Abstract

Constructed wetlands (CWs) are man-made ecosystems that mimic the properties of natural wetlands. They are being utilized to treat various types of wastewater, from domestic to agricultural, municipal, commercial, and industrial effluents. Despite their economic viability and environmental benefits, their widespread adoption is challenged with several uncertainties, including public support, technology learning, and the impacts of climate change. This study proposes a valuation framework that considers these uncertainties to analyze the feasibility of CWs. Using existing CWs in the Philippines as a case, this study employs the real options approach to (1) evaluate the feasibility of CW projects using cost–benefit analysis, (2) calculate the value of postponing decisions to implement CWs projects using real options analysis, and (3) identify the optimal investment decisions for CWs considering the opportunity costs of waiting and uncertainties in public support and the impacts of climate change. Results found that the project is feasible with a net present value of USD 88,968. Yet, the real options value at USD 208,865 indicates that postponing the project may be a more optimal decision. Considering the cost of waiting, the valuation identified the threshold at 5.56% to immediately implement the project. The calculated values increase with uncertainty in public support but decrease with uncertainty in climate change’s impacts. Yet, these uncertainties prolong the decision to implement CW projects until they are resolved. The findings from this case study provide a basis for recommendations to support the adoption of CWs as nature-based water treatment for a more sustainable future.

1. Introduction

Wastewater management is one of the current social challenges that has far-reaching implications for public and environmental health and socio-economic development. On a global scale, around 380 billion m3 of municipal wastewater is generated annually [1]. With an increasing world population, as well as increasing urbanization and industrialization, the volume of domestic and municipal wastewater is estimated to rise to 470–497 (24–38%) billion m3 annually by 2030 [2]. Over 80% of this wastewater is discharged into bodies of water without adequate treatment [2]. Moreover, the lack of public support, inadequate treatment facilities, inefficient treatment technologies, and limited institutional capacity further exacerbate this problem, posing risks to human communities and their environments [3,4].

To address this problem, numerous countries are utilizing conventional wastewater treatment technologies to reduce pollutants such as suspended and colloidal particulates, dissolved organics, nutrients, chemicals, and pathogens in the wastewater [5]. Various techniques have been recognized to treat wastewater, such as physical methods (adsorption, membrane filtration, coagulation/flocculation), chemical techniques (advanced oxidation, ozonation), and several biological procedures using microbes and enzymes [6]. These technologies are effective in removing water contaminants before releasing the wastewater into the environment [7,8,9]. Yet, they are not widely utilized, particularly in developing countries with limited financial and technical resources [10].

Another promising technology that utilizes the power of nature is constructed wetlands (CWs). As a nature-based solution (NbS) to water treatment, these ‘engineered’ systems have been designed and created to mimic the properties of natural wetlands utilizing vegetation, soils, and microbes to assist in the treatment of wastewater [11]. One of this solution’s main advantages is its minimal to no energy requirement, which accounts for the significant utility cost of various wastewater treatment technologies [12]. From an economic perspective, CWs, compared to conventional treatment systems, are cheaper and have a high potential for being applied in developing countries, particularly in rural areas [13]. Several studies and reviews have also revealed their efficiency in removing water impurities such as 80–91% biochemical oxygen demand (BOD5), 60–85% chemical oxygen demand (COD), 80–95% total suspended solids (TSS), 13–84% pathogens, and up to 75% antibiotics [14,15,16]. As an ecosystem, it provides several services such as water purification, climate change mitigation and adaptation, water supply, habitat for wildlife, biomass and renewable energy sources, flood prevention, nutrient cycling, and education and research [10,17]. On the other hand, among its disadvantages include the high investment cost, huge land area requirement, ineffective removal of metals, social acceptability, and operational uncertainties [4,18,19]. Moreover, CWs require intensive operations and maintenance, including regular cleaning, overhauling of all equipment, and monitoring of their performance, efficiency, and compliance with all regulatory requirements [19,20].

Besides socio-political, environmental, and technical factors, economic analysis is a critical aspect in making decisions concerning the adoption of CWs, as it ensures financial feasibility, optimizes resource allocation, attracts funding opportunities, evaluates cost efficiency, and generates societal benefits [21]. Several studies have utilized various methods to assess the economic value of CWs, including contingent valuation, shadow pricing, travel cost method (TCM), and cost–benefit analysis. For instance, Synder [22] applied the contingent valuation of the ecosystem services of CWs in Costa Rica and identified a cost of biomass production ranging from 38 to −290 USD dry Mg−1, in which the negative value indicated revenues high enough to pay for the wetland’s operations. In another study, Guila et al. [23] evaluated the community’s willingness to pay (WTP) for the CWs in the Philippines and found that 96.3% of the respondents were willing to pay a mean of USD 25.75/yr. Yang et al. [24] compared contingent valuation and shadow pricing for Hangzhou Botanical Garden and estimated the economic values of CW system ecosystem services at USD 185, 263 WTP, and USD 3.03 million in terms of shadow price in 20 years. For CWs located in peri-urban parks, Varela et al. [25] utilized the TCM to value the cost and externalities of such CWs in Catalonia, Spain and estimated the private costs ranging from 0.54 to 0.59 USD/m3 and positive externalities at 1.35 USD/m3. In terms of cost–benefit analysis, Garcia-Herrero et al. [26] estimated the market and non-market values of two CWs in Sicily and Emilia-Romagna, Italy, at a benefit–cost ratio of 4 and returns on investment of 5, which showed that the benefits outweighed the costs. In another study, Abdelhay and Abunaser [27] evaluated the economic value of four vertical-flow CWs in different rural areas in Jordan and revealed a net present value (NPV) range of USD 420–1730, an internal rate of return of 6–10.7%, and a payback period range of 8.8–15.5 years. Meanwhile, Castañer et al. [28] combined cost–benefit analysis with shadow prices of contaminants (phosphorus, nitrogen, and BOD5) and estimated the NPV at EUR 19.354 million, which highlighted the feasibility of CWs through the inclusion of environmental benefits in the analysis. Moreover, Cooper et al. [29] analyzed the effectiveness of three roadside CWs at reducing sediment enrichment in a tributary of the River Wensum and found the shadow price of mitigated damage cost equal to GBP 553 annually and a payback period of 8 years. Despite the usefulness of these economic valuation tools, they do not consider the uncertainties and risks that may affect the value of CWs. For instance, uncertainties in climate change affect the performance of CWs in terms of gas emission and nutrient release [30]. Moreover, public support or social acceptability also affects the successful implementation of CWs [4,31].

