1. Introduction

Given the global energy crisis, the building sector’s significant share of energy consumption and Greenhouse Gas (GHG) emissions is a pressing issue [

1]. South Africa, in particular, faces a serious energy crisis, characterised by frequent power outages, termed load-shedding, and heavy reliance on coal-fired power plants, which contribute significantly to carbon emissions [

2]. Eskom, the country’s main electricity supplier, struggles to meet the growing demand, resulting in ongoing load-shedding and a rising interest in alternative energy sources [

3]. This situation highlights the urgent need for sustainability.

Moreover, the uneven distribution of energy resources across regions means that some areas will experience more severe resource depletion than others [

4]. Net-zero carbon buildings are a category within net-zero buildings (NZBs), which are resource-efficient buildings. Without the effective and sustainable management of resources, the availability of energy sources will decline, leading to increased energy costs, reduced economic growth, and potential geopolitical instability [

5]. According to the Green Building Council of South Africa (GBCSA), NZBs are categorised into four categories: carbon, water, waste, and ecology [

6]. This study will focus on net-zero carbon buildings, which are defined as a highly energy-efficient building, with the remaining energy requirement generated from renewable energy, preferably on-site or off-site if necessary [

6]. Net-zero carbon buildings focus on energy efficiency, integrating renewable energy sources, and achieving carbon neutrality, which can help address some of South Africa’s energy challenges. Notably, green buildings have become more common in South Africa, with around 1000 certifications issued between 2009 and 2023. In contrast, NZBs are still emerging, with only 64 certifications recorded as of 2024. This indicates that there are specific drivers and barriers influencing their growth.

This study explores the factors affecting the adoption of NZBs in South Africa’s commercial property market. The following research question was formulated for analysis: what are the drivers and barriers regarding the adoption of NZBs that are unique in the South African commercial property market? The research questions led to the following research proposition: there are drivers and barriers which affect the adoption of NZBs in the South African commercial property market.

By understanding these factors, this research aims to offer insights into how NZBs can help create a more sustainable built environment in South Africa.

1.1. Sustainable Buildings: Green Buildings

A green building is a building that, in its design, construction, or operation, reduces or eliminates negative impacts and can create positive impacts on our climate and natural environment. They preserve precious natural resources and improve quality of life [

7]. While green buildings aim to reduce environmental impact throughout their life cycle, they also offer social and economic benefits such as improved indoor air quality [

8]. The Green Star South African rating system, introduced in South Africa in 2009, has seen increased adoption due to benefits like enhanced marketability and improved public relations [

8,

9,

10]. Similar to green buildings, NZBs provide solutions to building sustainability; however, they focus on energy efficiency and renewable energy integration, and present a solution for mitigating climate change and improving energy efficiency, which are global challenges that continue to persist [

11,

12]. Since green buildings have been established in South Africa and the number of these buildings is growing within the industry for both public and private sector buildings, along with existing funding structures, analysing green buildings can provide valuable insights for improving net-zero designs [

13]. As such, green buildings and NZBs use different certification systems.

1.2. Sustainable Buildings: Net-Zero Buildings

NZBs aims to balance resource consumption with restoration, focusing on achieving energy and carbon neutrality. These buildings incorporate various strategies such as renewable energy integration, energy efficiency, and carbon reduction to minimise their environmental impact and promote sustainability [

10]. NZBs aim to minimise energy consumption, reduce GHG emissions, and enhance economic competitiveness through various design strategies [

14]. Key strategies include passive measures like thermal insulation and natural ventilation, as well as active systems such as energy-efficient HVAC and renewable energy sources [

15,

16]. Despite their benefits, NZBs face challenges like low returns on investment and inconsistent design standards [

14,

17]. Tools like Green Building Information Modelling (BIM) are crucial for optimising NZB design and performance [

13,

18]. Effective NZB design must adapt to various climate conditions, balancing passive and active strategies with renewable energy systems [

19,

20].

