5.1. The Impact of Sustainable Finance on ROA

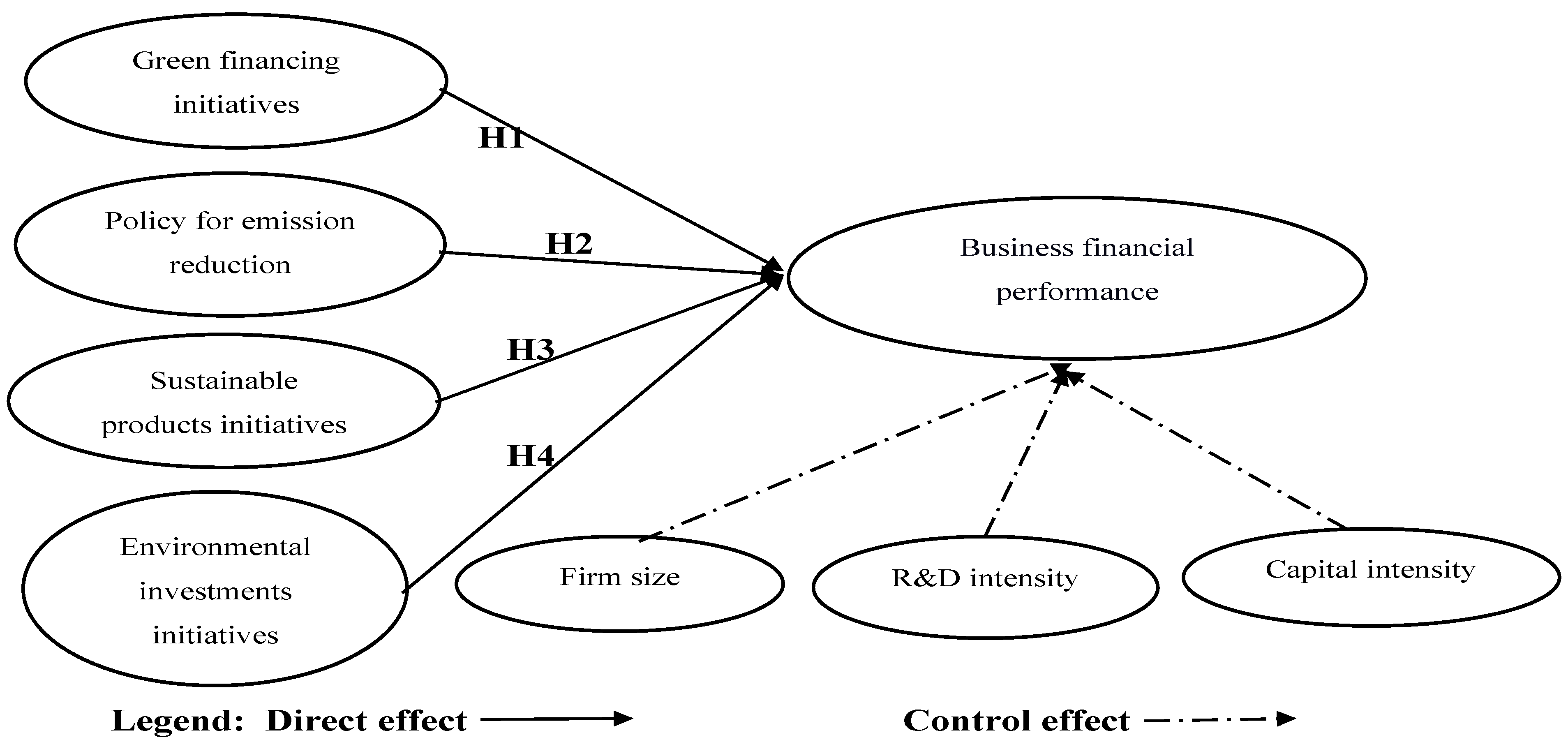

After careful analysis, the following findings emerged: the study discovered that green financing initiatives positively and significantly impacted ROA. Green financing involves investments in sustainable initiatives, enhancing a corporation’s long-term financial health [

77]. Stakeholder theory posits that firms must consider the interests of all stakeholders, including investors, consumers, employees, and the environment [

78]. By prioritizing green financing, organizations align their operations with the increasing environmental and social concerns of stakeholders, enhancing investor confidence, brand reputation, and customer loyalty [

79].

