Effects of Digital Transformation on Total Factor Productivity of Cultural Enterprises—Empirical Evidence from 251 Listed Cultural Enterprises in China

Abstract

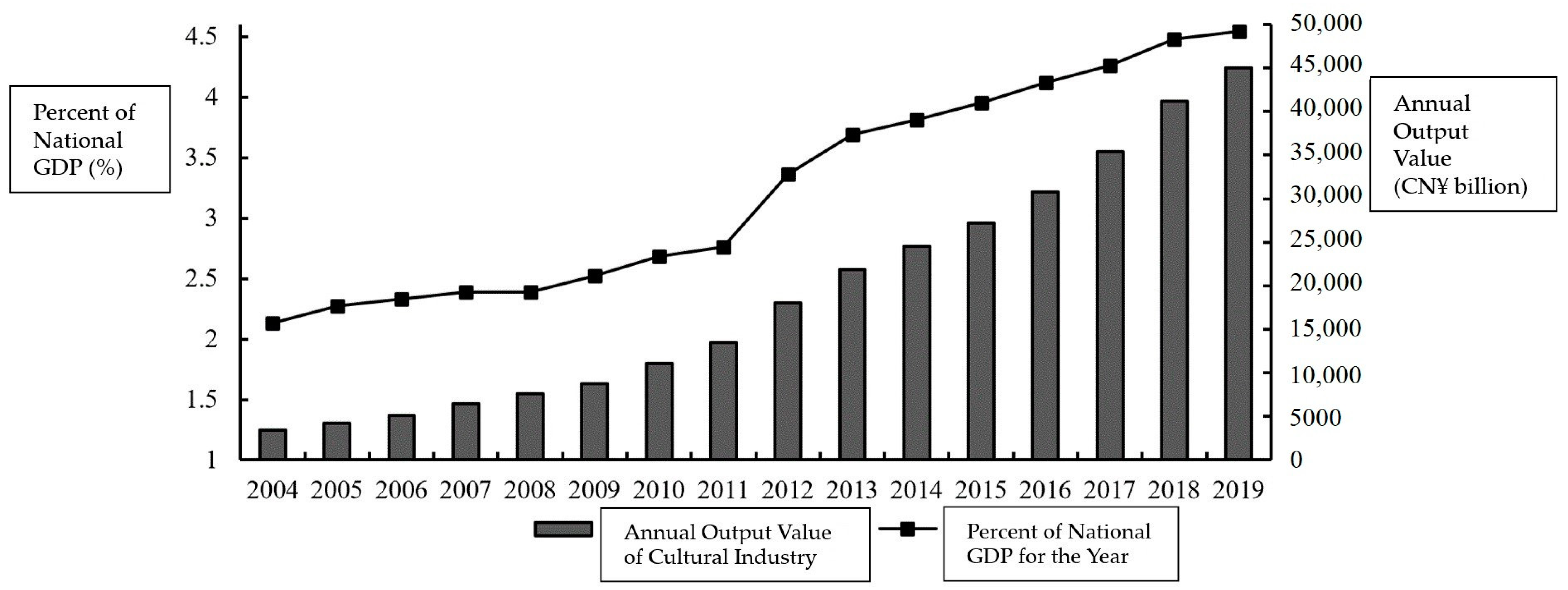

1. Introduction

2. Theoretical Framework and Mathematical Modeling

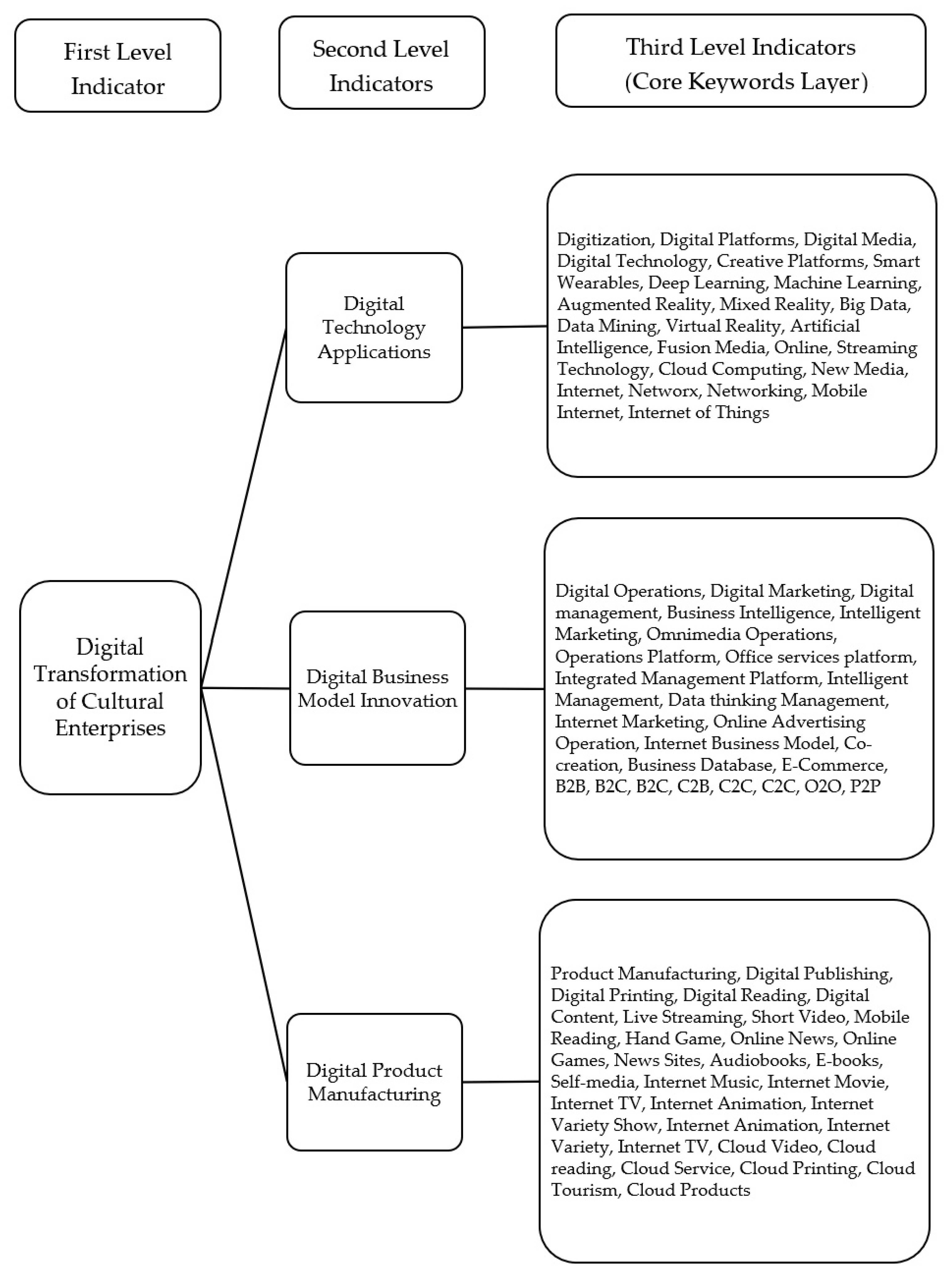

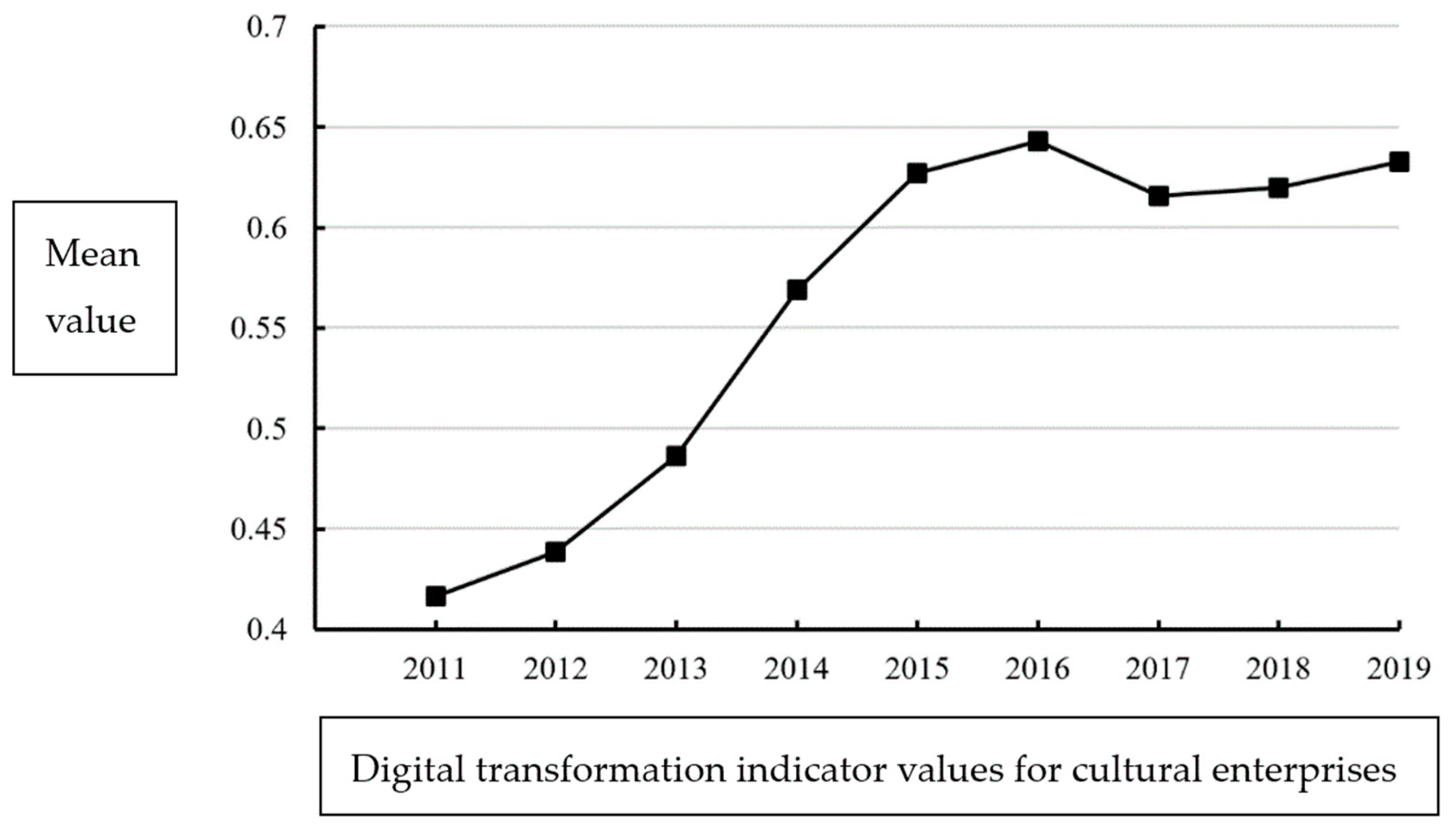

2.1. Enterprise Digital Transformation

2.2. Total Factor Productivity

2.3. Theoretical Modeling

2.4. Mathematical Modeling

2.4.1. Production Function Setting

2.4.2. R&D Innovation

2.4.3. Overall Performance

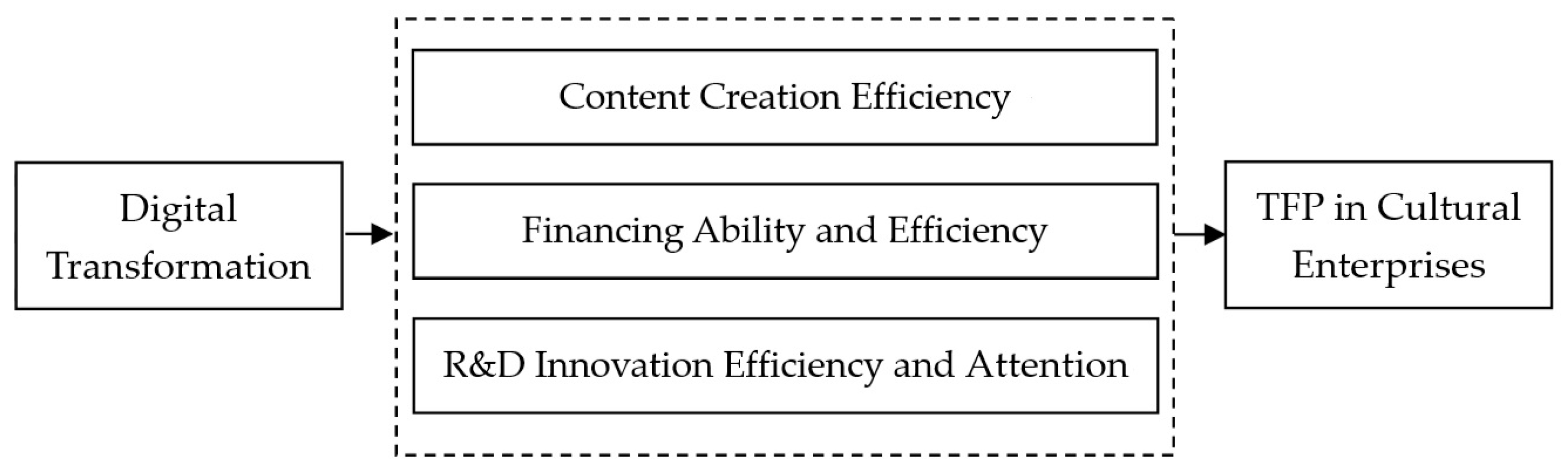

2.5. Impact Paths

2.5.1. Digital Transformation Affects Content Creation Efficiency

