Investigating the Factors Influencing Household Financial Vulnerability in China: An Exploration Based on the Shapley Additive Explanations Approach

Abstract

1. Introduction

2. Literature Review

3. Methods and Models

3.1. Data and Variables

3.2. ML Models

3.3. Performance Evaluation of Models

3.4. Interpretability Methods

4. Results and Discussion

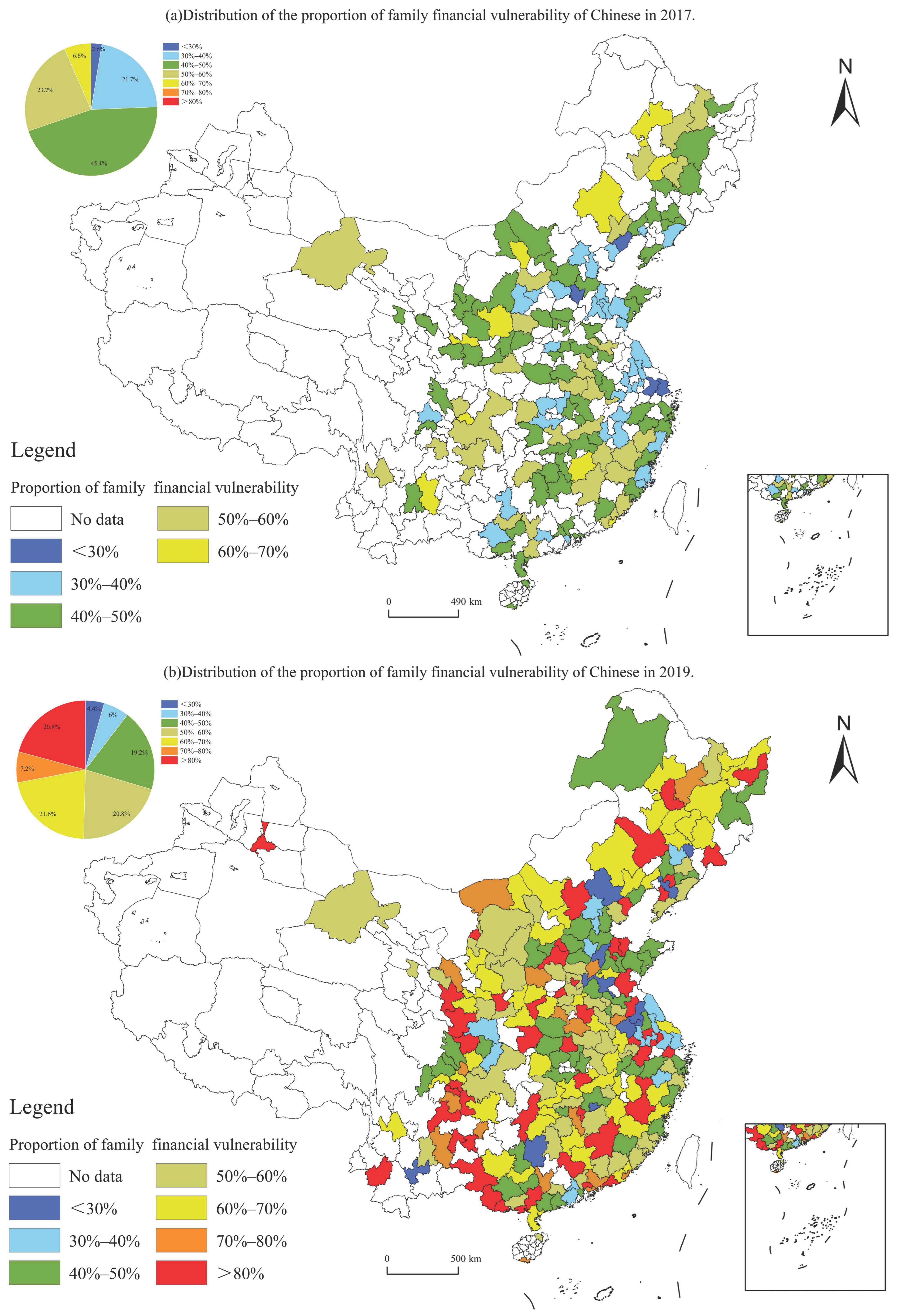

4.1. Distribution of Household Financial Vulnerability

4.2. Performance Evaluation of Different ML Models

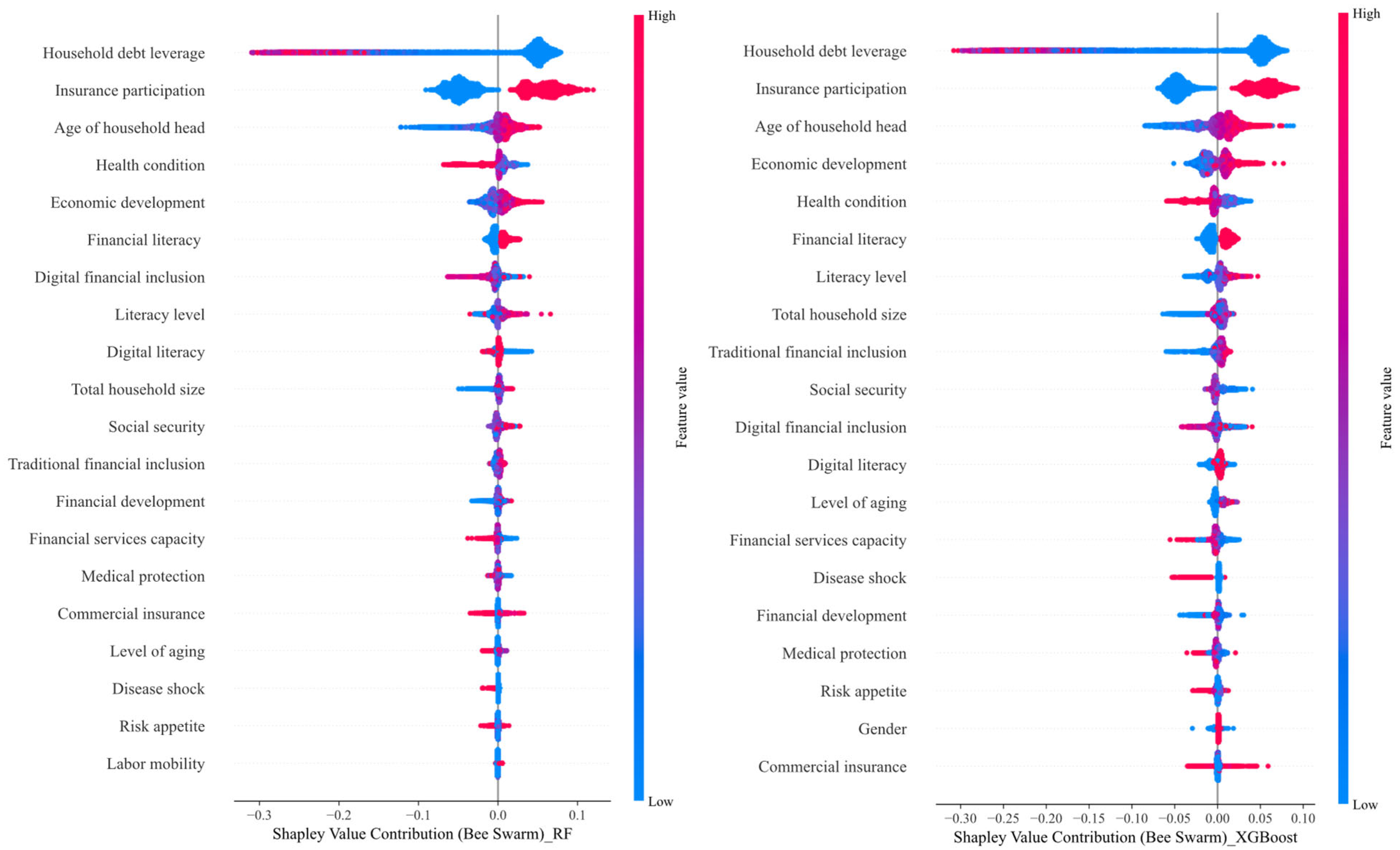

4.3. Weight Rankings of Different Feature Variables

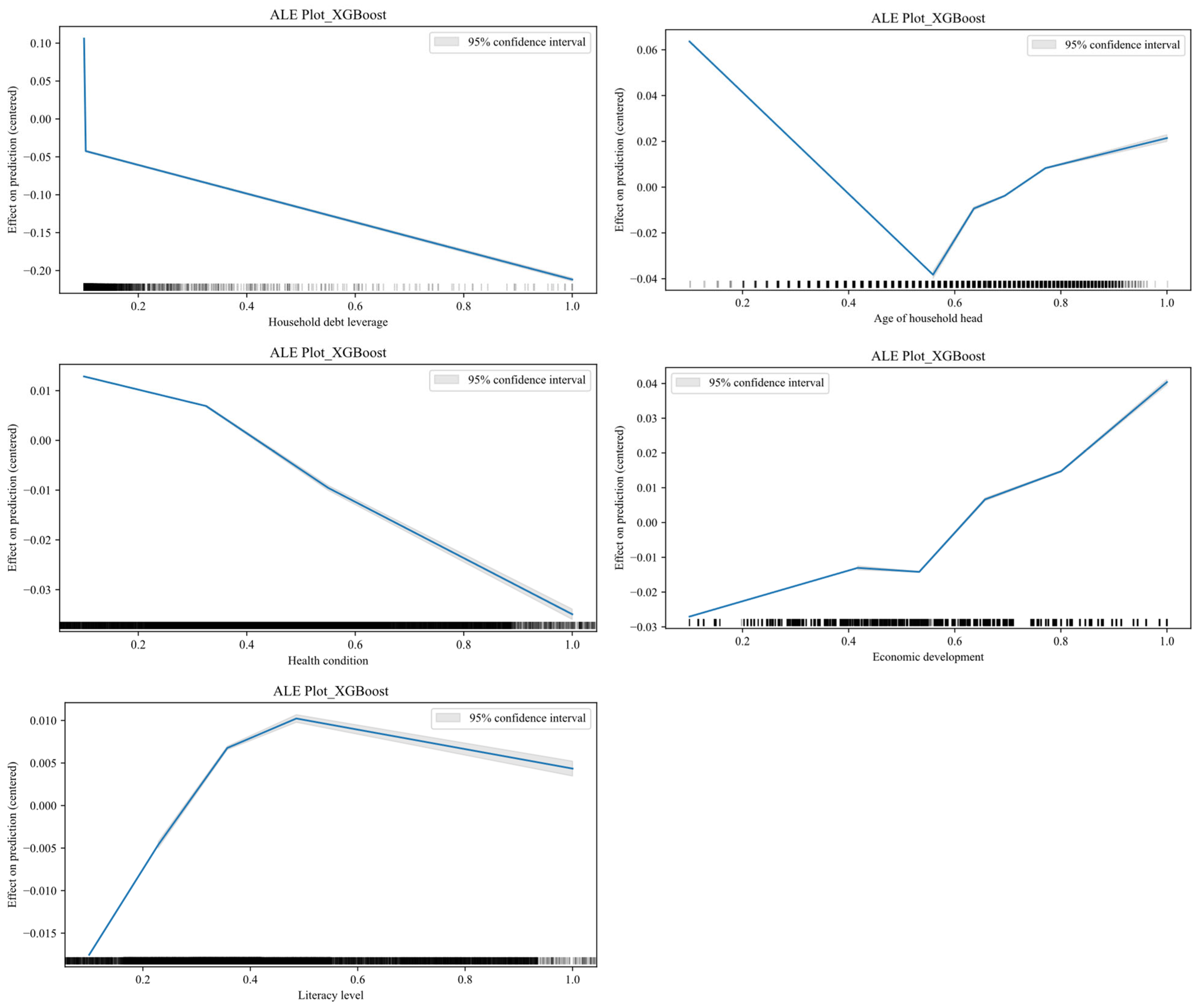

4.4. Visual Analysis of Local Effects of Major Variables

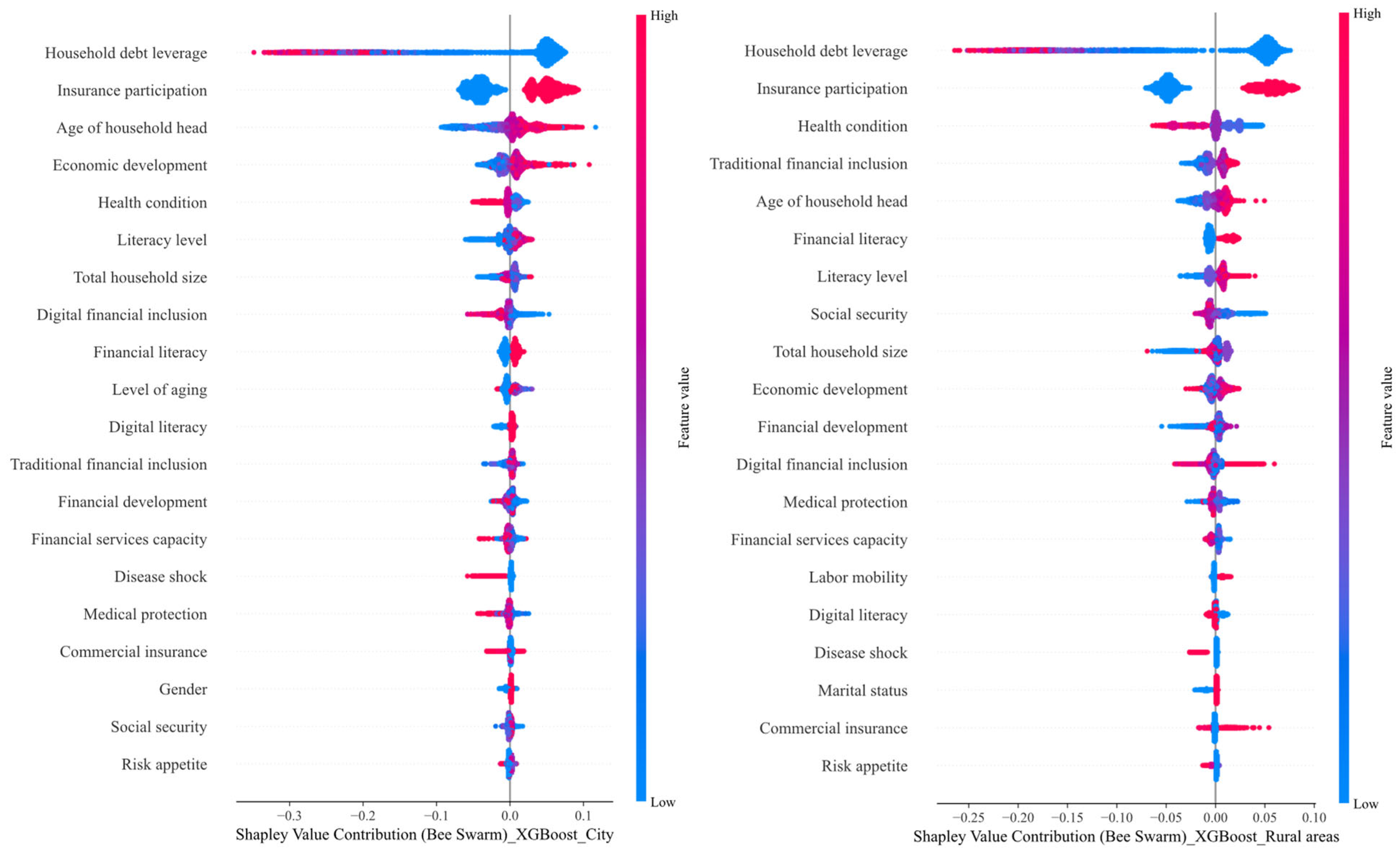

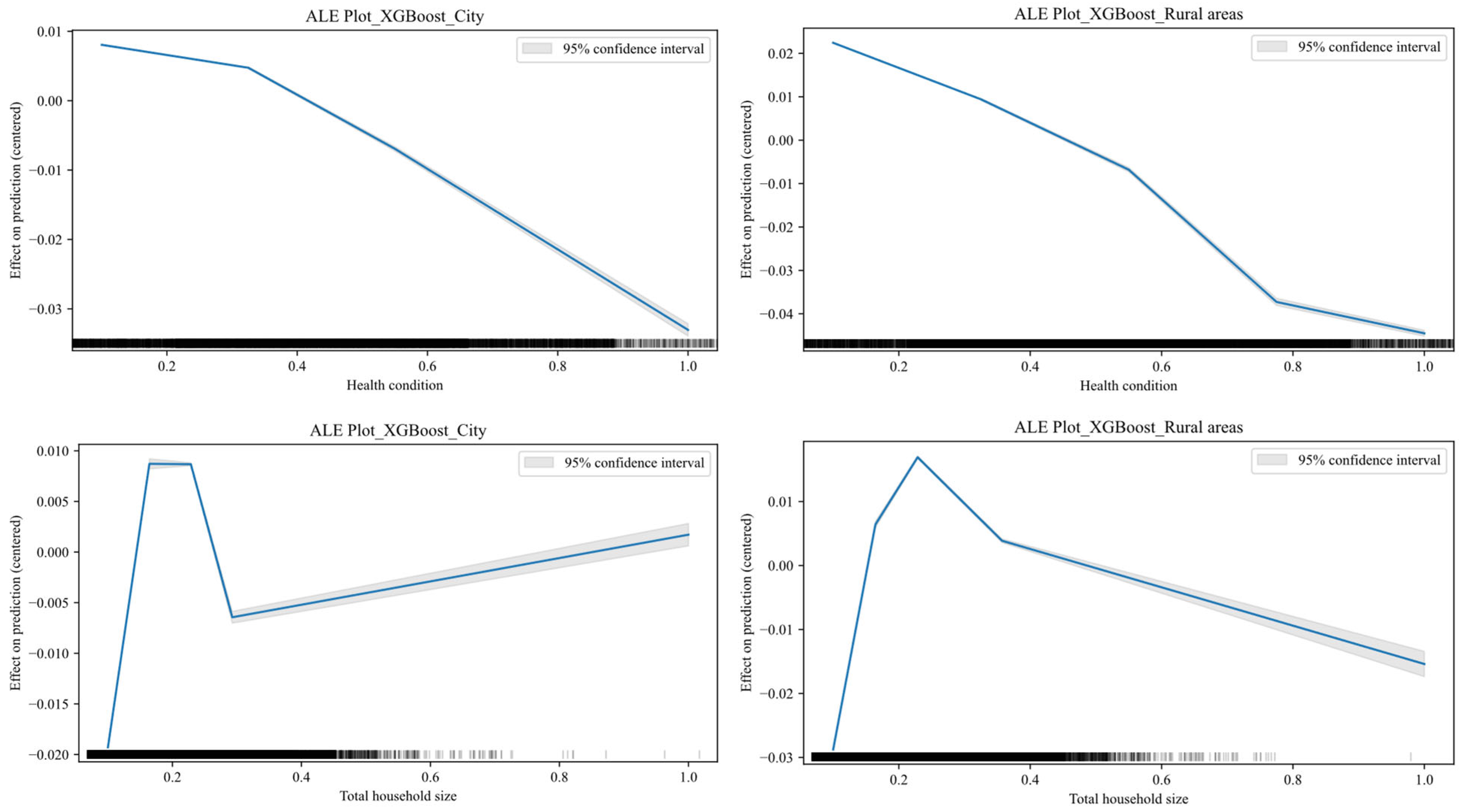

4.5. Analysis on Heterogeneity in Financial Vulnerability Between Urban and Rural Areas

