The global fertilizer market was valued at approximately USD 212.8 billion in 2023, and is estimated to reach USD 541.20 billion by the end of 2030 [

4], with a compound annual growth rate of 5.99%. Demand for fertilizers is primarily driven by field crops, spurred by population growth and rising global food consumption [

5,

6]. Nitrogen-based fertilizers hold the largest market share, followed by Phosphorus and Potassium. The Asia-Pacific region is projected to capture a significant portion of the market, supported by government initiatives for small and marginal farmers in food crop production [

7,

8]. In North America and Europe, advanced technology, steady growth, and high per capita fertilizer consumption are driving the markets, with the U.S. and Canada as primary contributors in North America, while Germany and France lead in Europe. The Middle East and Africa are expected to experience the fastest growth in fertilizer consumption due to rapid population growth, increased investment in agricultural infrastructure, and a focus on food security [

9]. The Australian fertilizers market is elaborated and compared using a three-dimensional analysis of time series data.

Figure 1 and

Figure 2 provide details of NPK fertilizer production and consumption in Australia. In

Figure 2, we observe that Australia has a significant portion of fertilizer consumption, though it produces only half of the amount consumed locally.

Figure 3 shows the NPK fertilizer export-to-import ratio in the context of Australia, which is the key striking point of this study.

Fertilizers contain essential nutrients such as Phosphorus, Nitrogen, Potassium, sulfur, concentrated nutrient blends, and essential trace elements. Annually, between 6.0 and 7.0 million tons of fertilizers are used in agricultural production, but only about half of this volume is produced locally; the rest is imported (

Figure 2 and

Figure 3). This reliance on imports exposes the industry to vulnerabilities in global supply chains, with limited control over pricing. Recent events, such as the COVID-19 pandemic, the European natural gas crisis, and the Russia–Ukraine conflict, have severely impacted global fertilizer supply chains, leading to significant price increases affecting the Australian fertilizer market [

7]. Moreover, these disruptions have heightened concerns about Australia’s dependence on imported fertilizers. Raw materials such as sulfur and phosphate rock, used to produce superphosphate fertilizer, are largely imported [

4]. This import dependence further exposes the fertilizer industry to vulnerabilities in global supply chain disruptions.

