The Rise and Fall of Regions: A Hybrid Multi-Criteria Analysis of Türkiye’s Regional Economies’ Sustainable Performance

Abstract

1. Introduction

- How does the macroeconomic performance of the 26 Turkish development regions compare over the 2019–2022 period?

- Which regions show consistently strong or weak performance, and which display fluctuating trends?

- How can the integration of SWARA and CoCoSo methods contribute to a more comprehensive and reliable regional performance assessment?

2. Literature Review

3. Materials and Methods

3.1. The Development Regions (Alternatives)

3.2. Macroeconomic Indicators (Criteria for Evaluation)

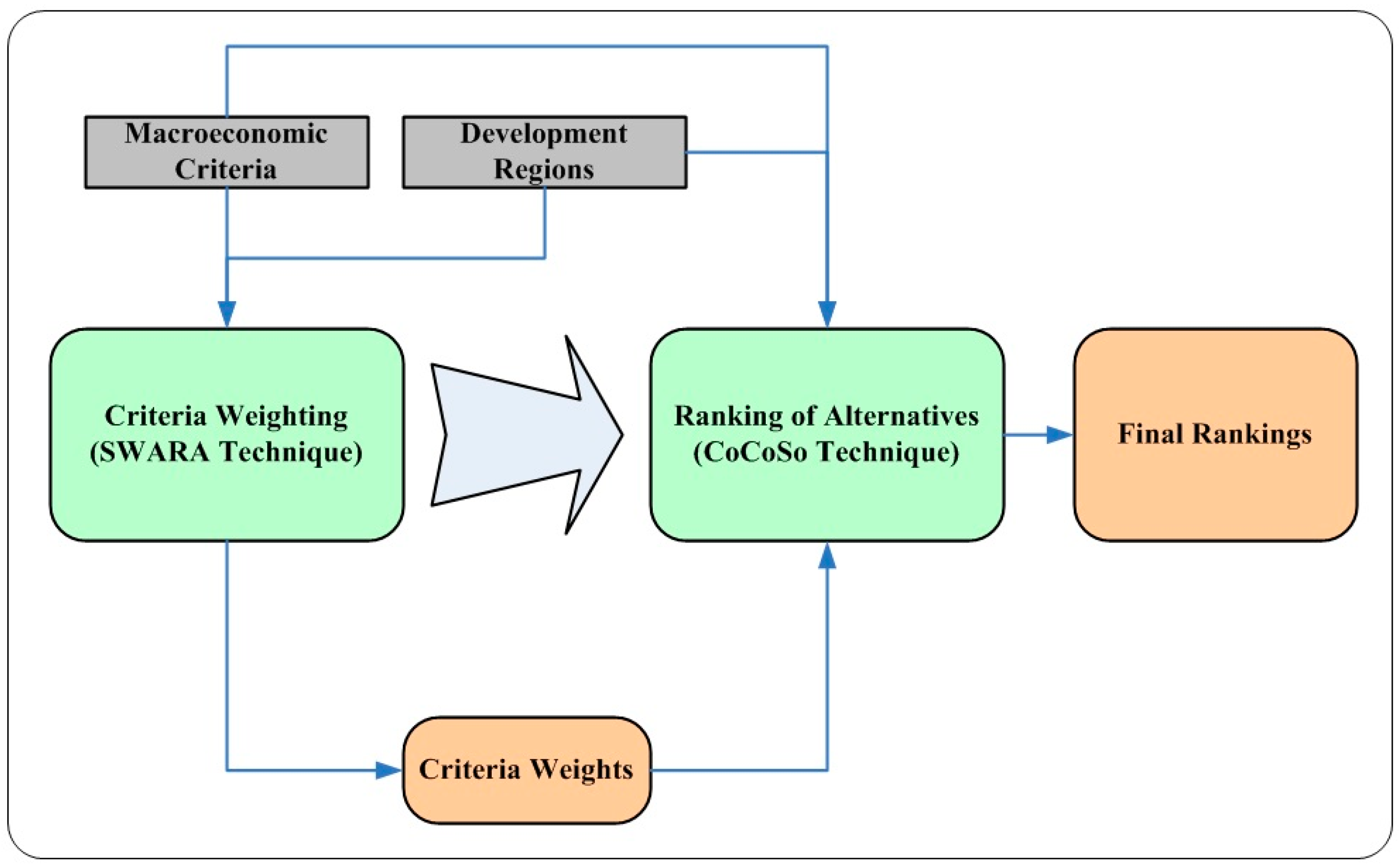

3.3. Multi-Criteria Analysis: A SWARA-Based CoCoSo Approach

3.3.1. Step-Wise Weight Assessment Ratio Analysis (SWARA) Method

3.3.2. Combined Compromise Solution (CoCoSo) Method

4. Results

4.1. Criteria Weights

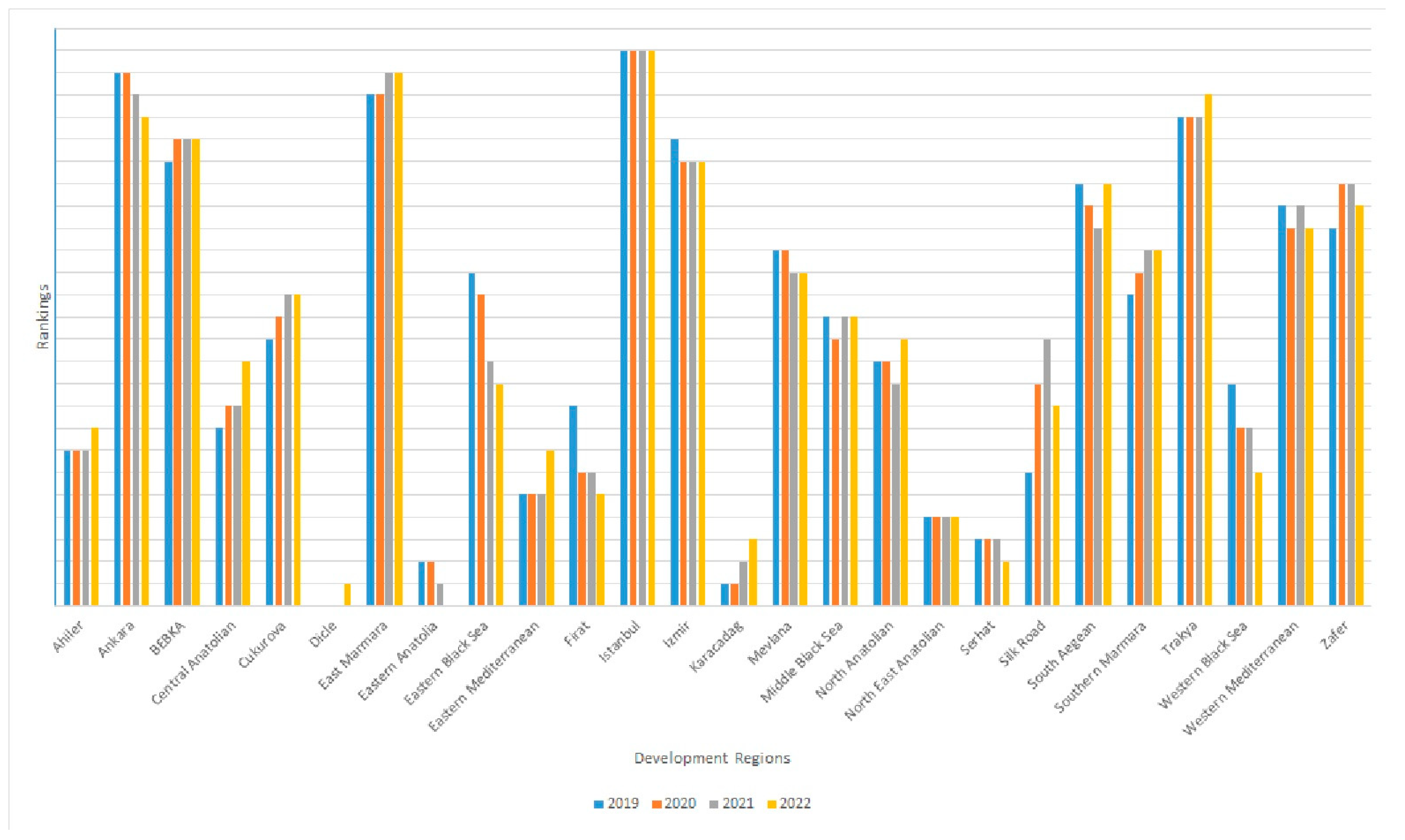

4.2. Rankings of the Development Regions

5. Discussion

5.1. Interpretation of Results

5.2. Hypotheses’ Evaluation

5.3. Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Belke, M. Evaluation of macroeconomic performance of G7 countries with CRITIC and MAIRCA methods. İstanbul Ticaret Üniversitesi Sos. Bilim. Derg. 2020, 19, 120–139. [Google Scholar]

