Abstract

This study examined how green innovation (GIN), environmental governance (EGR), and renewable energy transition (RET) influence trade-adjusted resource footprints (proxied by material footprint, MFP) in the top 15 Sub-Saharan African (SSA) countries from 1970 to 2022. After confirming the cross-sectional dependence and slope heterogeneity in the dataset, second-generation panel econometric techniques, including the cross-sectionally augmented Dickey–Fuller (CADF) unit root test and Kao cointegration test, were employed to establish stationarity and long-run equilibrium relationships. The Method of Moments Quantile Regression (MMQR) revealed heterogeneous effects across quantiles: GIN exhibited a positive impact on MFP, intensifying at higher quantiles (resource-intensive economies), while GDP per capita (GDPC) reduced MFP, with effects strengthening as quantiles raised. Conversely, EGR and RET exacerbated MFP across all quantiles, suggesting that governance and energy policies may inadvertently spur resource exploitation in SSA’s transitional economies. The Dumitrescu–Hurlin (D-H) causality test confirmed a unidirectional relationship from all independent variables to MFP, highlighting the need for integrated policies to decouple growth from material consumption. This suggests that while governance, innovation, and renewable energy transition influence resource footprints, MFP does not, in turn, impact these factors, reinforcing the importance of proactive policy interventions.

1. Introduction

Sub-Saharan Africa (SSA) is a region rich in natural resources and diverse ecosystems, yet it faces mounting environmental challenges, including deforestation, soil degradation, water scarcity, and air pollution [1,2]. These challenges are exacerbated by rapid population growth, limited access to modern energy sources, and inadequate environmental governance [2,3]. Since the Paris Agreement, countries worldwide have intensified efforts to combat climate change, with many embracing renewable energies, emphasizing self-sufficiency, and prioritizing off-grid solutions [4,5,6]. However, the COVID-19 pandemic and global energy crises have prompted some nations to reassess their climate policies [7,8,9].

Recent international climate summits, such as COP26 and COP27, have reinforced the urgency of transitioning to green energy, fostering innovation, and implementing sustainable resource management practices [10,11]. A crucial aspect of this transition is green innovation, which involves the development and adoption of eco-friendly technologies and sustainable practices [8,12]. In SSA, innovations such as energy-efficient cooking stoves, renewable energy solutions, and sustainable agricultural techniques can help mitigate environmental degradation while enhancing resource efficiency and improving living standards [13,14,15].

Natural resource efficiency plays a pivotal role in economic growth, yet industries dependent on resource extraction and consumption often pose challenges to sustainability [16]. The unsustainable exploitation of materials contributes to the triple planetary crisis—biodiversity loss, resource exhaustion, and environmental degradation [17]. Since 2016, greenhouse gas (GHG) emissions from resource-intensive production have reached 10 gigatons, constituting about 30% of global emissions [18]. To track and mitigate these environmental impacts, assessing natural resource consumption through trade-adjusted material footprint (MFP) is critical [6,9]. This metric accounts for interregional resource transfers driven by global trade networks [6,19].

Global MFP has risen from 7.4 metric tons per capita in 1970 to 12.2 metric tons today, highlighting increasing resource consumption [20]. While many studies have examined factors affecting carbon emissions and ecological footprints [21,22,23,24,25,26], limited research has explored the determinants of trade-adjusted resource footprints. Existing studies have focused on production-based metrics rather than consumption-based environmental impacts [27,28]. Addressing this gap, our study investigates whether green innovation, environmental governance, and renewable energy transition drive trade-adjusted resource footprints in top SSA economies.

Effective environmental governance (EGR) is essential for resource management and sustainability [29,30]. Strong governance frameworks promote responsible resource use, curb illegal activities, and mitigate pollution [31,32]. Conversely, weak governance exacerbates environmental degradation and inefficient resource utilization [3,5,33]. Recent literature evaluates EGR using ecological taxes [34], world governance indicators [5], and the Environmental Policy Stringency (EPS) index, which measures the effectiveness of regulatory frameworks [35].

Technological advancement, particularly green innovation (GIN), is pivotal for reconciling economic growth with sustainability. GIN drives energy efficiency, reduces emissions, and optimizes resource utilization across sectors, most notably in electricity generation, renewable energy storage, and smart grid systems [36,37]. For instance, innovations like electric vehicles and synthetic fuel extraction minimize the ecological toll of traditional extraction and transportation [37,38]. These advancements align with global climate agendas, as underscored by COP26’s emphasis on GIN as a catalyst for renewable energy transitions [39].

Renewable energy transition (RET) is critical in SSA, where many countries rely on fossil fuels and biomass, contributing to both environmental and health risks [9,35]. By investing in renewable energy infrastructure, SSA nations can reduce emissions, enhance energy security, and minimize their resource footprints [40]. The relationship between green innovation, environmental governance, and RET significantly influences trade-adjusted resource footprints in SSA [41]. Understanding this interplay is crucial for crafting policies that balance economic growth with environmental sustainability.

Despite increasing interest in these topics, research gaps persist. Most studies fail to capture the complex causal relationships and synergies among green innovation, environmental governance, and RET in shaping trade-adjusted resource footprints. Additionally, methodologies for assessing trade-adjusted footprints remain inconsistent, limiting cross-country comparisons. Furthermore, the role of international trade and global supply chains in resource utilization has been overlooked [42,43]. Bridging these gaps is essential for informing effective policies for sustainable resource management in SSA.

This study contributes to the literature in several ways. First, it investigates how green energy adoption, sustainable energy transitions, and green innovation enhance SSA’s trade competitiveness in global markets. Second, it provides empirical insights into whether green innovation, environmental governance, and RET drive trade-adjusted resource footprints in SSA. Unlike previous studies that focus on production-based footprints, this study emphasizes consumption-based resource use. Third, the study employs the Method of Moments Quantile Regression (MMQR) approach, which accommodates nonlinear relationships and cross-country heterogeneity, yielding robust findings [44]. The inclusion of SSA countries with diverse economic structures allows for nuanced insights into the relationship between green innovation, environmental governance, RET, and trade-adjusted resource footprints.

2. Literature Review

The quest of sustainable development in Sub-Saharan Africa (SSA) necessitates a comprehensive understanding of the interplay between green innovation (GIN), environmental governance (EGR), and renewable energy transition (RET). While global studies have extensively explored these domains, there remains a paucity of empirical research focusing specifically on SSA, particularly concerning trade-adjusted material footprints (MFP). This review synthesizes existing literature, emphasizing studies pertinent to SSA, to elucidate the relevance of GIN, EGR, and RET in shaping sustainable resource utilization.

