Motivating Green Transition: Analyzing Fuel Demands in Turkiye Amidst the Climate Crisis and Economic Impact

Abstract

1. Introduction

2. Data and Methods

2.1. Data

2.2. Methods

3. Results

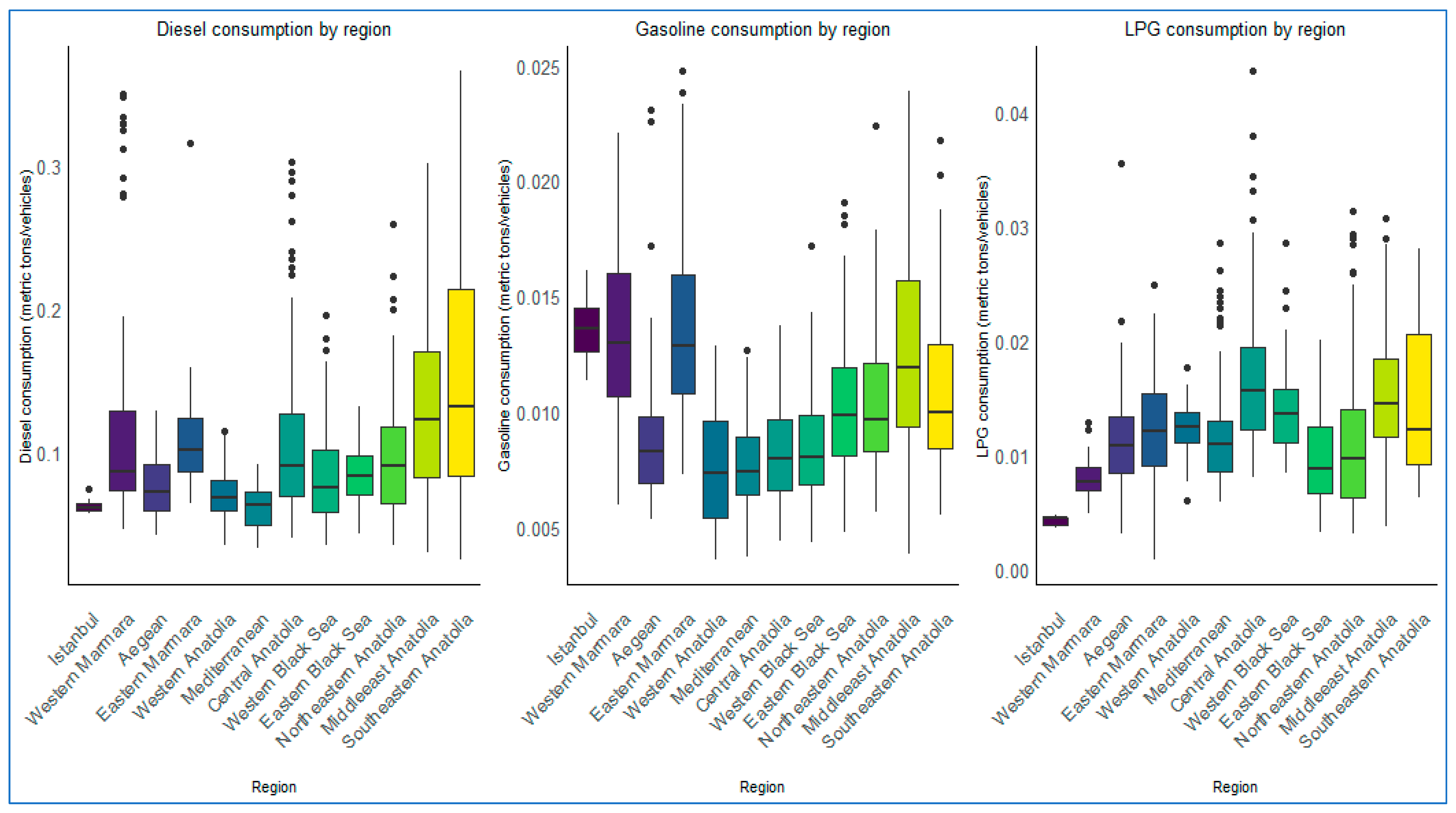

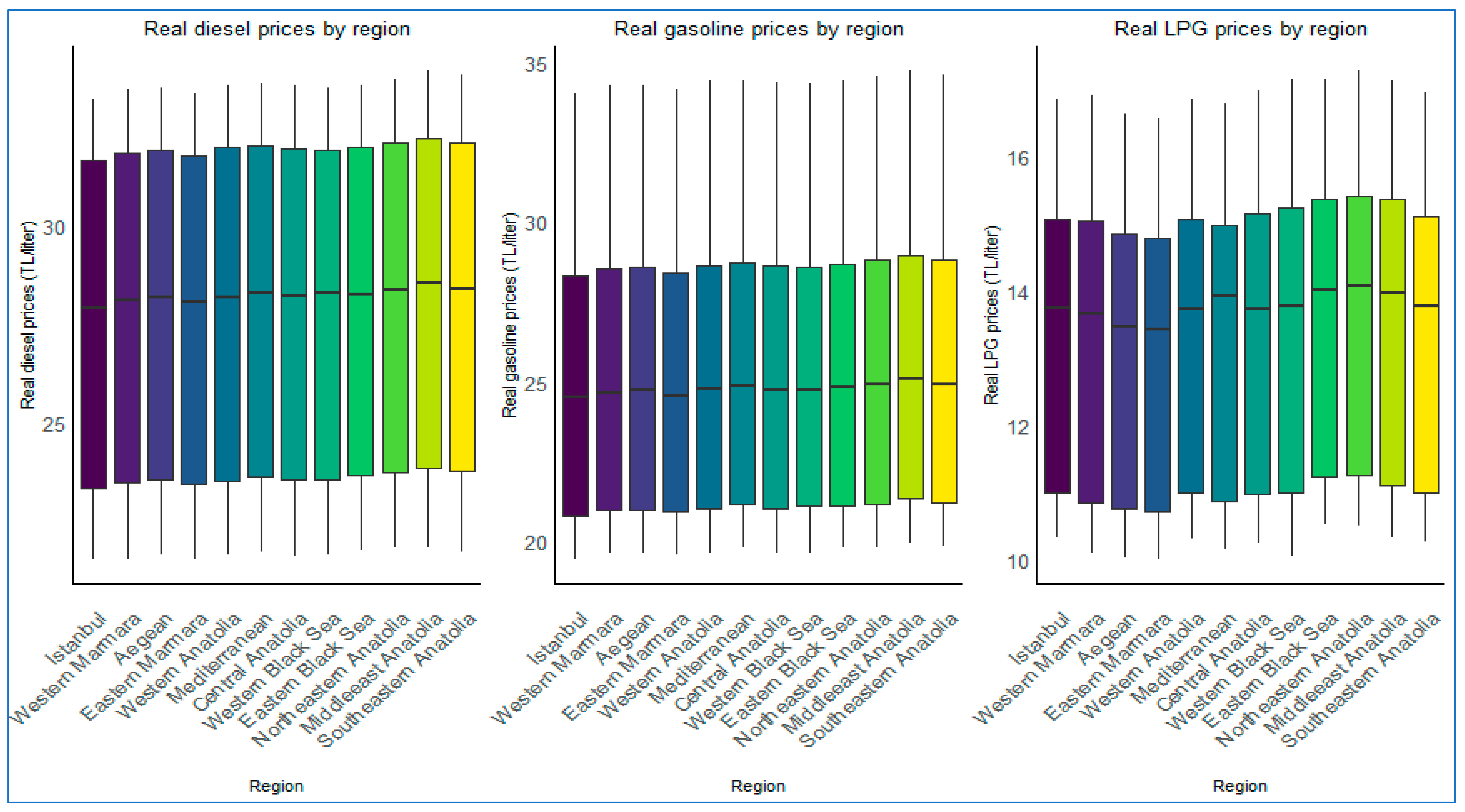