- Tekman, N. Foreign trade-based macroeconomic performance analysis of E7 countries. In Decision Making Approaches from a Macroeconomic Perspective, 1st ed.; Ordu, M., Ed.; BIDGE Publications: Ankara, Türkiye, 2024; pp. 4–19. [Google Scholar]

- Development Agencies. Available online: https://ka.gov.tr/sayfalar/bolgesel-kalkinma-ve-ulkemizde-bolgesel-kalkinma-politikalarinin-gelisim-sureci--22 (accessed on 31 January 2025).

- Ordu, M. Evaluating occupational accidents and diseases-based sustainable performances of the Turkish development regions using a hybrid MCDM approach. In Intelligent Engineering Applications and Applied Sciences for Sustainability, 1st ed.; Mishra, B.K., Ed.; IGI Global: Hershey, PA, USA, 2023; pp. 190–207. [Google Scholar]

- Tekman, N. A macroeconomic performance assessment regarding industry and employment for the Northeastern Anatolia Development Region. In Decision Making Approaches from a Macroeconomic Perspective, 1st ed.; Ordu, M., Ed.; BIDGE Publications: Ankara, Türkiye, 2024; pp. 20–36. [Google Scholar]

- Altay Topçu, B.; Oralhan, B. The comparison of Turkey and other OECD countries with multi criteria decision making methods in terms of basic macroeconomic indicators. Int. J. Acad. Value Stud. 2017, 3, 260–277. [Google Scholar]

- Ersoy, N. Assessment of macroeconomic performances of OECD countries using the MEREC-MULTIMOOSRAL model. Gümüşhane Univ. J. Soc. Sci. Inst. 2023, 14, 471–491. [Google Scholar]

- Öztürk, B.; Deniz Başar, Ö. Investigation of macroeconomic indicators of high income countries member of the World Trade Organization with multi-criteria decision making methods. Istanb. Ticaret Univ. J. Foreign Trade 2023, 1, 31–50. [Google Scholar]

- Oğuz, S.; Çetiner, Ö.; Yalçıntaş, D. Evaluation of EU candidate and potential candidate countries’ economic indicators with TOPSIS method. Çağ Univ. J. Soc. Sci. 2020, 17, 17–28. [Google Scholar]

- Orhan, M. Comparison of the macroeconomic performance between European Union member and candidate countries with ARAS method. J. Humanit. Tour. Res. 2020, 10, 115–129. [Google Scholar]

- Koşaroğlu, Ş.M. Comparison of the macroeconomic performances of E7 countries with the entropy and ARAS methods. Dumlupinar Univ. J. Soc. Sci. 2021, 68, 203–221. [Google Scholar]

- Sastry Musti, K.S. Multicriteria decision analysis for sustainable green financing in energy sector. In Green Finance Instruments, FinTech, and Investment Strategies, 1st ed.; Naifar, N., Elsayed, A., Eds.; Springer Cham: Switzerland, 2023; pp. 3–25. [Google Scholar]

- Li, T.; Wang, H.; Lin, Y. Selection of renewable energy development path for sustainable development using a fuzzy MCDM based on cumulative prospect theory: The case of Malaysia. Sci. Rep. 2024, 14, 15082. [Google Scholar] [CrossRef]

- Li, C.; Solangi, Y.A.; Ali, S. Evaluating the factors of green finance to achieve carbon peak and carbon neutrality targets in China: A delphi and fuzzy AHP approach. Sustainability 2023, 15, 2721. [Google Scholar] [CrossRef]