Green innovation, encompassing the development and application of eco-friendly technologies, is pivotal in mitigating environmental degradation. Obobisa Chen [45] examined the role of GIN and institutional quality in three African countries, revealing that GIN contributes to CO2 emission reduction, whereas institutional quality’s impact varies across contexts. Similarly, Traoré Ndour [46] highlighted that the diffusion of green technologies in SSA is significantly influenced by institutional frameworks, with efficient governance structures amplifying the positive effects of GIN on environmental performance. These findings underscore the necessity of context-specific policies to foster GIN in SSA.

Effective environmental governance is instrumental in ensuring sustainable resource management. Bambi Batatana [47] employed a dynamic panel data approach to assess the threshold effects of institutions and governance on environmental quality in 25 SSA nations. Their study revealed that beyond a certain point, enhanced governance and institutional quality synergistically reduce ecological footprints. This suggests that strengthening governance structures can mitigate the adverse environmental impacts associated with economic activities. Furthermore, Asongu and Odhiambo [48] emphasized the role of governance indicators, such as regulatory quality and government effectiveness, in curbing CO2 emissions in SSA, advocating for governance reforms to achieve environmental sustainability.

The transition to renewable energy sources is a basis of sustainable development strategies. Studies have indicated that RET can lead to significant reductions in greenhouse gas emissions. For instance, Sarkodie and Adams [49] found that in South Africa, diversifying energy portfolios to include renewable sources mitigated CO2 emissions. However, the effectiveness of RET is contingent upon supportive governance frameworks and technological capabilities. In SSA, challenges such as limited infrastructure and financial constraints hinder the widespread adoption of renewable energy technologies, necessitating targeted interventions to facilitate RET.

Traditional environmental indicators often fail to capture the full extent of resource consumption, particularly in the context of global trade. The material footprint (MF), which accounts for the raw materials used in the production of imported goods, offers a more comprehensive measure of resource use. Wiedmann Schandl [50] demonstrated that MF provides deeper insights into the environmental impacts of consumption patterns, revealing that wealthier nations often externalize resource-intensive production. Despite its relevance, MF has been underutilized in SSA-focused studies, indicating a gap in assessing the true environmental burden associated with consumption in the region.

Recent advancements in econometrics, such as the Method of Moments Quantile Regression (MMQR), have enabled researchers to disentangle complex, nonlinear relationships between variables. For instance, Obobisa Chen [45] utilized the augmented mean group (AMG) and common correlated effects mean group (CCEMG) estimators to uncover the heterogeneous effects of GIN and institutional quality on CO2 emissions, highlighting the nuanced nature of these relationships. Such methods mitigate biases inherent in traditional linear models, which often misrepresent nonlinear dynamics [51,52].

Despite progress, critical gaps persist. Existing studies rarely integrate trade-adjusted MF to reflect actual resource use, and many rely on linear panel estimators that yield misleading results for nonlinear interactions. This study bridges these gaps by employing MF as a robust environmental metric and applying the MMQR framework to analyze asymmetrical impacts of EGR, GIN, and RET on trade-adjusted MF in leading SSA economies. The findings offer actionable insights for sustainable resource management in the region.

3. Materials and Methods

3.1. Description of Data

This study investigates the interplay between green innovation, environmental governance, and renewable energy transition in shaping trade-adjusted resource footprints across 15 leading Sub-Saharan African (SSA) economies from 1970 to 2022. By analyzing these dynamics, the research seeks to identify pathways for enhancing the region’s external trade competitiveness and aligning its growth with global sustainability agendas. To quantify natural resource utilization adjusted for trade effects, the study employed the material footprint metric, a robust proxy for evaluating resource efficiency in international trade contexts [6,53]. Accordingly, environmental governance, a critical pillar of this analysis, is defined as the institutional and policy frameworks that impose explicit or implicit costs on environmental degradation [6,54,55]. This includes regulatory mechanisms, enforcement practices, and fiscal instruments designed to incentivize sustainable resource management. Complementing this, the study evaluates how green innovation—such as eco-friendly technologies and circular economy practices—and renewable energy adoption (e.g., solar, wind, and hydropower) mitigate resource overconsumption and reduce reliance on fossil fuels. The full description and units of measurement of the study parameters are depicted in Table 1.

Table 1.

Summary of the variables.

3.2. Theoretical Framework and Empirical Modeling

Building on the theoretical foundations of the IPAT model [56], this study examines the determinants of trade-adjusted resource consumption, measured through the material footprint, in Sub-Saharan Africa (SSA). The IPAT framework posits that environmental impact is a function of population, affluence, and technology. Extending this model, the study incorporates critical contemporary factors such as green innovation, environmental governance, renewable energy transition, and economic development, as highlighted in recent literature [6,27,57]. These elements are essential for understanding how SSA nations can decouple economic growth from resource overexploitation while enhancing trade competitiveness in a globalized economy.

The proposed model is expressed in Equation (1) in the following functional form:

where is the material footprint which represents the dependent variable. EGR denotes environmental governance, GIN represent green innovations; RET signifies renewable energy transition; and GDPC represents GDP per capita. To enhance the accuracy of data interpretation and mitigate issues associated with heteroscedasticity and multicollinearity, the variables MFP, GIN, and GDPC were transformed using their natural logarithms, as illustrated in Equation (2). This logarithmic transformation stabilizes the data by reducing volatility and improving consistency, thereby addressing potential statistical challenges and ensuring more reliable analysis.

The coefficients of the explanatory variables are denoted with “, , , , ”. While is used as a constant. The and denote the cross-section of SSA countries, and time (1970–2022), respectively. is the error term that represents all other variables not included in the model and must be identically, independently distributed around zero mean and constant variance (iid~0,1).

High economic growth is often driven by energy-intensive activities, which significantly increase the demand for natural resources. This reliance on resource-heavy industries exacerbates environmental challenges, including resource depletion, pollution, and delayed transitions to green economies [58]. Such trends underscore the urgent need to prioritize ecological sustainability and promote efficient resource consumption [59]. Environmental governance plays a pivotal role in addressing these challenges. By implementing robust policies and regulatory frameworks, it helps control resource depletion, accelerates the transition to renewable energy, and mitigates the adverse effects of economic activities on the material footprint [33]. These measures are essential for fostering sustainable development and ensuring that economic growth aligns with environmental preservation.

3.3. Empirical Background

Before proceeding with econometric estimation, it is essential to conduct preliminary diagnostic tests to determine the appropriate model specification and ensure the robustness of the empirical results. These pre-estimation tests are critical for addressing potential data issues, such as cross-sectional dependency (CSD), heterogeneity, and non-stationarity, which, if ignored, could lead to biased or inconsistent estimates [59,60].

3.3.1. Cross-Section Dependence and Slope Heterogeneity Tests

The first step in the pre-estimation analysis is to test for cross-sectional dependency (CSD) in the dataset. CSD arises when countries in the panel are influenced by common external shocks, spatial spillovers, or unobserved global factors, leading to correlated errors across cross-sections. Ignoring CSD can result in inefficient estimates and misleading inferences [61,62].