Meanwhile, the real options approach resolves these challenges by integrating risks and uncertainties in the decision-making process for irreversible investments [32]. A ‘real option’ is the right, but not the obligation to undertake an initiative or strategy, such as delaying, decommissioning, contracting, expanding, or terminating a capital investment project. A real option value is therefore the value of managerial flexibility to undertake these initiatives to maximize the value of a project. Due to its usefulness in making investment decisions, it is widely applied in various environmental projects. Particularly for NbS initiatives, Vogelsang et al. [33] developed a real options model that integrates climate change uncertainty (inland flooding and meteorological drought) as well as the flexibility of the timing of investment for retention areas in the Oldambt–Eemskanaal–Dollardboezem water system in Groningen, the Netherlands. In another study, Mei and Clutter applied a Monte Carlo simulation-based real options framework to analyze the timing of investment to forest carbon as an NbS to climate change, considering the uncertainty of the market prices of timber and carbon. Moreover, Agaton and Collera [34] proposed a real options framework based on a decision tree to evaluate the timing of investment in a mangrove rehabilitation project as an NbS to coastal protection under climate change uncertainty. Yet, the real options approach applied in previous studies has only considered the uncertainties on one side of the cost–benefit analysis or the future cashflows of NbS projects. Moreover, this approach has not been applied to the valuation of CWs projects.

This study applies real options valuation to provide decision support for investment in CWs as NbS to wastewater treatment. Specifically, this study aims to evaluate the feasibility of CWs projects using cost–benefit analysis; calculate the value of flexibility in postponing investment decisions for CWs using real options analysis; identify the optimal investment decisions for CWs, considering the opportunity costs of waiting as well as the uncertainties in public support and climate change impacts; and recommend policies that support the adoption of CWs as nature-based wastewater treatments for a more sustainable future. This study aims to contribute to the literature by (1) proposing a valuation framework for CWs projects using a real options approach; (2) integrating various sources of uncertainties on both cash inflows and outflows in the cost–benefit analysis, such as the opportunity cost, public support, and climate change impacts uncertainties; and (3) applying the framework in a developing country with limited technical and financial resources that is continuously affected by climate change.

2. Materials and Methods

2.1. Real Options Valuation

This study takes the perspective of a Local Government Unit (LGU) that is planning to address the wastewater problem using a CWs project. The project is subject to the limited budget of the LGU; hence, the planner may invest in the project or not. Considering the possible uncertainties that may affect the CWs, the planner may also delay the project to investment environments that are more favorable for the project.

For the first and second options, the value of the CWs project is calculated based on the technology capital cost and the present values of all benefits and costs. The NPV of the project is shown in Equation (1) as follows:

where is the discount factor equal to ; is the discount rate; Bt and Ct are the benefits and costs of the project at period t; TCWs are the valuation period or the lifetime of the CWs project; and ICWs is the investment cost.

The benefits Bt refer to the value of ecosystem services from CWs, which include provisioning (biomass and water supply), regulating (water treatment, climate regulation, flood prevention, and erosion control), cultural (recreation, esthetic, biodiversity, education, and research), and supporting (habitat formation, nutrient cycling, and hydrological cycle) benefits [10,23]. On the other hand, the costs Ct consist of all operational and maintenance costs, including the utility, labor, monitoring and water quality testing, preventive and regular maintenance and repairs, replacement of equipment and its parts, and capacity building [21]. Moreover, the investment costs ICWs are those incurred during the planning, area preparation, engineering and design, sourcing of construction materials and equipment, infrastructure development, installation, as well as land acquisition and labor for the construction [21,23].

Assuming that the project will be implemented at t = 0 and will be operated from t = 1 to TCWs, the annual cashflows are calculated to the present value at a discount rate, . The are then computed as the summation of the discounted cashflows () minus the investment cost. Positive NPV indicates that the project’s cashflows are expected to outweigh the initial investment [35], thus adding value to the LGU, and should be implemented. Otherwise, the investment will incur losses, hence, it should not be implemented, as shown in Equation (2) as follows:

For the third option, various uncertainties that affect the CWs project are integrated in the model. The literature identified these as public support or social acceptability (represented as the willingness to pay for the CWs), technology (investment) cost, political (implementation and governance) uncertainties, and climate change uncertainties [4,30,36,37]. Uncertainty in the social acceptability of CWs refers to the unpredictability of the perception of the local communities and other stakeholders in terms of supporting NbS projects [21,36]. However, the level of public support and the stakeholders’ WTP for CWs improve as they reap the benefits of the CWs [4,23]. Previous studies applied the Geometric Brownian motion (GBM) to calculate the future values of WTP, such as the tourists’ WTP for tourism management of a site in the Marine-Terrestrial National Park of the Atlantic Islands of Galicia, Spain [38], and ethanol producers’ WTP for switchgrass grown as an energy crop [39]. In line with these, this study also assumes the WTP for CWs follows GBM, thus the future benefits, , of the project can be estimated using Equation (3) as follows:

where and are percentage drift and percentage volatility of the public’s WTP for CWs and is a Wiener process or Brownian motion such that . Under this assumption, the project benefit at a future date t has a log-normal distribution with a variance that grows proportionally with the forecasted time interval and a drift that grows (or decays) exponentially [32].

Another uncertainty is the impact of climate change on CWs. A study shows that wetlands are susceptible to hydrological change and the increase in temperature due to global warming, as warmer conditions may accelerate the rate of decomposition and release of nutrients and GHGs, which can be exported downstream and cause serious ecological challenges [30]. This study considers the effects of climate change uncertainty on the operations and maintenance costs of CWs. Previous studies described climate-related events such as sea-level rise [40], flooding [41], typhoons, and storm surge [34] and their associated costs following GBM. Hence, future operations and maintenance costs can be estimated using Equation (4) as follows:

where and are percentage drift and percentage volatility of the operations and maintenance costs under CWs climate change uncertainty, respectively, and is a Wiener process or Brownian motion such that .

Since Equations (2) and (3) estimate various paths for and , the present value of future cashflows can be calculated using Equation (5) as follows:

as the expected value of is subject to the stochastic paths of and . Applying Monte Carlo simulations [42], is calculated by subtracting from for every period first. Next, the process is repeated in multiple times under stochastic public support and climate change cost. Then, the average are calculated from all the iterations.

In the third option, the planner may decide to immediately implement the project or delay it, but incur an opportunity cost for the regulating services equivalent to the shadow cost of treating domestic wastewater. The value of this managerial flexibility (called the option) to delay the project can be calculated using the closed-form Black–Scholes–Merton (BSM) model, developed by Black and Scholes [43] and Merton [44]. The real option value of the CWs project can be calculated using Equation (6) as follows:

where and are the present values of future cashflows and investment cost as presented in Equation (1), respectively; is the opportunity cost of delaying the project; and is the risk-free interest rate. represents the cumulative standard normal distribution function of the variable d1 (calculated using Equation (7)), which determines the probability that exceed at the end of . represents the cumulative standard normal distribution function of the variable d2 (calculated using Equation (8)), which determines the present value of the expected at the expiration of the option .

