Abstract

The importance of corporate reputation is a critical issue for business growth, sustainability, and success, as it represents a key intangible asset for the management of all companies. This business importance has its correlation in the academic and research field, where corporate reputation has a high number of publications in the literature. However, despite the importance of this concept, one of the great challenges of recent decades, and one that is still evident today, is how to measure corporate reputation quantitatively and how it affects sustainability. Following an in-depth exploration of the available literature, this manuscript aims to demonstrate the effective application of fuzzy models in enhancing decision-making processes within the realm of corporate reputation management for companies. To achieve this goal, this paper proposes a new corporate reputation measuring model based on the fuzzy 2-tuple linguistic and AHP (Analytic Hierarchy Process) methodologies. The proposed model promotes the computation of corporate reputation for companies based on three widely cited and universally recognized criteria outlined in the literature, drawing inspiration from a well-established framework in the field. This approach ensures a comprehensive and widely accepted foundation for evaluating corporate reputation: Capability, Benevolence, and Integrity and adding the Net Promote Score variable. To integrate sustainability into this equation, our model suggests the inclusion of variables related to sustainable practices in the measurement of corporate reputation. Recognizing the growing importance of sustainability in the public perception of companies, factors such as social responsibility, environmental management, and business ethics are recommended for consideration in the assessment of corporate reputation. The model proposed in this paper is tested and validated on a real business case, based on the selection of several companies selected for an empirical study in the selection of suppliers. For future research endeavors, the authors suggest expanding the model to encompass various decision-making processes. Additionally, they recommend exploring the integration of machine learning algorithms and data analysis techniques to identify patterns and provide recommendations for enhancing corporate reputation.

1. Introduction

Globalization and digitalization are setting a new context where there is abundant information, but at the same time uncertainty is growing [1]. In recent years, marked by constant and rapid changes in an environment that is increasingly ambiguous, complex, volatile, and uncertain, it is crucial for companies to cultivate a high capacity for adaptability [2]. In the new context described, the importance of the firm’s intangible capital becomes crucial and a differential factor as a generator of growth, sustainability, and productivity [3].

According to [4] the defining characteristics of intangible capital in companies are: “being valuable, being scarce or rare among competitors, being difficult to imitate or copy by competitors, and having no substitutes that can provide the same value”. In accordance with [5], the success of companies is increasingly focused on intangible capital, which includes, among other things, innovation, and the creation of a strong corporate reputation. According to [6], “Other possible intangible assets could be the company’s reputation, organizational capital, relational capital, patents, etc.”.

Corporate reputation and corporate sustainability are critical concepts in the business context and are also interrelated in several ways. Sustainability refers to a company’s ability to operate in a way that balances economic profitability, social responsibility, and environmental impact. In today’s dynamic and interconnected business environment, the importance of corporate reputation cannot be overstated. A company’s reputation serves as a crucial asset that influences customer loyalty, investor confidence, employee morale, and overall stakeholder trust. Moreover, in an era where information spreads rapidly through various channels, maintaining a positive corporate reputation is integral to navigating challenges and capitalizing on opportunities. Companies with strong reputations are better positioned to attract top talent, foster strategic partnerships, and weather crises more effectively. Therefore, understanding and actively managing both corporate reputation and sustainability are paramount for long-term success and resilience in the contemporary business landscape.

Many authors have highlighted the direct relationship between corporate reputation and economic sustainability. For instance, ref. [7] exposes in its work that sustainability has a significant positive impact on corporate reputation, with the economic, social, and environmental dimensions of sustainability all playing a role. In the same vein [8] highlight the concept of superior sustainability performance, which is associated with a positive reputation, while external assurance of sustainability disclosure does not directly affect reputation. In other words, sustainability is often seen as an antecedent of corporate reputation, with sustainability reporting and strategic management of both sustainability and reputation being key factors in enhancing reputation [9]. In conclusion, the interrelationship between legitimacy, reputation, sustainability, and branding is crucial for achieving sustainability and competitive advantage [10].

It is a fact that we have experienced a real reputation crisis in recent decades, which has led to an increased interest in corporate reputation. According to the UNCTAD 2010 report, the economic crisis of 2007–2008, which affected the world, provoked a clear need to rethink the corporate reputation of companies and its impact on their strategic processes. Over subsequent years, numerous studies have continued to support this research trajectory, particularly focusing on the influence of brand and corporate identity, UNCTAD 2023.

Corporate reputation has been defined and examined for decades by academics and practitioners and has been related to concepts such as external members’ perception of corporate image (or as a dimension of corporate image) [11]. One of the first conclusions that can be drawn from a review of the existing literature on corporate reputation is that it is often confused with the concepts of corporate image and corporate identity. This means that there is no academic or professional consensus on both the definition of corporate reputation and its measurement methodologies, as shown in [12], which presents a wide variety of theories on how corporate reputation is shaped and its measurement. Thus, we can affirm that this lack of consensus justifies all research in the field of clarifying both the definition and measurement of the concept of corporate reputation.

As a result of this need to measure corporate reputation, this paper presents an analysis of the existing literature, as well as some important shortcomings detected in some of them. One of the limitations that we have detected is that the methodologies take into consideration different variables that are unequally weighted. Similarly, the literature review carried out in recent decades has shown that there are several studies on the assessment of corporate reputation carried out by means of indexes, commonly known as rankings, which, in general, are published annually linked to consulting firms and the media and which usually enjoy a certain recognition in the business community.

Thus, the aim of this paper is to propose a model for the assessment of corporate reputation that tries to adjust to the definitions and variables most used by experts in the academic and professional fields. The main novelty of this model is the inclusion of the trust variable, and more specifically, it is based on the model of the generation of organizational trust by [13], where trust is considered a consequence of a company’s Ability, Benevolence, and Integrity.

Considering the above, this paper aims to contribute a novel model to the scientific community, serving as a guide to enhance corporate reputation. This model is anchored in a foundational element—sustainability—employing a carefully selected set of criteria that prioritize both sustainability and corporate image. This new model, thoroughly elucidated in the ensuing sections, is instrumental in identifying dimensions that delineate the level of corporate reputation based on sustainability. It stands out as a variable capable of distinguishing companies. Hence, amid the current literature on models for measuring corporate reputation, diverse studies feature distinct variables, highlighting once again the absence of consensus within the scientific community [14].

Therefore, this paper will address, on one hand, the most pertinent criteria for defining the level of corporate reputation for companies. On the other hand, it will explore the group multi-criterion decisions that may coexist within companies, stemming from various decision-making roles such as CEO, CFO, CSO, among others. To achieve this, mathematical models grounded in the AHP and fuzzy logic methods have been employed to introduce the new model for measuring corporate reputation.

As the primary contributions of the new model proposed in this article, the following aspects can be highlighted:

- To highlight corporate reputation as a key element in business and economic sustainability.

- Proposing a methodology for enhancing decision making related to corporate reputation using the AHP method and the fuzzy 2-tuple linguistic model.

- Deriving from this proposed methodology, the authors present a novel model for calculating corporate reputation, building upon the aforementioned methodologies.

- Selecting the criteria for the new model based on a comprehensive literature review that assesses the most frequently cited criteria for measuring digital maturity.

- Validating and testing this new model with a small group of companies and formulating a set of recommendations for enhancing the decision-making processes of these companies.

- Outlining future lines of work and potential improvements.

The remaining content of this paper is organized as follows: Section 2 provides a review of the existing literature on the concepts integral to the proposed model; Section 3 outlines the methodology employed in this study, encompassing both the literature review and fuzzy models; Section 4 introduces a new model for calculating corporate reputation; Section 5 offers a practical application of the model; and finally, Section 6, Section 7 and Section 8 delve into the discussion of results, present the main conclusions, and address the limitations and future directions of this work.

2. Theoretical Background

2.1. Corporate Reputation

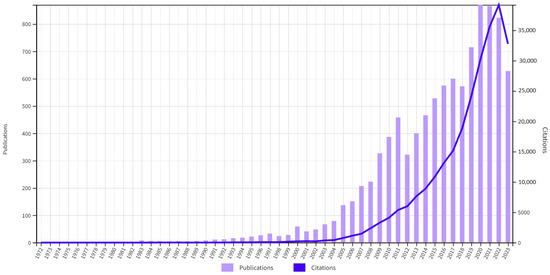

Figure 1 provides a comprehensive overview of publications related to the search variable TS = (CORPORATE REPUTATION). The aim is to showcase scientific publications associated with this concept. To generate these results, the research was conducted in the Web of Science Core Collection, employing journal articles as the sole criterion for selection and considering the entire available period.

