Abstract

Amidst the intensifying impacts of global economic turbulence and external instabilities, the urgency to enhance urban sustainable development capabilities has become increasingly pronounced. Urban green-infrastructure investment, as a pivotal investment direction, plays a significant role in strengthening urban sustainable development capabilities. Based on panel data from 281 prefecture-level cities in China from 2010 to 2022, this study employs an empirical model to thoroughly investigate the impact of urban green-infrastructure investment on urban sustainable development and its underlying mechanisms. The research findings indicate the following: ① Urban green-infrastructure investment significantly promotes the enhancement of urban sustainable development levels, a conclusion that remains robust after undergoing robustness tests. ② The mechanism tests reveal that the enhancement of industrial chain resilience, ecological environment resilience, and talent agglomeration are crucial pathways through which urban green-infrastructure investment drives sustainable urban economic development. ③ Heterogeneity analysis finds that cities in the central and western regions, resource-based cities, cities with lower levels of urbanization, and cities with higher degrees of openness are more sensitive to the sustainable development-enhancing effects of green-infrastructure investment. ④ Spatial effect tests show that urban green-infrastructure investment has a positive spatial spillover effect on enhancing urban sustainable development levels. Based on these findings, it is recommended that cities increase investment in green infrastructure, optimize investment structures, promote the enhancement of industrial chain and ecological environment resilience, strengthen talent agglomeration effects, and leverage regional comparative advantages to invest in green infrastructure in a location-specific manner. This study not only validates the positive impact of urban green-infrastructure investment on urban sustainable development but also provides multi-perspective insights and references for analyzing the effects of urban green-infrastructure investment, offering policy support for achieving urban sustainable development.

1. Introduction

In recent years, the impact of global ecological degradation and external economic environments on the global economy has intensified, posing unprecedented challenges to economic activities worldwide [1]. As the world’s largest developing country and a major trading nation deeply integrated into the global market, China has been significantly affected by environmental deterioration and external economic shocks. Data shows that in 2024, China’s real GDP grew by 4.6% year-on-year in the third quarter, slowing by 0.1 percentage points compared to the second quarter. In the first quarter of 2025, GDP increased by 5.4% year-on-year, a further decline from the same period in 2024. Under the persistent influence of weak demand, China’s total retail sales of consumer goods grew by only 3.5% in 2024, far below the average of 10.5% from 2014 to 2019. Meanwhile, the pressure of environmental decline on economic sustainability has become increasingly evident [2]. In 2024, China experienced frequent exceedances of air PM2.5 concentration standards, and ozone pollution worsened, with some regions reporting ozone exceedance days accounting for over 30% of the total. Water pollution pressures also increased, with significant exceedances of indicators such as ammonia nitrogen and total phosphorus in some major rivers. Under the combined effects of internal and external factors, China’s stable and positive economic development faces significant disruptions and threats. Therefore, exploring ways to enhance urban economic sustainability, boost the anti-interference capabilities of economic systems, and increase system resilience holds great contemporary significance. The level of urban economic sustainability can be measured by economic resilience, which refers to the ability of an economic system to quickly recover to its pre-shock state, or even achieve better development, after suffering external shocks such as natural disasters or economic crises, and to adapt to and withstand similar future shocks during the recovery process [3]. It is an important indicator of the stability and adaptability of an economic system, effectively reflecting its stress resistance and recovery capabilities in the face of uncertainties.

Cities, as key carriers of national economies, are characterized by highly concentrated economic activities and massive resource consumption. They face multiple risks, including natural disasters, economic fluctuations, and social unrest [4], and are the concentrated embodiment of environmental and economic pressures. They are also the direct units facing ecological degradation, economic turbulence, and the rise of trade protectionism. Changes in the external environment can not only directly impact urban infrastructure, residents’ lives, and economic activities but also trigger chain reactions that affect the operation and development of the entire urban economy [5]. Against this backdrop, researching ways to enhance urban economic sustainability is not only an urgent need to address current environmental challenges but also an inevitable choice for achieving sustainable urban economic development. Enhancing urban economic sustainability is also of great significance to national development as a whole. It has become an urgent need and an important focus for China and other countries worldwide to cope with internal and external environmental changes, achieve high-quality economic development, and promote global economic stability [6]. With efforts from all sides, China has continuously deepened its work on enhancing economic resilience and achieved good results. From October to December 2024, China’s manufacturing Purchasing Managers’ Index (PMI) remained above the critical point for three consecutive months, with market expectations continuing to improve. In the first quarter of 2025, despite the impact of tariff disputes, China’s total import and export volume of goods trade still achieved a year-on-year growth of 1.3%, with exports increasing by 6.9%, further demonstrating the strong resilience of China’s foreign trade. In the future, with the further implementation of relevant policies worldwide and the recovery of market confidence, the economic sustainability of cities in China and around the world will inevitably continue to strengthen.

Green-infrastructure investment attempts to integrate green concepts into infrastructure construction, covering areas such as renewable energy facilities, green transportation systems, ecological restoration projects, and water resource management [7]. It is primarily manifested in improving the urban ecological environment quality and resource utilization efficiency. Its core lies in combining environmental protection with economic development, meeting urban development needs in a sustainable manner, and continuously reducing dependence on natural resources and environmental degradation. Green-infrastructure investment is often based on environmental impact assessments, aiming to identify projects that significantly promote green economic sustainability. In practice, constructing renewable energy generation facilities can reduce urban dependence on traditional fossil fuels, lower carbon emissions, and enhance the stability and security of the energy supply [8]. Developing green transportation systems can alleviate urban traffic congestion, reduce air pollution, and improve residents’ travel efficiency [9]. Implementing ecological restoration projects can improve the urban ecological environment and enhance urban livability. Therefore, increasing urban green-infrastructure investment not only helps improve the urban ecological environment but also creates new opportunities and momentum for urban economic development by optimizing resource allocation and improving technical efficiency. This, in turn, significantly enhances urban economic sustainability. Currently, China and other countries worldwide are actively promoting the development of green-infrastructure investment and have achieved phased results [10]. In 2023, the global green economy investment scale exceeded USD 1.7 trillion, setting a new historical record. China, the United States, and the European Union, the three major economic blocs, contributed 75% of the global green investment. According to the International Energy Agency, global investment in solar and wind energy maintained a growth rate of over 20% for the third consecutive year in 2024. The construction of green and intelligent infrastructure, such as new energy vehicles and green smart transportation, has injected strong momentum into the continuous high-speed development of the world economy [11,12].

