Influence Mechanism of Digital Economy on Urban Green Development Efficiency: A Perspective on New Quality Productive Forces

Abstract

1. Introduction

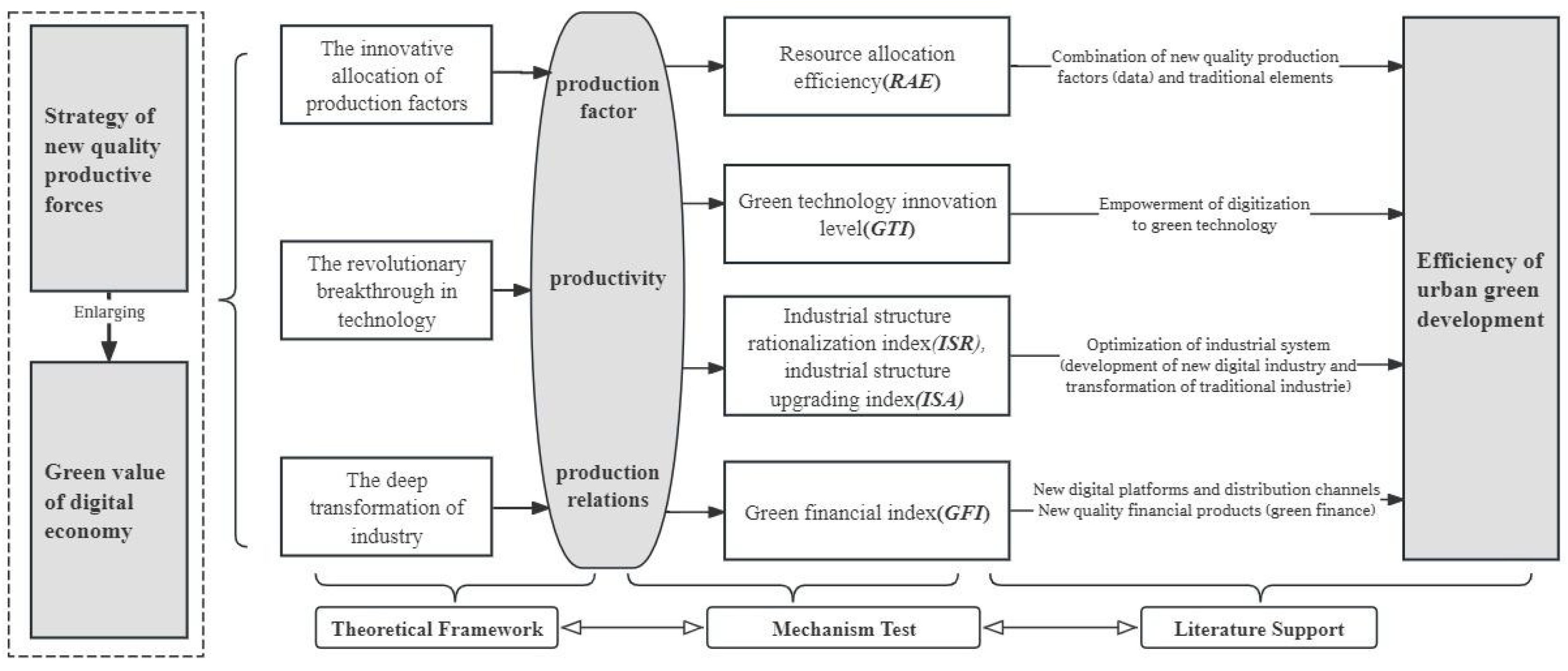

2. Theoretical Analysis and Hypotheses

2.1. Influence Effect of Digital Economy on Urban Green Development

2.2. Influence Mechanism of Digital Economy on Urban Green Development

2.2.1. Digital Economy, Resource Allocation, and Urban Green Development

2.2.2. Digital Economy, Green Technology, and Urban Green Development

2.2.3. Digital Economy, Industrial Structure, and Urban Green Development