To detect CSD, this study employs the Pesaran [62] CSD test, which is robust to heterogeneous panels and suitable for datasets with large N (cross-sections) and T (time periods). The test statistic is calculated as follows:

where CSD denotes cross-sectional dependency test statistic, T represents time dimension, N is the number of cross-sections (SSA countries), and pairwise correlation coefficients of residuals from individual regressions. The null hypothesis of the test assumes no cross-sectional dependency (, while alternative hypothesis suggests the presence of CSD (.

Slope heterogeneity refers to the variation in the relationship between independent and dependent variables across different groups or units within a panel dataset. Testing for slope heterogeneity ensures the robustness and relevance of the model, particularly in heterogeneous regions like SSA. By applying tests such as the Pesaran–Yamagata or Swamy tests, researchers can tailor their econometric approach to better reflect real-world diversity, thereby enhancing the credibility of their policy recommendations [63]. The null hypothesis suggests that all slope coefficients are homogeneous across cross-sectional units, whereas the alternative hypothesis posits that at least one cross-sectional unit has a different slope coefficient.

3.3.2. Unit Root and Cointegration Tests

To ensure the robustness of the empirical analysis, this study evaluates the stationarity properties of the variables—MFP, EGR, GIN, RET, and GDPC—using unit root tests. These tests are critical for confirming the integration order of the variables and avoiding spurious regression results. Traditional first-generation unit root tests (e.g., ADF, PP) are unsuitable for this analysis, as they fail to account for CSD, a common issue in panel datasets where countries are influenced by shared global shocks or spatial interdependencies [64]. Second-generation unit root tests, however, address these limitations by explicitly modeling CSD and slope heterogeneity, thereby producing reliable and unbiased results [61]. This study employed the cross-sectionally augmented Dickey–Fuller (CADF) test, a second-generation test that incorporates cross-sectional averages to mitigate dependency issues. The CADF regression equation is specified as follows:

where is the first difference of variable Y for country i at time t. The country-specific intercept is represents by . The coefficient of the lagged level term is denoted by represents the cross-sectional average of across all countries and lagged differences of cross-sectional averages.

To validate the presence of a long-term equilibrium relationship among the variables, this study conducted cointegration tests in the final pre-estimation step. These tests were fundamental in econometric analysis, as they determined whether non-stationary variables shared a stable, linear association over time, even if individual series exhibit short-term deviations [65]. Specifically, we employed the Kao [66] cointegration test, which was tailored for heterogeneous panel data. The Kao test evaluates the null hypothesis of no cointegration (H0) against the alternative hypothesis of cointegration (H1). Its augmented Dickey–Fuller (ADF) regression equation is specified as follows:

The meanings of and remain the same as in Equation (4). p denotes the coefficient testing stationarity of residuals (cointegration exists if ρ < 0ρ < 0), while is the lagged difference terms to correct for serial correlation.

3.3.3. Method of Moments Quantile Regression (MMQR)

This study employed the Method of Moments Quantile Regression (MMQR) proposed by Machado and Santos Silva [67] to investigate heterogeneous and distributional effects across various quantile levels. The MMQR framework is particularly advantageous in analyzing asymmetric relationships and nonlinear dynamics in panel data, as it combines the robustness of quantile regression with the flexibility of the method of moments [67,68]. MMQR performs well with skewed or heavy-tailed distributions, common in fields like finance and environmental economics, where Gaussian assumptions often fail [69]. Unlike traditional quantile methods, MMQR accommodates cross-sectional heterogeneity, endogeneity, and heteroskedasticity while generating non-crossing quantile estimates, ensuring interpretability and reliability in complex empirical settings [69,70,71]. The MMQR model employed in this study is presented in Equation (6).

where is the τth quantile of Yit conditional on covariate Xit. The quantile-specific intercepts capturing unobserved heterogeneity is denoted by . and represent coefficients for independent variable Xit, varying across quantiles and vector of covariates, respectively.

The MMQR approach was selected due to its ability to capture heterogeneous effects of explanatory variables on MFP across different levels of resource consumption. Unlike traditional quantile regression (QR), which estimates conditional quantiles individually, MMQR with fixed effects accounts for both cross-sectional dependence and within-panel heterogeneity. Alternative methods such as Bayesian Quantile Regression (BQR) and Quantile-on-Quantile Regression (QQR) were considered, but they pose limitations in handling unobserved heterogeneity in large panels. While BQR provides robust posterior inference, it requires strong prior assumptions, which may introduce biases. QQR, on the other hand, is computationally intensive and more suitable for nonlinear bivariate relationships rather than multi-predictor panel data models. Additionally, MMQR accommodates location-based asymmetries and provides extensive information when generating non-crossing estimates in quantile regression (Awan et al., 2022; Hossain et al., 2024) [69,70]. MMQR-FE was thus preferred as it efficiently estimates conditional quantiles while addressing bias from unobserved heterogeneity, making it well-suited for this study’s panel dataset (1970–2022) of 15 SSA economies.

3.3.4. Dumitrescu–Hurlin (D–H) Panel Causality

To complement the cointegration findings and unravel the direction of causal relationships between variables, this study employed the Dumitrescu–Hurlin (D–H) panel causality test [72]. This method is particularly suited for heterogeneous panel datasets and tests for both unidirectional and bidirectional causality. Understanding causal linkages is critical for policymaking, as it clarifies whether interventions targeting one variable (e.g., green innovation) will predictably influence another (e.g., material footprint) or if feedback effects exist. This method employed separate Wald statistics to test for causality, as outlined in Equation (7).

4. Results and Discussion

4.1. Descriptive Statistics Results

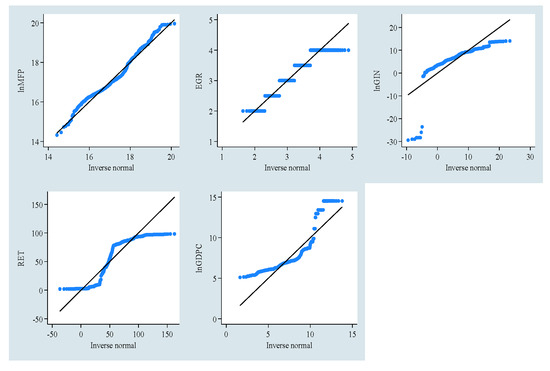

The descriptive statistics of the variables are summarized in Table 2. Notably, the MFP exhibited the highest mean and standard deviation, reflecting significant variability in resource consumption across the sample. In contrast, EGR showed the lowest mean value, suggesting limited institutional capacity to address ecological degradation in the region. Furthermore, MFP, GIN, and GDPC displayed wide ranges between their minimum and maximum values, indicating substantial disparities in these metrics across SSA countries. The non-normal distribution of the data, as visually confirmed by the quantile-quantile (Q-Q) plot in Figure 1, justifies the use of the MMQR over conventional regression methods [71,73]. This approach is robust to non-Gaussian data and provides nuanced insights across quantiles.

