1. Introduction

Promoting the decarbonization of economic and social development is crucial for China to achieve high-quality development [

1,

2]. The development of NEV is a pivotal strategy for China to realize low-carbon growth, meet its carbon peak and neutrality goals, and surpass global leaders in the automotive industry [

3]. Since 2010, China has implemented subsidy-based industrial policies, including fiscal subsidies and tax incentives, to boost the production and sales of NEVs (

Figure 1) [

4,

5]. By 2015, China became the world’s leading producer and seller of NEVs [

6]. However, while promoting industrial development, these original fiscal and tax policies may lead to “strategic” innovative behaviors [

7]. Companies, in pursuit of policy benefits, focus on the quantity of innovations rather than quality [

8], resulting in issues such as “subsidy dependence”, “fraudulent subsidy claims”, and “strategic innovation” [

9,

10,

11]. These behaviors are inconsistent in promoting the high-quality development of the NEV industry [

12]. Policy dependence has significantly constrained technological innovation in China’s NEV industry, necessitating a shift from selective to functional industrial policies [

13]. To adjust the NEV industry’s supply, optimize its structure, and promote industrial innovation, the “Dual Credit” Policy has been enacted [

14,

15].

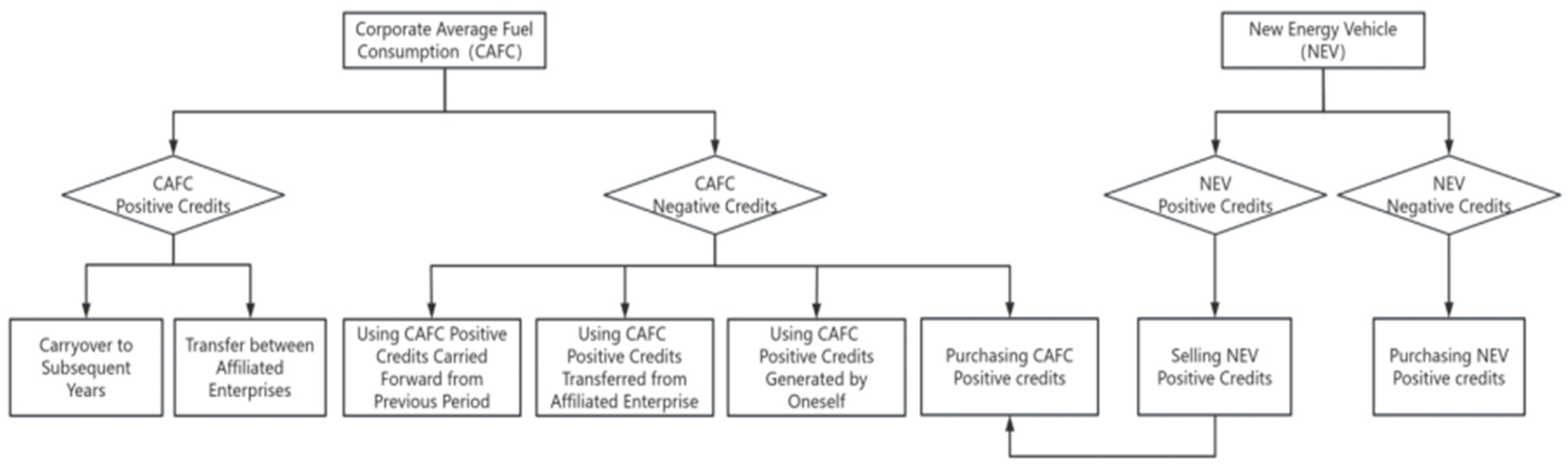

In September 2017, China issued the “Parallel Management Method for Passenger Car Enterprises’ Average Fuel Consumption and New Energy Vehicle Credits” (hereinafter referred to as the “Dual Credit” Policy), which was officially implemented in April 2018. China’s Dual Credit Policy draws on the United States’ Corporate Average Fuel Economy (CAFE) and Zero-Emission Vehicle (ZEV) fuel policies [

16]. The government provides a fair market competition environment by establishing market mechanisms [

17,

18] and encourages companies to enhance their competitive advantages through substantial innovation [

19]. Functional industrial policy raises market technical standards and thresholds, compelling companies to enhance their technical levels to meet market entry requirements (

Figure 2) [

20].

China’s Corporate Average Fuel (CAFC) credit and NEV credit accounting rules involve vehicle performance and corresponding production volume [

21]. Policies influence vehicle performance and production scale by setting standards and implementing incentive measures [

22]. The CAFC and NEV credit systems require automakers to produce a certain proportion of NEVs, and credits are calculated based on vehicle fuel efficiency and the production volume of NEVs [

23,

24].

As shown in

Figure 3, 38 new energy-listed vehicle enterprises are listed in the eastern region, followed by 14 in the central region and 6 in the eastern region. It can be found mainly concentrated in the eastern region. From the point of the company’s new energy credits, BYD credits total 7,653,922, while Chery Automobile is only 41,305; the credit difference between the companies is huge.