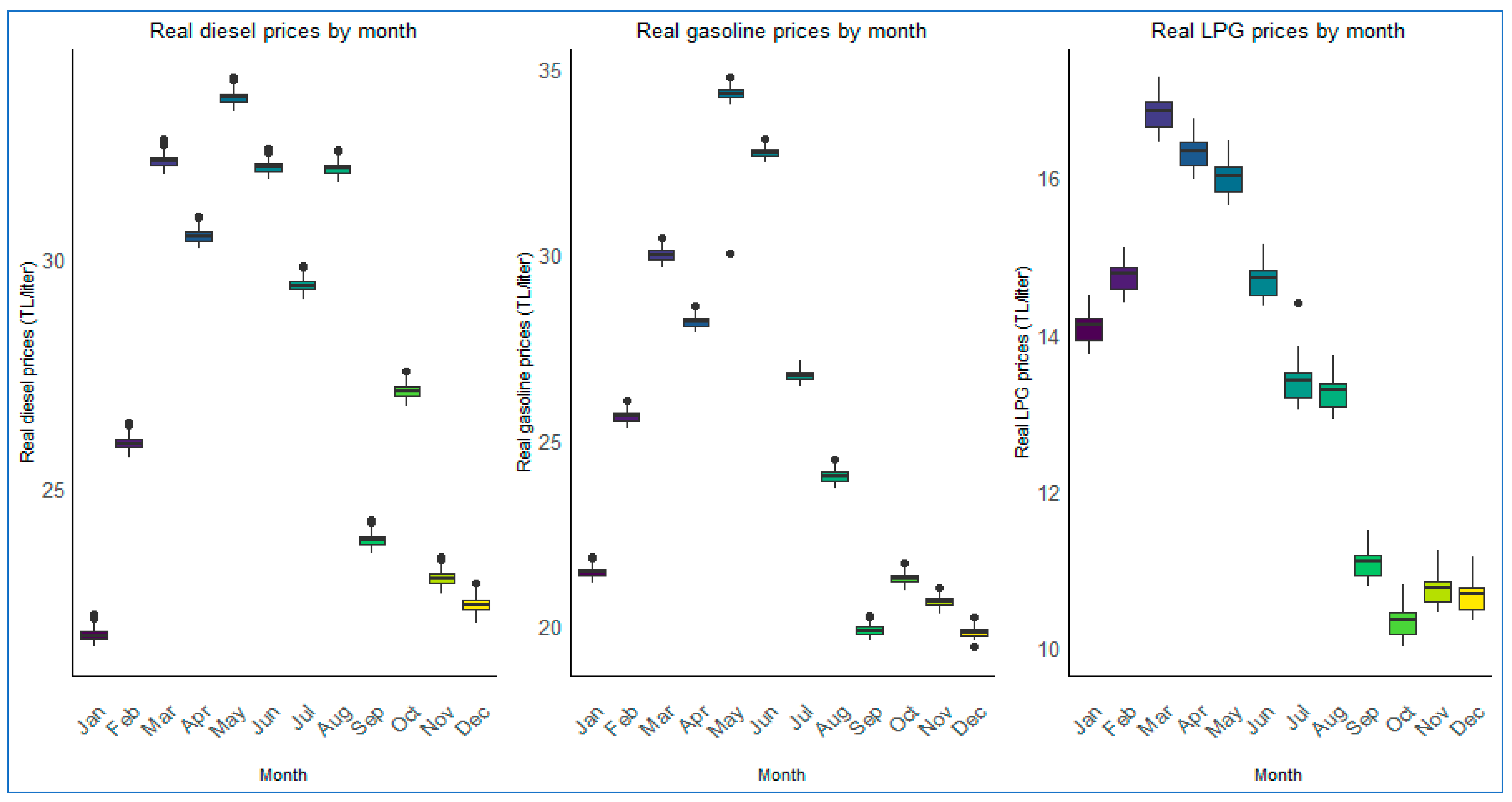

3.1. Preliminary Results

3.2. SUR Estimations

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- European Environment Agency, EEA. 2021. Available online: https://www.eea.europa.eu/tr/articles/temiz-hava-insan-sagligi-ve (accessed on 18 April 2023).