2.2.4. Digital Economy, Green Finance, and Urban Green Development

2.3. Difference in the Influence of Digital Economy on Urban Green Development

3. Variables and Methods

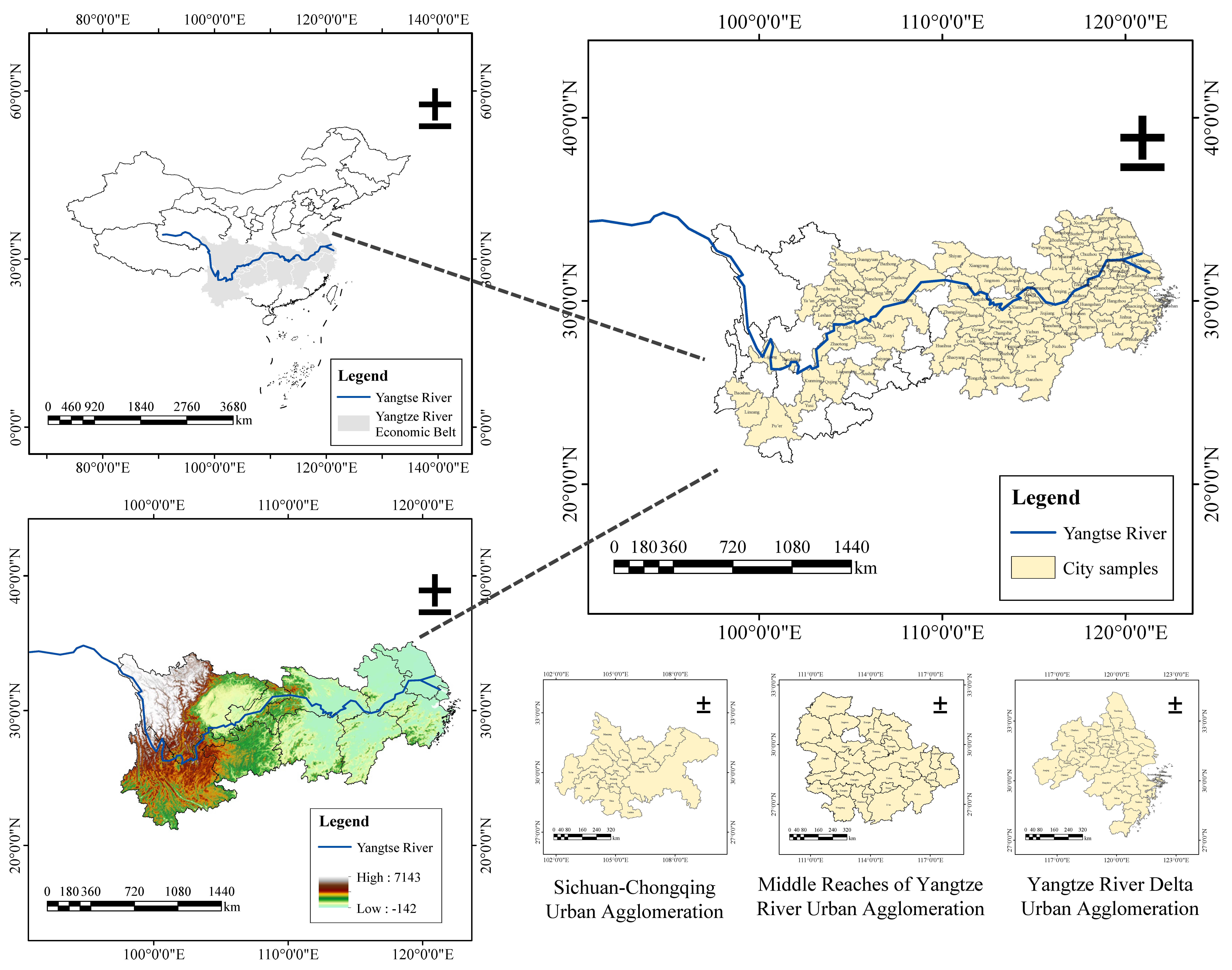

3.1. Research Sample

3.2. Variables Description

3.2.1. Explained Variable

3.2.2. Explanatory Variable

3.2.3. Mediating Variables

3.2.4. Control Variables

3.2.5. Data Sources

3.3. Model Methods

3.3.1. Baseline Regression Model

3.3.2. Mechanism Test Model

3.3.3. SBM-GML Method

- (1)

- Efficiency value ρ

- (2)