Table 2.

Descriptive statistics of the variables used.

Figure 1.

Quantile–quantile (Q-Q) plot.

4.2. Results of CSD and Slope Heterogeneity Tests

Table 3 presents the correlation matrix for the variables. The strongest pairwise correlation was observed between GIN and RET at 0.182, confirming the absence of multicollinearity concerns. To address CSD, the Pesaran, Friedman, and Frees tests were applied (Table 4). All tests unanimously rejected the null hypothesis of cross-sectional independence, underscoring the need for second-generation econometric techniques that account for interdependencies among SSA nations. From the middle half of Table 4, the slope heterogeneity test results indicate significant variation in the slope coefficients across different groups. Both the Pesaran–Yamagata and Blomquist–Westerlund tests strongly rejected the null hypothesis of homogeneity, with p-values well below 0.01. This finding confirms that the relationship between independent and dependent variables varies across the groups, highlighting the importance of accounting for these differences in the model to ensure accuracy and relevance in heterogeneous contexts.

Table 3.

Correlation matrix of the variables.

Table 4.

CSD and slope heterogeneity tests.

4.3. Results of Unit Root and Cointegration Tests

A key role of the CADF panel unit root test is to assess the stationarity of variables in the presence of CSD, which was previously detected in the dataset. As shown in Table 5, the CADF test confirms that all variables—material footprint, environmental governance, green innovation, renewable energy transition, and GDP per capita—achieved stationarity at both level and first difference. This outcome validates the suitability of the dataset for subsequent cointegration analysis.

Table 5.

Stationarity test (CADF).

Following the stationarity confirmation, the study proceeded to evaluate long-run equilibrium relationships among the variables using the Kao cointegration test. In panel cointegration analysis, H0 posits no cointegration, while H1 asserts the existence of a stable long-term relationship. The Kao test results, summarized in Table 6, decisively rejected H0 (p < 0.01), providing robust statistical evidence of cointegration among MFP, EGR, GIN, RET, and GDPC. This finding implies that these variables share a systematic equilibrium relationship over time, despite short-term deviations. Consequently, the analysis can proceed to advanced econometric techniques, such as error correction models, to quantify long- and short-term dynamics.

Table 6.

Cointegration test (Kao).

4.4. The Results of MMQR

This study employed the MMQR to analyze the heterogeneous impacts of environmental governance (EGR), green innovation (GIN), renewable energy transition (RET), and GDP per capita (GDPC) on the material footprint (MFP) across nine quantiles (10th to 90th) following the confirmation of long-run cointegration among the variables. The quantiles are categorized into three tiers: lower (10th, 20th, 30th), intermediate (40th, 50th, 60th), and high (70th, 80th, 90th), representing low, moderate, and elevated resource consumption levels, respectively. This approach enables a comprehensive examination of how these factors differentially influence MFP, offering critical insights for tailored policy interventions in SSA nations, where resource use patterns and institutional capacities vary widely across nations.

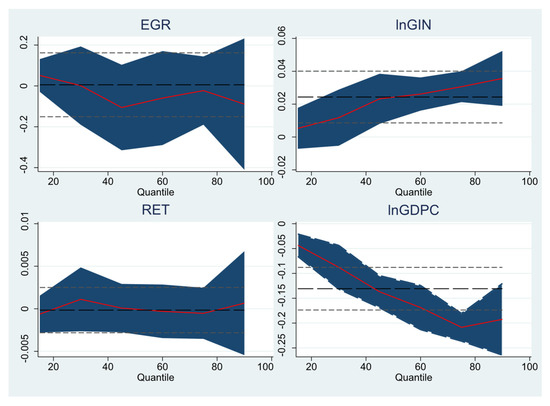

Table 7 summarizes the results of the MMQR, while Figure 2 illustrates the quantile-specific effects of the investigated variables. The consistent positive and statistically significant impact of GIN on the MFP across all quantiles, particularly intensifying at higher quantiles, indicates a rebound effect. This phenomenon occurs when efficiency gains from green technologies inadvertently lead to increased resource consumption due to behavioral or systemic responses [74]. Within the IPAT framework, technological change (T) can either mitigate or exacerbate environmental impact depending on its application. The observed positive relationship between GIN and MFP suggests that, in high-consuming economies, the deployment of green innovations may initially drive-up resource use before delivering efficiency gains. This underscores the paradoxical role of technology within the IPAT model, where eco-innovation, while aimed at sustainability, can lead to increased material consumption if not accompanied by complementary measures. For instance, renewable energy adoption in high-quantile nations may reduce per-unit material use but expand overall energy consumption, offsetting net sustainability benefits. Similar dynamics have been observed in advanced economies, such as the EU, Japan, and the U.S., where green innovations initially lower footprints but eventually drive resource-intensive growth [75,76,77]. In SSA, the adoption of green technologies may initially reduce per-unit material use but subsequently stimulate higher overall consumption and production scales, thereby offsetting net sustainability benefits [26,52]. This underscores the necessity for policies that not only promote green innovation, but also address consumption behaviors and systemic factors contributing to increased material use.

Table 7.

MMQREG results.

Figure 2.

Main results of the MMQREG.

In line with the IPAT framework, where affluence is a principal driver of environmental impact, GDP per capita significantly affects MFP at the 1% level across all quantiles, with coefficients ranging from 0.036 to 0.245. This confirms the scale effect of affluence at lower quantiles and a decoupling effect at higher income levels, consistent with both the EKC and the IPAT model’s emphasis on affluence-induced environmental pressure [78]. At lower and intermediate quantiles (10th–60th), representing low- and middle-income SSA economies, GDPC positively correlates with MFP. This reflects the scale effect of early industrialization, where resource-intensive sectors dominate growth, increasing material consumption [26]. Countries like Nigeria and Kenya, with a GDPC below the EKC turning point, rely on extractive industries (e.g., mining, fossil fuels), exacerbating trade-adjusted footprints [9]. Beyond the 70th quantile (e.g., South Africa and Mauritius), GDPC negatively impacts MFP, aligning with the technique and composition effects of the EKC. Economic advancement fosters GIN and EGR, enabling dematerialization. The emergence of a negative coefficient at higher quantiles confirms that, above a critical income threshold, economic growth curbs material footprint expansion through technological innovation, resource efficiency, and structural transformation [1,22]. This trend underscores the viability of sustainable development, demonstrating that higher-income SSA nations can decouple economic growth from resource exploitation through policy-driven advancements.

