Abstract

As the global economic environment becomes more complex and uncertain, economic resilience has become a crucial indicator of an economy’s ability to maintain sustainable development in response to external shocks. The digital economy contributes substantially to economic resilience. Notably, upgrading industrial structure is essential in facilitating this contribution. Therefore, it is necessary to study the impact mechanisms of the digital economy on economic resilience from the perspective of industrial structure upgrading. In this regard, this study employs a two-way fixed-effects model to examine the direct impact mechanisms of the digital economy on economic resilience, utilizing panel data covering 30 Chinese provincial-level regions between the years of 2013 and 2022. The empirical results demonstrate that the digital economy exerts a statistically significant positive impact on economic resilience. The impact shows regional variation, with stronger digital economy effects in the less service-developed mid-western region. Moreover, statistical analysis further identifies digital infrastructure and innovation capabilities as the two most impactful factors contributing to economic resilience enhancement. The digital economy enhances economic resilience through three mediating channels: the synergy effect, income-increasing effect, and allocation effect. Finally, uncovering these contextual factors relevant to the digital economy’s development of economic resilience can significantly benefit future research and practice.

1. Introduction

Economic resilience denotes an economy’s capacity to sustain development through structural and operational adaptations when facing external shocks [1]. In recent years, the global economy has become increasingly complex and uncertain. Whether it is an epidemic-induced recession, market volatility brought about by geopolitical tensions, or international trade disputes, these successive crises are testing the resilience of national economies. This has captured academic interest, establishing economic resilience as an increasingly prominent research subject [2,3].

Existing economic resilience research primarily concentrates on three dimensions. First, the definition of economic resilience. Equilibrium theory characterizes resilience as an economic system’s capacity to recover its original equilibrium or achieve new equilibrium states following disruptions [4]. On the contrary, evolutionary theory suggests that economic resilience manifests through dynamic adaptive capacities, where continuous innovation and adjustment emerge from complex interactions between external shocks and multidimensional factors [5]. Second, measuring economic resilience. Currently available measurement methods can be categorized mainly into the sensitivity index method [6] and comprehensive evaluation method [7]. The sensitivity index method quantifies post-shock economic fluctuations, whereas the comprehensive evaluation method examines multidimensional response heterogeneity across economic subsystems. Third, factors influencing economic resilience. It has been shown that factors such as worker skills, innovation levels, economic openness, and industry composition significantly affect economic resilience [8,9,10,11]. Most of the studies on the influencing factors focus on market-based factors such as resource agglomeration, while a small part of the literature focuses on institutional factors such as government management. Recently, the digital economy has emerged as a novel determinant attracting growing scholarly attention in resilience studies.

Advanced digital technologies, particularly AI and blockchain, are fundamentally restructuring economic systems through widespread adoption, establishing the digital economy as a core driver of both economic reorganization and development acceleration [12]. China’s digital economy surged from CNY 11.2 trillion (2012) to CNY 53.9 trillion (2023), marking a 4.8-fold expansion and progressively greater national economic significance. On the one hand, the digital economy mitigates problems such as resource mismatch and low-end lock-in of economic structure by improving the efficiency of information production and dissemination [13]; on the other hand, it promotes industrial integration and structural optimization by changing the traditional production model and promotes enterprises to make innovative changes by utilizing technologies such as AI and big data [14]. These distinctive attributes enable the digital economy to facilitate industrial upgrading and technological breakthroughs through synergistic integration between modern services and advanced manufacturing while fostering emergent business models that collectively strengthen economic resilience.

At the same time, upgrading industrial structure manifests as a self-reinforcing process where factor concentration in high-value sectors simultaneously drives and reflects China’s transition to innovation-led growth, achieved through three synergistic channels: factor market efficiency gains, productivity enhancement, and sustainability capacity building [15]. In this process, enhancing industrial relevance, improving labor productivity, and optimizing the allocation of innovation resources are key aspects of industrial structure upgrading. Expediting industrial structure advancement and facilitating the transition from traditional to new economic growth drivers constitutes the central mission of modern industrial system construction while simultaneously serving as an indispensable pathway to reinforce economic resilience [16].

Against the backdrop of the continued intensification of global economic risks, the synergistic relationship between the digital economy and economic resilience building has emerged as a core topic of academic research. Most of the current research on the impact mechanism of the digital economy on economic resilience focuses on industrial structure factors [11], technological innovation factors [17], and environmental regulation factors [18]. However, while extant literature has empirically established the digital economy’s positive association with economic resilience [19], the specific mechanism has not yet formed a unified understanding. Among them, most studies on industrial structure upgrading as a mediating variable predominantly concentrate on quantifying structural optimization outcomes [20], such as rationalization and supererogation of industrial structure. Nevertheless, little literature has explored the dynamic performance of the rule of industrial evolution. Although Xiao et al. [17] and Ye et al. [19] elaborated on the mediating role of technological innovation and other factors in the impact of the digital economy service industry on regional economic resilience, they mainly explained it from the perspective of technological progress. This study provides a more detailed characterization of the dynamic performance of industrial structure upgrading from both macro and micro perspectives and measures its mediating role. Examining the digital economy’s impact on economic resilience through upgrading industrial structure elucidates the structural transformation pathways through which digitalization bolsters systemic risk mitigation capacities, thereby advancing theoretical foundations for industrial policymaking. Moreover, China’s strategic emphasis on digital economy development and resilience building has yielded empirically validated policy frameworks, particularly through its successful management of major external shocks, including the SARS and COVID-19 pandemics. Utilizing China’s experience to study the impact mechanism of the digital economy on economic resilience is of great revelation.

Against this backdrop, this paper is designed to address the following core research questions:

Q1. Does the digital economy have a positive influence on economic resilience?

Q2. What are the key mechanisms by which the digital economy affects economic resilience?

To answer the above questions and fill the gap, utilizing panel data from 30 Chinese provincial-level regions (2013–2022), this study employs a two-way fixed effects model to systematically investigate the direct transmission mechanisms linking digital economy development with economic resilience enhancement. Furthermore, the investigation examines multidimensional regional heterogeneity patterns while implementing endogeneity tests and robustness tests across alternative model specifications. Ultimately, considering the specific performance of industrial structure upgrading, the synergy effect, income-generating effect, and allocation effect are selected as mediating variables to study the internal mechanism of the impact of the digital economy on economic resilience so as to provide both theoretical frameworks and policy-relevant insights.

