Abstract

The objective of the study is to demonstrate how cognitive chief executive officers (CEOs) influence corporate social and environmental performance under the moderating impact of innovation, supervisors and cash holdings. Significantly, we have formulated cognitive CEOs using data envelope analysis while considering the specific attributes of the incumbent CEO (by considering the age, tenure, goodwill, education and tacit knowledge of CEOs). The research approach aims to elucidate that cognitive CEOs strongly invigorate social and environmental performance. However, the moderating role of corporate innovation weakens this connection, whereas the moderating role of supervisors invigorates this relationship. In contrast, cash hoarding deters social and environmental performance through its moderating effectiveness. Conclusively, theoretical contribution illuminates the stakeholder theory frame of reference while emphasizing the identification of corporate social and environmental performance. Specifically, the role of cognitive CEOs has been signified as a promoter of such strategies, which indicate their orientation toward social responsibility. Empirical underpinnings illustrate the impact of corporate innovation, supervisors and cash holdings, which asymmetrically influence social and environmental performance. The recommendations of the research results refer to the characterization of the optimal attributes of cognitive CEOs that are essential to enhance social and environmental performance.

1. Introduction

Organizational theorists emphasize the importance of corporate governance that can be performed efficiently under the vigilant guidance of the CEO [1,2]. Advanced economies have improved their corporate mechanism while invigorating the top management team under the pivotal role of the chief executive officer [3,4]. With the emergence of environmental concerns, not only advanced but also emerging economies have orientated their organizations toward the adoption of corporate social and environmental responsibility [5]. However, without the endorsement of the CEO, it is impossible to launch such strategies within an organization [6]. Of note, distinct attributes of CEOs have been contemplated to assess whether such characteristics orient an incumbent CEO toward social and environmental responsibility or not. Specifically, the ways that the cognitive ability of an CEO can asymmetrically influence corporate social and environmental responsibility require exploration [7,8].

Convincingly, conscious cognitive activity in our complex global business environment landscape is a crucial factor for innovation [2]. The top companies are those economic entities that perceive the importance of research and innovation as a main economic goal and support this approach with a coherent business strategy and sufficient investments [9]. During past decades, the underlying assumptions of the stakeholder perspective enunciate the crossroads of political and business decisions in modern business literature, illustrating the link between business and society [10]. To integrate the points of view of society and the economic environment within the top management team, CEOs should require cognitive capability [11]. As the CEO makes progress, he or she can gain greater role-specific knowledge or expertise, which cause cognitive complexities to flourish [12,13].

Comprehensibly, the reciprocal revolutionary change caused by the cognitive complexity of leaders can recognize the proactive steps of corporate sustainability over time. In a study on cognitive complexity and sustainability, it was demonstrated that CEOs acquire more complex mindsets while revitalizing the comprehensive approach to sustainability and adopt dynamic measures that ultimately increase the growth of firms. Meanwhile, [14] it has been witnessed that the length of CEO tenure intensifies cognitive complexity, which assists them in strategic decisions undauntedly.

Distinctively, among Chinese firms, incumbent CEOs are bound to perform splendidly under the excessive supervision of government, specifically within state-owned enterprises. However, Chinese firms have not only adopted innovative strategies but also endorsed corporate social and environmental activities. Chinese companies have been transformed from imitating to innovation [15,16]. In this regard, a large amount of funds have been allocated to research and development to promote organizational innovation. Unfortunately, as new corporate structures, Chinese firms have been alleged to be involved in the agency cost problem [17]. In this regard, it would be detrimental for the upper echelon of Chinese firms to hold cash. Furthermore, political indulgence among the upper echelon can deteriorate the already miserable plight [18]. In such circumstances, it is challenging for the incumbent CEO to perceive, through his or her cognition, how to manipulate the funds either in research and development or socially responsible activities so that the opportunity of agency cost may be deterred.

Furthermore, Chinese companies have applauded corporate social responsibility activity while preferring to launch environmentally friendly products through advanced strategies [19,20]. Reasonably, Chinese firms are trying to confront the dynamic business environment. Doubtlessly, firms adopting social and environmental responsibility not only attract investors, but are also admired by the public through their philanthropist activity, and they ultimately improve business performance [21]. Chinese companies are forced to disclose their environmental measures [22] along with social responsibility reports. Despite this, Chinese firms still ignore environmental protection measures. Therefore, it is quite significant to contemplate whether a CEO having specific cognition characteristics can energize social and environmental performance or not while also demonstrating the moderating impact of innovation, cash holdings and supervisors.

Stunningly, the contribution of the study has been signified as follows. First, the formulation of a cognitive CEO has been substantiated while executing data envelope analysis (DEA) techniques. Second, the influence of innovation as a moderator has been identified through both innovation input and output between cognitive CEO and corporate social and environmental performance. Third, supervisors have been analyzed as moderators affecting social and environmental performance. Fourth, the moderating variable of cash holdings has been analyzed to identify their significance for practical implications. Fifth, the theoretical aspect of stakeholder theory has been revealed while interconnecting with the novel concept of cognition. Last, the authenticity of the results has been confirmed while performing the generalized method of moments (GMM) instrumental regression.

2. Theory and Hypothesis Formulation

Remarkably, stakeholder theory illustrates that the upper echelon team should endeavor to compensate all types of stakeholders, such as customers, employees, investors and suppliers [23]. Additionally, an aspect of stakeholder theory emphasizes the interconnection of corporate social performance with the financial performance of firms [24]. In this sense, even the sustainability of firms can be maintained while adopting CSR and environmental activities. Significantly, organizational theorists have revealed that stakeholder theory illustrates the intensity of corporate behavior under the influence of the upper echelon team that works efficiently for the benefit of stakeholders of organizations [25]. Some scholars have stated that the pressure of stakeholders also orients the upper echelon towards corporate social activities, which ultimately boosts the firm’s performance. Moreover, the theory of stakeholders has also deduced that firm environmental performance is also necessary to boost company growth [26].

Intuitively, instrumental stakeholder theory argues that managers or upper echelon teams should take care of external stakeholders and secure the benefits of its internal stakeholders strategically [27]. Although some cognitive abilities of firms have been interlinked with the salient features of stakeholder theory [28], the current study has revealed that altering the cognitive capacity of the incumbent CEO will ultimately revitalize the profits of stakeholders. In this regard, a philanthropist organization must vehemently invigorate both social and environmental performance.

