Valuing Carbon Assets for Sustainability: A Dual-Approach Assessment of China’s Certified Emission Reductions

Abstract

1. Introduction

2. Literature Review

2.1. Research on the Pricing of Intangible Assets

2.2. Research Related to Carbon Asset Trading

2.3. Research Related to the CCER Market and Trading

2.4. Determinants of Carbon Trading Prices

3. Practical Value Assessment of CCERs

3.1. Construction of a Practical Value Assessment Model for CCERs

3.2. Determination of Formula Parameters

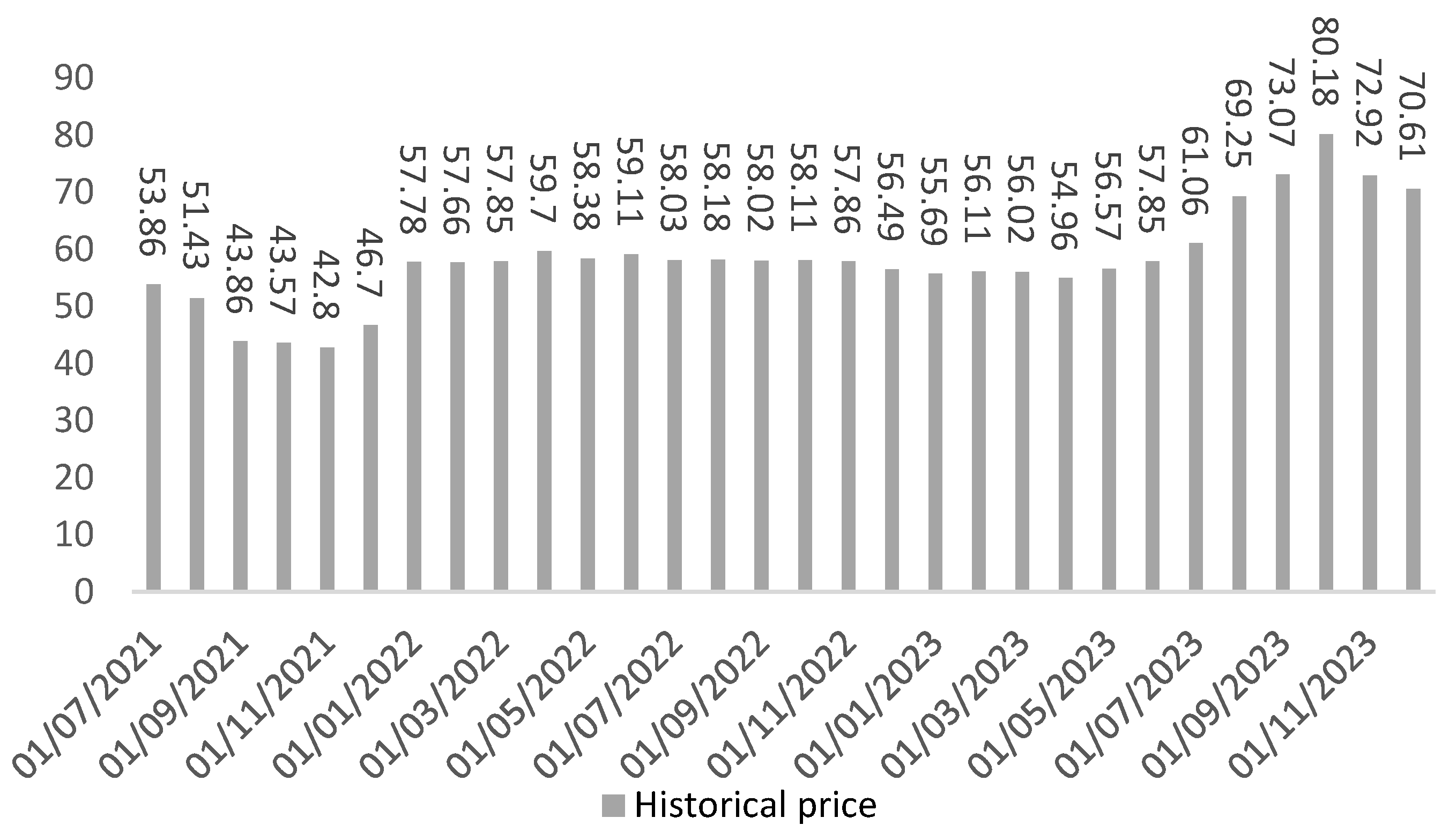

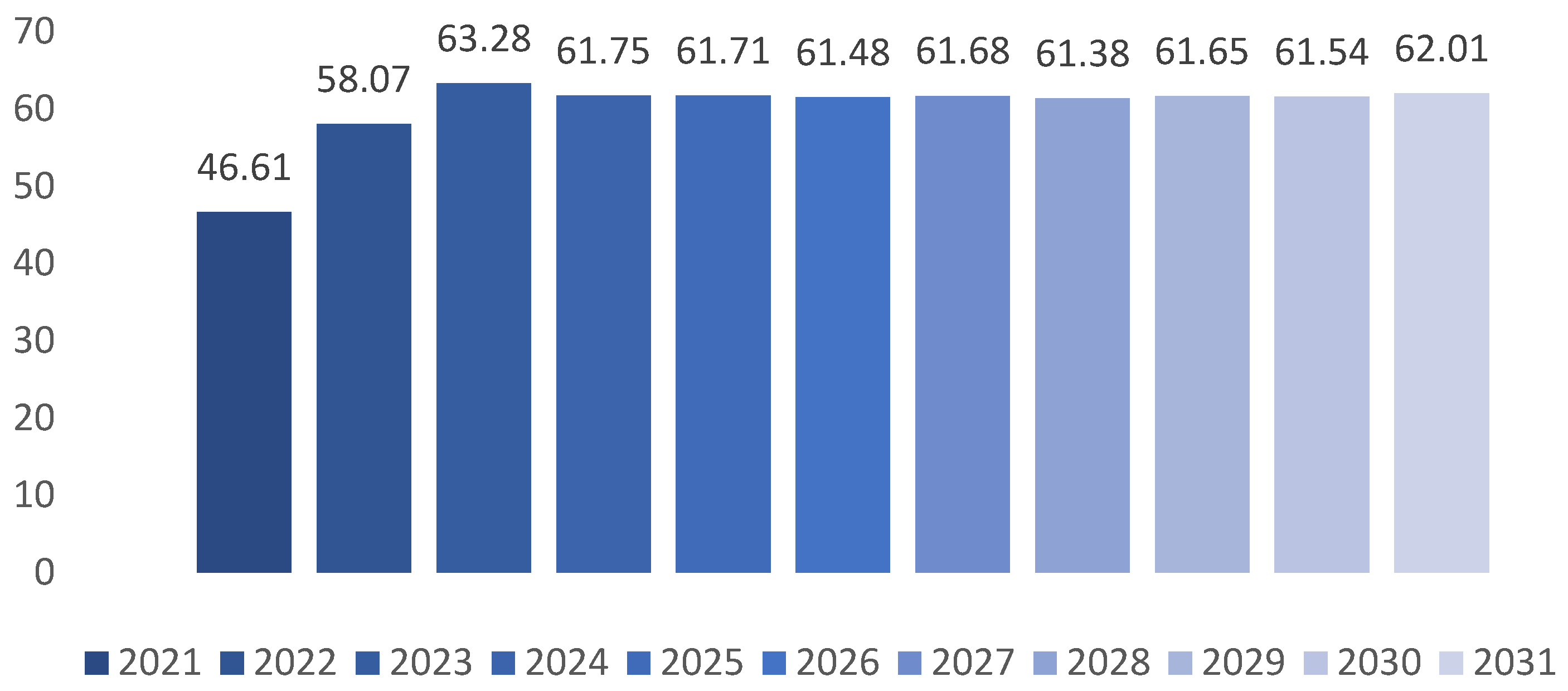

3.2.1. Prediction of CCER Prices

3.2.2. The Cost of CCER Carbon Emission Reduction

3.2.3. Beneficial Lifespan and Discount Rate

3.3. Valuation of the Practical Value of CCER

4. Assessment of the Market Value of CCER

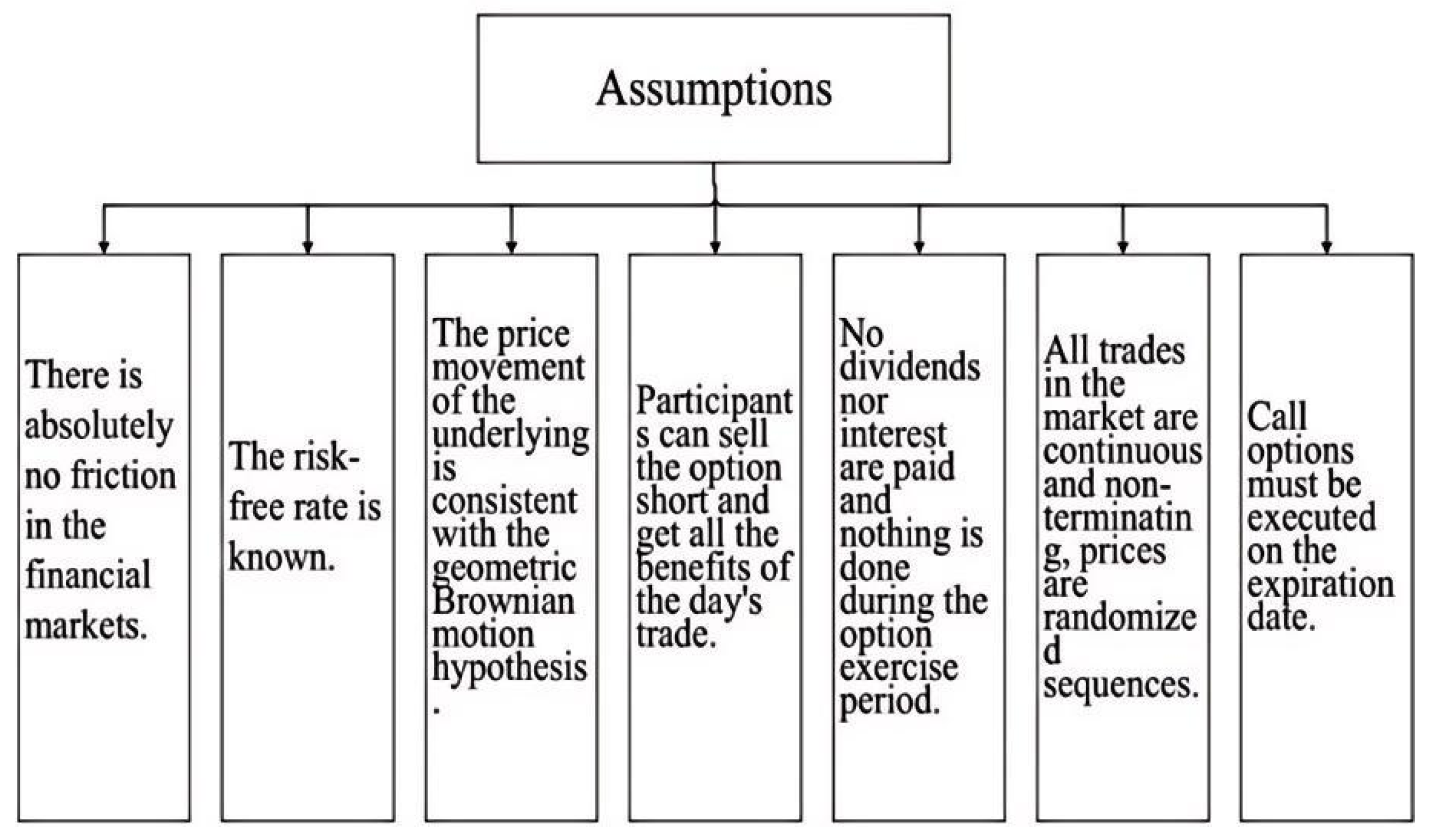

4.1. Construction of CCER Market Value Assessment Model

4.2. Determination of Formula Parameters in the B-S Model

4.3. Valuation of the CCER Market Value

4.4. Examination of the Model’s Reliability

5. Comparison and Summary

5.1. A Comparative Analysis of the Practical Value and Market Value of CCERs

5.2. Summative Assessment

6. Conclusions, Implications, and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Historical Transaction Date | Closing Price (CNY/ton) | Closing Price/Previous Day’s Closing Price | Natural Logarithm |

