Digital Transformation and ESG Performance—Empirical Evidence from Chinese Listed Companies

Abstract

1. Introduction

2. Literature Review and Hypothesis Research

2.1. Digital Transformation and ESG Performance

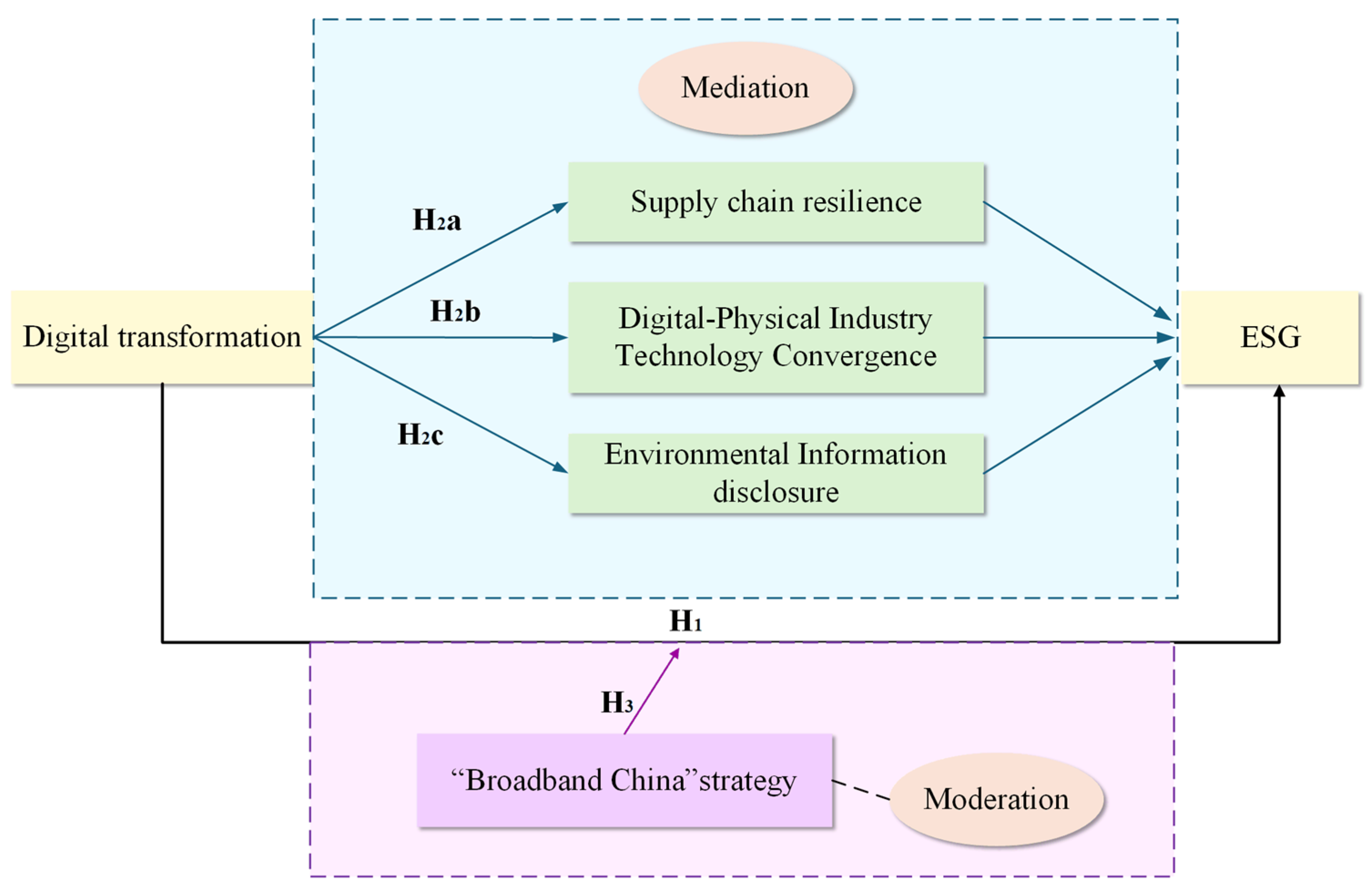

2.2. Digital Transformation and Its Mechanism Effect on ESG Performance

3. Research Design

3.1. Sample and Date

3.2. Definition of Variables

3.3. Model Specification

4. Empirical Results and Analysis

4.1. Descriptive Statistics

4.2. Benchmark Regression

4.3. Robustness Test

- (1)

