Co-Benefits of Carbon Pricing and Electricity Market Liberalization: A CGE Case Study

Abstract

1. Introduction

2. Literature Review

2.1. Review of ETS, Power Market Liberalization, and Interactions

2.2. Marginal Contributions on Research Design and Findings

3. Methodology

3.1. CEEEA2.0 Model

3.2. Data

3.3. Dynamics

3.4. Scenario Settings

4. Results and Discussion

4.1. Results

4.1.1. Impact on GDP and CO2 Emissions

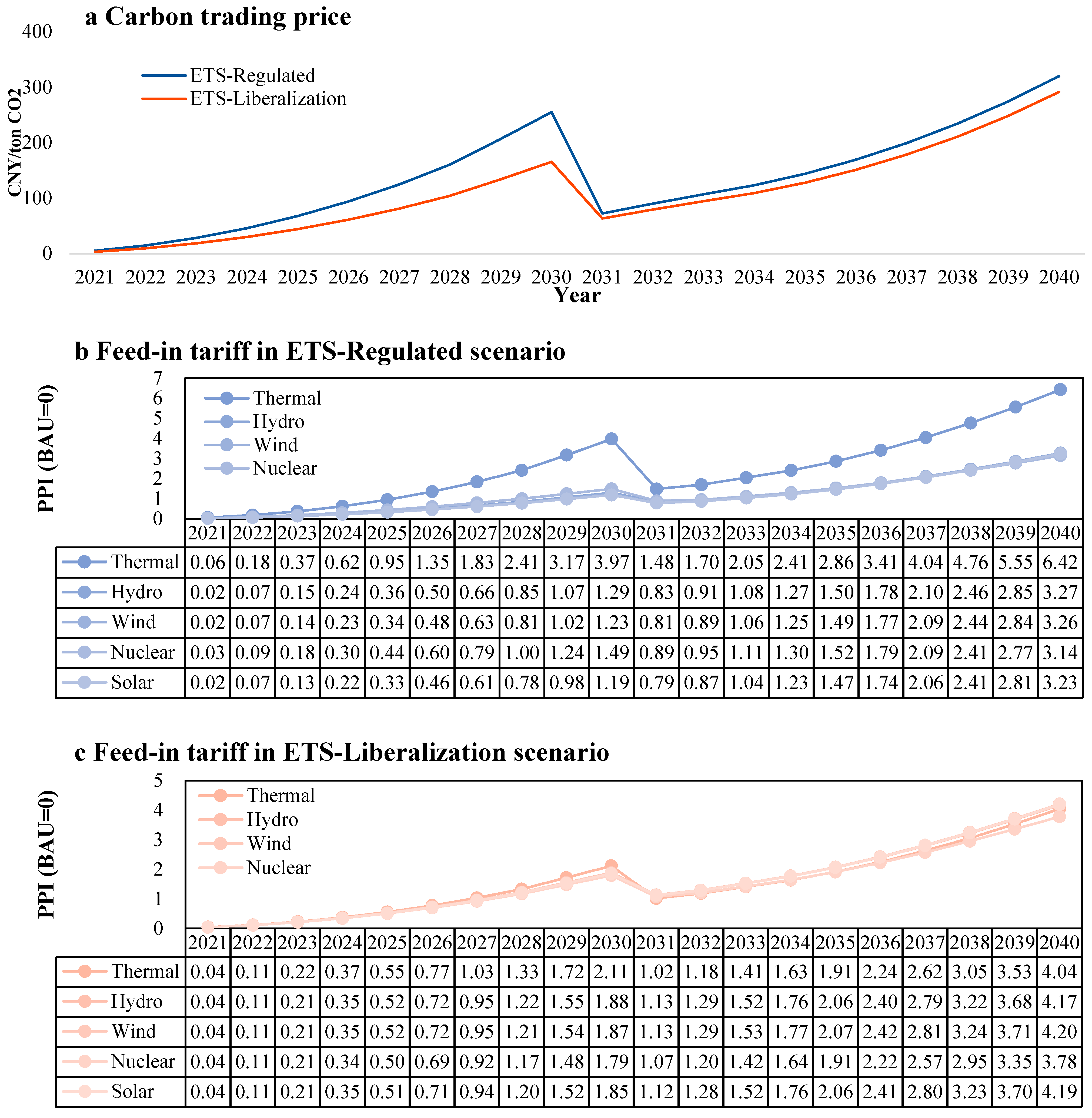

4.1.2. Impact on Carbon Trading Price and Feed-In Tariffs