- Total index and decomposition index ,

4. Results

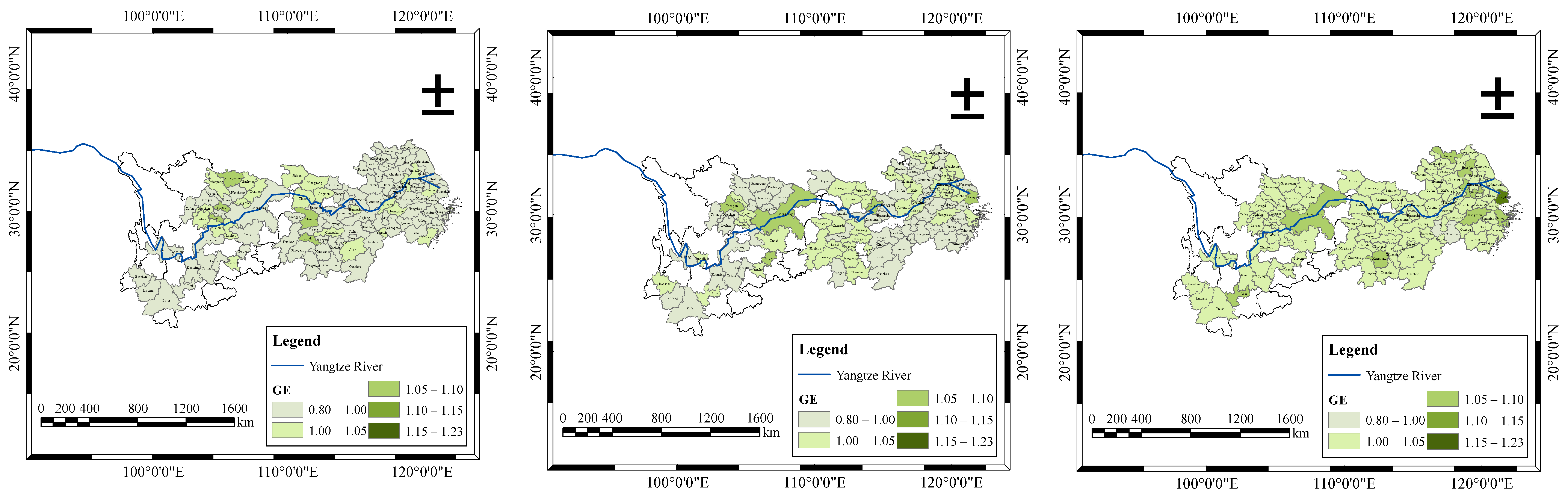

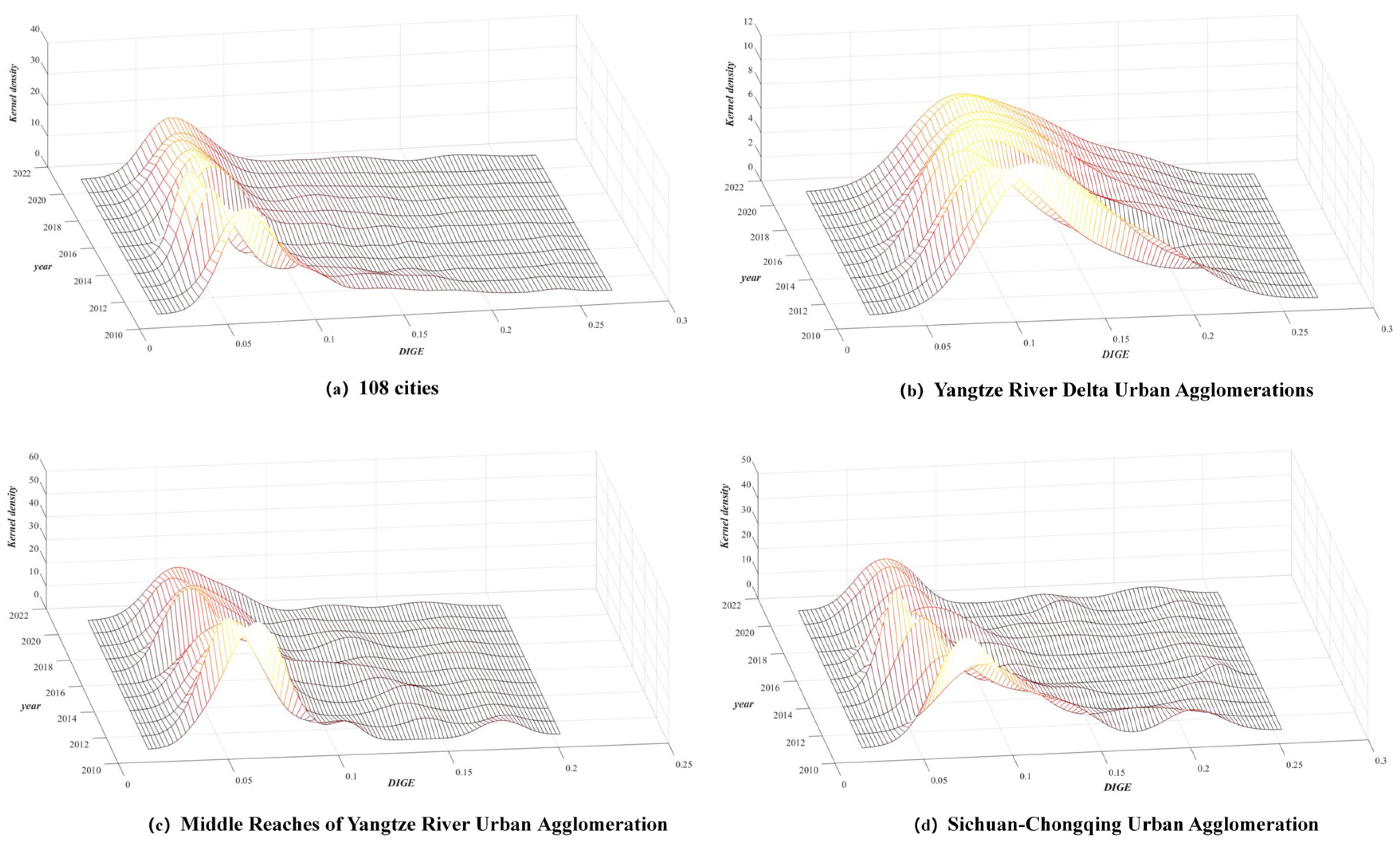

4.1. Influence Effect Analysis

4.1.1. Baseline Estimation Test

4.1.2. Endogenous Processing and Robustness Tests

4.2. Influence Mechanism Analysis

4.3. Further Analysis

4.3.1. Heterogeneity Among Individual Cities and Urban Agglomerations

4.3.2. Heterogeneity of Urban Resource Endowment

4.3.3. The Guiding Role of Policy Intensity

5. Discussion

5.1. Discussion of Influence Effect

5.2. Discussion of Influence Mechanism

5.2.1. Resource Allocation Mechanism

5.2.2. Green Technology Mechanism

5.2.3. Industrial Structure Mechanism

5.2.4. Green Finance Mechanism

5.3. Discussion of Influence Heterogeneity

5.4. Limitations

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Implications

- Fully release the green value of digitization. The 108 cities along the Yangtze River Economic Belt have collectively surpassed the development threshold, transitioning from a short-term phase where digital economy suppressed green development to a new long-term cycle that promotes it. Cities should seize the opportunity of new quality productive forces and promote green development with digital dividends. Simultaneously, concern should be paid to the ecological load and the crowding out of natural resources caused by early over-investment and extensive growth, so as to alleviate the ecological pressure accumulated in the early stage of digital economy development.