- Replacement of Core Explanatory Variable

- (2)

- One-period Lag

- (3)

- Changing the Sample Period

- (4)

- Replacement of Explained variable

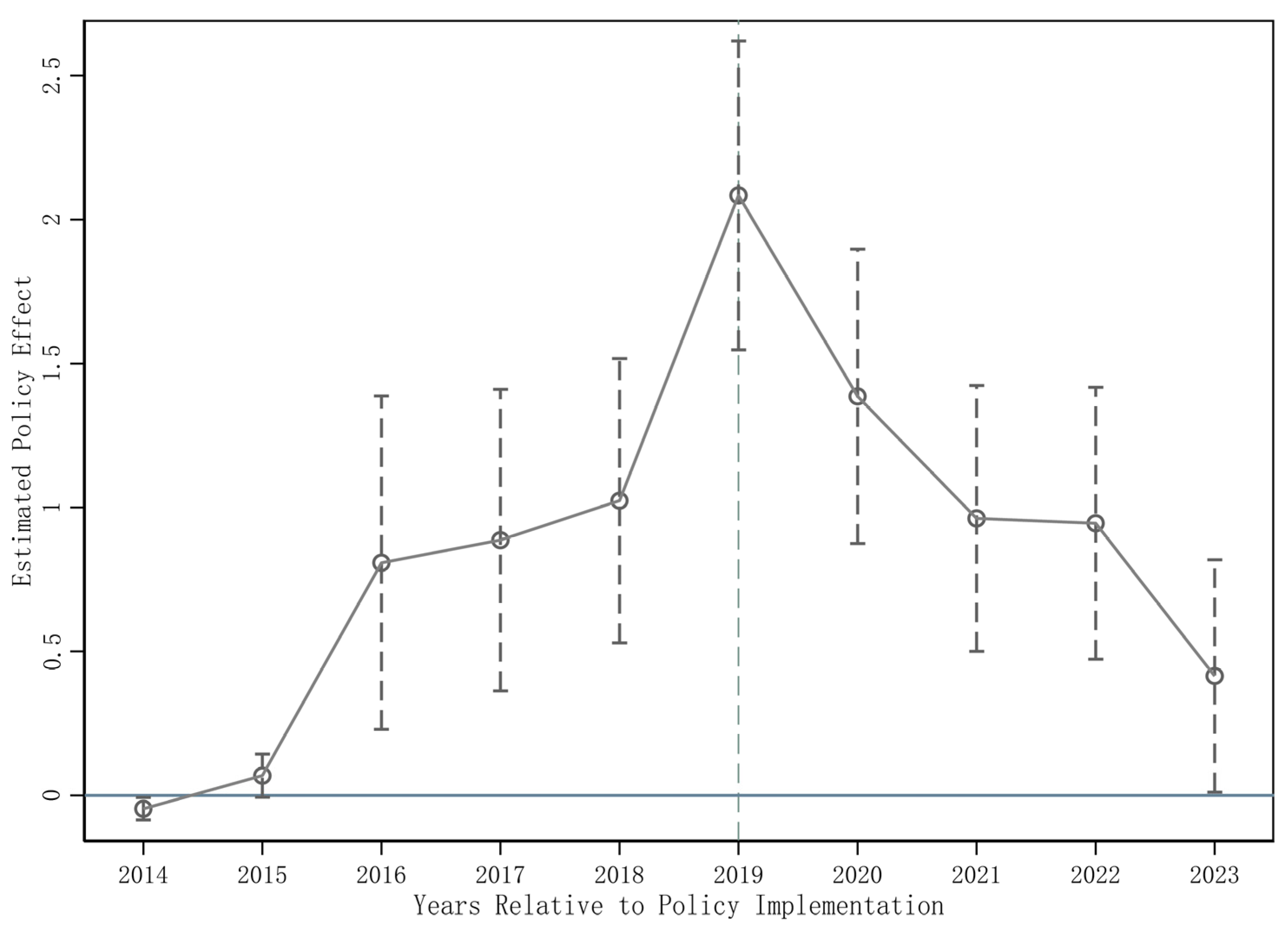

4.4. Endogeneity Test

4.5. Heterogeneity Test

5. Further Discussion

5.1. Mediating Effect

5.2. Moderating Effect

6. Conclusions and Recommendations

6.1. Conclusions

6.2. Recommendations

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Avramov, D.; Cheng, S.; Lioui, A.; Tarelli, A. Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 2022, 145, 642–664. [Google Scholar] [CrossRef]