|---|---|---|---|

| 2021/7/16 | 51.23 | 1.0000 | 0.0000 |

| 2021/7/19 | 52.30 | 1.0209 | 0.0207 |

| 2021/7/20 | 53.28 | 1.0187 | 0.0186 |

| 2021/7/21 | 54.40 | 1.0210 | 0.0208 |

| 2021/7/22 | 55.52 | 1.0206 | 0.0204 |

| 2021/7/23 | 56.97 | 1.0261 | 0.0258 |

| 2021/7/26 | 54.46 | 0.9559 | −0.0451 |

| 2021/7/27 | 54.63 | 1.0031 | 0.0031 |

| 2021/7/28 | 52.50 | 0.9610 | −0.0398 |

| 2021/7/29 | 52.96 | 1.0088 | 0.0087 |

| 2021/7/30 | 54.17 | 1.0228 | 0.0226 |

| 2021/8/2 | 51.99 | 0.9598 | −0.0411 |

| 2021/8/3 | 53.44 | 1.0279 | 0.0275 |

| 2021/8/4 | 58.70 | 1.0984 | 0.0939 |

| 2021/8/5 | 54.90 | 0.9353 | −0.0669 |

| …… | |||

| 2023/11/20 | 72.51 | 1.0006 | 0.0006 |

| 2023/11/21 | 72.52 | 1.0001 | 0.0001 |

| 2023/11/22 | 72 | 0.9883 | −0.0118 |

| 2023/11/23 | 72.04 | 1.0052 | 0.0051 |

| 2023/11/24 | 71.84 | 0.9972 | −0.0028 |

| 2023/11/27 | 72.11 | 1.0038 | 0.0038 |

| 2023/11/28 | 72.7 | 1.0082 | 0.0081 |

| 2023/11/29 | 70.95 | 0.9759 | −0.0244 |

| 2023/11/30 | 70.45 | 0.9930 | −0.0071 |

| 2023/12/1 | 70.53 | 1.0011 | 0.0011 |

| 2023/12/4 | 72.64 | 1.0299 | 0.0295 |

| 2023/12/5 | 71.7 | 0.9871 | −0.0130 |

| 2023/12/6 | 70.21 | 0.9792 | −0.0210 |

| 2023/12/7 | 67.91 | 0.9672 | −0.0333 |

| 2023/12/8 | 70.71 | 1.0412 | 0.0404 |

| Daily standard deviation | / | / | 0.0188 |

| Average trading days per year | / | / | 226 |

| Annual volatility | / | / | 28.26% |

References

- Trouwloon, D.; Streck, C.; Chagas, T.; Martinus, G. Understanding the Use of Carbon Credits by Companies: A Review of the Defining Elements of Corporate Climate Claims. Glob. Chall. 2023, 7, 2200158. [Google Scholar] [CrossRef]

- Spilker, G.; Nugent, N. Voluntary carbon market derivatives: Growth, innovation & usage. Borsa Istanb. Rev. 2022, 22, S109–S118. [Google Scholar] [CrossRef]

- Zhang, C.; Lin, B. Impact of introducing Chinese certified emission reduction scheme to the carbon market: Promoting renewable energy. Renew. Energy 2024, 222, 119887. [Google Scholar] [CrossRef]

- Rakov, A.W.; Strizhov, S.A.; Busov, V.I. Intangible Assets—Corporate Governance Tool (On The Example Of Conformity Marks). In Proceedings of the II International Scientific Conference GCPMED 2019—“Global Challenges and Prospects of the Modern Economic Development”, Samara, Russia, 7–8 November 2019; pp. 1273–1279. [Google Scholar] [CrossRef]

- Komarudin, M.; Dewi, G.C. Empirical Study of Tranfer Pricing on Consumption Companies on the Indonesia Stock Exchange. J. Ekon. 2022, 11, 359–365. [Google Scholar]

- Buzinskiene, R.; Rudyte, D. The Impact of Intangible Assets on the Company’s Market Value. Montenegrin J. Econ. 2021, 17, 59–73. [Google Scholar] [CrossRef]

- Park, W.; Cho, J. Effects of Tangible and Intangible Assets Investments by Air Transport Companies on the Firm’s Growth. JTLR 2021, 33, 315–333. [Google Scholar] [CrossRef]

- Dancaková, D.; Sopko, J.; Glova, J.; Andrejovská, A. The Impact of Intangible Assets on the Market Value of Companies: Cross-Sector Evidence. Mathematics 2022, 10, 3819. [Google Scholar] [CrossRef]

