Abstract

Digitalization and Industry 4.0 are transforming supply chain operations worldwide. However, traditional supply chain finance (SCF) practices often overlook sustainability. This study explores how SCF, supported by Industry 4.0 technologies, can enhance supply chain sustainability by integrating the Environmental, Social, and Governance (ESG) principles. By examining five real-world cases using a qualitative case study approach, we develop a conceptual framework that captures the roles and interrelationships among key actors in sustainable supply chain finance (SSCF). This study employed cognitive mapping to visually synthesize these complex processes. The findings reveal that innovative technologies, stakeholder engagement, and targeted financial incentives can drive sustainable improvements across supply chains. The insights from this research offer valuable guidance for practitioners and policymakers and provide a foundation for future empirical studies.

1. Introduction

Driven by sustainable development initiatives, companies in different industries are integrating Environmental, Social, and Governance (ESG) measures into their development strategies to reduce carbon emissions and improve human rights in the workplace. However, these companies do not operate independently, as they have close connections with suppliers in their supply chains. Consequently, developing sustainability in supply chains is crucial, with financial flows playing a critical role [1].

Supply chain finance (SCF) refers to financing solutions that optimize and balance working capital along the supply chain. It addresses suppliers’ liquidity challenges, enabling them to receive early payments, which is particularly beneficial for small and medium-sized enterprises (SMEs) [2,3]. Notable SCF solutions include reverse factoring and dynamic discounting.

Increasing public awareness of sustainability and efforts to combat climate change has resulted in the growing popularity of environmentally friendly products. This obligates companies to operate in an eco-friendly manner, with Industry 4.0 (I4.0) offering a potential solution. Industry 4.0, the fourth industrial revolution, integrates information technology with production and distribution processes. It facilitates continuous communication and connection among all value chain members, reducing production time and labor costs and increasing production quantity and quality [4]. Industry 4.0 is supported by various technologies, including the Internet of Things, big data analytics, smart robotics, and cloud computing, contributing to economic, ecological, and social improvements.

The influence of the SDGs, technological advancement, and the COVID-19 pandemic has compelled global companies to digitalize and improve their supply chain networks to achieve sustainability goals. However, there is a lack of research exploring the integration of sustainable supply chains and supply chain finance, as well as the main characteristics of sustainable supply chain finance (SCF). This knowledge gap hinders the adoption of SCF programs and limits the implementation of additional practical recommendations for companies. Furthermore, the existing studies primarily focus on the general roles of Industry 4.0 technologies in supply chain sustainability, neglecting the relationship between supply chain finance and sustainable development. The lack of specific explanations creates barriers for global companies to adopt SCF programs and hampers entrepreneurs’ ability to make informed decisions and implement the guidelines [4].

To address this research gap, this study explores how supply chain finance (SCF) solutions can enhance supply chain sustainability with the support of Industry 4.0 technologies. It focuses on the roles and processes of the actors involved in sustainable supply chain finance (SCF) and aims to develop a conceptual framework that presents their impact on sustainability enhancement. This framework serves as a reference for decision-makers, managers, and policymakers seeking to adopt SCF programs to promote supply chain efficiency and achieve sustainability goals. Furthermore, this study contributes to academia by providing a systematic understanding of sustainable supply chain finance for future studies in this field.

Problem Setting from an Industrial Perspective

Sustainable supply chain management is driven by external pressures from stakeholders, the government, and customers. For example, NGOs urge companies to address environmental and social issues in their supply chains [5]. Customer expectations also influence sales and financial performance, encouraging sustainability practices [6,7,8]. Moreover, governments prioritize Sustainable Development Goals [9], prompting companies to extend sustainability efforts throughout their supply chains.

Industry 4.0 (I4.0) technologies have been widely adopted by companies such as Volkswagen, Daimler, and BMW in Germany and through initiatives such as ‘Make in India’ and ‘Made in China 2025’ in India and China [10,11]. These digital strategies are transforming labor-intensive production into knowledge-intensive manufacturing processes. Initially applied in large retail chains, clothing manufacturers, and consumer goods companies, supply chain finance (SCF) has boosted innovation, competitive advantage, and financial performance. Additionally, SCF strengthens long-term relationships by enabling mutual financial guarantees among supply chain members [1]. I4.0 technologies such as IoT, cloud computing, and big data analytics further enhance SCF by automating and streamlining processes [12,13].

Traditional SCF focuses mainly on economic aspects, often neglecting environmental and social considerations [14]. Sustainable supply chain finance (SSCF) has emerged in response to growing concerns about resource depletion, climate change, and inequality [15]. However, the literature on SSCF remains limited. Hence, this study explores how SCF solutions supported by I4.0 can enhance sustainability. The guiding research question is: “How can Supply Chain Finance supported by Industry 4.0 enhance supply chain sustainability?” The specific objectives were as follows:

- To review the literature on supply chain finance, Industry 4.0, and sustainability;

- To develop a theoretical framework to explain how I4.0-supported SCF enhances supply chain sustainability;

- To validate the framework through case studies;

- To present a framework detailing the roles of actors in SSCF programs and their implementation processes.

2. Literature Review

Supply chain finance (SCF) promotes collaboration among supply chain members, optimizes finance by reducing capital costs, and accelerates cash flows [1]. SCF involves short-term financial solutions provided by financial institutions, focusing on payables, receivables, and inventories [16]. The definition of SCF varies and encompasses fixed asset financing, inventory financing, and accounts’ receivable or payable financing.

SCF consists of five key constructs: actors, instruments, processes and triggers, enablers and inhibitors, and financial benefits [17]. Actors include primary and supportive members, while instruments facilitate the provision of financial services. Supply chain processes and triggers integrate physical and financial supply chains. Enablers and inhibitors impact SCF implementation, and financial benefits are evident through improved financial ratios and optimized working capital.

2.1. Supply Chain Finance (SCF) in Industry 4.0

Industry 4.0 technologies improve supply chain performance by enhancing connectivity, visibility, and transparency [18]. Four widely applied Industry 4.0 technologies in SCF are Artificial Intelligence (AI), blockchain, and things- and internet-oriented technologies [18]. AI enables data processing, anomaly detection, and automated invoice handling, thereby improving the efficiency of SCF [19]. With its decentralized and secure ledger, blockchain technology enhances transaction efficiency, auditing, and risk control in SCF [20]. In summary, digital platforms and Industry 4.0 technologies have revolutionized SCF by facilitating direct connections, reducing transaction costs, enhancing visibility, and improving risk control. The integration of AI and blockchain technology further enhances the efficiency, security, and transparency of SCF processes.

There are three famous and widely used digital platforms. The first platform offers a unique white-label program integrated with state-of-the-art technology and deep expertise to support global SCF programs of any size. This platform is seamlessly combined with major enterprise resource planning (ERP) systems. In addition, it connects to local and international liquidity providers, saving companies the opportunity costs of adopting a new platform and time to reach available funders. Furthermore, this digital platform is fully functional and can be customized and branded, including privacy notices, email templates, and web portals. Specifically, buyers communicate with suppliers regarding payment terms based on industry benchmarks. The invoices are then available for the supplier to finance via the platform. Since the platform also connects to banks, they can execute financing in exchange for a discount. Consequently, the supplier can receive payment early as a new source of working capital. The final step is for the buyer to pay the invoices on the due date. The entire process can help buyers conserve cash for other purposes, obtain low-cost and free cash flow, mitigate supply chain risks such as supplier capacity or bankruptcy risk, and build better relationships with suppliers.