Significantly, managerial cognition is the form of perception which enables one to perceive the future of an organization. However, a manager’s cognitive capability is influenced by institutional or stakeholder pressure [29], which can influence environmental strategies. If the cognitive capability of a CEO interacts with a flexible approach, it can then bring innovative changes within organizations [30]. Undoubtedly, the cognition of managers is vital for firms’ sustainability [31]. Further, dynamic managerial cognition depends on managerial cognition, which ultimately boosts social responsibility [32].

Argumentatively, stakeholder cognition also recommends punishing organizations in the event of neglecting corporate social responsibility (CSR) activities [33]. Convincingly, there are two main aspects that have been identified by stakeholder theory: First, how to execute the strategic plans of an organization so that the benefit of the stakeholder can be emphatically enhanced. Second, CEOs of firms should manipulate strategic plans according to the demand of environmental performance [34].

Cognitive capabilities can also be measured as the cognitive psychology of a CEO that assists him or her in making an absolute decision for an organization during uncertain times. However, being an innovative CEO, he or she is just a troubleshooter [35]. According to [36], cognitive capability rejuvenates strategies, which ultimately boosts firms’ sustainability.

Remarkably, the cognitive CEO has been formulated while considering intangible assets as an input, which extant literature has witnessed to be a catalyst for firms’ performance [37]. Further, outputs such as CEO tenure, CEO education and CEO age are also conducive for firms’ growth. Moreover, a firm having vigorous growth also concentrates on corporate social responsible activities [38].

Clearly, corporate social and environmental responsibility is directly related to the innovation capacity of companies and intensifies the optimal growth of companies [39]. Moreover, firms that have a strong CSR performance are positively linked with performance, but such firms also indulge in agency costs due to the enormous holding of cash [40]. However, stakeholder theory enunciates that all stakeholders must benefit, but cash holdings can be detrimental to augmenting the agency cost problem. The incumbent CEO can spend huge amounts of funds for the sake of self-perks and privileges, which even the theory of stakeholders cannot demonstrate practically.

2.1. CEO Cognitive Capacities, Innovation, and Corporate Social and Environmental Performance

The existing literature has examined specific attributes of a chief executive officer (CEO) on firms’ growth, environmental disclosure and environmental performance [20]. Meanwhile, board diversity and board-specific characteristics are also positively correlated with firm performance [41]. Emphatically, the role of gender has been signified as a vigorous vehicle to intensify environmental performance [42,43]. Most significantly, [44] has revealed that corporate environmental performance and social performance escalate the performance of firms. Hence, companies are striving to adopt social and environmental measures to sustain their future performance [45].

Being a strong competitor, firms also endorse the adoption of innovative strategies [46]. Specifically, a previous study has elucidated that managerial innovation boosts environmental performance, whereas marketing innovation increases firm value while appeasing all stakeholders [47]. In addition, CSR has been seen to promote technological innovation [48]. Furthermore, [49] has considered that organizational innovation increases environmental reporting but neglected the moderating role of innovation between a cognitive CEO and social and environmental performance.

CEO-specific attributes that influence social and environmental activity have been analyzed [50]. Remarkably, the cognitive capability of a CEO has been demonstrated to not only boost innovative capability, but it also compels the incumbent chief executive officer to launch environmentally friendly strategies [29]. Argumentatively, cognitive capability assists the upper echelon team to make decisions accurately, which ultimately accelerates the firm’s sustainability [51]. Moreover, through cognition, the incumbent CEO can forecast the environmental issue which is conducive for firms’ performance [35]. Prior literature has evaluated the impact of CEOs’ cognition on firms’ performance but has not elucidated the effectiveness of innovation input and output as moderators between cognitive chief executive officers and corporate social and environmental performance [52]. Similarly, [49] has demonstrated the role of CEO cognitive capability for CSR disclosure strategies; however, only small and medium enterprises were analyzed. Moreover, the study disregarded the moderating impact of innovation input and output. Henceforth, we can encapsulate that cognitive CEO invigorates both social and environmental performance under the moderating influence of innovation input and output. Our hypotheses are as follows:

H1a:

The cognitive chief executive officer boosts social and environmental performance.

H1b:

Innovation input, as a moderator, escalates social and environmental performance.

H1c:

Innovation output, as a moderator, revitalizes social and environmental performance.

2.2. Cognitive CEO and Supervisory Board Members

The CSRC (Chinese Security Regulatory Council) promulgates rules and regulations for all listed firms. It has been imposed as a compulsory rule to have specific numbers of independent directors and of supervisors within the corporate board so that the efficiency of corporate governance may prevail emphatically [51,52]. Prior studies have witnessed that the presence of independent directors not only boosts corporate performance but also motivates the incumbent chief executive officer to promote CSR [53]. Additionally, even the size of the board of directors also intensifies CSR activities [54]. According to [55], the supportive role of supervisors augments employees’ motivation vehemently. Moreover, [56] has witnessed that the monitoring capability of supervisors ameliorates the accounting structure of firms. Further, their presence invigorates the internal mechanism of corporate mechanisms, which boosts the sustainable growth of firms [57]. Despite this, it is still required to contemplate whether supervisory boards as a moderator invigorate corporate social and environmental performance or not. Though [36] evaluated the negative relationship between supervisors and sustainable growth for Chinese SMEs, it neglected the impact of supervisors on corporate social and environmental performance. To encapsulate, the presence of supervisors synchronizes accounting irregularities, which can provide extra funds for allocating into corporate social and environmental activities. Henceforth, our next hypothesis can be formulated as follows:

H2:

Supervisory board members, as moderators, invigorate corporate social and environmental performance.

2.3. Cognitive CEO, Cash Holdings, Corporate Social and Environmental Performance

Assuredly, cash holdings are useless whenever firms suffer from agency cost problems [58]. In such a scenario, cash hoarding can be maneuvered through tunneling [59]. The extant literature has also revealed that cash holdings and cash flow are positively related among emerging economies, signifying that cash holdings are squandered through agency cost [60]. Additionally, [61] has contemplated that the intensity of cash holding is mitigated among firms having agency cost issues. Specifically, excessive agency cost problems have been observed among Chinese firms, which decelerates the firms’ performance [62]. Meanwhile, [63] has contemplated that CSR disclosure ameliorates monitoring capability while deterring agency cost problems.

Remarkably, specific attributes of CEOs mitigate agency costs while deterring cash holdings [64]. Similarly, [65] concludes that hierarchical CEOs mitigate cash holdings and reduces agency cost among Chinese firms [66]. Further, [49] has elucidated that specific attributes of CEOs endorse environmental disclosure. Moreover, CEO tenure and CEO educational background both reduce cash holdings [64,67]. Meanwhile, one study has witnessed that environmental, social and governance disclosure have negative relations with each other [68]. Additionally, [69] has concluded the reciprocal relation between environmental performance and cash holdings. Encapsulating the previous arguments, it can be deduced that cash holdings as a moderator mitigate corporate social and environmental performance decisively. Henceforth, our hypothesis can be formulated as follows:

H3:

Cash holdings, as a moderator, mitigate corporate social and environmental performance.