- Houston, J.F.; Shan, H. Corporate ESG profiles and banking relationships. Rev. Financ. Stud. 2022, 35, 3373–3417. [Google Scholar] [CrossRef]

- Burke, J.J. Do boards take environmental, social, and governance issues seriously? Evidence from media coverage and CEO dismissals. J. Bus. Ethics 2022, 176, 647–671. [Google Scholar] [CrossRef]

- Chen, D.; Wang, S. Digital transformation, innovation capabilities, and servitization as drivers of esg performance in manufacturing smes. Sci. Rep. 2024, 14, 24516. [Google Scholar] [CrossRef]

- Wang, X.; Shi, X. Impact of digital transformation on green production: Evidence from China. Heliyon 2024, 10, e35526. [Google Scholar] [CrossRef]

- Cai, C.; Tu, Y.; Li, Z. Enterprise digital transformation and ESG performance. Financ. Res. Lett. 2023, 58, 104692. [Google Scholar] [CrossRef]

- Feroz, A.K.; Zo, H.; Chiravuri, A. Digital transformation and environmental sustainability: A review and research agenda. Sustainability 2021, 13, 1530. [Google Scholar] [CrossRef]

- Agustian, K.; Mubarok, E.S.; Zen, A.; Wiwin, W.; Malik, A.J. The impact of digital transformation on business models and competitive advantage. Technol. Soc. Perspect. (TACIT) 2023, 1, 79–93. [Google Scholar] [CrossRef]

- Alojail, M.; Khan, S.B. Impact of digital transformation toward sustainable development. Sustainability 2023, 15, 14697. [Google Scholar] [CrossRef]

- Chen, J.; Guo, Z.; Lei, Z. Research on the mechanisms of the digital transformation of manufacturing enterprises for carbon emissions reduction. J. Clean. Prod. 2024, 449, 141817. [Google Scholar] [CrossRef]

- Dai, D.; Han, S.; Zhao, M.; Xie, J. The impact mechanism of digital transformation on the risk-taking level of Chinese listed companies. Sustainability 2023, 15, 1938. [Google Scholar] [CrossRef]

- Martínez-Peláez, R.; Ochoa-Brust, A.; Rivera, S.; Félix, V.G.; Ostos, R.; Brito, H.; Félix, R.A.; Mena, L.J. Role of digital transformation for achieving sustainability: Mediated role of stakeholders, key capabilities, and technology. Sustainability 2023, 15, 11221. [Google Scholar] [CrossRef]

- Wang, S.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs. J. Clean. Prod. 2023, 419, 137980. [Google Scholar] [CrossRef]

- Kwilinski, A.; Lyulyov, O.; Pimonenko, T. Unlocking sustainable value through digital transformation: An examination of ESG performance. Information 2023, 14, 444. [Google Scholar] [CrossRef]

- Alkaraan, F.; Albitar, K.; Hussainey, K.; Venkatesh, V. Corporate transformation toward Industry 4.0 and financial performance: The influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. Change 2022, 175, 121423. [Google Scholar] [CrossRef]

- Niu, Y.; Wen, W.; Wang, S.; Li, S. Breaking barriers to innovation: The power of digital transformation. Financ. Res. Lett. 2023, 51, 103457. [Google Scholar] [CrossRef]

- He, J.; Du, X.; Tu, W. Can corporate digital transformation alleviate financing constraints? Appl. Econ. 2024, 56, 2434–2450. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Y. Enterprise Digital Transformation and ESG Performance: Empirical Evidence from Chinese Listed Companies. J. Financ. Econ. 2023, 49, 94–108. [Google Scholar]

- Wang, L.; Hou, S. The impact of digital transformation and earnings management on ESG performance: Evidence from Chinese listed enterprises. Sci. Rep. 2024, 14, 783. [Google Scholar] [CrossRef] [PubMed]

