1. Introduction

With the rapid development of China’s economy, energy consumption has been increasing year by year, leading to tight energy supply and severe environmental pollution. Against the backdrop of global efforts to promote low-carbon development and environmental protection strategies, energy conservation and emission reduction have become key directions for the sustainable development of China’s energy sector. However, the pollutant emissions in China’s power industry remain high, mainly due to traditional thermal power generation and the cogeneration of large thermal power plants. Therefore, how to improve the grid integration and consumption of renewable energy and reduce the pollutant emissions from traditional thermal power generation units has become a new direction for power research. New energy sources such as wind energy have strong competitiveness due to their abundant resource reserves and environmental friendliness. However, the growth of China’s wind power consumption is significantly lagging behind the expansion of its installed capacity. To promote the development of renewable energy sources such as wind power, the government has implemented a series of policies and measures, including encouraging power generation companies to obtain reasonable income compensation through carbon trading and green certificate trading. As the world transitions towards a low-carbon economy, the role of carbon trading and green certificate trading has become more prominent.

At present, China is in the transition stage from a planned economy to a market economy, which provides new opportunities for the reform of the power industry. Power generation rights trading is a special trading behavior under the dual-track operation condition of planned power allocation and market trading, which can ensure the reallocation of power generation resources without changing the existing allocation pattern of power generation units. In April 2018, the National Energy Administration issued the “Notice on Further Promoting the Work Related to Power Generation Rights Trading”, emphasizing that “clean energy generation units are encouraged to replace each other for power generation, and the consumption of clean energy should be strengthened by further promoting the inter-provincial and inter-regional power generation rights trading”. Wind-thermal power generation rights trading is a product of China’s power industry to promote the consumption of wind power, optimize the allocation of power resources, and achieve the goal of energy conservation and emission reduction. As one of the main market ways to promote energy conservation and emission reduction in the power industry, it has been successfully carried out in many regions and has also gained more and more attention. On the one hand, wind-thermal power generation rights trading can promote thermal power units to transfer their planned power supply to wind power units, reduce coal consumption and environmental pollution, and promote energy conservation and emission reduction. On the other hand, wind power units have obtained more on-grid electricity through trading, thus improving the utilization rate of wind energy and effectively promoting the consumption of wind power.

In this context, power generation rights trading has emerged as a key mechanism for promoting renewable energy and reducing carbon emissions. However, the complexity of power systems and the varying objectives of market participants necessitate the development of novel approaches for optimizing bidding strategies in power generation rights trading. This paper proposes a game-theoretic approach for wind-thermal power generation rights trading, incorporating carbon trading and green certificate trading. Our approach builds upon existing research in power system economics and game theory [

1,

2]. The objective of this paper is to formulate an optimal bidding strategy for power generators that encourages their active participation in wind-thermal power generation rights trading, facilitating the consumption of wind power while achieving energy conservation and emission reduction in the electricity industry.

2. Literature Review

In recent years, the installed capacity of wind power in China has been steadily increasing. According to the Global Wind Energy Report 2023 released by the Global Wind Energy Council (GWEC), by 2022, the cumulative installed capacity of wind power in China reached 368.3 GW, accounting for 41% of the global share and firmly holding the top position in the world. However, the volatility of wind power output and the limitations on consumption channels lead China to forgo tens of billions of kilowatt-hours of wind power annually, highlighting the consumption issue as a critical bottleneck in the development of wind power. In this regard, some scholars suggested wind-thermal bundling to promote the consumption of wind power [

3,

4,

5]. Wind-thermal bundling can, to some extent, mitigate the volatility of wind power generation. However, it diminishes the clean energy value of wind power, which is pollution-free, and fails to fundamentally address the challenge of wind power consumption. Other scholars suggested improving the peak regulation capacity of the system to promote the consumption of wind power [

6,

7]. However, there is a lack of profit compensation mechanisms for thermal power units participating in system peak regulation, which leads to a general lack of enthusiasm for thermal power units participating in peak regulation.