1.3. Climate-Adaptive Net-Zero Buildings

1.3.1. Climate Adaptation in Net-Zero Buildings Design: Regional Case Studies in South Africa

Within South Africa, climate-adaptive NZB design aligns with global findings on passive cooling in hot and humid regions, where building energy use is dominated by cooling requirements [

20]. Local case studies demonstrate South Africa’s climatic diversity demands tailored NZB solutions. In the semi-arid conditions of Johannesburg, Lords View Industrial Park implemented a mixed-mode ventilation and a rooftop PV system to optimise industrial space energy use [

21] while in the mediterranean climate of Cape Town, Richmond Business Park implements occupancy-sensing lighting and heat pump water heating to optimise energy use [

22]. These projects validate region-specific applications of active and passive design principles.

1.3.2. Cost-Effective Design Tools: BIM and Performance Monitoring

Chen [

13] identifies that NZBs need constant improvement regarding their design, as well as a continuous analysis of building processes to meet their performance goals. Green BIM combines BIM and Building Performance Analysis (BPA) software (e.g., IUSKA, eQUEST, and DesignBuilder, etc.) to optimise environmental effectiveness. This is exemplified by 5 Parks Boulevard in Johannesburg, with its 217.1 kW solar array and envelope design ensuring 98% thermal comfort [

23], Richmond Business Park, which reduced thermal loads through fabric optimization and a 76,640 kWh/year PV system [

22], and Delecta Fruit Headquarters within Cape Town, where high-performance glazing and a 60,000 kWh/year PV system achieved net-positive emissions [

24]. These cases underscore BIM’s role in achieving [

13]’s “constant improvement” mandate.

1.3.3. Stakeholder-Specific Pathways to Net-Zero

Harkouss et al. [

19] investigated NZB feasibility across eight global climates, noting the need to tailor solutions to local contexts. South African projects confirm this: Fuchs Lubricants Headquarters adopted 100% electrification and passive ventilation [

25], while City Industrial Property—Bellville Facility implemented a mixed-mode ventilation, low-VOC finishes, and a roof-mounted PV system sized to exceed the facility’s energy consumption [

26]. All projects were validated by GBCSA audits, with less than 5% energy model deviations. While these case studies demonstrate the feasibility of climate-adaptive NZBs, they represent a minority of GBCSA-certified projects. Most buildings in South Africa still face systemic barriers to achieving a net-zero status, particularly under climate variability, which will be explored in

Section 1.5.3.

1.4. Key Factors Driving the Adoption of Net-Zero Buildings: A Review of the Literature

1.4.1. The Role of Environmental Concerns and Energy Scarcity

South Africa faces both an energy crisis with load-shedding and growing climate risks [

27]. From an architect’s perspective, an NZB is an ideal concept to address climate change [

28]. In South Africa, the urgency for such buildings is heightened by the country’s main energy supplier, Eskom, failing to meet the overgrowing electricity demand. South Africa has experienced continuous scheduled and unscheduled power blackouts [

2]. Therefore, energy resource scarcity and climate change are concerns because they threaten sustainability [

29]. Net-zero concepts can bring solutions to minimise the problem of the high energy consumption of buildings [

30].

1.4.2. Economic Incentives and Market Benefits

There are concerns surrounding energy security, which stem from the rising energy demand, increasing oil prices, and fossil fuel depletion [

31]. Additionally, it could be argued that the economic benefit is the most influential factor with regard to NZB uptake [

32]. NZBs are found to relate to energy savings, decreased electricity costs, energy independence, reduced pollution, and occupant comfort [

19]. Therefore, NZBs are suitable for the encouragement and promotion of energy efficiency and sustainability. Factors such as increased asset values, energy independence, and lower life-cycle costs are drivers of implementing NZBs by companies [

33]. The aim of NZBs is to mitigate energy consumption, GHG emissions, and related costs while ensuring indoor environmental quality and comfort [

1].

1.4.3. The Influence of Social Responsibility and Corporate Stewardship

Stewardship Theory is an ethical framework that emphasises the responsibility of organisations to act in the best interests of society and the environment, beyond just financial considerations [

34]. It could be a key driver for the adoption of net-zero buildings, emphasising that organisations have an ethical responsibility to do the right thing for society and the environment. This theory suggests that firms should act as stewards of societal resources, like Growthpoint and Old Mutual, who are platinum members of the Green Building Council of South Africa, considering the externalities of their operations and prioritising the social welfare function [

34]. In the context of net-zero buildings, this means that some organisations are encouraged to adopt sustainable practices, because this aligns with their ethical duties.