- European Environment Agency, EEA. 2023. Available online: https://www.eea.europa.eu/themes/sustainability-transitions/sustainable-development-goals-and-the/country-profiles/turkey-country-profile-sdgs-and?utm_source (accessed on 18 April 2023).

- Javadpoor, M.; Sharifi, A.; Gurney, K.R. Mapping the relationship between urban form and CO2 emissions in three US cities using the Local Climate Zones (LCZ) framework. J. Environ. Manag. 2024, 370, 122723. [Google Scholar] [CrossRef] [PubMed]

- ESSE, Energy Supply Security and Efficiency. Eleventh Development Plan (2019–2023), Special Expertise Commission Report, Ankara. 2018. Available online: https://www.sbb.gov.tr/wp-content/uploads/2022/12/On-Ikinci-Kalkinma-Plani-Ozel-Ihtisas-Komisyonlari-El-Kitabi-08122022.pdf (accessed on 4 May 2024).

- Worldometer. Turkiye Population. 2024. Available online: https://www.worldometers.info/world-population/turkey-population/ (accessed on 5 June 2024).

- Kodaneva, S.I. Green investments in Russia and abroad: Problems, mechanisms and prospects. Ross. Sovrem. Mir 2020, 3, 68–88. [Google Scholar] [CrossRef]

- Meidiana, C.; Leliana, D.H.; Agustina, D. Potential of urban greening for carbon dioxide reduction from transportation sector. IOP Conf. Ser. Earth Environ. Sci. 2021, 916, 012005. [Google Scholar] [CrossRef]

- OECD. Air Pollution. 2024. Available online: https://www.oecd.org/en/topics/air-pollution.html (accessed on 8 May 2025).

- Wu, Z.; Ren, Y. A bibliometric review of past trends and future prospects in urban heat island research from 1990 to 2017. Environ. Rev. 2019, 27, 241–251. [Google Scholar] [CrossRef]

- Raihan, A.; Tuspekova, A. The nexus between economic growth, renewable energy use, agricultural land expansion, and carbon emissions: New insights from Peru. Energy Nexus 2022, 6, 100067. [Google Scholar] [CrossRef]

- OECD. Climate Action Monitor, Helping Countries Advance Towards Net Zero. 2022. Available online: https://www.oecd.org/content/dam/oecd/en/publications/reports/2022/11/the-climate-action-monitor-2022_0737d48a/43730392-en.pdf? (accessed on 7 May 2025).

- OECD. Greenhouse Gas Emissions Data: Concepts and Data Availability, OECD Statistics Working Papers 2024/03. 2024. Available online: https://www.oecd.org/content/dam/oecd/en/publications/reports/2024/06/greenhouse-gas-emissions-data_57bb38a1/b3e6c074-en.pdf (accessed on 5 May 2025).

- IEA, International Energy Agency. CO2 Emissions in 2022. 2022. Available online: https://www.iea.org/reports/co2-emissions-in-2022 (accessed on 6 May 2025).

- UNEP, United Nations Environment Programme. Emissions Gap Report 2023. 2023. Available online: https://www.unep.org/interactives/emissions-gap-report/2023 (accessed on 4 May 2025).

- OECD, Decarbonisation and the Pricing of Road Transport. 2023. Available online: https://www.oecd.org/publications/decarbonisation-and-the-pricing-of-road-transport-54809337-en.htm (accessed on 5 May 2025).

- Statista. Carbon Dioxide Emissions from the Transportation Sector Worldwide from 1970 to 2023. Available online: https://www.statista.com/statistics/1291615/carbon-dioxide-emissions-transport-sector-worldwide/ (accessed on 5 May 2025).

- OECD. Environmental Outlook: OECD Environmental Outlook to 2050: The Consequences of Inaction—Key Facts and Figures. 2024. Available online: https://www.oecd.org/env/indicators-modellingoutlooks/oecdenvironmentaloutlookto2050theconsequencesofinaction-keyfactsandfigures.htm (accessed on 16 May 2025).

- World Bank. World Bank. World Development Indicators (WDI). In Data Series by The World Bank Group; The World Bank: Washington, DC, USA, 2022; Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 4 May 2024).

- IE, Energy Institute. Fossil Fuels Remain Strong in 2022 Globally, Despite Increases in Renewable Energy. 2022. Available online: https://www.instituteforenergyresearch.org/international-issues/fossil-fuels-remain-strong-in-2022-globally-despite-increases-in-renewable-energy/?utm_source (accessed on 10 May 2025).

- Andersson, Ö.; Börjesson, P. The greenhouse gas emissions of an electrified vehicle combined with renewable fuels: Life cycle assessment and policy implications. Appl. Energy 2021, 289, 116621. [Google Scholar] [CrossRef]

- Ağbulut, Ü. Forecasting of transportation-related energy demand and CO2 emissions in Turkiye with different machine learning algorithms. Sustain. Prod. Consum. 2022, 29, 141–157. [Google Scholar] [CrossRef]

- ABS, Australian Bureau of Statistics. 2020. Available online: https://www.abs.gov.au/ausstats/abs@.nsf/2f762f95845417aeca25706c00834efa/5c9180c568d1da9cca25779e001c471a!OpenDocument (accessed on 31 May 2024).

- Uzar, U.; Eyuboglu, K. The nexus between income inequality and CO2 emissions in Turkiye. J. Clean. Prod. 2019, 227, 149–157. [Google Scholar] [CrossRef]

- Şahin, U. Forecasting of Turkiye’s greenhouse gas emissions using linear and nonlinear rolling metabolic grey model based on optimization. J. Clean. Prod. 2019, 239, 118079. [Google Scholar] [CrossRef]

- Yeni, O. A sectoral analysis of greenhouse gas emissions and output growth in Turkey. In The Dynamics of Growth in Emerging Economies; Routledge: London, UK, 2018; pp. 283–305. Available online: https://www.taylorfrancis.com/chapters/edit/10.4324/9780429436369-13/sectoral-analysis-greenhouse-gas-emissions-output-growth-turkey-onur-yeni (accessed on 4 May 2024).