- Meng, X.; Shaikh, G.M. Evaluating environmental, social, and governance criteria and green finance investment strategies using fuzzy AHP and fuzzy WASPAS. Sustainability 2023, 15, 6786. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, Y.; Solangi, Y.A. Assessing ESG factors and policies of green finance investment decisions for sustainable development in China using the fuzzy AHP and fuzzy DEMATEL. Sustainability 2023, 15, 15214. [Google Scholar] [CrossRef]

- Nguyen, P.H.; Nguyen, L.A.T.; Le, H.Q.; Tran, L.C. Navigating critical barriers for green bond markets using a fuzzy multi-criteria decision-making model: Case study in Vietnam. Heliyon 2024, 10, e33493. [Google Scholar] [CrossRef] [PubMed]

- Atan, M.; Özcan, M.; Arslantürk, Y. Spatial relations based on regional efficiency on Nuts II in determining hunger and poverty threshold: Turkey case. Gazi İktisat Ve İşletme Derg. 2015, 1, 1–16. [Google Scholar]

- Belgin, Ö.; Apaydın Avşar, B. Measuring R&D and innovation performance at regional and provincial level in Turkey using grey relational analysis. J. Product. 2019, 2, 27–48. [Google Scholar]

- Demirdöğen, O.; Erdal, H.; Kul, S. A stochastic model proposal for distribution center location problem: A case study in TRA district. Atatürk Univ. J. Econ. Adm. Sci. 2017, 31, 555–570. [Google Scholar]

- Gergin, R.E.; Tip, F.N.; Peker, İ. Site selection of weapon industrial zone in TR-90 region with integrated FUCOM-VIKOR approach. J. Res. Bus. 2024, 9, 365–394. [Google Scholar]

- Durmaz, K.İ.; Çalış Boyacı, A.; Gencer, C. Evaluation of level-1 regions in Turkey in terms of educational indicators with multi-criteria decision making methods. J. Inf. Technol. 2020, 13, 13–25. [Google Scholar]

- Erkılıç, C.E. Comparison of level 1 regions according to the statistical regional unit classification of Turkey in terms of public health service infrastructure and human resources. J. Erciyes Acad. 2022, 36, 2006–2031. [Google Scholar] [CrossRef]

- Gök Kısa, A.C. Evaluation of renewable energy sources in TR83 region by CRITIC based grey relational analysis approach. Pamukkale Univ. J. Eng. Sci. 2021, 27, 542–548. [Google Scholar] [CrossRef]

- Örtlek, Z. Analysis of socioeconomic performance: Turkey level 2 region. Nevşehir Hacı Bektaş Veli Univ. J. ISS 2024, 14, 1934–1954. [Google Scholar] [CrossRef]

- Sungur, O.; Işık Maden, S. Ranking of manufacturing industry sectors in TR61 region (Antalya, Isparta, Burdur) with PROMETHEE method. Ege Akad. Rev. 2016, 16, 641–654. [Google Scholar]

- Yalçınkaya, Y.; Dulupçu, M.A.; Baykul, A. Evaluation of the investment climate of organized industrial zones with TOPSIS method: An implementation on Nuts 3. J. Mehmet Akif Ersoy Univ. Econ. Adm. Sci. Fac. 2018, 5, 90–107. [Google Scholar]

- Yıldırım, B.F.; Yeşilyurt, C. Bulanık analitik hiyerarşi prosesi yaklaşımı ile proje değerlendirme kriterlerinin önceliklendirilmesi: Kalkınma ajansı örneği. Atatürk İletişim Derg. 2014, 6, 23–50. [Google Scholar]

- Ordu, M.; Tekman, N. A macroeconomic investigation of the Organization of Turkic States by a hybrid decision-making approach. In Decision Making Approaches from a Macroeconomic Perspective, 1st ed.; Ordu, M., Ed.; BIDGE Publications: Ankara, Türkiye, 2024; pp. 37–52. [Google Scholar]

- Hokka, C.; Bektaş, S. Macroeconomic performance measurement with MCDM methods: The case of D8 countries in 2021–2022. Çukurova Univ. Soc. Sci. Inst. J. 2024, 33, 397–420. [Google Scholar]

- Pınar, A.; Yıldırım, M.; Erdoğan, S. COVID measuring the performance of the Turkish economy in the COVID period and after with the CRITIC, TOPSIS and MABAC methods. KMU J. Soc. Econ. Res. 2023, 25, 433–449. [Google Scholar]