- Trittin-Ulbrich, H.; Scherer, A.G.; Munro, I.; Whelan, G. Exploring the dark and unexpected sides of digitalization: Toward a critical agenda. Organization 2021, 28, 8–25. [Google Scholar] [CrossRef]

- Guo, X.; Pang, W. The impact of digital transformation on corporate ESG performance. Financ. Res. Lett. 2025, 72, 106518. [Google Scholar] [CrossRef]

- Xie, X.; Zhu, H.; Zhao, J. How effective is digital transformation? Heterogeneous insights from listed companies’ ESG performance. Humanit. Soc. Sci. Commun. 2024, 11, 1534. [Google Scholar] [CrossRef]

- Mo, Y.; Che, Y.; Ning, W. Digital Finance Promotes Corporate ESG Performance: Evidence from China. Sustainability 2023, 15, 11323. [Google Scholar] [CrossRef]

- Zhai, C.; Ding, X.; Zhang, X.; Jiang, S.; Zhang, Y.; Li, C. Assessing the Effects of Urban Digital Infrastructure on Corporate Environmental, Social and Governance (ESG) Performance: Evidence from the Broadband China Policy. Systems 2023, 11, 515. [Google Scholar] [CrossRef]

- Nguyen, N.B. Impacts of ESG performance on the profitability of ASEAN-6 commercial banks in the context of digital transformation. Glob. Bus. Financ. Rev. 2024, 29, 60–71. [Google Scholar] [CrossRef]

- Eriandani, R.; Winarno, W.A. ESG and firm performance: The role of digitalization. J. Account. Invest. 2023, 24, 993–1010. [Google Scholar] [CrossRef]

- Kotrba, V.; Menšík, J.; Martinez, L.F. ESG consequences for companies in the digital environment: Insights from sector-specific performance across the EU-27. J. Mark. Anal. 2025, 101889. [Google Scholar] [CrossRef]

- Nasis, A.; Siouziou, I.; Toudas, K. Digital Transformation and ESG Investing as the Driving Force for Sustainable Development. Theor. Econ. Lett. 2024, 14, 2066–2080. [Google Scholar] [CrossRef]

- Li, R.; Wan, Y. Analysis of the negative relationship between blockchain application and corporate performance. Mob. Inf. Syst. 2021, 2021, 9912241. [Google Scholar] [CrossRef]

- Umar, M.; Khan, S.A.R.; Yusoff Yusliza, M.; Ali, S.; Yu, Z. Industry 4.0 and green supply chain practices: An empirical study. Int. J. Product. Perform. Manag. 2022, 71, 814–832. [Google Scholar] [CrossRef]

- Sasmoko, S.; Mihardjo, L.W.W.; Alamsjah, F.; Elidjen, E.; Tarofder, A.K. Investigating the Effect of Digital Technologies, Energy Consumption and Climate Change on Customer’s Experience: A Study from Indonesia. Int. J. Energy Econ. Policy 2019, 9, 353–362. [Google Scholar] [CrossRef]

- Lin, C.; Wu, Q. Does Digital Transformation Promote Enterprise Green Transformation? West. Forum 2024, 34, 94–110. [Google Scholar][Green Version]

- Freeman, R.E.; Phillips, R.; Sisodia, R. Tensions in stakeholder theory. Bus. Soc. 2020, 59, 213–231. [Google Scholar] [CrossRef]

- McWilliams, A.; Siege, D. Corporate social responsibility: A theory of the firm Perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Fang, M.; Lin, J.; Nie, H. Does digital transformation promote common prosperity within firms? Evidence from Chinese A-share listed firms. J. Quant. Technol. Econ. 2022, 39, 50–70. [Google Scholar]

- Qi, Y.; Xiao, X. Enterprise Management Reform in the Era of Digital Economy. Manag. World 2020, 36, 18. [Google Scholar]

- He, F.; Guo, X.; Yue, P. Media coverage and corporate ESG performance: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103003. [Google Scholar] [CrossRef]

- Lu, Y.; Xu, C.; Zhu, B.; Sun, Y. Digitalization transformation and ESG performance: Evidence from China. Bus. Strategy Environ. 2024, 33, 352–368. [Google Scholar] [CrossRef]

