1. Introduction

The increasing growth of the world population is anticipated to reach 9.7 billion by 2050, and the growing urbanization indicates an escalating need for energy consumption globally [

1,

2]. In such a context, the building sector is identified as a critical contributor responsible for approximately 36 percent of final energy consumption worldwide [

3,

4]. It is also reported that building operations are responsible for 55 percent of global electricity consumption [

5]. Moreover, the building sector accounts for 39 percent of global carbon dioxide equivalent emissions, and, in particular, 28 percent of total CO

2 eq emissions are attributed to operational energy consumption around the world [

6]. Such data highlight the significance of targeting the building sector in the roadmaps aiming at reducing global energy consumption and climate change mitigation policy development.

The importance of the building sector becomes clearer and a central point in pursuing climate change mitigation targets given the fact that the majority of the existing building stock in the European Union (EU) has poor energy performance, and 85 percent of the existing building stock is expected to remain operational until 2050 [

7]. Most buildings in the EU are constructed before introducing the energy performance requirement, which indicates that 97 percent of the existing building stock requires enhancement from an energy performance perspective [

8]. Therefore, the existing building sector is a crucial sector to be targeted for achieving ambitious EU climate targets to reach 55 percent greenhouse gas (GHG) emissions by 2030 compared to the measured level in 1990 and be climate neutral by 2050 [

7].

Utilizing solar energy in buildings has become a significant element of energy strategies [

9] and could be an optimal solution due to its lower environmental impact compared to other energy sources and its noticeable harnessing potential worldwide [

10]. Furthermore, harnessing solar energy using building-integrated photovoltaic (BIPV) systems has been recognized as an effective solution to reducing the buildings’ environmental footprint, yields economic profits, and reduces the buildings’ dependency on the electricity grid particularly when coupled with thermal and electrical storage systems [

11]. In such a context, smart buildings with the capabilities of integrating renewable energy sources (RES) and enhancing energy efficiency through implementing smart technologies are known as pivotal solutions to improve the economic and environmental quality of the buildings [

12,

13].

Nevertheless, the application and economic feasibility of BIPV coupled with energy storage systems in buildings greatly depends on the cost-optimal sizing and total costs of the systems, including the initial investments, operation costs, and its potential to yield cost savings over the building life cycle that could be measured by life cycle cost indicators such as net present cost (NPC) and saving-to-investment ratios (SIRs).

Therefore, this article aims to evaluate the cost-effectiveness of coupled BIPV and electrical storage systems in residential buildings. For this purpose, the energy consumption of a multi-family residential complex is analyzed using energy modeling techniques, and the total life cycle cost of coupling electrical storage systems with BIPV is evaluated by the NPC indicator considering various scenarios of initial investment costs. The study contributes to understanding the impact of the market price of the electrical storage system on finding the optimal storage system’s size. The study also elaborates on the economic profits of the electrical storage systems in residential buildings.

The main novelty of the present study is to provide a techno-economic framework that simultaneously optimizes the battery storage size and evaluates the economic viability of electrical storage systems using two distinct life cycle cost indicators (i.e., NPC and SIR). The study applies a Monte Carlo-based optimization to residential BIPV-battery systems in Italy, providing novel insight into the interplay between battery price, sizing, and economic feasibility thresholds. Thus, the results of the present study can be utilized as a practical decision-support tool applicable for the cost-optimum sizing of battery energy storage systems coupled with BIPV in residential buildings. The study further discusses the optimization outcome by different economic indicators, elaborating on the impact of selecting each indicator in decision-making.

The current study and its findings are limited to the impact of the geographical and economic context, and it is suggested to replicate it in various geographical areas with different solar radiation potential and various macroeconomic parameters affecting the net present cost of energy efficiency measures in the building sector.

2. Literature Review

The application of BIPV and ESS is extensively covered in the literature, as it has high relevance in achieving Net Zero Energy Buildings (NZEBs) and smart buildings worldwide. While technical evaluation of such solutions is widely performed, economic aspects of integrating ESS and BIPV are still a critical research focus in this context that requires further investigation. Nevertheless, previous studies also provide insights into some aspects of these research questions. For instance, Do et al. [

14] carried out an economic assessment on integrating battery energy storage systems (BESS) and solar power plant systems at a large scale to measure the economic justification of such technical solutions by assessing levelized cost of electricity (LCOE), net present cost (NPC), and electrical productivity. They showed that in such solar power plants, installing BESS with a capacity of 2 MWh can decrease the NPC compared to the base scenario without BESS. and for larger BESS systems beyond 12 MWh, it is not economically viable. They proposed investment-based incentives and capital-based incentives to enhance the economic justification of integrated PV-BESS systems.