To overcome the limitations of methods such as wind-thermal bundling and improve the system’s ability to shift peak loads, some scholars suggest adopting power generation rights trading as a means to boost wind power consumption. Power generation rights trading is a market-based means of energy conservation, emission reduction, and optimal resource allocation, which has been successfully carried out nationwide. In 2003, Li et al. first put forward the concept of power generation rights trading and established a model for it [

8]. Since then, power generation rights trading has gradually become a hot topic of research for many scholars. Shang et al. believed that power generation rights trading is of great significance in reducing carbon emissions and plays an important role in cross-regional power trading [

9]. Chi et al. and Wang et al. have integrated carbon trading into power generation rights trading. They argued that this integration not only achieves a synergistic effect on energy saving and emission reduction but also, while reducing the cost of power generation, increases the profits of the trading parties. Consequently, this approach enhances the enthusiasm of thermal power companies to participate in power generation rights trading [

10,

11]. Zhao et al. incorporated carbon trading and green certificate trading into the traditional power generation rights trading model. They developed a power generation rights trading model aimed at maximizing regional net profits and have proposed an incremental profit distribution method based on the volume of electricity traded [

12]. In terms of wind-thermal power generation rights trading, Xu et al. proposed a wind-thermal power generation rights trading model based on stochastic production simulation and studied a rapid quantitative assessment method to promote the effect of wind power consumption [

13]. Jiang et al., in combination with “Internet +”, proposed a decentralized ultra-short-term wind-thermal power generation rights trading model, which has helped to solve the problem of wind power consumption [

14]. He et al. believed that power generation rights trading could alleviate the serious phenomenon of wind abandonment in the northwest region, which is of great significance in promoting the consumption of wind power [

15]. Ju et al. believed that when carbon trading and green certificate trading are implemented at the same time, they will maximize the promotion of wind power consumption [

16]. Jiang and Yu constructed a dynamic bidding simulation model for various trading entities to participate in wind-thermal power generation rights trading through cellular automata and directed networks [

17]. In the long run, how to make full use of the power generation rights trading mechanism to promote the consumption of wind power is a problem worth further study.

The traditional electricity generation rights trading is primarily conducted under a centralized matching trading model, with the premise of maximizing social welfare, through a high-low matching mechanism for bidding and profit allocation [

18]. There is little research on power generation rights trading between wind-thermal power in a bilateral negotiation trading model. Additionally, in wind-thermal power generation rights trading, the distribution of profits from the trading itself is a key factor in determining the profits for both parties. For the seller of power generation rights (thermal power units), its final income will also be affected by the carbon trading revenue; similarly, for the buyer of power generation rights (wind power units), its final income will also be influenced by the green certificate trading revenue. Yan et al. proposed a random optimal scheduling model combining the Stackelberg game, cross-regional carbon trading, and green trading [

19], believing that the combination of carbon trading and green certificate trading can enhance the income of market participants, thereby stimulating renewable energy generation and limiting the carbon emissions from traditional thermal power units. Liu et al. and Zheng et al. respectively constructed game models by integrating carbon trading and green certificate trading through a comprehensive energy system and multi-market trading mechanisms, both believing that the overall allocation of the two cannot only maximize the profits of both buyers and sellers but also is a feasible and effective way to promote renewable energy power generation and reduce carbon emissions in the power industry [

20,

21].

It is noteworthy that while most of the existing research models carbon trading in conjunction with green certificate trading from various angels, there is a dearth of research that integrates these mechanisms from the specific vantage point of wind-thermal power generation rights trading, particularly on developing a model for combined trading profits. Therefore, this paper will introduce carbon trading and green certificate trading into wind-thermal power generation rights trading under a bilateral negotiation model to analyze the environmental and economic benefits generated. Before the transaction is reached, both parties conduct round-by-round negotiations on the electricity price. Under the premise of incremental profit, both parties are clear about each other’s quotation space and the incremental profit that both parties can gain under this quotation, so this negotiation process can be regarded as a dynamic game under complete information, and the Rubinstein (Ariel Rubinstein) bargaining model is a classic dynamic game model suitable for such research. This paper first utilizes the Rubinstein model to allocate the incremental profit between the two parties involved, based on which the optimal bids of both parties are derived. Secondly, it constructs an energy-saving and emission-reducing model for thermal power units participating in power generation rights trading. Finally, carbon trading and green certificate trading are introduced into wind-thermal power generation rights trading to construct a combined trading revenue model, which determines the final income of both parties in power generation rights trading by profit allocation and optimal quotation.