Another widely used SCF digital platform emphasizes the importance of accommodating differences across businesses and their supplier networks. This underscores the need for flexible, scalable, and customizable solutions that align with companies’ specific strategic and operational objectives. Such platforms often offer seamless integration with major enterprise resource planning (ERP) systems and proprietary accounts payable (AP) systems. They also provide user-friendly interfaces and intuitive supplier onboarding processes. In addition, these solutions typically include flexible execution models, robust data protection mechanisms, and access to a broad network of funders. This in turn improves implementation efficiency, mitigates financial and IT risks, and enhances financing accessibility for suppliers.

The third digital platform is emphasizes powerful, secure, and easy working capital solutions with complete control. Similarly to the former two platforms, it provides customizable and sustainable solutions through scalable technology, which is easy to integrate with ERP and enables real-time visibility of liquidity and receivable status. Furthermore, it has the most extensive global multi-funder network, allowing for market-rate pricing, broad participation by suppliers, and mitigation of the risk of losing funding.

With the innovation of the SCF business model and the advancement of information technology, an increasing number of researchers are integrating information technology with SCF. Ref [21] built a new type of SCF platform using blockchain technology to manage the supply chain information flow, logistics, and capital flow. Blockchain technology is characterized by decentralization and non-tamperability, in which the nodes in the blockchain jointly complete the confirmation of transactions without a third organization. The application of blockchain technology in SCF significantly reduces the transaction costs and improves efficiency and its security. Moreover, protecting the privacy of participants is also important for digital platforms in SCF in terms of trade secrets, such as manufacturers’ financing quotas, order quantities, and prices. However, the blockchain feature that relies on public verification contradicts privacy protection. Studies have demonstrated how to combine advanced and specialized blockchain technologies with artificial intelligence to improve relationships in the supply chain and make funding decisions without disclosing sensitive trade information.

2.2. Industry 4.0 Technologies Enhance Supply Chain Finance (SCF)

Previous research emphasizes the importance of improving the supply chain’s connectivity, visibility, and transparency to improve performance. A common characteristic of Industry 4.0 technologies is that they allow for real-time communication and connection, which meets the requirements of a supply chain. Researchers have identified digital technologies as being thing-oriented, internet-oriented, and semantics-oriented. First, thing-oriented technologies mainly refer to technologies that enable monitoring, tracking, and controlling processes, which can improve product flow in the supply chain. Most current research and applications focus on the manufacturing sector. Second, internet-oriented technologies, such as cloud technologies, involve globalized networks and platforms to facilitate data transmission. These technologies are closely related to enhancing supply chain finance. Finally, semantics-oriented technologies can host, process, and synthesize data.

Four Industry 4.0 technologies have been widely applied in SCF. The first is Artificial Intelligence (AI). AI can be applied as hardware or software in a system that simulates human intelligence using machines. Specific applications of AI in real life include natural language processing, speech recognition, and machine vision. In supply chain finance, AI mainly plays a role in data processing. Millions of invoices must be processed across supply chains. The first practical application of AI was the detection of anomalies in documents and transactions [19]. Another benefit is the ability to extract data from the documents. AI can learn to interpret information and present it in a useful way for individuals to refer to in future activities. Banks have turned to AI for optical character recognition to digitize documents using continuous machine learning to redefine and reclassify data inputs [19]. From the perspective of buyers and suppliers in supply chain finance, AI streamlines invoice handling processes. In reality, it is possible to have hundreds or thousands of suppliers, which generates an even greater number of invoices. Companies can apply AI-driven parsing technologies to automate the receipt, sorting, and processing of invoices, which can ultimately shorten the time to approve these invoices and improve the efficiency of supply chain finance. Furthermore, AI can be applied to the ESG principles. As more companies demand that their suppliers meet the ESG criteria, AI-driven systems can integrate all factors to calculate the best terms based on suppliers’ and industry data to support the decision-making process [19].

The second is blockchain technology. A blockchain is a decentralized ledger of transactions across a peer-to-peer network, enabling participants to confirm transactions without a central authority, which largely increases the efficiency and accuracy of the transactions. It plays an essential role in effectively solving the problem of insufficient data sharing on supply chain finance platforms. The technical characteristics of blockchain include immutability, decentralization, enhanced security, distributed ledgers, consensus, and faster settlement, which bring convenience to auditing and supervision as well as risk control of the supply chain finance business [20]. For example, previous research has identified blockchain technology applications in warehouse receipt financing and reverse factoring, which are the two main instruments of supply chain finance [20]. For warehouse receipt financing, a traditional trading system cannot guarantee the authenticity and validity of transaction data and warehouse receipts because of the complicated system and the difficulty of personnel coordination. However, with the support of blockchain, the new system can connect all the parties involved in warehouse receipt financing, record key information, trigger warehouse auditing, and compare information, solving the problems with the traditional system. Moreover, in reverse factoring, the transfer of receivable bonds requires the focal company to be notified to sign multiple confirmations. Blockchain technology enables automatic cycle management through intelligent contracts that reduce links in the reverse-factoring mode and improve system efficiency [20].

The third is cloud computing. Information asymmetry is the main barrier that hinders SMEs from obtaining SCF. SMEs intend to commit fraudulent acts after obtaining financing, and financial providers are unable to obtain business information about SMEs through open channels. Meanwhile, before providing SCF solutions, financial service providers cannot accurately evaluate SMEs’ financial and credit status, and it is also difficult for them to grasp information on fund flows. However, cloud computing can help companies cross organizational boundaries to improve the efficiency of information sharing, data analysis, and processing, greatly reducing the negative influence of information asymmetry. From the perspective of financial service providers, cloud computing platforms can deepen the effectiveness, timeliness, and relevance of information transmission and provide SMEs with real-time operation and credit information. From the perspective of SMEs, cloud computing can reduce the cost of information sharing, improve access to SCF solutions, and enhance trust among all supply chain finance actors.

The last important technology is big data. Big data technology is defined as a software utility that can analyze, process, and extract information from complex and large datasets. ERP systems, IoT, and cloud computing applied in the supply chain can generate a vast amount of transaction and financial data at large volumes, variety, velocity, veracity, and value. Previous studies have revealed that big data analytics can forecast market demand, improve operational processes, and optimize financial flows by integrating SCF. With the support of big data technology, people can generate critical insights by processing and analyzing vast amounts of data through advanced analytical techniques and visualization tools to facilitate data-driven decision-making and, ultimately, improve the efficiency of supply chain finance.

2.3. Supply Chain Finance and Sustainability

2.3.1. Sustainable Supply Chain Finance Concept Development

The development of the sustainable supply chain finance concept started with [22], who identified financial resources as the key barrier to supplier sustainability engagement by conducting a UK dairy supply chain case study. Ref. [23] highlighted the importance of financial incentives in promoting supplier engagement in sustainability. Based on the two barriers stressed by previous research, scholars have started to overcome them. Ref. [24] stated that suppliers should have greater access to financial resources and advocated using financial strategies to stimulate them to engage in sustainable activities. Refs. [25,26] revealed the important role of SCF in providing better access to financial resources for suppliers, especially for those who are in rural areas or developing regions. Financial barriers have been recognized as the main obstacle that hampers suppliers’ ability to improve their sustainability performance, especially individual suppliers or SME suppliers, who tend to suffer from capital shortages, preventing them from complying with sustainable strategies. Meanwhile, the poor sustainability performance of suppliers can negatively influence the entire supply chain. Therefore, it is necessary to develop SCF to solve suppliers’ financial problems and enhance their sustainability.