1.5. Barriers to Net-Zero Building Implementation

1.5.1. Regulatory Hurdles to Net-Zero Buildings in South Africa

In terms of South Africa’s steps toward a low-carbon future, there are policies such as the Climate Change Act of 2024, National Development Plan (NDP) 2030′s transition to a low-carbon economy, the Carbon Tax Act of 2019, and the Integrated Resource Plan [

35]. While these frameworks address broader climate goals, they fall short regarding the built environment. Unlike the European Union’s comprehensive Energy Performance of Buildings Directive, South Africa still lacks mandatory net-zero building standards. However, the country is making meaningful progress through its Energy Performance Certificate (EPC) regulations, which mandate that all public buildings over 1000 m

2 must obtain and display energy efficiency ratings by 8 December 2025 [

36]. The policy gap creates significant challenges for implementing net-zero buildings in the commercial real estate sector [

37]. Furthermore, the absence of specific building codes and performance targets means developers face uncertainty about requirements and compliance, potentially slowing progress toward sustainable construction [

37].

Furthermore, the adoption of NZBs within the building sector has been constrained, with legislative barriers identified as a significant obstacle [

38]. According to [

38], there is no national regulation encouraging sustainable developments for South African cities, such as those that encourage efficient energy usage within buildings, reduced dependency on fossil fuels, and the usage of renewable energy [

37,

39].

1.5.2. Technical and Knowledge Barriers in the Construction Industry

In South Africa’s construction industry, there exists a knowledge gap regarding the benefits, costs, and implementation of sustainable buildings and NZBs [

37]. This stems from the risks associated with adopting unfamiliar techniques without prior experience [

40]. Additionally, there is a need for the testing and inspection of products lacking sufficient manufacturing and supplier support, combined with insufficient product information and increased resource requirements [

37]. Therefore, a significant barrier to the adoption of NZBs is a lack of expertise in NZBs within the South African property market [

30,

32]. Both the lack of organisational understanding and the lack of client knowledge and incentives have proven to be barriers to NZB adoption [

41].

1.5.3. Climate Variability and Design Challenges

NZBs face fundamental design challenges due to climate variability, as strategies effective in one region often fail in another. While the strategies show promise in

Section 1.3, their implementation faces climate-specific and technical barriers. For example, while passive daylight optimization and zoned active cooling [

16] succeed in hot–humid climates, such solutions require costly recalibration in arid or temperate zones [

42]. This lack of universal templates forces designers to reinvent approaches rather than replicate them, which is a key barrier to global NZB scalability.

Even in regions with advanced NZB adoption, climate-specific hurdles persist. Europe’s temperate-climate dominance [

43] and policy-driven successes (e.g., Portugal, Italy) [

30] offer limited guidance for hotter, energy-stressed economies. China’s rapid NZB expansion of seven million meters squares in 2020 highlights this disparity: despite progress, inconsistent definitions, immature technologies, and weak incentives hinder replication [

44].

For countries like South Africa and Brazil, which share hot-climate challenges and energy instability [

30], these global cases emphasise a critical gap. Climate-adaptive NZBs demand hyper-localized policies and technologies, yet most tools and benchmarks remain Eurocentric. Without standardised frameworks for divergent climates, NZB implementation will remain fragmented and inefficient [

30].

2. Materials and Methods

2.1. Research Design

This study used a qualitative approach and followed a multiple-case-study design to explore how NZBs are being adopted in South Africa’s commercial property market. Since this is a fairly new topic in the country, the aim was to gain deeper insight into what helps or holds back adoption by hearing directly from people in the industry. Other researchers in the field, like Häkkinen and Belloni [

40], Pan and Pan [

32], and Nduka et al. [

14], have used similar methods to study sustainability. These studies show that qualitative methods work well when trying to understand real-world experiences and challenges around new practices like net-zero development.

2.2. Case Study Selection

The participants were chosen using purposive sampling, which means they were selected because of their senior roles and ability to speak to their organisations’ sustainability efforts. This helped ensure the data came from people who are directly involved in decisions about the adoption of strategies relating to optimising business. A total of seven senior professionals were contacted. Of these, five participants across four different organisations agreed to be interviewed, while two were unavailable despite follow-up efforts. The final sample was, therefore, made up of five participants, each representing one of four commercial property organisations. Each organisation was treated as an individual case study. All the companies operate in the property sector, but they differ in size, focus, and level of sustainability involvement (

Table 1).