- Zhu, Y.; Zhang, Z. Supply chain digitalization and corporate ESG performance: Evidence from supply chain innovation and application pilot policy. Financ. Res. Lett. 2024, 67, 105818. [Google Scholar] [CrossRef]

- Wu, L.; Wang, M.; Kumar, A.; Choi, T.-M. Mitigating the bullwhip effect through supply chain ESG transparency: Roles of digitalization and signal strength. Int. J. Oper. Prod. Manag. 2024, 44, 1707–1731. [Google Scholar] [CrossRef]

- Li, W.; Zhang, M. Digital transformation, absorptive capacity and enterprise esg performance: A case study of strategic emerging industries. Sustainability 2024, 16, 5018. [Google Scholar] [CrossRef]

- Nitlarp, T.; Mayakul, T. The Implications of Triple Transformation on ESG in the Energy Sector: Fuzzy-Set Qualitative Comparative Analysis (fsQCA) and Structural Equation Modeling (SEM) Findings. Energies 2023, 16, 2090. [Google Scholar] [CrossRef]

- He, Y.; Li, J.; Ren, Y. Digital transformation and corporate ESG information disclosure herd effect. Financ. Res. Lett. 2024, 65, 105557. [Google Scholar] [CrossRef]

- Gölgeci, I.; Kuivalainen, O. Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment. Ind. Mark. Manag. 2020, 84, 63–74. [Google Scholar] [CrossRef]

- Jia, L.; Li, J. How does digital collaboration impact supply chain resilience. Financ. Res. Lett. 2024, 66, 105684. [Google Scholar] [CrossRef]

- Ahi, P.; Searcy, C. A comparative literature analysis of definitions for green and sustainable supply chain management. J. Clean. Prod. 2013, 52, 329–341. [Google Scholar] [CrossRef]

- Abdelaziz, F.B.; Chen, Y.-T.; Dey, P.K. Supply chain resilience, organizational well-being, and sustainable performance: A comparison between the UK and France. J. Clean. Prod. 2024, 444, 141215. [Google Scholar] [CrossRef]

- Wieland, A.; Stevenson, M.; Melnyk, S.A.; Davoudi, S.; Schultz, L. Thinking differently about supply chain resilience: What we can learn from social-ecological systems thinking. Int. J. Oper. Prod. Manag. 2023, 43, 1–21. [Google Scholar] [CrossRef]

- Huang, X.; Gao, Y. Technology convergence of digital and real economy industries and enterprise total factor productivity: Research based on Chinese enterprise patent information. China Ind. Econ. 2023, 11, 118–136. [Google Scholar]

- Karvonen, M.; Kässi, T. Patent citations as a tool for analysing the early stages of convergence. Technol. Forecast. Soc. Change 2013, 80, 1094–1107. [Google Scholar] [CrossRef]

- San Kim, T.; Sohn, S.Y. Machine-learning-based deep semantic analysis approach for forecasting new technology convergence. Technol. Forecast. Soc. Change 2020, 157, 120095. [Google Scholar]

- Li, Z.; Wang, J. The dynamic impact of digital economy on carbon emission reduction: Evidence city-level empirical data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Hughes, S.B.; Anderson, A.; Golden, S. Corporate environmental disclosures: Are they useful in determining environmental performance? J. Account. Public Policy 2001, 20, 217–240. [Google Scholar] [CrossRef]

- Daft, R.L.; Lengel, R.H. Organizational information requirements, media richness and structural design. Manag. Sci. 1986, 32, 554–571. [Google Scholar] [CrossRef]

- Clarkson, P.; Fang, X.; Li, Y.; Richardson, G.D. The Relevance of Environmental Disclosures for Investors and Other Stakeholder Groups: Are Such Disclosures Incrementally Informative? 2010. Available online: https://ssrn.com/abstract=1687475 (accessed on 5 October 2010).