- Focus on the transmission effect of resource allocation, green technology, industrial structure, and green finance. We should fully utilize the integration and penetration effect of digitization on traditional factors and establish a regional environmental data trading platform to activate the value of new production factors such as data. It is also recommended to promote the conversion of innovation achievements towards real productivity; set up special funds to support AI-driven pollution prediction models, blockchain-based carbon footprint traceability systems, and other “digital + green” cross-disciplinary technologies; and shorten the transmission cycle from digitization towards green technological innovation. Meanwhile, based on the current situation of the industrial structure of Yangtze River Economic Belt, cities should weaken their dependence on the secondary sector, formulate negative lists based on digitalization, restrict the expansion of high-energy-consuming enterprises, and provide incentives for traditional enterprises to upgrade through “digital transformation subsidies”. Furthermore, urban regions should reasonably promote the transformation from traditional “cornerstone finance” to “new quality finance” by designing “digital–green” linked bonds or credit products, binding financing interest rates with indicators like carbon emission intensity and digitalization levels.

- It is the development direction of urban spatial structure to build multi-center urban agglomeration. Relying on the construction of three major urban agglomeration, areas should accelerate the flow and cooperation of digital elements and technologies in surrounding cities. Efforts should be made to pilot a “Digital Green Integrated Demonstration Zone” along the Yangtze River Economic Belt, promoting cross-provincial data sharing and industrial collaboration for emission reduction, thereby addressing efficiency losses caused by administrative divisions.

- Resource-based and non-resource-based cities should make distinct positioning and choices in the process of digitization and green transformation. Non-resource-based cities should speed up the digitization process and give full impetus to the active influence on green growth. Resource-based cities should be more cautious and formulate rationalized digital economy development plans based on own resource endowment and carrying capacity.

- Match appropriate policy intensity for urban green upgrading. The government should promote the formulation of special digital economy policies, establish a dynamic evaluation mechanism for policy effects, conduct quantitative evaluation of the implementation effect of policies every year, and make dynamic adjustments according to the implementation effect, so as to continuously expand the scope of benefits and application scope of the policies.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Index | Types | Primary Indicators | Indicators Description |

|---|---|---|---|

| Urban green development efficiency | Input dimension | Capital factor | Capital stock |

| Labor force factor | Number of employees | ||

| Resource factors | Land use, energy consumption | ||

| Expected output dimension | Economic benefit | Regional actual GDP | |

| Non-expected output dimension | Environmental pollution | Emissions of industrial pollutants |

| Variable Relationships | Z-Bar | Z-Bar~ | p | Conclusions |

|---|---|---|---|---|

| DIGE → GE | 12.598 *** | 4.878 *** | 0.000 | Significant |

| GE → D | 1.545 | −0.704 | 0.481 | Not significant |

References

- Wang, R. Modernization of harmonious coexistence between man and nature: Historical achievements, Contradiction challenges and realization path. Manag. World 2023, 39, 19–30. [Google Scholar] [CrossRef]

- Santarius, T.; Dencik, L.; Diez, T.; Ferreboeuf, H.; Jankowski, P.; Hankey, S.; Hilbeck, A.; Hilty, L.M.; Höjer, M.; Kleine, D.; et al. Digitalization and Sustainability: A Call for a Digital Green Deal. Environ. Sci. Policy 2023, 147, 11–14. [Google Scholar] [CrossRef]

- He, G.; Jiang, H.Y.; Zhu, Y.N. The effect of digital technology development on the improvement of environmental governance capacity: A case study of China. Ecol. Indic. 2024, 165, 14. [Google Scholar] [CrossRef]

- Yi, M.; Chen, D.H.; Wu, T.; Tao, M.M.; Sheng, M.S.; Zhang, Y. Intelligence and carbon emissions: The impact of smart infrastructure on carbon emission intensity in cities of China. Sust. Cities Soc. 2024, 112, 20. [Google Scholar] [CrossRef]

- Yang, Z.; Gao, W.J.; Han, Q.; Qi, L.Y.; Cui, Y.J.; Chen, Y.Q. Digitalization and carbon emissions: How does digital city construction affect china’s carbon emission reduction? Sust. Cities Soc. 2022, 87, 14. [Google Scholar] [CrossRef]

- Liu, H.; Chen, D.L. Asymmetrical impact of natural resources and the digital economy on green growth in the top five Asian knowledge-based economies. Resour. Policy 2024, 88, 14. [Google Scholar] [CrossRef]

- Chatzistamoulou, N. Is digital transformation the Deus ex Machina towards sustainability transition of the European SMEs? Ecol. Econ. 2023, 206, 13. [Google Scholar] [CrossRef]

- Chen, X.H.; Li, Y.Y.; Song, L.L.; Wang, Y.J. Digital Economy Theory System and Research Prospects. Manag. World 2022, 38, 208–224+213–216. [Google Scholar] [CrossRef]

- Guo, F.; Xiong, Y.J.; Shi, Q.L. Digital economy and economic development in administrative border areas: Evidence from satellite light data. Manag. World 2023, 39, 16–33. [Google Scholar] [CrossRef]

- Karlilar, S.; Balcilar, M.; Emir, F. Environmental sustainability in the OECD: The power of digitalization, green innovation, renewable energy and financial development. Telecommun. Policy 2023, 47, 15. [Google Scholar] [CrossRef]

- Zhou, W.; Xu, L.Y. The new theory of productivity: The connotation characteristics and important focus. Reform 2023, 1–13. Available online: https://www.cnki.com.cn/article/cjfdtotal-refo202310001.htm (accessed on 10 May 2025).