Figure 1.

Studies related to the corporate reputation concept.

As we can observe, the concept has been deeply analyzed and defined, especially during the last two decades. Corporate reputation has been defined in many ways, according to the existing literature. In this study, ref. [15] focuses on the firm’s past actions and defines the concept as “set of economic and non-economic factors attributed to a firm and inferred from the firm’s past actions”. The perspective aligns with [16], who argue that “a firm’s reputation reflects the history of its past actions”.

In the late 1990s, a group of authors established the definition of corporate reputation based on several different perspectives or business areas. For example, ref. [17] based their definition of corporate reputation from the prism of different areas: accounting, economics, marketing, organizational, sociological, sustainability, and strategic. Other authors in this same line of thinking were [18] in the economic field or [19] in the field of marketing and business strategy.

Over the years, the concept of corporate reputation has been further refined by other authors, placing emphasis on the perceptions of external stakeholders. For instance, in [20], organizational reputation is defined as “a specific type of feedback received by an organization from its stakeholders concerning the credibility of the organization’s identity claims”. Similarly, ref. [21] characterizes corporate reputation as the “collective judgment of observers of a corporation based on the measure of financial, social, and environmental impacts attributed to the corporation over time”. Furthermore, ref. [22] conceptualizes corporate reputation as “an aggregate and relatively stable perceptual representation of a company’s past actions and future prospects with respect to a specific criterion, compared to some standard”.

Recent authors have emphasized the significance of trust in enhancing corporate reputation. In a study by [23], corporate reputation can be explained as “a socially transmissible overall assessment of a company, developed over time among stakeholders, that represents expectations of the company, and the level of trust, favorability, and recognition compared to its competitors”. This level of trust is highlighted by [24], who propose the concept of mistrust, understanding this as “the degree to which an individual expects an organization’s goals, intentions, and outcomes to be consistent with social norms”.

Research reflects a professional and academic predisposition to consider that the internal and external aspects of organizational reputation cannot be treated separately [25,26].

The distinction between various perspectives on corporate reputation, as adopted by different academic areas, lacks clarity and consensus [12]. In understanding the corporate reputation paradigm, the need to clarify the structure and its measurement is justified.

2.2. Criteria for Measuring Corporate Reputation

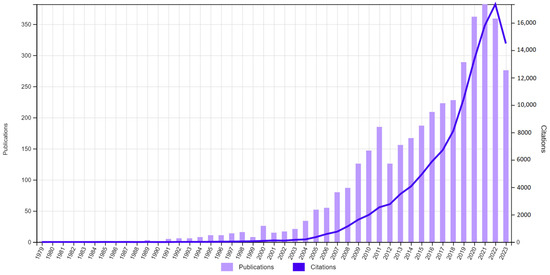

Figure 2 offers a comprehensive overview of publications related to the search variables TS = (CORPORATE REPUTATION MODELS) OR TS = (CORPORATE REPUTATION MEASURE).

Figure 2.

Studies related to the corporate reputation models of measurement.

The aim was to identify scientific publications pertaining to models for measuring corporate reputation. To achieve these results, the research was conducted in the Web of Science Core Collection, with the exclusive criterion of selecting journal articles and encompassing the entire available period. The outcomes are akin to those previously presented for the overarching concept of corporate reputation, albeit with a reduced number of articles and citations. Notably, there is a heightened frequency from the year 2000 onwards.

In the existing literature we find several applied measurement tools that have tried to measure the impact of changes in corporate reputation [27,28]. From the oldest ones, such as the one published by Fortune magazine (since 1982), with a marked financial impact [29,30], to all types of corporate reputation scales published by consulting firms or companies in more than 38 countries.

As mentioned above, over the last three decades, there have been different lines of thought on corporate reputation, which has led to different ways or proposals for measuring this variable. For example, following the line of [27], they proposed two environments of influence of corporate reputation, one that has a direct impact on emotional aspects and another more focused on aspects of business performance.

In this study, ref. [31] developed a proposal of six variables with which to measure a company’s corporate reputation. These variables included the two typologies described above (affective and business performance). The empirical way of testing his model was through four multinationals in Germany, the USA, and the UK. A year later, ref. [32] proposed a new model based on ten variables for measuring corporate reputation in Germany, which he measured through surveys of consumers, employees, and investors.

Other important models of measuring corporate reputation were based on focusing on the customer’s opinion and giving it full relevance. In this line of argument, were the studies conducted by [33], who introduced a model with 28 variables where customers assessed the companies under examination, and [34], who reduced the 28 variables of the previous model to only 15, testing the model in the United Kingdom and Germany.

One of the first conclusions we can draw from the study of corporate reputation measurement models is that there is a certain similarity in many of the variables proposed in the models, although they vary in their degrees of importance. We also found that, since the ranking proposed by Fortune magazine, models based on ratings have proliferated to compare the reputation of companies. These corporate reputation evaluation rankings are usually published annually by prestigious consulting firms and the media, such as Fortune World’s Most Admired Companies, the Global RepTrak Reputation Institute, BrandZ Top 100 Most Valuable Global Brands, Barron’s World’s Most Respected Companies, and in Spain and Latin American countries [35].

These are the most recognized worldwide, but there are many others, such as the British Most Admired Companies of Management Today magazine, which publishes the list of the most admired companies in the United Kingdom; Asian Business, which publishes the list of the most admired companies in Asia; and other platforms such as the Repustars Variety Corporate Reputation Index, which, using the Dow Jones indexes, calculates the impact of corporate reputation on the price of quoted shares.

In almost all these valuation rankings, the objective is to compare companies in the same geographical area through a methodology based on surveys of managers and financial analysts. These surveys use variables such as corporate behavior, product quality, financial performance, innovation, and management style, among others.

In Table 1 we can observe some of the most common rankings of corporate reputations.

Table 1.

Common rankings of corporate reputations.

In summary, we found the following points of improvement after analyzing the rankings and models presented above:

- Differences regarding the definition of the universe of companies to be taken into consideration.

- Defining different evaluator audiences (informed/uninformed) and assigning varying weights to their opinions concerning the overall assessment.

- Assessing different attributes by similar audiences.

- Failing to periodically review the evaluation criteria (dimensions and attributes) to assess their effectiveness in evaluating corporate reputation.

- Lack of variables of indicators to contrast with the opinions of the audiences and the weight of variables.

- The models are not capable of establishing multi-criterion decisions and, in the same representation domain, weight each variable differently and by different interlocutors.

- Many models use internal measurement scales in a qualitative way and do not establish recommendations or action plans to help the improvement strategy.

- General lack of methodological rigor, stemming from a lack of transparency in the measurement and weighting processes, as well as the absence of external auditing.

Considering the above, it makes sense to present a new model with the intention of making it as standard as possible, valid for companies of any size and geographic location, and taking into consideration inputs from a point of view. This model includes the approaches described above and is in line with the most cited references in the academic literature, thus allowing it to become a valid model. The variables defined below are based on the generation of trust as a direct source of corporate reputation.

The following are the four corporate reputation criteria most frequently utilized in the literature, forming the foundation for our work and the proposed model.

- CP (Capability): One of the most relevant business aspects is the range of capabilities and skills that companies can achieve to support their value proposition and to adapt them to change. In this study, ref. [36] define capability reputation as the “collective evaluations of the quality and performance characteristics of a particular firm”. In other words, capability can be defined as the alignment between organizational actions and outcomes and the economic standards advocated within a sustainable industry [37]. A strategy based on organizations enhancing their reputation through their capabilities would be based on promoting substantive rather than symbolic strategies and investments [38]. Examples of these investments would be to promote human capital, social capital, new product development, or diversification as a strategy [39]. This criterion could be defined into the following sub-criteria:

- ○

- PP (Profit Projection): Defined as the measuring growth and competitive advantage, the company will use a growth projection using a numerical variable (% growth). In [40], it is emphasized that “a good corporate reputation is one of the main business assets responsible for sustained financial outcomes”. The significance of financial capabilities is closely intertwined with corporate reputation, as ref. [41] introduces financial reputation as one of the three constructs in their definition of corporate reputation. Notably, refs. [19,42] incorporate financial terms such as financial strength, the utilization of corporate assets, and the value of long-term investments in their multi-criterion model of corporate reputation.

