Dynamic Impacts of Economic Growth, Energy Use, Urbanization, and Trade Openness on Carbon Emissions in the United Arab Emirates

Abstract

1. Introduction

2. Literature Review

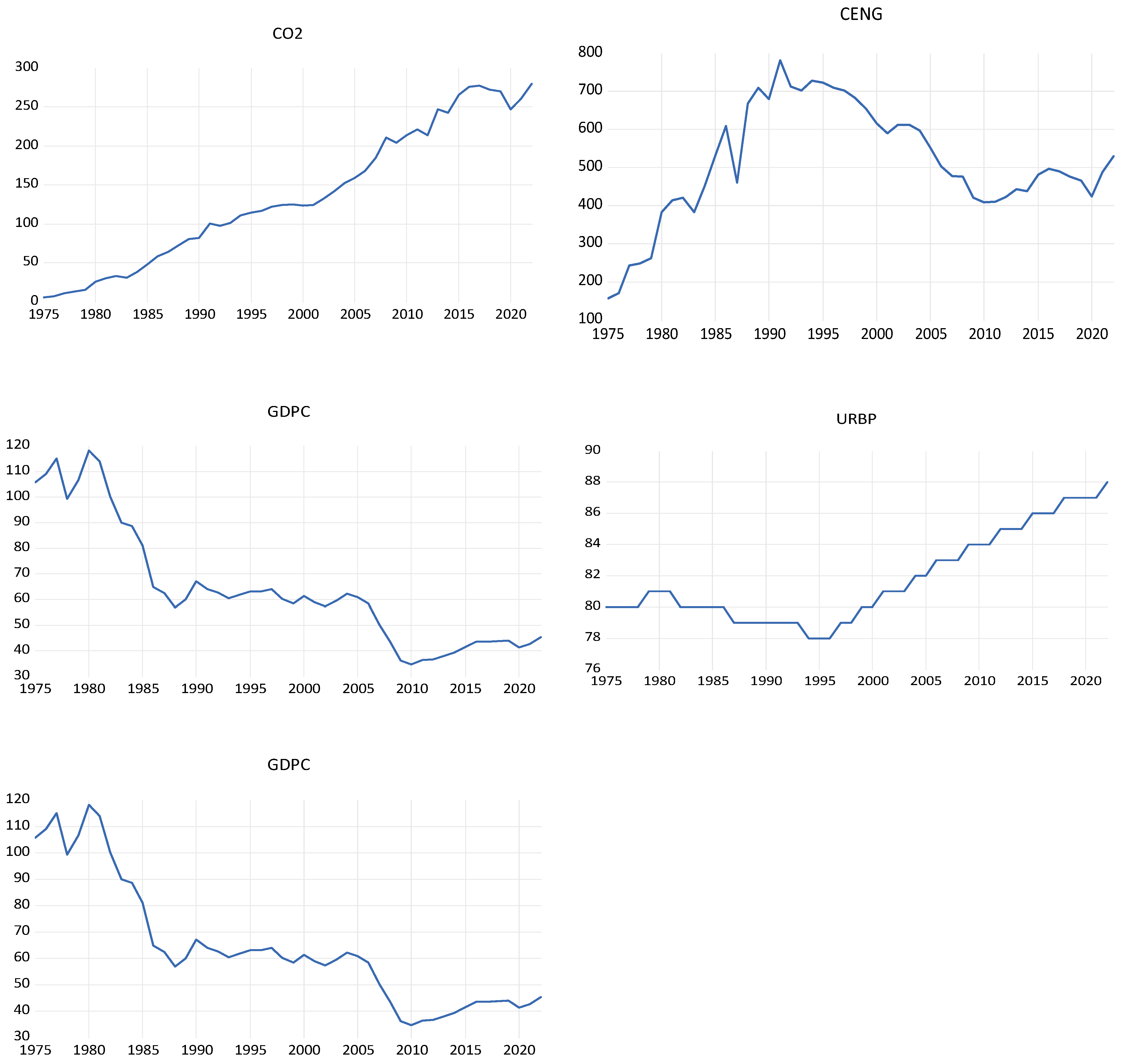

3. Data and Methodology

4. Methodology

5. Results and Discussion

6. Unit Root Tests

7. Optimal Lag Length Criteria

8. Diagnostic Statistics Tests

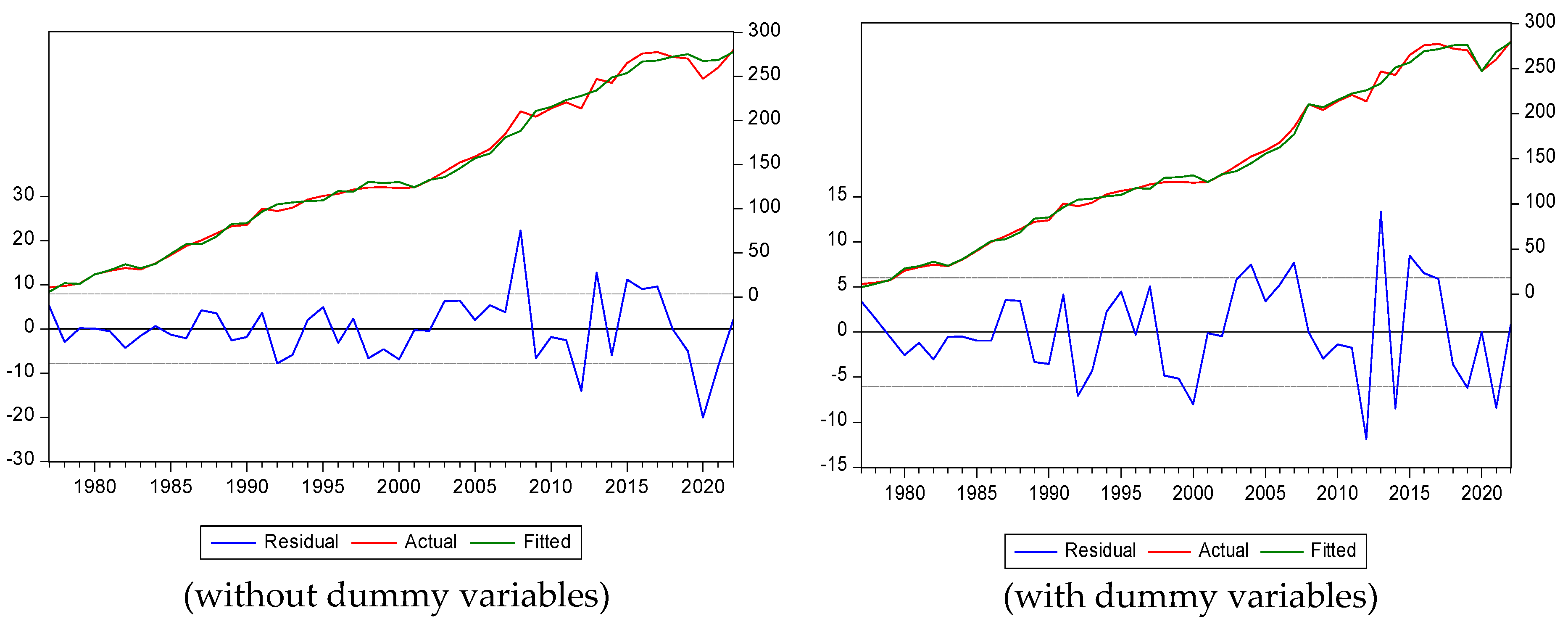

9. ARDL Bounds Cointegration Test

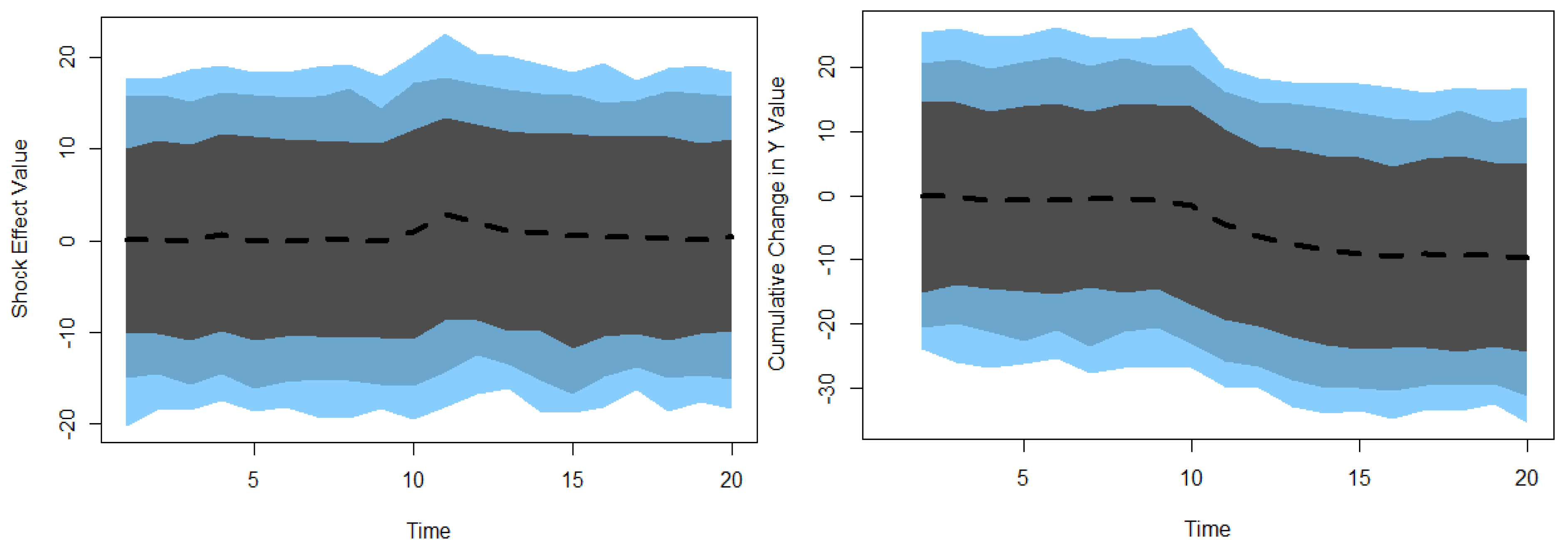

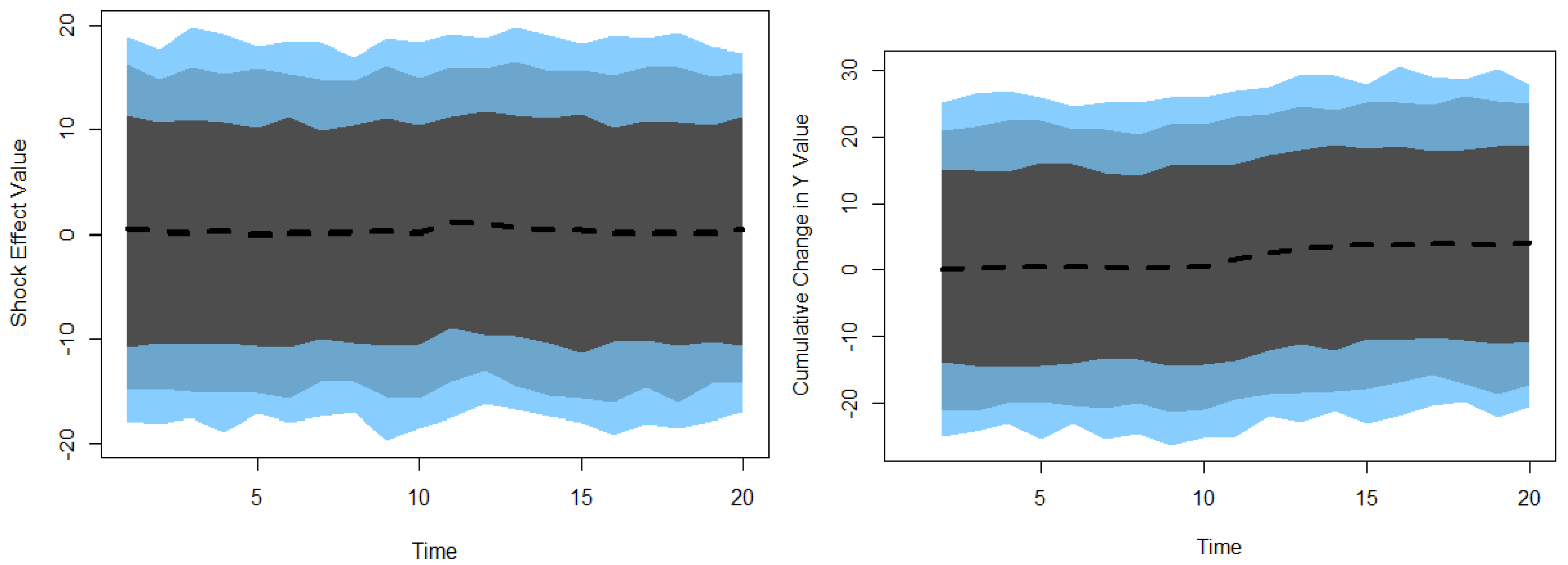

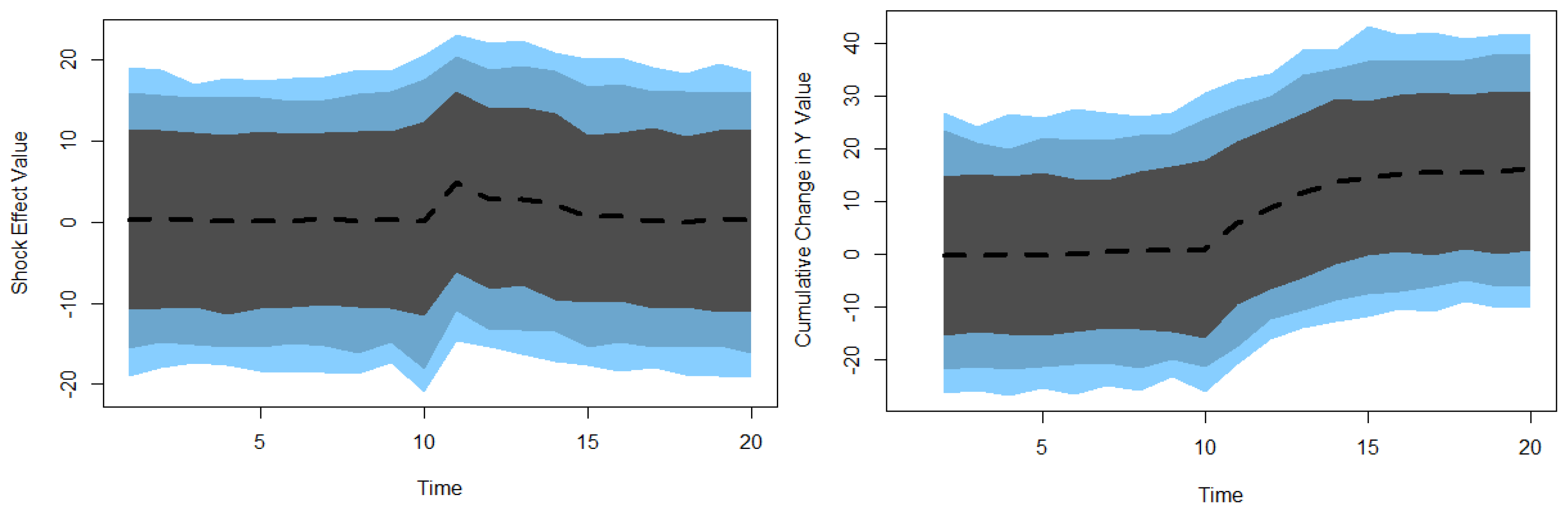

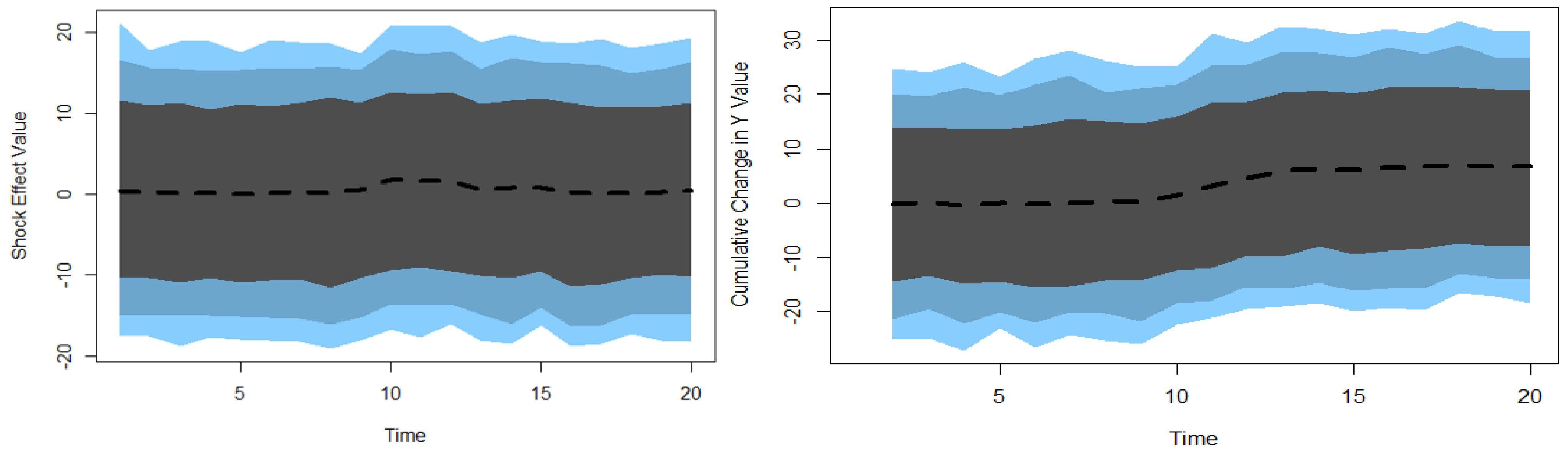

10. ARDL and DARDL Estimation Results and Discussion

11. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Olivier, J.G.J. Trends in Global CO2 and Total GHG Emissions. Trends in Global CO2 and Total Greenhouse Gas Emissions: 2021 Summary Report. PBL Netherlands Environmental Assessment Agency. 