- Hong, Y.X. New quality productive forces and their cultivation and development. Econ. Dyn. 2024, 3–11. Available online: https://www.cnki.com.cn/Article/CJFDTotal-JJXD202401001.htm (accessed on 10 May 2025).

- Ren, B.P. The Logic of the Transformation of Productive Forces into New Quality Productive Forces. Econ. Res. 2024, 59, 12–19. [Google Scholar]

- Shi, S.H.; Lou, Z.L. Research on the Impact of New Quality Productivity on Employment Scale. J. Xi’an Univ. Financ. Econ. 2025, 4, 1–14. Available online: https://link.cnki.net/doi/10.19331/j.cnki.jxufe.20250423.002 (accessed on 10 May 2025).

- Cui, H.Y.; Cao, Y.Q. Do smart cities improve energy efficiency? A test of spatial effects and mechanisms. Sust. Cities Soc. 2024, 101, 21. [Google Scholar] [CrossRef]

- He, W.W.; Hou, J.J. Has the digital economy promoted the formation of a unified labor market? Econ. Manag. 2023, 45, 5–21. [Google Scholar] [CrossRef]

- Wang, Q.X.; Hu, A.; Xin, Y.J. Can the digital economy boost green development?—Based on energy conservation, emission reduction, the synergistic mechanism of empirical test. Bus. Econ. Manag. 2022, 44–59. [Google Scholar] [CrossRef]

- Li, Y.; Zou, C.; Huang, Y.C.; Wan, A.W. Environmental Regulation, Green Innovation, and Corporate Brand Value. Sustainability 2025, 17, 3445. [Google Scholar] [CrossRef]

- Zhang, W.; Shu, C.Y.; Chen, B.Y.; Liu, H.L. Research on digital transformation strategy of the energy industry based on differential game under the dual-carbon background in China. Sci. Total Environ. 2024, 906, 18. [Google Scholar] [CrossRef]

- Wang, F.; Sun, S.H.; Liu, T.J. Does the development of digital economy Promote the reform of agricultural production mode? Evidence from prefecture-level cities in the Yellow River Basin. China’s Rural. Econ. 2023, 122–143. [Google Scholar] [CrossRef]

- Xu, H.; Zhang, Y.L.; Cao, Y.J. Digital economy, technology spillovers and dynamic competition policy. Manag. World 2020, 36, 63–84. [Google Scholar] [CrossRef]

- Zhang, S.L.; Li, Y.; Jiu, E.K.; Ji, Q.W. Path dependence, market entry and transformation of resource-based cities. Econ. Theory Econ. Manag. 2016, 36, 14–27. [Google Scholar] [CrossRef]

- Xu, J.; Li, Q.H.; Wang, Y.H. Mechanism analysis of supply-side reform driving the transformation of resource-based cities. China Popul. Resour. Environ. 2016, 26, 53–60. [Google Scholar] [CrossRef]

- Sun, G.L.; Fang, J.M.; Li, J.N.; Wang, X.L. Research on the impact of the integration of digital economy and real economy on enterprise green innovation. Technol. Forecast. Soc. Change 2024, 200, 123097. [Google Scholar] [CrossRef]

- Tao, C.Q.; Yi, M.Y.; Wang, C.S. Coupling coordination analysis and Spatiotemporal heterogeneity between data elements and green development in China. Econ. Anal. Policy 2023, 77, 1–15. [Google Scholar] [CrossRef]

- Lu, X.D.; Lian, Y.J. Estimation of the total factor productivity of industrial enterprise in China: 1999–2007. Economics 2012, 11, 541–558. Available online: https://d.wanfangdata.com.cn/periodical/jjx201202008 (accessed on 10 May 2025).

- Hu, J.; Yu, X.R.; Han, Y.M. Can ESG rating promote the green transformation of enterprises?—Verification based on multi-point double difference method. Quant. Tech. Econ. Res. 2023, 40, 90–111. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.Y.; Wang, F. Measure of financial development of China digital pratt & Whitney: Index and spatial characteristics. Economics 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Zhao, T.; Zhang, Z.; Liang, S.K. Digital economy, entrepreneurial activity and high-quality development: Empirical evidence from Chinese cities. Manag. World 2020, 36, 65–76. [Google Scholar] [CrossRef]

- Liu, C.; Xia, J.C. Online market, digital platform and resource allocation Efficiency: The role of price mechanism and data mechanism. China’s Ind. Econ. 2023, 84–102. [Google Scholar] [CrossRef]

- Qi, S.Z.; Lin, S.B.; Cui, J.B. Can the Environmental Rights trading market induce green innovation?-evidence based on green patent data of listed companies in China. Econ. Stud. 2018, 53, 129–143. [Google Scholar]

- Liu, F.; Huang, P.; Tang, D. Carbon reduction effect and the influence of green financial channels research. Financ. Econ. 2022, 37, 144–158. [Google Scholar]