- ○

- IT (Innovation): Defined as the ability to innovate and adapt to a sustainable changing digital environment. Innovation is defined by authors as a relevant capability to better understand the corporate reputation. Again, refs. [19,42] propose as a criterion for measuring capabilities of a company the level of innovation. Similarly, ref. [43] highlighted the relevant importance of innovation in terms of value creation and its impact on the corporate reputation of companies. In a very similar approach, ref. [44] argues the value of innocence in the sense of creating long-term marketing value in the way of reputational improvement.

- ○

- BQ (Quality of Business Management): This sub-criterion is defined as the capacity and quality of the business management of the firms. The study by [45] highlighted the importance of quality in management and operations to obtain a good corporate reputation. Once again, refs. [19,42] define directly managerial quality as an aspect of critical relation to the corporate reputation. Additionally, in another study, ref. [46] underscores the importance of measuring non-financial quality in business performance, for instance, through The European Foundation for Quality Management.

- BV (Benevolence): This criterion refers to the motives and intentions of the company. It assesses the principle of corporate social responsibility, delving into factors such as respect for consumers, the quality of the product and/or service, and the quality of the work team, with a particular emphasis on aspects related to sustainability. The study by [47] supports the same theory proposed by [13], that trust based on benevolence will lead to a stronger corporate reputation based on emotional appeal. This benevolence has a positive impact on corporate reputation in the sense that the company that has this skill can establish emotional connections that are very beneficial for business [48,49]. This criterion will be divided into the following sub-criteria:

- ○

- RC (Respect for Consumer Rights): The importance of respect for consumer rights and developing actions to improve customer satisfaction has been analyzed for several authors as key for a corporate reputation success. The work in [50] highlights the importance of developing a real “consumer company identification”. On the other hand, ref. [51] show the impact of customer loyalty on corporate reputation as do authors such as [52], ref. [53] highlighted the importance of customers as the most relevant stakeholders for the enhancement of corporate reputation.

- ○

- PS (Quality of product–service): In the study by [54], they highlight the importance of having a good corporate reputation in terms of “perceived quality”, i.e., the evaluation that stakeholders make of an organization in terms of its ability to produce quality products. Product and service quality is also one of the most important criteria to define corporate reputation in the reputed work of [17,19].

- ○

- LQ (Labor quality): It is important to keep in mind that employees are how a corporate reputation is created. The better the quality of work the better the employee satisfaction and the workplace environment. This workplace environment is proposed by [49] as a key factor to improve corporate reputation.

- INT (Integrity): This factor refers to the principles and values that govern the behavior of the company, encompassing ethical, social, and environmental commitments, with a particular focus on sustainability. The study by [49] argues that a company’s corporate reputation can be based on the generation of trust through the company’s integrity, and more specifically on social and environmental responsibility, vision, and leadership. In the same way, ref. [55] establishes a connection between integrity and trust and its positively impact on corporate reputation. This criterion will be divided into the following sub-criteria:

- ○

- EC (Ethical Commitment): Obviously, we must take into consideration all the ethical background of a company to study its corporate reputation. The study by [56] establishes a series of criteria that have a direct impact on the reputation of companies, among which are corporate ethics statements.

- ○

- SC (Social Commitment): The study [57], the author shows in his work the idea that corporate reputation is a concept that develops as a socially complex process. In this sense, it is mandatory to consider not only financial and business aspects, but also social issues to better understand corporate reputation, with a particular emphasis on sustainability. In [19,42], the concept of social responsibility among the community is considered as a key factor of corporate reputation.

- ○

- NC (Environmental Commitment): The study [58] establishes the importance of considering all of the field of environmental commitments to improve corporate reputation. On the other hand, we also must focus on aspects of environment related regulations [59].

- Net Promote Score (NPS): Net Promote Score is a widely used metric to evaluate three sub-criteria:

- ○

- CR (Customer Rating): This sub-criterion describes customer loyalty and satisfaction. It involves measuring the likelihood of customers recommending the company to others [60].

- ○

- SA (Supplier Assessment): NPS can also be applied to assess the satisfaction and loyalty of suppliers. By surveying suppliers and asking them to rate their likelihood of recommending the company, a supplier NPS can be calculated [61].

- ○

- IA (Internal Assessment): NPS can be used internally to gauge employee satisfaction and engagement [62].

2.3. Measuring Corporate Reputation through Decision Making Applying Fuzzy Logic

Table 2 outlines the publications and citations linked to the search variables TS = (FUZZY LOGIC) AND TS = (CORPORATE REPUTATION) in the Web of Science Core Collection, utilizing journal articles as the sole selection criterion and encompassing the entire available period. The objective of this research was to identify scientific publications related to these concepts.

Table 2.

Studies related to corporate reputation and fuzzy logic.

As can be seen, only four papers can be found which combine the concepts of fuzzy logic and corporate reputation. This could indicate that it is a field to be fully explored and to be able to extrapolate the use of fuzzy logic in a field that requires more and more help in multi-criterion decision making.

The subsequent section introduces the proposed methodology for developing a new model, marking a significant milestone in the existing literature. This model will be tested in a real case involving a group of Spanish companies in their supplier selection process.

3. Methodology

The objective of utilizing the fuzzy 2-tuple linguistic model (LD2T) and the analytic hierarchy process (AHP) in the decision-making process is to enhance the accuracy and effectiveness of decision making by incorporating linguistic uncertainty and hierarchical structuring.

The LD2T linguistic model allows for the representation and manipulation of linguistic variables in decision making. It enables the expression of subjective judgments using linguistic terms, such as “high”, “medium”, and “low”, instead of precise numerical values [69]. This linguistic approach helps capture the imprecision and vagueness inherent in human judgments, making decision making more expressive and aligned with human reasoning.

On the other hand, the analytic hierarchy process (AHP) is a structured decision-making technique that breaks down complex decisions into a hierarchical structure of criteria and alternatives. It allows decision makers to evaluate the relative importance of different criteria and make informed choices based on their preferences [70]. AHP provides a systematic framework for evaluating alternatives, considering multiple criteria, and synthesizing judgments to arrive at a final decision.

By combining the LD2T linguistic model and the AHP, decision makers can incorporate linguistic uncertainty, subjective judgments, and hierarchical structuring into the decision-making process. This integration enables a more comprehensive and robust decision analysis, facilitating better-informed decisions that align with the preferences and values of the decision makers [71].

3.1. The 2-Tuple Model (LD2T)

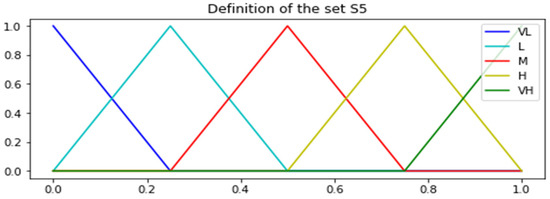

The 2-tuple linguistic model, originally proposed by F. Herrera and L. Martinez [69], offers a solution to mitigate information loss during computations by incorporating linguistic labels. This model is designed to enhance the precision of information representation by consolidating it into linguistic values. In the upcoming sections, we will present a succinct overview of the 2-tuple linguistic representation model and its computation system. Its objective is to enhance the precision of information representation by condensing it into linguistic values (), where and . Generally, the 2-tuple linguistic representation model employs a triangular function as the membership function. Figure 3 provides a visual representation of the S5 domain using this triangular function.

Figure 3.

Definition of the set in a domain .

Definition 1.

Let us define a set of linguistic terms, , where k is a number and β ∈ [0, k] represents a value within the specified range of S. To represent these terms using triangular functions, we assign a symbolic representation to each linguistic item, denoted by, , which corresponds to a number in the interval [−0.5, 0.5). This numerical value signifies the difference between the information obtained through a symbolic operation and the given value and its nearest integer value, .

Definition 2.

Contemplate a collection of linguistic terms, , and the set , along with a value representing the result of a symbolic operation. We can derive the linguistic 2-tuple corresponding to β using the following function:

where denotes the standard rounding operation, represents the linguistic label closest to , and represents the symbolic translation value. Thus, we establish an association between a value within the interval and a 2-tuple within the set .

Definition 3.

Let be a collection of linguistic terms, where represents the linguistic value 2-tuple that corresponds to . We can obtain the linguistic value 2-tuple by employing the following function:

Now, let us examine the computational model associated with this framework. For that purpose, we define the following operators:

2-tuple linguistic comparison operators. When presented with two 2-tuple linguistic values and representing amounts of information:

- If , then is less than .

