1. Introduction

Mongolia is ranked among the top 10 resource-rich countries globally, boasting over 80 types of mineral resources, including copper, coal, and iron ore. The mining sector accounts for over 20% of the GDP and more than 80% of total exports, thus driving the national economy. However, the economy is highly susceptible to fluctuations due to external factors such as international price changes of raw materials and slowing economic growth in major export destinations like China [

1]. However, in recent years, Mongolia has been pursuing digital transformation and policy reforms to move away from its high dependence on the mining sector in its economic and industrial structure [

2]. As a result, significant advancements have been observed in Mongolia’s financial technology (FinTech) sector, coupled with a growing emphasis on sustainable development.

As an emerging market economy with abundant natural resources and a burgeoning FinTech landscape, Mongolia stands at a pivotal juncture where the convergence of financial innovation and sustainability presents immense opportunities for economic growth and societal progress. In fact, Mongolia ranks 71st in the Global Innovation Index (GII) [

3] and has identified the telecommunications and information technology sectors as leading areas to advance the national economy, establishing a five-year roadmap to build a “digital nation” [

4]. In this context, this research paper investigates the potential of FinTech solutions to foster sustainable finance in Mongolia, offering insights and recommendations tailored to the country’s unique context.

Mongolia’s economic trajectory has been shaped by its rich endowment of minerals, vast landscapes, and nomadic heritage. Despite these strengths, the country faces challenges related to financial inclusivity, environmental conservation, and socio-economic disparities. In response, the Mongolian government has increasingly turned its attention towards fostering an inclusive and sustainable financial ecosystem that addresses the needs of all segments of society while safeguarding the environment for future generations. The intersection of FinTech and sustainable finance presents a promising avenue for addressing these challenges. FinTech innovations have the potential to revolutionize financial services delivery, expand access to capital, and promote responsible financial behaviors. Moreover, by harnessing technology, Mongolia can leapfrog traditional banking infrastructure and pave the way for more efficient and inclusive financial systems.

Drawing upon insights from Mongolia’s regulatory frameworks, FinTech ecosystems, and sustainable finance strategies, this paper aims to provide a comprehensive analysis of the opportunities and challenges associated with integrating FinTech into Mongolia’s sustainable finance agenda. By examining the current Mongolian FinTech initiatives, this study seeks to distill actionable business and regulatory recommendations that can drive Mongolia towards a more sustainable and resilient future.

Key areas of exploration include mobile-based digital payment systems, investment-based crowdfunding platforms, peer-to-peer (P2P) microfinance services, insurance services (InsurTech), and investment management (WealthTech) [

5,

6,

7,

8,

9,

10,

11]. Additionally, this paper will explore the FinTech ecosystem, encompassing FinTech startups, which pioneer groundbreaking technologies and solutions; technology developers, who drive innovation and create cutting-edge tools; regulatory government bodies, responsible for establishing and enforcing policies and regulations; financial customers, who drive demand and shape market trends; and established traditional financial institutions, which provide stability and expertise in conventional financial services. Each of these components plays a crucial role in shaping the landscape of financial technology, contributing unique perspectives, innovations, and regulations that collectively define the evolving FinTech ecosystem [

12].

Furthermore, this research will underscore the importance of creating an enabling environment that fosters collaboration between traditional financial institutions and FinTech firms. Initiatives such as enacting supportive and favorable legislature and leveraging emerging technologies like big data analytics, artificial intelligence (AI), and blockchain will be discussed for their potential to accelerate the development of sustainable finance solutions in Mongolia. Ultimately, this research paper seeks to offer practical recommendations for policymakers, traditional financial institutions, FinTech startups, and stakeholders in Mongolia. By embracing FinTech innovations and aligning them with sustainable development goals, such as eradicating poverty, safeguarding the environment, and enhancing the well-being and opportunities of people, Mongolia can unlock new pathways for economic prosperity, social inclusion, and environmental stewardship.

The purpose of this paper is to highlight the significance of FinTech, particularly in developing countries, for sustainable finance, and to illustrate this by utilizing a combination of a SWOT analysis and a multi-level perspective (MLP) framework for Mongolian FinTech industry. This paper is organized as follows: First, we provide a literature review of the digitization process of the financial sector and its functionalities. It covers a brief introduction of the digital transformation of the sector, the FinTech business models, and the FinTech ecosystem. Then, we provide an integrated SWOT-MLP analysis of Mongolia. Finally, we specify untapped business areas and propose potential strategies for the Mongolian FinTech industry.

2. Introduction to FinTech

FinTech, short for financial technology, denotes the application of technology to provide financial solutions. It encompasses a wide range of sectors and business models within the financial services industry, extending beyond traditional financing to encompass all services and products offered within this sector. Although FinTech gained widespread attention around 2014, its history dates back 158 years to 1866 [

13]. According to the research, FinTech 1.0 (1866–1987) represents the period when the integration of finance and technology was primarily led by established major banks and financial institutions, particularly during the early stages of industrialization. FinTech 2.0 (1987–2008) denotes the era influenced by the rapid advancement of mobile technology and the Internet, impacting traditional financial services and giving rise to new financial companies and startups focused on digital platforms and apps. The concept of FinTech emerged in the early 1990s with the inception of a project by a Citigroup predecessor aimed at fostering technological collaboration [

14]. FinTech 3.0 (2009–2019) signifies an economic era marked by shifts in public expectations following the global financial crisis of 2008, the entry of technology companies into the financial sector, and political demands for diversified banking systems. Finally, Arner et al. [

15] introduced FinTech 4.0 (2019–present), representing a shift in the financial sector driven by the rise of digital financial platforms and major tech firms. This innovation in the financial sector has led to increased accessibility, efficiency, and cost reduction, transforming the way individuals and businesses manage their finances [

16,

17,

18]. As countries worldwide seek to address pressing environmental and social challenges while fostering economic growth, understanding the role of FinTech in advancing sustainable development goals has become imperative. In this literature review, we examine FinTech business models and the FinTech ecosystem.

2.1. FinTech Business Models

Various taxonomies have been developed to classify and scrutinize the numerous business models prevalent within the FinTech sector. Examples of these are a taxonomy of consumer-oriented FinTech business models [

19], a taxonomy of blockchain-based business models [

5,

6], a taxonomy of cooperation between FinTech firms and traditional banks [

7], a taxonomy of an ecosystem involving digital transformation and emerging technologies [

8], and a taxonomy based on theoretical foundations and empirical evidence [

9]. These taxonomies serve as frameworks for understanding how FinTech companies innovate and transform traditional financial services, ultimately enhancing value for the consumers. In this research, we focus on five business models: payment services, investment-based crowdfunding, peer-to-peer (P2P) lending, insurance services, and investment management [

5,

6,

7,

8,

9,

10,

11].

2.1.1. Payment Services

Payment services comprise a broad spectrum of digital payment methods designed to facilitate convenient and secure transactions. Mobile payment, for instance, enables users to conduct financial transactions and make payments using their smartphones and associated digital wallets [

20,

21]. Peer-to-peer (P2P) transfers allow individuals to transfer funds directly to one another without the involvement of traditional financial intermediaries, offering a cost-effective and efficient alternative to traditional banking channels [

22]. Digital currencies, including cryptocurrencies like Bitcoin and Ethereum, are decentralized digital assets that utilize cryptographic techniques for secure transactions and independent control of funds, presenting an innovative approach to financial transactions outside the realm of traditional fiat currencies [

23,

24].