- Rizqi, A.M.; Rusydi, M.K. Pengaruh Tax Expense, Intangible Asset, Dan Foreign Ownership Terhadap Indikasi Praktik Transfer Pricing Dengan Firm Size Sebagai Variabel Moderasi (Studi Pada Perusahaan Manufaktur yang Terdaftar Di Bursa Efek Indonesia Tahun 2016–2020). TIARA 2023, 1, 61–74. [Google Scholar] [CrossRef]

- Azamat, K.; Galiya, J.; Bezhan, R.; Nurdana, Z. The impact of intangible assets on the value of FMCG companies worldwide. J. Innov. Knowl. 2023, 8, 100330. [Google Scholar] [CrossRef]

- Azzuhriyyah, A.A.; Kurnia, K. Pengaruh Tunneling Incentive, Intangible Asset, Dan Debt Covenant Terhadap Keputusan Transfer Pricing Dengan Tax Minimization Sebagai Variabel Moderasi (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2015–2021). Ecombis Rev. J. Ilm. Eco Bussines 2023, 11, 63–72. [Google Scholar] [CrossRef]

- Maharani, A.; Narsa, I.M. Six-factor plus intellectual capital in the capital asset pricing model and excess stock return: Empirical evidence in emerging stock markets. Cogent Econ. Financ. 2023, 11, 2252652. [Google Scholar] [CrossRef]

- Xu, Y.; Hassan, M.M.; Kutsanedzie, F.Y.H.; Li, H.; Chen, Q. Evaluation of extra-virgin olive oil adulteration using FTIR spectroscopy combined with multivariate algorithms. Qual. Assur. Saf. Crops Foods 2018, 10, 411–421. [Google Scholar] [CrossRef]

- Li, Y.; Sun, J.; Wu, X.; Lu, B.; Wu, M.; Dai, C. Grade Identification of Tieguanyin Tea Using Fluorescence Hyperspectra and Different Statistical Algorithms. J. Food Sci. 2019, 84, 2234–2241. [Google Scholar] [CrossRef] [PubMed]

- Yu, S.; Huang, X.; Wang, L.; Chang, X.; Ren, Y.; Zhang, X.; Wang, Y. Qualitative and quantitative assessment of flavor quality of Chinese soybean paste using multiple sensor technologies combined with chemometrics and a data fusion strategy. Food Chem. 2023, 405, 134859. [Google Scholar] [CrossRef] [PubMed]

- Shao, L.; Gong, J.; Fan, W.; Zhang, Z.; Zhang, M. Cost Comparison between Digital Management and Traditional Management of Cotton Fields—Evidence from Cotton Fields in Xinjiang, China. Agriculture 2022, 12, 1105. [Google Scholar] [CrossRef]

- Raheem, A.; Bankole, O.O.; Danso, F.; Musa, M.O.; Adegbite, T.A.; Simpson, V.B. Physical Management Strategies for Enhancing Soil Resilience to Climate Change: Insights From Africa. Eur. J. Soil. Sci. 2025, 76, e70030. [Google Scholar] [CrossRef]

- Sarkar, A.; Wang, H.; Rahman, A.; Azim, J.A.; Memon, W.H.; Qian, L. Structural equation model of young farmers’ intention to adopt sustainable agriculture: A case study in Bangladesh. Renew. Agric. Food Syst. 2022, 37, 142–154. [Google Scholar] [CrossRef]

- Islam, D.I.; Rahman, A.; Sarker, M.S.R.; Luo, J.; Liang, H. Factors affecting farmers’ willingness to adopt crop insurance to manage disaster risk: Evidence from Bangladesh. IFAM 2021, 24, 463–480. [Google Scholar] [CrossRef]

- Sun, H.; Samad, S.; Rehman, S.U.; Usman, M. Clean and green: The relevance of hotels’ website quality and environmental management initiatives for green customer loyalty. BFJ 2022, 124, 4266–4285. [Google Scholar] [CrossRef]

- Yao, S.; Yu, X.; Yan, S.; Wen, S. Heterogeneous emission trading schemes and green innovation. Energy Policy 2021, 155, 112367. [Google Scholar] [CrossRef]

- Alhussam, M.I.; Ren, J.; Yao, H.; Abu Risha, O. Food Trade Network and Food Security: From the Perspective of Belt and Road Initiative. Agriculture 2023, 13, 1571. [Google Scholar] [CrossRef]

- Nazir, M.J.; Li, G.; Zulfiqar, F.; Siddique, K.H.; Iqbal, B.; Du, D. Harnessing soil carbon sequestration to address climate change challenges in agriculture. Soil. Tillage Res. 2024, 237, 105959. [Google Scholar] [CrossRef]

