Abstract

In the context of intensifying global competition and mounting environmental pressures, understanding how firms can improve corporate sustainability through supply chain efficiency remains a pressing and underexplored issue. This study addresses this gap by investigating the relationship between supply chain efficiency and corporate sustainability, with a particular focus on the moderating roles of digitalization and internal governance. Using panel data of 8000 firm-year observations from Chinese A-share listed companies over the 2010–2022 period, we adopt a two-way fixed effects model to empirically examine how inventory turnover days and the warehousing and transportation cost ratio affect firms’ sustainable growth. Our findings indicate that improving supply chain efficiency—manifested in shorter inventory turnover cycles and lower logistics cost ratios—significantly enhances corporate sustainability. Furthermore, we find that higher levels of digitalization and stronger internal governance significantly strengthen this positive relationship. These findings extend the resource-based view and dynamic capability theory by revealing how supply chain efficiency, supported by digital and internal governance, contributes to long-term sustainability. This study offers theoretical insights and practical implications for managers and policymakers aiming to optimize supply chain strategies in support of sustainable development goals.

1. Introduction

Given increasing global competition and rising resource and environmental pressures, corporate sustainable development, represented by the sustainable growth rate (SGR), has become an important criterion for measuring a firm’s long-term competitiveness and market adaptability. Sustainable development is related to corporate profitability and growth potential and affects the stability of the entire economic system in addition to social well-being [1]. Modern enterprises must pursue short-term profit maximization while ensuring long-term stable growth and improving resource utilization efficiency to cope with market volatility and external uncertainty [2]. Additionally, as global supply chain networks expand, corporate sustainability has gone beyond the scope of individual firms and has become an important issue for the global business system [3].

Supply chain management plays a pivotal role in achieving sustainability because its efficiency directly impacts corporate profitability, competitiveness, and long-term viability [4]. Enhancing supply chain efficiency optimizes resource allocation, reduces operational costs, and minimizes energy wastage, as well as logistics expenses, thereby improving financial performance and market stability [5]. In particular, reducing inventory turnover time and optimizing warehousing and transportation costs improve cash flow and mitigate supply chain risks, ultimately strengthening market resilience [6]. Recent studies underscore that effective supply chain practices not only enhance organizational agility but also facilitate environmental and social goals by reducing waste and promoting circular economy principles [7]. Clearly, examining the relationship between supply chain efficiency and corporate sustainability is important.

Among related factors, digital transformation has emerged as a key driver for enhancing supply chain efficiency and corporate sustainability. Technologies like information management systems, blockchain, artificial intelligence (AI), and the Internet of Things (IoT) enable firms to better predict market demand, optimize inventory management, and improve supply chain transparency [8]. A digitalized supply chain enhances a company’s ability to respond to market changes while reducing uncertainties, thereby strengthening its overall operational resilience [9]. Advanced digital management, through intelligent scheduling and data analytics, improves inventory efficiency, optimizes warehousing and transportation costs, and, ultimately, fosters long-term corporate growth [10]. Recent studies further demonstrate the value of integrating digital intelligence into supply chain systems. For example, rotation-aware deep learning models have been developed to improve maritime logistics performance, enabling real-time vessel detection and efficient data acquisition through decoupled orientation features [11]. In addition, hybrid digital twin-assisted models are being applied to optimize container terminal operations with multiple objectives, demonstrating the effectiveness of predictive analytics in sustainable logistics planning [12]. Moreover, blockchain-based optimization frameworks are increasingly used in closed-loop supply chain design, offering data integrity and operational transparency for circular and sustainable business models [13]. These innovations provide a technological foundation for further empirical analysis of how digital capabilities amplify the sustainability impact of supply chain efficiency.

Similarly, internal corporate governance plays a critical role in translating supply chain efficiency into sustainable development. An effective governance structure optimizes resource allocation, enhances operational transparency, and ensures supply chain efficiency and compliance [14]. High-quality internal governance fosters the adoption of more scientific and efficient supply chain strategies, like optimizing procurement management and improving logistics operations, which help mitigate supply chain disruption risks [15]. Additionally, a good governance structure improves firms’ ability to manage supply chain data and makes the supply chain system more resilient and adaptive, thus better supporting long-term growth [16]. Internal governance mechanisms are also important for promoting green innovation and enhancing corporate environmental performance, underscoring internal governance as a critical moderating factor in sustainability practices [17]. Strong governance frameworks promote stakeholder inclusivity, ethical accountability, and strategic alignment across functional departments, thereby institutionalizing sustainability principles into core business processes [18,19]. Internal governance can therefore be viewed as both an enabler and a catalyst of sustainable value creation, offering procedural legitimacy and internal safeguards for sustainability-oriented transformation.

Here, we analyze data on Chinese A-share listed companies from 2010 to 2022 to explore the impact of supply chain efficiency on corporate sustainable development, and how digitization and internal governance levels affect this relationship.

The innovations of this study are as follows: First, most studies on the impact of supply chain efficiency on corporate sustainable development focus only on the impact of supply chain management on corporate financial performance. Fewer studies explore the specific role of supply chain efficiency in corporate sustainable development [20,21]. Addressing this gap, we systematically analyze how supply chain efficiency affects firms’ sustainable growth in terms of profitability and long-term development. Second, differing from traditional research, we adopt an operational perspective to define supply chain efficiency as “inventory turnover days” and “storage and transport cost ratio”. These indicators can more accurately measure corporate operational efficiency in the process of supply chain optimization, thereby overcoming the limitations of using crude supply chain performance indicators (e.g., total cost) in previous studies [22].

Finally, our contributions are three-fold: First, we expand the application of the resource-based view (RBV) and dynamic capability theory (DCT) in supply chain management and sustainable development. Second, we explore the moderating roles of digitalization and internal governance, providing a solid theoretical basis for enhancing the sustainability of listed companies. Finally, in the context of China’s dual-carbon strategy and increasing digital transformation, understanding how sustainable corporate growth can be enhanced through supply chain efficiency optimization has become an important corporate strategic decision-making issue [23]. Therefore, our empirical results provide actionable management suggestions for corporate managers and evidence for regulators to formulate supply chain management as well as sustainable development policies.

2. Theoretical Background and Hypotheses

2.1. Supply Chain Efficiency and Corporate Sustainability

Firms in a highly competitive and resource-constrained market must rely on efficient supply chain management to optimize resource allocation, enhance market competitiveness, and achieve sustainable growth. RBV suggests that a firm’s long-term competitive advantage depends on effectively acquiring and utilizing key resources [1]. Within the supply chain management context, this implies that firms must improve supply chain efficiency by acquiring, producing, and distributing resources at lower costs, in shorter time frames, and with greater precision. DCT further emphasizes that firms must continuously adjust and refine their supply chain strategies to adapt to market changes and maintain sustainable competitiveness [24]. Therefore, supply chain efficiency is not only a foundation for operational performance but also a critical pathway through which firms achieve long-term sustainability goals. Furthermore, long-term development is a key dimension of sustainability that extends beyond immediate financial gains. Efficient supply chains contribute to long-term resilience by reducing operational uncertainties, enhancing resource utilization, and enabling firms to better withstand external shocks [25]. This systemic effect reinforces sustainable growth and strategic competitiveness.