However, current research on the relationship between green-infrastructure investment and sustainable urban economic development remains relatively insufficient. On the one hand, although some studies have acknowledged the existence of a relationship between green-infrastructure investment and sustainable urban economic development [13], they have failed to employ systematic empirical research to verify its actual impact on urban economic sustainability. On the other hand, while the studies by Herath [14] and Gong et al. [15] theoretically agree that green-infrastructure investment has a positive effect on sustainable urban economic development, they do not elaborate on the specific pathways and extent of this impact. Moreover, cities vary in terms of economic development levels, industrial structures, and resource endowments, and these differences may affect the impact of green-infrastructure investment on sustainable urban economic development. Therefore, an in-depth exploration of how green-infrastructure investment can enhance urban economic resilience is not only theoretically significant but also provides practical guidance for formulating policies on sustainable urban economic development. This paper aims to systematically analyze the mechanisms through which green-infrastructure investment affects sustainable urban economic development. Using panel data from 281 Chinese cities over the period 2010–2022, we empirically test its impact. We attempt to explore the potential pathways through which green-infrastructure investment can enhance urban economic sustainability from the perspectives of industrial chain resilience, ecological resilience, and talent agglomeration. We also pay particular attention to its spatial spillover effects and the differences in its impact on cities with different locations and development statuses. We hope that this study can effectively address the current research gaps in this area and provide useful references and insights for cities to cope with environmental challenges and enhance their economic sustainability. Ultimately, we aim to promote the green and sustainable development of cities worldwide.

2. Literature Review

To date, both domestic and international scholars have conducted extensive research on green-infrastructure investment and sustainable urban economic development capabilities, focusing primarily on the following three dimensions.

2.1. The Meaning, Motivation, Impact, and Mechanism of Urban Green-Infrastructure Investment

The concept of “green infrastructure” originated in architecture and specifically referred to the integration of community development with nature in the United States, aiming to establish a systematic ecological function network. With economic development, “green infrastructure” has shifted more towards the ecological infrastructure engineering proposed by Moffatt, which focuses on environmentally friendly infrastructure in multiple aspects, such as renewable energy, sewage discharge, and transportation [16]. In terms of the motivation for urban green-infrastructure investment, existing research has examined the impact of environmental regulation on the decision-making and behavior of green investment entities, arguing that environmental protection goals and regulations are key drivers of urban green-infrastructure investment [17]. The planning of green-infrastructure investment projects for this purpose is often based on the environmental assessment of the project facilities (EIA) [18]. Dai et al. pointed out that the impact of environmental regulation on green investment efficiency is also moderated by factors such as the direction of economic growth, financing constraints, and urban industrial structure [19]. In addition, improving residents’ quality of life and facilitating urban economic operations are also important objectives of green-infrastructure investment [20]. To better leverage the effects of green-infrastructure investment, many studies have explored its relationship with nature-based solutions (NBS), suggesting that green-infrastructure investment combined with NBS has advantages in ecological restoration and improving capital utilization efficiency [21,22]. In terms of the impact of urban green-infrastructure investment, Zhao’s research indicates that green investment has significant economic, social, and environmental effects [23]. First, green-infrastructure investment can optimize the allocation of factors, leading to adjustments in energy structure, industrial structure, and consumption patterns towards greener models. Second, increased green-infrastructure investment will promote the development of a harmonious coexistence between humans and nature in cities. This is achieved through higher urban greening levels and a greater share of the green economy, which enhances urban livability and has positive effects on social stability and talent attraction [24]. Third, Almulhim et al. found that increased green-infrastructure investment provides strong financial support for cities to protect the environment and develop eco-friendly economies, effectively promoting the protection and development of urban ecological environments and thereby supporting the sustainability of urban economic growth [25]. In terms of the mechanism of green-infrastructure investment, existing research has examined its impact on related industries, the job market, and resource utilization efficiency. Li et al. found that urban green-infrastructure investment can drive the development of related industries such as renewable energy equipment manufacturing and green building construction, promoting urban economic structural upgrading and creating numerous job opportunities [26]. At the same time, green-infrastructure investment also improves urban resource utilization efficiency, reduces energy consumption in economic activities, minimizes energy waste, and lowers urban operating costs.

2.2. The Meaning, Measurement, and Optimization Pathways of Urban Economic Sustainable Development

Simmie’s research indicates that the capability of sustainable urban economic development refers to a city economy’s ability to withstand, adjust to, and transform in the face of adverse shocks and economic fluctuations [27]. Urban economic resilience not only reflects a city’s ability to adapt to and recover from external shocks such as economic volatility and environmental crises but also represents its core mechanism for promoting efficient resource allocation, industrial innovation, and inclusive social growth. Through diversified industrial structures, green technology applications, and equitable policy design, economic resilience enables cities to ensure stable economic operations while reducing dependence on non-renewable resources, lowering environmental burdens, and promoting social equity. This ultimately achieves long-term coordination of environmental, economic, and social benefits, which is highly consistent with the key dimensions of sustainable development goals [28]. Therefore, urban economic resilience levels can be used to measure sustainable urban economic development capabilities. The measurement of urban economic resilience can be broadly divided into single-dimensional indicator methods [29] and comprehensive indicator system evaluation methods. Chao et al. used the deviation of a city’s actual gross domestic product from that of 2008 to measure economic resilience levels [30]. The comprehensive indicator system evaluation method, on the other hand, constructs a multi-dimensional composite indicator system to measure urban economic resilience levels, thereby achieving a more comprehensive measurement [31]. Research on the optimization pathways of economic sustainable development levels has examined factors such as industrial structure diversification and agglomeration effects. It suggests that enhancing industrial structure diversification and promoting urban factor agglomeration can significantly improve sustainable urban economic development levels [32]. Technological spillover effects can also help economic systems quickly adapt to and mitigate risks and challenges, driving continuous and stable urban economic development [33]. With the development of the digital economy and increased attention to policy shocks, some studies have also examined the impact of digital economic development and industrial policy shocks on sustainable urban economic development levels [34]. Overall, research on sustainable urban economic development levels has preliminarily outlined the basic framework for exploring the stability of urban economic systems.

2.3. The Relationship Between Urban Green-Infrastructure Investment and Urban Economic Sustainable Development

In terms of impact, scholars have generally focused on the role of urban green-infrastructure investment in enhancing urban economic recovery and risk resistance capabilities. Zeng et al., based on panel data models, verified the significant positive effect of green-infrastructure investment on sustainable urban economic development, confirming that the process of green-infrastructure investment can significantly enhance a city’s recovery and adaptation capabilities in the face of external shocks [35]. This conclusion provides important theoretical support for understanding the role of green-infrastructure investment in enhancing economic sustainability. Nie et al. examined the impact of green-infrastructure investment on urban technological innovation and found that it mainly relies on multiple driving mechanisms, such as technological innovation and industrial collaboration [36]. Liu et al. further revealed that green-infrastructure investment can effectively promote urban policy support and collaborative governance, enabling cities to obtain more policy resources and thereby enhance economic sustainability [37]. Wang et al.’s study of multiple U.S. cities showed that green-infrastructure investment significantly promotes sustainable urban economic development through mechanisms such as improving urban ecological environments and enhancing resource utilization efficiency [38]. Lv et al.’s research on Chinese cities revealed a “U”-shaped dynamic relationship between green-infrastructure investment and economic sustainable development, characterized by initial suppression followed by promotion [39]. This conclusion was further confirmed in subsequent studies by Wang et al. [40], providing important theoretical evidence for understanding the dynamic relationship between green-infrastructure investment and economic sustainable development.