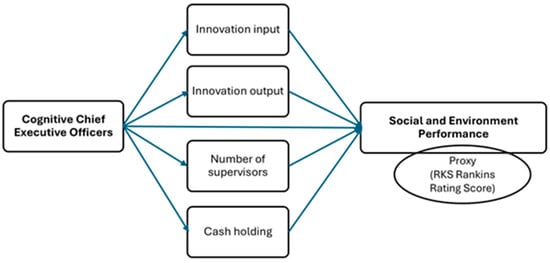

Based on the literature arguments and the definition of the research hypothesis, the theoretical framework has been designed, as presented in Figure 1.

Figure 1.

The theoretical framework.

3. Materials and Methods

3.1. Data and Measures

Chinese firms listed on both stock exchanges (Shenzhen and Shanghai) were endorsed for empirical analysis. The data for the years 2018 to 2022 were accumulated while preferring the firms issuing the reports [70]. Our selection of data was based on logic, as Chinese firms are required to disclose environmental protection information, the enforcement of which was intensified in 2018 [71]. Accordingly, for empirical analysis, 1058 listed firms were selected. The preferred resources for the accumulation of authenticated data were CSMAR and WIND, following extant literature [72]. The contributive concept of cognitive CEOs was formulated via the data envelopment analysis (DEA) statistical technique. The formulation of cognitive CEOs via mathematical equation is written as follows:

Equation (1) indicates the core concept of cognitive CEOs, where “s” represents inputs and “r” represents outputs. In Equation (1), intangible assets are embedded as an input, whereas the outputs are CEO age, CEO tenure, goodwill, CEO education and tacit knowledge (through the number of meetings attended and foreign experience) [35,46].

In empirical models, the regress and corporate social and environmental performance were reclaimed from Rankins Ratings (RKS) available at the web site “HEXUN”. According to [73,74], authors prefer the dataset accumulated from RKS, which emphasizes global reporting initiatives. Comprehensively, the rankings data set was formulated while contemplating the three aspects (which have been illustrated in Appendix A).

Significantly, specific control variables that were interlinked with CEO attributes and corporate social and environmental performance were endorsed. The variable “EPS”, earnings per share, signifies the spectacular performance of a firm [75]. The maximum value of “EPS” indicates that firms’ performance will also be spectacular [72]. In contrast, the variable “Leverage” (measured via proxy debt to equity ratio [75]) indicates the causes of deceleration of firms, which can deteriorate the firms’ future goal [76]. Particularly, firms with maximum profit are prone to decelerate with financial leverage as compared to low profit firms [77]. Further, among Chinese firms, leverage damages innovation input and output [78]. Therefore, this risk indicator variable was embedded in the panel regression. Further, Chinese firms are quite prominent due to being under the influential control of the government, specifically state-owned enterprises. Henceforth, “SOE” was embedded in the panel regression as a dummy variable [50]. Additionally, the duality of incumbent CEOs is a normal phenomenon among Chinese firms. Henceforth, the variable “Dual” was endorsed following the prior study [72]. Meanwhile, LNTA (indicating the logarithm of total assets) and LNEMP (represents the logarithm of the total number of employees) capture the finance capability and firm size [79], which can affect the corporate social and environmental performance. Therefore, these variables were included in our panel regression. Lastly, Chinese firms are ameliorating their corporate structure, and over the last few decades, the CSRC (Chinese Security Regulatory Commission) has been promulgating new rules so that the efficiency of corporate governance may be invigorated. In this regard, the specific percentage of independent directors has been made compulsory for the listed firms. Henceforth, independent directors (INPDIR) as a variable was also endorsed for the panel regression [76].

The moderator of the number of supervisors was accumulated from CSMAR following [46]. Remarkably, variables such as total assets, firm size and financial leverage are interlinked with firms’ growth. Additionally, the role of supervisors has been signified as monitoring to enhance the efficiency of corporate governance, which is conducive for firms’ sustainability [35]. Innovation (specified through innovation input and output) was measured through the proxies of research and development expenditures and the number of patents following [76]. Meanwhile, the moderator of cash holdings was measured through the proxy of the ratio of cash and cash equivalents to net assets following [80].

3.2. Empirical Models Formulation

Significantly, the effectiveness of cognitive CEOs on social and environmental performance has been demonstrated through the panel regression technique. Further, the underpinnings of lagged variable regression have confirmed the presence of the endogeneity problem (as differentiation among the signs of coefficients of some variables). Henceforth, generalized method of moment (GMM) instrumental regression has been preferred to get rid of endogeneity threat. Following prior study [35], specific cognitive CEO was endorsed as an instrumental variable (following [35], “specific cognitive CEO” was replaced as an instrumental variable; CEO compensation was added to formulate “specific cognitive CEO”). Specifically, the extant study preferred to interpret the results of the generalized method of instrumental regression rather than to indicate the results of OLS regression. Subsequently, only the results of GMM instrumental regression were interpreted. Mathematically, the empirical models were written as follows:

Equations (2)–(6) indicate the empirical models for demonstrating the influence of cognitive chief executive officers on corporate social and environmental performance. “LNCGCEO” indicates the logarithm of cognitive CEO following [35], which was modified further in this study. The interaction terms “(LNCGCEOi,t*LNRD)”, “(LNCGCEO(i,t)*Patents)”, “(LNCGCEO(i,t)*SUPV)” and “(LNCGCEO(i,t)*Cash holdings)” indicate the effectiveness of moderators (innovation input, innovation output, number of supervisors and cash holdings, respectively). The variables “” signify both dummy variables (industry dummy and year dummy, respectively).

4. Empirical Results

4.1. Descriptive Statistics and Correlation Matrix

GMM instrumental regression was regressed through the statistical software STATA 16, a statistical software package developed by StataCorp. (College Station, TX, USA) Table 1 indicates the number of observations, mean, standard deviation and maximum values of the variables, respectively. The standard deviation of the variables was acceptable. The variables “CSEPR”, “LNPT”, “LNRD”, “LNCGCEO”, “EPS”, “LNTA”, “LNEPM”, “Leverage”, “Dual”, “SOE”, “Fage”, “Lncash”, “INPDIR” and “NSUPV” indicate corporate social and environmental performance, logarithm of patents, logarithm of research and development expenses, logarithm of the number of employees, leverage, dual authority of a CEO, state-owned enterprise, firm age, algorithm of cash, the number of independent directors and the number of supervisors, respectively. The variables “SOE” and “Dual” are dummy variables (maximum value of “1”).