2. Literature Review and Hypothesis Development

2.1. Impact of Digital Economy on Economic Resilience

Economic resilience is characterized by different coping capacities at different stages of an external shock. At the onset of a shock, economic resilience denotes the dynamic capacity of economic systems to maintain functional stability and achieve efficient recovery trajectories following exogenous shocks [21]. Under shock conditions, economic resilience materializes through the system’s adaptive capacity to structurally recalibrate in response to prolonged economic perturbations [22]. After the end of the shock, economic resilience focuses on the innovation and development capacity under the economic growth model [23]. Currently, the academic exploration of the digital economy’s resilience implications is developing. Based on the existing literature, the digital economy has the following three significant impacts on economic resilience.

First, regarding resistance and resilience, the digital economy, based on new factor inputs, new allocation efficiency, and new production efficiency, can guarantee the stability of related industries when the national economy fluctuates [18]. Internet-based digital technologies facilitate geospatial and market data digitization, thereby enhancing predictive analytics for risk anticipation. The upgrading of this risk-mitigation capability translates directly into strengthened economic resilience ultimately.

Second, regarding adaptation and regulation, the digital economy facilitates the structural transition of labor-intensive sectors toward capital-intensive and knowledge-intensive production paradigms. Data-driven innovation ecosystems equip enterprises with real-time market intelligence and operational flexibility, critical for shock resilience through swift production adjustment and strategic pivoting [24]. This can effectively alleviate the downward pressure on the economy, further enhance its adaptive and regulatory capacities, and consolidate its resilience.

Third, regarding innovation and development, the digitalization–production–life triad fosters innovative business ecosystems encompassing O2O consumption, intelligent mobility, and automated retail, diversifying urban economic operational paradigms [25]. The digital economy, on the one hand, stimulates competitive dynamics through continuous business model innovation, compelling enterprises to accelerate their innovation cycles to maintain market positions. On the other hand, by integrating and utilizing information resources, it dramatically reduces the cost of information search, breaks down geographic restrictions, and promotes the sharing of technology and products among enterprises. Strategic advancement of digital economy capabilities accelerates high-tech sector innovation, thereby amplifying systemic economic resilience through technological sophistication and productivity gains.

Based on the above analysis, this research proposes the following hypothesis H1.

Hypothesis 1.

The digital economy facilitates the enhancement of the economy’s capacity for resistance and resilience, adaptation and regulation, and innovation and development.

2.2. Impact Mechanism of Digital Economy on Economic Resilience

- (1)

- Synergy Effect

The digital economy significantly enhances economic resilience by strengthening industrial collaborative agglomeration. Productive service industries function as catalytic intermediaries throughout manufacturing ecosystems, where mutual reinforcement between sectors boosts productive efficiency and propels manufacturing toward high-value-added chain segments [26,27]. The strong industrial chain and market network formed by such synergistic industrial agglomeration can provide a risk diversification mechanism through the rapid adjustment of internal resources and information in times of economic crisis, strengthening systemic shock absorption capacities to achieve improvements in economic resilience [28]. For example, transformative penetration of digital innovation, such as artificial intelligence and industrial robots, within the manufacturing industry in R&D and design and production and manufacturing has given rise to digital technology-intensive services such as industrial design and inspection and testing.

At the same time, digital technology promotes sharing of knowledge and technology between industries and promotes enterprise scientific and technological innovation and industrial upgrading [29]. Such developments stimulate infrastructure investments and policy interventions that accelerate industrial digital transformation, creating an enabling environment for digital economy expansion and indirectly fortifying economic resilience [30]. The digital economy promotes the transformation of resource-intensive industries by deepening the specialized division of labor in the productive service industry, thus enhancing the risk resistance and adaptive capacity of the economy [31].

Based on the above analysis, this research proposes the following hypothesis H2.

Hypothesis 2.

The digital economy enhances economic resilience through synergy effect.

- (2)

- Income-Generating Effect

Amidst global economic deceleration and volatile international cooperation, national economic systems confront intensified developmental challenges. The transitional benefits of industrialization-driven structural acceleration in China are progressively attenuating, marking a critical juncture for developmental model transformation [32]. Digitalization empowers service sector evolution through concurrent improvements in informational capacity, data liquidity, and technological frontier expansion. This not only promotes the structural upgrading of the service industry but also effectively increases the proportion of high value-added and high-adaptability sectors. It enhances economic resilience by strengthening global value chain resilience through dominating high-value-added segments, controlling critical nodes, and generating technology spillovers [33].

The explosive growth of user data and the improvement of data mining capabilities enable service industry enterprises to accurately locate user needs, optimize product life cycle management, and significantly improve R&D capabilities and service levels [34]. Through digitalized operations and networked production architectures, enterprises achieve process optimization that elevates both operational efficiency and labor productivity, thereby strengthening China’s economic stabilization capacities [35].

Based on the above analysis, this research proposes the following hypothesis H3.

Hypothesis 3.

The digital economy enhances economic resilience through income-generating effects.

- (3)

- Allocation Effect

Economic growth and structural transformation are significantly propelled by innovation as a key driving factor. The digital economy facilitates trans-regional and interdisciplinary innovation synergies, elevating R&D efficiency while fostering economic diversification. Through operational model transformation enabled by digital technologies, enterprises achieve optimized innovation resource allocation, with digital–physical integration substantially enhancing factor utilization productivity [36]. It more fully unlocks the potential value of talent, technology, and capital, thereby increasing total factor productivity and enhancing the economic system’s adaptability and recovery capacity against external shocks [37].

At the same time, the digital economy accumulates external knowledge by attracting innovative human resources, promotes the matching of data elements and human capital, and provides capacity support for industrial structure upgrading [23]. This development model has injected scientific and technological innovation power into the economic system, enabling it to maintain stable development in a complex environment [38]. This mechanism accelerates technological renewal cycles and industrial transformation processes, consequently enhancing the economic system’s adaptive capacity and economic resilience.

Based on the above analysis, this research proposes the following hypothesis H4.

Hypothesis 4.

The digital economy enhances economic resilience through the allocation effect.

2.3. Theoretical Model

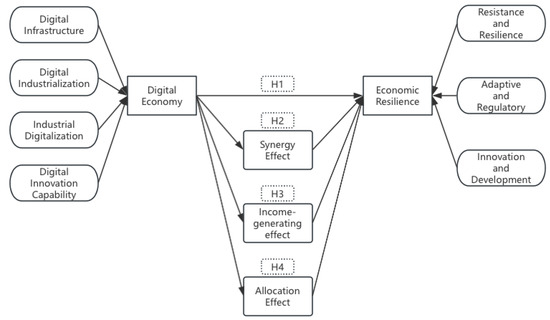

The digital economy construct encompasses four dimensions: digital infrastructure, digital industrialization, industrial digitalization, and digital innovation capability. The concept of economic resilience consists of capacity for resistance and resilience, capacity for adaptation and regulation, and capacity for innovation and development. According to the economic resilience theory [1,19] and the industrial economic theory [2,5,9], technological progress is an endogenous driver of economic growth, which can lead to the upgrading of industrial structure and promote resilient economic growth by, for example, increasing the share of high value-added industries. The digital economy, on the one hand, functioning as both an economic pillar and growth accelerator, exerts direct positive effects on economic resilience enhancement, which is hypothesis H1. On the other hand, the digital economy exerts significant indirect influences on economic resilience through synergy effect, income-generating effect, and allocation effect, which correspond to hypotheses H2, H3, and H4, respectively. A concept model with a hypothesis has been shown in Figure 1.