2.3. Data Collection

Data were gathered through semi-structured interviews, which means there were guiding questions, but the conversation could flow freely depending on the answers given. This method helped keep the interviews focused while also allowing new ideas to come up naturally. Interviews were recorded (with permission) via Microsoft Teams (version 4.15.58.0) on Windows 11, and the recordings were transcribed. The transcripts were then edited for clarity and to ensure anonymity. This approach is commonly used in similar sustainability studies, such as Managan [

33] and Nurick and Cattell [

34], because it helps gather honest and detailed opinions.

2.4. Data Analysis

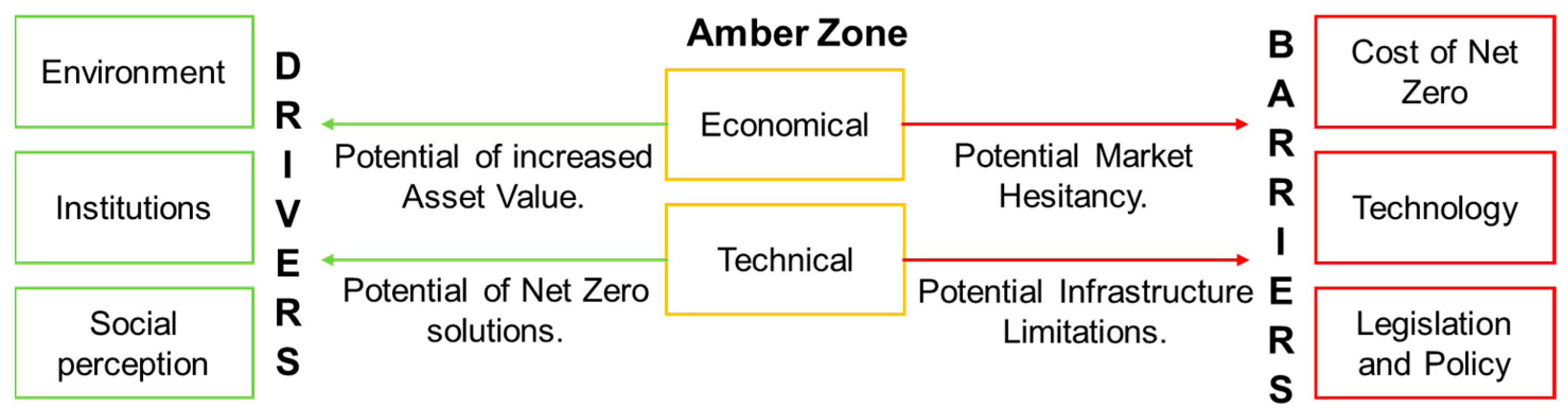

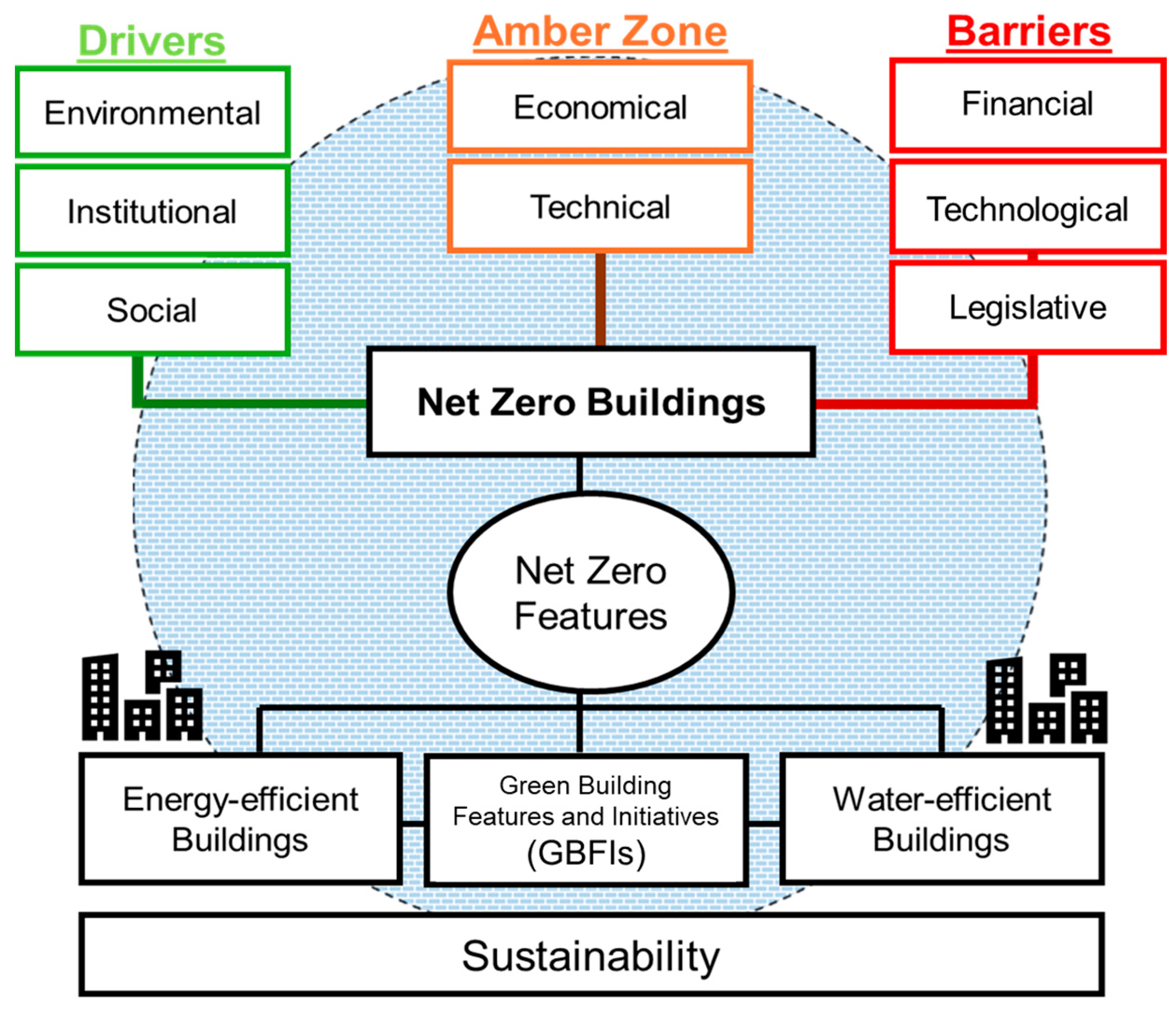

The interview transcripts were analysed using thematic analysis through inductive coding in NVivo 13, where data were coded and grouped into key themes based on recurring patterns and strongly expressed ideas. The main themes included sustainability commitments, net-zero costs, the emergence of NZBs in South Africa, and the drivers and barriers influencing their adoption. To ensure objectivity, the initial coding was reviewed by the research supervisor, with discrepancies resolved through discussion to strengthen consistency. Although NVivo experts were not involved, all researchers attended structured training qualitative methodology workshops on thematic analysis and NVivo coding. A cross-case analysis compared findings across the four companies, distinguishing industry-wide trends from organisation-specific perspectives. This process informed an empirical model linking drivers, barriers, and contextual factors including the “Amber Zone,” where variables like cost or technology could either enable or delay adoption, depending on circumstances.

2.5. Ethics and Consent

This study received ethical approval from the relevant institutional ethics committee (approval date: 17 May 2023). All participants provided written informed consent to participate. Their identities were kept confidential, and data were securely stored. Participants were also given the opportunity to review their responses to ensure their views were accurately represented.

2.6. Limitations

This study’s findings are based on a qualitative analysis of five participants from four organisations within South Africa’s commercial real estate sector. While this approach offers in-depth insights, the limited sample size restricts the generalizability of the results to the broader market. The use of non-probability sampling methods, such as purposive or convenience sampling, may introduce selection bias and limit the representativeness of the sample. Additionally, this study may not have captured the perspectives of all significant stakeholder groups, such as policymakers, financial institutions, tenants, and community representatives. The absence of these viewpoints could influence the comprehensiveness of the findings. Furthermore, this study’s focus on specific geographic locations may limit the applicability of the results to other regions within South Africa. Regional variations in market dynamics and stakeholder interactions could affect the transferability of the findings. Future research should consider incorporating a larger and more diverse sample, including underrepresented stakeholder groups, to enhance the robustness and generalizability of the findings.