In summary, existing research has achieved certain results in the area of urban green-infrastructure investment and sustainable urban economic development, but there are still the following shortcomings: ① Insufficient data basis: Existing research mainly focuses on a few cities or regions and lacks a comprehensive analysis of different types of cities nationwide. It also fails to examine the differences in the relationship between green-infrastructure investment and sustainable urban economic development levels among cities with different economic development levels and industrial structures. ② Incomplete indicator measurement: Existing research on measuring urban green-infrastructure investment often focuses on a single dimension, lacking comprehensiveness and failing to reflect the true situation of urban green-infrastructure investment. ③ Insufficient mechanism research: Existing research lacks a systematic analysis of the mechanisms through which urban green-infrastructure investment enhances urban economic resilience through pathways such as industrial chain resilience, ecological resilience, and talent agglomeration. ④ Existing research has not paid attention to the spatial spillover effects of urban green-infrastructure investment on sustainable urban economic development levels and lacks relevant analysis. Based on this, this paper conducts a series of empirical analyses based on data from 281 Chinese cities over 13 years to scientifically analyze the impact of urban green-infrastructure investment on economic sustainable development levels, aiming to provide references for urban economic development in China.

Compared with existing research, the innovations of this paper are as follows:

① A comprehensive evaluation indicator system is extensively used to avoid the problem of incomplete indicator measurement in existing research, enhancing the objectivity and scientific nature of the study.

② Multiple econometric models, such as machine learning, quantile regression, and the generalized method of moments, are employed. Various robustness tests, including IV-2SLS models and PCA principal component analysis, are used to verify the robustness of the benchmark regression results.

③ While examining the direct impact of urban green-infrastructure investment on sustainable urban economic development, this paper also explores the impact mechanisms from multiple dimensions, such as industrial chain resilience, ecological resilience, and talent agglomeration. This enriches the understanding of the effects of urban green-infrastructure investment in academia and reveals the causal pathways through which urban green-infrastructure investment impacts sustainable urban economic development.

④ Considering the characteristics of each city, this paper deeply discusses the heterogeneity of the impact of urban green-infrastructure investment based on traits such as location, resource conditions, and openness, leading to more specific conclusions.

⑤ Since current research pays little attention to the spatial spillover effects of urban green-infrastructure investment on economic sustainable development, this paper attempts to use the spatial Durbin model to examine the impact of urban green-infrastructure investment on sustainable urban economic development, providing policy references for cities to increase green-infrastructure investment.

3. Mechanism Analysis and Research Hypothesis

3.1. Industrial Structure Upgrading Effect

First, urban infrastructure investment enhances a city’s risk resistance by optimizing resource allocation. Specifically, it improves basic conditions like transportation, energy, and communication, boosting urban operational and resource utilization efficiency [41]. This not only increases economic efficiency but also strengthens the city’s ability to cope with external shocks.

Second, infrastructure investment spurs technological innovation in related industries, promoting the application of new technologies, materials, and processes [42]. For example, building intelligent transportation systems can enhance traffic management intelligence, reducing accidents and congestion. Increasing green-infrastructure investment in cities will accelerate the development of green technologies and industries [43], advancing the city’s green and sustainable development and its ability to resist disturbances.

Third, the implementation of urban infrastructure investment requires policy support from the government. By formulating and enforcing relevant policies, the smooth execution of infrastructure projects can be ensured. Thus, the development of urban green-infrastructure investment can also drive policy support and collaborative governance, providing vital institutional support for urban economic sustainability [44]. As macroeconomic regulation becomes more important, infrastructure investment will play an increasingly crucial role in urban economic development. Based on this, the following hypotheses are proposed in this study:

Hypothesis H1.

Regional integration policies have a significant promoting effect on urban green and urban sustainable development levels.

3.2. Industrial Agglomeration Effect

The main factors affecting sustainable urban economic development include industrial chain resilience, ecological environment resilience, and talent supply resilience. Investment in urban green infrastructure enhances the city’s resource utilization and risk resistance by boosting the resilience of the industrial chain, ecological environment, and talent supply [45]. This drives the transformation of industrial economies towards high-speed, coordinated, and sustainable development, thereby optimizing urban economic development models and promoting green and low-carbon transitions. Ultimately, it improves urban economic sustainability.

① Industrial Chain Resilience Enhancement Effect: First, investment in urban green infrastructure can optimize basic conditions such as transportation, energy, and communication by accelerating the construction of public transportation networks and energy pipelines [46]. This improves urban operational and resource utilization efficiency. By optimizing resource allocation, it significantly enhances the efficiency of the urban industrial chain and strengthens its ability to cope with external shocks. Second, increasing investment in green infrastructure can drive technological innovation in related industries and promote the development of green technologies, new materials, and derivative industries [47]. This enhances the adaptability of the urban industrial chain to rapid changes in the economic environment and boosts the city’s overall competitiveness. Third, governments can encourage private capital participation in green infrastructure construction through policies such as financial subsidies and tax incentives [48]. This optimizes policy support and enhances the resilience of the industrial chain.

Industrial chain resilience is a crucial component of sustainable urban economic development. Its impact on urban economic sustainability mainly includes increasing economic recovery speed, reducing economic fluctuation risks, and enhancing urban risk resistance. First, stronger industrial chain resilience significantly accelerates economic recovery following external shocks such as natural disasters or economic crises [49]. When all links of the industrial chain are highly resilient, cities can quickly resume production activities and minimize economic losses. Second, cities with stronger industrial chain resilience have higher resource allocation efficiency and adaptability. They can better cope with demand changes and market fluctuations [50]. When one industry is impacted, other links in the chain can adjust production strategies or find alternative suppliers to reduce dependence on a single industry, thereby lowering overall economic fluctuation risks [51]. This enhances urban economic sustainability. Third, stronger industrial chain resilience means greater resistance to external shocks. Cities can better ensure the stable and orderly operation of key infrastructure and core economic activities during external shocks, significantly reducing economic risks from supply chain disruptions or production halts. This plays an important role in improving urban economic sustainability. Based on this, the following hypothesis is proposed:

Hypothesis H2.

Urban green-infrastructure investment promotes the enhancement of sustainable urban economic development levels through the effect of enhancing industrial chain resilience.

② Ecological Environment Resilience Enhancement Effect: First, investment in urban green infrastructure can improve air quality and water quality by constructing more robust wastewater and exhaust emission monitoring systems to strictly oversee urban discharges [52]. This investment also provides necessary funding for increasing urban green spaces, enhancing ecological functions, and significantly boosting ecological resilience. Second, investing in green infrastructure such as rain gardens and wetlands can reduce urban flooding and enhance water self-purification capabilities, thereby stabilizing urban ecosystems [53]. Third, investment in renewable energy facilities and energy-efficient buildings can reduce dependence on traditional energy sources, improve energy efficiency, and mitigate pollution from fossil fuel consumption, effectively enhancing ecological quality.

The promotion of urban economic sustainability by ecological resilience is twofold. First, it reduces economic operation costs. Cities with high ecological resilience can minimize economic losses and post-disaster reconstruction costs during natural disasters like floods through wetland and flood control construction [54]. Additionally, a healthy environment reduces health issues caused by pollution, lowering medical and social security expenditures, alleviating fiscal burdens, and enhancing economic resilience and sustainability [55]. Second, it enhances economic risk resistance. Cities with strong ecological resilience can better withstand external shocks and reduce the risk of economic activity disruptions. For example, rainwater collection and wastewater treatment systems can mitigate risks from water scarcity and pollution. Moreover, a good environment boosts residents’ sense of belonging and happiness, reducing economic risks and social unrest caused by instability [56]. Based on this, the following hypothesis is proposed:

Hypothesis H3.