- If , then

- (a)

- If , then and represent identical information.

- (b)

- If , then is less than .

- (c)

- If , then is greater than .

Aggregation operators for 2-tuple linguistic values,

Definition 4.

Let constitute a collection of 2-tuple linguistic values , and represent their corresponding weights, where , then, in this scenario, the 2-tuple weighted average is defined by :

3.2. AHP Method

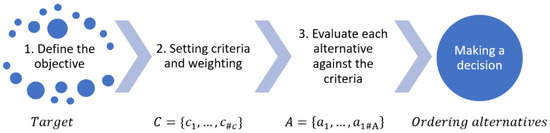

In everyday situations, including the business realm, decision making plays a vital role. We encounter complex problems regularly, which pose challenges due to the involvement of multiple criteria, sub-criteria, and alternatives [72].

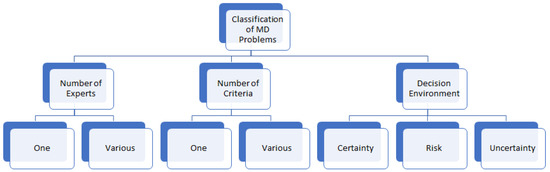

The decision-making process involves consideration of various crucial factors. These factors encompass the number of criteria, the decision environment, and the engagement of experts [73]. Figure 4 offers an overview of these factors.

Figure 4.

Classification of making decision problems.

- Number of criteria: In cases where multiple criteria are involved, it signifies a multi-criterion decision-making (MCDM) problem. MCDM problems pose a greater level of complexity compared to single-criterion problems, as they involve the integration of diverse information.

- Decision environment: The decision environment classification hinges on the extent of knowledge regarding the involved factors. An environment is deemed certain when all factors are precisely known. Conversely, if the available information lacks precision or specificity, it characterizes a decision problem under uncertainty. Furthermore, the inclusion of chance in any of the factors designates the environment as risky.

- Involvement of experts: When multiple experts engage in the decision-making process, it adds a layer of complexity. The need arises to amalgamate information from all experts to address the problem effectively. Considering diverse viewpoints can contribute to a more satisfactory solution. This form of decision making is commonly known as group decision making (GDM).

These factors wield substantial influence on the decision-making process and merit due consideration for effective and informed decision making. In enterprise environments, it is common to encounter multi-criterion decision-making problems involving both multiple criteria and experts (MCDM-ME).

An established model for Multi-Criterion Decision Making (MCDM) is the Analytic Hierarchy Process (AHP) [70]. This method, formulated on mathematical and psychological principles, is tailored to tackle intricate multi-criterion problems [74].

The distinguishing characteristic of the AHP model lies in its hierarchical structure for modeling decision problems. The top level represents the objective to be achieved, with criteria and sub-criteria featured at the second level. Through pairwise comparisons with other criteria, the weights of each criterion can be determined. Subsequently, each criterion is compared with the available alternatives. This process facilitates the precise and dynamic determination of the relative importance of one alternative over another in the decision problem. Utilizing an additive aggregation approach, the overall contribution of each alternative to the primary objective is calculated by assessing their contributions to higher-level elements in the hierarchy [75].

3.2.1. Structuring the Decision Model through Hierarchical Process

In the context of decision making, the hierarchical structuring of the decision model involves organizing various elements of the decision problem in a tiered manner. This systematic approach aids in the organization and analysis of decision factors, ultimately improving the effectiveness of the decision-making process. The hierarchical process entails breaking down the decision problem into different levels or tiers, each characterized by commonalities and relationships. At each level, distinct components contribute to the comprehensive understanding and evaluation of the decision at hand.

The uppermost tier of the hierarchy is generally reserved for the objective or target to be accomplished. This tier represents the goal or purpose of the decision-making process, offering a clear direction and establishing the context for the lower levels of the hierarchy.

The second level of the hierarchy consists of criteria, denoted as These criteria represent the key factors or dimensions that are essential in the decision-making process. They are selected based on their significance and relevance to the objective. Criteria can vary depending on the nature of the decision problem and can range from quantitative metrics to qualitative considerations.

Within each criterion, there can be further subdivisions, called sub-criteria, represented as , . These sub-criteria help in capturing more specific details and aspects related to each criterion. Sub-criteria provide a finer level of granularity, allowing decision makers to consider and evaluate various facets within each main criterion.

Finally, at the lowest level of the hierarchy, there are alternatives or options, denoted as . Alternatives represent the different choices or courses of action available to address the decision problem. These alternatives are evaluated and compared against the criteria to determine their suitability and compatibility with the desired objective.

The hierarchical structure of the decision model visually depicts the relationships and interdependencies among the objective, criteria, sub-criteria, and alternatives. It provides a clear framework for understanding the decision problem, identifying the relevant factors, and systematically evaluating different options. By organizing the decision model in a hierarchical process, decision makers can gain a comprehensive overview of the decision problem and its components. It facilitates a structured approach to decision making, ensuring that all relevant factors are considered and evaluated in a systematic manner. This approach enhances the clarity, transparency, and effectiveness of the decision-making process, ultimately leading to more informed and robust decisions.

Figure 5 illustrates the hierarchical structure of the decision problem, providing a visual representation of the relationships and interdependencies among the objective, criteria, sub-criteria, and alternatives.

Figure 5.

Analytic hierarchy process (AHP).

3.2.2. Criteria, Sub-Criteria, and Weighting

The Analytic Hierarchy Process (AHP) is a decision-making method that involves setting criteria and weighting them to determine their relative importance in the decision-making process. This step is crucial in the AHP model as it allows decision makers to prioritize criteria based on their significance and impact on the overall objective.

- Identification of Criteria: The first step in setting criteria in an AHP model is to identify and define the criteria that are relevant to the decision problem. Criteria should be specific, measurable, and directly related to the objective. They can be quantitative or qualitative in nature, depending on the nature of the decision.

- Establishing a Hierarchy: Once the criteria are identified, they are structured in a hierarchical manner. The top level of the hierarchy represents the objective or goal to be achieved. The second level consists of the main criteria, and if necessary, these criteria can be further divided into sub-criteria in lower levels.

- Pairwise Comparison: In AHP, decision makers compare the criteria pairwise to determine their relative importance, as result we obtains the comparison matrix, , where represents the importance of criterion relative to criterion . Decision makers assign numerical values indicating the relative importance or preference of one criterion over another. A scale is typically used to assign values, such as 1 (equally important), 3 (moderately important), 5 (strongly important), and so on, Table 3.

- Deriving Priority Weights: The pairwise comparison results are used to derive priority weights for the criteria. These weights reflect the relative importance of each criterion with respect to the objective. Several mathematical methods, such as the eigenvector method, are employed to calculate the priority weights based on the pairwise comparison matrix.

- Consistency Check: A consistency check is performed to ensure the reliability of the pairwise comparisons. Consistency measures, such as the Consistency Ratio (CR), are calculated to assess the consistency of the decision maker’s judgments. If the CR exceeds a certain threshold, it indicates inconsistency, and adjustments to the pairwise comparisons may be required.

The CR is determined by calculating the quotient between the Consistency Index (), defined as , and the Random Consistency Index (), Table 3.

Table 3.

Random consistency values [64].

Table 3.

Random consistency values [64].

| n | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Random Consistency Index (RI) | 0.00 | 0.00 | 0.58 | 0.9 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 |

If the calculated Consistency Ratio (CR) meets the predefined Consistency Limits specified in Table 4, it indicates that the outcomes of the individual hierarchical comparisons adhere to the consistency criteria.

Table 4.

Consistency limits [64].

- Sensitivity Analysis: Sensitivity analysis can be conducted to examine the impact of changes in the pairwise comparisons on the priority weights. This analysis helps in understanding the robustness of the criterion weights and their influence on the final decision [76].

By setting criteria and weighting them in an AHP model, decision makers can systematically assess the relative importance of different criteria in relation to the objective. This process provides a structured and quantifiable approach to decision making, enabling informed and rational choices based on the priorities assigned to the criteria.