In the BSM model, the volatility () is a crucial input parameter that represents the expected future fluctuations of as a result of uncertainties such as those described in Equations (2) and (3). Considering the correlation of WTP to reducing the ecological and health risks of climate change [45,46], this study assumes that the Wiener processes in Equations (2) and (3) are correlated such that or where . Consequently, the volatility of the real option can be calculated using Equation (9) as follows:

Comparing the calculated values, the is simply the sum of the discounted cashflows for the investment in the CWs project. On the other hand, is the value of delaying the investment to a later period. Hence, the real options valuation is considered an expanded NPV or strategic NPV, as the valuation includes both the NPV and the value of the flexibility [47] as shown in Equation (10) as follows:

This flexibility has added relevant value to the project, since optimal decisions might change over time with the release of new information, thereby reducing the project’s exposure to the market and other sources of uncertainties [48].

There are instances where the value of the flexibility to wait is equal to zero, implying a more optimal decision to invest immediately as postponing the investment incurs no additional value to the project [42,49]. In a worse case, the project flexibility may incur negative values, implying that delaying an investment could lead to a loss rather than a gain. This might happen due to extreme downside risks with unfavorable market conditions, high uncertainty, or significant risks that outweigh potential benefits [50]. Therefore, the real option decision rule in this study will focus on comparing the calculated values of and rather than the expanded NPV.

The real options valuation provides three decision options for the implementation of a CWs project, as shown in Equation (11) as follows:

Using this rule, the CWs project should only be implemented if the and postponing has no additional value to the project, . Additionally, if the and there is no value in waiting, , and the project should be rejected. On the other hand, if but OR and , then the more optimal decision is to postpone until the period .

2.2. Data, Parameter Estimation, and Scenarios

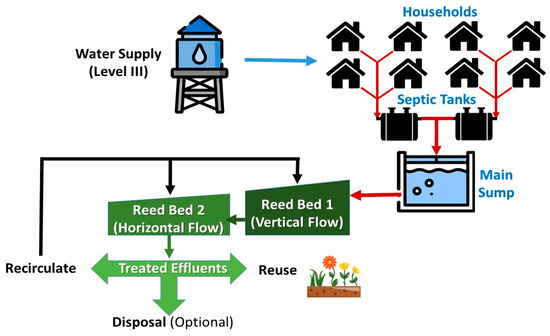

This study applies the proposed real options valuation model using the case of CWs in Bayawan City, Philippines (see actual photographs in Figure 1). The CWs project is composed of combined vertical flow (2 m deep) and horizontal flow (1.2 m deep) wetlands covering an area of 0.268 ha, and designed for a flow rate of 150 m3/day for 600 households with an average of 5 persons per household [23], as shown in Figure 2. The facility has been in operation since September 2006 with a pollutant removal efficiency of 97% (removal of BOD5) [51]. While the success of its operation can be attributed to government support, good governance of the LGU, and public acceptance, it also faced several challenges in terms of maintenance issues, overcapacity, foul odor, and climate-related uncertainties [4].

Figure 1.

Photographs of CWs in Bayawan City (left) Front view showing the tank for treated effluents and (right) Pathway between the vertical flow (left) and horizontal flow (right) CWS. Photos taken by the author.

Figure 2.

The framework of CWs in Bayawan City to treat the domestic wastewater in the nearby village. Republished from Guila et al. [23] under CC-BY-4.0.

The selection of this case is based on the following criteria: (a) a CWs facility is used to treat the domestic wastewater from the nearby village; (b) the project is already operational; (c) the WTP of the community is identified; (d) the operations of the CWs are affected by various uncertainties, including public support, technological learning, and climate change and natural disasters.

The data in this study are gathered from government data and existing studies about the CWs in Bayawan City, and other data from the literature. The summary of data and estimated parameters is presented in Table 1.

Table 1.

Estimation Parameters for the Real Option Valuation of Constructed Wetlands.

The investment for CWs in Bayawan City costs USD 180,000, including the labor and consulting fees [21,23]. The project’s annual operation and maintenance costs are estimated to be around USD 4000, composed of management, labor, utilities, and maintenance [21]. Currently, the project generates no income from the village, and the operations are subsidized by the local government as one of its social services. However, studies [23] value the willingness to pay of the residents at USD 20,000 annually. Moreover, shadow pricing, as described in previous studies [52,53], is used to calculate the economic value of the treated domestic wastewater at USD 11,600 annually. Assuming the implementation of the project at t = 0 and the operations at t = 1, the present values of the cashflows are calculated at a 10% discount rate up to a valuation period of 20 years.

The identification of the discount rate is crucial in the NPV calculation as it satisfies the targeted project’s return associated with the investment capital outlay and some unquantified elements of risks. A higher discount rate decreases the present value of future cashflows, leading to a lower or even negative NPV [54]. Meanwhile, it reflects the project’s risk or the company’s cost of capital. Hence, higher discount rates are used for riskier projects, which reduces the NPV to reflect the increased risk [54]. Yet, this study applied a 10% discount rate set by the National Economic Development Authority (NEDA) of the case country for public infrastructure and environment projects in the country.

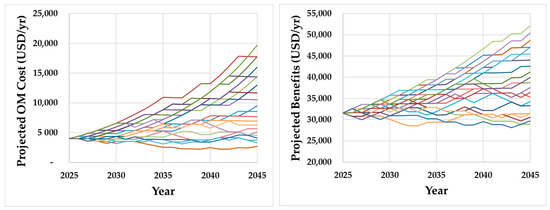

For the real options valuation, various paths of costs and benefits are calculated first. Using the historical data of climate-related disaster costs from 2004 to 2023 [55], the Augmented Dickey–Fuller unit root test shows that the time series has no unit root. The calculated percentage drift and volatility for the cost are and . The percentage drift and volatility for the benefits are and based on the WTP of residents for the CWs. These values are substituted in Equations (2) and (3) to calculate stochastic paths of costs and benefits of CWs, as shown in Figure 3. Each curve in the figures represents the projected cost (left) or benefits (right) from the years 2025 to 2045. These values are substituted in Equation (4) to calculate the expected value of future cashflows of the CWs.

Figure 3.

Projected paths (colored lines) for operations and maintenance cost (left) based on climate change uncertainty and for benefits (right) based on public support uncertainty from the year 2025 to 2045.

3. Results

3.1. Baseline Scenario

The results of the cost–benefit analysis and real options valuation for the CWs are shown in Table 2. Using the NPV rule, CWs can be implemented, as the NPV is positive, and the project can generate a value of USD 88,968. Considering management flexibility, this project can also be implemented in future periods when investment environments are more favorable. The result of real option valuation gives an ROV of USD 208,865. Using the ROV rule, the project must be postponed as the value of waiting is greater than immediately implementing the project. On the other hand, this ROV implies that if the planner wants to implement the project immediately, he must be willing to give up USD 208,865 and receive a lower value of USD 88,968.

Table 2.

Cost–benefit Analysis and Real Options Valuation of Constructed Wetlands.