Table 1.

Descriptive statistics.

Table 2 signifies whether multicollinearity exists or not. Convincingly, in Table 2, all of the coefficient values of correlation are less than 0.54, which confirms the absence of absolute multicollinearity.

Table 2.

Correlation matrix.

4.2. Robustness Checks

To ensure robustness, first, we regressed the lagged variables that indicated the difference in sign, which confirmed the endogeneity problem. Hence, instrumental variables were embedded in the panel regression following the extant literature. Furthermore, in Table 3, columns 2 and 3, the variables “LNEMP”, “LNTA” and “Fage” were omitted, but the significance of the variables remained stagnant. Moreover, in Table 4, the variables (columns 3 and 4) “Dual” and “INPDIR” were omitted without affecting the signs, and omitting the variables confirmed the robustness of our empirical models.

Table 3.

GMM instrumental regression: Cognitive CEOs and corporate social and environmental performance.

Table 4.

GMM instrumental regression: Innovation input as a moderator.

Table 3 illustrates the positive relation of cognitive CEOs with corporate social and environmental performance. In Table 3, the first row reveals that a cognitive CEO is a vigorous promoter of corporate social and environmental performance. The coefficient values of “LNCGCEO” are “0.954 ***”, “0.971 ***” and “0.967 ***”, respectively (which are highly absolutely significant). Similarly, “EPS” (earnings per share) also enhanced corporate social and environmental performance vehemently. On the contrary, “leverage” decelerated the CSEPR emphatically. Argumentatively, firms with vigorous earnings per share emphasize their corporate and environmental activities, which is why their RKS (Rankins score) will ultimately be revitalized. However, leverage curtails the allocation of funds among philanthropist activities. In this regard, firms cannot orientate towards corporate social and environmental activities.

Additionally, “SOE” and “Fage” both boosted corporate social and environmental performance. One possible reason is that state-owned enterprises of China work under the strict vigilance of the government, which compels the upper echelon to adopt CSR and environmental activities. Meanwhile, mature firms prefer to adopt CSR activities, which ultimately invigorate corporate social and environmental performance. Reciprocally, duality mitigates the CSEPR because being authoritative can divert the attention of an incumbent CEO towards adopting social and environmental activities.

Table 4 reveals that innovation input (LNRD) as a moderator boosts corporate social and environmental performance; however, the coefficient values are small (0.0580 *** and 0.0590 ***, respectively). Arguably, innovation is a costly phenomenon, meaning that if firms allocate funds for executing socially and environmentally responsible corporate activities, there will be fewer funds that can be allocated into research and development. Despite this, corporate social and environmental performance will be boosted. Additionally, “EPS”,” SOE” and “Fage” boosted the CSEPR. On the other hand, “Leverage” and “Dual” were signified as deterrent variables for corporate social and environmental performance.

Table 5 indicates that patents as a moderator intensified corporate social and environmental activity, but the coefficient values of “patents” (0.00496 **, 0.00523 ** and 0.00518 **, respectively) are almost the same (with miniscule difference) as compared to “LNRD” (0.0580 ***, 0.0590 *** and 0.0591 ***, respectively). Argumentatively, innovation input and output as moderators both influenced corporate social and environmental performance with less intensity due to having fewer funds allocated into research and development. Furthermore, the variables “Fage” and “SOE” were positively interlinked with corporate social and environmental performance, while “leverage” were remained negatively significant.

Table 5.

GMM instrumental regression: Innovation output as a moderator.

Table 6 reinforces that supervisors as moderators are vigorous promoters of CSR and environment performance. Supervisors monitor the CEO activity vigilantly. Therefore, empirical underpinnings are justified by the extant literature, which has revealed that supervisors boost the sustainable growth among Chinese firms [36]. Further, supervisory committees also augment firms’ performance [57]. To encapsulate these arguments, the role of supervisors is influential in boosting corporate social and environmental performance. Additionally, “SOE” and “Fage” were shown to be positively interlinked with CSEPR, while “leverage” deterred corporate social and environmental performance.

Table 6.

GMM instrumental regression: Supervisors as a moderator.

Further, the results of Table 6 are justifiable, as the sole objective of supervisory board members among Chinese firms is to monitor the behavior of the corporate board, as well as supervising the financial matters of firms [81]. Their presence mitigates financial risk, so negative signs of leverage are justified.

Table 7 unveils that firms’ cash holdings decelerated corporate social and environmental performance. Recently, Chinese firms have been alleged to be suffering from agency cost problems. Hence, if firms were to hold enormous amounts of cash, it would be spent through agency costs, and corporate social and environmental issues would ultimately be neglected. Therefore, CSEPR would decline comprehensively. Further, “leverage” mitigated corporate social and environmental performance. In contrast, “EPS”, “LNTA”, “SOE” and “Fage” were positively significant for augmenting CSEPR.

Table 7.

GMM instrumental regression: Cash holdings as a moderator.

5. Discussion and Conclusions

5.1. General Conclusions and Recommendations

Being a communist state, China has ameliorated its corporate culture by amalgamating with modern corporate mechanisms, which is why Chinese firms have attained the zenith of their success [82]. However, the intensity of surveillance among state-owned enterprises is still dominant. The state-owned enterprises of China have maximum market capitalization along with the distinguishing characteristics of government ownership structure.

Significantly, the corporate structure of Chinese firms has been ameliorated while orientating towards adopting corporate social and environmental measures so that international standards may be maintained comprehensively [83]. Implicatively, Chinese firms have endorsed innovative activities while declaring the years “Imitation to innovation” [84]. Although firms have adopted CSR measures, the role of CEO is partially independent [85,86]. Hence, it would be quite necessary to demonstrate the role of CEO having specific attributes while influencing corporate social and environmental performance.

The current study has contemplated the effectiveness of cognitive CEOs on CSEPR. Specifically, cognition was formulated while amalgamating CEO attributes such as tenure, education, age, tacit knowledge and goodwill, which emphatically influence corporate social and environmental performance. Moreover, organizational innovation, supervisors and cash holdings have been contemplated as moderators signifying their asymmetrical effectiveness.