2.1.2. Investment-Based Crowdfunding

Crowdfunding refers to a public appeal for financial contributions [

25] that is predominantly conducted on Internet platforms that bypass traditional financial mediators [

26]. Crowdfunding research started in 2010 and has significantly expanded since 2015, partly because of major legal changes that year, which made the landscape more inviting for financial innovation. A pivotal change in the United States was the introduction of the CROWDFUND Act within the JOBS Act of 2015, which made it legal for startups and small businesses to raise funds by selling shares online, using social media and other Internet platforms [

27].

2.1.3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers directly with individual or institutional lenders, facilitating the borrowing and lending of funds without the involvement of traditional financial institutions. These platforms leverage technology to streamline the lending process, assess creditworthiness, and mitigate risks, thereby enabling borrowers to secure loans at competitive rates and investors to earn attractive returns on their investments [

28,

29,

30]. Additionally, smart contract-based lending platforms utilize blockchain technology to automate lending agreements and execute transactions via self-executing contracts, enhancing transparency, security, and efficiency in the lending process [

31,

32].

2.1.4. Insurance Services

In the FinTech sector, technological innovations have transformed the insurance industry and enhanced the delivery of products and services, notably leading to the emergence of Insurance Technology or InsurTech. InsurTech is “a phenomenon comprising innovations of one or more traditional or non-traditional market players exploiting information technology to deliver solutions specific to the insurance industry” [

33]. InsurTech startups leverage cutting-edge technologies such as artificial intelligence, data analytics, and machine learning to enhance various aspects of the insurance value chain, including underwriting, claims processing, risk management, and customer engagement [

33,

34,

35,

36]. In particular, the adoption of smart contracts in insurance enables the automation of insurance policies and claims processing, eliminating the need for manual intervention and reducing the potential for fraud and disputes [

37,

38].

2.1.5. Investment Management

Investment management services in the FinTech sector encompass a diverse range of automated investment platforms and digital wealth management solutions designed to democratize access to investment opportunities and empower individual investors. This field, often referred to as WealthTech, is recognized as a specialized subset of FinTech. It focuses on utilizing digital technologies to enhance investment and client portfolio management, providing customized products and services tailored to individual needs [

39,

40]. Financial robo-advisors, for example, leverage artificial intelligence and machine learning algorithms to provide automated investment advice and portfolio management services to investors based on their financial goals, risk tolerance, and investment preferences [

22,

41]. Also, these platforms offer investors access to diversified investment portfolios, personalized investment recommendations, and automated portfolio rebalancing, making investment management more accessible, affordable, and efficient for retail investors [

22,

41,

42].

2.2. FinTech Ecosystem

The FinTech ecosystem refers to a complex and interdependent network, intricately combining technology with financial services to not only innovate but also significantly enhance traditional financial processes and institutions. This ecosystem comprises a wide array of entities, each of which plays an indispensable role in shaping the modern financial landscape. As outlined by Lee and Shin [

12], the key participants encompass FinTech startups, technology developers, government, financial customers, and traditional financial institutions.

To be more specific, FinTech startups are the companies that innovate existing financial services or develop new financial products, disrupting the market through technology and innovation. Technology developers develop and provide technologies such as cloud computing, blockchain, and big data, enabling FinTech companies to implement innovative services. Government facilitates the growth of the FinTech industry and maintains consumer protection and market stability through regulation. Financial customers are the end users of FinTech services, ranging from individual consumers to businesses, driving demand for innovative financial solutions. Traditional financial institutions are the established banks, insurance companies, investment firms, and other financial entities that may collaborate with or compete against FinTech startups, playing a crucial role in the financial ecosystem’s evolution and adaptation to new technologies. Together, these components synergistically contribute to the ecosystem’s overarching goals: fostering innovation, stimulating economic growth, facilitating a balance of collaboration and competition within the financial sector, and ultimately, delivering substantial benefits to consumers.

Figure 1 illustrates the five elements of the FinTech ecosystem [

12].

3. Theoretical Framework

As the financial sector undergoes transition, it is important to understand the structural and functional shifts taking place across different levels of the system, including industry, market, regulation, technology, and infrastructure. This study utilizes an integrated SWOT-MLP framework to delve into the Mongolian FinTech sector in detail. First, we introduce the multi-level perspective (MLP) approach to socio-technical transitions (

Section 3.1), followed by an examination of the theoretical foundations of the SWOT analysis (

Section 3.2). Lastly, we explore the connection between the two frameworks (

Section 4.1) [

43].

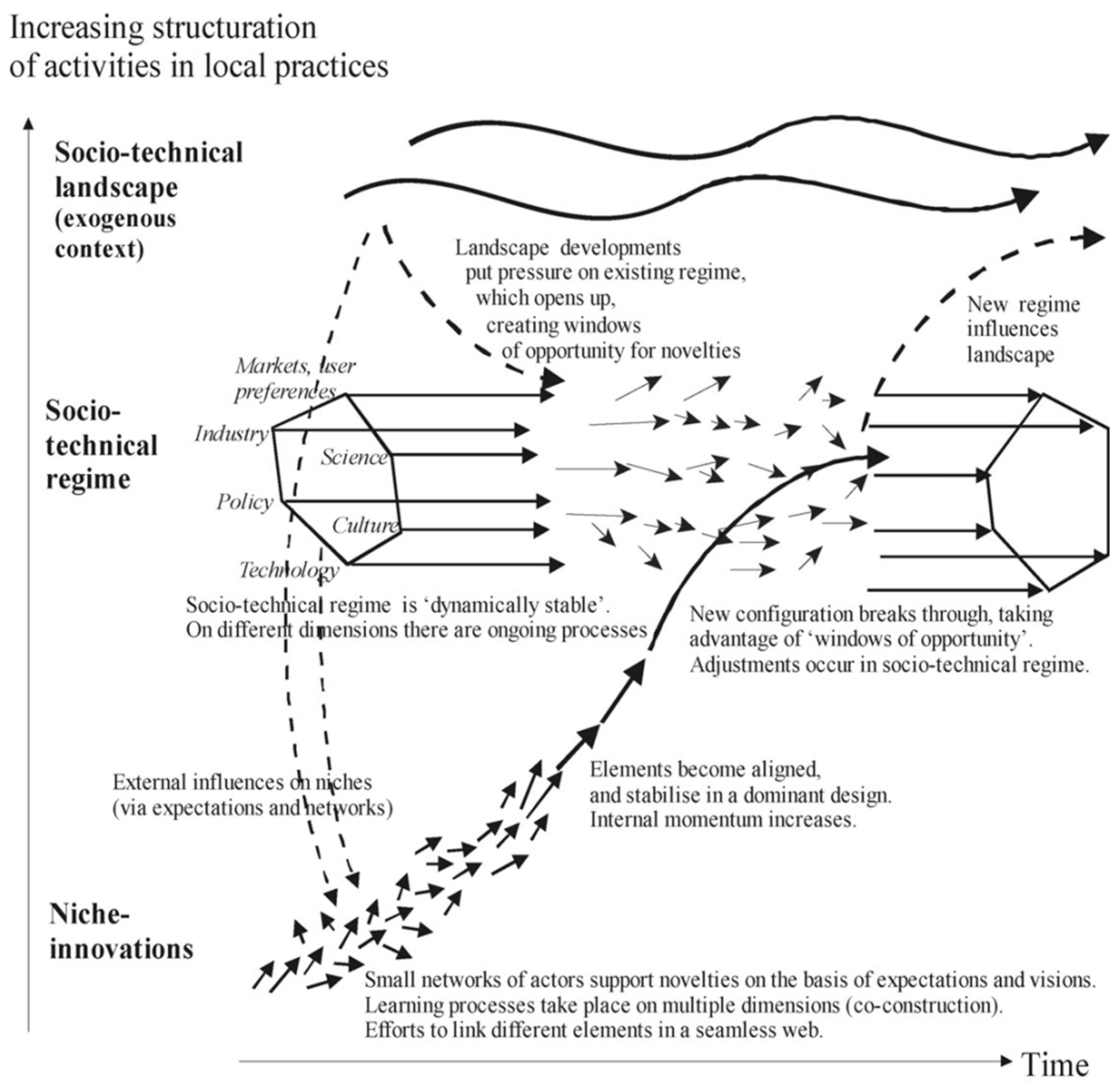

3.1. MLP Framework

There have been numerous studies in the past that have investigated different types of transitions leading to changes in systems. Geels and Schot [

44] defined transitions as changes from an existing system to a new system. In order to understand the interplay between various changes and developments across different levels leading to transitions that ultimately reconfigure the systems, Geels [

45] refined the multi-level perspective (MLP) framework. This framework comprises three conceptual levels: socio-technical landscape, socio-technical regime, and niche innovations.

