A Greener Paradigm Shift: The Moderating Role of Board Independence in Sustainability Reporting

Abstract

1. Introduction

- EIS = environmental innovation score;

- m = total number of innovation activities or processes performed in an accounting period;

- n = total number of innovation activities noted in an industry in an accounting period.

- EPS = environmental pillar score;

- m = total number of activities or processes performed by a firm in an accounting period;

- n = total number of activities noted in an industry in an accounting period.

2. Literature Review and Hypothesis Development

2.1. Theoretical Framework

2.2. The Role of Corporate Social Responsibility in the Greener Revolution

2.3. The Role of ESGS on the Greener Revolution

2.4. Board Independence as Moderator

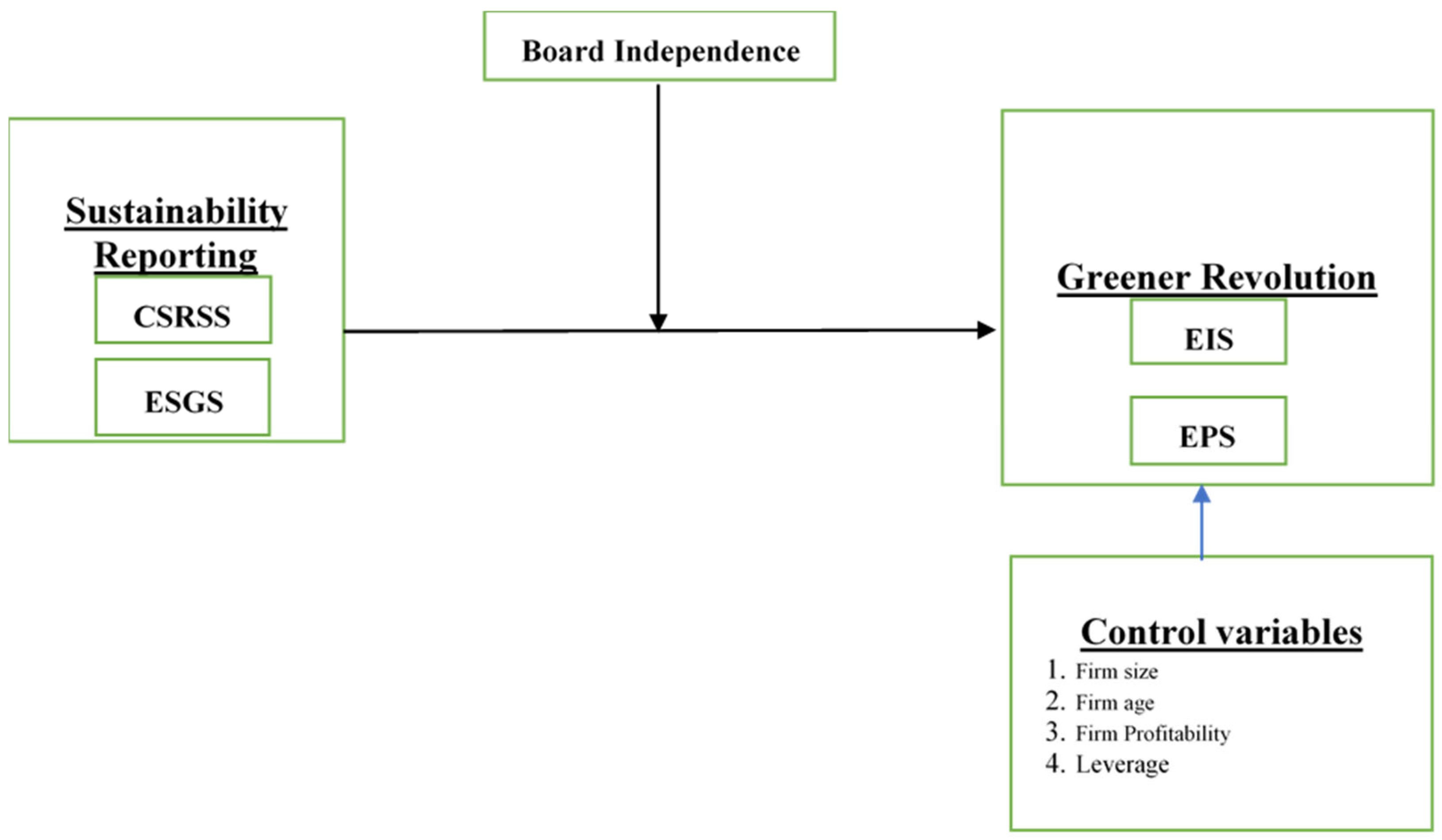

2.5. Conceptual Framework

3. Data and Methodology

3.1. Data Collection and Sampling Technique

3.2. Econometric Model

4. Results and Interpretation

4.1. Interaction Effect of Sustainability Reporting

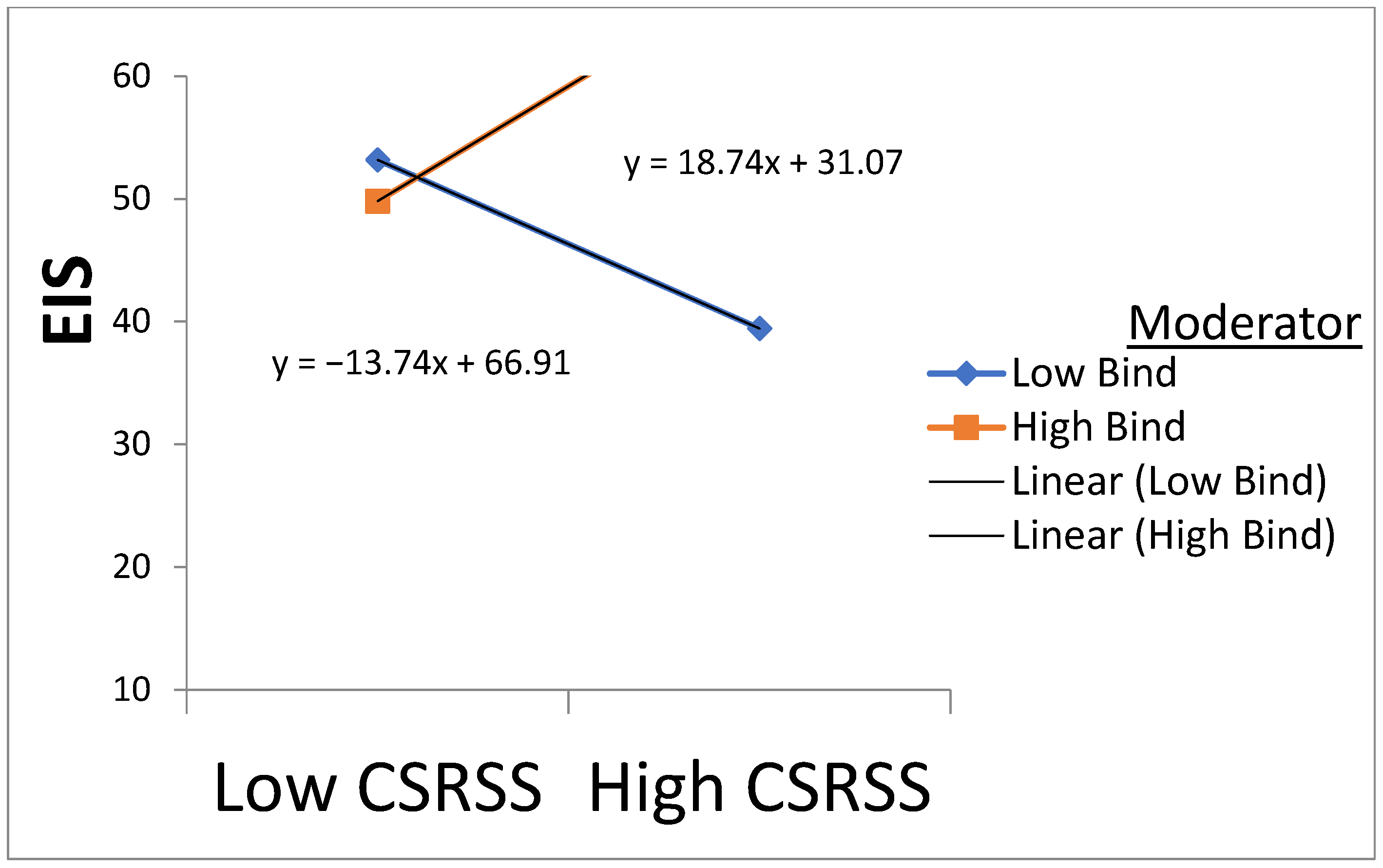

4.1.1. Interaction Effect of CSRSS with Bind, Using EIS as a Performance Variable

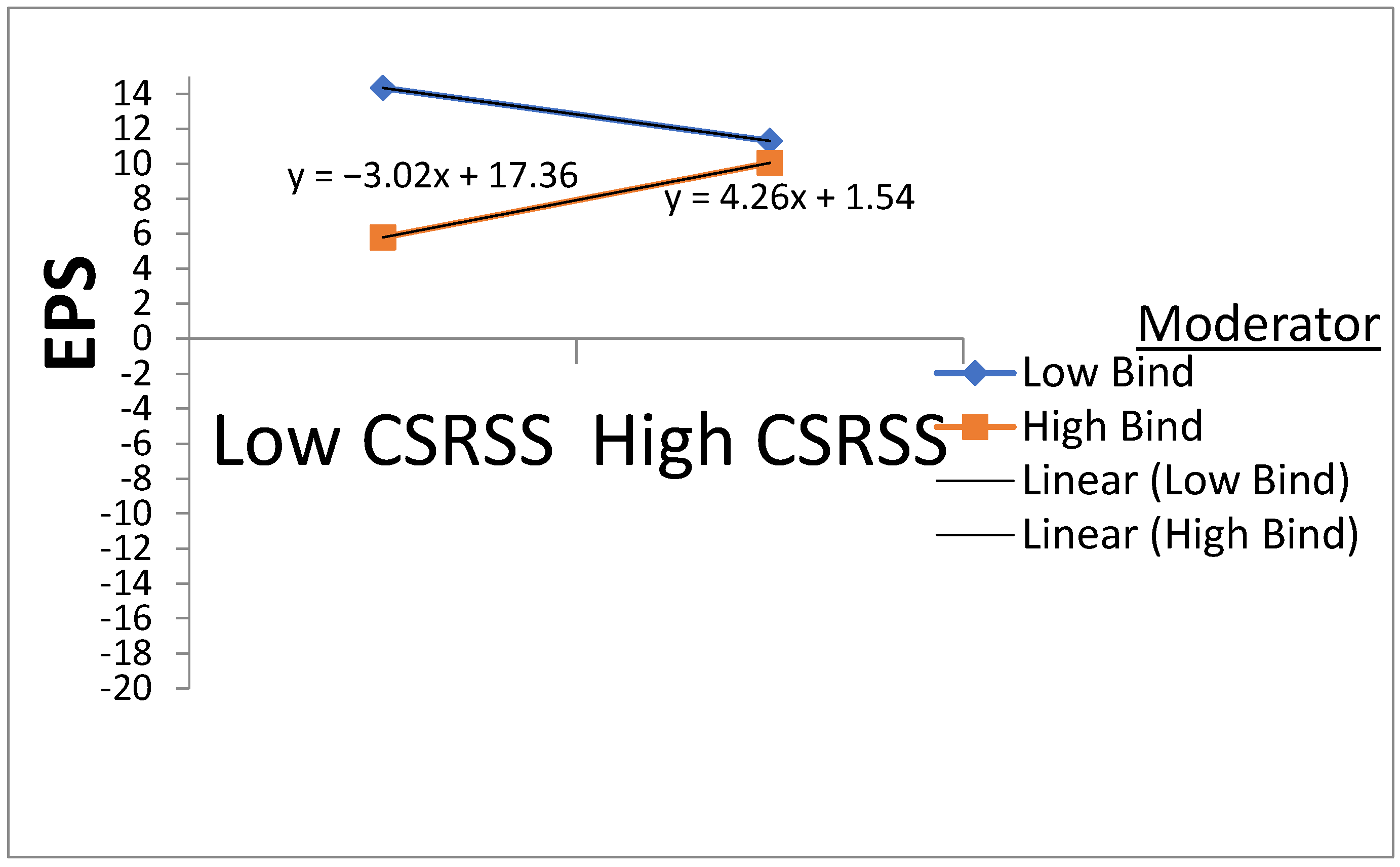

4.1.2. Interaction Effect of CSRSS with Bind, Using EPS as a Performance Variable

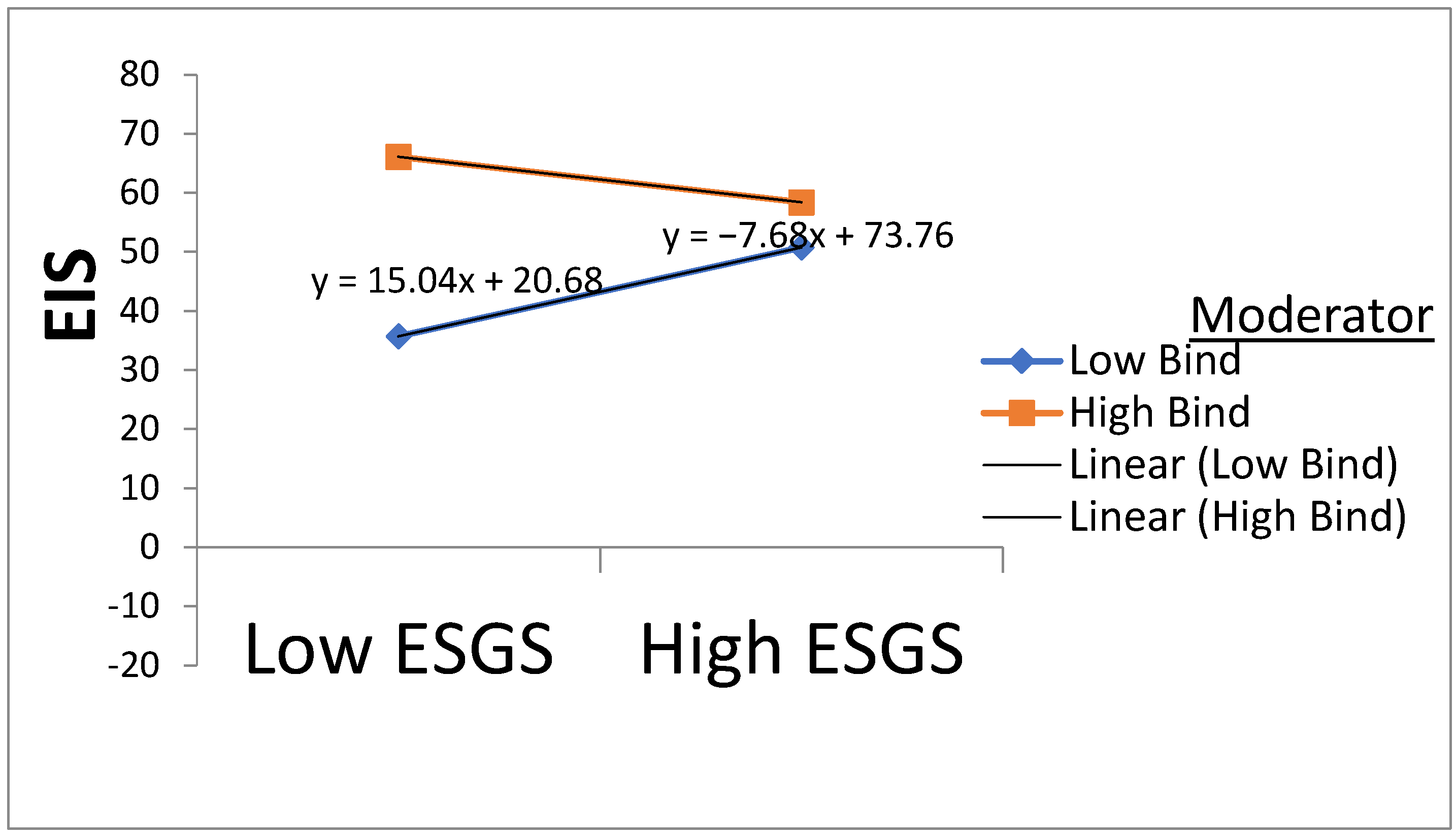

4.1.3. Interaction Effect of ESGS with Bind, Using EIS as a Performance Variable

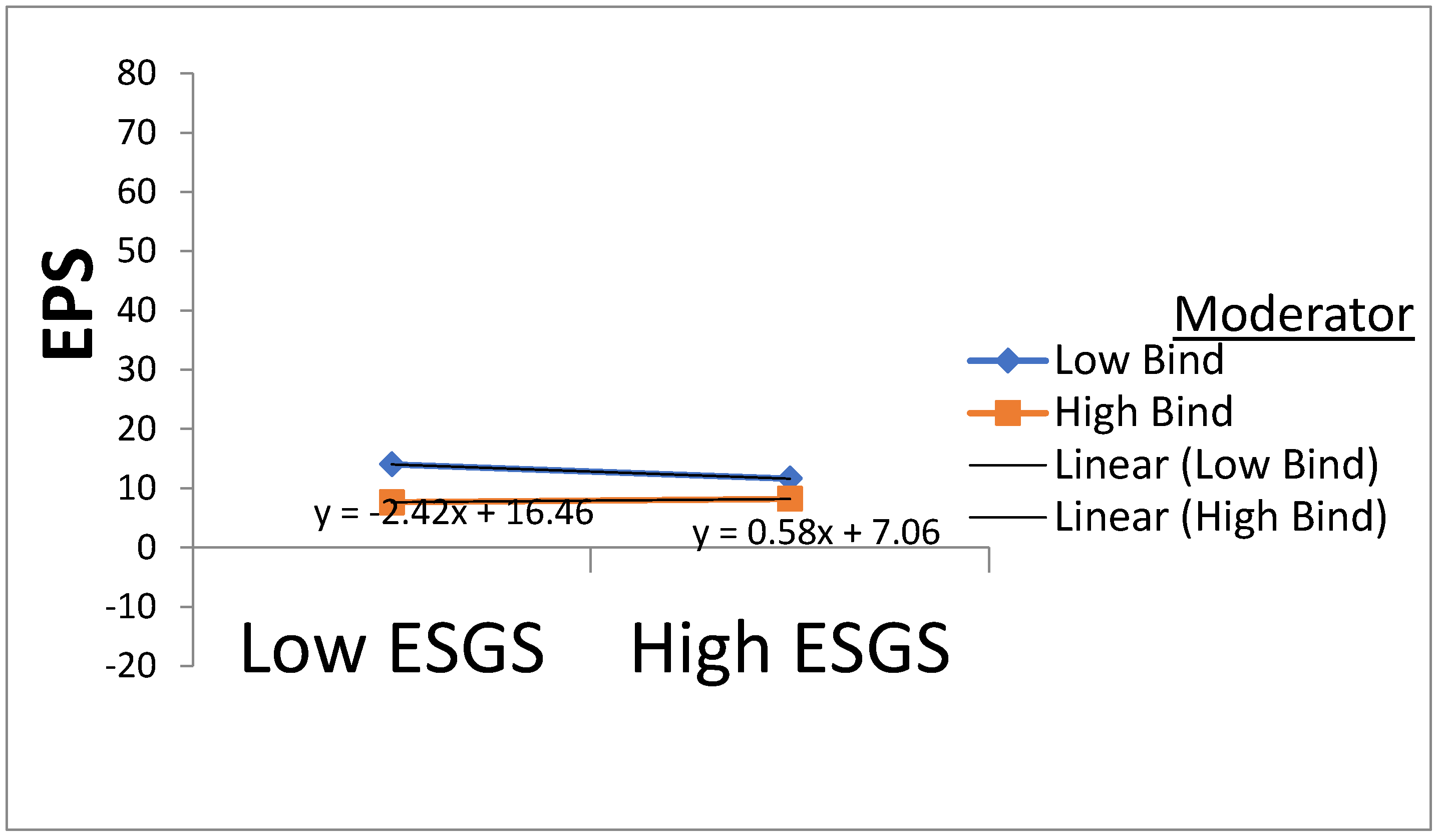

4.1.4. Interaction Effect of ESGS with Bind, Using EPS as a Performance Variable

5. Discussion of Findings

5.1. A Holistic Comparison of the Results with Those of Past Studies

5.2. Theoretical Implications

5.3. Policy Recommendation

5.4. Limitations of This Study

5.5. Avenues for Future Research and Recommendations

5.6. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| S.r No | Title of Activities |

|---|---|

| 1 | Occupational health |

| 2 | Consumer protection measures |

| 3 | Contribution towards natural calamities |

| 4 | Policy of mutual respect at the workplace |

| 5 | Employees’ children policy |

| 6 | Rural development program |

| 7 | The on-job vocational training program |

| 8 | Pension and retirement plans |

| 9 | Interest-free loans to employees |

Appendix B

| Environment, Social, and Governance |

| Environment |

|

| Social |

|

| Governance |

|

Appendix C

| EIS | Weight Assigned | |

|---|---|---|

| Environmental Impact Reduction | 30% | |

| ||

| Innovation and New Product Development | 30% | |

| ||

| Technology Adoption and Process Efficiency | 40% | |

| ||

Appendix D

| EPS | |

|---|---|

| Environmental Management Practices | 40% |

| |

| Resource Usage Efficiency | 25% |

| |

| Climate Change Strategies | 25% |

| |

| Biodiversity and Land Use | 10% |

| |

References