The observed positive influence of EGR on MFP in lower and intermediate quantiles, transitioning to a negative effect in higher quantiles, highlights the complexity of governance dynamics in SSA. In lower-income, resource-intensive economies, environmental governance may inadvertently drive resource use due to compliance costs and transitional inefficiencies. Weak enforcement, corruption, and institutional inefficiencies often compromise the effectiveness of environmental policies. Conversely, in higher-income SSA nations, robust governance frameworks can effectively curb material footprints by promoting sustainable practices and innovation. This dichotomy emphasizes the need to distinguish between the quality of governance structures and their actual outcomes, advocating for capacity building and institutional strengthening to enhance policy effectiveness across different economic contexts. Although the result is not statistically significant, it aligns with the EKC theory, highlighting the need for adaptive, context-specific governance strategies. Several studies validate the EKC theory in different regions, countries, and trade blocs [25,35]. In addition, EGR aims to regulate resource consumption, its effectiveness is often compromised by weak enforcement, corruption, and institutional inefficiencies [3]. Many SSA nations implement environmental policies reactively rather than proactively, leading to governance-induced resource inefficiencies. For example, increased environmental regulations in Nigeria and Ghana have sometimes resulted in higher compliance costs, which industries offset by increasing production scales, thereby raising material use.

The consistently negative association of RET with MFP across quantiles, albeit marginal at higher quantiles, indicates that renewable energy adoption contributes to reducing material consumption, particularly in lower-quantile, resource-intensive economies. However, the diminishing effect at higher quantiles suggests a saturation point in sustainability gains, where advanced nations may require supplementary measures, such as circular economy practices, to further reduce footprints. Additionally, the shift toward renewable energy infrastructure is inherently resource-intensive, demanding significant quantities of materials like lithium and cobalt. SSA nations, often reliant on imported renewable energy technology, may experience higher trade-adjusted footprints due to supply chain dependencies. This highlights the importance of developing local processing capacities and value chains to mitigate environmental impacts and enhance economic benefits [5,38]. Policymakers in low-quantile SSA countries should prioritize scaling RET to maximize material efficiency, while high-quantile nations must innovate beyond current systems. This underscores the need for tiered strategies to align energy transitions with sustainable material use globally [79]. While RET is expected to reduce environmental degradation, the shift toward solar, wind, and hydro energy infrastructure is highly resource-intensive [40]. The demand for rare metals (e.g., lithium, cobalt) and construction materials increases short-term material footprints before long-term sustainability gains can be realized. SSA nations relying on imported renewable energy technology may also experience higher trade-adjusted footprints due to supply chain dependencies.

4.5. Robutness Check

Table 8 reports the results of the robustness checks conducted using the Fully Modified Ordinary Least Squares (FMOLS) and Dynamic Ordinary Least Squares (DOLS) estimators. The direction of the coefficients remains consistent with the MMQR estimates, with only minor variations in magnitude. Notably, GIN and GDPC retain their statistical significance across both models, with coefficients of 0.159 and 0.317 in the FMOLS estimation, and 0.703 and 0.289 in the DOLS estimation, respectively. Furthermore, RET and EGR also emerge as statistically significant, at the 1% and 5% levels, respectively. These findings confirm the robustness of the core results and reinforce the central role of green innovation, renewable energy transition, and economic growth in shaping material footprint outcomes in Sub-Saharan Africa.

Table 8.

Robustness check.

4.6. Results of the Dumitrescu–Hurlin (D–H) Panel Causality Test

This study established long-run cointegration among MFP, EGR, GIN, RET, and GDP per capita. To address the undetermined causal direction, the Dumitrescu–Hurlin (D–H) panel causality test was applied. As shown in Table 9, unidirectional causality flowed from EGR, GIN, RET, and GDPC to MFP, confirming these factors as significant drivers of material footprint escalation in the sampled African economies. The unidirectional causality underscores that enhancing environmental governance, green innovation, renewable energy adoption, and economic development can directly curb material footprints in Africa. SSA countries should prioritize these levers to decouple growth from resource exploitation. However, the absence of feedback effects (e.g., MFP → EGR) suggests that interventions must proactively target governance and technology rather than relying on self-correcting mechanisms. This aligns with SDGs, advocating for integrated strategies to balance economic progress with ecological preservation in resource-intensive regions.

Table 9.

Causality test (Dumitrescu–Hurlin).

5. Conclusions

This study reveals critical insights into the drivers of trade-adjusted resource footprints (MFPs) in Sub-Saharan Africa (SSA), highlighting the complex interplay between green innovation (GIN), environmental governance (EGR), renewable energy transition (RET), and economic development (GDPC). Using a dataset from 15 top Sub-Saharan African (SSA) economies from 1970 to 2022, the study employed the Method of Moments Quantile Regression. The quantile-based analysis demonstrates that while GDPC reduced material footprints more effectively in high-resource-consuming economies (upper quantiles), green innovation paradoxically exacerbated MFP, particularly in resource-intensive contexts. Environmental governance and renewable energy transition, despite their sustainability intentions, worsened material footprints across all quantiles, likely due to transitional inefficiencies and policy misalignment. The study highlights the one-way relationship between economic growth, environmental governance, energy transition, and material footprints, necessitating holistic strategies to address resource exploitation in SSA.

Based on the results above, we propose the following policy implications.

Circular economy frameworks should be prioritized by supporting regional innovation hubs and community-based initiatives that promote resource-efficient, low-cost technologies suited for informal and rural economies. Adaptive innovation and localized recycling solutions should be encouraged to mitigate rebound effects from green technologies and reduce dependence on imported technologies. These efforts should align with Agenda 2063’s Aspiration 1 for inclusive growth and sustainable development.

Enforcement capacity should be enhanced by investing in local institutional frameworks for waste management and environmental monitoring, particularly in informal urban settlements. Ecological fiscal reforms such as material footprint levies and subsidies for low-resource enterprises should be introduced, while harmonizing environmental standards across SSA to curb regulatory arbitrage. This aligns with SDG 12 (Responsible Consumption and Production) and the African Continental Free Trade Area (AfCFTA) environmental provisions.

Decentralized renewable energy solutions like off-grid solar, mini-grids, and hybrid systems tailored to SSA’s infrastructural constraints should be promoted. Renewable infrastructure projects should be ensured to meet resource efficiency standards to prevent excessive extraction of critical minerals. Renewable energy subsidies should be linked to circular economy milestones and job creation targets in local value chains, contributing to SDG 7 (Affordable and Clean Energy) and Agenda 2063’s green industrialization goals.

High-growth sectors should be channeled into dematerialized economic activities such as digital services, e-commerce, and knowledge-based industries, reducing dependence on resource-intensive production. Green GDP accounting frameworks should be institutionalized to track and incentivize reductions in material intensity per unit of economic output, in line with SDG 8 (Decent Work and Economic Growth) and SDG 13 (Climate Action).