- Li, G.; Hei, B.; Ma, Q.; Wang, H. Subjective perception of economic policy uncertainty and ESG performance: Evidence from China. Invest. Anal. J. 2025, 54, 93–109. [Google Scholar] [CrossRef]

- Tan, X.; Shen, Z.; Wen, X. Pivoting to Avoid Pitfalls: Trade Policy Uncertainty and Corporate ESG Performance. Int. J. Financ. Econ. 2025. [Google Scholar] [CrossRef]

- Gao, D.; Yan, Z.; Zhou, X.; Mo, X. Smarter and prosperous: Digital transformation and enterprise performance. Systems 2023, 11, 329. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Zhao, X.; Zhu, R.; Li, Q.; Hu, J. Unleashing the impact of environmental information disclosure on corporate green innovation: The role of audit quality and media attention. Environ. Dev. 2024, 52, 101078. [Google Scholar] [CrossRef]

- Yao, Z.H.; Li, H.Z.; Yao, P.Y. The Impact of ESG Performance on Supply Chain Resilience Companies. J. Cap. Univ. Econ. Bus. 2025, 27, 95–112. [Google Scholar]

- Wei, M.; Yin, X. Broadband infrastructure and urban carbon emissions: Quasi-experimental evidence from China. Urban Clim. 2024, 54, 101863. [Google Scholar] [CrossRef]

- Su, Y.; Wu, J. Digital transformation and enterprise sustainable development. Financ. Res. Lett. 2024, 60, 104902. [Google Scholar] [CrossRef]

- Sun, Z.; Wang, W.; Wang, W.; Sun, X. How does digital transformation affect corporate social responsibility performance? From the dual perspective of internal drive and external governance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1156–1176. [Google Scholar] [CrossRef]

- Feng, H.; Wang, F.; Song, G.; Liu, L. Digital transformation on enterprise green innovation: Effect and transmission mechanism. Int. J. Environ. Res. Public Health 2022, 19, 10614. [Google Scholar] [CrossRef] [PubMed]

- Dai, X.; Cheng, L. Public selection and research and development effort of manufacturing enterprises in China: State owned enterprises versus non-state owned enterprises. Innovation 2015, 17, 182–195. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Ind. Econ. 2022, 5, 100–120. [Google Scholar]

- Wang, Z.; Xing, T. ESG information disclosure, stock price informativeness and corporate digital transformation. Appl. Econ. 2025, 57, 600–616. [Google Scholar] [CrossRef]

- Zhang, M.; Huang, Z. The impact of digital transformation on ESG performance: The role of supply chain resilience. Sustainability 2024, 16, 7621. [Google Scholar] [CrossRef]

- Wang, H.; Wang, S.; Zhang, C.; Zhang, C.; Guo, L. Does Digital Transformation Improve ESG Responsibility Performance? Empirical Research Based on MSCI Index. Foreign Econ. Manag. 2023, 45, 19–35. [Google Scholar]

- Yang, R. What do we learn from ratings about corporate social responsibility? New evidence of uninformative ratings. J. Financ. Intermediation 2022, 52, 100994. [Google Scholar] [CrossRef]

| Type | Variables | Symbol | Measurement Methods |

|---|---|---|---|

| Explanatory variable | Digital Transformation | DT | The logarithmic transformation of the sum of keywords related to digital transformation in the company’s annual report. |

| Explained variable | ESG Performance | ESG | Scores assigned to each ESG rating by Sino-Securities, converted into values ranging from 1 to 9 |

| Mediator variable | Environmental Information Disclosure | EID | Scores calculated across seven aspects, including environmental management, environmental supervision, and certification, with the total score subjected to logarithmic transformation. |

| Digital–Physical Industry Technology Convergence | Tech-Conv | The logarithmic transformation of the number of times enterprises integrate digital and physical industry technologies. | |

| Supply Chain Resilience | Resist | The comprehensive score is determined using the entropy weight-TOPSIS model. | |

| Control variable | Firm Size | Size | The natural logarithm of the company’s total assets. |

| Asset–Liability Ratio | Lev | The ratio of the company’s total liabilities to its total assets. | |

| Percentage of Shares Held by the Top Ten Shareholders | Top10 | The number of shares held by the top 10 shareholders as of year t divided by the total number of shares. | |

| Return on Equity | ROE | The ratio of net profit at the end of the period to net assets. | |

| Proportion of Independent Directors | Indep | The ratio of the number of independent directors to the total number of board members. | |

| Tobin’s Q | TobinQ | (The market value of tradable shares plus the number of non-tradable shares multiplied by the net asset value per share, plus the book value of liabilities) divided by total assets. | |

| Profitability Status | Loss | If the net profit for the year is less than 0, the value is set to 1; otherwise, it is set to 0. | |

| Years Since Listing | Listage | The current year minus the year the company went public. | |