3. Results

This section explores the prominent themes which emerged from the case studies. The purpose is to identify the level of NZB adoption and implementation in the South African commercial property market and to find the relevant drivers and barriers in this process.

3.1. Sustainability Commitment from Organisations

Across all four cases, there was a prominent trend of reducing energy consumption as an organisational priority. While all four companies reported having Green Star-rated buildings within their portfolios, CS2 was the only organisation that did not have a policy requiring a minimum four-Star Green Star rating for all new developments. This is because CS2 expressed that their focus was primarily on water and energy-efficient practices rather than pursuing certified NZBs. This highlights a contrast in formal sustainability commitments, with CS2 taking a more flexible approach compared to the other cases.

All cases mentioned the use of solar panels. CS1 highlighted the challenge of limited roof space on commercial buildings and emphasised the need to improve energy efficiency in order to maximise energy generation within these spatial constraints. Additionally, CS1 mentioned wheeling as a partial solution to this limitation, as it enables electricity generated off-site to be transmitted through the national grid to their buildings. Regarding the comfort of the building inhabitants, CS3 deemed NZB features to be more crucial than CS2 did. CS3 expressed the importance of features like natural ventilation, particularly in response to the COVID-19 pandemic. In contrast, CS2 expressed that one would not walk into a NZB or green building and feel its immediate benefits.

3.2. Net-Zero Costs

Cost emerged as a recurring barrier across most of the cases. However, there were nuanced perspectives among the stakeholders. CS4 challenged the assumption that NZBs are inherently more expensive. They argued that if a net-zero cost is set as a design goal from the start, rather than pursued solely to accumulate Green Star points, it does not necessarily cost more than any other high-performance building. CS4 serves a high-end international market, where ambitious sustainability goals are expected and better supported within budgets. In contrast, CS2 was more cautious about the financial implications tied to certification. They expressed concern over the costs associated with achieving Green Star points and therefore preferred to prioritise practical energy and water efficiency measures rather than pursue full compliance with the GBCSA framework. CS3 echoed the theme of financial constraint, noting that certification targets are not always achievable due to limited budgets. This suggests that even with the intention to pursue sustainability goals, the reality of funding can limit outcomes. However, CS4 offered a contrasting experience. They shared that some of their projects had initially aimed for a four-Star Green Star rating, but through efficient planning and resource allocation, they were ultimately able to achieve a six-Star certification all within the same budget.

3.3. Emergence of Net-Zero Buildings in South Africa

All case studies agreed that NZB implementation remains in its early stages in South Africa, with participants acknowledging the value of learning from more advanced contexts, such as the UK. Although the country is committed to global climate goals, as seen in its signatory to the Paris Agreement, membership in the C40 Cities network, and alignment with national strategies like the NDP Vision 2030, which includes a target for transitioning to a low-carbon economy, progress on sustainable buildings and resource efficiency has been limited. This is largely because urgent social and economic challenges, including widespread unemployment, inequality, and housing shortages, often take priority over environmental objectives.

Nevertheless, the case studies pointed to locally driven innovations, particularly in response to load-shedding (electricity instability) and Cape Town’s “Day Zero” water crisis, when the city nearly became the first major urban centre to run out of municipal water. These examples illustrate South Africa’s capacity for creative problem-solving and context-specific sustainable solutions, even under pressure.

3.4. Drivers of Net-Zero Buildings in South Africa

One of the most prominent shared drivers across all case studies was the rising cost of energy and the impact of ongoing power outages. All participants identified load-shedding as a major concern influencing building performance and long-term costs. CS2 noted that while solar energy offers a potential solution, the high cost of batteries necessary for reliable energy storage remains a challenge. CS1 emphasised that load-shedding has increased the demand for energy security and self-sufficiency. These perspectives highlight the growing importance of resilience in the face of energy instability. NZBs, with their integration of on-site renewable generation and energy storage systems, offer a practical solution to this need. As a result, energy-related pressures are not only operational challenges but also significant motivators in the adoption of sustainable building practices.