Figure 1.

Pathway illustrating the impact of the digital economy on economic resilience.

Although the existing literature has established correlational relationships between the digital economy and economic resilience, the current academic community has not yet produced a consensus on the path of impact. Few scholars have analyzed it from the perspective of industrial structure upgrading. Scholars mostly focus on the measurement of the results after the optimization of industrial structure and use the advanced industrial structure and the rationalization of industrial structure to measure the development level of industrial structure upgrading. However, few studies have explored the dynamic performance of industrial evolution rules.

Therefore, on this basis, this study further explores the mechanism of the digital economy’s impact on economic resilience with respect to the correlation effect, income-generating effect, and allocation effect in the perspective of industrial structure upgrading and provides practical theoretical references.

3. Methodology

3.1. Variables and Measurement

- (1)

- Dependent Variable

Economic resilience (Resi). As previously mentioned, economic resilience refers to the ability of an economic system to resist, adapt, and recover when confronting exogenous disturbances [18,39]. Correspondingly, based on existing relevant studies [40,41], we divide it into three dimensions: capacity for resistance and resilience, capacity for adaptation and regulation, and capacity for innovation and development. Capacity for resistance and resilience refers to the ability of an economy to quickly utilize its existing resources to counteract the negative impacts of external shocks and recover its original stable conditions. Capacity for adaptation and regulation refers to the ability of an economy, after experiencing an external shock, to adjust its production and development mode and economic structure in order to adapt to changes in the market environment and supply and demand relationships. Capacity for innovation and development refers to the ability of an economy to find new points of economic growth through the continuous iteration of innovative technologies that drive the development of new industries after stabilizing its operation. Therefore, this study establishes a comprehensive evaluation system consisting of the above three aspects and applies the entropy method to evaluate economic resilience (Table 1).

Table 1.

Comprehensive evaluation system for Resi.

- (2)

- Independent Variable

Digital economy (Dig). Digital industrialization is a core component of the digital economy, providing technical, product, and service support for the digital economy and promoting its continuous development [48,49]. Industrial digitization drives profound convergence between conventional industries and digital technologies, with its value-added outputs representing a core component of the digital economic ecosystem. Digital infrastructure is the basic condition for the normal functioning of digital economic development, while digital innovation capability provides constant vitality for the development of the digital economy. Most of the digital economy indicator systems constructed by existing studies [50,51] contain digital industrialization and industrial digitization dimensions, and a few studies have supplemented the digital infrastructure [52] and digital innovation capacity [53] dimensions. Based on this, and given data robustness and accessibility considerations, this study constructs an indicator system that consists of four aspects and employs the entropy method to compute the Dig index (Table 2).

Table 2.

Comprehensive evaluation system for Dig.

- (3)

- Mediating Variables

Synergy effect (Pconec). Synergy effect in this paper refers to the ability of the digital economy to enhance economic resilience through the strengthening of industrial synergistic agglomeration, a development mode where different industries improve overall efficiency via complementary cooperation [28,30]. Through digital technology diffusion and industrial digitization processes, the digital economy facilitates labor specialization and stimulates the manufacturing sector’s derived demand for producer services. This helps to promote the emergence of new service modes and strengthen inter-industry synergies, thereby enhancing the risk-resistant capacity of the economic system. Reviewing the existing literature, The interaction term between manufacturing digitization intensity and producer services wage levels serves as a proxy for measuring the extent to which the digital transformation of the manufacturing sector increases the demand for productive services by enhancing industrial correlation. Following Acemoglu and Restrepo [55], this study measures the degree of manufacturing digitization by the amount of robots invested in manufacturing in each province.

Income-generating effect (Serinc). It refers to the fact that the digital economy can enhance economic resilience by improving the labor productivity of the tertiary industry [33,56]. Enhanced labor productivity in service industries facilitates factor reallocation across sectors, thereby promoting industrial structure upgrading by driving factor allocation toward high-value-added services while spurring intelligent transformation in industries. This enhances economic resilience by diversifying economic pillars and strengthening the risk resistance of digitalized services. As we all know, the higher the output value and the fewer the laborers involved, the higher the labor productivity of the industry. Therefore, the impact of the tertiary sector on its economic growth by improving internal labor productivity is measured by the ratio of the gross value added of the tertiary sector to the number of employees in the tertiary sector.

Allocation effect (Realloc). The digital economy can enhance economic resilience by improving the allocation efficiency of innovation factors [36,57]. As previously mentioned, the digital economy enhances innovation factor allocation efficiency by leveraging big data analytics and platform-based collaboration to precisely optimize the flow and combination of talent, technology, and capital. It strengthens economic resilience by accelerating technological iteration and industrial upgrading, thereby improving the adaptive and recovery capacities of the economic system to external economic shocks. Referring to the idea of Aoki [58], the mismatch of innovative elements can be studied from two aspects: mismatch of R&D capital and mismatch of R&D personnel. This study uses the average of the R&D capital mismatch index and the R&D personnel mismatch index to comprehensively measure the level of innovation factor mismatch. Moreover, in mathematics, inverse represents a reverse relationship between two variables. The higher the allocation effect, the lower the degree of innovation resource mismatch; that is, the higher the level of resource allocation in the province. Therefore, this study takes the inverse of the innovation factor mismatch index as the allocation effect.

where and are the absolute distortion coefficients of R&D factor prices, which are measured by using the relative price distortion coefficients:

where is the innovation output share of province i, and and are the output elasticities of R&D capital and personnel in province i, respectively. The formula calculates the ratio between the theoretical level and the actual allocation of innovation factors in each province to measure the innovation factor mismatch index of the province. If the ratio is greater than 1, the province has a high degree of innovation factor mismatch, and vice versa, it has a low degree of innovation factor mismatch. To mitigate potential estimation bias arising from coefficient sign inconsistency across variables, this paper takes absolute values for both mismatch indices. Next, under the assumption of a constant return to scale, we derive industry elasticity, assuming that the innovation production function is a C-D production function, i.e.,

where is the innovation output, which is measured by the number of patent applications in each province; is the R&D capital input, which is measured by the R&D capital stock; and is the R&D personnel input, which is measured by the full-time equivalent of R&D personnel.