Remarkably, Chinese firms have ameliorated their corporate structure under the strict surveillance of the CSRC (Chinese Security Regulatory Commission), which has made it compulsory for firms to specify the specific numbers of independent directors, supervisors, etc [87]. Further, the CSRC has also imposed strict rules on listed firms to disclose corporate social and environmental reports publicly. Henceforth, adhering to CSRC rules, Chinese firms have specific numbers of supervisors who orientate the incumbent chief executive officer towards corporate social and environmental issues [88]. Relevantly, the current study has unveiled the vigorous influence of supervisors on corporate social and environmental performance. Our results are justified by the extant study, which witnessed the positive impact of supervisors on Chinese listed firms [57]. Further, Chinese firms have adopted innovation to accelerate their performance, but it is quite significant to contemplate whether firms investing enormous amounts in research and development can escalate their corporate social and environmental performance or not. Implicatively, the current study has accentuated that innovation (both innovation input and output) as a moderator escalates corporate social and environmental performance, but enhancement is miniscule. Reasonably, it is suggested that firms manipulate funds properly between innovation and CSR activities.

Chinese firms have been criticized for being excessively involved in the principal agent problem. In this regard, cash hoarding among firms would be detrimental. The extant literature on Chinese firms have unveiled that hierarchical CEOs mitigate the principal agent issue and cash holdings [63,64]. Henceforth, if there were excessive cash holdings, it would be spent extravagantly on the agency problem. Accordingly, the empirical underpinnings of the current study have unveiled that cash holdings as a moderator curtail corporate social and environmental performance. Doubtlessly, the maximum percentage of cash holdings has been spent for the sake of agency cost, while corporate social and environmental has remained neglected.

Further, it has been analyzed that firms with high earnings per share and maturity levels endorse the adoption of corporate social and environmental activities. Moreover, Chinese state-owned enterprises are orientated towards corporate social and environmental activity vehemently [89]. Certainly, governmental intervention has caused SOE to orientate towards CSR. Meanwhile, leverage has been signified as a decelerator for corporate social and environmental performance. One can assess that the loan burden cannot allow any firms to adopt CSR activities.

Outstandingly, the current study has indicated practical implications for practitioners, scholars, academicians and organizational theorists. First, the current study recommends reducing cash hoarding, which will mitigate agencies’ cost problems. Second, cognitive CEOs can accelerate corporate social and environmental performance comprehensively if there is a remarkable number of supervisors. Third, there must be a well-defined strategy in allocating funds into research and development so that corporate social and environmental performance may be boosted splendidly. Fourth, firms should curtail their loan burden so that enough funds may be allocated for philanthropist activities. Fifth, the government should take drastic steps for non-state-owned enterprises, either through subsidiaries or compensation, so that their orientation towards social and environmental activities may be augmented.

5.2. Limitations of the Study

Despite comprehensive contribution, the current study has certain limitations which can be analyzed for further study. First, there should have been a comparative study to elucidate gender differences in cognitive capabilities and how they can influence the EGS score. Second, the role of cognitive CEOs should have been analyzed within the period of COVID-19 (as an interesting comparison before and after COVID-19’s eruption). Thirdly, we have not demonstrated whether the cognition capability of CEOs is more conducive for state-owned enterprises or non-state-owned enterprises. Last, we included all types of firms in our sample data, which could have been segregated into small, medium and large firms.

5.3. Future Research

Significantly, it would be interesting to study whether a cognitive CEO can perform better under the influence of artificial intelligence (AI). Further, future research can contemplate whether a cognitive CEO mitigates the risks of firms or not. Last, gender difference within cognitive CEO will make excellent future research.

Author Contributions

Conceptualization, X.W. and S.G.M.S.; methodology, A.D.; software, D.W.; validation, V.T., A.D. and S.G.M.S.; formal analysis, X.W.; investigation, D.W.; resources, V.T.; data curation, X.W.; writing—original draft preparation, S.G.M.S.; writing—review and editing, V.T. and A.D.; visualization, D.W.; supervision, A.D.; project administration, S.G.M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by: the Shandong Province Social Science Planning Research Project “Research on the Construction of an Evaluation Index System for a Rule-of-Law-Based Business Environment” (24CFZJ31); MOE [Ministry of Education] Foundation on Humanities and Social Sciences [No.23YJA630092]; the Taishan Scholars Project Special Funding (NO.tstp20231228); and the Jinan City Philosophy and Social Science Planning Research Project “Research on the Construction of an Evaluation Index System for a Rule-of-Law-Based Business Environment in Jinan” (JNSK2025C067).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available from the author upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Measurement of Rankins Rating scores.

Table A1.

Measurement of Rankins Rating scores.

| Aspects | Description |

|---|---|

| Technical Assessment | This assessment constitutes transparency, regularity and accessibility of both social and environmental information. |

| Content Assessment | This assessment constitutes whether a firm has attained vigilant leadership to execute social, environmental and economic policies. |

| Overall Assessment | This assessment demonstrates whether creativeness of CSR policies and their strategies have been executed, as well as whether stakeholders have been involved in CSR practices and the issuance of comparison of CSR reports. |

References

- Ferry, L.; Funnell, W.; Oldroyd, D. A genealogical and archaeological examination of the development of corporate governance and disciplinary power in English local government c. 1970–2010. Account. Organ. Soc. 2023, 109, 101466. [Google Scholar] [CrossRef]

- Shui, X.; Zhang, M.; Smart, P.; Ye, F. Sustainable corporate governance for environmental innovation: A configurational analysis on board capital, CEO power and ownership structure. J. Bus. Res. 2022, 149, 786–794. [Google Scholar] [CrossRef]

- Huang, S.K. The impact of CEO characteristics on corporate sustainable development. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 234–244. [Google Scholar] [CrossRef]

- Manner, M.H. The Impact of CEO Characteristics on Corporate Social Performance. J. Bus. Ethics 2010, 93, 53–72. [Google Scholar] [CrossRef]

- Sarwar, H.; Aftab, J.; Ishaq, M.I.; Atif, M. Achieving business competitiveness through corporate social responsibility and dynamic capabilities: An empirical evidence from emerging economy. J. Clean. Prod. 2023, 386, 135820. [Google Scholar] [CrossRef]

- Riaz, Z.; Ray, P.; Ray, S. The impact of digitalisation on corporate governance in Australia. J. Bus. Res. 2022, 152, 410–424. [Google Scholar] [CrossRef]

- Gupta, P.; Chauhan, S. Dynamics of corporate governance mechanisms-family firms’ performance relationship-a meta-analytic review. J. Bus. Res. 2023, 154, 113299. [Google Scholar] [CrossRef]

- Tong, T.; Chen, X.; Singh, T.; Li, B. Corporate governance and the outward foreign direct investment: Firm-level evidence from China. Econ. Anal. Policy 2022, 76, 962–980. [Google Scholar] [CrossRef]