In another study, Sadat and Pearce [

15] evaluated the economic viability of battery system integration in Ontario, Canada, using economic metrics such as net present cost (NPC), levelized cost of energy (LCOE), internal rate of return (IRR), discounted payback period (DPP), and return on investment (ROI) under different electricity pricing structures and with three different scenarios including the baseline, optimistic, and pessimistic scenarios regarding the current pricing and costs, incentives, etc. the results showed that under the baseline condition, the battery integration is not viable. They concluded that cost reduction of battery systems and policy reforms are necessary to make battery storage economically viable.

Bird et al. [

16] carried out a financial analysis on integrated PV-battery systems in commercial buildings in the UK. They concluded that despite the operational savings in most scenarios, the battery system integration is not economically viable due to high upfront battery cost, and, therefore, a significant cost reduction in electrical battery systems and higher electricity price is required to justify the application of electrical storage.

In another study carried out by Ozcan et al. [

17], the results showed that the application of a second-life lithium-ion battery system is economically beneficial and can increase the NPC of the PV-battery system by around 15% to 21% in Turkey. They also suggested incentivizing the second-life batteries to enhance their economic attractiveness. Chen et al. [

18] performed a techno-economic analysis on PV systems coupled with electrical battery systems and cooling (thermal) storage systems for commercial buildings in China. They showed that in all their evaluated cases, thermal storage outperforms electrical storage from an economic viewpoint; nonetheless, they advised proceeding with electrical battery storage when the optimal thermal storage is exceeded. They noted that battery cost decline and higher electricity prices can encourage the application of electrical battery storage, especially if the battery cost drops to around 70

$/kWh.

Another study performed by Jivaganont et al. [

19] in Thailand also highlights the need to reduce the cost of battery systems for the economic viability of buildings. According to their findings, the current price estimated at around 200–300

$/kWh does not lead to economic profits when the scenario is compared to non-battery storage applications. Thus, to make the electrical battery storage economically justifiable, the cost of the battery system should drop to below 65–35

$/kWh with respect to the building type and loads.

Moreover, the techno-economic analysis of the PV-battery system performed by Li et al. [

20] concluded that the application of the battery system coupled with the PV system is only economically favorable under policy conditions in which the feed-in tariff is low, and therefore prioritizing self-consumption of PV-generated electricity is favored. A study carried out by Wang et al. [

21] on the technical and economic assessment of PV-battery systems revealed that although the application of the electrical battery storage led to enhancing the PV self-consumption, the payback of the PV system alone is short compared to the scenarios in which the battery system is integrated as well. It indicates that to justify the higher investment cost of the battery system, more subsidies are needed.

The existing literature underscores the critical impact of the economic feasibility aspects on the efforts to integrate electrical battery storage systems coupled with BIPV. Different studies emphasized the high upfront cost of the battery systems as a main barrier to encouraging the application of electrical storage. Although several studies focused on the technical performance of ESS and BIPV, the economic dimension, particularly the size optimization of the battery storage system under different battery price scenarios, remains a key area of further investigation to support real-world implementation. Moreover, this study uniquely quantifies the economic viability thresholds of battery system applications using multiple indicators including NPC and SIR, providing clear insight to the stakeholders to make informed multi-dimensional decisions according to their economic objectives and limitations.

3. Methods and Materials

To achieve the intended goals of this research, a multi-family residential building located in Reggio Emilia, Italy, is modeled using parametric energy modeling tools such as Honeybee in the Grasshopper environment, relying on the EnergyPlus simulation engine. The parametric energy model facilitates performing numerous scenarios to calculate the heating and cooling energy demand and the thermal energy required for supplying domestic hot water (DHW). The building has a total of 636 square meters of net conditioned surface area. It is equipped with efficient air-to-water heat pumps to deliver the thermal energy needed for heating, cooling, and DHW needs in the building. Furthermore, the building is equipped with photovoltaic systems installed on the building’s slanted roof with a peak power equal to 8.5 kW

p. The total thermal energy needed for heating, cooling, and DHW services is calculated as equivalent to 28,884 kWh

th, 10,785 kWh

th, and 13,226 kWh

th respectively. The total electricity consumption by heat pump units is estimated at 22.51 kWh/m

2.year. The data required for the energy modeling of the building case study is reported in

Table 1, including the building envelope characteristics and installed energy systems.

Moreover, the energy model is capable of measuring and evaluating the energy generation profile of the installed photovoltaic systems on the building’s slanted roof. The parametric model then compares and evaluates the energy consumption profile for the defined energy services (i.e., heating, cooling, and DHW) with the PV-generated electricity profile in an hourly timestep.