- (4)

- Control Variables

Given the influencing factors of the digital economy, the empirical model incorporates the following control variables:

Government fiscal size (Govsize). The proportion of local general budget expenditure to GDP is used to represent the government’s financial self-sufficiency.

Urban–rural income gap (Gincome). The proportion of disposable income per capita of urban residents to disposable income per capita of rural residents is used to measure it.

Industrial development scale (Lsize). We use the number of legal entities to measure the industrial development scale and treat it logarithmically.

Degree of marketization (Pmarket). The level of market development is measured using the relative process of marketization sub-index score.

3.2. Data Sources and Descriptive Statistics

China’s accelerated digital transformation during 2013–2022 provides an ideal empirical setting. We utilize panel data (2013–2022) covering 30 Chinese provincial-level regions. Primary data sources include the China Statistical Yearbook, the China Statistical Yearbook on Science and Technology, and the Peking University Digital Inclusive Finance Index (PKU-DFIIC). The missing data of individual years are supplemented by linear interpolation. Definitions and statistical descriptions of the variables are shown in Table 3.

Table 3.

Definitions and statistical descriptions of variables.

3.3. Fixed-Effect Model

To empirically validate Hypothesis 1 regarding the digital economy’s direct effect on economic resilience, we specify the following econometric specification:

where i denotes the province; t denotes the year; denotes the province i’s economic resilience at t; and denotes province i’s digital economy development at time t. is a series of control variables. and represent the regional fixed effects and time fixed effects, respectively, and is the random error term. represents the digital economy’s overall impact on the economic resilience of provinces.

To test the mediating effect of synergy effect, income-generating effect, and allocation effect, building upon Baron and Kenny’s [59] foundational methodology, we implement a stepwise regression method. The models are specified in Equations (5) and (6).

In Equations (5) and (6), represents synergy effect, income-generating effect, and allocation effect, respectively. Equation (5) examines the effect of digital economy development on the mediators, and Equation (6) examines whether synergy effect, income-generating effect, and allocation effect play a mediating role in the relationship between digital economy development and economic resilience. Control variables are the same as in Equation (4).

If is significant, it can confirm that the digital economy has a significant direct impact on economic resilience. If is significant, it indicates that the digital economy significantly affects the mediating variables. Therefore, if is not significant and is significant, or if the coefficient is less than , the existence of the mediating mechanism can be verified. However, due to the flaws in the causal identification theory of intermediary mechanisms, this article does not need to further test whether Equation (6) is valid and instead focuses on theoretical and economic objective facts for argumentation.

4. Results and Discussion

4.1. Baseline Regression Analysis

To address potential heteroskedasticity and autocorrelation concerns, we implement a fixed-effect model for regression analysis, where standard errors are simultaneously clustered and adjusted by province and year. The results of regression analysis are shown in Table 4.

Table 4.

Results of regression analysis.

Model (1) shows that the regression coefficient of Dig is significantly positive (, ). Model (2) shows that after entering control variables, the coefficient of Dig, although decreasing, is still significantly positive (, ), suggesting that digital economy development enhances economic resilience. Hypothesis 1 is supported.

Consistent with theoretical expectations, the control variables exhibit statistically significant coefficients. Notably, government fiscal scale demonstrates a robust positive association with economic resilience, indicating that larger government expenditure may enhance economic stability through policies and public service supply. The coefficients of urban–rural income gap and industrial development scale are significantly positive, indicating that higher income levels and sufficient labor force supply contribute to enhancing economic resilience. Marketization level exhibits a statistically significant positive impact on economic resilience, suggesting that institutional completeness in market mechanisms enhances resource allocation efficiency, which in turn strengthens the economic system’s ability to resist risks.

4.2. Endogeneity Test

To address potential endogeneity issues, we implement two-stage IV regression with the interaction of the number of provincial post offices in 1984 and the number of provincial internet broadband subscribers per 10,000 people last year as instrumental variables. The selection of instrumental variables is based on both relevance and exogeneity. In terms of relevance, traditional ICTs such as post and telecommunications are the basic carriers of digital development. The denser the layout of post offices, the higher the demand and acceptance of information technology by residents. In terms of exogeneity, as the frequency of use of traditional communication facilities decreases, their direct impact on economic resilience gradually diminishes. It acts on economic resilience only indirectly through iteratively upgraded digital technologies. Following Nunn and Qian’s idea [60], this paper multiplies it by the number of provincial internet broadband subscribers per 10,000 people last year, a variable that reflects temporal variation, to construct instrumental variables.

Table 5 reports the two-stage IV modeling estimation results. The first-stage regression shows that the regression coefficient of instrumental variables on the digital economy is significantly positive, indicating a strong correlation between instrumental variables and the digital economy. The Kleibergen–Paap rk LM test rejects the null hypothesis at the 1% significance level, confirming that the problem of “non-identification” of the selected instrumental variables was excluded. The Cragg–Donald Wald F-statistic (783.75) is much larger than 10, which excludes the problem of “weak instrumental variables”. The second-stage regression results show that the digital economy exhibits a statistically significant positive effect on economic resilience, consistent with the baseline estimates, confirming the robustness of our primary findings after accounting for the endogeneity test, further validating Hypothesis 1.

Table 5.

Results of endogeneity test.

4.3. Robustness Test

We implement the following robustness tests to verify result reliability. Firstly, winsorization. All continuous variables are shrink-tailed at the 1% level to exclude the interference of extreme values while controlling for joint province×year fixed effects. The regression results, as shown in column (1) of Table 6, show that the digital economy maintains a statistically significant positive impact on economic resilience, consistent with the above conclusion. Secondly, independent variable substitution. After standardizing the five key indicators, such as digital infrastructure, the integrated indicators are synthesized through the PCA method to represent the digital economy for regression analysis. The result is shown in column (2). Consistent with expectations, the Dig index demonstrates a positive association, which provides robust empirical evidence supporting the digital economy’s crucial role in enhancing economic resilience. Lastly, lagged regression. The independent variable “dig” is included in the regression equation with a one-period lag to control for its dynamic impact. The result, as shown in column (3), shows that the effect of the digital economy remains significantly positive, affirming that the impact of the digital economy on economic resilience is robustly present.

Table 6.

Results of robustness test.

4.4. Heterogeneity Analysis

4.4.1. Heterogeneity Analysis of Digital Economy by Dimension

To examine potential heterogeneity across digital economy dimensions, this paper estimates four indicators as independent variables: digital infrastructure (EcoInfra), digital industrialization (EcoInd), industrial digitization (IndEco), and digital innovation capability (EcoInn), respectively.