2022, pp. 1–72. Available online: https://www.pbl.nl/en/publications/trends-in-global-co2-and-total-greenhouse-gas-emissions-2021-summary-report (accessed on 3 May 2025).

- Intergovernmental Panel on Climate Change (IPCC). Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change; Core Writing Team, Lee, H., Romero, J., Eds.; Intergovernmental Panel on Climate Change (IPCC): Geneva, Switzerland, 2023; pp. 35–115. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Ahmad, P. Investigating the effects of natural resources and institutional quality on CO2 emissions during globalization mode in developing countries. Int. J. Environ. Sci. Technol. 2022, 20, 9663–9682. [Google Scholar] [CrossRef]

- UNDP. China. Available online: https://www.undp.org/china/about-china-0 (accessed on 6 December 2023).

- International Monetary Fund (IMF) World Economic Outlook Database. 2023. Available online: https://www.imf.org/en/Publications/WEO/weo-database/2023/April/groups-and-aggregates (accessed on 5 January 2024).

- Begum, R.A.; Raihan, A.; Said, M.N.M. Dynamic Impacts of Economic Growth and Forested Area on Carbon Dioxide Emissions in Malaysia. Sustainability 2020, 12, 9375. [Google Scholar] [CrossRef]

- Raihan, A.; Said, M.N.M. Cost–Benefit Analysis of Climate Change Mitigation Measures in the Forestry Sector of Peninsular Malaysia. Earth Syst. Environ. 2022, 6, 405–419. [Google Scholar] [CrossRef]

- International Energy Agency (IEA). 2023. Available online: https://www.trade.gov/country-commercial-guides/united-arab-emirates-oil-and-gas (accessed on 22 March 2024).

- Federal Competition and Statistic Center (FCSC). Open Data. Available online: https://fcsc.gov.ae/ar-ae/Pages/Footer%20Links/Careers.aspx (accessed on 8 February 2024).

- UAE. Strategies and Visions. Official Portal. Available online: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions (accessed on 11 February 2024).

- Ministry of Climate Change and Environment (MOCCAE). National Climate Change Plan of the United Arab Emirates 2017–2050. Available online: https://u.ae/en/about-the-uae/strategies-initiatives-and-awards/strategies-plans-and-visions/environment-and-energy/national-climate-change-plan-of-the-uae (accessed on 9 March 2024).

- International Energy Agency (IEA). Net Zero by 2050, A Roadmap for the Global Energy Sector 32-36. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 13 May 2024).

- Ministry of Climate Change and Environment (MOCCAE). Accelerating Action Towards a Green, Inclusive and Resilient Economy. pp. 1–69. Available online: https://www.moccae.gov.ae/ (accessed on 3 May 2025).

- World Bank. Data. Available online: https://data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=AE (accessed on 7 June 2024).