3.3. Treatment of Heterogeneous Information

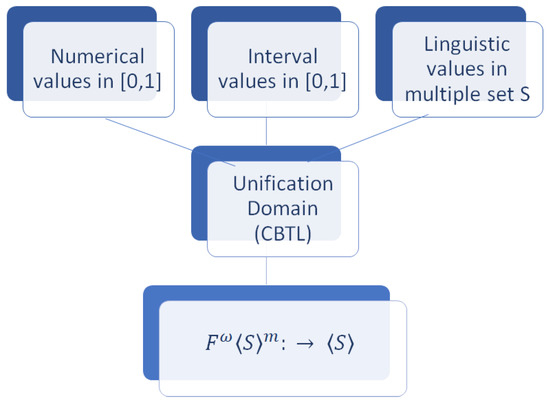

The techniques used in the CBTL domain for treating heterogeneous information include data fusion methods, natural language processing techniques, machine learning algorithms, and data integration approaches. These tools enable the coherent and efficient combination and analysis of data from different sources, thus facilitating decision making based on heterogeneous information.

In this research, our objective is to integrate diverse information by employing a 2-tuple linguistic information domain [77]. The unification process begins by establishing the Basic Set of Linguistic Terms (CBTL), which forms the basis for the analysis and computation in our study.

To determine the CBTL domain, denoted as , a set of linguistic terms is identified, offering the highest level of granularity within the heterogeneous framework [78]. This careful selection ensures the retention of the highest level of information within the linguistic domain. After establishing the CBTL set, we then proceed to adjust the various expression domains to align with this selected set.

Information can exist in various domains, including numerical, interval, and linguistic [70], as depicted in Figure 6. Our methodology endeavors to attain a holistic and cohesive representation of diverse information, enabling effective analysis and interpretation within a unified linguistic framework. Aligning various expression domains with the chosen CBTL set facilitates seamless integration and comparison of information from disparate sources, leading to more precise and meaningful insights.

Figure 6.

Unified CBTL domain.

For the specific case under consideration, we will encounter information that exists in both a linguistic domain, denoted as S5, and a numeric domain. To facilitate the integration and analysis of these two types of information, we need to establish a transformation from the numeric domain to the linguistic domain. The transformation from a numeric to a linguistic domain involves mapping numerical values to corresponding linguistic terms. This mapping is defined based on predetermined linguistic scales or membership functions that assign linguistic labels or terms to specific numerical ranges or values. By applying these mappings, we can convert numerical data into linguistic expressions that convey the same meaning or information.

Definition 5.

Taking into account a numerical value , and a set , if there is a numerical value within the CBTL domain, we define the numerical transformation function, :

where [0, 1] is the degree of association of n a ∈ .

By performing this transformation, we enable the integration and comparison of information from the linguistic and numeric domains within a unified linguistic framework. This approach allows for a more comprehensive analysis and interpretation of heterogeneous data, enhancing the accuracy and depth of insights derived from the information at hand. Once we have consolidated the heterogeneous information into a 2-tuple linguistic domain, we can perform specific operations on the LD2T domain. These operations are designed to yield interpretable results, bringing together diverse evaluations within a single domain for a specific criterion.

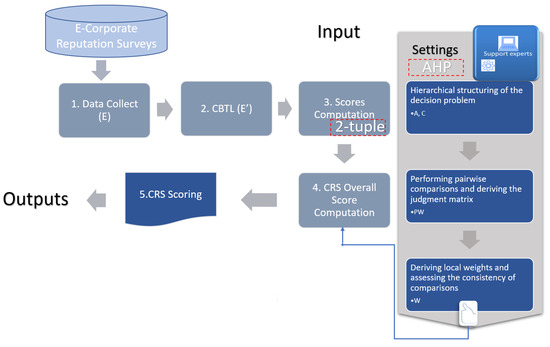

4. Proposed Model: Determining the Corporate Reputation Score (CRS)

The new Corporate Reputation Score (CRS) proposed in this document, Figure 7, is based on determining any company’s score by considering the following criteria and sub-criteria, identified in Section 2, Literature Review of this paper:

Figure 7.

Proposed model (CRS).

- CP (Capability): Our company stands out for a wide range of capabilities and skills that support our unique value proposition. This criterion will be divided into the following sub-criteria:

- ○

- PP (Profit Projection): measuring growth and competitive advantage, we will use a growth projection using a numerical variable (% growth).

- ○

- IT (Innovation): the ability to innovate and adapt to a changing digital environment will be measured in a linguistic range in .

- ○

- BQ (Quality of Business Management): the capacity and quality of business management will be measured in a linguistic range in .

- BV (Benevolence): This refers to the motives and intentions of the company. This criterion will be divided into the following sub-criteria:

- ○

- RC (Respect for Consumer Rights): respect for consumer rights will be measured in a linguistic range in .

- ○

- PS (Quality of product–service): the quality of the product/service will be measured in a linguistic range in .

- ○

- LQ (Labor quality): the quality of the workforce will be assessed within a linguistic range in level .

- INT (Integrity): This refers to the principles and values that govern the behavior of the company, and its ethical, social, and environmental commitment. This criterion will be divided into the following sub-criteria:

- ○

- EC (Ethical Commitment): ethical commitment will be measured in a linguistic range at .

- ○

- SC (Social Commitment): social engagement will be measured in a linguistic range at S5.

- ○

- NC (Environmental Commitment): engagement with the environment will be measured in a linguistic range at .

- NPS (Net Promote Score): This criterion will be divided into the following sub-criteria:

- ○

- CR (Customer Rating): the customer’s rating will be measured in a linguistic range in .

- ○

- SA (Supplier Assessment): the assessment of external collaborators will be measured in a linguistic range in .

- ○

- IA (Internal Assessment): the internal assessment will be measured in a linguistic range in .

These criteria and sub-criteria will be used to assess a company’s corporate reputation, providing information for improvement in these areas. The overall evaluation (CRS) considers the following functions:

All criteria defined in the model are obtained through auditors (CP, BV, INT) and surveys (NPS) and feedback from business specialists in each company. The following is the process to be followed:

- Collecting data.

- Identify the CBTL expression domain for each criterion and sub-criterion, and apply the 2-tuple model to the collected data.

- Derive a comprehensive evaluation for each interaction using the AHP model.

4.1. Data Collection

Data on each company are gathered through an assessment survey (NPS) and auditor process (CP, BV, INT), for each of the participants in the process, the following information is collected in a linguistic domain, except for the representation domain of Profit Projection (PP) which is numeric, obtaining the following data in a first phase:

The overall CRS value for each company , is obtained as follows:

In this study, and with respect to the specific use case, a five-point scale will be employed for the evaluations . This scale, being linguistic in nature, will be modeled using the set .

4.2. CBTL Domain, Scores Computation

In this step, calculate the 2-tuple scores for the set of linguistic terms.

For each company, it is necessary to calculate the variables:

; and is a number value.

It is necessary to apply the transformation of the variable from a numeric domain to a linguistic domain in , Equation (6). The rest of the variables are in an domain so no additional transformation is necessary. Nonetheless, we will transform this domain into 2-tuple linguistic variables to make effective use of the computational model for 2-tuple linguistic values.

4.3. DML, Overall Score

In this step, we find the value of 2-tuple , which characterizes the score of each evaluation , for each customer using Equation (3). This is performed in such a way that .

We proceed with a weighting process for every sub-criterion comprising each criterion, employing the hierarchical (AHP). Once the pairwise comparison matrix is derived based on the priorities established by the panel of experts, as represented by Equation (4), we obtain the subsequent vector of weights for each sub-criterion.

And finally, the matrix of weights for each of the criteria is obtained,

Once the weights of each sub-criterion have been defined and, consequently, the weights of the criteria that make up the decision problem, we can start to obtain the overall score for each of the companies according to their corporate reputation.

5. Corporate Reputation Model: Practical Application

In this section, we present a practical case study wherein the newly developed Corporate Reputation Score (CRS) model is applied to a sample of 100 medium-sized enterprises (SMEs). The pre-selection process for an Information and Communication Technology (ICT) solution provider for the implementation of an Enterprise Resource Planning (ERP) will result in the identification of 15 companies operating within the technology sector. This dataset serves as an illustrative example to showcase the practical application and efficacy of the CRS model in evaluating the corporate reputation of these companies. The CRS model can serve as a valuable tool for assessing service-providing companies prior to any procurement process, thus serving as a preliminary filter.

