ARIMA-Driven Vegetable Pricing and Restocking Strategy for Dual Optimization of Freshness and Profitability in Supermarket Perishables

Abstract

1. Introduction

2. Literature Review

2.1. Replenishment Strategy

2.2. Dynamic Pricing

2.3. Deterioration Inventory Management and Deterioration Rate Study

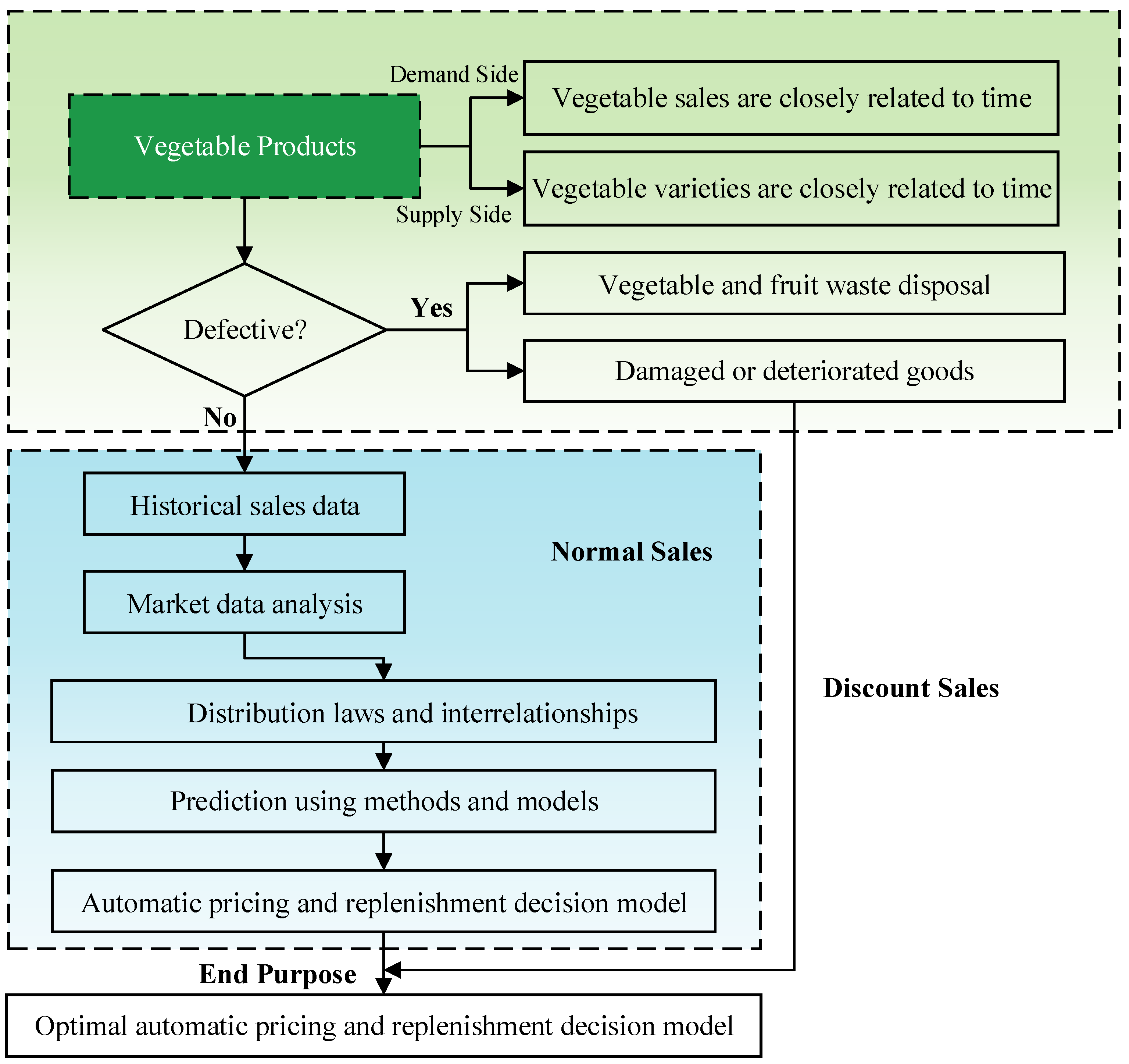

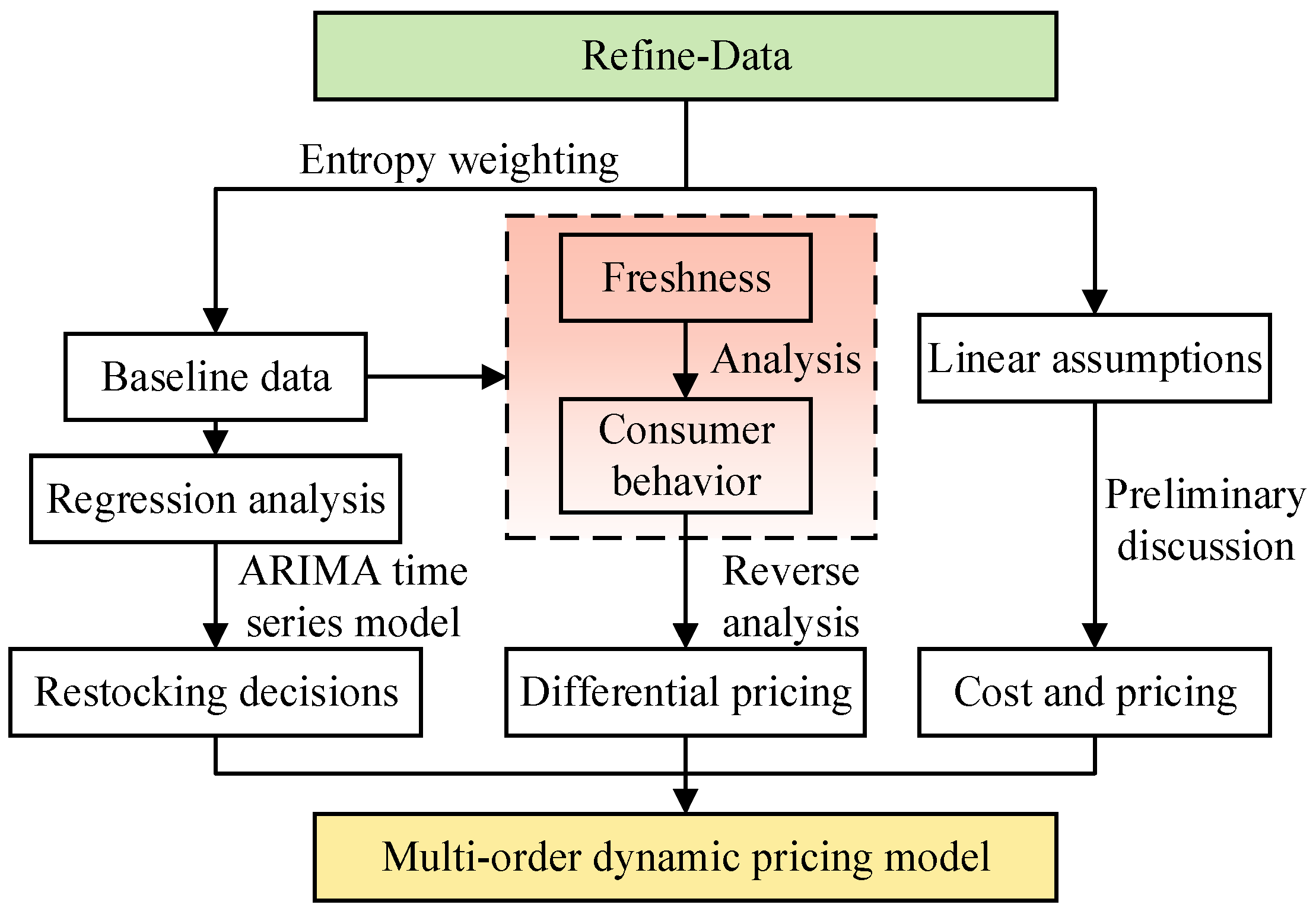

3. Materials and Methods

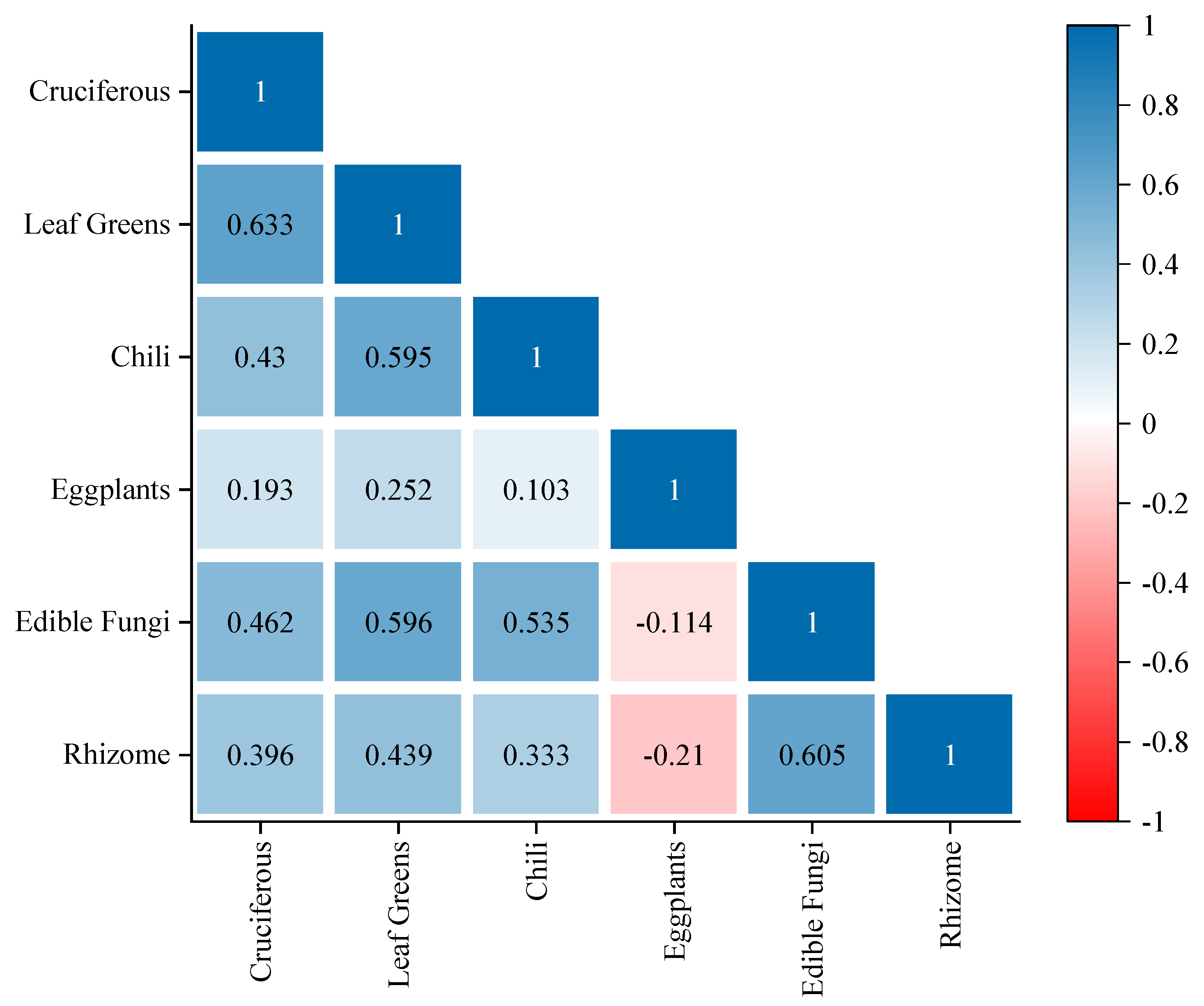

3.1. Analyzing Correlations in Vegetable Sales