2.5.2. Digital Transformation Enhances Financing Ability and Efficiency

2.5.3. Digital Transformation Improves R&D Innovation Efficiency and Attention

3. Theoretical Derivation

3.1. Econometric Modeling

3.2. Measurement and Description of Variables

3.3. Measurement and Description of Variables

3.4. Data Representativeness and Limitations

4. Empirical Tests

4.1. Full-Sample Regression Results

4.2. Robustness Tests

4.2.1. Robustness Test Involving Removal of First-Tier-City and Megacity Samples

4.2.2. Robustness Tests for Removing Potential Systematic Measurement Error Disturbances in Core Explanatory Variables

4.3. Endogenous Problem-Solving: A Retest Based on Matching Treatment Effect Estimates

4.4. Heterogeneity Analysis

4.4.1. Enterprise Size Heterogeneity

4.4.2. Regional Heterogeneity

4.4.3. Industry Segment Heterogeneity

5. Mechanism-of-Action Testing

5.1. Content Creation Efficiency Testing

5.2. Financing Ability Testing

5.3. R&D Innovation Testing

6. Research Conclusions and Policy Recommendations

6.1. Research Findings

6.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jorgenson, D.W. Accounting for growth in the information age. In Handbook of Economic Growth, 2nd ed.; Philippe, A., Steven, N.D., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, Part A, pp. 743–815. [Google Scholar]

- Caselli, F.; Coleman, W.J. Cross-country technology diffusion: The case of computers. Am. Econ. Rev. 2001, 2, 328–335. [Google Scholar] [CrossRef]