The control logic designed in this simulation activates the lithium-ion battery storage systems when the hourly PV-generated electricity is higher than the energy consumption profile using conditions related to the amount of electricity needed for the heat pumps and available electricity generated by BIPV systems in the same time steps. The amount of electricity needed over this period will be stored in the battery system if excess PV-generated electricity is available, and the rest of the excess BIPV-generated electricity is then fed into the grid. In case the BIPV-generated electricity and the stored electricity in the battery system are not sufficient to meet the electricity needs of the building’s energy systems, the remaining electricity needed is imported from the grid. While the energy simulation and demand prediction are conducted on an hourly timestep, the battery system is not designed to necessarily be fully charged and discharged hourly to minimize the number of charging/discharging cycles. Furthermore, it should be noted that the energy model in this study considers the predictable loads for heating, ventilation, and air conditioning (HVAC) systems and excludes the impact of uncertain user behaviors (electric vehicle charging, appliance usage pattern, etc.). Such simplification helps isolate the impact of battery size and price on economic outcomes and reduce analytical uncertainty.

Then the hourly electricity imports to the building and the amount of PV-generated electricity exported to the grid are measured to calculate the annual cost of electricity used by the heating and cooling system in the building. To carry out the economic feasibility analysis of the electrical battery storage system over the building life cycle, net present cost (NPC) and saving-to-investment ratio (SIR) as standard life cycle cost (LCC) indicators [

22] are employed in this case study. Thus, net present cost (NPC) is calculated using Equation (1), and further economic parameters to perform the economic assessment are reported in

Table 2.

Equation (1). Net present cost

where

is the fixed initial cost in the first year.

is the periodical cost (e.g., annual electricity cost, replacement costs, revenue, etc.).

is the inflation rate applied to future electricity costs and replacement costs.

is the nominal discount rate applied in this study.

is the study period starting from 1 to the end of the study period covering 30 years of operation.

Moreover, the saving-to-investment ratio (SIR) as the ratio between the total discounted financial savings during the building service life and the initial investment of the battery systems is calculated in this study. The results of the battery size optimization are then compared with NPC and SIR as life cycle cost indicators. The study period is fixed at 30 years, while the technical life span of the battery systems is estimated to be 10 years; therefore, two periodical full replacements of the battery systems are included in the economic analysis. Considering the full replacement of the battery system every 10 years according to lithium-ion battery systems’ life span, the performance degradation of the battery system in each operational life cycle is excluded from the analysis. The static electricity tariffs to buy from the grid and to feed into the grid are selected equal to 0.2 €/kWh and 0.1 €/kWh, as adopted in recent studies in Italy. The techno-economic data applied in this study are reported in

Table 2.

As shown in

Table 2, different initial costs of the battery system are used in this study, and the size of the battery system is selected as a variable to analyze the impact of battery system price on the cost-optimal size of the electrical storage system. The selected range of the battery system capacity in this study is 0 to 10 kWh, and the price range of the battery system is 100 to 500 euros per kWh of battery system capacity. A Monte Carlo analysis is then carried out for different combinations of design variables (i.e., the battery system price and size) and the total life cycle cost indicators in terms of NPC and SIR as the analysis outcome. The Monte Carlo analysis uses the Latin Hypercube Sampling method with 10,000 simulations of different input combinations as the sample size. The result will show the life cycle cost-optimum size of the battery system for the selected building case study under different scenarios of initial cost requirement.

4. Results

The initial results achieved by the energy simulation reveal considerable potential for energy storage when an electrical storage system is coupled with the building integrated photovoltaic systems. The self-consumption rate of PV-generated electricity is calculated as equal to 39 percent, indicating that the electricity produced by the PV system is not used in the building energy system directly and should be imported to the grid. In such a technical context, installing an electrical storage system can store the excess hourly BIPV-generated electricity and use it when required by the building energy system. This process maximizes the PV self-consumption rate and yields economic profits by minimizing the purchased electricity from the grid. However, the actual economic profit depends on other parameters such as the capacity of the installed electrical storage system and its associated initial investment. Therefore, the study evaluates the total life cycle cost for a various range of initial investments (market price) required in this case study and finds the life cycle cost-optimum size of the battery system in each scenario as well as the total net present costs and saving-to-investment ratio in each scenario.