3. Mathematical Model

3.1. The Rubinstein Model

The wind power unit and thermal power unit have a cooperative relationship through power generation rights trading. In this cooperative process, both parties are committed to maximizing their own profits, leading to a round-by-round negotiation on pricing issues until one party’s offer is accepted by the other, and the bargaining process is also regarded as a cooperative game. The Rubinstein bargaining game model is widely used in bargaining issues in economics, and its main assumptions are as follows:

Hypothesis 1 (rational behavior). Both parties in the game are rational individuals who seek to maximize their own interests.

Hypothesis 2 (full information). Both parties have knowledge of their own and each other’s strategy spaces and payment functions.

Hypothesis 3 (bargaining fixed cost). There will be fixed cost expenditure for each round of negotiation; that is, participants have to bear the expenditure of related negotiation expenses for each round of quotation.

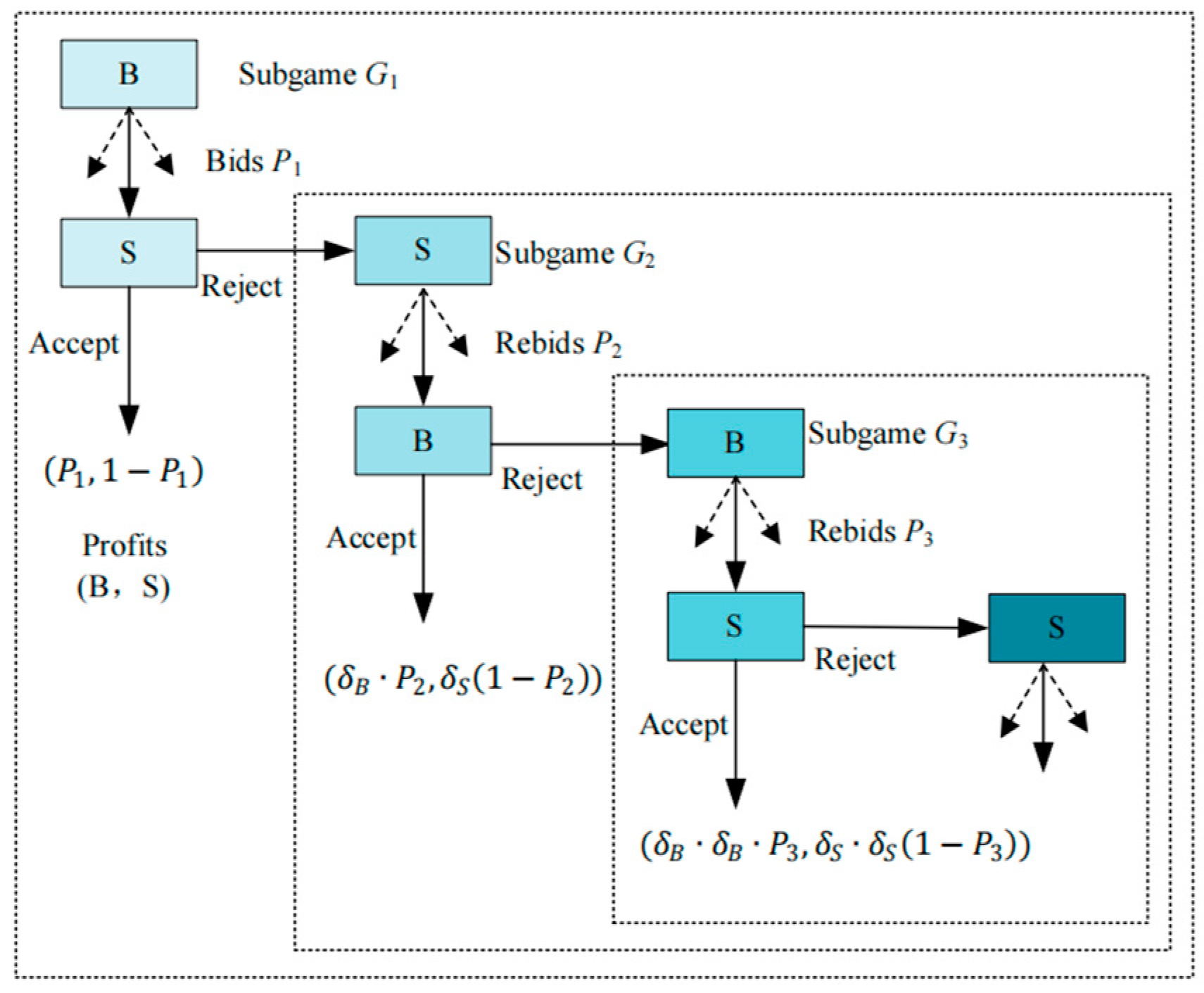

The bargaining model can be described as follows: the two players B and S share the interests, and they take turns to bid and propose the allocation plans. It is assumed that each player will accept an offer from the other if accepting or rejecting the offer has no impact on their interests, and there is no limit to the number of rounds of offers that can be made. After each round of negotiation, the unique perfect Nash equilibrium solution of the subgame is obtained. When player B makes the first offer, B requires that the allocation ratio given to S is (1 )/(1 ), and keeps the self-retention ratio at (1 )/(1 ), which is accepted by S. Similarly, when S makes the first offer, S requires that the allocation ratio given to B is (1 )/(1 ), and keeps the self-retention ratio at (1 )/(1 ), which is accepted by B.

In the model, the discount factor

represents the patience level of the two players involved, and they satisfy

. The bargaining game discussed in this paper is not a display of time value, but an attitude to participate in the game. Therefore, the discount factor can be interpreted as the patience level of the players. As the number of negotiation rounds increases, participants’ estimation of the negotiation costs varies, and their degree of patience will differ accordingly. Here, “patience” actually refers to the economic and psychological endurance of the participants. The greater a participant’s patience, the lower the discount rate, which in turn enlarges the discount factor, thereby amplifying the bargaining power [

22]. Due to the effect of the discount factor, the share X that a participant receives in this stage and the same share X they would receive in the next stage are not equal in value; the share X in the next stage, after discounting, is equivalent to