- Shah, H.J.; Khan, A.J.S.S.; Open, H. Globalization and nation states–Challenges and opportunities for Pakistan. Soc. Sci. Humanit. Open 2023, 8, 100621. [Google Scholar] [CrossRef]

- Fazal, R.; Rehman, S.A.U.; Bhatti, M.I. Graph theoretic approach to expose the energy-induced crisis in Pakistan. Energy Policy 2022, 169, 113174. [Google Scholar] [CrossRef]

- Aksar, I.A.; Firdaus, A.; Gong, J.; Anwar Pasha, S. Examining the impacts of social media on the psychological well-being in a patriarchal culture: A study of women in Pakistan. Online Inf. Rev. 2024, 48, 294–313. [Google Scholar] [CrossRef]

- Khan, M.F.; Raza, A.; Naseer, N. Cyber security and challenges faced by Pakistan. Pak. J. Int. Aff. 2021, 4, 865–881. [Google Scholar]

- Sheikh, M.K.; Gillani, A.H. Ethnic issues and National Integration in Pakistan: A review. Pak. J. Humanit. Soc. Sci. 2023, 11, 187–195. [Google Scholar] [CrossRef]

- Hussain, M.; Butt, A.R.; Uzma, F.; Ahmed, R.; Irshad, S.; Rehman, A.; Yousaf, B. A comprehensive review of climate change impacts, adaptation, and mitigation on environmental and natural calamities in Pakistan. Environ. Monit. Assess. 2020, 192, 1–20. [Google Scholar] [CrossRef]

- Hamid, S.; Riaz, Z.; Azeem, S.M.W. Carroll’s dimensions and CSR disclosure: Empirical evidence from Pakistan. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 365–381. [Google Scholar] [CrossRef]

- Ahmad, N.; Mahmood, A.; Han, H.; Ariza-Montes, A.; Vega-Muñoz, A.; Din, M.u.; Iqbal Khan, G.; Ullah, Z.J.S. Sustainability as a “new normal” for modern businesses: Are smes of pakistan ready to adopt it? Sustainability 2021, 13, 1944. [Google Scholar] [CrossRef]

- Khan, I.; Fujimoto, Y.; Uddin, M.J.; Afridi, M.A. Evaluating sustainability reporting on GRI standards in developing countries: A case of Pakistan. Int. J. Law Manag. 2023, 65, 189–208. [Google Scholar] [CrossRef]

- Rahman, H.U.; Zahid, M.; Khan, P.A.; Al-Faryan, M.A.S.; Hussainey, K. Do corporate sustainability practices mitigate earnings management? The moderating role of firm size. Bus. Strategy Environ. 2024, 33, 5423–5444. [Google Scholar] [CrossRef]

- Shakri, I.H.; Yong, J.; Xiang, E.J. Corporate governance and firm performance: Evidence from political instability, political ideology, and corporate governance reforms in Pakistan. Econ. Politics 2024, 36, 1633–1663. [Google Scholar] [CrossRef]

- Kandpal, V.; Jaswal, A.; Santibanez Gonzalez, E.D.; Agarwal, N. Corporate social responsibility (CSR) and ESG reporting: Redefining business in the twenty-first century. In Sustainable Energy Transition: Circular Economy and Sustainable Financing for Environmental, Social and Governance (ESG) Practices; Springer: Berlin/Heidelberg, Germany, 2024; pp. 239–272. [Google Scholar]

- Nugroho, D.P.; Hsu, Y.; Hartauer, C.; Hartauer, A. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability 2024, 16, 614. [Google Scholar] [CrossRef]