- Solow, R.M. We’d better watch out. N. Y. Times Book Rev. 1987, 36, 36. [Google Scholar]

- Gordon, R.J. Is US Economic Growth Over? Faltering Innovation Confronts the Six Headwinds; NBER Working Paper; National Bureau of Economic Research: Cambridge, MA, USA, 2012. [Google Scholar] [CrossRef]

- Acemoglu, D.; Dorn, D.; Hanson, G.H.; Brendan, P. Return of the Solow paradox? IT, productivity, and employment in US manufacturing. Am. Econ. Rev. 2014, 5, 394–399. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2021, 13, 13–66. [Google Scholar] [CrossRef]

- Li, H.J.; Zhao, L. Data Becomes a Factor of Production: Characteristics, Mechanisms, and the Evolution of Value Form. Shanghai J. Econ. 2021, 8, 48–59. [Google Scholar]

- Zhang, X. Data-Driven Innovation: Big Data for Growth and Well-Being, 1st ed.; Publishing House of Electronics Industry: Beijing, China, 2017. [Google Scholar]

- Chen, B.; Zhu, H. Has the Digital Economy Changed the Urban Network Structure in China?—Based on the Analysis of China’s Top 500 New Economy Enterprises in 2020. Sustainability 2022, 14, 150. [Google Scholar] [CrossRef]

- Karabarbounis, L.; Neiman, B. The Global Decline of the Labor Share. Q. J. Econ. 2014, 1, 61–103. [Google Scholar] [CrossRef]

- Huang, Q.H.; Yu, Y.Z.; Zhang, S.L. Internet Development and Productivity Growth in Manufacturing Industry: Internal Mechanism and China Experiences. China. Ind. Econ. 2019, 8, 5–23. [Google Scholar]

- Acemoglu, D.; Restrepo, P. Robots and jobs: Evidence from US labor markets. J. Polit. Econ. 2020, 6, 2188–2244. [Google Scholar] [CrossRef]

- Lewis, J. Art, Culture, and Enterprise: The Politics of Art and the Cultural Industries, 1st ed.; Routledge: London, UK, 1990. [Google Scholar]

- Kushner, R.J. Cultural Enterprise Formation and Cultural Participation in America’s Counties. In Creative Communities: Art Works in Economic Development, Symposium on Arts, New Growth Theory, and Economic Development; Brookings Inst.: Washington, DC, USA, 2012. [Google Scholar]

- Wang, W.W.; Gao, P.P.; Wang, J.H.R. Nexus among digital inclusive finance and carbon neutrality: Evidence from company-level panel data analysis. Resour. Policy 2023, 80, 103201. [Google Scholar] [CrossRef]

- Snowball, J.; Tarentaal, D.; Sapsed, J. Innovation and diversity in the digital cultural and creative industries. J. Cult. Econ. 2021, 45, 705–733. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Marante, C.A. A systematic review of the literature on digital transformation: Insights and implications for strategy and organizational change. J. Manag. Stud. 2021, 5, 1159–1197. [Google Scholar] [CrossRef]

- Wessel, L.; Baiyere, A.; Ologeanu-Taddei, R.; Cha, J.; Jensen, T.B. Unpacking the difference between digital transformation and IT-enabled organizational transformation. J. Assoc. Inf. Syst. 2021, 1, 102–129. [Google Scholar] [CrossRef]

- Corvello, V.; Verteramo, S.; Nocella, I.; Ammirato, S. Thrive During a Crisis: The Role of Digital Technologies in Fostering Antifragility in Small and Medium-Sized Enterprises. J. Ambient. Intell. Humaniz. Comput. 2022, 14, 1–13. [Google Scholar] [CrossRef] [PubMed]

- OECD. OECD Compendium of Productivity Indicators 2019, 1st ed.; OECD Publishing: Paris, France, 2019. [Google Scholar]

- Farrell, M.J. The measurement of productive efficiency. J. R. Stat. Soc. Ser. A 1957, 3, 253–281. [Google Scholar] [CrossRef]

- Solow, R.M. Technical change and the aggregate production function. Rev. Econ. Stat. 1957, 3, 312–320. [Google Scholar] [CrossRef]

- Olley, G.S.; Pakes, A. The Dynamics of Productivity in the Telecommunication Equipment Industry. Econometrica 1996, 6, 1263–1297. [Google Scholar] [CrossRef]

- Levinsohn, J.; Petrin, A. Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 2003, 2, 317–341. [Google Scholar] [CrossRef]

- Lyu, S.L.; Shao, J.T. Literature Review and Research Prospects of China’s Cultural Industry Investment and Financing. Contemp. Econ. Policy. 2020, 2, 66–69. [Google Scholar]

- Gu, H.F.; Bian, Y.C. Fiscal Expenditure Finance and FDI Development and Cultural Industry Growth: Moderate Effect of Urbanization and Education Level. China Soft Sci. 2021, 5, 26–37. [Google Scholar]

- Zeng, Y.P.; Kang, W. TFP Changes and Its Influence Factors of Chinese Cultural Service Enterprises: Analysis based on DEA-Malmquist Index Method. Shanghai J. Econ. 2019, 5, 63–72. [Google Scholar]