Factors Affecting Fertilizer Consumption: Conceptual Framework and Review

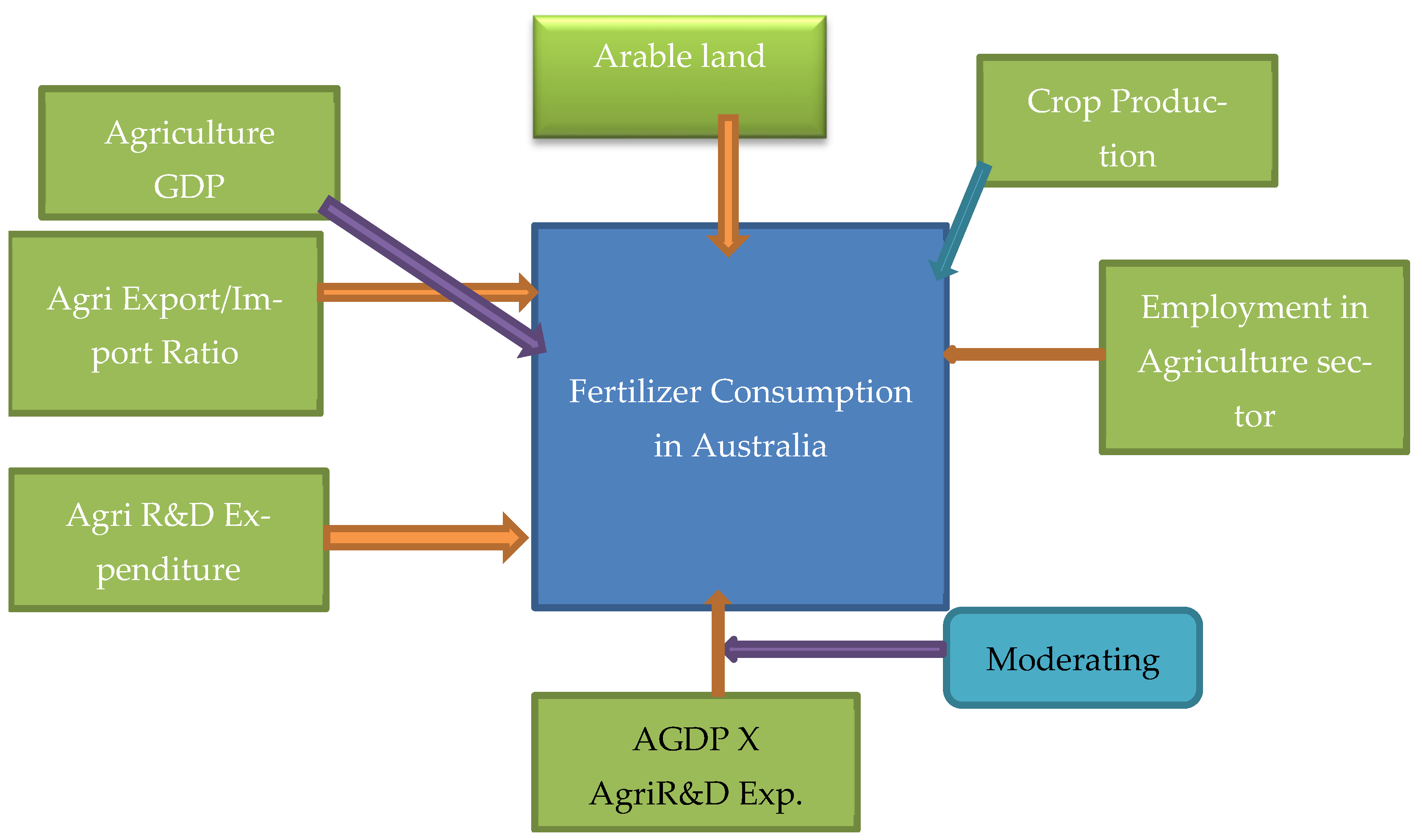

This study assesses influencing factors to determine fertilizer consumption, which will promote domestic agricultural activities and external markets for agricultural goods. The proposed factors were identified based on past studies that are aligned with the objectives of this study. Therefore, the key factors affecting fertilizer consumption are shown in

Figure 4. This framework establishes the relationship among the factors influencing demand and determining fertilizer consumption in the Australian economy. We have identified six factors that influence fertilizer consumption in the Australian economy: arable land, agricultural GDP, crop production, agricultural export to import ratio, agricultural sector employment, and agri R&D expenditure.

Moreover, the relationship dynamics between the interaction of agri GDP and agri R&D expenditure with fertilizer consumption is of interest.

Figure 4 shows the individual impact of agri GDP and agri R&D expenditure on fertilizer consumption. However, we are expecting that the moderating effects of these two variables will produce a new avenue to think about this relationship chemistry. This framework justifies dominant factors affecting fertilizer consumption in the Australian agricultural sectors and its impact on the sustainable ago-economic development in Australia.

Fertilizer use in the Australian agro-economy has grown significantly, with Nitrogen fertilizer consumption increasing by 14% annually since the early 1990s [

17,

18]. This trend is driven by increasing arable land, increasing demand for commercial crops such as cereals and canola, and the matching demand of soil Nitrogen supply with crop demand [

17]. However, refs. [

19,

20] found a decreasing trend of Nitrogen fertilizer application in the sugar industry since the mid-1990s, improving fertilizer use efficiency. Input subsidies, high-yielding varieties, and irrigated areas are directly affecting fertilizer consumption in many developing countries [

12,

21,

22,

23]. According to the findings of Refs. [

24,

25], nutrient application rates on agricultural land are increasing globally. Global Nitrogen (N) fertilizer from 1961 to 2018 has significantly increased from 3 to 26 kg N/ha [

26]. Key factors in the Sub-Saharan African region include population growth, increasing food demand, and decreasing arable land [

2,

27]. Maximizing firms’ profitability is also becoming a catalyst for increasing the amount of fertilizer consumption [

2,

17,

24,

28].