Socio-technical landscape includes the technical and material background that supports society, such as demographical trends, political ideologies, societal values, and macro-economic patterns. These form an exogenous context or an external environment that actors at the niche and regime levels cannot immediately or directly influence [

46]. Changes at the landscape level typically occur slowly, leading to destabilization within the existing regime and generating tension among the incumbent actors. Consequently, this creates opportunities for technological innovation niches to emerge [

44].

Socio-technical regime refers to a collection of rules that direct and organize activities within social groups. It builds upon Nelson’s concept [

47] of technological regime, which focused on common ways of thinking within engineering communities, explaining how technologies develop along specific paths. However, sociologists expanded this idea, suggesting that not only engineers but also scientists, policymakers, users, and interest groups shape how technologies evolve. The concept of the socio-technical regime encompasses this wider range of social groups and their coordinated activities. Within the socio-technical regime, there are seven key dimensions: technology, user practices and application domains (markets), symbolic meaning of technology, infrastructure, industry structure, policy, and techno-scientific knowledge. The activities across these dimensions interact to establish a stable structure [

44,

45].

Niche innovations refer to radical innovations that emerge from niches, which offer a protected environment for testing and developing unstable new ideas, models, and products, without facing hindrances from the mainstream market. In other words, niches serve as “incubation rooms” until the novelties either fail or succeed at impacting and replacing the established regime. Niche innovations are usually developed by small networks of committed individuals, often comprising outsiders or fringe actors [

44].

In summary, the MLP approach offers a comprehensive perspective on transitions, which occur through interactions among processes at three levels: (a) niche innovations accumulate internal momentum, (b) changes at the landscape level exert pressure on the existing regime, and (c) destabilization of the regime opens windows of opportunity for niche innovations to establish themselves. The convergence of these processes facilitates the introduction of innovations into mainstream markets, where they compete with the existing regime (see

Figure 2).

3.2. SWOT Analysis

The SWOT analysis is a strategic tool used to understand and analyze the strengths, weaknesses, opportunities, and threats of an entity. Strengths are internal capabilities and positive attributes of the entity that enhance its performance. Weaknesses are internal constraints or limitations that could potentially hinder or impede the performance of the entity. Opportunities are external advantages that can favor and facilitate the entity’s establishments. Threats are external challenges that can inhibit or delay the entity’s achievable goals [

48].

Previously, SWOT analysis has been utilized in various domains and contexts to provide valuable insights and strategies for the organization or projects. For instance, SWOT analysis has been used to develop sustainable strategies for (i) the regulatory framework for the FinTech sector in Turkey [

49], (ii) Italy’s forest-based bioeconomy [

43], (iii) water resource sustainable utilization [

50], (iv) tourism in Bangladesh [

51], (v) Uzbekistan’s textile industry [

52], and (vi) Turkey’s energy planning [

53]. Given this context, in this research, the SWOT analysis aims to identify potential strategies for the Mongolian FinTech industry based on combinations of its strengths, weaknesses, opportunities, and threats.

4. Methods and Materials

4.1. An Integrated SWOT-MLP Analysis

According to the MLP framework, a shift in regime occurs when a niche technology reaches a certain level of development and when there is significant pressure from the landscape. This pressure from the socio-technical landscape destabilizes the existing regime, allowing niche innovations to emerge and compete with the established regime, eventually integrating into the mainstream system. In other words, for a successful transition to occur, two conditions must be met: one internal condition linked to a niche development and one external condition related to a mix of regime and landscape pressures, which can present either opportunities or threats. In this regard, the MLP framework and SWOT framework are closely interconnected, allowing for their simultaneous utilization in an integrated SWOT-MLP analysis [

43].

In this research, we employed the integrated SWOT-MLP analysis, a relatively new approach in the literature, to identify potential drivers (i.e., strengths and opportunities) and obstacles (i.e., weaknesses and threats) at three levels—landscape, regime, and niche—within the Mongolian FinTech sector. This analysis facilitated a comprehensive understanding of the situation and provided strategies for an effective transition within the Mongolian financial sector.

4.2. Materials and Procedures

The aim of this research is to examine the latest state of FinTech in Mongolia in three dimensions, such as, the landscape, regime, and niche of the sector, because there has been a radical shift in the current FinTech industry of Mongolia. Due to the rapid pace of innovation, research and data in this area are relatively limited. Thus, we drew upon both academic and non-academic sources. For the search of academic publications, we searched with Google Scholar [

54]. A range of keywords that were used are “Mongolia”, “FinTech”, “financial technology”, “sustainability”, “sustainable growth”, and FinTech business models and the factors of the FinTech ecosystem. Articles published before 2014 were excluded due to the possibility of differing from the latest trends. This decision was made because in the case of Mongolia, the inception of FinTech dates back to 2014 [

55], and following the onset of the COVID-19 pandemic, the FinTech market in Mongolia, like the rest of the world, experienced significant upheaval [

56]. Moreover, with the recent emergence of AI, changes have been occurring at an even faster pace and on a larger scale. For enhanced study credibility and integrity, only peer-reviewed articles or conference papers were incorporated. For the non-academic secondary data, we collected the data or findings from sources such as global financial institutions, government reports, news, global consulting companies, industry analyses, startups, research institutions, business magazine articles, and interviews. For this non-academic search, we limited the scope to 2020 to the present. The secondary data were extensively reviewed through an MLP approach to identify a list of factors for the SWOT matrix.

The workflow of the current research is as follows: First, we examined the FinTech sector of Mongolia and its ecosystem through the lens of an MLP framework, analyzing the landscape, regime, and niche. Second, we identified the key factors of landscape, regime, and niche that have a direct or indirect impact on the sector and categorized them into the four categories of strengths, weaknesses, opportunities, and threats. Lastly, we highlighted the selected factors and leveraged them to suggest the SWOT-based strategies for the sector. By employing this comprehensive methodology, we aimed to provide a holistic and up-to-date view of Mongolia’s FinTech landscape and its potential to drive sustainable finance initiatives in the country.

5. MLP Analysis of FinTech Industry of Mongolia

Mongolia, situated at the heart of Central Asia, is witnessing a transformative wave in its financial sector with the emergence of FinTech. As a nation with a growing economy and a significant reliance on traditional banking services, Mongolia’s FinTech environment encompasses both strengths and weaknesses, and presents both opportunities and challenges. In this section, an overview of FinTech in Mongolia is provided, covering its landscape, regime, and niche, while exploring its business models, ecosystem, and growing significance in shaping the country’s financial future.

5.1. Landscape Level

Mongolia, a landlocked country known for its vast landscapes and nomadic culture, is experiencing a significant shift in its financial sector with the advent of FinTech. Historically, Mongolia’s financial sector has been dominated by traditional banking services, with limited innovation in terms of digital finance. However, in recent years, there has been a significant increase in Internet accessibility, leading to notable changes. According to a report [

57], in 2024, Mongolia had 83.9% Internet penetration with 2.91 million users and a mobile connectivity rate of 147.8%, representing 5.13 million cellular connections.