Material footprint reduction targets should be integrated within SSA’s regional development frameworks, particularly the African Union’s Green Recovery Action Plan and Agenda 2063 implementation strategies. Synergistic policies linking renewable energy transitions (RET) and green innovation (GIN) milestones to financial incentives, capacity-building programs, and technology transfer partnerships tailored for SSA contexts should be developed.

Limitations

This study acknowledges three key limitations. First, the use of CPIA ratings for environmental governance oversimplifies a multidimensional concept by excluding enforcement capacity, corruption, and fiscal incentives. Second, measuring green innovation through patent counts captures only formal sector activity, neglecting informal and grassroots innovations common in SSA. Third, the selection of the “top 15 SSA countries” may introduce sampling bias, limiting the generalizability of the findings. Future research should adopt more nuanced governance indicators, alternative innovation measures, and broader country coverage to enhance robustness.

Author Contributions

Conceptualization, K.A.A.D. and W.M.S.K.; methodology, K.A.A.D. and W.M.S.K.; software, K.A.A.D. and W.M.S.K.; validation K.A.A.D. and W.M.S.K.; formal analysis, K.A.A.D. and W.M.S.K.; investigation K.A.A.D. and W.M.S.K.; resources, K.A.A.D. and W.M.S.K.; data curation, K.A.A.D. and W.M.S.K.; writing—original draft preparation, K.A.A.D. and W.M.S.K.; writing—review and editing, K.A.A.D. and W.M.S.K.; visualization, K.A.A.D. and W.M.S.K.; supervision, W.M.S.K.; project administration, W.M.S.K. All authors have read and agreed to the published version of the manuscript.

Funding

The research received no external funding.

Institutional Review Board Statement

Not Applicable.

Informed Consent Statement

Not Applicable.

Data Availability Statement

Upon request, the corresponding author will make the data available at the University of Mediterranean Kapasia.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Kelly, A.M.; Nembot Ndeffo, L. Understanding the nexus: Economic complexity and environmental degradation in Sub-Saharan Africa. Clean Technol. Environ. Policy 2024, 23, 423–437. [Google Scholar] [CrossRef]

- Giyoh Gideon, N.; Dobdinga Cletus, F.; Boniface Ngah, E. Inclusive Human Development in Sub-Sahara Africa: Does the Environmental Quality Matter? Stud. Soc. Sci. Humanit. 2024, 3, 35–47. [Google Scholar]

- Asongu, S.A.; Odhiambo, N.M. Governance, CO2 emissions and inclusive human development in sub-Saharan Africa. Energy Explor. Exploit. 2020, 38, 18–36. [Google Scholar] [CrossRef]

- Chen, J.; Hu, X.; Razi, U.; Rexhepi, G. The sustainable potential of efficient air-transportation industry and green innovation in realising environmental sustainability in G7 countries. Econ. Res.-Ekon. Istraživanja 2022, 35, 3814–3835. [Google Scholar] [CrossRef]

- Hamid, I.; Alam, M.S.; Kanwal, A.; Jena, P.K.; Murshed, M.; Alam, R. Decarbonization pathways: The roles of foreign direct investments, governance, democracy, economic growth, and renewable energy transition. Environ. Sci. Pollut. Res. 2022, 29, 49816–49831. [Google Scholar] [CrossRef]

- Ozturk, I.; Razzaq, A.; Sharif, A.; Yu, Z. Investigating the impact of environmental governance, green innovation, and renewable energy on trade-adjusted material footprint in G20 countries. Resour. Policy 2023, 86, 104212. [Google Scholar] [CrossRef]

- Jiang, C.; Zhang, Y.; Razi, U.; Kamran, H.W. The asymmetric effect of COVID-19 outbreak, commodities prices and policy uncertainty on financial development in China: Evidence from QARDL approach. Econ. Res.-Ekon. Istraživanja 2022, 35, 2003–2022. [Google Scholar] [CrossRef]

- Heidenreich, S.; Spieth, P.; Petschnig, M. Ready, Steady, Green: Examining the Effectiveness of External Policies to Enhance the Adoption of Eco-Friendly Innovations. J. Prod. Innov. Manag. 2017, 34, 343–359. [Google Scholar] [CrossRef]

- Aliyu, U.S.; Ozdeser, H.; Çavuşoğlu, B.; Usman, M.A. Food Security Sustainability: A Synthesis of the Current Concepts and Empirical Approaches for Meeting SDGs. Sustainability 2021, 13, 11728. [Google Scholar] [CrossRef]

- Lokotola, C.L.; Mash, R.; Naidoo, K.; Mubangizi, V.; Mofolo, N.; Schwerdtle, P.N. Climate change and primary health care in Africa: A scoping review. J. Clim. Change Health 2023, 11, 100229. [Google Scholar] [CrossRef]

- IPPC. Climate Change 2022: Impacts, Adaptation and Vulnerability. In Fact Sheet; WHO, UNEP: Nairobi, Kenya, 2022. [Google Scholar]

- Shahzad, M.; Qu, Y.; Rehman, S.U.; Zafar, A.U. Adoption of green innovation technology to accelerate sustainable development among manufacturing industry. J. Innov. Knowl. 2022, 7, 100231. [Google Scholar] [CrossRef]

- Reynolds, T.W.; Waddington, S.R.; Anderson, C.L.; Chew, A.; True, Z.; Cullen, A. Environmental impacts and constraints associated with the production of major food crops in Sub-Saharan Africa and South Asia. Food Secur. 2015, 7, 795–822. [Google Scholar] [CrossRef]

- Hishan, S.S.; Sasmoko; Khan, A.; Ahmad, J.; Hassan, Z.B.; Zaman, K.; Qureshi, M.I. Access to clean technologies, energy, finance, and food: Environmental sustainability agenda and its implications on Sub-Saharan African countries. Environ. Sci. Pollut. Res. 2019, 26, 16503–16518. [Google Scholar] [CrossRef]

- Jiang, N.; Nuţă, A.C.; Zamfir, C.G. Literacy rate impact on innovations and environmental pollution in China. Front. Environ. Sci. 2023, 11, 1154052. [Google Scholar] [CrossRef]

- Groves, D.I.; Santosh, M.; Zhang, L. Net zero climate remediations and potential terminal depletion of global critical metal resources: A synoptic geological perspective. Geosyst. Geoenviron. 2023, 2, 100136. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Hughes, L.; Kar, A.K.; Baabdullah, A.M.; Grover, P.; Abbas, R.; Andreini, D.; Abumoghli, I.; Barlette, Y.; Bunker, D.; et al. Climate change and COP26: Are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. Int. J. Inf. Manag. 2022, 63, 102456. [Google Scholar] [CrossRef]

- Bhatt, R.P. Achievement of SDGS globally in biodiversity conservation and reduction of greenhouse gas emissions by using green energy and maintaining forest cover. GSC Adv. Res. Rev. 2023, 17, 001–021. [Google Scholar] [CrossRef]

- Arora, N.K.; Mishra, I. COP26: More challenges than achievements. Environ. Sustain. 2021, 4, 585–588. [Google Scholar] [CrossRef]

- United Nations. SDG Indicators: Regional Groupings Used in Report and Statistical Annex; United Nations: New York, NY, USA, 2022.