- Ren, S.; Huang, M.; Liu, D.; Yan, J. Understanding the impact of mandatory CSR disclosure on green innovation: Evidence from Chinese listed firms. Br. J. Manag. 2023, 34, 576–594. [Google Scholar] [CrossRef]

- Faisal, F. Corporate Social Responsibility (CSR) Exploring Disclosure Quality in Australia and Pakistan: The Context of a Developed and Developing Country. Master’s Thesis, University of Tasmania, Hobart, Australia, 2021. [Google Scholar]

- Weihong, J.; Kuo, T.-H.; Wei, S.-Y.; Hossain, M.S.; Tongkachok, K.; Imran, A. Relationship between trade enhancement, firm characteristics and CSR: Key mediating role of green investment. Econ. Res. Istraz. 2022, 35, 3900–3916. [Google Scholar] [CrossRef]

- Avotra, A.A.R.N.; Chenyun, Y.; Yongmin, W.; Lijuan, Z.; Nawaz, A. Conceptualizing the state of the art of corporate social responsibility (CSR) in green construction and its nexus to sustainable development. Front. Environ. Sci. 2021, 9, 774822. [Google Scholar] [CrossRef]

- Gull, A.A.; Saeed, A.; Suleman, M.T.; Mushtaq, R. Revisiting the association between environmental performance and financial performance: Does the level of environmental orientation matter? Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1647–1662. [Google Scholar] [CrossRef]

- Xiong, D.; Liu, H.; Yang, M.; Duan, Y. Does corporate environmental responsibility make firms greener in innovation? The role of knowledge flows. J. Knowl. Manag. 2025, 29, 393–414. [Google Scholar] [CrossRef]

- Wasiuzzaman, S.; Subramaniam, V. Board gender diversity and environmental, social and governance (ESG) disclosure: Is it different for developed and developing nations? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 2145–2165. [Google Scholar] [CrossRef]

- Del Gesso, C.; Lodhi, R.N. Theories underlying environmental, social and governance (ESG) disclosure: A systematic review of accounting studies. J. Acc. Lit. 2024, 47, 433–461. [Google Scholar] [CrossRef]

- Liu, H.; Lyu, C. Can ESG ratings stimulate corporate green innovation? Evidence from China. Sustainability 2022, 14, 12516. [Google Scholar] [CrossRef]

- Arvidsson, S.; Dumay, J. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Bus. Strategy Environ. 2022, 31, 1091–1110. [Google Scholar] [CrossRef]

- Mohy-ud-Din, K. ESG reporting, corporate green innovation and interaction role of board diversity: A new insight from US. Innov. Green Dev. 2024, 3, 100161. [Google Scholar] [CrossRef]

- Di Vaio, A.; Syriopoulos, T.; Alvino, F.; Palladino, R. “Integrated thinking and reporting” towards sustainable business models: A concise bibliometric analysis. Meditari Account. Res. 2021, 29, 691–719. [Google Scholar] [CrossRef]

- Tan, Y.; Zhu, Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers’ environmental awareness. Technol. Soc. 2022, 68, 101906. [Google Scholar] [CrossRef]

