Abstract

Under the dual transformation background of global digital economy and low-carbon development, the synergistic promotion of enterprise digital transformation and green upgrading has become an important path to realizing high-quality development. Based on the coupling coordination degree model, this paper constructs the enterprise “digital-green” dual transformation synergy measurement index system, and empirically analyzes the panel data of China’s A-share-listed companies from 2017 to 2022 using the entropy weight-coupling coordination degree model and the fixed effect model. This study finds that, firstly, the synergy degree of the eastern region is significantly higher than that of the inland, less-developed provinces, but the regional gap is narrowing and the spatial pattern is evolving from the “central collapse type” to the low-level equilibrium type. Second, there is a significant positive driving effect of digital finance on the collaborative transformation of enterprises’ digitalization and greening, and the path of its action includes the effect of alleviating financing constraints, the empowerment of information transparency, and the effect of moderating and amplifying entrepreneurship. Third, the driving efficacy of digital finance in state-owned enterprises is more prominent than that in private enterprises. Fourth, digital finance significantly affects the degree of synergy, but there is a threshold effect. This study reveals the catalytic role of digital finance in the coupling process of digital transformation and greening upgrading, which not only expands the analytical dimension of transition economy theory but also provides a quantitative basis for policymakers to optimize the allocation of financial resources and for enterprises to design transformation paths.

1. Introduction

At a time when global climate change is intensifying and the digital economy is intertwined with its intensification, the synergistic development of digitalization and greening has become a key path for countries to achieve the Sustainable Development Goals. According to the data of the International Energy Agency, the energy consumption of the global digital industry has accounted for 5–9% of the global power demand, while a report from the United Nations Environment Program pointed out that, if we do not accelerate the innovation of green technology, the global carbon emissions will increase by 13% by 2050 compared with those in 2010. This contradiction between the “digital dividend” and the “environmental cost” has prompted the international community to regard the synergistic development of digitalization and greening as the core issue in solving the dilemma of economic growth and ecological protection. In order to promote a sustainable future, the European Commission has developed the concept of “Twin Transition”, which represents a systemic transformation through digital technologies in pursuit of a green future and the use of digital transformation to offset the carbon footprint of businesses. In June 2022, the European Commission released the “2022 Strategic Foresight Report: twinning the green and digital transitions in the new geopolitical context”, which states that “Maximizing the synergies between the green and digital transitions” is essential. In China, since the 18th CPC (Communist Party of China) National Congress, General Secretary Xi Jinping has attached great importance to the transformation and development of digitalization and greening. The “14th Five-Year Plan” clearly states that it is necessary to “promote the synergistic development of digitalization and greening”. In November 2022, the central government chose 10 cities to be pilot cities for comprehensive reforms that aimed to promote the synergistic development of digitalization and greening. On 27 February 2023, the CPC Central Committee and the State Council issued the Overall Layout Plan for the Construction of Digital China, which further specifies the need to accelerate the synergistic transformation of digitalization and greening. On 24 August 2024, 10 departments jointly issued the Implementation Guidelines for the Development of Synergistic Transformation of Digitalization and Greening, which is aimed at promoting the transformation of China’s economy into a green, low-carbon, digitalized economy and realizing high-quality development, and provides a guide to action for the construction of a modernized green, low-carbon economic system. It can be seen that the synergistic development of digitalization and greening occupies an important position in the national strategic objectives of China. However, in practice, enterprises still face many challenges in promoting the synergistic development of digitalization and greening, and how to promote the synergistic development of enterprise digitalization and greening has become a cutting-edge and hot topic that is of general concern to all walks of life.

In fact, the synergistic development of enterprise digitalization and greening refers to the process of the mutual and synergistic promotion of enterprise digitalization and greening [1]. It mainly consists of two levels: one is digitalization empowering greening development; the other is greening pulling digital technology towards upgrading [2]. The synergistic development of enterprise digitalization and greening is characterized by high capital requirements and long output cycles, and is susceptible to high adjustment and financing costs [3]. Therefore, stable and sufficient financial resources are an important requirement in guaranteeing the smooth development of enterprise digitalization and greening. However, the traditional financial resources are unevenly and insufficiently allocated, which, to a certain extent, restricts the continuous promotion of the synergistic development of enterprise digitalization and greening [4]. In recent years, the rapid development of mobile internet and big data technology, as well as the organic combination of digital technology and financial services, has given rise to digital finance as a new financial model [5]. Digital finance refers to a new generation of financial service model that combines the internet and information technology with the traditional financial service industry, resulting in technology-driven, inclusive, personalized, customized, efficient, convenient, risk-controllable, and cross-border integration, among other characteristics [6]. Compared with traditional finance, digital finance has more advantages in all aspects, improves the efficiency of resource allocation, expands the scope of financial services, realizes the accurate docking of supply and demand [7], and provides more possibilities for the synergistic development of enterprise digitalization and greening. Therefore, it is of great theoretical value and practical significance to study how digital finance can promote the synergistic development of enterprise digitalization and greening.

Despite the valuable insights provided by existing studies, the exploration of digital finance and the synergistic development of digitalization and greening is not yet comprehensive. First, although academics have explored the impact of digital finance on digitalization and greening from different perspectives, there is a lack of a systematic and holistic approach to exploring the enabling effect and impact mechanism of digital finance on the synergistic development of the digitalization and greening of enterprises. In view of the fact that countries have introduced a series of policies to support the synergistic development of digitalization and greening, and the fact that this practice has entered a substantial stage of advancement, digitalization and green transformation cannot be completely separated and inevitably penetrate into each other. The combination of green technology and digital technology may even produce the “1 + 1 > 2” effect. Therefore, in order to avoid the errors caused by single transformation research and to better exert a synergistic effect, in-depth investigation of the impact of digital finance on the enterprise of the synergistic development of digitalization and greening has significant theoretical value and practical significance. Secondly, the digitalization and greening evaluation system used in the existing research is mostly constructed at the macro and meso levels, with less research being conducted on the construction of indicators at the micro enterprise level. Microenterprises are the basic units of the economy, and their behaviors and performances can reflect the changes and trends in the macroeconomy. Measuring the level of digitalization and greening collaborative transformation of microenterprises can provide reliable support for policy formulation and theoretical research at a higher level. Thirdly, the existing literature is still insufficient in portraying the spatial and temporal evolution of the synergistic development of digitalization and greening, and the static statistical charts and Kernel density estimates that exist mostly focus on a single time series or cross-sectional spatial differences, which leads to a disconnect between the spatial and temporal dimensions and makes it difficult to capture the dynamic evolution of the synergistic development of digitalization and greening. The “323” general framework (i.e., three types of implementation subjects, two major directions of effort, and three aspects of layout) proposed in the “Implementation Guidelines for Digitalization and Greening Synergistic Transformation and Development” emphasizes the importance of regional differentiation and temporal dynamic analysis of the synergistic development of digitalization and greening. In order to respond to the national policy and make up for the limitations of static analysis, it is of great practical significance to combine geospatial data and time series data to systematically reveal the spatial and temporal differentiation characteristics of the efficiency of the synergistic development of digitalization and greening. Fourthly, most of the current international academic research on digital finance and enterprise sustainable development focuses on developed countries, while there is a relative lack of case studies in developing countries. As China is the largest developing country and digital economy in the world, research on the impact of digital finance on the synergistic development of digitalization and greening that is based on the data of Chinese listed companies has a unique strategic value and global significance.