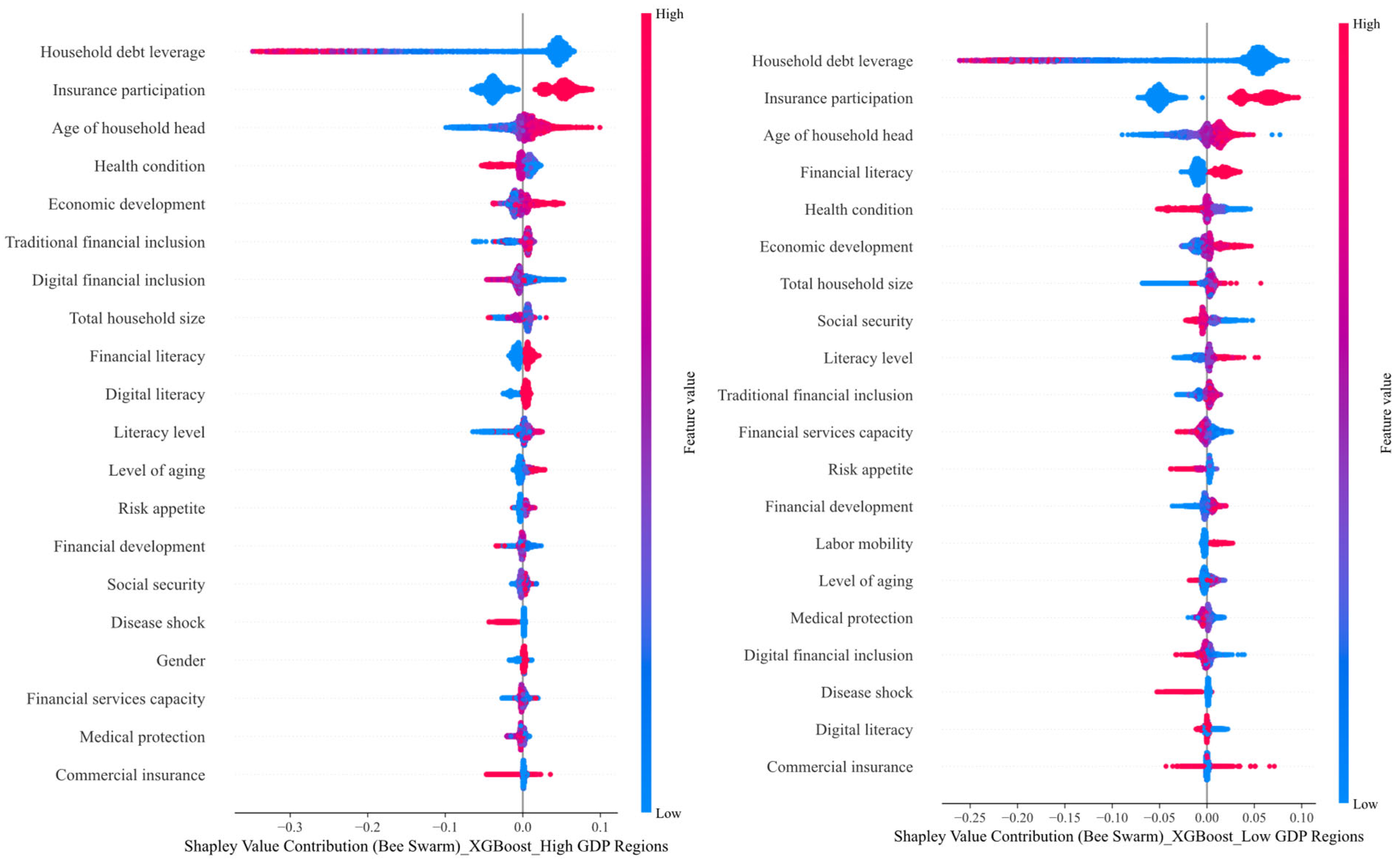

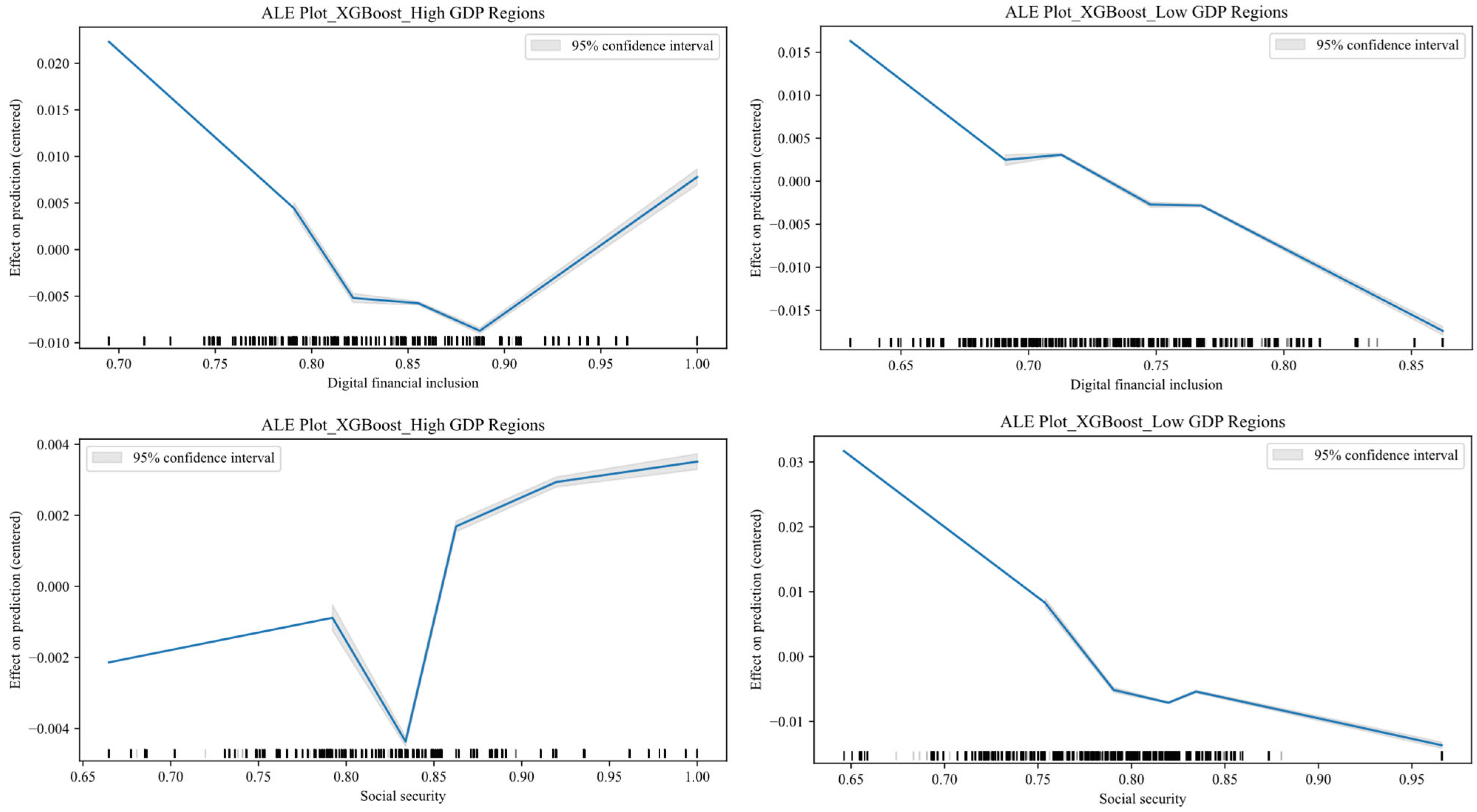

4.6. Heterogeneity Analysis of Household Financial Vulnerability Based on per Capita GDP

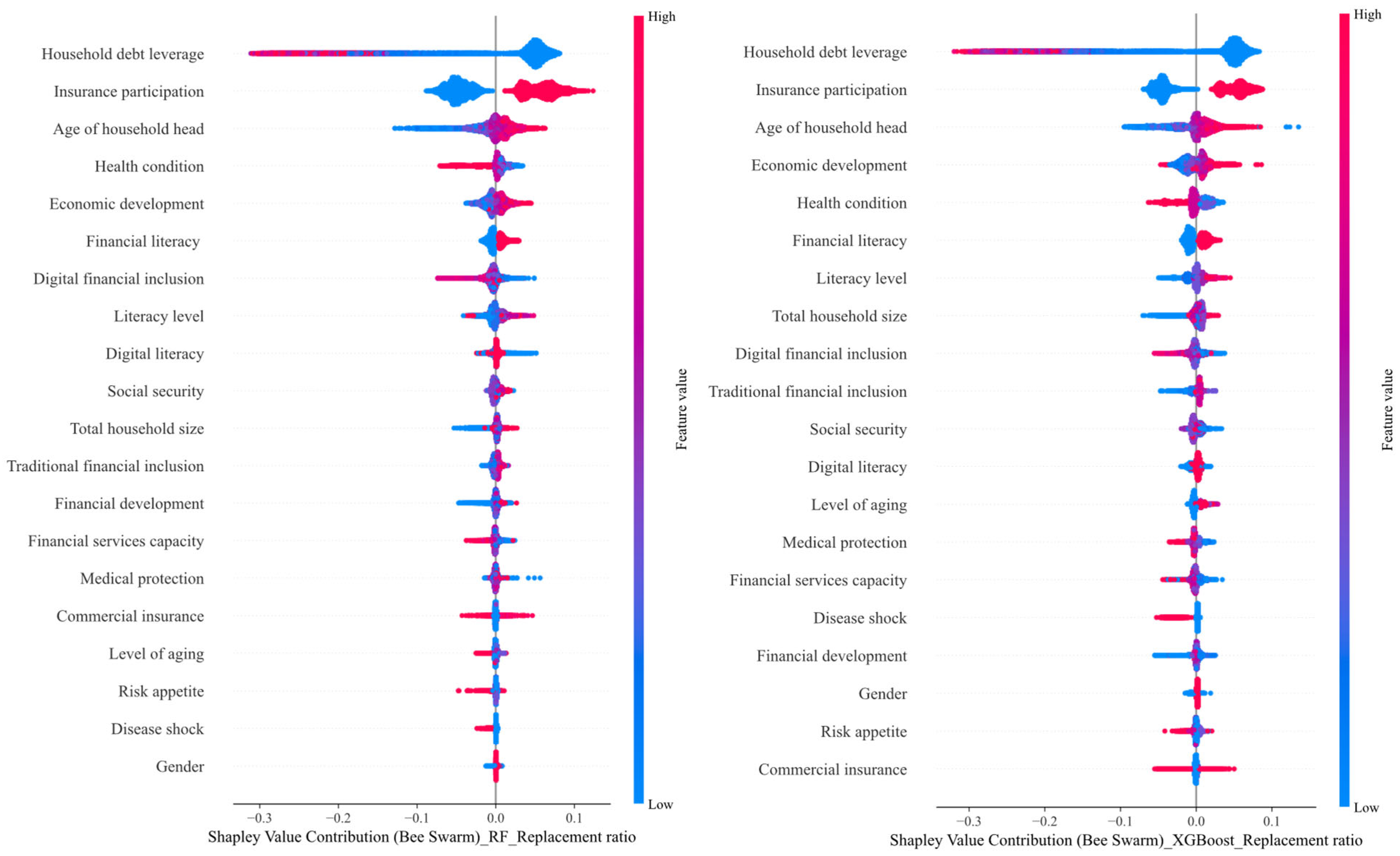

4.7. Robustness Test

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fernández-López, S.; Álvarez-Espiño, M.; Rey-Ares, L. Financial vulnerability of low-income households: Review of scopus and wos journals and future research agenda. Appl. Econom. Int. Dev. 2024, 24, 153–180. [Google Scholar]

- Leandro, J.C.; Botelho, D. Consumer over-indebtedness: A review and future research agenda. J. Bus. Res. 2022, 145, 535–551. [Google Scholar] [CrossRef]

- Acharya, V.; Bhadury, S.; Surti, J. Financial Vulnerability and Risks to Growth in Emerging Markets (No. w27411); National Bureau of Economic Research: Cambridge, UK, 2020; Available online: https://www.nber.org/papers/w27411 (accessed on 23 April 2025).