- Suoniemi, S.; Meyer-Waarden, L.; Munzel, A.; Zablah, A.R.; Straub, D. Big data and firm performance: The roles of market-directed capabilities and business strategy. Inf. Manag. 2020, 57, 103365. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate Social Responsibility: Perspectives on the CSR Construct’s Development and Future. Bus. Soc. 2021, 60, 1258–1278. [Google Scholar] [CrossRef]

- Durán, W.F.; Aguado, D. CEOs’ managerial cognition and dynamic capabilities: A meta-analytical study from the microfoundations approach. J. Manag. Organ. 2022, 28, 451–479. [Google Scholar] [CrossRef]

- Chen, C.; Lam, J.S.L. Sustainability and interactivity between cities and ports: A two-stage data envelopment analysis (DEA) approach. Marit. Policy Manag. 2018, 45, 944–961. [Google Scholar] [CrossRef]

- Fang, V.W.; Tian, X.; Tice, S. Does stock liquidity enhance or impede firm innovation? J. Financ. 2014, 69, 2085–2125. [Google Scholar] [CrossRef]

- Becker, P.B.; Klarner, P. Executing Change: Behavioral Implications of CEO Cognitive Complexity and Flexibility Across Tenure. Acad. Manag. 2023, 2023, 18349. [Google Scholar] [CrossRef]

- Hu, M.C.; Mathews, J.A. China’s national innovative capacity. Res. Policy 2008, 37, 1465–1479. [Google Scholar] [CrossRef]

- Wang, F.; Chen, K. Do product imitation and innovation require different patterns of organizational innovation? Evidence from Chinese firms. J. Bus. Res. 2020, 106, 60–74. [Google Scholar] [CrossRef]

- Chen, F.; Huyghebaert, N.; Lin, S.; Wang, L. Do multiple large shareholders reduce agency problems in state-controlled listed firms? Evidence from China. Pacific Basin Financ. J. 2019, 57, 101203. [Google Scholar] [CrossRef]

- Deng, Y.; Wu, Y.; Xu, H. Political Connections and Firm Pollution Behaviour: An Empirical Study. Environ. Resour. Econ. 2020, 75, 867–898. [Google Scholar] [CrossRef]

- Bu, M.; Qiao, Z.; Liu, B. Voluntary environmental regulation and firm innovation in China. Econ. Model. 2020, 89, 10–18. [Google Scholar] [CrossRef]

- Shahab, Y.; Ntim, C.G.; Chen, Y.; Ullah, F.; Li, H.; Ye, Z. Chief executive officer attributes, sustainable performance, environmental performance, and environmental reporting: New insights from upper echelons perspective. Bus. Strategy Environ. 2020, 29, 1–16. [Google Scholar] [CrossRef]

- Li, G.; He, Q.; Shao, S.; Cao, J. Environmental non-governmental organizations and urban environmental governance: Evidence from China. J. Environ. Manage. 2018, 206, 1296–1307. [Google Scholar] [CrossRef]

- Xu, F.; Yang, M.; Li, Q.; Yang, X. Long-term economic consequences of corporate environmental responsibility: Evidence from heavily polluting listed companies in China. Bus. Strategy Environ. 2020, 29, 2251–2264. [Google Scholar] [CrossRef]

- Orazalin, N. Do board sustainability committees contribute to corporate environmental and social performance? The mediating role of corporate social responsibility strategy. Bus. Strategy Environ. 2020, 29, 140–153. [Google Scholar] [CrossRef]

- Barauskaite, G.; Streimikiene, D. Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 278–287. [Google Scholar] [CrossRef]

- Wijethilake, C.; Lama, T. Sustainability core values and sustainability risk management: Moderating effects of top management commitment and stakeholder pressure. Bus. Strategy Environ. 2019, 28, 143–154. [Google Scholar] [CrossRef]

- Nguyen, T.H.H.; Elmagrhi, M.H.; Ntim, C.G.; Wu, Y. Environmental performance, sustainability, governance and financial performance: Evidence from heavily polluting industries in China. Bus. Strategy Environ. 2021, 30, 2313–2331. [Google Scholar] [CrossRef]

- Fu, L.; Boehe, D.; Orlitzky, M.; Swanson, D.L. Managing stakeholder pressures: Toward a typology of corporate social performance profiles. Long Range Plann. 2019, 52, 101847. [Google Scholar] [CrossRef]

- Jiang, W.; Wang, A.X.; Zhou, K.Z.; Zhang, C. Stakeholder Relationship Capability and Firm Innovation: A Contingent Analysis. J. Bus. Ethics 2020, 167, 111–125. [Google Scholar] [CrossRef]

- Yang, D.; Wang, A.X.; Zhou, K.Z.; Jiang, W. Environmental Strategy, Institutional Force, and Innovation Capability: A Managerial Cognition Perspective. J. Bus. Ethics 2019, 159, 1147–1161. [Google Scholar] [CrossRef]

- Kiss, A.N.; Libaers, D.; Barr, P.S.; Wang, T.; Zachary, M.A. CEO cognitive flexibility, information search, and organizational ambidexterity. Strateg. Manag. J. 2020, 41, 2200–2233. [Google Scholar] [CrossRef]

- Esau, E.; Kannegießer, C.L.; Reppmann, M.; Piening, E.P.; Edinger-Schons, L.M. Stairway to impact or highway to failure? A cognitive perspective on business model design processes in nascent sustainable ventures. Strateg. Entrep. J. 2025. [Google Scholar] [CrossRef]

- Chen, Y.; Guo, Y.; Hu, X. On the micro-foundations of corporate social responsibility: A perspective based on dynamic managerial capabilities. Cross Cult. Strateg. Manag. 2023, 30, 93–122. [Google Scholar] [CrossRef]

- Xu, J.; Wei, J.; Lu, L. Strategic stakeholder management, environmental corporate social responsibility engagement, and financial performance of stigmatized firms derived from Chinese special environmental policy. Bus. Strategy Environ. 2019, 28, 1027–1044. [Google Scholar] [CrossRef]

- Ren, S.; Tang, G.; Jackson, S.E. Effects of Green HRM and CEO ethical leadership on organizations’ environmental performance. Int. J. Manpow. 2020, 42, 961–983. [Google Scholar] [CrossRef]

- Li, H.; Hang, Y.; Shah, S.G.M.; Akram, A.; Ozturk, I. Demonstrating the Impact of Cognitive CEO on Firms’ Performance and CSR Activity. Front. Psychol. 2020, 11, 278. [Google Scholar] [CrossRef]