In view of this, the marginal contributions of this article are as follows: first, it systematically explores the empowering effect of digital finance on the synergistic development of the digitalization and greening of enterprises, and analyzes the mechanism of the influence of digital finance on the synergistic development of the digitalization and greening of enterprises from the perspectives of financing constraints and information constraints. This not only deepens the theoretical understanding of digital finance, but also expands the research dimension of the driving factors of the synergistic development of digitalization and greening. Second, based on the inputs and outputs of digitalization and greening elements, we construct a micro-enterprise-level evaluation system for digitalization and greening, which follows the dual principles of scientific rigor and data availability. Third, using the coupled coordination degree model, we measure the synergistic development of digitalization and greening index of China’s A-share-listed companies in 2017–2022. Further, we combine ArcGIS spatial analysis with Hansen’s threshold regression model to systematically reveal the temporal and spatial differentiation characteristics and nonlinear influence effects of the synergistic development of digitalization and greening, which will help us assess the development level of the synergistic development of digitalization and greening and analyze its evolution trend, as well as formulate differentiated policies to enhance the synergistic development of digitalization and greening. Fourth, based on the data of companies listed in China, we systematically verify the role of digital finance in promoting the synergistic development of digitalization and greening, and reveal the path by which it promotes enterprise transformation through the mechanisms of alleviating financing constraints and optimizing resource allocation, which provides a unique perspective on the emerging markets for the study of global sustainable development, and also provides empirical evidence and policy insights that will help global enterprises (especially developing countries) to cope with the challenges of the synergistic development of digitalization and greening.

2. Literature Review

2.1. The Impact of Digital Finance on the Digitalization or Greening of a Single Transformation to Carry Out Research

In the study of digital finance and digital transformation, some scholars find that digital finance can effectively promote digital transformation, and that its mechanism of action lies in exerting innovation effects, alleviating financing constraints, empowering information transparency, and strengthening market competition [8,9,10,11]. Research by Marta Barroso and Juan Laborda [8] affirms the positive impact of digital finance on digital transformation. Ibrahim Daud et al. [9] argue that digital finance has a positive and significant impact on digitalization, with information technology playing an important mediating role. Mohammed Sawkat Hossain and Maleka Sultana’s [10] research suggests that, by playing important roles in terms of firm performance, fintech and financial inclusion can be important determinants in the digitalization of firms. Siti Kurnia Rahayu et al. [11] found that the fintech landscape in Indonesia served as a driver for the digital transformation of MSMEs so that they could overcome the financing gap in the informal sector.

In the study of digital finance and green transformation, some studies confirm that digital finance can empower enterprises to carry out green transformation through technological innovation, a credit allocation effect, an internal governance effect, and increased green investment [12,13,14,15]. Mohammad Razib Hossain et al. [12] delve into the complex relationship between financial digitalization and green innovation, arguing that the increase in digital financial services has significantly contributed to green innovation. Nsisong Louis Eyo-Udo et al. [13] advocate for digital finance to improve the transparency, traceability, and accountability of green transactions through digital platforms and blockchain technology. Chien-Chiang Lee and Fuhao Wang [14] argue that digital financial inclusion can directly reduce carbon intensity, and that it can also influence carbon intensity by optimizing industrial structures and promoting green technology. The study by Muhammad Ahsan Iqbal et al. [15] explains the complex interactions that exist between global sustainable finance, green technology innovation, green energy adoption, climate change financial policies, green growth indices, government spending, and financial globalization.

2.2. Study on the Synergistic Development of Digitalization and Greening

The research on the synergistic development of digitalization and greening can be summarized into three aspects: first, the construction of the indicator system of the synergistic development of digitalization and greening; second, the way in which the spatial and temporal evolution of the synergistic development of digitalization and greening is characterized; and third, the research on the mechanism of the synergistic development of digitalization and greening.

Most of the existing studies focus on the macro and meso levels, using panel data of provinces, cities, and industries to measure the development level of the synergistic development of digitalization and greening in provinces, cities, and industries, respectively. Mahmoud Abdulhadi Alabdali et al. [16] examine the associations between green digital transformation leadership, green digital thinking, and green digital transformation at the industry level. Yang Shen and Zhihong Yang [17] evaluated the synergistic effect of industrial intelligent transformation on pollution control and carbon emission reduction, as well its mechanism, using the panel data of 30 provinces in China from 2006 to 2020 and a two-way fixed-effects model.

Most of the existing case studies rely on static statistical charts (line graphs, bar charts, three-line tables) and non-parametric estimation methods (Kernel density estimation) to present patterns of spatio-temporal divergence. Joseph Sarkis et al. [18] provide a reflective overview of the role of traditional and emerging digitalization and information technologies in leveraging environmental supply chain sustainability using diagrams. Pier Giacomo Cardinali and Pietro De Giovanni [19] develop a study of green practices and digital technologies through tables.

Some scholars have found that the digital transformation of enterprises promotes green transformation by improving their resource allocation capacity and information transparency, and that the greening of enterprises promotes digital transformation by boosting R&D investment. There is a coupled synergistic relationship between digitalization and greening. Laura V. Lerman et al. [20] examined how smart supply chains can contribute to green performance by managing green relationships (GSCM external activities) and establishing green operations (GSCM internal activities). The study by Hussam Al Halbusi et al. [21] provides valuable insights for startups and traditional companies as they explore the prospects of green innovation and digitalization.

Despite the valuable insights provided by existing studies, the exploration of digital finance and the synergistic development of digitalization and greening is not yet comprehensive. Firstly, although academics have explored the impact of digital finance on digitalization and greening from different perspectives, there is a lack of systematic and holistic perspectives that explore the empowering effect of digital finance on the synergistic development of the digitalization and greening of enterprises and its mechanism of influence. Secondly, the evaluation system for digitalization and greening is mostly constructed from the macro and meso levels, and there are fewer studies on the construction of indicators at the micro enterprise level. Thirdly, the existing literature on the spatial and temporal evolution of the synergistic development of digitalization and greening is still insufficient, as static statistical charts and Kernel density estimation focus on a single time series or cross-section of spatial differences, resulting in spatial and temporal dimensions of the analysis of the disconnect, and it is difficult to capture the dynamic evolution of the synergistic development of digitalization and greening with these methods alone. Finally, the current international academic research on digital finance and enterprise sustainable development focuses on developed countries, while there is a relative lack of cases in developing countries. This study aims to fill these gaps: Firstly, this aims to systematically explore the enabling effect of digital finance on the synergistic development of the digitalization and greening of enterprises, and to analyze the influence mechanism of digital finance on the synergistic development of the digitalization and greening of enterprises from the perspectives of financing constraints and information constraints. Secondly, based on the inputs and outputs of digitalization and greening elements, we construct a micro-enterprise level evaluation system for digitalization and greening. Thirdly, using the coupled coordination degree model to measure the synergistic development of digitalization and greening index of Chinese A-share-listed companies in 2017–2022, we combine ArcGIS spatial analysis and the Hansen threshold regression model to systematically reveal the spatial and temporal variability of the synergistic development of digitalization and greening index. Finally, based on the data of listed companies in China, we systematically validate the role of digital finance in promoting the synergistic development of digitalization and greening, which provides a unique perspective on emerging markets for the study of global sustainable development.

3. Theoretical Analysis and Research Hypothesis

According to Teece’s [22] dynamic capability theory, enterprises adapt to rapidly changing environments by integrating, constructing, and reconfiguring internal and external resources and capabilities. In the context of the dual transformation of the digital economy and green development, the synergistic development of the digitalization and greening of enterprises is essentially the process of optimizing resource allocation and reconstructing the existing development model through the construction of dynamic capabilities. As an important external empowerment tool, the core mechanism of digital finance is to help enterprises break through traditional resource constraints and enhance their environmental adaptability through technology-driven financial innovation, a process that is comprehensively influenced by the internal resource endowment of enterprises and their external institutional environment.

3.1. Direct Effect: Digital Finance’s Fundamental Enabling of the Synergistic Development of Digitalization and Greening

Dynamic capability theory [22] emphasizes the driving effect of changes in the external environment on the construction of enterprise capabilities. The development of digital finance enhances the dynamic ability of enterprises through two dimensions: first, through the dimension of digital empowerment, with the help of big data, cloud computing, and other technologies, digital finance not only expands intelligent investment, supply chain finance, and other financing channels, but also pushes enterprises to build digital connectivity through the digitalization of consumers’ payment habits, forming a positive cycle of “technology empowerment–business transformation” [23]. Second, through the greening dimension of empowerment, the long cycle of green transformation requires enterprises to establish continuous resource integration capabilities. By reducing information asymmetry and optimizing green resource allocation (such as ESG investment guidance), digital finance helps enterprises break through the financing barriers and supervision constraints of green technological innovation, which is in line with the core logic of “environmental adaptability capacity construction” in the theory of dynamic capacity [24].