- The World Bank. World Development Report 2022: Finance for an Equitable Recovery; The World Bank: Washington, DC, USA, 2022. [Google Scholar]

- Waxman, A.; Liang, Y.; Li, S.; Barwick, P.J.; Zhao, M. Tightening belts to buy a home: Consumption responses to rising housing prices in urban China. J. Urban Econ. 2020, 115, 103190. [Google Scholar] [CrossRef]

- Wu, F.; Chen, J.; Pan, F.; Gallent, N.; Zhang, F. Assetization: The Chinese path to housing financialization. Ann. Am. Assoc. Geogr. 2020, 110, 1483–1499. [Google Scholar] [CrossRef]

- Rothwell, D.W.; Giordono, L.; Stawski, R.S. How much does state context matter in emergency savings? Disentangling the individual and contextual contributions of the financial capability constructs. J. Fam. Econ. Issues 2022, 43, 703–715. [Google Scholar] [CrossRef]

- Ali, L.; Khan, M.K.N.; Ahmad, H. Financial vulnerability of Pakistani household. J. Fam. Econ. Issues 2020, 41, 572–590. [Google Scholar] [CrossRef]

- Bettocchi, A.; Giarda, E.; Moriconi, C.; Orsini, F.; Romeo, R. Assessing and predicting financial vulnerability of Italian households: A micro-macro approach. Empirica 2018, 45, 587–605. [Google Scholar] [CrossRef]

- Gao, H. The effects of financial spatial structure on household financial vulnerability: Evidence from China. PLoS ONE 2024, 19, e0313189. [Google Scholar] [CrossRef]

- Pan, H.; Yao, L.; Zhang, C.; Zhang, Y.; Gao, Y. Research on financial poverty alleviation aid for increasing the incomes of low-income Chinese farmers. Sustainability 2024, 16, 1057. [Google Scholar] [CrossRef]

- Lee, C.C.; Jiang, L.; Wen, H. Two aspects of digitalization affecting financial asset allocation: Evidence from China. Emerg. Mark. Financ. Trade 2024, 60, 631–649. [Google Scholar] [CrossRef]

- Batty, M.; Gibbs, C.; Ippolito, B. Health insurance, medical debt, and financial well-being. Health Econ. 2022, 31, 689–728. [Google Scholar] [CrossRef]

- Yue, P.; Korkmaz, A.G.; Yin, Z.; Zhou, H. The rise of digital finance: Financial inclusion or debt trap? Finance Res. Lett. 2022, 47, 102604. [Google Scholar] [CrossRef]

- Ramli, Z.; Nyirop, H.B.A.; Sum, S.M.; Awang, A.H. The impact of financial shock, behavior, and knowledge on the financial vulnerability of single youth. Sustainability 2022, 14, 4836. [Google Scholar] [CrossRef]

- Zhang, Y.; Wu, Q.; Zhang, T.; Yang, L. Vulnerability and fraud: Evidence from the COVID-19 pandemic. Humanit. Soc. Sci. Commun. 2022, 9, 424. [Google Scholar] [CrossRef]

- Athey, S. The Impact of Machine Learning on Economics. In The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2018; pp. 507–552. [Google Scholar]