The Chinese automobile industry is developing swiftly and steadily on the road to high-quality development, maintaining the world’s top position in the production and sales of NEVs for eight consecutive years [

25]. Production and sales figures of major listed companies for NEVs are shown in

Figure 4. NEVs have provided a brand-new track for transforming and upgrading and high-quality development of China’s automotive industry.

Industrial development is carried out and is implied by the companies. The production and sales of NEVs reached 7.058 million and 6.887 million units, respectively, increasing by 96.9% and 93.4% year-on-year and achieving a market share of 25.6%. Among them, the sales of battery electric vehicles reached 5.365 million units, and plug-in hybrid electric vehicles reached 1.518 million units (

Figure 5).

While the government formulates industrial policies to achieve specific macro-goals, the externalities of the policies significantly impact the business decisions and performance of enterprises, influencing their competitiveness and survival. Previous researchers have focused on investigating consumer satisfaction [

26,

27,

28,

29,

30] and purchase intention [

31,

32] for NEVs through questionnaires. Adolfo Perujo, through a comparative analysis of petrol, diesel, and purely electric vehicles, argues that purely electric NEVs align with the future trend of reducing carbon dioxide requirements in public transport. He asserts that targeted government policies are essential to overcome the initial cost losses and improve the industrial competitiveness of NEVs [

33]. In addition, empirical studies have shown that NEV policies can further enhance firms’ innovation through economies of scale [

34,

35]. However, limited research has examined the significant impact of industrial policies on corporate competitiveness, especially for new industrial policies such as the Dual Credit Policy, which combines credit limits, trading, and penalties. The Dual Credit Policy quantifies target values through credits, compelling companies to increase their efforts in innovation. Especially after 2017, the number of invention patent applications in the new energy industry surged. By 2022, patent applications reached 9815, nearly four times that of 2015. The proportion of invention patents and substantive innovations in the total number of patent applications has also increased, exceeding ninety percent since 2016 (

Figure 6).

However, will the policy affect the competitiveness of companies? What kind of innovation has a significant impact on corporate competitiveness? And what type of companies experience more significant changes in competitiveness? There are questions that have not yet been fully explained from a theoretical perspective.

This study selects listed new energy automobile companies listed in 2014–2022 as a sample. Regression methods were used to analyze the impact of Dual Credit Policy on the total factor productivity of enterprises. The instrumental variable method and a series of robustness tests are used to ensure the accuracy of the results. The heterogeneous characteristics of firms are fully considered. This study also takes innovation ability as a mediator to study its mediating effect, and the results provide an important reference for the construction and upgrading of traditional automobile manufacturing enterprises.

2. Theoretical Analysis and Research Hypotheses

From the perspective of research content, the prior literature on the Dual Credit Policy often considers factors such as supply chains [

36], battery recycling [

37], and charging infrastructure in the context of the substitution effect of subsidy policies [

38]. These studies assess the policy outcomes and impacts from different perspectives and predict the development trends of policy rules. Regarding research methods, many scholars construct decision models, setting hypothetical conditions and different scenarios, and employing a numerical analysis to study the Dual Credit Policy and its impact effects [

39]. The Dual Credit Policy aims to enhance the energy efficiency of passenger cars, establish a long-term mechanism for energy-saving and emission reduction of passenger cars, manage NEVs, and promote the healthy development of the automotive industry [

40,

41]. Enhancing a company’s competitiveness is the foundation for the healthy development of the industry. As a functional industrial policy, evaluating whether the Dual Credit Policy can truly enhance the competitiveness of enterprises after its implementation is important to assess the policy’s effectiveness. The Dual Credit Policy aims to promote enterprise innovation through market regulation by proposing clear market threshold requirements to achieve an overall enhancement in enterprise competitiveness. Therefore, the following hypothesis is proposed:

H1: The Dual Credit Policy can effectively promote corporate competitiveness.

Corporate competitiveness is defined by a company’s unique, non-replicable, and valuable collection of core technologies and skills [

42]. Technological innovation theory suggests that enhancing competitive advantages and enhancing operational performance are primary company objectives. Research indicates a positive impact of R&D investment intensity on corporate competitiveness [

43]. Patent applications are an important indicator for measuring corporate technological innovation [

44]. Patents can be divided into three types in China: invention patents, utility model patents, and design patents. Corporate patent applications represent high-quality, innovative behavior, which can lead to technological advancements and enhance competitive advantages [

45]. Invention patents are seen as high-quality, substantive innovations requiring significant resources and carrying high risk, unlike utility model and design patents, which are less innovative and easier to obtain. Thus, it requires companies to invest significant human and financial resources, and the outcomes of innovation usually have externalities. Therefore, when a company aims to obtain government subsidies and align with government policies and regulatory requirements, it tends to apply for utility model patents and design patents [

46,

47]. The intensity of R&D investment positively impacts corporate competitiveness, and technological innovation is the primary source of corporate competitiveness. Based on the above analysis, this study argues that the Dual Credit Policy can encourage companies to increase substantive innovation to obtain new growth opportunities and enhance their competitiveness. Therefore, the following hypothesis is proposed:

H2: Substantive innovation has a mediating effect on the impact of the Dual Credit Policy on corporate competitiveness.