Researchers then began to focus on specific financing schemes in SCF and related SCF to sustainability. Some studies have investigated the relationship between trade credit and carbon emission reduction. They found that trade credit can help establish a carbon-efficient supply chain, and that carbon emission regulations can tighten the credit period to reduce carbon emissions. Previous research has mainly focused on SCF assisting suppliers in achieving economic sustainability by solving working capital shortages, but has failed to study the environmental and social aspects. Ref. [27] conducted a case study of Alibaba’s agricultural finance from the perspective of three dimensions: SCF could also help suppliers be more environmentally sustainable by providing designated purchase credit to farmer suppliers to encourage them to purchase environmentally friendly materials. Based on the results of the previous literature, Ref. [15] provided a widely used definition for SSCF: “SSCF refers to innovative SCF solutions that can either incentivize and reward the sustainable performance of suppliers and/or retailers, thus facilitating the enablers and mitigating barriers toward sustainable SCM practice and therefore improve the sustainable performance of the entire supply chain”. However, this definition does not reveal specific SSCF solutions or their implementation to achieve sustainability.

2.3.2. SSCF Solutions

Ref. [28] investigated specific SSCF solutions under three preliminary models: the rewarding, entry barrier, and social models. The rewarding model involves rewarding suppliers for sustainability performance in SCF solutions. The entry barrier model uses ESG assessment as an entry barrier to SCF programs. The social model uses SCF solutions to attain social sustainability.

Under the rewarding model, suppliers are rewarded with lower interest rates or discounts based on ESG assessment results, which encourages continuous engagement in sustainable activities. The entry barrier model uses sustainability assessments to determine suppliers’ access to SCF programs. The social model focuses on offering financial solutions to SME suppliers to support their growth and promote sustainability.

ESG information providers and validating bodies play a crucial role in facilitating sustainable supply chain finance (SSCF) by assessing suppliers’ sustainability performance and certifying both buyers and suppliers for their sustainability practices. This process compensates for traditional supply chain finance (SCF) participants’ lack of ESG-related information, leading to improved supply chain sustainability. In addition to the original participants in the SCF (buyers, suppliers, SCF digital platforms, and financial institutions), ESG information providers and validating bodies are now integral to the network to facilitate SSCF. ESG information providers assess the sustainability performance of suppliers across key ESG dimensions, such as environmental impact (carbon emissions and waste management), social factors (labor practices and employee well-being), and governance aspects (board diversity and executive compensation). For instance, board diversity among suppliers can be a critical governance metric [29], while the distribution of earnings across different employee ranks can highlight social and governance issues within a company [30]. These assessments provide buyers and SCF providers with the necessary ESG-related data to determine whether suppliers can receive better financial conditions based on their sustainability performance.

Validating bodies, on the other hand, certify both buyers and suppliers for their commitment to sustainability practices. This certification process ensures that both parties are aligned with sustainability goals and standards. By providing detailed ESG assessments and certifications, these entities compensate for the shortcomings of traditional SCF participants, who often focus solely on financial indicators and lack comprehensive ESG-related information on suppliers.

As the results of sustainability assessments serve as the basis for accessing SCF programs, suppliers are incentivized to develop more sustainable strategies. This not only benefits individual suppliers, but also positively influences the overall sustainability of the supply chain. For example, suppliers may invest in renewable energy sources to reduce their carbon footprint, implement fair labor practices to enhance social responsibility, or improve corporate governance to ensure transparency and accountability. These actions collectively contribute to creating a more sustainable supply chain ecosystem.

3. Materials and Methods

This study aims to explore how Industry 4.0 technologies enhance the sustainability of supply chain finance. The research methodology involved a literature review, data collection, and analysis. Secondary data from official websites, news sources, white papers, and reports were collected to understand sustainability concepts, Industry 4.0 technologies, and supply chain finance instruments. Google searches and online databases were used to identify SSCF cases in the literature. Five cases were selected based on the availability of detailed information regarding the surgical procedure. Qualitative analysis was conducted using cognitive mapping, a modeling technique that visually represents the relationships and processes of SSCF solutions. Cognitive maps were created for each case, and an aggregate cognitive map was generated to present the overall relationship and processes involved in SSCF solutions.

3.1. Data Collection Methods and Sampling

A literature review was conducted to understand the background knowledge of sustainability concepts, Industry 4.0 technologies and their application, and the basic concepts and instruments of supply chain finance. Secondary data on providers and start-ups offering SSCF solutions were collected from several sources, such as material from the official websites of the companies, news about the launch of SSCF solutions, articles from white papers, and reports provided by the companies. The screening was conducted based on Google and dedicated online databases (e.g., Nexis), using keywords to search for related cases (e.g., “sustainable supply chain finance”; “ESG” AND “supply chain finance”). After filtering and confirming the companies, a thorough investigation was conducted based on the available sources. The information was collected in an Excel spreadsheet, including the company name, website link, news link, SSCF solution, description, actors involved, and notes. Overall, five of nine cases were screened, including companies that successfully implemented SSCF solutions or announced their development of SSCF programs and published relatively detailed information about their implementation, as well as SCF providers such as financial institutions, fintech companies, and ESG information providers.

3.2. Data Analysis Method

This study employed cognitive mapping for qualitative analysis to explore the intricate relationships and processes underpinning SSCF solutions. Cognitive mapping is a modeling technique that integrates ideas, beliefs, values, and attitudes into a visual representation. This method enables us to capture and display the core concepts and their interconnections in a single diagram, thus facilitating an accessible and organized overview of complex phenomena.

The primary advantage of cognitive mapping is its ability to visually consolidate and clarify the diverse elements and relationships inherent in SSCF processes. This allows us to present the nuanced interplay between various actors and mechanisms in a clear, interpretative format. However, we acknowledge that cognitive maps are simplified representations; by focusing on the most critical information, some peripheral details may be inevitably omitted.

We acknowledge that geopolitical issues and environmental factors may influence the implementation of SSCF initiatives in the automotive industry. Our case studies were conducted during a relatively stable period from March to November 2022, ensuring that macro-level influences were consistent across the selected cases. However, as these external factors are likely to affect all instances uniformly, they do not introduce differential nuances into the cross-case comparison. Our study design intentionally assumes that such external factors have a similar impact across all cases, allowing us to focus on firm-specific strategies and the intrinsic dynamics of SSCF implementation. Consequently, the comparative analysis remains robust because the common external influences do not skew the observed differences.

In this study, each selected case was analyzed individually through cognitive mapping based on extensive secondary data. These individual maps were then aggregated into a comprehensive cognitive map that illustrated the overall relationships and processes involved in SSCF solutions. This qualitative approach not only provided rich insights into the subject matter, but also ensured that the complexity of SSCF phenomena was captured in a visually coherent and meaningful manner.

4. Results

4.1. Company A’s Sustainable Supply Chain Finance Program

To achieve the goal of reducing or avoiding one billion metric tons of GHG from the global value chain by 2030, Company A encourages its direct ‘tier 1’ suppliers to reduce GHG emissions with early invoice payments. Four parties participate in Company A’s sustainable supply chain financing program, and their roles are as follows.

The core of the SSCF program is the focal company, Company A. It believes that committing to emission reductions and integrating sustainable practices into operations and sourcing are beneficial to the environment and good for business. These actions can bring the benefit of competitive advantage, technological innovation, brand loyalty, and increased employee engagement. In many industries, the company’s supply chain is responsible for most of the environmental influences, rather than the company itself. Therefore, to establish a sustainable future and help its suppliers improve their sustainable performance, Company A announced a supplier-focused emission reduction initiative in April 2017 as an initiative to inspire suppliers to reduce greenhouse gas (GHG) emissions. The project process starts with suppliers setting up a Project Gigaton account to manage their participation. Then, they must set an emissions reduction goal that is specific, measurable, achievable, relevant, and time-limited. After the first two steps, the participants were required to report their impact each year and receive recognition for their progress.