- OECD. Air and GHG Emissions (Indicator). 2021. Available online: https://data.oecd.org (accessed on 24 January 2024).

- TSI, Turkish Statistical Institute. Turkish Greenhouse Gas Inventory 1990–2020, National Inventory Report for Submission under the United Nations Framework Convention on Climate Change, Ankara. 2022. Available online: https://webdosya.csb.gov.tr/db/iklim/editordosya/NIR_TUR_2012.pdf (accessed on 18 October 2023).

- Rhodium Group. Global Greenhouse Gas Emissions: 1990–2021 and Preliminary 2022 Estimates. 2023. Available online: https://rhg.com/research/global-greenhouse-gas-emissions-2022/?utmsource (accessed on 5 May 2025).

- Güzel, T.D.; Alp, K. Modeling of greenhouse gas emissions from the transportation sector in Istanbul by 2050. Atmos. Pollut. Res. 2020, 11, 2190–2201. [Google Scholar] [CrossRef]

- Bayat, T.; İlarslan, K.; Shahbaz, M. How do logistics and financial ındicators contribute to carbon emissions in Turkiye? Environ. Sci. Pollut. Res. 2023, 30, 97842–97856. [Google Scholar] [CrossRef] [PubMed]

- Coruh, E.; Bilgic, A.; Cengiz, V.; Urak, F. Uncovering the Determinants of Bottom-Up CO2 Emissions Among Households in Turkiye: Analysis and Policy Recommendations. J. Clean. Prod. 2024, 469, 143197. [Google Scholar] [CrossRef]

- Isik, M.; Sarica, K.; Ari, I. Driving forces of Turkiye’s transportation sector CO2 emissions: An LMDI approach. Transp. Policy 2020, 97, 210–219. [Google Scholar] [CrossRef]

- Coruh, E.; Urak, F.; Bilgic, A.; Yen, S.T. The role of household demographic factors in shaping transportation spending in Turkiye. Environ. Dev. Sustain. 2022, 24, 3485–3517. [Google Scholar] [CrossRef]

- Akbostancı, E.; Tunç, G.İ.; Türüt-Aşık, S. Drivers of fuel based carbon dioxide emissions: The case of Turkey. Renew. Sustain. Energy Rev. 2018, 81, 2599–2608. [Google Scholar] [CrossRef]

- MFA, Republic of Turkiye Ministry of Foreign Affairs. 2023. Available online: https://www.mfa.gov.tr/kureselisinma-bm-iklim-degisikligi-cerceve-sozlesmesi-ve-kyto-protokolu.tr.mfa (accessed on 1 October 2023).

- Bakay, M.S.; Ağbulut, Ü. Electricity production based forecasting of greenhouse gas emissions in Turkey with deep learning, support vector machine and artificial neural network algorithms. J. Clean. Prod. 2021, 285, 125324. [Google Scholar] [CrossRef]

- Erdogdu, E. Motor fuel prices in Turkiye. Energy Policy 2014, 69, 143–153. [Google Scholar] [CrossRef]

- Hasanov, M. The demand for transport fuels in Turkey. Energy Econ. 2015, 51, 125–134. [Google Scholar] [CrossRef]

- Sapnken, F.E.; Kibong, M.T.; Tamba, J.G. Analysis of household LPG demand elasticity in Cameroon and policy implications. Heliyon 2023, 9, e16471. [Google Scholar] [CrossRef]

- Wadud, Z.; Graham, D.J.; Noland, R.B. A cointegration analysis of gasoline demand in the United States. Appl. Econ. 2009, 41, 3327–3336. [Google Scholar] [CrossRef][Green Version]

- Havranek, T.; Irsova, Z.; Janda, K. Demand for gasoline is more price-inelastic than commonly thought. Energy Econ. 2012, 34, 201–207. [Google Scholar] [CrossRef]

- TSI, Turkish Statistical Institute. Motor Vehicles, Ankara, Turkiye. 2022. Available online: https://data.tuik.gov.tr/Bulten/Index?p=Motorlu-Kara-Tasitlari-Aralik-2022-49436 (accessed on 10 January 2023).

- Turkish Petroleum. 2022. Available online: https://www.tppd.com.tr/gecmis-akaryakit-fiyatlari?id=25&county=288&StartDate=01.04.2022&EndDate=30.04.2022# (accessed on 15 February 2024).

- Taş, B. Adaptation Process to The European Union (EU) For Turkey’s New Region Concept: The Nomenclature of Territorial Units for Statistics (NUTS). Afyon Kocatepe University J. Soc. Sci. 2006, 8, 185–197. [Google Scholar]

- Croissant, Y.; Milo, G. Panel Data Econometrics with R; John Wiley and Sons: Hoboken, NJ, USA, 2019. [Google Scholar]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. Cambridge Working Papers. Economics 2004, 1240, 1. [Google Scholar]

- Barla, P.; Gilbert-Gonthier, M.; Kuelah, J.R.T. The demand for road diesel in Canada. Energy Econ. 2014, 43, 316–322. [Google Scholar] [CrossRef]

- Gillingham, K.; Munk-Nielsen, A. A tale of two tails: Commuting and the fuel price response in driving. J. Urban Econ. 2019, 109, 27–40. [Google Scholar] [CrossRef]

- Knittel, C.R.; Tanaka, S. Driving Behavior and the Price of Gasoline: Evidence from Fueling-Level Micro Data (No. w26488); National Bureau of Economic Research: Cambridge, MA, USA, 2019. [Google Scholar] [CrossRef]

- Gasim, A.A.; Agnolucci, P.; Ekins, P.; De Lipsis, V. Modeling final energy demand and the impacts of energy price reform in Saudi Arabia. Energy Econ. 2023, 120, 106589. [Google Scholar] [CrossRef]

- Alberini, A.; Horvath, M.; Vance, C. Drive less, drive better, or both? Behavioral adjustments to fuel price changes in Germany. Resour. Energy Econ. 2022, 68, 101292. [Google Scholar] [CrossRef]