Urban green-infrastructure investment promotes sustainable urban economic development through the enhancement of ecological resilience.

③ Agglomeration Effect: Talent is the core driver of urban economic development [57]. Green-infrastructure investment spurs related industries like renewable energy equipment manufacturing, green building construction, and ecological restoration, creating jobs and attracting talent. Second, this investment funds infrastructure improvements, optimizing research environments and attracting high-tech and innovative talent, boosting urban competitiveness [58]. Third, by enhancing livability through better ecological quality and recreational spaces like parks and wetlands, green infrastructure significantly increases urban talent attractiveness [59]. The addition of modern green infrastructure, such as green buildings and smart transportation, also improves the city’s overall image, attracting more high-tech and innovative talent.

The role of talent agglomeration in enhancing urban economic sustainability is threefold. First, high-quality talent drives technological innovation, improving technological and production levels, efficiency, and resource utilization, and accelerating economic growth and resilience. Second, talent agglomeration creates a more flexible labor market, reducing unemployment caused by skill mismatches during economic crises [60], stabilizing employment, and enhancing sustainability. Third, high-quality talent, with rich technical reserves [61], can quickly develop and apply new technologies and approaches during emergencies like natural disasters or pandemics, improving emergency response capabilities, reducing losses, and boosting economic sustainability. Based on this, the following hypothesis is proposed:

Hypothesis H4.

Urban green-infrastructure investment promotes sustainable urban economic development through the talent agglomeration effect.

3.3. Spatial Spillover Effects

This study further examines the spatial spillover mechanisms of urban green-infrastructure investment on sustainable urban economic development. First, based on agglomeration and selection effects [62], green-infrastructure investment guides the tertiary sector to core cities with advanced economies and technology while shifting the secondary sector to surrounding areas. This accelerates regional industrial upgrading, curbs the expansion of high-energy-consuming and polluting enterprises, and fosters green industry growth points. Second, urban infrastructure development strengthens inter-city network connections. Through interconnected infrastructure and cross-regional resource sharing, it significantly enhances the spatial diffusion efficiency of economic sustainability promotion effects [63]. Additionally, research confirms that environmental regulation has positive spatial spillover effects [64]. Green-infrastructure investment, through policy coordination and standard alignment, forms cross-regional environmental governance communities. Advanced cities drive less developed areas through technological spillovers and institutional demonstrations, promoting spatial diffusion of economic development. Based on this, the following hypothesis is proposed:

Hypothesis H5.

Urban green-infrastructure investment has a positive spatial spillover effect on sustainable urban economic development capabilities.

Figure 1 is the research framework diagram of this paper.

Figure 1.

Research framework diagram.

Overall, urban green-infrastructure investment not only directly enhances urban economic sustainability but also boosts economic resilience and sustainability through improved industrial chain resilience, ecological resilience, and talent focus. Moreover, this investment also has a positive spatial spillover effect, meaning that the promotion of economic sustainability in one city can spread to surrounding cities.

4. Research Design

4.1. Model Specifications

To empirically examine the impact of urban green-infrastructure investment on sustainable urban economic development levels, drawing on the research by Zhang et al. [65], the econometric model is specified as follows:

Ecoreskt = β0 + β1Scorekt + β2Controlskt + ζk + δt + εkt

In Model (1), which is employed to analyze the impact of green-infrastructure investment on economic resilience in cities, the dependent variable is denoted as Ecoreskt, representing the level of green-infrastructure investment for city k in year t; the independent variable is Scorekt, indicating the level of sustainable development for city k in year t. Controlskt represents a set of city-level control variables. ζk signifies regional fixed effects, δt denotes time fixed effects, and εkt is the stochastic error term of the equation. The coefficient β1 is the primary parameter of interest for estimation. A significant positive value of β1 would suggest that green-infrastructure investment significantly enhances the level of urban sustainable development.

4.2. Variable Explanation

(1) Dependent Variable: Given that sustainable urban economic development capabilities can be measured by urban economic resilience, and that urban economic resilience can be assessed from three core perspectives—resistance and recovery capacity, adjustment and adaptation capacity, and optimization and transformation capacity [66]—this study adopts the entropy method to construct an Urban Economic Sustainable Development Level Index (Ecores). The entropy method, as an objective weighting approach, effectively minimizes subjective influences on weight determination, thereby enhancing data objectivity. Drawing on the research of Zhang et al. and Ding et al. [67,68], the Ecores index measures sustainable urban economic development from three aspects: resistance and recovery capacity (Res), adjustment and adaptation capacity (Adp), and optimization and transformation capacity (Tran). A higher index value indicates a higher level of sustainable urban economic development. The weights of each indicator, determined by the entropy method formula, are detailed in Appendix A, and the entropy measurement system is presented in Table 1.

Table 1.

Measurement system of urban economic resilience indicators.

(2) Independent Variable: Construct the urban green-infrastructure investment level variable Score. Given that key urban green-infrastructure investments typically focus on sewage transportation capacity, public transportation development, and urban greening, the reasons are as follows: First, sewage transportation capacity is a vital part of urban infrastructure. With urban growth and population increase, sewage generation rises. Enhancing sewage transportation can safely and efficiently convey sewage from all urban areas, preventing random discharge and environmental pollution, thereby protecting the urban environment. Second, improving public transportation is crucial for urban economic sustainability. A good public transit system can alleviate traffic congestion, reduce private car use, and lower energy consumption and exhaust emissions, thus improving environmental quality. Third, urban greening is an important measure for improving the urban ecological environment. Green spaces can absorb carbon dioxide, release oxygen, regulate local climate, and mitigate urban heat-island effects. Additionally, green areas provide recreational spaces for residents, enhancing their quality of life and overall urban livability. Based on this, this study, drawing on the research of Yu et al. [69], constructs a green-infrastructure investment level index using the entropy method. The specific calculation system for the index is shown in Table 2.

Table 2.

Measurement system of indicators for urban green-infrastructure investment levels.

(3) Control Variables: Considering that other factors at the urban level may potentially impact urban sustainable development, this study follows established practices by selecting factors that may influence urban sustainable development as control variables [70]. These mainly include the following aspects, with the measurement of control variables detailed in Table 3:

Table 3.

Measurement of control variables.

① Urban Hukou Population (LnPop): The number of urban hukou (household registration) population directly affects the labor supply, consumer demand, and public service requirements of a city. A larger hukou population implies a more abundant labor supply and greater demand for consumption and public services [71]. This, in turn, influences the city’s economic system’s ability to cope with certain shocks and has a significant impact on urban economic development and sustainable development capabilities, thus necessitating its inclusion in the analysis.

② Level of Economic Development (AvGDP): GDP is a crucial indicator of the economic scale and total volume of economic activities in a region, reflecting a city’s economic strength and development level. Generally, cities with higher GDP levels have a stronger economic foundation and more financial and economic resources, which enhances their capacity to withstand external shocks [72]. This is an important factor influencing urban sustainable development.