- International Energy Agency (IEA). Emissions from Oil and Gas Operations in Net Zero Transitions, a World Energy Outlook Special Report on the Oil and Gas Industry and COP28. pp. 1–33. Available online: https://www.iea.org/reports/emissions-from-oil-and-gas-operations-in-net-zero-transitions (accessed on 21 June 2024).

- Dinda, S. Environmental Kuznets Curve Hypothesis: A Survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Hailemariam, A.; Dzhumashev, R.; Shahbaz, M. Carbon emissions, income inequality and economic development. Empir. Econ. 2020, 59, 1139–1159. [Google Scholar] [CrossRef]

- Dahmani, M.; Mabrouki, M.; Ragni, L. Decoupling Analysis of Greenhouse Gas Emissions from Economic Growth: A Case Study of Tunisia. Energies 2021, 14, 7550. [Google Scholar] [CrossRef]

- Mitic, P.; Fedajev, A.; Radulescu, M.; Rehman, A. The relationship between CO2 emissions, economic growth, available energy, and employment in SEE countries. Environ. Sci. Pollut. Res. 2023, 30, 16140–16155. [Google Scholar] [CrossRef]

- Khan, M.I.; Teng, J.Z.; Khan, M.K. The impact of macroeconomic and financial development on carbon dioxide emissions in Pakistan: Evidence with a novel dynamic simulated ARDL approach. Environ. Sci. Pollut. Res. 2020, 27, 39560–39571. [Google Scholar] [CrossRef]

- Ajide, K.B.; Ibrahim, R.L. Threshold effects of capital investments on carbon emissions in G20 economies. Environ. Sci. Pollut. Res. 2021, 28, 39052–39070. [Google Scholar] [CrossRef]

- Adeleye, B.N.; Osabohien, R.; Lawal, A.I.; Alwis, T.D. Energy use and the role of per capita income on carbon emissions in African countries. PLoS ONE 2021, 16, e0259488. [Google Scholar] [CrossRef]

- Dimitriadis, D.; Katrakilidis, C.; Karakotsios, A. Investigating the dynamic linkages among carbon dioxide emissions, economic growth, and renewable and non-renewable energy consumption: Evidence from developing countries. Environ. Sci. Pollut. Res. 2021, 28, 40917–40928. [Google Scholar] [CrossRef] [PubMed]

- Espoir, D.K.; Sunge, R.; Bannor, F. Exploring the dynamic effect of economic growth on carbon dioxide emissions in Africa: Evidence from panel PMG estimator. Environ. Sci. Pollut. Res. 2023, 30, 112959–112976. [Google Scholar] [CrossRef] [PubMed]

- Raihan, A.; Tuspekova, A. Dynamic impacts of economic growth, energy use, urbanization, agricultural productivity, and forested area on carbon emissions: New insights from Kazakhstan. World Dev. Sustain. 2022, 1, 100019. [Google Scholar] [CrossRef]

- Solarin, S.A.; Nathaniel, S.P.; Bekun, F.V.; Okunola, A.; Alhassan, A. Towards achieving environmental sustainability: Environmental quality versus economic growth in a developing economy on ecological footprint via dynamic simulations of ARDL. Environ. Sci. Pollut. Res. 2021, 28, 17942–17959. [Google Scholar] [CrossRef] [PubMed]

- Raihan, A.; Tuspekova, A. Dynamic impacts of economic growth, renewable energy use, urbanization, industrialization, tourism, agriculture, and forests on carbon emissions in Turkey. Carbon Res. 2022, 1, 20. [Google Scholar] [CrossRef]

- Orhan, A.; Adebayo, T.S.; Genc, S.Y.; Kirikkaleli, D. Investigating the Linkage between Economic Growth and Environmental Sustainability in India: Do Agriculture and Trade Openness Matter? Sustainability 2021, 13, 4753. [Google Scholar] [CrossRef]

- Hossain, M.E.; Soumen, R.E.J.; Sourav, M.; Saha, S.M.; Onwe, J.C.; Nwulu, N.; Bekun, V.B.; Taha, A. Can Energy Efficiency Help in Achieving Carbon-Neutrality Pledges? A Developing Country Perspective Using Dynamic ARDL Simulations. Sustainability 2021, 14, 7537. [Google Scholar] [CrossRef]

- Shaheen, A.; Jinyong, S.J.; Sadia, A.S.; Shafaq, S.A.; Muhammad, H.M. The Dynamic Linkage between Income, Energy Consumption, Urbanization and Carbon Emissions in Pakistan. Pol. J. Environ. Stud. 2020, 29, 267–276. [Google Scholar] [CrossRef] [PubMed]

- Bekhet, H.A.; Othman, N. Impact of Urbanization Growth on Malaysia CO2 Emissions: Evidence from the Dynamic Relationship. J. Clean. Prod. 2017, 154, 374–388. [Google Scholar] [CrossRef]

- Yusuf, A. Dynamic effects of energy consumption, economic growth, international trade and urbanization on environmental degradation in Nigeria. Energy Strategy Rev. 2023, 50, 101228. [Google Scholar] [CrossRef]

- Jordan, S.; Philips, A.Q. Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J. 2018, 18, 902–923. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In Chapter 11 in Econometrics and Economic Theory in the 20th Century the Ragnar Frisch Centennial Symposium; Strom, S., Ed.; Cambridge University Press: Cambridge, UK, 1999; pp. 371–413. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches the analysis of level relationships. J. Appl. Econom. 2001, 3, 289–326. [Google Scholar] [CrossRef]