Additionally, like the rest of the world, during the COVID-19 pandemic, Mongolia experienced a significant activation of cross-border e-commerce, prompting Mongolia to enhance its payment systems. Also, the pandemic notably hastened the transition to online shopping and electronic payments, resulting in a substantial surge in digital transactions by the year 2022 [

56]. Currently, the FinTech payment services sector in Mongolia is undergoing rapid transformation, characterized by the adoption of digital payment solutions. For example, GrapeCity Mongolia, MOST Money, and SendMN are paving the way for a digital future by addressing various financial needs through innovative solutions like banking and payment solution software, digital payment services, and international money transfer services, respectively.

Although the FinTech sector in Mongolia is still in its early stages of development, the rapid increase in Internet penetration, smartphone usage, and subsequent demand for convenient and accessible financial services are driving Mongolia towards the onset of a FinTech revolution. This burgeoning interest and early adoption of financial technologies signal the start of significant transformation within its financial services landscape [

58].

5.2. Regime Level

This section examines the regime-level dynamics within the Mongolian financial sector, exploring the current situation of incumbent government policies, markets including financial customers and their preferences, and traditional financial institutions.

5.2.1. Government Policy

The emergence of artificial intelligence (AI) and cryptocurrency technologies has globally disrupted the financial sector, resulting in substantial regulatory changes in the FinTech landscape in recent years. This has led to a “regulatory revolution” aimed at enhancing transparency, compliance, and investor protection. For instance, within the digital assets and crypto sectors, there was a sharp increase in global penalties and more rigorous scrutiny of crypto firms [

59], signaling a proactive regulatory stance towards ensuring financial stability and consumer protection. The situation in Mongolia is not dissimilar to the global context. Consequently, Mongolia is swiftly introducing relevant legislation. This will be detailed further in

Section 5.3.7. The evolution of regulations concerning beneficial ownership information and the adoption of artificial intelligence in regulatory compliance highlight the continuous shifts in the financial regulatory landscape. These changes are pushing financial institutions to prioritize greater accountability and efficiency.

5.2.2. Financial Customers and User Preferences

In Mongolia’s FinTech ecosystem, financial customers are increasingly at the center of development strategies. This focus reflects a broader trend towards customer-centric solutions, where the needs and preferences of users guide the creation and implementation of financial technologies. By prioritizing the experience of financial customers, Mongolia aims to enhance access to banking and financial services, improve customer satisfaction, and drive financial inclusion. This approach leverages technology to address traditional barriers, offering more personalized, efficient, and accessible financial products and services.

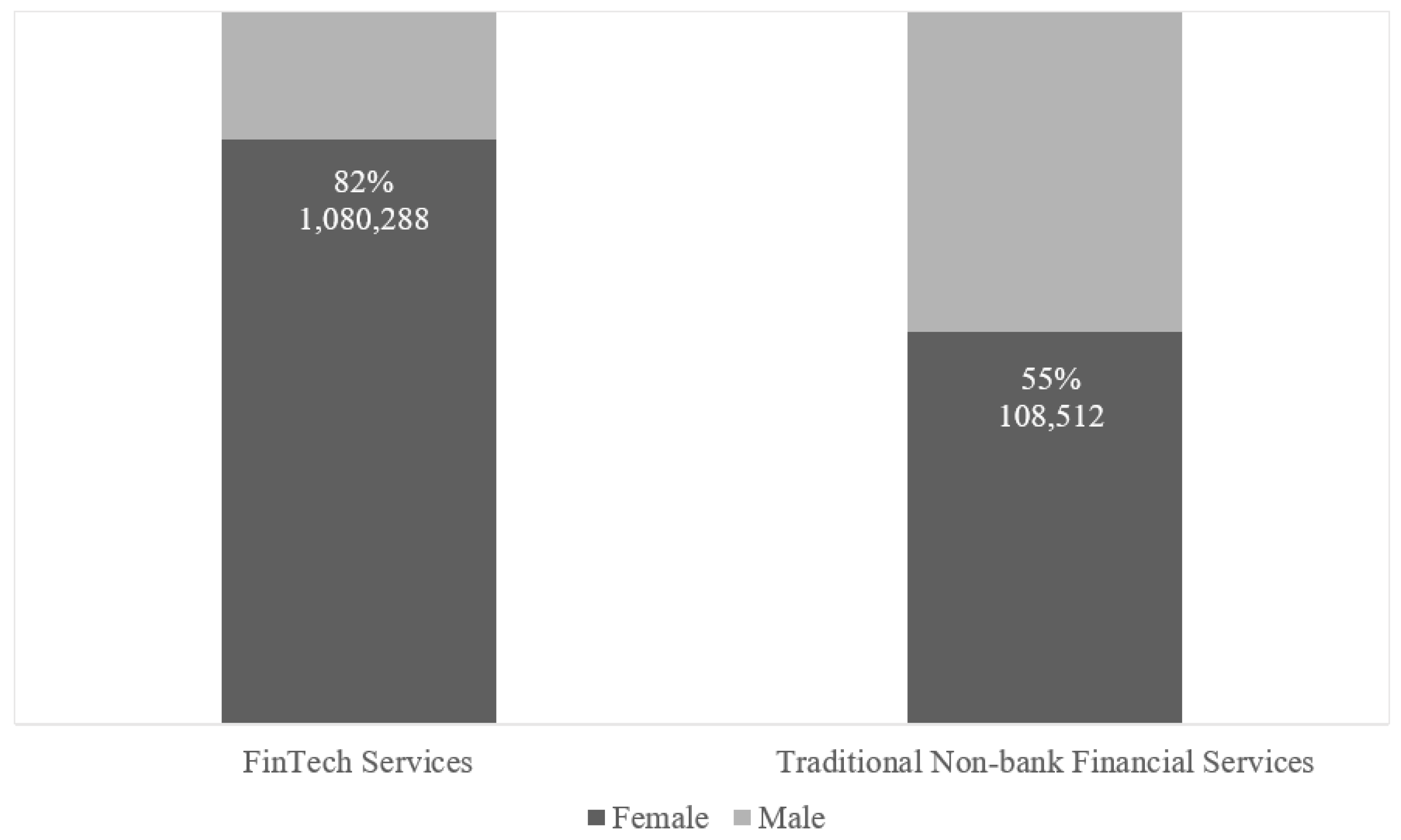

According to the Financial Regulatory Commission of Mongolia, in Mongolia’s FinTech ecosystem, 8 out of 10 users are women, highlighting a significant gender trend. With about 1.31 million people using FinTech and roughly 200,000 using traditional non-bank financial services, a gender analysis shows that 82% of FinTech users are female compared to 55% in traditional services. This suggests that Mongolian women are more inclined to use FinTech solutions over conventional financial options (see

Figure 3).