- Arsu, T. Assessment of macroeconomic performances and human development levels of BRICS and MINT countries using CRITIC and COPRAS methods. Pac. Bus. Rev. 2022, 14, 1–19. [Google Scholar]

- Doğan, H. Evaluation of Turkey’s macroeconomic performance for 2010–2020 with the CRITIC based ARAS method. Asya Stud. —Acad. Soc. Stud. 2022, 6, 189–202. [Google Scholar] [CrossRef]

- Al, İ.; Demirel, S.R. The Evaluation of macroeconomic performance of Turkey with TOPSIS method: The period of 2002-2019. Mehmet Akif Ersoy Univ. J. Econ. Adm. Sci. Fac. 2022, 9, 202–222. [Google Scholar]

- Coşkun, A.E. Evaluation of macroeconomic performances of BRICS-T economies: Entropy-based WASPAS approach. İstanbul Ticaret Üniversitesi Sos. Bilim. Derg. 2022, 21, 1320–1340. [Google Scholar] [CrossRef]

- Uludağ, A.S.; Ümit, A.Ö. An analysis of value-added production and macroeconomic performances of the Turkic countries via DEMATEL and COPRAS methods. Sosyoekonomi 2020, 28, 139–164. [Google Scholar] [CrossRef]

- Yapa, K.; Durmus, M.; Tayyar, N.; Akbulut, İ. Comparison of the European Union countries and Turkey’s macroeconomic indicators with Best Worst method. In Handbook of Research on Social and Economic Development in the European Union, 1st ed.; Bayar, Y., Ed.; IGI Global: Hershey, PA, USA, 2020; pp. 204–219. [Google Scholar]

- Chattopadhyay, S.; Bose, S. Global macroeconomic performance: A comparative study based on composite scores. J. Rev. Glob. Econ. 2015, 4, 51–68. [Google Scholar] [CrossRef]

- Turkish Statistical Institute. Available online: https://www.tuik.gov.tr/ (accessed on 31 January 2025).

- Geographic Statistics Portal. Available online: https://cip.tuik.gov.tr/ (accessed on 31 January 2025).

- General Directorate of Relations with Civil Society. Available online: https://www.siviltoplum.gov.tr/bilgimerkezi/kalkinma-ajanslari (accessed on 31 January 2025).

- Keršuliene, V.; Zavadskas, E.K.; Turskis, Z. Selection of rational dispute resolution method by applying new step-wise weight assessment ratio analysis (SWARA). J. Bus. Econ. Manag. 2010, 11, 243–258. [Google Scholar] [CrossRef]

- Yazdani, M.; Zarate, P.; Kazimieras Zavadskas, E.; Turskis, Z. A combined compromise solution (CoCoSo) method for multi-criteria decision-making problems. Manag. Decis. 2019, 57, 2501–2519. [Google Scholar] [CrossRef]

- Torkayesh, A.E.; Pamucar, D.; Ecer, F.; Chatterjee, P. An integrated BWM-LBWA-CoCoSo framework for evaluation of healthcare sectors in Eastern Europe. Socio-Econ. Plan. Sci. 2021, 78, 101052. [Google Scholar] [CrossRef]

| Study | Macroeconomic Indicators | MCDM Approach Used |

|---|---|---|

| Ordu and Tekman [29] | Gross domestic product (GDP), GDP per capita (GDPPC), Export (EXP), Import (IMP), Labor Force, Population | Entropy-based COPRAS |

| Hokka and Bektaş [30] | Gross Domestic Product (GDP), Unemployment Rate (UR), Inflation Rate (IR), Misery Index (MI), Gross Domestic Product per Capita (GDPPC) | Entropy-based ARAS |

| Öztürk and Deniz Başar [8] | Growth (G), Export (EXP), Import (IMP), IR, UR | Expert Opinion, DEMATEL, and Equally Weighted-based TOPSIS and EVAMIX |

| Pınar et al. [31] | Growth Rate (GR), IR, UR, Current Balance (CB), Budget Balance (BB)/GDP | CRITIC-based TOPSIS and MABAC |