X of the current stage. Since the size of the “pie” is fixed, the negotiation costs increase with each round, so the “pie” will “shrink” as the number of negotiation rounds increases. Therefore, both parties want to conclude the negotiation as soon as possible; otherwise, even if they secure the same or a larger share in the next round of negotiations, its value may be less than the value of the share obtained in this round. To facilitate understanding, an example is provided below (

Figure 1).

3.2. Incremental Profit Allocation Model for Bilateral Negotiation of Wind-Thermal Power Generation Rights Trading

Under the bilateral negotiation model, there are only two market entities involved: the generation rights seller (thermal power unit) and the generation rights buyer (wind power unit). Both parties reach a transaction through free negotiation. It is important to emphasize that generation rights trading is a relatively special transaction in the electricity market. The relationship between the seller and the buyer, as well as the payment direction, differs from general commodity trading. Specifically, the payment direction in power generation rights trading is opposite to that in general commodity trading. Although the thermal power unit is the seller of generation rights, it only transfers the planned transaction electricity to the wind power unit. This portion of the electricity is completed by the wind power unit, and the thermal power unit needs to purchase electricity from the wind power unit for grid connection. Therefore, the thermal power unit’s quote is the price it is willing to pay to the wind power unit for purchasing this portion of electricity. Similarly, the price quoted by the wind power unit is the price it charges the thermal power unit for selling this portion of the electricity. At the final settlement, the State Grid first settles with the generation rights seller according to the feed-in tariff of the seller, and then the seller completes the payment to the buyer according to the generation rights trading contract signed with the buyer. Therefore, the seller of power generation rights hopes for a lower settlement price, while the buyer hopes for a higher one.

During the negotiations, both parties alternately propose prices for power generation rights, ultimately reaching a consensus. The wind power unit and the thermal power unit each have two optional strategies during the negotiation process: a higher offer strategy and a lower offer strategy. It is assumed that for each unit of electricity, the highest price the thermal power unit is willing to pay is H, and the lowest price the wind power unit can accept is L. H and L are the reservation prices of both parties, and the difference between the transaction price and the reservation price represents the incremental profit allocated to the traders. Therefore, as long as the negotiation can reach an agreement, the transaction will bring about incremental profits. Corresponding to the choices made by both parties, the profit allocation is illustrated in

Figure 2.

