4.1. Econometric Modeling

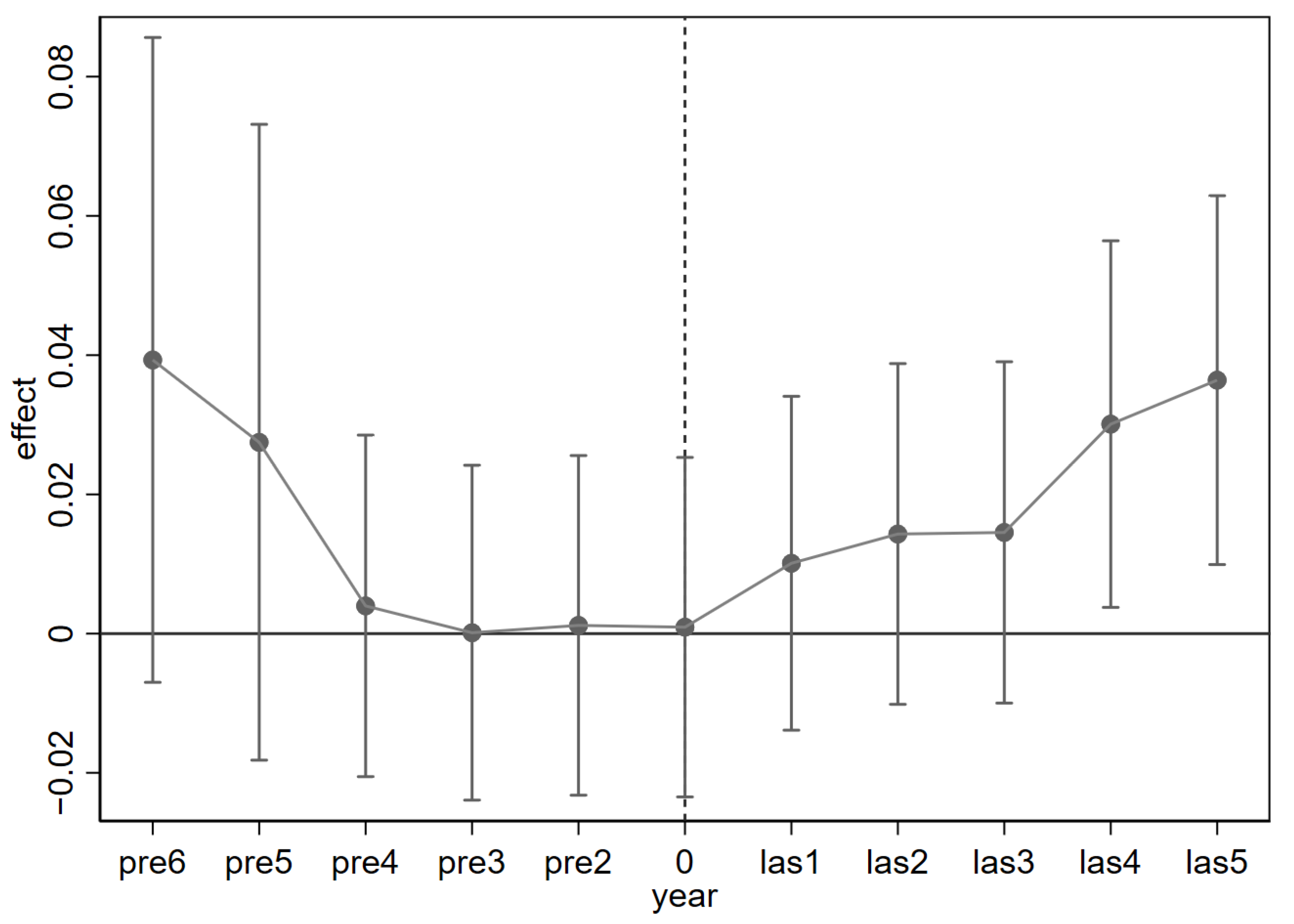

This study employs a staggered DID approach to estimate the impact of pilot zones for green finance reform and innovation policy on energy resilience. The staggered DID model constructs dual-dimensional differentials across the sample individuals and the temporal phases by setting up an experimental group, a control group, and different policy implementation time points. The model incorporates individual and time-fixed effects to eliminate unobservable factors that vary exclusively across time or individuals, thereby identifying the net policy effect. This study utilizes panel data covering 30 provinces from 2013 to 2022. Adopting the research method of Guo et al. [

36], the study constructs the DID model by introducing time dummy variables (Time) and city dummy variables (Treat) as follows:

where subscripts

i and

t denote province and year respectively.

represents the explained variable, representing provincial energy resilience intensity.

is the explanatory variable for the policy of pilot zones for green finance reform and innovations, which takes the value of 1 for the experimental group implementing the policy and 0 for the control group.

denotes control variables that affect energy resilience and varies with

i and

t.

represents time-fixed effects and region-fixed effects, controlling for factors that affect the strength of energy resilience but do not vary over time.

denotes time-fixed effects, controlling for temporal factors that have an impact over time.

represents the random error term.

represents core regression coefficients, reflecting the net policy effect of the establishment of pilot zones on energy resilience.