③ Urban Industrial Structure (Ind): Different industries rely on distinct resource markets. A diverse industrial structure within a city can enhance its economic adaptability and flexibility. When one industry is impacted, others can provide a buffer, reducing overall economic fluctuations [73]. Moreover, the upgrading of urban industrial structures increases the proportion of high value-added and resource-efficient industries such as services [74], which can significantly boost the level of urban sustainable development.

④ Degree of Government Intervention (Gov): A higher degree of government intervention in urban development and market activities often drives urban industries towards more rational, greener, sustainable, and forward-looking directions. Existing research has found that cities with higher levels of government intervention have stronger capabilities to resist economic shocks and natural disasters [75]. Therefore, the degree of government intervention is included as a control variable in this study.

⑤ Urban Innovation Investment Level (Fin): Increased innovation investment in cities can promote technological progress and industrial upgrading, enhancing the city’s competitiveness and adaptability to change [76]. Moreover, higher innovation investment can help nurture emerging industries in cities, creating new growth points and significantly strengthening the city’s economic sustainable development capabilities.

(4) Data Sources: This study selects panel data from Chinese prefecture-level cities from 2010 to 2022 as the research sample. All indicator data for each city is sourced from the China City Statistical Yearbook, China Energy Yearbook, and local government work reports. Before conducting econometric regressions, to avoid the influence of extreme values on the results, the following standardization processes are applied to the raw data: (1) Cities with a data missing rate of over 15% are excluded; (2) Linear interpolation is used to fill in non-consecutive missing values. This results in a balanced panel dataset covering 281 prefecture-level cities; (3) In the section on spatial spillover effects of policies, this study calculates a spatial economic and geographical nested matrix among Chinese cities, comprehensively measuring the distances between cities from both GDP and geographical coordinates (latitude and longitude) perspectives. Descriptive statistics of the variables are presented in Table 4.

Table 4.

Descriptive statistics.

5. Empirical Results Analysis

5.1. Benchmark Regression Analysis

Prior to constructing the specific model, this study first conducted a correlation analysis among the variables selected for the model. The random forest method was employed to fit the explanatory power of the core independent variables and control variables on the dependent variable, yielding an R2 value of 0.996. This indicates that the core independent variables and control variables selected in this study can effectively explain the dependent variable, thereby ruling out the issue of omitted variable bias. Subsequently, the gradient-boosting decision tree method was utilized to assess the importance of the core independent variables and control variables within the model. The regression results from the gradient-boosting decision tree reveal that the factors influencing urban sustainable development, in descending order of weight, are urban green-infrastructure investment, urban hukou population, urban innovation investment, level of urban economic development, urban industrial structure, and degree of government intervention. This finding corroborates the rationality of selecting green-infrastructure investment as the core independent variable in this study. Finally, the Hausman test was conducted. With a Hausman test value of 286 and a p-value of 0.000, the results indicate that the fixed-effects model is more appropriate for examining the causal relationship between urban green-infrastructure investment and urban sustainable development. Therefore, this study employs a two-way fixed-effects model, controlling for both time and city factors, for the benchmark regression analysis, and further conducts quantile regression based on the benchmark regression.

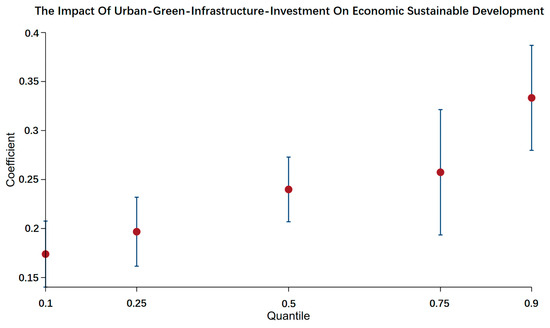

Building on the aforementioned tests, this study empirically examines the impact of urban green-infrastructure investment on urban sustainable development. Table 5 presents the estimation results of the effect of urban green-infrastructure investment on urban sustainable development. After controlling for individual and time fixed effects, Column (1) in Table 5 shows that the coefficient of Score is 0.0588 and significant at the 1% level. This suggests that urban green-infrastructure investment significantly enhances the level of urban sustainable development, bolstering the city’s capacity to cope with external risks. The results in Columns (2), (3), and (4) further support this conclusion. The quantile regression results in Table 6 indicate that the coefficient of Score is positive and significant across all quantiles, demonstrating a positive impact of green-infrastructure investment on urban sustainable development. Moreover, the coefficient of Score increases from 0.174 at the 10th quantile to 0.333 at the 90th quantile, suggesting that the marginal benefits of green-infrastructure investment are greater in cities with higher levels of sustainable development. The chart of quantile regression results is shown in Figure 2. Overall, urban green-infrastructure investment has a significant positive effect on urban sustainable development, thereby validating Hypothesis H1.

Table 5.

Baseline regression results.

Table 6.

Quantile regression results.

Figure 2.

Quantile results plot.

5.2. Mechanism Test Results

Urban green-infrastructure investment effectively promotes the enhancement of sustainable urban economic development by improving the resilience of the industrial chain, ecological environment, and talent agglomeration level. Drawing on the research of Wen et al., this study conducts mechanism tests on the above three channels [77].

For the industrial chain resilience enhancement effect**, this study references the research of Chen et al. [78] and uses the entropy method to comprehensively represent industrial chain resilience (IndRes) from two dimensions: urban resistance and recovery capacity and transformation and renewal capacity. The empirical results in Column (1) of Table 7 show that the coefficient of Score is 0.0114, which is significantly positive at the 1% level. This indicates that urban green-infrastructure investment significantly enhances urban industrial chain resilience. The possible reasons are as follows: First, green infrastructure, such as eco-parks and green transportation networks, can reduce corporate operating costs and improve resource utilization efficiency [79], thereby enhancing enterprises’ resistance and recovery capabilities in the face of external shocks. Second, green-infrastructure investment promotes collaborative innovation among industries and drives traditional industries to transform in a green and low-carbon direction, enhancing the adaptability and flexibility of industries [80]. The improvement of industrial chain resilience can enhance the ability of each link in the urban industrial chain to resist external shocks, ensure the stability of key urban infrastructure and core economic activities in the face of shocks, and improve urban economic resilience.

Table 7.

Mechanism tests (1).

Further, the study uses the Sobel–Goodman method to enhance the reliability of the mechanism test results, as shown in Columns (2)–(4) of Table 7. It can be concluded that IndRes plays a significant mediating role between Score and EcoRes, consistent with the findings of Fang et al. [81].

In terms of ecological resilience enhancement, urban green-infrastructure investment improves environmental resilience by constructing disaster-resistant facilities, establishing protection mechanisms and organizations, enhancing disaster-resistance capabilities, improving ecosystem functions, and promoting sustainable resource use. Enhanced environmental resilience reduces risks to the economy from external shocks such as disasters and enhances economic stability. The development of environmental protection also promotes industrial transformation and attracts investment towards green emerging industries [82], thereby improving economic sustainability and urban economic resilience. Based on the core factors affecting urban environmental development, which are urban manufacturing activities, and considering the level of environmental disturbance reflected by green total factor productivity (GTFP) in urban economic activities, this study, drawing on the research of Li et al., uses the super-efficiency SBM model to measure urban GTFP as an indicator of urban ecological resilience [83]. The specific calculation formula is shown in Appendix B. The results in Column (1) of Table 8 show that the coefficient of Score is 1.283, which is significantly positive at the 1% level. This indicates that urban green-infrastructure investment significantly enhances urban GTFP, thereby improving ecological resilience and promoting the growth of urban economic resilience. Columns (2)–(4) further attest to the role of this mechanism.