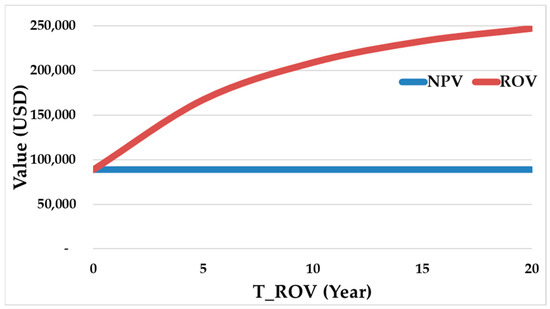

Meanwhile, the dynamics of NPV and ROV at various waiting periods are shown in Figure 4. It can be observed that NPV (blue line) is constant, as it is not affected by . On the other hand, ROV increases with but with . It should be noted that the NPV and ROV are equal at , which is a no-waiting period. Due to uncertainties in public support and the impacts of climate change, ROVs are increasing, as this provides the flexibility to adapt, wait for better information, mitigate risks, and strategically position the CWs project in volatile and uncertain investment environments.

Figure 4.

Net present value (NPV) and real options value (ROV) dynamics at different option expiration periods.

Moreover, it should be noted that if the percentage volatility of the cashflows for CWs at , the value ROV is also the same as NPV. When uncertainty is zero, there are no risks or variability in future cashflows, making the CWs project’s outcome certain. In this case, the value of flexibility provided by real options is irrelevant as both NPV and ROV reflect the present value of future cashflows without any adjustment for risk or flexibility.

3.2. Opportunity Cost Scenario

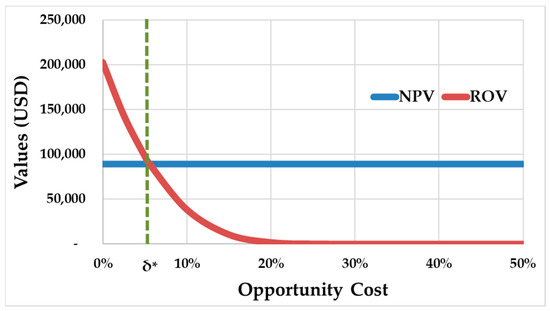

Opportunity costs are the foregone benefits of an option not chosen when deciding between different alternatives. From a real options perspective, waiting on or delaying the implementation of a project benefits a firm/planner as it can gather more information about market conditions, technological advancements, or other relevant factors. In this case, the opportunity cost is the potential benefits that could have been gained if a project had been implemented immediately. In this study, the impact of opportunity cost is evaluated for the calculation of NPV and ROV, as presented in Table 3 and Figure 5.

Table 3.

Real Options Valuation of Constructed Wetlands at Different Opportunity Costs.

Figure 5.

Net present value (NPV) and real options value (ROV) dynamics at different opportunity costs. At , the ; at , the .

The first point of interest here is the constant values of NPV at USD 88,968 at different opportunity costs. This indicates that NPV is not affected by the opportunity cost of waiting, as it only focuses on the present value of cashflows generated by the CWs project and the required initial investment. Whether a CWs project is implemented or not using the NPV rule, there is an opportunity cost incurred from waiting to invest.

On the other hand, ROV decreases with opportunity cost as illustrated by the red curves. For instance, ROV is equal to USD 207,295 at zero, USD 38,399 at 10%, USD 1746 at 20%, and so on. This is due to the higher opportunity costs that limit the flexibility to make decisions over time by increasing the pressure to commit resources to opportunities from immediate investment in CWs projects rather than waiting. Hence, the ability to exercise real options effectively decreases, leading to a decrease in ROV. Moreover, at rightwards, the ROV is equal to zero. This means that the CWs project does not offer any additional value beyond its immediate cashflows from . This suggests that there are no real options in the investment that could increase the value of the CWs project over time.

Another point of interest is the distance between the curves, which indicates the value of waiting. For instance, at , the NPV is USD 88,968 while ROV is USD 207,295, giving a value of waiting equivalent to USD 118,327. Hence, the more optimal decision is to wait or postpone the implementation of the CWs project. At , the NPV is still USD 88,968 while the ROV is USD 1746, giving a waiting value equal to USD −87,222. Therefore, the decision should be an immediate implementation of the project, as postponement up to the terminal period (10 years in this example) incurs a loss of USD 87,222. Furthermore, the intersection of the curves at shows that the NPV is equal to the ROV at USD 88,968. Starting from this value, the NPV > ROV and the value of waiting increases negatively, which indicates that the immediate implementation of the CWs project may be a more optimal decision.

3.3. Uncertainty in Public Acceptance Scenario

Uncertainty in public acceptance poses significant challenges to the implementation of CWs as this causes delays, increased costs, reputational damage, funding constraints, and missed opportunities for environmental sustainability. This study analyzes the impact of this uncertainty on the investment decisions for a CWs project. The results of the analyses using the NPV and ROV at various levels of volatility in the WTP of residents for the CWs are presented in Table 4.

Table 4.

Real Options Valuation of Constructed Wetlands at Different Levels of Public Acceptance.

It can be observed that both NPV and ROV increase with . For instance, at 0.05% uncertainty, NPV increases from USD 53,164 to USD 58,094, while ROV increases from USD 167,108 to USD 172,033. This is because the proposed valuation model considers the uncertainty in public acceptance in the calculation of the benefits, particularly the WTP of the residents for CWs. Meanwhile, the increase in ROV is expected, as higher uncertainty in public support provides better flexibility to delay investment decisions to a period when the support is favorable for the successful implementation of the CWs project.

On the other hand, while both are increasing, , which means that the increase in NPV is greater than ROV. This is because , while . The real options value is affected by several uncertainties, and therefore the impact of uncertainty in public acceptance is lower compared to NPV. Moreover, since ROV > NPV, it implies an optimal decision may be to postpone the investment given the increasing uncertainty in the households’ WTP for the CWs. On the other hand, postponing the investment may increase the WTP over time as households realize the necessity of implementing the CWs project and reap the different ecosystem services it provides to the community.

3.4. Uncertainty in Climate Change Scenario

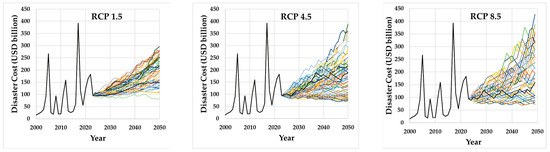

Uncertainty in climate change impacts poses significant challenges to the design, implementation, management, and sustainability of CWs projects. This study considers this uncertainty and analyzes its effects on the decision to invest in CWs projects. Using the scenarios described in the Intergovernmental Panel on Climate Change (IPCC) report [56], this study utilized the RCP 1.5 (sustainable pathway), RCP 4.5 (middle of the road), and RCP 8.5 (fossil fuel-rich development) estimates, and identified the volatility to simulate future disaster costs as shown in Figure 6. The left parts of the curves represent the historical weather and climate-related disaster costs based on the NOAA National Centers for Environmental Information (NCEI) data. On the other hand, the right sides of the curves are the projected curves of future disaster costs assuming that these costs follow GBM as presented in Equation (3).

