1. Introduction

Climate change represents a critical existential threat to humanity [

1]. According to China’s National Climate Center, 2023 witnessed over 200 major climate disasters globally, including extreme heatwaves, tropical cyclones, and accelerated sea-level rise [

2]. These anomalies have significantly impeded global sustainable development through multidimensional impacts on food security, ecosystem stability, and critical infrastructure [

3,

4]. In response, China has implemented progressive climate policies like the National Climate Change Adaptation Strategy 2035 and the Interim Regulations on Carbon Emission Trading Administration. However, increasing extreme weather events, geopolitical tensions, and economic pressures have substantially complicated climate governance, thereby elevating climate policy uncertainty [

5]. Climate policy uncertainty (CPU) refers to the uncertainties in climate policy instrument selection (e.g., carbon taxes and carbon trading), implementation schedules, and regulatory stringency [

6].

Existing studies have demonstrated that climate policy uncertainty generates substantial adverse effects on both macroeconomic and microeconomic dimensions [

7]. At the macroeconomic level, CPU hinders low-carbon energy transition [

8], consequently suppressing urban green total factor productivity [

9]. Moreover, frequent climate policy adjustments reduce investment returns and exacerbate financial market volatility [

10]. At the microeconomic level, earnings fluctuations induced by CPU lead to bank credit contraction, thereby intensifying corporate financing constraints and ultimately restraining green innovation investments [

11,

12]. These findings collectively indicate that CPU essentially creates a multidimensional risk transmission environment. However, little attention has been paid to whether and how firms can rebuild risk resilience through technological means under such circumstances—a critical gap this study aims to address.

With the advent of the Fourth Industrial Revolution (Industry 4.0), artificial intelligence (AI) technology has become deeply embedded in critical sectors such as healthcare, agriculture, retail, and finance [

13,

14]. This rapid adoption has propelled the global AI industry to a market size exceeding USD 513.2 billion in 2023, reflecting a year-on-year growth rate of 20.7% [

15]. Intelligent transformation, powered by artificial intelligence as its core technology, is emerging as a pivotal engine driving macroeconomic development and facilitating corporate strategic upgrading [

16]. Specifically, corporate intelligent transformation significantly enhances operational efficiency by reducing information asymmetry [

17] and promotes product innovation [

18]. Thereby, it achieves carbon emission reduction and ESG performance improvements through strategic optimization [

19,

20]. This demonstrates that intelligent technologies effectively elevate corporate operational and innovative capabilities by strengthening information acquisition. However, existing research primarily focuses on technological benefits under stable policy environments, with limited understanding of whether intelligent transformation effects can be strengthened amid frequent policy fluctuations.

As the global leader in artificial intelligence patent filings, China has institutionalized systematic support for corporate intelligent transformation through policy innovations. These include establishing national pilot zones for intelligent transformation and innovative development, along with green finance pilot policies [

21,

22]. Under the dual background of rising climate policy uncertainty and the accelerating global wave of intelligent transformation, CPU may create strategic opportunities for corporate transformation. Empirical evidence demonstrates that CPU enhances the efficiency of capital allocation by curbing excessive investment [

23]. Concurrently, CPU drives enterprises to pursue green technological innovation, thereby facilitating the low-carbon transition [

24,

25].