- Li, S.; Tian, Y. How Does Digital Transformation Affect Total Factor Productivity: Firm-Level Evidence from China. Sustainability 2023, 15, 9575. [Google Scholar] [CrossRef]

- Economides, N.; Tag, J. Network neutrality on the Internet: A two-sided market analysis. Inf. Econ. Policy. 2012, 2, 91–104. [Google Scholar] [CrossRef]

- Wang, R.Y.; Liang, Q.; Li, G.Q. Virtual Aggregation: A New Form of Spatial Organization for the Deep Integration of New-Generation Information Technology and Real Economy. J. Manag. World 2018, 2, 13–21. [Google Scholar]

- Yang, X.Y.; Li, M.; Li, Y.Z. The Power, Characteristic and Evolution of Cultural Industry Spatial Agglomeration in China. Mod. Econ. Sci. 2021, 1, 118–134. [Google Scholar]

- Bogers, M.; Chesbrough, H.; Heaton, S.; Sohvi, H.; David, J.T. Strategic management of open innovation: A dynamic capabilities perspective. Calif. Manag. Rev. 2019, 1, 77–94. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econometrica 1992, 2, 323–351. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. The Economics of Growth, 1st ed.; MIT Press: Cambridge, MA, USA, 2008. [Google Scholar]

- Levine, R. Finance and Growth: Theory and Evidence. In Handbook of Economic Growth, 2nd ed.; Philippe, A., Steven, N.D., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, Part A, pp. 865–934. [Google Scholar]

- Sun, Z.; Hou, Y.L. The Influence of Artificial Intelligence Development on Industrial Total Factor Productivity: An Empirical Research Based on Manufacturing Industries in China. Economist 2021, 1, 32–42. [Google Scholar]

- Aghion, P.; Akcigit, U.; Howitt, P. Lessons from Schumpeterian Growth Theory. Am. Econ. Rev. 2015, 5, 94–99. [Google Scholar] [CrossRef]

- Jones, L.E.; Manuelli, R.E. Neoclassical Models of Endogenous Growth: The Effects of Fiscal Policy, Innovation and Fluctuations. In Handbook of Economic Growth, 2nd ed.; Philippe, A., Steven, N.D., Eds.; Elsevier: Amsterdam, The Netherlands, 2005; Volume 1, Part A, pp. 13–65. [Google Scholar]

- Jensen, C. An Endogenously Derived AK Model of Economic Growth. Macroecon. Dyn. 2018, 8, 2182–2200. [Google Scholar] [CrossRef]

- Hu, X.Y.; Gu, G.D.; Song, X.Y. Searching Effect, Internet Use and Imports Quality Upgrading: Evidence from China. Zhejiang Soc. Sci. 2021, 5, 12–22. [Google Scholar]

- Kanat, I.; Raghu, T.S.; Vinzé, A. Heads or tails? Network effects on game purchase behavior in the long tail market. Inf. Syst. Front. 2020, 4, 803–814. [Google Scholar] [CrossRef]

- Hong, Y. Book Review: Exploring Internet+ Cross-border Integration and Promoting Diversified Development of Cultural Industry—Review of <Study on Cross-field Integration Diversification of Internet and Cultural Industry>. J. Shanxi Univ. Financ. Econ. 2020, 8, 128. [Google Scholar]

- Zhao, C.; Cao, W.; Yao, Z.Y.; Wang, Z.Q. Will “Internet Plus” Help to Reduce the Cost Stickiness of Enterprises? J. Financ. Econ. 2020, 4, 33–47. [Google Scholar]

- Wang, S.G.; Lei, X.F. The Development of China’s Cultural Industry: Model Innovation and Institutional Support. Arts Crit. 2020, 2, 29–47. [Google Scholar]

- Wang, A.Q. Mechanism and Path of Scientific and Technological Innovation to Promote the Transformation and Upgrading of Cultural Industry. Qinghai Soc. Sci. 2019, 3, 79–86. [Google Scholar]

- Wang, K.M.; Liu, J.; Li, X.X. Industrial Policy, Government Support and Corporate Investment Efficiency. J. Manag. World 2017, 3, 113–124. [Google Scholar]

- Han, X.F.; Song, W.F.; Li, B.X. Can the Internet Become a New Momentum to Improve the Efficiency of Regional Innovation in China? China Ind. Econ. 2019, 7, 119–136. [Google Scholar]

- Yang, X.Y.; Li, Z.P.; Li, M.; Guan, T. The Impact of Financing Constraints on Technological Efficiency and Its Stability of Cultural and Creative Enterprises. Mod. Econ. Sci. 2019, 4, 48–61. [Google Scholar]

- Lei, Y.; Zhao, Q.; Zhu, Y.N. The Efficiency Analysis of Chinese Cultural Originality Industry: The Empirical Research Based on 68 Listed Companies. Mod. Econ. Sci. 2015, 2, 89–96. [Google Scholar]

- Yao, J.Q.; Zhang, K.P.; Luo, P. Text Mining in Financial Big Data and Its Research Progress. Econ. Perspect. 2020, 4, 143–158. [Google Scholar]