As shown in Table 7, columns (1) to (4), heterogeneity analysis indicates that the promotion effect of digital infrastructure and digital innovation capability demonstrates significantly stronger effects than other dimensions, with coefficients of 0.26 and 0.34, respectively, both passing the 1% level significance test. Digital industrialization and industrial digitization also have significant positive effects on economic resilience, significant at the 5% level. This suggests that digital infrastructure and digital innovation capabilities are more critical to economic resilience.

Table 7.

Results of heterogeneity analysis of digital economy by dimension.

4.4.2. Regional Heterogeneity Analysis

In order to analyze regional heterogeneity, the sample is partitioned into the eastern region and the mid-western region according to NBS standards, and heterogeneity regression analysis is conducted separately.

As shown in Table 8, columns (1) to (2), heterogeneity analysis indicates that the boosting effect of digital infrastructure, digital industrialization, and industrial digitization is significant in the mid-western region but not in the eastern region. The impact of digital innovation capability on economic resilience is significant in both the eastern region and the mid-western region. However, the boosting effect is more obvious in the mid-western region. This may be related to the lower level of servitization in the mid-western region and the existence of the advantage of backwardness in the development of the digital economy.

Table 8.

Results of regional heterogeneity analysis.

Regional heterogeneity tests confirm the digital economy’s superior performance in the mid-western region. This regional difference likely stems from the mid-western region’s comparatively underdeveloped service sector. The mid-western region exhibits significantly greater traditional industry concentration, and the marginal enhancement effect of digital technology application is stronger, which can more effectively improve the problem of insufficient toughness of the original industrial structure [45]. Furthermore, lower servitization levels create greater room for structural upgrading through digital-service integration, leading to more substantial resilience enhancement [33]. This finding aligns with the established scholarship.

From the perspective of industrial structure upgrading, the digital economy initiates industrial upgrading through service sector transformation, catalyzing the development of modern producer services, which in turn accelerates the upgrading of the industrial structure and enhances the resilience of China’s economy. Specifically, the entry threshold of the digital economy-enabled service industry is relatively low, and the reproducibility of the business model is high. China’s large multi-level consumer market gives the service industry a more inclusive digital economy empowerment. The modernization system in the eastern part of China has a higher level of construction. The effect of the digital economy is relatively limited. The servitization level of the industrial structure of the mid-western region is relatively low. Digital economic empowerment for the mid-western region is like a low-cost, high-yield opportunity for backwardness, which can quickly attract venture capital. Therefore, the digital economy has a relatively greater impact on enhancing the economic resilience of the mid-western region.

4.5. Mechanism Test

We considered that digital economy development may affect economic resilience through synergy effect, income-generating effect, and allocation effect. Therefore, this section conducts mechanism tests for each of these three potential channels of influence. We first test whether the independent variable (X) acts on the mediating variable (M). To address potential insufficiency in establishing the M→Y causal pathway, we further test the effect of M on Y to supplement relevant quantitative analysis evidence support.

The regression result in column (1) of Table 9 shows that Dig is significantly positively correlated with Pconec. It shows that the digital economy helps to enhance the industrial relevance in China. The manufacturing industry generates more demand for productive services through digital transformation and stimulates economic growth. The result in column (2) shows that the regression coefficient of Pconec on Resi is significantly positive, indicating that the stronger the industrial relevance, the stronger the synergy effect, and the stronger the economic resilience of China. On the one hand, the digital economy breeds emergent industries and generates novel business paradigms. Data elements penetrate into the real industry, which can upgrade the production capacity and organization mode of traditional industries and reconstruct and extend the industrial value chain [61]. On the other hand, the digital economy accelerates the transmission of demand and market response, which can stimulate the growth of consumer demand in the short term, promote high-end and diversified consumer preferences in the long term, and ultimately force the supply structure to converge with the consumption structure [62]. The upgrading of industrial structure implies the improvement of industrial chain collaboration. The synergy effect of the digital economy accelerates the evolution of the industrial system, which can better withstand external shocks and ultimately feed back to economic resilience.

Table 9.

The mediating effect of Pconec.

The regression result in column (1) of Table 10 shows that Dig is significantly and positively correlated with Serinc, indicating that the digital economy boosts service sector labor productivity in China. The radiation effect of digitization will take the lead in the tertiary industry and boost output with limited human resources. The result in column (2) shows that the regression coefficient of Serinc on Resi is significantly positive. It shows that the higher the labor productivity of China’s service industry, the stronger the income-generating effect and the stronger the resilience of China’s economy. Regarding factor matching, the use of digital technology and the Internet is conducive to breaking the spatial restrictions on the flow of labor factors, providing more abundant employment options for workers, and thus enhancing the allocation efficiency of labor factors [63]. From the perspective of human capital, high-quality human capital serves as critical reinforcement for improving economic resilience. The digital economy can optimize the social and regional division of labor of factors and commodities, upgrade the skills of workers through the popularization of professional knowledge of digital technology, and then enhance the industrial labor production efficiency, promote the upgrading of the technical structure of the industry, and improve the level of economic development [64].

Table 10.

The mediating effect of Serinc.

The regression result in column (1) of Table 11 shows that Dig is significantly positively correlated with Realloc, indicating that the digital economy helps to alleviate the mismatch of innovation factors in China and improve the efficiency of resource allocation. The result in column (2) shows that the regression coefficient of Realloc and Resi is significantly positive. It shows that the higher the allocation efficiency of China’s innovation resources, the stronger the allocation effect, and the stronger the resilience of China’s economy accordingly. The above results indicate that the income-generating effect is also a potential channel of influence for the digital economy to enhance China’s economic resilience. The intervention of regional platform trading models in the digital economy facilitates the process of local enterprises entering global value networks. Local advantaged industries are able to seek greater development space abroad, while enterprises in inefficient industries but protected by the government face elimination, thus releasing resources that can flow to advantaged industries and high-growth sectors. This specialized division of labor effect originating from the product market will be transmitted to the factor market, effectively alleviating and improving the mismatch of local financial resources and technological resources [65]. Moreover, in the process of embedding digital technology into existing factors of production, it realizes the materialization and dynamization of factor information with the help of chips and other carriers. Utilizing Internet technology for real-time sharing in the cloud can effectively cut down the barriers to the flow of innovative resources between industries and enterprises and enhance the use and allocation efficiency of R&D factors [66].

Table 11.

The mediating effect of Realloc.