Numerous factors contribute to the positive impacts of green financing initiatives on ROA. First, enterprises utilizing green finance tend to attract environmentally conscious clientele [

80], which increases their revenue. Second, government subsidies, tax reductions, and incentives that these enterprises may receive could assist in reducing costs and enhancing financial performance. Third, sustainability initiatives can yield operational advantages such as reduced waste or energy use and improved profitability [

81].

These findings support the stakeholder theory by demonstrating how organizations with environmental policies can enhance stakeholder value through sustainable growth and improved financial performance. This indicates to investors that companies prioritizing environmental initiatives are more likely to yield stable earnings. For management, it underscores the necessity of integrating sustainability into strategic decisions to improve financial performance and attract long-term investors. These findings underline economic advantages like improved profitability, cost-effectiveness, and ongoing financial stability. Emphasizing the financial feasibility of sustainable investments, they urge companies and governments to prioritize green finance for improved economic resilience and a competitive edge and strengthen investor trust in sustainable business practices.

Policies for emission reduction were observed to have a positive and significant impact on ROA. Businesses implementing initiatives to reduce emissions address the increasing concerns of the public, investors, and regulatory authorities. Companies that proactively adopt emission reduction initiatives may evade potential fines and regulatory costs as environmental regulations intensify [

82], enhancing their financial performance.

The probable cause of the positive result was that emission reduction policies allow enterprises to minimize waste, enhance energy efficiency, and bolster their reputation among environmentally conscious consumers [

83]. Enterprises prioritizing sustainability also benefit from governmental subsidies, which reduce operational costs and enhance profitability. These policies promote operational efficiency and inventiveness, leading to financial benefits, including improved asset use.

These findings align with stakeholder theory, demonstrating how addressing environmental concerns can benefit a business and its employees. This indicates to investors that firms committed to reducing emissions are more likely to exhibit stability and profitability in the long run. It underscores the strategic necessity for management to adopt sustainable practices to meet stakeholder expectations and improve their financial performance. The findings suggest that enhancing efficiency, resolving regulatory challenges, and attracting sustainable investments contribute to economic stability through carbon reduction strategies. They encourage enterprises to adopt ecologically sustainable policies, leading to long-term cost savings, enhanced market competitiveness, and increased investor trust in eco-friendly initiatives.

The study found that sustainable product initiatives positively and significantly impacted ROA. Addressing the requirements and anticipations of many stakeholders—including consumers, investors, and regulatory bodies—highlights the necessity of stakeholder theory. Companies can address the increasing demand for environmentally sustainable and socially responsible products by introducing eco-friendly products, enhancing their brand, and cultivating stronger connections with like-minded consumers [

84]. This can enhance market share and sales, increase revenues, and improve financial performance.

The probable cause of the positive impact was that sustainable product initiatives attract environmentally conscious consumers and generate new business opportunities [

85]. Companies that invest in sustainability frequently innovate, improving their products’ quality and production methods. These initiatives also aid companies in mitigating risks associated with changing consumer preferences and environmental regulations [

85]. Moreover, sustainable products qualify for government incentives, increasing companies’ profitability.

The findings support the stakeholder theory by illustrating how prioritizing sustainability can benefit an organization and its workforce. This underscores the strategic necessity for business management to integrate sustainability into product development strategies. By doing so, they can enhance profitability while simultaneously satisfying stakeholders’ expectations, thereby playing a crucial role in their financial performance. Sustainable product initiatives foster economic growth by stimulating innovation, enhancing client demand, and bolstering brand reputation. They provide equitable advantages, attract ethical investors, and enhance long-term profitability. They also assist enterprises in predicting future market patterns, promoting sustainability, and reducing environmental compliance costs.

This investigation revealed that environmental investment initiatives negatively and significantly impacted ROA. Stakeholder theory emphasizes the alignment between organizational performance and stakeholder needs [

86]. The theory suggests that firms must address the interests of various stakeholders, not just shareholders. Environmental investments, while enhancing stakeholder trust and long-term value, may increase short-term costs, reducing ROA in the near term due to resource allocation trade-offs. Environmental investment initiatives for enterprises may necessitate substantial initial expenditures, encompassing costs associated with green technologies, infrastructure, and compliance with environmental regulations. While these costs will ultimately be beneficial, they may initially exert pressure on financial performance by diminishing short-term profitability [

87].