The financial service provider partners with Company A to start an SSCF program that pegs suppliers’ financing rates to their sustainable performance. Based on measuring suppliers’ progress, HSBC provides SCF programs where variable pricing is applied to encourage suppliers to meet sustainability targets. The financing program is supported by C2FO, an early payment platform that is already Company A’s technology provider. C2FO offers a seamless and reliable platform and global funding network with world-class service.

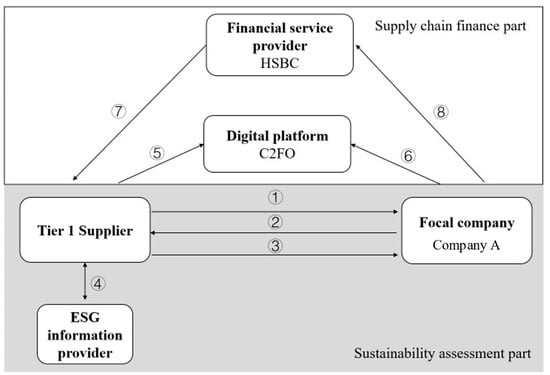

Furthermore, as mentioned above, suppliers must set reasonable emission reduction goals and disclose their results. However, most suppliers lack professional knowledge of sustainability or are unable to set scientific goals. To help suppliers get started, Company A identified six pillars that present opportunities to reduce GHG emissions. The six pillars are energy, nature, waste, packaging, product use, and transportation. Suppliers can focus on one or more of these aspects to improve their existing work. Company A also recommends outside consulted organizations corresponding to the six pillars for suppliers if they need additional support, including the World Wildlife Fund, Environmental Defense Fund, The Nature Conservancy, The Sustainability Consortium, CDP, the Sustainable Packaging Coalition, and Conservation International. In addition, suppliers are required to report their impact annually, which can also be completed using the Project Gigaton system. The system shows the specific data points that suppliers are required to report, and Company A provides an accounting methodology for converting the data information into emissions. The entire process of Company A’s SSCF program is illustrated in Figure 1.

Figure 1.

Company A’s SSCF program.

- The supplier signs up and sets an emission reduction goal in Company A’s system;

- Company A recognizes the supplier’s goal, and the supplier initiates its emission reduction plan;

- The supplier reports the results annually and has access to the SCF program based on progress;

- The supplier can consult the ESG information provider for support in achieving its goals, implementation, and reporting;

- The supplier uploads invoices to a digital platform;

- The focal company approves invoices on a digital platform;

- The financial service provider makes early payments to the supplier;

- The focal company makes the full payment on the due date.

In summary, Company A launched Project Gigaton to inspire its suppliers to reduce greenhouse gas (GHG) emissions and achieve sustainability goals. The program involves Company A as the focal company, HSBC as the financial service provider, C2FO as the early payment platform, and ESG information providers. Suppliers set emission reduction goals and report their progress annually. HSBC offers SCF programs with variable pricing based on sustainability targets, and C2FO provides a seamless platform and global funding network. Company A’s SSCF program follows a rewarding model, where SCF solutions are used as a reward to incentivize suppliers. The program helps to reduce Scope 3 emissions for Company A and Scope 1 and 2 emissions for suppliers.

4.2. Company B Bank, Ltd.’s Sustainable Supply Chain Finance Program

Company B Bank, Ltd. is a leading global bank with a primary customer base in Japan. It launched Japan’s first SSCF program on 9 May 2022, aiming to support clients’ working capital needs and sustainability goals. The program offers SCF solutions as an incentive for medium-sized and small-sized suppliers to adhere to environmental and social guidelines. Consequently, suppliers are encouraged to achieve CO2 emission reduction goals and improve their sustainability performance throughout the entire supply chain.

Company B Bank applies suppliers’ ratings of their sustainability performance to evaluate whether they meet the sustainability guidelines. A French professional sustainability rating agency, EcoVadis, provided the rating service. Company B Bank, Ltd. will provide the supplier with financing on a supply chain platform operated and managed by itself if the supplier meets these guidelines.

EcoVadis is the leading ESG information provider in this program. It evaluates suppliers’ sustainability performance to decide interest rates and annually reviews their performance. EcoVadis categorizes suppliers into five levels based on its evaluation methods: platinum, gold, silver, bronze, and no medal. Its evaluation methods are as follows:

- Certification-based assessment;

- Industry type, country, and size;

- Multilateral evaluations (NGOs, trade unions, international organizations, local governments, and third-party organizations, etc.);

- Using technology;

- Evaluation by corporate social responsibility (CSR) experts;

- Traceability and transparency;

- Based on the seven principles of continuous improvement efforts.

Its assessment model measures seven management indicators, such as policies, endorsements, measures, certifications, coverage, reporting, and 360° watch findings (the output of applying stakeholder inputs to the rating process), across 21 sustainability criteria in four themes: environment, labor and human rights, ethics, and sustainable procurement (Table 1). The assessment process starts with an online questionnaire customized to the supplier’s industry, country of operations, and size. The assessment considers the supplier’s documentation, third-party inputs such as labels and certifications, and an AI-powered engine that monitors external news, watchlists, and databases. Experts from EcoVadis then analyze this information. The results were published in a scorecard, benchmarks, and in detailed feedback on the strengths and improvement areas of each of the four themes.

Table 1.

EcoVadis sustainability criteria.

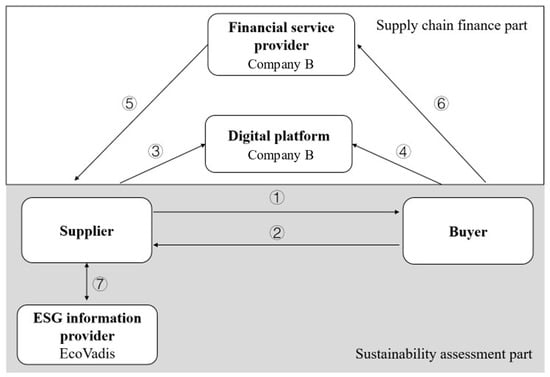

The entire process of Company B Bank, Ltd.’s SSCF program is illustrated in Figure 2.

Figure 2.

Company B Bank’s SSCF program.

- The buyer and supplier form a sales contract;

- The supplier delivers the goods and the buyer issues an invoice;

- The supplier uploads the invoices to the digital platform and applies for early payment;

- The buyer approves the invoices on a digital platform;

- The financial service provider makes the supplier’s early payment;

- The buyer completes the full payment by the due date;

- The ESG information provider evaluates the supplier’s sustainability performance, and the supplier discloses its classification (five levels).

In contrast to Company A’s SSCF program, Company B Bank, Ltd. plays a core role in the program. It not only develops its supply chain platform, which increases the security of the transaction, but also introduces a professional sustainability rating agency to assess suppliers. The program process also complies with the reward model. However, in this case, the financial service provider applies SCF solutions to reward suppliers who have made progress in sustainability performance. In addition, the role of the ESG information provider, in this case, is different from that of Company A. The ESG information providers mainly provide additional consulting in Company A’s case, and Company A states that it is not necessary to find a consulting company if Company A has provided comprehensive guidance and a system.

4.3. Company C’s Sustainable Supply Chain Finance Program

Company C is a leading SCF SaaS provider operating in East Asia. It also ranks first in terms of market share among supply chain finance technology solution providers in China. Company C focuses on applying artificial intelligence, blockchain, cloud technology, and big data to SCF to improve financial market efficiency. First, artificial intelligence-driven optical character recognition (OCR) and natural language processing (NLP) technologies can recognize text in scanned documents and images and understand human language as it is spoken and written. These technologies automate manual processes and reduce the risks associated with operations. Second, blockchain technology improves the transparency and security of assets and information, increasing trust among multiple institutions. Third, cloud technology greatly improves data storage flexibility and reduces the burden on data storage because the SaaS model enables customers to access the platform via the internet instead of by installing the software. Finally, big data allows for the automatic verification of entity identity, assets, related party transactions, and false trades.