- Lin, W.P.; Feng, B.Y. Curve effect in the field of management and statistical test method. Nankai Manag. Rev. 2022, 25, 155–166. [Google Scholar] [CrossRef]

- Jiang, T. Mediation effect and adjustment effect in the study of causal inference experience. China’s Ind. Econ. 2022, 100–120. [Google Scholar] [CrossRef]

- Wen, Z.L.; Ye, B.J. Intermediary effect analysis: Method and model development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Lin, B.Q.; Tan, R.P. Chinese economy agglomeration and green economic efficiency. Econ. Stud. 2019, 54, 119–132. [Google Scholar]

- Lind, J.T.; Mehlum, H. With or Without U? The Appropriate Test for a U-Shaped Relationship. Oxf. Bull. Econ. Stat. 2010, 72, 109–118. [Google Scholar] [CrossRef]

- He, L.Y.; Qi, X.F. Environmental regulation and green total factor productivity: Evidence from Chinese industrial firms. Economics 2022, 97–114. Available online: https://www.cnki.com.cn/article/cjfdtotal-jjxd202206007.htm (accessed on 10 May 2025).

- Wu, D.S.; Xie, Y.; Lyu, S. Disentangling the complex impacts of urban digital transformation and environmental pollution: Evidence from smart city pilots in China. Sust. Cities Soc. 2023, 88, 24. [Google Scholar] [CrossRef]

- Ma, L.; Li, X.M.; Pan, Y. Employee allocation efficiency in the context of the digital economy: Evidence from “Broadband China” demonstration cities. Econ. Anal. Policy 2024, 82, 735–752. [Google Scholar] [CrossRef]

- Jing, W.J.; Sun, W.B. Digital economy promotes the high quality and economic development: A theoretical analysis framework. Economist 2019, 66–73. [Google Scholar] [CrossRef]

- Yang, Z.; Ling, H.C.; Chen, J. Urban green development awareness and green technology innovation. World Econ. 2024, 47, 211–232. [Google Scholar] [CrossRef]

- Liu, J.; Yu, S.W. The impact of industrial structure optimization on ecological efficiency in Green development: A case study of the Yangtze River Economic Belt. Environ. Econ. Res. 2019, 4, 73–91. [Google Scholar] [CrossRef]

- Zhao, Y.Z.; Xing, R.N.; Niu, Z.M. New Quality Productivity, Digital Economy and High-quality Development of Manufacturing. Reg. Financ. Res. 2024, 23–32. Available online: https://xueshu.baidu.com/usercenter/paper/show?paperid=1w3602707d2c0mg0qj540ev0eq268925&site=xueshu_se&hitarticle=1 (accessed on 10 May 2025).

- Miao, X.; Chen, M.K.; Tu, J.Y.; Tian, Y.Z.; Hao, Y. The environmental consequences of industrial agglomeration: New evidence from city-level data in China. Struct. Change and Econ. Dyn. 2024, 71, 630–645. [Google Scholar] [CrossRef]

- Wu, S.; Wang, P.; Sun, B.; Turok, I. Internet, transportation infrastructure and the spatial structure of urban employment in China. Reg. Stud. 2024, 58, 1033–1046. [Google Scholar] [CrossRef]

- Peldon, D.; Banihashemi, S.; Lenguyen, K.; Derrible, S. Navigating urban complexity: The transformative role of digital twins in smart city development. Sust. Cities Soc. 2024, 111, 18. [Google Scholar] [CrossRef]

- Schloer, H.; Venghaus, S. Measuring resilience in the food-energy-water nexus based on ethical values and trade relations. Appl. Energy 2022, 323, 15. [Google Scholar] [CrossRef]

- Corò, G.; Plechero, M.; Rullani, F.; Volpe, M. Industry 4.0 technological trajectories and traditional manufacturing regions: The role of knowledge workers. Reg. Stud. 2021, 55, 1681–1695. [Google Scholar] [CrossRef]

- Taylor, M.; Street, P. Learning to (not quite) buy nothing: Digital gift economies and household innovations reducing consumption. Environ. Innov. Soc. Transit. 2024, 53, 100929. [Google Scholar] [CrossRef]

| Variables | Statistical Interpretation | N | M | SD | p50 |

|---|---|---|---|---|---|

| GE | Green total factor productivity | 1296 | 1.00 | 0.04 | 1.00 |

| DIGE | Digital economy index | 1296 | 0.10 | 0.05 | 0.09 |

| RGDP | Natural logarithm of per capita GDP | 1296 | 1.17 | 0.58 | 1.17 |

| IND | Industrial value added/gross regional product | 1296 | 0.40 | 0.10 | 0.40 |

| FIL | Actual utilization of foreign capital/gross product | 1296 | 0.02 | 0.02 | 0.02 |

| CIL | General expenditure of government finance/gross product | 1296 | 0.20 | 0.08 | 0.18 |

| STL | Expenditure on science and technology/general expenditure of government finance | 1296 | 0.02 | 0.02 | 0.02 |

| HCL | Natural logarithm of number of students in ordinary colleges and universities | 1296 | 10.77 | 1.17 | 10.61 |

| ESL | Employment in the tertiary sector/total employment | 1296 | 0.53 | 0.14 | 0.53 |