- Wagenhofer, A. Sustainability reporting: A financial reporting perspective. Account. Eur. 2024, 21, 1–13. [Google Scholar] [CrossRef]

- Mukhtar, Z. Environmental pollution and regulatory and non-regulatory environmental responsibility (reviewing Pakistan environmental protection act). Am. J. Ind. Bus. Manag. 2023, 13, 443–456. [Google Scholar] [CrossRef]

- Mumtaz, M. Green infrastructure as key tool for climate adaptation planning and policies to mitigate climate change: Evidence from a Pakistani City. Urban Clim. 2024, 56, 102074. [Google Scholar] [CrossRef]

- Hanif, A.; Shirazi, S.A.; Majid, A. Role of community for improvement of ecosystem services in urban parks. Pak. J. Agric. Sci. 2020, 57, 1591–1596. [Google Scholar]

- Nasar-u-Minallah, M.; Jabbar, M.; Zia, S.; Perveen, N. Assessing and anticipating environmental challenges in Lahore, Pakistan: Future implications of air pollution on sustainable development and environmental governance. Environ. Monit. Assess. 2024, 196, 865. [Google Scholar] [CrossRef]

- Morri, G.; Yang, F.; Colantoni, F. Green investments, green returns: Exploring the link between ESG factors and financial performance in real estate. J. Prop. Invest. Financ. 2024, 42, 435–452. [Google Scholar] [CrossRef]

- Baocheng, H.; Jamil, A.; Bellaoulah, M.; Mukhtar, A.; Clauvis, N.K. Impact of climate change on water scarcity in Pakistan. Implications for water management and policy. J. Water Clim. Change 2024, 15, 3602–3623. [Google Scholar] [CrossRef]

- Singhania, M.; Saini, N.; Shri, C.; Bhatia, S. Cross-country comparative trend analysis in ESG regulatory framework across developed and developing nations. Manag. Environ. Qual. Int. J. 2024, 35, 61–100. [Google Scholar] [CrossRef]

- Islam, R.; Ali, M.; French, E. Director independence and its influence on corporate social responsibility decisions and performance. Soc. Responsib. J. 2023, 19, 1917–1934. [Google Scholar] [CrossRef]

- Al Amosh, H. From home to boardroom: Marital status and its influence on ESG disclosure. Bus. Strategy Dev. 2024, 7, e402. [Google Scholar] [CrossRef]

- Yu, J.; Hwang, Y.-S. The Interaction Effects of Board Independence and Digital Transformation on Environmental, Social, and Governance Performance: Complementary or Substitutive? Sustainability 2024, 16, 9098. [Google Scholar] [CrossRef]

- Arif, M.; Sajjad, A.; Farooq, S.; Abrar, M.; Joyo, A.S. The impact of audit committee attributes on the quality and quantity of environmental, social and governance (ESG) disclosures. Corp. Gov. Int. J. Bus. Soc. 2021, 21, 497–514. [Google Scholar] [CrossRef]

- Awan, T.; Gul, A. Impact of environmental, social, and governance (ESG) performance on investment mix. New empirical evidence from non-financial firm in Pakistan. Int. Res. J. Manag. Soc. Sci. 2024, 5, 880–900. [Google Scholar]

- Lydenberg, S.; Sinclair, G. Mainstream or daydream? The future for responsible investing. In Landmarks in the History of Corporate Citizenship; Routledge: London, UK, 2024; pp. 47–68. [Google Scholar]

- Brohi, N.A.; Qureshi, M.A.; Shaikh, D.H.; Mahboob, F.; Asif, Z.; Brohi, A. Nexus Between Servant Leadership, Green Knowledge Sharing, Green Capacities, Green Service Innovation, and Green Competitive Advantage in the Hospitality Sector of Pakistan: An Sdg & Esg Stakeholder Compliance Framework. J. Mark. 2024, 6, 211–433. [Google Scholar]

- Hassan, S. The Impact of Environmental, Social and Governance on Firm Performance: Moderating Role of Financial Slacks and Research &Development Intensity. City Univ. Res. J. 2024, 14, 24–38. [Google Scholar]

- Jan, F.U.; Zahid, M. Environmental, Social, Governance (ESG) and Financial Performance of Firm in the Context of Corporate Governance Code 2019 in Pakistan. J. Bus. Manag. Res. 2024, 3, 973–1000. [Google Scholar]

- Albitar, K.; Borgi, H.; Khan, M.; Zahra, A. Business environmental innovation and CO2 emissions: The moderating role of environmental governance. Bus. Strategy Environ. 2023, 32, 1996–2007. [Google Scholar] [CrossRef]

- Senadheera, S.S.; Withana, P.A.; Dissanayake, P.D.; Sarkar, B.; Chopra, S.S.; Rhee, J.H.; Ok, Y.S. Scoring environment pillar in environmental, social, and governance (ESG) assessment. Sustain. Environ. 2021, 7, 1960097. [Google Scholar] [CrossRef]

- Omran, M.S.; Zaid, M.A.; Dwekat, A. The relationship between integrated reporting and corporate environmental performance: A green trial. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 427–445. [Google Scholar] [CrossRef]

- Mansoor, M.; Jam, F.A.; Khan, T.I. Fostering eco-friendly behaviors in hospitality: Engaging customers through green practices, social influence, and personal dynamics. Int. J. Contemp. Hosp. Manag. 2025. ahead-of-print. [Google Scholar] [CrossRef]

- Chi, Y.; Hu, N.; Lu, D.; Yang, Y. Green investment funds and corporate green innovation: From the logic of social value. Energy Econ. 2023, 119, 106532. [Google Scholar] [CrossRef]

- Aastvedt, T.M.; Behmiri, N.B.; Lu, L. Does green innovation damage financial performance of oil and gas companies? Resour. Policy 2021, 73, 102235. [Google Scholar] [CrossRef]

- Young-Ferris, A.; Roberts, J. ‘Looking for something that isn’t there’: A case study of an early attempt at ESG integration in investment decision making. Eur. Acc. Rev. 2023, 32, 717–744. [Google Scholar] [CrossRef]

- Raghunandan, A.; Rajgopal, S. Do ESG funds make stakeholder-friendly investments? Rev. Acc. Stud. 2022, 27, 822–863. [Google Scholar] [CrossRef]

- Xie, R.; Teo, T.S. Green technology innovation, environmental externality, and the cleaner upgrading of industrial structure in China—Considering the moderating effect of environmental regulation. Technol. Forecast. Soc. Change 2022, 184, 122020. [Google Scholar] [CrossRef]

- Mukhtar, B.; Shad, M.K.; Woon, L.F.; Haider, M.; Waqas, A. Integrating ESG disclosure into the relationship between CSR and green organizational culture toward green Innovation. Soc. Responsib. J. 2024, 20, 288–304. [Google Scholar] [CrossRef]

- Awa, H.O.; Etim, W.; Ogbonda, E. Stakeholders, stakeholder theory and corporate social responsibility (CSR). Int. J. Corp. Soc. Responsib. 2024, 9, 11. [Google Scholar] [CrossRef]

- Habib, A.; Oláh, J.; Khan, M.H.; Luboš, S. Does Integration of ESG Disclosure and Green Financing Improve Firm Performance: Practical Applications of Stakeholders Theory. Heliyon 2025, 11, e41996. [Google Scholar] [CrossRef]

- Treepongkaruna, S.; Au Yong, H.H.; Thomsen, S.; Kyaw, K. Greenwashing, carbon emission, and ESG. Bus. Strategy Environ. 2024, 33, 8526–8539. [Google Scholar] [CrossRef]

- Corazza, L.; Cottafava, D.; Torchia, D.; Dhir, A. Interpreting stakeholder ecosystems through relational stakeholder theory: The case of a highly contested megaproject. Bus. Strategy Environ. 2024, 33, 2384–2412. [Google Scholar] [CrossRef]

- del Águila, I.M.; del Sagrado, J. Salience-based stakeholder selection to maintain stakeholder coverage in solving the next release problem. Inf. Softw. Technol. 2023, 160, 107231. [Google Scholar] [CrossRef]

- Bhandari, K.R.; Ranta, M.; Salo, J. The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Bus. Strategy Environ. 2022, 31, 1525–1537. [Google Scholar] [CrossRef]

- Singh, S.; Verma, R.; Fatima, A.; Kumar, M. Building Brand Reputation and Fostering Customer Loyalty Through ESG Practices: A Strategic Imperative for Competitive Advantage. In ESG Frameworks for Sustainable Business Practices; IGI Global: Hershey, PA, USA, 2024; pp. 281–309. [Google Scholar]

- Cui, Y.; Li, L.; Lei, Y.; Wu, S. The performance and influencing factors of high-quality development of resource-based cities in the Yellow River basin under reducing pollution and carbon emissions constraints. Resour. Policy 2024, 88, 104488. [Google Scholar] [CrossRef]

- Farrukh, A.; Mathrani, S.; Sajjad, A. A comparative analysis of green-lean-six sigma enablers and environmental outcomes: A natural resource-based view. Int. J. Lean Six Sigma 2024, 15, 481–502. [Google Scholar] [CrossRef]

- Qaderi, S.A.; Ghaleb, B.A.A.; Hashed, A.A.; Chandren, S.; Abdullah, Z. Board characteristics and integrated reporting strategy: Does sustainability committee matter? Sustainability 2022, 14, 6092. [Google Scholar] [CrossRef]