Inventory turnover days are a key indicator of a firm’s inventory management efficiency. A reduction in inventory turnover days implies faster inventory cycles, lower stockpiling, and less tied-up capital, ultimately enhancing financial flexibility [26]. Efficient inventory management also reduces warehousing costs, obsolete stocks, and waste, thereby mitigating resource inefficiencies and environmental burdens. These improvements not only strengthen a firm’s short-term operational performance but also contribute to its long-term corporate sustainability. By minimizing resource use and waste, firms align more closely with environmental goals; by improving cash flow and responsiveness, they enhance resilience and adaptability in uncertain markets. That is, accelerated inventory turnover improves a firm’s profitability while simultaneously enhancing environmental performance, yielding comprehensive benefits in economic, social, and environmental sustainability [5].

Thus, reducing inventory turnover days supports both economic efficiency and environmental responsibility, forming a tangible link between operational improvements and sustainable development. Accordingly, we propose the following hypothesis:

Hypothesis 1.

A reduction in inventory turnover days improves corporate sustainability.

Next, controlling warehousing and transportation costs can also influence supply chain efficiency. These costs constitute a significant portion of logistics costs. Excessive logistics costs erode profitability and impose additional environmental burdens [27]. According to RBV, firms can optimize warehouse locations and enhance logistics network coordination to eliminate unnecessary costs while improving overall supply chain efficiency [28]. Meanwhile, DCT underscores that firms need to develop the agility to adjust logistics models and transportation strategies in response to market fluctuations, thereby ensuring long-term sustainable growth [29].

The widespread adoption of smart logistics technologies, like automated warehouse management systems, intelligent delivery networks, and data-driven transportation optimization, enables firms to manage warehousing resources with greater precision and enhances delivery efficiency. Together, this improves supply chain efficiency and strengthens firms’ sustainable competitive advantage by reducing energy consumption and carbon emissions [30]. Additionally, firms are increasingly adopting green logistics practices to lower their warehousing and transportation costs. Strategies like optimizing transportation modes, utilizing shared storage facilities, and implementing low-carbon transportation solutions help reduce energy consumption and environmental pollution while enhancing overall supply chain performance, thereby creating higher integrated value [31].

In summary, reducing warehousing and transportation costs not only enhances operational effectiveness but also plays a key role in environmental protection and resource conservation. This dual benefit reinforces a firm’s capacity to deliver sustainable value. Accordingly, we propose the following hypothesis:

Hypothesis 2.

A reduction in the warehousing and transportation cost ratio improves corporate sustainability.

2.2. The Moderating Role of Digitalization

A firm’s digitalization level refers to the depth of digital technology application in its operations and management, as well as its ability in information integration, processing, and intelligent decision-making. This ability is mainly reflected in the degree of the firm’s adoption and integration of cutting-edge technologies, like the IoT, big data, cloud computing, and AI. Thus, the depth of digitalization directly influences a firm’s efficiency in information processing, resource allocation, and decision-making accuracy [32].

In the supply chain management context, higher digitalization enhances a firm’s agility and visibility, enabling it to respond more quickly to market demand and supply chain fluctuations. This accelerates the conversion of efficiency improvements into sustainability outcomes [23]. Moreover, digital tools like real-time inventory monitoring via the IoT, AI-driven demand forecasting, and blockchain-enabled supply chain transparency significantly enhance both environmental performance and operational capabilities [33,34]. Indeed, integrating AI technologies significantly boosts corporate green product innovation capabilities, implying digital capabilities’ potential to elevate supply chain sustainability through enhanced innovation outcomes [35].

Specifically, firms with high digitalization can better detect demand fluctuations, optimize inventory structures, and efficiently allocate transportation resources. These improvements contribute to lower carbon emissions and resource conservation, reinforcing corporate sustainability. Conversely, due to insufficient information integration or lagging system response, firms with lower digitization can hardly effectively promote sustainable development, even if they have improved their supply chain efficiency [32]. Accordingly, we propose the following hypotheses:

Hypothesis 3a.

The level of digitization enhances the positive effect of reducing the inventory turnover days on sustainable development.

Hypothesis 3b.

The level of digitization enhances the positive effect of reducing the warehouse and transportation expense ratio on sustainable development.

2.3. The Moderating Role of Internal Governance

Internal governance refers to the mechanisms and processes that regulate a firm’s operational management, decision-making oversight, and risk control. It reflects the effectiveness and standardization of a firm’s organizational structure and management system. A well-developed internal governance framework ensures the effective implementation of strategic objectives and the stable realization of corporate performance. When a firm has a robust governance structure, decision-making becomes more systematic and supervision mechanisms are more comprehensive. This enables firms to quickly identify, assess, and capitalize on sustainability opportunities arising from supply chain efficiency improvements, further amplifying the economic and environmental benefits of inventory optimization and logistics cost reductions. Indeed, strong internal governance enhances a firm’s strategic centrality within the supply chain, increasing its control and coordination over sustainability mechanisms. This helps in achieving sustainable development goals across the supply chain [36].

Internal governance also strengthens a firm’s ability to manage risks, improving its resilience and adaptability to supply chain fluctuations and uncertainty [37]. Effective governance structures foster communication and collaboration between internal and external stakeholders, mitigating the governance challenges caused by information asymmetry, compliance pressures, and regulatory gaps [38]. Importantly, governance mechanisms moderate the relationship between supply chain management and corporate sustainability, enhancing a firm’s ability to translate efficiency gains into sustainable outcomes [39]. Conversely, firms with weak governance structures are more prone to delayed decision-making and execution biases, limiting their ability to fully convert supply chain efficiency improvements into tangible sustainability outcomes. Firms can only achieve governance effectiveness and sustainability objectives if they establish governance mechanisms consistent with the complexity of their supply chain structures [40].

Accordingly, we propose the following hypotheses:

Hypothesis 4a.

Internal governance strengthens the positive impact of reduced inventory turnover days on corporate sustainability.

Hypothesis 4b.

Internal governance strengthens the positive impact of lowering the warehousing and transportation cost ratio on corporate sustainability.

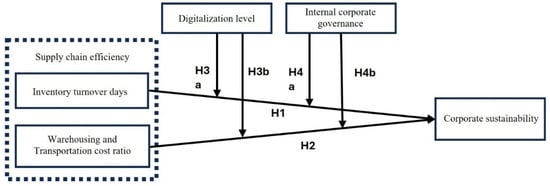

Figure 1 is the research model of the study.

Figure 1.

Our research model.

3. Methodology

3.1. Data and Sample

Our initial sample comprised A-share listed companies on the Shanghai and Shenzhen stock exchanges from 2010 to 2022. This was processed as follows: first, only companies listed before 2010 were retained and companies in the financial sector were excluded; second, firms classified as ST, *ST, PT, or delisted during the sample period were excluded; and third, observations with missing key variables were removed. The final dataset comprised 8000 firm-year observations.

Data were sourced from the China Stock Market and Accounting Research (CSMAR), China Research Data Service (CSMAR), and Choice databases. Digitalization-related word frequency data were extracted from annual reports by using text analysis. To mitigate the influence of extreme values, all continuous variables were winsorized at the 1% level on both tails. Data were processed and analyzed using Stata 16.0 and Python 3.8.