Above all, we empirically analyze the direct impact of the digital economy on economic resilience as well as its indirect impact. The test results show that the digital economy can significantly affect economic resilience, i.e., hypothesis H1 is valid. In addition, the digital economy can have an indirect impact on economic resilience through the correlation effect, income-generating effect, and allocation effect. This implies that hypotheses H2, H3, and H4 hold, respectively. The testing results of the model are shown in Table 12.

Table 12.

Testing results.

5. Conclusions and Recommendation

5.1. Conclusions

Confronted with a complex and uncertain global economic environment, insufficient domestic demand, and low-end locking about the industrial structure, the key path to enhancing China’s economic resilience and achieving stable economic development is to vigorously develop the digital economy, promote the construction of digital infrastructure, facilitate industrial digitization and digital industrialization, and enhance the capability for digital innovation. With the development of the digital economy, enhancing the economy’s ability to resist and recover, innovate and develop, as well as adapt and regulate, will not only help China cope with risk shocks but also provide sustained impetus for the high-quality development of the economy.

Grounded in theoretical analysis, this paper puts forward the research hypothesis that the digital economy significantly influences economic resilience and systematically explores the direct and indirect effects of the digital economy on economic resilience, utilizing the provincial panel data from 2013 to 2022.

Based on the analysis conducted, we have drawn the following four conclusions:

(1) The digital economy significantly enhances China’s economic resilience (β = 0.62, p < 0.01). This effect remains robust after accounting for endogeneity and alternative model specifications.

(2) Mechanism analysis reveals that the digital economy fosters economic resilience primarily by improving synergy effects, income-generating effects, and resource allocation efficiency. These findings suggest that the digital economy strengthens systemic coordination and productivity gains, offering policymakers concrete leverage points and improving the efficiency of innovative resource allocation for building of resilience.

(3) Heterogeneity analysis shows that digital infrastructure (β = 0.26) and innovation capacity (β = 0.34) contribute most strongly to resilience. This implies that hardware and R&D investments yield higher marginal returns in stabilizing regional economies.

(4) Economic resilience in the mid-western region is enhanced more significantly by the digital economy than in the eastern region. This “latecomer advantage” highlights digitization as a viable catch-up strategy for less-developed areas, urging targeted policy support.

5.2. Recommendation

- (1)

- Promote Deep Development of the Digital Economy

First, digital infrastructure development should be a strategic priority for nations undergoing digital transformation, particularly for developing countries seeking to bridge the digital divide. Second, fostering new digital service formats requires establishing market-oriented mechanisms and regulatory frameworks tailored to different national development stages. Third, policies promoting traditional industries’ digital transformation should account for sector-specific characteristics and firm size variations, which holds significance for global industrial chain restructuring. Finally, digital innovation incentives should align with national innovation systems while considering potential international technology collaboration. Future research could compare policy implementation outcomes across institutional contexts to identify universally applicable development pathways.

- (2)

- Utilize the Synergy Effect and Income-Generating Effect to Promote Industrial Structure Upgrading

First, the policy framework for enhancing industrial synergies through digital integration provides a reference model for nations at various development stages to cultivate new economic growth drivers. Second, digital human capital strategies require adaptation to different national education systems, which is crucial for addressing global digital divide challenges. Third, labor productivity enhancement through intelligent transformation must balance technological suitability with institutional inclusivity, particularly relevant for global value chain restructuring. Future research should focus on examining the boundary conditions of these policies across different institutional and cultural contexts, as well as the feasibility conditions for cross-national policy transfer in digital economy development.

- (3)

- Leveraging Resource Allocation Efficiency for Digital Momentum Generation

First, the mechanism design for enhancing innovation capital fluidity through blockchain technology provides a replicable pathway for developing countries to establish modern financial infrastructure. Second, the establishment of adaptive regulatory frameworks requires balancing innovation incentives with risk prevention—a principle with universal relevance for digital financial regulatory reforms across nations. Third, the geospatial development stratification strategy offers policy insights for countries facing regional disparities to bridge the digital divide. Future research could further examine the applicability boundaries of these policy instruments under varying legal systems, market maturity levels, and digital infrastructure conditions, as well as explore potential models for cross-border policy coordination.

- (4)

- Strategic Policy Architecture for Resilient Digital Ecosystems

First, the multi-stakeholder governance framework provides transferable solutions for addressing digital policy fragmentation, particularly enlightening for federal states and regional economic integration organizations. Second, the innovative regional digital synergy model presents a scalable prototype for cross-border digital infrastructure connectivity and industrial complementarity cooperation. Future research should focus on examining the adaptive transformation pathways of these governance mechanisms across different political systems, development stages, and cultural contexts, as well as exploring potential innovations in global governance paradigms for regional collaborative development in the digital era.

5.3. Limitations and Future Research

While this study offers valuable insights, certain constraints remain to be explored in subsequent research. First, in terms of the selection of research objects, the sample is limited to the provincial data of China in the past ten years, and some provinces could not be studied due to the lack of data. Our results may only represent the impact of China’s digital economy on the economic resilience of provinces during the research period and likely cannot be generalized. Therefore, further research could delve deeper into city-level data. This approach will facilitate deeper analysis of how digital economy development strengthens economic resilience through industrial structure upgrading. Second, in terms of variable construction, this paper selects four indicators, such as digital infrastructure, to measure the digital economy and three indicators, such as capacity for resistance and resilience, to measure economic resilience. However, the economy may face other economic shock risks and show more layers of resilience, and the indicator system adopted in this paper may be more one-sided. Therefore, further research can rationally optimize the indicator system of digital economy and economic resilience for a more comprehensive measurement.

Despite these limitations, our findings on the impact of the digital economy on economic resilience should help the government gain a more comprehensive understanding of the impact path of the digital economy. Consequently, these empirical insights therefore enable policymakers to achieve significant advances in both the design and implementation of policies.