5.1. Data Collection

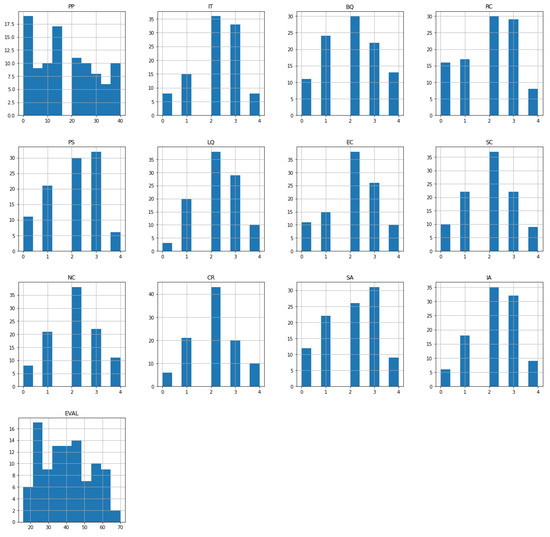

The data gathered for evaluating the performance of the proposed model is depicted in Figure 8.

Figure 8.

Model histogram.

An exploratory analysis of the initial data indicates that the average evaluation follows a right-skewed Gaussian distribution. This implies moderate to high values for the variables. The overall evaluation variables without utilizing weight matrices.

5.2. CBTL Domain, Scores Computation

After placing the variables into the linguistic domain , the initial results have been obtained for a sample of 15 companies in the small and medium-sized enterprise (SME) category operating within the technology sector, specifically those with a workforce ranging from 50 to 249 employees. The results are presented in Table 5.

Table 5.

CRS, Matrix in the Domain.

5.3. DML, Overall Score

During this stage, it is essential to determine the relative importance of each feature in the CRS model before calculating the overall interaction score. To achieve this, we will employ the AHP model, as mentioned earlier.

Using the Saaty scale, a consensus was achieved among the group of experts, and they have provided the following matrix for the criterion:

- Pairwise CRS Global AHP

The individual hierarchical results are deemed satisfactory, and consistency is assured only when , as indicated by Equation (5). In the specific case at hand, CR is calculated to be , confirming the accuracy and reliability of the model’s outcomes.

The weights obtained through the final calculations are as follows: . Therefore, the experts have assigned greater importance to company Integrity, followed by Capability, Net Promote Score, and Benevolence.

Next, the same hierarchical analysis is applied to each of the sub-criteria, resulting in the following matrices, consistency indices, and weights.

- Pairwise CP, AHP

Ensuring the individual hierarchical outcomes are deemed satisfactory, and consistency is guaranteed only when , as indicated by Equation (5). In the specific case at hand, CR is calculated to be , confirming the accuracy and reliability of the model’s outcomes.

The weights obtained through the final calculations are as follows: . Therefore, the experts have assigned greater importance to Capacity and Quality of Business Management, followed by Capacity for Innovation, and Profit Projection.

- Pairwise BV, AHP

Ensuring the individual hierarchical outcomes are deemed satisfactory, and consistency is guaranteed only when , as indicated by Equation (5). In the specific case at hand, CR is calculated to be , confirming the accuracy and reliability of the model’s outcomes.

The weights obtained through the final calculations are as follows: . Therefore, the experts have assigned greater importance to Respect for Consumer Rights, followed by Quality of Product–Service, and Labor Quality.

- Pairwise INT, AHP

Ensuring the individual hierarchical outcomes are deemed satisfactory, and consistency is guaranteed only when , as indicated by Equation (5). In the specific case at hand, CR is calculated to be , confirming the accuracy and reliability of the model’s outcomes.

The weights obtained through the final calculations are as follows: . As observed, the panel of experts has unanimously assigned equal importance to the three sub-criteria: Ethical, Social, and Environmental Commitment.

- Pairwise NPS, AHP

Ensuring the individual hierarchical outcomes are deemed satisfactory, and consistency is guaranteed only when , as indicated by Equation (5). In the specific case at hand, CR is calculated to be , confirming the accuracy and reliability of the model’s outcomes.

The weights obtained through the final calculations are as follows: . Therefore, the experts have assigned greater importance to Internal Assessment, followed by Supplier Assessment, and Customer Rating.

Once the weights have been determined and the entire dataset has been transformed into a 2-tuple domain, we can proceed with data processing to obtain the aggregate score for each of the companies initially considered for ERP implementation.

Table 6, Table 7, Table 8, Table 9 and Table 10 present the Overall CRS model scores for the initially shortlisted companies. Table 6 illustrates the 2-tuple values of the sub-criteria comprising the CP criterion, while Table 7 showcases the 2-tuple values of the sub-criteria constituting the BV criterion. Similarly, Table 8 provides the 2-tuple values for the sub-criteria of the INT criterion, and Table 9 displays the same for the NPS criterion. Finally, Table 10 presents the total aggregate value derived from all criteria (CP, BV, INT, NPS).

Table 6.

CP criterion, score.

Table 7.

BV criterion, score.

Table 8.

INT criterion, score.

Table 9.

NPS criterion, score.

Table 10.

CRS, overall score.

As evident from the selected pool of suppliers for the ERP management system migration, the first five companies can be retained, and the subsequent selection process can proceed based on criteria directly associated with this process. The companies selected based on the established CRS process are as follows, Table 11:

Table 11.

CRS, company pre-selection.

6. Discussion

As observed in the obtained results, if a conventional approach were followed, wherein the scores of each criterion in the selection process were simply summed up, the outcomes would be significantly different from those obtained. For instance, the company with ID = 5 would have a 2-tuple score of (L, 0.083); however, applying the CRS methodology, the value obtained is (H, 0.035). Conversely, in the case of the company with ID = 20, it would have a 2-tuple score of (H, 0.065), but employing the CRS methodology, the value obtained is (M, 0.035); Table 5 and Table 10.

The presented procedure enables the derivation of individual scores based on the chosen criteria and sub-criteria. Nevertheless, the objective of this paper is to propose a functional methodology that can be expanded to incorporate a broader range of criteria, sub-criteria, diverse numerical and linguistic representation domains, and multiple decision makers, with a special consideration for aspects related to sustainability. As a result, it can be employed to determine the level of corporate reputation for any given company.

The outlined criteria offer guidance on how the corporate image of any company can be enhanced, thereby aiding medium-sized companies, which constitute the targeted segment of this study, in progressing towards augmenting their corporate image.

The methodology employed in this paper facilitates the generation of a score and measurement of corporate reputation for any company. We have chosen to focus on the SME segment (50–249 employees) as it constitutes a key component of the Spanish business fabric. Although we have come across studies in the literature that apply to large companies, we have not found a methodology in either scholarly works or practical applications that allows for the assessment of reputational commitment specifically within this segment. If the model is extended to the SME segment, companies would be able to assess collaboration with technology partners while considering the specificities of the administrative specifications and reputation evaluation.

The model exhibits a high degree of flexibility, enabling the incorporation of multiple criteria and sub-criteria while allowing for a customized process of assigning weights to each of them. This adaptability ensures that the model can dynamically adjust to continuously evolving business contexts. Despite the extensive literature reviewed in the state of the art, we have not encountered literature specifically addressing the decision-making process applied to the classification of corporate reputation.

As mentioned in the preceding section, the model can serve as an initial support tool in the supplier selection process, filtering out those providers that do not meet the minimum requirements specified by the contracting company.

Lastly, it is worth noting that the applied methodology can be extended to provide support for solving various decision-making problems within the business domain. Future work could explore the utilization of larger datasets to define a clustering of corporate image for Spanish companies, considering sectors of activity and company size as additional dimensions.

7. Conclusions

Corporate reputation holds significant importance in the field of business. It is regarded as an intangible asset that is arduous for rival firms to duplicate, thus resulting in a sustainable competitive advantage [79]. Multiple researchers have established a robust correlation between corporate reputation and financial performance [80]. An admirable corporate reputation has the potential to generate positive effects on stock returns and risk, thereby contributing to a continuous superior performance [81]. Chief Executive Officers (CEOs) who actively manage their reputation possess a greater understanding of the reputation-enhancing potential of corporate social responsibility (CSR) [82]. Moreover, corporate reputation also plays a pivotal role in the disclosure of CSR and firm performance [83]. As can be highlighted in this paper, corporate reputation significantly influences the perceptions of stakeholders, influences financial outcomes, and possesses the capability to improve economic sustainability.

Based on the concept of corporate reputation as a key to improving corporate and economic sustainability, the conducted study aimed to evaluate the level of corporate reputation among SMEs in the Spanish business landscape. A sample of 100 companies from diverse sectors was utilized for this purpose. In the next phase, we selected the top 15 companies related to the target sector of study and subsequently conducted a selection process to identify the top five positioned companies.