Furthermore, Company C helps the supply chain achieve sustainability through two main methods. The first method involves reducing carbon emissions by reducing energy and resource consumption in transactions. The specific implementation includes digital and paperless SCF processes. On the one hand, digital SCF solutions enable the participants to complete SCF activities online, including conducting due diligence, opening bank accounts, collecting assets, and signing contracts. Thus, it achieves emission reduction goals by reducing the offline transportation of relevant personnel. On the other hand, Company C’s ABS cloud (a blockchain-driven intelligent platform for securitization issue management services and post-issuance management services) enables participants to complete their transactions via user interfaces without printing, delivering, or storing large amounts of documents, which saves a significant amount of paper and consequently reduces carbon emissions. Furthermore, these two methods avoid the need for delivery and on-site queuing, as well as in-person contact throughout the process, which ensured the authenticity of the due diligence process and transaction security and enabled SMEs to receive financing safely and timely during the COVID-19 pandemic.

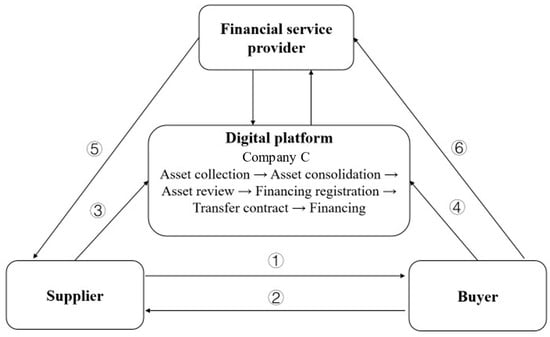

The second method links sustainability performance to green finance. For example, Company C has developed an AMS cloud (a cloud-based supply chain asset processing platform) with a green-label function. This function can identify and label projects or enterprises that meet green environmental requirements. Consequently, investors or financial institutions can easily determine which projects fall within the scope of green finance or sustainable development. Meanwhile, Company C has also developed a proprietary green SSCF data platform. It is a green data information-sharing platform that identifies customers, measures emissions, and tracks footprints to integrate carbon footprint and carbon emission reduction with green financial products, which greatly helps banks to improve green credit efficiency, reduce risks, and standardize supervision. The whole process of Company C’s SSCF program is illustrated in Figure 3.

Figure 3.

Company C’s SSCF program.

- The buyer and the supplier form a sale contract;

- The supplier delivers the goods and the buyer issues the invoices;

- The supplier uploads the invoices to the digital platform and applies for early payment. The digital platform identifies customers, measures emissions, tracks footprints, and informs financial institutions of the results. By applying advanced technologies, the platform completes asset collection, consolidation, review, financing registration, contract transfer, and financing;

- The buyer approves the invoices on the digital platform;

- The financial service provider makes the supplier’s early payment;

- The buyer completes the full payment on the due date.

Unlike the former two cases, this case demonstrates how a digital platform improves the SSCF process and the role of I4.0 technologies in SSCF. Company C not only directly reduces carbon emissions through digital and paperless platforms, but also records the sustainability data of suppliers for financial institutions so that banks can determine which suppliers can obtain financing solutions. This process complies with the entry barrier model, which states that the suppliers’ sustainability performance determines whether they have access to SCF solutions.

4.4. Company D Corp.’s Sustainable Supply Chain Finance Program

Company D Corp. is a global fashion group with multiple well-known clothing brands. It cooperates with HSBC Bank to propose its SSCF program, which is tied to environmental and social objectives based on suppliers’ sustainability ratings.

This SSCF program plays a core role in the forward fashion strategy that Company D uses to transform how clothes are made and used and take actions to move its business and the fashion industry toward a more innovative and responsible future because of limited resources and non-negotiable human rights. The strategy includes three main goals. The first is to reduce negative impacts to zero, which means that Company D Corp.’s products and operations generate zero waste, zero carbon emissions, and zero hazardous chemicals. Its second target is to ensure that 100% of its products and packaging are ethically and sustainably sourced and that 100% of its suppliers respect human rights and are good employers. The final target is to improve the lives of over 1 million people across its value chain. This mainly refers to helping women develop professional and life skills across the supply chain, expanding unconscious bias training, and achieving gender parity in leadership roles. To achieve these goals, Company D requires efforts from its suppliers to improve environmental and social performance, including providing a healthy and safe working environment, compensation, and benefits, as well as avoiding employment issues such as forced labor, child labor, and harassment and abuse. Therefore, financing is pivotal in empowering its suppliers to invest in their businesses and labor to contribute to Company D’s major environmental and social targets.

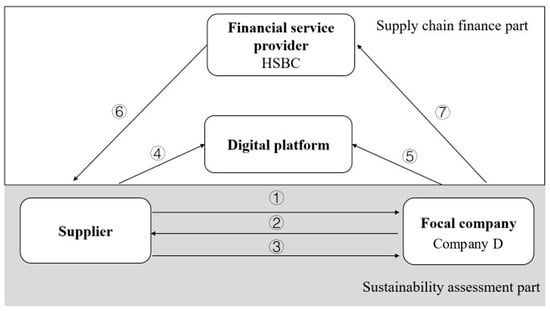

Suppliers’ performance is measured against Company D’s human rights and environmental supply chain standards using industry-aligned tools. Specific measurement methods include the Social Labor Convergence Program (SLCP), which measures a facility’s working conditions, and the Sustainable Apparel Coalition (SAC)’s Higg Facility Environmental Module (Higg FEM), an assessment tool that standardizes how facilities measure and evaluate their environmental performance. Based on these trusted standards and its established expertise in SSCF programs, HSBC provides cheaper funding to suppliers and drives progress toward environmental targets and social elements. The entire process of Company D’s SSCF program is illustrated in Figure 4.

Figure 4.

Company D’s SSCF program.

- The focal company and supplier form a sales contract;

- The supplier delivers the goods and the focal company issues invoices;

- The focal company measures the suppliers’ performance based on the SLCP and Higg FEM to decide on sustainability ratings;

- The supplier uploads the invoices to the digital platform and applies for early payment;

- The buyer approves the invoices on the digital platform;

- The financial service provider makes the supplier’s early payment;

- The buyer completes the full payment on the due date.

Most current sustainable supply chain finance programs focus on suppliers’ environmental performance and assess their emission reductions. However, solving the environmental aspect alone cannot achieve sustainability and may even harm the other two aspects of sustainability. Company D’s case demonstrates how to tie the SSCF program to both environmental and social objectives by applying two standards as assessment tools to evaluate suppliers based on both aspects, including the SLCP and Higg FEM.

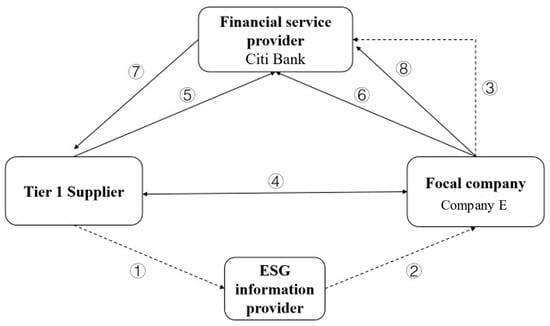

4.5. Company E’s Sustainable Supply Chain Finance Program

Company E, a German company, specializes in chemical products, including detergents and cleaners, cosmetics and skin care products, adhesives, and sealants. Its main brands include Schwarzkopf, Loctite, COMBAT, and SYOSS. Company E has set a goal to become climate-positive by 2040 and created a positive impact on communities. Similarly to all focal companies, Company E cannot achieve its goals alone. Therefore, it is essential to establish common environmental and social standards across the supply chain and finance to incentivize suppliers. The SSCF program has two key aims. First, it aims to incentivize environmental and social improvements. Second, it plans to enhance supply chain resilience by providing suppliers with better liquidity access.