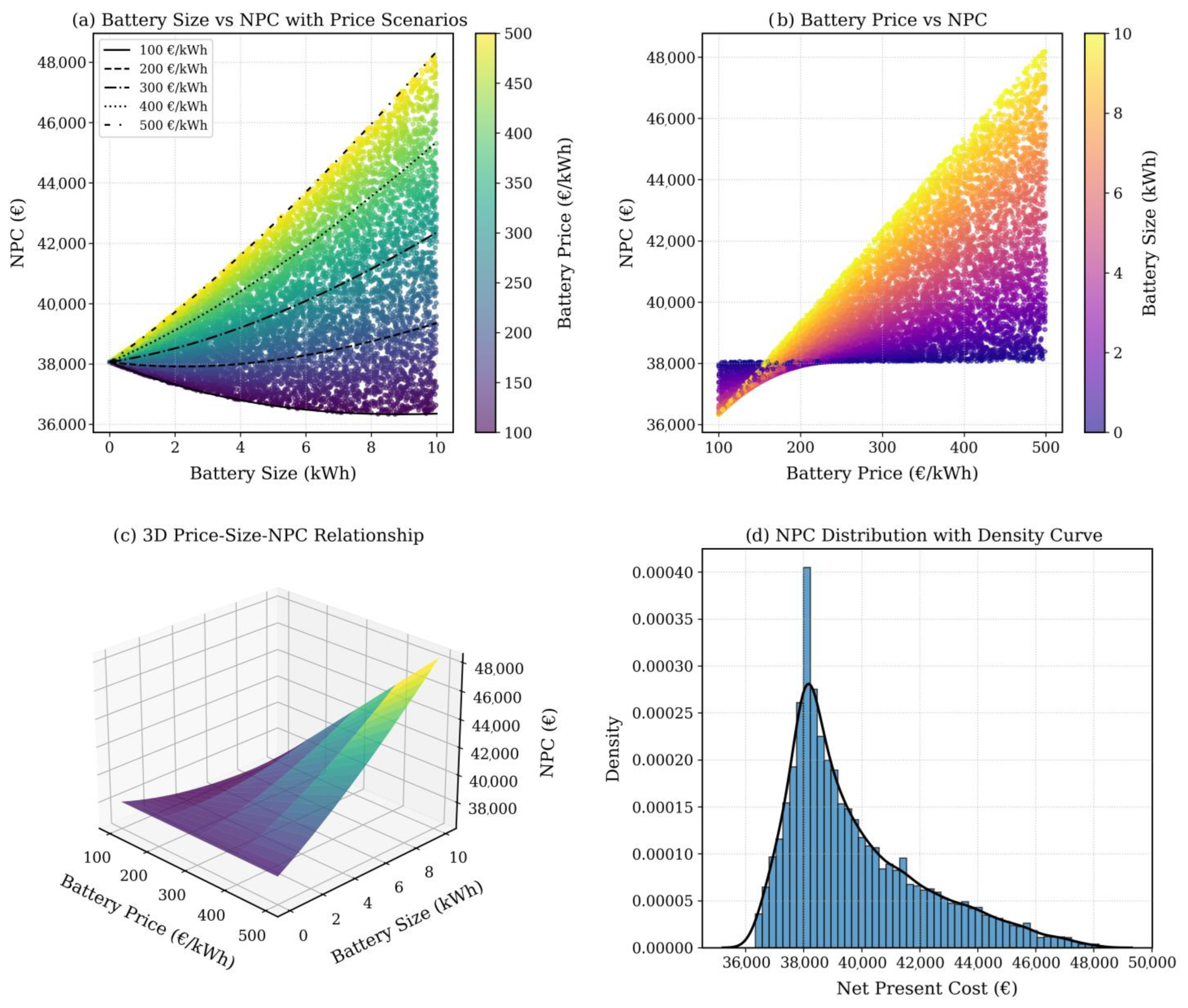

The results achieved in this study also reveal that NPC varies significantly and is influenced by battery system size and price. As illustrated in

Figure 1, the lower battery system price encourages installing a larger battery system due to low investment cost and its high potential to reduce imported electricity from the grid.

Figure 1a presents the battery size against NPC, with each point representing a scenario under varying battery prices. The results show that in lower battery price scenarios (around 100 €/kWh), the larger battery sizes become economically viable due to their lower capital costs and the higher capacity to store excess BIPV-generated electricity to be used in the building. In contrast, as the battery price approaches higher values, increasing the battery size will lead to a significant net present cost of the system as a result of higher initial costs of battery systems that could not be compensated for by the economic benefits associated with the electrical storage systems. Hence, a clear cost-optimal band emerges in the moderate battery size range for mid-range battery prices.