3.2. Replenishment Model

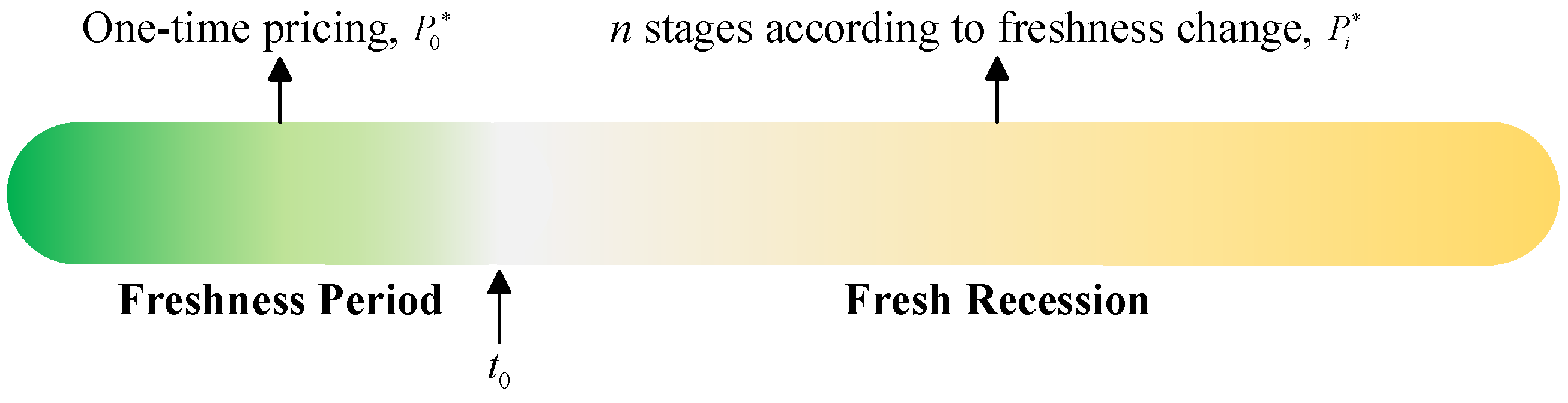

3.3. Pricing Model

4. Results and Discussion

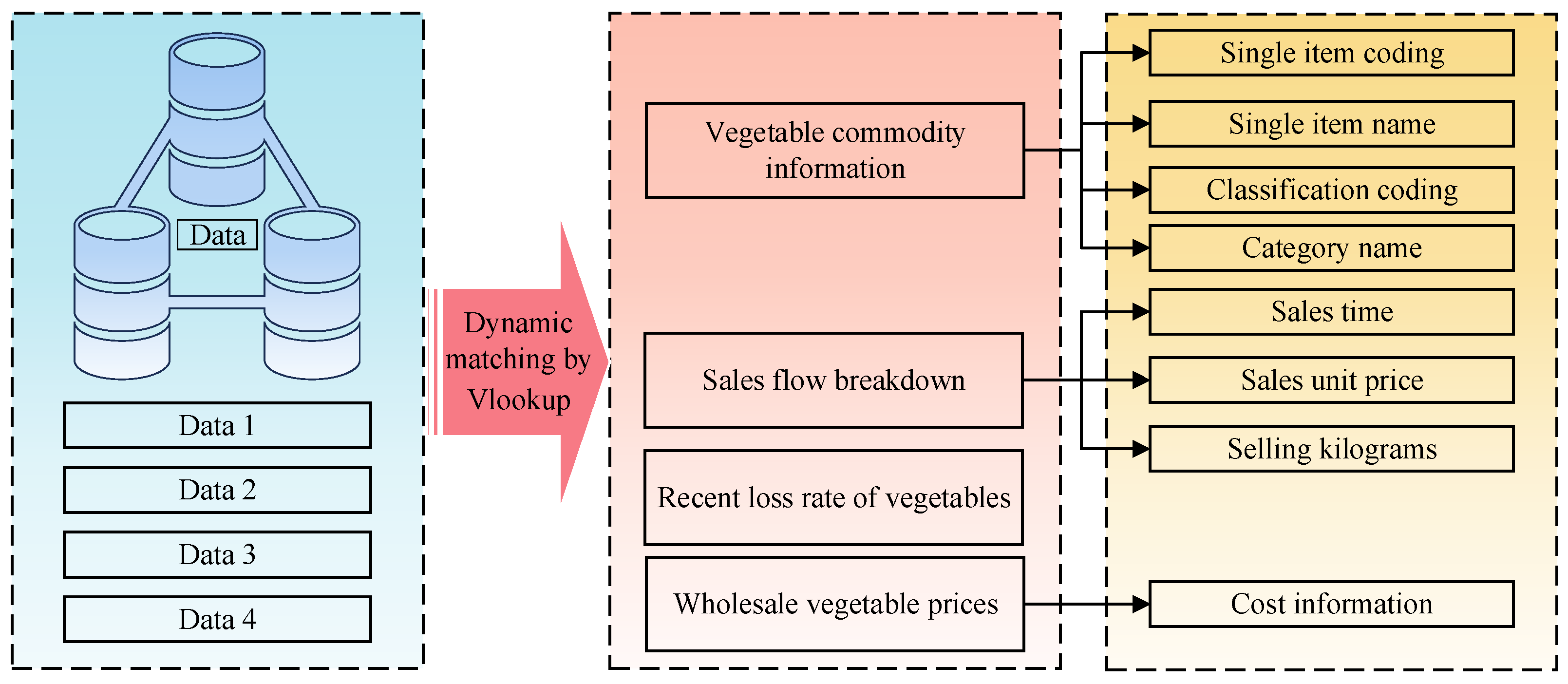

4.1. Data Pre-Processing

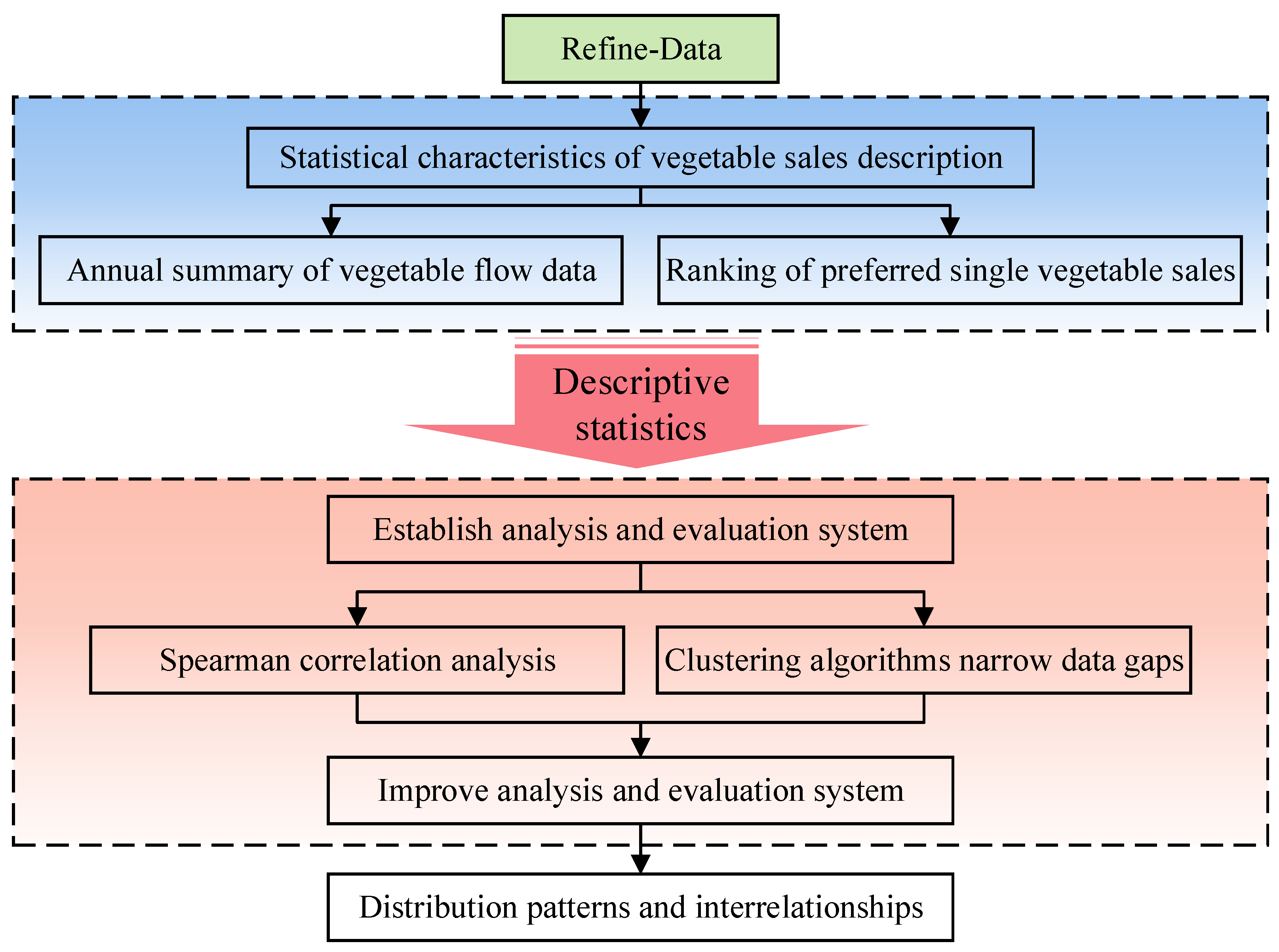

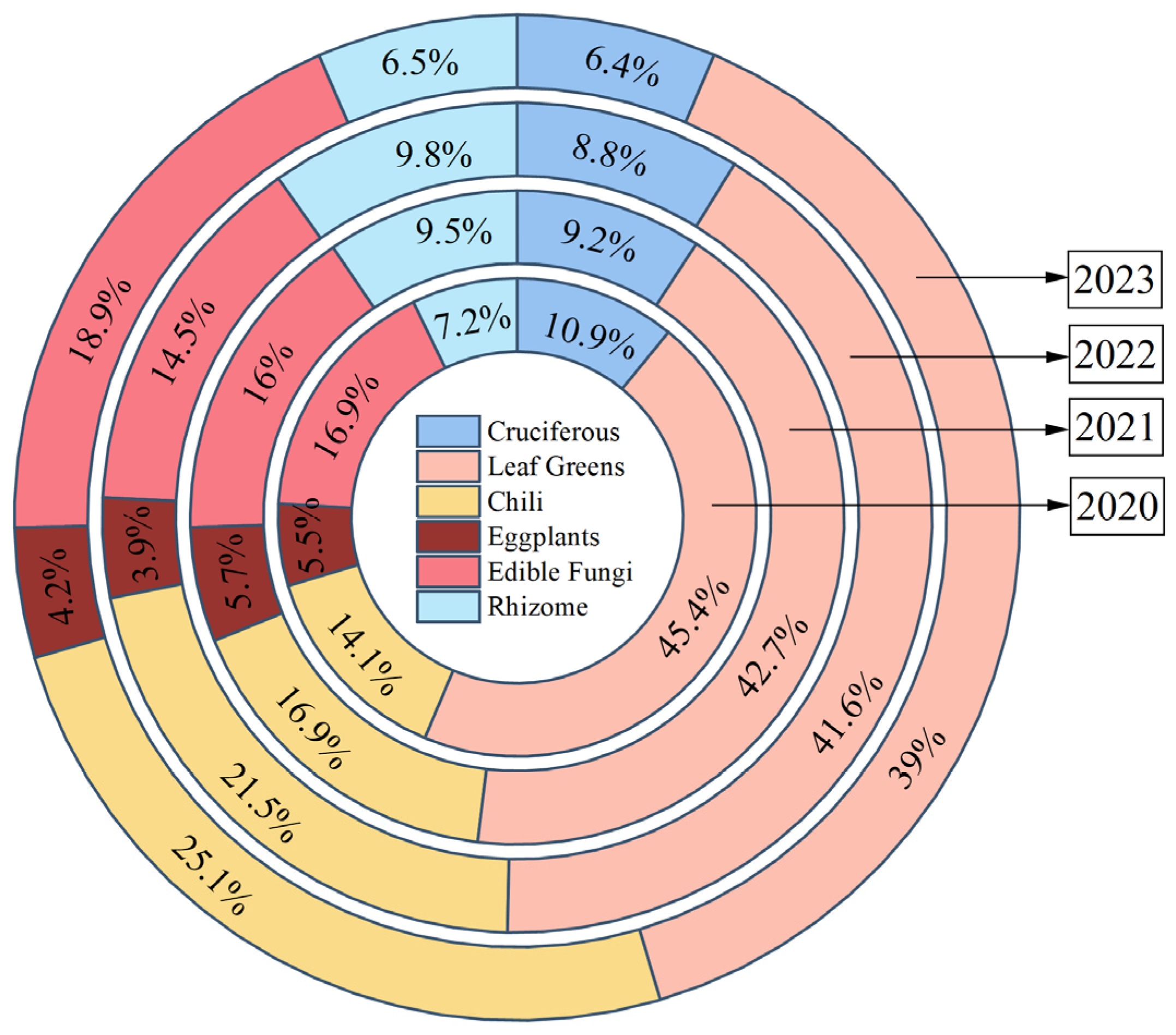

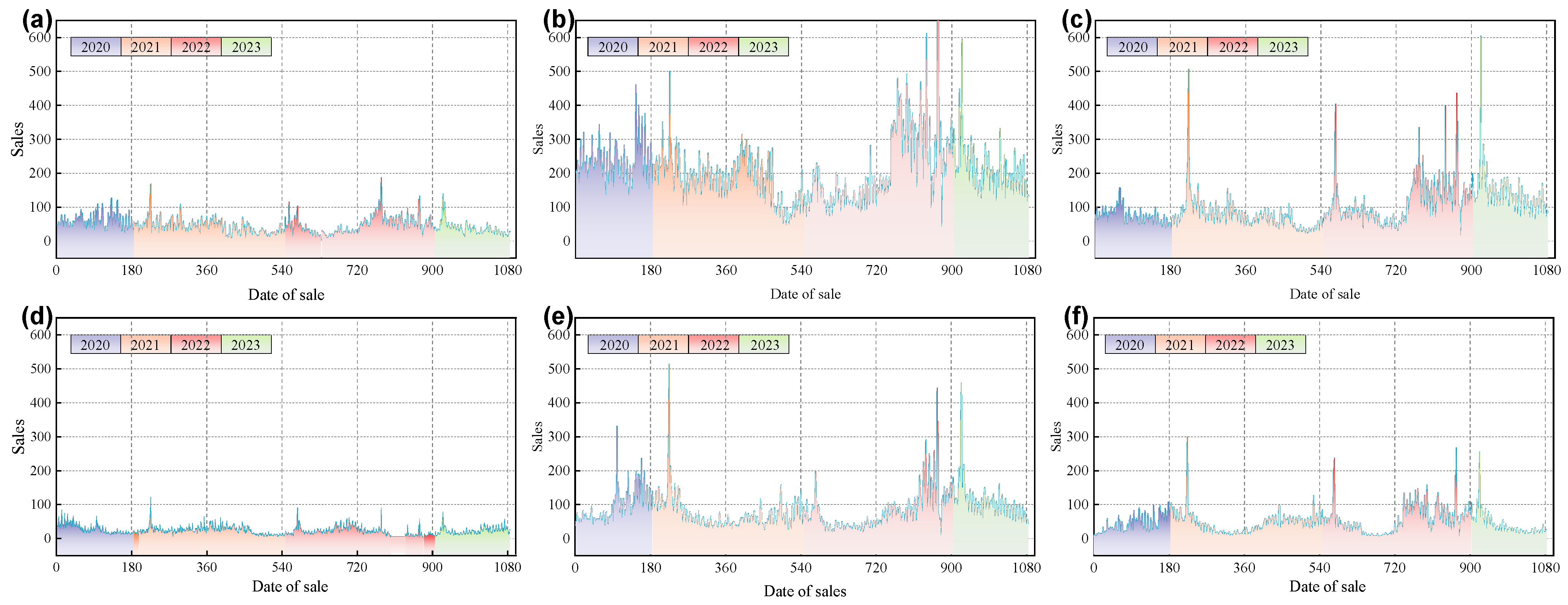

4.2. Descriptive Statistics and Correlation Analysis of Vegetable Sales Status

4.2.1. Sales Volume Distribution Patterns

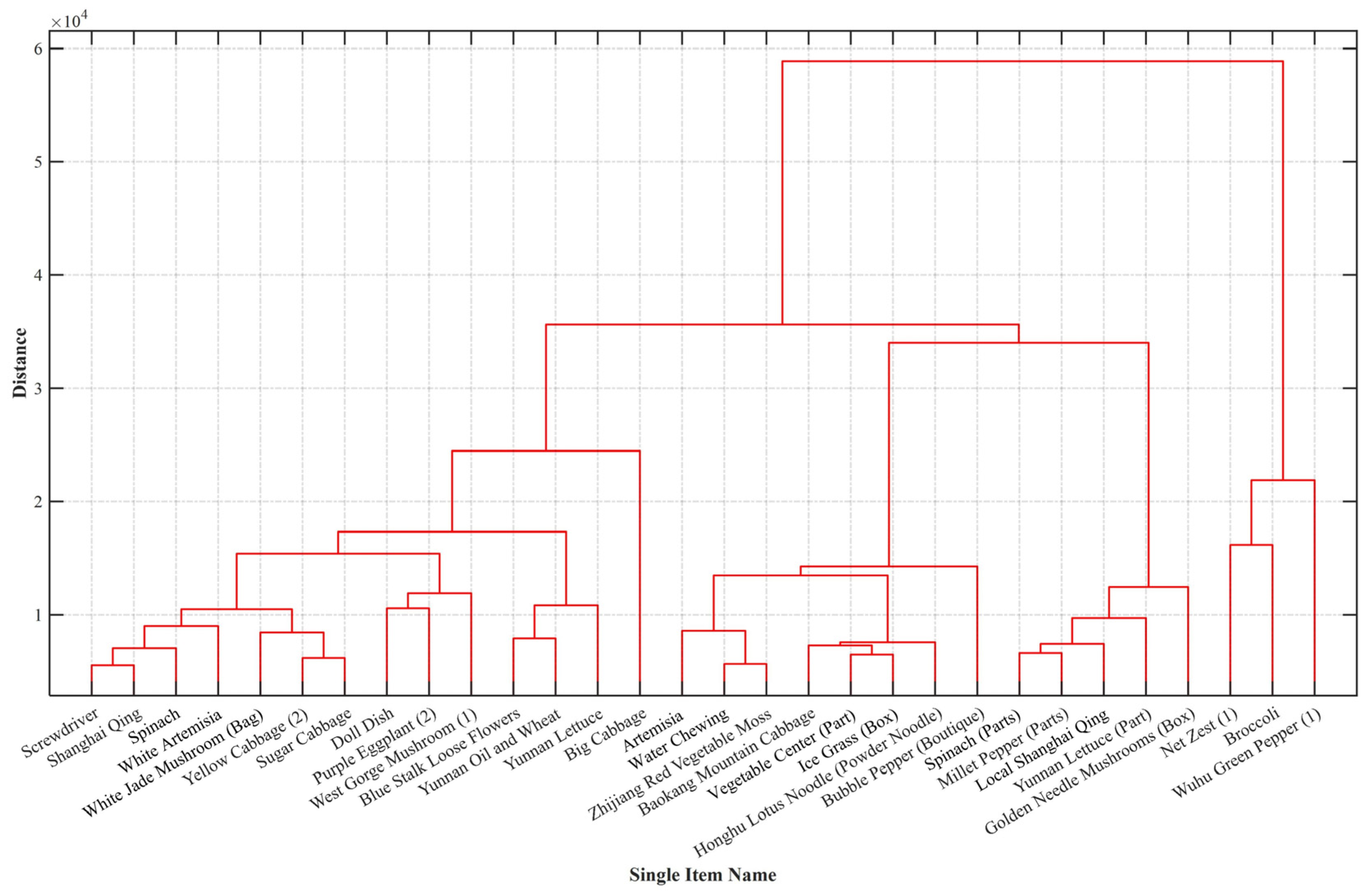

4.2.2. Correlation between Category and Individual Item

- (1)

- Home-cooking vegetables. This category includes staples like Chinese cabbage. These vegetables are diverse, high in volume, and commonly used in home cooking, indicating a steady supermarket demand. This category may necessitate strategies focusing on mass production and supply to meet consistent consumer needs.

- (2)

- Common side dish vegetables. Encompassing vegetables like lotus root, broccoli, and Wuhu green peppers, these are characterized by their nutritional richness and frequent use in side dishes across various cuisines. The variety of dishes incorporating these vegetables could result in higher purchasing demand from food manufacturers and caterers.

- (3)

- Specialized demand vegetables. The third category features vegetables with a smaller gap between their use in dishes and their sales volumes. While the market demand for these vegetables might not be as robust as the first two categories, they cater to specific consumer groups, indicating a niche market.