The developed methodology aids in decision-making processes, such as supplier selection. We can collaborate with a set of suppliers that have a reputation evaluation exceeding a certain threshold value, with a particular emphasis on sustainability. Additionally, there is a plan to develop a company clustering process to provide recommendations based on cluster typology. However, due to the limited number of participating companies in this project, it remains open for further exploration in a second phase of work.

The study reveals that the average Spanish medium-sized enterprise has acceptable corporate image data. Nevertheless, in many cases, the awareness of this evaluation is predominantly limited to large companies [35].

To enhance precision and applicability, it is advisable to carry out industry-specific investigations when implementing the developed model. Each sector might possess distinctive criteria essential for its digitalization journey, resulting in potential differences in the number of criteria incorporated into the model. Furthermore, the results obtained from the AHP group decision-making model could fluctuate depending on the specific characteristics and demands of individual sectors.

By conducting sector-specific analyses, organizations can customize the evaluation and decision-making processes to align with the unique needs of their respective industries. This approach facilitates a more comprehensive and precise assessment of digitalization efforts, enabling the formulation of targeted and effective strategies to address sector-specific challenges and capitalize on opportunities. Customizing initiatives to enhance corporate reputation accordingly allows organizations to navigate the intricacies of their sectors more effectively and maximize the benefits of their digitalization endeavors.

8. Future Works

The results of this investigation, incorporating insights from the latest developments, industry expertise, and reputational requisites specifically tailored for medium-sized enterprises, underscore various avenues for enhancement and potential pathways for future research. These encompass:

- Expand the developed model to encompass diverse industries and utilize it as a robust decision-making procedure applicable to various business contexts, with a specific focus on sustainability.

- Establish an online platform that allows for the evaluation and scoring of a larger number of companies, facilitating a more comprehensive data model for enhanced company clustering and improved recommendation processes.

- Develop an application specifically designed to assess the corporate reputation of companies, with a particular focus on SMEs.

- Investigate the potential of emerging technologies, such as artificial intelligence and automation, in supporting the digital transformation of SMEs and fostering a positive corporate reputation.

- Foster collaboration with industry experts and stakeholders to establish a comprehensive framework for evaluating and enhancing corporate reputation within the SME context.

- Extend the developed model into a comprehensive decision-making methodology that incorporates multi-criterion analysis and caters to multiple decision makers, encompassing various numerical, interval, and linguistic representation domains. Incorporate fuzzy linguistic models to enhance the decision-making process.

- Explore the incorporation of machine learning algorithms and data analytics techniques to recognize patterns and insights associated with corporate reputation and its influence on business performance. Assess the effectiveness of particular strategies in enhancing key performance indicators and overall organizational success.

- Validate the effectiveness and applicability of the devised models and methodologies through empirical research and case studies in real-world settings. Seek input from SMEs and industry experts to continually refine and improve the approaches.

Author Contributions

Conceptualization, G.M.D. and J.L.G.S.; methodology, G.M.D.; software, G.M.D. and J.L.G.S.; validation, G.M.D. and J.L.G.S.; formal analysis, G.M.D. and J.L.G.S.; investigation, G.M.D. and J.L.G.S.; resources, G.M.D.; data curation, G.M.D.; writing—original draft preparation, G.M.D. and J.L.G.S.; writing—review and editing, G.M.D. and J.L.G.S.; visualization, G.M.D.; supervision, G.M.D. and J.L.G.S.; project administration, G.M.D. and J.L.G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Altig, D.; Baker, S.; Barrero, J.M.; Bloom, N.; Bunn, P.; Chen, S.; Davis, S.J.; Leather, J.; Meyer, B.; Mihaylov, E.; et al. Economic uncertainty before and during the COVID-19 pandemic. J. Public Econ. 2020, 191, 104274. [Google Scholar] [CrossRef] [PubMed]

- Grigorescu, A.; Pelinescu, E.; Ion, A.E.; Dutcas, M.F. Human Capital in Digital Economy: An Empirical Analysis of Central and Eastern European Countries from the European Union. Sustainability 2021, 13, 2020. [Google Scholar] [CrossRef]

- Goodridge, P.; Haskel, J.; Wallis, G. Spillovers from R&D and Other Intangible Investment: Evidence from UK Industries. Rev. Income Wealth 2017, 63, S22–S48. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Marrocu, E.; Paci, R.; Pontis, M. Intangible capital and firms’ productivity. Ind. Corp. Chang. 2012, 21, 377–402. [Google Scholar] [CrossRef]

- Simó, P.; Sallán, J.M. Capital Intangible y Capital Intelectual: Revisión, Definiciones y Líneas de Investigación Intangible Capital and Intellectual Capital: Literature Review, Definitions and Agenda for Research. 2008. Available online: www.revista-eea.net (accessed on 13 December 2023).

- Martínez, P.; Rodríguez del Bosque, I. Sustainability Dimensions: A Source to Enhance Corporate Reputation. Corp. Reput. Rev. 2014, 17, 239–253. [Google Scholar] [CrossRef]

- Alon, A.; Vidovic, M. Sustainability Performance and Assurance: Influence on Reputation. Corp. Reput. Rev. 2015, 18, 337–352. [Google Scholar] [CrossRef]

- Gomez-Trujillo, A.M.; Velez-Ocampo, J.; Gonzalez-Perez, M.A. A literature review on the causality between sustainability and corporate reputation: What goes first? Manag. Environ. Qual. Int. J. 2020, 31, 406–430. [Google Scholar] [CrossRef]

- Czinkota, M.; Kaufmann, H.R.; Basile, G. The relationship between legitimacy, reputation, sustainability and branding for companies and their supply chains. Ind. Mark. Manag. 2014, 43, 91–101. [Google Scholar] [CrossRef]

- Barich, H.; Kotler, P. A framework for marketing image management. Sloan Manag. Rev. 1991, 32, 94–101. [Google Scholar]

- Barnett, M.L.; Pollock, T.G. (Eds.) The Oxford Handbook of Corporate Reputation; online edition; Oxford Academic: Oxford, UK, 2012. [Google Scholar] [CrossRef]

- Mayer, R.C.; Davis, J.H.; Schoorman, F.D. An Integrative Model of Organizational Trust. 1995. Available online: https://www.jstor.org/stable/258792?seq=1&cid=pdf- (accessed on 13 December 2023).

- CFombrun, J. List of Lists: A Compilation of International Corporate Reputation Ratings. Corp. Reput. Rev. 2007, 10, 144–153. [Google Scholar] [CrossRef]

- Weigelt, K.; Camerer, C. Reputation and corporate strategy: A review of recent theory and applications. Strateg. Manag. J. 1988, 9, 443–454. [Google Scholar] [CrossRef]

- Yoon, E.; Guffey, H.J.; Kijewski, V. The effects of information and company reputation on intentions to buy a business service. J. Bus. Res. 1993, 27, 215–228. [Google Scholar] [CrossRef]

- Fombrun, C.; Van Riel, C. The reputational landscape: A convergence of research and practice. Corp. Reput. Rev. 1997, 1, 1–16. [Google Scholar]

- Clark, B.H.; Montgomery, D.B. Deterrence, Reputations, and Competitive Cognition. Manag. Sci. 1998, 44, 62–82. [Google Scholar] [CrossRef]

- Fombrun, C.; Shanley, M. What’s in a Name? Reputation Building and Corporate Strategy. Acad. Manag. J. 1990, 33, 233–258. [Google Scholar] [CrossRef]

- Whetten, D.A.; Mackey, A. A Social Actor Conception of Organizational Identity and Its Implications for the Study of Organizational Reputation. Bus. Soc. 2002, 41, 393–414. [Google Scholar] [CrossRef]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate Reputation: The Definitional Landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Walker, K. A Systematic Review of the Corporate Reputation Literature: Definition, Measurement, and Theory. Corp. Reput. Rev. 2010, 12, 357–387. [Google Scholar] [CrossRef]

- Smaiziene, I.; Jucevicius, R. Corporate Reputation: Multidisciplinary Richness and Search for a Relevant Definition. Eng. Econ. 2009, 62. Available online: https://inzeko.ktu.lt/index.php/EE/article/view/11631 (accessed on 13 December 2023).