- Kamarudin, K.A.; Mohamad Ariff, A.; Azmi, N.A.; Mohd Suffian, M.T. Nonlinear effects of board size and board independence on corporate sustainability performance: International evidence. Corp. Gov. Int. J. Bus. Soc. 2024. ahead-of-print. [Google Scholar] [CrossRef]

- Heubeck, T. Walking on the gender tightrope: Unlocking ESG potential through CEOs’ dynamic capabilities and strategic board composition. Bus. Strategy Environ. 2024, 33, 2020–2039. [Google Scholar] [CrossRef]

- Onwuka, O.U.; Adu, A. Eco-efficient well planning: Engineering solutions for reduced environmental impact in hydrocarbon extraction. Int. J. Sch. Res. Multidiscip. Stud. 2024, 4, 033–043. [Google Scholar]

- Le, T.T.; Tran, P.Q.; Lam, N.P.; Tra, M.N.L.; Uyen, P.H.P. Corporate social responsibility, green innovation, environment strategy and corporate sustainable development. Oper. Manag. Res. 2024, 17, 114–134. [Google Scholar] [CrossRef]

- Srivastava, V.K. Impact of Corporate Social Responsibility (CSR) initiatives on brand reputation: A study on how CSR activities enhance brand reputation and consumer loyalty in the context of sustainable marketing practices. Int. J. Sci. Res. Arch. 2024, 13, 1910–1930. [Google Scholar] [CrossRef]

- Kavadis, N.; Thomsen, S. Sustainable corporate governance: A review of research on long-term corporate ownership and sustainability. Corp. Gov. Int. Rev. 2023, 31, 198–226. [Google Scholar] [CrossRef]

- Veche, B. The Representation Of Corporate Social Responsibility (Csr) In American Bank Slogans. Ann. Univ. ORADEA 2024, 33, 463. [Google Scholar] [CrossRef]

- Fallah Shayan, N.; Mohabbati-Kalejahi, N.; Alavi, S.; Zahed, M.A. Sustainable development goals (SDGs) as a framework for corporate social responsibility (CSR). Sustainability 2022, 14, 1222. [Google Scholar] [CrossRef]

- Le, T.T. How do corporate social responsibility and green innovation transform corporate green strategy into sustainable firm performance? J. Clean. Prod. 2022, 362, 132228. [Google Scholar] [CrossRef]

- Li, Z.; Wei, S.-Y.; Chunyan, L.; Aldoseri, M.M.N.; Qadus, A.; Hishan, S.S. The impact of CSR and green investment on stock return of Chinese export industry. Econ. Res.-Ekon. Istraživanja 2022, 35, 4971–4987. [Google Scholar] [CrossRef]

- Zhang, Y.; Berhe, H.M. The impact of green investment and green marketing on business performance: The mediation role of corporate social responsibility in Ethiopia’s Chinese textile companies. Sustainability 2022, 14, 3883. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Tabish, M.; Zhang, Y. Embracement of industry 4.0 and sustainable supply chain practices under the shadow of practice-based view theory: Ensuring environmental sustainability in corporate sector. J. Clean. Prod. 2023, 398, 136609. [Google Scholar] [CrossRef]

- Sarfraz, M.; Ozturk, I.; Yoo, S.; Raza, M.A.; Han, H. Toward a new understanding of environmental and financial performance through corporate social responsibility, green innovation, and sustainable development. Humanit. Soc. Sci. Commun. 2023, 10, 1–17. [Google Scholar] [CrossRef]

- Arshad, M.; Yu, C.K.; Qadir, A.; Rafique, M. The influence of climate change, green innovation, and aspects of green dynamic capabilities as an approach to achieving sustainable development. Environ. Sci. Pollut. Res. 2023, 30, 71340–71359. [Google Scholar] [CrossRef]

- Yuan, B.; Cao, X. Do corporate social responsibility practices contribute to green innovation? The mediating role of green dynamic capability. Technol. Soc. 2022, 68, 101868. [Google Scholar] [CrossRef]

- Fosu, E.; Fosu, F.; Akyina, N.; Asiedu, D. Do environmental CSR practices promote corporate social performance? The mediating role of green innovation and corporate image. Clean. Responsible Consum. 2024, 12, 100155. [Google Scholar] [CrossRef]

- Olanrewaju, O.I.K.; Daramola, G.O.; Babayeju, O.A. Transforming business models with ESG integration: A strategic framework for financial professionals. World J. Adv. Res. Rev. 2024, 22, 554–563. [Google Scholar]

- Chen, S.; Song, Y.; Gao, P. Environmental, social, and governance (ESG) performance and financial outcomes: Analyzing the impact of ESG on financial performance. J. Environ. Manag. 2023, 345, 118829. [Google Scholar] [CrossRef]

- Ghosn, C.; Warren-Myers, G.; Candido, C. Mapping the International Valuation Standards ESG criteria and sustainability rating tools adopted at scale by the Australian commercial real estate market. J. Prop. Investig. Financ. 2024, 42, 494–523. [Google Scholar] [CrossRef]

- Sun, Y. The real effect of innovation in environmental, social, and governance (ESG) disclosures on ESG performance: An integrated reporting perspective. J. Clean. Prod. 2024, 460, 142592. [Google Scholar] [CrossRef]

- De la Fuente, G.; Ortiz, M.; Velasco, P. The value of a firm’s engagement in ESG practices: Are we looking at the right side? Long Range Plan. 2022, 55, 102143. [Google Scholar] [CrossRef]

- Liou, J.J.; Liu, P.Y.; Huang, S.-W. Exploring the key barriers to ESG adoption in enterprises. Syst. Soft Comput. 2023, 5, 200066. [Google Scholar] [CrossRef]

- Asante-Appiah, B.; Lambert, T.A. The role of the external auditor in managing environmental, social, and governance (ESG) reputation risk. Rev. Account. Stud. 2023, 28, 2589–2641. [Google Scholar] [CrossRef]

- Kuo, F.-I.; Fang, W.-T.; LePage, B.A. Proactive environmental strategies in the hotel industry: Eco-innovation, green competitive advantage, and green core competence. J. Sustain. Tour. 2022, 30, 1240–1261. [Google Scholar] [CrossRef]

- Nilashi, M.; Abumalloh, R.A.; Keng-Boon, O.; Tan, G.W.-H.; Cham, T.-H.; Aw, E.C.-X. Unlocking sustainable resource management: A comprehensive SWOT and thematic analysis of FinTech with a focus on mineral management. Resour. Policy 2024, 92, 105028. [Google Scholar] [CrossRef]

- Li, C.; Ba, S.; Ma, K.; Xu, Y.; Huang, W.; Huang, N. ESG rating events, financial investment behavior and corporate innovation. Econ. Anal. Policy 2023, 77, 372–387. [Google Scholar] [CrossRef]

- Naimy, V.; El Khoury, R.; Iskandar, S. ESG versus corporate financial performance: Evidence from East Asian Firms in the industrials sector. Stud. Appl. Econ. 2021, 39, 1–24. [Google Scholar] [CrossRef]

- Long, H.; Feng, G.F.; Gong, Q.; Chang, C.P. ESG performance and green innovation: An investigation based on quantile regression. Bus. Strategy Environ. 2023, 32, 5102–5118. [Google Scholar] [CrossRef]

- Leoni, L. Integrating ESG and organisational resilience through system theory: The ESGOR matrix. Manag. Decis. 2024, 63, 401–422. [Google Scholar] [CrossRef]

- Hussain, R.T.; Akhtar, K.; Ahmad, F.; Salman, A.; Malik, S. Examining the intervening effect of earning management in governance mechanism and financial misstatement with lens of SDG and ESG: A study on non-financial firms of Pakistan. Environ. Sci. Pollut. Res. 2024, 31, 46325–46341. [Google Scholar] [CrossRef]

- Muhammad, K.; Ghani, E.K.; Ilias, A.; Ibrahim, M.A.; Jamil, N.N.; Anwar, N.A.M.; Razali, F.M. Do Board Size, Female Directors and Ownership Dispersion Influence Financial Performance of Cooperatives? An Analysis Using Upper Echelons Theory. Int. J. Econ. Financ. Issues 2024, 14, 1–9. [Google Scholar] [CrossRef]

- Fogel, K.; Ma, L.; Morck, R. Powerful independent directors. Financ. Manag. 2021, 50, 935–983. [Google Scholar] [CrossRef]

- Rashid, A. Board independence and corporate social responsibility reporting: Mediating role of stakeholder power. Manag. Res. Rev. 2021, 44, 1217–1240. [Google Scholar] [CrossRef]

- Khoo, E.S.; Lim, Y.; Lu, L.Y.; Monroe, G.S. Corporate social responsibility performance and the reputational incentives of independent directors. J. Bus. Financ. Account. 2022, 49, 841–881. [Google Scholar] [CrossRef]

- Cosma, S.; Schwizer, P.; Nobile, L.; Leopizzi, R. Environmental attitude in the board. Who are the “green directors”? Evidences from Italy. Bus. Strategy Environ. 2021, 30, 3360–3375. [Google Scholar] [CrossRef]

- Ruiz-Castillo, M.; Aragón-Correa, J.A.; Hurtado-Torres, N.E. Independent directors and environmental innovations: How the visibility of public and private shareholders’ environmental activism moderates the influence of board independence. Bus. Strategy Environ. 2024, 33, 424–440. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Gallego-Álvarez, I.; Zafra-Gómez, J.L. Do independent, female and specialist directors promote eco-innovation and eco-design in agri-food firms? Bus. Strategy Environ. 2021, 30, 1136–1152. [Google Scholar] [CrossRef]