- Ma, C.F.; Chen, Z.J.; Zhang, S.M. A survey on accounting and finance research based on textual big data analysis. J. Manag. Sci. China. 2020, 9, 19–30. [Google Scholar] [CrossRef]

- Thorsrud, L.A. Words are the new numbers: A newsy coincident index of the business cycle. J. Bus. Econ. Stat. 2020, 2, 393–409. [Google Scholar] [CrossRef]

- Shen, Y.; Chen, Y.; Huang, Z. A Literature Review of Textual Analysis in Economic and Financial Research. China Econ. Q. 2019, 4, 1153–1186. [Google Scholar]

- Zhang, J.C.; Long, J. Digital Transformation, Dynamic Capability, and Enterprise Innovation Performance: Empirical Evidence from High-Tech Listed Companies. Econ. Manag. 2022, 3, 74–83. [Google Scholar]

- Wen, J.; Feng, G.F. Stock Liquidity, Ownership Governance and SOEs. Performance. Econ. Manag. 2021, 4, 1301–1322. [Google Scholar]

- Mao, Q.L.; Chen, L.Y. Financial Geographic Structure and the Import of Enterprises: Micro Evidence from Chinese Manufacturing Industry. World Econ. Stud. 2022, 1, 30–46. [Google Scholar]

- Su, D.W.; Mao, J.H. Stock Market Overspeculation and the Chinese Real Economy: Theory and Evidence. Econ. Res. J. 2019, 10, 152–166. [Google Scholar]

- MacKinnon, D.P.; Fairchild, A.J.; Fritz, M.S. Mediation Analysis. Annu. Rev. Psychol. 2007, 1, 593–614. [Google Scholar] [CrossRef]

- Wen, Z.L.; Ye, B.J. Analyses of Mediating Effects: The Development of Methods and Models. Adv. Psychol. Sci. 2014, 5, 731–745. [Google Scholar] [CrossRef]

- Xiao, W.; Xue, T.H. Rising Labour Costs, Financial Constraints and Changing TFP of Enterprises in China. J. World Econ. 2019, 1, 76–94. [Google Scholar]

- Lyu, K.F.; Yu, M.Y.; Ruan, Y.P. Digital transformation and resource allocation efficiency of enterprises. Sci. Res. Manag. 2023, 8, 11–20. [Google Scholar]

- Zhou, D.H.; Wan, Y.J. Can Firm’s Digitalization Promote the Total Factor Productivity in Firms? Stat. Res. 2023, 12, 106–118. [Google Scholar]

- Lei, Z.H.; Wang, D.M. Digital transformation and total factor productivity: Empirical evidence from China. PLoS ONE 2023, 18, e0292972. [Google Scholar] [CrossRef] [PubMed]

- Wu, Y.; Li, H.H.; Luo, R.Y.; Yu, Y.B. How digital transformation helps enterprises achieve high-quality development? Empirical evidence from Chinese listed companies. Eur. J. Innov. Manag. 2023. [Google Scholar] [CrossRef]

| Variable Type | Definition | Symbolic | Calculation |

|---|---|---|---|

| Explanatory Variable | TFP of cultural enterprises (Baseline indicators) | lnLP | Logarithmic TFP of enterprises measured using the LP method |

| TFP of cultural enterprises (Auxiliary indicators) | lnOP | Logarithmic TFP of enterprises measured using the OP method | |

| Core Explanatory Variables | Level of digital transformation | lnINT | ln(Number of keywords related to annual reports +1) |

| Control Variables | Finance expense rate | Finexr | Financial expenses/Operating income |

| Fixed assets ratio | Fixr | Net fixed assets/Total assets | |

| Return on assets | ROA | Net profit/Balance of total assets | |

| Enterprise size | Size | Logarithm of total assets | |

| Board scale | Boars | Logarithm of the number of board members | |

| Leadership structure | Dual | Whether chairman and manager are two positions in one, 1 for yes, 0 for no | |

| Average compensation of executives | EAC | Logarithm of the average compensation among executives | |

| Age of enterprise | Age | Years of existence in cultural enterprise | |

| Enterprise ownership | SOE | Whether the actual controller of the enterprise is central or local government, 1 for yes, 0 for no |

| Variable | Observed Value | Mean | Minimum | Median | Maximum | Variance |

|---|---|---|---|---|---|---|

| lnLP | 1541 | 1.924 | 1.666 | 1.923 | 2.128 | 0.089 |

| lnOP | 1541 | 1.631 | 0.422 | 1.635 | 1.963 | 0.116 |

| lnINT | 1541 | 3.121 | 0 | 3.296 | 5.394 | 1.377 |

| Finexr | 1541 | 0.012 | −0.055 | 0.004 | 0.172 | 0.034 |

| Fixr | 1541 | 0.183 | 0.001 | 0.129 | 0.648 | 0.164 |

| ROA | 1541 | 0.033 | −0.602 | 0.046 | 0.225 | 0.105 |

| Size | 1541 | 21.841 | 19.625 | 21.785 | 24.304 | 1.030 |

| Boars | 1541 | 2.123 | 1.609 | 2.197 | 2.708 | 0.205 |

| Dual | 1541 | 0.330 | 0 | 0 | 1 | 0.470 |

| EAC | 1541 | 12.547 | 11.115 | 12.545 | 14.290 | 0.648 |

| Age | 1541 | 18.910 | 4 | 18 | 54 | 6.411 |

| SOE | 1541 | 0.352 | 0 | 0 | 1 | 0.478 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| lnOP | lnLP | lnOP | lnLP | |