Regarding the profit matrix in

Figure 2, the following explanations are provided: if both parties choose the H strategy for the transaction after the deal is concluded, the thermal power unit will receive an incremental profit of 0, while the wind power unit will receive

; if both parties choose the L strategy after the deal is concluded, the thermal power unit will receive

as incremental profit, while the wind power unit will receive 0; if thermal power chooses the L strategy and wind power chooses the H strategy, the negotiation will fail, and both parties will receive an incremental profit of 0; if thermal power chooses the H strategy and wind power chooses the L strategy, then both parties will determine the final transaction price through rounds of negotiations. The process of bargaining can be seen as a process of allocating the incremental profit between the two parties. According to the Rubinstein bargaining model, the incremental profits per unit of electricity transacted and the optimal offer prices for both parties are as follows:

In the above model, (1) represents the incremental profit allocation when wind power makes the first offer; (2) represents the incremental profit allocation when thermal power makes the first offer; (3) represents the optimal offers for both parties in the transaction. and represent the incremental profits earned by wind power and thermal power per unit of electricity traded, respectively. and represent the optimal bidding prices for wind power and thermal power for each unit of electricity traded.

3.3. Energy Conservation and Emission Reduction Model

To study the energy conservation and emission reduction effect of thermal power units after transactions, the standard coal consumption rate and the carbon emission coefficient of standard coal are important parameters. The standard coal consumption rate refers to the amount of standard coal consumed to produce a unit of electrical energy (1 MWh). The carbon emission coefficient refers to the amount of carbon emissions generated by consuming a unit of standard coal (1 ton). Assuming that the standard coal consumption rate and carbon emission coefficient of the thermal power unit are

and

, respectively, and these two parameters remain unchanged during the trading period, the energy conservation and emission reduction model can be expressed as follows:

In the equation, E and C respectively represent the amount of standard coal saved and the reduced CO2 emissions of the thermal power unit after the transaction.

3.4. Combined Trading Revenue Model

Carbon trading in the electricity market is a mechanism where low-emission power units, upon having actual carbon emissions below their initial allocated quotas, can sell their surplus carbon emission rights to reap revenue. Conversely, high-emission power units must purchase carbon emission permits in the market to evade steeper penalties resulting from excessive emissions. This market-driven carbon trading strategy not only achieves significant environmental benefits at a reduced cost but also minimizes political opposition. It further incentivizes thermal power units to enhance their carbon emission reduction technologies, contributing to the reduction in carbon emissions in China’s power industry.

Green certificate trading entails the process where, if a power generation company or electricity user possesses more green certificates than their mandated quota, they can monetize their excess certificates by selling them for profit. Conversely, those who fall short of their quota are required to purchase green certificates in the designated trading market to avert potential penalties.

Assuming the transaction volume between the two parties is denoted as

, and the feed-in tariff and generation cost of thermal power are represented by

and

, respectively, the combined trading revenue model for both parties can be expressed as follows:

In the equation, and denote the respective final profits garnered by wind power and thermal power following their engagement in the combined transaction. and represent the prices of green certificates and CO2 emissions, while and correspond to the quantities of green certificates and CO2 emissions traded.

4. Discount Factors Analysis and Empirical Study of Incremental Profit Allocation

4.1. Parameter Setting

This paper investigates how both wind power and thermal power can gain increased profits by participating in power generation rights trading, which in turn motivates them to actively engage in such transactions, assuming the relevant parameters for both parties in the trade are as shown in

Table 1.

The green certificate price and the carbon trading price are determined as follows:

- (1)

Determination of Green Certificate Price

The green certificate voluntary subscription online trading platform was officially launched in July 2017. This paper utilizes data from China’s Green Certificate Subscription Platform to evaluate and determine the price of green certificates. As shown in

Figure 3, the volatility of green certificate prices in recent years exhibits a three-tier “ladder” characteristic and a downward trend over time. With the gradual improvement of the trading mechanism for new energy participation in the electricity market, the price of wind power green certificates has also gradually declined, fluctuating between 0 and 50 Yuan per unit. In this study, given the importance of stability and timeliness, we primarily consider the most recent price trends close to the current time as samples for estimation, specifically selecting samples after January 2023. Among the 132 sample points after 2023, data within the 0-to-50-Yuan bracket represent a significant majority, constituting 92.42% of the total observations. Therefore, it can be considered that there is a high probability that the future price of green certificates will fluctuate within the range of [0, 50]. For the convenience of calculation and considering the price trend of green certificates, the mode of 30 Yuan is chosen as the estimated future price of green certificates.