- Imam, M.S.; Abbas, A.; Malik, M.S. How Much Independent Is Independent Director on Board of Directors: A Study of Pakistani Listed Companies. J. Law Soc. Stud. 2024, 6, 136–146. [Google Scholar] [CrossRef]

- Naseem, M.A.; Ali, R.; Ur Rehman, R. Is there a mediating role of corporate social responsibility between board independence, board diversity, and dividend payouts decision? Gend. Manag. Int. J. 2024, 39, 291–308. [Google Scholar] [CrossRef]

- Hassan, S.W.U.; Kiran, S.; Gul, S.; Khatatbeh, I.N.; Zainab, B. The perception of accountants/auditors on the role of corporate governance and information technology in fraud detection and prevention. J. Financ. Report. Account. 2025, 23, 5–29. [Google Scholar] [CrossRef]

- Zahoor, S.; Tian, Y. The board of directors’ role in ensuring effective corporate governance in Pakistani firms. Ann. Hum. Soc. Sci. 2023, 4, 85–101. [Google Scholar]

- Zhang, W.; Ke, J.; Ding, Y.; Chen, S. Greening through finance: Green finance policies and firms’ green investment. Energy Econ. 2024, 131, 107401. [Google Scholar] [CrossRef]

- Chang, X.; Fu, K.; Jin, Y.; Liem, P.F. Sustainable finance: ESG/CSR, firm value, and investment returns. Asia-Pac. J. Financ. Stud. 2022, 51, 325–371. [Google Scholar] [CrossRef]

- Guo, M.; Wang, H.; Kuai, Y. Environmental regulation and green innovation: Evidence from heavily polluting firms in China. Financ. Res. Lett. 2023, 53, 103624. [Google Scholar] [CrossRef]

- Wang, Y.; Tsang, A.; Xiang, Y.; Yan, S. How can regulators affect corporate social responsibility? Evidence from regulatory disclosures of consumer complaints in the US. Br. Account. Rev. 2024, 56, 101280. [Google Scholar] [CrossRef]

- Chen, C.-M.; Li, D. Weighing in on the average weights: Measuring corporate social performance (CSP) score using DEA. Omega 2024, 126, 103072. [Google Scholar] [CrossRef]

- Yasmeen, R.; Hao, G.; Ye, Y.; Shah, W.U.H.; Kamal, M.A. The role of governance quality on mobilizing environmental technology and environmental taxations for renewable energy and ecological sustainability in belt and road economies: A methods of Moment’s quantile regression. Energy Strategy Rev. 2023, 50, 101258. [Google Scholar] [CrossRef]

- Semenova, A.; Semenov, K.; Storchevoy, M. Green Patents or Growth? European and the USA Firms’ Size Dynamics and Environmental Innovations Financial Gains. Sustainability 2024, 16, 6438. [Google Scholar] [CrossRef]

- Dal Maso, L.; Gianfagna, L.; Maglione, F.; Lattanzi, N. Going green: Environmental risk management, market value and performance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 122–132. [Google Scholar] [CrossRef]

- Ouyang, Z.; Lv, R.; Liu, Y. Can corporate social responsibility protect firm value during corporate environmental violation events? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 1942–1952. [Google Scholar] [CrossRef]

- Kim, H.J.; Mun, S.; Han, S.H. Corporate social responsibility and the alignment of CEO and shareholders wealth: Does a strong alignment induce or restrain CSR? Corp. Soc. Responsib. Environ. Manag. 2023, 30, 720–741. [Google Scholar] [CrossRef]

- Sachdeva, S.; Ramesh, L. Aligning Investments with Values: Creating Portfolios Based on Corporate Social Responsibility and NIM. In Sustainable Development Goals: The Impact of Sustainability Measures on Wellbeing; Emerald Publishing Limited: Leeds, UK, 2024; pp. 183–194. [Google Scholar]

- Aras-Beger, G.; Taşkın, F.D. Corporate social responsibility (CSR) in multinational companies (MNCs), small-to-medium enterprises (SMEs), and small businesses. In The Palgrave Handbook of Corporate Social Responsibility; Palgrave Macmillan: London, UK, 2021; pp. 791–815. [Google Scholar]

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Sustainable finance: A journey toward ESG and climate risk. Int. Rev. Environ. Resour. Econ. 2024, 18, 1–59. [Google Scholar] [CrossRef]

- Park, K.; Pinsky, E.; Pattnaik, S.; Subramani, A.; Ying, Y. Innovation and Environmental, Social, and Governance Initiatives in Enterprise Management: A Machine Learning Analysis. In Entrepreneurship, Innovation, and Technology: A Holistic Analysis of Growth Factors; Springer: Berlin/Heidelberg, Germany, 2024; pp. 201–222. [Google Scholar]

- Mansour, M.; Al Zobi, M.t.; Altawalbeh, M.; Abu Alim, S.; Lutfi, A.; Marashdeh, Z.; Al-Nohood, S.; Al Barrak, T. Female leadership and environmental innovation: Do gender boards make a difference? Discov. Sustain. 2024, 5, 331. [Google Scholar] [CrossRef]

- Cek, K.; Ercantan, O. The relationship between environmental innovation, sustainable supply chain management, and financial performance: The moderating role of environmental, social and corporate governance. Int. J. Organ. Leadersh. 2023, 12, 176–197. [Google Scholar] [CrossRef]

- Agliardi, E.; Alexopoulos, T.; Karvelas, K. The environmental pillar of ESG and financial performance: A portfolio analysis. Energy Econ. 2023, 120, 106598. [Google Scholar] [CrossRef]

- Peng, S. Sharing economy and sustainable supply chain perspective the role of environmental, economic and social pillar of supply chain in customer intention and sustainable development. J. Innov. Knowl. 2023, 8, 100316. [Google Scholar] [CrossRef]

- Goodell, J.W.; Li, M.; Liu, D. Causes and consequences of flocked resignations of independent directors: Inferences from firm impacts following Kangmei Pharmaceutical’s scandal. Financ. Res. Lett. 2023, 51, 103496. [Google Scholar] [CrossRef]

- Ding, H.; Wang, Z.; Xu, H.; Lin, Z. A Study on the Impact of Board Characteristics on the Environmental, Social, and Governance (ESG) Responsibilities of Listed Companies—Evidence from Chinese Listings. Sustainability 2024, 16, 10490. [Google Scholar] [CrossRef]

- Ghafran, C.; O’Sullivan, N.; Yasmin, S. When does audit committee busyness influence earnings management in the UK? Evidence on the role of the financial crisis and company size. J. Int. Account. Audit. Tax. 2022, 47, 100467. [Google Scholar] [CrossRef]

- Steinbrunner, P. Is larger really better? Productivity and firm size in European electricity generation sectors. J. Clean. Prod. 2024, 446, 141382. [Google Scholar] [CrossRef]

- Musa, H.; Krištofík, P.; Medzihorský, J.; Klieštik, T. The development of firm size distribution–Evidence from four Central European countries. Int. Rev. Econ. Financ. 2024, 91, 98–110. [Google Scholar] [CrossRef]

- Bataineh, M.J.; Sánchez-Sellero, P.; Ayad, F. Green is the new black: How research and development and green innovation provide businesses a competitive edge. Bus. Strategy Environ. 2024, 33, 1004–1023. [Google Scholar] [CrossRef]

- Homroy, S. GHG emissions and firm performance: The role of CEO gender socialization. J. Bank. Financ. 2023, 148, 106721. [Google Scholar] [CrossRef]

- Hendayana, Y.; Arief Ramdhany, M.; Pranowo, A.S.; Abdul Halim Rachmat, R.; Herdiana, E. Exploring impact of profitability, leverage and capital intensity on avoidance of tax, moderated by size of firm in LQ45 companies. Cogent Bus. Manag. 2024, 11, 2371062. [Google Scholar] [CrossRef]

- Agnese, P.; Carè, R.; Cerciello, M.; Taddeo, S. Reconsidering the impact of environmental, social and governance practices on firm profitability. Manag. Decis. 2025, 63, 25–48. [Google Scholar] [CrossRef]

- Lin, W.L.; Chong, S.C.; Wong, K.K.S. Sustainable development goals and corporate financial performance: Examining the influence of stakeholder engagement. Sustain. Dev. 2025, 33, 2714–2739. [Google Scholar] [CrossRef]

- Li, L.; Suhrab, M.; Radulescu, M.; Banuta, M. Moving Toward Sustainable Finance: Leveraging Environment, Social and Governance (ESG) Performance and Risk Management to Drive Corporate Financing Efficiency. Eng. Econ. 2025, 36, 72–95. [Google Scholar] [CrossRef]

- de Souza, P.V.S.; Dalcero, K.; Ferreira, D.D.M.; Paulo, E. The impact of environmental innovation and national culture on ESG practices: A study of Latin American companies. Acad. Rev. Latinoam. Adm. 2024, 37, 246–264. [Google Scholar] [CrossRef]

- Ma, C.; Chishti, M.F.; Durrani, M.K.; Bashir, R.; Safdar, S.; Hussain, R.T. The corporate social responsibility and its impact on financial performance: A case of developing countries. Sustainability 2023, 15, 3724. [Google Scholar] [CrossRef]

- Bonsu, M.O.-A.; Guo, Y.; Zhu, X. Does green innovation mediate corporate social responsibility and environmental performance? Empirical evidence from emerging markets. J. Appl. Account. Res. 2024, 25, 221–239. [Google Scholar] [CrossRef]