Company E then collaborates with Citi Bank to provide a sustainable SCF structure. Based on its successful SCF program, Company E intends to convert it into an enhanced program to attract more suppliers who share Company E’s sustainability commitment. Suppliers with strong or improving sustainability performance have access to financing at preferential rates. Suppliers’ performance is assessed in the areas of management, environment, health and safety, labor and human rights, and issues of ethical corporate governance, according to 21 criteria linked to the United Nations Sustainable Development Goals. Meanwhile, the measurements vary according to the suppliers’ geography, industry, and scale. Company E and Citi Bank work closely to ensure timely data transmission, such as the suppliers’ sustainability scores. Therefore, suppliers can obtain automated financing at the appropriate rate. Meanwhile, Citi Bank supports Company E with supplier communication, onboarding digital suppliers, and pricing schemes to attract more suppliers.

The SSCF program has benefited both the focal company and its suppliers. From the perspective of the focal company, Company E’s strategy and implementation secure its reputation as a sustainability-led company. It also encourages closer relationships with suppliers by providing cost-effective financing and automating supplier communication. From the perspective of suppliers, the program boosts supply chain resilience, which was significant during COVID-19. Early payment and preferential financing enable suppliers to resist and quickly recover from disruptions. In addition, the effective investment brought by this program improves sustainability performance across the entire supply chain. The entire process of Company E’s SSCF program is illustrated in Figure 5.

Figure 5.

Company E’s SSCF program.

- Providers of sustainability assessments evaluate the supplier’s performance;

- The provider then sends the sustainability score to the focal company;

- The focal company sends the supplier assessment results to the financial service institution;

- The focal company and the supplier form a sale contract. The supplier delivers the goods and the focal company issues the invoices;

- The supplier uploads the invoices to the digital platform of the financial service institution and applies for early payment;

- The focal company approves the invoices on the digital platform;

- The financial service provider makes the supplier’s early payment;

- The buyer completes the full payment on the due date.

4.6. Sustainable Supply Chain Finance Program Participants

Based on the analysis of the cases, Table 2 summarizes the cross-comparison among the companies. In addition, the actors of the SSCF program can be divided into four categories: facilitators, ESG information providers, financial institutions, and practitioners. Facilitators formulate frameworks and policies and promote the relevant information disclosure standards. Evaluation service providers refer to institutions that establish and develop ESG rating systems and provide assessment services. Financial institutions mainly refer to commercial banks that provide supply chain finance instruments to accelerate companies’ liquidity. Finally, practitioners develop business activities based on sustainability concepts.

Table 2.

Cross-comparison of companies.

Facilitators, though not directly participating in the SSCF program, play a role in improving ESG disclosure standards, policies and regulations, and rating systems. Facilitators include intergovernmental or non-governmental international organizations, governments, and regulators. First, intergovernmental organizations are mainly responsible for establishing and improving new ESG regulations. They set the path for ESG development and advocate for governments and regulators to collaborate with international NGOs to support ESG development. Specific facilitators include international organizations with global leadership, such as the United Nations (UN), Principles for Responsible Investment (PRI), and the Organisation for Economic Co-operation and Development (OECD). Second, government and regulatory bodies, including government departments and public authorities, are responsible for developing ESG-related policies and regulations and supporting and monitoring global and national ESG development goals. Third, non-governmental international organizations are responsible for developing and publishing ESG disclosure standards, improving the ESG disclosure system, and promoting the development of ESG disclosure. They consist of industry associations and industry self-regulatory and advocacy organizations, such as the Chartered Financial Analyst (CFA) Institute, Task Force on Climate-related Financial Disclosures (TCFD), and other international disclosure framework standards organizations.

According to these cases, ESG information providers have two main roles in SSCF programs. The first is as a consultant to provide ESG information for other participants to apply ESG knowledge in evaluating or improving companies’ sustainability performance. For example, in Company A’s case, ESG information providers assist suppliers in setting science-based emission reduction goals and guide them to develop sustainable working activities. The second role is to evaluate and rate suppliers’ sustainability performance. First, rating agencies pre-develop rating systems according to the standards or guidelines published by international organizations. They then collect information and data through companies’ CSR reports, public channels, or questionnaires. Finally, the rating agencies give scores and ratings, and some agencies also provide additional evaluations for specific subjects.

Financial institutions are responsible for providing SCF solutions to suppliers who meet sustainability requirements. Financial institutions can participate in SSCF programs in two main ways. The first is commercial banks that work with focal companies and provide SCF solutions based on the ratings of suppliers reported by the focal companies. The second is commercial banks cooperating with ESG rating agencies and providing SCF solutions to suppliers who meet the guidelines.

As for practitioners, an increasing number of companies are recognizing that high-quality ESG development can help them improve their performance in both business and finance and create greater value for the company. Therefore, companies inherently driven by profits have begun to pursue better ESG performance. Furthermore, there are several benefits for companies in developing ESG from the stakeholders’ perspective. First, they can obtain preferential treatment from the government. Companies that perform well in the ESG criteria are more likely to build good relationships with the government and win relatively better preferential policy treatment for business development. Therefore, to gain more opportunities, companies tend to continuously promote ESG development. Second, from the perspective of customers, developing ESG performance can improve customer satisfaction with the company. Companies that develop ESG performance communicate good governance and responsibility for the environment and society to customers. This impression helps companies to establish a good reputation for their products or services, thus increasing customer trust and satisfaction, which is beneficial for companies’ long-term growth. Third, from the employees’ perspective, an increasing number of employees who apply for jobs consider a company’s ESG performance. Companies seeking ESG development are generally better at recruiting talent and ensuring team stability, and have higher levels of employee satisfaction. Finally, from the public’s perspective, developing ESG performance enhances the corporate reputation and positive social influence, further improving the enterprise’s core competitiveness. For instance, Companies A and D Corp. are the focal companies that initiate SSCF programs because they intend to improve their competitive advantage, technological innovation, brand loyalty, and employee engagement.

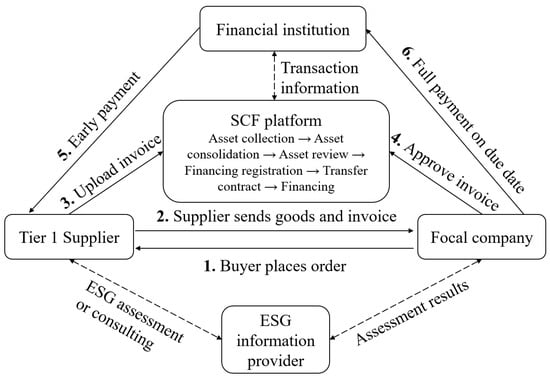

Sustainable Supply Chain Finance Program Process

Four cases followed the rewarding model, where suppliers were evaluated and granted SCF solutions based on their sustainability performance. One case aligns with the entry barrier model, where only suppliers meeting certain criteria can access SCF solutions.