| Ersoy [7] | IR, UR, GDPPC, CB | MEREC-based MULTIMOOSRAL |

| Arsu [32] | Economic Growth Rate, UR, IR, EXP/IMP, GDPPC | CRITIC-based COPRAS |

| Doğan [33] | GDP, GDPPC, EXP/IMP, Foreign Direct Investment (FDI) Inflow, Interest Rate, IR, UR | CRITIC-based ARAS |

| Al and Demirel [34] | EG, IR, UR, CB | TOPSIS |

| Coşkun [35] | GDP, GDPPC, EXP, IMP, Growth Rate (GR), FDI, IR, UR | Entropy-based WASPAS |

| Koşaroğlu [11] | EG, Investment Rate, EXP, IMP, Current Account Balance (CAB)/GDP, UR, IR | Entropy-based ARAS |

| Uludağ and Ümit [36] | GDP, GDPPC, Real GDP per Capita in Purchasing Power Parity, GDP Deflator Representing Inflation, Foreign Debt/GDP, FDI Inflow/GDP, UR, EXP/IMP | DEMATEL-based COPRAS |

| Oğuz et al. [9] | Public Debts (PD)/GDP, UR, Budget Deficit/GDP, GDP/Population, IR | TOPSIS |

| Orhan [10] | GDPPC, Employment Rate (ER), EXP, IMP | ARAS |

| Yapa et al. [37] | Bond Yields, GDPPC, UR, IR, Growth | Expert Opinion-based BWM |

| Belke [1] | GDPPC, EG, Investment Rate, Trade, CAB, BB, PD, UR, IR | CRITIC-based MAIRCA |

| Altay Topçu and Oralhan [6] | GDPPC, GR, IR, EXP, IMP, ER | ELECTRE, TOPSIS |

| Chattopadhyay and Bose [38] | GR of Real GDP, GDPPC, UR, Fiscal Balance, IR, and CAB | Entropy-based TOPSIS |

| Criteria | Unit | Type of Optimization |

|---|---|---|

| Gross Domestic Product (GDP) | Thousand TRY | Maximization |

| Gross Domestic Product per Capita (GDPPC) | TRY | |

| Employment Rate (ER) | % | |

| Number of Enterprise (NoE) | - | |

| Export (EXP) | Thousand USD | |

| Unemployment Rate (UR) | % | Minimization |

| Import (IMP) | Thousand USD |

| Criteria | Periods | Mean | Standard Deviation | Minimum | Maximum | ||

|---|---|---|---|---|---|---|---|

| Development Region | Value | Development Region | Value | ||||

| GDP | 2019 | 166,069,609 | 252,114,375 | Serhat | 25,573,945 | Istanbul | 1,325,199,566 |

| 2020 | 194,175,690 | 289,085,530 | 31,618,816 | 1,518,604,665 | |||

| 2021 | 279,082,375 | 421,185,939 | 38,931,419 | 2,204,761,565 | |||

| 2022 | 577,375,999 | 869,942,147 | 79,538,996 | 4,564,280,141 | |||

| GDPPC | 2019 | 42,991 | 16,432.31 | Karacadag | 20,285 | Istanbul | 86,651 |

| 2020 | 50,450 | 18,251.20 | 24,139 | 98,032 | |||

| 2021 | 71,052 | 28,303.89 | 31,335 | 140,864 | |||

| 2022 | 145,358 | 56,925.97 | Eastern Anatolia | 63,706 | 287,524 | ||

| ER | 2019 | 44.80 | 5.22 | Dicle | 30.00 | Trakya | 53.00 |

| 2020 | 42.30 | 5.31 | 26.00 | 50.90 | |||

| 2021 | 44.52 | 4.84 | 29.90 | 52.00 | |||

| 2022 | 46.58 | 4.53 | 33.80 | 54.10 | |||

| NoE | 2019 | 152,104 | 174,865.8 | Serhat | 30,567 | Istanbul | 944,954 |

| 2020 | 157,508 | 182,664.3 | 30,507 | 985,862 | |||

| 2021 | 168,641 | 198,471.7 | 31,097 | 1,069,885 | |||

| 2022 | 178,483 | 212,819.0 | 30,676 | 1,144,953 | |||

| EXP | 2019 | 6,955,104 | 17,234,804 | North East Anatolian | 37,783 | Istanbul | 88,827,640 |