Table 8.

Mechanism tests (2).

Considering the key role of scientific research and technical talent in urban economic development, this study, drawing on the research of Gao et al., uses the entropy method to measure the talent agglomeration effect (TalGath) from three dimensions: the number of practitioners (in ten thousand people) in scientific research, technical services, and education in the city in the current year [84]. The results in Column (1) of Table 9 show that the coefficient of Score is 1.031, which is significantly positive at the 1% level. This indicates that urban green-infrastructure investment significantly promotes the agglomeration of high-tech talent in cities. The possible reasons are as follows: First, urban green-infrastructure investment drives the improvement of the urban ecological environment, enhancing urban livability, attractiveness, and competitiveness [85]. Second, it guides the development of emerging industries, creating more job opportunities for high-tech talent. These aspects jointly create a favorable working and living environment and broad development space for high-tech talent, thereby significantly promoting their agglomeration in cities. The agglomeration of high-tech talent strongly promotes urban technological development and economic transformation, improves environmental protection levels, enhances urban innovation and anti-interference capabilities [86], and improves urban economic sustainability. Columns (2)–(4) further verify the role of this mechanism.

Table 9.

Mechanism tests (3).

In summary, the mechanism test results in Table 7, Table 8 and Table 9 confirm that the enhancement of industrial chain resilience, ecological resilience, and talent agglomeration are three major important channels through which urban green-infrastructure investment improves sustainable urban economic development capabilities, further supporting the research Hypotheses H2, H3, and H4.

5.3. Spatial Effect Test

Initially, this study calculates a spatial economic and geographical nested matrix and employs the global Moran’s I index to examine the spatial correlation between urban green-infrastructure investment and sustainable urban economic development levels. The results in Table 10 show that the Moran’s I indices for both green-infrastructure investment and economic sustainable development levels are not zero, indicating significant spatial correlation. This means that urban green-infrastructure investment not only affects local economic sustainability but may also influence neighboring cities through spatial spillover effects.

Table 10.

Global spatial autocorrelation test.

To further explore the impact of urban green-infrastructure investment on sustainable urban economic development and its potential spatial spillover effects, this study draws on the research of Wang et al. and compares various econometric models. To effectively control for biases from time-series and individual heterogeneity and to accurately capture spatial interdependencies and spillovers, this study, following Arogundade et al. [87], adopts a spatial Durbin model with double fixed effects as the core analytical framework. This provides a more scientific and reliable empirical basis. Table 11 clearly presents the quantified results of the spatial spillover effects of urban green-infrastructure investment on sustainable urban economic development. As shown in Column (1) of Table 11, the spatial autoregressive coefficient is significantly positive at the 1% level. This indicates that in geographically adjacent cities, improvements in economic sustainability are not isolated but significantly interdependent. Thus, enhancements in one city’s economic sustainability can positively promote that of neighboring cities, providing important theoretical support for regional economic coordination.

Table 11.

Spatial autoregressive coefficient.

To further analyze the specific mechanisms through which urban green-infrastructure investment affects sustainable urban economic development, this study decomposes the overall impact into direct, indirect, and total effects. The indirect effect, which measures the impact on other cities through spatial spillovers, is a key indicator for testing the existence of spatial spillover effects. As shown in Column (3) of Table 11, the indirect effect is significantly positive at the 1% level, and the spatial autoregressive coefficient is also significantly positive at the 1% level. This strongly indicates that urban green-infrastructure investment not only positively affects the local city’s economic sustainability but also significantly promotes that of neighboring cities through spatial spillovers, thereby verifying Hypothesis H5.

Drawing on real-world examples, the Yangtze River Delta region in China has established a green integrated development demonstration zone. This allows cities with advanced green development policies and investment experiences to more easily transfer their successful practices to neighboring cities. For example, after the successful implementation of electric buses and sponge city projects in some cities, these initiatives quickly spread to surrounding areas. This greatly improved the efficiency of green-infrastructure investment and the rationality and scientific nature of green-infrastructure construction, rapidly transforming the region into a world-class green demonstration zone [88]. It also significantly promoted the intelligent and green development of cities within the region and enhanced their economic resilience. However, fully leveraging the spatial spillover effects of green-infrastructure investment on urban economic resilience faces challenges such as inconsistent supporting policies and significant differences in development levels among cities, which hinder the application of advanced experiences from other cities. These issues require continuous optimization of policy measures [89].

Overall, the findings of this study—that urban green-infrastructure investment has spatial spillover effects on urban economic resilience—enrich the theoretical research on the relationship between green-infrastructure and sustainable urban economic development. They also provide important practical guidance for urban planners and policymakers in promoting regional coordinated development and enhancing urban economic sustainability.

The specific formulas and steps for the economic–geographic nested matrix are shown in Appendix C.

6. Heterogeneity Analysis

6.1. Urban Location Heterogeneity

The geographical location of a city has a significant impact on its economic development. Based on the geographical distribution of the sample cities, this study divides them into cities in the central and western regions and cities in the eastern region and conducts heterogeneity tests, respectively. The results are shown in Columns (1) and (2) of Table 12. Column (1) shows that in the sample of cities in the central and western regions, the coefficient of Score is 0.1800, which is significant at the 1% level. However, Column (2) indicates that in the sample of cities in the eastern region, the coefficient of Score is 0.0405, which is significant at the 1% level. This suggests that the promoting effect of urban green-infrastructure investment on urban sustainable development levels is more pronounced in the central region of China than in the eastern region. The reasons may include the following: ① The industrial structure of the central and western regions is relatively simple, with lower technological interconnection and complexity and greater potential for development [90]. It is easier to promote economic transformation and upgrading, and the effect on enhancing sustainable development levels is more evident. ② Compared with cities in the eastern region, cities in the central and western regions, being located inland, have a market that is more reliant on domestic demand and is less affected by fluctuations in foreign markets. Under the impact of economic crises, the central and western regions are affected to a lesser extent than the eastern region and recover relatively faster. ③ Since the launch of environmental protection work in China, cities in the central and western regions, with fewer polluting enterprises and easier access to green energy such as photovoltaic and hydropower, have more advantageous opportunities for the development of green industries than cities in the eastern region [91]. Therefore, the effect of urban green-infrastructure investment on enhancing their sustainable development levels is more pronounced. In summary, the differences in industrial structure foundation, market supply-and-demand sources, and conditions for green industry development together lead to a more significant effect of urban green-infrastructure investment on enhancing the sustainable development levels of cities in the central and western regions.

Table 12.

Heterogeneity analysis results (1).