- Adams, J.E.; Highhouse, S.; Zickar, M.J. Understanding General Distrust of Corporations. Corp. Reput. Rev. 2010, 13, 38–51. [Google Scholar] [CrossRef]

- Shee, P.S.B.; Abratt, R. A new approach to the corporate image management process. J. Mark. Manag. 1989, 5, 63–76. [Google Scholar] [CrossRef]

- Gray, E.R.; Balmer, J.M.T. Managing Corporate Image and Corporate Reputation. Long Range Plann. 1998, 31, 695–702. [Google Scholar] [CrossRef]

- Fombrun, C.J.; Gardberg, N. Who’s Tops in Corporate Reputation? Corp. Reput. Rev. 2000, 3, 13–17. [Google Scholar] [CrossRef]

- Bromley, D. Comparing Corporate Reputations: League Tables, Quotients, Benchmarks, or Case Studies? Corp. Reput. Rev. 2002, 5, 35–50. [Google Scholar] [CrossRef]

- Fryxell, G.E.; Wang, J. The Fortune Corporate ‘Reputation’ Index: Reputation for What? J. Manag. 1994, 20, 1–14. [Google Scholar] [CrossRef]

- Brown, B.; Perry, S. Removing the financial performance halo from Fortune’s “most admired” companies. Acad. Manag. J. 1994, 37, 1347–1359. [Google Scholar] [CrossRef]

- Schwaiger, M. Components and Parameters of Corporate Reputation—An Empirical Study. Schmalenbach Bus. Rev. 2004, 56, 46–71. [Google Scholar] [CrossRef]

- Helm, S. Designing a Formative Measure for Corporate Reputation. Corp. Reput. Rev. 2005, 8, 95–109. [Google Scholar] [CrossRef]

- Walsh, G.; Beatty, S.E. Customer-based corporate reputation of a service firm: Scale development and validation. J. Acad. Mark. Sci. 2007, 35, 127–143. [Google Scholar] [CrossRef]

- Walsh, G.; Beatty, S.E.; Shiu, E.M.K. The customer-based corporate reputation scale: Replication and short form. J. Bus. Res. 2009, 62, 924–930. [Google Scholar] [CrossRef]

- Merco Spain. (s. f.). Available online: https://www.merco.info/es/ (accessed on 13 December 2023).

- Mishina, Y.; Block, E.S.; Mannor, M.J. The path dependence of organizational reputation: How social judgment influences assessments of capability and character. Strateg. Manag. J. 2012, 33, 459–477. [Google Scholar] [CrossRef]

- Puncheva, P. The Role of Corporate Reputation in the Stakeholder Decision-Making Process. Bus. Soc. 2008, 47, 272–290. [Google Scholar] [CrossRef]

- Mahon, J.F. Corporate Reputation. Bus. Soc. 2002, 41, 415–445. [Google Scholar] [CrossRef]

- Petkova, A.P.; Rindova, V.P.; Gupta, A.K. How can New Ventures Build Reputation? An Exploratory Study. Corp. Reput. Rev. 2008, 11, 320–334. [Google Scholar] [CrossRef]

- Roberts, P.W.; Dowling, G.R. Corporate reputation and sustained superior financial performance. Strateg. Manag. J. 2002, 23, 1077–1093. [Google Scholar] [CrossRef]

- Dollinger, M.J.; Golden, P.A.; Saxton, T. The effect of reputation on the decision to joint venture. Strateg. Manag. J. 1997, 18, 127–140. [Google Scholar] [CrossRef]

- Fombrun, C.J. Reputation, Realizaing Value form the Corporate Image; Harvard Business School: Boston, MA, USA, 1996. [Google Scholar]

- Boulton, R.E.; Libert, B.D.; Samek, S.M. A business model for the new economy. J. Bus. Strategy 2000, 21, 29. [Google Scholar] [CrossRef]

- Lusch, R.F. Creating long-term marketing health. Mark. Manag. 2000, 9, 16. [Google Scholar]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Leadbeater, C. New Measures for the New Economy: A Discussion Paper for the Institute of Chartered Accountants in England and Wales; Institute of Chartered Accountants in England and Wales: London, UK, 2000. [Google Scholar]

- Schwaiger, M.; Raithel, S.; Schloderer, M. Recognition or rejection—How a company’s reputation influences stakeholder behaviour. In Reputation Capital; Springer: Berlin/Heidelberg, Germany, 2009; pp. 39–55. [Google Scholar] [CrossRef]

- Schoorman, F.D.; Mayer, R.C.; Davis, J.H. An Integrative Model of Organizational Trust: Past, Present, and Future. Acad. Manag. Rev. 2007, 32, 344–354. [Google Scholar] [CrossRef]

- Brickson, S.L. Organizational identity orientation: The genesis of the role of the firm and distinct forms of social value. Acad. Manag. Rev. 2007, 32, 864–888. [Google Scholar] [CrossRef]

- Lii, Y.-S.; Lee, M. Doing Right Leads to Doing Well: When the Type of CSR and Reputation Interact to Affect Consumer Evaluations of the Firm. J. Bus. Ethics 2012, 105, 69–81. [Google Scholar] [CrossRef]

- Valenzuela, L.M.; Mulki, J.P.; Jaramillo, J.F. Impact of Customer Orientation, Inducements and Ethics on Loyalty to the Firm: Customers’ Perspective. J. Bus. Ethics 2010, 93, 277–291. [Google Scholar] [CrossRef]

- Matuleviciene, M.; Stravinskiene, J. The importance of stakeholders for corporate reputation. Eng. Econ. 2015, 26, 75–83. [Google Scholar] [CrossRef]

- Sarstedt, M.; Wilczynski, P.; Melewar, T.C. Measuring reputation in global markets—A comparison of reputation measures’ convergent and criterion validities. J. World Bus. 2013, 48, 329–339. [Google Scholar] [CrossRef]

- Rindova, V.P.; Williamson, I.O.; Petkova, A.P.; Sever, J.M. Being Good or Being Known: An Empirical Examination of the Dimensions, Antecedents, and Consequences of Organizational Reputation. Acad. Manag. J. 2005, 48, 1033–1049. [Google Scholar] [CrossRef]

- Morgan, R.M.; Hunt, S.D. The Commitment-Trust Theory of Relationship Marketing. J. Mark. 1994, 58, 20–38. [Google Scholar] [CrossRef]

- Stanaland, A.J.S.; Lwin, M.O.; Murphy, P.E. Consumer Perceptions of the Antecedents and Consequences of Corporate Social Responsibility. J. Bus. Ethics 2011, 102, 47–55. [Google Scholar] [CrossRef]

- Deephouse, D.L. Media Reputation as a Strategic Resource: An Integration of Mass Communication and Resource-Based Theories. J. Manag. 2000, 26, 1091–1112. [Google Scholar] [CrossRef]

- Walsh, G.; Mitchell, V.-W.; Jackson, P.R.; Beatty, S.E. Examining the Antecedents and Consequences of Corporate Reputation: A Customer Perspective. Br. J. Manag. 2009, 20, 187–203. [Google Scholar] [CrossRef]

- Williams, R.J.; Barrett, J.D. Corporate Philanthropy, Criminal Activity, and Firm Reputation: Is There a Link? J. Bus. Ethics 2000, 26, 341–350. [Google Scholar] [CrossRef]

- Reichheld, F.F. The One Number You Need to Grow. Harv. Bus. Rev. 2003, 81, 46–55. [Google Scholar] [PubMed]

- Keiningham, T.L.; Cooil, B.; Andreassen, T.W.; Aksoy, L. A Longitudinal Examination of NetPromoter and Firm Revenue Growth. J. Mark. 2007, 71, 39–51. [Google Scholar] [CrossRef]

- Morgan, N.A.; Rego, L.L. The value of different customer satisfaction and loyalty metrics in predicting business performance. Mark. Sci. 2006, 25, 426–439. [Google Scholar] [CrossRef]

- Sacconi, L. A social contract account for CSR as an extended model of corporate governance (II): Compliance, reputation and reciprocity. J. Bus. Ethics 2007, 75, 77–96. [Google Scholar] [CrossRef]

- Sacconi, L. Incomplete contracts and corporate ethics: A game theoretical model under fuzzy information. In Legal Orderings and Economic Institutions; Routledge: London, UK, 2007; pp. 310–350. [Google Scholar] [CrossRef]

- Kasemsap, K. Corporate social responsibility: Theory and applications. In Strategic Human Capital Development and Management in Emerging Economies; IGI Global: Hershey, PA, USA, 2017; pp. 188–218. [Google Scholar]