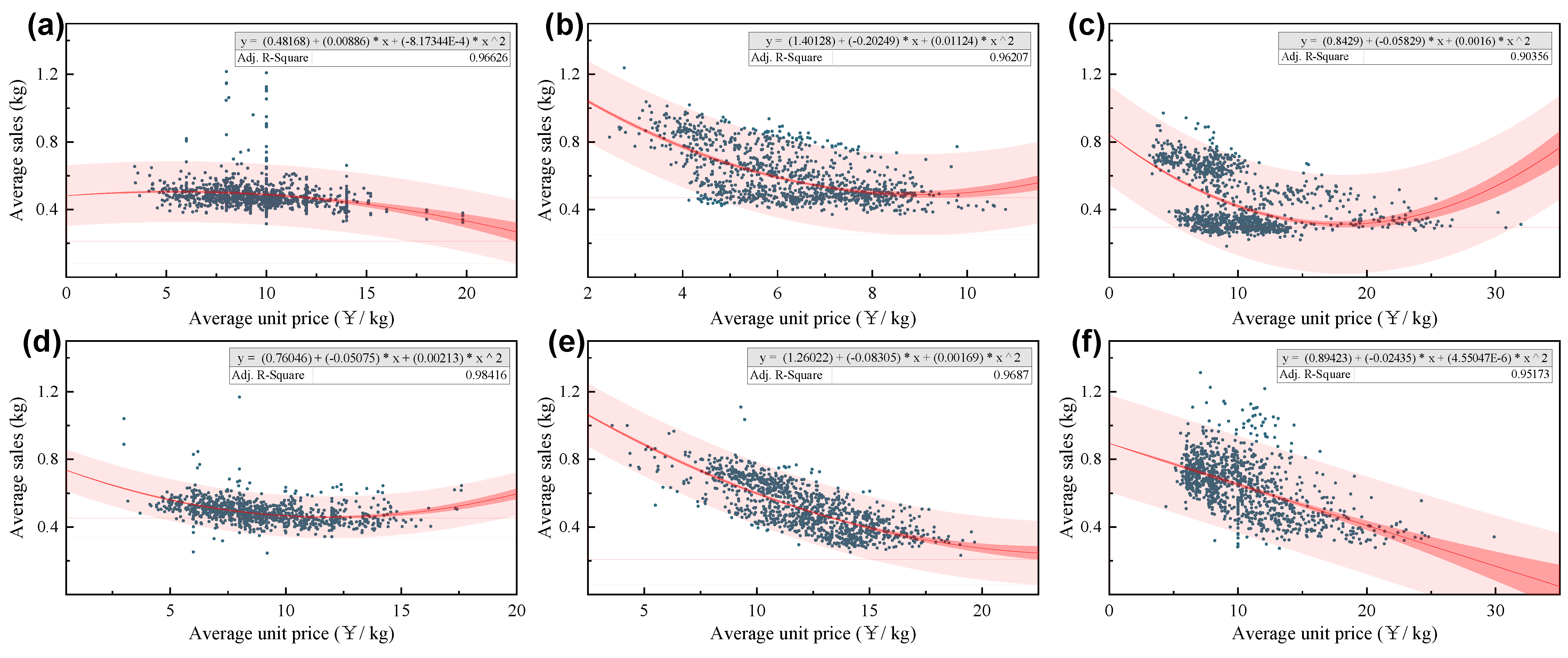

4.3. Strategy Analysis in the Pricing Model

4.3.1. Dynamic Adjustment Benchmark for Category Sales Unit Price

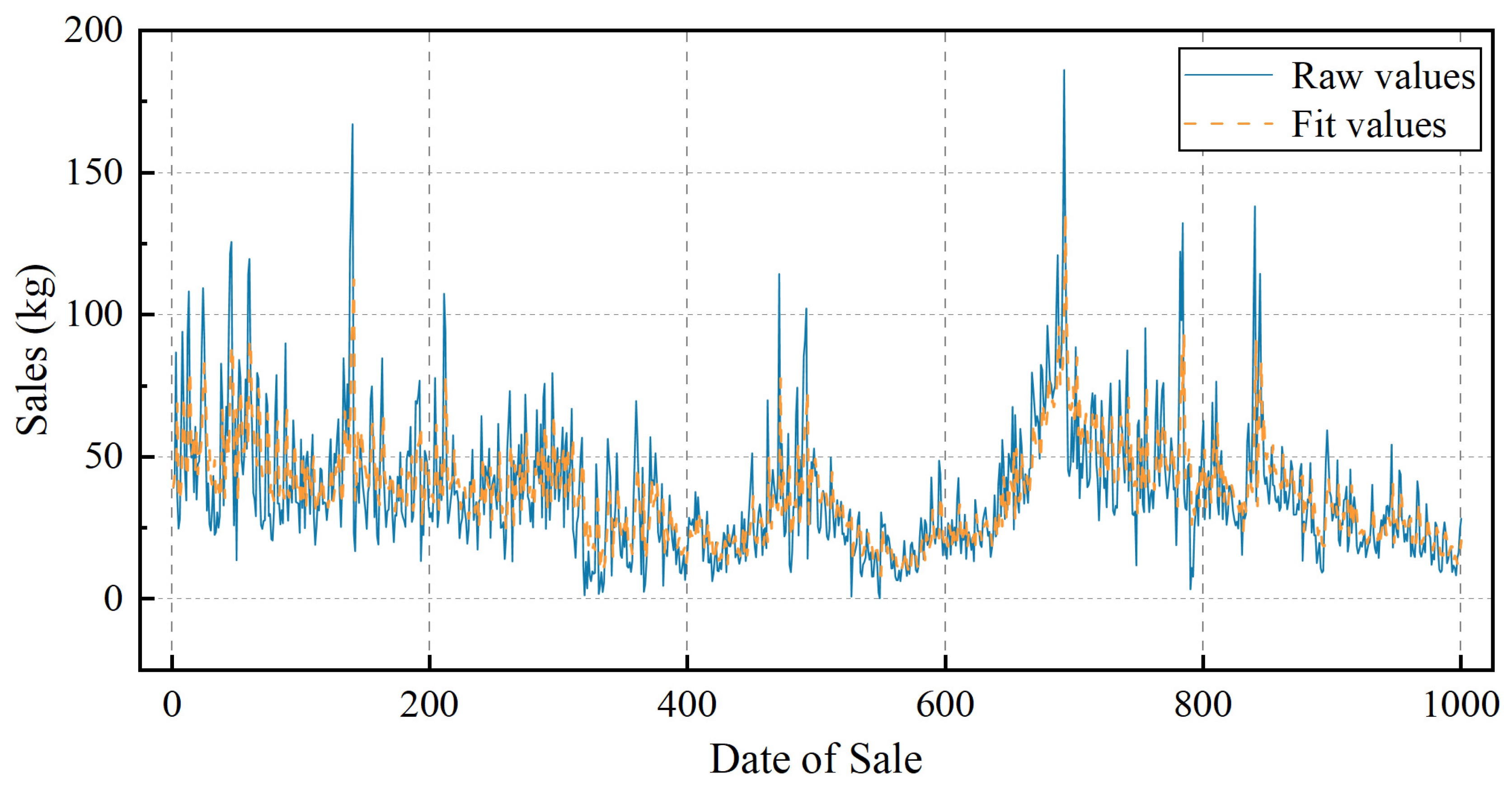

4.3.2. ARIMA-Based Replenishment Forecasting

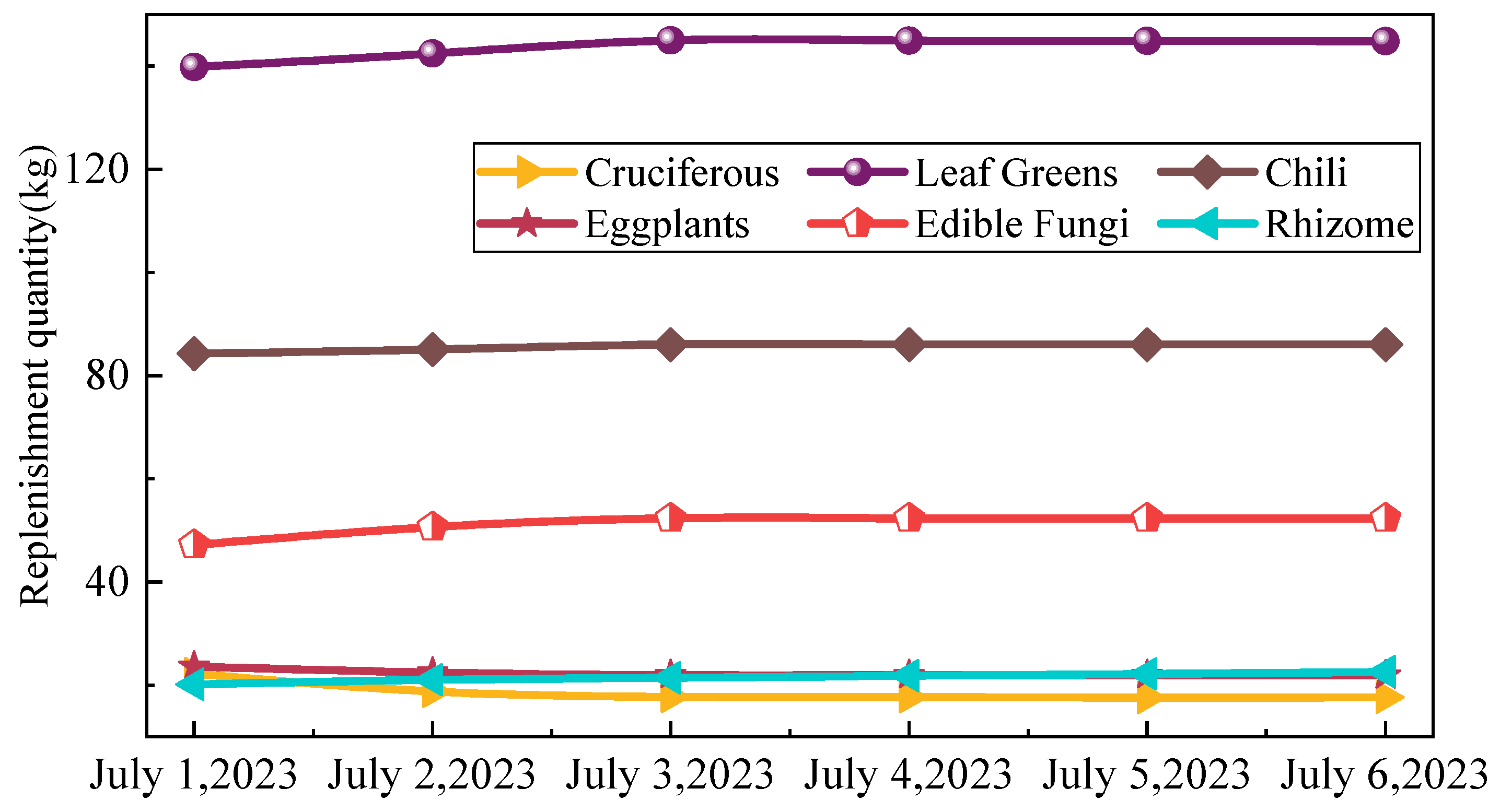

4.4. Multi-Order Dynamic Model

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Ferguson, M.; Ketzenberg, M.E. Information sharing to improve retail product freshness of perishables. Prod. Oper. Manag. 2006, 15, 57–73. [Google Scholar] [CrossRef]

- Yang, S.; Xiao, Y.; Kuo, Y.-H. The supply chain design for perishable food with stochastic demand. Sustainability 2017, 9, 1195. [Google Scholar] [CrossRef]

- The Loadstar—Making Sense of the Supply Chain. Available online: https://theloadstar.com/china-must-improve-its-cool-supply-chain-to-keep-pace-with-demand-for-fresh-food/ (accessed on 25 January 2024).

