2024, 175, 170–182. [Google Scholar] [CrossRef] [PubMed]

- Chioatto, E.; Liscio, M.C.; Sospiro, P. State of the Art of Economy-Wide Material Flow Accounting in the Scientific Literature. In Trash or Treasure; Springer: Cham, Switzerland, 2024; pp. 57–78. [Google Scholar]

- EUROSTAT. Secondary Materials in European Material Flow Accounts in Raw Material Equivalents. 2018. Available online: https://ec.europa.eu/eurostat/documents/1798247/6874172/Eurostat+EEEA+technical+note+%282018%29+-+Secondary+materials+in+European+MFA-RME (accessed on 14 May 2025).

- EUROSTAT. Economy-Wide Material Flow Accounts-Handbook. 2018. Available online: https://ec.europa.eu/eurostat/documents/3859598/9117556/KS-GQ-18-006-EN-N.pdf/b621b8ce-2792-47ff-9d10-067d2b8aac4b?t=1537260841000 (accessed on 14 May 2025).

- JRC. Best Available Techniques (BAT) Reference Document for the Manufacture of Glass. 2013. Available online: https://eippcb.jrc.ec.europa.eu/sites/default/files/2019-11/GLS_Adopted_03_2012_0.pdf (accessed on 14 May 2025).

- Zier, M.; Stenzel, P.; Kotzur, L.; Stolten, D. A review of decarbonization options for the glass industry. Energy Convers. Manag. X 2021, 10, 100083. [Google Scholar] [CrossRef]

- Amicarelli, V.; Rana, R.L.; Lombardi, M.; Fellner, J.; Tricase, C.; Bux, C. Material flow analysis and carbon footprint of water-packaging waste management. Environ. Impact Assess. Rev. 2024, 106, 107517. [Google Scholar] [CrossRef]

- Lagioia, G.; Calabrò, G.; Amicarelli, V. Empirical study of the environmental management of Italy’s drinking water supply. Resour. Conserv. Recycl. 2012, 60, 119–130. [Google Scholar] [CrossRef]

- D’Adamo, I.; Daraio, C.; Di Leo, S.; Gastaldi, M.; Rossi, E.N. Driving EU sustainability: Promoting the circular economy through municipal waste efficiency. Sustain. Prod. Consum. 2024, 50, 462–474. [Google Scholar] [CrossRef]

- Chioatto, E.; Zecca, E.; D’Amato, A. Which innovations for Circular Business Models? A product life-cycle categorisation. Ind. Innov. 2024, 31, 809–831. [Google Scholar] [CrossRef]

- Assovetro Associazione Nazionale Degli Industriali del Vetro. Rapporto di Sostenibilità 2021; Assovetro Associazione Nazionale Degli Industriali del Vetro: Roma, Italy, 2021. [Google Scholar]

- CoReVe. Sintesi del Rapporto di Sostenibilità. 2023. Available online: https://coreve.it/wp-content/uploads/2024/10/COREVE-bilancio-2023-MR_compressed.pdf (accessed on 14 May 2025).

- Testa, M.; Malandrino, O.; Sessa, M.R.; Supino, S.; Sica, D. Long-term sustainability from the perspective of cullet recycling in the container glass industry: Evidence from Italy. Sustainability 2017, 9, 1752. [Google Scholar] [CrossRef]

- Schmitz, A.; Kamiński, J.; Scalet, B.M.; Soria, A. Energy consumption and CO2 emissions of the European glass industry. Energy Policy 2011, 39, 142–155. [Google Scholar] [CrossRef]

- Westbroek, C.D.; Bitting, J.; Craglia, M.; Azevedo, J.M.C.; Cullen, J.M. Global material flow analysis of glass: From raw materials to end of life. J. Ind. Ecol. 2021, 25, 333–343. [Google Scholar] [CrossRef]

- Butler, J.H.; Hooper, P.D. Chapter 15—Glass Waste. In Waste (Second Edition)—A Handbook for Management; Academic Press: Cambridge, MA, USA, 2019; pp. 307–322. [Google Scholar]

- EUROSTAT. Economy-Wide Material Flow Accounts and Derived Indicators—A Methodological Guide; EUROSTAT: Luxembourg, 2001. [Google Scholar]

- STAN Software, About STAN. Consultato il Giorno 2025. Available online: https://www.stan2web.net/infos/about-stan (accessed on 14 May 2025).