| RAE | Resource mismatch index | 1296 | 1.19 | 0.30 | 1.16 |

| GTI | Number of patent applications for green inventions/total patent applications | 1296 | 0.13 | 0.05 | 0.12 |

| ISR | Industrial rationalization index | 1296 | 0.32 | 0.24 | 0.27 |

| ISA | Industrial upgrading index | 1296 | 0.97 | 0.44 | 0.91 |

| GFI | Green finance index | 1296 | 0.32 | 0.10 | 0.32 |

| Variables | GE | GE | GE | GE | GE | GE | GE | GE | GE |

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

| DIGE | 0.162 ** | −0.264 * | −0.246 * | −0.250 * | −0.272 * | −0.287 * | −0.291 * | −0.291 * | −0.295 ** |

| (2.06) | (−1.81) | (−1.65) | (−1.68) | (−1.83) | (−1.92) | (−1.96) | (−1.96) | (−1.98) | |

| DIGE2 | 0.961 *** | 0.898 *** | 0.964 *** | 1.027 *** | 1.054 *** | 1.010 *** | 1.008 *** | 0.993 *** | |

| (3.12) | (2.78) | (2.98) | (3.17) | (3.25) | (3.11) | (3.10) | (3.06) | ||

| RGDP | −0.009 | −0.008 | −0.002 | −0.005 | −0.003 | −0.002 | 0.001 | ||

| (−0.64) | (−0.63) | (−0.14) | (−0.37) | (−0.23) | (−0.17) | (0.08) | |||

| STL | −0.331 ** | −0.377 *** | −0.375 *** | −0.335 ** | −0.335 ** | −0.301 ** | |||

| (−2.55) | (−2.87) | (−2.86) | (−2.52) | (−2.52) | (−2.25) | ||||

| IND | −0.053 ** | −0.052 ** | −0.053 ** | −0.053 ** | −0.045 * | ||||

| (−2.11) | (−2.09) | (−2.12) | (−2.11) | (−1.79) | |||||

| GIL | −0.053 | −0.040 | −0.041 | −0.040 | |||||

| (−1.44) | (−1.07) | (−1.08) | (−1.06) | ||||||

| FIL | −0.258 * | −0.260 * | −0.247 * | ||||||

| (−1.93) | (−1.94) | (−1.84) | |||||||

| HCL | −0.002 | −0.001 | |||||||

| (−0.33) | (−0.27) | ||||||||

| ESL | 0.030 ** | ||||||||

| (2.03) | |||||||||

| Constant | 0.974 *** | 0.991 *** | 0.997 *** | 1.003 *** | 1.023 *** | 1.035 *** | 1.037 *** | 1.052 *** | 1.026 *** |

| (256.28) | (147.59) | (88.07) | (87.24) | (68.71) | (60.33) | (60.43) | (21.13) | (20.01) | |

| City fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.336 | 0.342 | 0.342 | 0.346 | 0.348 | 0.350 | 0.352 | 0.352 | 0.355 |

| Cities | 108 | 108 | 108 | 108 | 108 | 108 | 108 | 108 | 108 |

| Sample size | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 |

| Variables | Lower Bound | Upper Bound |

|---|---|---|

| Interval | 0.026 | 0.335 |

| Slope | −0.242 | 0.369 |

| t-value | −1.822 | 3.778 |

| p > |t| | 0.034 | 0.000 |

| Extreme point interval: Min = 0.022; Max = 0.478 | ||

| Variables | 2SLS | GE | TC | |||

|---|---|---|---|---|---|---|

| (1) The First Stage | (2) The First Stage | (3) The Second Stage | (4) | (5) | (6) | |

| DIGE | −2.674 * | −0.279 * | −0.291 * | 0.495 *** | ||

| (−1.48) | (−1.89) | (−1.81) | (2.75) | |||

| DIGE2 | 5.019 * | 0.976 *** | 0.959 *** | 1.429 *** | ||

| (1.54) | (3.03) | (2.68) | (3.64) | |||

| iv_DIGE | 0.001 *** | |||||

| (2.86) | ||||||

| iv_DIGE2 | 0.001 *** | |||||

| (2.43) | ||||||

| Constant | 0.147 *** | 0.174 *** | 1.046 *** | 1.051 *** | 1.086 *** | |

| (2.89) | (3.68) | (17.88) | (17.46) | (21.65) | ||

| F | 18.61 | 17.25 | ||||

| Cragg–Donald Wald F | 10.216 [7.03] | |||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| City fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.924 | 0.919 | 0.915 | 0.281 | 0.355 | 0.349 |

| Cities | 108 | 108 | 108 | 106 | 108 | 108 |

| Sample size | 1296 | 1296 | 1296 | 1272 | 1188 | 1296 |

| Variables | RAE | GTI | ISR | ISA | GFI | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

| DIGE | −1.362 *** | 1.430 | 0.021 | −0.332 ** | −0.484 * | −0.489 | 0.127 | −0.689 | 0.074 | 0.302 ** |

| (−3.40) | (1.66) | (0.25) | (−2.17) | (−1.72) | (−0.64) | (0.20) | (−0.45) | (1.20) | (2.28) | |