The results indicate that the electrical storage can be economically favored only in cases where the battery price is below 300 €/kWh. The current battery system’s price estimated at higher values is not economically justified within the existing economic contexts and macroeconomic parameters such as electricity tariffs, inflation, and nominal discount rate used in this study. Lowering the battery system’s price to 200 €/kWh could justify implementing electrical storage with a battery capacity equal to 2 kWh as the life cycle cost-optimum solution.

Figure 1b presents the results in a different form and reaffirms the trend where NPC is highly sensitive to both the battery size and the battery system’s price. In particular, higher battery system prices show a wide range of possible NPC outcomes under different battery system sizes, while the minimum variation is found around the battery system’s price equal to 200 €/kWh. Nevertheless, reducing the battery system’s price to 100 €/kWh can justify installing larger battery systems.

Figure 1c shows a low-cost region that signifies the combination of the battery system’s size and price that leads to minimum net present costs. At a low battery price, a relatively flat surface is created, showing that a wide range of battery sizes yield similar cost outcomes. Conversely, at a high battery system price, NPC escalates sharply for larger battery system size scenarios. These results reinforce the need to consider both the system size and the market price to identify cost-optimum solutions.

Figure 1d presents the histogram showing an almost left to central clustering of NPC values, meaning that most scenarios converge around a main peak and suggesting that a typical combination of the battery sizes and price scenarios leads to an NPC with a low to moderate range. However, the long tail towards higher NPC values indicates the non-negligible risk of significantly high cost under some conditions, which highlights the importance of considering an accurate and cost-aware design process.

Figure 1 and its subplots together reveal that the optimal design of electrical battery storage for a BIPV system strongly depends on both the battery system’s market price and the battery size implemented. When the market price of the battery system is lower, the larger battery systems become economically viable and attractive through enhancing the utilization of BIPV-generated electricity and reducing the grid reliance. Conversely, the higher price of the battery systems leads to smaller electrical storage systems and more conservative storage investments.