However, Australia’s fertilizer production has declined recently, with a growing reliance on imports, particularly for Phosphorus and Potassium-based fertilizers from China, Morocco, Canada, and Russia [

7]. Domestic production of Nitrogen-based fertilizers like urea remains significant and local production of Phosphorus and Potassium is minimal due to the limited availability of raw materials [

29]. Ref. [

30] observed a shifting trend towards high-yield fertilizers, which contain a higher concentration of essential nutrients for agricultural productivity. These fertilizers are more efficient, allowing farmers to apply fewer products while achieving the same or improved yield outcomes. Refs. [

31,

32] postulated that products such as urea and ammonium phosphate (DAP) have gained popularity due to their high nutrient contents, ease of application, and cost-effectiveness in crop productivity. Refs. [

16,

33,

34,

35] surveyed grain growers in Western Australia and found that fertilizer decisions are most influenced by agronomic factors, such as rainfall, as well as logistical factors, including farm size, cropping areas, and the number of fertilizer applications per season.

Many previous studies have examined global trends expected to influence agriculture and fertilizer use over the next decade [

11,

36,

37]. Previous studies are categorized into three types based on their contribution to this field. Firstly, the supply and demand dynamics and factors influence the supply and consumption of chemical fertilizers. For example, Refs. [

9,

38,

39,

40] postulate a wide range of responsible factors that were identified to determine supply and consumption of fertilizers varies across countries. In Pakistan’s economy, fertilizer consumption has a positive and significant influence on Agri GDP. Government policy, infrastructure, and finance are the prerequisites for farmers to acquire fertilizers to boost demand for fertilizers in the Zimbabwean economy. In the Indian economy, irrigation, institutional credit, and subsidy are the factors that increase fertilizer consumption.

Secondly, the cropping system, farmers’ characteristics, and technology adoption are factors regarding fertilizer usage. In the most recent studies, the socioeconomic characteristics of the household have been given attention as influencing factors [

41,

42]. Major socioeconomic factors influencing agriculture include the age and education level of the household head, farm size, and the degree of farmland fragmentation. Geographic factors include landform characteristics, drainage capacity, irrigation capacity, and topsoil thickness. Additionally, studies have examined several other characteristics, including those of the household head [

39], family dynamics [

43], farmland attributes [

44], and technology features [

45]. Promoting technology and farmers’ perceptions of it reflect their understanding and access to such technologies [

41]. Furthermore, the endowments of farmland resources—encompassing geological, physical, and chemical traits—significantly influence farmers’ technology choices [

46].

Thirdly, chemical fertilizers used in agricultural products have a negative impact on the environment. The overuse of chemical fertilizers has resulted in severe agricultural non-point source pollution in China [

40,

42,

47,

48]. Ref. [

25] found that increased use of fertilizers harms the environment in the US economy. Ref. [

49] argued that the issue is exacerbated by the increased use of urea fertilizer, which is both soluble and mobile in surface water flows. The growing demand for environmentally sustainable agricultural practices is influencing fertilizer production. Ref. [

50] strongly suggested adopting organic and bio-fertilizers in Australia to reduce environmental impacts. Though these organic fertilizers are still a tiny part of the overall market, they are gaining momentum due to consumer demand for organic products and regulatory pressure to reduce nutrient runoff and greenhouse gas emissions. Fertilizer consumption in Australia is primarily driven by the requirements of large-scale cereal cropping, particularly in wheat, barley, and canola production. The report in Ref. [

1] revealed that Nitrogen-based fertilizers, particularly urea, are the most widely used because they boost yields in Nitrogen-deficient soils.