Digital finance can be a source of empowerment regarding “digital empowerment for greening development” and “greening pulling digital technology upgrading”, respectively. First of all, in the process of “digital empowerment for greening development”, data resources are the key source of green value creation. Through the deep excavation and analysis of data resources, we can discover the potential points of energy saving and emission reduction, optimize the efficiency of energy use [25], and promote green technological innovation, so as to achieve the goal of green transformation [26]. Relying on cloud computing and big data technology, digital finance is able to aggregate massive data resources, and the mining of data resources has significant advantages and potential. At the same time, digital finance can also use advanced big data analysis and intelligent risk control means to significantly improve the accuracy of information screening and the efficiency of risk management. Therefore, digital finance can be a source of “digital empowerment for greening development”. Secondly, regarding the process of “greening pulling digital technology upgrading”, the concept of green development is deeply rooted in people’s hearts and minds, which provides a strong impetus for digital technology innovation. With the deepening of green transformation, the concept of green development becomes deeply rooted in people’s hearts, which puts forward higher requirements for digital technology [27]. When enterprises take green development as their goal and driving force, and when they encounter technical difficulties in the process of pursuing this goal, a number of new digital technologies and solutions will be spawned to promote the continuous progress of digital technology. Digital finance itself has green attributes, providing convenient and efficient means of payment through new payment methods such as mobile payment and online payment. These payment methods not only reduce cash usage and the costs of printing and circulating banknotes but also the lower carbon emissions that result from cash transactions [28]. Thereby, they foster a green, low-carbon lifestyle and embed the concept of sustainable development into societal consciousness. Therefore, digital finance can be a source of empowerment for “greening pulling digital technology upgrading”. In addition, digital finance has shown remarkable results in alleviating the difficulties in externally financing enterprises, reducing the friction and obstacles in the financing process [29], enabling corporate governance to deploy financial resources more flexibly, and finding the optimal balance between promoting the digital transformation of enterprises and green transformation to achieve the effective coordination and mutual promotion of the two. Based on this, this paper proposes hypothesis 1:

H1:

Digital finance has a significant positive effect on the synergistic development of enterprise digitalization and greening.

3.2. Indirect Effect: Theoretical Extensions of Resource Allocation Mechanisms

The core chain of dynamic capability theory [22] is “environmental change–resource integration–capability construction”. In the process of the synergistic development of digitalization and greening, enterprises face double resource constraints.

Firstly, the financing constraint cracking mechanism is a mechanism by which the traditional financial system’s collateral preference and risk aversion lead to an imbalance in resource allocation, digital finance through P2P lending, supply chain finance, and other innovative modes and big data risk control models; this allows the realization of the precise allocation of financial resources to the field of the synergistic development of digitalization and greening, in line with the theory of the “breakthrough in the rigid constraints on resources” of the key path.

The synergistic development of enterprise digitalization and greening essentially belongs to enterprise innovation. According to Schumpeter’s theory of enterprise innovation, innovation is undergone to “establish a new production function”, which will inevitably bring about the reconfiguration of factor resources [30]. Therefore, in the process of promoting the synergistic development of enterprise digitalization and greening, the demand and allocation of resources between the two may generate potential conflicts, especially in the context of the restricted financing environment, and limited financial resources may exacerbate this contradiction. If financial resources are not reasonably and effectively allocated, it may lead to the enterprises developing unevenly in terms of their digitalization and green transformation. Digital finance is an important way to alleviate the financing constraints of enterprises, and the rapid development of digital finance has significantly broadened the funding channels of enterprises and effectively increased the amount of financing that is available to them [31]. Firstly, digital finance platforms such as P2P (peer-to-peer) lending, crowdfunding, digital currency, and other new financing methods provide more financing options for startups. These platforms have lowered the financing threshold and shortened the financing time of enterprises, making it possible for enterprises that would otherwise find it difficult to obtain financing from traditional financial institutions to obtain the financial support they need. Secondly, the development of digital finance also promotes the optimal allocation of financial resources [32]. Digital finance platforms can leverage big data analysis and risk assessment models to more accurately evaluate enterprises’ credit profiles and operational capabilities. This enables them to provide more personalized financing solutions for enterprises [27], enhance the allocation efficiency of financial resources, and advance the synergistic development process of enterprise digitalization and greening.

Secondly, the information constraint elimination mechanism is the construction of dynamic capabilities that relies on high-quality information input. Digital financial platforms realize the real-time uploading of enterprise data to the chain through blockchain technology, integrate multi-source market data to provide decision-making support, and form the transmission path of “information empowerment–decision-making optimization–synergistic promotion”.

Information, as an important production factor, plays an important role in the process of the synergistic development of enterprise digitalization and greening. In the strategic planning stage of the synergistic development of digitalization and greening, if the information within an enterprise is asymmetric, the management may not be able to obtain comprehensive and accurate information to make scientific decisions [33]. At the same time, information asymmetry may also lead to bias in resource allocation, with limited resources being put into inefficient or ineffective projects, hindering the promotion of the synergistic development of digitalization and greening [34]. Digital finance reduces the degree of information asymmetry by breaking down information barriers [35]. On the one hand, digital finance platforms can provide enterprises with more comprehensive and accurate market information and policy guidance. Digital finance platforms are able to collect market data from multiple channels, including social media, news reports, and industry reports. By integrating these data, these platforms can provide enterprises with more comprehensive market information. Digital finance platforms can also customize the push of relevant information according to the specific needs of enterprises. On the other hand, digital financial platforms are also able to provide more detailed and reliable enterprise information to the capital supply side. With the help of technologies such as big data and blockchain, digital financial platforms are able to obtain and verify information such as the operational data, financial statements, and credit records of enterprises in real time. This two-way information exchange helps alleviate the problem of information asymmetry. Overall, digital finance increases the transparency of information within and outside enterprises and alleviates the information constraints on the synergistic development of the digitalization and greening of enterprises.

The above two mechanisms are essentially the specific embodiment of the “resource integration capability” in the dynamic capability theory, i.e., digital finance helps enterprises reconfigure their resource allocation function by alleviating the double constraints. Based on this, this paper proposes hypotheses 2 and 3:

H2:

Digital finance promotes the synergistic development of enterprise digitalization and greening by alleviating enterprise financing constraints.

H3:

Digital finance promotes the synergistic development of enterprise digitalization and greening by alleviating enterprise information constraints.

3.3. Moderating Effect: The Capacity-Enhancing Role of Entrepreneurship

Dynamic capability theory [22] emphasizes the key role of entrepreneurs as the main body of the core capabilities of an enterprise. Three dimensions of entrepreneurial spirit constitute the mechanism of capacity strengthening: Firstly, the spirit of innovation drives enterprises to break through organizational inertia and take the initiative to embed digital financial tools into the synergistic development of digitalization and greening (e.g., the development of green digital credit products), which is in line with the logic of the theory of “Opportunity Recognition and Capability Building”. Secondly, the spirit of risk-taking, which supports enterprises to bear the cost of technical trial and error (e.g., the research and development of blockchain carbon emission monitoring system) and accelerates the formation of capabilities under the uncertainty of risk at the initial stage of digital financial application. Thirdly, responsibility, which encourages enterprises to establish a risk management system (e.g., dynamic compliance framework) that is suitable for digital finance and guarantees the sustainability of capacity building. Entrepreneurship is essentially a materialization of the “cognitive framework of top managers” in the dynamic capability theory, and its level directly affects the degree of the digital financial empowerment effect. Based on this, this paper proposes hypothesis 4:

H4:

Entrepreneurship positively regulates the promotion effect of digital finance on the synergistic development of enterprise digitalization and greening.