- Mensah, J.T.; Marbuah, G.; Amoah, A. Energy demand in Ghana: A disaggregated analysis. Renew. Sustain. Energy Rev. 2016, 53, 924–935. [Google Scholar] [CrossRef]

- De Borger, B.; Mulalic, I.; Rouwendal, J. Substitution between cars within the household. Transp. Res. Part A Policy Pract. 2016, 85, 135–156. [Google Scholar] [CrossRef][Green Version]

- Burke, P.J.; Nishitateno, S. Gasoline prices, gasoline consumption, and new-vehicle fuel economy: Evidence for a large sample of countries. Energy Econ. 2013, 36, 363–370. [Google Scholar] [CrossRef]

- Lin, C.Y.C.; Zeng, J.J. The elasticity of demand for gasoline in China. Energy Policy 2013, 59, 189–197. [Google Scholar] [CrossRef]

- Arzaghi, M.; Squalli, J. How price inelastic is demand for gasoline in fuel-subsidizing economies? Energy Econ. 2015, 50, 117–124. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; López-Otero, X. A meta-analysis on the price elasticity of energy demand. Energy Policy 2017, 102, 549–568. [Google Scholar] [CrossRef]

- Yii, K.J.; Geetha, C.; Chandran, V.V. Estimating the elasticity of energy over consumption at micro level: A case study in Sabah, Malaysia. Energy Proc. 2017, 105, 3571–3576. [Google Scholar] [CrossRef]

- Hu, W.; Ho, M.S.; Cao, J. Energy consumption of urban households in China. China Econ. Rev. 2019, 58, 101343. [Google Scholar] [CrossRef]

- Hymel, K.M.; Small, K.A. The rebound effect for automobile travel: Asymmetric response to price changes and novel features of the 2000s. Energy Econ. 2015, 49, 93–103. [Google Scholar] [CrossRef]

- Bhuvandas, D.; Gundimeda, H. Welfare impacts of transport fuel price changes on Indian households: An application of LA-AIDS model. Energy Policy 2020, 144, 111583. [Google Scholar] [CrossRef]

- Dahl, C.A. Measuring global gasoline and diesel price and income elasticities. Energy Policy 2012, 41, 2–13. [Google Scholar] [CrossRef]

- Del Granado, F.J.A.; Coady, D.; Gillingham, R. The unequal benefits of fuel subsidies: A review of evidence for developing countries. World dev. 2012, 40, 2234–2248. [Google Scholar] [CrossRef]

- Molloy, R.; Shan, H. The effect of gasoline prices on household location. Rev. Econ. Stats. 2013, 95, 1212–1221. [Google Scholar] [CrossRef]

| Variables | Definition | Mean | Std. Dev. |

|---|---|---|---|

| Diesel quantity | Monthly diesel consumption in the province (metric tons) | 25,274.70 | 40,862.69 |

| Gasoline quantity | Monthly gasoline consumption in the province (metric tons) | 3391.10 | 8014.215 |

| LPG quantity | Monthly LPG consumption in the province (metric tons) | 3177.17 | 4314.52 |

| Real diesel price | Diesel pump liter price (Turkish Lira (TL)/per liter) | 27.84 | 4.12 |

| Real gasoline price | Gasoline pump liter price (TL/per liter) | 25.40 | 4.85 |

| Real LPG price | LPG pump liter price (TL/per liter) | 13.52 | 2.25 |

| Gross domestic product | Per capita annual gross domestic product in TL in each province | 64,915.61 | 24,819.05 |

| Vehicle numbers | Total number of vehicles registered on the road per month | 319,276.08 | 620,751.39 |

| Village numbers | Total number of villages/neighbors in each province | 429.57 | 246.01 |

| Area | Total area of the city in square kilometers | 9598.21 | 6275.71 |

| Population | Total population | 1,053,979.96 | 1,890,874.44 |

| Regions: | |||

| Istanbul | 1 if Istanbul sub-region, 0 otherwise | 0.012 | 0.110 |

| Western Marmara | 1 for provinces in the Western Marmara sub-region (including Tekirdağ, Edirne, Kırklareli, Balıkesir, and Çanakkale); 0 otherwise | 0.062 | 0.241 |

| Aegean | 1 for provinces in the Aegean sub-region (Izmir, Aydın, Denizli, Muğla, Manisa, Afyonkarahisar, Kütahya, and Uşak); 0 otherwise. | 0.099 | 0.299 |

| Eastern Marmara | 1 if the province belongs to the Eastern Marmara sub-region (Bursa, Eskişehir, Bilecik, Kocaeli, Sakarya, Düzce, Bolu, and Yalova); 0 otherwise | 0.099 | 0.299 |

| Western Anatolia | 1 if the provinces are in the Western Anatolia sub-region (Ankara, Konya, and Karaman); 0 otherwise. | 0.037 | 0.189 |

| Mediterranean | 1 for provinces in the Mediterranean sub-region (Antalya, Isparta, Burdur, Adana, Mersin, Hatay, Kahramanmaraş, and Osmaniye); 0 otherwise. | 0.099 | 0.299 |

| Central Anatolia | 1 for provinces in the Central Anatolia sub-region (Kırıkkale, Aksaray, Niğde, Nevşehir, Kırşehir, Kayseri, Sivas, and Yozgat); 0 otherwise | 0.099 | 0.299 |

| Western Black Sea | 1 if located in the Western Black Sea sub-region (Zonguldak, Karabük, Bartın, Kastamonu, Çankırı, Sinop, Samsun, Tokat, Çorum, and Amasya); 0 otherwise. | 0.123 | 0.329 |

| Eastern Black Sea | 1 for provinces in the Eastern Black Sea sub-region (Trabzon, Ordu, Giresun, Rize, Artvin, and Gümüşhane); 0 otherwise | 0.074 | 0.262 |

| Northeastern Anatolia | 1 for provinces in the Northeastern Anatolia sub-region (Erzurum, Erzincan, Bayburt, Ağrı, Kars, Iğdır, and Ardahan); 0 otherwise | 0.086 | 0.281 |