- Ahmed, Y.N.; Delin, H. Current Situation of Egyptian Cotton: Econometrics Study Using ARDL Model. J. Agric. Sci. 2019, 11, 88–97. [Google Scholar] [CrossRef]

- Sarkodie, A.S.; Owusu, P.A. The relationship between carbon dioxide and agriculture in Ghana: A comparison of VECM and ARDL model. Environ. Sci. Pollut. Res. 2016, 23, 10968–10982. [Google Scholar] [CrossRef]

- Ali, S.; Zubair, M.; Hussain, S. The combined effect of climatic factors and technical advancement on yield of sugarcane by using ARDL approach: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2021, 28, 39787–39804. [Google Scholar] [CrossRef]

- Voumik, L.C.; Ridwan, M. Impact of FDI, industrialization, and education on the environment in Argentina: ARDL approach. Heliyon 2023, 9, e12872. [Google Scholar] [CrossRef] [PubMed]

- Raj, P.; Kalluru, S.R. Does crime impede economic growth? An evidence from India. Cogent Soc. Sci. 2023, 9, 2196814. [Google Scholar] [CrossRef]

- Shaari, M.S.; Nasir, N.M.; Harun, N.H.; Muhsain, S.N.F.; Ridzuan, A.R. Exploring the Relationship between Tertiary Education and Child Maltreatment: An ARDL Analysis. J. Hum. Earth Future 2023, 4, 10–22. [Google Scholar] [CrossRef]

- Menegaki, A.N. The ARDL Method in the Energy-Growth Nexus Field; Best Implementation Strategies, economies. Economies 2019, 7, 105. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegrating vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. Higher education, real income, and real investment in China: Evidence from granger causality tests. Educ. Econ. 2007, 14, 107–125. [Google Scholar] [CrossRef]

- Sultanuzzaman, M.R.; Hongzhong, F.; Akash, M.; Wang, B.; Shakij, U.S.M. The role of FDI inflows and export on economic growth in Sri Lanka: An ARDL approach. Cogent Econ. Financ. 2018, 6, 1518116. [Google Scholar] [CrossRef]

- Shin, Y.; Yu, B.; Greenwood-Nimmo, M. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmid; Sickles, R.C., Horrace, W.C., Eds.; SSRN; Springer: New York, NY, USA, 2014; pp. 281–314. [Google Scholar] [CrossRef]

- Allen, D.E.; McAleer, M. A nonlinear autoregressive distributed lag (NARDL) analysis of the FTSE and S&P500 indexes. Risks 2021, 9, 195. [Google Scholar] [CrossRef]

- Danish; Ulucak, R. Linking biomass energy and CO2 emissions in China using dynamic Autoregressive-Distributed Lag simulations. J. Clean. Prod. 2020, 250, 119533. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Strezov, V.; Weldekidan, H.; Asamoah, E.F.; Owusu, P.A.; Doyi, I.N.Y. Environmental sustainability assessment using dynamic Autoregressive-Distributed Lag simulations—Nexus between greenhouse gas emissions, biomass energy, food and economic growth. Sci. Total Environ. 2019, 668, 318–332. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Zhang, Y.Z.; Arshian, S.; Golpira, H. Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: Evidence from panel ARDL. Environ. Sci. Pollut. Res. 2020, 27, 45675–45687. [Google Scholar] [CrossRef]

- Hannan, E.J.; Quinn, B.G. The determination of the order of an autoregression. J. R. Stat. Soc. Ser. B 1979, 2, 190–195. [Google Scholar] [CrossRef]

- Yaniv, O.; Schwartz, B. Criterion for loop stability in MIMO feedback systems having an uncertain plant. Int. J. Control 1991, 3, 527–539. [Google Scholar] [CrossRef]

- Bruns, S.B.; Stern, D.I. Lag length selection and p-hacking in Granger causality testing: Prevalence and performance of meta-regression models. Empir. Econ. 2019, 56, 797–830. [Google Scholar] [CrossRef]

- Othman, A.H.A.; Syed, M.A.; Razali, H.; Azman, B.M.N. The Future of the Banking System under the Dominance and Development of the Cryptocurrency Industry: Empirical Evidence from Cointegration Analysis. J. Wealth Manag. 2019, 2, 109–127. [Google Scholar] [CrossRef]

- Kripfganz, S.; Schneider, D.C. Response surface regressions for critical value bounds and approximate p-values in equilibrium correction models. Oxf. Bull. Econ. Stat. 2020, 82, 1456–1481. [Google Scholar] [CrossRef]

- Canm, M.; Gozgor, G. Dynamic Relationships Among CO2 Emissions, Energy Consumption. Economic Growth, and Economic Complexity in France. In Energy Consumption, Economic Growth, and Economic Complexity in France; SSRN; University Library of Munich: Munich, Germany, 2016; pp. 1–21. [Google Scholar] [CrossRef]

- Leal, P.H.; Marques, A.C. The evolution of the environmental Kuznets curve hypothesis assessment: A literature review under a critical analysis perspective. Heliyon 2022, 8, e11521. [Google Scholar] [CrossRef]

- British Petroleum. Data. Available online: https://www.bp.com/en/global/corporate/energy-economics.html (accessed on 21 July 2024).