This negative impact was due to environmental investments yielding returns over a more extended period [

88]. As sustainability objectives become paramount, enterprises may experience financial pressure and diminished short-term revenues. Moreover, the initial costs may outweigh the immediate benefits, particularly if the company is still adapting its operations to new sustainable practices or if the market response to these investments is incremental.

These findings do not fully support stakeholder theory in the short run, as investments, while aligned with long-term stakeholder interests, may not produce immediate financial rewards. This underscores management’s need for strategic planning to oversee environmental investment initiatives. Ensuring that long-term sustainability objectives do not hinder short-term financial performance is crucial, highlighting the importance of management’s role in managing these investments. Firms can balance short-term financial pressures with long-term sustainability goals by integrating sustainability into their core strategies, prioritizing efficient resource use, and adopting phased investment approaches that gradually yield financial returns while enhancing environmental and reputational performance over time. Environmental investment initiatives may induce temporary financial pressures, elevating operational expenses and diminishing immediate profitability. Enterprises may incur legal compliance expenses, substantial capital investments, and extended returns on investment periods. Enhanced efficiency, reduced risk, and bolstered stakeholder confidence may yield long-term economic benefits despite the initial adverse financial impacts.

This research revealed that a firm’s size positively and significantly impacted ROA. The stakeholder theory emphasizes maintaining financial performance while addressing diverse stakeholder interests [

78]. Larger organizations with more extensive resources can invest in innovation, enhancing their operational efficiency and contributing to economies of scale [

89]. These advantages may result in an enhanced financial performance and increased profitability. Furthermore, large corporations have access to capital markets, facilitating the acquisition of funds at favorable rates, which will improve their financial performance.

Larger companies have more substantial market positions, a more extensive client base, and greater brand recognition [

90], which may contribute to this positive impact. These factors ensure stable revenue streams and enhance profitability. Furthermore, larger corporations are better equipped to navigate industry-specific challenges or economic recessions, maintaining financial stability even in adverse conditions.

This result supports the stakeholder theory, as larger companies are better positioned to meet stakeholders’ expectations due to their resources and stability. A firm’s size can serve as an indicator of its financial health and resilience for investors. This underscores the necessity of management leveraging their organizational scale to enhance profitability and deliver value to stakeholders.

The study discovered that R&D intensity had a positive and significant relationship with ROA. The stakeholder theory posits that corporations finance R&D to meet the expectations of key stakeholders, including consumers, investors, and employees [

16]. Concentrating on R&D enables companies to generate innovative concepts, improve existing processes, and strengthen their competitive advantage in the marketplace [

91]. This improves financial performance, as innovative concepts attract new clients and enhance operational efficiency.

Companies with a higher R&D intensity are generally more innovative, which accounts for this positive effect, resulting in increased sales, an enhanced market share, and cost reductions through process optimization [

92]. Investing in R&D allows companies to produce products that satisfy consumer demand, enhancing revenue and profitability. Moreover, firms with substantial R&D capabilities may be perceived by investors as more probable candidates for long-term success, which contributes to enhancing investor confidence and financial performance.

This result supports the stakeholder theory, as R&D intensity reflects a company’s commitment to fulfilling the needs and expectations of various stakeholders. For investors, this indicates that firms with a vigorous R&D intensity might yield substantial returns due to their growth driven by innovation. The outcome emphasizes the need for management to maintain continuous R&D investment to meet stakeholder expectations and drive long-term financial performance.

The study found that capital intensity had a positive and significant relationship with ROA. These findings suggest that corporations enhancing their fixed asset and infrastructure investments yield superior financial returns. Stakeholder theory posits that organizations must balance the interests of various stakeholders—such as investors, employees, and customers—by making strategic investments that enhance long-term value [

16]. A higher capital intensity enhances operational efficiency, increases production capacity, and expands economies of scale, bolstering profitability. This result indicates that well-managed capital investments benefit shareholders and other stakeholders through enhanced financial stability and growth.

The potential reason for these results is the enhanced utilization of assets, in which corporations efficiently utilize resources to maximize output and revenue. Capital-intensive organizations occasionally gain competitive advantages through infrastructure and technological advancements, leading to reduced costs and increased profitability.