Moreover,

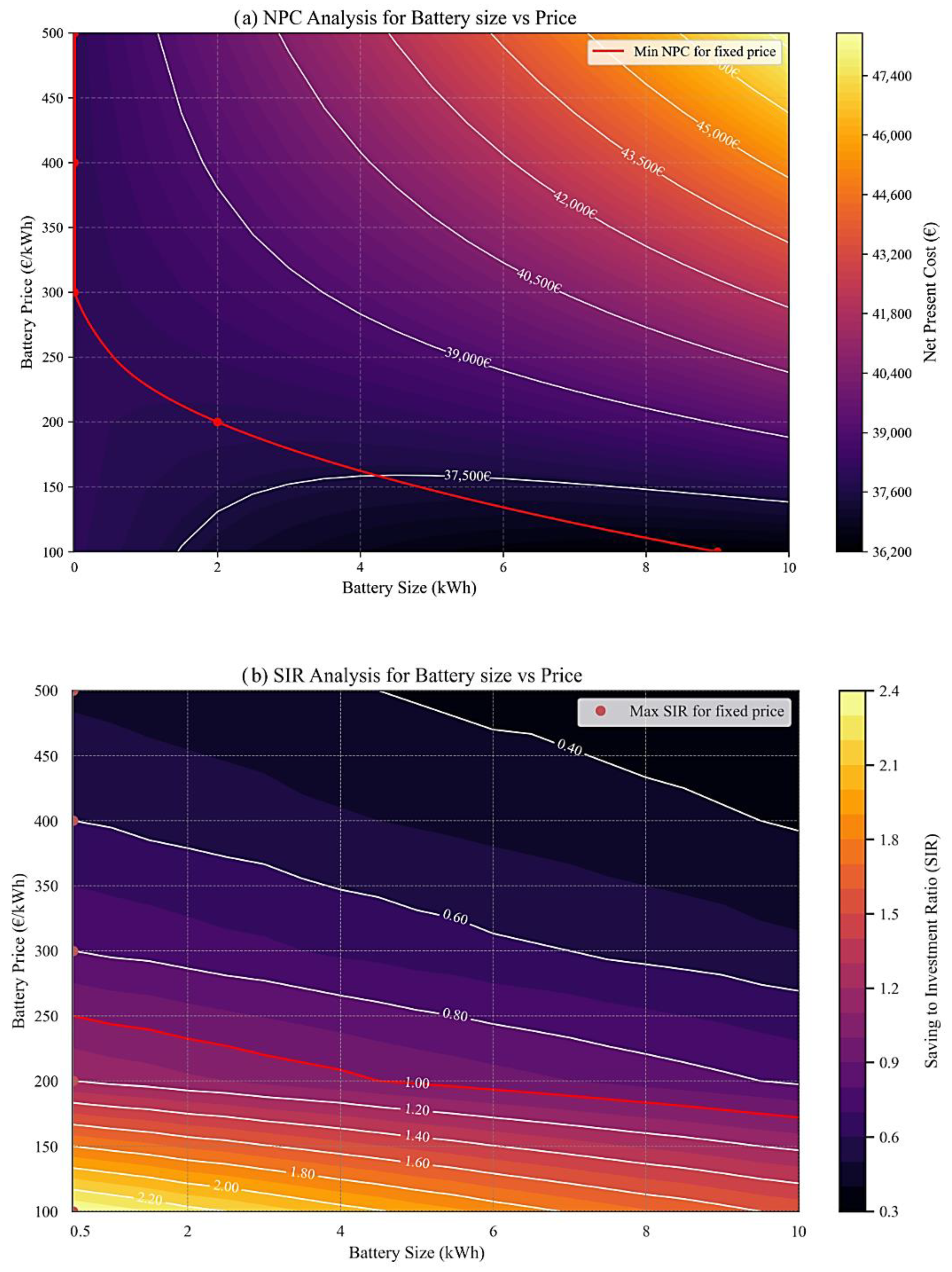

Figure 2 represents the optimization results using SIR as another standard LCC indicator. The optimization based on the SIR indicator tends to find the scenarios with the highest saving potential and the lowest initial required investment. Unlike the NPC indicator focusing on the overall life cycle cost, SIR also takes into account the budget limitations and focuses on the scenarios with the highest financial return based on investment costs.

The Monte Carlo analysis results presented in

Figure 2a show a declining SIR corresponding to the increasing size of the battery system beyond a certain size. However, SIR strongly depends on the battery system’s market price as well. Increasing the market price of the battery systems from 100 to 500 €/kWh will discourage the application of electrical battery storage by reducing the SIR from 2.4 to below 0.5. The results in

Figure 2a highlight that the optimum size of an electrical battery storage system is 0.5 kWh when the battery price system is approximately around 200 €/kWh or lower. However, SIR never reaches values higher than 1 when the market price of the battery system is around 300 €/kWh or higher. This means that the economic viability of installing an electrical battery storage system is highly dependent on the market price of the battery systems.

Furthermore, the results presented in

Figure 2b indicate that regardless of the chosen capacity of the battery system, the application of the battery storage system is not economically attractive for the scenarios in which the market price of the battery system is approximately over 250 €/kWh.

Conversely, for the scenarios in which the market price of the battery system is approximately between 100 to 150 €/kWh, all battery capacity scenarios lead to an SIR higher than 1, meaning economic attractiveness, although the SIR-based optimum size for these scenarios is found when the capacity is equal to 0.5 kWh. For the price scenarios between 150 and 250 €/kWh, some battery capacity alternatives result in an SIR over 1, while others lead to values below 1, emphasizing the accurate cost-optimum sizing of the battery system to yield the most possible economic profits.

In all cases in which the application of a battery system is economically justifiable (battery price approximately < 250 €/kWh), the optimum size of the battery system is found at a capacity equal to 0.5 kWh, and the highest achievable SIR is equal to 2.4 when the battery price and battery size are taken into account and equal to 100 €/kWh and 0.5 kWh, respectively. The optimum size based on SIR indicators as shown in

Figure 2 is lower than the optimum values shown in

Figure 1, where the optimization is carried out based on the NPC indicator. This difference is due to the different indicators chosen and the fact that SIR promotes the scenarios that yield higher savings with less initial investment concerning the ratio of saving to investment. However, the optimization based on the NPC indicator promotes the scenario in which the overall discounted cost over the building life cycle is minimized even slightly. These findings also reveal that the optimal solution is highly influenced by the indicator chosen as the optimization objective and suggest that the indicator must be chosen carefully according to the project goals and priorities.

Figure 3 presents a summative and comprehensive overview of the optimization results and techno-economic analysis in this study. It shows the results of the techno-economic analysis for minimum achievable net present costs and maximum saving-to-investment ratio obtained for each combination of battery systems size and market price. The subplots represented in

Figure 3 illustrate the net present cost and the saving-to-investment ratio of the systems in the study period as corresponding colors to the value of these indicators shown in the heatmap graphs in subplot (a) and subplot (b), respectively, while the

x-axis and

y-axis correspond to the battery system size and the market price, respectively.

Subplot (a) illustrates the variation of the NPC indicator across the defined parameters space, while subplot (b) presents the variation of the SIR indicator within the same parameters space. Furthermore, the overlaid red curves in the two subplots indicate the trajectory of the minimum NPC and the maximum SIR achievable in this case study. The analysis of NPC indicators illustrated in subplot (a) reveals that the battery system’s price is the dominant driver of the system’s total costs. The contour lines show a direct relationship between the battery market price and the NPC indicator value, demonstrating that the net present cost of the system increases sharply with increasing the battery system market price, while the variation in battery system size has a milder impact on the NPC costs except for high battery price scenarios.