- Hao, L.-N.; Umar, M.; Khan, Z.; Ali, W. Green growth and low carbon emission in G7 countries: How critical the network of environmental taxes, renewable energy and human capital is? Sci. Total Environ. 2021, 752, 141853. [Google Scholar] [CrossRef]

- Jahanger, A.; Usman, M.; Murshed, M.; Mahmood, H.; Balsalobre-Lorente, D. The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 2022, 76, 102569. [Google Scholar] [CrossRef]

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and International trade in G7 countries: The role of Environmental innovation and Renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef]

- Samour, A.; Pata, U.K. The impact of the US interest rate and oil prices on renewable energy in Turkey: A bootstrap ARDL approach. Environ. Sci. Pollut. Res. 2022, 29, 50352–50361. [Google Scholar] [CrossRef]

- Usman, M.; Kousar, R.; Yaseen, M.R.; Makhdum, M.S.A. An empirical nexus between economic growth, energy utilization, trade policy, and ecological footprint: A continent-wise comparison in upper-middle-income countries. Environ. Sci. Pollut. Res. 2020, 27, 38995–39018. [Google Scholar] [CrossRef]

- Abdullahi, N.M.; Ibrahim, A.A.; Zhang, Q.; Huo, X. Dynamic linkages between financial development, economic growth, urbanization, trade openness, and ecological footprint: An empirical account of ECOWAS countries. Environ. Dev. Sustain. 2024. [Google Scholar] [CrossRef]

- Shao, S.; Razzaq, A. Does composite fiscal decentralization reduce trade-adjusted resource consumption through institutional governance, human capital, and infrastructure development? Resour. Policy 2022, 79, 103034. [Google Scholar] [CrossRef]

- Sun, Y.; Ajaz, T.; Razzaq, A. How infrastructure development and technical efficiency change caused resources consumption in BRICS countries: Analysis based on energy, transport, ICT, and financial infrastructure indices. Resour. Policy 2022, 79, 102942. [Google Scholar] [CrossRef]

- Safdar, S.; Khan, A.; Andlib, Z. Impact of good governance and natural resource rent on economic and environmental sustainability: An empirical analysis for South Asian economies. Environ. Sci. Pollut. Res. 2022, 29, 82948–82965. [Google Scholar] [CrossRef]

- Young, O.R. Environmental Governance: The Role of Institutions in Causing and Confronting Environmental Problems. Int. Environ. Agreem. 2003, 3, 377–393. [Google Scholar] [CrossRef]

- Tatar, M.; Harati, J.; Farokhi, S.; Taghvaee, V.; Wilson, F.A. Good governance and natural resource management in oil and gas resource-rich countries: A machine learning approach. Resour. Policy 2024, 89, 104583. [Google Scholar] [CrossRef]

- Manigandan, P.; Alam, M.S.; Murshed, M.; Ozturk, I.; Altuntas, S.; Alam, M.M. Promoting sustainable economic growth through natural resources management, green innovations, environmental policy deployment, and financial development: Fresh evidence from India. Resour. Policy 2024, 90, 104681. [Google Scholar] [CrossRef]

- Wang, X.; Huang, Y. The heterogeneous impact of environmental regulations on low-carbon economic transformation in China: Empirical research based on the mediation effect model. Greenh. Gases Sci. Technol. 2021, 11, 81–102. [Google Scholar] [CrossRef]

- Tao, R.; Umar, M.; Naseer, A.; Razi, U. The dynamic effect of eco-innovation and environmental taxes on carbon neutrality target in emerging seven (E7) economies. J. Environ. Manag. 2021, 299, 113525. [Google Scholar] [CrossRef]

- Nathaniel, S.P.; Murshed, M.; Bassim, M. The nexus between economic growth, energy use, international trade and ecological footprints: The role of environmental regulations in N11 countries. Energy Ecol. Environ. 2021, 6, 496–512. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Oladipupo, S.D.; Adeshola, I.; Rjoub, H. Wavelet analysis of impact of renewable energy consumption and technological innovation on CO(2) emissions: Evidence from Portugal. Environ. Sci. Pollut. Res. Int. 2022, 29, 23887–23904. [Google Scholar] [CrossRef]

- Wurlod, J.-D.; Noailly, J. The impact of green innovation on energy intensity: An empirical analysis for 14 industrial sectors in OECD countries. Energy Econ. 2018, 71, 47–61. [Google Scholar] [CrossRef]

- Østergaard, P.A.; Duic, N.; Noorollahi, Y.; Kalogirou, S.A. Recent advances in renewable energy technology for the energy transition. Renew. Energy 2021, 179, 877–884. [Google Scholar] [CrossRef]

- Usman, M.; Jahanger, A.; Makhdum, M.S.A.; Balsalobre-Lorente, D.; Bashir, A. How do financial development, energy consumption, natural resources, and globalization affect Arctic countries’ economic growth and environmental quality? An advanced panel data simulation. Energy 2022, 241, 122515. [Google Scholar] [CrossRef]

- Bishoge, O.K.; Kombe, G.G.; Mvile, B.N. Renewable energy for sustainable development in sub-Saharan African countries: Challenges and way forward. J. Renew. Sustain. Energy 2020, 12, 052702. [Google Scholar] [CrossRef]

- Erdogan, S. On the impact of natural resources on environmental sustainability in African countries: A comparative approach based on the EKC and LCC hypotheses. Resour. Policy 2024, 88, 104492. [Google Scholar] [CrossRef]

- Liu, Y.; Lin, Z. Impact of regional trade integration and energy transition on natural resources footprints in Asian Countries. Resour. Policy 2024, 89, 104545. [Google Scholar] [CrossRef]

- Hossain, M.R.; Dash, D.P.; Das, N.; Hossain, M.E.; Haseeb, M.; Cifuentes-Faura, J. Do Trade-Adjusted Emissions Perform Better in Capturing Environmental Mishandling among the Most Complex Economies of the World? Environ. Model. Assess. 2024, 30, 87–105. [Google Scholar] [CrossRef]

- Zhao, X.; Samour, A.; AlGhazali, A.; Wang, W.; Chen, G.J.R.P. Exploring the impacts of natural resources, and financial development on green energy: Novel findings from top natural resources abundant economies. Resour. Policy 2023, 83, 103639. [Google Scholar] [CrossRef]

- Obobisa, E.S.; Chen, H.; Mensah, I.A. The impact of green technological innovation and institutional quality on CO2 emissions in African countries. Technol. Forecast. Soc. Change 2022, 180, 121670. [Google Scholar] [CrossRef]