The SSCF programs process is summarized in Figure 6. Suppliers typically start by setting ESG goals and initiating sustainability-related activities. This involves considering factors such as the current business situation and stakeholders’ expectations. Suppliers may seek assistance from ESG information providers to set goals or obtain guidance for implementation. Once signed up for the SSCF program, suppliers undergo annual evaluations by rating agencies, and the assessment results determine their eligibility for financing discounts or access to SCF solutions. Rating information flows efficiently among the main actors through digital platforms enabled by advanced technologies.

Figure 6.

Process of SSCF programs.

After suppliers are recognized as eligible for financing solutions, they can apply for early payments via a digital platform and upload the relevant documentation. The subsequent SCF process may vary depending on the specific financial instruments used.

5. Discussion

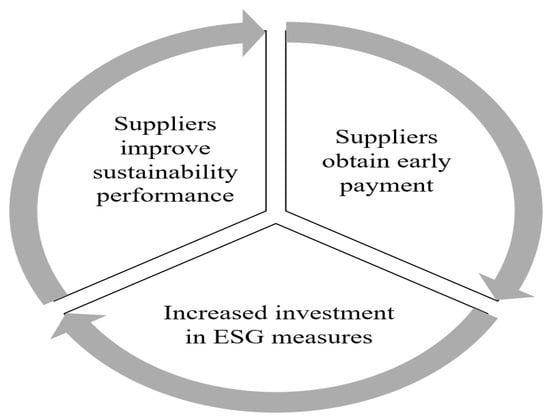

How Can Sustainability Be Achieved?

SSCF programs contribute to supply chain sustainability in three key ways (Figure 7). First, they directly reduce carbon emissions by eliminating paper-based documents and offline SCF activities, leveraging digital platforms supported by advanced technologies. This digital transformation not only enhances operational efficiency, but also minimizes the environmental impact associated with traditional documentation processes [29].

Figure 7.

SSCF programs’ contribution to supply chain sustainability.

Second, suppliers are incentivized to improve their sustainability performance through SCF solutions. Buyers often collaborate with financial institutions to provide early payment incentives to suppliers who meet the ESG guidelines. This not only motivates suppliers to engage in ESG measures, but also helps them to achieve lower financing rates. In a world where anti-ESG sentiment may be rising, as documented by [31], these incentives become even more critical. They ensure that suppliers remain committed to sustainability, despite potential external pressures. By aligning financial incentives with ESG performance, SSCF programs help suppliers to navigate the complex interplay between stakeholder demands for ESG and potential anti-ESG trends, ultimately fostering a more resilient and sustainable supply chain.

Third, SCF solutions play a crucial role in enhancing sustainability. By bridging the payment gap between buyers and suppliers, SCF allows suppliers to access funds earlier and improves liquidity. These funds can be invested in advanced technologies such as AI, machine learning, IoT, and blockchain, which accelerate suppliers’ sustainability efforts. As suppliers improve their ESG performance, they receive better ratings from ESG rating agencies, resulting in access to cheaper financing [30]. This virtuous circle benefits both suppliers and focal companies, leading to lower costs, improved reputation, brand loyalty, and reduced risk.

During periods of elevated inflation, such as the 2021–2022 inflationary episode documented by [32], sustainable supply chain financing faces unique challenges. The inflation during this period was driven by a combination of supply-side constraints and demand-side pressures. These conditions not only increase the cost of financing, but also reduce the availability of credit, as banks tend to cut back on lending during high inflation periods [33]. This reduction in credit availability can undermine the efforts to finance sustainable supply chains, which often require significant upfront investment. However, the value of achieving sustainable supply chain solutions is marginally higher during such periods, as sustainable practices can help mitigate long-term risks and improve resilience against future disruptions. Therefore, while financing sustainable supply chains may be more challenging during high inflation, the potential benefits make it a worthwhile pursuit.

6. Conclusions

6.1. Theoretical Contributions

This study contributes to the existing literature by providing a structured understanding of SSCF programs, including the roles of various actors. This study explores the relationship between Industry 4.0 technologies, supply chain finance, and sustainability. It presents sustainability concepts, Industry 4.0 technologies, and common SCF instruments to form a theoretical framework. Case studies and analyses of secondary data validate and improve the framework, highlighting actors’ involvement and the detailed process of SSCF programs. This study emphasizes a rewarding model, where SCF solutions incentivize suppliers to contribute to ESG measures and foster continuous improvement in sustainability performance.

6.2. Managerial Contributions

From a managerial perspective, this study offers practical guidelines for implementing SSCF programs. It raises awareness of sustainability, describes how SSCF works, and outlines the benefits to companies. Managers can use the research findings to understand the actors involved and the SSCF program process. Additionally, they can explore new collaborations based on the existing frameworks.

6.3. Limitations and Future Research

This study has limitations that suggest avenues for future research. Notably, the qualitative nature of this study, which relies on five in-depth case studies, provides rich contextual insights into SSCF implementation. However, this approach has inherent limitations in terms of its internal and external validity. The internal validity was affected by the potential subjectivity of the cognitive mapping process. Although this technique captures the core relationships and processes, some nuances may be omitted. Moreover, this study, based on qualitative case studies, offers valuable insights into Sustainable Supply Chain Finance (SSCF), but has limitations. The findings may not be generalizable beyond the selected companies, and the specific context and qualitative nature of the research constrain internal and external validity. Additionally, focusing on successful cases may have introduced selection bias. Future research could address these limitations through large-scale quantitative studies or mixed methods approaches. One key limitation of this study is its reliance on qualitative analysis. Although qualitative methods offer a rich, contextualized understanding of the complex and nuanced phenomena within SSCF, they may lack the empirical rigor and scalability that quantitative methods can provide. Future research could benefit from integrating quantitative validation or statistical testing to further validate the findings and generalize the conceptual framework of this study. Second, this study focuses on developing suppliers’ sustainability and exploring the structure of SSCF programs, but the impact on the entire supply chain should be further studied. Future research should examine downstream suppliers’ SSCF programs and their effects on supply chain sustainability. Third, this study analyzes tier 1 SSCF programs between buyers and direct suppliers. Future research should investigate SSCF programs involving deep-tier suppliers and their impact on the supply chain. Future research should explicitly consider the impact of evolving ESG policies, particularly in light of the growing influence of anti-ESG sentiments and regulations [31]. Researchers are encouraged to incorporate the policy environment as a key variable and examine how different regulatory contexts (pro-ESG vs. anti-ESG) influence ESG adoption, implementation, and outcomes. Scenario analyses can help to assess the robustness of findings under varying policy conditions, while cross-country comparative studies can highlight regional differences and identify best practices. Additionally, longitudinal research can track the evolution of ESG practices over time, providing insights into their long-term sustainability and resilience to policy changes. It is also important to consider the role of ESG investors, as their demand for transparency and long-term sustainability has been shown to influence corporate behavior [34]. Finally, future studies should investigate the interplay between stakeholder demand for ESG and regulatory pressures, as well as the direct and indirect effects of anti-ESG policies on corporate behavior, investor sentiment, and market dynamics. By addressing these aspects, researchers can offer more comprehensive and contextually relevant insights into the role of ESG measures in corporate strategies and sustainability. In short, our findings are intended to provide a deep understanding of the dynamics involved in SSCF solutions within the selected cases, rather than statistically generalizable conclusions. This study offers a valuable conceptual foundation, and we encourage future research to employ complementary quantitative approaches to further explore these relationships.