| 2020 | 6,524,497 | 16,012,069 | 43,787 | 82,815,389 | |||

| 2021 | 8,661,976 | 20,988,042 | 51,230 | 108,666,008 | |||

| 2022 | 9,775,715 | 24,098,595 | 54,167 | 124,661,773 | |||

| UR | 2019 | 13.42 | 5.71 | North Anatolian | 7.60 | Dicle | 30.90 |

| 2020 | 12.77 | 5.78 | 6.60 | 33.50 | |||

| 2021 | 12.00 | 4.86 | 5.80 | 29.80 | |||

| 2022 | 10.58 | 3.32 | 6.20 | Eastern Anatolian | 19.20 | ||

| IMP | 2019 | 7,027,495 | 21,172,603 | North East Anatolian | 35,873 | Istanbul | 109,280,926 |

| 2020 | 7,779,628 | 24,568,897 | 46,520 | 126,858,302 | |||

| 2021 | 9,190,814 | 26,780,975 | Serhat | 104,799 | 138,122,531 | ||

| 2022 | 11,576,546 | 34,562,483 | North East Anatolian | 64,151 | 178,524,546 | ||

| Criteria | sj | kj | qj | wj |

|---|---|---|---|---|

| Gross Domestic Product per Capita (GDPPC) | 1.00 | 1.0000 | 0.2203 | |

| Gross Domestic Product (GDP) | 0.10 | 1.10 | 0.9091 | 0.2003 |

| Employment Rate (ER) | 0.30 | 1.30 | 0.6993 | 0.1541 |

| Unemployment Rate (UR) | 0.15 | 1.15 | 0.6081 | 0.1340 |

| Export (EXP) | 0.15 | 1.15 | 0.5288 | 0.1165 |

| Number of Enterprise (NoE) | 0.20 | 1.20 | 0.4406 | 0.0971 |

| Import (IMP) | 0.25 | 1.25 | 0.3525 | 0.0777 |

| Development Regions | GDP | GDPPC | ER | NoE | EXP | UR | IMP |

|---|---|---|---|---|---|---|---|

| Ahiler | 213,743,671 | 131,544 | 45.20 | 85,956 | 782,995 | 9.40 | 638,674 |

| Ankara | 1,329,809,540 | 230,677 | 47.20 | 338,871 | 12,004,809 | 12.10 | 14,496,010 |

| BEBKA | 821,862,745 | 191,030 | 50.00 | 235,252 | 14,228,703 | 8.90 | 11,339,450 |

| Central Anatolian | 323,443,080 | 129,796 | 45.30 | 118,839 | 4,074,288 | 9.40 | 1,925,501 |

| Cukurova | 618,038,019 | 148,121 | 45.70 | 211,617 | 9,279,324 | 12.30 | 11,738,531 |

| Dicle | 215,432,252 | 90,491 | 33.80 | 62,230 | 2,275,470 | 18.50 | 815,354 |

| East Marmara | 969,517,862 | 233,964 | 50.90 | 212,590 | 20,848,966 | 10.10 | 23,424,210 |

| Eastern Anatolia | 138,051,386 | 63,706 | 40.20 | 57,440 | 338,909 | 19.20 | 367,097 |

| Eastern Black Sea | 264,414,966 | 98,239 | 50.00 | 135,524 | 2,091,527 | 9.20 | 436,371 |

| Eastern Mediterranean | 397,697,166 | 116,663 | 50.30 | 149,915 | 5,851,995 | 14.60 | 10,305,331 |

| Firat | 169,766,688 | 96,062 | 44.00 | 74,551 | 836,172 | 8.10 | 220,209 |

| Istanbul | 4,564,280,141 | 287,524 | 44.10 | 1,144,953 | 124,661,773 | 10.20 | 178,524,528 |

| Izmir | 972,237,714 | 218,779 | 47.30 | 280,685 | 17,014,901 | 13.00 | 13,576,367 |

| Karacadag | 267,712,079 | 67,695 | 37.70 | 117,058 | 728,269 | 11.50 | 465,607 |

| Mevlana | 361,266,882 | 141,867 | 47.30 | 138,163 | 3,609,945 | 7.40 | 1,550,248 |