- Radu, C.; Smaili, N.; Constantinescu, A. The impact of the board of directors on corporate social performance: A multivariate approach. J. Appl. Account. Res. 2022, 23, 1135–1156. [Google Scholar] [CrossRef]

- Dwekat, A.; Abu Alia, M.; Abdeljawad, I.; Meqbel, R. Governing for the green: How European board attributes are driving environmental innovation. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 2128–2146. [Google Scholar] [CrossRef]

- Li, C.; Ahmad, S.F.; Ayassrah, A.Y.B.A.; Irshad, M.; Telba, A.A.; Awwad, E.M.; Majid, M.I. Green production and green technology for sustainability: The mediating role of waste reduction and energy use. Heliyon 2023, 9, e22496. [Google Scholar] [CrossRef] [PubMed]

- Adnan, M.; Xiao, B.; Bibi, S.; Xiao, P.; Zhao, P.; Wang, H.; Ali, M.U.; An, X. Known and unknown environmental impacts related to climate changes in Pakistan: An under-recognized risk to local communities. Sustainability 2024, 16, 6108. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, D. Do environmental, social, and governance scores improve green innovation? Empirical evidence from Chinese-listed companies. PLoS ONE 2023, 18, e0279220. [Google Scholar] [CrossRef]

- Khalil, M.A.; Khalil, R.; Khalil, M.K. Environmental, social and governance (ESG)-augmented investments in innovation and firms’ value: A fixed-effects panel regression of Asian economies. China Financ. Rev. Int. 2024, 14, 76–102. [Google Scholar] [CrossRef]

- Galloppo, G. Pillar 1—Environment Investment Theme. In A Journey into ESG Investments: The Theory and Practice of the CSR-Financial Performance Nexus; Springer: Berlin/Heidelberg, Germany, 2025; pp. 181–237. [Google Scholar]

- Lakhani, L.; Herbert, S.L. Theoretical frameworks applied in integrated reporting and sustainability reporting research. S. Afr. J. Econ. Manag. Sci. 2022, 25, 4427. [Google Scholar] [CrossRef]

- Jan, A.A.; Lai, F.-W.; Draz, M.U.; Tahir, M.; Ali, S.E.A.; Zahid, M.; Shad, M.K. Integrating sustainability practices into islamic corporate governance for sustainable firm performance: From the lens of agency and stakeholder theories. Qual. Quant. 2021, 56, 2989–3012. [Google Scholar] [CrossRef]

- Diwan, H.; Amarayil Sreeraman, B. From financial reporting to ESG reporting: A bibliometric analysis of the evolution in corporate sustainability disclosures. Environ. Dev. Sustain. 2024, 26, 13769–13805. [Google Scholar] [CrossRef]

- Herbert, S.; Graham, M. Applying legitimacy theory to understand sustainability reporting behaviour within South African integrated reports. S. Afr. J. Account. Res. 2022, 36, 147–169. [Google Scholar] [CrossRef]

- Akhter, F.; Hossain, M.R.; Elrehail, H.; Rehman, S.U.; Almansour, B. Environmental disclosures and corporate attributes, from the lens of legitimacy theory: A longitudinal analysis on a developing country. Eur. J. Manag. Bus. Econ. 2023, 32, 342–369. [Google Scholar] [CrossRef]

- Lewa, E.M.; Gatimbu, K.K.; Kariuki, P.W.o. Board attributes and sustainability reporting of selected listed nonfinancial firms in anglophone Sub-Saharan African countries: A multinomial logistic regression. Heliyon 2024, 10, e29824. [Google Scholar] [CrossRef]

- Roszkowska-Menkes, M.; Aluchna, M.; Kamiński, B. True transparency or mere decoupling? The study of selective disclosure in sustainability reporting. Crit. Perspect. Account. 2024, 98, 102700. [Google Scholar] [CrossRef]

- Sun, Y.; Davey, H.; Arunachalam, M.; Cao, Y. Towards a theoretical framework for the innovation in sustainability reporting: An integrated reporting perspective. Front. Environ. Sci. 2022, 10, 935899. [Google Scholar] [CrossRef]

- Jamil, A.; Mohd Ghazali, N.A.; Puat Nelson, S. The influence of corporate governance structure on sustainability reporting in Malaysia. Soc. Responsib. J. 2021, 17, 1251–1278. [Google Scholar] [CrossRef]

- Ahmadi-Gh, Z.; Bello-Pintado, A. Why is manufacturing not more sustainable? The effects of different sustainability practices on sustainability outcomes and competitive advantage. J. Clean. Prod. 2022, 337, 1–11. [Google Scholar] [CrossRef]

- Mehjabeen, M. Sustainability reporting practices in Bangladesh: Insights from upper echelons theory. J. Financ. Mark. Gov. 2022, 21, 65–86. [Google Scholar] [CrossRef]

- Dhir, A.; Khan, S.J.; Islam, N.; Ractham, P.; Meenakshi, N. Drivers of sustainable business model innovations. An upper echelon theory perspective. Technol. Forecast. Soc. Change 2023, 191, 122409. [Google Scholar] [CrossRef]

- Oprean-Stan, C.; Oncioiu, I.; Iuga, I.C.; Stan, S. Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability 2020, 12, 8536. [Google Scholar] [CrossRef]

- Mahran, K.; Elamer, A.A. Chief Executive Officer (CEO) and corporate environmental sustainability: A systematic literature review and avenues for future research. Bus. Strategy Environ. 2024, 33, 1977–2003. [Google Scholar] [CrossRef]

- Alhawaj, A.; Buallay, A.; Abdallah, W. Sustainability reporting and energy sectorial performance: Developed and emerging economies. Int. J. Energy Sect. Manag. 2023, 17, 739–760. [Google Scholar] [CrossRef]

- Al-Shaer, H.; Hussainey, K. Sustainability reporting beyond the business case and its impact on sustainability performance: UK evidence. J. Environ. Manag. 2022, 311, 114883. [Google Scholar] [CrossRef] [PubMed]

- Baah, C.; Opoku-Agyeman, D.; Acquah, I.S.K.; Agyabeng-Mensah, Y.; Afum, E.; Faibil, D.; Abdoulaye, F.A.M. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustain. Prod. Consum. 2021, 27, 100–114. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Shah, S.F.; Mehmood, S.; Khan, M.A.; Popp, J. Earnings management opportunistic or efficient in Pakistan? The role of corporate governance practices. Cogent Bus. Manag. 2024, 11, 2398716. [Google Scholar] [CrossRef]

- Mahmood, Z.; Uddin, S. Institutional logics and practice variations in sustainability reporting: Evidence from an emerging field. Account. Audit. Account. J. 2021, 34, 1163–1189. [Google Scholar] [CrossRef]

- Shahzad, M.F.; Xu, S.; An, X.; Asif, M.; Jafri, M.A.H. Effect of stakeholder pressure on environmental performance: Do virtual CSR, green credit, environmental and social reputation matter? J. Environ. Manag. 2024, 368, 122223. [Google Scholar] [CrossRef]

- Wu, Y.; Tham, J. The Impact of Executive Green Incentives and Top Management Team Characteristics on Corporate Value in China: The Mediating Role of Environment, Social and Government Performance. Sustainability 2023, 15, 12518. [Google Scholar] [CrossRef]

- Adeneye, Y.B.; Kammoun, I.; Ab Wahab, S.N.A. Capital structure and speed of adjustment: The impact of environmental, social and governance (ESG) performance. Sustain. Account. Manag. Policy J. 2023, 14, 945–977. [Google Scholar] [CrossRef]

- Xiong, Z.; Liu, J.; Yan, F.; Shi, D. Corporate ESG performance when neighboring the Environmental Protection Agency. J. Environ. Manag. 2024, 349, 119519. [Google Scholar] [CrossRef]

- Dohrmann, M.; Martinez-Blasco, M.; Moring, A.; Margarit, J.C. Environmental performance and firm performance in Europe: The moderating role of board governance. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 5863–5880. [Google Scholar] [CrossRef]

- Kwarteng, P.; Appiah, K.O.; Addai, B. Influence of board mechanisms on sustainability performance for listed firms in Sub-Saharan Africa. Future Bus. J. 2023, 9, 85. [Google Scholar] [CrossRef]

| Type of Variable | Variable | Proxies | Measurement Criteria | References |

|---|---|---|---|---|

| Independent variable | ESG reporting | CSRSS | An average score of all CSR activities over the last 12 years. | [113,114,115,116] |

| ESGS | A weighted average score of all the ESG activities over the last 12 years. | [39,117,118] | ||

| Dependent variable | Greener revolution | EIS | The weighted average cost is based on three factors: ‘environmental impact reduction’, ‘innovation and new product development’, and ‘technology adoption and process efficiency’. | [24,119,120] |

| EPS | A weighted average score of four indicators including ‘environmental management practices’, ‘resource usage efficiency’, ‘climate change strategies’, and ‘biodiversity and land use’. | [24,121,122] | ||

| Moderator | Board independence | Bind | The ratio of independent directors to total board members. | [99,123,124] |

| Control Variable | Firm size | Fs | Log total assets of the firm. | [125,126,127] |

| Firm age | Fage | Log firm age (where firm age is taken from the date of its incorporation till today). | [128,129] | |

| Firm profitability | FP | ROA | [130,131] | |

| Leverage | Lvg | The ratio of debt to total assets | [86,132,133] |

| Variables | Mean | Std.dev | CSRSS | ESGS | Bind | EIS | EPS | Fs | Fage | FP | Lvg | CSRSSBind | ESGSBind |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CSRSS | 0.405 | 0.215 | 1.000 | ||||||||||