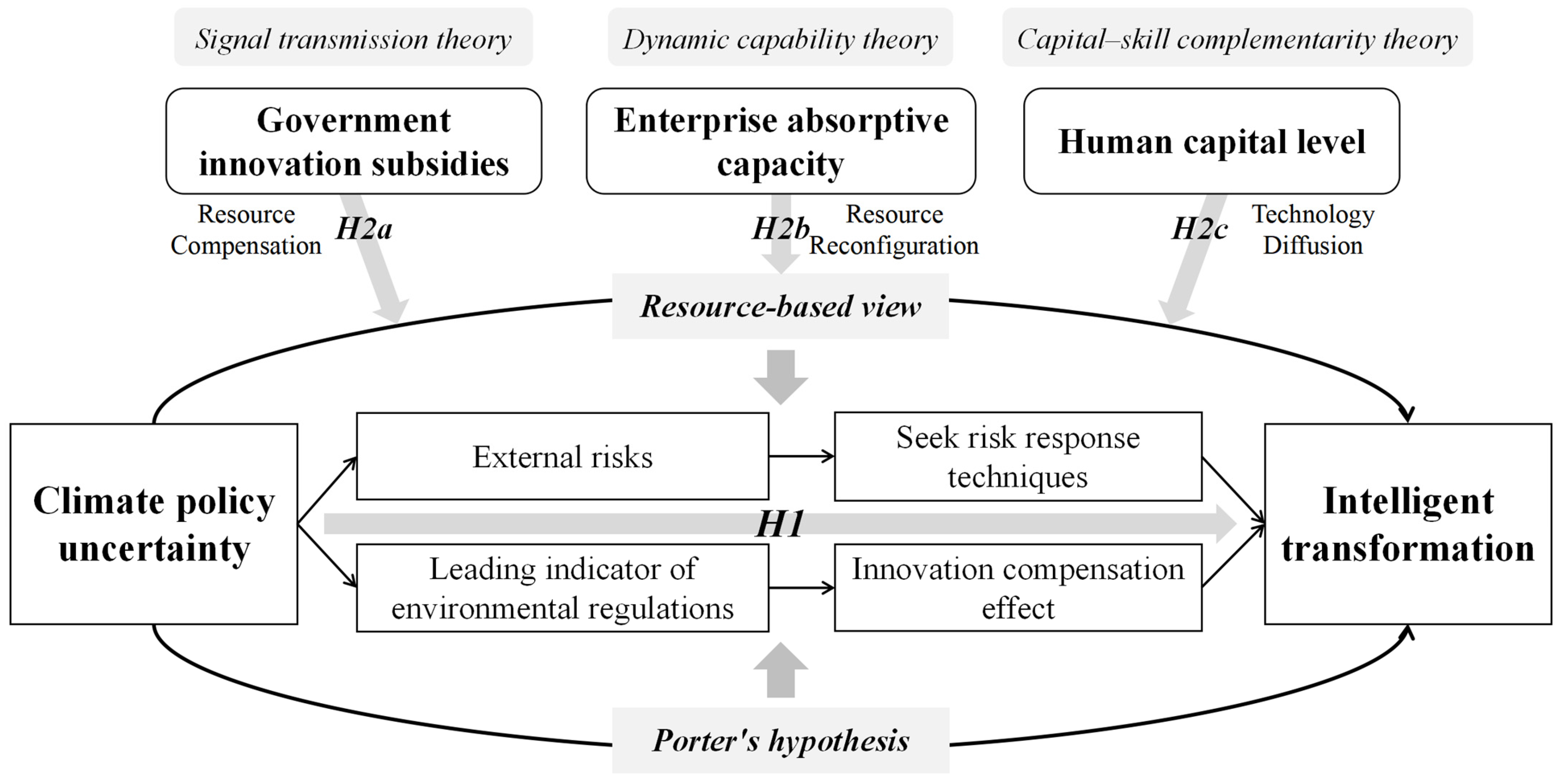

Using panel data from Chinese firms (2011–2022), this study examines the impact of climate policy uncertainty on corporate intelligent transformation, while investigating the moderating effects of external factors (government innovation subsidies) and internal factors (absorptive capacity, human capital) in this relationship.

The marginal contributions of this study are three-fold. First, while existing research has primarily examined CPU’s effects on stock market volatility, investment efficiency, and green innovation [

26,

27,

28], we extend the analysis of CPU’s microeconomic consequences to the domain of intelligent transformation. Second, existing studies on intelligent transformation have largely focused on drivers such as financial support, scientific output, digital infrastructure, and workforce competency [

29,

30,

31]. This paper enriches the literature on intelligent transformation drivers by conceptualizing CPU as an external shock. Third, we reveal synergistic effects among government innovation subsidies, firm absorptive capacity, human capital structure, and CPU in facilitating intelligent transformation. Additionally, heterogeneous responses to CPU are further documented across varying levels of financial support. These findings provide empirical evidence and policy insights for firms to adapt to CPU-driven challenges strategically.

The paper is organized as follows:

Section 2 develops hypotheses regarding the direct impact of CPU on intelligent transformation and its moderating effects.

Section 3 details the research design.

Section 4 presents the empirical analysis, while

Section 5 examines heterogeneous effects. Finally,

Section 6 concludes with policy implications and discussion.

6. Conclusions and Recommendations

6.1. Conclusions

As climate issues become increasingly severe, the importance of climate policies has correspondingly grown. Against the backdrop of accelerated restructuring in global climate governance systems and the concurrent industrial intelligence transformation, climate policy uncertainty (CPU) has become an unavoidable factor in corporate strategic decision-making. Using a sample of A-share, non-financial listed companies from the Shanghai and Shenzhen stock exchanges between 2011 and 2022, this study examines the effects, mechanisms, and heterogeneous impacts of financial support on how CPU influences corporate intelligence transformation levels.

The main research findings are as follows:

- (1)

CPU significantly enhances the level of enterprise intelligent transformation, and the results remain robust after addressing endogeneity concerns, replacing regression models, excluding pandemic effects, and removing municipalities directly under the central government. This suggests that enterprises significantly increase their investment in intelligent transformation technologies to mitigate the risks associated with climate policy adjustments.