3.2. Definition and Measurement of Variables

3.2.1. Dependent Variable

Corporate sustainability refers to a firm’s ability to achieve long-term operations, maintain competitive advantage, and sustain stable growth. Following Wu et al. [41], we adopted Van Horne’s static model to measure corporate profitability and competitive sustainability [42] as follows:

3.2.2. Independent Variable

Enhancing supply chain efficiency requires effective supply chain management, which involves managing and coordinating the flow of products, information, and capital among various supply chain participants [43]. A slowdown in the flow of factors, like inventory, can cause conflicts of interest between upstream and downstream firms, which is not conducive to improving supply chain efficiency. As a result, an important aspect of improving supply chain efficiency is improving inventory management capabilities, as suggested by Zahran and Jaber [44]. Accordingly, following Chen et al. [45] and Feng et al. [46], we first selected listed companies’ inventory turnover days (inventory_day) to measure supply chain efficiency. Additionally, supply chain logistics and transport costs reflect supply chain efficiency to a large extent, as they account for a significant proportion of project costs and are significantly correlated with project efficiency [47]. Thus, the warehousing and transport cost ratio can be an appropriate proxy for supply chain efficiency [48], defined as the warehouse–transport-cost ratio (WTC).

3.2.3. Moderator Variable

Corporate digitalization is a complex and systematic process, making it challenging to quantify at the firm level. Most studies adopt a macroeconomic perspective, often relying on regional- or industry-level digital economy indicators to assess digitalization [49]. At the micro level, limited empirical research has primarily evaluated digitalization through measures like information capital and information technology (IT) system applications [50]. However, these methods have notable limitations.

Some studies use IT investment, telecommunications expenditure, and the proportion of intangible assets related to digitalization to measure information technology adoption. While these indicators are straightforward, they may be influenced by firms’ signaling behavior. Furthermore, IT investment levels do not necessarily reflect actual digital application [51]. Other studies rely on surveys or interviews [52]; however, the high cost of collecting comprehensive digitalization data poses challenges.

Currently, the most common approach is to measure digitalization (DT) based on the proportion of digitally related intangible assets [53]. However, these metrics often fail to provide a precise and comprehensive assessment of digitalization. Since digital transformation is a critical strategy for corporate development, it is frequently reflected in firms’ annual reports. The language used in annual reports conveys strategic priorities and future outlooks [54,55], providing insights into corporate management philosophies and growth trajectories. Because annual reports typically contain summaries and strategic discussions, they are likely to include details related to digitalization [56].

Following Wen et al. [57] and Guo et al. [58], we applied machine-learning-based text analysis to quantify the frequency of digitalization-related terms in annual reports and used it as a proxy for digital transformation.

Specifically, we first created a special list of keywords. This dictionary included two types of words: terms concerning digital technologies and words that describe how these technologies are used. We built this keyword list by looking at previous research studies, checking government websites, such as that of the Ministry of Industry and Information Technology, and reviewing other reports on technology.

After collecting the potential keywords, we used Python software to analyze them. We retained only the words that appeared at least five times. Through this process, 238 important digitalization terms were identified. These words became the official corporate digitalization dictionary for this study.

Third, we constructed a corporate digitalization index. To account for differences in the text length of the Management Discussion and Analysis (MD&A) section across firms, we measured digitalization by dividing the total frequency of digitalization-related keywords by the total length of the MD&A section. For ease of interpretation, this index was multiplied by 100. A higher index value indicates a greater level of corporate digitalization. The full list of keywords is provided in Table 1.

Table 1.

Keywords for digital transformation.

Next, for internal governance, following the literature [59,60], we selected eight corporate governance variables and employed principal component analysis to construct a comprehensive corporate governance quality index (CorpGov). A higher CorpGov value indicates better governance quality.

The eight corporate governance variables are as follows. First is the separation of the CEO and chairperson roles (CeoNotPresident). Agency theory suggests that combining these roles weakens board oversight, leading to poorer firm performance and lower transparency [61,62]. Second is the proportion of independent directors (IndDirectRatio). A higher proportion of independent directors increases voluntary disclosure [63,64]. Third and fourth are the shareholding ratios of directors (ShareDirectors) and executives (ShareManager), respectively. According to agency theory, higher ownership by directors and executives aligns managerial and investor interests [65]. Fifth is the largest shareholder’s shareholding ratio (ShareContHolder). Concentrated ownership mitigates the free-rider problem associated with dispersed ownership, thereby enhancing shareholder monitoring [66]. Sixth and seventh are board size (DirectorNumb) and supervisory board size (SupervisorNumb), respectively. Finally, we considered the total compensation of the top three executives (ManagerComp).

3.2.4. Control Variables

Following recent research [67,68,69,70], we controlled for firm size (Size), leverage (Lev), book/market ratio (Bm), Tobin’s Q (TobinQ), firm age (Firmage), cash flow ratio (Cashflow), revenue growth rate (Growth), and whether the firm is audited by a Big Four accounting firm (Big4).

Industry (Ind) and year (YEAR) dummy variables were also included. If a firm belongs to a specific industry or year, the corresponding dummy variable equaled 1 and was 0 otherwise. Table 2 provides the definitions and measurement details of all variables.

Table 2.

Variable definition.

3.3. Model Design

To empirically test the proposed hypotheses, we constructed the following econometric models by using a two-way fixed effects panel regression framework that accounts for both industry and year effects. We gradually introduce key independent variables, control variables, and interaction terms across Models (1) through (6) to test baseline effects and moderation effects in line with our hypotheses.

The dependent variable in all models is the SGR; the independent variable in models is ITDs or WTC. and represent the digitalization level and corporate governance quality of firm i in year t, respectively.

3.3.1. Baseline Model

To examine Hypotheses 1 and 2, we constructed Models (1) and (2). represents firm i’s sustainability level in year t. ITDs and WTC capture the firm’s inventory turnover days and warehousing and transportation cost ratio, respectively. represents the control variables.

and are dummy variables that account for Year and Ind fixed effects, respectively. is the error term. The models analyze the relationship between inventory turnover days, the warehousing and transportation cost ratio, and corporate sustainability. If the is negative and statistically significant, it suggests that reducing inventory turnover days and lowering warehousing and transportation costs (i.e., improving supply chain efficiency) enhance corporate sustainability, thereby supporting Hypotheses 1 and 2.