- GMW.cn. Available online: https://epaper.gmw.cn/wzb/html/2021-04/15/nw.D110000wzb_20210415_8-01.htm (accessed on 27 January 2024).

- Jadidi, O.; Jaber, M.Y.; Zolfaghari, S. Joint pricing and inventory problem with price dependent stochastic demand and price discounts. Comput. Ind. Eng. 2017, 114, 45–53. [Google Scholar] [CrossRef]

- Chew, E.P.; Lee, C.; Liu, R.; Hong, K.-s.; Zhang, A. Optimal dynamic pricing and ordering decisions for perishable products. Int. J. Prod. Econ. 2014, 157, 39–48. [Google Scholar] [CrossRef]

- Wang, K.-M.; Ma, Z.-J. Age-based policy for blood transshipment during blood shortage. Transp. Res. Part E Logist. Transp. Rev. 2015, 80, 166–183. [Google Scholar] [CrossRef]

- Gaimon, C.; Singhal, V. Flexibility and the choice of manufacturing facilities under short product life cycles. Eur. J. Oper. Res. 1992, 60, 211–223. [Google Scholar] [CrossRef]

- Nahmias, S. Perishable Inventory Theory: A Review. Oper. Res. 1982, 30, 680–708. [Google Scholar] [CrossRef] [PubMed]

- Goyal, S.K.; Giri, B.C. Recent trends in modeling of deteriorating inventory. Eur. J. Oper. Res. 2001, 134, 1–16. [Google Scholar] [CrossRef]

- Bakker, M.; Riezebos, J.; Teunter, R.H. Review of inventory systems with deterioration since 2001. Eur. J. Oper. Res. 2012, 221, 275–284. [Google Scholar] [CrossRef]

- Janssen, L.; Claus, T.; Sauer, J. Literature review of deteriorating inventory models by key topics from 2012 to 2015. Int. J. Prod. Econ. 2016, 182, 86–112. [Google Scholar] [CrossRef]

- Chen, J.; Dong, M.; Chen, F.F. Joint decisions of shipment consolidation and dynamic pricing of food supply chains. Robot. Comput.-Integr. Manuf. 2017, 43, 135–147. [Google Scholar] [CrossRef]

- Ping, H.Y.; Li, Z.C.; Shen, X.Z.; Sun, H.Z. Optimization of vegetable restocking and pricing strategies for innovating supermarket operations utilizing a combination of ARIMA, LSTM, and FP-Growth algorithms. Mathematics 2024, 12, 1054. [Google Scholar] [CrossRef]

- Chen, W.; Li, J.; Jin, X. The replenishment policy of agri-products with stochastic demand in integrated agricultural supply chains. Expert Syst. Appl. 2016, 48, 55–66. [Google Scholar] [CrossRef]

- Huang, G.; Ding, Q.; Dong, C.; Pan, Z. Joint optimization of pricing and inventory control for dual-channel problem under stochastic demand. Ann. Oper. Res. 2021, 298, 307–337. [Google Scholar] [CrossRef]

- He, Y.; Huang, H.; Li, D. Inventory and pricing decisions for a dual-channel supply chain with deteriorating products. Oper. Res. 2020, 20, 1461–1503. [Google Scholar] [CrossRef]

- Shen, L.; Li, F.; Li, C.; Wang, Y.; Qian, X.; Feng, T.; Wang, C. Inventory optimization of fresh agricultural products supply chain based on agricultural superdocking. J. Adv. Transp. 2020, 2020, 2724164 . [Google Scholar] [CrossRef]

- Wang, X.-z.; Liu, S.; Yang, T. Dynamic pricing and inventory control of online retail of fresh agricultural products with forward purchase behavior. Econ. Res.-Ekon. Istraž. 2023, 36, 2180410. [Google Scholar] [CrossRef]

- Sabir, L.B.; Farooquie, J.A. Managing fruits and vegetables inventory: A study of retail stores. South Asian J. Mark. Manag. Res. 2015, 5, 47–60. [Google Scholar]

- RELEX Solutions. Available online: https://www.relexsolutions.com/resources/managing-the-intricacies-of-fresh-fruits-and-vegetables-in-grocery-retail/ (accessed on 30 January 2024).

- Fujiwara, O.; Perera, U. EOQ models for continuously deteriorating products using linear and exponential penalty costs. Eur. J. Oper. Res. 1993, 70, 104–114. [Google Scholar] [CrossRef]

- Avinadav, T.; Arponen, T. An EOQ model for items with a fixed shelf-life and a declining demand rate based on time-to-expiry technical note. Asia-Pac. J. Oper. Res. 2009, 26, 759–767. [Google Scholar] [CrossRef]

- Li, R.; Teng, J.-T. Pricing and lot-sizing decisions for perishable goods when demand depends on selling price, reference price, product freshness, and displayed stocks. Eur. J. Oper. Res. 2018, 270, 1099–1108. [Google Scholar] [CrossRef]

- Zheng, Q.; Ieromonachou, P.; Fan, T.; Zhou, L. Supply chain contracting coordination for fresh products with fresh-keeping effort. Ind. Manag. Data Syst. 2017, 117, 538–559. [Google Scholar] [CrossRef]

- Herbon, A. Optimal piecewise-constant price under heterogeneous sensitivity to product freshness. Int. J. Prod. Res. 2016, 54, 365–385. [Google Scholar] [CrossRef]

- Lu, L.; Zhang, J.; Tang, W. Optimal dynamic pricing and replenishment policy for perishable items with inventory-level-dependent demand. Int. J. Syst. Sci. 2016, 47, 1480–1494. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, S.; Han, J. Dynamic pricing and periodic ordering for a stochastic inventory system with deteriorating items. Automatica 2017, 76, 200–213. [Google Scholar] [CrossRef]

- Petruzzi, N.C.; Dada, M. Pricing and the newsvendor problem: A review with extensions. Oper. Res. 1999, 47, 183–194. [Google Scholar] [CrossRef]

- Buisman, M.; Haijema, R.; Bloemhof-Ruwaard, J. Discounting and dynamic shelf life to reduce fresh food waste at retailers. Int. J. Prod. Econ. 2019, 209, 274–284. [Google Scholar] [CrossRef]

- Bose, S.; Orosel, G.; Ottaviani, M.; Vesterlund, L. Monopoly pricing in the binary herding model. Econ. Theory 2008, 37, 203–241. [Google Scholar] [CrossRef]

- Besanko, D.; Winston, W.L. Optimal price skimming by a monopolist facing rational consumers. Manag. Sci. 1990, 36, 555–567. [Google Scholar] [CrossRef]

- Li, M.; Mizuno, S. Comparison of dynamic and static pricing strategies in a dual-channel supply chain with inventory control. Transp. Res. Part E Logist. Transp. Rev. 2022, 165, 102843. [Google Scholar] [CrossRef]

- Zhang, J.; Wei, Q.; Zhang, Q.; Tang, W. Pricing, service and preservation technology investments policy for deteriorating items under common resource constraints. Comput. Ind. Eng. 2016, 95, 1–9. [Google Scholar] [CrossRef]

- Liu, L.; Zhao, L.; Ren, X. Optimal preservation technology investment and pricing policy for fresh food. Comput. Ind. Eng. 2019, 135, 746–756. [Google Scholar] [CrossRef]

- Ghare, P. A model for an exponentially decaying inventory. J. Ind. Eng. 1963, 14, 238–243. [Google Scholar]

- Dave, U. A probabilistic scheduling period inventory model for deteriorating items with lead time. Z. Oper. Res. 1986, 30, A229–A237. [Google Scholar] [CrossRef]