- Ministry of Climate Change and Environment (MOCCAE). Annual Report 2019/2020. Available online: https://www.moccae.gov.ae/en/knowledge-and-statistics/green-economy.aspx (accessed on 25 July 2024).

- Ministry of Climate Change and Environment (MOCCAE). UAE Green Jobs Program: Jobs and Skills for the UAE’s Green Economy Transformation. Available online: https://worldgreeneconomy.org/greenjobs.pdf (accessed on 20 August 2024).

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef]

- Lv, Z.; Xu, T. Trade openness, urbanization, and CO2 emissions: Dynamic panel data analysis of middle-income countries. J. Int. Trade Econ. Dev. 2019, 28, 317–330. [Google Scholar] [CrossRef]

- Cetin, M.; Ecevit, E.; Yucel, A.G. The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 36589–36603. [Google Scholar] [CrossRef]

- Tran, V.N. The environmental effects of trade openness in developing countries: Conflict or cooperation? Environ. Sci. Pollut. Res. 2020, 27, 19783–19797. [Google Scholar] [CrossRef]

- Udeagha, M.C.; Ngepah, N. Does trade openness mitigate the environmental degradation in South Africa? Environ. Sci. Pollut. Res. 2022, 29, 19352–19377. [Google Scholar] [CrossRef]

- Chhabra, M.; Giri, A.K.; Kumar, A. Do trade openness and institutional quality contribute to carbon emission reduction? Evidence from BRICS countries. Environ. Sci. Pollut. Res. 2023, 30, 50986–51002. [Google Scholar] [CrossRef]

- Wang, Q.; Zhang, F. The effects of trade openness on decoupling carbon emissions from economic growth—Evidence from 182 countries. J. Clean. Prod. 2021, 279, 123838. [Google Scholar] [CrossRef] [PubMed]

- Al-Ayouty, I.; Hassaballa, H.; Rizk, R. Clean manufacturing industries and environmental quality: The case of Egypt. Environ. Dev. 2017, 21, 19–25. [Google Scholar] [CrossRef]

- UNCTAD. World Investment Report. Available online: https://unctad.org/system/files/official-document/wir2023_en.pdf (accessed on 7 August 2024).

- Gillani, S.; Sultana, B. Empirical Relationship between Economic Growth, Energy Consumption and CO2 Emissions: Evidence from ASEAN Countries. iRASD J. Energy Environ. 2020, 1, 83–93. [Google Scholar] [CrossRef]

- Sufyanullah, K.; Arshad, K.; Sufyan, A.M.A. Does emission of carbon dioxide is impacted by urbanization? An empirical study of urbanization, energy consumption, economic growth and carbon emissions—Using ARDL bound testing approach. Energy Policy 2022, 164, 112908. [Google Scholar] [CrossRef]

- Ullah, A.; Munir, S.; Badshah, S.L.; Khan, N.; Ghani, L.; Poulson, B.G.; Emwas, A.H.; Jaremko, M. Important Flavonoids and Their Role as a Therapeutic Agent. Molecules 2020, 25, 5243. [Google Scholar] [CrossRef]

| Variables | Definition | Sources |

|---|---|---|

| gdpc | Gross Domestic Product per capita (100 = 2015) in US $ | (World Bank, 2023) https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.KD?locations = AE (accessed on 7 April 2024) |

| urbp | Urban population (% of total population) | (World Bank, 2023) https://data.worldbank.org/indicator/SP.URB.TOTL.IN.ZS?locations=AE (accessed on 7 April 2024) |

| trad | Trade openness (total trade of merchandise and services of exports and imports % of GDP) | (UNCTAD, 2023) https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx (accessed on 9 April 2024) |

| ceng | Energy consumption per capita | (British Petroleum, 2023) https://www.bp.com/en/global/corporate/energy-economics.html (accessed on 15 April 2024) |

| CO2 | Carbon dioxide emissions per capita (Million tons/population) | https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html (accessed on 22 May 2024) https://data.worldbank.org/indicator/SP.POP.TOTL?locations=AE (accessed on 22 May 2024) |

| CO2 | CENG | GDPC | URBP | TRAD | Residuals | |

|---|---|---|---|---|---|---|

| Mean | 135.7125 | 512.8937 | 63.99771 | 81.77083 | 101.8604 | 1.622213 |

| Median | 123.8500 | 489.2500 | 60.25000 | 81.00000 | 85.05000 | 1.010533 |

| Maximum | 280.0000 | 782.1000 | 118.1000 | 88.00000 | 187.8000 | 3,632,316 |

| Minimum | 5.300000 | 156.7000 | 34.50000 | 78.00000 | 50.30000 | −3,070,813 |

| Std. Dev. | 88.50509 | 151.6864 | 23.78209 | 2.926326 | 41.09131 | 13.52234 |

| Skewness | 0.196419 | −0.339155 | 0.921556 | 0.655782 | 0.555025 | 0.033518 |

| Kurtosis | 1.789443 | 2.666330 | 2.802366 | 2.106992 | 1.896642 | 3.461036 |

| Jarque–Bera | 3.239539 | 1.142880 | 6.872248 | 5.035322 | 4.899222 | 0.434096 |

| Probability | 0.197944 | 0.564712 | 0.032189 | 0.080648 | 0.086327 | 0.804891 |