- Sarfraz, M.; Ozturk, I.; Shah, S.G.M.; Maqbool, A. Contemplating the Impact of the Moderators Agency Cost and Number of Supervisors on Corporate Sustainability Under the Aegis of a Cognitive CEO. Front. Psychol. 2020, 11, 965. [Google Scholar] [CrossRef]

- Intara, P.; Suwansin, N. Intangible assets, firm value, and performance: Does intangible-intensive matter? Cogent Econ. Financ. 2024, 12, 2375341. [Google Scholar] [CrossRef]

- Al-Shammari, M.A.; Banerjee, S.N.; Rasheed, A.A. Corporate social responsibility and firm performance: A theory of dual responsibility. Manag. Decis. 2022, 60, 1513–1540. [Google Scholar] [CrossRef]

- Zhou, H.; Wang, Q.; Zhao, X. Corporate social responsibility and innovation: A comparative study. Ind. Manag. Data Syst. 2020, 120, 863–882. [Google Scholar] [CrossRef]

- Arouri, M.; Pijourlet, G. CSR Performance and the Value of Cash Holdings: International Evidence. J. Bus. Ethics 2017, 140, 263–284. [Google Scholar] [CrossRef]

- Zou, H.; Xie, X.; Qi, G.; Yang, M. The heterogeneous relationship between board social ties and corporate environmental responsibility in an emerging economy. Bus. Strategy Environ. 2018, 28, 40–52. [Google Scholar] [CrossRef]

- Lu, J.; Herremans, I.M. Board gender diversity and environmental performance: An industries perspective. Bus. Strategy Environ. 2019, 28, 1449–1464. [Google Scholar] [CrossRef]

- Cordeiro, J.J.; Profumo, G.; Tutore, I. Board gender diversity and corporate environmental performance: The moderating role of family and dual-class majority ownership structures. Bus. Strategy Environ. 2020, 29, 1127–1144. [Google Scholar] [CrossRef]

- Hang, M.; Geyer-Klingeberg, J.; Rathgeber, A.W. It is merely a matter of time: A meta-analysis of the causality between environmental performance and financial performance. Bus. Strategy Environ. 2019, 28, 257–273. [Google Scholar] [CrossRef]

- Naciti, V. Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. J. Clean. Prod. 2019, 237, 117727. [Google Scholar] [CrossRef]

- Sarfraz, M.; Shah, S.G.M.; Fareed, Z.; Shahzad, F. Demonstrating the interconnection of hierarchical order disturbances in CEO succession with corporate social responsibility and environmental sustainability. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2956–2971. [Google Scholar] [CrossRef]

- Zhu, Q.; Zou, F.; Zhang, P. The role of innovation for performance improvement through corporate social responsibility practices among small and medium-sized suppliers in China. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 341–350. [Google Scholar] [CrossRef]

- Bocquet, R.; Le Bas, C.; Mothe, C.; Poussing, N. CSR, Innovation, and Firm Performance in Sluggish Growth Contexts: A Firm-Level Empirical Analysis. J. Bus. Ethics 2017, 146, 241–254. [Google Scholar] [CrossRef]

- Sarfraz, M.; He, B.; Shah, S.G.M. Elucidating the effectiveness of cognitive CEO on corporate environmental performance: The mediating role of corporate innovation. Environ. Sci. Pollut. Res. 2020, 27, 45938–45948. [Google Scholar] [CrossRef]

- Shah, S.G.M.; Sarfraz, M.; Ivascu, L. Assessing the interrelationship corporate environmental responsibility, innovative strategies, cognitive and hierarchical CEO: A stakeholder theory perspective. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 457–473. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. Managerial cognitive capabilities and the microfoundations of dynamic capabilities. Strateg. Manag. J. 2015, 36, 831–850. [Google Scholar] [CrossRef]

- Cao, C.; Tong, X.; Chen, Y.; Zhang, Y. How top management’s environmental awareness affect corporate green competitive advantage: Evidence from China. Kybernetes 2022, 51, 1250–1279. [Google Scholar] [CrossRef]

- Wang, L.; Liu, Q.; Hanazaki, M. Corporate Board Structure and Corporate Performance: Empirical Analysis of Listed Companies in China. Fudan J. Humanit. Soc. Sci. 2019, 12, 137–175. [Google Scholar] [CrossRef]

- Zubeltzu-Jaka, E.; Álvarez-Etxeberria, I.; Ortas, E. The effect of the size of the board of directors on corporate social performance: A meta-analytic approach. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1361–1374. [Google Scholar] [CrossRef]

- Gillet, N.; Gagné, M.; Sauvagère, S.; Fouquereau, E. The role of supervisor autonomy support, organizational support, and autonomous and controlled motivation in predicting employees’ satisfaction and turnover intentions. Eur. J. Work Organ. Psychol. 2013, 22, 450–460. [Google Scholar] [CrossRef]

- Ran, G.; Fang, Q.; Luo, S.; Chan, K.C. Supervisory board characteristics and accounting information quality: Evidence from China. Int. Rev. Econ. Financ. 2015, 37, 18–32. [Google Scholar] [CrossRef]

- Haß, L.H.; Johan, S.; Schweizer, D. Is Corporate Governance in China Related to Performance Persistence? J. Bus. Ethics 2016, 134, 575–592. [Google Scholar] [CrossRef]

- Xu, S.; Ma, P. CEOs’ poverty experience and corporate social responsibility: Are CEOs who have experienced poverty more generous? J. Bus. Ethics 2021, 180, 747–776. [Google Scholar] [CrossRef]

- Rama Iyer, S.; Sankaran, H.; Walsh, S.T. Influence of Director Expertise on Capital Structure and Cash Holdings in High-Tech Firms. Technol. Forecast. Soc. Change 2020, 158, 120060. [Google Scholar] [CrossRef]

- Diaw, A. Corporate cash holdings in emerging markets. Borsa Istanbul Rev. 2020, 21, 139–148. [Google Scholar] [CrossRef]

- Clarkson, P.; Gao, R.; Herbohn, K. The relationship between a firm’s information environment and its cash holding decision. J. Contemp. Account. Econ. 2020, 16, 100201. [Google Scholar] [CrossRef]

- Li, J.; Li, P.; Wang, B. The liability of opaqueness: State ownership and the likelihood of deal completion in international acquisitions by Chinese firms. Strateg. Manag. J. 2019, 40, 303–327. [Google Scholar] [CrossRef]

- Liu, L.; Tian, G.G. Mandatory CSR disclosure, monitoring and investment efficiency: Evidence from China. Account. Financ. 2021, 61, 595–644. [Google Scholar] [CrossRef]