| Middle Eastern Anatolia | 1 for provinces in the Middle Eastern Anatolia sub-region (Malatya, Elazığ, Bingöl, Tunceli, Van, Muş, Bitlis, and Hakkari); 0 otherwise | 0.099 | 0.299 |

| Southeastern Anatolia | 1 for provinces located in the Southeastern Anatolia sub-region (Gaziantep, Adıyaman, Kilis, Şanlıurfa, Diyarbakır, Mardin, Batman, Şırnak, and Siirt); 0 otherwise | 0.111 | 0.314 |

| Regions | Quantity Consumed (Tons/Vehicles) | Prices (TL/L) | ||||

|---|---|---|---|---|---|---|

| Diesel Consumption | Gasoline Consumption | LPG Consumption | Diesel | Gasoline | LPG | |

| Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | |

| Istanbul | 0.06284 (0.00480) | 0.01358 (0.00144) | 0.00421 (0.00040) | 27.51292 (4.31761) | 25.08066 (5.08108) | 13.52003 (2.34507) |

| Western Marmara | 0.13494 (0.09714) | 0.01315 (0.00369) | 0.00780 (0.00161) | 27.69909 (4.14577) | 25.26699 (4.88394) | 13.46480 (2.26682) |

| Aegean | 0.07686 (0.02110) | 0.00890 (0.00319) | 0.01118 (0.00417) | 27.76580 (4.14393) | 25.33262 (4.87969) | 13.27715 (2.25104) |

| Eastern Marmara | 0.10752 (0.03244) | 0.01367 (0.00398) | 0.01244 (0.00456) | 27.62799 (4.13845) | 25.13804 (4.80494) | 13.22413 (2.24798) |

| Western Anatolia | 0.07063 (0.01958) | 0.00756 (0.00251) | 0.01218 (0.00238) | 27.80359 (4.18794) | 25.37016 (4.92606) | 13.51747 (2.25053) |

| Mediterranean | 0.06215 (0.01445) | 0.00762 (0.00182) | 0.01185 (0.00476) | 27.84924 (4.14644) | 25.41907 (4.87621) | 13.42201 (2.23920) |

| Central Anatolia | 0.10883 (0.06019) | 0.00830 (0.00216) | 0.01689 (0.00673) | 27.78909 (4.14489) | 25.34911 (4.88185) | 13.54063 (2.25671) |

| Western Black Sea | 0.08312 (0.03216) | 0.00836 (0.00243) | 0.01380 (0.00363) | 27.76830 (4.13028) | 25.32191 (4.86880) | 13.55280 (2.27175) |

| Eastern Black Sea | 0.08530 (0.01998) | 0.01042 (0.00331) | 0.00967 (0.00410) | 27.83641 (4.15083) | 25.40253 (4.89399) | 13.77044 (2.27196) |

| Northeastern Anatolia | 0.09815 (0.04541) | 0.01042 (0.00306) | 0.01145 (0.00689) | 27.95189 (4.14148) | 25.51205 (4.88882) | 13.83540 (2.26299) |

| Middle Eastern Anatolia | 0.13390 (0.06752) | 0.01294 (0.00487) | 0.01546 (0.00559) | 28.10659 (4.11240) | 25.65394 (4.85382) | 13.63614 (2.24527) |

| Southeastern Anatolia | 0.15462 (0.08809) | 0.01072 (0.00342) | 0.01434 (0.00631) | 28.01193 (4.12124) | 25.57491 (4.86152) | 13.53791 (2.24340) |

| Variables/Months | Quantity Consumed (Metric Tons/Vehicles) | Prices (TL/L) | ||||

|---|---|---|---|---|---|---|

| Diesel Consumption | Gasoline Consumption | LPG consumption | Diesel | Gasoline | LPG | |

| Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | Mean (Std. Dev.) | |

| January | 0.08435 (0.05985) | 0.00839 (0.00280) | 0.00882 (0.00322) | 21.80764 (0.15707) | 21.45138 (0.15941) | 14.09576 (0.19197) |

| February | 0.07825 (0.04317) | 0.00856 (0.00313) | 0.00966 (0.00528) | 25.99200 (0.16433) | 25.63824 (0.16783) | 14.75147 (0.19431) |

| March | 0.08486 (0.05318) | 0.00733 (0.00247) | 0.01005 (0.00392) | 32.15994 (0.16580) | 29.98689 (0.17402) | 16.82953 (0.20598) |

| April | 0.09440 (0.05057) | 0.00980 (0.00276) | 0.01094 (0.00410) | 30.52167 (0.15785) | 28.18682 (0.15912) | 16.32753 (0.19649) |

| May | 0.10313 (0.05417) | 0.01015 (0.00329) | 0.01358 (0.00539) | 33.54428 (0.15716) | 34.27952 (0.50521) | 16.01195 (0.21250) |

| June | 0.09780 (0.05685) | 0.00833 (0.00272) | 0.01238 (0.00457) | 32.02989 (0.14635) | 32.72875 (0.13937) | 14.69852 (0.19893) |

| July | 0.11366 (0.05663) | 0.01342 (0.00406) | 0.01715 (0.00688) | 29.43973 (0.15820) | 26.73922 (0.15346) | 13.39646 (0.24053) |

| August | 0.12391 (0.06443) | 0.01338 (0.00428) | 0.01557 (0.00596) | 31.99610 (0.15815) | 24.03686 (0.17409) | 13.27029 (0.21123) |

| September | 0.11443 (0.06448) | 0.01153 (0.00360) | 0.01430 (0.00543) | 23.89369 (0.17019) | 19.90233 (0.15460) | 11.08422 (0.18276) |

| October | 0.11573 (0.06586) | 0.01145 (0.00372) | 0.01400 (0.00551) | 27.13726 (0.17146) | 21.30280 (0.15332) | 10.33676 (0.20264) |

| November | 0.10436 (0.06126) | 0.00914 (0.00325) | 0.01313 (0.00530) | 23.06214 (0.17771) | 20.66761 (0.15566) | 10.75490 (0.19772) |