The red curve highlighted in subplot (a) traces the minimum net present costs in the explored design space for the combination of battery system price and size that can be used to find the NPC-based optimum battery size for each market price scenario. It demonstrates that smaller battery capacities are optimal at higher battery system market prices and vice versa due to the impact of capital costs for battery systems and its interplay with the economic benefits derived by the increased self-consumption by the storage systems. More in detail, the results in subplot (a) indicate that the application of the battery energy storage systems in this case study becomes ineffective from an economic perspective when the market price of battery systems exceeds 300 €/kWh, as the cost-optimum size for such price range (i.e., ≥300 €/kWh) is found to be equal to zero. This finding is demonstrated as the minimum NPC curve tends to become vertical at zero battery capacity for the NPC-based economic viability threshold (i.e., =300 €/kWh) of battery price. Hence, the cost-efficient size of the battery energy storage system increases as the battery market prices drop equal to 2 kWh for the scenario in which the battery system’s market price is equal to 200 €/kWh and reaches over 8 kWh when the market prices ideally drop to around 100 €/kWh. The results illustrated in

Figure 3, subplot (a), provide techno-economic insights into the application of battery energy storage systems and can be utilized as a straightforward decision-making tool to design cost-optimum battery systems for BIPV-supported smart buildings and to realize the overall net present cost of the energy systems in the building under the design and evaluation process.

Furthermore, the results in subplot (b) complement the NPC analysis by focusing on investment effectiveness by measuring the saving-to-investment ratio, indicating the achievable saving potential per investment in battery energy storage systems. As it is required to base SIR analysis on a measurable investment, the minimum size of battery systems in this analysis starts at 0.5 kWh. The key observation in this analysis is that the viable investment (i.e., SIR ≥ 1) is only attainable when the market prices of the battery systems are below approximately 250 €/kWh regardless of the battery size. The optimal SIR trajectory highlighted in the red line shows that large battery system sizes (e.g., >5 kWh) are still economically viable when the market price of the battery system drops to below 200 €/kWh. As shown in subplot (b), high SIR values corresponding to the highest saving potential per investment occur for the scenarios with low market prices below 150 €/kWh and small to moderate battery size (e.g., 0.5 kWh–5 kWh), in which the SIR can reach approximately 2.

Moreover, the results demonstrate that while for the price scenarios in which the battery system’s market price exceeds the SIR-based viability threshold (250 €/kWh), the application of battery systems cannot be justified from an economic perspective. The SIR-based optimum size of battery systems is found equal to the minimum battery capacity as selected equal to 0.5 kWh for all battery system prices below 250 €/kWh. The NPC analysis indicates that the optimal size of the battery system based on NPC indicators is estimated at 2 kWh for the battery system price equal to 200 €/kWh and increases by reducing the battery system market price. This deviation in optimal results based on SIR and NPC is because the optimization based on SIR tends to prioritize the minimum investment per benefit achievable by cost saving over the study period, while the optimization based on NPC indicator prioritizes the lowest discounted cost of the system over its life cycle. Therefore, SIR-based optimization leads to a smaller battery system size compared to optimization with minimized NPC as the primary objective.

Together, the two subplots in

Figure 3 reveal that the configurations leading to minimum NPC and maximum SIR do not necessarily coincide. While the NPC-based optimization may justify larger battery systems, particularly low-price battery systems, the SIR-based optimization favors more conservative system sizing to maximize the economic return per investment. Such divergence highlights the importance of application-specific optimization and the choice of optimization objective, where the decision-makers aim to prioritize either the overall life cycle cost minimization or investment efficiency depending on the stakeholders’ objectives.

The optimization based on net present cost could be prioritized for the projects aiming to minimize the total life cycle cost within long-term investment planning (e.g., public sector), while SIR-based optimization is more suitable for decision-making in projects with capital constraints seeking for high investment efficiency.

In summary, the results presented in this section provide clear techno-economic insights into defining the boundary of cost-effective application of battery systems in BIPV-supported smart buildings. The results indicate that the market price of the battery systems must fall below the critical threshold to unlock economically viable configurations. The economic viability thresholds of the battery system’s market prices in this case study are estimated at 300 €/kWh and 250 €/kWh according to NPC and SIR indicators, respectively. These values mean that a battery system with a market price beyond these thresholds cannot be economically justified in this case study regardless of the system size. However, the decreasing trend of the market price for lithium-ion battery systems over the last decade and the prediction of further decline of the market (expected to reach approximately 100 €/kWh) in the following years highlight the potential of the economic viability of battery energy storage systems in BIPV-supported smart buildings.