Environmental awareness and the value of a positive public image also emerged as key drivers behind NZB adoption. CS2 mentioned that more commercial tenants are actively seeking environmentally responsible spaces, while CS1 pointed out that tenants are drawn to buildings that help reduce carbon footprints and enhance climate change mitigation efforts. Both CS1 and CS2 shared the following sentiment: “If it is good for the environment, it is good for business.” This suggests that NZBs are not only seen as environmentally beneficial but also as a strategic asset for businesses wanting to align with growing societal expectations around sustainability. The appeal of such buildings lies in their ability to balance environmental impacts with enhanced brand reputation and tenant satisfaction.

Investor and stakeholder expectations were also consistently identified across the case studies as significant drivers. CS4 noted that NZBs tend to attract socially responsible investors and align with the increasing emphasis on ethical and sustainable business practices. With the global rise of Environmental, Social, and Governance (ESG) frameworks, there is greater scrutiny over how properties perform in terms of environmental impact and long-term value. These expectations are influencing development decisions, financing strategies, and leasing priorities. As a result, sustainability is not only a matter of regulatory compliance but also a reflection of market demand and investment appeal.

Despite the challenges faced, the South African property industry has demonstrated a strong sense of resilience and innovation in response to local crises. CS4 commended South Africans for their adaptability in navigating load-shedding and drought conditions. The “Day Zero” water crisis in Cape Town, when the city nearly ran out of municipal water, is a striking example of the urgency and ingenuity that shape local sustainability efforts. In the face of such pressures, South Africans have developed context-specific solutions that prioritise efficiency, self-reliance, and long-term resilience. These responses underscore the country’s capacity to tackle complex environmental challenges, reinforcing the relevance and necessity of NZBs within the local context.

3.5. Barriers to Net-Zero Buildings in South Africa

Cost is one of the most consistent barriers to NZB implementation across all four case studies, though it is perceived with nuance. CS1 and CS2 emphasised the high upfront capital investment required for technologies such as solar panels, with CS1 noting that the limited energy return from solar panels in constrained urban sites makes the cost difficult to justify. CS2 added that retrofitting existing buildings is especially expensive, and NZ features often require higher rental premiums, which many tenants are unwilling to pay. Similarly, CS4 pointed out that in the middle and lower segments of the market, the cost of high-quality, energy-efficient buildings remains out of reach. CS3 linked all categories of barriers, including technical, technological, and policy barriers, to cost, noting that NZBs require performance standards that exceed national minimums, driving up expenditure. While CS4 challenged the assumption that NZBs must cost more, they acknowledged that early-stage design integration and a capable team are critical to cost efficiency, suggesting that cost may be more of a planning issue than a fixed constraint.

Technology and technical capacity were also widely recognised as major barriers, though again with overlapping potential as drivers. CS1 and CS2 identified the limited availability of green materials and energy-efficient technologies within the South African market as a constraint. CS3 and CS4 agreed that skills shortages, particularly in maintenance and system management, compromise the long-term performance of NZBs. CS3 noted that building users often lack the knowledge to operate advanced systems, diminishing the effectiveness of sustainable features. There were also concerns about the social acceptance of newer technologies, particularly among older generations in the workplace. While CS4 viewed technology as an enabler when applied correctly, they cautioned that having the wrong team on a project could undermine even the most innovative design.

Policy, legislation, and regulatory conditions presented mixed perspectives across the case studies. CS1 viewed the lack of supportive legislation and regulatory clarity as a key barrier, echoing the broader literature. CS3 acknowledged efforts at the municipal level such as in Cape Town and Johannesburg but noted that net-zero policies are not a national priority, and political instability poses additional risks to infrastructure investment. In contrast, CS4 believed there was sufficient flexibility within current regulations to implement NZBs, suggesting that the real constraint is complacency. They argued that resistance to change and preference for conventional practices act as hidden barriers to innovation, as familiar routes are often perceived as safer or more profitable.

Retrofitting existing buildings was another shared concern, with each case highlighting structural and financial limitations. CS2 and CS4 emphasised that adapting older building stocks, particularly buildings from the 1970s to 80s, was costly and complex, often requiring major redesigns that deliver limited financial returns. CS3 noted that even where retrofits are technically feasible, the health risks associated with water recycling systems and potential failures in treatment processes (especially blackwater) raise safety concerns, making developers hesitant. CS2 similarly reported that tenants question the safety of using recycled water, and the cost of filtration systems often outweighs the benefit, especially when municipal water remains inexpensive.