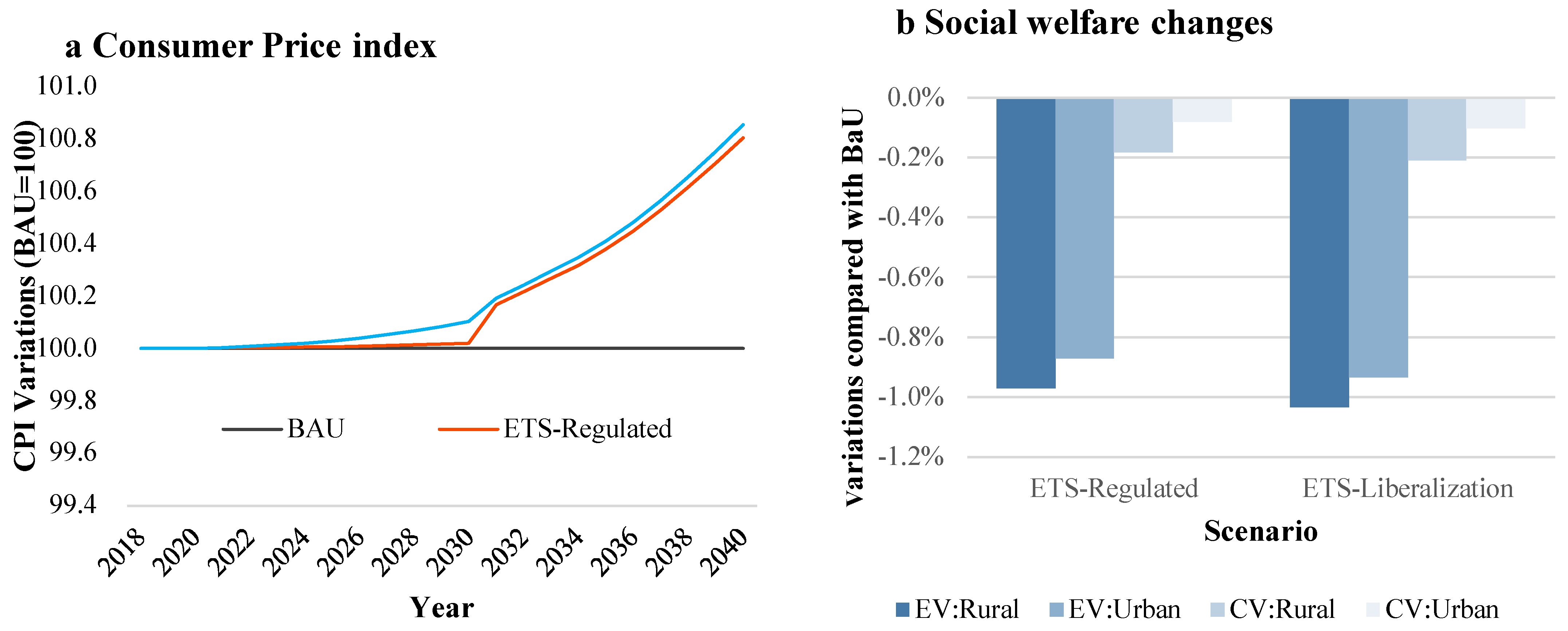

4.1.3. Impact on CPI and Social Welfare

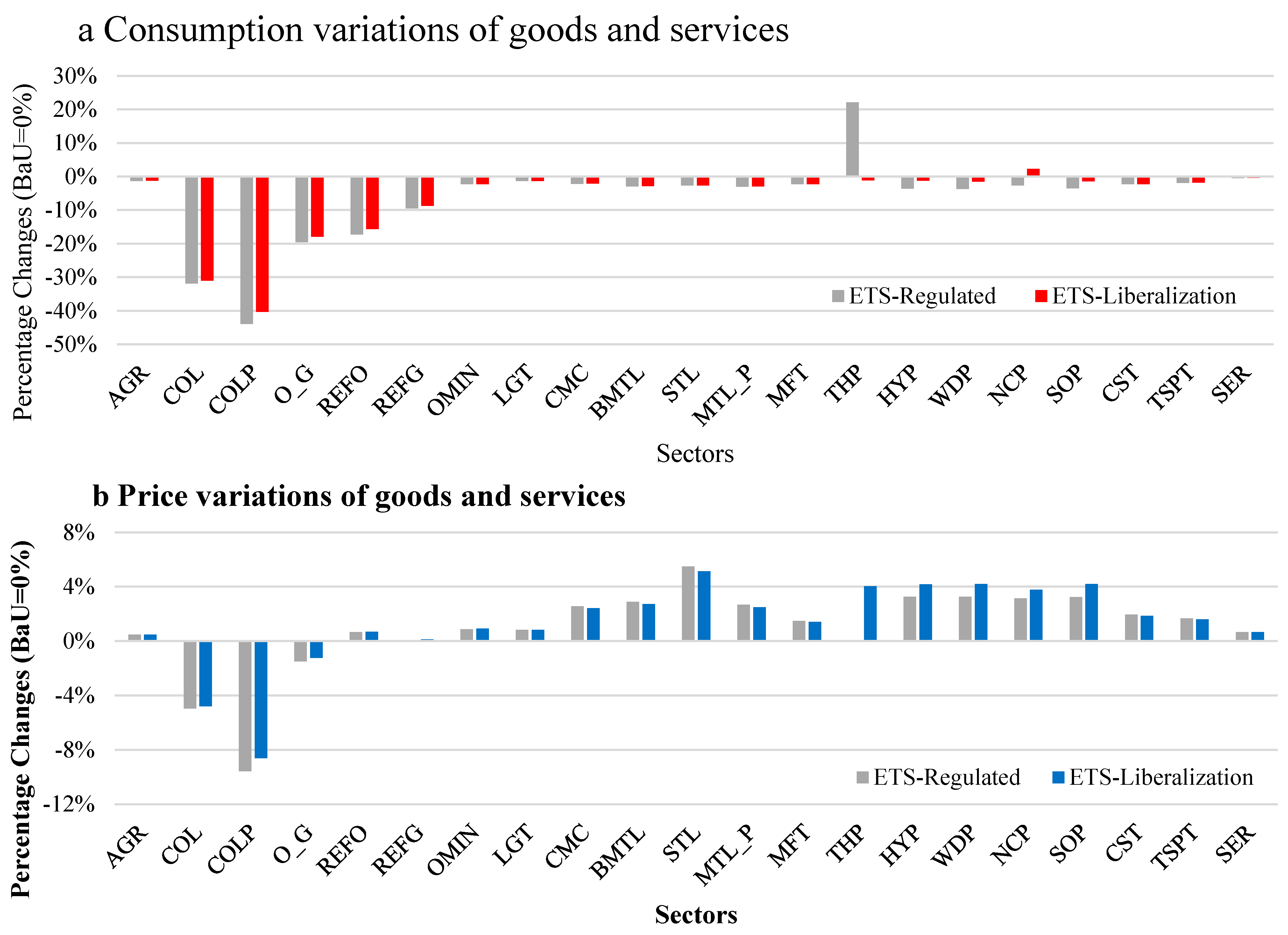

4.1.4. Impact on Commodity Market

4.1.5. Sensitivity Analysis

4.2. Discussions

5. Conclusions and Policy Implications

5.1. Conclusions

5.2. Policy Implications

- ➢

- Electricity Market Reform as a Complement to Carbon Pricing. The findings confirm that electricity market liberalization can enhance the effectiveness of carbon pricing by eliminating price distortions and enabling more accurate emission cost internalization. Policymakers should view market reform not as a competing priority but as a complementary instrument to carbon markets.

- ➢

- Designing Equitable Transition Strategies. The regressive impact of rising electricity prices on household welfare—especially in rural areas—requires the implementation of well-targeted compensation policies. Options include using carbon revenues to fund direct transfers, electricity rebates, or subsidies for energy-efficient appliances in vulnerable communities.