Figure 6.

Historical (from 2000 to 2023) and projected (2024–2050) paths (colored lines) for disaster costs for RCPs 1.5, 4.5, and 8.5.

The real options valuation results at different climate change scenarios are presented in Table 5. The results show that both NPV and ROV decrease with . For instance, at RCP 1.5, the NPV decreases from USD 93,507 to USD 86,114, while ROV decreases from USD 207,295 to USD 200,153. For the NPV, the calculation of annual operations and maintenance costs is affected by the impacts of climate change with changes in vegetation, water quality management, CWs infrastructure maintenance, energy interruptions, and other impacts.

Table 5.

Real Options Valuation of Constructed Wetlands at Different Climate Change Scenarios.

It is expected that higher uncertainty increases the ROV. However, the impact of this uncertainty on the cashflows is negatively greater than its impact on the overall volatility of CWs, . Note that the overall volatility is based on the uncertainties in the costs (climate change cost) and the benefits (willingness to pay). These two have contrasting effects on the cashflows, with while . Furthermore, since ROV > NPV, the optimal decision is to postpone the investment in CWs project even at any level of uncertainty in terms of the impacts of climate change.

3.5. Sensitivity Analysis

To test the robustness of the estimation results above, this study analyzes their sensitivity to various explanatory variables, including the investment cost, operations and maintenance cost, shadow prices, willingness-to-pay, decision period, and the volatility of real options. It can be observed in Table 6 that the NPV is more sensitive than the ROV, which implies that the ROV is more robust to changes in the explanatory variables.

Table 6.

Sensitivity Analysis and Threshold Values for Immediate Investment.

In terms of the signs of the values, negative elasticities with respect to investment and OM costs are expected, since the costs incurred for the project decrease the NPV and the value of expected future cash flow for ROV. The positive values of elasticity with respect to shadow prices and WTP are also expected, as both NPV and ROV increase with benefits. It can also be highlighted that only ROV is sensitive to the decision period and the volatility of real options. This means that the period to delay the investment does not affect the value of NPV, as its decision is only based on whether to invest or not.

Among the variables, both NPV and ROV are most sensitive to project benefits, particularly WTP. This implies that, for CWs to be a more attractive solution to wastewater treatment, society’s WTP for its ecosystem services must be improved. This can be achieved through stakeholder consultations, citizen science, and intensive information, education, and communication campaigns. Furthermore, decreasing the investment cost can significantly improve the NPV and ROV, implying the government to provide financial support in terms of subsidies and incentives or facilitate finding alternative funding sources for the project.

4. Discussion

This study applied a real options approach to evaluate how uncertainties affect the investment decisions for CWs as an NbS to wastewater treatment. Applying the valuation framework in the case of CWs in Bayawan City, Philippines, results found that (a) the WTP and shadow price of CWs exceed the costs of the technology and implementation of the project; (b) considering the uncertainties and flexibility in making investments, it is more optimal to postpone the decision to implement the project; (c) the opportunity cost of waiting decreases this flexibility, urging an earlier investment to avoid losses; (d) uncertainty in public support increases the value of CWs and the flexibility leading to postponement of the project; and (e) uncertainty in terms of climate change impacts decreases the value of the investment, but suggests the postponement of the project until uncertainty is resolved.

4.1. Feasibility of Constructed Wetlands

The cost–benefit analysis of CWs in this case study resulted in a positive NPV, indicating that the project generates more benefits than costs. This result supports previous claims that CWs projects are economically feasible considering the ecosystem services they provide [26,27]. On the other hand, this contrasts with the current situation in Bayawan City, as the operations and maintenance of the CWs facility are subsidized by the local government [23]. Note that in this case study, the facility is integrated into a social housing project of the government in which the residents belong to indigent families with minimal to no income. Therefore, the CWs facility currently does not generate any income from the project. From a financial point of view, treatment facilities are characterized by a high cost compared with benefits, hence, the inclusion of environmental externalities should be considered.

The integration of ecosystem services and environmental externalities in the valuation of environmental projects is imperative for better decision-making and sustainability [57]. In this study, these externalities are integrated into the valuation of the benefits through shadow pricing of the pollutants removed from the domestic wastewater. This study also considered the WTP of residents for the ecosystem services provided by the CWs. If ecosystem services are included, the value of benefits increases, resulting in higher NPV, faster recovery of costs, and higher returns on investments. However, other externalities may also be considered, including community health improvement due to pollution-related diseases [4,26] as well as the improvements in water, air, and soil quality [35]. Moreover, this study did not include the land acquisition cost in the capital outlay. Studies found the availability of land and its acquisition as among the main challenges in implementing NbS initiatives, particularly in highly urbanized areas [58]. Therefore, the trade-offs between the environmental benefits and land requirements and the technical complexity of CWs must also be considered in the early stages of the planning and decision-making processes.

4.2. Real Options Valuation of Constructed Wetlands

Uncertainties play a crucial role in project decision-making, particularly for huge infrastructure and irreversible projects. As uncertainty becomes more prevalent, decision-makers adopt more complex capital budgeting techniques and real options reasoning. Existing real options literature on NbS initiatives [33,34] shows that postponement of investment results in better decision-making with higher economic efficiency due to learning. On the contrary, this case study found scenarios where investing immediately in CWs projects is a more optimal decision. Considering the opportunity costs of waiting, this study identified the threshold points at which further postponement of CWs projects incurs economic losses. These include the foregone benefits of treating wastewater and providing various ecosystem services to the community [21]. Therefore, project planners should be cautious of these ‘investment tipping points’ to avoid lower economic efficiencies than if the investment was made before this threshold. Moreover, these flexibilities highlight the advantage of using a real options approach over traditional cost–benefit analysis.

Despite the environmental benefits, CWs face public skepticism due to concerns about their foul odor, risk perception, government trust, and other technical and economic implementation issues [4,31]. For instance, public protests have proven to be successful in the temporary or permanent stopping of projects, while societal values, norms, or behavioral changes increase the social desirability of certain design proposals [59]. This case study supports these claims, as the calculated values of CWs increased with better public support through increased WTP of the residents. However, both NPV and ROV are increasing with uncertainty in public support, resulting in further postponement of the project. This is because the current model assumes better public support in the future, when the residents reap the benefits of having the CWs in the community’s vicinity. Public perception as additional uncertainty influences the success of a project, as the lack of social acceptance hinders the uptake of new technologies. Therefore, overcoming negative perceptions and gaining public acceptance is essential for the successful implementation of CWs projects.