- Chang, C.-T.; Teng, J.-T.; Goyal, S.K. Optimal replenishment policies for non-instantaneous deteriorating items with stock-dependent demand. Int. J. Prod. Econ. 2010, 123, 62–68. [Google Scholar] [CrossRef]

- Balkhi, Z.T.; Benkherouf, L. On an inventory model for deteriorating items with stock dependent and time-varying demand rates. Comput. Oper. Res. 2004, 31, 223–240. [Google Scholar] [CrossRef]

- Tripathi, R.P.; Misra, S. An optimal inventory policy for items having constant demand and constant deterioration rate with trade credit. Int. J. Inf. Syst. Supply Chain Manag. (IJISSCM) 2012, 5, 89–95. [Google Scholar] [CrossRef]

- Zhang, Y.; Chai, Y.; Ma, L. Research on multi-echelon inventory optimization for fresh products in supply chains. Sustainability 2021, 13, 6309. [Google Scholar] [CrossRef]

- Yang, H.-L.; Teng, J.-T.; Chern, M.-S. An inventory model under inflation for deteriorating items with stock-dependent consumption rate and partial backlogging shortages. Int. J. Prod. Econ. 2010, 123, 8–19. [Google Scholar] [CrossRef]

- Tripathy, C.K.; Mishra, U. Ordering policy for linear deteriorating items for declining demand with permissible delay in payments. Int. J. Open Probl. Compt. Math. 2012, 5, 152–161. [Google Scholar] [CrossRef]

- Ahmed, M.; Al-Khamis, T.; Benkherouf, L. Inventory models with ramp type demand rate, partial backlogging and general deterioration rate. Appl. Math. Comput. 2013, 219, 4288–4307. [Google Scholar] [CrossRef]

- Krishnaraj, R.B.; Ramasamy, K. An EOQ model for linear deterioration rate of consumption with permissible delay in payments with special discounts. J. Appl. Math. Bioinform. 2013, 3, 35. [Google Scholar]

- Çalışkan, C. A comparison of simple closed-form solutions for the EOQ problem for exponentially deteriorating items. Sustainability 2022, 14, 8389. [Google Scholar] [CrossRef]

- He, Q.; Li, S.; Xu, F.; Qiu, W. Deep-processing service and pricing decisions for fresh products with the rate of deterioration. Mathematics 2022, 10, 745. [Google Scholar] [CrossRef]

- Duary, A.; Das, S.; Arif, M.G.; Abualnaja, K.M.; Khan, M.A.; Zakarya, M.; Shaikh, A.A. Advance and delay in payments with the price-discount inventory model for deteriorating items under capacity constraint and partially backlogged shortages. Alex. Eng. J. 2022, 61, 1735–1745. [Google Scholar] [CrossRef]

- CUMCM. Available online: http://en.mcm.edu.cn/html_en/node/b75cd3c6757828b576be40e0b98c4ccc.html (accessed on 25 April 2024).

| Categories | Cruciferous | Leafy Greens | Chilis | Eggplants | Edible Fungi | Rhizomes |

|---|---|---|---|---|---|---|

| Varieties | 5 | 100 | 45 | 10 | 72 | 19 |

| Categories | Mean | Median | Standard Deviation | Maximum | Minimum | Kurtosis Coefficient | Skewness Coefficient | Dispersion Coefficient |

|---|---|---|---|---|---|---|---|---|

| Cruciferous | 38.49 | 34.07 | 22.69 | 186.16 | 0.00 | −1.81 | 0.253 | 58.96 |

| Leafy Greens | 182.97 | 173.19 | 86.20 | 1265.47 | 31.30 | 1.84 | 0.482 | 47.11 |

| Chilis | 84.41 | 72.93 | 53.44 | 604.23 | 6.07 | 0.55 | 0.523 | 63.30 |

| Eggplants | 20.67 | 18.30 | 13.48 | 118.93 | 0.00 | −1.62 | 0.264 | 65.22 |

| Edible Fungi | 70.13 | 57.54 | 48.49 | 511.14 | 3.01 | 0.30 | 0.498 | 69.15 |

| Rhizomes | 37.40 | 30.19 | 31.36 | 296.79 | 0.93 | −0.49 | 0.417 | 83.84 |

| Individual Item | Green-Stemmed Cruciferous | Broccoli | Green-Stemmed Cruciferous | Purple Cabbage 1 | Purple Cabbage 2 |

|---|---|---|---|---|---|

| Entropy weight | 0.0739 | 0.0029 | 0.0948 | 0.3361 | 0.4924 |

| Categories | Regression Equation | R2 |

|---|---|---|

| Cruciferous | 0.9663 | |

| Leafy Greens | 0.9621 | |

| Chilis | 0.9036 | |

| Eggplants | 0.9842 | |

| Edible Fungi | 0.9687 | |

| Rhizomes | 0.9517 |

| Objective | Order of Differencing | t | p | Critical Values | ||

|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||

| Sales volume | 0 | −3.129 | 0.024 ** | −3.44 | −2.86 | −2.57 |

| 1 | −11.653 | 0.000 *** | −3.44 | −2.86 | −2.57 | |

| 2 | −14.5 | 0.000 *** | −3.44 | −2.86 | −2.57 | |

| Error Indicators | MAPE (%) | RMSE | SMAPE (%) | TIC |

| 5.253 | 0.024 | 4.988 | 0.018 |

| Linear Assumption Model | Multi-Order Dynamic Model | |||

|---|---|---|---|---|

| Planning Date | Daily Replenishment (kg) | Profit Margin (%) | Daily Replenishment (kg) | Profit Margin (%) |

| 1 July | 343.50 | 34.31 | 370.36 | 42.76 |

| 2 July | 314.26 | 35.83 | 351.01 | 43.96 |

| 3 July | 296.31 | 25.86 | 380.36 | 41.68 |

| 4 July | 295.81 | 21.48 | 346.17 | 39.13 |

| 5 July | 295.32 | 33.92 | 379.95 | 43.18 |

| 6 July | 294.82 | 34.31 | 372.65 | 42.12 |

| 7 July | 292.87 | 35.83 | 349.38 | 41.79 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Liu, J.; Qiu, J.; Zhou, Y.; Zhang, X.; Wang, Y.; Guo, W. ARIMA-Driven Vegetable Pricing and Restocking Strategy for Dual Optimization of Freshness and Profitability in Supermarket Perishables. Sustainability 2024, 16, 4071. https://doi.org/10.3390/su16104071

Li H, Liu J, Qiu J, Zhou Y, Zhang X, Wang Y, Guo W. ARIMA-Driven Vegetable Pricing and Restocking Strategy for Dual Optimization of Freshness and Profitability in Supermarket Perishables. Sustainability. 2024; 16(10):4071. https://doi.org/10.3390/su16104071

Chicago/Turabian StyleLi, Hongliang, Jun Liu, Jiangjie Qiu, Yunsen Zhou, Xu Zhang, Yuming Wang, and Wei Guo. 2024. "ARIMA-Driven Vegetable Pricing and Restocking Strategy for Dual Optimization of Freshness and Profitability in Supermarket Perishables" Sustainability 16, no. 10: 4071. https://doi.org/10.3390/su16104071

APA StyleLi, H., Liu, J., Qiu, J., Zhou, Y., Zhang, X., Wang, Y., & Guo, W. (2024). ARIMA-Driven Vegetable Pricing and Restocking Strategy for Dual Optimization of Freshness and Profitability in Supermarket Perishables. Sustainability, 16(10), 4071. https://doi.org/10.3390/su16104071