3.3.2. Moderating Effects Model

We incorporated moderating variables in the baseline regression models, including the interaction terms of digitalization level [71] with inventory turnover days, and the warehousing and transportation cost ratio. To test Hypotheses 3a and 3b, we constructed Models (3) and (4), respectively. Model (3) builds on Model (1) by adding the digitalization level and its interaction with inventory turnover days. Model (3) predicts that if the coefficients , for inventory turnover days, and , for interaction terms, are statistically significant and negative, the digitalization level positively affects the reduction in inventory turnover days, thus contributing to corporate sustainability and supporting Hypothesis 3a:

Model (4) extends Model (2) by including the digitalization level and its interaction with the warehousing and transportation cost ratio. Model (4) predicts that if the coefficients , for inventory turnover days, and , for interaction terms, are statistically significant and negative, this suggests that the digitalization level positively impacts the reduction in warehousing costs, leading to enhanced corporate sustainability, thus supporting Hypothesis 3b:

To test Hypotheses 4a and 4b, we constructed Models (5) and (6), respectively. Similarly, if the coefficients , for inventory turnover days, and , for interaction terms, are statistically significant and negative, Hypotheses 4a and 4b are supported:

3.3.3. Statistical Methods

First, we used descriptive statistics to observe the sample data’s distribution characteristics, ensuring that the data met the assumptions for linear regression. Second, we conducted a correlation analysis by calculating Pearson’s correlation coefficients to preliminarily assess the relationships between the variables. We also calculated the variance inflation factor (VIF) to check for multicollinearity issues. Third, before performing linear regression, we applied the Hausman test to determine whether to use a random or fixed effects model, ensuring the applicability of the model to the sample data. Finally, we performed linear regression analysis using alternative explanatory variables and two-stage least squares (2SLS) to ensure the robustness of the results.

4. Results

4.1. Descriptive Statistics

Table 3 reports the descriptive statistics. The skewness and kurtosis of all data meet the requirements for a normal distribution. The mean and standard deviation of the corporate sustainability growth rate (SGR) are 6.686 and 5.254, respectively, indicating that sales growth rates vary across companies, with significant differences among them. The median SGR is 5.717, which is lower than the mean, suggesting that more than half of the Chinese listed companies exhibit relatively low levels of sustainability. This finding aligns with the literature [69] on the sustainability of Chinese companies. Clearly, improving sustainability through digital transformation is crucial for firms’ long-term development. The median ITDs is 4.569, which is close to the mean of 4.576, indicating that approximately half of the sample companies have moderate inventory turnover days. The standard deviation of 0.767 suggests minimal variation across companies, with relatively consistent efficiency in inventory management. The mean WTC is 1.145, while the median is 0.872. Thus, most companies have relatively low warehousing and transportation cost ratios, though some companies exhibit higher values. The standard deviation of 1.082 and range of 0 to 10.64 demonstrate significant variation across companies. The mean DT is 0.824, while the median is 0.544, suggesting that most companies have low digitalization. The standard deviation of 0.827 shows considerable variation in digitalization levels across companies. Overall, substantial disparity in digital transformation levels exists among Chinese listed companies, consistent with extant research [72]. The mean ICG is −0.0240, with a median of 1.250, indicating that most companies have high internal governance levels. The standard deviation of 9.585 reveals significant variability in governance levels across companies.

Table 3.

Descriptive statistics.

4.2. Correlation Analysis

As shown in Table 4, Pearson’s correlation coefficients were used to represent the relationships between all variables. The correlation coefficients of inventory turnover days and the warehousing and transportation cost ratio with corporate sustainability are −0.095 and −0.138, respectively. Both coefficients were statistically significant and negatively correlated with corporate sustainability. These two variables, representing supply chain efficiency, suggest that reducing inventory turnover days and lowering warehousing and transportation costs (i.e., improving supply chain efficiency) can enhance corporate sustainability. Thus, Hypotheses 1 and 2 have some preliminary support. The VIF values are lower than three, indicating no significant multicollinearity issues.

Table 4.

Correlation analysis.

4.3. Regression Results

A Hausman test was conducted before the regression analysis to ensure the accuracy of the regression results. The p-values of the test were all 0.000, indicating that the fixed effects model is more appropriate. Therefore, we used a two-way fixed effects model that includes fixed effects for both industry and year.

Table 5 presents the regression results for ITDs and WTC in relation to corporate sustainability. After controlling for multiple variables, the regression coefficients for ITDs and WTC with the SGR are −0.399 and −0.247, respectively, and significantly negative at the 1% level. Thus, fewer inventory turnover days and lower warehousing costs are associated with higher sustainability, indicating that higher supply chain efficiency leads to greater corporate sustainability. Hence, Hypotheses 1 and 2 are supported.

Table 5.

Regression results.

An increase in digitalization strengthens the relationship between supply chain efficiency and corporate sustainability. After controlling for multiple variables, in Model (5), the coefficient of ITDs is −0.408, while that for the interaction term with digitalization (ITDs × DT) is −0.188. Both coefficients are significantly negative at the 5% level. This indicates that digitalization amplifies the negative effect of ITDs on sustainability; that is, increased digitalization enhances the positive impact of reducing inventory turnover days on sustainability. Thus, Hypothesis 3a is supported.

In Model (6), the coefficient for WTC is −0.294, while that for the interaction term with digitalization (WTC × DT) is −0.198. Both coefficients are significantly negative at the 5% level. Thus, the lower the warehousing and transportation cost ratio, the greater the potential for corporate sustainability. Moreover, when digitalization levels increase, this positive effect is further amplified; that is, increased digitalization enhances the positive impact of reducing warehousing costs on sustainability. Thus, Hypothesis 3b is supported.

In summary, digitalization positively impacts both supply chain efficiency and corporate sustainability.

A firm’s internal governance strengthens the relationship between supply chain efficiency and corporate sustainability. After controlling for multiple variables, in Model (3), the coefficient for ITDs is −0.407, while that for the interaction term with internal corporate governance (ITDs × ICG) is −0.015. Both coefficients are significantly negative at the 5% level. Thus, fewer ITDs are associated with greater corporate sustainability, while higher internal governance strengthens this effect. Therefore, improving internal governance increases the positive impact of reducing inventory turnover days on sustainability. Thus, Hypothesis 4a is supported.

Similarly, in Model (4), the coefficient for WTC is −0.280, while that for the interaction term with internal governance (WTC × ICG) is −0.010. Both coefficients are significantly negative at the 5% level. This indicates that internal governance amplifies the negative effect of WTC on corporate sustainability. Therefore, improving internal governance amplifies the positive effect of reducing warehousing and transportation costs on sustainability. Thus, Hypothesis 4b is supported.

In summary, enhanced internal governance positively affects both supply chain efficiency and corporate sustainability.

4.4. Robustness Tests

We employed some robustness checks on the main findings to ensure their reliability. First, we used an alternative independent variable. Second, we employed 2SLS regression to address issues of endogeneity and reciprocal causality [73].

4.4.1. Replacing the Dependent Variable

We replaced the SGR with the long-term sustainable growth rate (LSGR) from the CSMAR database. Table 6 shows that both the ITD and WTC coefficients are negative and statistically significant in the first and second rows. Thus, fewer inventory turnover days and a lower warehouse and transport cost ratio positively impact corporate sustainability, further supporting Hypotheses 1 and 2. As shown in the fourth and fifth rows of Table 6, the interaction term coefficients are negative and statistically significant. Thus, higher digitalization levels and good internal governance positively moderate the effect of reducing inventory turnover days and warehousing costs on corporate sustainability. Thus, internal governance and digitalization levels actively enhance the impact of supply chain efficiency on corporate sustainability. This further validates Hypotheses 3a, 3b, 4a, and 4b.

Table 6.

Robustness test: changing explanatory variable.

4.4.2. Two-Stage Least Squares Regression

To address potential reverse causality issues, we selected the one-period lagged values of inventory turnover days and warehousing transportation costs (L.ITDs and L.WTC) as instrumental variables, and performed a regression analysis using 2SLS.