Another challenge in the implementation of CWs projects is the uncertainty surrounding climate change impacts. Extreme variability in climate conditions incurs additional costs in the operations and maintenance of a project. For instance, drought might shift the role of wetlands from carbon sinks to carbon sources, while more rain maintains its role as a carbon sink [30]. Extreme weather and climate conditions incur damage costs to NbS initiatives, which have been increasing in recent decades [34]. Accounting for this uncertainty, this case study showed that the value of CWs decreased with greater climate change impact. Yet, a higher ROV than NPV implied a more optimal decision to postpone CWs projects. This supports previous studies that delay the investment profits of the project if the decision-maker expects to learn more about the true climate scenarios in the future and make necessary managerial flexibilities to adapt to these uncertainties [33]. Moreover, the uncertainty about the impacts of changes in temperature and water level as well as their interactions might be resolved over time as environmental managers find appropriate actions to maintain the services of CWs while mitigating the impacts of climate change [30]. Therefore, incorporating climate resilience measures and adaptive management strategies is crucial for enhancing the resilience of CWs to climate change’s impacts.

4.3. Limitations and Prospects

This case study made several simplifications for valuing CWs, resulting in various limitations in this research. First, this study applied the Black–Scholes–Merton model for real options valuation. While BSM offers simplicity that can be easily understood by practitioners and policymakers, other valuation methods can be used, such as decision trees, particularly binomial, trinomial, and other lattices/trees. Decision trees can incorporate complex interactions among multiple sources of uncertainties, such as public support dynamics, climate change impacts, and market variables. Another method is dynamic optimization, which offers rigor and realism in valuation. This method can capture the dynamic nature of real options, which is particularly useful for CWs projects including dynamics in flexibility, irreversibility, and technology learning. Future research may combine different valuation methods to better capture the multidimensionality of the uncertainties in CWs projects while providing simpler use for practitioners and policymakers.

Second, this study analyzed the effects of uncertainties in public support and climate change impacts on decision-making. Several uncertainties affect the CWs from various stages of the project’s development cycle. These include learning effects, governance, policy support, shadow prices, and natural events. Future studies should consider these uncertainties to better capture various factors that affect the dynamics of investment decisions for CWs projects. Lastly, this research applied the proposed real options valuation model to a case of operational CWs in Bayawan City. These CWs only treat domestic wastewater from the nearby village. The proposed model should also be applied to other case studies including CWs for agriculture, commercial, and industrial wastewaters to test the robustness of the method and the results.

Despite these limitations, the proposed framework would be a good benchmark for further analysis of the valuation of CWs as an NbS to wastewater treatment for a more sustainable future.

5. Conclusions

CWs projects are crucial in achieving sustainable futures by lowering the health and environmental risks of wastewater, recycling domestic wastewater back to a circular economy, generating economic and societal benefits, and empowering communities. While existing literature evaluated the CWs projects using economic valuation methods, this study extended this by integrating uncertainties that affect the successful implementation of CWs. Applying the real options approach, this study evaluated a CWs project and the flexibility in its implementation considering the opportunity cost and uncertainties in public support and climate change impacts.

Using the CWs in Bayawan City as a case study, the cost–benefit analysis calculated a net present value of USD 88,968, which indicated the viability of the project. However, the real options value at USD 208,865 indicated that the optimal decision may be to delay the implementation of the project. Considering the opportunity cost of waiting, the valuation identified the threshold of opportunity cost at 5.56% to make an immediate investment. This study showed that the presence of uncertainties delays the project until some uncertainties are resolved. Moreover, real option value decreased with uncertainty in terms of climate change’s impacts due to a significant increase in cash outflows, while it increased with public support due to a significant increase in cash inflows through a higher willingness to pay for the constructed wetlands. These findings highlighted the advantage of the application of real options to CWs projects, with the flexibility to make investment decisions under various uncertain environmental conditions.

With the increasing demand for water resources and the management of wastewater, governments should consider CWs projects as more ecologically sound NbS for wastewater treatment. The findings from the case of CWs in the Philippines provided recommendations for the replicability and successful implementation of CWs projects in other localities. First, the government must foster community engagement, stakeholder collaboration, and inclusive decision-making processes to empower local communities while building public trust in the wetland projects. Information and education campaigns can raise the awareness of various stakeholders in the community on the ecosystem services of constructed wetlands, which can foster further support for different conservation and restoration efforts in constructed wetlands. Finally, climate and disaster risk assessment, resilience-building measures, and adaptive strategies should be integrated into the planning, implementation, and management of constructed wetlands projects for more sustainable use and reuse of water resources.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

All data used in the calculations are presented in Methodology. Simulation results data are available upon request from the author.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Environment and Natural Resources Department. Wastewater as a Resource; European Investment Bank (EIB): Luxembourg, 2022. [Google Scholar]

- United Nations Environment Programme. Wastewater—Turning Problem to Solution. A UNEP Rapid Response Assessment; UNEP: Nairobi, Kenya, 2023. [Google Scholar]

- Kesari, K.K.; Soni, R.; Jamal, Q.M.S.; Tripathi, P.; Lal, J.A.; Jha, N.K.; Siddiqui, M.H.; Kumar, P.; Tripathi, V.; Ruokolainen, J. Wastewater Treatment and Reuse: A Review of its Applications and Health Implications. Water Air Soil Pollut. 2021, 232, 208. [Google Scholar] [CrossRef]

- Agaton, C.B.; Guila, P.M.C. Success Factors and Challenges: Implications of Real Options Valuation of Constructed Wetlands as Nature-Based Solutions for Wastewater Treatment. Resources 2024, 13, 11. [Google Scholar] [CrossRef]

- Rout, P.R.; Zhang, T.C.; Bhunia, P.; Surampalli, R.Y. Treatment technologies for emerging contaminants in wastewater treatment plants: A review. Sci. Total Environ. 2021, 753, 141990. [Google Scholar] [CrossRef] [PubMed]

- Rashid, R.; Shafiq, I.; Akhter, P.; Iqbal, M.J.; Hussain, M. A state-of-the-art review on wastewater treatment techniques: The effectiveness of adsorption method. Environ. Sci. Pollut. Res. 2021, 28, 9050–9066. [Google Scholar] [CrossRef]

- Kurt, Z.; Özdemir, I.; James, R.A.M. Effectiveness of microplastics removal in wastewater treatment plants: A critical analysis of wastewater treatment processes. J. Environ. Chem. Eng. 2022, 10, 107831. [Google Scholar] [CrossRef]

- Saravanan, A.; Senthil Kumar, P.; Jeevanantham, S.; Karishma, S.; Tajsabreen, B.; Yaashikaa, P.R.; Reshma, B. Effective water/wastewater treatment methodologies for toxic pollutants removal: Processes and applications towards sustainable development. Chemosphere 2021, 280, 130595. [Google Scholar] [CrossRef]