- ➢

- Phased and Adaptive Implementation. A gradual approach to market liberalization, paired with continuous monitoring of price and welfare impacts, can help mitigate transitional shocks. Policymakers should also consider dynamic policy adjustment mechanisms that respond to real-time inflation or inequality indicators.

- ➢

- Integrated Carbon and Energy Policy Planning. The success of China’s long-term decarbonization goals hinges on integrated policy design. Carbon pricing, electricity reform, and complementary social protection measures must be planned jointly rather than in silos.

5.3. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Huang, J.; Xu, X.; Zhao, T. The Moderating Effect of Clean Technology Innovation in the Process of Environmental Regulation Affecting Employment: Panel Data Analysis Based on 22 Industrial Sectors in China. J. Clean. Prod. 2023, 414, 137672. [Google Scholar] [CrossRef]

- Chen, S.; Liang, E.; Liu, C. “Size-Dependent” Environmental Regulations and Spatial Labor Allocation. J. Environ. Econ. Manag. 2025, 132, 103158. [Google Scholar] [CrossRef]

- Yu, X.; Wu, Z.; Wang, Q.; Sang, X.; Zhou, D. Exploring the Investment Strategy of Power Enterprises under the Nationwide Carbon Emissions Trading Mechanism: A Scenario-Based System Dynamics Approach. Energy Policy 2020, 140. [Google Scholar] [CrossRef]

- Song, Y.; Liang, D.; Liu, T.; Song, X. How China’s Current Carbon Trading Policy Affects Carbon Price? An Investigation of the Shanghai Emission Trading Scheme Pilot. J. Clean. Prod. 2018, 181, 374–384. [Google Scholar] [CrossRef]

- Zhang, W.; Chen, C.; Li, M. Impacts of Electricity Market Reforms: From the Perspective of Economic-Energy-Environment System Synergies. J. Clean. Prod. 2025, 509, 145603. [Google Scholar] [CrossRef]

- Cheng, Y.; Chung, M.; Tsang, K. Electricity Market Reforms for Energy Transition: Lessons from China. Energies 2023, 16, 905. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B.; Wen, S. Electricity Market Reform: The Perspective of Price Regulation and Carbon Neutrality. Appl. Energy 2022, 328, 120164. [Google Scholar] [CrossRef]

- Stepanyan, D.; Heidecke, C.; Osterburg, B.; Gocht, A. Impacts of National vs. European Carbon Pricing on Agriculture. Environ. Res. Lett. 2023, 18, 074016. [Google Scholar] [CrossRef]

- Meng, S.; Siriwardana, M.; Shen, Y. The Impact of a National Carbon Price on China. J. Asia Pac. Econ. 2021, 26, 601–618. [Google Scholar] [CrossRef]

- Koo, B. Examining the Impacts of Feed-in-Tariff and the Clean Development Mechanism on Korea’s Renewable Energy Projects through Comparative Investment Analysis. Energy Policy 2017, 104, 144–154. [Google Scholar] [CrossRef]

- Liu, X.; Jin, Z. An Analysis of the Interactions between Electricity, Fossil Fuel and Carbon Market Prices in Guangdong, China. Energy Sustain. Dev. 2020, 55, 82–94. [Google Scholar] [CrossRef]

- Qi, L.; Lin, X.; Shi, X.; Zhang, Y.; Pan, H.; Sharp, B. Feed-in Tariffs and the Carbon Emission Trading Scheme under China’s Peak Emission Target: A Dynamic CGE Analysis for the Development of Renewable Electricity. J. Environ. Manag. 2023, 335, 117535. [Google Scholar] [CrossRef] [PubMed]

- Yao, Y.F.; Liang, Q.-M.; Yang, D.-W.; Liao, H.; Wei, Y.-M. How China’s Current Energy Pricing Mechanisms Will Impact Its Marginal Carbon Abatement Costs? Mitig. Adapt. Strateg. Glob. Change 2016, 21, 799–821. [Google Scholar] [CrossRef]

- Goulder, L.H.; Scheins, A.R. Carbon Taxes Versus Cap and Trade: A Critical Review. Clim. Change Econ. 2013, 4, 1350010. [Google Scholar] [CrossRef]