- (2)

Determination of Carbon Trading Price

Considering the availability and completeness of data, the mean carbon prices of the seven major carbon markets in Beijing, Shanghai, Guangdong, Tianjin, Shenzhen, Hubei, and Fujian (from August 2013 to March 2021) are selected, and their distribution is shown in

Figure 4. It can be seen from the figure that the carbon trading price roughly follows the pattern of normal distribution. Therefore, it can be assumed that the carbon trading price satisfies the normal distribution with a mean of 26.81 and a standard deviation of 10.32. Through correlation analysis, the correlation coefficient between carbon trading price and green certificate price is 0.048, indicating a very weak correlation between the two. Thus, they can be considered as independent variables.

Wind power participates in power generation rights trading by quoting

to the thermal power unit. To guarantee that wind power does not suffer losses following its participation in the transaction, it is essential to fulfil the following conditions:

Before participating in power generation rights trading, thermal power could generate a profit of 200 Yuan per megawatt-hour (MWh). After allocating the intended transaction volume to wind power and offering a price of

, it is essential that the remaining profit exceeds 200 Yuan/MWh, in accordance with the subsequent condition:

According to conditions (6) and (7), the minimum acceptable price L for wind power is 50 Yuan/MWh, and the maximum acceptable quote H for thermal power is 150 Yuan/MWh. Consequently, the incremental profit is 100 Yuan/MWh.

4.2. Analysis of Discount Factors for Incremental Profit Allocation between Transacting Parties

- (1)

Discount Factors

Based on

Section 3.1, this paper mainly considers the level of patience in analyzing the discount factor, with its core being the discount rate. The following functional relationship is thus established:

In the equation, is the discount factor of the trading party and is the discount rate of the trading party, where B, S (with B and S denoting the different parties involved in the transaction, such as the buyer and the seller).

In this section, the selected range of values for the discount factor is (0, 1). Under different bidding orders,

Figure 5 shows how the incremental profit of 100 Yuan/MWh is allocated between the two parties as the discount factor changes. (a) and (b) simulate the distribution trend of incremental profit between the two trading parties when wind power bids first and the discount factor varies within (0, 1) (both parties can have the same or different levels of patience). Similarly, (c) and (d) simulate the distribution trend of incremental profit when thermal power bids first and the discount factor varies within (0, 1) (both parties can have the same or different levels of patience).

According to

Figure 5, it can be observed that whether it is wind power or thermal power that bids first, the proportion of incremental profits allocated to the trading parties increases as their own discount factor increases and decreases as the opponent’s discount factor increases. This indicates that when a trading party’s bargaining power strengthens, the incremental profit it receives will increase, and when the opponent’s bargaining power strengthens, the incremental profit it receives will decrease.

Figure 5 primarily simulates the impact of the discount factor on the distribution of incremental profits. However, the effect of the bidding order on the distribution of incremental profits is not directly observable in

Figure 5. Therefore, it is necessary to conduct separate research on how the bidding order affects the distribution of incremental profits.

- (2)

Bidding Order

For ease of analysis, this section will select some discrete points on the interval (0, 1) and assume that both parties have the same discount factor. According to Equations (1) and (2), the allocation of the 100 Yuan/MWh incremental profit between the two parties as the discount factor changes is shown in

Figure 6. Among them, (a) shows the proportion of incremental profits allocated to wind power when wind power bids first, and both parties have the same discount factor that varies synchronously within the range (0, 1); (b) shows the proportion of incremental profits allocated to thermal power when thermal power bids first, and both parties have the same discount factor that varies synchronously within (0, 1).

As shown in

Figure 6, under the premise that both parties have the same level of patience (the same discount factor), provided that the patience level of both parties falls between complete patience (discount factor close to 1) and complete impatience (discount factor close to 0), the party who bids first will have a first-mover advantage and always obtain more incremental profit than the party who bids second.