| December | 0.11256 (0.06582) | 0.01133 (0.00371) | 0.01263 (0.00480) | 22.48988 (0.17636) | 19.82938 (0.16363) | 10.67025 (0.19616) |

| Variables | Diesel Quantity Demanded | Gasoline Quantity Demanded | LPG Quantity Demanded | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Estimate | Std. Err. | 95% Confidence Interval | Estimate | Std. Err. | 95% Confidence Interval | Estimate | Std. Err. | 95% Confidence Interval | ||||

| Lower | Upper | Lower | Upper | Lower | Upper | |||||||

| Constant | −9.857 *** | 3.600 | −16.912 | −2.802 | −13.574 *** | 3.552 | −20.535 | −6. 613 | −6.761 * | 3.515 | −13.650 | 0.129 |

| Log diesel price | 0.744 *** | 0.083 | 0.582 | 0.907 | 0.936 *** | 0.073 | 0.794 | 1.078 | 0.862 *** | 0.076 | 0.712 | 1.011 |

| Log gasoline price | −0.532 *** | 0.091 | −0.710 | −0.355 | −1.184 *** | 0.079 | −1.339 | −1.029 | −0.215 *** | 0.083 | −0.378 | −0.052 |

| Log LPG price | −0.291 ** | 0.092 | −0.470 | −0.111 | 0.274 *** | 0.080 | 0.117 | 0.431 | −0.600 *** | 0.084 | −0.765 | −0.435 |

| Log GDP | 1.186 *** | 0.313 | 0.572 | 1.800 | 1.313 *** | 0.309 | 0.707 | 1.918 | 0.609 ** | 0.306 | 0.009 | 1.208 |

| Log village number | 0.494 ** | 0.232 | 0.039 | 0.949 | 0.733 *** | 0.229 | 0.283 | 1.182 | 0.867 *** | 0.227 | 0.423 | 1.312 |

| Log area | 0.478 ** | 0.238 | 0.011 | 0.945 | 0.275 | 0.235 | −0.186 | 0.736 | 0.214 | 0.232 | −0.242 | 0.670 |

| Vehicles per population | −1.983 ** | 0.845 | −3.640 | −0.326 | −0.132 | 0.830 | −1.759 | 1.495 | 0.926 | 0.826 | −0.693 | 2.545 |

| Regions: | ||||||||||||

| Aegean | 0.325 | 0.305 | −0.273 | 0.922 | 0.145 | 0.300 | −0.445 | 0.735 | 0.117 | 0.298 | −0.467 | 0.700 |

| Eastern Marmara | −1.618 *** | 0.289 | −2.184 | −1.051 | −1.325 *** | 0.285 | −1.885 | −0.766 | −1.627 *** | 0.282 | −2.180 | −1.074 |

| Western Anatolia | −0.197 | 0.287 | −0.759 | 0.365 | −0.373 | 0.283 | −0.928 | 0.182 | 0.081 | 0.280 | −0.468 | 0.630 |

| Mediterranean | −0.563 * | 0.290 | −1.131 | 0.004 | −0.757 *** | 0.286 | −1.317 | −0.196 | −0.601 ** | 0.283 | −1.155 | −0.047 |

| Central Anatolia | 0.058 | 0.454 | −0.832 | 0.949 | 0.010 | 0.449 | −0.870 | 0.889 | 0.456 | 0.444 | −0.414 | 1.325 |

| Western Black Sea | −0.880 *** | 0.313 | −1.494 | −0.267 | −0.741 ** | 0.309 | −1.347 | −0.135 | −1.110 *** | 0.306 | −1.710 | −0.511 |

| Eastern Black Sea | 0.161 | 0.359 | −0.543 | 0.866 | 0.009 | 0.355 | −0.687 | 0.705 | −0.546 | 0.351 | −1.234 | 0.142 |

| Northeastern Anatolia | 0.029 | 0.341 | −0.639 | 0.698 | 0.062 | 0.337 | −0.599 | 0.722 | 0.004 | 0.333 | −0.650 | 0.657 |

| Middle Eastern Anatolia | −1.458 *** | 0.293 | −2.033 | −0.882 | −1.113 *** | 0.290 | −1.681 | −0.545 | −1.209 *** | 0.287 | −1.771 | −0.648 |

| Southeastern Anatolia | 2.458 *** | 0.713 | 1.060 | 3.855 | 3.100 *** | 0.704 | 1.720 | 4.480 | 2.359 *** | 0.696 | 0.994 | 3.724 |

| Seasons: | ||||||||||||

| Winter | −0.213 *** | 0.021 | −0.254 | −0.172 | −0.276 *** | 0.018 | −0.312 | −0.241 | −0.227 *** | 0.019 | −0.264 | −0.190 |

| Some useful statistics: | ||||||||||||

| σα | 0.620 | 0.613 | 0.606 | |||||||||

| σu | 0.175 | 0.153 | 0.161 | |||||||||

| R-squared | 0.692 | 0.732 | 0.733 | |||||||||

| Overall R-squared | 0.720 | |||||||||||

| Huasman specification test | 12.588 ** (p = 0.013) | 0.071 (p = 0.999) | 3.401 (p = 0.493) | |||||||||

| Cross-dependence (CD) test | 60.685 *** (p < 0.000) | 135.900 *** (p < 0.000) | 118.100 *** (p < 0.000) | |||||||||

| Slope homogeneity (Δadj) test | −17.734 *** (p < 0.000) | −17.103 *** (p < 0.000) | −15.921 *** (p < 0.000) | |||||||||

| Variables | Diesel Quantity Demanded | Gasoline Quantity Demanded | LPG Quantity Demanded | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Estimate | Std. Err. | 95% Confidence Interval | Estimate | Std. Err. | 95% Confidence Interval | Estimate | Std. Err. | 95% Confidence Interval | ||||

| Lower | Upper | Lower | Upper | Lower | Upper | |||||||

| Constant | −6.025 | 3.951 | −13.768 | 1.718 | −9.611 ** | 3.866 | −17.187 | −2.034 | −1.914 | 3.682 | −9.129 | 5.302 |