| Middle Black Sea | 293,470,888 | 103,649 | 49.90 | 138,161 | 3,385,632 | 8.10 | 5,049,454 |

| North Anatolian | 98,425,885 | 124,181 | 49.80 | 38,439 | 669,685 | 6.20 | 479,368 |

| North East Anatolian | 111,061,603 | 103,193 | 45.40 | 39,968 | 54,167 | 9.20 | 64,151 |

| Serhat | 79,538,996 | 72,793 | 44.50 | 30,676 | 159,063 | 12.70 | 137,371 |

| Silk Road | 377,360,208 | 129,110 | 44.40 | 130,229 | 11,406,449 | 10.70 | 8,635,387 |

| South Aegean | 501,514,462 | 155,292 | 49.90 | 226,636 | 6,664,840 | 8.60 | 3,529,164 |

| Southern Marmara | 290,556,641 | 160,313 | 47.60 | 109,577 | 1,126,976 | 7.10 | 763,328 |

| Trakya | 421,082,669 | 220,555 | 54.10 | 106,449 | 3,487,090 | 7.80 | 3,484,830 |

| Western Black Sea | 144,270,133 | 138,415 | 43.80 | 49,155 | 959,288 | 9.20 | 3,316,676 |

| Western Mediterranean | 598,661,465 | 177,477 | 52.20 | 239,654 | 3,302,104 | 14.60 | 2,057,482 |

| Zafer | 468,558,836 | 148,170 | 50.50 | 167,976 | 4,325,254 | 7.10 | 3,649,490 |

| Development Regions | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|

| Ahiler | 19 | 19 | 19 | 18 |

| Ankara | 2 | 2 | 3 | 4 |

| BEBKA | 6 | 5 | 5 | 5 |

| Central Anatolian | 18 | 17 | 17 | 15 |

| Cukurova | 14 | 13 | 12 | 12 |

| Dicle | 26 | 26 | 26 | 25 |

| East Marmara | 3 | 3 | 2 | 2 |

| Eastern Anatolia | 24 | 24 | 25 | 26 |

| Eastern Black Sea | 11 | 12 | 15 | 16 |

| Eastern Mediterranean | 21 | 21 | 21 | 19 |

| Firat | 17 | 20 | 20 | 21 |

| Istanbul | 1 | 1 | 1 | 1 |

| Izmir | 5 | 6 | 6 | 6 |

| Karacadag | 25 | 25 | 24 | 23 |

| Mevlana | 10 | 10 | 11 | 11 |

| Middle Black Sea | 13 | 14 | 13 | 13 |

| North Anatolian | 15 | 15 | 16 | 14 |

| North East Anatolian | 22 | 22 | 22 | 22 |

| Serhat | 23 | 23 | 23 | 24 |

| Silk Road | 20 | 16 | 14 | 17 |

| South Aegean | 7 | 8 | 9 | 7 |

| Southern Marmara | 12 | 11 | 10 | 10 |

| Trakya | 4 | 4 | 4 | 3 |

| Western Black Sea | 16 | 18 | 18 | 20 |

| Western Mediterranean | 8 | 9 | 8 | 9 |

| Zafer | 9 | 7 | 7 | 8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tekman, N.; Ordu, M. The Rise and Fall of Regions: A Hybrid Multi-Criteria Analysis of Türkiye’s Regional Economies’ Sustainable Performance. Sustainability 2025, 17, 5222. https://doi.org/10.3390/su17115222

Tekman N, Ordu M. The Rise and Fall of Regions: A Hybrid Multi-Criteria Analysis of Türkiye’s Regional Economies’ Sustainable Performance. Sustainability. 2025; 17(11):5222. https://doi.org/10.3390/su17115222

Chicago/Turabian StyleTekman, Nazli, and Muhammed Ordu. 2025. "The Rise and Fall of Regions: A Hybrid Multi-Criteria Analysis of Türkiye’s Regional Economies’ Sustainable Performance" Sustainability 17, no. 11: 5222. https://doi.org/10.3390/su17115222

APA StyleTekman, N., & Ordu, M. (2025). The Rise and Fall of Regions: A Hybrid Multi-Criteria Analysis of Türkiye’s Regional Economies’ Sustainable Performance. Sustainability, 17(11), 5222. https://doi.org/10.3390/su17115222