3.4. Threshold Effect: The Law of Evolution of Capacities in the Institutional Environment

Dynamic capability theory suggests that there is an “environmental fitness cycle” for enterprise capability construction. The three stages of digital finance development correspond to different states of capability evolution. In the initial exploration and conversion stage, enterprises begin to feel the power of changes brought on by digital finance, which, in this period, provides enterprises with more financing channels and promotes technological innovation, and the facilitating effect on the synergistic development of enterprise digitalization and greening begins to appear [36] In the rapid development and popularization stage, digital finance promotes the synergistic development of enterprise digitalization and greening by providing financial support, optimizing resource allocation, and facilitating innovation and cooperation. With the increasing demand of enterprises for digitalization and greening, the demand for digital financial products and services is also growing, providing a strong impetus for the development of digital finance. At this stage, digital finance and enterprise digitalization and greening have achieved in-depth integration, forming a virtuous cycle of mutual promotion and common development. The impact of digital finance on the synergistic development of enterprise digitalization and greening has reached its peak; in the stage of regulation and governance, with the rapid development of digital finance, various types of fintech risks are gradually accumulating and being exposed, such as the rapid updating of the technology on which digital finance relies, and it is often difficult for regulatory regulations to keep up with the pace of technological development in a timely manner, which can easily lead to the problem of regulatory lag [37]. Due to regulatory lag, enterprises may face the risk of violation in promoting the synergistic development process of digitalization and greening. Some innovative fintech products or services may not yet be covered by the existing regulatory framework. As a result, enterprises lack clear guidance and norms when conducting such business, which increases the probability of non-compliance and makes them prone to concerns about violating regulatory requirements. This conservative attitude may limit enterprise innovation and hinder the process of enterprises using digital financial technology to promote the synergistic development of digitalization and greening, which causes the facilitating effect of digital finance on the synergistic development of enterprise digitalization and greening to decline. Based on this, this paper proposes hypothesis 5:

H5:

There is a threshold effect in the impact of digital finance on the synergistic development of digitalization and greening, i.e., with the development of digital finance, its impact on the synergistic development of enterprise digitalization and greening shows a nonlinear change of increasing first and then decreasing.

3.5. Logical Framework

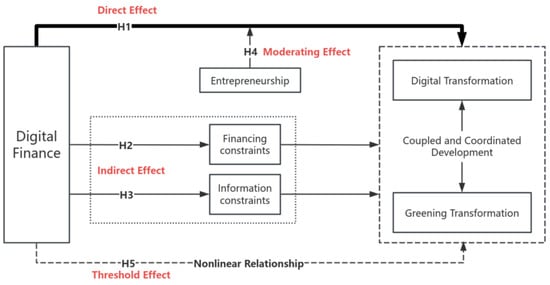

Based on the above theoretical analysis and research hypotheses, the logical framework of this study is constructed as shown in Figure 1. The research in this paper includes four parts, which are the direct effect, indirect effect, moderating effect, and threshold effect. The research takes hypothesis 1 as the main hypothesis, and hypothesis 2, hypothesis 3, hypothesis 4, and hypothesis 5 are all extended on the basis of hypothesis 1. (1) Direct effect: hypothesis 1 mainly studies the influence of digital finance on the synergistic development of the digitalization and greening of enterprises based on theoretical analysis. (2) Indirect effect: hypotheses 2 and 3 are based on hypothesis 1, which analyzes how digital finance promotes the synergistic development of digitalization and greening by alleviating the financing constraints and information constraints on enterprises. (3) Moderating effect: hypothesis 4 focuses on analyzing the moderating role of entrepreneurship between digital finance and the synergistic development of digitalization and greening, on the basis of Hypothesis 1. (4) Threshold effect: hypothesis 5 is based on hypothesis 1 and analyzes the different stages of the development of digital finance (the initial exploration and conversion stage, the rapid development and popularization stage, and the regulation and governance stage) and the different impacts that they have on the synergistic development of the digitalization and greening of enterprises.

Figure 1.

Logical framework of the research.

4. Research Design

4.1. Sample Selection and Data Sources

This paper takes A-share-listed companies in China from 2017–2022 as the research sample to explore the impact of digital finance on the synergistic development of the digitalization and greening of enterprises. In this paper, the resulting company samples are processed as follows: firstly, the financial listed companies were excluded; secondly, we excluded companies under Special Treatment (ST), Risk Warning of Delisting (*ST), and Particular Transfer (PT); thirdly, the samples with missing indicators of important variables were excluded; fourthly, the upper and lower 1% shrinkage was applied to all continuous variables. The final collation yielded a total of 11,112 observations for the annual sample of 1852 firms. The data on digital finance used in this paper are from the Digital Financial Inclusion Index, and the firm-level data are from the China Stock Market & Accounting Research Database (CSMAR), the Wind Information (WIND), and the Chinese Research Data Services Platform (CNRDS).

4.2. Main Variables

4.2.1. Explained Variable

The degree of coupled synergy between enterprise digitalization and greening () was studied. In order to comprehensively and objectively assess the level of the synergistic development of China’s listed companies in the process of digitalization and greening, a comprehensive evaluation index system was constructed under the dual principles of scientific rigor and data accessibility. In this system, the indicators of enterprise digitalization were set based on the inputs and outputs of digitalization elements, and the indicators of the enterprise greening system were set based on the inputs and outputs of greening elements [1,2]. The specific indicator settings and calculation methods are shown in Table 1.

Table 1.

Structure of the enterprise digital greening synergy development indicator system.

Referring to Mateusz Toma’s research [38], considering that the synergistic development of digitalization and greening focuses on the interaction between digitalization and greening and the degree of their transformation at the same time point, and considering that the coupling coordination degree model can reflect the degree of interconnection between the two systems as well as indicate the strength of inter-system interactions, this paper adopts the coupling coordination degree model to measure the degree of the synergistic development of the digitalization and greening of enterprises.

- (1)

- Standardized Treatment of Indicators.

The formula for the standardized treatment of positive indicators is as follows:

The formula for standardizing negative indicators is as follows:

where denotes the value after standardization; denotes the original value of the indicator; and denote the maximum and minimum values of the original data of the indicator during the evaluation period.

- (2)

- Calculation of the Composite Development Index.

and represent the comprehensive development level of the enterprise digitalization system and greening system, respectively; and represent the values after standardization of the corresponding indicators of digitalization and greening, respectively; and are the weights of each indicator, which were determined using the entropy value method.

- (3)

- Coupling Coordination Degree Model.

The coupling coordination degree is used to quantify the degree of benign interaction between systems, and applying the coupling coordination model can reveal the state of dynamic and balanced development between the enterprise digitalization and greening systems and embody the overall level of coordination under the interaction of these two systems [39,40]. The construction process is as follows:

Step 1: Calculation of the coupling (). The coupling degree of the two systems is calculated according to the comprehensive development level of the enterprise’s digitalization system () and the comprehensive development level of the greening system (). The calculation process is as follows:

Step 2: Calculation of the harmonization index ():

and represent the weights of the digitalization level and greening level, respectively.

Step 3: Calculation of the coupling synergy degree (). Based on the coupling degree () and coordination index (), calculate the coupling coordination degree ():

The larger the value of , the higher the level of synergistic development, which reflects the digitalization and greening of the enterprise. The criteria for determining the level of coupled synergistic development are shown in Table 2.

Table 2.

Criteria for determining the level of coupled synergy development.

4.2.2. Explanatory Variable

Total digital finance index (). This paper uses the Digital Inclusive Finance Index compiled by the Digital Finance Research Center of Peking University as a proxy variable for the degree of development of digital finance in the study area. The index, which is formed using a comprehensive multi-level index system to portray the development trend of digital finance in different regions of China, has been widely used in academia. This paper selects the digital inclusive finance index at each provincial level in this index as a proxy variable for digital finance. In order to avoid errors, we divide it by 100. Meanwhile, this paper further refines the impact of digital finance through the breadth of coverage (), depth of use (), and degree of digitalization () [27,32].