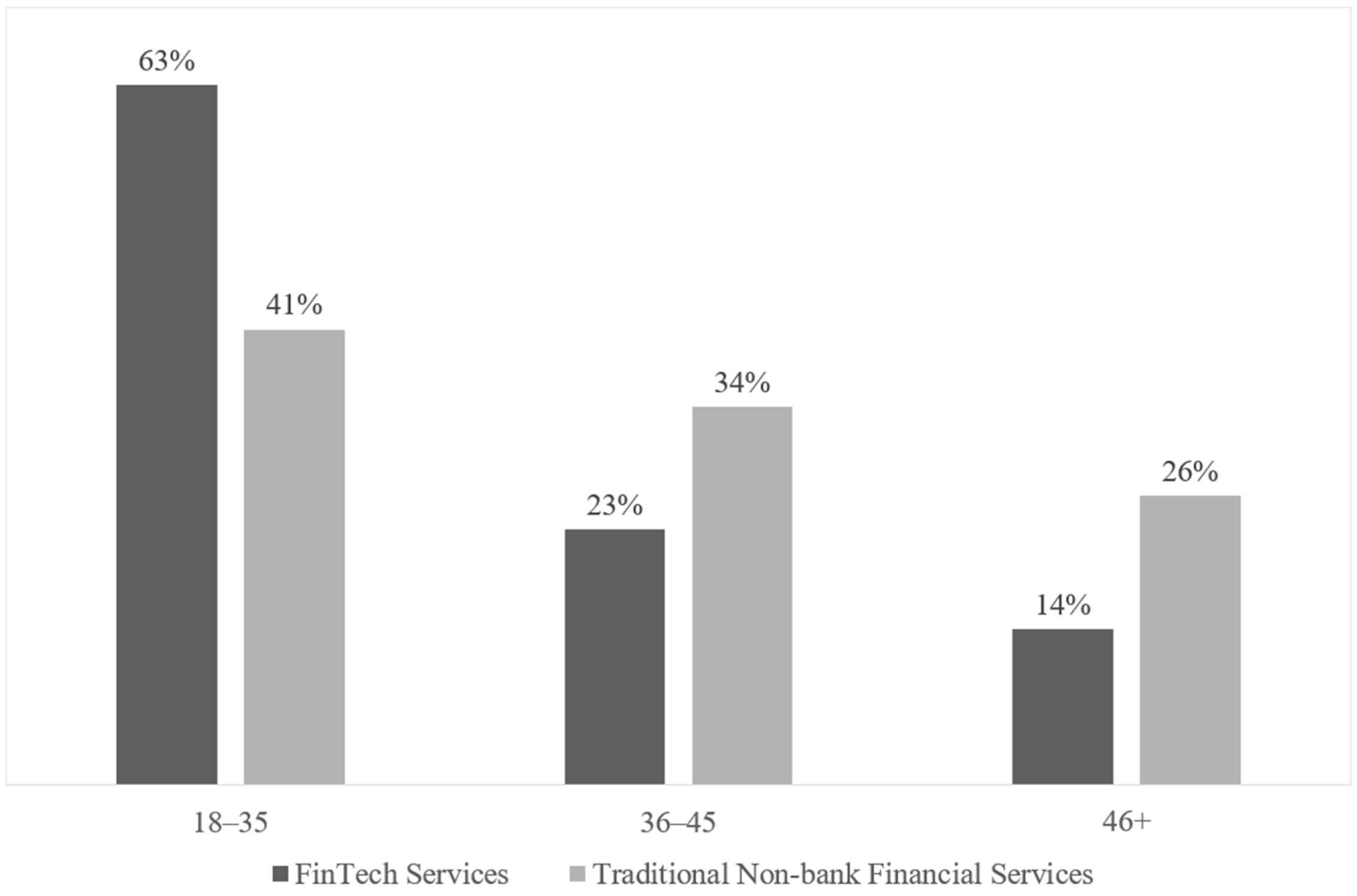

Additionally, according to the Financial Regulatory Commission of Mongolia, in Mongolia’s FinTech ecosystem, 63% of users are 18–35 years old, while in traditional non-banking financial institutions, this age group represents 41% of users. Similarly, only 14% of FinTech users are aged 46 and above, compared to 26% in traditional financial settings. These data suggest a clear trend: younger individuals are more drawn to FinTech services, indicating a shift towards digital financial solutions among Mongolia’s youth, while older generations continue to rely more on conventional financial services (see

Figure 4) [

55].

5.2.3. Traditional Financial Institutions

The rise of FinTech has significantly disrupted traditional financial institutions’ ecosystem, bringing forth numerous challenges [

60]. For instance, in Mongolia, although traditional banks continue to maintain dominance in both market share and profitability, the growth rate of FinTech businesses has surpassed that of traditional banks. Additionally, reports indicate that FinTech businesses exhibit higher return on assets (ROA) and net profit margins compared to traditional banks [

61]. One contributing factor to this trend is the lack of technological advancements in traditional financial institutions, limiting their ability to offer the same digital services and values as FinTech companies. As a result, traditional financial institutions are facing significant threats posed by FinTech companies, often referred to as “disruptors” [

62], which challenge the stability of the existing system.

5.3. Niche Level

Mongolia’s FinTech ecosystem is rapidly emerging as a dynamic and innovative sector within the country’s financial landscape. With the convergence of technology and finance, and regulatory reforms aimed at fostering growth and innovation, Mongolia is witnessing a surge in FinTech startups that have been innovating and diversifying their offerings to meet the growing demand for convenient and accessible financial services (see

Appendix A for a list of 78 FinTech startups). This section examines the innovations of various FinTech business models in Mongolia, encompassing payment services, investment-based crowdfunding, peer-to-peer lending, insurance services, and investment management [

5,

6,

7,

8,

9,

10,

11]. Furthermore, the innovations in technology and government policies are also examined.

5.3.1. FinTech Startups: Payment Services

In 2019, with the introduction of the low-value payment “Automatic Clearing House (ACH+)” system, Mongolia established a secure payment system necessary for e-commerce transactions. In 2018, Mongolia enacted the “Law on National Payment System”, officially recognizing various payment instruments and channels, such as cash, Internet banking, payment orders and invoices, mobile banking, payment cards, remittances, e-money, and billing, primarily utilized in e-commerce transactions [

63]. These solutions offer convenient and cost-effective alternatives to traditional banking services while utilizing technology to reach unbanked or underbanked individuals and small businesses, thus fostering financial inclusion.

Table 1 presents a list of key developments and the companies harnessing these innovations to shape the FinTech industry. Based on the exploration of payment services-related FinTech businesses in Mongolia, it is evident that the shift away from cash-heavy practices has spurred the activation of businesses offering services like contactless payment, including mobile payment, and peer-to-peer transfers.

On the other hand,

Table 1 also shows that some FinTech businesses or practices are not as active at the moment. For instance, first, while cryptocurrency exchanges thrive, actual cryptocurrency usage for purchasing goods remains limited. Second, there is a noticeable scarcity of companies providing programmable money and smart contracts. Third, businesses catering to the “buy now, pay later (BNPL)” trend, highly regarded globally, seem to be relatively less active. Fourth, the absence of Mongolian social media platforms creates a gap in FinTech services facilitating purchases through social media. Fifth, biometric authentication primarily relies on fingerprint recognition, with few companies implementing more advanced biometric technologies. Sixth, companies specializing in payments via the Internet of Things (IoT) appear to be notably scarce.

5.3.2. FinTech Startups: Investment-Based Crowdfunding

Belleflamme et al. [

64] categorize crowdfunding into two primary types: investment-based and reward- or donation-based. In investment-based crowdfunding, contributors act as investors, potentially earning financial returns from the ventures they fund. On the other hand, reward-based crowdfunding and donation-based crowdfunding do not offer financial returns; instead, backers may receive non-monetary rewards such as music CDs, T-shirts, or product discounts as a gesture of appreciation. Our study concentrates on investment-based crowdfunding rather than reward- and donation-based forms, because the former has been developed as an alternative financial tool that bypasses conventional financial intermediaries and registration processes, thereby simplifying regulatory compliance and minimizing transaction costs for those seeking funds [

27].

The investment-based crowdfunding platforms opened up access to capital by allowing entrepreneurs to bypass traditional financing channels and directly engage with potential investors. For investors, on the other hand, the platforms allowed them to participate in investment opportunities that were typically reserved for institutional or accredited investors, enabling individuals to diversify their investment portfolios and support early-stage businesses and innovative projects.