- Traoré, A.; Ndour, C.T.; Asongu, S.A. Promoting environmental sustainability in Africa: Evidence from governance synergy. Clim. Dev. 2023, 16, 321–334. [Google Scholar] [CrossRef]

- Bambi, P.D.R.; Batatana, M.L.D.; Appiah, M.; Tetteh, D. Governance, institutions, and climate change resilience in Sub-Saharan Africa: Assessing the threshold effects. Front. Environ. Sci. 2024, 12, 1352344. [Google Scholar] [CrossRef]

- Asongu, S.A.; Odhiambo, N.M. Enhancing governance for environmental sustainability in sub-Saharan Africa. Energy Explor. Exploit. 2020, 39, 444–463. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Adams, S. Renewable energy, nuclear energy, and environmental pollution: Accounting for political institutional quality in South Africa. Sci. Total Environ. 2018, 643, 1590–1601. [Google Scholar] [CrossRef]

- Wiedmann, T.O.; Schandl, H.; Lenzen, M.; Moran, D.; Suh, S.; West, J.; Kanemoto, K. The material footprint of nations. Proc. Natl. Acad. Sci. USA 2015, 112, 6271–6276. [Google Scholar] [CrossRef]

- Dada, J.T.; Ajide, F.M.; Arnaut, M. Income inequality, shadow economy and environmental degradation in Africa: Quantile regression via moment’s approach. Int. J. Dev. Issues 2023, 22, 214–240. [Google Scholar] [CrossRef]

- Opoku, E.E.O.; Aluko, O.A. Heterogeneous effects of industrialization on the environment: Evidence from panel quantile regression. Struct. Change Econ. Dyn. 2021, 59, 174–184. [Google Scholar] [CrossRef]

- Hofmann, B. Persuasive innovators for environmental policy: Green business influence through technology-based arguing. Environ. Politics 2024, 33, 45–69. [Google Scholar] [CrossRef]

- Kostka, G.; Nahm, J. Central–Local Relations: Recentralization and Environmental Governance in China. China Q. 2017, 231, 567–582. [Google Scholar] [CrossRef]

- Salihi, A.A.; Ibrahim, H.; Baharudin, D.M. Environmental governance as a driver of green innovation capacity and firm value creation. Innov. Green Dev. 2024, 3, 100110. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Holdren, J.P. Impact of Population Growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef]

- Zhang, R.J.; Razzaq, A. Influence of economic policy uncertainty and financial development on renewable energy consumption in the BRICST region. Renew. Energy 2022, 201, 526–533. [Google Scholar] [CrossRef]

- Sun, Y.; Razzaq, A. Composite fiscal decentralisation and green innovation: Imperative strategy for institutional reforms and sustainable development in OECD countries. Sustain. Dev. 2022, 30, 944–957. [Google Scholar] [CrossRef]

- Khalid, F.; Razzaq, A.; Ming, J.; Razi, U. Firm characteristics, governance mechanisms, and ESG disclosure: How caring about sustainable concerns? Environ. Sci. Pollut. Res. Int. 2022, 29, 82064–82077. [Google Scholar] [CrossRef]

- Abdullahi, N.M.; Danlami, M.; Kakar, S.K.; Bah, A.S. Modeling the dynamic nexus between climate change, ICT, and agriculture in sub-Saharan Africa: A panel quantile ARDL. GeoJournal 2024, 89, 203. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Pesaran, M.H. General Diagnostic Tests for Cross Section Dependence in Panels; CESifo Working Paper, No. 1229; Center for Economic Studies and ifo Institute (CESifo): Munich, Germany, 2004. [Google Scholar]

- Bersvendsen, T.; Ditzen, J. Testing for slope heterogeneity in Stata. Stata J. 2021, 21, 51–80. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxf. Bull. Econ. Stat. 2002, 61, 631–652. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Appl. Econom. 2015, 39, 107–135. [Google Scholar]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Machado, J.A.F.; Santos Silva, J.M.C. Quantiles via moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Arsawan, I.W.E.; Koval, V.; Rajiani, I.; Rustiarini, N.W.; Supartha, W.G.; Suryantini, N.P.S. Leveraging knowledge sharing and innovation culture into SMEs sustainable competitive advantage. Int. J. Product. Perform. Manag. 2020, 71, 405–428. [Google Scholar] [CrossRef]

- Hossain, M.R.; Dash, D.P.; Das, N.; Ullah, E.; Hossain, M.E. Green energy transition in OECD region through the lens of economic complexity and environmental technology: A method of moments quantile regression perspective. Appl. Energy 2024, 365, 123235. [Google Scholar] [CrossRef]

- Awan, A.; Abbasi, K.R.; Rej, S.; Bandyopadhyay, A.; Lv, K. The impact of renewable energy, internet use and foreign direct investment on carbon dioxide emissions: A method of moments quantile analysis. Renew. Energy 2022, 189, 454–466. [Google Scholar] [CrossRef]

- Chandio, A.A.; Ozdemir, D.; Jiang, Y. Modelling the impact of climate change and advanced agricultural technologies on grain output: Recent evidence from China. Ecol. Model. 2023, 485, 110501. [Google Scholar] [CrossRef]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Shayanmehr, S.; Radmehr, R.; Ali, E.B.; Ofori, E.K.; Adebayo, T.S.; Gyamfi, B.A. How do environmental tax and renewable energy contribute to ecological sustainability? New evidence from top renewable energy countries. Int. J. Sustain. Dev. World Ecol. 2023, 30, 650–670. [Google Scholar] [CrossRef]

- Karlilar, S.; Pata, U.K. Determinants of material footprint in OECD countries: The role of green innovation and environmental taxes. Nat. Resour. Forum 2023, 49, 100–115. [Google Scholar] [CrossRef]

- Aldieri, L.; Makkonen, T.; Vinci, C.P. Do research and development and environmental knowledge spillovers facilitate meeting sustainable development goals for resource efficiency? Resour. Policy 2022, 76, 102603. [Google Scholar] [CrossRef]

- Fatima, N.; Usman, M.; Khan, N.; Shahbaz, M. Catalysts for sustainable energy transitions: The interplay between financial development, green technological innovations, and environmental taxes in European nations. Environ. Dev. Sustain. 2023, 26, 13069–13096. [Google Scholar] [CrossRef]

- Latief, R.; Sattar, U.; Javeed, S.A.; Gull, A.A.; Pei, Y. The Environmental Effects of Urbanization, Education, and Green Innovation in the Union for Mediterranean Countries: Evidence from Quantile Regression Model. Energies 2022, 15, 5456. [Google Scholar] [CrossRef]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Liao, J.; Liu, X.; Zhou, X.; Tursunova, N.R. Analyzing the role of renewable energy transition and industrialization on ecological sustainability: Can green innovation matter in OECD countries. Renew. Energy 2023, 204, 141–151. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).