- Mun, S.; Han, S.H.; Seo, D. The impact of CEO educational background on corporate cash holdings and value of excess cash. Pacific Basin Financ. J. 2020, 61, 101339. [Google Scholar] [CrossRef]

- Sarfraz, M.; He, B.; Shah, S.G.M.; Fareed, Z. Myth or reality? Unveiling the effectiveness of hierarchical CEO succession on firm performance and cash holdings. J. Bus. Econ. Manag. 2021, 22, 1008–1025. [Google Scholar] [CrossRef]

- Shah, S.G.M.; Tang, M.; Sarfraz, M.; Fareed, Z. The aftermath of CEO succession via hierarchical jumps on firm performance and agency cost: Evidence from Chinese firms. Appl. Econ. Lett. 2019, 26, 1744–1748. [Google Scholar] [CrossRef]

- Lim, J.; Lee, S.C. Relationship Between the Characteristics of CEOs and Excess Cash Holdings of Firms. Emerg. Mark. Financ. Trade 2019, 55, 1069–1090. [Google Scholar] [CrossRef]

- Atif, M.; Liu, B.; Nadarajah, S. The effect of corporate environmental, social and governance disclosure on cash holdings: Life-cycle perspective. Bus. Strategy Environ. 2022, 31, 2193–2212. [Google Scholar] [CrossRef]

- Harper, J.; Sun, L. Environmental performance and corporate cash holdings. Appl. Econ. Lett. 2020, 27, 1234–1237. [Google Scholar] [CrossRef]

- Ren, S.; Huang, M.; Liu, D.; Yan, J. Understanding the Impact of Mandatory CSR Disclosure on Green Innovation: Evidence from Chinese Listed Firms. Br. J. Manag. 2023, 34, 576–594. [Google Scholar] [CrossRef]

- Wu, X.; Hąbek, P. Trends in Corporate Social Responsibility Reporting. The Case of Chinese Listed Companies. Sustainability 2021, 13, 8640. [Google Scholar] [CrossRef]

- Sha, Y.; Shah, S.G.M.; Muddassar, S. Short selling and SME irregular CEO succession: Witnessing the moderating role of earnings management. Int. Rev. Econ. Financ. 2023, 85, 163–173. [Google Scholar] [CrossRef]

- Shahab, Y.; Ntim, C.G.; Chengang, Y.; Ullah, F.; Fosu, S. Environmental policy, environmental performance, and financial distress in China: Do top management team characteristics matter? Bus. Strategy Environ. 2018, 27, 1635–1652. [Google Scholar] [CrossRef]

- Sial, M.S.; Chunmei, Z.; Khan, T.; Nguyen, V.K. Corporate social responsibility, firm performance and the moderating effect of earnings management in Chinese firms. Asia-Pacific J. Bus. Adm. 2018, 10, 184–199. [Google Scholar] [CrossRef]

- Shah, S.G.M.; Palomino, P.R.; Abbas, J. A Virtuous Relation Between Vigorous Board and Small Medium Enterprises’ Performance Under the Auspices of Cash Holdings and Corporate Innovation. Emerg. Mark. Financ. Trade 2024, 61, 547–561. [Google Scholar] [CrossRef]

- Shah, S.G.M.; Ivascu, L. Accentuating the moderating influence of green innovation, environmental disclosure, environmental performance, and innovation output between vigorous board and Romanian manufacturing firms’ performance. Environ. Dev. Sustain. 2023, 26, 10569–10589. [Google Scholar] [CrossRef]

- Ghardallou, W. The heterogeneous effect of leverage on firm performance: A quantile regression analysis. Int. J. Islam. Middle East. Financ. Manag. 2023, 16, 210–225. [Google Scholar] [CrossRef]

- Iqbal, N.; Xu, J.F.; Fareed, Z.; Wan, G.; Ma, L. Financial leverage and corporate innovation in Chinese public-listed firms. Eur. J. Innov. Manag. 2022, 25, 299–323. [Google Scholar] [CrossRef]

- Yang, H.; Shi, X.; Wang, S. Moderating Effect of Chief Executive Officer Narcissism in the Relationship Between Corporate Social Responsibility and Green Technology Innovation. Front. Psychol. 2021, 12, 717491. [Google Scholar] [CrossRef]

- Xu, N.; Chen, Q.; Xu, Y.; Chan, K.C. Political uncertainty and cash holdings: Evidence from China. J. Corp. Financ. 2016, 40, 276–295. [Google Scholar] [CrossRef]

- Smith, J.A.; Tian, Y. Empirical Insights into Supervisory Boards of Listed Companies in China. Asian J. Econ. Bus. Account. 2020, 19, 19–37. [Google Scholar] [CrossRef]

- Zheng, J.; Wu, G.; Xie, H.; Li, H. Leadership, organizational culture, and innovative behavior in construction projects: The perspective of behavior-value congruence. Int. J. Manag. Proj. Bus. 2019, 12, 888–918. [Google Scholar] [CrossRef]

- He, F.; Du, H.; Yu, B. Corporate ESG performance and manager misconduct: Evidence from China. Int. Rev. Financ. Anal. 2022, 82, 102201. [Google Scholar] [CrossRef]

- Shen, Z.; Siraj, A.; Jiang, H.; Zhu, Y.; Li, J. Chinese-style innovation and its international repercussions in the new economic times. Sustainability 2020, 12, 1859. [Google Scholar] [CrossRef]

- Wu, H.; Li, S.; Ying, S.X.; Chen, X. Politically connected CEOs, firm performance, and CEO pay. J. Bus. Res. 2018, 91, 169–180. [Google Scholar] [CrossRef]

- Jiang, F.; Kim, K.A. Corporate governance in China: A modern perspective. J. Corp. Financ. 2015, 32, 190–216. [Google Scholar] [CrossRef]

- Liu, Y.; Miletkov, M.K.; Wei, Z.; Yang, T. Board independence and firm performance in China. J. Corp. Financ. 2015, 30, 223–244. [Google Scholar] [CrossRef]

- Yongsheng, X.; Xiaole, Z.; Wei, W. Coupling or lock-in? Co-evolution of cultural embeddness and cluster innovation-exploratory case study of Shaoxing textile cluster. Technol. Soc. 2021, 67, 101765. [Google Scholar] [CrossRef]

- Shuaib, K.M.; He, Z.; Song, L. Effect of organizational culture and quality management on innovation among Nigerian manufacturing companies: The mediating role of dynamic capabilities. Qual. Manag. J. 2021, 28, 223–247. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).