Importantly, many of these barriers such as cost, technology, and awareness, also mirror key drivers discussed in other parts of this study, revealing a duality in how they are perceived. For example, while CS1 and CS2 cite the lack of awareness as a barrier, CS4 observes that awareness is growing, and market preferences are shifting toward sustainability. Similarly, load-shedding is seen as both a constraint and a catalyst, with several case studies acknowledging how energy insecurity motivates interest in self-sufficiency and renewable energy integration. CS4′s optimism about overcoming barriers through early-stage design and the right team underscores a broader theme: the challenges facing NZB implementation in South Africa are not fixed, but dynamic, shaped by market maturity, leadership, and innovation.

5. Conclusions and Practical Recommendations

This study has identified the key drivers and barriers influencing the adoption of NZBs in South Africa’s commercial property sector. This research highlights how energy security concerns, rising electricity costs, and tenant demand for sustainable spaces act as powerful drivers, while high upfront costs, technical capacity gaps, and inconsistent policy frameworks remain significant barriers. The empirical model developed in this study, particularly the concept of the “Amber Zone,” demonstrates how factors like retrofitting challenges and energy pricing can shift between being obstacles and opportunities depending on contextual changes. These findings provide a foundation for targeted interventions to accelerate NZB adoption across South Africa’s property market.

For the South African government, immediate action should focus on creating enabling policy frameworks and financial incentives. This could include introducing tax rebates for NZB-certified projects and establishing subsidies for on-site renewable energy installations. Regulatory reforms are equally critical, particularly strengthening the SANS 204 building code to incorporate mandatory NZB standards for new developments, with phased implementation over 5–10 years to allow industry adaptation. Municipal governments can lead by example through pilot projects, such as retrofitting public buildings with NZB technologies. These measures would provide much-needed market certainty while addressing the policy gaps identified in this study.

Property developers can adopt several practical strategies to overcome cost barriers and drive NZB implementation. Integrated design approaches that prioritise passive strategies such as mixed-mode ventilation (Lords View Industrial Park), building envelope optimization (5 Parks Boulevard), and occupancy-sensing lighting (Richmond Business Park) can significantly reduce energy demands while keeping costs manageable. For existing buildings, developers should focus on incremental retrofits, starting with high-impact, low-cost interventions like LED lighting upgrades and smart HVAC systems, which have shown 15–25% energy savings in case studies. Engaging tenants through green lease agreements can help distribute costs while enhancing property marketability, as evidenced by Case B’s successful implementation. These approaches align with this study’s finding that NZB features can be implemented within existing budgets when planned strategically from the project outset.

For investors and property owners, this study highlights the long-term value proposition of NZBs in the South African context. These buildings offer critical risk mitigation against Eskom’s escalating tariffs, including the approved 18.65% increase for 2025 and future carbon tax adjustments. This research also reveals a growing demand from international tenants and ESG-focused investors for sustainable properties, suggesting NZBs can command rental premiums and enhance asset liquidity. Perhaps most compelling in the South African context is the resilience dividend on-site renewable energy systems, as implemented at CS1’s 2 MW solar campus, providing operational continuity during load-shedding while future-proofing assets against energy market volatility.

Looking ahead, several research priorities emerge from this study. There is a pressing need for localised NZB solutions tailored to South Africa’s diverse climate zones, from Durban’s humidity to the Northern Cape’s arid conditions. Future studies should also examine multi-stakeholder collaboration models that can align municipal policies like Cape Town’s net-zero 2050 roadmap with private sector financing mechanisms. Innovative funding approaches, particularly blended finance models combining green bonds with public–private partnerships, warrant further exploration as potential solutions to the upfront cost barriers identified in this research.

By implementing these recommendations, South Africa can position NZBs as catalysts for both energy resilience and inclusive low-carbon growth. Such an approach would directly address immediate challenges like load-shedding while aligning with broader national objectives outlined in the NDP’s 2030 vision. This study demonstrates that with targeted policy interventions, cost-effective design strategies, and a clear recognition of the long-term investment value, NZBs can transition from niche projects to mainstream solutions in South Africa’s commercial property sector.