Table 7 shows that, in the first stage, L.ITDs and L.WTC are significantly positive (L.ITDs = 0.950, L.WTC = 0.873) at the 1% significance level. In the second stage, the coefficients of ITDs and WTC on corporate sustainability are significantly negative (ITDs = −0.758, WTC = −0.189) at the 1% significance level. Thus, even after controlling for endogeneity issues, the core variables still have a significant negative impact on corporate sustainability.

Table 7.

Robustness test: 2SLS results.

Moreover, the Kleibergen–Paap rk LM statistics are 984.816 and 509.868, with p-values of 0.000, refuting the null hypothesis of “insufficient instrument identification.” The Kleibergen–Paap rk Wald F statistics are 23,201.97 and 3360.342, both exceeding the 10% critical value (16.38) in the Stock–Yogo weak identification test. This further confirms that the chosen instrumental variables do not suffer from weak identification issues.

In conclusion, the direction and significance of the effects of the ITDs and WTC remain robust after controlling for endogeneity, further validating the empirical findings.

5. Discussion and Conclusions

5.1. Discussion

Supply chain management plays a crucial role in enhancing corporate competitiveness and achieving long-term development goals. It also serves as an essential tool to boost a firm’s adaptability and flexibility while strengthening strategic resilience [74]. Well-executed supply chain management has two important aspects. First, it enhances a company’s capacity to handle unexpected external challenges. Second, and perhaps more crucially, it is vital for maintaining competitive advantages that last [75].

While extant research has examined how supply chain efficiency is connected to business growth, most studies concentrate on immediate benefits, such as higher profit margins or improved cash flow situations [76]. A thorough investigation of how supply chain efficiency systematically influences a company’s long-term sustainability remains elusive.

Another issue is how researchers measure supply chain efficiency. Several studies used broad-based indicators to provide an overall picture, including general cost ratios and subjective performance ratings [77,78]. However, these methods do not reveal what actually happens in the most important supply chain operations. Consequently, they may not accurately reflect the real effectiveness of supply chain processes. The lack of targeted and actionable measurement methods means that the pathway through which supply chain efficiency influences a company’s sustainable strategic goals remains unclear, thus creating a gap in the research on how supply chains contribute to corporate sustainability.

Addressing these gaps, we advance supply chain management and sustainability research in three ways. First, we clearly define and precisely measure the critical dimensions of supply chain efficiency by constructing a refined measurement framework centered on inventory turnover days and the warehousing transportation cost ratio. Second, we reveal the mechanisms through which supply chain efficiency influences corporate sustainability at the micro level and empirically demonstrate the positive impact of supply chain efficiency on corporate sustainability. In particular, better inventory management and reduced logistics costs directly improve corporate sustainability. Third, this study reveals the moderating roles of digital transformation and internal governance as critical capability-based resources in the relationship between supply chain efficiency and corporate sustainability. The findings indicate that both digitalization and internal governance significantly enhance the positive impact of supply chain efficiency on corporate sustainability, aligning with most existing research. For instance, Yao et al. [79] emphasize that the application of digital technologies substantially improves firms’ responsiveness and resource allocation efficiency, thereby strengthening the link between supply chain efficiency and sustainable performance. Similarly, Govindan et al. [39] highlight that a sound internal governance structure provides effective decision-making, oversight, and risk management mechanisms, which ensure that supply chain efficiency improvements are effectively implemented, ultimately amplifying their contribution to long-term sustainable development.

Moreover, our findings are consistent with related studies in other countries. For instance, studies in Mexico and Europe confirm that digital tools enhance supply chain flexibility and that strong internal governance supports sustainable development [80,81]. These comparisons suggest that the mechanisms identified in this study have broader applicability across different institutional settings.

To achieve real, long-term sustainability, businesses must simultaneously develop three key capabilities: they must maintain efficient operations while also building digital intelligence and organizational resilience. Only by combining these elements can companies create supply chain systems that are truly “efficient, smart, and adaptable” to changing market conditions. This integrated approach represents the path toward sustainable competitive advantage.

5.2. Conclusions

As globalization and digitalization accelerate, businesses must operate in more complex environments. They also face stricter sustainability rules. The supply chain is the central part that connects companies to the market. In particular, digital transformation and better governance can help improve supply chain efficiency. By drawing on longitudinal data from A-share listed companies in China (2010–2022), this research contributes novel empirical evidence from an emerging economy, thereby expanding the global relevance of sustainability [82]. We examine how supply chain efficiency, digitalization, and corporate governance affect corporate sustainability in Chinese publicly listed companies.

While prior literature has largely focused on the short-term financial benefits of supply chain management—such as improved profitability or cash flow [83,84]—this study shifts the focus to long-term corporate sustainability. We find that supply chains significantly impact sustainability. When companies reduce their inventory turnover days, their sustainability improves. Cutting warehouse and transportation costs is also helpful. Better supply chain efficiency does more than just improve profits; it also reduces waste and carbon emissions, which are beneficial to the environment and society, supporting Hypotheses 1 and 2. Thus, making supply chains more efficient is key to comprehensively achieving sustainability.

Moreover, this study introduces a novel dual-moderator model by examining the roles of digitalization and internal governance. While previous studies have considered these elements separately [85,86], this research integrates both into a unified framework, providing empirical support for their interactive effects on the relationship between supply chain efficiency and sustainability.

The empirical results support Hypothesis 3a, indicating that digitalization significantly amplifies the positive impact of inventory turnover efficiency on corporate sustainability. Firms have improved supply chain intelligence and transparency and strengthened their resource utilization and market responsiveness through technologies like big data analytics, the IoT, and blockchain. Digital transformation improves firms’ operational efficiency and helps them remain competitive in a rapidly changing market. Hypothesis 3b is also supported, showing that digitalization enhances the effect of warehousing and transportation cost reduction on sustainability, further confirming its critical role in enabling environmentally and economically efficient supply chain practices.

Furthermore, internal corporate governance plays a significant moderating role, supporting both Hypothesis 4a and Hypothesis 4b. Specifically, Hypothesis 4a shows that internal governance strengthens the positive relationship between inventory turnover efficiency and sustainability, while Hypothesis 4b confirms that governance also enhances the effect of logistics cost efficiency on sustainable outcomes. Governance optimization enables firms to pay more attention to environmental and social responsibilities in supply chain management, thereby promoting sustainable development while achieving long-term strategic goals. A good governance mechanism is essential for firms to achieve efficient resource utilization and responsibility fulfillment.

As such, firms should improve their supply chain efficiency to achieve more comprehensive sustainable development. Meanwhile, firms need to actively improve their level of digitalization and internal governance to better adapt to market changes and policy requirements and provide good conditions for improving supply chain efficiency.

5.3. Implications

Theoretically, firstly, this study enriches the theory of supply chain management. Specifically, we analyze supply chain efficiency in a multidimensional manner, providing a new perspective for research on the intersection of supply chain management and sustainable development. This introduces a systematic and multidimensional analysis paradigm to supply chain management research. Secondly, we reveal digitalization and internal corporate governance as moderating variables in the relationship between supply chain efficiency and sustainability, thereby providing a theoretical foundation for future studies and deepening supply chain efficiency research. Finally, we contribute evidence from developing countries using data from publicly listed companies in China, thereby highlighting the unique impact of supply chain efficiency on sustainability in various economic contexts. This provides both empirical support for supply chain management theory in the context of globalization and offers guidance for developing countries to explore more efficient supply chain management models.