These results underscore investors’ need to employ capital investing strategies to achieve financial outcomes. Efficient resource allocation by firms facilitates sustainable profitability, enhancing their attractiveness as investment options. This underscores management’s need to optimize capital expenditure by aligning long-term investments with short-term financial outcomes. Ensuring that capital-intensive activities align with stakeholder interests will enhance return on assets and bolster firm sustainability and competitive positioning.

5.2. Robustness Testing (The Impact of Sustainable Finance on Return on Net Operating Assets)

This study discovered that green financing initiatives positively and significantly impacted the return on net operating assets. These findings suggest that organizations incorporating sustainable finance exhibit an enhanced operational efficiency and profitability. Stakeholder theory emphasizes that corporations must fulfill the expectations of various stakeholders, including investors, consumers, and regulatory bodies, by adopting ecologically sustainable financial practices [

16]. Green financing enables organizations to invest in environmentally sustainable innovations, infrastructure, and energy-efficient technology while enhancing their operational performance and financial returns [

93]. This result supports the stakeholder theory, as firms prioritizing sustainability generate long-term value for their stakeholders and enhance financial resilience.

Cost reductions from decreased energy consumption, enhanced access to green financing at reduced interest rates, and a more substantial brand reputation contribute to these positive outcomes [

94]. Enterprises using green finance may optimize asset performance, mitigate operational risks, and achieve enduring financial stability.

These results underscore the financial viability of green investments for investors, enhancing confidence in enterprises with ecologically sustainable financing strategies. Business management must comprehend the strategic significance of integrating green financing into business decision making. This will assist organizations in securing long-term competitiveness and stakeholder confidence by enhancing asset efficiency, having a good financial return, and aligning with global sustainability trends.

Policies for emission reduction were observed to have a positive and significant impact on the return on net operating assets. These findings suggest that financial efficiency is enhanced with environmental accountability. Stakeholder theory posits that corporations should address consumer, investor, and regulators’ concerns, generating long-term value [

16]. Companies using emission reduction policies benefit from operational cost reductions, regulatory incentives, and enhanced reputation, hence optimizing assets and profitability. This result supports the stakeholder theory, indicating that organizations aligning with sustainability criteria exhibit financial resilience and competitive advantages.

This positive impact is due to decreased energy expenses, enhanced resource efficiency, and the advantages of regulatory compliance, such as tax rebates and subsidies [

95]. Strong emission reduction policies attract environmentally conscious consumers and investors, ultimately fostering long-term financial stability and income enhancement.

These findings emphasize the financial advantages of environmentally responsible enterprises for investors, reinforcing the attractiveness of sustainable investing. Emission reduction policies should be prioritized in business management as a strategic tool for enhancing operational profitability and efficiency. Incorporating sustainable practices enables organizations to mitigate long-term financial risks, enhance asset productivity, and foster stakeholder confidence, thus ensuring sustainable development and market competitiveness in an increasingly environmentally conscious business landscape [

50].

The study found that sustainable product initiatives positively and significantly impacted return on net operating assets. These results highlight the economic benefits of integrating sustainability into the production of consumer goods. Stakeholder theory posits that organizations should fulfill stakeholder expectations—encompassing consumers, lawmakers, and investors—culminating in long-term value [

16]. Companies prioritizing sustainable products gain brand differentiation, consumer loyalty, and regulatory adherence while improving asset utilization and profitability [

47]. This outcome aligns with the premise that addressing stakeholder concerns enhances financial performance.

The increasing consumer demand for eco-friendly products, potential for premium pricing, and cost reductions from sustainable production practices may contribute to this positive outcome [

96]. Firm sustainability commitments attract impact-focused investors and foster enduring commercial partnerships, enhancing financial stability.

These results suggest to investors that companies involved in sustainable product initiatives might mitigate environmental risks while still achieving favorable financial returns. Perceiving sustainability as a mechanism for value creation, business management should integrate eco-friendly items to enhance operational efficiency and revenue growth. By aligning with market and regulatory advancements, organizations can enhance profitability, optimize asset productivity, and strengthen their market position, ensuring long-term business resilience and sustainability in an evolving global economy.