- Raza, S.; Irshad, A.; Margenot, A.; Zamanian, K.; Li, N.; Ullah, S.; Mehmood, K.; Khan, M.A.; Siddique, N.; Zhou, J.; et al. Inorganic carbon is overlooked in global soil carbon research: A bibliometric analysis. Geoderma 2024, 443, 116831. [Google Scholar] [CrossRef] [PubMed]

- Bautista, N.; Marino, B.D.V.; Munger, J.W. Science to Commerce: A Commercial-Scale Protocol for Carbon Trading Applied to a 28-Year Record of Forest Carbon Monitoring at the Harvard Forest. Land. 2021, 10, 163. [Google Scholar] [CrossRef]

- Xu, Y.; Salem, S. Explosive behaviors in Chinese carbon markets: Are there price bubbles in eight pilots? Renew. Sustain. Energy Rev. 2021, 145, 111089. [Google Scholar] [CrossRef]

- Li, Y.; Song, J. Research on the Application of GA-ELM Model in Carbon Trading Price—An Example of Beijing. Pol. J. Environ. Stud. 2021, 31, 149–161. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, Z.; Zhang, Z. Carbon price prediction for China’s ETS pilots using variational mode decomposition and optimized extreme learning machine. Ann. Oper. Res. 2025, 345, 809–830. [Google Scholar] [CrossRef]

- Han, Y.; Tan, S.; Zhu, C.; Liu, Y. Research on the emission reduction effects of carbon trading mechanism on power industry: Plant-level evidence from China. IJCCSM 2023, 15, 212–231. [Google Scholar] [CrossRef]

- Blumberg, G.; Sibilla, M. A Carbon Accounting and Trading Platform for the uk Construction Industry. Energies 2023, 16, 1566. [Google Scholar] [CrossRef]

- Shen, W.; Zhang, Y.; Zhang, X.; Xia, D.; Zhao, J.; Xiong, Z.; Liang, L. Research on digital energy carbon management platform and services for energy-using companies under the “3060” target. IOP Conf. Ser. Earth Environ. Sci. 2023, 1171, 012019. [Google Scholar] [CrossRef]

- Mashari, D.P.S.; Zagloel, T.Y.M.; Soesilo, T.E.B.; Maftuchah, I. A Bibliometric and Literature Review: Alignment of Green Finance and Carbon Trading. Sustainability 2023, 15, 7877. [Google Scholar] [CrossRef]

- Petukhina, A.A.; Reule, R.C.G.; Härdle, W.K. Rise of the machines? Intraday high-frequency trading patterns of cryptocurrencies. Eur. J. Financ. 2021, 27, 8–30. [Google Scholar] [CrossRef]

- Tiwari, S.; Ramampiaro, H.; Langseth, H. Machine Learning in Financial Market Surveillance: A Survey. IEEE Access 2021, 9, 159734–159754. [Google Scholar] [CrossRef]

- Geng, L.; Hu, J.; Shen, W. The impact of carbon finance on energy consumption structure: Evidence from China. Environ. Sci. Pollut. Res. 2022, 30, 30107–30121. [Google Scholar] [CrossRef]

- Yao, Y.; Tian, L.; Cao, G. The Information Spillover among the Carbon Market, Energy Market, and Stock Market: A Case Study of China’s Pilot Carbon Markets. Sustainability 2022, 14, 4479. [Google Scholar] [CrossRef]

- Håkansson, A.; Fernández-Aranda, F.; Jiménez-Murcia, S. Gambling-Like Day Trading During the COVID-19 Pandemic—Need for Research on a Pandemic-Related Risk of Indebtedness and Mental Health Impact. Front. Psychiatry 2021, 12, 715946. [Google Scholar] [CrossRef]

- Awad, A.L.; Elkaffas, S.M.; Fakhr, M.W. Stock Market Prediction Using Deep Reinforcement Learning. ASI 2023, 6, 106. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhou, M.; Wen, F. Asymmetric effects of oil shocks on carbon allowance price: Evidence from China. Energy Econ. 2021, 97, 105183. [Google Scholar] [CrossRef]