- Aghalari, Z.; Dahms, H.-U.; Sillanpää, M.; Sosa-Hernandez, J.E.; Parra-Saldívar, R. Effectiveness of wastewater treatment systems in removing microbial agents: A systematic review. Glob. Health 2020, 16, 13. [Google Scholar] [CrossRef]

- Agaton, C.B.; Guila, P.M.C. Ecosystem Services Valuation of Constructed Wetland as a Nature-Based Solution to Wastewater Treatment. Earth 2023, 4, 78–92. [Google Scholar] [CrossRef]

- Vymazal, J.; Zhao, Y.; Mander, Ü. Recent research challenges in constructed wetlands for wastewater treatment: A review. Ecol. Eng. 2021, 169, 106318. [Google Scholar] [CrossRef]

- Waly, M.M.; Ahmed, T.; Abunada, Z.; Mickovski, S.B.; Thomson, C. Constructed Wetland for Sustainable and Low-Cost Wastewater Treatment: Review Article. Land 2022, 11, 1388. [Google Scholar] [CrossRef]

- Gorgoglione, A.; Torretta, V. Sustainable Management and Successful Application of Constructed Wetlands: A Critical Review. Sustainability 2018, 10, 3910. [Google Scholar] [CrossRef]

- Parde, D.; Patwa, A.; Shukla, A.; Vijay, R.; Killedar, D.J.; Kumar, R. A review of constructed wetland on type, treatment and technology of wastewater. Environ. Technol. Innov. 2021, 21, 101261. [Google Scholar] [CrossRef]

- Lamori, J.G.; Xue, J.; Rachmadi, A.T.; Lopez, G.U.; Kitajima, M.; Gerba, C.P.; Pepper, I.L.; Brooks, J.P.; Sherchan, S. Removal of fecal indicator bacteria and antibiotic resistant genes in constructed wetlands. Environ. Sci. Pollut. Res. 2019, 26, 10188–10197. [Google Scholar] [CrossRef] [PubMed]

- Hazra, M.; Durso, L.M. Performance Efficiency of Conventional Treatment Plants and Constructed Wetlands towards Reduction of Antibiotic Resistance. Antibiotics 2022, 11, 114. [Google Scholar] [CrossRef]

- Hassan, I.; Chowdhury, S.R.; Prihartato, P.K.; Razzak, S.A. Wastewater Treatment Using Constructed Wetland: Current Trends and Future Potential. Processes 2021, 9, 1917. [Google Scholar] [CrossRef]

- Hadidi, L.A. Constructed Wetlands a Comprehensive Review. Int. J. Res.-GRANTHAALAYAH 2021, 9, 395–417. [Google Scholar] [CrossRef]

- Crini, G.; Lichtfouse, E. Advantages and disadvantages of techniques used for wastewater treatment. Environ. Chem. Lett. 2018, 17, 145–155. [Google Scholar] [CrossRef]

- Davis, L. A Handbook of Constructed Wetlands: A Guide to Creating Wetlands for: Agricultural Wastewater, Domestic Wastewater, Coal Mine Drainage, Stormwater. In The Mid-Atlantic Region. Volume 1: General Considerations; USDA-Natural Resources Conservation Service: Washington, DC, USA, 1995. [Google Scholar]

- Agaton, C.B.; Guila, P.M.C.; Rodriguez, A.D.H. Economic Analysis of NbS for Wastewater Treatment Under Uncertainties. In Water Treatment in Urban Environments: A Guide for the Implementation and Scaling of Nature-based Solutions; Jegatheesan, V., Velasco, P., Pachova, N., Eds.; Springer Nature: Cham, Switzerland, 2024. [Google Scholar]

- Snyder, B.F. The Inclusion of Ecosystem Service Valuations in Bioenergy Cost Analysis: A Case Study of Constructed Wetlands in the Neotropics. Ecol. Econ. 2019, 156, 196–201. [Google Scholar] [CrossRef]

- Guila, P.M.C.; Agaton, C.B.; Rivera, R.R.B.; Abucay, E.R. Household Willingness to Pay for Constructed Wetlands as Nature-Based Solutions for Wastewater Treatment in Bayawan City, Philippines. J. Hum. Ecol. Sustain. 2024, 2, 5. [Google Scholar] [CrossRef]

- Yang, W.; Chang, J.; Xu, B.; Peng, C.; Ge, Y. Ecosystem service value assessment for constructed wetlands: A case study in Hangzhou, China. Ecol. Econ. 2008, 68, 116–125. [Google Scholar] [CrossRef]

- Varela, H.; García, J.; Alfranca, O. Economic valuation of a created wetland fed with treated wastewater located in a peri-urban park in Catalonia, Spain. Water Sci. Technol. 2011, 63, 891–898. [Google Scholar] [CrossRef][Green Version]

- García-Herrero, L.; Lavrnić, S.; Guerrieri, V.; Toscano, A.; Milani, M.; Cirelli, G.L.; Vittuari, M. Cost-benefit of green infrastructures for water management: A sustainability assessment of full-scale constructed wetlands in Northern and Southern Italy. Ecol. Eng. 2022, 185, 106797. [Google Scholar] [CrossRef]

- Abdelhay, A.; Abunaser, S.G. Modeling and Economic Analysis of Greywater Treatment in Rural Areas in Jordan Using a Novel Vertical-Flow Constructed Wetland. Environ. Manag. 2020, 67, 477–488. [Google Scholar] [CrossRef] [PubMed]

- Castañer, C.M.; Bellver-Domingo, Á.; Hernández-Sancho, F. Environmental and Economic Approach to Assess a Horizontal Sub-Surface Flow Wetland in Developing Area. Water Resour. Manag. 2020, 34, 3761–3778. [Google Scholar] [CrossRef]

- Cooper, R.J.; Battams, Z.M.; Pearl, S.H.; Hiscock, K.M. Mitigating river sediment enrichment through the construction of roadside wetlands. J. Environ. Manag. 2019, 231, 146–154. [Google Scholar] [CrossRef]

- Salimi, S.; Almuktar, S.A.A.A.N.; Scholz, M. Impact of climate change on wetland ecosystems: A critical review of experimental wetlands. J. Environ. Manag. 2021, 286, 112160. [Google Scholar] [CrossRef]

- Ricart, S.; Rico-Amorós, A.M. Constructed Wetlands to Face Water Scarcity and Water Pollution Risks: Learning from Farmers’ Perception in Alicante, Spain. Water 2021, 13, 2431. [Google Scholar] [CrossRef]

- Agaton, C.B. Application of real options in carbon capture and storage literature: Valuation techniques and research hotspots. Sci. Total Environ. 2021, 795, 148683. [Google Scholar] [CrossRef]

- Vogelsang, L.G.; Weikard, H.-P.; van Loon-Steensma, J.M.; Bednar-Friedl, B. Assessing the cost-effectiveness of Nature-based Solutions under climate change uncertainty and learning. Water Resour. Econ. 2023, 43, 100224. [Google Scholar] [CrossRef]