4.2.3. Mediating Variables

- Financing constraints (): This paper uses the index to measure the degree of corporate financing constraints [41]. The index is calculated as ( is the natural logarithm of the enterprise’s total asset size; is the enterprise’s operating year. The index calculated by this method is negative, and its absolute value is ; the larger the absolute value of the index, the more serious the financing constraints of enterprises):

- Information constraint (): Asymmetry of information with the outside world is the main reason why enterprises face information constraints. Analysts, as intermediaries for mining and transferring information, collect corporate information through the comprehensive use of research, interviews, and other means, and prepare detailed research reports accordingly. In this way, they serve as a bridge for information dissemination to enhance corporate information transparency, thus alleviating the information asymmetry between corporations and the outside world. Therefore, the natural logarithm of the number of analysts tracked by a firm for the year plus one is taken to measure the degree of information constraints of that firm. The higher the number of analysts a firm has, the lower its information constraints and the stronger its information transparency [42].

4.2.4. Moderating Variable

Entrepreneurship (): Five indicators, namely, fixed assets per capita, intangible assets per capita, income per capita, number of patent applications, and board of directors’ independence, are used to comprehensively measure entrepreneurship. Among them, fixed assets per capita, intangible assets per capita, and income per capita are the results of enterprises’ balance between the pursuit of market share expansion and short-term gains, and the more obvious the entrepreneurial spirit characteristics of the enterprises in these aspects, the better its performance; the number of patents is the embodiment of the enterprise’s internal innovation vitality, which directly maps the entrepreneur’s spirit of innovation; the board of directors’ independence portrays the enterprise’s self-employment situation, whether or not the two positions of the chairman and the general manager are combined can reflect the enterprise’s entrepreneurial spirit. Finally, the entropy weighting method is used to obtain the weights of the above indicators before calculating the composite result, and the natural logarithm of the result is used to measure entrepreneurship [43].

4.2.5. Control Variables

Drawing on existing studies, the age of the firm (), gearing ratio (), return on net assets (), Tobin’s Q value (), proportion of independent directors (), and size of the board of directors () are controlled. The names, symbols, and measures of the main variables are shown in Table 3 [33,44,45,46,47].

Table 3.

Variable definitions.

4.3. Modeling

4.3.1. Panel Regression Model

Based on the above analysis, this paper establishes the following model (10) to test hypothesis 1. If > 0, it means that hypothesis 1 is valid.

where denotes the degree of the digital greening coupled synergy of firms; denotes digital finance, including the digital finance development index (), breadth of coverage (), depth of use (), and digitalization degree (); denotes a set of control variables; and are year dummy variables and industry dummy variables, respectively; is a random disturbance term; and subscripts and refer to year for firm , respectively.

4.3.2. Mediating Effect Model 1

The following models, models (11) and (12), are built to test the mediating effect of hypothesis 2. If < 0 and < 0, it means that hypothesis 2 is valid.

where represents the mediator variable and the other variables are the same as above.

4.3.3. Mediating Effect Model 2

The following models, models (13) and (14), are developed to test the mediating effect of hypothesis 3. If > 0 and > 0, it means that hypothesis 3 is valid:

where represents the mediator variable and the other variables are the same as above.

4.3.4. Moderating Effects Model

The following model, model (15), is established to test the moderating effect of hypothesis 4. If > 0, it means that hypothesis 4 is valid.

where denotes entrepreneurship and the other variables are as described above.

4.3.5. Threshold Effect Model

The following model, model (16), was developed to test the double threshold effect and to verify whether hypothesis 5 is valid.

where is the threshold variable; is the threshold to be estimated; is the indicator function; and the other variables are as above.

5. Empirical Analysis

5.1. Spatial and Temporal Characteristics of the Coupled Synergistic Development of Enterprise Digitalization and Greening

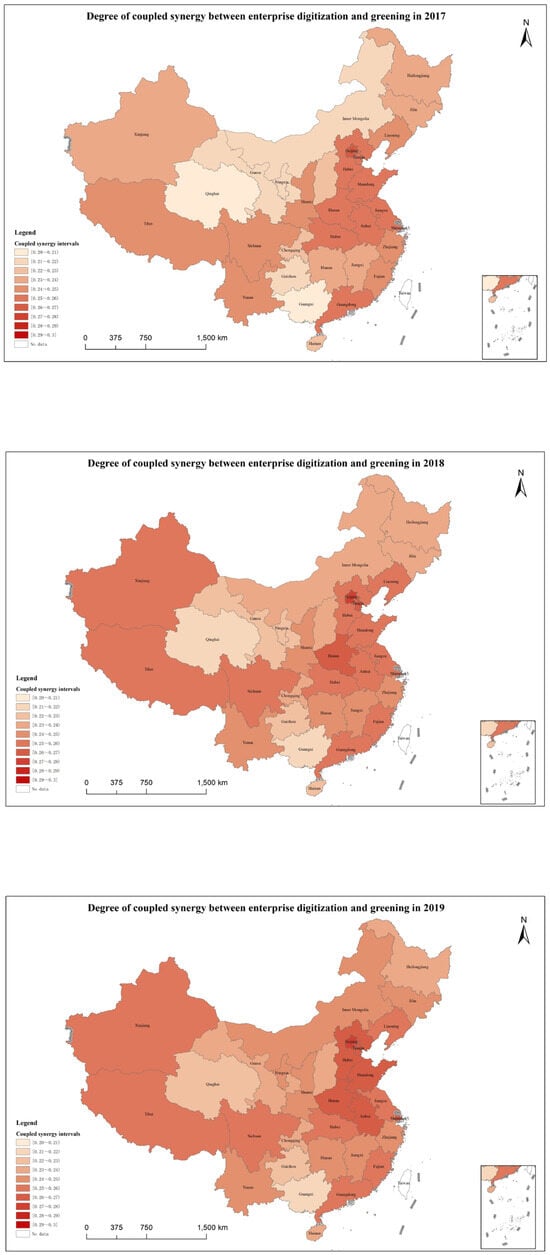

In this paper, the coupled synergies of the digitalization and greening () of 1852 sample enterprises from 2017–2022 are measured. Further, the coupling synergies of the same enterprises are summed up for the provinces where they are registered to find the mean value, and the coupling synergies of the digitalization and greening of the enterprises in each province in 2017–2022 are obtained. Referring to Helena Atteneder et al.’s study [48], the spatial visualization of the coupled synergies of the digitalization and greening of enterprises was carried out using ArcGIS 10.8 software, as shown in Figure 2.

Figure 2.

Synergy of coupling digitalization and greening in Chinese enterprises, 2017–2022.

First of all, from the time dimension, the level of the synergistic development of the digitalization and greening of Chinese enterprises during the period of 2017–2022 has shown a steady trend of improvement, but the overall level is still in the moderate dissonance stage (D-value range of 0.2–0.3). The figure shows clearly, through the chromatographic gradient, that the eastern coastal provinces (e.g., Jiangsu, Zhejiang, and Guangdong) always maintain relatively darker shades, and their coupling synergy is higher than the national average, while the central and western regions (e.g., Gansu, Guizhou, and Ningxia) are characterized by lighter shades and lower values. Secondly, with regard to the evolution of spatial patterns, in 2017, China’s level of synergistic development of digitalization and greening showed a clear distribution of “low in the middle and high around the periphery”, with Beijing-Tianjin-Hebei, the Yangtze River Delta, and the Pearl River Delta constituting relatively high-value core areas. By 2022, this structure will gradually evolve into a low-level “balanced” distribution. On the one hand, the absolute value of the traditional high-value areas will continue to rise. Further, synergistic development will be realized in the central and western provinces through the diffusion of technology and policy guidance, and the development gap between regions will converge significantly.

It is worth noting that, despite the overall increase in the level of synergistic development of digitalization and greening and the enhancement of regional balance, the overall level is still in the moderate dislocation stage, indicating that China’s level of synergistic development of digitalization and greening still has a lot of room for improvement and that, in the future, we need to pay attention to the efficiency of the technological transformation of the central and western regions and the mechanism of innovation spillover in the eastern region.