| lnINT | 0.008 ** | 0.009 *** | 0.007 ** | 0.006 *** |

| (2.30) | (4.11) | (2.02) | (2.67) | |

| Finexr | −0.782 *** | −0.465 *** | ||

| (−9.14) | (−8.42) | |||

| Fixr | 0.044 * | 0.039 ** | ||

| (1.69) | (2.29) | |||

| ROA | −0.043 ** | −0.013 | ||

| (−2.09) | (−1.01) | |||

| Size | −0.003 | 0.015 *** | ||

| (−0.57) | (4.37) | |||

| Boars | 0.008 | −0.003 | ||

| (0.42) | (−0.27) | |||

| Dual | 0.006 | 0.006 | ||

| (1.04) | (1.53) | |||

| EAC | 0.035 *** | 0.022 *** | ||

| (5.78) | (5.71) | |||

| Age | 0.003 ** | 0.001 * | ||

| (2.23) | (1.65) | |||

| SOE | 0.016 | 0.014 | ||

| (0.84) | (1.11) | |||

| Intercept | 1.595 *** | 1.881 *** | 1.177 *** | 1.275 *** |

| (164.99) | (300.33) | (10.03) | (16.85) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes |

| Firm Fixed Effects | Yes | Yes | Yes | Yes |

| N | 1541 | 1541 | 1541 | 1541 |

| R2 | 0.064 | 0.117 | 0.148 | 0.204 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Excluding the Samples in First-Tier Cities | Excluding the Samples in Megacities | |||

| lnOP | lnLP | lnOP | lnLP | |

| lnINT | 0.011 *** | 0.008 *** | 0.012 *** | 0.009 *** |

| (3.09) | (3.29) | (3.26) | (3.37) | |

| Finexr | −0.628 *** | −0.430 *** | −0.613 *** | −0.422 *** |

| (−6.40) | (−5.94) | (−6.18) | (−5.78) | |

| Fixr | 0.037 | 0.041 ** | 0.036 | 0.043 ** |

| (1.38) | (2.04) | (1.31) | (2.12) | |

| ROA | 0.014 | 0.006 | 0.007 | −0.000 |

| (0.55) | (0.30) | (0.29) | (−0.02) | |

| Size | −0.016 ** | 0.004 | −0.017 ** | 0.004 |

| (−2.39) | (0.82) | (−2.45) | (0.82) | |

| Boars | 0.045 ** | 0.034 ** | 0.050 ** | 0.037 ** |

| (2.26) | (2.27) | (2.45) | (2.48) | |

| Dual | 0.010 | 0.008 | 0.011 | 0.009 * |

| (1.47) | (1.60) | (1.48) | (1.66) | |

| EAC | 0.040 *** | 0.028 *** | 0.040 *** | 0.029 *** |

| (5.57) | (5.25) | (5.48) | (5.25) | |

| Age | 0.003 * | 0.001 | 0.003 * | 0.002 |

| (1.79) | (1.40) | (1.93) | (1.45) | |

| SOE | 0.012 | 0.011 | 0.014 | 0.012 |

| (0.59) | (0.73) | (0.68) | (0.79) | |

| Intercept | 1.298 *** | 1.352 *** | 1.290 *** | 1.328 *** |

| (8.77) | (12.39) | (8.35) | (11.66) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes |

| Firm Fixed Effects | Yes | Yes | Yes | Yes |

| N | 896 | 896 | 874 | 874 |

| R2 | 0.191 | 0.200 | 0.198 | 0.208 |

| Variable | (1) | (2) |

|---|---|---|

| lnOP | lnLP | |

| rINT | 0.002 *** | 0.001 *** |

| (3.54) | (2.82) | |

| Intercept | 1.223 *** | 1.280 *** |

| (10.44) | (16.88) | |

| Year Fixed Effects | Yes | Yes |

| Firm Fixed Effects | Yes | Yes |

| N | 1541 | 1541 |

| R2 | 0.154 | 0.205 |

| Variable | PSM Matching with Put-Back | PSM Matching without Put-Back | Kernel Density Function Matching | Mahalanobis Distance Matching |

|---|---|---|---|---|

| (1) | (2) | (5) | (7) | |

| DID | 0.148 *** | 0.147 ** | 0.153 *** | 0.138 *** |

| (2.88) | (2.41) | (3.00) | (2.75) | |

| DID-1 | 0.104 | 0.094 | 0.092 | 0.084 |

| (1.12) | (0.90) | (1.00) | (0.93) | |

| Intercept | 1.725 * | 1.969 * | 2.513 *** | 2.255 ** |

| (1.76) | (1.72) | (2.64) | (2.41) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes |

| Firm Fixed Effects | Yes | Yes | Yes | Yes |

| N | 698 | 452 | 692 | 506 |

| R2 | 0.253 | 0.345 | 0.251 | 0.249 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Supporting Indicators Measured by the OP Method | Benchmark Indicators Measured by the LP Method | |||