| Cash Flow Ratio | Cashflow | Net cash flow generated from operating activities divided by total liabilities. | |

| Moderating variable | “Broadband China” Strategy | DID | For a city approved as a “Broadband China” pilot city in the year of approval and thereafter, this variable is assigned a value of 1; if not selected, it is assigned a value of 0. |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | N | Mean | sd | Min | Max |

| ESG | 38,416 | 4.614 | 1.805 | 1 | 8 |

| DT | 38,416 | 5.269 | 0.105 | 3.655 | 5.987 |

| EDI | 38,416 | 0.414 | 0.348 | 0 | 1.778 |

| Techconv | 38,416 | 1.565 | 1.413 | 0 | 5.357 |

| Resist | 38,416 | 1.016 | 0.826 | 0.0135 | 26.48 |

| Size | 38,416 | 22.23 | 1.303 | 19.58 | 26.44 |

| Lev | 38,416 | 0.413 | 0.206 | 0.0349 | 0.925 |

| ROE | 38,416 | 0.0573 | 0.138 | −0.962 | 0.414 |

| Cashflow | 38,416 | 0.0478 | 0.0681 | −0.199 | 0.266 |

| Loss | 38,416 | 0.131 | 0.338 | 0 | 1 |

| Indep | 38,416 | 37.74 | 5.378 | 0 | 60 |

| Top10 | 38,416 | 0.586 | 0.154 | 0.208 | 0.910 |

| TobinQ | 38,416 | 2.020 | 1.345 | 0.789 | 16.65 |

| ListAge | 38,416 | 2.062 | 0.935 | 0 | 3.434 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | ESG | ESG | ESG |

| DT | 1.223 *** | 1.204 *** | 0.748 *** |

| (10.00) | (5.47) | (3.04) | |

| Lev | −1.095 *** | −1.121 *** | |

| (−10.42) | (−13.36) | ||

| Size | 0.115 *** | 0.145 *** | |

| (6.08) | (6.53) | ||

| Top10 | −0.062 | 0.096 | |

| (−0.41) | (0.78) | ||

| ROE | 1.011 *** | 0.857 *** | |

| (6.17) | (5.23) | ||

| Indep | 0.008 *** | 0.007 *** | |

| (4.90) | (4.70) | ||

| TobinQ | −0.089 *** | −0.082 *** | |

| (−5.60) | (−5.12) | ||

| Loss | −0.074 | −0.164 ** | |

| (−1.04) | (−2.55) | ||

| ListAge | −0.254 *** | −0.246 *** | |

| (−6.95) | (−8.05) | ||

| Cashflow | −0.149 | 0.249 | |

| (−0.67) | (1.42) | ||

| Constant | −1.827 *** | −3.412 *** | −1.749 |

| (−2.80) | (−3.55) | (−1.58) | |

| Observations | 38,416 | 38,416 | 38,416 |

| R-squared | 0.005 | 0.058 | 0.095 |

| Industry-FE | NO | NO | YES |

| Year-FE | NO | NO | YES |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | ESG | ESG | ESG | E | S | G |

| DT* | 0.780 *** | |||||

| (2.91) | ||||||

| L-DT | 0.595 ** | |||||

| (2.56) | ||||||

| DT | 0.746 *** | 0.758 *** | 1.494 *** | 0.233 *** | ||

| (2.95) | (9.97) | (14.59) | (2.76) | |||

| Control | YES | YES | YES | YES | YES | YES |

| Industry-FE | YES | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES | YES |

| Observations | 38,416 | 32,193 | 34,799 | 38,416 | 38,416 | 38,416 |

| R-squared | 0.0926 | 0.0880 | 0.0928 | 0.1590 | 0.2403 | 0.1763 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| First | Second | First | Second | |