5.2. Descriptive Statistics

The mean, maximum, minimum, and standard deviation of the enterprise digitalization and greening coupling synergy () are 0.26, 0.71, 0.11, and 0.05, respectively, indicating that the development level of the digitalization and greening coupling synergy of the sample enterprises is low. Most of them are in the stage of moderate dissonance, they are very different from each other, and their level of coupling synergy covers severe dissonance and intermediate coordination. The mean, maximum, minimum, and standard deviation of the total digital finance index () are 3.60, 4.61, 2.40, and 0.52, respectively, indicating that the level of digital finance development varies across provinces in China, and that it is generally at the upper-middle level. The descriptive statistics of other control variables are within reasonable limits.

5.3. Benchmark Regression Analysis

Table 4 shows the regression results of the synergy between digital finance and enterprise digitalization and greening coupling when model (10) is used. In the model, columns (1), (2), (3), and (4) present the regression results of the total digital finance index, coverage breadth, usage depth, and digitalization level on the coupling synergistic degree of enterprise digitalization and greening without the addition of control variables. Columns (5), (6), (7), and (8), respectively, show the regression results of the above digital finance indicators on the coupling synergistic degree of enterprise digitalization and greening after introducing enterprise-level control variables. It can be seen that the regression coefficients of total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the synergy of enterprise digitalization and greening coupling are all positive and significant at the 1% level, regardless of whether control variables are added or not. This indicates that digital finance has a significant positive effect on the synergistic development of enterprise digitalization and greening, which verifies hypothesis 1.

Table 4.

Benchmark regression results.

5.4. Robustness Tests

5.4.1. Variable Lagging

Considering that the impact of digital finance on the synergistic development of enterprise digitalization and greening takes time, the explanatory variables are lagged to further validate the benchmark regression. The regression results are shown in Table 5. The regression coefficients of the lagged digital finance total index, coverage breadth, use depth, and digitalization degree on the coupling synergistic degree of enterprise digitalization and greening are 0.007, 0.007, 0.005, and 0.011, respectively, and all of them are significant at the 1% level. The regression results are consistent with the baseline regression results, further verifying hypothesis 1.

Table 5.

Regression results with one-period lag of the independent variables.

5.4.2. Higher-Order Joint Fixed-Effects Model

Considering that the use of a two-way fixed model of time and industry in regression models is a conventional practice, despite potentially being more “flexible” and the control of endogeneity not being strict enough, the higher-order joint fixed-effects method of “industry × time” is adopted. As shown in Table 6, digital finance continues to have a significant driving effect on the synergistic development of enterprise digitalization and greening.

Table 6.

Adoption of joint time and industry fixed models.

5.5. Endogeneity Test

5.5.1. Instrumental Variables Approach

Although this paper controls for several control variables that may affect the synergistic development of enterprise digitalization and greening, the model may still suffer from endogeneity problems due to omitted variables, selectivity bias, and measurement errors. Therefore, this paper applies the instrumental variable two-stage least squares method to validate the benchmark regression. Considering that internet penetration can provide support for the development of digital finance and is highly correlated with digital finance, the internet penetration rate in each province will not directly affect the synergistic development of the digitalization and greening of micro-enterprises. Therefore, the internet penetration rate in each province is selected as an instrumental variable for regression.

The results are shown in Table 7, where columns (1), (3), (5), and (7) are the regression results of the first stage, and the coefficients of the internet penetration rate () are all significantly positive. As can be seen from Table 7, there are no weak instrumental variables and over-identification problems, and the choice of instrumental variables is appropriate. Columns (2), (4), (6), and (8) show the regression results of the second stage. After addressing the endogeneity issue through the instrumental variable method, the regression coefficients of the total digital finance index, coverage breadth, usage depth, and digitalization level on the coupling synergistic degree of enterprise digitalization and greening are all significant. This further demonstrates the robustness of the baseline regression results.

Table 7.

Instrumental variable test results.

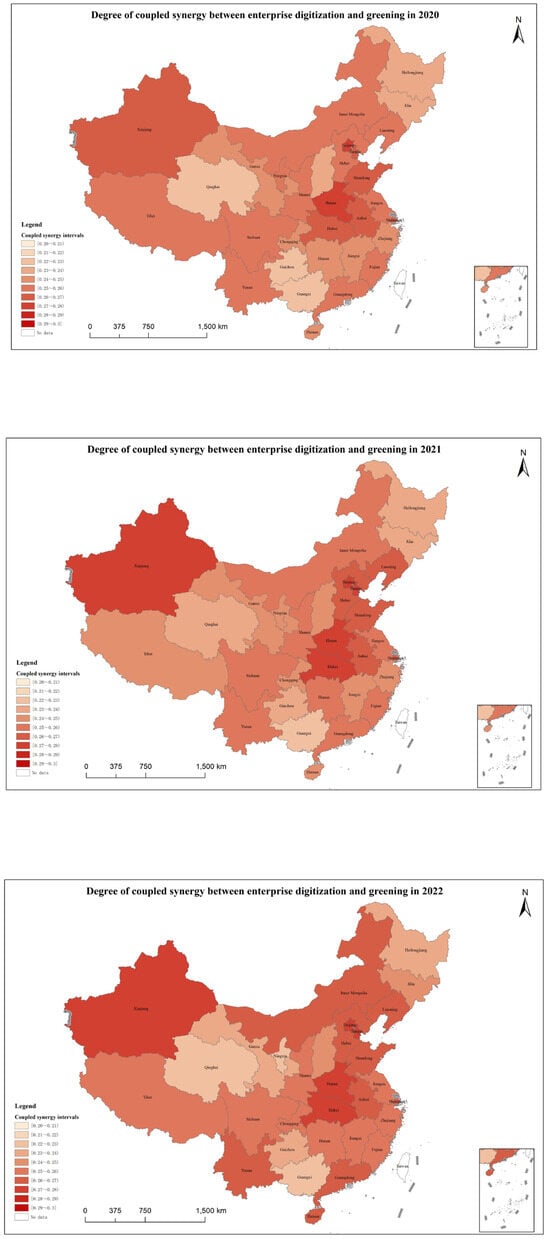

5.5.2. Placebo Test

In order to test whether the effect of digital finance on the synergistic development of enterprise digitalization and greening shown in Table 4 is caused by unobservable omitted factors, we draw on Cornaggia et al.’s [49] methodology to determine that the effect of digital finance on the synergistic development of enterprise digitalization and greening is observed by randomly matching listed firms by their level of digital finance development and then re-regressing the model. If the positive effect of digital finance on the synergistic development of firms’ digitalization and greening remains significant under this virtual placebo test, it implies that the results in Table 4 are due to some unobservable factors; conversely, it can be inferred that the results in Table 4 are unaffected by the unobservable omitted factors. The process of the above random designation and regression analysis is simulated 500 times, and the results are shown in Figure 3. The estimated values of the regression coefficients of the simulations are centrally distributed around 0, and the true regression coefficients and values of the level of digital financial development () shown in Table 4 are located outside the 99% confidence intervals in the 500 simulations, which implies that the results of the baseline regression are not caused by omitted variables.

Figure 3.

Placebo test.

5.6. Analysis of Mediating Effects

The existence of mediating variables that affect pathways is verified by drawing on Claudio Oliveira de Moraes et al. [50]. We use model (11) to test the effect of the independent variable digital finance on the mediating variable financing constraints [32]. As shown in columns (1), (3), (5), and (7) of Table 8, the coefficients of the total digital finance index, coverage breadth, usage depth, and digitalization degree on financing constraints are −0.051, −0.055, −0.033, and −0.068, respectively, all of which are significant at the 1% level. This indicates that digital finance development alleviates corporate financing constraints. Using model (12) for regression, it can be seen from columns (2), (4), (6), and (8) in Table 8 that, when the mediating variables of financing constraints are added, the regression coefficients of the total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the degrees of synergy of the coupling of enterprise digitalization and greening are 0.007, 0.007, 0.005, and 0.012, respectively, compared with those in the benchmark regression The coefficients are all reduced and significantly positive at the 1% level, while the regression coefficients of financing constraints on the coupled synergy of enterprise digitalization and greening are all −0.028 and significantly negative at the 1% level. Therefore, financing constraints play a mediating role between digital finance and enterprise digitalization and greening synergy, specifically by alleviating enterprise financing constraints. This means that hypothesis 2 is valid.