Practically, firstly, this study can guide companies to optimize their supply chains. Companies should focus on inventory management and the optimization of warehouse logistics, reducing costs, and minimizing resource waste by improving supply chain efficiency, thus achieving an economic–environmental win–win. This can help companies achieve their short-term goals while supporting long-term sustainable development. Secondly, digital transformation should be promoted. Companies should actively adopt digital technologies to enhance supply chain transparency and collaboration, enabling them to adapt better to market changes and policy requirements. Digital technology application can further enhance firms’ ability to cope with complex supply chain challenges. Thirdly, governance structures should be strengthened, including internal governance mechanisms, and integrate environmental and social responsibilities into strategic planning to better meet sustainable development challenges. A sound governance structure can improve firms’ efficiency and sustainability performance in supply chain management. Fourthly, firms should not only seek efficiency gains for immediate benefits but also embed supply chain strategies within long-term development frameworks. This is particularly critical in an era of heightened global uncertainty and sustainability-driven regulation, where long-term resilience defines competitive success.

5.4. Limitations and Future Research Directions

We only used a sample of Chinese listed companies, limiting the generalizability to other countries or regions. Future studies should explore different economies and industries.

Further, this study does not filter out firms that issued new equity or took on significant new debt during the study period. Such changes in capital structure may affect corporate financial decisions and indirectly influence sustainability outcomes. Although control variables and fixed effects were included to reduce bias, the lack of direct screening of capital structure changes remains a limitation. Future research could improve upon this by incorporating capital issuance events or leverage changes as exclusion criteria or control variables to more precisely isolate the causal impact of operational efficiency on sustainability.

Finally, we did not fully investigate external influences, like government policies and industry trends, which can affect how supply chain efficiency influences sustainability. Examining how policies, industry features, and economic situations impact supply chains can help create a more complete understanding. Adding these elements to future studies will improve the overall research approach and provide deeper insights.

Author Contributions

A.L.: data curation, formal analysis, methodology, and writing—original draft. K.M.: conceptualization, investigation, and review and editing. S.J.: conceptualization, methodology, and review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Correction Statement

This article has been republished with a minor correction to the existing affiliation information. This change does not affect the scientific content of the article.

References

- Burritt, R.; Schaltegger, S. Accounting towards sustainability in production and supply chains. Br. Account. Rev. 2014, 46, 327–343. [Google Scholar] [CrossRef]

- Linton, J.; Klassen, R.; Jayaraman, V. Sustainable supply chains: An introduction. J. Oper. Manag. 2007, 25, 1075–1082. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Environmental Sustainability and Energy-Efficient Supply Chain Management: A review of research trends and proposed guidelines. Energies 2018, 11, 275. [Google Scholar] [CrossRef]

- Chen, L.; Zhao, X.; Tang, O.; Price, L.; Zhang, S.; Zhu, W. Supply chain collaboration for sustainability: A literature review and future research agenda. Int. J. Prod. Econ. 2017, 194, 73–87. [Google Scholar] [CrossRef]

- Klumpp, M. How to achieve supply chain sustainability efficiently? Taming the triple bottom line split business cycle. Sustainability 2018, 10, 397. [Google Scholar] [CrossRef]

- Borregan-Alvarado, J.; Alvarez-Meaza, I.; Cilleruelo-Carrasco, E.; Garechana-Anacabe, G. A Bibliometric analysis in Industry 4.0 and advanced manufacturing: What about the Sustainable Supply Chain? Sustainability 2020, 12, 7840. [Google Scholar] [CrossRef]

- Liu, L.; Song, W.; Liu, Y. Leveraging digital capabilities toward a circular economy: Reinforcing sustainable supply chain management with Industry 4.0 technologies. Comput. Ind. Eng. 2023, 178, 109113. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2018, 57, 2117–2135. [Google Scholar] [CrossRef]

- Park, A.; Li, H. The Effect of blockchain technology on supply chain sustainability performances. Sustainability 2021, 13, 1726. [Google Scholar] [CrossRef]

- Amouei, M.; Valmohammadi, C.; Fathi, K. Developing and validating an instrument to measure the impact of digital supply chain activities on sustainable performance. J. Enterp. Inf. Manag. 2023, 36, 925–951. [Google Scholar] [CrossRef]

- Chen, X.; Wu, H.; Han, B.; Liu, W.; Montewka, J.; Liu, R.W. Orientation-aware ship detection via a rotation feature decoupling supported deep learning approach. Eng. Appl. Artif. Intell. 2023, 125, 106686. [Google Scholar] [CrossRef]

- Li, Y.; Chang, D.; Gao, Y.; Zou, Y.; Bao, C. Automated Container Terminal Production Operation and Optimization via an AdaBoost-Based Digital Twin Framework. J. Adv. Transp. 2021, 2021, 1936764. [Google Scholar] [CrossRef]

- Chen, S.; Piao, L.; Zang, X.; Luo, Q.; Li, J.; Yang, J.; Rong, J. Analyzing differences of highway lane-changing behavior using vehicle trajectory data. Phys. A Stat. Mech. Appl. 2023, 624, 128980. [Google Scholar] [CrossRef]

- Formentini, M.; Taticchi, P. Corporate sustainability approaches and governance mechanisms in sustainable supply chain management. J. Clean. Prod. 2016, 112, 1920–1933. [Google Scholar] [CrossRef]

- Gimenez, C.; Sierra, V. Sustainable supply chains: Governance mechanisms to greening suppliers. J. Bus. Ethics 2013, 116, 189–203. [Google Scholar] [CrossRef]

- Esfahbodi, A.; Zhang, Y.; Watson, G.; Tao, Z. Governance pressures and performance outcomes of sustainable supply chain management: An empirical analysis of UK manufacturing industry. J. Clean. Prod. 2017, 155, 66–78. [Google Scholar] [CrossRef]

- Ju, W.; Jin, S. The impact of green innovation on the carbon performance of Chinese manufacturing enterprises: Moderating role of internal governance. Heliyon 2024, 10, e31272. [Google Scholar] [CrossRef]

- Wang, J.; Ran, B. Sustainable Collaborative Governance in Supply Chain. Sustainability 2018, 10, 171. [Google Scholar] [CrossRef]

- Meidinger, E. Governance Interactions in Sustainable Supply Chain Management. In Transnational Business Governance Interactions; Elgar Publishing: Cheltenham, UK, 2019. [Google Scholar] [CrossRef]

- Xu, Q.; Hu, Q.; Chin, T.; Chen, C.; Shi, Y.; Xu, J. How supply chain integration affects innovation in a digital age: Moderating effects of sustainable policy. Sustainability 2019, 11, 5460. [Google Scholar] [CrossRef]

- Jin, M.; Tang, R.; Ji, Y.; Liu, F.; Gao, L.; Huisingh, D. Impact of advanced manufacturing on sustainability: An overview of the special volume on advanced manufacturing for sustainability and low fossil carbon emissions. J. Clean. Prod. 2017, 161, 69–74. [Google Scholar] [CrossRef]