Investment-based crowdfunding in Mongolia is becoming an increasingly significant part of the financial landscape, offering promising avenues for startups and small businesses to access capital. The Mongolian financial market, accounting for 16% of the GDP, demonstrates substantial growth and a conducive environment for investment activities, particularly in crowdfunding [

65]. Currently, the regulatory landscape in Mongolia necessitates obtaining a license from the Financial Regulatory Commission (FRC) for operating a crowdfunding platform, ensuring that platforms adhere to the legal and regulatory standards. The emphasis on registration within Ulaanbaatar, given its concentration of licensed non-banking financial institutions, highlights the strategic importance of location in maximizing the crowdfunding platform’s reach and effectiveness. Although the crowdfunding sector is promising, it still faces challenges, including the relatively small size of the Mongolian financial market, limited financial literacy among the population, and the necessity for enhanced regulatory policies to bolster a more developed capital market [

65].

5.3.3. FinTech Startups: Peer-to-Peer Lending

During the COVID-19 pandemic, as banks tightened their lending criteria in response to the economic uncertainty brought about by the pandemic, many small and medium enterprises (SMEs) and individuals found themselves excluded from conventional financing options. Moreover, many traditional banks and financial institutions lacked suitable online systems. Then, P2P platforms emerged as a critical means, offering both borrowers and lenders a more accessible and flexible route to the financial services they needed. This period highlighted the potential of P2P lending as a viable alternative to conventional banks, showcasing its capacity to innovate and broaden financial access [

66,

67].

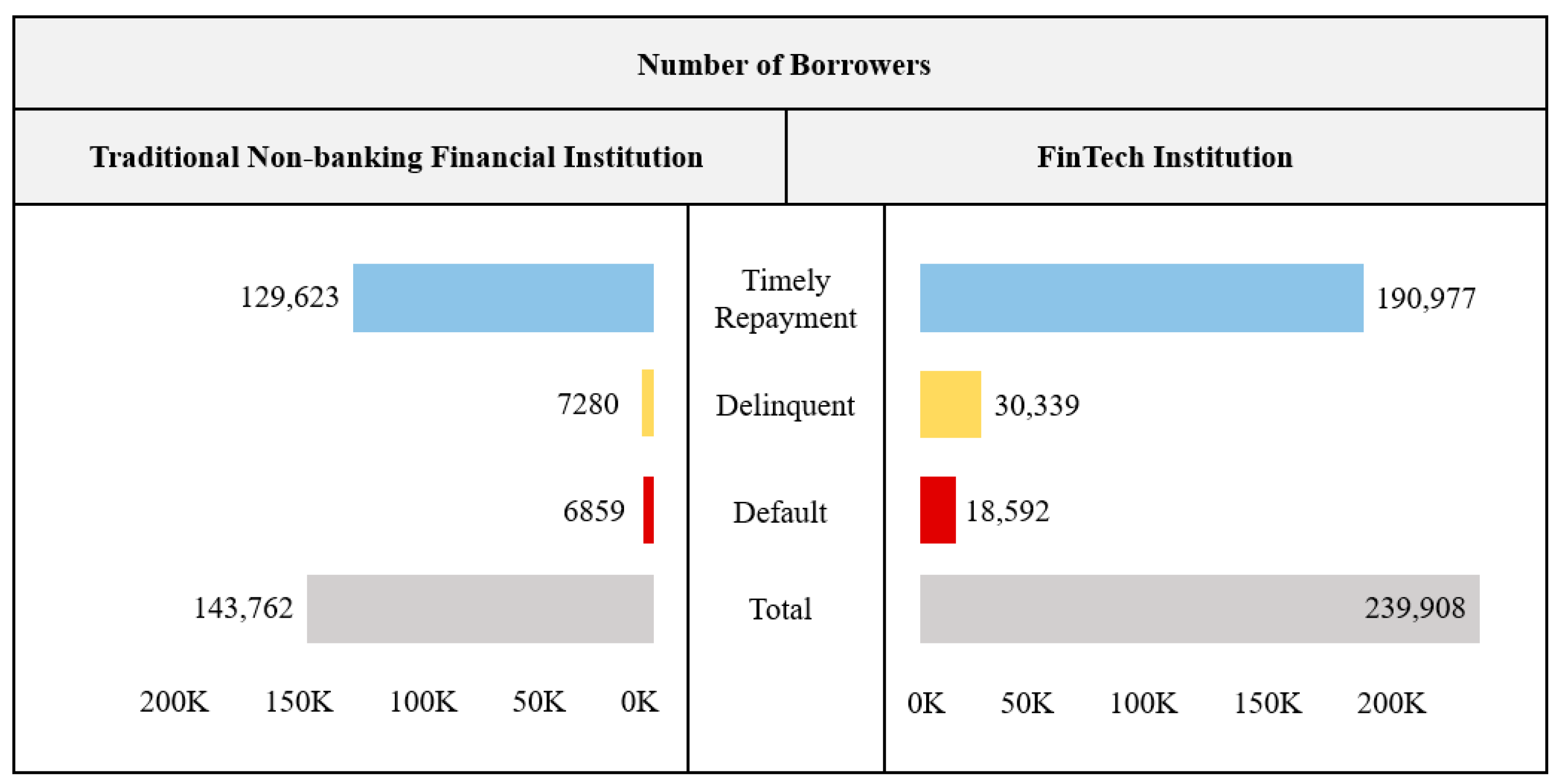

FinTech platforms offering peer-to-peer (P2P) lending and microfinance services facilitate direct lending and borrowing transactions between individuals or entities, bypassing traditional banking intermediaries. Also, these platforms promote financial inclusion by providing access to capital for underserved segments of the population. Currently, P2P lending services are emerging as important businesses in Mongolia’s financial landscape. However, it should be noted that the timely repayment rate for FinTech institutions is lower than that of traditional financial institutions. According to the Financial Regulatory Commission of Mongolia [

68], 18.2% of FinTech (P2P transfer service) customers, or one in five people, are using lending services, with 79.6% (190,977 people) repaying loans on time, while 72.8% of non-banking financial institution customers have loans, with 90.2% (129,623 people) making timely repayments (see

Figure 5). In other words, although FinTech institutions have more users, traditional non-banking financial institutions have an 11% higher rate of on-time loan repayment [

55].

By streamlining the lending process and utilizing alternative data sources for credit assessment, FinTech firms are helping to bridge the financing gap and spur entrepreneurship and economic development. Regarding their business model, in the case of P2P loans, since they are typically small in amount, the proportion of service fees outweighs interest fees, resulting in higher revenue from service fees than interest income [

55]. These P2P FinTech services are expected to enhance accessibility, transparency, and accountability in the microloan market.

5.3.4. FinTech Startups: Insurance Services

In Mongolia, FinTech companies offering insurance services have emerged to address the evolving needs of consumers in the digital age. These InsurTech companies leverage technology to provide innovative and accessible insurance products tailored to the Mongolian market. Additionally, these FinTech firms often incorporate features such as personalized insurance plans, instant claims processing, and digital documentation management, revolutionizing the traditional insurance industry. Through their offerings, they aim to increase insurance penetration, promote financial literacy, and empower individuals and businesses to manage risks effectively in an ever-changing landscape [

69].

For instance, Agula Insurance, a Mongolian-based InsurTech company, collaborates with Deloitte Luxembourg to implement an AI-driven car damage recognition solution. This solution automates the detection of vehicle damage and estimates repair costs based on client-provided photos, significantly reducing the duration of the reimbursement process and enhancing the overall customer experience. This AI-driven solution not only streamlines the claims processing but also reduces the overall duration from 4 business days to just less than 2 h, exemplifying the innovative commitment of Agula Insurance to cutting-edge solutions. Through collaborations and utilization of AI and data-driven solutions, InsurTech businesses strategically position themselves ahead of less digitalized insurance companies in Mongolia, optimizing client care and service delivery with unmatched efficiency [

70].