Table 8.

Results of the mediation effect test1.

We conduct regression using model (13) to test the impact of the independent variable digital finance on the mediating variable information constraints [33]. As shown in columns (1), (3), (5), and (7) of Table 9, the coefficients of the total digital finance index, coverage breadth, usage depth, and digitalization degree on information constraints are 0.240, 0.229, 0.174, and 0.412, respectively, all of which are significant at the 1% level. This suggests that digital finance development alleviates corporate information constraints. Using model (14) for regression, it can be seen from columns (2), (4), (6), and (8) of Table 9 that, when the mediating variable of information constraint is added, the regression coefficients of the total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the degree of synergy of the coupling of digitalization and greening in the enterprise are 0.008, 0.007, 0.005, and 0.012, respectively, and are all are significant at the 1 percent level. Further, the regression coefficients of information constraints on the degree of synergy of enterprise digitalization and greening coupling are all 0.004 and significantly positive at the 1% level. Therefore, information constraints play a mediating role between digital finance and enterprise digitalization and greening synergy, specifically by alleviating enterprise information constraints. This means that hypothesis 3 holds.

Table 9.

Results of the mediation effect test2.

5.7. Analysis of Moderating Effects

Drawing on the approach of Horst Treiblmaier et al. [51], in order to verify the moderating role of entrepreneurship in the process of using digital finance to promote the synergistic development of enterprise digitalization and greening, regression analysis was conducted by using model (15), the results of which are shown in Table 10. The regression coefficients for the interaction terms of the total digital finance index and entrepreneurship, the coverage breadth and entrepreneurship, the use depth and entrepreneurship, and the digitalization degree and entrepreneurship on the coupled synergy of enterprise digitalization and greening are 0.003, 0.002, 0.002, and 0.004, respectively. All of these coefficients are significantly positive at the 1% level, indicating that entrepreneurship enhances digital finance’s promotion of synergistic development in enterprise digitalization and greening. Thus, hypothesis 4 is validated.

Table 10.

Moderated effects test results.

5.8. Heterogeneity Analysis

Digital finance is a national policy, and state-owned enterprises (SOEs) have certain political functions and need to better fulfill their social responsibilities. Therefore, there is a difference between the driving effect of digital finance on the synergistic development of enterprise digitalization and greening in SOEs and that in non-SOEs [52]. Based on the above considerations, this paper divides the sample enterprises into state-owned enterprises and non-state-owned enterprises according to the nature of their property rights. As can be seen from the regression results in Table 11, the regression coefficients of the total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the coupled synergy of enterprise digitalization and greening are all significantly positive at the 1% level. Due to the different regression coefficients, a further test of intergroup variability was conducted, the results of which are shown in Table 11. The test results show that the effect of digital finance on the synergistic development of enterprise digitalization and greening is more obvious in the sub-sample of state-owned enterprises than in the sub-sample of non-state-owned enterprises. The reason for this is that digital finance is a national policy, and state-owned enterprises bear certain political functions and need to better fulfill their social responsibilities. Therefore, compared with non-state-owned enterprises, the effect of digital finance on the coupled synergistic development of enterprise digitalization and greening is more obvious in the sub-sample of state-owned enterprises compared with the sub-sample of non-state-owned enterprises. The driving effect of digital finance on the synergistic development of enterprises is stronger in SOEs than in non-SOEs.

Table 11.

Property rights heterogeneity test.

5.9. Analysis of Threshold Effects

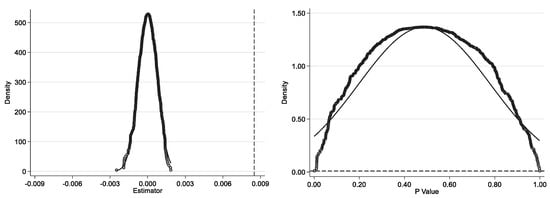

Considering the different effects of different stages of digital finance development (initial exploration and conversion stage, rapid development and popularization stage, and regulation and governance stage) on the synergistic development of enterprise digitalization and greening, we tested whether there is a threshold effect of the impact of digital finance on the synergistic development of enterprise digitalization and greening [53]. Drawing on the threshold model proposed by Hansen [54], the total digital finance index () was used as the threshold variable.

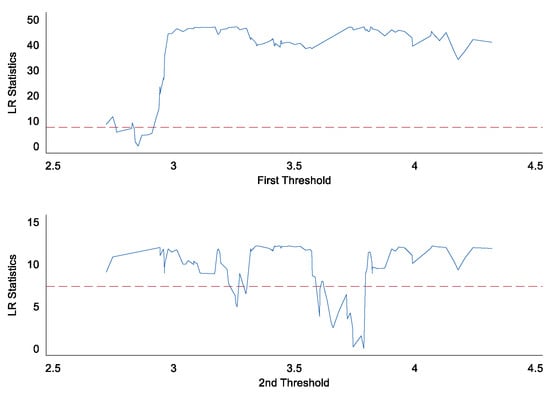

Before the threshold regression, we verified whether the threshold effect exists and whether the threshold estimates are true, and the results of this verification are shown in Table 12 and Figure 4, respectively. As shown in Table 12, passes the double-threshold test, but fails the triple-threshold test, indicating that there is a double-threshold effect. The confidence intervals are shown in Figure 4, with the thresholds (2.8528 and 3.7883) placed within the confidence intervals, which indicates that the thresholds obtained in this paper are true and reliable.

Table 12.

Threshold effect test results.

Figure 4.

Threshold authenticity test.

Table 13 reports the threshold model regression results. When the total digital finance index is at < 2.8528, the coefficient is 0.00233, which is significant at the 5% level. When the total word finance index is at 2.8528 ≤ < 3.7883 and ≥ 3.7883, the coefficients are 0.00442 and 0.00381, which are both significant at the 1% level. It can be seen that there is a positive effect of digital finance on the synergistic development of enterprise digitalization and greening that first increases and then decreases.

Table 13.

Threshold model estimation results.

6. Research Conclusions and Policy Recommendations

6.1. Conclusions of the Study

This paper measures the level of synergistic development of the digitalization and greening of Chinese A-share-listed companies from 2017 to 2022 based on the coupling coordination model, and combines ArcGIS spatial analysis, a two-way fixed effect model, and a threshold regression model to carry out its empirical analysis and to explore the impact of digital finance on the synergistic development of the digitalization and greening of enterprises, as well as its mechanism. This study finds the following:

Firstly, in the time dimension, the level of synergistic development of the digitalization and greening of Chinese enterprises during the period of 2017–2022 has shown a steady trend of improvement, but the overall level is still in the moderate dissonance stage (D-value range of 0.2–0.3). With regard to the evolution of spatial patterns, in 2017, China’s level of synergistic development of digitalization and greening showed a clear distribution of “low in the middle and high around the periphery”, with Beijing-Tianjin-Hebei, the Yangtze River Delta, and the Pearl River Delta constituting relatively high-value core areas. By 2022, this structure will gradually evolve into a low-level “balanced” distribution. Despite the overall increase in the level of synergistic development of digitalization and greening and the enhancement of regional balance, the overall level is still in a moderate dislocation stage, and there is still much room for improvement in the synergistic development of digitalization and greening in China. This paper finds the spatial and temporal variability in the synergistic development of enterprise digitalization and greening, and provides a decision-making reference for the coupled synergistic development of the two.

Secondly, the results of the benchmark regression show that the regression coefficients of the total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the coupling synergy of enterprise digitalization and greening are 0.009, 0.008, 0.006, and 0.014, respectively, all of which are all significant at 1% level, which indicates that digital finance has a driving effect on the synergistic development of digitalization and greening. While, previous studies have focused on the single impact of digital finance on enterprise digitalization and greening, this paper examines the relationship between digital finance and the coupled synergistic development of enterprise digitalization and greening from the perspective of the coupled synergistic development of the two, which provides a new way of thinking and an in-depth understanding of the relationship between digital finance and the coupled synergistic development of enterprise digitalization and greening.