- Martin, R.; Muûls, M.; de Preux, L.B.; Wagner, U.J. Industry Compensation under Relocation Risk: A Firm-Level Analysis of the EU Emissions Trading Scheme. Am. Econ. Rev. 2014, 104, 2482–2508. [Google Scholar] [CrossRef]

- Günther, C.; Pahle, M.; Govorukha, K.; Osorio, S.; Fotiou, T. Carbon Prices on the Rise? Shedding Light on the Emerging Second EU Emissions Trading System (EU ETS 2). Clim. Policy 2025, 1–12. [Google Scholar] [CrossRef]

- Song, X.; Pan, C.; Yuan, H.; Wang, Z. Does Emission Trading System (ETS) Deserve Further Promotion in the Building Sector? Evidence from China. Renew. Energy 2024, 237, 121713. [Google Scholar] [CrossRef]

- Hughes, L.; Meckling, J. The Politics of Renewable Energy Trade: The US-China Solar Dispute. Energy Policy 2017, 105, 256–262. [Google Scholar] [CrossRef]

- Huang, S.; Du, C.; Jin, X.; Zhang, D.; Wen, S.; Wang, Y.; Cheng, Z.; Jia, Z. The Boundary of Porter Hypothesis: The Energy and Economic Impact of China’s Carbon Neutrality Target in 2060. Energies 2022, 15, 9162. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. Can Carbon Tax Complement Emission Trading Scheme? The Impact of Carbon Tax on Economy, Energy and Environment in China. Clim. Change Econ. 2020, 11, 2041002. [Google Scholar] [CrossRef]

- Silva, P.F.; Ferreira da Costa, V.B.; Dias, B.H.; Soares, T.A.; Bonatto, B.D.; Balestrassi, P.P. Socioeconomic Impact of Brazilian Electricity Market Liberalization: Forecasting and Optimized Tariff Analysis. Energy 2024, 313, 133992. [Google Scholar] [CrossRef]

- Ali, H.; Phoumin, H.; Suryadi, B.; Farooque, A.A.; Yaqub, R. Assessing ASEAN’s Liberalized Electricity Markets: The Case of Singapore and the Philippines. Sustainability 2022, 14, 11307. [Google Scholar] [CrossRef]

- Newbery, D. Electricity Liberalisation in Britain: The Quest for a Satisfactory Wholesale Market Design. Energy J. 2005, 26, 43–70. [Google Scholar] [CrossRef]

- Pollitt, M.G. The Role of Policy in Energy Transitions: Lessons from the Energy Liberalisation Era. Energy Policy 2012, 50, 128–137. [Google Scholar] [CrossRef]

- Arcelay, I.; Goti, A.; Oyarbide-Zubillaga, A.; Akyazi, T.; Alberdi, E.; Garcia-Bringas, P. Definition of the Future Skills Needs of Job Profiles in the Renewable Energy Sector. Energies 2021, 14, 2609. [Google Scholar] [CrossRef]

- Acworth, W.; de Oca, M.M.; Boute, A.; Piantieri, C.; Matthes, F.C. Emissions Trading in Regulated Electricity Markets. Clim. Policy 2020, 20, 60–70. [Google Scholar] [CrossRef]

- Li, R.; Hu, Y.; Wang, X.; Zhang, B.; Chen, H. Estimating the Impacts of a New Power System on Electricity Prices under Dual Carbon Targets. J. Clean. Prod. 2024, 438, 140583. [Google Scholar] [CrossRef]

- Nie, Y.; Zhang, G.; Zhong, L.; Su, B.; Xi, X. Urban—rural Disparities in Household Energy and Electricity Consumption under the Influence of Electricity Price Reform Policies. Energy Policy 2024, 184, 113868. [Google Scholar] [CrossRef]

- Zhao, X.; Hu, S.; Wang, H.; Haowei, C.; Wenbin, Z.; Wenjie, L. Energy, Economic, and Environmental Impacts of Electricity Market-Oriented Reform and the Carbon Emissions Trading: A Recursive Dynamic CGE Model in China. Energy 2024, 298, 131416. [Google Scholar] [CrossRef]