- Mullainathan, S.; Spiess, J. Machine learning: An applied econometric approach. J. Econ. Perspect. 2017, 31, 87–106. [Google Scholar] [CrossRef]

- Minsky, H.P. The financial instability hypothesis: An interpretation of keynes and an alternative to “standard” theory. Challenge 1977, 20, 20–27. [Google Scholar] [CrossRef]

- Lusardi, A.; Schneider, D.; Tufano, P. Financially Fragile Households: Evidence and Implications (No. w17072); National Bureau of Economic Research: Cambridge, UK, 2011. [Google Scholar]

- Jappelli, T.; Pagano, M.; Di Maggio, M. Households’ indebtedness and financial vulnerability. J. Financ. Manag. Mark. Inst. 2013, 1, 23–46. [Google Scholar]

- Lusardi, A.; Tufano, P. Debt literacy, financial experiences, and overindebtedness. J. Pension Econ. Financ. 2015, 14, 332–368. [Google Scholar] [CrossRef]

- Dang, C.; Chen, X.; Yu, S.; Chen, R.; Yang, Y. Credit ratings of Chinese households using factor scores and K-means clustering method. Int. Rev. Econ. Financ. 2022, 78, 309–320. [Google Scholar] [CrossRef]

- Noerhidajati, S.; Purwoko, A.B.; Werdaningtyas, H.; Kamil, A.I.; Dartanto, T. Household financial vulnerability in Indonesia: Measurement and determinants. Econ. Model. 2021, 96, 433–444. [Google Scholar] [CrossRef]

- Kuypers, S.; Marx, I. The truly vulnerable: Integrating wealth into the measurement of poverty and social policy effectiveness. Soc. Indic. Res. 2019, 142, 131–147. [Google Scholar] [CrossRef]

- Chen, H.L.; Hsu, Y.L.; Lu, C.Y. Revisiting financial vulnerability during the COVID-19 pandemic: Evidence from Taiwan. J. Behav. Exp. Financ. 2024, 44, 100993. [Google Scholar] [CrossRef]

- Chhatwani, M.; Mishra, S.K. financial vulnerability and financial optimism linkage during COVID-19: Does financial literacy matter? J. Behav. Exp. Econ. 2021, 94, 101751. [Google Scholar] [CrossRef] [PubMed]

- Kleimeier, S.; Hoffmann, A.O.I.; Broihanne, M.H.; Plotkina, D.; Göritz, A.S. Determinants of individuals’ objective and subjective financial vulnerability during the COVID-19 pandemic. J. Bank. Financ. 2023, 153, 106881. [Google Scholar] [CrossRef]

- Ampudia, M.; Van Vlokhoven, H.; Żochowski, D. Financial vulnerability of euro area households. J. Financ. Stab. 2016, 27, 250–262. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S.; Oggero, N. Debt and financial vulnerability on the verge of retirement. J. Money. Credit. Bank 2020, 52, 1005–1034. [Google Scholar] [CrossRef]

- Daud, S.N.M.; Marzuki, A.; Ahmad, N.; Kefeli, Z. Financial vulnerability and its determinants: Survey evidence from Malaysian households. Emerg. Mark. Financ. Trade 2019, 55, 1991–2003. [Google Scholar] [CrossRef]

- Kim, H.J.; Lee, D.; Son, J.C.; Son, M.K. Household indebtedness in Korea: Its causes and sustainability. Jpn. World Econ. 2014, 29, 59–76. [Google Scholar] [CrossRef]

- Kim, K.T.; Xiao, J.J.; Porto, N. Financial inclusion, financial capability and financial vulnerability during COVID-19 pandemic. Int. J. Bank Mark. 2024, 42, 414–436. [Google Scholar] [CrossRef]

- Korniotis, G.M.; Kumar, A. Do older investors make better investment decisions? Rev. Econ. Stat. 2011, 93, 244–265. [Google Scholar] [CrossRef]

- Angrisani, M.; Burke, J.; Lusardi, A.; Mottola, G. The evolution of financial literacy over time and its predictive power for financial outcomes: Evidence from longitudinal data. J. Pension Econ. Financ. 2023, 22, 640–657. [Google Scholar] [CrossRef]

- Hasler, A.; Lusardi, A.; Yagnik, N.; Yakoboski, P. Resilience and wellbeing in the midst of the COVID-19 pandemic: The role of financial literacy. J. Account. Public Policy 2023, 42, 107079. [Google Scholar] [CrossRef]

- Yusof, S.A. Ethnic disparity in financial vulnerability in Malaysia. Int. J. Soc. Econ. 2019, 46, 31–46. [Google Scholar] [CrossRef]

- Morudu, P.; Kollamparambil, U. Health shocks, medical insurance and household vulnerability: Evidence from South Africa. PLoS ONE 2020, 15, e0228034. [Google Scholar] [CrossRef] [PubMed]

- Vo, T.T.; Van, P.H. Can health insurance reduce household vulnerability? Evidence from Vietnam. World Dev. 2019, 124, 104645. [Google Scholar] [CrossRef]

- Chen, Y.; Deng, Z. Liquidity constraint shock, job search and post match quality—Evidence from rural-to-urban migrants in China. J. Labor Res. 2019, 40, 332–355. [Google Scholar] [CrossRef]

- García, B.M.; Martín, A.S. Income inequality and household debt as a factor of financial vulnerability in the Spanish economy. Socio. Econ. Rev. 2022, 20, 1425–1447. [Google Scholar] [CrossRef]

- Lin, Y.; Grace, M.F. Household life cycle protection: Life insurance holdings, financial vulnerability, and portfolio implications. J. Risk Insur. 2007, 74, 141–173. [Google Scholar] [CrossRef]

- Choudhury, M.S. Poverty, vulnerability and financial inclusion: The context of Bangladesh. J. Politics Adm. 2014, 2, 1–13. [Google Scholar]

- Lee, C.C.; Lou, R.; Wang, F. Digital financial inclusion and poverty alleviation: Evidence from the sustainable development of China. Econ. Anal. Policy 2023, 77, 418–434. [Google Scholar] [CrossRef]

- Nikolov, P.; Adelman, A. Do private household transfers to the elderly respond to public pension benefits? Evidence from rural China. J. Econ. Ageing 2019, 14, 100204. [Google Scholar] [CrossRef]

- Giudici, P.; Spelta, A. Graphical network models for international financial flows. J. Bus. Econ. Stat. 2016, 34, 128–138. [Google Scholar] [CrossRef]

- Giudici, P.; Parisi, L. Sovereign risk in the Euro area: A multivariate stochastic process approach. Quant. Financ. 2017, 17, 1995–2008. [Google Scholar] [CrossRef]

- Zhang, L.; Hu, H.; Zhang, D. A credit risk assessment model based on SVM for small and medium enterprises in supply chain finance. Financ. Innov. 2015, 1, 14. [Google Scholar] [CrossRef]

- Brunetti, M.; Giarda, E.; Torricelli, C. Is financial vulnerability a matter of illiquidity? An appraisal for Italian households. Rev. Income Wealth 2016, 62, 628–649. [Google Scholar] [CrossRef]