- Agaton, C.B.; Collera, A.A. Now or later? Optimal timing of mangrove rehabilitation under climate change uncertainty. For. Ecol. Manag. 2022, 503, 119739. [Google Scholar] [CrossRef]

- Langit, E.R.A.; Parungao, C.A.S.; Gregorio, E.T.A.; Sabo-o, A.J.M.; Dulay, B.A.Y.; Loren, D.D.; Patria, K.A.M.; Quines, B.A.B.; Dacumos, M.V.F.; Catabay, J.A.C.; et al. Feasibility Study of an Integrated Waste Management Technology System for a Circular Economy in the Philippines. J. Hum. Ecol. Sustain. 2024, 2, 3. [Google Scholar] [CrossRef]

- Devanadera, M.C.E.; Estorba, D.S.; Guerrero, K.M.; Lecciones, A. Social Acceptability Assessment for Nature-based Solution for Wastewater Treatment. In Water Treatment in Urban Environments: A Guide for the Implementation and Scaling of Nature-Based Solutions; Jegatheesan, V., Velasco, P., Pachova, N., Eds.; Springer Nature: Cham, Switzerland, 2024. [Google Scholar]

- Gonzalez-Flo, E.; Romero, X.; García, J. Nature based-solutions for water reuse: 20 years of performance evaluation of a full-scale constructed wetland system. Ecol. Eng. 2023, 188, 106876. [Google Scholar] [CrossRef]

- Piñeiro-Chousa, J.; López-Cabarcos, M.Á.; Romero-Castro, N.; Vázquez-Rodríguez, P. Sustainable tourism entrepreneurship in protected areas. A real options assessment of alternative management options. Entrep. Reg. Dev. 2021, 33, 249–272. [Google Scholar] [CrossRef]

- Song, F.; Zhao, J.; Swinton, S.M. Switching to Perennial Energy Crops Under Uncertainty and Costly Reversibility. Am. J. Agric. Econ. 2014, 96, 1239. [Google Scholar] [CrossRef]

- Abadie, L.M. Sea level damage risk with probabilistic weighting of IPCC scenarios: An application to major coastal cities. J. Clean. Prod. 2018, 175, 582–598. [Google Scholar] [CrossRef]

- Gersonius, B.; Ashley, R.; Pathirana, A.; Zevenbergen, C. Climate change uncertainty: Building flexibility into water and flood risk infrastructure. Clim. Change 2012, 116, 411–423. [Google Scholar] [CrossRef]

- Agaton, C.B.; Guno, C.S. Renewable energy in sustainable agricultural production: Real options approach to solar irrigation investment under uncertainty. Renew. Energy Sustain. Dev. 2024, 10, 77–91. [Google Scholar] [CrossRef]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Merton, R.C. Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141. [Google Scholar] [CrossRef]

- Graham, H.; de Bell, S.; Hanley, N.; Jarvis, S.; White, P.C.L. Willingness to pay for policies to reduce future deaths from climate change: Evidence from a British survey. Public Health 2019, 174, 110–117. [Google Scholar] [CrossRef]

- Veronesi, M.; Chawla, F.; Maurer, M.; Lienert, J. Climate change and the willingness to pay to reduce ecological and health risks from wastewater flooding in urban centers and the environment. Ecol. Econ. 2014, 98, 1–10. [Google Scholar] [CrossRef]

- Fernández-González, R.; Pérez-Pérez, M.I.; Pérez-Vas, R. Real options for a small company in a context of market concentration: A case study of investment in a turbot farming plant in Spain. Mar. Policy 2021, 134, 104828. [Google Scholar] [CrossRef]

- Gilson Dranka, G.; Cunha, J.; Donizetti de Lima, J.; Ferreira, P. Economic evaluation methodologies for renewable energy projects. AIMS Energy 2020, 8, 339–364. [Google Scholar] [CrossRef]

- Batac, K.I.T.; Collera, A.A.; Villanueva, R.O.; Agaton, C.B. Decision support for investments in sustainable energy sources under uncertainties. Int. J. Renew. Energy Dev. 2022, 11, 801–814. [Google Scholar] [CrossRef]

- Harikae, S.; Dyer, J.S.; Wang, T. Valuing Real Options in the Volatile Real World. Prod. Oper. Manag. 2021, 30, 171–189. [Google Scholar] [CrossRef]

- Lipkow, U.; von Münch, E. Constructed wetland for a peri-urban housing area Bayawan City, Philippines—Case study of sustainable sanitation projects. Sustain. Sanit. Alliance 2010, 12. [Google Scholar]

- Ćetković, J.; Knežević, M.; Lakić, S.; Žarković, M.; Vujadinović, R.; Živković, A.; Cvijović, J. Financial and Economic Investment Evaluation of Wastewater Treatment Plant. Water 2022, 14, 122. [Google Scholar] [CrossRef]

- Molinos-Senante, M.; Hernández-Sancho, F.; Sala-Garrido, R. Cost–benefit analysis of water-reuse projects for environmental purposes: A case study for Spanish wastewater treatment plants. J. Environ. Manag. 2011, 92, 3091–3097. [Google Scholar] [CrossRef]

- Blaset Kastro, A.N.; Kulakov, N.Y. Risk-adjusted discount rates and the present value of risky nonconventional projects. Eng. Econ. 2020, 66, 71–88. [Google Scholar] [CrossRef]

- NOAA National Centers for Environmental Information (NCEI). U.S. Billion-Dollar Weather and Climate Disasters (2024); NOAA National Centers for Environmental Information: Asheville, NC, USA, 2024. [Google Scholar] [CrossRef]

- Lee, J.-Y.; Marotzke, J.; Bala, G.; Cao, L.; Corti, S.; Dunne, J.P.; Engelbrecht, F.; Fischer, E.; Fyfe, J.C.; Jones, C.; et al. Future Global Climate: Scenario-based Projections and Near-term Information. In Climate Change 2021—The Physical Science Basis; Masson-Delmotte, V., Zhai, P., Pirani, A., Connors, S.L., Péan, C., Berger, S., Caud, N., Chen, Y., Goldfarb, L., Gomis, M.I., et al., Eds.; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2023; pp. 553–672. [Google Scholar]

- Bherwani, H.; Nair, M.; Kapley, A.; Kumar, R. Valuation of Ecosystem Services and Environmental Damages: An Imperative Tool for Decision Making and Sustainability. Eur. J. Sustain. Dev. Res. 2020, 4, em0133. [Google Scholar] [CrossRef]

- Asare, P.; Atun, F.; Pfeffer, K. Nature-Based Solutions (NBS) in spatial planning for urban flood mitigation: The perspective of flood management experts in Accra. Land Use Policy 2023, 133, 106865. [Google Scholar] [CrossRef]

- Coppens, T.; Van Acker, M.; Machiels, T.; Compernolle, T. A real options framework for adaptive urban design. J. Urban Des. 2021, 26, 681–698. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).