- Bag, S.; Telukdarie, A.; Pretorius, J.; Gupta, S. Industry 4.0 and supply chain sustainability: Framework and future research directions. Benchmarking: Int. J. 2018, 28, 1410–1450. [Google Scholar] [CrossRef]

- Schilling, L.; Seuring, S. Linking the digital and sustainable transformation with supply chain practices. Int. J. Prod. Res. 2023, 62, 949–973. [Google Scholar] [CrossRef]

- Negri, M.; Cagno, E.; Colicchia, C.; Sarkis, J. Integrating sustainability and resilience in the supply chain: A systematic literature review and a research agenda. Bus. Strategy Environ. 2021, 30, 2858–2886. [Google Scholar] [CrossRef]

- Liu, Z.; Costa, C.; Wu, Y. Data-Driven Optimization of Production Efficiency and Resilience in Global Supply Chains. World J. Innov. Mod. Technol. 2024, 7, 47–57. [Google Scholar] [CrossRef]

- Panigrahi, S.; Bahinipati, B.; Jain, V. Sustainable supply chain management. Manag. Environ. Qual. Int. J. 2019, 30, 1001–1049. [Google Scholar] [CrossRef]

- Gestring, I. Green Supply Chain Design Considering Warehousing and Transportation. In Smart City 360°; Leon-Garcia, A., Lenort, R., Holman, D., Staš, D., Krutilova, V., Wicher, P., Cagáňová, D., Špirková, D., Golej, J., Nguyen, K., Eds.; Lecture Notes of the Institute for Computer Sciences; Springer: Cham, Switzerland, 2016; pp. 648–658. [Google Scholar] [CrossRef]

- Lier, T.; Caris, A.; Macharis, C. Sustainability SI: Bundling of outbound freight flows: Analyzing the potential of internal horizontal collaboration to improve sustainability. Netw. Spat. Econ. 2016, 16, 277–302. [Google Scholar] [CrossRef]

- Agyabeng-Mensah, Y.; Ahenkorah, E.; Afum, E.; Dacosta, E.; Tian, Z. Green warehousing, logistics optimization, social values and ethics and economic performance: The role of supply chain sustainability. Int. J. Logist. Manag. 2020, 31, 549–574. [Google Scholar] [CrossRef]

- Mallidis, I.; Dekker, R.; Vlachos, D. The impact of greening on supply chain design and cost: A case for a developing region. J. Transp. Geogr. 2012, 22, 118–128. [Google Scholar] [CrossRef]

- Fichtinger, J.; Ries, J.; Grosse, E.; Baker, P. Assessing the environmental impact of integrated inventory and warehouse management. Int. J. Prod. Econ. 2015, 170, 717–729. [Google Scholar] [CrossRef]

- Nazir, H.; Fan, J. Revolutionizing retail: Examining the influence of blockchain-enabled IoT capabilities on sustainable firm performance. Sustainability 2024, 16, 3534. [Google Scholar] [CrossRef]

- Raman, S.; Patwa, N.; Niranjan, I.; Ranjan, U.; Moorthy, K.; Mehta, A. Impact of big data on supply chain management. Int. J. Logist. Res. Appl. 2018, 21, 579–596. [Google Scholar] [CrossRef]

- Varriale, V.; Cammarano, A.; Michelino, F.; Caputo, M. Sustainable supply chains with blockchain, IoT and RFID: A simulation on order management. Sustainability 2021, 13, 6372. [Google Scholar] [CrossRef]

- Ying, Y.; Jin, S. Artificial intelligence and green product innovation: Moderating effect of organizational capital. Heliyon 2024, 10, e28572. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Zhao, X.; Shi, D.; Li, X. Governance of sustainable supply chains in the fast fashion industry. Eur. Manag. J. 2014, 32, 823–836. [Google Scholar] [CrossRef]

- Eltantawy, R. Supply management governance role in supply chain risk management and sustainability. In Supply Chain Management—New Perspectives; IntechOpen: London, UK, 2011. [Google Scholar] [CrossRef][Green Version]

- Boström, M.; Jönsson, A.M.; Lockie, S.; Mol, A.P.; Oosterveer, P. Sustainable and responsible supply chain governance: Challenges and opportunities. J. Clean. Prod. 2015, 107, 1–7. [Google Scholar] [CrossRef]

- Govindan, K.; Seuring, S.; Zhu, Q.; Azevedo, S. Accelerating the transition towards sustainability dynamics into supply chain relationship management and governance structures. J. Clean. Prod. 2016, 112, 1813–1823. [Google Scholar] [CrossRef]

- Nguyen, L.; Zuidwijk, R. Sustainable supply chain governance: A literature review. Bus. Ethics Environ. Responsib. 2024, 34, 541–564. [Google Scholar] [CrossRef]

- Wu, K.; Fu, Y.; Kong, D. Does the digital transformation of enterprises affect stock price crash risk? Financ. Res. Lett. 2022, 48, 102888. [Google Scholar] [CrossRef]

- Liao, Y.; Qiu, X.; Wu, A.; Sun, Q.; Shen, H.; Li, P. Assessing the impact of green innovation on corporate sustainable development. Front. Energy 2022, 9, 800848. [Google Scholar] [CrossRef]

- Disney, S.M.; Towill, D.R. The effect of vendor managed inventory (VMI) dynamics on the bullwhip effect in supply chains. Int. J. Prod. Econ. 2003, 85, 199–215. [Google Scholar] [CrossRef]

- Zahran, S.K.; Jaber, M.Y. Investigation of a consignment stock and a traditional inventory policy in a three-level supply chain system with multiple suppliers and multiple buyers. Appl. Math. Model. 2017, 44, 390–408. [Google Scholar] [CrossRef]

- Chen, H.; Frank, M.Z.; Wu, O.Q. What actually happened to the inventories of American companies between 1981 and 2000? Manag. Sci. 2005, 51, 1015–1031. [Google Scholar] [CrossRef]

- Feng, M.; Li, C.; McVay, S.E.; Skaife, H. Does ineffective internal control over financial reporting affect a firm’s operations? Evidence from firms’ inventory management. Account. Rev. 2015, 90, 529–557. [Google Scholar] [CrossRef]

- Subiyanto, S.; Rini, D. The impact of warehouse and transportation costs on project efficiency. Uncertain Supply Chain. Manag. 2020, 9, 487–500. [Google Scholar]

- Vilcapoma, L.; Solis, Y.; Ramos, W. The effect of production costs on the provisioning management of materials: Evidence from the paper industry in Peru. Uncertain Supply Chain. Manag. 2021, 9, 99–106. [Google Scholar] [CrossRef]

- Solari, A.; Magri, M. A New Approach to the SCI journal citation reports, a system for evaluating scientific journals. Scientometrics 2000, 47, 605–625. [Google Scholar] [CrossRef]

- Li, C.; Long, G.; Li, S. Research on measurement and disequilibrium of manufacturing digital transformation: Based on the text mining data of A-share listed companies. Data Sci. Financ. Econ. 2023, 3, 30–54. [Google Scholar] [CrossRef]