6.2. Urban Resource Endowment Heterogeneity

A city’s resource endowment often determines its basic development status. Drawing on the research of Hu et al. [92], this study categorizes cities into resource-based and non-resource-based cities for separate empirical analyses. The results in Columns (3) and (4) of Table 12 indicate that in cities with better resource endowments, green-infrastructure investment has a more significant impact on sustainable urban economic development. The possible reasons for this phenomenon are as follows: ① Cities with better resource endowments can leverage their advantages to achieve economic development earlier and have a stronger economic foundation [93]. This provides more sufficient financial support for green-infrastructure investment. ② Cities rich in resources such as water, forests, minerals, and clean air can use green-infrastructure investment to promote the rational use and protection of these resources. This enhances sustainable resource utilization and urban innovation, thereby boosting economic sustainability. ③ Cities with better resource endowments often have industrial structures dominated by heavy industries with higher pollution levels. Increased green-infrastructure investment can more significantly improve urban environmental quality and ecological resilience, injecting strong momentum into sustainable urban development.

6.3. Urbanization Level Heterogeneity

The level of urbanization in a city typically reflects its development stage and basic condition. In this paper, the proportion of urban household population to the total household population in a city is used to measure the level of urbanization. Cities with an urbanization rate lower than the average urbanization rate of all cities by one standard deviation in each year are selected as cities with a lower urbanization rate, while cities with an urbanization rate higher than the average by one standard deviation are considered as cities with a higher urbanization rate. Empirical analyses are then conducted separately for these two groups of cities. The results in Columns (1) and (2) of Table 13 indicate that in cities with a lower urbanization rate, the impact of green-infrastructure investment on urban sustainable development is more significant. The possible reasons for this phenomenon are as follows: First, cities with a lower urbanization rate are generally still in the development stage, with a greater demand for urban expansion and infrastructure construction [94]. Green-infrastructure investment can be more effectively integrated into urban planning and development, playing a greater economic and social role. Second, in cities with a lower urbanization rate, the urban household population is relatively small, creating a larger demand gap for urban residents. Green-infrastructure investment can promote the formation and development of related industries, directly create job opportunities, attract more labor to move into the city, and enhance the city’s economic vitality and sustainable development capacity. Third, cities with a lower urbanization rate usually lag behind cities with a higher urbanization rate in terms of green and public facility construction. Investment in green infrastructure can improve the urban ecological environment, enhance the livability of the city, effectively improve the quality of life of residents [95], promote population inflow and economic development, and inject strong momentum into improving the level of urban sustainable development.

Table 13.

Heterogeneity analysis results (2).

6.4. Urban Openness Level Heterogeneity

The level of openness of a city reflects its participation in the global market. In this paper, the proportion of a city’s annual total import and export volume to its GDP in the same year is used to measure the city’s level of openness. Cities with an openness level lower than the average openness level of all cities by one standard deviation in each year are selected as cities with a lower level of openness, while cities with an openness level higher than the average by one standard deviation are considered as cities with a higher level of openness. Empirical analyses are then conducted separately for these two groups of cities, with the results presented in Columns (3) and (4) of Table 13. According to the regression results, it is found that in cities with a higher level of openness, the positive impact of green-infrastructure investment on urban sustainable development is more pronounced. The possible reasons are as follows: ① Cities with a higher level of openness are more likely to attract international cooperation projects, and the promotion of green-infrastructure investment through international technological exchanges is stronger [96], which enhances the efficiency and effectiveness of investment. ② Open cities generally enjoy better policy support and urban innovation capabilities, which can better promote the implementation of green-infrastructure investment and related policies and enhance the effect of green-infrastructure investment. ③ Cities with a higher level of openness are more strongly influenced by the mainstream international environmental protection ideas [97], and usually have higher environmental awareness and public participation within the city, which effectively promotes the implementation of green-infrastructure investment and the improvement of public acceptance, and enhances the positive impact of green-infrastructure investment on the level of sustainable development.

6.5. Urban Scale Heterogeneity

Previous research has found that urban scale has a strong interactive relationship with regional innovation and economic growth [98]. Therefore, it is necessary to examine the differences in effects across different urban scales. Following the research of Wang et al., this study classifies cities with a population of less than 5 million as medium and small cities, and those with a population of more than 5 million as large cities. Empirical analyses are conducted separately for these two groups. The results in Columns (1) and (2) of Table 14 show that in large cities, green infrastructure investment has a more significant impact on sustainable urban economic development. The possible reasons for this phenomenon are as follows: First, large cities typically have large populations and high population densities. Improvements in green infrastructure, such as increasing urban green spaces and optimizing sewage systems, generate more noticeable environmental benefits and have a more pronounced impact on urban green economic sustainability. Second, large cities, with their frequent economic activities and large-scale industries, consume a significant amount of resources. Green-infrastructure investment helps improve resource utilization efficiency. For example, constructing advanced sewage treatment systems and recycled water facilities can effectively treat and reuse large amounts of wastewater, reducing dependence on freshwater resources and thus more significantly enhancing the city’s ability to withstand natural disasters and other shocks. Third, large cities usually have more complex and diverse industrial structures with high inter-industry linkages. Green-infrastructure investment is more effective in promoting synergistic development among industries and in driving the formation of a highly integrated and complex economic model, thereby more effectively boosting urban economic resilience.

Table 14.

Heterogeneity analysis results (3).

6.6. Government Intervention Heterogeneity

Since large-scale infrastructure investment often relies on unified planning and construction by the government, this study, following the research of Li et al. [99], uses the frequency of terms related to green infrastructure in city government work reports to measure the level of government intervention in green-infrastructure investment. Cities with a term frequency greater than one standard deviation above the mean are classified as having high government intervention, while those with a frequency less than one standard deviation below the mean are classified as having insufficient government intervention. Empirical analyses are conducted separately for these two groups, with the results shown in Columns (3) and (4) of Table 14. The regression results indicate that, in cities with higher levels of government intervention, green-infrastructure investment has a more pronounced positive effect on sustainable urban economic development. The possible reasons are as follows: First, cities with higher levels of government intervention can develop comprehensive and systematic plans for green infrastructure. By integrating green infrastructure construction with urban spatial layout, industrial planning, and population development, these cities enhance the benefits of green infrastructure for urban economic sustainability. Second, governments can allocate substantial public resources to green infrastructure projects. Therefore, cities with higher government intervention can better utilize public power and financial capabilities to coordinate land, funding, and human resources, ensuring the smooth implementation of key green-infrastructure projects. Third, cities with higher government intervention have stronger regulatory capabilities. They can strictly monitor the construction and operation of green-infrastructure projects, effectively address issues such as misuse of funds, and ensure that the benefits of green-infrastructure investment are fully realized.

7. Robustness Tests

7.1. Addressing Endogeneity Issues

As research deepens, an increasing number of scholars have begun to focus on endogeneity issues [100]. First, to address endogeneity caused by correlation between explanatory variables and the error term, this study selects instrumental variables and employs two-stage least-squares (2SLS) regression. For the choice of instrumental variables, the following approaches are taken:

First, this study constructs a dummy variable, using whether a city is included in the key air pollution control zone as the instrumental variable Ins1. If a city is included in the key air pollution control zone, Ins1 takes a value of 1; otherwise, it takes a value of 0. On the one hand, being included in the key air pollution control zone implies that the city must enhance its focus on environmental protection and actively improve urban environmental quality through increased green-infrastructure investment, thus satisfying the relevance requirement of the instrumental variable. On the other hand, whether a city is included in the key air pollution control zone has a negligible impact on the current level of urban sustainable development, meeting the exogeneity condition of the instrumental variable. Columns (1) and (2) of Table 15 present the estimation results for Ins1. The first-stage 2SLS regression results show that the coefficient of Ins1 is 0.2021, which is significantly positive at the 1% level. This indicates that the selected instrumental variable is significantly positively correlated with the level of urban green-infrastructure investment. The second-stage estimation results show that the coefficient of Score is 0.5852, which is significantly positive at the 1% level, indicating robust study results. Additionally, the results of the weak instrument variable test show that the Kleibergen–Paap rk Wald F statistic significantly exceeds the critical value of 16.38 at the 5% significance level, passing the weak instrument variable test well. The p-values of the chi-squared (1) statistic are all less than 0.1, indicating that the Durbin–Wu–Hausman test cannot reject the null hypothesis that the instrumental variables are endogenous, meaning the instrumental variables are exogenous to the explained variable.