Thirdly, through the mediation effect test and moderating effect test, it is found that, when the mediating variables of financing constraints are added, the regression coefficients of the total digital finance index, the breadth of coverage, the depth of use, and the degree of digitalization on the degree of coupled synergy of enterprise digitalization and greening are 0.007, 0.007, 0.005, and 0.012, respectively, all of which are significantly positive at the 1% level, while the regression coefficients of the constraints of financing on the regression coefficients of the coupled synergies are all −0.028 and significantly negative at the 1% level. When the mediating variable of information constraint is added, the regression coefficients of the total digital finance index, breadth of coverage, depth of use, and degree of digitalization on the coupling synergistic degree of enterprise digitalization and greening are 0.008, 0.007, 0.005, and 0.012, respectively, and are significantly positive at the 1% level, while the regression coefficients of information constraints on the coupling synergistic degree of enterprise digitalization and greening are all 0.004, and are significantly positive at the 1% level. The regression coefficients of the interaction terms of the total digital finance index and entrepreneurship, the coverage breadth and entrepreneurship, the usage depth and entrepreneurship, and the digitalization degree and entrepreneurship on the synergistic degree of coupling enterprise digitalization and greening are 0.003, 0.002, 0.002, and 0.004, respectively, which are all significantly positive at the 1% level. Digital finance promotes the synergistic development of enterprise digitalization and greening by alleviating financing constraints and information constraints, and entrepreneurship has a positive moderating role in the process of enterprise digitalization and greening synergistic development that is driven by digital finance. This paper theoretically and empirically analyzes the mechanism by which digital finance acts on the synergistic development of enterprise digitalization and greening, and opens the “black box” of the influence of digital finance on the synergistic development of enterprise digitalization and greening.

Fourthly, the results of the heterogeneity test show that, compared to non-state-owned enterprises, in state-owned enterprises, the regression coefficients of the total index of digital finance, breadth of coverage, depth of use, and degree of digitalization on the degree of coupled synergy of enterprise digitalization and greening are larger and pass the test of between-group difference (p = 0.000), indicating that, compared with non-state-owned enterprises, the driving effect of digital finance on the synergistic development of enterprise digitalization and greening in state-owned enterprises is more obvious. This paper enriches the research on digital finance and enterprise digitalization and greening by studying the differentiated impact of digital finance on the synergistic development of enterprise digitalization and greening in different contexts.

Fifthly, according to the threshold effect test, there is a double threshold value of 2.8528 and 3.7883, indicating that, with the development of digital finance, its impact on the synergistic development of enterprise digitalization and greening shows a nonlinear change of first increasing and then decreasing. The obtained conclusions help policymakers to make effective adjustments to the policies that support the synergistic development of enterprise digitalization and greening from the perspective of digital finance.

6.2. Policy Recommendations

6.2.1. Optimizing the Allocation of Digital Financial Resources and Promoting Regional Synergistic Development

In view of the current low level of synergistic development of digitalization and greening and the trend of regional equalization, it is recommended to guide digital financial resources to tilt to the central and western parts of China through financial subsidies, tax incentives, and other policies, so as to narrow the gap with the eastern part of the country. This would serve to encourage the areas with digital financial advantages in the east to establish technology transfer, talent exchange, and other cooperation platforms with the central and western parts of the country, and promote the sharing of experience in the synergistic development of digitalization and greening.

6.2.2. Dynamic Monitoring of Threshold Effects and Adjustment of Policy Gradients

We dynamically tracked the input–output ratio of digital finance and identified threshold critical points. We adjusted the policy gradient and adjusted the support according to different stages of digital finance development. At the early stage of digital finance development, inclusive digital infrastructure subsidies and financing guarantee support should be maintained. Digital financial development should be conducted at the rapid development stage, which would tilt policy resources toward industrial internet platform docking, green smart equipment procurement, and other scenarios. In the mature stage of digital finance development, a transformation quality whitelist system should be established, which would serve to shift policy support to quantum computing, digital twins, and other cutting-edge technology research. Further, the mandatory disclosure of ESG information and post-assessment of transformation effects should be implemented.

6.2.3. Implementing Categorized Guidance to Enhance Policy Precision

First, in view of the stronger digital financial driving effect of SOEs, policymakers should deepen the reform of state-owned enterprises (SOEs), and incentivize SOEs to improve their assessment mechanisms for digital transformation and incorporate green technology innovation into their performance evaluation systems for senior executives. Secondly, policymakers should formulate a private enterprise empowerment plan, provide private enterprises with technical advice on the synergistic development of digitalization and greening, subsidize digital tools, and support enterprises in building supply chain green ecosystems with digital financial platforms.

6.2.4. Stimulating Entrepreneurship and Releasing Endogenous Power for Transformation

First, enterprises should cultivate a culture of innovation, enhance entrepreneurs’ knowledge of the synergistic development of digitalization and greening through policy propaganda and case promotion, and encourage the application of digital technology to green production process innovation. Secondly, enterprises should improve their fault-tolerance mechanisms and explore the establishment of a governmental financing guarantee fund for business risks caused by technical trial and error in the synergistic development of digitalization and greening, so as to alleviate entrepreneurs’ decision-making concerns.

6.3. Research Limitations and Perspectives

This paper has the following shortcomings.

First, due to the difficulty of obtaining primary data on the synergistic development of digitalization and greening of enterprises, this paper focuses on the selection of corresponding indicators based on publicly available secondary data and measures the level of synergistic development of the digitalization and greening of enterprises by constructing a comprehensive indicator evaluation system for the synergistic development of the digitalization and greening of enterprises. Secondly, in terms of control variables, this paper has selected six control variables, such as enterprise age. However, there are many factors that affect the synergistic development of the digitalization and greening of enterprises, and it is inevitable that there are omissions in the selection of control variables.

To address the above shortcomings, in future research, we will try to develop scales and use questionnaires to obtain primary data to measure the degree of synergy between enterprises’ digital transformation and their green transformation. In addition, future research will further categorize and summarize the relevant control variables that affect the synergistic development of the digitalization and greening of enterprises, so that the control variables can be included in a structured manner at different levels to obtain more accurate research conclusions.

Author Contributions

Concepts, Y.L. and H.X.; methods, H.X.; software, H.X.; verification, C.L. and H.X.; formal analysis, H.X. and C.L.; data organization, H.X.; writing—original draft preparation, H.X.; writing—review and editing, Y.L., H.X. and C.L.; supervision, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Social Science Fund of China (22BGL010).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data provided in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- She, Q.; Qian, J.; He, L. Research on the relationship of coupling coordination between digitalization and green development. Sci. Rep. 2024, 14, 19569. [Google Scholar] [CrossRef] [PubMed]

- Tian, Q.; Shen, W.; Wang, Y.; Liu, L. Mechanism and evolution trend of digital green fusion in China’s regional advanced manufacturing industry. J. Clean. Prod. 2023, 427, 139264. [Google Scholar] [CrossRef]

- Ye, F.; Zheng, J.; Li, Y.; Li, L.; Linghu, D. Exploring the fusion of greening and digitalization for sustainability. J. Clean. Prod. 2024, 442, 141085. [Google Scholar] [CrossRef]

- Collevecchio, F.; Cappa, F.; Peruffo, E.; Oriani, R. When do M&As with Fintech Firms Benefit Traditional Banks? Br. J. Manag. 2023, 35, 192–209. [Google Scholar] [CrossRef]

- Razzaq, A.; Yang, X. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Change 2023, 188, 122262. [Google Scholar] [CrossRef]

- Li, Q.; Gupta, P. Research on the Impact Mechanism and Application of Financial Digitalization and Optimization on Small- and Medium-Sized Enterprises. Sci. Program. 2021, 2021, 9534976. [Google Scholar] [CrossRef]