| Sum | 6514.200 | 24,618.90 | 3071.890 | 3925.000 | 4889.300 | |

| Sum Sq. Dev. | 368,158.1 | 1,081,412 | 26,582.62 | 402.4792 | 79,359.29 | |

| Observations | 48 | 48 | 48 | 48 | 48 |

| CO2 | CENG | GDPC | TRAD | URBP | |

|---|---|---|---|---|---|

| CO2 | 1.000000 | ||||

| CENG | 0.128722 | 1.000000 | |||

| GDPC | −0.873793 | −0.410460 | 1.000000 | ||

| TRAD | 0.948409 | −0.092684 | −0.748544 | 1.000000 | |

| URBP | 0.846007 | −0.333429 | −0.558712 | 0.910357 | 1.000000 |

| Name of Variables | ADF | PP |

|---|---|---|

| Level—Intercept | ||

| CO2 | −0.000799 | −0.051173 |

| gdpc | −1.946174 | −1.604992 |

| ceng | −2.476056 | −2.480298 |

| urbp | 1.196783 | 1.395271 |

| trad | 1.111451 | 0.997145 |

| First difference—Intercept | ||

| CO2 | −7.453174 *** | −7.451163 *** |

| gdpc | −5.381963 *** | −5.328618 *** |

| ceng | −7.765042 *** | −7.694939 *** |

| urbp | −7.147115 *** | −7.202300 *** |

| trad | −5.505809 *** | −5.479583 *** |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −900.3810 | NA | 5.133311 | 41.15368 | 41.35643 | 41.22887 |

| 1 | −687.1708 | 368.2722 | 99715813 | 32.59867 | 33.81517 * | 33.04981 * |

| 2 | −656.3285 | 46.26340 * | 80025633 * | 32.33311 | 34.56335 | 33.16019 |

| 3 | −632.5539 | 30.25859 | 95416859 | 32.38881 | 35.63280 | 33.59184 |

| 4 | −603.5024 | 30.37204 | 1.02e+08 | 32.20465 * | 36.46238 | 33.78362 |

| Test | (F Value) | (p Value) | |

|---|---|---|---|

| Breusch–Godfrey Serial Correlation LM test | 0.820568 | 0.4487 | No serial coloration |

| ARCH Heteroscedasticity test | 0.263196 | 0.7699 | No heteroscedasticity |

| Ramsey RESET test | 2.577443 | 0.0907 | The model is specified correctly |

| Jarque–Bera normality test | 3.544464 | 0.169953 | Estimated residuals are normally distributed |

| Calculated Values | Kripfganz and Schneider (2020) Critical Values | |||||

|---|---|---|---|---|---|---|

| F-statistic 9.9088794 | 10% | 5% | 1% | |||

| I(0) | I(1) | I (0) | I(1) | I(0) | I(1) | |

| 2.402 | 3.345 | 2.850 | 3.905 | 3.892 | 5.173 | |

| 2.372 | 3.320 | 2.823 | 3.872 | 3.845 | 5.150 | |

| 2.200 | 3.090 | 2.560 | 3.490 | 3.290 | 4.370 | |

| Short and Long Run ARDL Cointegration Estimation Coefficients | |

|---|---|

| −0.292210 (0.0000) *** | |

| [−8.258111] | |

| c | −971.5859 (0.0007) *** |

| [-3.737654] | |

| gdpct−1 | −0.623702 (0.0285) ** |

| [−2.288064] | |

| cengt−1 | 0.168313 (0.0001) *** |

| [4.304784] | |

| urbpt−1 | 11.63541(0.0010) *** |

| [3.597406] | |

| tradt−1 | 1.241712 (0.0000) *** |

| [4.922813] | |

| D(trad) | 0.265802 (0.0400) ** |

| [2.136070] | |

| D_2008 | 22.07872 (0.0009) *** |

| [3.646860] | |

| D_2012 | −14.54701 (0.0186) *** |

| [−2.471032] | |

| D_2013 | 20.09106 (0.0019) *** |

| [3.362280] | |

| D_2020 | −24.57638 (0.0002) *** |

| [−4.179439] | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adela, H.A.; Aldhaheri, W.B.; Ali, A.H. Dynamic Impacts of Economic Growth, Energy Use, Urbanization, and Trade Openness on Carbon Emissions in the United Arab Emirates. Sustainability 2025, 17, 5823. https://doi.org/10.3390/su17135823

Adela HA, Aldhaheri WB, Ali AH. Dynamic Impacts of Economic Growth, Energy Use, Urbanization, and Trade Openness on Carbon Emissions in the United Arab Emirates. Sustainability. 2025; 17(13):5823. https://doi.org/10.3390/su17135823

Chicago/Turabian StyleAdela, Hatem Ahmed, Wadeema BinHamoodah Aldhaheri, and Ahmed Hatem Ali. 2025. "Dynamic Impacts of Economic Growth, Energy Use, Urbanization, and Trade Openness on Carbon Emissions in the United Arab Emirates" Sustainability 17, no. 13: 5823. https://doi.org/10.3390/su17135823

APA StyleAdela, H. A., Aldhaheri, W. B., & Ali, A. H. (2025). Dynamic Impacts of Economic Growth, Energy Use, Urbanization, and Trade Openness on Carbon Emissions in the United Arab Emirates. Sustainability, 17(13), 5823. https://doi.org/10.3390/su17135823