5.3.5. FinTech Startups: Investment Management

With a burgeoning economy and growing interest from international investors, Mongolia presents a unique opportunity for FinTech innovation in investment management services. One notable domain is fractional investment. For example, ORDA, an investment platform, empowers retail investors by offering fractional ownership of diverse assets such as real estate, luxury items, artwork, commodities, and private equity. Through its intuitive mobile app, ORDA provides sophisticated recommendation algorithm, driven by behavioral finance principles, machine learning, and data science. This algorithm tailors investment suggestions to each user’s risk profile, financial objectives, and investment preferences, enhancing the overall investment experience [

71].

Another notable domain is robo-advisory investment. For instance, AvtaMata is a private banking and robo-advisor app that simplifies professional investment portfolio management by providing automated investment advice or portfolio management. Users can invest in line with their financial goals, risk tolerance, and preferences through algorithms and mathematical models. Also, the platform allows users to buy and own portfolio elements on a fractional basis, enabling them to invest in real estate, international stocks, funds, and other securities with a minimum of USD 100 [

72].

The robo-advisors market is experiencing significant growth, with assets under management projected to reach USD 110.20 million by 2024. As the market expands, the number of users is also expected to increase, reaching an estimated 5,880,000 users by 2028. With this growth in both assets under management and user base, the average assets under management per user in the robo-advisors market is anticipated to amount to USD 2,277,000 in 2024 [

73]. This indicates a growing adoption of robo-advisors as a preferred investment solution among investors.

5.3.6. Technology Developers

Technology developers play a crucial role in driving innovation and providing the technological infrastructure necessary for FinTech startups and companies to thrive. In Mongolia, there are numerous startups that develop emerging technologies such as artificial intelligence, machine learning, big data analytics, and blockchain to support secure, efficient, and user-friendly financial products and services. For example, Chimege provides speech and text recognition solutions through natural language processing (NLP) technology. Ocurus presents a virtual tour creation solution. Chatbot.mn offers an AI-based smart business assistant. Metaland provides a metaverse platform. Lastly, Intelligo Systems develops conversational AI.

These developers are instrumental in creating and maintaining the digital platforms, software solutions, and technological tools that power various FinTech services, such as payment systems, mobile banking apps, P2P lending, robo-advisors, and blockchain applications. Moreover, they collaborate closely with other stakeholders in the FinTech ecosystem, including regulators, financial institutions, users, and investors, to ensure compliance with regulatory requirements and industry standards while driving continuous innovation [

12]. Their contributions are essential in shaping Mongolia’s FinTech landscape, facilitating digital transformation, and promoting financial inclusion and accessibility across the country.

5.3.7. Government

Due to the rapid development of the FinTech sector, numerous challenges are being encountered. The roles of the government are not only to navigate and address multifaceted challenges but also to foster the growth and expansion of the FinTech industry. The key government institutions related to Mongolia’s financial sector are the Bank of Mongolia, which is the central bank of Mongolia, the Financial Regulatory Commission (FRC), and the Mongolian Fintech Association [

68].

These government agencies and regulatory authorities are increasingly engaging with FinTech stakeholders to develop supportive frameworks that encourage innovation while safeguarding consumer protection and financial stability. In fact, the Mongolian government’s concerted efforts and dedication are clear as it swiftly introduces relevant legislation to ensure the safe and rapid expansion of the FinTech market [

2,

55,

60,

74,

75,

76]. This endeavor is underpinned by its commitment to promoting financial inclusion and leading the digitization of the economy, which are pivotal in driving the growth of FinTech in Mongolia.

6. SWOT Analysis

The key findings obtained and discussed from the analysis of the Mongolian FinTech sector, conducted via the MLP approach, were further examined through the SWOT framework. In accordance with the MLP methodology, factors at the landscape and regime levels were considered external, while those at the niche level were regarded as internal [

43]. Subsequently, these factors were inspected to determine their favorability (i.e., favorable vs. unfavorable), to be classified into four distinct categories: strengths, weaknesses, opportunities, and threats [

77].

6.1. Strengths

S1: Rapid growth and activation of businesses offering “unbundled” contactless payment services

S2: A swiftly growing number of technology developers and subsequent acquisition of technological capabilities

S3: The Mongolian government’s concerted efforts and dedication to FinTech aiming to enhance financial inclusion

6.3. Opportunities

O1: A substantial growth of the Mongolian financial market and a conducive environment for investment activities

O2: The fast-growing trend of the FinTech industry and its market

O3: A significant increase in Internet penetration and Internet accessibility rates

O4: A marked rise in smartphone usage and mobile connectivity rates

O5: A notable surge in demand for convenient and accessible financial services offering digital transactions, observed during and following the COVID-19 pandemic

O6: A shift towards FinTech solutions among Mongolia’s youth

6.4. Threats

T1: Relatively small size of the Mongolian financial market

T2: Limited financial and digital literacy among the population

T3: Absence of relevant legislation due to the rapid development of the FinTech sector

T4: Tightened lending criteria by traditional banks following the pandemic, in response to economic uncertainty, resulting in exclusion of small and medium enterprises (SMEs) from conventional financing options

T5: Comparatively lower rate of timely loan repayment for FinTech institutions compared to traditional financial institutions

T6: Gender imbalance in FinTech usage: women utilize FinTech services more than men (a potential threat considering Mongolia’s relatively male-dominated society, where men often have primary decision-making authority)

T7: Preference for traditional financial services persists among older generations compared to younger ones

T8: Limited technological capabilities of traditional financial institutions and the resulting slowdown in their growth rate

7. SWOT-Based Strategies

This section proposes and discusses four different categories of potential strategies based on the SWOT analysis:

- (a)

S-O strategies that capitalize on strengths to take advantage of opportunities;

- (b)

S-T strategies that leverage strengths to minimize or counteract potential threats;

- (c)

W-O strategies that focus on overcoming weaknesses to capitalize on opportunities;

- (d)

W-T strategies that address weaknesses to avoid or mitigate potential threats.

Table 2 summarizes the SWOT analysis of the Mongolian FinTech industry and the SWOT-based strategies.

One of the most challenging issues in the global FinTech industry, not only in Mongolia but worldwide, is the conflict between traditional financial institutions and FinTech companies. While it is true that FinTech companies contribute to the sustainable growth of nations and societies by supporting financial inclusion, economic efficiency, and environmentally friendly digital financial solutions, they are often perceived as “disruptors” by traditional financial institutions [

62]. Therefore, we provide additional insight into this issue.

For the FinTech businesses and traditional financial institutions to coexist, thrive, and create synergies for expansion, collaboration is essential [

78]. BaaS (banking as a service) and PaaS (platform as a service) stand out as prime examples of such cooperation. BaaS (banking as a service) enables FinTech firms to use traditional banks’ infrastructure to offer financial services, fostering innovation and expanding customer reach without the need for banks to develop new technologies in-house [

79]. In fact, one of the promising strategies for Turkey’s financial sector is incorporating BaaS, emphasizing its significance as a collaboration strategy between traditional financial institutions and FinTech businesses. Turkey is one of the largest emerging market economies globally, boasting a robust banking system and significant tech adoption. Moreover, due to seamless collaboration among regulatory bodies, FinTech firms, traditional financial institutions, and other stakeholders, Turkey’s financial sector has effectively fostered sustainable development. Thus, Turkey’s case serves as a guideline for the FinTech sectors of developing countries. The noteworthy attention given to BaaS underscores its importance as a pivotal collaboration strategy, as evidenced by Turkey’s focus on it. This highlights the crucial role of BaaS in promoting sustainable financial growth [

80].