| Larger Enterprises | Smaller Enterprises | Larger Enterprises | Smaller Enterprises | |

| lnINT | 0.003 | 0.010 * | 0.003 | 0.008 *** |

| (0.69) | (1.91) | (1.07) | (2.63) | |

| Intercept | 1.000 *** | 0.792 *** | 1.113 *** | 1.047 *** |

| (4.99) | (3.51) | (8.10) | (7.50) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes |

| Firm Fixed Effects | Yes | Yes | Yes | Yes |

| N | 770 | 771 | 770 | 771 |

| R2 | 0.181 | 0.202 | 0.218 | 0.213 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Supporting Indicators Measured by the OP Method | Benchmark Indicators Measured by the LP Method | |||

| East | Midwest | East | Midwest | |

| lnINT | 0.004 | 0.012 ** | 0.004 | 0.009 ** |

| (0.97) | (2.29) | (1.46) | (2.51) | |

| Intercept | 1.223 *** | 1.353 *** | 1.326 *** | 1.326 *** |

| (8.78) | (6.31) | (15.17) | (8.44) | |

| Year Fixed Effects | Yes | Yes | Yes | Yes |

| Firm Fixed Effects | Yes | Yes | Yes | Yes |

| N | 1177 | 364 | 1177 | 364 |

| R2 | 0.173 | 0.215 | 0.239 | 0.226 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Supporting Indicators Measured by the OP Method | Benchmark Indicators Measured by the LP Method | |||||

| Cultural Creation Industry | Cultural Communication and Entertainment Industry | Culture-Related Manufacturing Industry | Cultural Creation Industry | Cultural Communication and Entertainment Industry | Culture-Related Manufacturing Industry | |

| lnINT | 0.012 ** | 0.026 *** | −0.005 | 0.010 *** | 0.019 *** | −0.002 |

| (2.00) | (3.39) | (−1.34) | (2.69) | (3.37) | (−1.01) | |

| Intercept | 1.475 *** | 1.832 *** | 1.116 *** | 1.469 *** | 1.665 *** | 1.149 *** |

| (8.11) | (4.63) | (6.40) | (12.65) | (5.70) | (10.21) | |

| N | 729 | 238 | 574 | 729 | 238 | 574 |

| R2 | 0.188 | 0.339 | 0.296 | 0.250 | 0.306 | 0.309 |

| Variable | (1) | (2) |

|---|---|---|

| Intar | lnLP | |

| lnINT | −0.004 *** | 0.005 ** |

| (−2.60) | (2.29) | |

| Intar | −0.218 *** | |

| (−5.64) | ||

| Intercept | 0.087 | 1.294 *** |

| (1.61) | (17.29) | |

| Year Fixed Effects | Yes | Yes |

| Firm Fixed Effects | Yes | Yes |

| N | 1541 | 1541 |

| R2 | 0.029 | 0.223 |

| Variable | (1) | (2) |

|---|---|---|

| TDR | lnLP | |

| lnINT | 0.016 ** | 0.005 ** |

| (2.37) | (2.50) | |

| TDR | 0.023 *** | |

| (2.67) | ||

| Intercept | −2.321 *** | 1.329 *** |

| (−9.50) | (17.01) | |

| Year Fixed Effects | Yes | Yes |

| Firm Fixed Effects | Yes | Yes |

| N | 1541 | 1541 |

| R2 | 0.352 | 0.208 |

| Variable | (1) | (2) |

|---|---|---|

| RDI | lnLP | |

| lnINT | 0.001 ** | 0.005 ** |

| (2.40) | (2.53) | |

| RDI | 0.262 ** | |

| (2.06) | ||

| Year Fixed Effects | Yes | Yes |

| Firm Fixed Effects | Yes | Yes |

| N | 1541 | 1541 |

| R2 | 0.137 | 0.207 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Feng, Y.; Zhao, M.; Yang, X. Effects of Digital Transformation on Total Factor Productivity of Cultural Enterprises—Empirical Evidence from 251 Listed Cultural Enterprises in China. Sustainability 2024, 16, 1451. https://doi.org/10.3390/su16041451

Feng Y, Zhao M, Yang X. Effects of Digital Transformation on Total Factor Productivity of Cultural Enterprises—Empirical Evidence from 251 Listed Cultural Enterprises in China. Sustainability. 2024; 16(4):1451. https://doi.org/10.3390/su16041451

Chicago/Turabian StyleFeng, Yaoyao, Meng Zhao, and Xiuyun Yang. 2024. "Effects of Digital Transformation on Total Factor Productivity of Cultural Enterprises—Empirical Evidence from 251 Listed Cultural Enterprises in China" Sustainability 16, no. 4: 1451. https://doi.org/10.3390/su16041451

APA StyleFeng, Y., Zhao, M., & Yang, X. (2024). Effects of Digital Transformation on Total Factor Productivity of Cultural Enterprises—Empirical Evidence from 251 Listed Cultural Enterprises in China. Sustainability, 16(4), 1451. https://doi.org/10.3390/su16041451