4.3. Empirical Study

This section takes the transaction volume of 1 MWh as the research object and lists in detail the transaction results obtained by setting different discount factor values under the conditions of wind power bidding first and thermal power bidding first, as shown in

Table 2 and

Table 3. Through multiple calculations, this paper has found that the setting of discount factor values only affects the numerical size of the final results and does not affect the conclusion. Additionally, the purpose of the empirical study is not to identify in which situation the gains of the trading parties are the greatest, because the Rubinstein game model discussed in this paper explores how to determine the optimal bids of both trading parties under the condition of certain discount factors and bidding orders, and then calculate the optimal return in this situation. Therefore, when both parties have the same level of patience,

and

are selected as 90%; when the patient level of the wind power unit is lower than that of the thermal power unit,

is set at 70% and

is set at 90%; when the patient level of the thermal power unit is lower than that of the wind power unit,

is set at 90% and

is set at 70%.

To facilitate the readers’ verification, the specific calculation process for the first scenario in

Table 2 (

=

= 90%) is provided below. The calculation processes for other scenarios are similar and will not be further elaborated.

Calculation process for the first scenario ( = = 90%):

According to Equation (1), it can be deduced that for each unit of transaction electricity, the 100-Yuan incremental profit is, respectively, allocated between wind power and thermal power as 52.63 Yuan and 47.37 Yuan. Based on Equation (3), the optimal bidding prices for wind power and thermal power are determined to be 102.63 Yuan.

For wind power, with a generation cost of 50 Yuan, power generation rights trading brings a profit of 52.63 Yuan. Additionally, by selling one green certificate, the revenue obtained is 30 Yuan. According to Equation (5), the final profit for wind power amounts to 82.63 Yuan.

For thermal power, with a feed-in tariff of 350 Yuan and an optimal bidding price of 102.63 Yuan, the revenue generated from power generation rights trading is 247.37 Yuan. According to Equation (4), for every 1 MWh of electricity that thermal power reduces, it can save 320 kg of standard coal and reduce carbon emissions by 0.83 t. If the saved carbon emission quotas are sold, it can obtain an income of 22.31 Yuan. According to Equation (5), the final income for thermal power is 269.68 Yuan.

Based on

Table 2 and

Table 3, it can be concluded that: ① after participating in power generation rights trading, both parties involved in the transaction have realized a net increase in profits above their pre-transaction levels, concurrently facilitating the absorption of wind power while advancing energy conservation and emission reduction; ② when carbon trading and green certificate trading are introduced into power generation rights trading, the final profits obtained by both parties will be higher; ③ the discount factor specifically affects the allocation of incremental profits in power generation rights trading, without impacting the earnings from carbon and green certificate trading; ④ when the discount factors of both parties are the same, the party that makes the first offer has a certain first-mover advantage and can obtain more incremental profits than the party that quotes later; ⑤ when the discount factors of the two parties vary, each party’s share of the incremental profits escalates with an increase in their own discount factor, while it diminishes in response to an increase in the other party’s discount factor.

5. Conclusions

This study explores the feasibility of incorporating carbon trading and green certificate trading as incentives within wind-thermal power generation rights trading, aiming to boost the enthusiasm of thermal power entities to participate and effectively foster wind power consumption, against the backdrop of market-oriented reforms in the power industry. By constructing an energy conservation and emission reduction model and establishing a combined trading revenue model based on the Rubinstein game model, this study analyzes the economic and environmental benefits brought by the combined trading. The results show that after introducing carbon trading and green certificate trading into wind-thermal power generation rights trading, the combined trading revenue model can effectively increase the economic benefits of both parties to the transaction. This compensates thermal power units for their role in peak load adjustment, enhancing their enthusiasm to participate in generation rights trading and supporting system peak load adjustment, which in turn helps to reduce the pollutant emissions of the power industry. In addition, by participating in the transaction, wind power units obtain more power generation shares, thereby improving the utilization rate of wind energy and reducing the occurrence of wind power curtailment. This ultimately contributes to the optimization of resource allocation and the promotion of wind power consumption.

It should be pointed out that the models in this paper are based on certain assumptions, and if the assumptions change, the models also need to be adjusted accordingly. In practical application, it is also necessary to consider the characteristics of wind power itself, such as intermittence, randomness, uncertainty of output power, and high difficulty in prediction. The problem of wind power consumption, as a global issue, has not been fundamentally solved. How to use technologies such as artificial intelligence and big data analysis to improve the accuracy and real-time nature of wind power forecasting, thereby effectively reducing the impact of wind power intermittence and randomness, is an important direction for future research.