- Cencic, O.; Rechberger, H. Material Flow Analysis with Software STAN. 2008. Available online: https://www.researchgate.net/publication/284663142_Material_flow_analysis_with_Software_STAN (accessed on 14 May 2025).

- Stanmore, B.R.; Gilot, P. Review—Calcination and carbonation of limestone during thermal cycling for CO2 sequestration. Fuel Process. Technol. 2005, 86, 1707–1743. [Google Scholar] [CrossRef]

- Eurostat-European Commission, Material Flow Accounts (env_ac_mfa). 2024. Available online: https://ec.europa.eu/eurostat/databrowser/view/env_ac_mfa__custom_10057694/default/table?lang=en (accessed on 14 May 2025).

- Solvay. Solvay’s Soda Ash Production in Rosignano. 2020. Available online: https://www.solvay.com/sites/g/files/srpend616/files/2022-01/Solvay%20Rosignano%20-%20Factsheet.pdf (accessed on 14 May 2025).

- Sudsakorn, K.; Palitsakun, S. Production of Thermally Stable Solids from CO2 Capture Using Ammoniated Brine; In International ASET Inc.: Orléans, ON, Canada, 2018. [Google Scholar]

- Manahan, S.E. 5.13: Industrial Chemical Reactions—The Solvay Process. 2021. Available online: https://chem.libretexts.org/Bookshelves/Environmental_Chemistry/Green_Chemistry_and_the_Ten_Commandments_of_Sustainability_(Manahan)/05%3A_Chemical_Reactions-_Making_Materials_Safely_and_Sustainable/5.13%3A_Industrial_Chemical_Reactions_-_The_Solvay_Process (accessed on 14 May 2025).

- Terna S.p.A. Rete Elettrica Nazionale, Pubblicazioni Statistiche. Available online: https://www.terna.it/it/sistema-elettrico/statistiche/pubblicazioni-statistiche (accessed on 14 May 2025).

- Eurostat-European Commission. Glossary: Tonnes of Oil Equivalent (Toe). 2018. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Tonnes_of_oil_equivalent_(toe) (accessed on 14 May 2025).

- Assovetro. Dati di Settore. [Consultato il Giorno 2025]. 2024. Available online: https://assovetro.it/dati-di-settore/ (accessed on 14 May 2025).

- ISPRA. Le Emissioni di Gas Serra in Italia: Obiettivi di Riduzione e Scenari Emissivi. 2023. Available online: https://www.isprambiente.gov.it/files2023/pubblicazioni/rapporti/rapporto_384_2023_le-emissioni-di-gas-serra-in-italia.pdf (accessed on 14 May 2025).

- ISPRA. Il Metano Nell’inventario Nazionale Delle Emissioni di Gas Serra. L’Italia e il Global Methane Pledge. 2021. Available online: https://www.isprambiente.gov.it/files2022/pubblicazioni/rapporti/r374-2022-1.pdf (accessed on 14 May 2025).

- European Environmental Agency. Industrial Reporting Under the Industrial Emissions Directive 2010/75/EU and European Pollutant Release and Transfer Register Regulation (EC) No 166/2006; European Environmental Agency: Copenhagen, Denmark, 2022. [Google Scholar]

- EUROSTAT. Material Flow Accounts-Main Indicators. [Consultato il giorno 2025]. 2024. Available online: https://ec.europa.eu/eurostat/databrowser/view/env_ac_mfain__custom_17169058/default/table?lang=en (accessed on 14 May 2025).

- Masai, H.; Nishibe, T.; Yamamoto, S.; Niizuma, T.; Kitamura, N.; Akai, T.; Ohkubo, T.; Yoshida, M. Low melting oxide glasses prepared at a melt temperature of 500 °C. Sci. Rep. 2021, 11, 214. [Google Scholar] [CrossRef] [PubMed]

- Chai, C.; Yan, Y.; Cao, B.; Guo, L.; Huang, L.; Xu, S.; Zhao, S. Low melting temperature chloride borosilicate photothermal refractive glass for holographic applications. Ceram. Int. 2025, 51, 15129–15137. [Google Scholar] [CrossRef]

- Kilinc, E.; Hand, R.J. Mechanical properties of soda–lime–silica glasses with varying alkaline earth contents. J. Non-Cryst. Solids 2015, 429, 190–197. [Google Scholar] [CrossRef]