The Dual Credit Policy applies to both pure NEV and traditional passenger car companies. The policy aims to promote energy conservation and advocate for the coordinated development of enterprises using new energy [

48]. For traditional car companies, achieving the standard of credits through self-sufficiency is often not feasible. They must obtain points from affiliated companies (e.g., SAIC-GM-Wuling produces macro-mini Wuling to obtain positive points) to offset the negative points of other brands of SAIC or buy positive points from other businesses to offset their negative points (

Figure 7). However, purchasing credits will significantly increase management expenses [

49,

50]; for example, in the first half of 2021, Changan’s management expenses were as high as CNY 2.217 billion, up 93.45% year-on-year. Changan Automobile stated that this was exactly the impact of “allocating new energy credits”.

After implementing the Dual Credit Policy, there is a high demand for positive credit in the market. Traditional car companies are facing greater pressure [

51]. Enhancing competitiveness by increasing R&D efforts and generating more NEV-positive credits is necessary. Therefore, the following hypothesis is proposed:

H3: Traditional automakers emphasize enhancing competitiveness through substantial innovation more than pure NEV manufacturers.

5. Discussion

Different industrial policies significantly impact industry development. China’s NEV industry policy has transitioned from early selective policies to the functional Dual Credit Policy to establish a long-term mechanism promoting NEV industry growth. The current Dual Credit Policy draws lessons from the United States’ ZEV credit policy, which has been shown to promote R&D innovation and technological maturity in the automotive industry [

58]. In China, scholars have also studied the Dual Credit Policy’s incentive effects on corporate technological innovation and its role in industrial development, and findings are confirmed in this study. Under the Dual Credit Policy, NEV companies have enhanced their competitiveness through innovation, as represented by total factor productivity, supporting hypothesis 1.

Studies indicate that the Dual Credit Policy promotes technological innovation in NEV companies by regulating the market and setting clear technological thresholds. NEV companies have adjusted their R&D investments’ scale, intensity, and structure, promoting substantive innovation. This study confirms that the Dual Credit Policy enhances corporate competitiveness by encouraging significant innovation, validating hypothesis 2.

Researchers have examined whether the Dual Credit Policy can replace the NEV purchase subsidy policy based on the trade-off between fuel and NEV production and fuel consumption. Properly adjusting the Dual Credit Policy mechanism by setting NEV proportion requirements can lead to increased investment in fuel efficiency for traditional vehicles. This study also verifies that traditional automakers, compared to pure NEV manufacturers, emphasize enhancing competitiveness through substantial innovation, consistent with hypothesis 3.

6. Conclusions and Implications

Using new energy-listed car companies from 2014 to 2022 as the sample, this study investigates the role of the Dual Credit Policy in promoting the competitiveness of NEV enterprises. A vast amount of the literature focuses on the effects after the implementation of the policy. This study emphasizes the functionality of the industrial policy, particularly the high-quality development of the new energy industry. The results show that consistent with the purpose of the Dual Credit Policy, the competitiveness of China’s automobile manufacturing companies has been enhanced after the implementation of the policy. This study explores the mechanisms of competitiveness enhancement and finds that the sample firms have raised their level of competitiveness through increased substantial innovation. Furthermore, a DID model is constructed to explore the extent of the policy’s impact on two types of automobile manufacturers: pure NEV manufacturers and traditional automakers. Traditional automakers must reduce fuel consumption and increase the production of NEVs to meet the credit requirements. This study finds that the traditional automakers are prone to enhancing competitiveness compared with pure NEV manufacturers due to greater policy pressure (

Figure 9).

In terms of research significance, this study is crucial for the sustainable development of the NEV industry; the adjustment of industrial policies is vital for the healthy and sustainable growth of the sector. The development of the NEV industry significantly reduces pollutant emissions in the transportation sector, promotes a high-quality carbon peak, and decreases dependence on oil imports. Industrial policies continue to support NEV development, constantly enhancing their international competitiveness. The Dual Credit Policy, implemented in 2017, has pressured automotive manufacturers to transform their production models, reducing traditional fuel vehicle output and increasing the production of NEV.

This study finds that substantive innovation is an important mechanism for NEVs to enhance their competitiveness. Future research should focus on the impact of R&D personnel, R&D investment, and intensity on corporate competitiveness, which has practical significance for the healthy and sustainable development of enterprises.

This study indicates that the Dual Credit Policy positively impacts the new energy industry, providing an empirical basis for evaluating China’s NEV industry policy. Based on the conclusions of this study, the following policy recommendations are proposed:

China should continue to refine and adjust the Dual Credit Policy to stimulate the motivation for technological innovation in NEV enterprises. It is suggested that the government update credit requirements based on the development of enterprise technology, effectively promoting corporate innovation and achieving high-quality development of the industry.

The NEV industry policy should focus on guiding non-state-owned enterprises. Non-state-owned enterprises are less sensitive to policies and face higher innovation risks, which may weaken their willingness to innovate. The government should consider providing more support for non-state-owned enterprises, such as offering easier access to financing, to reduce their innovation risks and stimulate their innovative vitality.