4.3. Variables’ Selection

The explained variable [

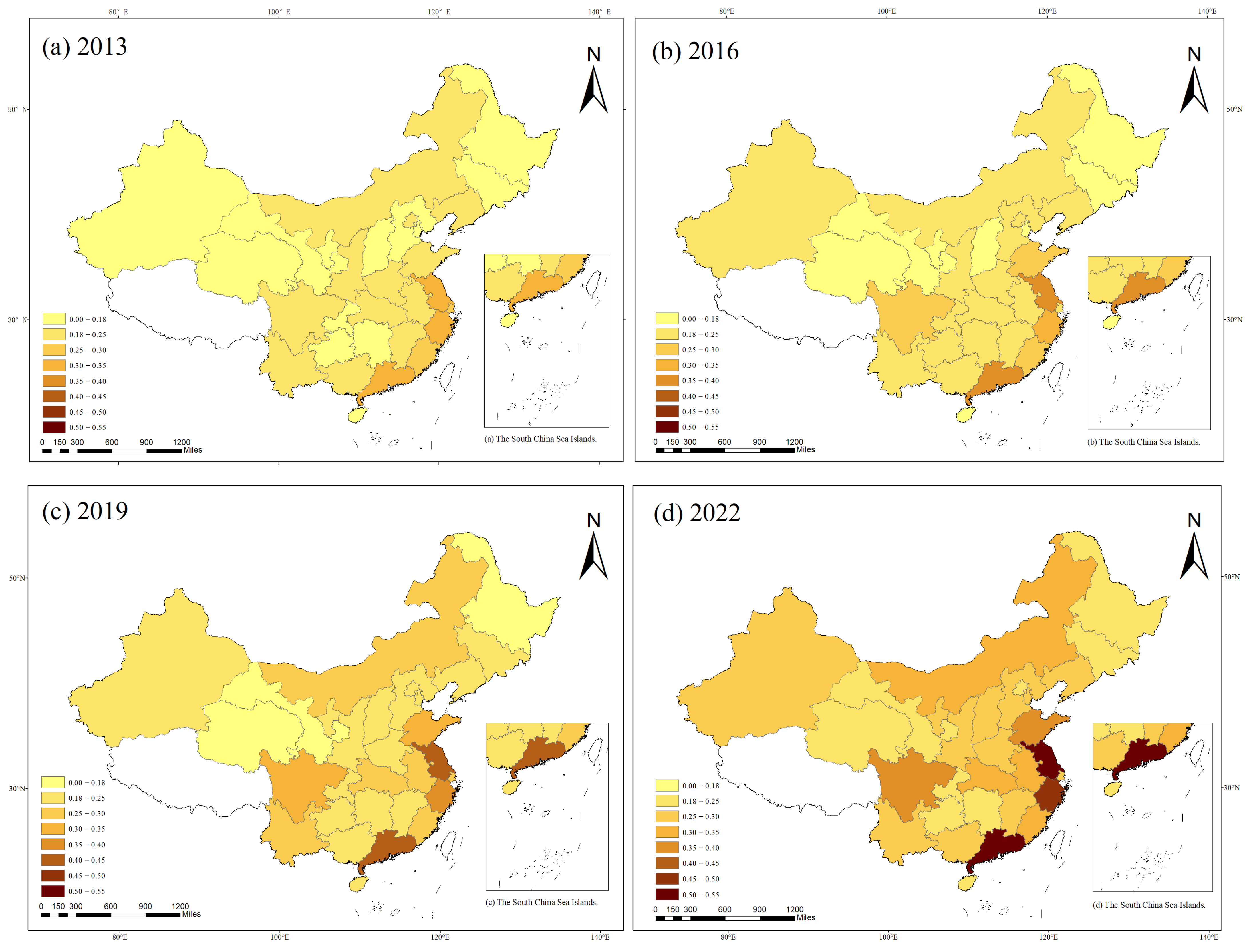

37] in this study represents provincial energy resilience indices. Given the nascent stage of energy resilience research, no standardized metric currently exists to quantify resilience intensity. In this paper, the characteristics of the energy system and the perturbation factors are considered. We construct a comprehensive evaluation system with 15 indicators across economic, social, resource, and environmental dimensions, building on Gatto et al. and Nepal et al.’s frameworks [

37,

38]. Utilizing the entropy method, we calculate four sub-indices: economic energy resilience; social energy resilience; environmental energy resilience; and energy endowment resilience. This allows for a multidimensional analysis of green finance policy impacts.

The complete indicator system is detailed in

Table 2.