| DIGE2 | −6.542 *** | 0.827 *** | 0.012 | 1.922 | −0.540 * | |||||

| (−3.71) | (2.79) | (0.01) | (0.51) | (−1.68) | ||||||

| RGDP | 0.093 | 0.010 | 0.025 | 0.035 | 0.093 | 0.093 | −0.081 | −0.058 | 0.006 | −0.001 |

| (0.64) | (0.07) | (0.86) | (1.22) | (1.05) | (0.99) | (−0.71) | (−0.54) | (0.55) | (−0.07) | |

| GIL | 1.503 ** | 1.748 ** | −0.068 | −0.069 | 0.033 | −0.036 | 0.124 | 0.147 | ||

| (2.15) | (2.32) | (−0.11) | (−0.11) | (0.03) | (−0.03) | (0.92) | (1.07) | |||

| HCL | −0.047 | −0.002 | 0.009 | 0.005 | −0.003 | 0.001 | ||||

| (−0.25) | (−0.01) | (0.32) | (0.16) | (−0.12) | (0.04) | |||||

| STL | −0.361 | −0.317 | 0.069 | 0.062 | −0.300 | −0.300 | 0.370 | 0.354 | 0.122 *** | 0.126 *** |

| (−1.24) | (−1.10) | (1.20) | (1.08) | (−0.88) | (−0.89) | (0.56) | (0.54) | (4.51) | (4.60) | |

| IND | −0.002 | −0.004 | 0.005 | 0.005 | 0.036 | 0.036 | 0.074 | 0.074 | −0.006 ** | −0.006 ** |

| (−0.04) | (−0.07) | (0.73) | (0.78) | (0.69) | (0.69) | (1.17) | (1.18) | (−2.02) | (−2.06) | |

| FIL | 0.340 * | 0.359 ** | −0.870 | −0.870 | 1.705 | 1.762 | −0.065 | −0.080 | ||

| (1.96) | (2.11) | (−1.04) | (−1.02) | (1.52) | (1.57) | (−0.48) | (−0.57) | |||

| ESL | −0.026 | −0.026 | 0.014 | 0.015 | ||||||

| (−1.01) | (−1.03) | (0.99) | (1.04) | |||||||

| Constant | 1.298 ** | 1.179 * | 0.034 * | 0.048 ** | 0.051 | 0.051 | 0.153 | 0.185 | 0.334 *** | 0.324 *** |

| (2.12) | (1.96) | (0.45) | (0.64) | (0.09) | (0.09) | (0.21) | (0.25) | (9.12) | (8.61) | |

| City fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.864 | 0.867 | 0.587 | 0.589 | 0.696 | 0.696 | 0.883 | 0.883 | 0.952 | 0.953 |

| Sample size | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 | 1296 |

| Variables | GE | GE | GE | GE |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DIGE | −0.342 ** | −0.214 | −0.074 | −0.317 * |

| (−2.01) | (−0.54) | (−0.18) | (−1.81) | |

| DIGE2 | 1.152 *** | 1.318 | 0.223 | 1.029 *** |

| (3.16) | (1.00) | (0.16) | (2.87) | |

| Constant | 1.075 *** | 0.924 *** | 0.942 *** | 1.057 *** |

| (16.03) | (11.44) | (9.39) | (16.82) | |

| Control variables | Yes | Yes | Yes | Yes |

| City fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| R2 | 0.384 | 0.330 | 0.286 | 0.286 |

| Cities | 71 | 37 | 39 | 69 |

| Sample size | 852 | 444 | 468 | 828 |

| Variables | GE | GE | GE |

|---|---|---|---|

| (1) | (2) | (3) | |

| DIGE | −0.470 | −0.347 * | −0.470 * |

| (−0.83) | (−1.82) | (−1.66) | |

| DIGE2 | 0.060 | 1.021 ** | 1.499 *** |

| (0.03) | (2.57) | (2.76) | |

| Constant | 1.019 *** | 1.007 *** | 1.056 *** |

| (3.65) | (16.39) | (11.67) | |

| Control variables | Yes | Yes | Yes |

| City fixed | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes |

| R2 | 0.165 | 0.211 | 0.216 |

| Sample size | 324 | 540 | 756 |

| Time segment | 2011–2013 | 2011–2015 | 2016–2022 |

| Fisher’s permutation test | / | −2.883 *** | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Li, S.; Wu, Q.; Cheng, J. Influence Mechanism of Digital Economy on Urban Green Development Efficiency: A Perspective on New Quality Productive Forces. Sustainability 2025, 17, 4539. https://doi.org/10.3390/su17104539

Li X, Li S, Wu Q, Cheng J. Influence Mechanism of Digital Economy on Urban Green Development Efficiency: A Perspective on New Quality Productive Forces. Sustainability. 2025; 17(10):4539. https://doi.org/10.3390/su17104539

Chicago/Turabian StyleLi, Xianmin, Shixiang Li, Qiaosheng Wu, and Jinhua Cheng. 2025. "Influence Mechanism of Digital Economy on Urban Green Development Efficiency: A Perspective on New Quality Productive Forces" Sustainability 17, no. 10: 4539. https://doi.org/10.3390/su17104539

APA StyleLi, X., Li, S., Wu, Q., & Cheng, J. (2025). Influence Mechanism of Digital Economy on Urban Green Development Efficiency: A Perspective on New Quality Productive Forces. Sustainability, 17(10), 4539. https://doi.org/10.3390/su17104539