- Chioatto, E.; Khan, M.A.; Sospiro, P. Sustainable solid waste management in the European Union: Four countries regional analysis. Sustain. Chem. Pharm. 2023, 33, 101037. [Google Scholar] [CrossRef]

| MF.3 for glass production, (tonnes) | ||||||

| Raw material | DE equivalent | IM equivalent | ||||

| Silicon dioxide (Silica) | 70% | 4,223,861.6 | Sand eq. | 4,693,179.6 | 4,490,254.9 | 202,924.6 |

| Calcium oxide | 12% | 724,090.6 | Limestone eq. | 1,448,181.1 | 1,448,181.1 | negligible |

| Sodium oxide | 15% | 905,113.2 | Limestone eq. | 1,925,772.8 | 1,925,772.8 | negligible |

| MF.4 Fossil energy results (tonnes) | ||||||

| DE equivalent | IM equivalent | |||||

| Coal and other solid (4.1) | 6891.4 | 1886.5 | ||||

| Liquid energy (4.2) | 1450.2 | 397.0 | ||||

| Natural gas (4.2.2) | 78,596.7 | 594,187.1 | ||||

| MF 7.1 Emission to air | ||||||

| Quantity (tonnes) | ||||||

| CO2 (1.01) production direct and indirect | 2,070,002.0 | |||||

| CO2(1.01) waste management | 118,789.9 | |||||

| NOx 1.04) | 8198.0 | |||||

| SO2 (1.10) | 3457.0 | |||||

| Particles (1.14) | 78.1 | |||||

| CH4 (1.02) (from waste management) | 76,448.9 | |||||

| Overall DPO values | Overall DE-IM values | |||||

| DPO from production | 2,719,066 | Total DE (tonnes) | 7,951,147.05 | |||

| DPO from Waste Mgmt. | 195,238.83 | Total IM (tonnes) | 2,559,395.25 | |||

| Total DPO (tonnes) | 2,914,304.70 | |||||

| Balancing Items (Input = Output) (tonnes) | ||||||

| Emissions | Input values | Step 1 (O2) | Step 2 (O2) | Step 3 (O2) | ||

| CO2 | 2,183,322.85 | 1,587,275.71 | 1797.1 | 27,751.24 | ||

| NO2 | 8198.00 | 5705.81 | 2480.2 | - | ||

| SO2 | 3457.00 | 1728.50 | 1,226,686.7 | 127,360.91 | ||

| Coal | 8358.81 | |||||

| Oil products | 1759.03 | |||||

| Natural Gas | 670,320.58 | |||||