Economic resilience represents the financial support for energy system operations, denoting the capacity of economic systems to revert to equilibrium states following perturbations induced by energy system transformations. The operational quality of economic systems significantly affects energy construction and energy costs. Economic structure reflects regional economic development levels. Economic potential facilitates technological advancement in the energy sector and strengthens energy system adaptability. Economic potential facilitates technological advancement in the energy sector and strengthens energy system adaptability. The decoupling effect between economic growth and energy consumption reflects the quality of economic growth, signaling that the structure of energy demand is moving towards diversification and greening. The triad of superior economic performance, optimized structural configuration, and enhanced economic potential collectively reinforce energy systems’ resistance to perturbations.

Social resilience refers to infrastructural support for energy resistance capabilities across production, transportation, and communication domains. It ensures engineering safeguards for energy systems to restore stability under external shocks, and is operationalized through two dimensions: supply and transportation infrastructure and information transmission. Effective management and control of energy transport systems are critical for building resilient multi-energy supply systems. This capability also enhances the system’s ability to address diverse challenges [

39]. Insufficient energy supply capacity can readily trigger energy crises. Therefore, assessment frameworks for energy resilience must also incorporate a nation’s practical capacity to maintain the stability and reliability of its energy supply. Investment in energy supply provides security safeguards for energy infrastructure. Investment in technologies such as information transmission fosters innovation and facilitates the integrated optimization of energy by balancing environmental, economic, and social benefits [

40]. Supply and transportation infrastructure incorporates indicators such as total electricity generation and total length of gas supply pipelines. The dimension of information transmission dimension systems encompasses metrics like internet broadband access ports and mobile phone penetration rates.

Resource resilience is the material foundation for energy adaptability. It represents the contribution of each province’s own resource endowment to the restoration of a steady state when the local energy system is subject to fluctuations. This resilience manifests through two dimensions: energy endowment and energy consumption. Structural shifts in energy consumption indirectly reflect diversification levels of energy utilization types. Substantial resource reserves, diversified energy types, and multi-channel supply systems mitigate the risks associated with energy source concentration, thereby effectively resisting external disruptions. At the energy endowment level, the indicator is represented by the sum of per capita natural gas production and per capita electricity generation. Energy consumption encompasses per capita energy consumption and the ratio of the combined output of natural gas and electricity to total energy consumption.

Environmental resilience is the material basis for energy resilience. It reflects provincial ecosystems’ capacity to regain stability after energy system fluctuations under safe carbon reduction constraints. This resilience encompasses two dimensions: ecological security and environmental pollution. While ecosystems provide essential resources for human survival, anthropogenic activities exert discernible stress on ecological systems. Environmental pollution mirrors ecosystem degradation induced by energy consumption patterns. Environmental pollution reflects the destruction of ecosystems by energy consumption. The magnitude of ecological damage positively correlates with disaster risk probability. Ecological security can reduce environmental pollution and increase the resilience of energy systems to natural disasters. Increasing forest cover rate contributes to reducing atmospheric greenhouse gas concentrations, thereby advancing the achievement of carbon neutrality [

41]. Simultaneously, forests perform multiple functions, including biodiversity conservation and the provision of diverse ecosystem services. Forests can mitigate natural disasters and influence ecosystems, consequently affecting energy resilience. Furthermore, pollutant emissions constitute a critical component that cannot be overlooked in the assessment of energy resilience [

42].

Explanatory variable. The core explanatory variable DID is the interaction term between regional dummy variables and time dummy variables. The regional dummy variable is coded as 1 for provinces designated as pilot zones for green finance reform and innovations, and 0 otherwise. The temporal dummy variable is coded as 1 from the policy implementation year onwards, and 0 prior to implementation.

Control variables. To mitigate estimation bias from other variables, this paper draws from the research conducted by Zhang et al. [

43], Xu et al. [

44], Lin and Zhou [

45], and Nepal et al. [

38]. The following control variables were selected: ① Economic situation (PGDP) is measured by GDP per capita. ② Environmental regulation (ER) is expressed by local government expenditure on environmental protection. ③ Urbanization rate (UR) is calculated as urban population proportion of total resident population. ④ Financial development [

13] is quantified by the ratio of total deposits and loans of financial institutions to GDP at year-end. ⑤ The degree of industrial agglomeration [

19] is expressed as the ratio of provincial industrial value added to the total industrial value added.

Mediator variables. In examining the link between energy resilience and green finance, this study designed a mechanism test based on a theoretical model. The following two intermediate variables were used in the empirical process to further explore the mediating effects of industrial structure transformation and green technology innovation in the relationship. Industrial structure (IS) is expressed as the proportion of regional tertiary industry output value to GDP [

36]. Green technology innovation (GTI) is quantified by the annual count of green patent applications at the provincial level [

46]. Details on the definition and source of data can be found in

Table 3.