- Qu, G.; Guo, C.; Cui, J. Influencing Factors and Formation Mechanism of Carbon Emission Rights Prices in Shanghai, China. Sustainability 2024, 16, 9081. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, T.; Zhou, R. The Impact of Legal Recycling Constraints and Carbon Trading Mechanisms on Decision Making in Closed-Loop Supply Chain. Int. J. Environ. Res. Public Health 2022, 19, 7400. [Google Scholar] [CrossRef]

- Song, X.; Zhang, W.; Ge, Z.; Huang, S.; Huang, Y.; Xiong, S. A Study of the Influencing Factors on the Carbon Emission Trading Price in China Based on the Improved Gray Relational Analysis Model. Sustainability 2022, 14, 8002. [Google Scholar] [CrossRef]

- Mo, J.Y.; Jeon, W. Determinants of firm-level energy productivity—Evidence from the Korean emission trading scheme. Energy Environ. 2022, 33, 897–915. [Google Scholar] [CrossRef]

- Zhang, C.; Huo, Y.; Li, X.; Ma, C. The pathway of carbon trading to reduce the cost of tidal energy. In Proceedings of the Second International Conference on Sustainable Technology and Management (ICSTM 2023), Macau, China, 21–23 July 2023; Qu, X., Ed.; SPIE: Dongguan, China, 2023; p. 102. [Google Scholar] [CrossRef]

- Zhong, W.; Yue, W.; Haoran, W.; Nan, T.; Shuyue, W. Integrating fast iterative filtering and ensemble neural network structure with attention mechanism for carbon price forecasting. Complex. Intell. Syst. 2025, 11, 6. [Google Scholar] [CrossRef]

- Mao, Y.; Yu, X. A hybrid forecasting approach for China’s national carbon emission allowance prices with balanced accuracy and interpretability. J. Environ. Manag. 2024, 351, 119873. [Google Scholar] [CrossRef] [PubMed]

- Agnolucci, P.; Fischer, C.; Heine, D.; Leon, M.M.D.O.; Pryor, J.; Patroni, K.; Hallegatte, S. Measuring Total Carbon Pricing; The World Bank: Washington, DC, USA, 2023. [Google Scholar] [CrossRef]

- Hochreiter, S.; Schmidhuber, J. Long Short-Term Memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef]

- Taha, M.F.; Mao, H.; Mousa, S.; Zhou, L.; Wang, Y.; Elmasry, G.; Al-Rejaie, S.; Elwakeel, A.E.; Wei, Y.; Qiu, Z. Deep Learning-Enabled Dynamic Model for Nutrient Status Detection of Aquaponically Grown Plants. Agronomy 2024, 14, 2290. [Google Scholar] [CrossRef]

- Xue, Y.; Jiang, H. Monitoring of Chlorpyrifos Residues in Corn Oil Based on Raman Spectral Deep-Learning Model. Foods 2023, 12, 2402. [Google Scholar] [CrossRef] [PubMed]

- Adade, S.Y.-S.S.; Lin, H.; Nunekpeku, X.; Johnson, N.A.N.; Agyekum, A.A.; Zhao, S.; Teye, E.; Qianqian, S.; Kwadzokpui, B.A.; Ekumah, J.-N.; et al. Flexible paper-based AuNP sensor for rapid detection of diabenz (a,h)anthracene (DbA) and benzo(b)fluoranthene (BbF) in mussels coupled with deep learning algorithms. Food Control 2025, 168, 110966. [Google Scholar] [CrossRef]

- Gu, C. Research on Prediction of Investment Funds Performance before and after Investment Based on Improved Neural Network Algorithm. Wirel. Commun. Mob. Comput. 2021, 2021, 5519213. [Google Scholar] [CrossRef]

| Years | Baseline Emissions (TCO2e) | Project Emissions (TCO2) | Leakage (TCO2e) | Emission Reduction (TCO2e) |

|---|---|---|---|---|

| 2022.01–2022.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2023.01–2023.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2024.01–2024.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2025.01–2025.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2026.01–2026.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2027.01–2027.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2028.01–2028.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2029.01–2029.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2030.01–2030.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| 2031.01–2031.12 | 107,359.00 | 0 | 0 | 107,359.00 |

| Total | 1,073,590.00 | 0 | 0 | 1,073,590.00 |

| Total credit period time | 10 years | |||

| Included in the annual average value during the period | 107,359.00 | 0 | 0 | 107,359.00 |