This investigation revealed that environmental investment initiatives negatively and significantly impacted return on net operating assets. This indicates that while these expenditures align with environmental goals, they may not yield immediate financial returns. Stakeholder theory emphasizes reconciling the interests of various stakeholders, including communities, politicians, and investors [

16]. Conversely, substantial initial costs associated with environmental investments—such as waste management systems or renewable energy—may hinder short-term profitability, diminishing returns on operational assets [

97].

Significant capital expenditures, more extended payback periods, and regulatory compliance costs—which may temporarily surpass financial benefits—are potential factors for this negative impact [

98]. Moreover, firms in industries with substantial operational requirements may struggle to recuperate investments, swiftly diminishing short-term asset utilization efficiency. These findings illustrate the importance of investors adopting a long-term perspective when evaluating companies with substantial environmental credentials. Corporate management should employ strategic planning to equilibrate environmental investments with financial performance, yielding long-term competitive advantages. By effectively utilizing government incentives and resource allocation, corporations can gradually transform these investments into value-generating assets, enhancing financial sustainability and meeting stakeholder expectations in the evolving corporate landscape.

This research revealed that a firm’s size positively and significantly impacted return on net operating assets. Larger organizations benefit from operational efficiency, resource availability, and economies of scale, enhancing profitability [

89]. According to stakeholder theory, larger companies more effectively meet stakeholder expectations by utilizing resources. Their varied income streams, established market presence, and access to finance enable them to optimize asset use and improve financial performance.

Augmented negotiation power with suppliers, savings in production costs, and heightened brand recognition are the reasons for this positive impact, contributing to greater returns. Enhancing operational efficiency is occasionally facilitated by more intricate risk management strategies and superior technical access prevalent in larger corporations [

99].

These results highlight the financial stability of larger corporations, which attracts investors as a viable investment option. Business management should leverage firm size to enhance operational processes, expand market reach, and foster innovation. However, they must also ensure prudent expansion management to sustain profitability without excessive financial burden. By achieving an equilibrium between fiscal discipline and expansion, organizations can leverage the benefits of their scale while maintaining favorable returns on operational assets.

The findings showed that R&D intensity had a positive and significant relationship with return on net operating assets. Investing in R&D enhances operational profitability and efficiency. Stakeholder theory posits that, by fostering innovation and generating long-term value, organizations investing in R&D fulfill the requirements of several stakeholders, including investors, consumers, and regulatory bodies [

16]. The invention of new products, enhancement of processes, and augmentation of efficiency enable organizations to attain a competitive edge, yielding greater financial returns.

Technological advancements that reduce manufacturing expenses, the production of distinctive products with higher pricing, and enhanced operational procedures that optimize asset utilization all contribute to this positive impact. By ensuring adaptability to evolving market demands and regulatory requirements, R&D investments prepare organizations for future growth. These results emphasize the strategic importance of R&D in enhancing investors’ financial performance, generating investment opportunities for companies with greater R&D intensity. R&D must remain paramount for business management to ensure expenditures align with market demands and profitability objectives while fostering innovation-driven growth. Organizations must integrate R&D expenditure with fiscal prudence to optimize returns while conserving resources. Practical research and development projects will enhance financial performance and bolster long-term sustainability.

The study found that capital intensity had a positive and significant relationship with return on net operating assets. These findings indicate that firms that invest more in physical assets, specifically equipment and technology, attain a greater profitability and efficiency. Stakeholder theory advocates that organizations should optimize resource allocation to generate long-term value for investors, employees, and consumers [

16]. Strategic capital investment optimizes asset utilization, reduces operational costs, and amplifies output, improving financial returns.

Economies of scale, where firms with substantial capital investments benefit from decreased per-unit costs and enhanced production efficiency due to advanced technology and automation, are probable contributors to this advantageous effect. Capital-intensive enterprises that sustain robust market positions facilitate steady income generation and enhanced asset turnover. The results indicate that firms with a greater capital intensity can deliver a sustained financial performance, appealing to investors as a viable investment opportunity. Management’s strategic capital allocation will ensure asset efficiency and long-term profitability while mitigating excessive fixed costs that could jeopardize financial flexibility. Preserving competitive advantage and maximizing returns rely on the suitable maintenance and technical enhancements of capital assets. Balancing operational agility and capital investment in competitive markets can foster financial stability and growth.