- (2)

The increases in government innovation subsidies, improvements in enterprise absorptive capacity, and the accumulation of human capital collectively positively moderate CPU’s promotional effect on intelligent transformation. The influence mechanisms manifest through three pathways: First, government innovation subsidies alleviate corporate financial constraints via dual mechanisms of resource compensation and signal transmission. Second, organizational absorptive capacity facilitates the effective integration of internal and external information through dynamic capability theory. Third, human capital levels enhance technological absorptive capacity through capital–skill complementarity effects. The synergistic interaction between CPU and these three factors amplifies the promotion effect on intelligent transformation.

- (3)

The heterogeneity analysis revealed that enterprises in technology–finance pilot cities, those with higher digital finance development levels, and those led by CEOs with banking experience demonstrate stronger responsiveness of intelligent transformation levels to CPU.

6.2. Policy Implications

Under the climate policy uncertainty, we propose policy recommendations for collaborative efforts between enterprises and governments to advance intelligent transformation.

First, enterprises should fully utilize intelligent transformation technologies to enhance climate risk response capabilities. At the decision-making level, enterprises should integrate intelligent algorithms into policy monitoring systems to construct a climate risk early-warning matrix containing core parameters, such as carbon price fluctuations and regulatory intensity, thereby shortening the policy response cycle. In terms of production processes, enterprises should apply digital twin technology to establish supply chain collaboration platforms, achieving dynamic optimization of resource allocation to effectively buffer production volatility. Furthermore, corporate intelligent transformation requires systematic policy support from the government. Therefore, the government should establish a special risk compensation fund for intelligent transformation, using financial instruments such as subsidized loans to hedge against market risks in corporate technology upgrades. Simultaneously, it should expand the scale of AI innovation pilot zones to promote the regional adoption and application of intelligent response technologies.

Second, the government should improve the precision and transmission efficiency of smart technology innovation subsidies. On the one hand, the hierarchical evaluation mechanism of intelligent technology maturity should be established to focus on providing stepwise subsidy support to enterprises in the critical stage of industrialization. On the other hand, the government subsidy qualification certification should be embedded in the ESG information disclosure framework of enterprises to correct the short-term investment behavior caused by climate policy fluctuations. At the same time, financial institutions should be encouraged to establish a “white list” rapid approval mechanism based on the rating of the intelligent transformation of enterprises to effectively alleviate the financing constraints of R&D investment.

Third, enterprises need to enhance the resilience of intelligent transformation through organizational innovation and talent system optimization. For the upgrading of organizational structure, enterprises should set up full-time policy analysis teams to track industrial policy trends in real time, dynamically adjust R&D budgets and technology upgrading paths, and ensure the accurate allocation of resources. For the construction of talent ecology, the government should take the lead in formulating an intelligent talent ability framework and clarify the core skill requirements of technology–industry integration. At the same time, the government should improve the service mechanism for foreign experts, give tax incentives to enterprises that introduce top talent in the field of intelligence, and promote localized technological innovation.

Fourth, the government should build a diversified financial support system to ensure the sustainability of enterprise intelligent transformation. The government is advised to establish a science and technology credit risk compensation mechanism and a special fund for intelligent transformation and to support the transformation and application of key technologies through blockchain storage technology. Financial institutions are mandated to rely on supply chain finance platforms to provide differentiated financing solutions to focus on alleviating the liquidity pressure of micro-, small-, and medium-sized enterprises. Corporate entities are required to incorporate the financial strategy into the decision-making system, carry out regular training on capital market operations for the management, and cooperate with professional institutions to formulate financing plans for the window period of technology upgrading.

6.3. Limitations and Future Research Directions

While this study advances the understanding of how climate policy uncertainty promotes corporate intelligent transformation, certain research limitations persist due to inherent methodological and conceptual constraints.

First, due to limitations in data timeliness and model constraints, this study primarily focuses on the short-term responses of enterprises under climate policy uncertainty. However, given the lagged coupling between policy iterations and technological updates, future research should expand the exploration of CPU’s long-term dynamic technological effects. Specifically, further studies could introduce threshold regression models to identify critical points in CPU’s impact on enterprise intelligent transformation and examine the differential effects of uncertainty intensity and policy implementation pace on technological change.

Second, this study primarily employs text analysis methods to measure CPU, which can effectively capture regional variations in CPU. However, more precise variable measurement approaches remain to be explored. Future research could differentiate between “ambiguity” and “stringency” in climate policy texts, quantifying the semantic complexity of policies to enhance the reliability and robustness of empirical tests.

Finally, this study primarily examines the moderating effects of capital, knowledge, and talent, as well as the heterogeneity of financial support, while leaving the underlying mechanisms unexplored. Future research could further explore the transmission mechanisms through which enterprises convert policy pressure into technological innovation momentum. Additionally, enriching the heterogeneous characteristics of CPU’s influence on corporate intelligent transformation represents a promising direction for future research innovation. For instance, comparative studies between high-carbon industries and low-carbon service sectors, or between state-owned enterprises’ “policy priority” and private firms’ “market adaptation” strategies, may reveal potential biases in research findings.