| Year | Carbon Price (CNY/ton) | Emission Reduction (tons) | Project Consulting Fee (Million CNY) | Certification Fee (Million CNY) | Transaction Fee (Million CNY) | Management Expenses (Million CNY) | Net Cash Flow (Million CNY) |

|---|---|---|---|---|---|---|---|

| 2022 | 58.07 | 107,359 | 31.17 | 180 | 4.68 | 12.47 | 399.79 |

| 2023 | 63.28 | 107,359 | 33.97 | 171 | 5.10 | 13.59 | 460.81 |

| 2024 | 61.75 | 107,359 | 33.15 | 162.45 | 4.97 | 13.26 | 454.09 |

| 2025 | 61.71 | 107,359 | 33.13 | 154.33 | 4.97 | 13.25 | 461.81 |

| 2026 | 61.48 | 107,359 | 33.00 | 146.61 | 4.95 | 13.20 | 467.23 |

| 2027 | 61.68 | 107,359 | 33.11 | 139.28 | 4.97 | 13.24 | 476.56 |

| 2028 | 61.38 | 107,359 | 32.95 | 132.32 | 4.94 | 13.18 | 480.53 |

| 2029 | 61.65 | 107,359 | 33.09 | 125.70 | 4.96 | 13.24 | 489.84 |

| 2030 | 61.54 | 107,359 | 33.03 | 119.42 | 4.96 | 13.21 | 495.02 |

| 2031 | 62.01 | 107,359 | 33.29 | 113.44 | 4.99 | 13.31 | 505.69 |

| Period | Period | ||||

|---|---|---|---|---|---|

| 1 | 0.4904 | 0.2078 | 6 | 0.1862 | −0.5060 |

| 2 | 0.3989 | −0.0008 | 7 | 0.1659 | −0.5818 |

| 3 | 0.2664 | −0.2231 | 8 | 0.1607 | −0.6386 |

| 4 | 0.2290 | −0.3362 | 9 | 0.1494 | −0.6984 |

| 5 | 0.1989 | −0.4331 | 10 | 0.1502 | −0.7434 |

| Period | Period | ||||

|---|---|---|---|---|---|

| 1 | 0.6881 | 0.5823 | 6 | 0.5739 | 0.3064 |

| 2 | 0.6550 | 0.4997 | 7 | 0.5659 | 0.2804 |

| 3 | 0.6050 | 0.4117 | 8 | 0.5638 | 0.2615 |

| 4 | 0.5906 | 0.3684 | 9 | 0.5594 | 0.2425 |

| 5 | 0.5788 | 0.3325 | 10 | 0.5597 | 0.2286 |

| Value | Market Value (CNY/ton) | Emission Reduction (tons) | Value | Market Value (CNY/ton) | Emission Reduction (tons) |

|---|---|---|---|---|---|

| 4.4217 | 107,359 | 15.1215 | 107,359 | ||

| 5.6032 | 107,359 | 16.5157 | 107,359 | ||

| 9.4149 | 107,359 | 17.6625 | 107,359 | ||

| 11.6809 | 107,359 | 18.7106 | 107,359 | ||

| 13.5932 | 107,359 | 19.6119 | 107,359 | ||

| Total value (million) | 1420.75 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, J.; Liu, Y.; Wang, J.; Chen, X.; Deng, L. Valuing Carbon Assets for Sustainability: A Dual-Approach Assessment of China’s Certified Emission Reductions. Sustainability 2025, 17, 4777. https://doi.org/10.3390/su17114777

Liu J, Liu Y, Wang J, Chen X, Deng L. Valuing Carbon Assets for Sustainability: A Dual-Approach Assessment of China’s Certified Emission Reductions. Sustainability. 2025; 17(11):4777. https://doi.org/10.3390/su17114777

Chicago/Turabian StyleLiu, Jiawen, Yue Liu, Jiayi Wang, Xinyue Chen, and Liyuan Deng. 2025. "Valuing Carbon Assets for Sustainability: A Dual-Approach Assessment of China’s Certified Emission Reductions" Sustainability 17, no. 11: 4777. https://doi.org/10.3390/su17114777

APA StyleLiu, J., Liu, Y., Wang, J., Chen, X., & Deng, L. (2025). Valuing Carbon Assets for Sustainability: A Dual-Approach Assessment of China’s Certified Emission Reductions. Sustainability, 17(11), 4777. https://doi.org/10.3390/su17114777