- Kotsiantis, S.B. Decision trees: A recent overview. Artif. Intell.Rev. 2013, 39, 261–283. [Google Scholar] [CrossRef]

- Cutler, A.; Cutler, D.R.; Stevens, J.R. Random Forests. In Ensemble Machine Learning: Methods and Applications; Zhang, C., Ma, Y., Eds.; Springer: New York, NY, USA, 2012; pp. 157–175. [Google Scholar] [CrossRef]

- Freund, Y.; Schapire, R.E. A decision-theoretic generalization of on-line learning and an application to boosting. J. Comput. Syst. Sci. 1997, 55, 119–139. [Google Scholar] [CrossRef]

- Meng, Y.; Yang, N.; Qian, Z.; Zhang, G. What makes an online review more helpful: An interpretation framework using XGBoost and SHAP values. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 466–490. [Google Scholar] [CrossRef]

- Sagi, O.; Rokach, L. Approximating XGBoost with an interpretable decision tree. Inf. Sci. 2021, 572, 522–542. [Google Scholar] [CrossRef]

- Bertomeu, J.; Cheynel, E.; Floyd, E.; Pan, W. Using machine learning to detect misstatements. Rev. Account. Stud. 2021, 26, 468–519. [Google Scholar] [CrossRef]

- Chen, X.I.; Cho, Y.H.; Dou, Y.; Lev, B. Predicting future earnings changes using machine learning and detailed financial data. J. Account. Res. 2022, 60, 467–515. [Google Scholar] [CrossRef]

- Zhou, L.; Shi, X.; Bao, Y.; Gao, L.; Ma, C. Explainable artificial intelligence for digital finance and consumption upgrading. Financ. Res. Lett. 2023, 58, 104489. [Google Scholar] [CrossRef]

- Zhou, W.; Zhai, X.; Tan, H. Research on financial fraud prediction model of listed companies based on XGBoost. Quant. Econ. Tech. Econ. Res. 2022, 7, 176–196. [Google Scholar]

- Apley, D.W.; Zhu, J. Visualizing the effects of predictor variables in black box supervised learning models. J. R. Stat. Soc. B Stat. Methodol. 2020, 82, 1059–1086. [Google Scholar] [CrossRef]

- Jiang, Y.; Liu, Y. Does financial inclusion help alleviate household poverty and vulnerability in China? PLoS ONE 2022, 17, e0275577. [Google Scholar] [CrossRef]

- Li, B.; Zhu, T. Debt leverage, financial literacy and household financial vulnerability: An empirical analysis based on the China household tracking survey CFPS 2014. Int. Financ. Stud. 2020, 7, 25–34. [Google Scholar]

- Seefeldt, K.S. Constant consumption smoothing, limited investments, and few repayments: The role of debt in the financial lives of economically vulnerable families. Soc. Serv. Rev. 2015, 89, 263–300. [Google Scholar] [CrossRef]

- Abid, A.; Shafiai, M.H.M. Determinants of household financial vulnerability in Malaysia and its effect on low-income groups. J. Emerg. Econ. Islam. Res. 2018, 6, 32–43. [Google Scholar] [CrossRef]

- Moreno-García, E.; Hernández-Mejía, S.; Núñez, H.F.S. Financial literacy and financial vulnerability in Mexico. Rev. Mex. Econ. Finanz. 2024, 19, 1–21. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Levine, R. Finance, inequality and the poor. J. Econ. Growth 2007, 12, 27–49. [Google Scholar] [CrossRef]

- Wang, X.; Zhao, Y. The development of digital finance and the difference of financial availability between urban and rural households. Chin. Rural Econ. 2022, 1, 44–60. [Google Scholar]

- Waliszewski, K.; Cichowicz, E.; Gębski, Ł.; Kliber, F.; Kubiczek, J.; Niedziółka, P.; Solarz, M.; Warchlewska, A. Digital loans and buy now pay later from LendTech versus bank loans in the era of ‘black swans’: Complementarity in the area of consumer financing. Equilibrium. Q. J. Econ. Econ. Policy 2024, 19, 241–278. [Google Scholar] [CrossRef]

- Chen, C.; Tan, Z.; Liu, S. How does financial literacy affect households’ financial vulnerability? The role of insurance awareness. Int. Rev. Econ. Financ. 2024, 95, 103518. [Google Scholar] [CrossRef]

| Variables | Definition | Average | SD |

|---|---|---|---|

| Household financial vulnerability | Log (financial margin against unanticipated shocks) | 0.2155 | 10.9508 |

| Age of household head | Log (age + 1) | 3.9844 | 0.2413 |

| Gender | The male is 1 and the female is 0 | 0.8109 | 0.3916 |

| Literacy level | Illiterate = 0, primary = 1, junior = 2, senior = 3, technical secondary = 4, junior college = 5, undergraduate = 6, graduate = 7 | 2.4309 | 1.5808 |

| Marital status | Married is 1 and unmarried is 0 | 0.8919 | 0.3104 |

| Digital literacy | Whether to use a smartphone: yes is 1, no is 0 | 0.7209 | 0.4485 |

| Financial literacy | The correct answer rate of the financial knowledge questions, the value of both questions answered correctly is 1, otherwise it is 0 | 0.4262 | 0.4945 |

| Risk preference | Investors are not willing to take any risk projects to high risk and high return projects in order of 1–5 | 1.8033 | 1.1119 |

| Insurance participation | Participates in the insurance is 1, otherwise is 0 | 0.4827 | 0.4997 |

| Health condition | Compared with their peers, they rated their physical condition as very good to very bad on a scale of 1–5 | 2.6308 | 0.9961 |

| Disease shock | Whether major diseases such as cancer have occurred: yes is 1, no is 0 | 0.0600 | 0.2375 |

| Household size | Total number of families interviewed | 3.1992 | 1.5277 |

| Level of aging | Proportion of the population aged over 65 | 0.2353 | 0.3581 |

| Labor mobility | Whether there were any migrant workers in the past year: yes is 1, no is 0 | 0.1862 | 0.3893 |

| Non-agricultural employment | Whether the work industry is agriculture, forestry, animal husbandry and fishery: yes is 1, no is 0 | 0.1022 | 0.1098 |

| Household debt leverage | Outstanding debt as a share of total household assets | 0.1240 | 0.6052 |

| Family housing turnover | Whether the housing is transferred/rented: yes is 1, no is 0 | 0.0266 | 0.1608 |

| Expenditures on commercial insurance | The total expenditure of family commercial insurance is taken as the correct value | 1.4067 | 3.1621 |

| Percentage of expenditure on life insurance | Proportion of life insurance expenditure to total commercial insurance expenditure | 0.0843 | 0.2708 |

| Percentage of expenditure on health insurance | Proportion of health insurance expenditure to total commercial insurance expenditure | 0.0536 | 0.2162 |

| Percentage of other Insurance expenditures | Proportion of other insurance expenditure to total commercial insurance expenditure | 0.0349 | 0.2809 |

| Economic development | Log (GDP) | 17.5413 | 1.1411 |

| Financial development | Ratio of the balance of deposits and loans of financial institutions to GDP | 3.4397 | 1.7213 |