Furthermore, while the results based on both NPC and SIR analysis demonstrated the cost-effective system size under each market price scenario, they show a complex interplay between the battery system size, the battery system price, and the economic optimization objective, highlighting the need for an accurate optimization process. The results provided in this section can be utilized as a decision-making tool to find the cost-optimum solutions for battery system integration by navigating the multiple plots presented in this case study. The analysis carried out further implies the necessity of policy programs such as revising the electricity tariffs and subsidy schemes and incentivizing the adoption of electrical storage in the residential building sector to encourage building energy autonomy through maximizing the self-consumption rate of BIPV-generated electricity in buildings.

5. Conclusions

Integrating electrical storage systems into different typologies of buildings equipped with BIPV has become increasingly important to enhance the self-consumption rate of BIPV-generated electricity, decreasing the dependency on the electricity grid, improving the overall energy performance of the building, and creating economic benefits and viability of photovoltaic systems in buildings. This study employed a Monte Carlo analysis to evaluate the impact of the battery system’s price on total net present costs and saving-to-investment ratio and find the cost-optimum size of the electrical storage system in a multi-family residential building in Italy.

The results provided techno-economic insight into sizing electrical storage in residential smart buildings, reaffirming the high sensitivity of effect of the battery system’s price on net present cost as the total discounted cost of the systems and energy consumption over the system’s lifetime. It also provided insight into cost trade-offs and optimal battery configuration from a financial perspective for both designers and decision-makers in energy storage development projects. The results revealed that when the market price of a battery system is higher than 250–300 €/kWh, depending on the chosen LCC indicators (i.e., NPC and SIR), the application of electrical battery storage systems in a multi-family residential building will not be economically viable. However, reducing the market price of the electrical battery storage can effectively encourage their application coupled with BIPV. The results also revealed that using different life cycle cost indicators such as NPC and SIR leads to different optimal battery sizes. For instance, if the market price of the battery systems drops to 200 €/kWh, the optimal size of the electrical storage is estimated at 2 kWh, while replacing NPC with SIR as the optimization objective decreases the cost-optimum size of the battery system to 0.5 kWh due to prioritizing lower required initial investment. The difference between the cost-optimum sizes of battery systems based on NPC and SIR indicators highlights the importance of choosing the economic indicators according to the project goals and constraints since the optimization based on NPC promotes long-term investment plans, while SIR-based optimum solutions lead to short investment payback and higher investment efficiency suitable for energy investment projects with budget limitations. Comparing the current market price, particularly considering the declining price trends (estimated to drop to approximately 100 €/kWh for lithium-ion battery system) with the obtained economic viability threshold in this study (approximately 250–300 €/kWh), it is evident that the battery energy storage systems integration into BIPV-supported smart building could be economically viable within the following years.

Electrical storage is found to be financially viable and beneficial when designed at the optimum size, while oversizing the battery systems beyond the optimum size causes excessive financial burdens due to the high required initial investment. The results also clarified that the net present cost and saving-to-investment ratio, as well as the optimum size of the electrical storage, are highly dependent on the market price of the battery systems. Such results advocate for reducing the overall initial cost of electrical storage systems to make them more feasible and viable from an economic point of view. Therefore, this finding suggests that policymakers and manufacturers focus on reducing electrical storage market prices through various solutions such as technological advancements, economies of scale, incentives, and subsidies. Thus, policymakers are encouraged to monitor the market dynamics and provide the building and energy sector with economic schemes to reduce the initial costs of the electrical storage systems to make them feasible from an economic viewpoint. The results also highlight the significant importance of accurate and optimized sizing of the battery system, as the lower size below the optimal values loses the potential economic benefits and oversizing the system causes excessive cost, leading to the unfavorable higher net present cost of the system.

Although this analysis is conducted on a residential complex in Italy, the modeling framework, including the parametric energy model, Monte Carlo optimization, and life cycle cost analysis, is transferable and replicable to other geographic contexts; however, that requires updating the environmental and economic input data. Further studies could also be suggested to evaluate the different economic schemes and financial mechanisms suggested in this article, as well as the evaluation of the electrical storage design under macro-economic parameters’ uncertainties such as the energy price variation, feed-in tariffs policies, inflation rate, and discount rate. Moreover, future studies could extend the present analysis by incorporating dynamic load behaviors such as electric vehicle charging patterns integrated into building energy systems.