- Sijm, J.; Neuhoff, K.; Chen, Y. CO2 Cost Pass-through and Windfall Profits in the Power Sector. Clim. Policy 2006, 6, 49–72. [Google Scholar] [CrossRef]

- Bojnec, Š.; Križaj, A. Electricity Markets during the Liberalization: The Case of a European Union Country. Energies 2021, 14, 4317. [Google Scholar] [CrossRef]

- Zhang, K.; Yao, Y.-F.; Liang, Q.-M.; Saren, G. How Should China Prioritize the Deregulation of Electricity Prices in the Context of Carbon Pricing? A Computable General Equilibrium Analysis. Energy Econ. 2021, 96, 105187. [Google Scholar] [CrossRef]

- Jia, Z.; Lin, B. CEEEA2.0 Model: A Dynamic CGE Model for Energy-Environment-Economy Analysis with Available Data and Code. Energy Econ. 2022, 112, 106117. [Google Scholar] [CrossRef]

- Huang, S.; Du, C.; Jin, X.; Zhang, D.; Wen, S.; Jia, Z. The Impact of Carbon Emission Trading on Renewable Energy: A Comparative Analysis Based on the CGE Model. Sustainability 2023, 15, 12649. [Google Scholar] [CrossRef]

- Jia, Z.; Wu, R.; Liu, Y.; Wen, S.; Lin, B. Can Carbon Tariffs Based on Domestic Embedded Carbon Emissions Reduce More Carbon Leakages? Ecol. Econ. 2024, 220, 108163. [Google Scholar] [CrossRef]

- Jia, Z.; Liu, Y.; Lin, B. The Impossible Triangle of Carbon Mitigation Policy. Energy Policy 2024, 189, 114107. [Google Scholar] [CrossRef]

- Jia, Z.; Wen, S.; Liu, Y. China’s Urban-Rural Inequality Caused by Carbon Neutrality: A Perspective from Carbon Footprint and Decomposed Social Welfare. Energy Econ. 2022, 113, 106193. [Google Scholar] [CrossRef]

- Jia, Z. The Hidden Benefit: Emission Trading Scheme and Business Performance of Downstream Enterprises. Energy Econ. 2023, 117, 106488. [Google Scholar] [CrossRef]

| Abbreviations | Sector’s Full Name |

|---|---|

| AGR | Agriculture |

| COL | Coal mining |

| COLP | Coal processing |

| O_G | Oil and gas exploitation |

| REFO | Refined oil |

| REFG | Refined gas |

| OMIN | Other mining |

| LGT | Light industry |

| CMC | Chemicals |

| BMTL | Building material |

| STL | Steel |

| MTL_P | Metal product |

| MFT | Manufacturing |

| THP | Thermal power |

| HYP | Hydropower |

| WDP | Wind power |

| NCP | Nuclear power |

| SOP | Solar power |

| CST | Construction |

| TSPT | Transportation |

| SER | Services |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, N.; Huang, S.; Chen, Y.; Zhang, D.; Xu, Q.; Yang, X.; Wen, S. Co-Benefits of Carbon Pricing and Electricity Market Liberalization: A CGE Case Study. Sustainability 2025, 17, 5992. https://doi.org/10.3390/su17135992

Yan N, Huang S, Chen Y, Zhang D, Xu Q, Yang X, Wen S. Co-Benefits of Carbon Pricing and Electricity Market Liberalization: A CGE Case Study. Sustainability. 2025; 17(13):5992. https://doi.org/10.3390/su17135992

Chicago/Turabian StyleYan, Ning, Shenhai Huang, Yan Chen, Daini Zhang, Qin Xu, Xiangyi Yang, and Shiyan Wen. 2025. "Co-Benefits of Carbon Pricing and Electricity Market Liberalization: A CGE Case Study" Sustainability 17, no. 13: 5992. https://doi.org/10.3390/su17135992

APA StyleYan, N., Huang, S., Chen, Y., Zhang, D., Xu, Q., Yang, X., & Wen, S. (2025). Co-Benefits of Carbon Pricing and Electricity Market Liberalization: A CGE Case Study. Sustainability, 17(13), 5992. https://doi.org/10.3390/su17135992