PaaS (platform as a service) provides a cloud-based platform that allows banks and FinTech firms to develop, run, and manage applications without building and maintaining the infrastructure typically required [

81]. In 2024, Mongolia’s PaaS market is expected to generate USD 12.48 million, with a projected compound annual growth rate (CAGR) of 17.20% from 2024 to 2028, leading to a market size of USD 23.55 million by 2028. Additionally, the average expenditure per employee within the PaaS market is anticipated to be USD 9.09 in 2024 [

82].

In order to facilitate the integration of the infrastructure of traditional financial institutions and the innovative solutions of FinTech businesses, policymakers must consider how regulatory environments can incentivize firms to prioritize shared sustainability goals, such as by offering tax incentives or establishing sandbox environments for collaborative experimentation and development of sustainable financial products and services.

As Mongolia continues to bolster its digital financial infrastructure and regulatory frameworks, the FinTech industry is poised for further growth. The integration of technology and finance, coupled with initiatives to enhance financial inclusion, positions Mongolia as a promising player in the dynamic FinTech landscape.

8. Implications and Limitations

In this research, we aim to provide valuable insights into practical implications for stakeholders in the Mongolian FinTech industry. By identifying key strengths, weaknesses, opportunities, and threats through the MLP framework and SWOT analysis, our study offers actionable recommendations to foster sustainable development goals within the sector. These recommendations are tailored to capitalize on opportunities and mitigate threats, thereby contributing to the advancement and resilience of the Mongolian FinTech industry. By fostering collaboration among the FinTech businesses, traditional financial institutions, government agencies, and stakeholders, we envision a robust sustainable system that leverages collective expertise and resources.

However, there are several limitations in this paper. First, this study employs SWOT analysis, drawing insights from relevant studies and the current state of the industry. Given the dynamic nature of the industry, the analysis serves as a guide, recognizing that findings may evolve over time. Additionally, some people believe that SWOT analysis can be overly simplistic and subjective [

83]. Thus, future research should undertake empirical studies to gain deeper insights into the Mongolian FinTech industry in a timely manner.

Second, in this research, while SWOT analysis has been utilized as a valuable framework for evaluating the strengths, weaknesses, opportunities, and threats, it is crucial to acknowledge the absence of a validation process for the SWOT analysis findings. The validation process for SWOT analysis involves several steps to ensure the credibility and reliability of the results, including data collection, stakeholder involvement, cross-verification, expert review, and iterative refinement [

84]. By not incorporating a validation process for the SWOT analysis in this research, there may be limitations in the accuracy and comprehensiveness of the identified factors. Future studies should consider implementing a validation process to enhance the robustness of the SWOT analysis findings and ensure a more rigorous examination.

Third, our study does not include a crucial step in the SWOT analysis process, which involves gathering opinions from experts or stakeholders regarding the identified strengths, weaknesses, opportunities, and threats, and aggregating these opinions to determine the relative importance of each factor. This step is essential for ensuring the comprehensiveness and accuracy of the SWOT analysis findings, as it allows for a broader perspective and consideration of diverse viewpoints. Without incorporating this step, our analysis may lack depth and may not fully capture the nuances and complexities of the subject matter. Future research should consider integrating stakeholder feedback and expert opinions into the SWOT analysis process to enhance its validity and reliability.

Fourth, we searched academic publications using Google Scholar. While Google Scholar is recognized as a comprehensive resource for searching [

54], there is a contrasting viewpoint that argues that Google Scholar is an inappropriate source for searching [

85]. It is important to acknowledge that the limitations associated with relying solely on Google Scholar as a research tool may impact the comprehensiveness and accuracy of the findings in this study. Further validation from additional scholarly databases or empirical studies could provide a more nuanced understanding of the topic.

Fifth, we recognize that one of the limitations of our study lies in the lack of comprehensive analysis regarding the actual effects of the strategies discussed. While we have explored the strategies adopted by government, traditional financial institutions, FinTech businesses, and other stakeholders to foster sustainable growth in the financial sector, our analysis falls short in providing a detailed examination of the tangible outcomes and impacts of these strategies. This limitation underscores the need for further research and empirical evidence to ascertain the effectiveness and efficacy of the implemented measures in driving the sustainable development of Mongolia’s FinTech sector.

9. Conclusions

In recent years, there has been a notable shift towards integrating sustainable principles into various sectors, including finance. FinTech, with its innovative approaches and technological advancements, has been playing a significant role in promoting sustainable finance practices on a global scale. In Mongolia, the advent of FinTech solutions is revolutionizing the financial sector and its ecosystem. The FinTech startups are introducing innovative business platforms across five key areas: payment services, investment-based crowdfunding, peer-to-peer (P2P) lending, insurance services, and investment management. These platforms are rapidly growing, responding to the needs of consumers who value the convenience of digital finance management. They offer specialized, unbundled services, allowing users to select precisely what they need, aligning with their preferences for a more tailored financial experience.

In fact, in this paper, the integrated SWOT-MLP analysis identified that Mongolian FinTech companies are seeing robust growth, especially in payment services, notably in areas such as contactless payments, mobile payments, P2P transfers, and cryptocurrency exchanges. While the buy now, pay later (BNPL) sector is growing globally and shows promise in Mongolia, there is potential for even greater acceleration. Investment-based crowdfunding and P2P lending are also thriving, with P2P lending, in particular, experiencing rapid growth. InsurTech, still in its early stages, primarily focuses on auto insurance, but expanding into livestock, health, and travel insurance could offer new opportunities. Similarly, investment management is starting to grow, with room for more companies to offer fractional and robo-advisory investment services. Lastly, payments via the Internet of Things (IoT) remain largely untapped, presenting a potential avenue for growth.

Also, regarding the ecosystem, especially in the AI era, with AI’s potential to revolutionize industries, it is recommended that more tech developers and entities focus on AI technologies. Government support through tax incentives for tech and FinTech companies could enhance this effect. Addressing the preferences and requirements of younger financial demographics, such as millennials and Gen Z, has the potential to further stimulate growth. Enhancing digital literacy, mitigating digital reluctance, fostering a more accessible FinTech environment, and reducing entry barriers into the system will aid in reaching a broader demographic. Finally, collaboration between traditional financial institutions and FinTech firms, addressing each other’s weaknesses, can offer more comprehensive, efficient, and effective services, contributing to national development.

In essence, Mongolia, with a population of just three million, represents a relatively small market centered around its capital, Ulaanbaatar, where economic and industrial activities are concentrated. Although its international competitiveness in banking and financial institutions may be relatively modest, the foundation for the FinTech market is laid with a high proportion of smartphone ownership and Internet usage per capita. Moreover, there exists a demand for diverse financial products due to the increasing integration of financial information and services into the daily lives of its citizens. Therefore, there is significant potential for expansion into various financial product offerings tailored to meet the evolving needs and preferences of Mongolian consumers and improve their financial well-being.

FinTech offers a promising avenue for fostering sustainable economic development and financial inclusion in developing countries. Nevertheless, to fully leverage its potential, it is imperative to tackle infrastructural, regulatory, and educational obstacles. In our research, we have identified both the opportunities and challenges facing Mongolia’s FinTech industry. While each country’s trends in the FinTech industry and ecosystem are unique, valuable lessons can be gleaned from the case of Mongolia in promoting sustainable finance through FinTech. The current case study offers insights into successful FinTech initiatives that have driven financial inclusion [

80]. By examining the current study, policymakers and practitioners in Mongolia or other countries can identify best practices and adapt them to the local context.