Author Contributions

Conceptualization, Y.F. and X.S.; methodology, Y.F.; software, Y.F.; validation, Y.F. and X.S.; formal analysis, Y.F.; investigation, Y.F.; resources, Y.F.; data curation, Y.F.; writing—original draft preparation, Y.F.; writing—review and editing, Y.F.; visualization, Y.F. and X.S.; supervision, Y.F. and X.S.; project administration, Y.F. and X.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Gan, C.H.; Zheng, R.G.; Yu, D.F. An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 2011, 46, 4–16. [Google Scholar]

- Hu, X.; Li, L.; Dong, K. What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 2022, 120, 103440. [Google Scholar] [CrossRef] [PubMed]

- Pendall, R.; Foster, K.A.; Cowell, M. Resilience and regions: Building understanding of the metaphor. Camb. J. Reg. Econ. Soc. 2010, 3, 71–84. [Google Scholar] [CrossRef]

- Simmie, J.; Martin, R. The economic resilience of regions: Towards an evolutionary approach. Camb. J. Reg. Econ. Soc. 2010, 3, 27–43. [Google Scholar] [CrossRef]

- Doran, J.; Fingleton, B. US metropolitan area resilience: Insights from dynamic spatial panel estimation. Environ. Plan. A Econ. Space 2018, 50, 111–132. [Google Scholar] [CrossRef]

- Cardoni, A.; Noori, A.Z.; Greco, R.; Cimellaro, G.P. Resilience assessment at the regional level using census data. Int. J. Disaster Risk Reduct. 2021, 55, 102059. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Crespo, J.; Suire, R.; Vicente, J. Lock-in or lock-out? How structural properties of knowledge networks affect regional resilience. J. Econ. Geogr. 2014, 14, 199–219. [Google Scholar] [CrossRef]

- Damasceno, A.O.; Guedes, D.R. Financial openness, capital accumulation, and productivity in emerging and developing economies. Econ. Model. 2024, 133, 106663. [Google Scholar] [CrossRef]

- Xu, S.; Zhong, M.; Wang, Y. Can innovative industrial clusters enhance urban economic resilience? A quasi-natural experiment based on an innovative pilot policy. Energy Econ. 2024, 134, 107544. [Google Scholar] [CrossRef]

- Rusch, M.; Schöggl, J.; Baumgartner, J. Application of digital technologies for sustainable product management in a circular economy: A review. Bus. Strategy Environ. 2022, 32, 1159–1174. [Google Scholar] [CrossRef]

- Lee, M.J.; Roh, T. Unpacking the sustainable performance in the business ecosystem: Coopetition strategy, open innovation, and digitalization capability. J. Clean. Prod. 2023, 412, 137433. [Google Scholar] [CrossRef]

- Ding, Z.F. Research on the mechanism of digital economy driving high-quality economic development: A theoretical analysis framework. Mod. Econ. Res. 2020, 1, 85–92. [Google Scholar]

- Ren, X.; Zeng, G.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef]

- Chang, H.; Ding, Q.; Zhao, W.; Hou, N.; Liu, W. The digital economy, industrial structure upgrading, and carbon emission intensity—Empirical evidence from China’s provinces. Energy Strategy Rev. 2023, 50, 101218. [Google Scholar] [CrossRef]

- Xiao, S.; Zhou, P.; Zhou, L.; Wong, S. Digital economy and urban economic resilience: The mediating role of technological innovation and entrepreneurial vitality. PLoS ONE 2024, 19, e0303782. [Google Scholar] [CrossRef]

- He, S.; Yang, S.; Razzaq, A.; Erfanian, S.; Abbas, A. Mechanism and impact of digital economy on urban economic resilience under the carbon emission scenarios: Evidence from China’s urban development. Int. J. Environ. Res. Public Health 2023, 20, 4454. [Google Scholar] [CrossRef]

- Ye, T.; Liang, X.; Zhu, H.; Ye, J.; Jiang, C. The effect of the digital economy service industry on regional economic resilience: Evidence from three major urban agglomerations in China. Appl. Econ. 2024, 57, 2459–2475. [Google Scholar] [CrossRef]

- Zhao, X.; Shang, Y.; Song, M. Industrial structure distortion and urban ecological efficiency from the perspective of green entrepreneurial ecosystems. Socio-Econ. Plan. Sci. 2020, 72, 100757. [Google Scholar] [CrossRef]

- Ding, J.; Wang, Z.; Liu, Y.; Yu, F. Measurement of economic resilience of contiguous poverty-stricken areas in China and influencing factor analysis. Prog. Geogr. 2020, 39, 924–937. [Google Scholar] [CrossRef]

- Shaohua, W.; Yujia, L. Study on Evaluation of urban competitiveness in Western China based on principal component analysis. Econ. Probl. 2021, 2021, 115–120. [Google Scholar]

- Tao, Z.; Zhang, Z.; Shangkun, L. Digital economy, entrepreneurship, and high-quality economic development: Empirical evidence from urban China. Front. Econ. China 2022, 17, 393. [Google Scholar]

- Che, S.; Wang, J. Digital economy development and haze pollution: Evidence from China. Environ. Sci. Pollut. Res. 2022, 29, 73210–73226. [Google Scholar] [CrossRef]

- Huo, R. The Impact of Digital Economy on Industrial Structure Upgrading under the Perspective of Political Economy. Appl. Math. Nonlinear Sci. 2024, 9, 1–16. [Google Scholar] [CrossRef]

- Zheng, H.; He, Y. How does industrial co-agglomeration affect high-quality economic development? Evidence from Chengdu-Chongqing Economic Circle in China. J. Clean. Prod. 2022, 371, 133485. [Google Scholar] [CrossRef]

- He, W.; Li, Y.; Meng, X.; Song, M.; Ramsey, T.S.; An, M. Will green technological progress help industrial collaborative agglomeration increase regional carbon productivity: Evidence from Yangtze River Delta urban agglomerations. Environ. Dev. Sustain. 2024, 26, 26019–26046. [Google Scholar] [CrossRef]

- Zeng, W.; Li, L.; Huang, Y. Industrial collaborative agglomeration, marketization, and green innovation: Evidence from China’s provincial panel data. J. Clean. Prod. 2021, 279, 123598. [Google Scholar] [CrossRef]

- Kai Lisa, L.; Zhang, J.; Xia, F. Does digital technology innovation work better for industrial upgrading? An empirical analysis of listed Chinese manufacturing firms. Appl. Econ. Lett. 2022, 30, 2504–2509. [Google Scholar]

- Yuan, D.; Du, J.; Pan, Y.; Li, C. The collaborative agglomeration of industries and the realization of the digital economy on the green high-quality development of cities. Bus. Process Manag. J. 2024, 31, 1222–1245. [Google Scholar] [CrossRef]

- Williams, L.D. Concepts of Digital Economy and Industry 4.0 in Intelligent and information systems. Int. J. Intell. Netw. 2021, 2, 122–129. [Google Scholar] [CrossRef]

- Zuo, P. Internet development, urbanization and the upgrading of China’s industrial structure. J. Quant. Technol. Econ. 2020, 235, 03062. [Google Scholar]

- Kan, D.; Lyu, L.; Huang, W.; Yao, W. Digital economy and the upgrading of the global value chain of China’s service industry. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1279–1296. [Google Scholar] [CrossRef]

- Jabri, A.; Lahrech, A. The Role of Strategic Orientations in the Relationship Between Adaptive Marketing Capabilities and Ambidexterity in Digital Services Firms: The Case of a Highly Competitive Digital Economy. Systems 2025, 13, 358. [Google Scholar] [CrossRef]