- Harzing, A.; Van Der Wal, R. Google Scholar as a new source for citation analysis. Ethics Sci. Environ. Politics 2008, 8, 61–73. [Google Scholar] [CrossRef]

- Li, L. Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Mark. Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Li, N.; Wang, X.; Wang, Z.; Luan, X. The impact of digital transformation on corporate total factor productivity. Front. Psychol. 2022, 13, 1071986. [Google Scholar] [CrossRef]

- Buchanan, D.A.; Bryman, A. Contextualizing methods choice in organizational research. Organ. Res. Methods 2007, 10, 483–501. [Google Scholar] [CrossRef]

- Fiss, P.C.; Zajac, E.J. The symbolic management of strategic change: Sensegiving via framing and decoupling. Acad. Manag. J. 2006, 49, 1173–1193. [Google Scholar] [CrossRef]

- Zeng, H.; Ran, H.; Zhou, Q.; Jin, Y.; Cheng, X. The financial effect of firm digitalization: Evidence from China. Technol. Forecast. Soc. Change 2022, 183, 121951. [Google Scholar] [CrossRef]

- Wen, H.; Zhong, Q.; Lee, C.C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Guo, X.; Song, X.; Dou, B.; Wang, A.; Hu, H. Can digital transformation of the enterprise break the monopoly? Pers. Ubiquitous Comput. 2023, 27, 1629–1642. [Google Scholar] [CrossRef]

- Larcker, D.; Richardson, S.; Tuna, A. How Important is Corporate Governance? Compustat Fundamentals (Topic); S&P Global Market Intelligence: New York, NY, USA, 2005. [Google Scholar] [CrossRef]

- Zhou, H.; Zhou, C.; Lin, W.; Li, G. Corporate governance and credit spreads on corporate bonds: An empirical study in the context of China. China J. Account. Stud. 2017, 5, 50–72. [Google Scholar] [CrossRef]

- Duru, A.; Iyengar, R.; Zampelli, E. The dynamic relationship between CEO duality and firm performance: The moderating role of board independence. J. Bus. Res. 2016, 69, 4269–4277. [Google Scholar] [CrossRef]

- Molz, R. Managerial domination of boards of directors and financial performance. J. Bus. Res. 1988, 16, 235–249. [Google Scholar] [CrossRef]

- Fama, E.; Jensen, M. Separation of ownership and control. J. Law Econ. 1983, 26, 301–325. [Google Scholar] [CrossRef]

- Leftwich, R.; Watts, R.; Zimmerman, J. Voluntary corporate disclosure: The case of interim reporting. J. Account. Res. 1981, 19, 50–77. [Google Scholar] [CrossRef]

- Huang, S.; Bowblis, J. Managerial ownership in nursing homes: Staffing, quality, and financial performance. Gerontologist 2017, 58, 1136–1146. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R. Large shareholders and corporate control. J. Political Econ. 1986, 94, 461–488. [Google Scholar] [CrossRef]

- Zheng, S.; Jin, S. Can Enterprises in China achieve sustainable development through green investment? Int. J. Environ. Res. Public Health 2023, 20, 1787. [Google Scholar] [CrossRef]

- Wu, L.; Jin, S. Corporate social responsibility and sustainability: From a corporate governance perspective. Sustainability 2022, 14, 5457. [Google Scholar] [CrossRef]

- Zhang, D.; Kong, Q. Green energy transition and sustainable development of energy firms: An assessment of renewable energy policy. Energy Econ. 2022, 111, 106060. [Google Scholar] [CrossRef]

- Zhang, D.; Kong, Q. Renewable energy policy, green investment, and sustainability of energy firms. Renew. Energy 2022, 192, 118–133. [Google Scholar] [CrossRef]

- Zhang, Y.; Jin, S. How does digital transformation increase corporate sustainability? The moderating role of top management teams. Systems 2023, 11, 355. [Google Scholar] [CrossRef]

- Chen, Y.; Xu, J. Digital transformation and firm cost stickiness: Evidence from China. Financ. Res. Lett. 2023, 52, 103510. [Google Scholar] [CrossRef]

- Zhang, C.; Jin, S. What drives sustainable development of enterprises? Focusing on ESG management and green technology innovation. Sustainability 2022, 14, 11695. [Google Scholar] [CrossRef]

- Mentzer, J.; DeWitt, W.; Keebler, J.; Min, S.; Nix, N.; Smith, C.; Zacharia, Z. Defining supply chain management. J. Bus. Logist. 2001, 22, 1–25. [Google Scholar] [CrossRef]

- Hult, G.; Ketchen, D.; Arrfelt, M. Strategic supply chain management: Improving performance through a culture of competitiveness and knowledge development. South. Med. J. 2007, 28, 1035–1052. [Google Scholar] [CrossRef]

- Fawcett, S.; Magnan, G.; McCarter, M. Benefits, barriers, and bridges to effective supply chain management. Supply Chain Manag. 2008, 13, 35–48. [Google Scholar] [CrossRef]

- Beamon, B. Measuring supply chain performance. Int. J. Oper. Prod. Manag. 1999, 19, 275–292. [Google Scholar] [CrossRef]

- Tripathi, S.; Gupta, M. A Current Review of Supply Chain Performance Measurement Systems. In Advances in Industrial and Production Engineering; Lecture Notes in Mechanical Engineering; Springer: Singapore, 2019. [Google Scholar] [CrossRef]

- Yao, J.; Shi, H.; Liu, C. Optimising the configuration of green supply chains under mass personalisation. Int. J. Prod. Res. 2020, 58, 7420–7438. [Google Scholar] [CrossRef]

- Michel-Villarreal, R.; Vilalta-Perdomo, E.L.; Canavari, M.; Hingley, M. Resilience and digitalization in short food supply chains: A case study approach. Sustainability 2021, 13, 5913. [Google Scholar] [CrossRef]

- Ludwig, P.; Sassen, R. Which internal corporate governance mechanisms drive corporate sustainability? J. Environ. Manag. 2022, 301, 113780. [Google Scholar] [CrossRef]

- Liao, F.; Hu, Y.; Chen, M.; Xu, S. Digital transformation and corporate green supply chain efficiency: Evidence from China. Econ. Anal. Policy 2023, 59, 195–207. [Google Scholar] [CrossRef]

- Gao, D.; Guo, J.; Shen, Y.; Xu, X. CEOs’ supply chain experience and firm innovation: Evidence from China. Eur. J. Financ. 2020, 28, 461–486. [Google Scholar] [CrossRef]

- Gao, D.; Zhao, Y.J. How Does Supply Chain Information Disclosure Relate to Corporate Investment Efficiency? Evidence from Chinese-Listed Companies. Sustainability 2023, 15, 6479. [Google Scholar] [CrossRef]

- Tian, L.; Tian, W.; Guo, M. Can supply chain digitalization open the way to sustainable development? Evidence from corporate ESG performance. Corp. Soc. Responsib. Environ. Manag. 2024, 32, 2332–2346. [Google Scholar] [CrossRef]

- Chen, S.; Leng, X.; Luo, K. Supply chain digitalization and corporate ESG performance. Am. J. Econ. Sociol. 2024, 83, 855–881. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).