| Financial services capacity | Regional financial agglomeration level | 1.1125 | 0.4944 |

| Traditional financial inclusion | Log (number of bank outlets) | 7.2173 | 0.7896 |

| Digital financial inclusion | Peking University Digital Financial Inclusion Index | 246.1115 | 27.4396 |

| Medical care | Log (number of beds in hospitals and health centers) | 10.3457 | 0.8446 |

| Social security | Log (social security and employment spending) | 8.8170 | 0.8814 |

| Models | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| MLR | 0.0778 | 0.0774 | 0.0774 | 0.0733 | 0.2599 | 0.2588 |

| LASSO | 0.0719 | 0.0628 | 0.0632 | 0.0749 | 0.2659 | 0.2658 |

| DT | 0.1998 | 0.1708 | 0.1708 | 0.0659 | 0.2304 | 0.2261 |

| RF | 0.2820 | 0.1999 | 0.2003 | 0.0640 | 0.2279 | 0.2159 |

| GBDT | 0.2394 | 0.2044 | 0.2045 | 0.0632 | 0.2272 | 0.2182 |

| AdaBoost | 0.1688 | 0.1667 | 0.1670 | 0.0666 | 0.2391 | 0.2440 |

| XGBoost | 0.2390 | 0.2057 | 0.2057 | 0.0631 | 0.2259 | 0.2157 |

| Rank | RF | XGBoost | ||

|---|---|---|---|---|

| Variables | SHAP | Variables | SHAP | |

| 1 | Household debt leverage | 0.0793 | Household debt leverage | 0.0804 |

| 2 | Insurance participation | 0.0531 | Insurance participation | 0.0501 |

| 3 | Age of household head | 0.0145 | Age of household head | 0.0190 |

| 4 | Health condition | 0.0096 | Health condition | 0.0124 |

| 5 | Economic development | 0.0081 | Economic development | 0.0115 |

| 6 | Literacy level | 0.0067 | Financial literacy | 0.0107 |

| 7 | Financial literacy | 0.0062 | Literacy level | 0.0080 |

| 8 | Digital financial inclusion | 0.0054 | Total household size | 0.0065 |

| 9 | Social security | 0.0043 | Digital financial inclusion | 0.0060 |

| 10 | Digital literacy | 0.0035 | Traditional financial inclusion | 0.0052 |

| Rank | Urban Family | Rural Family | ||

|---|---|---|---|---|

| Variables | SHAP | Variables | SHAP | |

| 1 | Household debt leverage | 0.0825 | Household debt leverage | 0.0730 |

| 2 | Insurance participation | 0.0466 | Insurance participation | 0.0538 |

| 3 | Age of household head | 0.0229 | Health condition | 0.0159 |

| 4 | Economic development | 0.0127 | Total household size | 0.0094 |

| 5 | Literacy level | 0.0083 | Age of household head | 0.0093 |

| 6 | Health condition | 0.0082 | Financial literacy | 0.0093 |

| 7 | Financial literacy | 0.0078 | Economic development | 0.0089 |

| 8 | Digital financial inclusion | 0.0068 | Social security | 0.0087 |

| 9 | Total household size | 0.0067 | Literacy level | 0.0074 |

| 10 | Level of aging | 0.0067 | Digital financial inclusion | 0.0061 |

| Rank | High GDP Regions | Low GDP Regions | ||

|---|---|---|---|---|

| Variables | SHAP | Variables | SHAP | |

| 1 | Household debt leverage | 0.0759 | Household debt leverage | 0.0799 |

| 2 | Insurance participation | 0.0437 | Insurance participation | 0.0533 |

| 3 | Age of household head | 0.0178 | Age of household head | 0.0154 |

| 4 | Health condition | 0.0101 | Financial literacy | 0.0123 |

| 5 | Economic development | 0.0095 | Health condition | 0.0111 |

| 6 | Traditional financial inclusion | 0.0085 | Economic development | 0.0085 |

| 7 | Digital financial inclusion | 0.0083 | Total household size | 0.0074 |

| 8 | Total household size | 0.0080 | Social security | 0.0073 |

| 9 | Financial literacy | 0.0076 | Literacy level | 0.0070 |

| 10 | Digital literacy | 0.0063 | Traditional financial inclusion | 0.0054 |

| Models | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Panel A Change response variable | ||||||

| MLR | 0.0294 | 0.0297 | 0.0297 | 0.7413 | 0.7792 | 0.8534 |

| LASSO | 0.0288 | 0.0263 | 0.0263 | 0.7517 | 0.7882 | 0.8625 |

| DT | 0.0621 | 0.0475 | 0.0475 | 0.7277 | 0.7713 | 0.8167 |

| RF | 0.1662 | 0.0565 | 0.0570 | 0.7279 | 0.7731 | 0.7843 |

| GBDT | 0.1069 | 0.0702 | 0.0702 | 0.7104 | 0.7626 | 0.7987 |

| AdaBoost | 0.0346 | 0.0313 | 0.0315 | 0.7473 | 0.7865 | 0.8802 |

| XGBoost | 0.1009 | 0.0716 | 0.0716 | 0.7093 | 0.7611 | 0.7999 |

| Panel B Randomly divide the datasets into a training set and a test set in a 7:3 ratio | ||||||

| MLR | 0.0776 | 0.0771 | 0.0772 | 0.0734 | 0.2600 | 0.2583 |

| LASSO | 0.0740 | 0.0628 | 0.0628 | 0.0749 | 0.2657 | 0.2652 |

| DT | 0.1985 | 0.1774 | 0.1775 | 0.0655 | 0.2299 | 0.2225 |

| RF | 0.2600 | 0.1937 | 0.1938 | 0.0644 | 0.2291 | 0.2174 |

| GBDT | 0.2393 | 0.2096 | 0.2097 | 0.0629 | 0.2262 | 0.2161 |

| AdaBoost | 0.1703 | 0.1623 | 0.1623 | 0.0669 | 0.2406 | 0.2446 |

| XGBoost | 0.2456 | 0.2114 | 0.2114 | 0.0628 | 0.2247 | 0.2139 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, X.; Hu, G.; Wen, H. Investigating the Factors Influencing Household Financial Vulnerability in China: An Exploration Based on the Shapley Additive Explanations Approach. Sustainability 2025, 17, 5523. https://doi.org/10.3390/su17125523

Chen X, Hu G, Wen H. Investigating the Factors Influencing Household Financial Vulnerability in China: An Exploration Based on the Shapley Additive Explanations Approach. Sustainability. 2025; 17(12):5523. https://doi.org/10.3390/su17125523

Chicago/Turabian StyleChen, Xi, Guowan Hu, and Huwei Wen. 2025. "Investigating the Factors Influencing Household Financial Vulnerability in China: An Exploration Based on the Shapley Additive Explanations Approach" Sustainability 17, no. 12: 5523. https://doi.org/10.3390/su17125523

APA StyleChen, X., Hu, G., & Wen, H. (2025). Investigating the Factors Influencing Household Financial Vulnerability in China: An Exploration Based on the Shapley Additive Explanations Approach. Sustainability, 17(12), 5523. https://doi.org/10.3390/su17125523