| Variables | DT | ESG | DT | ESG |

| IV1 | 0.002 *** | |||

| (38.43) | ||||

| Ln (IV2) | 0.048 *** | |||

| (74.61) | ||||

| DT | 1.064 ** | 2.979 *** | ||

| (2.40) | (12.21) | |||

| Constant | 5.298 *** | −0.991 | 4.827 *** | −11.091 *** |

| (5165.89) | (−0.42) | (814.04) | (−8.63) | |

| Control | YES | YES | YES | YES |

| Industry-FE | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES |

| LM-test | 985.721 *** | 239.171 *** | ||

| [0.000] | [0.000] | |||

| F-test | 884.992 | 1871.174 | ||

| Hausman Test | 11.079 *** | 11.491 *** | ||

| [0.0009] | [0.0007] | |||

| Observations | 35,175 | 35,175 | 30,350 | 30,350 |

| R-squared | 0.3646 | 0.1452 | 0.0771 | 0.1093 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | SOE | Non-SOE | Eastern | Central | Western | PE | Non-PE | Grow | Maturity | Decline |

| DT | 0.295 | 1.152 *** | 0.971 *** | 0.116 | 0.352 | 0.109 | 0.937 *** | 0.393 *** | 0.191 | 0.272 |

| (1.32) | (6.32) | (5.80) | (0.32) | (0.96) | (1.61) | (6.04) | (2.68) | (0.49) | (0.94) | |

| Constant | −1.342 | −3.524 *** | −2.961 *** | 0.201 | −2.836 | 0.196 | −3.236 *** | 0.146 | −0.047 | −0.585 |

| (−1.20) | (−3.73) | (−3.43) | (0.11) | (−1.57) | (0.09) | (−4.10) | (0.22) | (−0.03) | (−0.44) | |

| Control | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Industry-FE | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 12,033 | 23,099 | 25,232 | 5433 | 4446 | 7658 | 27,474 | 26,451 | 4637 | 4044 |

| R-squared | 0.0608 | 0.0876 | 0.0666 | 0.0831 | 0.1210 | 0.0669 | 0.0710 | 0.0820 | 0.1260 | 0.1325 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | ESG | EID | Tech-Conv | Resist | ESG |

| DT | 0.765 *** | 0.654 *** | 3.591 *** | 0.825 *** | 0.268 * |

| (5.44) | (16.94) | (23.56) | (18.57) | (1.91) | |

| DID | −0.892 * | ||||

| (−1.75) | |||||

| DID × DT | 0.170 * | ||||

| (1.75) | |||||

| Constant | −2.602 *** | −5.188 *** | −20.738 *** | −9.217 *** | 0.303 |

| (−3.62) | (−31.36) | (−33.08) | (−45.21) | (0.45) | |

| Control | YES | YES | YES | YES | YES |

| Firm-FE | NO | NO | NO | NO | YES |

| Industry-FE | YES | YES | YES | YES | YES |

| Year-FE | YES | YES | YES | YES | YES |

| Observations | 35,132 | 35,132 | 35,132 | 35,132 | 38,416 |

| R-squared | 0.0702 | 0.3350 | 0.4600 | 0.4234 | 0.0930 |

| (1) | (2) | |

|---|---|---|

| Variables | PE | Non-PE |

| DT | 1.122 *** | 0.081 |

| [3.40] | [0.53] | |

| DID | −0.173 | −1.100 * |

| [−0.15] | [−1.94] | |

| DID × DT | 0.013 | 0.216 ** |

| [0.06] | [2.00] | |

| Constant | −3.466 ** | 1.161 |

| [−2.23] | [1.56] | |

| Control | YES | YES |

| Firm-FE | YES | YES |

| Industry-FE | YES | YES |

| Year-FE | YES | YES |

| Observations | 7658 | 27,474 |

| R-squared | 0.0755 | 0.1009 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, H.; Zhang, X.; He, Y. Digital Transformation and ESG Performance—Empirical Evidence from Chinese Listed Companies. Sustainability 2025, 17, 6165. https://doi.org/10.3390/su17136165

Liu H, Zhang X, He Y. Digital Transformation and ESG Performance—Empirical Evidence from Chinese Listed Companies. Sustainability. 2025; 17(13):6165. https://doi.org/10.3390/su17136165

Chicago/Turabian StyleLiu, Hantao, Xiaoyun Zhang, and Yang He. 2025. "Digital Transformation and ESG Performance—Empirical Evidence from Chinese Listed Companies" Sustainability 17, no. 13: 6165. https://doi.org/10.3390/su17136165

APA StyleLiu, H., Zhang, X., & He, Y. (2025). Digital Transformation and ESG Performance—Empirical Evidence from Chinese Listed Companies. Sustainability, 17(13), 6165. https://doi.org/10.3390/su17136165