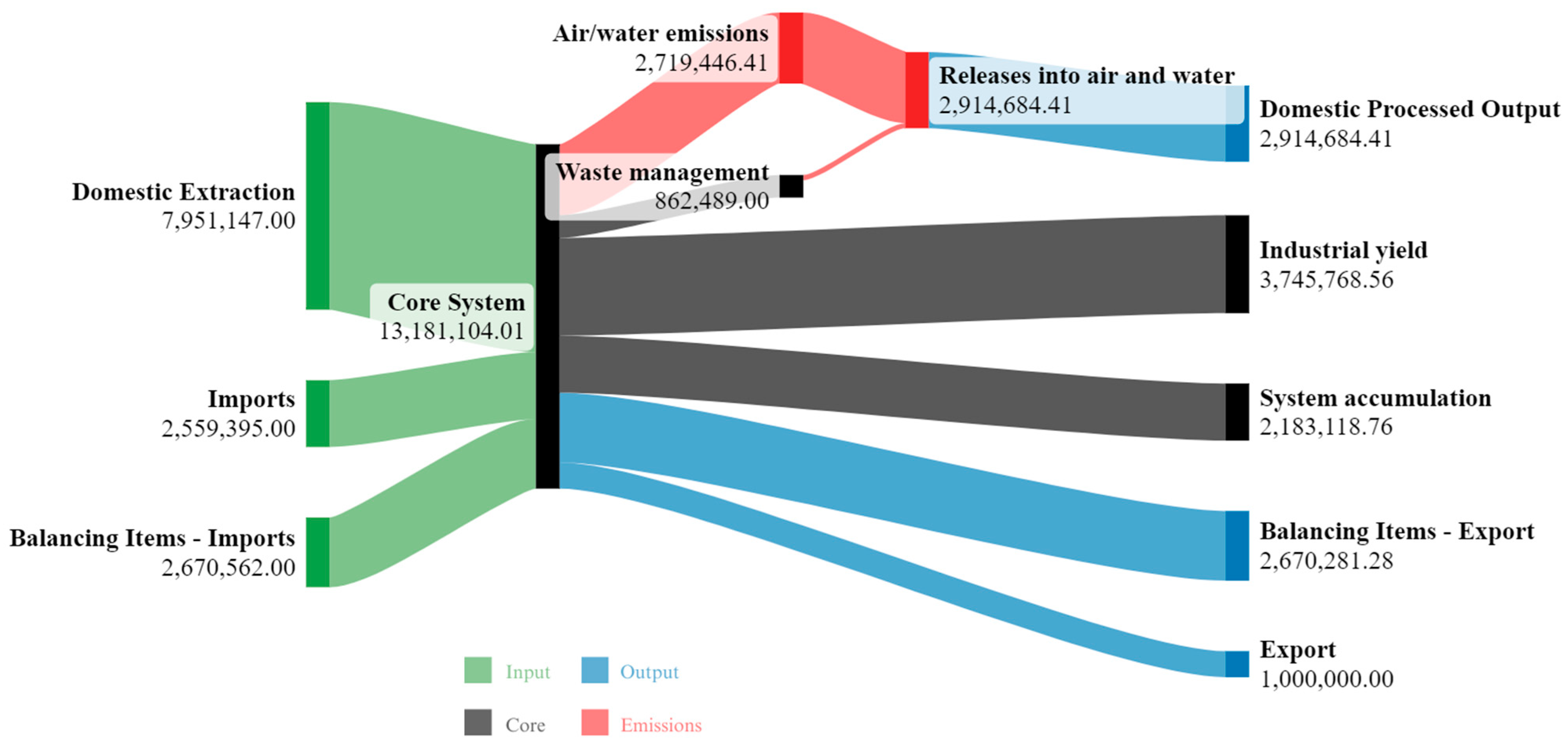

| Final System flows (tonnes) | ||||

| Input | Output | |||

| DE | 7,951,147.1 | DPO | 2,914,304.7 | |

| IM | 2,559,395.3 | EX | 1,000,000.0 | |

| BII | 2,670,561.9 | BIE | 2,670,561.9 | |

| Total | 13,181,104 | Total | 6,584,867 | |

| Net Addition to Stock NAS (tonnes) | 6,596,238 | |||

| Final Indicators—Category | Indicator | Formula | Value (tonnes) | |

| Input | DEU | - | 7,951,147.1 | |

| DMI | DEU + Imports | 10,510,542.3 | ||

| Output | DPO | - | 2,914,304.7 | |

| DMO | DPO + Exports | 3,914,304.7 | ||

| Consumption | DMC | DMI − Exports | 9,510,542.3 | |

| Balance | NAS | DMI – DPO − Exports | 6,596,237.6 | |

| PTB | Imports − Exports | 1,559,395.3 | ||

| Productivity | GDP/DMI | $/tonnes | 201,165.6 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmed, S.; Liscio, M.C.; Pelaggi, A.; Sospiro, P.; Voukkali, I.; Zorpas, A.A. Economy-Wide Material Flow Accounting: Application in the Italian Glass Industry. Sustainability 2025, 17, 6180. https://doi.org/10.3390/su17136180

Ahmed S, Liscio MC, Pelaggi A, Sospiro P, Voukkali I, Zorpas AA. Economy-Wide Material Flow Accounting: Application in the Italian Glass Industry. Sustainability. 2025; 17(13):6180. https://doi.org/10.3390/su17136180

Chicago/Turabian StyleAhmed, Salik, Marco Ciro Liscio, Andrea Pelaggi, Paolo Sospiro, Irene Voukkali, and Antonis A. Zorpas. 2025. "Economy-Wide Material Flow Accounting: Application in the Italian Glass Industry" Sustainability 17, no. 13: 6180. https://doi.org/10.3390/su17136180

APA StyleAhmed, S., Liscio, M. C., Pelaggi, A., Sospiro, P., Voukkali, I., & Zorpas, A. A. (2025). Economy-Wide Material Flow Accounting: Application in the Italian Glass Industry. Sustainability, 17(13), 6180. https://doi.org/10.3390/su17136180