Author Contributions

Conceptualization: W.Z. and D.M.; methodology and calculation, W.Z. and D.M.; data collection and the result analysis, W.Z. and D.M.; writing—original draft, W.Z. and D.M.; writing—review and editing, W.Z. and D.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are contained within this article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Pawlicka, K.; Bal, M. Supply chain finance and challenges of modern supply chains. Logforum 2021, 17, 71–82. [Google Scholar] [CrossRef]

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46. [Google Scholar] [CrossRef]

- Guida, M.; Moretto, A.; Angelo Caniato, F. How to select a Supply Chain Finance solution? J. Purch. Supply Manag. 2021, 27, 100701. [Google Scholar] [CrossRef]

- Bilgin, E. Industry 4.0 and Sustainable Supply Chain. Marmara Üniv. İktisadi İdari Bilim. Derg. 2021, 43, 123–144. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar]

- Berrone, P.; Gomez-Mejia, L. The pros and cons of rewarding social responsibility at the top. Hum. Resour. Manag. 2009, 48, 959–971. [Google Scholar] [CrossRef]

- Gong, M.; Gao, Y.; Koh, S.; Sutcliffe, C.; Cullen, J. The Role of Customer Awareness in Promoting Firm Sustainability and Sustainable Supply Chain Management. Int. J. Prod. Econ. 2019, 217, 88–96. [Google Scholar] [CrossRef]

- Hart, O. Corporate Governance: Some Theory and Implications. Econ. J. 1995, 105, 678. [Google Scholar] [CrossRef]

- Yu, W.; Wong, C.; Chavez, R.; Jacobs, M. Integrating big data analytics into supply chain finance: The roles of information processing and data-driven culture. Int. J. Prod. Econ. 2021, 236, 108135. [Google Scholar] [CrossRef]

- Luthra, S.; Kumar, A.; Zavadskas, E.; Mangla, S.; Garza-Reyes, J. Industry 4.0 as an enabler of sustainability diffusion in supply chain: An analysis of influential strength of drivers in an emerging economy. Int. J. Prod. Res. 2019, 58, 1505–1521. [Google Scholar] [CrossRef]

- Li, L. China’s manufacturing locus in 2025: With a comparison of ‘Made-in-China 2025’ and ‘Industry 4.0’. Technol. Forecast. Soc. Change 2018, 135, 66–74. [Google Scholar] [CrossRef]

- Abdirad, M.; Krishnan, K. Industry 4.0 in Logistics and Supply Chain Management: A Systematic Literature Review. Eng. Manag. J. 2021, 33, 187–201. [Google Scholar] [CrossRef]

- Eslami, M.; Jafari, H.; Achtenhagen, L.; Carlbäck, J.; Wong, A. Financial performance and supply chain dynamic capabilities: The Moderating Role of Industry 4.0 technologies. Int. J. Prod. Res. 2021, 62, 809–8109. [Google Scholar] [CrossRef]

- Kumar, S.; Sharma, D.; Rao, S.; Lim, W.; Mangla, S. Past, present, and future of sustainable finance: Insights from big data analytics through machine learning of scholarly research. Ann. Oper. Res. 2022, 345, 1061–1104. [Google Scholar] [CrossRef]

- Jia, F.; Blome, C.; Sun, H.; Yang, Y.; Zhi, B. Towards an integrated conceptual framework of supply chain finance: An information processing perspective. Int. J. Prod. Econ. 2020, 219, 18–30. [Google Scholar] [CrossRef]

- Camerinelli, E. Supply chain finance. J. Paym. Strategy Syst. 2009, 3, 114–128. [Google Scholar] [CrossRef]

- Chakuu, S.; Masi, D.; Godsell, J. Exploring the relationship between mechanisms, actors and instruments in supply chain finance: A systematic literature review. Int. J. Prod. Econ. 2019, 216, 35–53. [Google Scholar] [CrossRef]

- Hofmann, E.; Belin, O. Supply Chain Finance Solutions; Springer: Berlin/Heidelberg, Germany, 2011; pp. 644–645. [Google Scholar]

- Basquill, J. Artificial Intelligence: A Revolution for SCF? Glob. Trade Rev. 2021, GTR Supply Chain Finance Supplement, August. Available online: https://www.gtreview.com/supplements/gtr-scf-2021/artificial-intelligence-revolution-scf/ (accessed on 10 May 2025).

- Du, M.; Chen, Q.; Xiao, J.; Yang, H.; Ma, X. Supply chain finance innovation using blockchain. IEEE Trans. Eng. Manag. 2020, 67, 1045–1058. [Google Scholar] [CrossRef]

- Rijanto, A. Blockchain Technology Adoption in Supply Chain Finance. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3078–3098. [Google Scholar] [CrossRef]

- Glover, J.L.; Champion, D.; Daniels, K.J.; Dainty, A.J. An Institutional Theory perspective on sustainable practices across the dairy supply chain. Int. J. Prod. Econ. 2014, 152, 102–111. [Google Scholar] [CrossRef]

- Upstill-Goddard, J.; Glass, J.; Dainty, A.; Nicholson, I. Implementing sustainability in small and medium-sized construction firms: The role of absorptive capacity. Eng. Constr. Archit. 2016, 23, 407–427. [Google Scholar] [CrossRef]

- McDermott, T.; Stainer, A.; Stainer, L. Contaminated land: Bank credit risk for small and medium size UK enterprises. Int. J. Environ. Technol. Manag. 2005, 5, 1. [Google Scholar] [CrossRef]

- Bhuiyan, A.B.; Siwar, C.; Ismail, A.G.; Omar, N. The Islamic microfinancing contributions on sustainable livelihood of the borrowers in Bangladesh. Int. J. Bus. Soc. 2017, 18, 79–96. [Google Scholar]

- Sim, J.; Prabhu, V. A microcredit contract model with a Black Scholes model under default risk. Int. J. Prod. Econ. 2017, 193, 294–305. [Google Scholar] [CrossRef]

- Zhou, Q.; Chen, X.; Li, S. Innovative financial approach for agricultural sustainability: A case study of Alibaba. Sustainability 2018, 10, 891. [Google Scholar] [CrossRef]

- Medina, E.; Caniato, F.; Moretto, A. Framing Sustainable Supply Chain Finance (SSCF): An overview of the phenomenon. In Proceedings of the IPSERA 2022 CONFERENCE Programme, Jönköping, Sweden, 21–24 June 2022. [Google Scholar]

- Bogan, V.L.; Potemkina, E.; Yonker, S.E. What Drives Racial Diversity on Us Corporate Boards? Mandates or Movements. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3952897 (accessed on 10 May 2025).

- Potemkina, E. Do CEOs Benefit From Employee Pay Raises? Evidence from a Federal Minimum Wage Law. 2022. Available online: https://www.aeaweb.org/conference/2024/program/paper/Dd8kRE7s (accessed on 10 May 2025).

- Rajgopal, S.; Srivastava, A.; Zhao, R. Do Political Anti-ESG Sanctions Have Any Economic Substance? The Case of Texas Law Mandating Divestment from ESGAsset Management Companies. 2023. Available online: https://haskayne.ucalgary.ca/sites/default/files/teams/47/2022%20Haskayne%20and%20Fox%20Accounting%20Conference/99_Anup%20Srivastava_Do%20Political%20Anti-ESG%20Sanctions.pdf (accessed on 10 May 2025).

- Govindarajan, V.; Ilyas, H.; Silva, F.B.; Srivastava, A.; Enache, L. How Companies Can Prepare for a Long Run of High Inflation. Harv. Bus. Rev. 2022, 2. Available online: https://hbr.org/2022/05/how-companies-can-prepare-for-a-long-run-of-high-inflation (accessed on 10 May 2025).

- Agarwal, I.; Baron, M. Inflation and Disintermediation. J. Financ. Econ. 2024, 160, 103902. [Google Scholar] [CrossRef]

- Dantas, M. Are ESG Funds More Transparent? 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3269939 (accessed on 10 May 2025).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).