Additionally, consumption patterns vary by region, with Western Australia, New South Wales, and Queensland being the highest consumers due to the large expanses of arable land dedicated to grain production [

21,

37,

51]. Environmental concerns have become more significant in influencing fertilizer consumption patterns. The impact of fertilizers’ use of nutrient overflow on water quality has led to tighter regulations in several Australian states [

23,

32]. As a result, policy adoption of imposing control while releasing fertilizers and precision agriculture technologies helps to minimize environmental impacts by reducing over-applications. Moreover, a vastly flexible climate also affects fertilizer consumption in the states of Australia [

11]. The findings of Ref. [

36] reveal that drought environments prevail in large parts of the country and can significantly reduce fertilizer use as farmers plant less or embrace conservative farming practices. According to Ref. [

32], fertilizer application rates drop considerably during extended dry periods, as farmers focus on maintaining soil health rather than increasing yields.

Moreover, commodity prices are a crucial determinant of fertilizer consumption in Australia, as they significantly influence farmers’ profitability, leading to the use of inputs in farming [

12]. Ref. [

27] found that higher prices for agricultural products (e.g., wheat, barley, and canola) induce farmers to invest more in fertilizers to maximize yields. In contrast, when commodity prices drop, farmers reduce fertilizer inputs to cut costs, leading to fluctuations in fertilizer consumption. Ref. [

17] documented that fertilizer use also shows regional variations. Western Australia shows the highest fertilizer usage per hectare, mainly due to its vast cropping areas and poor soil fertility. As a result, the adoption of precision agriculture technologies in these states has significantly improved the efficiency of fertilizer application. These technologies enable farmers to apply fertilizers more accurately, tailoring the application to the specific needs of the soil and crops. According to Ref. [

30], the fertilizer market in Australia is extremely sensitive to global prices for raw materials. Phosphorus and Potassium, two dominant fertilizers, are imported mainly due to the absence of local reserves. Thus, global price volatility significantly affects local production costs and availability. The exchange rate of the Australian dollar with leading currencies also plays a crucial role in determining imported fertilizer prices in the home country, which in turn affects fertilizer usage and farmers’ incentives for crop production [

52]. Moreover, logistical challenges distort fertilizer consumption in Australia due to large distances between agricultural regions and fertilizer manufacturing or import hubs [

53]. Farmers from remote areas must pay more to acquire fertilizers when transportation costs are higher from wholesalers to retailers.

Technological advancements, particularly, precision agriculture, policy restrictions, and climate versatilities across the states, are transforming fertilizer use in Australia [

45,

54]. Ref. [

6] shows that using precision farming tools such as GPS-guided machinery, soil mapping, and variable rate technology has led to more efficient fertilizer application in Australia. This technology reduces wastage and environmental impact while increasing crop yields. Hence, trending towards more sustainable farming practices is leading to an increase in the use of organic and bio-fertilizers. According to a report [

21], organic farming is rapidly expanding with the use of organic fertilizers due to surging consumer demand. However, the market share of organic fertilizers is still tiny compared to total fertilizer consumption. Consumer awareness and policy applications for environmentally sustainable agricultural practices are imperative to boost the market share.

This study identifies a gap in the existing literature regarding a comprehensive examination of supply-side factors. Previous research has not explored the moderating role of specific factors in the relationship between key determinants of fertilizer consumption. This research focuses on two critical variables, agricultural R&D expenditure and the agricultural export-to-import ratio, and their impact on fertilizer consumption in Australia. Our study evaluates the independent effects of agricultural GDP and agricultural R&D expenditure on fertilizer consumption, but we also hypothesize that the interaction between agricultural GDP and R&D expenditure may exert a stronger influence on fertilizer consumption. To explore this, we employ an ARDL framework to investigate the relationship between agricultural GDP, R&D expenditure, and fertilizer consumption, with an emphasis on the moderating effects of agricultural GDP and R&D as a distinctive contribution of this study.