Table 15.

Robustness tests (1).

Second, considering that the number of employees in urban environmental protection (Env) is an important indicator reflecting the emphasis on urban green construction and has a clear positive correlation with urban green-infrastructure investment while having almost no direct correlation with sustainable urban economic development levels, this study, following Pierce et al. [101], introduces the number of employees (in ten thousand) in the urban environmental protection sector as the second instrumental variable (Ins2) for testing. The results are shown in Columns (3) and (4) of Table 15. The Wald F statistic exceeds the critical value of 16.38 at the 5% significance level, passing the weak instrument variable test. In these tests, the conclusions remain unchanged, and the positive promoting effect of urban green-infrastructure investment on sustainable urban economic development levels is robust.

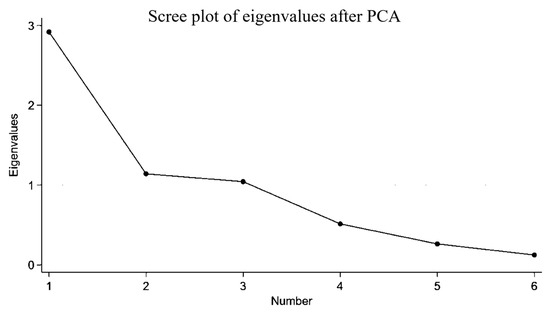

Further, the entropy method used to calculate sustainable urban economic development levels and green-infrastructure investment data may introduce confounding information into the data, affecting the baseline regression results. Principal component analysis (PCA), as an effective dimensionality reduction technique, can extract key information and reduce variable redundancy, thereby simplifying the model and reducing the risk of overfitting [102]. Additionally, PCA can eliminate the impact of outliers in individual variables on model results, enhancing model robustness [103]. Based on this, to avoid interference from potential multicollinearity in the original data, the study conducts a PCA. Figure 3 shows the decay of variables after dimensionality reduction, and the empirical results are presented in Table 16. The extracted principal components (pc1–pc6) all show that urban green-infrastructure investment has a significant impact on economic sustainable development levels, with the model demonstrating high explanatory power, further validating the robustness of the original model. After considering potential endogeneity issues, the conclusions remain unchanged, enhancing the credibility of the study results.

Figure 3.

Dimensionality reduction diagram of core variables.

Table 16.

Robustness tests (2).

7.2. Adding Control Variables

Previous studies have indicated that the financing level of a city exerts a significant influence on its investment capacity. Generally, cities with higher financing levels and more active financing markets tend to have larger investment amounts in various types of infrastructure. Therefore, it is necessary for this study to take into account the financing level of cities. In this paper, the basic financing level of a city is measured by the ratio of the annual total deposits and loans of financing institutions (in CNY ten thousand) to the city’s annual GDP (in CNY ten thousand), and the Fin variable is included as a control variable. Moreover, the accelerated advent of the intelligent and technological era will amplify the agglomeration effect of talent [104]. Thus, it is essential for the study to consider the initial conditions of talent agglomeration. Since the talent level of a city is constrained by the level of education, which is usually reflected by the number of education practitioners, this paper also includes the number of education practitioners in the city (in ten thousand people) as the Tech variable in the empirical model for control. The results in Column (1) of Table 17 show that the coefficient of Score is 0.4552, which is significant at the 1% level. This indicates that even after controlling for the impact of urban financing level and urban education level, urban green-infrastructure investment still has a significant positive effect on the level of urban sustainable development.

Table 17.

Robustness tests (3).

7.3. High-Dimensional Fixed-Effects Test

Taking into account the unobservable heterogeneity in economic development and social environment across Chinese provinces, including cultural differences, policy environments, and historical backgrounds, which may influence the results of empirical analysis, this paper conducts a high-dimensional fixed-effects test after controlling for the province to which the city belongs. The results are presented in Column (2) of Table 17. At this juncture, the coefficient of Score stands at 0.2341, which is significantly positive at the 1% level. This finding indicates that, after excluding interprovincial differences, urban green-infrastructure investment still exerts a significant positive impact on the enhancement of sustainable urban development. Thus, the research conclusion remains robust.

7.4. Exclusion of Data from Anomalous Years

In 2020, China and the rest of the world were severely impacted by the COVID-19 pandemic, which had a significant influence on economic and social development across regions. Therefore, it is necessary to address the interference caused by the data from 2020. Following the approach of Zucaro et al. [105], after excluding the sample data from 2020, the empirical results are shown in Column (1) of Table 18, where the coefficient of Score is 0.1594 and is significantly positive at the 1% level. Thus, even after removing the data from this anomalous year, urban green-infrastructure investment still significantly enhances the level of urban sustainable development, maintaining the robustness of the research conclusion.

Table 18.

Robustness tests (4).

7.5. Mitigation of Outlier Interference

To avoid the interference of outliers in the sample on the research results, this study, in line with Kolditz et al. [106], applies a two-sided 1% winsorization and trimming process to continuous variables. The results are presented in Columns (2) and (3) of Table 18. In both samples, the coefficients for Score are 0.4661 and 0.5620, respectively, both significantly positive at the 1% level. This indicates that, even after eliminating the influence of extreme values, urban green-infrastructure investment still significantly promotes the enhancement of urban sustainable development levels. The research conclusion remains unchanged in both the winsorized and trimmed samples, further validating the robustness of the results.

7.6. Lagged Effect Test

As an economic investment, urban green-infrastructure investment may exert a lagged effect on the sustainable development capacity of a city. From the perspective of project planning and construction cycles, the complexity of planning leads to difficulties in coordinating across multiple fields and departments. The differing interests and objectives of various departments can prolong the planning period. Moreover, the construction phase is lengthy; for instance, large-scale green buildings and ecological parks typically take several years from initiation to operation, making it challenging to swiftly bolster sustainable development capacity. Therefore, this paper conducts a lagged-effect test, examining the situation of urban green-infrastructure investment with a lag of one and two periods, respectively.

According to the test results in Table 19, after lagging the situation of urban green-infrastructure investment by one and two periods, the investment still significantly and positively affects the level of urban sustainable development at the 1% significance level. This indicates that even when considering the lagged impact of investment, it can still be concluded that urban green-infrastructure investment positively promotes the enhancement of urban sustainable development.

Table 19.

Robustness tests (5).

8. Discussion

8.1. Discussion on the Role of Urban Green-Infrastructure Investment in the Sustainable Development of Urban Economy