| ESGS | 1.991 | 0.396 | 0.07 *** | 1.000 | |||||||||

| Bind | 0.253 | 0.434 | 0.005 | −0.03 ** | 1.000 | ||||||||

| EIS | 61.229 | 10.905 | −0.021 | 0.05 *** | 0.03 * | 1.000 | |||||||

| EPS | 8.285 | 2.613 | 0.06 *** | 0.07 *** | −0.04 *** | 0.07 *** | 1.000 | ||||||

| Fs | 3.110 | 0.779 | −0.24 *** | −0.22 *** | 0.024 | −0.09 *** | −0.13 *** | 1.000 | |||||

| Fage | 1.604 | 0.244 | 0.07 *** | 0.06 *** | 0.021 | 0.03 ** | 0.004 | −0.08 *** | 1.000 | ||||

| FP | 0.162 | 0.344 | 0.03 ** | 0.005 | 0.013 | 0.039 | −0.003 | 0.187 | −0.000 *** | 1.000 | |||

| Lvg | 0.362 | 0.171 | −0.21 *** | −0.05 *** | 0.013 | −0.06 *** | −0.03 ** | 0.273 | −0.07 *** | −0.05 *** | 1.000 | ||

| CSRSSBind | 0.103 | 0.204 | 0.27 *** | −0.003 | 0.094 *** | 0.025 | −0.005 | −0.069 | 0.036 | 0.01 *** | −0.04 * | 1.000 | |

| ESGSBind | 0.498 | 0.946 | 0.014 | 0.0759 *** | 0.099 *** | 0.03 ** | −0.02 * | 0.001 | 0.02 * | 0.013 | 0.006 | 0.03 *** | 1.000 |

| Model 1 | Model 2 | |||||

|---|---|---|---|---|---|---|

| Variables | Pooled OLS | RE | FE | Pooled OLS | RE | FE |

| EIS | EIS | EIS | EPS | EPS | EPS | |

| CSRSS | −2.98 *** (0.000) | −0.19 (0.825) | 0.58 (0.549) | 0.39 ** (0.037) | 0.53 ** (0.016) | 0.72 *** (0.006) |

| ESGS | 0.88 ** (0.037) | 0.63 (0.162) | 0.41 (0.400) | 0.29 *** (0.004) | −0.02 (0.829) | −0.28 ** (0.029) |

| Fs | −1.30 *** (0.000) | −0.57 (0.159) | 1.57 ** (0.045) | −0.40 *** (0.000) | −0.39 *** (0.000) | −0.22 (0.272) |

| Fage | 0.97 (0.146) | 0.71 (0.287) | 0.56 (0.420) | −0.11 (0.476) | −0.19 (0.262) | −0.25 (0.175) |

| FP | 1.75 *** (0.000) | 1.42 *** (0.001) | 1.29 *** (0.003) | 0.14 (0.209) | 0.098 (0.374) | 0.07 (0.488) |

| Lvg | −3.04 *** (0.002) | −2.00 * (0.068) | −1.68 (0.155) | 0.15 (0.535) | −0.195 (0.475) | −0.48 (0.122) |

| _cons | 63.98 *** (0.000) | 61.18 *** (0.000) | 54.80 *** (0.000) | 8.90 *** (0.000) | 9.69 *** (0.000) | 9.81 *** (0.000) |

| R-sq | 0.023 | 0.038 | 0.016 | 0.029 | 0.0627 | 0.022 |

| Adj-R-sq | 0.022 | 0.037 | 0.014 | 0.019 | 0.0626 | 0.021 |

| Prob (F) | 12.97 (0.000) | 20.24 (0.002) | 3.03 (0.005) | 15.70 (0.000) | 35.83 (0.000) | 2.78 (0.010) |

| BP-LM TEST | chibar2(01) = 2583.66 | chibar2(01) = 813.04 | ||||

| Prob > chibar2 = 0.000 | Prob > chibar2 = 0.000 | |||||

| Hausman Test | Chi2 (7) = 19.87 | Chi2 (7) = 22.81 | ||||

| p > chi 2 = 0.001 | p > chi 2 = 0.000 | |||||

| Model 1 | Model 2 | |||||

|---|---|---|---|---|---|---|

| Pooled OLS | RE | FE | Pooled OLS | RE | FE | |

| Variables | EIS | EIS | EIS | EPS | EPS | EPS |

| CSRSS | 4.77 *** (0.004) | 1.77 (0.153) | 1.25 (0.342) | −0.45 (0.113) | −0.05 (0.859) | 0.31 (0.367) |

| ESGS | 2.13 ** (0.010) | 1.93 *** (0.004) | 1.84 *** (0.009) | −0.17 (0.270) | −0.32 * (0.055) | −0.46 ** (0.012) |

| Bind | 6.44 (0.148) | 8.97 ** (0.049) | 9.50 ** (0.049) | −1.49 *** (0.000) | −3.28 *** (0.001) | −2.45 (0.053) |

| Fs | −0.99 *** (0.000) | −0.54 (0.181) | 1.47 * (0.059) | −0.11 *** (0.000) | −0.37 *** (0.000) | −0.22 (0.268) |

| Fage | 0.77 (0.163) | 0.64 (0.335) | 0.48 (0.490) | −0.02 (0.607) | −0.17 (0.323) | −0.23 (0.197) |

| FP | 2.83 *** (0.000) | 1.40 *** (0.001) | 1.27 *** (0.003) | 0.21 (0.161) | 0.10 (0.366) | 0.07 (0.502) |

| Lvg | −3.11 *** (0.002) | −1.99 * (0.069) | −1.62 (0.171) | 0.09 (0.582) | −0.18 (0.509) | −0.47 (0.134) |

| CSRSSBind | 2.03 (0.581) | 6.82 * (0.073) | 8.12 ** (0.043) | 3.37 *** (0.000) | 2.50 *** (0.009) | 1.82 * (0.085) |

| ESGSBind | −3.02 (0.114) | −5.17 *** (0.008) | −5.68 *** (0.005) | 1.74 *** (0.000) | 1.21 ** (0.014) | 0.75 (0.163) |

| _cons | 62.27 *** (0.000) | 58.86 *** (0.000) | 52.74 *** (0.000) | 10.23 *** (0.000) | 10.53 *** (0.000) | 10.38 *** (0.000) |

| 0.102 | 0.026 | 0.014 | 0.0287 | 0.0845 | 0.037 | |

| Adj- | 0.101 | 0.0245 | 0.011 | 0.0267 | 0.0841 | 0.034 |

| Prob (F) | 9.44 (0.000) | 34.08 (0.000) | 3.67 (0.000) | 14.51 (0.000) | 49.22 (0.000) | 2.40 (0.012) |

| BP-LM TEST | chibar2(01) = 2597.99 | chibar2(01) = 752.69 | ||||

| Prob > chibar2 = 0.000 | Prob > chibar2 = 0.000 | |||||

| Hausman Test | Chi2 (7) = 21.67 | Chi2 (7) = 31.26 | ||||

| p > chi 2 = 0.010 | p > chi 2 = 0.003 | |||||

| EIS | EPS | |||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 1 | Model 2 | |

| Variables | Base Model | Full Model | Base Model | Full Model |

| CSRSS | −2.98 *** | 4.77 *** | 0.39 ** | −0.45 |

| ESGS | 0.88 ** | 2.13 ** | 0.29 *** | −0.17 |

| Fs | −1.3 *** | −0.99 *** | −0.40 *** | −0.11 *** |

| Fage | 0.97 | 0.77 | −0.11 | −0.02 |

| FP | 1.75 *** | 2.83 *** | 0.14 | 0.21 |

| Lvg | −3.03 *** | −3.11 *** | 0.14 | 0.09 |

| Bind | 6.44 | −1.49 *** | ||

| CSRSSBind | 2.03 | 3.37 *** | ||

| ESGSBind | −3.02 | 1.74 *** | ||

| cons | 63.98 *** | 62.26 *** | 8.90 *** | 10.23 *** |

| 0.017 | 0.102 | 0.029 | 0.042 | |

| change in | F-test | Sig | ||

| Model 1(EIS) | 0.017 | 0.102 | 7.49 | (0.000) |

| Model 2 (EPS) | 0.029 | 0.042 | 9.73 | (0.000) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Noor, A.; Hassan, R.; Fortea, C.; Antohi, V.M. A Greener Paradigm Shift: The Moderating Role of Board Independence in Sustainability Reporting. Sustainability 2025, 17, 4776. https://doi.org/10.3390/su17114776

Noor A, Hassan R, Fortea C, Antohi VM. A Greener Paradigm Shift: The Moderating Role of Board Independence in Sustainability Reporting. Sustainability. 2025; 17(11):4776. https://doi.org/10.3390/su17114776

Chicago/Turabian StyleNoor, Abid, Rohail Hassan, Costinela Fortea, and Valentin Marian Antohi. 2025. "A Greener Paradigm Shift: The Moderating Role of Board Independence in Sustainability Reporting" Sustainability 17, no. 11: 4776. https://doi.org/10.3390/su17114776

APA StyleNoor, A., Hassan, R., Fortea, C., & Antohi, V. M. (2025). A Greener Paradigm Shift: The Moderating Role of Board Independence in Sustainability Reporting. Sustainability, 17(11), 4776. https://doi.org/10.3390/su17114776