| Log diesel price | 0.757 *** | 0.083 | 0.594 | 0.921 | 0.947 *** | 0.073 | 0.804 | 1.091 | 0.872 *** | 0.077 | 0.722 | 1.023 |

| Log gasoline price | −0.532 *** | 0.091 | −0.710 | −0.355 | −1.193 *** | 0.079 | −1.349 | −1.036 | −0.215 ** | 0.084 | −0.379 | −0.051 |

| Log LPG price | −0.320 *** | 0.092 | −0.500 | −0.140 | 0.260 *** | 0.081 | 0.101 | 0.419 | −0.630 *** | 0.085 | −0.797 | −0.464 |

| Log GDP | 0.977 *** | 0.321 | 0.349 | 1.605 | 1.089 *** | 0.314 | 0.475 | 1.704 | 0.312 | 0.299 | −0.273 | 0.898 |

| Log village number | 0.697 *** | 0.244 | 0.220 | 1.174 | 0.953 *** | 0.238 | 0.485 | 1.420 | 1.173 *** | 0.227 | 0.729 | 1.618 |

| Log area | 0.250 | 0.252 | −0.245 | 0.744 | 0.028 | 0.247 | −0.456 | 0.511 | −0.129 | 0.235 | −0.590 | 0.332 |

| Vehicle per population | −3.022 *** | 0.973 | −4.930 | −1.114 | −1.296 | 0.946 | −3.151 | 0.559 | −0.858 | 0.910 | −2.642 | 0.926 |

| Regions: | ||||||||||||

| Aegean | 0.176 | 0.365 | −0.540 | 0.892 | 0.152 | 0.357 | −0.547 | 0.853 | 0.693 ** | 0.340 | 0.026 | 1.359 |

| Eastern Marmara | −0.274 | 0.278 | −1.016 | 0.467 | −0.104 | 0.370 | −0.829 | 0.621 | 0.317 | 0.353 | −0.374 | 1.008 |

| Western Anatolia | 0.054 | 0.502 | −0.930 | 1.038 | 0.171 | 0.491 | −0.792 | 1.134 | 1.237 *** | 0.468 | 0.320 | 2.154 |

| Mediterranean | 0.148 | 0.377 | −0.591 | 0.886 | 0.327 | 0.369 | −0.396 | 1.050 | 1.015 *** | 0.351 | 0.326 | 1.703 |

| Central Anatolia | −0.442 | 0.396 | −1.218 | 0.334 | −0.474 | 0.387 | −1.233 | 0.285 | 0.491 | 0.369 | −0.232 | 1.214 |

| Western Black Sea | −1.022 ** | 0.400 | −1.806 | −0.237 | −1.089 *** | 0.392 | −1.857 | −0.322 | −0.510 | 0.373 | −1.241 | 0.221 |

| Eastern Black Sea | −1.394 *** | 0.437 | −2.251 | −0.537 | −1.137 *** | 0.428 | −1.975 | −0.298 | −1.120 *** | 0.408 | −1.919 | −0.321 |

| Northeastern Anatolia | −2.132 *** | 0.447 | −3.008 | −1.257 | −1.724 *** | 0.437 | −2.579 | −0.868 | −1.648 *** | 0.416 | −2.464 | −0.832 |

| Middle Eastern Anatolia | −2.018 *** | 0.469 | −2.938 | −1.098 | −1.563 *** | 0.459 | −2.461 | −0.664 | −1.310 *** | 0.438 | −2.167 | −0.452 |

| Southeastern Anatolia | −0.916 ** | 0.465 | −1.826 | −0.005 | −0.834 * | 0.454 | −1.724 | 0.056 | −0.627 | 0.433 | −1.476 | 0.222 |

| Seasons: | ||||||||||||

| Winter | −0.216 *** | 0.021 | −0.257 | −0.176 | −0.280 *** | 0.018 | −0.316 | −0.244 | −0.233 *** | 0.019 | −0.270 | −0.195 |

| Some useful statistics: | ||||||||||||

| σα | 0.619 | 0.606 | 0.576 | |||||||||

| σu | 0.175 | 0.153 | 0.161 | |||||||||

| R-squared | 0.668 | 0.707 | 0.748 | |||||||||

| Overall R-squared | 0.710 | |||||||||||

| Huasman specification test | 12.208 ** (p = 0.016) | 0.064 (p = 0.999) | 3.815 (p = 0.432) | |||||||||

| Cross-dependence (CD) test | 60.224 *** (p < 0.000) | 135.890 *** (p < 0.000) | 117.530 *** (p < 0.000) | |||||||||

| Slope homogeneity (Δadj) test | −14.063 *** (p < 0.000) | −12.988 *** (p < 0.000) | −11.574 *** (p < 0.000) | |||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coruh, E.; Yıldız, M.S.; Urak, F.; Bilgic, A.; Cengiz, V. Motivating Green Transition: Analyzing Fuel Demands in Turkiye Amidst the Climate Crisis and Economic Impact. Sustainability 2025, 17, 4851. https://doi.org/10.3390/su17114851

Coruh E, Yıldız MS, Urak F, Bilgic A, Cengiz V. Motivating Green Transition: Analyzing Fuel Demands in Turkiye Amidst the Climate Crisis and Economic Impact. Sustainability. 2025; 17(11):4851. https://doi.org/10.3390/su17114851

Chicago/Turabian StyleCoruh, Emine, Mehmet Selim Yıldız, Faruk Urak, Abdulbaki Bilgic, and Vedat Cengiz. 2025. "Motivating Green Transition: Analyzing Fuel Demands in Turkiye Amidst the Climate Crisis and Economic Impact" Sustainability 17, no. 11: 4851. https://doi.org/10.3390/su17114851

APA StyleCoruh, E., Yıldız, M. S., Urak, F., Bilgic, A., & Cengiz, V. (2025). Motivating Green Transition: Analyzing Fuel Demands in Turkiye Amidst the Climate Crisis and Economic Impact. Sustainability, 17(11), 4851. https://doi.org/10.3390/su17114851