- Liu, Y.; He, Z. Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Ghobakhloo, M. Determinants of information and digital technology implementation for smart manufacturing. Int. J. Prod. Res. 2020, 58, 2384–2405. [Google Scholar] [CrossRef]

- Wang, B.; Liu, Y. Calculating regional innovation efficiency and factor allocation in China: The price signal perspective. Appl. Econ. 2024, 56, 2451–2469. [Google Scholar] [CrossRef]

- Guo, B.; Wang, Y.; Zhang, H.; Liang, C.; Feng, Y.; Hu, F. Impact of the digital economy on high-quality urban economic development: Evidence from Chinese cities. Econ. Model. 2023, 120, 106194. [Google Scholar] [CrossRef]

- Qiliang, M.; Wang, Z.; Wang, H. Entrepreneurship and Natural Resource Curse on Regional Economic Resilience: Evidence From China. J. Reg. Sci. 2025. [Google Scholar] [CrossRef]

- Zhao, R.; Fang, C.; Liu, J.; Zhang, L. The evaluation and obstacle analysis of urban resilience from the multidimensional perspective in Chinese cities. Sustain. Cities Soc. 2022, 86, 104160. [Google Scholar] [CrossRef]

- Zhu, J.H.; Sun, H.X. Research on spatial-temporal evolution and influencing factors of urban resilience of China’s three metropolitan agglomerations. Soft Sci. 2020, 34, 72–79. [Google Scholar]

- Guo, X.; Li, X.; Chen, X.; Jiang, Y. The Impact of Population Shrinkage on Economic Resilience in Mountain Cities: A Case Study of Guizhou Province, China. Sustainability 2024, 16, 7442. [Google Scholar] [CrossRef]

- Tang, Y.; Song, Y.; Xue, D.; Ma, B.; Ye, H. Urban Shrinkage from the Perspective of Economic Resilience and Population Change: A Case Study of the Shanxi-Shaanxi-Inner Mongolia Region. Land 2024, 13, 444. [Google Scholar] [CrossRef]

- Yang, M.; Zhai, G. Measurement and Influencing Factors of Economic Resilience over a Long Duration of COVID-19: A Case Study of the Yangtze River Delta, China. Land 2024, 13, 175. [Google Scholar] [CrossRef]

- Gu, J.; Liu, Z. A study of the coupling between the digital economy and regional economic resilience: Evidence from China. PLoS ONE 2024, 19, e0296890. [Google Scholar] [CrossRef]

- Zhao, Q.; Yuan, C.H. Does Fiscal Vertical Imbalance Enhance the Economic Resilience of Chinese Cities? Sustainability 2025, 17, 3044. [Google Scholar] [CrossRef]

- Zhong, F.; Chen, R.; Luo, X.; Song, X.; Ullah, A. Assessing regional resilience in China using a sustainable livelihoods approach: Indicators, influencing factors, and the relationship with economic performance. Ecol. Indic. 2024, 158, 111588. [Google Scholar] [CrossRef]

- Lu, Y.; Zhuang, J.; Yang, C.; Li, L.; Kong, M. How the digital economy promotes urban–rural integration through optimizing factor allocation: Theoretical mechanisms and evidence from China. Front. Sustain. Food Syst. 2025, 9, 1494247. [Google Scholar] [CrossRef]

- Wei, Z.; Wei, K.; Yang, J.; Zhang, M.; Yang, F. Can the digital economy foster advancements in the healthcare sector?—A case study using interprovincial data from China. BMC Public Health 2025, 25, 196. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Kunkel, S.; Tyfield, D. Digitalisation, sustainable industrialisation and digital rebound–Asking the right questions for a strategic research agenda. Energy Res. Soc. Sci. 2021, 82, 102295. [Google Scholar] [CrossRef]

- Ma, R.; Lin, B. Digital infrastructure construction drives green economic transformation: Evidence from Chinese cities. Humanit. Soc. Sci. Commun. 2023, 10, 1–10. [Google Scholar] [CrossRef]

- Zhang, Q. The Impact of Digitalization on the Upgrading of China’s Manufacturing Sector’s Global Value Chains. J. Knowl. Econ. 2024, 15, 15577–15600. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, W.; Zhang, X.; Liao, W. Digital economy, consumption structure and rural economic transformation: A case study of China. Front. Sustain. Food Syst. 2025, 9, 1565067. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. The race between man and machine: Implications of technology for growth, factor shares, and employment. Am. Econ. Rev. 2018, 108, 1488–1542. [Google Scholar] [CrossRef]

- Song, Y.; Jiang, Y. How does the digital economy drive the optimization and upgrading of industrial structure? the mediating effect of innovation and the role of economic resilience. Sustainability 2024, 16, 1352. [Google Scholar] [CrossRef]

- Shang, X.; Liu, Q. Can digital inclusive finance enhance regional economic resilience? The approach of innovation and resource allocation efficiency. Financ. Res. Lett. 2024, 69, 105953. [Google Scholar] [CrossRef]

- Aoki, S. A simple accounting framework for the effect of resource misallocation on aggregate productivity. J. Jpn. Int. Econ. 2012, 26, 473–494. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personal. Soc. Psychol. 1986, 51, 1173. [Google Scholar] [CrossRef]

- Nunn, N.; Qian, N. US Food Aid and Civil Conflict. Am. Econ. Rev. 2014, 104, 1630–1666. [Google Scholar] [CrossRef]

- Lei, H.; Tang, C.; Long, Y. Study on the impact of digital economy on industrial collaborative agglomeration: Evidence from manufacturing and productive service industries. PLoS ONE 2024, 19, e0308361. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Li, L. Digital economy, industrial structure upgrading, and residents’ consumption: Empirical evidence from prefecture-level cities in China. Int. Rev. Econ. Financ. 2024, 92, 1045–1058. [Google Scholar] [CrossRef]

- Shen, Y.; Zhang, X. Digital economy, intelligent manufacturing, and labor mismatch. J. Adv. Comput. Intell. Intell. Inform. 2022, 26, 655–664. [Google Scholar] [CrossRef]

- Autor, D.H. Why are there still so many jobs? The history and future of workplace automation. J. Econ. Perspect. 2015, 29, 3–30. [Google Scholar] [CrossRef]

- Chen, X.Y. A review of western scholars’ research on capitalist labor-capital relations in the digital economy era. Economist 2022, 34, 37–44. [Google Scholar]

- Wu, X.X.; Ren, B.P. The path and policy adjustment of the reconstruction of resource allocation mechanism under the background of digital economy. Reform Econ. Syst. 2022, 2, 5–10. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).